Hello! My partner and I have come together to create a new arts movement that I think you might want to know about and even support. We are set up as two individual entities partnering to present a series of projects. G Music, LLC. is my partner’s company and Lady On Top Productions is mine. Through this partnership, we have also formed Friendly Financial Solutions Group, a corporate-serving organization. We now have a collective of renowned and highly respected networks we work with to present, promote, and indentify funding . We hope to gain sponsors, venues and presenting partners. With my children as my main inspiration, Lady on Top Promotions works to ensure cultural education, strives to invest in cultural capital - all done in the most raw and global fashion. Through youth and family engagement, we hope to dispel common generational stereotypes by insuring noncommercial arts programming. This partnership proposes to be the gap between what and who our kids see and hear on TV and the pan national movement of art, culture, and cultural capital. I need your help! We seek funding and support to bring this work to the students of the New York Public School System. I want to talk to you more about these and other projects that we support.

Don't wanna be here? Send us removal request.

Text

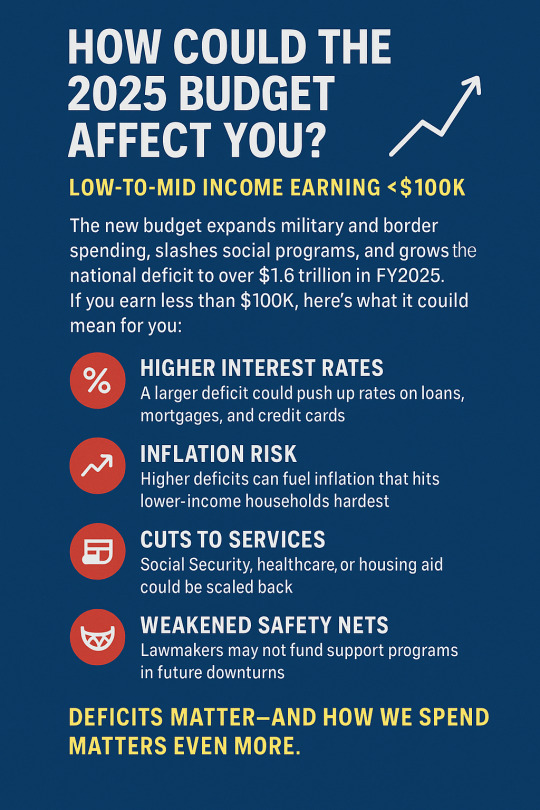

🔍 What is the Deficit, and how does it affect you?

The deficit is the amount the government spends beyond what it collects in revenue (taxes) in a given year.

📈 How Does the 2025 Budget Increase the Deficit?

Massive tax cuts for high-income earners and corporations were extended.

Military and border spending were significantly increased (e.g., $79 billion for border enhancements).

Discretionary domestic spending, especially for social programs and the arts, was cut—but not enough to offset the revenue shortfall and defense increases.

As a result, the Congressional Budget Office and independent analysts expect a substantial increase in the annual deficit, possibly surpassing $1.6 trillion in FY2025.

💥 How Does This Impact Low-to-Mid Income Citizens?

Higher Interest Rates

The government borrows more by issuing Treasury bonds.

This can push up interest rates on loans, mortgages, and credit cards, making it harder for families to afford big purchases or repay debt.

Cuts to Services

To eventually "balance the books," lawmakers may push for future cuts to Social Security, Medicare, housing aid, or education programs—all of which disproportionately benefit people earning under $100K.

Inflation Risk

While not guaranteed, a higher deficit can stoke inflation, especially if borrowing increases faster than economic growth. Inflation hits lower-income households hardest, as a larger portion of their income goes toward food, gas, and rent.

Weakened Safety Nets

If federal debt becomes politically controversial, future Congresses may refuse to fund or expand support programs, even during economic downturns—again hurting lower-income citizens most.

✅ Summary for Facebook:

💸 The new 2025 budget expands military and border spending while slashing support for the arts and education—and it's set to grow the national deficit by over $1.6 trillion.

📉 If you earn under $100K, here's what it could mean for you: higher interest rates, more inflation, and possible cuts to Social Security, healthcare, and housing programs down the road.

💬 Deficits matter—and how we spend matters even more.

#Budget2025 #FederalDeficit #EconomicJustice #Under100k #FinancialAwareness #USBudget #WorkingClassVoices #SocialProgramsMatter #CostOfLivingCrisis #MiddleClassStruggles #DebtAndDeficits #PolicyMatters #TruthInNumbers #EconFacts #PeopleOverPolitics

0 notes

Text

SPRING 2025 | FRIENDLY SOLUTIONS POLICY WATCH

Title: Federal Cuts in Motion — What You Need to Know

On March 14, 2025, the Trump administration signed Executive Order 14238, aiming to “reduce federal bureaucracy.” But what’s really happening is the potential dismantling of programs that protect housing access, community development, and economic equity.

Agencies on the chopping block include:

CDFI Fund 💰 (funding for underserved small businesses + housing)

USICH 🛏️ (coordinates efforts to end homelessness)

Minority Business Development Agency

Institute of Museum and Library Services

Federal Mediation and Conciliation Service

and more...

These programs are being ordered to shut down anything not explicitly required by law. That means less support for marginalized communities, fewer resources for shelters, libraries, and nonprofits—and potential job losses + service gaps across the country.

Why it matters:

Groups like OFN, NAAHL, and credit union associations are calling this a direct threat to financial equity, housing justice, and small business survival.

Stay informed. Speak out.

We’ll keep sharing updates as this unfolds. Together, we can defend the programs our communities depend on.

#PolicyWatch #CDFIFund #HousingJustice #StopTheCuts #CommunitySupport #FederalBureaucracy #FriendlySolutions #Spring2025 #ExecutiveOrder14238

#businesscredit#corporatecredit#commercialpaymentsolutions#specialtypaymentsolutions#FriendlySolutions#budget2025#federal deficit#economic justice#Under100k

0 notes

Text

February 11th, 2025

Friendly Solution LLC

Quarterly Newsletter

**📢 Addressing the Trade War Threat**

In light of Trump’s decision to impose a 25% tariff on all steel and aluminum imports—which risks igniting a global trade war—here are some key recommendations to ease the potential fallout:

• **Diplomatic Engagement:** Renew and expand talks with major trading partners to renegotiate or update trade agreements and possibly secure targeted product exemptions or temporary waivers.

• **Support for Domestic Industries:** Provide subsidies, tax breaks, and incentives to help manufacturers absorb higher costs, diversify supply chains, and remain competitive.

• **Currency Risk Management:** Encourage the use of financial hedging strategies to protect businesses from market volatility and currency fluctuations.

• **Coordinated Action:** Foster coordinated responses with key trading partners to address global market distortions and prevent retaliatory measures.

These steps could help mitigate economic disruption, protect supply chains, and maintain stability in both domestic and global markets. What are your thoughts on these strategies?

Contact Information:

Kritzia Gomez

Founder

Friendly Solutions LLC

(678) 760-6213

#TradeWar #Tariffs #GlobalEconomy #SupplyChain #Diplomacy

0 notes

Text

FOR IMMEDIATE RELEASE

youtube

Friendly Solutions LLC Unveils Zero Percent Interest Financing for Businesses through Commercial Payment Solutions Powered by MasterCard

Atlanta, GA – November 2024 – Friendly Solutions LLC, a leader in innovative financing strategies, has introduced a breakthrough zero percent interest financing solution in partnership with MasterCard. Corpay’s partnership initiative aims to empower businesses across varying revenue tiers with tailored commercial credit options to fuel growth, enhance cash flow, and streamline payment processes. Available for companies with annual revenues ranging from $1 million to $50 million, this program offers unmatched financial flexibility for start-ups and established businesses alike.

Transforming Business Growth with Zero Percent Financing

This unique financing solution opens doors for businesses to access up to $50 million in commercial credit lines without incurring interest. Friendly Solutions LLC has strategically designed this program to benefit companies that may not have pre-existing commercial banking relationships or wish to expand their credit options beyond traditional means. With the backing of MasterCard’s robust purchasing, payroll, fleet management, and virtual card programs, clients can look forward to efficient and secure transactions backed by a trusted global network.

Tailored Financing for Every Business Stage

The zero percent financing initiative is tailored to meet the needs of businesses at different growth stages:

Educating and Empowering Businesses through Ongoing Support

As a Corpay partner, Friendly Solutions LLC offers monthly application seminars and weekly strategic compliance sessions, enabling businesses to understand and utilize commercial payment solutions fully. This hands-on approach includes in-depth cross-corporate guarantee education, reducing risk while maximizing investment opportunities for start-ups. Through these sessions, companies gain insights into credit application strategies and commercial payment solutions presented by industry experts like ComData and Corpay.

Access to the Friendly Solutions Network

Beyond financing, Friendly Solutions LLC provides a unique membership that includes access to exclusive financing techniques, discounted consulting, weekly credit committee webinars, and introductions to essential industry relationships to facilitate business expansion. Members benefit from the company’s Friendly Techniques, which are designed to help businesses secure credit and maintain compliance for all capital development projects, mergers, and acquisitions.

A Game-Changer for Corporate Credit and Financing

“Our goal is to make high-level financial solutions accessible and practical for businesses at every stage of growth,” said Kritzia Gomez Taylor, Founder at Friendly Solutions LLC. “By offering zero percent interest on financing, we’re providing a revolutionary opportunity for companies to expand and invest without the typical financial constraints. We are honored to partner with MasterCard, a trusted global leader, to bring this innovative program to life.”

Upcoming Events and Registration Information

Friendly Solutions LLC hosts ongoing webinars and live-streamed events where potential clients can learn about financing options, credit application strategies, and more. Companies interested in exploring these financing solutions can register for the monthly application seminar and weekly strategic compliance sessions on the Friendly Solutions LLC linktree.

For more information on the zero percent

interest financing and corporate credit options, visit [Lintree URL: https://linktr.ee/friendlysolutions or contact Friendly Solutions LLC directly.

About Friendly Solutions LLC

Friendly Solutions LLC is a financing and consulting firm dedicated to providing businesses with innovative solutions for credit and capital management. By leveraging extensive industry expertise and strategic partnerships, Friendly Solutions LLC offers customized credit options, risk management strategies, and financial growth tools to meet the needs of businesses in diverse industries.

Contact Information:

Friendly Solutions LLC

(678)760-6213

[Linktree: https://linktr.ee/friendlysolutions]

#businesscredit#commercialpaymentsolutions#corporatecredit#specialtypaymentsolutions#wealthmanagement#arts & entertainment#Youtube

0 notes

Text

Friendly Solutions LLC

#POLETIN Trimenstral 10/24

youtube

La Importancia de #Establecer un #Fideicomiso Familiar #Privado: Una Guía para Transferir Activos y Cuentas Financieras Correctamente

Queridos amigos,

En el complejo panorama financiero de hoy, asegurar la transferencia fluida de activos a futuras generaciones es crucial para una planificación patrimonial eficaz. Una herramienta efectiva que muchas familias eligen es el Fideicomiso Familiar Privado. Este mes, exploramos la importancia de establecer un fideicomiso familiar y ofrecemos una guía completa sobre cómo transferir correctamente activos y cuentas financieras al mismo.

¿Por Qué Establecer un Fideicomiso Familiar Privado?

Evitar el Proceso de Sucesión: Un fideicomiso permite que sus activos eviten el largo y a menudo costoso proceso de sucesión, asegurando que sus beneficiarios reciban su herencia puntualmente.

Privacidad: A diferencia de un testamento, que se convierte en un registro público al fallecer, un fideicomiso mantiene la confidencialidad sobre sus activos y su distribución.

Control sobre la Distribución de #Activos: Con un fideicomiso, puede especificar condiciones para la distribución de activos, asegurando que sus seres queridos estén apoyados de acuerdo con sus deseos.

#Protección contra #Acreedores: Los activos en un fideicomiso pueden estar protegidos de acreedores, brindando tranquilidad a usted y a sus beneficiarios.

Beneficios en Impuestos de Sucesión: Dependiendo de la estructura de su fideicomiso, puede haber oportunidades para reducir los impuestos de sucesión para sus herederos.

Cómo Establecer un Fideicomiso Familiar Correctamente

Paso 1: Elegir el Tipo de Fideicomiso Correcto

Considere si un fideicomiso #revocable (que puede modificar) o un fideicomiso #irrevocable (que no puede cambiarse una vez establecido) se adapta mejor a sus necesidades.

Paso 2: Redactar el Acuerdo de Fideicomiso

Involucre a un abogado con experiencia en planificación patrimonial para que le ayude a redactar el acuerdo de fideicomiso, especificando los términos, responsabilidades del fiduciario y beneficiarios.

La Membresía y Participación con Friendly Solutions LLC incluye acceso al paquete de Establecimiento de Fideicomisos Familiares Friendly, que incluye un manual, plantillas legales, acceso a profesionales fiscales e instituciones financieras que pueden hacer que la transferencia y financiación del fideicomiso sea mucho menos complicada.

Paso 3: Designar un Fiduciario

Seleccione una persona de confianza o un profesional para administrar el fideicomiso. Esta persona será responsible de supervisar los activos del fideicomiso y asegurar que sus deseos se cumplan.

Paso 4: Financiar el Fideicomiso

Transfiera activos al fideicomiso para hacerlo efectivo. Esto puede incluir bienes inmuebles, cuentas bancarias, inversiones y propiedad personal.

La Membresía y Participación con Friendly Solutions LLC incluye acceso al paquete de Establecimiento de Fideicomisos Familiares Friendly, que incluye un manual, plantillas legales, acceso a profesionales fiscales e instituciones financieras que pueden hacer que la transferencia y financiación del fideicomiso sea mucho menos complicada.

Cómo Transferir Activos y Cuentas Financieras a un Fideicomiso

Cuentas Bancarias

Contacte su Banco: Hable con un representante sobre la transferencia de la propiedad de la cuenta al fideicomiso.

Complete los Formularios Requeridos: Rellene los formularios necesarios para el cambio de cuenta y proporcione una copia del acuerdo de fideicomiso.

Verifique la Transferencia: Solicite confirmación del banco de que la cuenta ha sido transferida exitosamente.

La Membresía y Participación con Friendly Solutions LLC incluye acceso al paquete de Establecimiento de Fideicomisos Familiares Friendly, que incluye un manual, plantillas legales, acceso a profesionales fiscales e instituciones financieras que pueden hacer que la transferencia y financiación del fideicomiso sea mucho menos complicada.

Cuentas de Inversión

Consulte con su Corredora: Comuníquese con su firma de corretaje para conocer sus procedimientos específicos para la transferencia de cuentas.

Envíe los Formularios de Transferencia: Complete los formularios necesarios, como un formulario de transferencia de activos, y proporcione la documentación del fideicomiso.

Confirme los Cambios: Asegúrese de que la cuenta de inversión esté ahora a nombre del fideicomiso.

La Membresía y Participación con Friendly Solutions LLC incluye acceso al paquete de Establecimiento de Fideicomisos Familiares Friendly, que incluye un manual, plantillas legales, acceso a profesionales fiscales e instituciones financieras que pueden hacer que la transferencia y financiación del fideicomiso sea mucho menos complicada.

Bienes Inmuebles

Redacte una Nueva Escritura: Prepare una escritura de renuncia de derechos que transfiera la propiedad de su nombre al nombre del fideicomiso.

Firme y Notarice: Firme la escritura ante un notario público y regístrela en la oficina de registro del condado.

Actualice las Pólizas de Seguro: Notifique a su proveedor de seguros para reflejar al fideicomiso como propietario de la propiedad.

Cuentas de Retiro

Revise las Pautas: Revise las políticas sobre la transferencia de cuentas de retiro a fideicomisos, ya que esto a menudo implica nombrar al fideicomiso como beneficiario en lugar de transferir la propiedad.

Consulte a un Asesor Financiero: Discuta la mejor estrategia para integrar las cuentas de retiro en su plan patrimonial.

La Membresía y Participación con Friendly Solutions LLC incluye acceso al paquete de Establecimiento de Fideicomisos Familiares Friendly, que incluye un manual, plantillas legales, acceso a profesionales fiscales e instituciones financieras que pueden hacer que la transferencia y financiación del fideicomiso sea mucho menos complicada.

Conclusión

Establecer y transferir activos a un Fideicomiso Familiar Privado es un paso proactivo para proteger su legado y asegurar que su familia esté atendida de acuerdo con sus deseos. Si tiene preguntas o necesita ayuda para establecer su fideicomiso, estamos aquí para ayudar.

Para obtener asesoramiento personalizado, comuníquese con nuestra oficina haciendo clic en el enlace o escaneando la aplicación o visite nuestro sitio web en www.FriendlyCreditSource.com.

Saludos cordiales,

Kritzia Taylor

Fundadora

Friendly Solutions LLC

#businesscredit#commercialpaymentsolutions#specialtypaymentsolutions#corporatecredit#familytrust#Youtube

1 note

·

View note

Text

FRIENDLY SOUTIONS LLC PRESENTS

A conversational series for our VETS!

How Insurance Premium Financing Works:

Listen to our conversation!

1. Loan for Insurance Premiums: The individual or business owner takes out a loan from a bank or financing company to pay for the premiums of a life insurance policy, typically a high-value policy like Indexed Universal Life (IUL), Whole Life, or Term Life with significant death benefits.

2. Collateral and Security: The life insurance policy itself serves as partial collateral for the loan, but additional collateral may be required, such as other liquid assets or investments, to cover the risk to the lender.

3. Interest Payments: The borrower typically pays only the interest on the loan during the life of the loan, which can be structured at a fixed or variable rate. The principal loan amount, which represents the insurance premiums, may not need to be repaid until a later date, such as when the insured individual passes away or the policy matures.

4. Repayment of Loan: Upon the death of the insured or another triggering event, the death benefit from the life insurance policy is used to repay the outstanding loan balance. Any remaining portion of the death benefit is then paid to the beneficiaries. Alternatively, the loan can be repaid during the insured’s lifetime, often by using other financial strategies or assets.

Key Components of Premium Financing:

1. Borrower: The individual or business purchasing the life insurance policy and obtaining the loan.

2. Lender: The financial institution that provides the loan to cover the premiums. The lender earns revenue through interest payments made by the borrower.

3. Life Insurance Policy: This is the policy being financed, typically a high-value permanent life insurance policy such as IUL or Whole Life, which has cash value accumulation over time.

4. Collateral: In addition to the life insurance policy, which provides part of the collateral, the lender may require the borrower to pledge additional assets to secure the loan, particularly when the value of the loan exceeds the early cash value of the policy.

5. Loan Structure: Premium financing loans are often structured with flexible terms. The borrower may only pay interest during the loan term and defer principal repayment until the death benefit is paid out or until a later time.

Benefits of Insurance Premium Financing:

1. Preserves Liquidity: Premium financing allows the borrower to preserve cash flow and other liquid assets, rather than tying them up in large life insurance premium payments.

2. Leverage: The borrower can leverage other assets to obtain a life insurance policy with significant coverage without paying out-of-pocket for the premiums in the short term.

3. Tax Advantages: Depending on the structure, life insurance proceeds are typically paid out tax-free to beneficiaries, and the growth in the policy’s cash value is tax-deferred.

4. Estate Planning Tool: High-net-worth individuals often use premium financing as part of their estate planning to provide liquidity for paying estate taxes, ensuring that heirs are not forced to sell off illiquid assets (such as property or businesses).

5. Business Benefits: Businesses can use premium financing to fund key-person life insurance or executive compensation packages without diverting large amounts of capital from business operations.

Risks and Considerations:

1. Loan Repayment Risk: If the policy’s cash value or death benefit is not sufficient to cover the loan, or if the borrower is unable to meet collateral requirements, there is a risk of default. In such cases, the lender may liquidate other pledged assets.

2. Interest Rate Risk: If the loan has a variable interest rate, rising interest rates can increase the cost of borrowing, making the loan more expensive to maintain.

3. Collateral Risk: If the value of the collateral (such as investments or real estate) declines, the borrower may be required to provide additional collateral to maintain the loan.

4. Policy Performance: Premium financing strategies are often dependent on the performance of the life insurance policy’s cash value growth, especially in policies like Indexed Universal Life (IUL). If the policy underperforms, it may not generate sufficient returns to cover loan interest or repay the loan.

5. Taxation: Although the death benefit is typically tax-free, the loan itself is not. Borrowers should carefully consider the tax implications of premium financing, especially when repaying the loan with other assets.

Who Can Benefit from Insurance Premium Financing?

• High-Net-Worth Individuals: Premium financing is ideal for individuals with significant assets who want to purchase a large life insurance policy without depleting liquid resources.

• Business Owners: Companies can use premium financing to cover key-person insurance or provide executive benefits while preserving capital for business operations.

• Estate Planners: Premium financing is often used as part of a larger estate planning strategy, particularly for those looking to minimize estate taxes and provide liquidity for heirs.

Membership and Engagement with Friendly Solutions LLC includes access to the Friendly Family Trust Establishing package which includes a manual, legal templates, access to tax professionals, and financial institutions which can make transferring and funding the trust much less cumbersome.

Conclusion

Insurance premium financing is a sophisticated financial strategy that allows individuals or businesses to obtain life insurance coverage without immediately paying large premiums. By leveraging a loan to finance premiums, high-net-worth individuals can maintain liquidity and maximize estate planning benefits. However, it is important to carefully consider the associated risks, including interest rate fluctuations, loan repayment, and policy performance, before committing to premium financing. Working with a financial advisor or estate planner is essential to ensuring the strategy fits into your broader financial goals.

All rights reserved to FRIENDLY SOLUTIONS LLC, 2024

1 note

·

View note

Text

0 notes

Text

The Importance of Establishing a Private Family Trust: A Guide to Properly Transferring Assets and Financial Accounts

Friendly Solutions LLC

Quarterly Newsletter October, 2024

The Importance of Establishing a Private Family Trust: A Guide to Properly Transferring Assets and Financial Accounts

Dear Friends,

In today’s complex financial landscape, ensuring the smooth transfer of assets to future generations is crucial for effective estate planning. One effective tool that many families are choosing to use is a Private Family Trust. This month, we delve into the importance of establishing a family trust and provide a comprehensive guide on how to properly transfer assets and financial accounts into it.

Why Establish a Private Family Trust?

Avoiding Probate: A trust allows your assets to bypass the lengthy and often costly probate process, ensuring that your beneficiaries receive their inheritance promptly.

Privacy: Unlike a will, which becomes a public record upon your passing, a trust maintains confidentiality regarding your assets and how they are distributed.

Control Over Asset Distribution: With a trust, you can specify conditions for asset distribution, ensuring your loved ones are supported according to your wishes.

Protection from Creditors: Assets held in a trust may be protected from creditors, providing peace of mind for you and your beneficiaries.

Estate Tax Benefits: Depending on the structure of your trust, there may be opportunities to reduce estate taxes for your heirs.

How to Properly Establish a Family Trust

Step 1: Choose the Right Type of Trust Consider whether a revocable trust (which you can modify) or an irrevocable trust (which cannot be changed once established) best suits your needs.

Step 2: Draft the Trust Agreement Engage an experienced estate planning attorney to help you draft the trust agreement, outlining the terms, trustee responsibilities, and beneficiaries. Membership and Engagement with Friendly Solutions LLC includes access to the Friendly Family Trust Establishing package which includes a manual, legal templates, access to tax professionals, and financial institutions which can make transferring and funding the trust much less cumbersome.

Step 3: Appoint a Trustee Select a trustworthy individual or professional to manage the trust. This person will be responsible for overseeing the trust assets and ensuring that your wishes are carried out.

Step 4: Fund the Trust Transfer assets into the trust to make it effective. This can include real estate, bank accounts, investments, and personal property. Membership and Engagement with Friendly Solutions LLC includes access to the Friendly Family Trust Establishing package which includes a manual, legal templates, access to tax professionals, and financial institutions which can make transferring and funding the trust much less cumbersome.

How to Transfer Assets and Financial Accounts into a Trust

1. Bank Accounts

Contact Your Bank: Speak with a representative about transferring the account ownership to the trust.

Complete Required Forms: Fill out the necessary account change forms and provide a copy of the trust agreement.

Verify Transfer: Request confirmation from the bank that the account has been successfully transferred.

Membership and Engagement with Friendly Solutions LLC includes access to the Friendly Family Trust Establishing package which includes a manual, legal templates, access to tax professionals, and financial institutions which can make transferring and funding the trust much less cumbersome.

2. Investment Accounts

Consult Your Brokerage: Reach out to your brokerage firm to learn their specific procedures for transferring accounts.

Submit Transfer Forms: Complete any required forms, such as a transfer of assets form, and provide your trust documentation.

Confirm Changes: Ensure that the investment account is now under the name of the trust.

Membership and Engagement with Friendly Solutions LLC includes access to the Friendly Family Trust Establishing package which includes a manual, legal templates, access to tax professionals, and financial institutions which can make transferring and funding the trust much less cumbersome.

3. Real Estate

Draft a New Deed: Prepare a quitclaim deed transferring the property from your name to the trust’s name.

Sign and Notarize: Sign the deed in front of a notary public and file it with the county recorder's office.

Update Insurance Policies: Notify your insurance provider to reflect the trust as the property owner.

4. Retirement Accounts

Check Guidelines: Review the policies regarding transferring retirement accounts to trusts, as this often involves naming the trust as a beneficiary rather than transferring ownership.

Consult a Financial Advisor: Discuss the best strategy for integrating retirement accounts into your estate plan.

Conclusion

Establishing and transferring assets into a Private Family Trust is a proactive step towards safeguarding your legacy and ensuring that your family is taken care of according to your wishes. If you have questions or need assistance in setting up your trust, we are here to help.

For personalized advice, please contact our office clicking the link or scanning the app or visit our website at www.FriendlyCreditSource.com.

Warm regards,

Kritzia Taylor Founder Friendly Solutions LLC

0 notes

Video

FLEETCOR's Position on EV Adoption from FLEETCOR on Vimeo.

0 notes

Video

Congratulations Autumn, you are on your way to 500K!

youtube

Autumn Marini - DRIVE (Official Video)

LONG LIVE AALIYAH! I am a person committed to preserving the ways of our ancestors. As I have the power to influence, I will inject informed narrative and continue to make business moves that will bring justice and honor. I am acting on a duty bestowed in me.

The @VideoGod has made the most prolific video of the year. We have officially overcome all obstacles, and we are #CHAMPIONS! #AtlantaBraves this is for US #THECITYOFATLANTA. #Drive is Autumn Marini’s first single that has been released by a major record label. When expression and collaboration #TAKE FORM, the future thrives.

Autumn_Marini with GT Marini and Blackground Record 2.0, is everywhere you ain’t never there. The evolution of this project brings an era of collective progression. This #sound was born and bred in Atlanta. #Drive was produced by Damon Thompson, Tchalla, Gavin and stamped by Jazze Pha. Drive is part of a collection of songs titled, “CAUTION”.

Caution is anticipated and authentic in its sound which was shaped by Greg “G Hooked It Up” Taylor. He squashed the East, West coast beef and now he stands on his experience and talent to focus on the silver lining by keeping the legacy of our music #OurBusiness. The formula remains simple, create moments when our wise ones can empower our bold ones, highlight the outcome, and make it accessible. Barry Hankerson of the recording label Blackground 2.0, continues to prove he is a #wiseone by giving space to youthful opportunities and allowing them to come to fruition.

Icons like Anthony Dent who made Destiny’s Child a “Survivor” contributed to this album with a fusion of upbeat classic and trap melodic elation sound. Showcasing moves from VON, moves straight from you can remember when and we are here now! Autumn_Marini, is light on her feet, sings sweet, handles business, and a radiant beauty.

Like Busta, appreciating Aaliyah’s life after death but in the meantime..

#EatFood

#Already

2 notes

·

View notes

Video

youtube

Autumn Marini - DRIVE (Official Video)

LONG LIVE AALIYAH! I am a person committed to preserving the ways of our ancestors. As I have the power to influence, I will inject informed narrative and continue to make business moves that will bring justice and honor. I am acting on a duty bestowed in me.

The @VideoGod has made the most prolific video of the year. We have officially overcome all obstacles, and we are #CHAMPIONS! #AtlantaBraves this is for US #THECITYOFATLANTA. #Drive is Autumn Marini’s first single that has been released by a major record label. When expression and collaboration #TAKE FORM, the future thrives.

Autumn_Marini with GT Marini and Blackground Record 2.0, is everywhere you ain’t never there. The evolution of this project brings an era of collective progression. This #sound was born and bred in Atlanta. #Drive was produced by Damon Thompson, Tchalla, Gavin and stamped by Jazze Pha. Drive is part of a collection of songs titled, “CAUTION”.

Caution is anticipated and authentic in its sound which was shaped by Greg “G Hooked It Up” Taylor. He squashed the East, West coast beef and now he stands on his experience and talent to focus on the silver lining by keeping the legacy of our music #OurBusiness. The formula remains simple, create moments when our wise ones can empower our bold ones, highlight the outcome, and make it accessible. Barry Hankerson of the recording label Blackground 2.0, continues to prove he is a #wiseone by giving space to youthful opportunities and allowing them to come to fruition.

Icons like Anthony Dent who made Destiny’s Child a “Survivor” contributed to this album with a fusion of upbeat classic and trap melodic elation sound. Showcasing moves from VON, moves straight from you can remember when and we are here now! Autumn_Marini, is light on her feet, sings sweet, handles business, and a radiant beauty.

Like Busta, appreciating Aaliyah’s life after death but in the meantime..

#EatFood

#Already

2 notes

·

View notes

Video

youtube

Cardi B, Bad Bunny & J Balvin - I Like It [Official Music Video] #SorryTho #PaidTooB #FriendlyBusinessSolutions. I appreciate Cardi B for many reasons, mainly because her Mami named her Berkalis. Cardi is inspirational to me because she represents a deep rooted passion in my Caribbean make-up. She sounds and looks like my twenty year old me. Her win stands as a beacon for Uptown Manhattan, and The Boogie Down Bronx.

0 notes

Text

I just saw it on CNN.com: Haitians unleash anger over cholera epidemic at U.N

*Please note, the sender's email address has not been verified. Please continue to support our babies. ******************** If you are having trouble with any of the links in this message, or if the URL's are not appearing as links, please follow the instructions at the bottom of this email. Title: Haitians unleash anger over cholera epidemic at peacekeepers - CNN.com Copy and paste the following into your Web browser to access the sent link: http://www.emailthis.clickability.com/et/emailThis?clickMap=viewThis&etMailToID=192054746&pt=Y Copy and paste the following into your Web browser to SAVE THIS link: http://www.savethis.clickability.com/st/saveThisPopupApp?clickMap=saveFromET&partnerID=211911&etMailToID=192054746&pt=Y Copy and paste the following into your Web browser to forward this link: http://www.emailthis.clickability.com/et/emailThis?clickMap=forward&etMailToID=192054746&partnerID=211911&pt=Y ******************** Email pages from any Web site you visit - add the EMAIL THIS button to your browser, copy and paste the following into your Web browser: http://www.emailthis.clickability.com/et/emailThis?clickMap=browserButtons&pt=Y" ********************* Instructions:

0 notes