Text

Beginner’s Guide to Embedded Lending-M2P Fintech

The size of the Fintech market via Embedded Finance — embedded insurance, embedded lending, and embedded payments is going to be 400 lakh crores in the next 10 years.”- The Economic Times

Lending has existed since civilization started. Mankind has borrowed for various reasons: seeds, animals, currencies, jewels, mortgages, credit cards, and digital.

Embedded Lending or embedded credit is the latest in the line receiving the spotlight. Being an active subject of debate, many businesses believe embedded lending can increase their revenue by 5x. This article summarizes the story of Embedded Lending and its potential to bridge the gap between businesses, lenders, and the end customer.

0 notes

Text

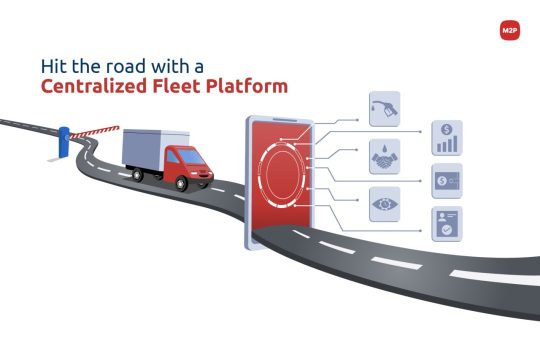

Optimize Fleet Payments through Fintech Innovations-M2P Fintech

Fleet businesses experienced significant revenue growth in the past few years for two primary reasons. One, the evolution of fleet management systems that enabled digital solutions like telematics-based route optimizations and the emergence of fleet aggregators. Fleet management systems have radically disrupted the rather traditional fleet industry by integrating modern technologies and services into the value chain. According to recent reports, fleet management systems as an industry is estimated to grow 14% yearly to 6.8 million units in 2025. As the current market penetration is hanging around 10% for the entire commercial vehicle industry, the growth potential is tremendous. The emergence of fleet aggregators has enabled seamless order and demand management and has generated great opportunities to stabilize and monitor productivity leading to sustainable profitability and growth.

And two, the government of India had initiated several digital policies such as FASTag-based toll collection, digital e-way bills, and compulsory installation of GPS devices in commercial vehicles to tap into the day-to-day fleet operations data.

0 notes

Text

5 Reasons why Banks need Behavioral Biometrics- M2P Fintech

Stronger security: Behavioral biometrics uses unique behavioral patterns and actions to verify the identity of an individual, providing a stronger form of authentication when compared to traditional methods such as passwords and security tokens.

User convenience: Unlike traditional biometrics, such as fingerprints and facial recognition, behavioral biometrics do not require any physical input from the user. Instead, it uses actions and behaviors that are performed naturally, such as typing rhythm and mouse movements. This makes it a convenient and user-friendly method of authentication.

Continuous authentication: Behavioral biometrics continuously monitor the actions and behaviors of the user, ensuring that the user’s identity is continuously verified even after initial authentication. This helps prevent fraud by detecting any changes in behavior that may indicate that a fraudster has taken over the account.

More difficult to mimic: Unlike other forms of biometrics, it is difficult for a fraudster to mimic the unique behavioral patterns of an individual. This makes it a more secure form of authentication, reducing the risk of fraud.

Improved fraud detection: By continuously monitoring user behavior, behavioral biometrics can help financial institutions identify potential fraud and investigate suspicious activity, giving them another layer of security to their customer’s accounts.

The technology behind behavioral biometrics is evolving, and there is no doubt that a lot of work in this space is already underway. The early indications are quite clear that it will be a key component of banks’ arsenal against the continuously evolving world of fraud. It’s high time banks take behavioral biometrics seriously to authenticate and protect end-users from hacking and fraud.

#credit card Fraud detection for banks#Credit card Fraud detection solution providers for banks#Fraud transcation detection solution providers#bank#software

0 notes

Text

Recon360 - Redefining Payment Reconciliation- M2P Fintech

Businesses record revenues and expenses every day. Ever wondered why it is important to accurately document these transactions?

Maintaining accurate financial records is critical to the success of any business. It helps the management make informed accounting decisions and ensures a strong base for growth and operations. Payment reconciliation secures the financial health of a business.

In the next few minutes, you will learn what payment reconciliation is all about, why it matters, its benefits, M2P’s Recon360, why it is a game changer, and how it works.

Let’s dive in!

#Reconcilation solution providers#Bank reconcilation software providers#Reconcilation & setellement platform for bank

0 notes

Text

Simplify Debit Card Management with M2P’s Revolutionary Platform

The pandemic changed the world as we know it, and banking was no exception.

Customers began preferring mobile-first, secure, personalized, and digital payment methods over direct ones to transact, and banks had to adapt to survive.

Traditional banks had to find efficient ways to drive customer experience and security. They embraced digital transformation rapidly and implemented new technologies to offer customers a seamless banking experience.

Banks had to ensure that their Debit Card Management Systems (DCMS) were equipped to handle personalization, security, and the surge in usage. They had to adopt measures such as fraud detection and prevention systems, real-time transaction monitoring, and enhanced security protocols to ensure the safety of customer data.

But running a debit card operation can be a challenging task for banks. Pressure from evolving customer preferences, competition from contactless payment modes, and evolving regulatory changes severely affect the debit card landscape. Legacy banking systems are plagued by cost and effort bottlenecks that further impact the operational efficiency and profitability of banks.

#Debit card solutions provider#Visa debit card solutions provider#Master debit card solutions provider

0 notes

Text

Focus:Rise of Co-Lending Model- M2P Fintech

The priority sector has embraced economic hardships due to the pandemic and its repercussions. Industry experts believe the renewed co-lending model has great potential to significantly transform the sector. For one, banks can leverage the market outreach, loan origination, and servicing acumen of NBFCs, and NBFCs can bank on improved liquidity and profitability.

In addition, per RBI’s circular, NBFCs are the single point of interface for customers. They are responsible for loan origination, fund routing, servicing, and collection. Given their extensive reach at the grassroots level, better last mile connectivity, and customer relationship, NBFCs have established themselves as being more effective than banks in handling loan recovery/collection. Therefore, this approach is expected to augment the timely servicing of debt by the borrowers.

Under the renewed co-lending model, the banks’ finances and NBFCs’ (customer reach and) capabilities meld with fintechs’ technology. If exercised in the true spirit, RBI can score a hat-trick.

1. Render tailor-made and affordable financial solutions at the grassroots level

2. Catalyze the upraise of the priority sector from its economic hardships

3. Drive financial inclusion and accelerate the overall economic development of the country

Learn more about the features of co-lending and why it is the future here.

0 notes

Text

Digital Microfinance-The Next Wave in MFI

Loan origination is a critical process for lenders. From initial credit assessment, approving/denying loan applications, to disbursing the right loan amount to the right borrower, loan origination can be quite tricky. It is even trickier to originate accurate loans in a matter of minutes/seconds.

Digital Microfinance accelerates loan originations by employing digital methods for KYC verification, bank account verification, borrower credibility check, borrower credit assessment, performing Compulsory Group Training, etc.

0 notes

Text

3 reasons why you need a secured credit card-M2P Fintech

A secured card is a credit card that allows you to spend in a risk-free and rewarding manner. They are backed by a fixed deposit (FD) that is used as collateral by the issuing bank. A secured card earns you rewards not just in the form of cash backs but even gold.

Consider you want to purchase a secured credit card. All you need is a fixed deposit as supporting collateral. The FD can be an amount of your choice that will act as a credit limit for your card. The fixed deposit serves as a kitty for card issuers to rely on when there is any default in your payments.

0 notes

Text

Remittance with UPI - A Giant Leap for Cross-Border Payments

As UAE’s first UPI-enabled remittance service provider, we enable banks and foreign exchange operators to facilitate end-to-end settlements inclusive of conversion facility. Our deep domain expertise, innovation, and technology know-how render a hassle-free/frictionless remittance experience for both the payer and payee.

Most importantly, our intermediary banks are certified by NPCI, and we are compliant with the remittance directives issued by the Reserve Bank of India (RBI). Our full-fledged, mobile-first, customizable API stack simplifies UPI transactions and enables real-time international transfer.

To know more about using UPIs for cross-border remittances, write to us at [email protected].

0 notes

Text

Cross- Border Payments: A Swift Money Flow Across Borders-M2P Fintech

What are cross border payments?

Cross border payments happen when the payee and the recipient are in different countries. These transactions can be retail, wholesale or recurring in nature. Decades back, the electronic messaging system served as a crucial mode to enable cross border payments.

The cross border payments industry now utilizes many payment modes like credit cards, cross-border payment gateways, wire transfers, e-wallet, distributed ledger technology, APIs, etc., every day to facilitate international payments.

#Cross border payments solutions provider#Cross border payments fintech India#b2b cross border payments#Swift cross border payments

0 notes

Text

Six Profitable BNPL Business Models to Unlock Infinite Value-M2P Fintech

Buy Now, Pay Later (BNPL) is a global payments phenomenon that drives growth and profitability for merchants. With giants like Klarna, AfterPay, Affirm, Zip, Tabby, Cashew, Pine labs, PayPal, Atome, VISA, MasterCard, and several other players leading the way, BNPL records an impressive 36.2% CAGR in revenue, getting ready to reach USD 15470 million by 2026.

#Pay later solutions#Buy now pay later solutions#BNPL Solutions#Buy now pay later systems#BNPL system

0 notes

Text

Neo banking solutions provider-M2P Fintech

Neo banks deliver digital banking services on steroids. The digital empowerment and financial possibilities they offer the underbanked and unbanked population are phenomenal. Their ability to foster financial inclusion with digitized convenience, lower cost, and personalized customer experiences are a few of the primary reasons for the success of neo banks in India.

0 notes

Text

ekyc Solution Provider-M2P Fintech

M2P’s e-KYC suite facilitates businesses to get customer KYC from anywhere in the nation while adhering to all regulatory requirements. It enables financial institutions to control the user data necessary to be captured from the customer, which is collected through the user journeys built into the partner/bank’s digital assets. The customer’s KYC is performed using the bank’s/authorized entity’s KYC APIs, and the outcome of the activity is captured by M2P. Our e-KYC Gateway facilitates seamless customer onboarding for corporates & to better the service delivery by governments. Further, M2P ensures robust integration between the partner’s/bank’s digital assets and issuing bank’s core banking solution

#ekyc solution provider#ekyc service provider#kyc suite solutions#ekyc solutions for banks#ekyc solutions for fintech

0 notes

Text

Simplifying Acquisitions and Payments for BNPL Issuers-M2P Fintech

The global ecommerce payments industry is constantly evolving to adapt to the ever-changing needs of the customer. With the pandemic fueling digital commerce, flexible payment options have become an element of convenience in online shopping. What started with basic debit/credit card payments now includes internet banking, e-wallets, Buy Now Pay Later (BNPL), EMI, and more. Among these, BNPL is one of the most popular payment choices as it enhances the customers’ purchasing power.

1 note

·

View note