Don't wanna be here? Send us removal request.

Text

Tips to Succeed In CFA Exam and Tips for a Successful Exam Day!

The CFA is a serious exam. Ideally, it takes 300 hours of preparation, but it can take longer too. Here are some tips to help you on the way.

1. Start at least 6 months before the exam

It is important to set aside time and commit to staying on track, regardless of the duration of your study plan. Spreading your studying over six months allows you to establish a solid routine, digest the material, and reschedule study sessions if needed. This approach can help you stay on track and avoid falling behind in your preparations for the exam.

2. Minimize Distractions

Make sure you minimize distractions and maximize your study time. If you are working, consider taking a week off from work if you are behind on your study schedule. Use an auto-response for emails and texts, and plan to anticipate your internal needs such as hunger, boredom, stress, and sleep deprivation. Keep snacks nearby and vary your study plan to keep your brain engaged. This can help you focus and make the most of your remaining study time.

3. Use the 50/10 Rule

This is a popular study method which can help you increase your productivity. Use a timer to set the time to 50 minutes. You do not get to take any breaks or distractions for these 50 minutes. If you have completed 50 mins, take a 10-minute break. This is a very effective way to increase your output. It is better to study hard for 50 minutes than half-study with frequent distractions.

4. Utilize Every Spare Minute

It could seem a little extreme, but for the focused learner, rest is impossible until the goal is achieved. Use every spare minute to learn something. Engage with your resources whenever you get the chance. Keep flashcards and small notes handy so that you can keep your brain active.

5. Practice For Time Management

CFA exams are quite long, taking a minimum of four and a half hours for each level. Managing your time well is very important. It's not just about learning the material; you also need to practice using that knowledge. This helps you remember things quickly and understand the questions better. The CFA institute gives you many practice questions and mock exams in their books. So, begin with those.

Identify the topics you're not good at and focus on studying them. About two months before the exam, start taking mock exams. Keep an eye on the clock so that you do not rush towards the end. Optimal time management makes your performance all the more better.

6. Do Not be Overwhelmed, Take Breaks

Keep going and stay determined, but also allow yourself to take breaks. When you're dealing with a lot of information, like the overwhelming CFA exam materials, your brain sometimes needs a short break. If you feel overwhelmed, take 30-minute or 1-hour breaks during your study time.

To put things into perspective, individual CFA exam topics aren't incredibly hard. What makes it tough is the sheer amount. That's why starting six months before the exam is important. With some determination, energy, and a logical mind, you'll do great in the end.

7. Master Your Financial Calculator

Familiarize yourself thoroughly with your financial calculator, a pivotal tool for the exam. You can bring one of two designated calculator models. Practice with your chosen device to grasp its functions. Proficiency here can help you save time – especially in areas like Time Value of Money questions. As you become better with the device, you will get a head start. This skill provides an edge, enhancing your efficiency and confidence during the test.

Tips for a Successful Exam Day

1. Dress Comfortably

Wear comfy clothes on exam day. CFA Institute suggests layering for comfort and choosing quiet shoes. Since the exam is quite long, it's smart to avoid uncomfortable attire.

2. Stay Hydrated

Drink plenty of water. Your body and brain need water to work well. The exam takes a while, so remember to keep hydrated.

3. Get a Good Night's Sleep

Sleeping well is really important for your health and thinking clearly. Before the exam day, rest up. You'll be awake for the whole test, so feeling refreshed helps a lot.

4. Relax Before the Big Day

You've been preparing for months, so take it easy. Avoid stressing or talking about the exam. Get everything ready for tomorrow, and give your mind a break. Your study plan has you ready, and confidence matters.

Get Started With 1FIN by IndigoLearn

Passing the CFA exams requires a combination of intelligence, stamina, and the right tools and strategies. With the help of coaching, focusing on concepts, using the best study material, attending mock tests, and strategically selecting topics to focus on, you can increase your chances of success.

If you’re looking for a comprehensive and effective way to prepare for the CFA exams, consider enrolling in a prep course with Indigolearn. Our lectures are taken by CFA/ FRM Charter holders who have practical experience in the topics they teach. This makes your conceptual foundation very solid and the learning process more interesting as well as comprehensive; in addition, we offer high-quality study materials from Kaplan Schweser - the world’s no 1 CFA Prep Provider, which includes practice questions and mock exams to help you achieve your goals. Take the first step towards success on the CFA exams by enrolling with 1FIN by IndigLearn today!

0 notes

Text

Unlock Lucrativе Carееrs in Financе with thе CFA Dеsignation

In today's competitive job market, aspiring finance professionals are constantly seeking ways to distinguish themselves. The finance industry, known for its dynamic nature and rewarding opportunities, often requires a unique set of skills and qualifications. Among the numerous certifications available, the Chartered Financial Analyst (CFA) designation stands out as a benchmark for excellence and expertise in the field.

Aspiring finance professionals looking to carve a niche in this industry find the CFA designation an invaluable asset, opening doors to lucrative career prospects and establishing credibility in the finance domain. Whether you are just beginning your journey or progressing through CFA Level 2, the opportunities for advancement in CFA jobs are immense. Let's delve into CFA careers, exploring the expanding job landscape, particularly in India, while navigating the global opportunities presented by CFAs in the digital age.

Understanding the CFA Designation

The CFA designation, offered by CFA Institute, is a globally recognized credential for investment and financial professionals. It's a rigorous program that covers a broad range of topics, including investment management, financial analysis, economics, ethics, and more. Divided into three levels, the CFA program assesses candidates' competence, integrity, and dedication to the highest standards of professional conduct.

Enhanced Knowledge and Expertise Earning the CFA designation signifies a comprehensive understanding of investment management and financial analysis. The program delves deep into various aspects of finance, equipping candidates with a robust skill set required in the industry. Completing CFA Level 2, in particular, prepares professionals for more advanced analytical roles, enhancing their qualifications for top CFA jobs.

Global Recognition and Credibility The CFA charter is recognized and respected worldwide. It demonstrates a commitment to ethical standards and professionalism, enhancing credibility among employers, clients, and peers across borders.

Career Advancement and Opportunities Individuals with a CFA designation often find themselves on a fast track to career progression. From investment banking to portfolio management, equity research, and beyond, the credential opens doors to a diverse array of high-paying roles. As you progress through CFA Level 2 and beyond, your opportunities in CFA jobs expand significantly, offering paths to leadership and specialized finance roles.

Networking and Industry Connections Becoming a CFA charterholder provides access to a vast network of finance professionals. The CFA community offers opportunities for networking, knowledge sharing, and staying updated with industry trends.

Remuneration and Financial Rewards Statistics consistently show that CFA charterholders tend to command higher salaries compared to their non-designated peers. The designation often leads to increased earning potential and better compensation packages.

Global Career Opportunities for CFAs

The beauty of the CFA qualification lies in its global recognition. CFA charterholders have the advantage of pursuing careers internationally, transcending geographical boundaries. From financial hubs like New York and London to emerging markets in Asia and Africa, CFAs are sought after for their universal expertise in investment management, paving the way for lucrative career prospects across continents.

Rewarding CFA Careers to Choose From

The CFA designation stands as a hallmark of expertise and dedication in the finance industry. Holding this credential not only signifies a comprehensive understanding of investment management but also unlocks a plethora of career opportunities across various sectors within finance. CFA charterholders possess a unique skill set that positions them for roles demanding analytical rigor, ethical integrity, and strategic financial acumen.

Investment Banking These professionals are highly valued for their deep understanding of financial markets, valuation techniques, and analytical prowess. Roles within investment banking, such as financial analysts, investment bankers, and corporate finance advisors, often attract CFA charterholders due to the demanding nature of the work and the opportunities for high earnings and career advancement.

Portfolio Management Portfolio managers play a pivotal role in managing investment portfolios for institutions or individual clients. With their expertise in asset valuation, risk management, and financial analysis, CFA charterholders are well-equipped for these roles. They make critical decisions on asset allocation, investment strategies, and risk mitigation, aiming to maximize returns for their clients or organizations.

Equity Research Equity research analysts conduct in-depth analysis of companies and industries to provide investment recommendations to clients. CFA charterholders possess the analytical skills required to evaluate financial statements, assess market trends, and forecast company performance. This makes them ideal candidates for equity research roles in investment firms, banks, or independent research firms.

Hedge Funds and Private Equity CFA charterholders are highly sought after in the alternative investment space, including hedge funds and private equity firms. These roles often involve complex investment strategies, requiring a deep understanding of risk management, valuation techniques, and market dynamics. CFA charterholders bring credibility and expertise to positions such as hedge fund analysts, private equity associates, or fund managers.

Risk Management CFA charterholders are well-positioned to excel in this domain. Their understanding of financial markets, quantitative analysis, and risk assessment allows them to navigate and mitigate various types of financial risks, including market risk, credit risk, and operational risk.

Wealth Management and Financial Advisory CFA charterholders possess the knowledge and skills necessary to excel in wealth management and financial advisory roles. These professionals provide personalized financial advice, investment strategies, and wealth preservation solutions to high-net-worth individuals, families, or institutions.

Corporate Finance Within corporations, CFA charterholders often find roles in corporate finance departments. Their expertise in financial analysis, valuation, and strategic planning is invaluable for functions such as financial planning and analysis, mergers and acquisitions, capital budgeting, and treasury management.

Real Estate and Infrastructure Investment CFA charterholders with an interest in real estate and infrastructure find opportunities in investment firms, real estate development companies, or infrastructure funds. Their financial expertise is leveraged in analyzing investment opportunities, conducting due diligence, and managing real estate or infrastructure portfolios.

Key Takeaway

The CFA designation embodies a dedication to excellence, ethics, and adaptability in finance. It's a strategic investment, opening doors to diverse opportunities worldwide. CFAs navigate India's growing economy and global markets, empowered by fintech and ethical investing. In the digital era, their expertise is pivotal, shaping finance with integrity and a global outlook. Charterholders excel in conventional and specialized finance, showcasing technical prowess, ethical commitment, and analytical skills, vital for organizational success and client financial security.

Ready to unlock your CFA potential? Join 1FIN by IndigoLearn for comprehensive CFA preparation. Gain mastery, ace exams, and step confidently into lucrative finance careers. Elevate your expertise with personalized guidance and top-notch resources. Start your journey to CFA success with 1FIN today!

0 notes

Text

The Best Faculty and SFM Classes for CA Final and CA Inter in India

The journey to becoming a Chartered Accountant (CA) in India is both challenging and rewarding. One of the pivotal stages in this journey is mastering the Strategic Financial Management (SFM) for the CA Final and choosing the best faculty for CA Intermediate (CA Inter). Here’s a detailed look at why selecting the right SFM classes for CA Final and the best faculty for CA Inter is crucial for aspiring CAs.

SFM Classes for CA Final

Strategic Financial Management (SFM) is a crucial subject in the CA Final exam, requiring a deep understanding of financial concepts, strategic decision-making, and analytical skills. To excel in this subject, choosing the right SFM classes for CA final is essential. Here’s why:

Comprehensive Coverage: The right SFM classes will cover the entire syllabus comprehensively, ensuring that students grasp all necessary concepts.

Expert Guidance: Experienced faculty can break down complex topics into easily understandable segments, making learning more effective.

Practical Approach: Quality SFM classes incorporate practical examples and case studies, helping students apply theoretical knowledge to real-world scenarios.

Updated Material: The financial world is constantly evolving. Good SFM classes offer updated study materials reflecting the latest trends and practices.

Interactive Learning: Engaging teaching methods, including interactive sessions, doubt-clearing forums, and peer discussions, enhance the learning experience.

CA Inter: Best Faculty

The CA Intermediate level serves as a bridge between the foundational knowledge and the advanced concepts in the CA curriculum. Having the best faculty for CA Inter can make a significant difference in a student’s performance. Here’s what to look for in the best CA Inter faculty:

Expertise and Experience: The best faculty possess extensive knowledge and years of teaching experience, allowing them to deliver content effectively.

Innovative Teaching Methods: They use innovative teaching methods to simplify complex topics, making them easier for students to understand and retain.

Personalized Attention: Great teachers recognize that each student learns differently and provide personalized guidance to address individual learning needs.

Strong Communication Skills: Effective communication helps in clearly conveying concepts and engaging students, fostering a better learning environment.

Success Record: Faculty with a proven track record of producing successful students can instill confidence and motivation in their pupils.

Conclusion

Excelling in the CA exams requires dedication, hard work, and the right guidance. Selecting the best SFM classes for CA Final and the CA intern best faculty can significantly impact your preparation and success. By choosing wisely, you equip yourself with the knowledge and skills necessary to navigate the complexities of the CA curriculum and achieve your goal of becoming a Chartered Accountant.

Investing in quality education and expert guidance is a step toward a successful CA career. Choose the best, and let your journey to becoming a Chartered Accountant be smooth and rewarding.

0 notes

Text

Navigating the Challenges of ICAI CA Inter and CA Final FR

The journey to becoming a Chartered Accountant (CA) in India is undoubtedly rigorous, requiring dedication, perseverance, and a solid understanding of complex financial concepts. Among the many hurdles aspiring CAs face, the examinations conducted by the Institute of Chartered Accountants of India (ICAI) for CA Inter and CA Final Financial Reporting (FR) stand out as significant milestones. Mastering Financial Reporting is crucial not only for passing these exams but also for building a strong foundation for a successful career in accountancy and finance.

Understanding the Importance of Financial Reporting:

Financial Reporting (FR) is a cornerstone of the CA curriculum, encompassing principles, standards, and regulations governing the preparation and presentation of financial statements. CA Inter and CA Final FR examinations assess candidates' understanding of accounting standards, corporate financial reporting practices, and their ability to apply theoretical knowledge to practical scenarios.

Challenges Faced by Aspirants:

Complexity of Concepts: Financial Reporting involves intricate concepts such as consolidation, accounting for amalgamations, and fair value measurement, which can be challenging to grasp initially.

Vast Syllabus: The syllabus for CA Inter and CA Final FR is extensive, requiring candidates to cover a wide range of topics within a limited timeframe.

Dynamic Regulatory Environment: Keeping up with the frequent changes in accounting standards and regulatory requirements adds another layer of difficulty for aspirants.

Tips for Success:

Build Strong Fundamentals: A solid understanding of basic accounting principles is essential for tackling advanced topics in Financial Reporting. Take the time to grasp concepts such as double-entry accounting, recognition, measurement, and disclosure criteria.

Effective Time Management: Create a study schedule that allocates sufficient time to each topic in the syllabus. Prioritize areas of weakness while ensuring adequate revision of familiar topics.

Practice, Practice, Practice: Solve as many practice problems and past exam papers as possible to familiarize yourself with the exam format and improve problem-solving skills. This will also help in developing speed and accuracy, crucial for success in CA exams.

Stay Updated: Keep abreast of the latest amendments to accounting standards and regulatory changes by referring to ICAI study materials, supplementary materials, and professional publications. Joining study groups or forums can also provide valuable insights into contemporary issues in Financial Reporting.

Seek Guidance: Don't hesitate to seek guidance from experienced faculty members, mentors, or peers if you encounter difficulties understanding certain concepts. Engaging in discussions and seeking clarification can enhance comprehension and retention.

Mock Tests: Participate in mock tests and mock interviews to simulate exam conditions and identify areas that need improvement. Analyze your performance in these tests to refine your exam-taking strategies.

Stay calm and Confident: Maintain a positive attitude towards your preparation and approach the exams with confidence. Remember that thorough preparation and self-belief are key to overcoming exam anxiety and performing well on the day of the exam.

Conclusion:

Preparing for ICAI CA Inter and CA Final FR examinations requires dedication, discipline, and a strategic approach. By focusing on building a strong conceptual foundation, effective time management, and regular practice, aspirants can navigate through the challenges posed by these exams successfully. Remember, becoming a Chartered Accountant is not just about passing exams; it's about acquiring the knowledge and skills necessary to excel in the dynamic world of finance and accounting.

0 notes

Text

ACCA Journey – From Beginner To Professional

If you're a millennial with a passion for accounting and finance, then the ACCA (Association of Chartered Certified Accountants) qualification is the perfect fit for you. ACCA is a globally recognized finance & accounting qualification that prepares you for a career in fields of finance, accounting and audit. However, the ACCA journey from novice to pro is not an easy one. It requires dedication, hard work, and a passion for the subject. In this article, we'll take you through a journey from novice to pro, exploring the steps you need to take to become an ACCA professional.

Step 1: Understanding the basics.

Before you embark on your ACCA journey, it's important to understand what the qualification is all about. The ACCA qualification consist of three levels, starting with the Applied Knowledge exams and progressing to the Strategic Professional exams. The qualification is recognized internationally and employers all around the world prefer ACCA professionals.

Step 2: Enrolling in an ACCA program.

The next step in your ACCA journey is to enroll in an ACCA program. To know more on how to enroll acca course details.

Step 3: Studying hard.

Studying for the ACCA exams is not easy, and it requires a lot of dedication and hard work. The practically oriented exams are challenging and require a deep understanding of accounting concepts and principles. Therefore, you'll need to put in the time to read and understand the study materials, practice exam questions, and attend classes or webinars. However, there are plenty of resources available to help you along the way, including study guides, online forums, and study groups. We at IndigoLearn focus on in depth conceptual clarity and examination success. Click here to know more.

Step 4: Gaining practical experience.

In addition to passing the exams, the ACCA also requires you to gain practical experience (PER) in relevant accounting and finance. You'll need to complete 36 months of supervised experience before you can become an ACCA member. Practical experience is a vital component of the ACCA qualification, as it allows you to apply the concepts and principles you've learned in a real-world setting.

Step 5: Becoming an ACCA member.

Once you've passed all the required exams and gained the necessary practical experience, it's time to apply for ACCA membership. As a member, you'll have access to a wide range of benefits, including networking opportunities, career support, and continuing professional development resources. Additionally, ACCA members are highly respected in the industry, which can lead to better job opportunities and higher salaries.

Step 6: Continuing your professional development.

Becoming an ACCA member is just the beginning of your successful professional journey. To stay ahead in your career and continue to grow, you'll need to keep learning and developing your skills. The ACCA offers a wide range of continuing professional development resources, including courses, webinars, and events. Additionally, ACCA professionals are required to maintain their membership through ongoing professional development, ensuring that they stay up to date with the latest developments in the field.

In conclusion, the ACCA journey from novice to pro requires dedication, hard work, and a passion. However, for millennials who are inclined in pursuing a career in accounting and finance, the ACCA qualification can be an asset. Therefore, if you're interested in ACCA and want to know more in detail click here.

0 notes

Text

Navigating the CA Final New Syllabus: Understanding Pass Percentages and Success Strategies

The Chartered Accountancy (CA) Final examination, administered by the Institute of Chartered Accountants of India (ICAI), is the ultimate milestone for aspiring chartered accountants. With the recent introduction of the CA Final New Syllabus, candidates are facing new challenges and opportunities. Understanding the pass percentages and devising effective strategies are crucial for success in this rigorous examination.

CA Final New Syllabus: The CA Final New Syllabus was introduced to align with international accounting standards and to ensure that candidates are equipped with the latest knowledge and skills required in the dynamic field of accountancy. The updated syllabus includes contemporary topics such as International Financial Reporting Standards (IFRS), Ind AS, and advanced auditing techniques, reflecting the evolving needs of the profession.

Pass Percentages: CA final pass percentage is a reflection of the overall performance of candidates and the difficulty level of the examination. Historically, the pass percentage has varied, influenced by factors such as syllabus changes, exam pattern modifications, and the preparedness of candidates. With the introduction of the new syllabus, there may be fluctuations in pass percentages as candidates adapt to the revised curriculum.

Strategies for Success:

Early Preparation: Start preparing for the CA Final examination well in advance, allowing sufficient time to cover the entire syllabus comprehensively. Allocate dedicated study hours and create a realistic study schedule to stay on track.

Understand the Syllabus: Familiarize yourself with the CA Final New Syllabus and its nuances. Identify the weightage of each topic and prioritize areas that require more attention. Stay updated with any revisions or amendments made by ICAI.

Practice Regularly: Practice solving past exam papers, mock tests, and sample questions to gauge your preparation level and improve time management skills. Practicing under exam-like conditions helps in reducing anxiety and increasing confidence during the actual examination.

Seek Guidance: Enroll in a reputed coaching institute or seek guidance from experienced mentors who can provide valuable insights and strategies for tackling the examination effectively. Joining study groups or online forums can also facilitate collaborative learning and knowledge sharing.

Revision and Self-assessment: Allocate sufficient time for revision before the examination and consolidate your understanding of key concepts. Conduct self-assessment tests to identify weak areas and focus on improving them. Utilize revision notes and mnemonic techniques to aid memory retention.

Maintain a Healthy Lifestyle: Take care of your physical and mental well-being during the preparation phase. Maintain a balanced diet, exercise regularly, and ensure an adequate amount of sleep. Managing stress and maintaining a positive mindset is essential for optimal performance. Conclusion: The CA Final examination is a rigorous test of knowledge, skills, and perseverance. With the introduction of the CA Final New Syllabus, candidates need to adapt their preparation strategies to meet the evolving demands of the profession. By understanding pass percentages and implementing effective study techniques, aspiring chartered accountants can increase their chances of success in this prestigious examination. Remember, dedication, discipline, and determination are key to achieving your goals in the CA Final examination.

0 notes

Text

Top 5 Reasons Why You Should Do ACCA after CA

In the dynamic world of accounting and finance, achieving the coveted Chartered Accountant (CA) qualification is a significant milestone. It shows dedication to precision, adept analysis, and upholding financial integrity.

However, this path need not conclude with a CA designation. The financial landscape keeps changing. By incorporating the Association of Chartered Certified Accountants (ACCA) qualification, it may be further enriched and expanded.

In a global study of 1300 employees, 50% rated ACCA as a top professional organization and had positive views about pursuing ACCA. Let's explore how an ACCA after CA may be a game-changer towards a future of endless opportunities.

Can you pursue ACCA after CA from ICAI?

CA is one of those flagship qualifications that is very difficult to clear. For many students who study hard and sacrifice to become a CA, it is like a dream come true.

ACCA is a UK-based global accounting body and is comparable with the ICAI's local qualification in India. They have a global community of 241,000 members and 542,000 future members based in 178 countries. Around 15000 Indians are members of ACCA.

ACCA complements CA, and does not compete with it. ACCA's foundation in accounting, reporting, and business strengthens the foundation of CA.

Unlocking Dual Expertise: Benefits of Doing ACCA After CA

Global Recognition

ACCA is a globally recognized qualification. The US Bureau of Labor Statistics predicts a consistent 6% increase in accountants and auditors employed between 2021 and 2031.

The demand for ACCAs in the Big 4 and global organisations, such as Accenture, IBM, EY, PwC, Oracle, UBS, Barclays, etc., has increased recently.

Earning Potential with Dual Qualification

The pay that organizations offer after completing ACCA is a major factor in why most people choose this dual degree path.

With this dual degree, there's no denying that pay would be significant even when you start as a fresher. The starting salary for an ACCA member in India can range from INR 4 Lakh annually and can reach up to 15 lakh p.a.

Expedited Learning Journey

ACCA allows candidates to pass all three certification exam levels within ten years of registration. But it usually takes two to three years to pass all three levels.

Completing the ACCA after obtaining a CA qualification reduces the time required to pass the ACCA examination by several months. The ACCA after CA duration is around 18 months.

Moreover, students who have already completed their CA qualification are eligible for concessions or exemptions on ACCA fees. The average ACCA after CA fees, including the tuition fees, are approximately INR 1.8 lakh.

Advanced Financial Skills and Strategic Vision

Leaders need to be flexible in today's changing global economy. ACCA gives you the necessary advanced financial skills and innovation for strategic and leadership positions worldwide.

These include:

Reporting on financial performance

International taxation

Legal compliance

Risk and control assessment

Corporate audit and assurance

Management reporting

Strategic alliances (M&A)

Business/financial analysis

Leveraging CA Exemptions for Swift Success

When pursuing ACCA after CA, you gain the remarkable benefit of ACCA after CA exemptions. This allows you to speed up through the ACCA program with credits from your CA qualification.

Out of the total 13 ACCA papers, CA students are eligible for up to 9 exemptions. You are eligible for 5 exemptions from the total 13 ACCA papers if you cleared the CA Inter level. Hence, you can clear the ACCA exam within 18 months.

Key Takeaway

Combining CA with ACCA offers a robust foundation in accounting, reporting, and business acumen. Pursuing ACCA after CA is not about adding to your qualifications. It also establishes yourself as a flexible and in-demand professional.

By pursuing this dual degree, you're on a path of continuous learning and growth. Besides, you have unparalleled opportunities in the ever-evolving finance and accounting world.

Ready to elevate your career in finance and accounting? Explore 1FIN by Indigolearn for the perfect blend of CA and ACCA expertise. Unlock limitless opportunities for continuous learning and professional growth today!

0 notes

Text

CFA for Non-Finance Students: How to Do it?

When it comes to taking the Chartered Financial Analyst (CFA) exams, having a background in the field undoubtedly provides a head start. But does that mean you cannot do it if you do not have an experience in the financial background? Not at all!

In this article, we will explore whether not having an academic background in Accounting or Finance puts you at a disadvantage when attempting the CFA exam.

While a finance background might offer some familiarity with certain concepts, your success in the CFA exam is more heavily influenced by your determination and disciplined approach to studying.

As a Reddit user says:

Study Tips for Non-Finance Background Students Pursuing the CFA Exam

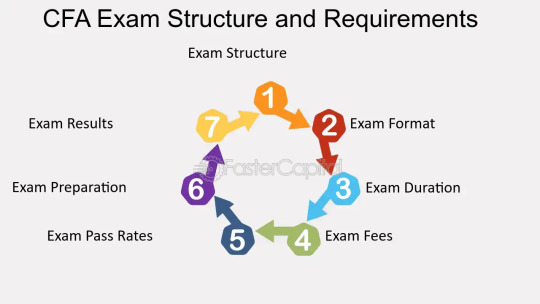

Understanding CFA Exam Levels

Before delving into your study plan, it's crucial to understand the differences between the CFA online exam levels. Take some time to read articles explaining the distinctions between cfa level 1 and Level II, as well as between Level II and Level III. This knowledge will guide your preparation strategy for each level.

Each level has a different approach and a question paper style. Make sure you understand these differences before you begin to study. While some papers test your fundamental skills, others focus on testing your application and interpretive thinking capacity. Each level pushes your limits. Knowing how they do it can help you prepare accordingly.

Develop a Comprehensive Study Plan

Begin crafting your study plan at least 9 months before your scheduled exam date. While the CFA Institute suggests dedicating around 300 hours of study, consider investing approximately 360 hours or more. This extra time accounts for mastering concepts that finance professionals might already be familiar with.

Allocate the initial 120 hours to reading and listening to lectures. 1FIN by IndigoLearn provides CFA Classes with the world’s no. 1 resource - Kaplan Schweser. Then, dedicate roughly 150 hours to working through practice questions. Reserve the final 90 hours for realistic practice and mock exams, which simulate actual exam conditions and help you gauge your readiness. These mock exams are also valuable for learning how to maintain composure on the actual exam day.

The CFA Institute has some free mock tests to work on. It can give you an idea of the expected questions in the exam. However, it should only be a rough guide for your study plan.

Incorporate Learning Outcome Statements (LOS)

Mastering Learning Outcome Statements (LOS) is pivotal in shaping a robust study plan. Each LOS is paired with a command word, a strategic indicator of the cognitive demands it poses. Although these command words might not be explicitly present in exam questions, they dictate the depth of understanding required in your responses.

The CFA program employs seventeen official command words, each conveying a specific purpose. From "analyze" which dissects components, "calculate" which demands numerical prowess, to "describe" which articulates features using words, these words shape the essence of your exam responses.

Integrating these command words into your study journey makes sure you can cover the exam material in the most effective way possible. Align your study approach with the demands of each command word.

Being thoroughly aware of the learning outcomes, you can ensure you tackle the questions most effectively and showcase your grasp of the subject matter. This strategy becomes a potent tool, enhancing your readiness for exam success.

Leverage CFA Exam Prep Courses

It is admirable to attempt to write the exam with self-preparation. But is it the most effective way?

Our experts suggest the use of seasoned instructors and curated study materials provided by a reputable prep organization to improve your chances of success. You can also use this time to learn finance for non-finance students to bridge your gap between the topics.

Enroll in a CFA exam prep course to help you stay on track and organized. Treat the course like you would a university class. Before attending, familiarize yourself with the relevant materials and develop a basic understanding of the topics that will be covered. Prepare a list of questions you'd like to ask during the course to maximize your learning experience.

cfa institute India is a great option to begin with. Our partnership with Kaplan Schweser provides you with some of the best study materials on the topic.

Relate Concepts to Real-World Applications

For a better grasp of the material, consider how each concept applies in real-world scenarios. If you are feeling unsure, seek guidance from individuals with experience in the field. Engaging with resources like local CFA Societies, online forums, or financial education meet ups can connect you with professionals who can provide practical insights.

Investing your time to network and learn from experienced people can help you gather a better understanding of the world you want to enter.

Take Breaks to Combat Overwhelm

Let us not trivialize the exam and your efforts by calling it easy. There is a huge load of portions to cover. The formats are challenging, and the effort demanded from a candidate is huge.

As you progress, you might experience moments of overwhelm. It is quite natural too. You might end up questioning the value of your efforts. When this happens, resist the urge to give up.

Instead, grant yourself a short break of a few days or even a full week. During this time, refrain from answering practice questions or opening your study materials. You'll be surprised at how even a brief respite can rekindle your motivation and enthusiasm for your studies.

By adhering to these study tips, non-finance background students can confidently navigate the challenges of the CFA examination and achieve their desired outcomes.

1 note

·

View note

Text

Enhancing Efficiency and Durability with Ceramic Tap Cartridges and Water Tap Valves

As we celebrate the one-year anniversary of technological advancements in the field of plumbing, it's crucial to highlight the pivotal role played by ceramic tap cartridges and water tap valves in revolutionizing water management systems. These components have not only improved the efficiency of water taps but have also significantly contributed to the durability and longevity of plumbing fixtures.

The Rise of Ceramic Tap Cartridges:

Ceramic tap cartridges have emerged as a game-changer in the world of plumbing. Traditionally, rubber or plastic washers were used in tap mechanisms, leading to frequent leaks and wear and tear. However, with the advent of ceramic tap cartridges, these issues have become a thing of the past.

The ceramic material used in these cartridges is known for its exceptional hardness and resistance to wear. This translates to a longer lifespan for tap mechanisms, reducing the need for frequent replacements and repairs. Additionally, the smooth surface of ceramic ensures a frictionless operation, allowing for easy and precise control of water flow.

Benefits of Ceramic Tap Cartridges:

Durability: Ceramic tap cartridges are known for their robustness and resistance to corrosion, ensuring a longer lifespan compared to traditional materials.

Smooth Operation: The inherent smoothness of ceramic allows for seamless operation, reducing friction and wear over time.

Water Conservation: The precise control offered by ceramic tap cartridges enables users to manage water flow more effectively, contributing to water conservation efforts.

Water Tap Valves: A Crucial Component:

Water tap valves, although often overlooked, play a crucial role in the overall functionality of water taps. These valves regulate the flow of water and control its temperature, ensuring a seamless and user-friendly experience.

The Importance of Quality Water Tap Valves:

Reliability: High-quality water tap valves guarantee reliable performance, preventing sudden leaks or temperature fluctuations.

Temperature Control: Modern water tap valves come equipped with advanced temperature control features, allowing users to set and maintain their desired water temperature accurately.

Energy Efficiency: Efficient water tap valves contribute to energy conservation by preventing unnecessary heating or cooling of water, thus reducing energy consumption.

The Synergy of Ceramic Cartridges and Water Tap Valves:

When combined, ceramic tap cartridges and high-quality water tap valves create a synergy that elevates the overall performance of water taps. The durability of ceramic ensures long-lasting reliability, while precision valves contribute to efficient water management.

Conclusion:

As we reflect on the progress made in the plumbing industry over the past year, it's evident that innovations such as ceramic tap cartridges and water tap valves have played a pivotal role in enhancing the efficiency and durability of water taps. By embracing these advancements, we not only improve the functionality of our plumbing systems but also contribute to sustainable water use and conservation efforts. Here's to another year of innovation and progress in the world of plumbing!

0 notes

Text

The Value of CFA Soft Skills

If there is one thing as important as technical skills for a finance professional, then it is soft skills. A report by the CFA Institute titled The Future of Work in Investment Management: The Future of Skills and Learning has findings that prove this. The survey revealed that technical skills would pay off at the entry level. But, it is the soft skills that will matter over time. A Stanford and Harvard study shows that 85% of job success is directly related to soft and people skills. Only 15% comes from technical skills.

With new data sources emerging, the technical skills required for the investment industry are changing. But, most of the soft skills remain the same. Skills like time management, direct communication and being resourceful are taking center Centre stage.

Let us look at what are the essential soft skills for a CFA and how they add value to the job.

Before that, if you are thinking to join CFA, do check 1FIN by IndigoLearn. Call us on 9640111110

Emphasizing Salesmanship for Every CFA Professional

We are at a point in time where everyone is a salesman. Everyone is out there pitching an idea and selling something. This is true for a CFA professional as well.

A skilled CFA professional should be able to sell, persuade and build strong client relationships. A finding from The Future of Work in Investment Management: The Future of Skills and Learning confirms this. The study says soft skills now revolve around influencing, persuading, and negotiating with people.

A popular TED talk by Daniel Pink on the art of selling demonstrates this. He asserts that everyone is, in a broader sense, involved in sales. This sentiment holds particularly true in the finance industry. It is all about client interactions which determine the success of any organizations. CFAs, as representatives of their firms, are responsible for conveying technical knowledge. They also need to build trust and rapport with clients.

The competition in the financial services sector is fierce, and client trust is paramount. Here effective salesmanship makes all the difference. With a client-centric approach, CFA professionals can create better work relationships.

Explaining Articulating Complex Topics with Simplicity

Understanding a technical concept is one thing, but conveying it in simple terms is the hard part. A CFA professional must explain complex financial topics to others in simple language. They will have to evaluate news, grasp market trends and effectively translate them to clients. This will directly lead to better trust, engagement and strong relationship with the clients.

According to Lead squared, mastering the art of explanations can increase brand loyalty and improve customer retention. It also opens up opportunities for up-selling and cross-selling. What it does is it reduces the sales cycle as customer advocates for their services.

Thought Leadership and its Impact on Career Growth

Thought leadership is important in all industries because it helps organizations become experts and leaders in their field. This helps others to learn and grow. Thought leadership is about growth, innovation, and creating opportunities.

The CFA Institute's Future of Finance program focuses on developing thought leadership. It helps create a more trustworthy, forward-thinking investment professional.

Investing in thought leadership has other advantages as well. It increases the credibility of the organization. As an expert in the field, clients, colleagues, and potential employers will find you more insightful.

Like other soft skills that help advance a career, thought leadership also helps climb the ladder. A CFA with such a skill demonstrates expertise and value to potential employers.

Tips to Strengthen Soft Skills for CFA Professionals

CFA institute India help CFA professionals to build their Soft skills for succeed in their careers. These skills can help professionals effectively interact with clients, colleagues, and stakeholders. Here are some tips for building soft skills as a CFA professional.

Get professional training: Professional training can ensure you have the necessary skills to succeed. This can include workshops, courses, or other training opportunities. It should focus on communication, teamwork, and other essential soft skills.

Utilize industry resources: Many industry resources and workshops are available to help CFA professionals improve their communication skills. Find ones that are relevant to you and most accessible. These can include online courses, webinars, or in-person workshops by veterans.

Find mentorship programs: The value of mentorship and continuous learning in honing soft skills is immense. Working with a mentor can provide guidance and support to develop your skills. You can learn the best practices from experienced people. It also opens up a lot of networking opportunities.

Practice active listening: Active listening involves fully focusing on the speaker, understanding their message, and providing appropriate feedback. This skill is essential for building strong relationships with clients and colleagues. A CFA professional will find this skill handy.

Developing EQ: Emotional Intelligence, also known as Eemotional Quotient (EQ), is a critical skill that needs nurturing. It involves being aware of and managing your own emotions. It is also understanding and responding to the emotions of others. This skill can help you navigate challenging situations and build strong relationships. It is an essential skill for a leader.

Practice communication skills: One of the best ways to get better at communication skills is to practice them. Consider taking a course or workshop to get ample practice.

Seek feedback: Ask your colleagues, mentors, or supervisors for feedback on your soft skills. This can help you identify areas for improvement and develop a growth plan.

Get involved in teamwork: Teamwork is essential for achieving shared goals and collaborating effectively with colleagues. Practice active listening, clear communication, and conflict resolution to strengthen your teamwork skills.

Key Takeaway

No one can deny the value of soft skills for CFA professionals. As the finance industry evolves, CFA professionals must invest in both technical and soft skills. It opens up opportunities for growth, innovation, and exceptional career advancement.

It is clear from the CFA Institute's report that technical skills may be crucial for entry-level positions, but soft skills matter in the long run. Effective communication, being an expert salesman, and breaking down complex concepts are all essential soft skills that a CFA must master.

If you aspire to unlock your potential as a finance professional, it's time to start brushing up your soft skills.

To start with CFA or to know more about it visit 1finin/cfa or contact us on 9640111110.

At IndigoLearn, we are here to support you through your journey to becoming a CFA. Join us to take the first step towards a successful and fulfilling career in finance. Your future as a CFA awaits!

0 notes

Text

CFA vs. MBA A Comparison of the Two Most Popular Programs in Finance!

The Chartered Financial Analyst (CFA) program and the Master of Business Administration (MBA) degree are two prominent paths for those aspiring to build a career in finance. But how do they compare? How is one different from the other? And most importantly, which one should you choose?

The decision to pursue a CFA program or an MBA degree depends on numerous factors. Some individuals even undertake both programs as they provide complementary skill sets and knowledge. In fact, it is not uncommon for prospective MBA candidates in India to complete the CFA Level 1 or Level 2 exams prior to joining a business school, signaling their commitment to the finance industry to potential employers during internships.

However, not everyone has the opportunity or desire to pursue both qualifications simultaneously.

Whether you are interested in acquiring both credentials and any one of them, knowing the differences between these programs is crucial. It’s the first step to making informed decisions and charting a successful career trajectory.

In this blog, we’ll discuss how a CFA program and an MBA degree compare and explore the differences from various angles.

What’s Your Career Plan?

The choice between a CFA program and an MBA degree largely depends on your career goals within the finance industry.

If your aim is to move up within finance, the CFA institute India is a compelling option. It equips professionals with specialized knowledge for roles like investment research analyst, portfolio manager, or asset manager. The rigorous curriculum covers financial analysis, valuation, investment management, and ethics, demonstrating expertise and dedication.

An MBA degree provides a broader skill set for those seeking a career switch or exploring different avenues in finance. It covers finance, marketing, operations, strategy, and leadership, opening doors to corporate finance, investment banking, consulting, or entrepreneurship roles. An MBA equips you with skills to navigate complex business challenges and offers a holistic understanding of different functional areas.

Both the CFA program and an MBA degree can be beneficial for entry-level positions in finance. The CFA program offers a quick path to employment after Level 1 or Level 2. On the other hand, one must complete the full MBA program to be considered for the job. However, MBA internships are a good way to experience different domains of finance before deciding to pick one.

Ultimately, your career goals and desired specialization will determine whether the CFA program or an MBA degree better fits your aspirations.

Cost of Pursuing CFA vs. MBA

The cost implications of pursuing a CFA program or an MBA degree can significantly influence the decision-making process. Generally, the CFA program is considered more cost-effective than an MBA.

The primary expenses for the CFA program include the CFA Institute exam registration fee for 3 levels of CFA exam and any fee for coaching or preparatory materials. In India, the cost of pursuing the CFA program typically ranges from ₹2.5 lakh to ₹3.25 lakh, excluding coaching expenses.

On the other hand, pursuing an MBA can involve substantial financial commitments. The cost of an MBA program varies based on factors such as the reputation and location of the institution. Indian Institutes of Management (IIMs) often have higher tuition fee (ranging between ₹ 12-24 lakhs), and foreign MBA programs, especially those offered by renowned business schools, can be significantly more expensive. One must also consider the potential loss of income during the study period, as many students forego employment to focus on their studies.

How Long Does It Take to Complete Each Course?

The time commitment required for completing a CFA program or an MBA degree is crucial when deciding between the two.

For the CFA program, candidates often pursue it while working – it can be completed in 2 to 2.5 years if a candidate clear all levels in the first attempt. One must dedicate approximately 300 hours or more of study time for each level.

On the other hand, an MBA program typically requires a dedicated commitment of two years full-time. (There are some one-year MBA programs too like ISB and INSEAD) This period allows students to immerse themselves in the curriculum, participate in internships or experiential learning opportunities, and build a strong professional network.

Salary to Expect After Pursuing Each Program:

In terms of salary levels, the CFA Institute conducts surveys to provide insights into compensation trends for CFA charter holders. A recent survey of 2000+ CFA constituents from India’s major cities revealed that a new charter holder with 6 years of work experience on an average earn ₹28.6 LPA.

On the other hand, for MBA graduates, referring to placement reports of specific business schools can provide an understanding of the salary levels and job opportunities typically associated with an MBA degree. According to National Institutional Ranking Framework, the average MBA salary in India can be anywhere from ₹ 6- ₹23 LPA, depending on the rank of the business school you're graduating from.

How difficult is it to Enroll?

The enrollment requirements and difficulty level differ between the CFA program and an MBA degree.

To enroll in the CFA program, candidates must meet any one of the three criteria set by the CFA Institute. These criteria include

Completed a bachelor's degree, or

Pursuing a bachelor's degree and being within last two years of its completion, or

Having 4,000 hours of work experience and/or higher education.

The enrollment process is straightforward, allowing individuals with diverse backgrounds to pursue the program. However, the CFA exams are known for their challenging nature, with pass rates typically hovering around 45%, requiring diligent preparation and commitment.

In contrast, enrollment for an MBA program typically requires a bachelor's degree. For reputable institutions, additional entrance exams such as CAT/GMAT (for Indian colleges) or GMAT/GRE (for foreign programs) are necessary. MBA programs can be more competitive, with admission committees considering factors like academic achievements, work experience, recommendation letters, and personal statements.

Curriculum & Exam Format of CFA Vs. MBA

The curriculum and exam formats differ between the CFA program and an MBA degree.

The CFA program is structured around ten topics covering ethics, economics, financial analysis, and portfolio management, to name a few. Exams are conducted in testing windows and consist of multiple-choice questions (MCQs) for all three levels. Level 3 also includes essay-type questions that assess candidates' ability to apply their knowledge and critical thinking skills.

In contrast, the MBA curriculum offers a broader range of topics, encompassing various business areas such as finance, marketing, operations, and strategy. The evaluation methods in MBA programs typically involve semester or term-end exams, assignments, class participation and projects. Additionally, internships or experiential learning opportunities may form an integral part of the curriculum to provide practical exposure and real-world application of concepts.

What Type of Placement Support You’ll Get

The level of placement support differs between the CFA program and MBA degrees.

The CFA Institute does not directly provide placement services. However, each local CFA society in a particular country may list job vacancies on its website, offering opportunities for CFA candidates and charter holders. Having a CFA designation enhances job prospects compared to those with only a bachelor's degree. Leveraging platforms like LinkedIn and tapping into the global CFA network can benefit networking and accessing job opportunities.

On the other hand, MBA colleges in India typically provide robust placement support, connecting students with potential employers. These institutions often boast strong alumni networks, providing additional support and industry connections to secure internships and job placements. The alumni network of MBA programs is often vibrant and active, offering valuable resources and networking opportunities to help students advance their careers.

Conclusion

The decision between pursuing a CFA program or an MBA degree should be driven by carefully considering various factors. Both offer unique advantages and cater to different career goals within the finance industry.

The CFA program provides a rigorous curriculum and globally recognized credentials for those seeking specialized knowledge and advancement in finance roles. It equips professionals with the necessary skills to excel as investment research analysts, portfolio managers, or asset managers. With its relatively lower cost and flexible study options, the CFA program offers a viable path for individuals seeking to enhance their finance careers.

On the other hand, an MBA degree offers a broader skill set and a holistic business education. It is ideal for individuals seeking a career in finance or exploring various avenues within the business world. An MBA provides opportunities to develop a strong network, gain practical experience through internships, and acquire various business skills.

0 notes

Text

How to Prepare for the CFA Exams

The Chartered Financial Analyst (CFA) exams are known for their difficulty. Even though Levels 1 & 2 are only MCQ-based and without negative markings, only 45-50% of the students manage to clear the exams successfully.

However, with the right tools and strategies, it is possible to clear the CFA exams comfortably and earn this prestigious certification.

Not only does the CFA designation demonstrate a high level of commitment and knowledge, but it also opens up opportunities for higher earning potential and career advancement i. Overall, it is a highly desirable qualification.

Coaching Over Self Learning

Like any other exam, one can prepare for cfa preparation also with self-study. But is it the easiest way?

Our experts suggest that if you take the assistance of a good training institute, like 1FIN by IndigoLearn, your chances of success go up multifold. The exam in itself will cost you a good amount, so why take the risk and lose the money for multiple attempts?

Choose a well-established, reputed training provider like 1FIN and increase your chances of succeeding. The structured and goal-oriented learning provided at a training institute will also greatly help you if you do not have a background in finance or accounting.

Focus on Concepts

The CFA exam is highly concept-oriented, meaning that it tests your understanding of the underlying concepts rather than just your ability to memorize facts. The questions can be very tricky and require a deep understanding of the material to answer correctly. Training can be very helpful in clearing up any confusion and solidifying your understanding of the concepts.

Study materials like those provided by Kaplan Schweser offer a concise look at the concepts, making it easier to grasp the concepts. 1FIN has partnered with Kaplan Schweser to provide their students with these high-quality study material. By focusing on the concepts, you can increase your chances of success on the CFA exam.

Use the Best Study Materials

Using the best study material is crucial for success on the CFA exams. 1FIN by IndigoLearn provides Kaplan Schweser materials, which are widely regarded as the best in the industry. These materials are concept-oriented and concise, making it easier to grasp the material and prepare for the exam.

The cfa institute India also provides study material, but it tends to be bulkier and more in-depth. While the material can be useful for gaining a deeper understanding of the concepts, it may not be as efficient for exam preparation.

Ultimately, it is important to choose study material that works best for your learning style and needs.

Attend Mock Tests

Attending mock tests is an important strategy for preparing for the CFA exams. Since the CFA exams do not have previous question papers available, the mock tests provided by the CFA Institute are a good guide on what to expect on the actual exam. Some mock tests are available for free on their website, while others are available for purchase.

Kaplan Schweser also offers a variety of mock tests to help candidates prepare for the exam. By taking mock tests, you can familiarize yourself with the format and content of the exam, identify areas where you need to improve and build confidence in your ability to succeed on the actual exam.

Focus on Topics Strategically

To maximize your chances of success in the CFA exams, it is important to strategically select the topics you focus on. The exam questions are weighted by topic area, so you should weigh your studying similarly.

For Level 1, Pay special attention to the Ethical and Professional Standards section, which accounts for 15-20% of the exam. A strong performance in this section can ensure you can secure a good portion of the score.

Other important topic areas to focus on include Quantitative Methods (8-12%), Economics (8-12%), Financial Statement Analysis (13-17%), Corporate Issuers (8-12%), Equity Investments (10-12%), Fixed Income (10-12%), Derivatives (5-8%), Alternative Investments (5-8%), and Portfolio Management and Wealth Planning (5-8%).

0 notes

Text

Common Mistakes to Avoid When Taking the CFA Exams!

The Chartered Financial Analyst (CFA) exams are renowned for testing conceptual understanding of the financial markets and hold significant importance in the field of investment management. Cracking the exam requires a disciplined and rigorous journey where there is no room for mistakes.

The CFA (Chartered Financial Analyst) exams are a rigorous series of examinations divided into three levels. These exams have varying passing rates and levels of difficulty. Over the past decade, the pass rates for each level of the CFA exams have been as follows: Level I - 41%, Level II - 45%, and Level III - 52%. These pass rates indicate the challenging nature of the exams and the need for thorough CFA preparation and dedication.

While the pass rates may seem challenging, there is hope for candidates through prep providers like 1FIN. While 1FIN offers a pass protection scheme, it is important to note that retaking the CFA exam would still require candidates to pay the registration fee again to the CFA Institute.

To excel in these exams and unlock promising career opportunities, it is crucial to avoid common mistakes that candidates often encounter. This article aims to delve into some of these mistakes and provide valuable insights on how to avoid them, paving the way for success in the CFA exams.

Mistakes to Avoid When Taking the CFA Exams

1. Starting the CFA preparation late

Starting late in preparing for the CFA exams can significantly affect a candidate's performance. Adequate preparation is crucial for success, and failing to begin studying on time can lead to insufficient coverage of the exam syllabus. The CFA Institute recommends 300+ study hours for each exam level, and adhering to these guidelines is essential.

By starting late, candidates may not allocate sufficient time to grasp the complex concepts tested in the exams. This can result in a lack of conceptual clarity, making it challenging to answer questions accurately. Moreover, starting late increases the risk of missing out on important topics, negatively impacting overall exam performance.

Understanding the exam pattern is also crucial. For Level I, independent multiple-choice questions (MCQs) are presented, while Level II and III involve short case studies followed by MCQs and essay-type questions, respectively. Starting late can limit candidates' ability to effectively tackle these varied question formats, further jeopardizing their chances of success.

To avoid the pitfalls of starting late, candidates should create a study schedule, adhere to recommended study hours, and allocate ample time for concept revision and topic coverage. Beginning the preparation process early allows for a comprehensive understanding of the exam material, increasing the likelihood of success on exam day.

2. Failure to Give Due Weightage to Topics

It is crucial to give each topic its due weight when preparing for the CFA exams. Different topics hold varying levels of importance in the exams, and understanding their weightage can help you prioritize your study efforts effectively.

For example, in Level 1, topics such as Ethics and Financial Statement Analysis (FSA) carry a significant weightage of 15-20% and 11-14%, respectively. Similarly, in Level 3, Portfolio Management & Wealth Planning holds a substantial weightage of 35-40%.

While it's essential to focus on these high-weightage topics, it is equally important not to neglect other areas. Maintaining a well-rounded understanding of all subjects ensures you have a comprehensive grasp of the exam material and can tackle questions from various areas.

You increase your chances of performing well across the exam sections by allocating appropriate time and emphasis to each topic. So, be mindful of the weightage assigned to different subjects and create a study plan that covers all areas adequately.

3. Not Practicing Enough

In addition to having a solid understanding of the concepts, it is essential to dedicate enough time to practice solving questions when preparing for the CFA exams. The exams not only test your knowledge but also your ability to apply that knowledge effectively.

Many questions in the CFA exams present options that may seem similar at first glance. Through practice, you can sharpen your skills in differentiating between these options and selecting the most appropriate answer. By engaging in regular practice, you become familiar with the types of questions asked and the patterns in which they are presented.

The question formats vary across the exam levels. Level I consists of independent multiple-choice questions (MCQs) that require you to select the correct answer from the options provided. In Level II, you encounter short case studies followed by MCQs, which require you to analyze the given scenario and make informed choices. Level III includes short case studies, essay-type questions, and MCQs.

By incorporating practice questions into your study routine, you can apply your knowledge effectively, improve your time management skills, and gain confidence in tackling different question formats. Practice is a valuable tool in refining your exam-taking strategies and boosting your overall performance.

4. Choosing the Right Exam Prep Guide

When it comes to preparing for the CFA exams, self-study is undeniably important. However, the effectiveness of self-study alone can vary depending on individual learning styles and preferences.

Many candidates find prep courses highly beneficial in their CFA exam journey. These courses offer structured study plans, expert guidance, and additional resources that can complement your self-study efforts.

When choosing a prep provider, evaluating certain factors is crucial.

Consider the quality of instructors who can offer valuable insights, clarify concepts, and provide exam guidance.

Assess the study notes and materials provided for effective concept comprehension and comprehensive syllabus coverage.

Check if the provider offers an online interface for exam practice, simulating the actual exam environment and facilitating time management skills.

Indigolearn is the best CFA institute in India is the right prep provider that aligns with your learning style and offers high-quality resources can enhance your preparation and increase your chances of success in the CFA exams.

5. Exam Day Preparation

Preparing for the exam day is crucial to perform your best during the CFA exams. The exams are conducted in a single day, consisting of two sessions, each lasting 2 hours and 12 minutes. To ensure success, it is important to be mentally and physically prepared. Taking sufficient mock exams is essential to build confidence and assess your knowledge. Aim to achieve a target of 70% correct answers in your practice tests, which indicates a solid understanding of the material.

Time management is a critical factor during the exams. Some questions may be more time-consuming than others, so it is important to allocate your time wisely. Avoid spending too much time on a single question and maintain a steady pace throughout the exam. By practicing time management strategies during your mock exams, you can develop the skills to navigate the exam on D-day efficiently.

0 notes

Text

Unlocking Your Potential: Discovering the World of ACCA Courses and Course Details

Are you passionate about finance and accounting? Do you dream of becoming a skilled and globally recognized finance professional? If so, you may want to consider embarking on an exciting journey with the Association of Chartered Certified Accountants (ACCA) course. Whether you are a recent graduate or an experienced professional seeking to enhance your skills, the ACCA course offers a gateway to a world of opportunities in the finance industry. In this article, we will explore what the ACCA course entails and delve into the essential details you need to know before enrolling.

What is the ACCA Course?

The Association of Chartered Certified Accountants (ACCA) is a leading international accountancy organization that provides a comprehensive and globally recognized qualification for finance and accounting professionals. Established in 1904, ACCA has evolved into one of the most respected accounting bodies worldwide, with a presence in over 170 countries and a network of 227,000 members and 544,000 students.

The ACCA course is designed to equip individuals with the knowledge and skills necessary to thrive in the finance industry. It covers a wide range of topics, including financial accounting, management accounting, taxation, audit and assurance, corporate and business law, and more. The course is tailored to meet the demands of the modern business world, ensuring that candidates are well-prepared to face the challenges of a dynamic and ever-changing financial landscape.

ACCA Course Details

Eligibility Criteria: To enroll in the ACCA course, there are no specific academic prerequisites. Anyone with a high school diploma or its equivalent can register as an ACCA student. However, to qualify as an ACCA member, candidates must complete the required examinations, gain relevant practical experience, and adhere to the professional ethics module.

Examination Structure: The ACCA course is divided into several levels, each consisting of a series of examinations. The main levels include the Applied Knowledge, Applied Skills, and Strategic Professional levels. These examinations assess candidates' knowledge and skills at different stages of their journey, progressively becoming more challenging as they advance.

Flexibility: One of the significant advantages of the ACCA course is its flexibility. Students have the freedom to choose their study pace and sit for examinations at their convenience during four exam sessions held throughout the year. This flexibility allows candidates to balance their studies with work or other commitments.

Practical Experience: In addition to passing the required examinations, students must complete a minimum of three years of relevant practical experience to become a fully qualified ACCA member. This practical experience ensures that ACCA members possess the necessary skills and competencies to excel in real-world scenarios.

Global Recognition: ACCA is a globally recognized qualification, respected by employers and financial institutions worldwide. Obtaining the ACCA qualification opens doors to international job opportunities, allowing you to work in diverse industries and regions.

Professional Ethics Module: As part of its commitment to maintaining the highest ethical standards, ACCA requires students and members to complete the Professional Ethics module. This module fosters a strong sense of ethical responsibility and integrity, which are crucial traits for finance professionals.

Conclusion

The ACCA course is a powerful platform that enables individuals to pursue rewarding careers in finance and accounting. With its global recognition, comprehensive syllabus, and emphasis on professional ethics, ACCA equips students with the knowledge and skills to thrive in the competitive finance industry.

If you are ready to unlock your potential and embark on a journey to becoming a respected finance professional, the ACCA course is the ideal path to follow. Take the first step today by enrolling in the ACCA course and embrace a world of opportunities that await you in the fascinating realm of finance. Remember, the journey may be challenging, but the destination is incredibly rewarding.

#acca course#acca course details#acca registration#acca eligibility#acca online coaching#acca exemptions

0 notes

Text

The US CMA Certification: Unlocking New Career Horizons

In today's competitive business landscape, professionals are constantly seeking ways to enhance their skills and advance their careers. One certification that has gained significant recognition and credibility is the US CMA (Certified Management Accountant). Recognized globally, the US CMA certification equips individuals with comprehensive management accounting knowledge and opens doors to exciting career opportunities. In this article, we will delve into the details of the US CMA and explore the benefits of pursuing this esteemed qualification.

What is US CMA?

The US CMA is a globally recognized certification awarded by the Institute of Management Accountants (IMA). It is designed to validate proficiency in management accounting and financial management skills. The certification equips professionals with the ability to make informed business decisions, analyze financial data, and drive overall organizational success. The US CMA program focuses on both financial and non-financial aspects of management accounting, making it a well-rounded qualification for professionals seeking to excel in their careers.

Course Details:

To attain the US CMA certification, candidates must fulfill certain requirements and successfully pass a two-part examination. Here is an overview of the course details:

Educational Requirements:

Candidates must hold a bachelor's degree from an accredited university or college or an equivalent degree from a recognized institution. This educational prerequisite ensures that candidates have a solid foundation in accounting and related disciplines.

US CMA Exam Structure:

The US CMA exam consists of two parts:

a. Part 1: Financial Reporting, Planning, Performance, and Control

b. Part 2: Financial Decision Making

Each part comprises multiple-choice questions and two essay scenarios that assess candidates' understanding and application of management accounting concepts. The exam is computer-based and can be taken at parametric test centers worldwide.

Exam Preparation:

Several reputable institutions offer US CMA courses details to help candidates prepare for the examination. These courses cover the exam syllabus comprehensively, provide practice questions, and offer valuable insights from experienced instructors. Additionally, self-study using official study materials and resources is also an option for motivated individuals.

Benefits of US CMA Certification:

Global Recognition: The US CMA certification is globally recognized, enabling professionals to showcase their expertise in management accounting across borders. It enhances career prospects in multinational organizations and provides a competitive edge in the job market.

Expanded Career Opportunities: Holding the US CMA designation opens doors to a wide range of career opportunities. Certified professionals can pursue roles such as management accountant, financial analyst, cost accountant, budget analyst, financial controller, or even top-level management positions.

Comprehensive Skill Set: The US CMA curriculum covers a broad spectrum of topics, including financial planning, analysis, control, decision-making, and strategic management. These skills enable CMAs to contribute effectively to organizational success by providing valuable insights for decision-making processes.

Higher Earning Potential: US CMA certification often leads to higher earning potential. According to the IMA's 2020 Salary Survey, CMAs earn significantly higher salaries compared to non-certified professionals in similar roles, showcasing the value and return on investment of the certification.

Continued Professional Development: To maintain the US CMA certification, professionals must fulfill continuing professional education (CPE) requirements. This ensures that CMAs stay updated with the latest industry trends, regulatory changes, and best practices, allowing them to remain at the forefront of their field.

Conclusion:

The US CMA certification is a prestigious qualification that validates professionals' management accounting skills and opens up exciting career opportunities. By acquiring this globally recognized credential, individuals can enhance their career prospects, gain a competitive advantage, and contribute significantly to organizational success. The comprehensive curriculum, coupled with the continued professional development requirements, ensures that CMAs remain equipped with

0 notes

Text