Text

Interviewing is a Holistic Process

Introduction

Interviewing is a holistic process. A lot of my audience are students, but this advice applies even to junior professionals. Most of our lives up until we cross the professional threshold center on exams and quizzes. This means you prepare your understanding of a circumscribed subset of knowledge, then you go and get tested on it. Interviews are somewhat like this exam process we’re used to from grade school and college.

In terms of similarities, there are extremely common technical interviews questions that you can and should prepare to answer. In this case, the answer is as easy as studying guides for careers in REPE such as those offered by Leveraged Breakdowns. These easy-to-study questions are generally referred to as technicals, because there are right answers and there are wrong answers.

Behavioral Questions Aren’t Formulaic

But not all interview questions are technical. This fact can catch plenty of new interviewees off-guard. They walk in expecting an exam, might nail the technicals, but otherwise flounder on the behaviorals. Behavioral is a catch-all phrase that refers to the other sorts of interview questions that aren’t so formulaic. But even more than that, behavioral interview preparation encompasses your entire performance throughout the interview.

You will Define the Business

Let’s look at the interview from the company’s perspective. Every hire into an REPE career is a strategic business decision. Each person who works at the company will shape it in some way. Some people are extremely successful and can define the culture of entire departments. If you’re being interviewed, they’re looking to hire the best candidate for the job. If chosen, you will eventually shape the firm’s future. So they want to choose well!

Help your Interviewers Choose You

Interviewing is a sales process. You’re selling yourself as the best fit not just for a career in REPE in general, but at their firm specifically. If you only prepare for technical questions, reciting hard facts and formula, you will not seem like a dynamic problem-solver. Further, if you don’t have any interesting anecdotes to define your life path thus far, you risk seeming uninspired.

Your interviewer will be judged by their investment in you. If they hire well, they will be celebrated internally. If they hire poorly, they’ll lose the right to hire. So they’re taking a risk on picking you. You should use your interview as an opportunity to give your interviewer selling points that they can give to their colleagues. Love the industry, demonstrate curiosity, share interesting anecdotes about your life and character. It’s not easy, but it’s something you need to practice before you step into an interview.

Conclusion

There are a million and a half ways to sell yourself for an REPE career. The mistake is not picking the wrong one, but picking none at all. If you don’t have a strategy to sell yourself when you’re interviewing, then you’re hamstringing your own campaign to land your dream job. If you’re looking for help to improve your interview performance, both technically and behaviorally, check out everything that Leveraged Breakdowns has to offer.

0 notes

Text

Leveraged Breakdowns Will Teach You How You Impress Your REPE Interviewers

Real estate private equity interview questions can seem tough to the untrained outsider. There are so many resources online that teach real estate, how should you prepare? There are countless model walkthroughs, textbook references, the quantity of information can be overwhelming. Wouldn’t it be nice if somebody just told you what to study?

Well in a way, that’s what Leveraged Breakdowns is for. Our team of real estate private equity insiders basically tells you exactly how to prepare for your interviews. Collectively, we’ve been through the processes at most of the major funds and have mentored hundreds of students who have gone through processes with the others. We’ve rolled this knowledge up into the suite of both free and premium products that you can access on our website.

The problem is, a lot people don’t tell you how to actually prepare for an interview. Leveraged Breakdowns believe in specific, direct advice. Our technical guide literally lists entire set of questions we’ve ever encountered when interviewing or helping others interview for these coveted positions. If you get asked a question that our guide didn’t prepare you for, tell us and we’ll include it. We make sure we cover all of your bases.

We get it it, you’re probably studying for real estate private equity interview questions either after your job or between a heavy courseload. You don’t have time to waste reading every textbook and primary source of information. What you need is fast, efficient answers. In fact, that’s what your interviewer needs.

Textbooks and college classes make you a smarter, more well-rounded person. However, they don’t teach you how to absolutely dominate an interview. You could be the smartest and most capable person for the job. But if you don’t answer efficiently and in the way the interviewer expects, then you still may not get hired. Interviewers want to hire people who sound like they already work on the job.

Take the example of a real estate private equity interview case study. You might grasp the ins-and-outs of unlevered cash flows, returns metrics, and operational forecasting. But if you don’t know how to succinctly explain the case efficiently, the interviewer will think you don’t know what you’re talking about. I guess what I’m getting at is this - textbooks and classes will give you the knowledge, but they won’t teach you how to package it.

Leveraged Breakdowns not only teaches you what you need to know, but we also show you how to package your responses in a way that will impress interviewers. We know this industry quite well - both through years upon years of direct and continued industry experience, but also through interacting with hundreds of students who have already found value through our various mentorship options. Our mission is to level the playing field. Why should the lucky few with insider access through friends, family, and alumni have a leg up in real estate private equity interview case studies? If you’re willing to work hard, the opportunity should be yours for the taking.

0 notes

Text

Comparing Cap Rates and Yield on Cost

Let’s say you have an REPE case study where your interviewer asks you to compare the cap rates versus the yield on cost. Why are they asking this question? And how should you respond? This post will unpack the meaning behind the two metrics and how comparing the two can give you insight on a project’s projected success. If you have an upcoming interview and need to study as quickly as possible, check out the REPE career development course starter kit at Leveraged Breakdowns.

Background Information

So let’s say you are going to develop an apartment building. Upon stabilization, you plan to sell this building immediately. So once all apartments have been leased out to a near-stabilized level of occupancy, say about 90% but perhaps up to 95%, you will sell the building. But a few things have to happen before that point:

You need to buy the land and properly entitle it

You have to build the building

You have to lease-up the building and cover the operating shortfall until the building stabilizes

You have to broker and sell the building once it stabilizes

Calculating Stabilized Yield on Cost

This whole process of buying the land and building the building and covering the operating shortfall includes many nuanced costs that we will not cover here. But for simplicity, let’s just say it will cost $100M to do the whole thing from start to finish. And once completed, the building will generate $7M of annual NOI. This brings us to our first metric - the stabilized yield on cost (YoC). To calculate the stabilized yield on cost, simply divide your stabilized NOI by your cost to build. So in this simple scenario, your stabilized YoC is 7.0%. But how does that compare to your exit cap rate?

Exit Cap Rates

Exit cap rates are generally plugs in development models. This means that developers will input a specific number they expect the asset to sell at. Exit cap rates help you calculate your exit value. You calculate exit value by dividing your exit NOI by your exit cap rate. Since you plan to sell this asset at stabilization, your exit NOI will be $7M as described above. Let’s say recent market transactions have made you believe that a 5.0% exit cap rate is a strong estimate for this market. Thus, your exit value is $140M.

Comparing Exit Cap Rate versus Yield on Cost

So the initial question in this REPE case study is to compare the cap rate versus the yield on cost for this deal. Per the above, we can say your exit cap rate of 5.0% implies a 2.0% spread versus your exit yield on cost of 7.0%. What does this quick statement tell us?

You always want a spread between your exit cap rate and your yield on cost. You build for 100 and sell for 140. This difference in denominator generates your spread between cap rate and yield on cost, since both use the exit NOI at stabilization of $7M in their numerator. So, whenever you see a positive spread between cap rate and yield on cost (with cap rate being lower), this means you’re making a profit on your development costs.

Conclusion

You always want to see a spread between cap rate and yield on cost, otherwise your proposed development is unprofitable. If you’re interested in building similar skills with an REPE career development course, check out the courses and interview guides at Leveraged Breakdowns.

0 notes

Text

Questions Preparing For a Real Estate Private Equity Interview

Student: Hello, tomorrow morning I have a 2.5-hour real estate private equity interview case study. The fund primarily focuses on value-add(1) multifamily and office, but they also have a mezzanine debt fund(2). I dont think a full Verdant-style model(3) would be reasonable in four hours - what do you think I should expect? This real estate private equity interview process is for a lightly-experienced analyst role, and I have one year of experience.

Lev: Hey there. To answer your first question, I’d say a promote-based waterfall is fair game at any point during the real estate private equity interview process. You should always expect something where you have to at least have to input rent, forecast growth, set an expense margin, then calculate a gross IRR and build a quick dummy waterfall to arrive at net returns.

To that end, have you worked through the one in the REPE starter kit? Also, you should download the Excel for the preferred case study I posted (see “free cases” on my website), it also has a waterfall example.

Student: Yes, I have worked through the REPE starter kit enough times to construct a paper LBO and promote-based waterfall with no issues. But if I'm asked to give an investment recommendation or something along those lines, what are some talking points I should hit? In other words, what things should never be left out of an elevator pitch? Delivering investment theses is not part of my current job, so I could use some help understanding the structure of a solid investment recommendation.

Lev: You basically want to dictate the equivalent of an executive summary in an investment committee memo. Within 60 seconds, answer the following:

Describe the assets in question, and quickly explain the value-add play. What are neighboring properties charging for higher-end units? How much will a renovation cost to achieve a similar level of finish? Do you think you’ll be able to charge the same as the competition, or a bit less? Ultimately, What ROI does that imply? For instance, a $250 per-unit monthly rent bump (3k per year) at a renovation cost of $10,000 per unit implies a 30% ROI. You typically want something above a ~20% ROI for value-add.

Detail current market dynamics Here you will want to speak through both (1) the historical performance of the sector and (2) the expected future performance, and why you believe it to be true. So for value-add multi, I would recommend emphasizing residential resiliency corroborated by historically low cap rates. And explain how multifamily is a safer sector during uncertain pandemic times as evidenced by higher collection % per NAREIT surveys, etc.

Summarize your pricing in total dollars, PSF, and the entry cap rate

Finish with implied returns, which should match the fund’s hurdle rate(1). That being 20% if opp fund, ~12% if core+ fund, etc.

Endnotes

Learn more about value-add investing and the other categories of REPE (core, core+, opportunistic, etc.) with the Leveraged Breakdowns Complete Bundle

Mezzanine debt is typically the last slice of debt in the capital stack, before preferred equity and common equity

We build a deep-dive model on the hypothetical Verdant Apartments in our flagship course, Breaking Down REPE.

0 notes

Text

Real Estate Private Equity Acquisitions versus Development

The Question

A student once asked: “What are the advantages of real estate private equity and development? Would appreciate personal experiences.” Here is my response.

Response

Hey, I work in REPE investments and teach real estate private equity for beginners over at Leveraged Breakdowns. I do have a bit of experience underwriting developments for our opportunistic fund, yet I mostly underwrite stabilized property acquisitions and public company take-outs. By the way, if you’re looking for the best real estate private equity course, check out all we have to offer.

So, for REPE acquisitions, stabilized properties are further along the life cycle, since they exist already and have in-place tenancy. That said, there is much less guess work involved with stabilized underwriting. On the expense side, you’re already incurring expenses so you know how your opex line will appear. Perhaps you can run the property more efficiently, but you know where the ballpark is. On the revenue side, you have a full tenancy that’s already paying known rents. You might anticipate a renovation which would increase the in-place rents upon turn, but generally you have a lot more existing data for the exact building you’re looking at to confirm your guesses.

On the contrary, development modeling requires much more guessing. Development as a whole is much more speculative since you’re building something that does not yet exist. Further compounding the issue is that developments take years to finish. So you could be right today, but the market could change and you could be wrong tomorrow. At the end of the day, you’re really rolling the dice and guessing at a lot of your assumptions. Because of this, developers are less fastidious about their assumptions and care less for perfection. Instead, they focus more on the business side of effectuating a development. What neighborhoods are up-and-coming? What political hurdles will we need to cross for proper entitlements? Who should be the GP or LP (depending which side you’re on)? Is supply going to be an issue in the submarket you’ve chosen?

So if you’re an analytical person who enjoys working with numbers, you would probably like REPE acquisitions more. Underwriting stabilized properties will allow you to dive into the weeds and poke holes around assumptions. You’ll grind your mental gears a bit more since there is a higher degree of reliability in your data.

On the other hand, development is a better fit for people who care more about the process of creating something new. This isn’t a fully technical process, there are a lot of soft skills you have to enjoy. Expect lots of excitement, shaking hands, meeting new people, facing plenty of risk, and redefining your city’s skyline.

Both are interesting, it’s really about fit. And I want to emphasize that development still is pretty analytical. It’s just that developers are facing more inherent risk, so they literally cannot be as certain as stabilized acquisitions underwriters. Thus, they spend less time nitpicking the assumption details. Instead, they focus on making the building as fast and efficiently as possible, and mitigating risks along the way.

Learn with Leveraged Breakdowns

Leveraged Breakdowns teaches real estate private equity for beginners. We offer the best real estate private equity course for outsiders looking to break into this exclusive industry. We even offer several free case studies for anyone to access and enjoy.

0 notes

Text

The Qualities of a Talented Real Estate Private Equity Analyst

A lot of my readers naturally want a successful career in repe. Most of them are also pretty junior, meaning they’re either undergraduates, business school students, or junior analysts in feeder roles such as investment banking or commercial brokerage. I figured it might be helpful if I try to put together a list of the traits and qualities I’ve seen in the best analysts I’ve met during my career in real estate private equity. Nobody has every trait, but you should emphasize those that are your strongest.

Be a Breath of Fresh Air

You should always be a pleasure to work with. Nobody likes a person that is mopey or complaining, or otherwise intolerable. But if you’re upset or something is rubbing you the wrong way, this doesn’t mean pretend everything is okay. You should always be honest and direct when expressing your opinion. If your firm does not want you to be direct, then that probably isn’t a great place to work anyway. You should build your career in REPE in a place that cares about your individual development.

Think Before you Speak

Silence is golden. As an analyst, I would talk too much. This probably isn’t an issue with most of my readers, but if you’re a chatterbox like me, tone it down a bit. Especially when communicating numbers. It’s okay to say “I don’t know” - just follow up quickly. In certain careers, typically with a heavy emphasis on sales, you’re expected to always have an answer ready. But for a career in REPE, you’re actually expected to stay quiet if you don’t have the right answer.

Own the Assignment

The person who gives you work was given the work themselves. They want it off their plate, that’s why you have a job. You should always ask questions if you are lost, but don’t have a hair trigger when it comes to questioning your manager. Stick with a problem for a bit and try to figure it out yourself. I find it helps a lot to write my problems out and list my questions in OneNote. Then I just check things off as I find solutions, and I either hit zero questions or I hit “good” questions that my manager would appreciate me bringing up. It’s a win-win.

Be Fast in Excel

You need to be fast in Excel. Everything can always go faster. If you’re doing something, you’re probably doing it slowly. Not a day goes by where I don’t find some better way of producing analysis. If you don’t know where to start, neither does anybody. Your entire career in real estate private equity will be a series of challenges that you have to figure out for yourself. So when it comes to learning Excel, always strive to be faster and more clever with your formulas. If you’re looking for a great place to learn Excel for REPE, check out our courses at leveraged breakdowns.

0 notes

Text

The REPE M&A Process, Part Seven: Other Assets

Introduction

All real estate private equity interview questions eventually work their way back to understanding NAV. This is because a meaningful discount to NAV is the key indicator of a buyout opportunity. Of course if you’re looking to take a REIT private, the critical piece of information you must understand is the market value of the real estate. In fact, the core function of investment-focused real estate private equity jobs is learning to underwrite asset value. However, REITs do own other things of value that are not real estate. These other assets generally do not represent the core value of the business, yet it is important to account for all elements of value when you underwrite a corporate acquisition.

Liquid Assets Are Easy to Value

The more liquid the asset, the easier it is to value. In this sense, liquidity refers to the ease at which you can convert an asset to cash without sacrificing value. On the extreme end, you will always see a literal cash balance published each quarter. Cash and restricted cash are the most liquid assets since they are already worth the exact number you read on the balance sheet. Other liquid assets include net working capital accounts such as rents receivable and accounts payable. Other assets that are somewhat difficult but still pretty easy to value are marketable securities and other investments the company may have in debt instruments or JV partnerships.

Certain Other Assets Require Nuanced Valuation

Assets that may be more difficult to value are land held for sale, construction in progress, or below-market purchase options. These assets are less straightforward to value because they are not as liquid as cash and net working capital. As the investor, it’s your discretion to assign proper valuations to each of these other balance sheet assets.

Valuing Land and Construction in Progress

For land and construction in progress, a conservative take would be to value those items at cost. Public companies report these metrics quarterly, so they should be pretty easy to find. However if you’re hunting for any incremental value you can find, you could perhaps apply a premium on any land that may have appreciated in value since acquisition. And perhaps some of the construction projects look quite promising for one reason or another. Whatever it may be, your fund might find it reasonable to to ascribe additional value beyond cost to land and construction in progress.

Learn with Leveraged Breakdowns

Are you on the hunt for real estate private equity jobs? Come visit us at Leveraged Breakdowns, where we teach you everything you need to wow your interviewers. We are mega fund investors who have committed literal billions of dollars of direct equity across tens of billions of dollars of gross asset value in every sector, from asset-level to corporate-level transactions. We share our insight through our various courses and free content to help you master all possible real estate private equity interview questions. More than that, our lessons will set you ahead of the curve so you can hit the desk fully prepared to amaze your new team.

0 notes

Text

The REPE M&A Process, Part Five: Asset Valuation

Introduction

We need to calculate a public company’s NAV to understand whether its current share price indicates an attractive relative valuation. If we find a stock that is trading at a discount to our opinion of NAV, we should buy the entire company. That’s how M&A style real estate equity investment works. Yet to calculate NAV, we must know two things. First, we must know the value of a company’s liabilities. We learned all about liabilities in part two and part three of this series. Second, we must know the gross value of the company’s assets. Once you know both, you subtract the liabilities from the gross asset value (GAV) to arrive at the net asset value. So, how do we determine gross asset value?

Gross Asset Value

This is the last thing to discuss, and the most important. Gross asset value represents the total value of all of a company’s assets. Common assets include: cash (easiest to value), current assets such as accounts receivable, and, of course, real estate. Cash and current assets are as easy to value as liabilities -- you just take the number from the balance sheet. Real estate, however, is not so simple. Yes, public companies report a book value of real estate. Yet book value of real estate hardly ever represents the true market value of a building. So how do you calculate the market value of a building?

The four most common approaches to valuing real estate

The four common approaches to valuing real estate are: net present value, hurdle rate, precedent transaction comps (aka sales comps), and trading multiples. The net present value (NPV) and hurdle rate methodologies are two sides of the same coin, meaning they are both discounted cash flow analyses. These two analyses are what investors call intrinsic, since all assumptions to determine asset value are completely internal. The other two methodologies, sales comps and trading multiples, are both extrinsic methodologies since they rely on completely external data to calculate value. Private equity real estate returns are dependent on your gross asset value calculations, so it is important to employ all four methodologies when valuing real estate.

NPV and Hurdle Rate Analyses are both just variations on DCF Analysis

The only difference between an NPV and hurdle rate analysis is that an NPV takes the discount rate as an input and exports asset value as an input, whereas a hurdle rate analysis takes value as an input and exports the discount rate as an output. In fact, they’re so similar that an NPV model can quickly be turned into a hurdle rate model with just a few formula changes. The real meat and potatoes of these methodologies is forecasting cash flows for each building.

Eager for Hands-On Practice?

Subsequent articles will dive into the details of DCF analysis. Yet if you’re eager to get started with real practice, you should check out our course Breaking Down REPE where we build an extremely granular single property DCF model from scratch. If you’re in a time crunch and need to learn fast, our REPE Starter Kit is just the right practice for you. Both courses will teach you how to calculate accurate private equity real estate returns through fundamental analysis that you build from scratch with source materials

Conclusion

The intrinsic valuation methodologies often take the spotlight in real estate private equity courses because they require the most effort and diligence. However, real estate private equity investors use all valuation methodologies to triangulate gross asset value. If all methodologies signal a tight valuation range, then you might insinuate a higher confidence interval that your real estate equity investment calculations are accurate. Of course you never know if you’re correct until you exit your investment and finalize your private equity real estate return, but it is nice to see your estimates all lining up toward a similar value.

0 notes

Text

The REPE M&A Process, Part Four: Net Asset Value

Commit to succeed today

Deliberate practice is purposeful and systematic. It’s what sets success apart from failure. Leveraged Breakdowns provides the courses and the tools you need to deliberately practice the most critical skills for all types of private equity strategies within real estate. For outsiders by insiders, our megafund real estate private equity investors teach you all the ins and outs of this exclusive industry.

Taking Stock

So where are we in this tutorial? You are an REPE analyst. You want to know if a publicly traded company is a good investment. To do this, you need to perform a net asset value (NAV) analysis. An NAV analysis will tell you what your private opinion of the company’s value is. Let’s say this company has 100 shares outstanding. If you think the company is worth $2,500 total, and the stock is trading at $21.37, is this a good buy? Yes, of course.

Premium / (Discount) to NAV

This hypothetical company is a good buy because its public stock price, at which you can purchase the company today, is trading at a ~15% discount to its $25.00 NAV per share. This quick comparison is commonplace in real estate private equity and is referred to as a discount to NAV. However, if the stock price is above the NAV, then this metric is called a premium to NAV. Shortly put, you do not want to purchase companies that trade at a premium to the NAV that you believe in.

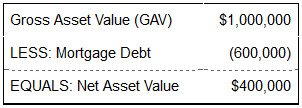

How do you determine a company’s NAV?

So you can find a company’s stock price pretty easily on Google. But how do you figure out its NAV? Most simply, you could copy it from a broker research report from an outfit such as Green Street Advisors (the premier real estate research outfit), or Morgan Stanley, ISI, etc. But this does not represent original thought. In real estate private equity, we prefer to calculate NAV on our own, from scratch. Here’s a quick example of how we would perform an NAV analysis for a single asset before we begin to examine full companies.

High level NAV analysis example

Imagine you issue a $600,000 mortgage to purchase a $1,000,000 warehouse. You, of course, fund the $400,000 equity commitment. The NAV analysis would look like this:

Conclusion

That’s it! That is as straightforward as it gets. All types of private equity fund structures within real estate perform this exact type of NAV analysis. Of course, the magic happens when you determine the value of that $1,000,000 warehouse. In real life, there is no correct answer to a property’s value. It doesn’t just have a price tag like an Xbox or a gallon of milk. Although there are many types of private equity strategies, Leveraged Breakdowns focuses on fundamental analysis. This means subsequent articles will dive into the weeds on how we actually value the individual components of a company.

Eager to learn more?

Visit Leveraged Breakdowns to kickstart your prep for a career in real estate private equity. Our courses cover concepts stretching from the types of private equity fund structures to granular asset-level LBO modeling. Come check us out!

0 notes

Text

The Real Estate Private Equity M&A Process, Part One

You’ve been tasked to invest in a public company, where to begin?

As an M&A investments associate, you’re often asked to determine whether an LBO of a particular public company would generate meaningful private equity real estate returns. But how do you figure out if a company is a good target? To answer that question, let’s first take a twenty-thousand foot view of the REPE M&A process. Hang tight, we’ll get to technical nuances quickly enough.

Defining your goal: make good investments

First, what is your goal as a real estate private equity M&A investor? You want to make smart investments with your fund’s capital to achieve the highest possible private equity real estate returns. More specifically, you want to purchase entire companies at a discount to their intrinsic value (of course, assuming the relative value holds after all transaction costs and take-out premiums). Thus, you need to develop a view on value against which you will compare the public share price. If the public share price looks cheap versus the value you’ve come up with, then you should buy that company.

Long-Only vs Long-and-Short

Quick aside. Most real estate private equity funds are long-only, meaning they only purchase assets. Thus, we’re often looking for undervalued companies and not overvalued companies. Yet, a handful of private equity funds are able to take short positions, often through a hedge fund subsidiary. If this is the case, then you will be just as excited to find an overvalued company since you can place a short as your real estate equity investment. But for the sake of this guide, let’s assume we’re hunting after long-only positions.

How do you determine a company’s intrinsic value?

Back to the main story. So you want to take a company private if it trades at a discount to its intrinsic value. But how do you come up with that intrinsic value? Simple -- you calculate its net asset value (NAV). NAV simply represents the gross asset value less the value of all the company’s liabilities. In other words, what value of the company is left over for the residual equity holders after the senior members of the capital stack take their share. Sound familiar? It should -- NAV is just an alternative measurement of equity market capitalization.

Side Note: Efficient Markets

Let’s pause on the critical nuance of NAV versus equity market capitalization. Efficient markets purists argue that the share price perfectly reflects the value of the company. In their view, the net asset value is exactly equal to the equity market capitalization. Yet, if you believe market efficiency exists on a spectrum, and that real estate markets are less than perfectly efficient, then you can start to argue whether the share price correctly reflects the net asset value. In the real estate private equity vernacular, a public company trading at a discount to NAV is undervalued, whereas a company trading at a premium to NAV is overvalued.

To Be Continued

Our next post in this series will continue this story, diving further into the methodology of calculating net asset value. Continue reading to learn how M&A teams perform their real estate equity investment process.

0 notes

Text

REPE Transaction Types: Single-Asset, Portfolio, and Entity M&A

A career in REPE can take many shapes. Your career is largely shaped by the type of real estate private equity fund you choose to work at. Some are big, some are small. Some only buy one sector of real estate, some buy all of the sectors. Some invest in sectors so weird, you didn’t even realize they were real estate. Some are hyper contrarian, others follow the herd. Some are famous, others will be famous. If I haven’t belabored the point enough, real estate private equity funds are different in a lot of ways. This article is going to focus on just one of those ways that your career in real estate private equity could differ from your friend’s: the type of transaction you work on.

Backing out, when I say type of transaction, I mean the structure of the acquisition itself. It will probably make more sense if I put it in concrete terms. There are three styles of transaction that I am going to cover today. All of them reference direct equity investments, and they are generally the most common style of transaction at a real estate private equity fund. These three are, in ascending order of transaction value, are (i) single asset acquisitions, (ii) portfolio acquisitions, and (iii) entity mergers and acquisitions.

Let’s start with the first transaction style: single asset acquisitions. This type of transaction is the most straightforward. Simply put, a real estate private equity fund buys a single building. This is very easy to grasp. When you buy a building, you have to go through some pretty cookie cutter motions. Often, the investments teams have a reusable single-asset acquisition model template that they constantly recycle. If you’re working at a megafund, then single asset acquisitions might be primarily run by specific asset-level teams or portfolio companies. For instance, Blackstone’s LivCor team underwrites most of their multifamily real estate.

Let’s move onto the second transaction style: portfolio acquisitions. What is a portfolio acquisition? A portfolio acquisition is very similar to a single-asset acquisition, with one key difference. A portfolio acquisition includes multiple buildings. Now, these buildings are usually very identical. For instance, most portfolios for sale are all the same asset class. Perhaps it’s a portfolio of all office buildings, or just multifamily assets, or maybe it’s all industrial. The point is, brokers don’t often mix-and-match assets in their portfolio sales unless an entire fund or entity is liquidating under distress. Also, portfolios usually blend into the same investment strategy. So you are less likely to receive a mix of core and opportunistic assets. Rather, it’ll all be opportunistic or it’ll all be core, or maybe it’ll all be core plus. Either way, there is minimal variance between the quality and type of assets in portfolio sales.

Let’s finish with the third transaction style: entity m&a. This is just a fancy way of saying a public buyout. Megafunds have enough capital to buy entire publicly traded companies. The biggest buyout funds are like massive whales that can swallow sharks. Colorful imagery aside, transaction value (aka total enterprise value) can range from $500M to tens of billions of dollars. It really depends on the acquisition target.

Keep all of this in mind when you interview. if you want asset-level experience (I am biased, I think everyone needs it), then be sure to ask this in your interviews. If you want to work on public M&A, see if the firm has ever done any of that with a quick search. Dig in, and make sure you pick the right firm to launch your career in REPE.

0 notes

Text

Ask Leveraged Breakdowns: Pivoting to Real Estate Investments

A Student Recently Asked...

“I want to pivot my career into real estate investments. I know these positions exist at banks, funds, endowments, and many other capital managers. Given your experience in this field, could you please share some insights on your day to day, skills needed, how you got into it, and what’s a good way to enter the industry?

A little background on myself: I’m a trader at a self-directed Canadian brokerage. I have a BCOMM degree from a non-target, and am willing to do an MBA and possibly take the CFA. Thanks.”

My Personal Background

So, my personal background. I work in acquisitions for a Manhattan real estate private equity (“REPE”) megafund. A REPE megafund is a large pool of money set up by a private equity firm for the purpose of investing in real estate companies, portfolios, or single assets. In the last couple years I have spent with my investments team, I have invested over $4B of our own equity straight into various real estate opportunities representing over $14B of GAV across more than 150 individual assets.

Day to Day

I spend 70% of my professional time working in Microsoft Excel. I’ll be building property-level LBO models (such as the Verdant Apartments model I built in my walk-through), pulling together high-level supply-demand analyses, or managing the models of former investments. I’d say my time is evenly split between these three tasks, though any particular day can change that balance.

The other 30% of my time is spent in meetings for active and prospective investment opportunities. I could be meeting with brokers, internal tax counsel, legal, really anybody at any time for any subject. Of course, the end goal of any meeting is to move the deal pipeline forward.

Skills Needed

First, you need to understand financial theory and Excel. If you need a reference, and don’t want to shell out for the Leveraged Breakdowns modeling course just yet, try this free real estate investment case study.

Second, you need to understand real estate fundamentals. If you actually want to stand a real chance in an investments interview, you should be able to knock these quizzes out cold: industry jargon, income-based technicals, expense-related technicals, and capital formation technicals. If you don't know the answer to each question while practicing in your own home, you certainly won’t perform during a live, high-pressure interview.

Third, perfect your mental arithmetic. What’s 50 divided by 5%? What’s the CAGR of an investment that increases in value from $100 to $121 in two years? It isn’t fun and might not seem relevant in the digital era, but fundamental numeracy is critical to quickly shape and feel out investment opportunities. During an interview, you might be asked to estimate the returns of a real estate investment case study in your head, and you don’t want to be caught unprepared.

Finally, follow the news. I like all of these sources: Urban Land, NAREIT Portfolio News, MultiHousing Professional, etc.

For more detail on relevant skills, see the fourth section of this article that covers the most important real estate private equity analyst skills.

How I Got Into Real Estate Private Equity

As a non-target student, I landed my megafund REPE job through networking and persistence. Before, I was a real estate investment banker at a bulge bracket (and before that, a student at a non-target university). Unfortunately, my REIB career did not prepare me for most of the REPE interview questions I faced. Through trial and error, I eventually picked up on the most important facts to track.

Good Way to Enter

First, assess your options. If you don’t have a fancy investment banking background or MBA, you might face difficulty breaking into the giant megafund shops. That’s fine. In fact, there are plenty of local REPE shops in every city that you should consider. The skill set at a big shop and a small shop is transferable enough such that if you ever wish to work at a megafund, that path could still open up down the road.

Once you’ve assessed your options and identified ten or so target shops, begin networking. Figure out how to chat with people that work at those firms. I always suggest people to get on the phone with the most junior people first, get a lay of the land, then at the end of the call ask to speak with a colleague. This way, you’ll slowly work through the entire organization

Aside from networking, you need to master all REPE interview questions. As an outsider, this might seem like an endless effort. But the team at Leveraged Breakdowns has been through enough interviews, and now leads enough interviews, to assure you the process is pretty formulaic. If you can knock out the case studies and quizzes linked above, you’ll be in a great place to ace the REPE interview process.

By the way, if you found this helpful, you might enjoy the 10 page guide you get when you sign up for the Leveraged Breakdowns newsletter. You can sign up here, and you’ll get the guide immediately. The guide covers a lot of topics in detail, including: my background, REPE fund structure, how REPE GPs make money, the multiple career tracks at an REPE fund (investments, asset management, investor relations), an overview of an investments career, what it’s like as a junior investor, as a mid-level investor, and as a senior investor.

0 notes

Text

Leveraged Breakdowns Presents: A Retail Real Estate Investment Case Study

We receive many requests for real estate investment case studies. Students desire to practice their skills for personal growth as well as preparation for job interviews. In either case, case studies are an excellent way to sharpen your skills and launch into a career in real estate private equity.

This case study will provide the information you will need to build a quick LBO model, simulating a live REPE interview situation. There are more case studies and courses available from Leveraged Breakdowns (here and here), and you can post your results and discuss this case study with others on the Forums.

The Overview

You are an analyst with a large real estate private equity firm. You receive an email from your manager with an offering for a grocery-anchored shopping center in suburban Atlanta. Your manager states that this property may be a fit for the firm’s Core-Plus fund, which has been struggling to find suitable investments. You are to build an investment model based on the offering and report back in 24 hours with your analysis.

The Details

Tenant 1: Publix grocery, 60,000 sf, $14/sf NNN for 12 years; four options to extend for five years with $0.50 bumps each option term

Tenant 2: UPS Store, 2,500 sf, $25/sf NNN for seven years; two options to extend for five years with 10% bumps each option term

Tenant 3: Heart Attack Jack’s restaurant, 4,000 sf, $20/sf NNN for five years; one option to extend for five years with a 12% increase

Tenant 4: Anytime Fitness, 4,500 sf, $18.50/sf NNN for seven years, 7.5% increase beginning year three; two five-year options to renew with 7.5% increases

Operating Expenses (total): $3.95/sf, assume 2% annual increase

Asking Price: $14.25 million

Target Leverage: 50%

Debt Terms: 5.00% fixed for 10 years, 20 year amortization

Hold Period: 10 years

Exit Cap: 6.00%

The Analysis

Here are a list of questions for you to answer (post your answers on our Forum!)

What is the unlevered and levered IRR of the investment?

What is the multiple on invested equity?

What risks do you see in this opportunity?

What questions would you ask of the listing agent?

If you were to build a sensitivity analysis, which variables would you test?

If you are considering a career in real estate private equity, reviewing case studies is a smart way to prepare yourself for a high-pressure and competitive interview process. Don’t fall into the trap of thinking you only need to get the right answer, though. You also need to think about what clarifying questions you would ask, and how you would present your findings. In some situations there may be gaps in the information included in the real estate investment case study. This is intended to tease out the types of questions you would ask, or how you incorporate, document, and report your assumptions.

Getting the right answer is imperative, but showing the interviewer how you think is just as important. Visit Leveraged Breakdowns for more case studies, courses, blog articles, and practical advice on how to conquer your real estate private equity career!

0 notes

Text

Two Important Soft Skills For Real Estate Private Equity Analysts

This post analyzes two real estate private equity soft skills. Mastery of these skills can make or break an early career in real estate private equity.

First, you must learn to manage expectations on timing. This means you always give a realistic expectation for completion on any assignment.

Second, you must learn to handle feedback with grace. Read below for specific advice that will guide you to success in your real estate private equity career.

Learn To Manage Expectations On Timing

When you’re a real estate private equity analyst, people mostly ask you to do work. Most analysts don’t demand work from others. As an analyst, it’s important to clearly communicate when you expect to finish your work. When making any estimates on timing, follow this simple rule of thumb.

Real estate private equity analysts should always multiply their expectation of deliverable timing by 1.5x. For example, if you think the project is going to take you one hour, say that it will take an hour and a half. If you think it will take you two days, say it will take you three and a half days.

However, note the important caveats below:

All requests are time-sensitive. If you think a project will take you two days and you say three and a half, that includes working late every day and over weekends if necessary. Don’t price early exits or personal downtime into that extended figure.

Don’t mill about if you owe somebody a deliverable. Coffee breaks and quick walks to lunch are acceptable. But if somebody’s waiting on you to complete an analysis, don’t act like you have all the time in the world.

If you sense a delay, immediately tell your superior. Delays are annoying, but they happen. When you face a delay, immediately alert your team. Explain exactly why the delay is inevitable, and how you’re going to mitigate the delay. Keep your team on track with proper timing at all times. Yet, never announce a delay that you can fix through hard effort. Only mention delays that are unavoidable, such as a business partner with key information is out on vacation or the website with critical data is offline for maintenance.

Every level of the real estate private equity hierarchy has to manage expectations on timing. At the bottom, analysts are expected to deliver work requests at regular intervals. Upon promotion from analyst, associates no longer just do work asked of them, but also ask other people to do work for them. This creates another layer of complexity where proper management of expectations becomes critical. Learn to manage expectations as an analyst so you become a more effective associate.

Don’t Get Defensive, Receive Feedback With Grace and Appreciation

When your team gives you feedback, your first reaction might be to defend your previous assumptions. Swallow that response and listen to the feedback with earnest ears. This advice is critical for junior analysts and associates who are relatively new to the workforce.

Your reaction to defend yourself comes with good intentions. You want to reassure your team that you are competent, that you didn’t realize some nuanced subject had to be done some other way, etc. However, defending yourself in the face of feedback is a very bad look. Remember, you joined the team because you have faith in the expertise of the fund’s real estate investors. Thus, listen to your superiors who have far more experience.

When receiving feedback, your superiors want to make sure that their advice has fully registered. Thus, listen actively, say yes affirmatively, and take notes. Don’t apologize extensively, but acknowledge your errors. If you learn to take feedback with grace, you have mastered an important real estate private equity skill.

A Good Response At The End of Receiving Feedback Sounds Like This:

“Thank you for pointing out my mistake on X. I made that error because of Y. I know Y is the wrong thing to do because of [reason], and the method Z you taught me is clearly the better option. Now that I am going to do Z instead of Y, X will never happen again. Thanks for showing me the right path, I appreciate your help catching me up to speed.”

#real estate private equity skills#real estate private equity analyst#career in real estate private equity#real estate private equity career

0 notes

Text

The Number One Skill For Real Estate Private Equity Job Interviews

Students and career switchers justify expensive degrees in their eager search for a six-figure salary. However, higher education often struggles to bridge the gap between theory and practice. This gap puts outsiders at a disadvantage against insiders when interviewing for coveted positions. Leveraged Breakdowns has studied this gap, and knows exactly what to teach to bring you up to par with your insider competition.

When students first join Leveraged Breakdowns, they often express frustration at the difficulty of securing real estate private equity jobs. The problem is, real estate private equity interviewers only like people who speak the language of real estate investing. This means you need to hold your own in any high-level real estate investment discussion. Thus, the number one skill for real estate private equity job interviews is investment underwriting and analysis. Leveraged Breakdowns teaches you how to think like an investor.

Even if you’re doing everything else right, from scoring a top GPA to landing prestigious internships, you cannot afford to sound foreign when interviewing. Insiders prefer to hire other insiders. It requires less effort and training, and is generally a much safer bet. You can de-risk your candidacy by studying real estate underwriting. Leveraged Breakdowns teaches you this entire thought process through a highly structured and efficiently challenging course load.

Leveraged Breakdowns bridges the insider-outsider gap. With several years of Manhattan Megafund investments experience across strategies and asset classes, Leveraged Breakdowns teaches hard skills that are directly applicable to any real estate private equity job such as advanced Excel formulas and nuanced real estate private equity LBO modeling.

From the outside, even the real estate private equity for beginners might seem complex and difficult to understand. You might picture a course full of dense formulas and cold, white Excel sheets. Leveraged Breakdowns is not that course. Real estate private equity is not rocket science. We break every concept into bite-sized components that are easily digestible in sequential video lectures averaging 15-20 minutes each. Every skill we teach is absolutely essential for interviews.

How are we certain in our methods?

First, we broke into our real estate private equity careers as complete outsiders. We taught ourselves everything, and we’ve since built Leveraged Breakdowns to be the guide we wish we had when we were hustling into the industry.

Second, we actively mentor junior analysts and associates at our own funds. We know the most pressing questions asked by every entry-level hire. We’ve consolidated all of this knowledge to make Leveraged Breakdowns the perfect resource on real estate private equity for beginners.

Finally, we know the real estate private equity interview process inside-and-out. Our network of students and insiders has seen it all, and we teach you everything and more to ace your next interview.

Leveraged Breakdowns’ mentorship approach bridges the insider-outsider knowledge gap. We teach outsiders who are eager to develop long-lasting career skills and master complex, nuanced subjects. Leveraged Breakdowns teaches the language of real estate.

#real estate private equity jobs#real estate private equity for beginners#real estate private equity interview process#real estate private equity interview#real estate private equity interview questions

1 note

·

View note