Posts about Kevin Henehan's interests in business products and industries

Don't wanna be here? Send us removal request.

Text

Coors Banquet

Coors Banquet, a MolsonCoors product, has seen a recent increase in sales within the last couple years after ending a 11-year sales decline in 2018. You may ask yourself why the brand is doing so well recently? The success comes from the Banquet's marketing strategy. A marketing strategy that includes market expansion, organic growth, market penetration, rebranding, and marketing mix through promotions.

DSM food specialties had written an article about how the beer industry is changing in the way of the millennials. Two good points the article brought up are that purpose matters and the younger crowd is more adventurous. According to the article, from the ages 18-30, more than 45% strongly agreed that the beer they drink says something about them. Brands are trying to tell a story through their marketing strategy and even through the label. Also, younger drinkers are always looking for the next trend as they are eager to try something different. Coors Banquet is succeeding at using these trends to their advantage.

Over the summer Coors continued to implement their marketing campaigns and released two types of strategies as the rebranded their packaging and cans/bottles for a bigger purpose. The first line is called the Legacy Collection as they rebranded their can to tell the story of “The Coveted Lager”. The cans include a brief story containing the brands history of the 149-year-old beer. The can exhibits inspiration as it has factors that inspire us. The marketing manager for Banquet, Steph Canfield said that “each can has its own story” (MolsonCoors, 2022). Along with the small history lesson on the side of the can is a QR code that leads to a complete timeline of the Banquets history, starting with the exploration of the American West.

The other package and marketing campaign that was released is the “Protect Our Protectors”. This is a partnership with the Wildland Firefighter Foundation as the company has donated more than $2 million dollars (MarketingDive, 2022). Along with the release of new branding, Banquet has collaborated with Huckberry for their Legacy Collection and Brixton for their Protect Our Protectors collection. Both brands help Banquet provide consumers with limited merchandise as it generates them revenue while being another form of advertising. Both collections included commercials that promoted their goals of sustainability and environmental protection.

Coors Banquet's new campaigns give a reason for consumers to buy as it supports social issues as well tells a story behind the beer, all while being environmentally friendly. The first step in the marketing strategy is to understand the consumer. Banquet used the industry trends of having a beer that tells a story and appeals to new drinker. Banquet appeals to the new adventurous consumers as they’ve promoted the product tremendously. Along with the Huckberry and Brixton collaborations is the use of product placement in TV the shows Yellowstone and Cobra Kai. MolsonCoors says that the audience of Yellowstone encompasses what Banquet resembles as viewers are people of the lager’s target market. With over 220 million viewers, Banquet will be catching eyes of potential consumers. Not to mention they sell Coors Banquet merchandise at trendy stores like Urban Outfitters and PacSun. Banquet is moving with millennial trends and culture as it makes a comeback as a domestic beer. These appearances have boosted sales for Banquet. As of October 30th sales are up 12% over the last 13 weeks (MolsonCoors, 2022).

Banquet fills two out of four boxes in the product market growth model; market penetration and market growth. They’ve been able to drive home their product to current consumers. They’ve expanded the market to attract more millennials through the use of product placement in high viewed TV shows. More importantly Coors Banquet has increased revenue through organic growth’s investing and preforming strategies. They invested their time and money into Banquet to set it back on a path of sales incline. They also performed in their marketing department to give banquet new branding, promotions, merchandise, as well as advertisements.

Since May of 2022 I’ve had the opportunity to work with Origlio Beverage as it’s the Philadelphia’s area wholesaler for Coors Banquet. In company meetings for On and Off premise accounts, they’ve seen Banquets numbers increase on a year-to-date basis. I had the pleasure of promoting Coors Banquet during a sampling that included Yellowstone branding as Banquet is now the official beer of the show’s 5th season. I was able to speak to customers directly on AATMF sensory information and the Banquet’s Rocky Mountain water history. We continued to push banquet as it is very trendy in the market today.

MolsonCoors has done a tremendous job in implementing their marketing strategy to give “The Coveted Lager” new life. But will MolsonCoors continue to purse promotions that aid to the millennial crowd? Will they implement merchandise, industry trends, and product placement for future marketing strategies? In my opinion I think it’s very efficient to do so for their smaller products. You’re always going to have a market and customers for MolsonCoors products like Miller Lite and Coors light. But what will happen for products like Blue Moon, Banquet, High Life, and Leinenkugel. For example, Palast Blue Ribbon just had a promotion in the film The Greatest Beer Run Ever. The movie tells a true story and the movie appeals to the younger crowd. Potentially, this could affect sales the way Cobra Kai and Yellowstone affected Banquet. How will they continue to appeal to a fresh market is the question to be asked?

0 notes

Text

Ford Bronco

Ford Motor Company in 2021 re-released the much-anticipated Ford Bronco as the product has been off the market since 1996. The launch was very successful as Ford executives said they “broke the internet”. All within 48 hours of the launch the Bronco had secured 100,000 reservation which were majority new customers. Fords marketing team’s goal was to stay connected to their new customers so they can have a positive experience from obtaining the Bronco through the length of their ownership. Tom Hing, the Bronco’s marketing team’s manager, created a SWAT team that designed a three-stem marketing strategy approach to achieve their goal of clear communication and positive experiences (thenewswheel, 2022). The three-step strategy include emotional appeal, product benefits/features, and efficient communication.

Right off the bat the Ford Bronco was emotionally appealing considering its past. People gravitated toward the style of the new Bronco. The vehicle kept the same box like, off road, and rugged look but added a clean and sleek modern look. As if they took a thunderbird off road while combining it with a designer lifestyle. The Bronco meets the modern design with keeping that old vintage feel. The buzz was in the air as the Bronco was set to make its return and it didn’t disappoint. Along with the anticipation, their advertisements are emotionally appealing as they try to motivate consumers using phrases and themes like “American Made”, “Built Ford Tough”, “Raised By Goats”, and “Bronco Rides Again”.

Ford Bronco’s product benefits are endless. They used the same acronym as they did in 1966, GOAT. This stands for “Goes Over Any Terrain”. There are seven different GOAT modes in the Bronco giving the consumer an option to go wherever they want. Normal for everyday driving, eco for efficiency, sport for handling, mud for uneven terrain, slippery for rain and snow, sand for soft terrain, and Baja for desserts. Stuart Jennings, the creative director put in good terms saying, “Whatever you’re into, you can make this vehicle work for you”. Depending on the model you purchase the Bronco will come equipped with at least five of the terrain management options (lethalperformance, 2022). Other product benefits include standard active safety features, east to remove doors, capability, customizability, 400-watt inverter, cargo management system, and a state-of-the-art liftgate.

The third stem is having efficient communication to its consumers causing the Bronco brand to excel. Since the marketing team wanted that positive experience for their customers, they were able to highlight the customizability of the Bronco. This helps appeal to each individual consumer’s needs. The Bronco team were able to implement features quickly that were requested from consumers like different types of interiors, hardtop/rooftops options, accessories, and colors. For instance, they created an all-black interior that was significantly requested which led to the sellout of the first edition models. Today the consumer can go and design a Bronco to their own specific specifications virtually. This shows the consumer how the vehicle looks while highlighting the benefits and features before purchasing. Tim Hing wanted his team to listen to customers to ultimately improve the Bronco experience as well as sales. The chart below shows that people tend to buy models that are more customizable.

The implantation of the marketing strategy to highlight the emotional feel, product benefits/features, and transparent communication helped backed the Broncos success. With 2021 the Bronco won awards like 4X4 of the year, best adventure vehicle, and American car of the year (FordMedia, 2022). In 2022 Forbes called it the wheels of the year and the best off road SUV, while being the best in motoring and a finalist in utility. In terms of sales Ford sold 116,227 vehicles in 2021 as they’re on pace to match that in 2022 (carfigures, 2022).

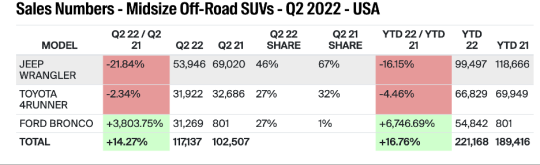

Although it’s still third in its segment behind the Jeep Wrangler and 4runner, both competing lines have seen a decrease of sales due to the Bronco. The Bronco now contains about 27% of the market as sales decreased for Wrangler by 22% and 2% for the 4runner. On a YTD trend the Bronco shows positive growth in Q2 of this year (fordauthority, 2022). It might be hard to catch Wrangler’s 46% of market share, but they’ve already surpassed the 4runner with only being existence for only two years.

If you use the product-market growth diagram, the Ford Motor Company utilize their resources in product expansion when it comes to the Bronco. Ford already had a present market of rugged outdoor vehicles like the Raptor trucks, but they expanded in that market when they introduced the Bronco. Now Ford has a SUV in the market to compete with Jeep and Toyota. They increased sales in the best possible way by using organic growth. They invested their money in a retired Ford product that provided them organic growth 30 years ago. Through the investment of the Bronco, they were able to create a modern version that appealed to the market. Lastly, they performed and drove home their marketing strategy as it was so important for Tim Hing to get the results Ford Motor company was looking for.

The question that comes to the table is, will Ford be able to keep the Bronco line growing or is it just a trend due to the recent release. Many people are having the same conversation if the Bronco is a bust or not. Will Jeep respond with another feature within the Wrangler? Although the Bronco’s awards do speak for themselves. Let’s see if the Bronco can have a positive trend of sales throughout 2022.

0 notes

Text

Yuengling

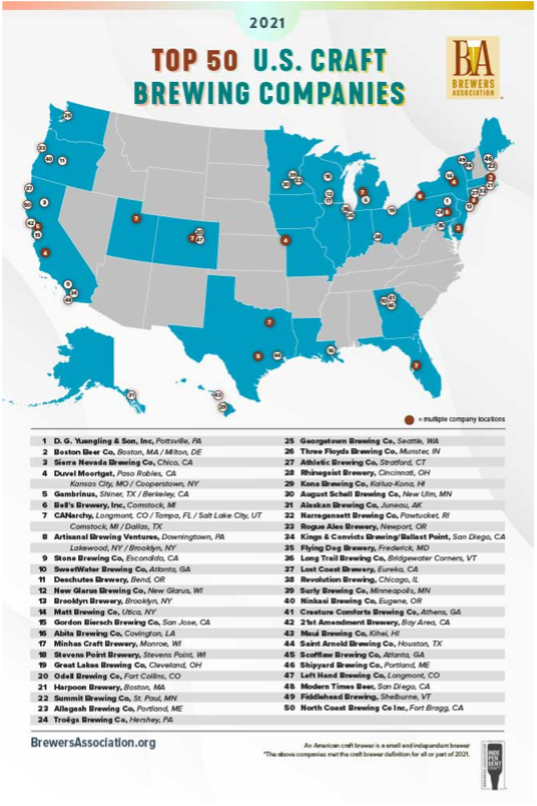

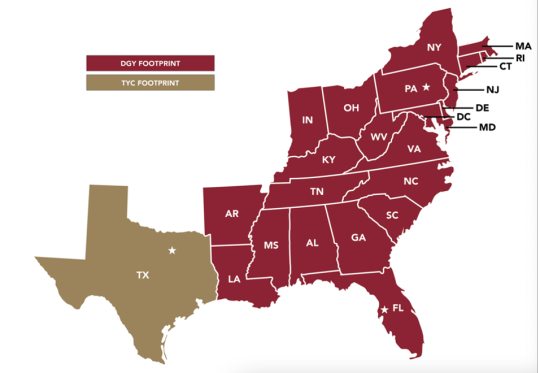

D. G. Yuengling & Son has been making recent noise in the beer industry with the expansion of their markets and the release of a new light beer. Yuengling has been a popular lager craft beer in the Northeast section of the country for many years, but they have recently expanded to Texas as well as Kansas, Missouri, and Oklahoma in 2023. With the craft market constantly growing, Americas Oldest Brewery took the journey to expand while also introducing their new light beer Yuengling Flight to their current markets. Yuengling calls it the “Next Generation of Light Beer” as it looks to take aim at the next generation of drinkers.

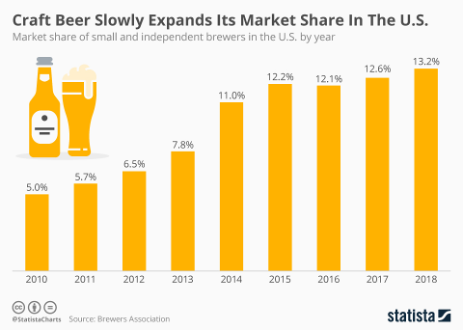

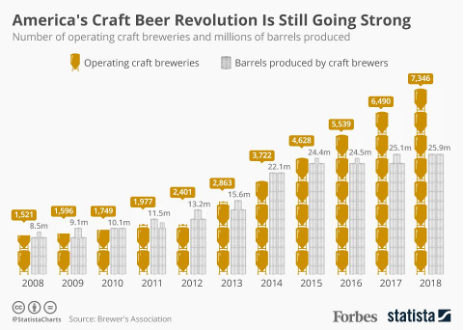

The craft brewery industry as a whole has been on a steady increase, selling more barrels by the millions while taping into about 13.2% of the beer market share (Statista).

At the top of the craft beer industry is no other than D. G. Yuengling & Son. They take first place as other powerhouse companies like Boston Beer and Sierra Nevada fall in behind the local Pennsylvania Brewery. Yuengling has held this rank for many years and when considering their market expansion to the Midwest, they will continue to grow. I think it's impressive that they’ve been at the top of the craft brew industry when they just recently sprouted out of the Northeast, now selling in about 25 different states. The difference between Yuengling and Sam Adams (Boston Beer) is that Sam Adams is available nationwide and it still falls below Yuengling in the craft brew market. I believe this family owned and operated brewery will continue to increase sales and volume within the expansion states and see even more states in the future.

Not only is Yuengling expanding to new markets, but they’ve developed products in introducing Yuengling Flight in 2020. Coming out of the pandemic Flight continued to grow as Yuengling ramped up its marketing, advertisements, and promotions for the beer. Flight is only 95 calories with 2.6 carbs (Yuengling, 2021). When comparing it to Bud light, it is 15 calories less. When comparing it to a growing seltzer drink like White Claw, it is one calorie less. Flight also draws attention as beer consumer profiles are changing due to lifestyles and millennial trends (MensJournal, 2021). Consumers are looking for drinks that are less carbs and calories as Flight offers a refreshing beer that contains these characteristics. Some are even comparing it to Michelob Ultra but with more taste. It also appeals to adventurous drinkers as Yuengling, America's oldest brewery, offers a brand-new light beer, something that drifts away from the traditional lager.

A big difference between Yuengling and other big breweries is that Yuengling uses organic growth. Yuengling isn’t going out and acquiring other brands like how Boston Beer acquires Angry Orchard and Dogfish Head. For over 190 years Yuengling has stuck with what they know best and poured all their resources into perfecting their own products. They’ve invested in their current products and expanded down South and out to the Midwest, they’ve created Flight in order to provide the upcoming generation with a new light beer, and they’ve preformed phenomenally to be able to hold the top spot in the craft brewing industry. I think organic growth in general helps build the culture of your organization as you believe and allocate resources to grow your products, rather than acquiring another product that comes from a different organization with a different culture.

The biggest uncertainty for Yuengling is if the brand will perform as well in the Midwest as it does in the Northeast. In the Northeast it’s one of the most recognizable beers while it's starting from the ground up in the expansion states. But what’s next for Yuengling? I believe the brand will continue to promote and penetrate markets with Flight, but will Flight stand up there with their traditional lager and lager light? Some may be wondering if the brand will continue to make its way across the nation and eventually expand out West.

Post

1 note

·

View note