Luther Speight is the founder and managing partner of Luther Speight & Company CPAs, a prominent accounting firm headquartered in New Orleans, LA. With offices spanning Louisiana, Tennessee, and Georgia, the firm, under Luther's guidance, offers a comprehensive range of accounting services. Holding a BS in Accounting from Clark Atlanta University and a CPA certification, Luther's dedication to financial precision and client satisfaction has positioned his firm as a trusted name in the accounting sector.

Don't wanna be here? Send us removal request.

Text

Understanding the Importance of the Balance Sheet in Financial Accounting

When it comes to financial accounting, few documents hold as much significance as the balance sheet. Often referred to as a company’s financial snapshot, the balance sheet provides a clear picture of what a business owns, owes, and its net worth at a given moment. It’s an indispensable tool for accountants and business owners, investors, and creditors. Understanding its components and how to interpret the data can provide critical insights into a company’s financial health and guide decision-making. In this article, I’ll walk you through the essential aspects of the balance sheet, its practical applications, and its importance in financial accounting.

What Is a Balance Sheet?

A balance sheet is one of the three primary financial statements, alongside the income statement and the cash flow statement. It’s structured around the fundamental accounting equation:

Assets = Liabilities + Equity.

This equation reflects the financial position of a company by showing how its resources (assets) are financed—either through borrowing (liabilities) or owner investment (equity). Unlike the income statement, which covers a specific period, the balance sheet represents a single point in time. This makes it a vital tool for understanding the company’s financial standing at any given moment.

Key Components of a Balance Sheet

A well-prepared balance sheet is divided into three main sections:

Assets

Assets are the resources a company owns that have economic value. They are typically categorized into two types:

Current Assets: These are short-term resources expected to be converted into cash or used up within a year, such as cash, accounts receivable, and inventory.

Non-Current Assets: These include long-term investments like property, plant, equipment, and intangible assets such as patents or trademarks.

Liabilities

Liabilities represent obligations or debts that the company must pay to external parties. They are also classified into:

Current Liabilities: Short-term debts due within a year, such as accounts payable, salaries payable, and short-term loans.

Long-Term Liabilities: These include obligations like bonds payable, long-term leases, and pension liabilities.

Equity

Equity represents the shareholders’ claim on the company’s assets after liabilities are deducted. It includes items like common stock, retained earnings, and additional paid-in capital. In essence, equity reflects the net worth of the business.

By breaking down these components, the balance sheet provides a comprehensive view of a company’s financial structure, showing how assets are funded through liabilities and equity.

Assessing Financial Health Through a Balance Sheet

One of the primary reasons a balance sheet is so important is its ability to help assess a company’s financial health. When reviewing a balance sheet, stakeholders often look at key financial ratios to evaluate liquidity, solvency, and overall stability. For instance:

Liquidity Ratios: The current ratio (current assets divided by current liabilities) helps determine whether a company can meet its short-term obligations. A ratio above 1 indicates healthy liquidity.

Solvency Ratios: The debt-to-equity ratio (total liabilities divided by total equity) reveals the proportion of debt financing relative to equity. Lower ratios suggest less financial risk.

Asset Turnover: This ratio shows how efficiently a company uses its assets to generate revenue, providing insights into operational efficiency.

Understanding these metrics allows business owners to make informed decisions about managing resources, reducing debt, or pursuing growth opportunities.

Guiding Investment Decisions

For investors, the balance sheet is a critical document that helps them evaluate whether a company is a sound investment. A strong balance sheet, characterized by a healthy balance of assets and liabilities, signals financial stability and lower risk. On the other hand, a balance sheet showing excessive debt may indicate potential financial troubles.

Investors also use balance sheets to analyze trends over time. By comparing the balance sheets of consecutive periods, they can assess a company’s growth trajectory, identify patterns in debt management, and evaluate whether the business is effectively reinvesting its profits. This information is vital when deciding whether to buy, hold, or sell shares.

Facilitating Credit and Loan Approvals

From a lender’s perspective, the balance sheet plays a central role in determining a company’s creditworthiness. Banks and other financial institutions rely on the balance sheet to assess whether a business can repay loans. Key factors they evaluate include the company’s liquidity, debt levels, and asset base.

A strong balance sheet with a solid equity base and manageable debt levels often leads to favorable loan terms, such as lower interest rates or extended repayment periods. Conversely, a weak balance sheet may result in loan denial or higher borrowing costs. For business owners, maintaining a healthy balance sheet is crucial for accessing external funding when needed.

Informing Strategic Business Decisions

The balance sheet is more than just a financial document; it’s a strategic tool for business owners and managers. By providing a clear picture of the company’s financial position, it helps guide decisions on resource allocation, expansion, and risk management. For instance, if the balance sheet reveals a high level of unused inventory, management might adjust purchasing practices or implement marketing strategies to boost sales.

Similarly, the balance sheet can highlight opportunities for growth. A strong cash position might encourage investment in new equipment, product development, or entering new markets. On the flip side, high debt levels may prompt a company to focus on reducing liabilities before pursuing aggressive growth strategies.

Ensuring Compliance and Transparency

Compliance with accounting standards and regulations is a non-negotiable aspect of financial reporting. The balance sheet ensures transparency by accurately presenting the company’s financial position, which is crucial for maintaining the trust of stakeholders, including investors, creditors, and regulatory bodies. Inaccurate or misleading balance sheets can result in legal penalties, loss of reputation, or even financial ruin.

For publicly traded companies, balance sheets are a required part of quarterly and annual financial disclosures. These statements provide investors and analysts with the information needed to evaluate the company’s performance and make informed decisions. For smaller businesses, maintaining accurate balance sheets demonstrates professionalism and fosters trust with partners and clients.

Limitations of the Balance Sheet

While the balance sheet is an essential tool, it’s not without its limitations. One of its primary drawbacks is that it reflects the company’s financial position at a single point in time, which may not capture fluctuations in financial performance. Additionally, some assets, like brand value or intellectual property, are not always fully represented on the balance sheet, potentially underestimating the company’s true worth.

Another limitation is the reliance on historical costs for valuing assets, which may not reflect current market conditions. For example, property values may have appreciated since their initial purchase, but this increase won’t be reflected in the balance sheet.

To overcome these limitations, it’s important to analyze the balance sheet alongside other financial statements, such as the income statement and cash flow statement, and consider qualitative factors like market conditions and industry trends.

Key Points About the Balance Sheet

Summarizes assets, liabilities, and equity

Evaluates financial health through liquidity and solvency ratios

Guides investment and credit decisions

Informs business strategies and risk management

Ensures compliance and transparency in financial reporting

In Conclusion

The balance sheet is an invaluable tool in financial accounting, offering a clear and concise snapshot of a company’s financial health. Whether you’re a business owner, investor, or creditor, understanding its components and applications is essential for making sound financial decisions. By leveraging the balance sheet effectively, you can gain insights into liquidity, solvency, and operational efficiency, paving the way for smarter strategies and long-term success. While it’s just one piece of the financial puzzle, its importance cannot be overstated.

0 notes

Text

How to Handle Payroll Processing Without Stressing Your Finance Team

Payroll processing is one of those tasks that is both essential and time-consuming. It impacts every employee in your organization and must be done with precision and timeliness to maintain trust and compliance. Yet, for finance teams, it can become a source of stress due to its complexity and the stakes involved. Having worked closely with businesses of all sizes, I’ve seen how the right approach can transform payroll processing from a stressful ordeal into a streamlined operation. Let’s walk through practical strategies that ensure payroll is handled efficiently without overburdening your finance team.

Invest in Payroll Automation

One of the most effective ways to simplify payroll processing is through automation. Manual calculations are prone to errors and consume valuable time that could be spent on strategic initiatives. Payroll software can automate repetitive tasks like calculating wages, deducting taxes, and generating pay slips.

Automation also ensures compliance with tax laws and labor regulations, as most modern systems are regularly updated to reflect legislative changes. Additionally, many payroll tools integrate with time-tracking systems, enabling seamless processing of employee hours. By implementing the right software, you reduce the risk of mistakes and give your team the tools they need to focus on higher-value tasks.

Standardize Payroll Policies

Clear and consistent payroll policies are a game-changer. These policies should cover everything from payment schedules to overtime calculations and benefits administration. When employees know what to expect, they’re less likely to bombard the finance team with questions.

Standardization also minimizes confusion internally. Whether you’re managing regular payments, bonuses, or deductions, having well-documented procedures ensures that everyone is on the same page. It’s a simple step that reduces misunderstandings and allows payroll processes to run smoothly.

Maintain Accurate and Up-to-Date Records

Accurate records are the backbone of any successful payroll system. Employee data—including tax withholding information, benefits enrollments, and work hours—needs to be up-to-date and readily accessible. Errors in these records can lead to incorrect payments or compliance issues, both of which can cause significant headaches.

Implement a system for regular updates to your employee database. Whenever there’s a change in employment status, salary adjustments, or benefit enrollments, ensure these changes are reflected in your payroll system immediately. Consistency in record-keeping prevents last-minute scrambles and ensures payroll accuracy.

Establish Clear Deadlines for Inputs

Late timesheets or missing expense reports can wreak havoc on payroll processing. To avoid this, set firm deadlines for employees and managers to submit all payroll-related data. Communicate these deadlines clearly and enforce them consistently.

When employees understand the importance of timely submissions, it helps your finance team stay on track. Consider sending reminders as deadlines approach and providing training on how to complete required documents correctly. These proactive measures save time and reduce the stress of last-minute corrections.

Conduct Regular Payroll Audits

Payroll audits are essential for maintaining the integrity of your system. Regularly reviewing payroll data helps identify discrepancies, such as incorrect payments or unreported overtime. It also ensures compliance with tax regulations and labor laws.

Audits don’t have to be intimidating or disruptive. By conducting them periodically—say quarterly or semi-annually—you can catch small issues before they become larger problems. Use these audits to assess the effectiveness of your payroll policies and identify areas for improvement. A proactive approach to auditing keeps your payroll system reliable and compliant.

Train and Support Your Payroll Staff

Your payroll team plays a critical role in the organization, and equipping them with the right skills and resources is vital. Provide training on the latest payroll software and ensure they’re familiar with current tax laws and labor regulations. Continuous education empowers your team to handle complex situations with confidence.

In addition to technical training, create an environment where your payroll staff feels supported. Encourage open communication and collaboration, and address any challenges promptly. A well-trained and supported team is more likely to approach payroll processing with efficiency and accuracy.

Consider Outsourcing Payroll

For businesses with limited resources or particularly complex payroll needs, outsourcing can be a viable option. Payroll providers specialize in managing payroll processing, compliance, and reporting, which can alleviate significant pressure from your finance team.

Outsourcing also offers access to advanced payroll systems and expertise in navigating regulations. While there’s a cost involved, the time and stress saved often outweigh the investment. Many providers also offer flexible packages, allowing you to scale their services to match your needs.

Addressing Common Payroll Challenges

Even with the best systems in place, payroll can still present challenges. One common issue is ensuring compliance with constantly changing tax laws and labor regulations. Using automated payroll systems or outsourcing to a provider who stays updated on these changes can help.

Another challenge is managing payroll for a remote or global workforce, where employees might be subject to different tax jurisdictions or currency requirements. In such cases, working with payroll providers that specialize in international payroll can simplify the process.

Lastly, errors in data entry or miscommunication between departments can lead to payroll discrepancies. Encourage clear communication between HR, payroll, and management teams to avoid such issues.

How to Simplify Payroll Processing

Automate payroll tasks to save time and reduce errors.

Set clear policies and deadlines for payroll inputs.

Maintain accurate employee records and conduct regular audits.

Train payroll staff and consider outsourcing for complex needs.

In Conclusion

Payroll processing doesn’t have to overwhelm your finance team. By automating repetitive tasks, standardizing policies, maintaining accurate records, and providing ongoing training, you can streamline the process and reduce stress. Regular audits and clear communication further enhance accuracy and efficiency. For businesses looking to alleviate even more pressure, outsourcing payroll is a practical solution that allows teams to focus on strategic priorities.

When payroll runs smoothly, it creates a ripple effect throughout the organization—employees are paid on time, compliance risks are minimized, and finance teams can work more effectively. By implementing these strategies, you’re not just simplifying a process; you’re fostering a more productive and harmonious workplace.

0 notes

Text

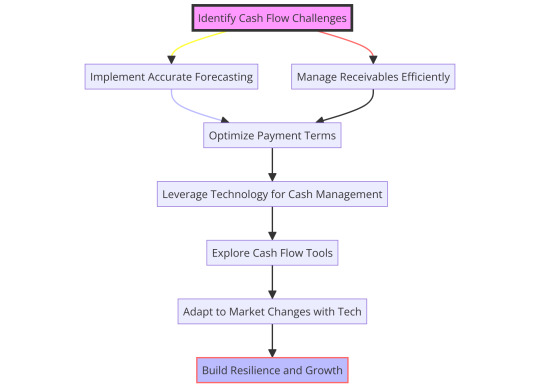

The Importance of Cash Flow Management in Growing Businesses

For growing businesses, effective cash flow management is essential to support expansion, maintain financial health, and sustain daily operations. In this guide, I’ll outline how cash flow management impacts various aspects of a growing business, covering its role in liquidity, expansion, creditworthiness, and more. Managing cash flow is not just about tracking money—it’s about making strategic choices to fuel growth while protecting your business’s stability.

Ensuring Liquidity to Meet Operational Needs

One of the core purposes of cash flow management is to maintain enough liquidity to meet daily financial needs. As your business grows, so do the expenses—employee salaries, rent, utilities, supplier payments, and more. If cash flow isn’t managed well, even profitable companies can find themselves short on cash for necessary expenses, which can disrupt operations. By consistently monitoring cash inflow and outflow, you can ensure that your business has sufficient liquidity to keep things running smoothly.

For instance, suppose you land a large order from a new client. This requires upfront spending on materials or labor, so having cash readily available becomes crucial. Effective cash flow management helps you prepare for these scenarios, ensuring that growth opportunities don’t hinder operational stability.

Supporting Expansion and Investment Opportunities

Growing businesses often require additional funds for expansion—whether that’s hiring new staff, purchasing equipment, expanding inventory, or opening a new location. Cash flow management provides the financial foundation to make these investments without compromising daily operations. By understanding your cash position, you can allocate funds strategically, making sure you’re investing in growth while keeping reserve funds for unexpected needs.

When cash flow is well-managed, you can seize opportunities when they arise. For example, if a new supplier offers a bulk discount that requires a larger upfront payment, effective cash flow planning can make it possible to take advantage of the offer, ultimately boosting profitability.

Enabling Informed Decision-Making

Understanding cash flow patterns allows business owners and managers to make more informed decisions. By analyzing cash flow statements and projections, you gain insights into trends and can forecast future cash needs. For instance, if you see that cash inflow is seasonal, you can plan for periods with lower income by adjusting expenses or securing short-term financing in advance.

These insights empower you to make proactive decisions rather than reacting to cash shortfalls after they occur. Whether deciding to pursue a major project, hire additional staff, or delay certain purchases, effective cash flow management provides a clear picture of what’s financially feasible, helping you make choices that support sustainable growth.

Enhancing Creditworthiness and Access to Financing

A solid cash flow management system reflects positively on your business’s creditworthiness, making it easier to secure financing on favorable terms. Lenders and investors look closely at a company’s cash flow to assess its ability to repay loans or provide a return on investment. If your business demonstrates consistent, well-managed cash flow, financial institutions are more likely to offer credit or financing at lower interest rates.

In contrast, businesses with erratic cash flow may struggle to gain favorable financing, as lenders view irregular income as a risk. Keeping a steady cash flow supports operations and opens doors to affordable financing, which can fuel further growth.

Ensuring Compliance with Financial Obligations

Cash flow management also plays a vital role in staying compliant with financial obligations. From payroll taxes to supplier payments, businesses have a range of recurring obligations. Poor cash flow management can result in delayed or missed payments, leading to penalties, interest charges, or even legal complications.

Timely payments avoid these issues and improve relationships with suppliers, creditors, and employees. When you manage cash flow effectively, you can consistently meet these obligations, enhancing your business’s reputation as reliable and trustworthy.

Detecting and Preventing Fraud

Cash flow management, when conducted regularly, can help in detecting unusual financial activities and preventing fraud. For instance, if expenses spike unexpectedly or if there are discrepancies in cash flow records, these could be signs of financial mismanagement or fraudulent activity. Consistent monitoring of cash flow helps you identify such irregularities early, minimizing potential financial losses.

Beyond detection, regular cash flow checks act as a preventive measure, signaling to employees and partners that finances are closely monitored. This layer of oversight can deter fraudulent activities, as would-be perpetrators know that financial transactions are under constant review.

Building Confidence Among Stakeholders

Transparent and effective cash flow management builds confidence among key stakeholders—employees, investors, and creditors. Stakeholders rely on your company’s financial health, and cash flow management is a clear indicator of stability. Investors are more likely to support a business that can demonstrate steady, reliable cash flow, as it suggests sound financial practices and a lower investment risk.

Employees, too, value stability in their workplace. When your business has a consistent cash flow, employees feel secure in their positions, knowing that the company is financially stable. This confidence fosters loyalty and helps maintain a motivated, productive workforce.

Key Benefits of Cash Flow Management

Ensures Liquidity: Meets operational expenses smoothly.

Supports Growth: Funds expansion opportunities.

Aids Decision-Making: Provides insights for planning.

Improves Creditworthiness: Facilitates access to financing.

Maintains Compliance: Ensures timely payments.

Prevents Fraud: Detects unusual activities early.

Builds Stakeholder Trust: Increases confidence in business stability.

In Conclusion

Cash flow management is more than tracking numbers—it’s a strategic tool that supports sustainable growth, financial health, and stability for growing businesses. By maintaining liquidity, enabling expansion, informing decisions, enhancing creditworthiness, and building stakeholder confidence, effective cash flow management plays a critical role in your business’s success. For any growing company, prioritizing cash flow is essential. When managed carefully, it opens up opportunities, safeguards against risks, and ensures your business remains on a steady path forward.

0 notes

Text

What Does an Accountant’s Financial Consultation Really Involve?

Financial consultations with an accountant are far more than just routine tax filings or record-keeping—they offer strategic guidance that can transform both personal and business finances. From tax planning and budgeting to risk management and estate planning, accountants play a crucial role in helping clients make informed financial decisions. Here’s a breakdown of what an accountant’s financial consultation typically involves, providing insights into how these services can support your financial health.

Comprehensive Financial Analysis: Laying the Groundwork

The first step in any financial consultation is a comprehensive financial analysis. This involves taking a detailed look at your current financial situation, including assets, liabilities, income, expenses, and cash flow. For businesses, this might also involve a review of operational costs, profit margins, and financial ratios, which are essential for evaluating financial health.

For individuals, the analysis may focus on income sources, savings, debt, and investment portfolios. The goal here is to understand where you currently stand, allowing the accountant to identify strengths and weaknesses in your financial situation. This step provides a clear foundation for more advanced planning and helps highlight areas where improvements can be made, such as reducing unnecessary expenses or re-allocating investments.

By conducting this analysis, accountants can offer recommendations on how to better manage your finances, making sure that your financial goals align with your current situation.

Strategic Tax Planning: Minimizing Liabilities

One of the most sought-after services during a financial consultation is tax planning. Accountants help you develop strategies to minimize your tax liabilities while remaining compliant with federal, state, and local tax regulations. This goes beyond just filing your taxes at the end of the year—it involves proactive planning throughout the year to optimize your financial decisions.

For instance, an accountant may suggest structuring investments or retirement contributions in a way that maximizes tax benefits. They might also identify deductions or credits that you may not have been aware of. Whether you're a business or an individual, tax strategies like deferring income, accelerating expenses, or taking advantage of tax credits can have a significant impact on your overall tax burden.

By staying ahead of tax deadlines and planning with foresight, accountants help ensure that you aren’t paying more than you need to in taxes, allowing you to keep more of your hard-earned money.

Investment Guidance: Optimizing Wealth Management

While accountants are not always investment advisors, they play a key role in investment management by providing insights on how to structure your portfolio for tax efficiency and long-term growth. During a financial consultation, your accountant can assess your current investments—such as stocks, bonds, and retirement accounts—and offer suggestions for optimizing your portfolio based on your financial goals.

For example, an accountant may suggest tax-advantaged accounts like IRAs or 401(k) plans to maximize retirement savings while minimizing current tax liabilities. They can also advise on how capital gains taxes will affect your investments, providing a holistic view of how your investment decisions fit into your overall financial plan.

In some cases, your accountant might work in tandem with your financial advisor to create a unified investment strategy that aligns with your tax strategy and long-term financial objectives.

Budgeting and Cash Flow Management: Creating a Financial Roadmap

Whether you’re a business owner or an individual, effective budgeting is key to financial success. During a financial consultation, your accountant will help you create a realistic budget that takes into account your income, expenses, and financial goals. For businesses, this could include forecasting future revenues, managing operational expenses, and planning for capital investments. For individuals, it may involve setting savings goals, paying down debt, or planning for major life events such as buying a home or sending children to college.

Effective cash flow management is a critical component of budgeting, especially for businesses. Accountants provide insights into how to maintain positive cash flow by ensuring that income covers expenses and by identifying periods of financial strain in advance. This forward-looking approach allows businesses and individuals to make informed decisions that prevent shortfalls and enable long-term financial health.

Risk Management and Insurance Review: Protecting Your Assets

A financial consultation also involves reviewing potential risks to your financial health and recommending strategies to mitigate them. For businesses, this can involve assessing operational risks and ensuring that you have the right insurance coverage, such as liability insurance or business interruption insurance, to protect against unforeseen events.

For individuals, this might include reviewing life insurance, health insurance, and disability coverage to ensure that you and your family are adequately protected. In many cases, accountants will also recommend estate planning tools, such as wills and trusts, to safeguard assets and provide for future generations. By identifying potential financial risks and providing solutions to mitigate them, accountants help ensure that unexpected events won’t derail your financial stability.

Estate and Succession Planning: Preparing for the Future

For individuals and business owners alike, estate planning is an essential part of a financial consultation. Accountants can help you plan for the transfer of wealth to future generations, ensuring that your estate is structured to minimize taxes and protect your assets. They also work closely with estate attorneys to ensure that your will, trusts, and other legal documents align with your financial plan.

For business owners, succession planning is equally important. Accountants assist in creating a succession strategy that ensures the smooth transfer of business ownership when the time comes, whether through family inheritance, a sale, or an internal transition. Succession planning is not just about leadership—it’s about ensuring the financial health of the business long after the current owner steps down.

Ongoing Financial Monitoring and Adjustments

A financial consultation doesn’t end after the initial meeting. Most accountants offer ongoing financial monitoring services to help you adjust your financial strategies as your life circumstances or business conditions change. For instance, as tax laws evolve or market conditions shift, your accountant will recommend updates to your financial plan to ensure that it remains optimal.

This ongoing relationship provides clients with peace of mind, knowing that a professional is consistently monitoring their financial health and offering advice on how to stay on track with their goals. Whether it’s a change in tax law or a shift in your personal finances, accountants help you pivot your strategy when needed to achieve the best possible outcome.

What an Accountant’s Financial Consultation Involves

Financial analysis: Review income, expenses, assets, and liabilities.

Tax planning: Minimize liabilities and ensure compliance.

Investment guidance: Structure portfolios for efficiency and growth.

Budgeting: Develop forward-looking financial forecasts.

Risk management: Recommend insurance and risk mitigation strategies.

In Conclusion

An accountant’s financial consultation provides a deep dive into your financial situation, offering actionable insights that can help you save money, reduce risk, and plan for the future. Whether you’re an individual looking to optimize your taxes and investments or a business owner planning for growth, a financial consultation can provide the guidance you need to succeed. With a focus on proactive planning, risk management, and long-term strategy, accountants are more than just number-crunchers—they are essential partners in your financial success.

0 notes

Text

What Is a CPA and How Can They Help Your Business Thrive?

Running a business is a multifaceted venture, often filled with challenges, especially when it comes to handling finances. To stay on top of tax regulations, financial reporting, and long-term planning, many business owners turn to a Certified Public Accountant (CPA). A CPA isn’t just another accountant—these professionals hold a higher qualification, are held to stringent standards, and can offer a wide array of services that help businesses grow and thrive. In this article, we’ll explore what a CPA does and how they can benefit your business by providing much-needed support, from tax planning to strategic financial advice.

What is a CPA and How Do They Differ from Accountants?

A Certified Public Accountant (CPA) is an accountant who has achieved specific credentials beyond that of a general accountant. To become a CPA, one must pass a rigorous examination, meet experience requirements, and complete ongoing continuing education to stay current with evolving tax laws and accounting practices. This sets CPAs apart from regular accountants, giving them the legal authority to perform certain tasks such as auditing financial statements, offering detailed tax strategies, and providing formal business valuations.

Unlike general accountants, CPAs are licensed professionals and are often seen as trusted advisors, especially when businesses face complex financial challenges. While an accountant can help with bookkeeping and basic financial management, a CPA brings an added level of expertise that is critical for compliance, tax strategy, and long-term planning.

Tax Planning and Preparation: A CPA’s Primary Role

One of the most well-known services a CPA provides is tax preparation. Filing taxes is a complex task, especially for businesses that must account for multiple revenue streams, deductions, and expenses. A CPA is well-versed in tax regulations and keeps up with changes in tax laws to ensure that your business remains compliant.

Beyond simple preparation, CPAs offer proactive tax planning, which can make a significant difference in your overall tax liability. By analyzing your business’s financial situation, a CPA can identify potential tax deductions, credits, and strategies to reduce the amount of taxes you owe. For example, they may suggest accelerating or deferring expenses, investing in tax-advantaged accounts, or restructuring the business to take advantage of more favorable tax treatments. Their expertise ensures that your tax strategy aligns with both short-term goals and long-term growth plans.

Financial Reporting and Compliance: Ensuring Accuracy and Accountability

Accurate financial reporting is essential for maintaining the health of any business. CPAs play a pivotal role in preparing key financial statements, such as balance sheets, income statements, and cash flow statements. These documents provide a snapshot of your business’s financial health and are crucial when applying for loans, attracting investors, or negotiating contracts.

CPAs ensure that these statements comply with the relevant accounting standards, such as Generally Accepted Accounting Principles (GAAP), which adds credibility and accuracy to your financial records. This can be especially important when your business undergoes external audits or when you need to demonstrate financial transparency to stakeholders. Furthermore, CPAs can help set up internal controls that protect your company from financial mismanagement, fraud, and inefficiencies.

Business Planning and Strategic Growth Advice

A CPA isn’t just a number-cruncher; they can serve as strategic partners, especially when planning for business growth. Whether you're launching a startup or expanding an established business, a CPA can provide valuable insights into how to structure your business financially. They help craft detailed business plans that include revenue projections, cost estimates, and capital requirements, all of which are crucial for securing loans and attracting investors.

Moreover, as your business grows, a CPA can help you navigate key decisions such as expanding into new markets, acquiring assets, or merging with another company. They can conduct a cost-benefit analysis of different scenarios, helping you understand the financial implications of each option. Their expert advice allows you to make decisions that are aligned with both immediate business needs and long-term goals.

Managing Cash Flow and Budgeting

Cash flow management is critical for business survival, especially in industries where revenue can be seasonal or unpredictable. CPAs help businesses develop comprehensive budgets that outline income, expenses, and cash flow for both short and long-term periods. They monitor your cash flow to identify trends, risks, and opportunities, ensuring that your business has sufficient working capital to meet its obligations and invest in growth.

Through regular financial reviews, CPAs can help adjust budgets and forecasts based on market changes or unexpected challenges. This real-time adjustment ensures that your business remains on solid financial footing, allowing you to allocate resources effectively and avoid shortfalls.

Audit Support and Representation: Guiding You Through Regulatory Hurdles

One of the most stressful scenarios for any business is an audit by tax authorities or other regulatory bodies. A CPA is not only qualified to help you prepare for an audit but can also represent your business during the audit process. They ensure that all financial records are organized, accurate, and comply with relevant regulations.

CPAs help communicate with auditors on your behalf, addressing any questions and providing the necessary documentation. If discrepancies are identified, they work with you to resolve the issues quickly and efficiently, minimizing disruptions to your business. This expert representation can be invaluable in avoiding penalties and ensuring that your financial practices stand up to scrutiny.

Additional Services: Payroll, Risk Management, and More

Beyond the core services of tax planning, financial reporting, and audits, CPAs offer a wide range of additional services that can help your business thrive. For instance, they can assist with payroll management, ensuring that your employees are paid accurately and on time while managing tax withholdings and deductions.

CPAs are also skilled at conducting risk assessments to identify potential financial vulnerabilities in your business. They can suggest strategies to mitigate these risks, such as improving internal controls, securing adequate insurance, and planning for economic downturns. Some CPAs also offer succession planning, which is crucial for business owners who want to ensure a smooth transition when they retire or sell their business.

In Conclusion

A CPA can be one of the most valuable assets to your business, providing much-needed expertise in managing finances, reducing tax liabilities, and planning for future growth. With their comprehensive understanding of tax laws, financial management, and business strategy, CPAs help ensure that your business remains compliant, financially sound, and prepared for any challenges that may arise. By partnering with a CPA, you gain not only a trusted advisor but a strategic ally who is dedicated to helping your business thrive.

0 notes

Text

Beyond QuickBooks: Understanding Its Limitations

QuickBooks has become a staple for many small and medium-sized businesses due to its ease of use and comprehensive accounting features. However, as businesses grow and evolve, the limitations of QuickBooks can become apparent. While it serves well in the early stages, understanding when QuickBooks may no longer meet your needs is crucial for sustained growth. This article will explore the various limitations of QuickBooks, helping you determine when it might be time to consider more advanced solutions.

Limited Scalability for Growing Businesses

One of the most significant drawbacks of QuickBooks is its limited scalability, particularly for businesses that are expanding rapidly. While QuickBooks is designed to handle the basic accounting needs of small businesses, it can struggle when faced with larger volumes of transactions or a growing number of users. As your business scales, you might encounter system slowdowns, frequent crashes, and overall reduced performance, especially during peak periods when the software is under heavy use.

Additionally, QuickBooks has limitations on user licenses, often capping the number of users who can access the system simultaneously. This restriction can create bottlenecks in workflow and collaboration, particularly in growing companies where multiple team members need access to financial data at the same time. As a result, businesses may find that QuickBooks no longer meets their operational needs, prompting them to look for more scalable solutions.

Challenges with Advanced Reporting

While QuickBooks provides basic financial reports that are adequate for many small businesses, it falls short when more advanced reporting is required. The software’s reporting tools are often static and lack the dynamic features needed for comprehensive financial analysis. As businesses grow and require more detailed insights into their financial performance, QuickBooks’ limitations become evident.

For example, QuickBooks’ reporting tools might not offer the level of detail needed for complex financial forecasting or trend analysis. Businesses that need to track performance across multiple departments, products, or geographic regions may find the reporting capabilities of QuickBooks inadequate. This can lead to a reliance on external tools or manual workarounds, which are both time-consuming and prone to error.

Moreover, the lack of customization in QuickBooks reports can hinder a company’s ability to tailor financial analysis to specific business needs. As a result, decision-makers might not have access to the timely and accurate data they need to make informed strategic decisions, potentially slowing down business growth.

Limited Integration Capabilities

Integration with other business tools is essential for maintaining efficiency and accuracy in today’s interconnected business environment. However, QuickBooks offers limited integration capabilities compared to more comprehensive Enterprise Resource Planning (ERP) systems. As businesses grow, they often need to integrate their accounting software with other critical systems, such as Customer Relationship Management (CRM) platforms, e-commerce solutions, or inventory management systems.

QuickBooks’ limitations in this area can lead to inefficiencies, as businesses may need to rely on manual processes to transfer data between systems. This increases the risk of errors and consumes valuable time that could be better spent on more strategic activities. Furthermore, as your business operations become more complex, the need for seamless integration between various systems becomes increasingly important, making QuickBooks less viable as a long-term solution.

Inventory Management Limitations

Inventory management is a critical aspect of many businesses, particularly in retail, manufacturing, and distribution sectors. While QuickBooks offers basic inventory management features, these are often insufficient for businesses with more complex inventory needs. For example, QuickBooks can struggle with tracking inventory across multiple locations or managing large product catalogs.

The limitations of QuickBooks in inventory management can lead to several challenges, including inaccurate stock levels, difficulties in forecasting demand, and inefficiencies in order management. These issues can result in overstocking, stockouts, and ultimately, lost sales opportunities. For businesses that rely heavily on accurate and efficient inventory management, these shortcomings can significantly impact profitability and customer satisfaction.

Additionally, the lack of advanced inventory tracking features, such as batch and serial number tracking or multi-location management, means that businesses may need to invest in additional software solutions or manual processes to fill the gaps. This can increase costs and complicate workflows, further highlighting the limitations of QuickBooks as a comprehensive business solution.

Inadequate Controls and Security

Security and control are paramount when managing financial data, especially as businesses grow and more users require access to sensitive information. QuickBooks, while offering basic security features, lacks the advanced controls found in more robust accounting or ERP systems. This can leave businesses vulnerable to unauthorized access, data manipulation, and other security risks.

For instance, QuickBooks does not provide detailed audit trails or advanced user permissions, making it difficult to enforce strict financial controls. This can lead to potential issues such as unauthorized changes to financial records, which can go unnoticed and result in significant discrepancies. For businesses that require stringent financial oversight and compliance with industry regulations, these limitations can pose serious risks.

Furthermore, as the volume of financial data increases, QuickBooks’ ability to maintain data integrity can be compromised, leading to concerns about data accuracy and reliability. This is particularly problematic in industries that are heavily regulated or require rigorous financial reporting standards.

Handling Complex Business Requirements

As businesses expand, their financial and operational needs often become more complex, requiring more sophisticated tools to manage them effectively. QuickBooks is primarily designed for small businesses with relatively simple accounting needs. However, as businesses grow and begin to deal with multi-entity financials, multi-currency transactions, or complex revenue recognition processes, QuickBooks can fall short.

These complex business requirements often necessitate advanced features that QuickBooks does not offer, such as comprehensive project management, detailed job costing, or advanced financial forecasting. As a result, businesses may need to implement additional software solutions or develop custom workarounds to manage these complexities. This increases operational costs and adds layers of complexity to the financial management process, making QuickBooks less effective as a standalone solution.

The Need for More Robust Solutions

Given these limitations, it is crucial for growing businesses to recognize when QuickBooks may no longer be the best fit for their needs. While QuickBooks offers a strong foundation for small businesses, it is not designed to handle the complexities of larger, more dynamic organizations. Businesses that have outgrown QuickBooks should consider transitioning to more robust ERP systems that offer greater scalability, integration capabilities, and advanced features.

ERP systems provide a unified platform that integrates various business processes, from accounting and inventory management to customer relationship management and supply chain operations. This holistic approach improves efficiency and provides the flexibility and control needed to support long-term business growth. By upgrading to an ERP system, businesses can overcome the limitations of QuickBooks and gain access to the tools they need to thrive in an increasingly competitive market.

Conclusion: Recognizing When It’s Time to Move Beyond QuickBooks

QuickBooks is a powerful tool for small businesses, offering essential accounting features that are easy to use and cost-effective. However, as businesses grow and their needs become more complex, the limitations of QuickBooks can become a hindrance. From scalability issues and inadequate reporting to limited integration and security concerns, these challenges can impact your ability to manage your business effectively.

Understanding these limitations is the first step in determining when it might be time to move beyond QuickBooks. By recognizing the signs that your business has outgrown the software, you can explore more advanced solutions that offer the scalability, integration, and advanced features necessary for continued growth and success.

0 notes

Text

Balance Sheet No-Nos: What to Leave Off

Creating a balance sheet is a crucial part of financial reporting for any business, providing a snapshot of its financial health at a specific point in time. However, including the wrong items on a balance sheet can mislead stakeholders and compromise the integrity of financial analysis. This article aims to guide you through common mistakes to avoid, ensuring that your balance sheet remains accurate and reliable. We'll explore items that should never appear on a balance sheet, provide insights into why they should be excluded, and offer best practices for maintaining a clear and precise financial statement. Understanding these principles will help you create balance sheets that truly reflect your business's financial standing, aiding in better decision-making and maintaining stakeholder trust.

Intangible Assets Without Clear Valuation

One of the first items to leave off your balance sheet are intangible assets without clear, reliable valuation. Intangible assets, such as goodwill, brand reputation, and intellectual property, can be significant for a company, but they are challenging to quantify accurately. Including these assets without a rigorous valuation method can lead to overstatement of the company’s worth and mislead investors and stakeholders. Only intangible assets that have a clear, market-based valuation, such as patents or trademarks with a determinable fair value, should be included. Goodwill, which arises from acquisitions, should only be recorded when it has been objectively valued during the acquisition process. This ensures that the balance sheet reflects realistic asset values and maintains its credibility. Moreover, constantly updating the valuations of these intangibles, based on market conditions and operational effectiveness, helps in maintaining an accurate financial portrayal of the company.

Personal Assets and Liabilities

A common mistake, especially in small businesses or sole proprietorships, is the inclusion of personal assets and liabilities on the company’s balance sheet. Personal items such as the owner’s home, personal bank accounts, or personal debts should never appear on a business balance sheet. This practice can obscure the true financial position of the business and complicate financial reporting and tax calculations. Keeping personal and business finances separate is not only good practice but also a legal requirement in most jurisdictions. This separation simplifies accounting processes, ensures compliance with tax regulations, and provides a clear picture of the business’s financial health, making it easier to secure financing and attract investors. Additionally, mixing personal and business finances can lead to legal complications, particularly in the event of an audit or legal dispute, potentially exposing personal assets to business liabilities.

Speculative Investments

Speculative investments, including high-risk stocks, options, or cryptocurrency holdings, should be carefully considered before including them on a balance sheet. These investments can be highly volatile and may not provide a reliable basis for assessing the company’s financial health. If speculative investments are included, they should be clearly categorized and valued conservatively. Overvaluing speculative assets can lead to significant discrepancies between reported and actual financial conditions, potentially misleading investors and creditors. It's best to report speculative investments separately or in the notes to the financial statements, providing transparency without overstating the company’s financial stability. This approach not only maintains the accuracy of the balance sheet but also ensures that stakeholders are aware of the risks associated with these investments.

Unrealized Gains

Unrealized gains on investments, such as increases in the value of securities that have not been sold, should not be recorded on the balance sheet. These gains are not yet realized in cash and can fluctuate significantly before the assets are actually sold. Including unrealized gains can give an inflated view of a company’s profitability and financial stability. Instead, such gains should be reported in the notes to the financial statements or within other comprehensive income until they are realized. This approach ensures that the balance sheet reflects only actualized financial changes, providing a more accurate picture of the company’s financial status. Additionally, this practice helps in maintaining the integrity of the balance sheet, avoiding the presentation of an overly optimistic financial situation that could mislead stakeholders and potential investors.

Contingent Liabilities

Contingent liabilities, such as potential lawsuits or warranty claims, should not be included on the balance sheet if they are not probable and measurable. Contingent liabilities are potential liabilities that may occur depending on the outcome of a future event. Including these on the balance sheet can misrepresent the company's financial obligations. Instead, they should be disclosed in the notes to the financial statements, providing stakeholders with relevant information without distorting the balance sheet. This practice ensures transparency and allows stakeholders to understand potential risks without overstating current liabilities. For example, disclosing the nature and potential impact of these liabilities in the notes can provide a clearer picture of the company’s risk profile without affecting the balance sheet figures directly.

Non-Operating Assets

Non-operating assets, such as excess real estate, idle equipment, or non-essential investments, should generally be excluded from the balance sheet. These assets do not contribute to the company’s core business operations and can complicate the financial analysis. Keeping the balance sheet focused on operational assets ensures a clearer picture of the company’s operational efficiency and financial health. Non-operating assets can be disclosed separately or in the notes to provide a complete financial overview without cluttering the main statement. This separation helps stakeholders focus on the assets that directly impact business performance and profitability, ensuring a more accurate assessment of the company’s operational capabilities and financial health.

Obsolete Inventory

Including obsolete or unsellable inventory on the balance sheet is another common error. Inventory should be valued at the lower of cost or market value, and any obsolete or slow-moving inventory should be written down or written off. Retaining outdated inventory on the balance sheet can overstate assets and distort the company’s true financial position. Regular inventory reviews and adjustments ensure that the balance sheet reflects only the current, marketable inventory. This practice helps in maintaining accurate financial records and provides a true picture of the company’s available resources and potential for future sales. Additionally, accurately valuing inventory helps in managing cash flow and planning for future inventory purchases, ensuring the company remains financially healthy and capable of meeting market demands.In conclusion, crafting an accurate and insightful balance sheet involves understanding not just what to include, but also what to leave off. By excluding intangible assets without clear valuation, personal assets and liabilities, speculative investments, unrealized gains, contingent liabilities, non-operating assets, and obsolete inventory, you can maintain the integrity of your financial statements. A well-prepared balance sheet not only complies with accounting standards but also provides a reliable basis for financial analysis and decision-making. Regular reviews and adherence to best practices in financial reporting will ensure that your balance sheet remains a true reflection of your company's financial health, helping you build trust with investors, creditors, and other stakeholders. By focusing on accurate and relevant data, your balance sheet can effectively communicate your business’s financial standing, supporting strategic decisions and fostering long-term success. This diligent approach to financial reporting not only enhances transparency but also strengthens the overall credibility and reputation of your business.

0 notes

Text

Avoiding Pitfalls: Common Accounting Errors to Watch For

Accounting errors, whether minor or major, can disrupt your business operations, lead to financial losses, and damage your credibility. These errors can occur at any stage of the accounting process, from data entry to financial reporting. The objective of this article is to highlight the most common accounting errors, explain why they occur, and provide practical tips on how to avoid them. By being proactive and implementing effective accounting practices, you can minimize errors and ensure that your financial records accurately reflect your business's performance. Accurate accounting is the backbone of financial integrity and is essential for strategic decision-making, legal compliance, and maintaining trust with stakeholders. Understanding these common errors and their preventive measures can save your business from costly repercussions.

Data Entry Errors

Data entry errors are among the most frequent mistakes in accounting. These can include transposed numbers, typos, or incorrect entries. For example, entering $1,000 instead of $10,000 can significantly skew your financial reports. Such errors often arise from manual data entry processes where human oversight is a factor. To avoid these errors, it's essential to implement a double-entry system where each transaction is recorded in two accounts. This helps catch discrepancies early on. Additionally, using accounting software that includes validation rules and error checks can significantly reduce the risk of data entry mistakes. Regularly reviewing and reconciling your accounts can also help identify and correct errors promptly. Automating data entry processes where possible, such as using OCR (Optical Character Recognition) for invoices and receipts, can further minimize the risk of human error.

Errors of Omission

Errors of omission occur when a transaction is completely left out of the accounting records. This can happen due to oversight or misplacing an invoice. These errors can lead to inaccurate financial statements and misinformed business decisions. Omissions might also occur when there's a lack of robust documentation practices or when multiple people are involved in the accounting process without clear accountability. To prevent omission errors, maintain a systematic filing system for all financial documents and ensure that all transactions are recorded promptly. Regular audits and reconciliations can help ensure that no transactions are overlooked. Using digital tools to scan and store receipts and invoices can also reduce the likelihood of missing records. Establishing clear protocols for the handling and recording of financial documents can create a more efficient and error-free accounting environment.

Errors of Commission

Errors of commission happen when a transaction is recorded in the wrong account or with incorrect details. For instance, recording a payment received in the wrong customer's account can cause confusion and mismanagement. These errors can occur from misunderstandings of accounting principles or haste in recording transactions. To avoid these errors, establish clear accounting procedures and provide adequate training to your staff. Using accounting software with automated processes can help ensure transactions are recorded correctly. Regular reviews and reconciliations are also essential to catch and correct these errors early. It's also beneficial to have a second set of eyes review transactions, particularly for high-value entries, to ensure accuracy. Additionally, maintaining detailed and up-to-date chart of accounts helps ensure that transactions are recorded in the correct accounts.

Misclassifying Income and Expenses

Misclassifying income and expenses is a common error that can distort your financial reports. For example, classifying a capital expenditure as an operating expense can affect your profit and loss statement and tax calculations. This misclassification can lead to inaccurate financial ratios and misinformed business decisions. To avoid this, ensure that you and your accounting team understand the different categories of expenses and income. Regular training and using detailed accounting guidelines can help maintain accuracy. Accounting software can also assist by providing predefined categories and automated classification suggestions. Regularly reviewing your financial statements with a professional accountant can help catch and correct any misclassifications before they lead to significant issues. Keeping abreast of the latest accounting standards and tax laws is also essential for accurate classification.

Failing to Reconcile Accounts

Reconciling your accounts regularly is crucial to ensure that your financial records match your bank statements. Failing to do this can result in undetected errors, such as unrecorded transactions or fraudulent activity. Account reconciliation also helps in identifying discrepancies that might indicate theft or misappropriation of funds. Schedule monthly reconciliations and use accounting software that can integrate with your bank accounts to streamline the process. Reconciliation helps validate the accuracy of your records and provides an opportunity to identify and address discrepancies promptly. Implementing regular reconciliation not only ensures accuracy but also enhances financial transparency and control within your organization. It also builds confidence among stakeholders about the integrity of your financial management practices.

Overstating Revenue

Overstating revenue is a serious error that can lead to incorrect tax filings and financial misstatements. This often occurs when invoices are recorded as revenue before payment is received or when payments are recorded twice. This error can significantly impact your profit margins and lead to overestimating your financial performance. To avoid this, implement strict workflows for recording income and ensure that payments are applied correctly against open invoices. Regularly review your accounts receivable to ensure that all entries are accurate and that there are no duplicate records. Having a clear policy on revenue recognition and ensuring compliance with accounting standards can prevent revenue overstatement. Regular financial reviews and audits can also help detect any discrepancies early on, allowing for timely corrections.

Lack of Internal Controls

Strong internal controls are essential for preventing accounting errors and fraud. Lack of segregation of duties, inadequate review processes, and poor documentation can lead to significant issues. Without robust internal controls, it's easier for errors to go unnoticed and for fraudulent activities to occur. Implement internal controls such as segregation of duties, where different individuals handle different parts of the accounting process. Regular audits and reviews, both internal and external, can help ensure that your controls are effective and that any weaknesses are addressed promptly. Clear policies and procedures, along with regular staff training, are also vital components of a robust internal control system. Establishing a culture of accountability and transparency within the organization can further strengthen internal controls and minimize the risk of errors.

In Conclusion

Accounting errors can have far-reaching consequences, from financial misstatements to legal troubles. By understanding common accounting errors and implementing strategies to prevent them, you can safeguard your business's financial health. Regular reconciliations, proper training, robust internal controls, and the use of reliable accounting software are key steps in minimizing these errors. Staying vigilant and proactive in your accounting practices will help ensure that your financial records are accurate and reliable, enabling you to make informed business decisions and maintain your company's credibility. In summary, being aware of and addressing common accounting pitfalls is essential for any business aiming for financial accuracy and success. Regular reviews, audits, and continuous improvement of accounting practices are fundamental in building a solid financial foundation for your business.

0 notes

Text

Unlocking the Golden Rules of Accounting: A Beginner's Guide

If you’ve ever wondered how businesses keep track of their finances or if you’re considering a career in accounting, you’ve likely encountered the term "golden rules of accounting." These fundamental principles are the backbone of the accounting process, ensuring accuracy, consistency, and transparency in financial reporting. But what exactly are these golden rules, and how do they work?

This article aims to demystify the golden rules of accounting, providing a comprehensive guide for beginners. We’ll explore each rule in detail, discuss their importance, and offer practical examples to help you understand how they are applied in real-world scenarios. Whether you’re a student, a small business owner, or just curious about accounting, this guide will equip you with the knowledge you need to navigate the world of finance confidently.

Understanding the Basics of Accounting

Before diving into the golden rules, it’s essential to grasp the basic concepts of accounting. At its core, accounting is the process of recording, classifying, and summarizing financial transactions to provide useful information for decision-making. The primary objectives of accounting are to track income and expenses, ensure statutory compliance, and provide stakeholders with quantitative financial information that helps in making informed business decisions. One of the fundamental aspects of accounting is the double-entry system, which means that every financial transaction affects at least two accounts. This system relies on the accounting equation: Assets = Liabilities + Equity. Understanding this equation is crucial because it underpins all accounting practices and ensures that the books remain balanced.

The Golden Rules of Accounting

The golden rules of accounting are based on the double-entry system and are designed to ensure that all financial transactions are recorded accurately. There are three golden rules, each corresponding to a specific type of account: personal, real, and nominal. Let’s explore these rules in detail.

Rule 1: Debit the Receiver, Credit the Giver (Personal Accounts)

Personal accounts relate to individuals, firms, and companies. The golden rule for personal accounts is straightforward: Debit the receiver and credit the giver. This means that when a person or entity receives something, their account is debited, and when they give something, their account is credited. For example, if a business borrows money from a bank, the bank is the giver, and the business is the receiver. The journal entry would be to debit the business’s cash account (receiver) and credit the bank’s loan account (giver). This rule ensures that personal transactions are accurately recorded, reflecting the flow of resources between entities.

Rule 2: Debit What Comes In, Credit What Goes Out (Real Accounts)

Real accounts pertain to tangible and intangible assets. The golden rule for real accounts is: Debit what comes in and credit what goes out. This means that when an asset is acquired, it is debited, and when an asset is disposed of, it is credited. For instance, if a business purchases office equipment, the equipment account (an asset) is debited, and the cash account is credited because cash is used to make the purchase. The journal entry would be to debit the office equipment account (what comes in) and credit the cash account (what goes out). This rule helps in tracking the acquisition and disposal of assets, ensuring that the financial statements accurately reflect the company’s resources.

Rule 3: Debit All Expenses and Losses, Credit All Incomes and Gains (Nominal Accounts)

Nominal accounts deal with expenses, losses, incomes, and gains. The golden rule for nominal accounts is: Debit all expenses and losses, credit all incomes and gains. This means that expenses and losses are always debited, and incomes and gains are always credited. For example, if a business incurs a utility expense, the utility expense account is debited, and the cash account is credited. Conversely, if the business earns revenue from sales, the sales account is credited, and the cash or accounts receivable account is debited. The journal entries would be to debit the utility expense account (expense) and credit the cash account (payment for the expense), and to debit the accounts receivable account (revenue earned) and credit the sales account (income). This rule ensures that all financial performance elements are accurately recorded, reflecting the company’s profitability and financial health.

Importance of the Golden Rules in Accounting

The golden rules of accounting are fundamental because they ensure the consistency and accuracy of financial records. By following these rules, businesses can maintain balanced books, which is crucial for producing reliable financial statements. These statements are used by stakeholders, including investors, creditors, and regulatory bodies, to assess the financial performance and stability of the business. Moreover, adhering to the golden rules helps in maintaining transparency and accountability. Accurate financial records are essential for auditing purposes and for complying with legal and regulatory requirements. They also facilitate better decision-making by providing clear and precise financial information.

Learning and Mastering the Golden Rules

Mastering the golden rules of accounting requires practice and a good understanding of the basic accounting principles. Here are some tips to help you learn and apply these rules effectively:

Study Examples: Reviewing multiple examples of journal entries can help solidify your understanding of the golden rules. Practice with different types of transactions to become comfortable with the process.

Use Accounting Software: Many accounting software programs automate the application of the golden rules, making it easier to record transactions accurately. Familiarizing yourself with these tools can enhance your accounting skills.

Take Accounting Courses: Enrolling in accounting courses, whether online or in-person, can provide structured learning and expert guidance. Look for courses that cover the fundamentals of accounting and the double-entry system.

Consult Resources: Books, articles, and tutorials on accounting can provide valuable insights and additional practice problems. Resources like "Accounting for Dummies" or online platforms like Khan Academy offer accessible explanations and examples.

Seek Professional Advice: If you’re managing business finances, consider consulting with a professional accountant. They can provide personalized advice and help you ensure that your records are accurate and compliant.

In Conclusion

Unlocking the golden rules of accounting is essential for anyone looking to understand or pursue a career in accounting. These fundamental principles ensure that financial transactions are recorded accurately, maintaining balanced books and providing reliable financial information. By following the rules of debiting the receiver and crediting the giver, debiting what comes in and crediting what goes out, and debiting all expenses and losses while crediting all incomes and gains, you can navigate the world of accounting with confidence. Whether you’re a student, small business owner, or aspiring accountant, mastering these rules will equip you with the knowledge needed to manage financial records effectively. Remember, the key to success in accounting is practice and continuous learning. Embrace the journey, utilize available resources, and don’t hesitate to seek professional guidance when needed. With these tools and a clear understanding of the golden rules, you’re well on your way to unlocking the full potential of accounting.

0 notes

Text

The Three Pillars of Accounting: What You Need to Know

Welcome to the foundational world of accounting, where precision meets strategy! In this article, we delve into the three pillars of accounting—critical concepts that underpin every financial process and report in the business world. These pillars are not just theoretical; they are the backbone of practical accounting, ensuring that financial statements are accurate, reliable, and reflective of a business's true financial state. By understanding these core principles, professionals and students alike can better navigate the complex landscape of accounting and enhance their financial decision-making capabilities.

The First Pillar: The Accounting Equation

The Foundation of Financial Stability

At the heart of accounting lies the Accounting Equation: Assets = Liabilities + Equity. This simple yet powerful formula is the cornerstone of all financial reporting and analysis. It represents a fundamental truth in accounting—that a company's resources (assets) are financed either by borrowing (liabilities) or by what the owners provide (equity).

Balancing the Books

The beauty of the accounting equation lies in its ability to maintain balance in the financial statements. Every transaction that a company records affects this equation in a way that keeps it balanced, ensuring that every financial activity is accurately captured. This balance is crucial for assessing the financial health of a business, providing stakeholders with a clear picture of where the money comes from and where it goes. It's this transparency and reliability that make the accounting equation a pivotal tool in financial reporting.

The Second Pillar: Double Entry System

Ensuring Balance with Every Transaction

The double-entry system is a fundamental concept in accounting that requires every financial transaction to affect at least two accounts in opposite ways. This method ensures that the Accounting Equation (Assets = Liabilities + Equity) remains balanced at all times. In practice, this means for every action there is an equal and opposite reaction in the books of accounts, which is crucial for maintaining the integrity of financial records.

Debits and Credits: The Building Blocks

In the double-entry system, transactions are recorded in terms of debits and credits. When an asset is increased, the asset account is debited; when it decreases, it is credited. Conversely, liabilities and equity are increased by credits and decreased by debits. For example, if a business takes a loan (increasing liabilities), the loan account is credited. If it purchases equipment by cash, the equipment account (an asset) is debited and the cash account (also an asset) is credited, thus keeping the accounting equation in balance.

The Third Pillar: Accounting Cycle

The Framework for Financial Reporting

The accounting cycle is a systematic process used by organizations to record and manage their financial activities. The cycle starts with identifying and analyzing transactions and ends with the compilation of financial statements. This standardized sequence ensures that financial data are processed consistently and accurately, leading to reliable financial reports.

Steps of the Accounting Cycle

The cycle begins with transaction analysis, where each transaction is examined for its financial impact on the organization. These transactions are then recorded as journal entries according to the double-entry accounting system. The entries are posted to the general ledger, and a trial balance is prepared to check for any discrepancies. Adjusting entries are made for accruals, deferrals, and other adjustments, leading to an adjusted trial balance. From this, the financial statements are prepared, providing a comprehensive report of the organization’s financial status at the end of the period. The cycle concludes with closing entries to clear temporary accounts and prepare the books for the next accounting period.

Practical Applications of the Pillars

Real-World Examples

In the realm of accounting, the three pillars serve as the backbone for daily operations and strategic decision-making within businesses. For instance, the accounting equation ensures that for every financial transaction, such as purchasing equipment or taking out a loan, there is a balanced record in the books. The double-entry system sees these transactions recorded in two accounts—debiting the equipment account and crediting cash or loans—ensuring that the books always balance. This precision is crucial for preparing accurate financial statements which are vital for analysis and decision-making by management.

Role of Technology in Modern Accounting

Technological tools play a pivotal role in upholding these accounting pillars. Modern accounting software automates many of the processes involved in the double-entry system and ensures that all entries are balanced and errors are minimized. These tools also facilitate a smoother progression through the accounting cycle, from recording transactions to generating financial reports, allowing accountants to focus more on analysis and strategy rather than manual bookkeeping.

Challenges and Considerations

Overcoming Common Challenges

Accountants often face challenges in applying these fundamental principles, such as maintaining accuracy within the double-entry system. A single error in entry can throw off entire financial statements, leading to hours of backtracking and corrections. Ensuring timely progression through the accounting cycle is another challenge, especially for large companies with complex transactions, which can delay financial reporting and strategic decision-making.

Implications of Non-Adherence

Failing to adhere to these accounting pillars can lead to significant repercussions. Discrepancies in financial records can lead to incorrect financial reporting, potentially misleading stakeholders and making the business vulnerable to legal consequences, including fines and sanctions. This underscores the importance of rigorous adherence to accounting principles to maintain the integrity and legality of financial records.

In Conclusion