Don't wanna be here? Send us removal request.

Text

Global contract development and manufacturing organization Recipharm announced that it has secured product development contracts that strengthen its position in blow-fill-seal (BFS) technology, a single continuous process within a sterile closed system in which containers are formed, filled, and sealed minimizing the risk of contamination. The company said it has a new contract with a “top five” global ophthalmic organization that involves the rapid production of clinical trial material for a Phase 1 study, while it has also signed an agreement with a global ophthalmic biotech to support a Phase 2/3 ophthalmic suspension program. Recipharm said the recent customer contracts will leverage four ophthalmic areas of expertise: BFS, pre-filled syringes, oral solid technologies, as well as product development services including analytical and stability support. The company claims it is the only CDMO with BFS capabilities for both biologics and small molecules from early phase development through to commercialization, and that its clinical capabilities deliver over 90% active pharmaceuticals ingredient (API) savings compared to commercial manufacturing approaches. “Recipharm’s BFS clinical platform is designed for speed, adaptability and efficient API use, enabling the delivery of high quality clinical trial material across Phases 1, 2 and 3,” Vincenza Pironti, head of business development, said in a statement. “Combined with our specialist expertise, we are empowering clients to bring innovative products to market faster and with greater confidence.” Headquartered in Stockholm, Sweden, Recipharm operates 17 facilities in 10 countries around the world, giving it a global presence with local expertise that rivals some of the largest CDMOs, according to CEO Greg Behar, who took the company’s reins in January 2024. Recipharm, which became private in 2021 and has more than 5,000 employees worldwide, is “one of the oldest CDMOs out there” and is the fifth largest CDMO globally serving the biopharma industry, Behar told Pharma Manufacturing in a profile of the company earlier this year. In 2024, it secured record-breaking revenue of €827 million, a 7% year-over-year increase driven by growth in its biologics business. “We are partnering with eight out of the top 10 pharma,” Behar said, adding that in 2025 he projects that Recipharm will exceed last year’s results by achieving double-digit growth. Continue at: https://www.pharmamanufacturing.com/industry-news/news/55298665/recipharm-locks-in-new-development-contracts-leveraging-its-blow-fill-seal-capabilities

0 notes

Text

European biotechs have historically struggled to find capital on the continent, but the funding ecosystem now aims to scale up. he science is brilliant in Europe, but the translation is what’s lacking,” said V-Bio Ventures managing partner Christina Takke on the state of the European funding ecosystem for biotechs at the ongoing BIO International Convention 2025. The discussion on funding for European biotechs comes at a time when federal funding in the US is facing cuts while the European Union and France have pledged €500m to attract researchers to pursue projects in the EU. However, this alone is unlikely to foster the necessary ecosystem required to allow European biotechs to thrive. Historically, US venture capital (VCs) have provided a fillip to early-stage biotechs to build pipelines, influencing how companies operate in the US and Europe. An oft-cited distinction as a result of this is cultural differences between US and European biotechs and their approach to research. The BIO conference is taking place in Boston, where Avante Biocapital CEO Matthew Foy said an environment exists for a two-way dialogue between academics and VCs. The hubs in Europe are relatively more disparate. Even when it comes to telling a story, Hansa Biopharma CEO Renée Aguiar-Lucander said European biotechs are more focused on the science, while talk of products, market opportunity and domination takes place much earlier with US companies. Nonetheless, it is often not the company’s management team, but the board and how these companies were built by those investors who previously operated in a market without later-stage capital, that can hold back a European company, said Foy. Against the backdrop of the threat of Asian biotechs, it might be difficult to compete in a global setting with cultural touchpoints like wanting to work fewer hours in Europe, said Lucander. However, there is no reason to reinvent the wheel. It can be cheaper to develop something in Europe than in Boston’s Kendall Square, so it is important to combine the approaches that work best, said Takke. On that point of efficiency—or the ability to do more with less, Aguiar-Lucander said European biotechs are already used to being cost efficient, so they may not be impacted as much as US companies when compared to Chinese biotechs. The evolution of the European funding ecosystem European biotech has come a long way in the last 10–15 years in terms of the sophistication of VCs, management teams, quality of science, and more, said Foy. European VC companies such as Sofinnova, Forbion, which recently funded RNA editing company AIRNA, and sleep apnoea therapeutic-focused Mosanna, have raised billions of dollars in 2025. Finding a silver lining in the conversation on biotech funding that has recently been fraught with challenges, Foy said these VC raises show there is fresh capital to fund and accelerate development. While the sector deals with geopolitical issues, raising money without a syndicate is “nearly impossible”, he said, highlighting the importance of early efforts to build a network. Nonetheless, much larger, later-stage funds are emerging in Europe, which can fund companies further, he said. VIB managing director Jérôme Van Biervliet said there is capital, but “the problem is how much of it is being deployed in either venture capital or….the stock market at some point; that’s where we’re short”. Van Biervliet was optimistic that with ongoing efforts that invite new talent and management styles, now is the time to push forward for the European funding ecosystem. Alternate funding models have often been suggested as an antidote to biotechs to counter some of the early funding challenges in Europe. VIB is a non-profit research institute with an emphasis on entrepreneurship and has bio-incubators for startups across Belgium. In the beginning, the institute collaborated with big pharma, but has prioritised small biotechs more recently, said Van Biervliet. He cited the example of VIB’s work with Belgian biotech argenx to develop an a...

0 notes

Text

0 notes

Text

Global biopharma company UCB has announced plans to build a new biologics manufacturing facility in the United States, a move expected to deliver an estimated $5 billion in economic impact. The site will support the company’s expanding U.S. patient base and product pipeline, while creating approximately 300 high-skilled direct jobs and over 500 construction jobs, according to the announcement. As part of the expansion, UCB is also scaling up its partnerships with U.S.-based contract manufacturing organizations (CMOs) to increase capacity for its growth products. The company’s U.S. workforce has grown by 73% since 2017, and it has secured 15 FDA approvals or indication expansions, with eight occurring in the last two years. UCB, with more than 9,000 employees in approximately 40 countries, generated revenue of €6.1 billion in 2024. The new site is part of UCB’s strategy to reinforce its global supply chain and prepare for expected pipeline growth. The company is conducting a feasibility study to select the ideal U.S. location, focusing on areas with strong talent and innovation ecosystems. CEO Jean-Christophe Tellier said the investment reflects UCB’s goal to deliver long-term value to patients and strengthen biomedical innovation. The announcement builds on UCB’s recent U.S. investments and underscores its commitment to sustainable healthcare and economic contribution. Continue at: https://www.pharmamanufacturing.com/industry-news/news/55296959/ucb-plans-new-us-biologics-manufacturing-facility-with-5b-economic-impact

0 notes

Text

0 notes

Text

The microgravity environment enables the production of purer crystals, resulting in more concentrated therapies. BioOrbit aims to kick off pre-clinical trials to study protein crystals for monoclonal antibodies (mAbs) produced in a pharmaceutical factory in space in 2026. The UK-based company hopes that production in space would allow therapies that are currently administered intravenously (IV) to be administered subcutaneously. Speaking during a panel at HLTH Europe, taking place in Amsterdam on 16-19 June, BioOrbit CEO Dr Katie King said that the microgravity environment enables the production of purer crystals, resulting in more concentrated therapies. King said: “Manufacturing drugs in space sounds like sci-fi – but the time is now. Crystallisation is a process that is better in space compared to on Earth, and that’s because gravity inhibits that process. By doing it in space, you get much more uniform and perfect crystals than you can produce on Earth. When that is applied to antibody drugs, you get uniform and reproducible crystals of these antibodies that enable you to produce a concentrated drug formulation.” King added that the reason why microgravity assists in this is that you do not have sedimentation or convection currents in space, meaning during production, the crystals do not sink to the bottom, creating a better growth pattern. She explained that this manufacturing will likely take place within satellites, but there is still a way to go to fully understand the capabilities. Going into the timeline of BioOrbit’s ambitions, King explained: “Our first step is to develop our proof-of-concept manufacturing line, which is flying this summer to the International Space Station (ISS). Then the next step is to produce meaningful quantities of these crystals, which will be next year.” “Then, we will need to run pre-clinical trials of these crystals, which will be in 2026 or 2027. After that, it will be about compliance and regulation, as we must ensure that all our processes adhere to pharma regulations. Regulation has not been done in a space environment before, so we recognise we’ve got some hurdles to jump through, but these conversations are starting and that is exciting.” Healthcare in space has been a fast-evolving topic. In February 2025, Auxilium’s 3D printer built eight implantable medical devices for peripheral nerve repair on the ISS in two hours. Microgravity is also a significant factor in why space is optimal for tissue manufacturing. Structures would usually collapse but this is not the case in space, as they remain stable, allowing the potential for organ creation from a patient’s stem cells. Continue at: https://www.pharmaceutical-technology.com/newsletters/bioorbit-2026-pre-clinical-trials-space-manufactured-protein-crystals/?type=Analysis&utm_source=&utm_medium=&utm_content=Other_Daily_News_Articles&utm_campaign=type3_pharmaceuticals-market&cf-view

0 notes

Text

AstraZeneca has joined the long list of big pharma companies enlisting the services of Chinese biotechs, signing a deal worth up to $5.2bn with CSPC Pharmaceuticals to research chronic disease drug candidates. China is enjoying a fruitful alliance with Western big pharma companies, despite a frosty relationship with US President Trump’s administration, mainly due to the BIOSECURE ACT, which is admittedly now in legislative limbo. Licensing deals between US and Chinese biopharma companies hit record highs last year, up 280% from 2020, according to analysis by GlobalData. Across big pharma, transactions rose 66% from $16.6bn in 2023 to $41.5bn in 2024, demonstrating that China is still the go-to place to discover pipeline candidates. For deals specific to US companies, the analysis found that total deal value rose from $15.7bn in 2023 to $21.3bn in 2024. Continue at: https://www.pharmaceutical-technology.com/news/astrazeneca-taps-chinese-biotech-in-5-2bn-chronic-disease-research-deal/?utm_source=email_NS&utm_medium=email&utm_content=Spotlight_News_Article&utm_campaign=type3_Pharmaceutical%20Technology-market&cf-view&cf-view

0 notes

Text

0 notes

Text

The U.S. saw a 185% spike in demand for biomanufacturing space over the past six months, as large pharma companies and contract development and manufacturing organizations (CDMOs) looked to expand their domestic operations, according to a new report from commercial real estate and investment management company JLL. Driven by the Trump administration’s threat of pharmaceutical tariffs and other cost pressures, JLL’s report notes that 15 major pharma companies have so far announced more than $270 billion in U.S. biomanufacturing and R&D investments planned over the next five to 10 years. President Trump has repeatedly threatened to impose tariffs on pharmaceuticals to pressure drugmakers to bring manufacturing back to the U.S. It’s a threat that appears to be working with some Big Pharma companies including AbbVie, Bristol Myers Squibb, Eli Lilly, Gilead Sciences, Johnson & Johnson, Novartis, Roche, Sanofi, and Takeda — all of whom have recently pledged billions of dollars in U.S. investment. “Large and public commitments by global pharmaceutical companies is off the charts,” Mark Bruso, director, Boston and national life sciences research at JLL, said in a statement. “Even if it takes a while to materialize, it is undoubtedly an unmitigated tailwind for the manufacturing sector.” JLL contends that while an undetermined number of those investment commitments will wind up on pharma-owned campuses, the firm said it has seen a significant spike in touring activity for built biomanufacturing space in key U.S. markets. “While the pullback in public funding is great cause for concern and a supply shake-up is on the horizon, the desire to strengthen the supply chain, geopolitical factors, patent and data security concerns and uncertain tariff landscape have all sparked strong interest in domestic pharma manufacturing,” Travis McCready, head of industries, leasing advisory and chair, global life sciences advisory board at JLL, said in a statement. Given that the U.S. is the world’s biggest importer of pharmaceuticals, life sciences companies are more likely to incorporate reshoring into their long-term strategies, according to Kevin Wayer, division president, global-life sciences at JLL. Lab leasing volume craters Although pharmaceutical reshoring offers a bright spot in the current business environment, U.S. lab leasing declined significantly in the first quarter of 2025, according to the report. “Lab leasing volume experienced a notable slowdown in early 2025, dropping from its promising growth trajectory seen in 2024,” states the report. “The current market conditions reflect a cautious approach by life sciences companies in their real estate decisions, influenced by macroeconomic, policy, and funding uncertainties.” JLL believes the industry trend is poised to continue, noting that the reductions in tenant demand in early 2025 across the U.S. “suggest muted leasing volume growth for the rest of the year as the sector grapples with a rocky decision-making environment.” The U.S. lab market, which currently totals 200 million square feet, would require between 20 million square feet and 25 million square feet of net absorption or supply reductions to return to equilibrium, according to the report. “It would take three times the uptake of space seen per year during the peak of the last cycle to reach equilibrium,” Maddie Holmes, senior research analyst, life sciences industry insight and advisory at JLL, said in a statement. The sustained period of oversupply in the U.S. lab market has resulted in elevated vacancy levels, forcing many struggling buildings to consider changing uses, according to JLL, which has observed a net reduction of 1.2 million square feet in built lab space across 13 buildings over the past four quarters — part of the 3.2 million square feet that has changed or is in the process of changing uses. The report found that Boston, the San Francisco Bay Area, and San Diego are “exhibiting comparable market conditions in the face of prolonged oversupply and ...

0 notes

Text

The Tar Heel State’s decades-long focus on economic development in life sciences and pharma manufacturing is bearing fruit, as it looks to rival the Bay Area and Boston. If you haven’t been to North Carolina recently, you’re missing out on seeing one of the nation’s biggest biotechnology success stories. In the U.S., the two largest life sciences clusters — Boston and the San Francisco Bay Area — often get much of the attention. However, the Tar Heel State has created a biotech hub that rivals those juggernauts. For decades, North Carolina has been focused on economic development in the life sciences and pharmaceutical manufacturing, an investment of time, resources, partnerships, and political will that is bearing fruit. The state is now home to 840 life sciences companies that employ 75,000 people in a business-friendly environment, according to the North Carolina Biotechnology Center (NCBiotech). North Carolina “pretty much placed a bet 20-plus years ago on biomanufacturing,” said Bill Bullock, senior vice president for economic and statewide development at NCBiotech. “A lot of conversation is going on right now around tariffs, tax policy, and onshoring. We’ve kind of been doing that for a while.” In the past 18 months alone, North Carolina has seen $11 billion worth of announced investments — including the creation of more than 5,000 new jobs — with 93% of this capital expenditure in life sciences manufacturing sites, according to NCBiotech. Last month, Roche’s Genentech announced plans to build a $700 million, 700,000-square-foot manufacturing facility in Holly Springs, which will create more than 400 jobs and support Roche and Genentech’s future portfolio of obesity medicines. Fujifilm, Lilly, and Thermo On a press trip last week, organized by the Economic Development Partnership of North Carolina, I had the opportunity to see firsthand the thriving life sciences sector in the state, including manufacturing facilities at Eli Lilly, Fujifilm Biotechnologies, and Thermo Fisher Scientific. Fujifilm Biotechnologies is investing $3.2 billion to build a large-scale production facility in Holly Springs, a booming bedroom community about 20 miles from Raleigh. At the center of North Carolina’s innovative life sciences community is Raleigh-Durham’s Research Triangle Park (RTP), the largest research park in the U.S., whose 7,000 acres are home to more than 375 companies, as well as startups, nonprofits, and academic institutions. However, the biotech boom in the state goes well beyond just RTP. In Greenville, approximately 85 miles east of Raleigh, Thermo Fisher is expanding its sterile fill-finish capabilities and adopting continuous manufacturing, a fully integrated process that runs uninterrupted from beginning to end providing an alternative to traditional batch manufacturing in which drug production is segmented into a series of slow-moving steps. While Thermo Fisher has been using continuous manufacturing at its Greenville site on the clinical side, the first commercial product is slated for later this year. In Concord, Eli Lilly has built one of its most advanced, state-of-the-art manufacturing facilities. Equipped with high-speed lines, robotics, and automated systems, the Lilly site started commercial production at the end of 2024 after completing construction in only two years — more than twice as fast as the industry average of five years. The site was selected by Lilly to leverage North Carolina’s “reliable manufacturing workforce and partner with top-tier research and medical institutions as well as community colleges with strong programs in science, technology, engineering and math (STEM),” according to the company. Workforce is key Securing top talent in R&D and manufacturing remains a challenge for life sciences companies. A 2022 report found that the U.S. faces a shortage of workers with the specialized knowledge for pharmaceutical manufacturing, with 60% of those jobs going unfilled. However, North Carolina has made a decades-long investment in workforce...

0 notes

Text

Largest Biotech companies by Market Cap Companies: 847 total market cap: $6.072 T Rank Name Market Cap Price Today Price (30 days) Country 1 Eli Lilly LLY $724.99 B $807.58 1.44% USA 2 Johnson & Johnson JNJ $373.47 B $155.22 1.20% USA 3 Novo Nordisk NVO $342.74 B $77.02 3.52% Denmark 4 AbbVie ABBV $337.13 B $190.86 0.12% USA 5 Roche ROG.SW $259.11 B $322.91 0.08% Switzerland 6 Novartis NVS $234.35 B $118.09 1.14% Switzerland 7 AstraZeneca AZN $232.04 B $73.55 1.17% UK 8 Merck MRK $203.29 B $80.96 0.07% USA 9 Amgen AMGN $158.92 B $295.56 0.12% USA 10 Thermo Fisher Scientific TMO $152.91 B $405.08 0.58% USA 11 Pfizer PFE $138.72 B $24.40 0.57% USA 12 Gilead Sciences GILD $137.86 B $110.83 0.77% USA 13 Sanofi SNY $122.58 B $49.41 0.52% France 14 Vertex Pharmaceuticals VRTX $115.79 B $450.91 1.00% USA 15 Bristol-Myers Squibb BMY $99.02 B $48.66 2.19% USA 116 Chugai Pharmaceutical 4519.T $83.94 B $51.01 1.05% Japan 117 GlaxoSmithKline GSK $83.42 B $40.49 0.91% UK Close Ad X 18 CSL CSL.AX $75.66 B $156.27 0.08% Australia 19 Zoetis ZTS $73.18 B $164.38 0.03% USA 20 Regeneron Pharmaceuticals REGN $56.43 B $522.68 1.24% USA 21 Samsung Biologics 207940.KS $52.72 B $740.81 0.49% S. Korea 22 Lonza LONN.SW $49.99 B $693.03 0.56% Switzerland 23 Jiangsu Hengrui Medicine 600276.SS $47.69 B $7.22 3.57% China 24 Takeda Pharmaceutical TAK $47.07 B $15.07 0.86% Japan 25 Sun Pharmaceutical SUNPHARMA.NS $46.04 B $19.19 1.96% India 26 Daiichi Sankyō 4568.T $44.41 B $23.85 1.23% Japan 27 Alnylam Pharmaceuticals ALNY $40.26 B $308.78 0.26% USA 28 UCB UCB.VI $35.71 B $186.89 0.52% Belgium 29 Argenx ARGX $35.59 B $551.22 4.62% Netherlands 30 Novozymes NZYM.VI $34.88 B $74.83 0.74% Denmark 31 Agilent Technologies A $33.80 B $119.02 1.66% USA 132 DexCom DXCM $32.54 B $83.00 1.23% USA 133 Galderma Group GALD.SW $31.98 B $134.72 0.63% Switzerland 134 Bayer BAYN.DE $30.67 B $31.22 2.03% Germany 135 BeOne Medicines ONC $30.55 B $264.42 1.93% China 136 Celltrion 068270.KS $26.86 B $118.68 0.00% S. Korea 137 WuXi AppTec 2359.HK $26.74 B $9.75 3.65% China 38 Otsuka Holdings 4578.T $26.23 B $49.68 0.31% Japan 39 BioNTech BNTX $25.56 B $106.33 0.23% Germany 40 Sandoz Group SDZ.SW $22.40 B $52.02 0.42% Switzerland 141 LabCorp LH $22.09 B $263.96 1.09% USA 142 Hansoh Pharma 3692.HK $21.43 B $3.61 3.41% China 43 Divis Laboratories DIVISLAB.NS $20.16 B $75.96 2.20% India 44 Teva Pharmaceutical Industries TEVA $20.06 B $17.50 3.00% Israel 45 Royalty Pharma RPRX $19.73 B $35.10 0.75% UK 146 Insmed INSM $19.29 B $101.59 2.90% USA 147 Biogen BIIB $19.20 B $131.04 0.30% USA 48 Astellas Pharma 4503.T $17.10 B $9.55 0.18% Japan 149 bioMérieux BIM.PA $16.48 B $137.89 1.24% France 150 Innovent Biologics 1801.HK $16.09 B $9.82 3.99% China 51 Baxter BAX $15.81 B $30.82 0.65% USA 52 Alteogen 196170.KQ $15.53 B $291.56 1.97% S. Korea 153 Summit Therapeutics SMMT $14.81 B $19.95 0.86% UK 154 Shionogi 4507.T $14.67 B $17.25 0.48% Japan 355 Illumina ILMN $14.28 B $90.25 3.82% USA 156 Cipla CIPLA.NS $14.10 B $17.47 1.51% India 157 Genmab GMAB $14.07 B $22.86 0.18% Denmark 358 Incyte INCY $13.78 B $71.22 5.12% USA 459 WuXi Biologics WXXWY $13.72 B $6.69 3.04% China 160 Dr. Reddy’s Laboratories RDY $13.08 B $15.72 0.51% India 161 Recordati REC.MI $13.03 B $62.64 0.91% Italy 62 United Therapeutics UTHR $13.01 B $288.56 1.84% USA 63 Torrent Pharmaceuticals TORNTPHARM.NS $12.80 B $37.82 0.60% India 64 Tempus AI TEM $12.46 B $72.00 0.95% USA 65 Neurocrine Biosciences NBIX $12.37 B $125.00 0.49% USA 66 ICON plc ICLR $11.68 B $147.04 0.95% Ireland 367 Exelixis EXEL $11.38 B $41.75 0.38% USA 468 Revvity RVTY $11.35 B $96.3...

0 notes

Text

True clarity comes from directly engaging with the shop floor, where value creation coexists with real challenges. I recently visited a very large and complex manufacturing operation struggling to produce enough material to meet demand. On paper, there seemed little room left for improvement. Conventional wisdom suggested investing in additional equipment or expanding capacity. My approach always starts by stepping onto the production floor—not as a casual observer, but as an active participant genuinely seeking understanding. I aimed to listen, learn and truly experience what it felt like to be part of that operation for an entire shift. My goal was to build trust, enabling operators and supervisors to openly share their experiences without feeling judged. I wanted to do a gemba walk. “Gemba” is a Japanese term meaning “the real place,” specifically where value is created and challenges are most clearly observed. Unlike the superficial 1990s management practice “management by walking around” (MBWA), a genuine gemba walk is purposeful, involving active engagement and focused inquiry. It emphasizes discovering and replicating the root causes of success, turning isolated high-performance moments into sustained excellence. During this gemba walk, an operator revealed that frequent, brief equipment stoppages of just one or two minutes weren’t recorded as downtime. Management’s data only included interruptions lasting over five minutes, leaving critical gaps in their understanding. As a result, leadership had inadvertently been trying to solve the wrong problem. Leadership had focused on the largest visible problem from the data, a mechanical failure. The larger, real problem, however, was a material feed issue that required more direct experience to understand. A complete picture enables leaders and operators to address the real loss. This experience underscored a crucial insight: True clarity comes from directly engaging with the shop floor—where value creation and real challenges coexist—not from remote dashboards or meetings. Only through firsthand observation and genuine interaction can leaders uncover insights essential for unlocking their operation’s full potential—their “super performance.” Super performance is sustained peak performance, where teams consistently operate at their highest potential. Achieving super performance involves systematically identifying and scaling best practices, clarifying expectations and actively engaging teams to remove ambiguity. Gemba walks are critical because they bridge perception and reality. By directly engaging with the actual work environment, leaders gain insights that transform brief episodes of excellence—the “golden hour”—into enduring operational success. Three Keys to an Effective Gemba Walk Identify and scale success, not just problems. Leaders often excessively focus on fixing problems rather than recognizing successes. For instance, during a factory visit, managers initially blamed poor training for productivity issues. However, a gemba walk revealed that successful teams had developed effective undocumented methods. Capturing and scaling these practices transformed sporadic successes into sustained improvements. Clarify expectations to erase ambiguity. Operational inefficiencies often stem from ambiguity, not incompetence. A motivated workforce struggled because different shifts held varying definitions of “correct.” A gemba walk highlighted this confusion, and clear, standardized expectations resolved ambiguity, empowering employees to consistently achieve peak performance. Engage actively and authentically. True gemba walks involve active engagement, meaningful questions and genuine listening. One manufacturing leader’s passive walks changed dramatically after a quality issue prompted direct dialogue. This interaction uncovered crucial insights, significantly improving performance and fostering mutual respect. My “aha” moment about gemba walks came from a retired operations executive who advised, “Find yo...

0 notes

Text

Activity Based Planning Definition Activity-based planning is a management approach where each activity involved in producing an item or service is planned, costed, and budgeted for, aiding in an efficient allocation of resources. It’s a method that aligns activities with strategic objectives, focusing on planned outputs, and allocating the organization’s resources accordingly to optimize profits. Aiding Decision-Making Activity-based planning plays a crucial role in the decision-making process. It presents a clear picture of how resources are allocated and where costs are incurred. This visibility enables business leaders to make well-informed decisions in relation to operational, strategic, and financial choices. For example, it allows them to identify areas of waste where resources could be re-allocated. By mapping the cost and performance of specific activities, organizations have the necessary data to evaluate alternatives and make decisions that align with their strategic objectives. Improving Efficiency Efficiency is a key benefit of activity-based planning. It provides a mechanism to identify and eliminate non-value-adding activities, thereby streamlining operations. Activity-based planning’s granular view of costs makes it easier to trace even indirect costs to relevant activities and products. By revealing these insights and relationships between different costs, it helps organizations to identify inefficiencies. The outcome is a more streamlined and cost-efficient process, where businesses can focus on activities that add value. Fostering Informed Financial Decisions Lastly, activity-based planning fosters informed financial decisions. It provides crucial insights into the cost drivers in an organization, offering the ability to predict costs more accurately with future growth or changes. This form of financial modeling helps businesses identify profitable and unprofitable products or services by showing the true cost of providing them. This enables the decision-makers to adjust strategies, pricing, or resource allocation accordingly. By understanding the detailed cost structure, managers can make strategic decisions that boost profitability. Likewise, it promotes a cost-conscious culture within the organization, wherein employees become more aware of how their activities and decisions impact the financial standing of the business. The end result is a financially healthier organization with strong profitability and sustainability prospects. Resistance to Change One of the substantial challenges concerning the implementation of activity-based planning is resistance to change. As with any significant shift in business procedures or planning, pushback from employees and management teams alike can be expected. This resistance usually stems from people’s natural inclination to maintain the status quo or their discomfort with having to learn new processes and systems. For successful implementation, an organization must invest in change management processes, coaching, training, and support to ensure the adoption of activity-based planning. Difficulties in Data Collection Data collection is a critical part of activity-based planning, and it’s where problems often arise. Activity-based planning requires precise and detailed data about activities, processes, and resources. Nevertheless, many organizations lack the necessary systems to capture such specific data accurately and efficiently. There may also be an issue with data integrity if the present data collection processes are flawed or insufficient. Accurate data collection is essential as it directly influences the effectiveness of activity-based planning. Any errors or issues in the data can significantly hamper accurate planning and lead to suboptimal decisions. Need for New Software Implementing activity-based planning might necessitate investment in new software or upgrades to existing systems. Many organizations may struggle with this aspect due to budget constraints or lack of technological expertise in choosing and implementing the suitable sof...

0 notes

Text

Oral nutritional supplements can be a powerful tool in the struggle against malnutrition. They provide an easy and concentrated energy source with plenty of much-needed nutrition during the best of times, and the worst of times, when it can be very difficult to consume enough nutrition to maintain a healthy immune system and overall health. This article will discuss some of the various oral nutritional supplements out there, and the pros and cons of each, to help guide you in making a decision for yourself or a loved one. I always advocate for whole food first but, in certain diseases or conditions, when eating enough is not feasible or realistic (e.g., flare up of inflammatory bowel disease, severe malabsorption, short bowel syndrome, oral cancer, dementia, anorexia, or severe and unintentional weight loss), then oral nutritional supplements can be an excellent choice to get in those much-needed calories. Malnutrition Experts estimate that even a 10% decrease in caloric intake can weaken the immune system. Working as a dietitian in the hospital, I see a lot of people who consume much less than that. If a healthy adult typically consumes 2,000 calories a day, then this means that eating only 200 fewer calories per day can weaken their immune system. That is the equivalent of one small banana with one and a half tablespoons of peanut butter, not very much when you think about it. The Canadian Malnutrition Task Force reports that up to one in two people admitted to the hospital are malnourished, and suggest using oral nutritional supplements appropriately to prevent and treat malnutrition.1 Oral Nutritional Supplements Oral nutritional supplements provide calories, protein, vitamins, and minerals, and they can replace a meal. They may or may not contain additional fibre, omega-3 fats, prebiotics, and probiotics. They are available at almost any grocery store, drug store, or online, and there are many different brands out there, including Boost®, Compleat®, Ensure®, Glucerna®, Isosource®, Premier Protein®, Rumble®, and Soylent®. Many oral nutritional supplements are created to provide 100% of the daily recommended intakes (DRIs) for vitamins and minerals in a volume of 1-1.5 L per day, but remember that the DRIs are meant for a healthy population, and if you have specific health conditions, you may need more vitamins and minerals than those provided in these supplements. Boost® Soothe, for example, has a cooling sensation specifically designed for persons who have sensory alteration or oral discomfort after undergoing chemo or radiation therapy. It is a clear liquid designed without certain ingredients known to have a metallic aftertaste, as this is an issue for individuals who undergo oncology treatments. Please don’t hesitate to ask your doctor or dietitian about any special nutritional needs, especially if you are relying on oral supplements for the majority of your daily caloric intake. The calories provided in these drinks tend to range from one to two calories per ml, with the majority of calories coming from carbohydrates. These carbohydrates often come from corn syrup solids, and they tend to taste very sweet, which some people enjoy, but many others do not. Strategies to make these supplements less sweet include drinking them cold with plenty of ice and/or diluting them with milk or milk alternatives, such as oat milk. These drinks can also be warmed up, as some people prefer to drink warm liquids, but it is not recommended to boil them as that can denature the protein and make it less nutritious. You can also add these supplements to various food items, including oatmeal, overnight oats, and chia seed pudding, or frozen into popsicles, if you want to get creative. They can also replace milk in some recipes, such as in soup, muffins, or quick breads like banana or zucchini bread. Manufacturers use a variety of different ingredients in their products, and there are some that have lower amounts of sugar, such as the Canadian-created Rumble®, which is sweetened with maple syrup and provides only 1...

0 notes

Text

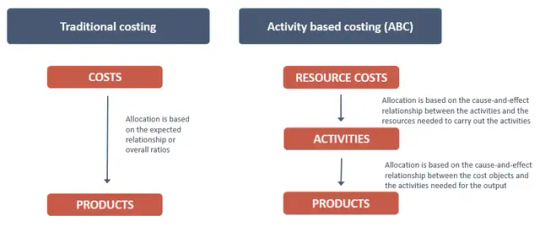

Cost price, along with market information, is a crucial factor in pricing decisions. The significance of cost price in decision-making varies for different types of organizations (e.g. manufacturing, service, sales), and the required cost calculation method also differs based on the organization’s activities. This article provides a brief overview of the activity-based costing method used by Optime in several implementation projects. The Problem The modern business environment is characterized by intense competition, shrinking margins, and rapid changes. In such a scenario, a company’s ability to predict and evaluate various scenarios of its operations and choose the best option is crucial. The cost price of products and resource needs are essential factors, even in optimistic sales projections, as it is important to understand if the forecasted volumes can be achieved. This can only be achieved through an activity-based costing system that accurately assigns costs, provides a correct cost price, and can model future cost and resource use. Traditional costing methods have several drawbacks, such as: Lack of causality between inputs and outputs Inaccurately determining product/service level costs; Distorting results in favor of small-scale or non-standard products; Not providing feedback to management for controlling and managing operations; Not providing information on resource utilization and the reasons behind costs. Not suitable for forecasting due to its inability to handle significant changes in business volumes and product structure. These problems arise because traditional costing is based on accounting, which focuses on control rather than management and reflects past events. Objective of the cost accounting Looking at the costs of the organization as a whole, their distribution can be viewed as shown in the figure Costs in an organization can be broadly divided into direct costs related to outputs (cost objects) and non-specific costs. Direct costs can be further divided into costs related to outputs (services, products, and customers), costs related to the operation of the organization, and support costs that support the resources carrying out other activities. The ABC (activity-based costing) theory links support activities directly to primary activities. However, linking support activities to resources is more logical as it reflects the cause-and-effect relationship between the resources and the sales process. The ABC method is more valuable when the proportion of direct costs is smaller and activities play a more important role. The goal of cost accounting and the cost model should be to reflect the whole company, provide a causal and understandable cost price, and have sufficient detail and accuracy for forecasting. Excessive perfection should be avoided in the implementation of ABC, as it can make the project too complicated. Organizing cost accounting So, how do we achieve these objectives? Traditional approaches to implementing activity-based costing models often begin with mapping activities, i.e. analyzing processes, which makes the implementation challenging, time-consuming, and prone to errors. An alternative approach is to focus on analyzing and organizing the inputs and outputs of the company and building a cost model based on them. This makes the implementation process easier, while still ensuring the accuracy of the model. Cost objects To build a cost model, we start by focusing on outputs, or cost objects, which are products/services that lead to costs and create value for customers. The cost object structure is based on revenue and may include products/services, customers, and channels. To make the list of cost objects simple, we start with the price list and include any services provided for free. It is best to group the list and later describe the activities to help find procedural similarities. Customer groups are described rather than modeling individual customer costs. To complete the cost object list, it is necessary to gather information on revenue, which can be challenging...

0 notes

Text

AstraZeneca continues Western big pharma’s growing dependence on Chinese biotechs for drug discovery. AstraZeneca has joined the long list of big pharma companies enlisting the services of Chinese biotechs, signing a deal worth up to $5.2bn with CSPC Pharmaceuticals to research chronic disease drug candidates. Under the deal, AstraZeneca will pay an upfront fee of $110m, along with milestone payments of $1.62bn. CSPC are also in line to receive $3.6bn in sales milestone payments. AstraZeneca and CSPC will discover and develop pre-clinical candidates for multiple targets, which, according to the companies, will have the “potential to treat diseases across chronic indications, including a pre-clinical small molecule oral therapy for immunological diseases”. CSPC will use its AI-powered drug discovery platform, which uses the technology to analyse the binding patterns of target proteins with existing compound molecules. The AI models work out targeted optimisation, advancing small molecules with the best developability. For any candidates identified via the research partnership, AstraZeneca will have the right to exercise options for exclusive licences to develop and commercialise candidates worldwide. AstraZeneca’s executive vice president and biopharmaceuticals R&D head Sharon Barr said: “This strategic research collaboration underscores our commitment to innovation to tackle chronic diseases, which impact over two billion people globally. “Forming strong collaborations allows us to leverage our complementary scientific expertise to support the rapid discovery of high-quality novel therapeutic molecules to deliver the next-generation medicines.” The partnership marks the second time this year AstraZeneca has invested resources in China. In March 2025, the drugmaker revealed plans to infuse $2.5bn over the next five years in Beijing to establish an R&D hub. Big pharma’s blossoming China relationship China is enjoying a fruitful alliance with Western big pharma companies, despite a frosty relationship with US President Trump’s administration, mainly due to the BIOSECURE ACT, which is admittedly now in legislative limbo. Licensing deals between US and Chinese biopharma companies hit record highs last year, up 280% from 2020, according to analysis by GlobalData. Across big pharma, transactions rose 66% from $16.6bn in 2023 to $41.5bn in 2024, demonstrating that China is still the go-to place to discover pipeline candidates. For deals specific to US companies, the analysis found that total deal value rose from $15.7bn in 2023 to $21.3bn in 2024. Continue at: https://www.pharmaceutical-technology.com/news/astrazeneca-taps-chinese-biotech-in-5-2bn-chronic-disease-research-deal/?utm_source=email_NS&utm_medium=email&utm_content=Spotlight_News_Article&utm_campaign=type3_Pharmaceutical%20Technology-market&cf-view

0 notes

Text

0 notes