Text

Differences between Kusama and Polkadot

Are you ready to explore the intriguing world of blockchain and decentralized technologies? In this blog, we'll embark on an exciting journey of discovery as we compare and contrast two remarkable platforms: Polkadot (DOT) and Kusama (KSM). These networks have gained significant attention in the crypto space for their unique features and capabilities. So, let's dive in and unravel the differences between Polkadot and Kusama, shedding light on their strengths, use cases, and everything you need to know to make an informed choice.

Polkadot (DOT) and Kusama (KSM) are both cutting-edge blockchain platforms that share common origins but serve different purposes. While Polkadot focuses on stability and production-ready use cases, Kusama embraces experimentation and rapid innovation. These platforms are designed to enable interoperability between multiple blockchains, but they have distinct governance models, token economics, and approaches to scalability.

Whether you're a developer looking for a secure and scalable environment or an enthusiast eager to witness groundbreaking experiments, understanding the differences between Polkadot and Kusama is essential. So, keep reading to discover the unique features, use cases, and characteristics of these platforms. By the end of this blog, you'll have a solid grasp of Polkadot and Kusama, empowering you to make informed decisions and dive into the world of blockchain with confidence. Are you ready? Let's get started!

Here's a quick chart summarizing the key differences between Kusama (KSM) and Polkadot (DOT):

Polkadot (DOT)Kusama (KSM)FocusStability and production-ready use casesExperimentation and rapid innovationPurposeInteroperability between multiple blockchainsSandbox environment for testing and experimenting with new features before deployment on PolkadotGovernanceFormal and structured governance process with longer upgrade cyclesAgile and expedited governance process for quicker decision-making and implementationSecurityEmphasizes high security and undergoes extensive testing and auditsShares security with Polkadot but encourages risk-taking and experimentationTokenDOT is the native token used for governance, staking, and bondingKSM is the native token used for governance, staking, and bondingParachainsLimited parachain slots allocated through competitive auctionsParathreads offer temporary slots on a pay-as-you-go basisEcosystemStable and attracts established projects, enterprises, and developersExperimental and attracts risk-takers and early adopters

Introductions

Introduction to Polkadot (DOT)

To begin, let's acquaint ourselves with Polkadot. Launched in 2020, Polkadot is an open-source blockchain platform designed to facilitate interoperability between multiple blockchains. Created by Dr. Gavin Wood, one of the co-founders of Ethereum, Polkadot aims to address the issue of blockchain fragmentation by enabling different networks to communicate and share information securely and efficiently.

Key Features of Polkadot

Polkadot introduces several key features that set it apart from other blockchain platforms:

- Scalability and Sharding: Polkadot employs a sharding mechanism to enhance scalability. It divides the network into multiple shards, known as "parachains," each capable of processing transactions independently. This design allows Polkadot to handle a high volume of transactions in parallel, making it a scalable solution.

- Interoperability: One of Polkadot's primary objectives is to establish interoperability between different blockchains. It achieves this through its "relay chain," which acts as a central hub connecting various parachains. This allows different chains to communicate and share information seamlessly, enabling the transfer of assets and data across networks.

- Shared Security: Polkadot utilizes a unique shared security model, whereby all parachains within the network benefit from the collective security of the entire ecosystem. By pooling security resources, Polkadot ensures that even smaller chains can enjoy robust protection against attacks.

- Governance and Upgradability: Polkadot implements an on-chain governance mechanism that allows token holders to participate in decision-making processes. This democratic approach empowers the community to propose and vote on protocol upgrades, ensuring the platform remains adaptable and future-proof.

Introduction to Kusama (KSM)

Now that we have a grasp of Polkadot, let's turn our attention to Kusama. Considered as Polkadot's "canary network" or "wild cousin," Kusama was also developed by the team behind Polkadot, led by Dr. Gavin Wood. Launched in 2019, Kusama serves as a sandbox environment for testing and experimenting with new features and protocols before they are deployed on the Polkadot network.

Key Features of Kusama

Kusama shares several core features with Polkadot but also introduces some distinctive elements of its own:

- Fast-paced Innovation: Kusama is designed to be a highly experimental network that encourages developers and innovators to push the boundaries of blockchain technology. It provides a platform for testing bleeding-edge features and concepts that may not yet be ready for deployment on the more stable Polkadot network.

- Faster Governance and Upgrades: Unlike Polkadot, where protocol upgrades undergo a rigorous approval process, Kusama adopts a more expedited approach to governance. This allows for quicker decision-making and faster implementation of upgrades, making it an ideal environment for rapid innovation.

- Lower Barrier to Entry: Kusama provides a more accessible entry point for projects and developers compared to Polkadot. The cost of deploying a parachain on Kusama is generally lower, making it a viable option for teams looking to test their ideas and gain real-world experience before transitioning to Polkadot.

- Community and Risk-Tolerant Environment: Kusama attracts a community of builders, enthusiasts, and risk-takers who embrace the platform's experimental nature. Participants on Kusama understand and accept the higher degree of risk associated with testing and deploying cutting-edge technologies, making it an exciting and dynamic ecosystem.

Comparing Polkadot and Kusama

Now that we have a basic understanding of both Polkadot and Kusama, let's delve deeper into their similarities and differences across various aspects:

Governance and Upgrades

Both Polkadot and Kusama embrace decentralized governance models, allowing token holders to participate in decision-making processes. However, there are differences in the speed and approach to governance between the two networks.

Polkadot follows a more structured and formal governance process, requiring extensive community discussion and referenda before implementing upgrades. This process ensures a thorough evaluation of proposed changes, prioritizing stability and security. As a result, the upgrade process on Polkadot might take longer.

On the other hand, Kusama adopts a more agile and expedited approach to governance. It encourages faster decision-making and implementation of upgrades, making it a suitable environment for rapid experimentation. Kusama's governance process is designed to facilitate innovation, even if it involves taking higher risks.

Security and Reliability

Both Polkadot and Kusama leverage shared security, benefiting from the robustness of the underlying network. However, there is a difference in the level of security between the two platforms.

Polkadot prioritizes a high level of security and stability, as it serves as a production-ready network for mission-critical applications. It undergoes rigorous audits, testing, and a longer stabilization period for upgrades. This cautious approach ensures that only thoroughly vetted and tested features are deployed on Polkadot.

Kusama, being an experimental network, adopts a more risk-tolerant stance. While it benefits from shared security, the network encourages developers to test new and potentially disruptive features that may carry higher risks. Participants in the Kusama ecosystem understand the experimental nature of the network and are willing to accept a certain level of uncertainty.

Token Economics and Use Cases

Polkadot (DOT) and Kusama (KSM) have separate native tokens with distinct use cases within their respective networks.

DOT is the native token of Polkadot and serves multiple functions. It is used for governance, allowing token holders to vote on proposals and participate in the decision-making process. Additionally, DOT is staked to secure the network and participate in the nomination and election of validators. DOT holders can also bond their tokens to support parachains during the auction process.

KSM is the native token of Kusama and functions similarly to DOT. It is used for governance participation, staking, and participating in the Kusama network's consensus mechanism. KSM holders can also bond their tokens to support Kusama parachains during the auction process.

Both DOT and KSM tokens have the potential for price appreciation based on market demand and the success of their respective networks. However, it's important to note that while they have similarities, they are distinct tokens with different use cases and purposes.

Parachains and Parathreads

Both Polkadot and Kusama utilize the concept of parachains and parathreads to enable scalability and interoperability. However, there are differences in how these components are allocated and utilized on each network.

Polkadot has a limited number of parachain slots available, and the allocation process follows a competitive auction model. Projects interested in securing a parachain slot need to participate in the auction and bond DOT tokens for the desired duration. This allocation mechanism ensures fair access to

parachain slots and encourages projects to demonstrate long-term commitment.

Kusama, on the other hand, has a more dynamic approach to parachains called "parathreads." Parathreads function similarly to parachains but do not require a long-term lease or the same level of upfront commitment. Instead, they operate on a pay-as-you-go basis, allowing projects to secure temporary slots and access the Kusama network without participating in the competitive auction process. This flexibility makes Kusama an attractive platform for projects that want to test their ideas or launch shorter-term initiatives.

Ecosystem and Development

Both Polkadot and Kusama foster vibrant ecosystems and provide opportunities for developers and projects to build and innovate. However, there are differences in the focus and maturity of their respective ecosystems.

Polkadot has positioned itself as a more stable and production-ready network. It appeals to projects and developers looking for a secure and scalable platform to deploy their applications. As a result, the Polkadot ecosystem has seen significant growth, attracting established projects, enterprises, and developers focused on building robust decentralized applications (dApps) and services.

Kusama, with its experimental nature, attracts a community of early adopters, risk-takers, and developers seeking a more dynamic and fast-paced environment. The Kusama ecosystem is characterized by its openness to experimentation and its focus on pushing the boundaries of blockchain technology. It provides a platform for testing new ideas, protocols, and features before they are deployed on Polkadot.

Relationship Between Polkadot and Kusama

It's important to note that Polkadot and Kusama are not competing networks; rather, they are complementary to each other. Kusama serves as a proving ground for new features, upgrades, and ideas before they are implemented on Polkadot. It acts as a valuable testing environment, allowing developers to gain real-world experience and gather feedback before deploying on the more stable Polkadot network.

The relationship between Polkadot and Kusama can be likened to that of a parent and a child network. Kusama inherits many of Polkadot's features and technologies but provides a more agile and experimental playground. Successful experiments and innovations on Kusama can be later integrated into Polkadot, ensuring a robust and well-tested ecosystem.

Conclusion

In conclusion, Polkadot (DOT) and Kusama (KSM) are both exciting blockchain platforms designed to enable interoperability, scalability, and innovation. Polkadot emphasizes stability, security, and long-term production-ready use cases, while Kusama embraces experimentation, agility, and faster iterations.

While Polkadot provides a solid foundation for deploying mission-critical applications, Kusama serves as an invaluable testing ground for new ideas and features. Both networks offer unique opportunities for developers, projects, and communities to contribute to the advancement of decentralized technologies.

Whether you're interested in building secure and scalable applications or exploring bleeding-edge concepts, Polkadot and Kusama provide platforms that cater to different needs and risk appetites. So, dive into the world of Polkadot and Kusama, and embrace the limitless possibilities they offer in shaping the future of decentralized systems.

FAQs

What is the main difference between Polkadot (DOT) and Kusama (KSM)? The main difference lies in their focus and purpose. Polkadot is designed for stability and production-ready use cases, offering a secure and scalable platform for deploying mission-critical applications. Kusama, on the other hand, is an experimental network that encourages rapid innovation and experimentation. It serves as a sandbox environment for testing new features and protocols before they are implemented on Polkadot. How do Polkadot and Kusama differ in terms of governance? Polkadot follows a structured and formal governance process, involving extensive community discussions and referenda before implementing upgrades. This ensures thorough evaluation and prioritizes stability. In contrast, Kusama adopts an agile governance approach, allowing for faster decision-making and implementation of upgrades. The aim is to facilitate innovation and quicker iterations on the network. What are the differences in token economics between Polkadot and Kusama? Polkadot has its native token called DOT, which is used for governance participation, staking, and bonding to secure the network. DOT holders can also bond their tokens to support parachains during the auction process. Kusama has its native token called KSM, which serves similar functions to DOT. KSM holders can participate in governance, stake their tokens, and support Kusama parachains during the auction process. While there are similarities, DOT and KSM are distinct tokens with different use cases within their respective networks. How do Polkadot and Kusama differ in terms of their ecosystems? Polkadot attracts established projects, enterprises, and developers focused on building robust decentralized applications (dApps) and services. It is considered a more stable and production-ready network. Kusama, on the other hand, appeals to risk-takers, early adopters, and developers seeking a dynamic and experimental environment. It encourages faster iterations and provides a platform for testing new ideas and concepts. Both ecosystems contribute to the advancement of decentralized technologies but cater to different needs and risk appetites. Are Polkadot and Kusama competing networks? No, Polkadot and Kusama are not competing networks. Instead, they complement each other. Kusama serves as a proving ground for new features, upgrades, and ideas before they are implemented on Polkadot. Successful experiments on Kusama can be later integrated into Polkadot, ensuring a robust and well-tested ecosystem. The relationship between Polkadot and Kusama is more like that of a parent and a child network, with Kusama providing a platform for innovation and experimentation.

Read More:

- Polkadot vs Ethereum

- Polkadot vs Solana

- Polkadot vs NEAR Protocol

- Polygon vs Polkadot

- Cosmos (ATOM) vs Polkadot (DOT)

- Polkadot vs Cardano

- Polkadot vs Chainlink

Read the full article

0 notes

Text

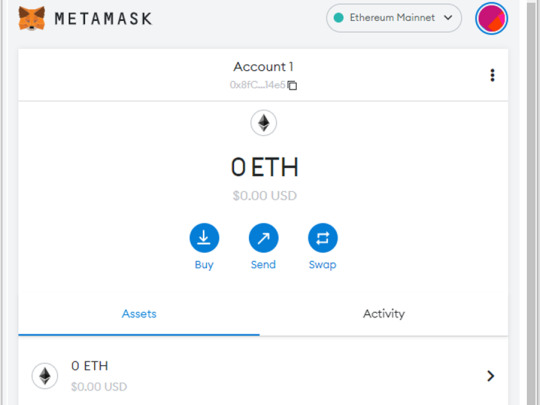

Differences between Trust Wallet and Metamask

Are you ready to dive into the world of cryptocurrency and take control of your digital assets? As you embark on this exciting journey, it's crucial to choose the right wallet to securely manage and store your cryptocurrencies. In this blog post, we'll explore the differences between two popular wallets: Metamask and Trust Wallet. By the end of this article, you'll have a clear understanding of their unique features, allowing you to make an informed decision on which wallet best suits your needs.

Metamask and Trust Wallet are both widely recognized and trusted wallets in the crypto community. However, they have distinct characteristics that set them apart. Metamask, developed by ConsenSys, is a browser extension wallet primarily designed for interacting with decentralized applications (dApps) on the Ethereum blockchain. On the other hand, Trust Wallet, a mobile wallet, offers multi-chain support, enabling you to manage various digital assets across different blockchains. Whether you prefer a browser-based experience or a mobile-first approach, understanding the differences between these two wallets is key to finding the perfect fit for you.

So, if you're eager to explore the unique features of Metamask and Trust Wallet and gain a deeper understanding of their functionalities, read on. By the end of this blog, you'll be equipped with the knowledge to make an informed decision on which wallet aligns best with your crypto goals. Let's dive in and discover the world of Metamask and Trust Wallet together!

Here's a quick chart outlining the key differences between Metamask and Trust Wallet:

MetamaskTrust WalletMain FocusEthereum ecosystemMulti-chain compatibilityInterfaceBrowser extensionMobile-firstDApp SupportExtensiveLimitedSupported ChainsEthereumEthereum, BSC, and moreHardware WalletYes (Ledger, Trezor)NoBuilt-in DEXNoYesCommunityStrong Ethereum focusCollaborative and diverse

Differences between Metamask and Trust Wallet

Getting Acquainted: Metamask and Trust Wallet

Metamask: Unleashing the Power of Ethereum

Metamask, developed by ConsenSys, is a browser extension wallet primarily designed to interact with decentralized applications (dApps) on the Ethereum blockchain. With Metamask, you can securely manage your Ethereum-based assets, such as Ether (ETH) and ERC-20 tokens, directly from your web browser. It offers a user-friendly interface, making it accessible even to crypto newcomers.

Trust Wallet: Embracing Multi-Chain Support

Trust Wallet, on the other hand, is a mobile wallet that supports a wide range of blockchains, making it a versatile option for managing various digital assets. Originally designed for Ethereum, Trust Wallet expanded its capabilities and now supports Binance Smart Chain (BSC), Polkadot, Tron, and many other blockchains. Its intuitive mobile app interface and robust security features have earned it a loyal user base.

Wallet Functionality: How They Work

Metamask: Empowering Ethereum dApps

Metamask acts as a bridge between your web browser and the Ethereum blockchain. When you install the Metamask browser extension, it creates a digital wallet for you, allowing you to securely store your private keys and interact with Ethereum-based dApps. You can easily send and receive ETH and ERC-20 tokens, as well as participate in token sales (ICOs) and decentralized finance (DeFi) activities.

Metamask also supports Ethereum Name Service (ENS), a decentralized domain name system, which allows you to replace long hexadecimal addresses with human-readable names. This feature enhances the user experience and simplifies the process of sending and receiving transactions.

Trust Wallet: A Multi-Chain Marvel

Trust Wallet is a mobile wallet available for both iOS and Android devices. Upon installation, you create a wallet that securely stores your private keys locally on your device. Trust Wallet provides support for multiple blockchains, enabling you to manage a diverse portfolio of cryptocurrencies from a single app.

The wallet's user-friendly interface allows you to send and receive tokens effortlessly. Trust Wallet also features a built-in decentralized exchange (DEX) that supports swapping tokens directly within the app. Additionally, it enables you to participate in staking, where you can earn rewards by locking your tokens on supported networks.

Supported Blockchains and Tokens

Metamask: Focusing on Ethereum

Metamask is primarily focused on the Ethereum blockchain and is best suited for those who mainly deal with Ethereum-based assets. It seamlessly integrates with popular Ethereum dApps and offers extensive support for ERC-20 tokens. As Ethereum continues to be a leading platform for smart contracts and decentralized applications, Metamask provides a robust solution for Ethereum enthusiasts.

While Metamask started as a browser extension, it has expanded its offerings to include a mobile app, allowing users to manage their wallets on the go. This ensures flexibility and accessibility for those who prefer mobile-based interactions.

Trust Wallet: Embracing Multi-Chain Compatibility

Trust Wallet stands out by supporting a wide range of blockchains beyond Ethereum. This versatility allows users to manage various digital assets from different ecosystems within a single application. In addition to Ethereum and its tokens, Trust Wallet supports Binance Smart Chain (BSC), which is gaining popularity due to its lower transaction fees and faster block times. It also supports networks like Polkadot, Tron, and many others, catering to the needs of users with diverse crypto portfolios.

With Trust Wallet, you can seamlessly switch between different blockchains, making it convenient for those who engage in cross-chain transactions and decentralized applications. The wallet's compatibility with multiple networks expands your options and opens up new opportunities for exploring different blockchain ecosystems.

Security and Control

Metamask: Strengthening Security Measures

Metamask takes security seriously and offers robust features to protect your funds. When creating a Metamask wallet, you are provided with a 12-word seed phrase, which acts as the master key to your wallet. It's essential to store this phrase securely offline, as it can be used to restore your wallet in case of device loss or theft.

Metamask also integrates with hardware wallets like Ledger and Trezor, allowing you to enhance the security of your funds by storing your private keys offline. This feature provides an additional layer of protection against potential cyber threats.

Trust Wallet: Putting You in Control

Trust Wallet puts the control of your funds directly in your hands. When setting up a Trust Wallet, you are provided with a 12-word recovery phrase that serves as a backup for your wallet. It's crucial to store this phrase securely and refrain from sharing it with anyone. With Trust Wallet's emphasis on user control, your private keys remain on your device, reducing the risk of unauthorized access to your funds.

To further enhance security, Trust Wallet supports biometric authentication such as fingerprint and facial recognition, adding an extra layer of protection to your wallet. The combination of local key storage and biometric security measures gives users peace of mind and control over their digital assets.

User Interface and User Experience

Metamask: Simplicity and Familiarity

Metamask offers a clean and intuitive user interface that integrates seamlessly with popular web browsers like Chrome, Firefox, and Brave. Its browser extension provides a familiar experience to users who spend significant time interacting with web-based applications and dApps. Metamask's user-friendly design makes it easy to navigate and manage your Ethereum-based assets, even for those new to cryptocurrencies.

The wallet also provides a straightforward process for connecting to various dApps. With a single click, you can authorize transactions and interact with smart contracts directly from the web browser. Metamask's simplicity and ease of use make it an excellent choice for beginners and experienced users alike.

Trust Wallet: Mobile Accessibility and Intuitive Design

Trust Wallet excels in delivering a mobile-first experience. Its intuitive interface is optimized for smartphones, making it convenient for users who prefer managing their digital assets on the go. The mobile app provides a seamless and responsive experience, allowing you to send, receive, and trade cryptocurrencies with ease.

Trust Wallet's design emphasizes simplicity and accessibility. Navigating through the app is straightforward, and the wallet's integration with decentralized exchanges simplifies the process of swapping tokens within the application. Whether you're a seasoned crypto enthusiast or a beginner exploring the world of digital assets, Trust Wallet's mobile-centric approach ensures a smooth and enjoyable user experience.

Community and Development Support

Metamask: A Strong Presence in the Ethereum Ecosystem

Metamask benefits from its close association with the Ethereum ecosystem and has established itself as one of the leading wallets for Ethereum users. It has a robust and active community of developers, dApp creators, and users who contribute to its growth and development. The Metamask team actively engages with the community, providing support and addressing user queries and concerns.

The wallet's integration with popular Ethereum dApps and its support for Ethereum Improvement Proposals (EIPs) demonstrate its commitment to staying up-to-date with the latest developments in the Ethereum space. Metamask also offers a developer-friendly environment, providing tools and resources for developers to build and interact with decentralized applications.

Trust Wallet: Embracing Collaboration and Expanding Partnerships

Trust Wallet has also cultivated a strong community of users and developers, with a focus on multi-chain compatibility. The wallet's team actively engages with users through social media channels, forums, and community events, fostering a collaborative environment. Trust Wallet values feedback from its community and incorporates user suggestions into its roadmap, ensuring that user needs are met.

Furthermore, Trust Wallet has established partnerships with various blockchain projects and exchanges, expanding its ecosystem and providing users with additional features and opportunities. The wallet's integration with Binance, one of the largest cryptocurrency exchanges, offers seamless connectivity for users looking to trade their assets. These collaborations and partnerships contribute to the continuous development and enhancement of Trust Wallet.

Additional Features and Integrations

Metamask: Diverse Browser Extensions and Hardware Wallet Support

Metamask offers a range of browser extensions beyond its core functionality. These extensions enable users to integrate Metamask with popular dApps and services, enhancing the overall user experience. For example, MetaMask Snaps allows developers to create custom plugins, while MetaMask Mobile Sync enables seamless synchronization between the browser extension and the mobile app.

Metamask also provides integration with hardware wallets like Ledger and Trezor, allowing users to manage their funds securely on these external devices. This integration adds an extra layer of protection to your private keys and offers peace of mind for users who prioritize security.

Trust Wallet: DEX Integration and Binance Smart Chain Support

Trust Wallet differentiates itself with its built-in decentralized exchange (DEX), which allows users to swap tokens directly within the app. This integration eliminates the need for users to navigate external exchanges, simplifying the process of trading and exchanging cryptocurrencies.

Additionally, Trust Wallet's support for Binance Smart Chain (BSC) opens up a broader range of possibilities for users. BSC is known for its lower transaction fees and faster block confirmations compared to the Ethereum network. With Trust Wallet, users can leverage the benefits of BSC while still enjoying a user-friendly interface and seamless multi-chain management.

Summary: Choosing the Right Wallet for You

Metamask and Trust Wallet are both reputable wallets that cater to the needs of crypto enthusiasts. Understanding their differences and strengths is essential in selecting the right wallet for your specific requirements. Here's a summary of their key distinctions:

- Metamask focuses primarily on the Ethereum ecosystem, offering seamless integration with Ethereum-based dApps and extensive support for ERC-20 tokens.

- Trust Wallet embraces multi-chain compatibility, supporting various blockchains beyond Ethereum, including Binance Smart Chain, Polkadot, and Tron.

- Metamask provides a browser extension that is ideal for users who frequently interact with web-based applications and dApps, while Trust Wallet offers a mobile-first experience optimized for smartphones.

- Metamask prioritizes security with features like hardware wallet integration, while Trust Wallet emphasizes user control by storing private keys locally on the user's device.

- Metamask benefits from its strong presence in the Ethereum ecosystem, actively engaging with the Ethereum community and supporting the latest developments.

- Trust Wallet fosters a collaborative community and expands its partnerships, providing users with additional features and opportunities.

- Metamask offers diverse browser extensions and hardware wallet support, while Trust Wallet integrates a built-in DEX and supports Binance Smart Chain.

When choosing between Metamask and Trust Wallet, consider your specific needs and preferences. If you primarily work with Ethereum-based assets and dApps, and prefer a browser-based interface, Metamask may be the ideal choice for you. On the other hand, if you have a diverse portfolio across multiple blockchains, value a mobile-first experience, and seek a wallet with a built-in DEX, Trust Wallet might be the better option.

Ultimately, both wallets have their strengths and cater to different user requirements. It's worth noting that you can also use both wallets simultaneously to leverage their respective features based on your specific use cases.

Before making a decision, we recommend trying out both wallets and exploring their functionalities firsthand. Remember to prioritize security by following best practices such as backing up your recovery phrase and keeping your wallet software up to date.

In conclusion, Metamask and Trust Wallet are two popular wallets that provide secure and user-friendly solutions for managing digital assets. By understanding their differences and assessing your own needs, you can make an informed choice and embark on your cryptocurrency journey with confidence.

FAQs

What are the main differences between Metamask and Trust Wallet? The main differences between Metamask and Trust Wallet lie in their primary focus, interface, and supported chains. Metamask is primarily designed for the Ethereum ecosystem and offers extensive support for Ethereum-based dApps. It operates as a browser extension, making it suitable for users who frequently interact with web-based applications. On the other hand, Trust Wallet embraces multi-chain compatibility, supporting various blockchains beyond Ethereum. It provides a mobile-first experience, optimized for users managing their digital assets on smartphones. Does Metamask support hardware wallets? Yes, Metamask supports hardware wallets such as Ledger and Trezor. This integration allows users to enhance the security of their funds by storing their private keys offline on these external devices. By connecting a hardware wallet to Metamask, users can securely manage and access their digital assets. Does Trust Wallet have a built-in decentralized exchange (DEX)? Yes, Trust Wallet features a built-in decentralized exchange (DEX) that enables users to swap tokens directly within the app. This integration eliminates the need for users to navigate external exchanges and simplifies the process of trading and exchanging cryptocurrencies.

Read More:

- Metamask vs Coinbase wallet

- Best Bitcoin Hardware Wallets of 2023

- Best Decentralized Exchanges (DEXs)

- FOMO vs FUD

- Litecoin (LTC) vs Ethereum (ETH)

Read the full article

0 notes

Text

Difference between Dogecoin and Litecoin

Are you ready to dive into the world of cryptocurrencies and explore the intriguing differences between Litecoin (LTC) and Dogecoin (DOGE)? In this blog post, we'll embark on an exciting journey to unravel the distinctions between these two popular digital assets. Whether you're a seasoned crypto enthusiast or just beginning your crypto adventure, understanding the unique features and characteristics of LTC and DOGE will broaden your knowledge and help you make informed decisions in the ever-evolving crypto market.

We'll start by exploring the fascinating origins of Litecoin and Dogecoin. Litecoin, created by former Google engineer Charlie Lee, emerged in 2011 as a "lite" version of Bitcoin. Lee's vision was to address some of Bitcoin's limitations by introducing faster transaction confirmation times and utilizing a different hashing algorithm. On the other paw, Dogecoin came into existence in 2013, inspired by an internet meme featuring the lovable Shiba Inu dog. Its founders, Billy Markus and Jackson Palmer, created Dogecoin as a playful and lighthearted cryptocurrency, never anticipating the immense popularity and impact it would eventually achieve.

Next, we'll delve into the technological disparities between LTC and DOGE. While both coins are based on blockchain technology, they employ different consensus mechanisms and hashing algorithms. Litecoin utilizes a proof-of-work (PoW) algorithm called Scrypt, which aims to make mining more accessible to a broader range of participants. Dogecoin initially used Scrypt as well but later transitioned to a merged mining model with Litecoin, allowing miners to simultaneously mine both LTC and DOGE. Additionally, Litecoin boasts a faster block time of 2.5 minutes, making transactions quicker and more efficient, while Dogecoin impressively has a block time of just 1 minute, promoting lightning-fast transactions.

Here's a quick chart highlighting the key differences between Litecoin (LTC) and Dogecoin (DOGE):

Litecoin (LTC)Dogecoin (DOGE)Created in 2011 byCreated in 2013 byCharlie LeeBilly Markus and Jackson PalmerPurpose:Purpose:- "Silver to Bitcoin's gold"- Fun-loving and meme-inspiredTechnology:Technology:- Blockchain-based- Blockchain-based- Proof-of-Work (PoW)- Proof-of-Work (PoW)algorithm: Scryptalgorithm: ScryptBlock Time:Block Time:- 2.5 minutes- 1 minuteMaximum Supply:Maximum Supply:- 84 million coins- No maximum supply limit

Differences Between Litecoin and Dogecoin

The Genesis Story: Origins and Founders

Every great cryptocurrency has a story behind its creation. Litecoin was born in 2011, when a former Google engineer named Charlie Lee decided to create a digital currency that addressed some of Bitcoin's limitations. Lee aimed to create a "lite" version of Bitcoin by reducing block generation time and using a different hashing algorithm. Thus, Litecoin was brought to life.

On the other hand, Dogecoin emerged in late 2013, inspired by an internet meme featuring the iconic Shiba Inu dog. Billy Markus, an IBM software engineer, and Jackson Palmer, a software engineer at Adobe, teamed up to create Dogecoin as a lighthearted and fun cryptocurrency. Unlike Litecoin, Dogecoin was not designed to be a serious contender in the crypto market but rather as a satirical response to the growing number of altcoins.

The Technology: Similarities and Differences

- Blockchain Architecture: Both Litecoin and Dogecoin are based on blockchain technology, which ensures secure and transparent transactions. However, they employ different consensus mechanisms. Litecoin uses a proof-of-work (PoW) algorithm called Scrypt, whereas Dogecoin initially used Scrypt but later transitioned to a merged mining model with Litecoin. This means that both coins share the same mining process, allowing miners to simultaneously mine Litecoin and Dogecoin.

- Block Time and Supply: One of the primary differences between Litecoin and Dogecoin lies in their block generation time and total supply. Litecoin has a faster block time of 2.5 minutes, making transactions quicker and more efficient. Additionally, Litecoin has a maximum supply cap of 84 million coins, four times larger than Bitcoin's supply. On the other hand, Dogecoin boasts an incredibly fast block time of just 1 minute, promoting speedy transactions. However, Dogecoin has no maximum supply limit, leading to a higher inflation rate.

- Hashing Algorithm: Another key distinction between Litecoin and Dogecoin is their hashing algorithms. Litecoin utilizes Scrypt, a memory-hard algorithm that aims to make mining more accessible to a broader range of participants. In contrast, Dogecoin initially used Scrypt but later transitioned to Auxiliary Proof-of-Work (AuxPoW), which allows Dogecoin miners to piggyback on Litecoin's mining process, enhancing network security.

The Purpose: Serious vs Fun

Litecoin: The Silver to Bitcoin's Gold: From its inception, Litecoin positioned itself as the "silver to Bitcoin's gold." Charlie Lee envisioned Litecoin as a complementary cryptocurrency that offered faster transaction confirmation times and a different hashing algorithm. Litecoin's goal was to provide a viable alternative to Bitcoin, catering to users who valued speed and efficiency in their transactions. Over time, Litecoin has gained recognition as a reliable and established cryptocurrency, often seen as a "testnet" for Bitcoin due to its technological similarities.

Dogecoin: The Internet's Favorite Meme: Unlike Litecoin's serious undertones, Dogecoin was created as a lighthearted and meme-inspired cryptocurrency. Dogecoin's primary purpose was to bring joy and humor to the crypto world while promoting charitable acts. Its community, known as the "Dogecoin Army" or "Shibes," quickly grew and embraced the coin's playful nature. Dogecoin gained popularity through various internet communities, especially Reddit, where users often tipped each other with Dogecoin as a form of appreciation. This lighthearted and fun-loving spirit propelled Dogecoin to become a beloved cryptocurrency among internet users, often associated with memes and viral moments.

Market Perception and Adoption

Litecoin's Market Position: As one of the early altcoins, Litecoin has established itself as one of the most prominent cryptocurrencies in the market. It is widely accepted by various online and offline merchants, offering users an additional option for conducting transactions. Litecoin has also gained recognition as a valuable investment asset and is available on numerous cryptocurrency exchanges. Its position as a reliable and established cryptocurrency has attracted investors and traders alike.

Dogecoin's Popularity Surge: Dogecoin's journey has been quite remarkable. While initially created as a joke, it gained unexpected popularity and a massive following. The coin's meteoric rise can be attributed to several factors, including endorsements from high-profile individuals, social media trends, and online communities rallying behind it. The surge in popularity led to increased adoption, with some businesses and online platforms accepting Dogecoin as a form of payment. However, it's important to note that Dogecoin's market perception is influenced to a significant extent by its meme-driven nature, which can lead to volatility and speculative trading.

Community and Social Impact

Litecoin's Dedicated Community: Litecoin has a dedicated and supportive community of users and developers. Its community actively contributes to the development of the project, proposing improvements and implementing new features. The community also engages in educational initiatives, spreading awareness about cryptocurrencies and blockchain technology. Litecoin's community-driven approach has helped it maintain a strong presence in the crypto space and fostered a sense of trust and reliability among its supporters.

Dogecoin's Enthusiastic and Generous Shibes: Dogecoin's community is known for its enthusiastic and generous nature. The community has participated in various charitable initiatives, raising funds for causes like disaster relief, community projects, and even sponsoring athletes and events. The Dogecoin community's philanthropic endeavors have brought positive attention to the coin and highlighted the power of cryptocurrencies to make a real-world impact. While the community's actions are often driven by fun and humor, they have demonstrated the potential of harnessing the collective power of a crypto community for social good.

Volatility and Investment Considerations

Litecoin's Stability: Litecoin is generally considered to be less volatile compared to many other cryptocurrencies. Its established position, widespread adoption, and consistent development contribute to a sense of stability in the market. While Litecoin's price may experience fluctuations along with the broader crypto market, it is often seen as a relatively safe investment option for those seeking a more established digital asset.

Dogecoin's Rollercoaster Ride: Dogecoin's price history is marked by significant volatility. Its meme-driven nature and the influence of social media trends can result in rapid price movements that may not necessarily align with traditional investment principles. Dogecoin's price surges and subsequent corrections have attracted both fervent supporters and skeptics, making it a subject of intense debate within the crypto community. Investors considering Dogecoin should be prepared for its inherent volatility and understand the risks associated with investing in meme-driven assets.

Development and Future Roadmap

Litecoin's Continued Development: Litecoin has an active development team that continues to work on improving the coin's technology and enhancing its capabilities. The team focuses on maintaining compatibility with Bitcoin and implementing innovative features. Over the years, Litecoin has undergone upgrades such as Segregated Witness (SegWit) and the Lightning Network, which aim to improve scalability and transaction efficiency. Litecoin's development roadmap includes ongoing improvements and collaborations with other projects in the crypto ecosystem, ensuring its relevance and competitiveness in the market.

Dogecoin's Development Challenges: Dogecoin, due to its origins as a meme coin, has faced unique challenges in terms of development. While the coin has a dedicated community, the development efforts have been relatively limited compared to more established cryptocurrencies. Dogecoin's codebase is based on Litecoin, which means it benefits from the ongoing development of the Litecoin project. However, the lack of a defined development roadmap specific to Dogecoin has raised questions about its long-term sustainability and ability to adapt to evolving market demands.

Regulatory and Institutional Adoption

Litecoin's Compliance and Institutional Interest: As one of the early cryptocurrencies, Litecoin has garnered a level of regulatory compliance and institutional interest. Its reputation as a reliable and established digital asset has attracted the attention of traditional financial institutions and investment firms. Litecoin's compliance with regulations and integration with financial infrastructure contribute to its potential for broader institutional adoption, offering users additional avenues for accessing and utilizing the coin.

Dogecoin's Regulatory Landscape: Dogecoin, being a meme-driven cryptocurrency, has a different perception in the eyes of regulators and institutions. While it has gained popularity and a dedicated community, its association with internet memes and its lighthearted nature may lead to varying levels of acceptance among regulatory bodies and institutional investors. Dogecoin's market volatility and speculative trading activity have also prompted caution from regulators, highlighting the need for a clearer regulatory framework to address meme coins and their impact on the market.

Conclusion: Different Paths, Unique Charms

In the vast world of cryptocurrencies, Litecoin and Dogecoin have carved out their own unique paths, capturing the hearts and minds of crypto enthusiasts in different ways. Litecoin's serious and reliable nature positions it as a strong contender among cryptocurrencies, with its established technology, widespread adoption, and supportive community. On the other hand, Dogecoin's meme-inspired origins and fun-loving community have brought joy and a sense of camaraderie to the crypto space, showcasing the power of a united community.

While Litecoin focuses on technological advancements and its role as a complementary cryptocurrency to Bitcoin, Dogecoin's journey is intertwined with internet culture and social impact. Both coins have their strengths and weaknesses, and their future trajectories will depend on various factors such as market dynamics, regulatory developments, and community support.

As the tale of Litecoin and Dogecoin continues to unfold, it reminds us of the diverse and ever-evolving nature of the cryptocurrency landscape. Whether you lean towards the silver charm of Litecoin or the playful spirit of Dogecoin, the choice ultimately lies in your own preferences, investment goals, and beliefs in the potential of these digital assets. So, choose wisely, embark on your crypto adventures, and remember to enjoy the ride!

FAQs

How do Litecoin and Dogecoin differ in terms of purpose? Litecoin's purpose is to serve as a digital currency for conducting fast and low-cost transactions. It aims to be a complementary asset to Bitcoin, providing a more efficient payment method. Dogecoin, on the other hand, has a more light-hearted purpose. It gained popularity as a tipping currency and is often used for microtransactions, online donations, and community-driven initiatives. What are the technological differences between Litecoin and Dogecoin? Both Litecoin and Dogecoin are blockchain-based cryptocurrencies. However, they differ in their hashing algorithms. Litecoin uses Scrypt, which aims to make mining more accessible. Dogecoin initially used Scrypt as well but later transitioned to a merged mining model with Litecoin, allowing miners to mine both LTC and DOGE simultaneously. Additionally, Litecoin has a faster block time of 2.5 minutes, while Dogecoin boasts an even faster block time of just 1 minute. How do Litecoin and Dogecoin differ in terms of market perception? Litecoin is generally regarded as a more established and reliable cryptocurrency. It has gained recognition among merchants and investors, with a wider acceptance and integration into the financial ecosystem. Dogecoin, on the other hand, gained popularity through its meme-driven nature and a strong community following. It has a more volatile market perception due to its association with internet culture and the influence of social media trends. How do the communities surrounding Litecoin and Dogecoin differ? Litecoin has a dedicated community of users and developers who actively contribute to its development and promote education about cryptocurrencies. Dogecoin's community, known as the "Shibes," is characterized by their fun-loving and generous nature. They have been involved in various charitable initiatives and community projects, showcasing the power of collective action.

Read More:

- Litecoin (LTC) vs Ethereum (ETH)

- Bitcoin vs Litecoin

- Bitcoin Cash vs Litecoin

- Ethereum vs Bitcoin

- Metamask vs Coinbase wallet

- Kusama vs Polkadot

- Terra vs Tether

Read the full article

0 notes

Text

Difference between Polkadot and Chainlink

Today, we'll explore the key differences between Chainlink (LINK) and Polkadot (DOT), two innovative projects revolutionizing the blockchain industry. If you've ever wondered how these technologies differ in their objectives, architectures, and functionalities, you're in the right place. By the end of this article, you'll have a clearer understanding of the unique characteristics and potential use cases of Chainlink and Polkadot. So, let's dive in and unravel the distinctions between these intriguing projects!

Chainlink (LINK) and Polkadot (DOT) may both operate within the blockchain realm, but their goals and functionalities set them apart. Chainlink focuses on providing reliable and secure data to smart contracts through its decentralized oracle network. With its ingenious architecture, Chainlink acts as a bridge, connecting smart contracts with real-world data and external APIs. On the other hand, Polkadot (DOT) takes a different approach, aiming to create a scalable and interoperable ecosystem of blockchains. Its multi-chain platform enables seamless communication and collaboration among different chains, fostering innovation and synergy in the blockchain space.

As we delve deeper into the intricacies of Chainlink and Polkadot, you'll discover how they differ in token utility, governance models, scalability approaches, and community dynamics. Whether you're a blockchain enthusiast, developer, or investor, understanding these differences is crucial for evaluating their potential applications and determining which project aligns best with your goals. So, grab a cup of coffee, sit back, and join us on this exciting journey as we unravel the distinctions between Chainlink (LINK) and Polkadot (DOT)!

Here's a quick comparison chart highlighting the key differences between Chainlink (LINK) and Polkadot (DOT):

FeatureChainlink (LINK)Polkadot (DOT)ObjectiveProvide reliable data to smart contractsCreate an interconnected ecosystem of blockchainsArchitectureDecentralized oracle networkMulti-chain platform with a relay chainUse CasesDeFi, insurance, gaming, supply chainDeFi, cross-chain asset transfers, dApps, governance systemsToken UtilityStaking for node operators, payment feesGovernance, staking for validatorsGovernance ModelPrimarily guided by the Chainlink teamStake-weighted voting on proposals and referendaScalabilityFocuses on data provision scalabilitySharding mechanism for parallel executionCommunity and EcosystemActive community with partnershipsActive developer community and project collaborations

Introductions

Understanding Chainlink (LINK)

Chainlink is a decentralized oracle network that aims to connect smart contracts with real-world data and external APIs. Smart contracts are self-executing agreements that run on the blockchain, and they require external data to perform certain functions accurately. Chainlink provides a reliable and secure method of obtaining this off-chain data and feeding it into the smart contracts.

Decentralized Oracle Network

The core innovation of Chainlink lies in its decentralized oracle network. Oracles act as bridges between the blockchain and the external world, enabling the flow of data between the two. Chainlink's decentralized oracle network consists of numerous independent nodes that retrieve data from various sources, ensuring the accuracy and reliability of the information provided.

Secure Data Transmission

Chainlink prioritizes the security and integrity of the data it delivers to smart contracts. It achieves this through several mechanisms, including data encryption, off-chain computation, and cryptographic proofs. By ensuring the authenticity and reliability of the data, Chainlink minimizes the risk of manipulation or tampering, enhancing the overall security of the smart contracts.

Use Cases

Chainlink's ability to connect smart contracts with real-world data opens up a wide range of use cases. For example, it can facilitate decentralized finance (DeFi) applications by providing accurate price feeds for various assets. It can also enable insurance contracts that trigger payouts based on specific events, such as flight delays or natural disasters. Additionally, Chainlink has applications in supply chain management, gaming, prediction markets, and more.

Understanding Polkadot (DOT)

Polkadot, on the other hand, is a multi-chain platform that seeks to enable seamless interoperability and scalability among different blockchains. It aims to create a decentralized and interconnected ecosystem of specialized blockchains, known as parachains, that can communicate and share information with each other.

Shared Security Model

Polkadot introduces a unique shared security model, where multiple parachains can benefit from the collective security provided by the Polkadot network. Instead of each parachain needing to maintain its security infrastructure, they can rely on the robustness of the Polkadot relay chain. This approach improves efficiency and reduces the barriers to entry for new projects, as they can leverage the existing security of the Polkadot network.

Interoperability and Cross-Chain Communication

Polkadot's architecture enables seamless interoperability between different blockchains. It achieves this through a central component called the relay chain, which acts as a hub for cross-chain communication. Parachains can connect to the relay chain, facilitating the transfer of assets, data, and messages between different chains. This interoperability fosters collaboration and synergy among various blockchain projects within the Polkadot ecosystem.

Scalability and Governance

Scalability is a crucial challenge in the blockchain industry, and Polkadot addresses this issue through its sharding mechanism. By dividing the network into multiple parachains, each with its dedicated set of validators, Polkadot can process transactions and execute smart contracts in parallel, significantly improving scalability. Moreover, Polkadot employs a sophisticated governance model that allows token holders to participate in the decision-making process, ensuring the network's decentralized management.

Differences Between Chainlink and Polkadot

Objectives

Chainlink primarily focuses on providing reliable and accurate data to smart contracts through its decentralized oracle network. Its main objective is to bridge the gap between blockchain and real-world data, enabling the execution of smart contracts that rely on external information.

On the other hand, Polkadot aims to create a scalable and interoperable ecosystem of blockchains. It seeks to solve the scalability and interoperability challenges faced by individual blockchains by connecting them through a central relay chain. Polkadot's objective is to foster collaboration and synergy among different blockchain projects, enabling them to communicate and share information seamlessly.

Architectural Differences

Chainlink's architecture revolves around its decentralized oracle network. It consists of independent nodes that retrieve data from various sources and deliver it to smart contracts. Chainlink focuses on the security and reliability of data transmission, employing encryption, off-chain computation, and cryptographic proofs to ensure data integrity.

Polkadot, on the other hand, employs a multi-chain architecture with a central relay chain. The relay chain serves as the hub for cross-chain communication, enabling different parachains to interact and share information. Polkadot's shared security model allows parachains to benefit from the collective security of the network, reducing the need for individual security infrastructure.

Use Cases

Chainlink's primary use case revolves around providing reliable data to smart contracts. It has found significant adoption in decentralized finance (DeFi), where accurate price feeds are crucial for executing financial transactions. Chainlink also has applications in insurance, gaming, supply chain management, and other sectors that require real-world data integration with blockchain.

Polkadot's use cases extend beyond data provision. Its interoperability and scalability features make it suitable for a wide range of applications. It enables projects to build specialized parachains tailored to specific use cases while benefiting from the shared security and cross-chain communication. Polkadot can be utilized for DeFi, cross-chain asset transfers, decentralized applications (dApps), governance systems, and more.

Community and Ecosystem

Both Chainlink and Polkadot have vibrant and active communities supporting their respective ecosystems.

Chainlink has gained significant traction in the blockchain space, attracting developers, data providers, and users interested in its oracle services. The Chainlink community actively contributes to the project's development and expansion, ensuring a robust ecosystem of decentralized oracle networks.

Polkadot, with its unique approach to interoperability and scalability, has garnered a strong community of developers and projects. Its ecosystem fosters collaboration among different blockchain projects, encouraging innovation and the development of new applications. Polkadot's community actively participates in the governance of the network, ensuring decentralized decision-making.

Token Utility and Economics

Chainlink has its native utility token called LINK. LINK tokens are used for various purposes within the Chainlink ecosystem. Node operators, who provide data and services to the network, are required to stake LINK tokens as collateral to ensure the accuracy of their data. Additionally, smart contract developers and users pay LINK tokens as fees to access and utilize Chainlink's oracle services.

Polkadot has its native utility token called DOT. DOT tokens serve multiple functions within the Polkadot network. They are used for governance, allowing token holders to participate in decision-making processes and propose changes to the protocol. DOT tokens are also used for staking, as validators are required to lock a certain amount of tokens as collateral to secure the network and participate in block production.

Development and Partnerships

Both Chainlink and Polkadot have seen significant growth in terms of development and partnerships.

Chainlink has a robust developer community, and the project has been successful in forging partnerships with various blockchain projects and enterprises. These partnerships aim to integrate Chainlink's oracle services into different platforms, expanding the adoption of decentralized oracle solutions.

Polkadot, with its interoperability features, has attracted attention from developers and projects looking to build on a scalable and connected blockchain infrastructure. Polkadot has established partnerships with multiple projects and has an active ecosystem of parachains being developed. The ecosystem benefits from collaborations and cross-chain communication opportunities provided by the Polkadot network.

Governance Models

Chainlink's governance model is centered around its community and token holders. While Chainlink aims to decentralize decision-making, the development and upgrades of the protocol are primarily guided by the Chainlink team. However, Chainlink has also introduced the Chainlink Improvement Proposal (CLIP) process, which allows community members to submit proposals for consideration.

Polkadot's governance model is more decentralized and includes on-chain governance. Token holders can participate in the decision-making process through stake-weighted voting on proposals and referenda. This ensures that the Polkadot network's evolution and upgrades are determined by token holders and stakeholders in a democratic manner.

Scalability Approaches

Chainlink focuses on the scalability of data provision rather than scaling the underlying blockchain itself. By leveraging decentralized oracle networks and off-chain computation, Chainlink ensures that the process of retrieving and delivering data to smart contracts is scalable and efficient.

Polkadot takes a different approach to scalability. It employs a sharding mechanism where multiple parachains can run in parallel, enabling higher transaction throughput and execution of smart contracts. This allows Polkadot to achieve scalability by distributing the workload across multiple chains, increasing the network's overall capacity.

Conclusion

Chainlink and Polkadot are two distinct projects in the blockchain industry, addressing different aspects of decentralization and data integration. While Chainlink focuses on providing reliable and secure data to smart contracts through its decentralized oracle network, Polkadot aims to create an interconnected ecosystem of blockchains that can communicate and share information seamlessly.

Understanding the objectives, architectures, and use cases of Chainlink and Polkadot is crucial for grasping their unique characteristics and potential applications. Whether it's leveraging accurate data for smart contracts or building scalable and interoperable blockchain solutions, both Chainlink and Polkadot contribute to the growth and advancement of the decentralized economy.

FAQs

What is the main objective of Chainlink (LINK) and Polkadot (DOT)? Chainlink aims to provide reliable and secure data to smart contracts through its decentralized oracle network. It bridges the gap between blockchain and real-world data, enabling smart contracts to access accurate information. On the other hand, Polkadot's primary objective is to create an interconnected ecosystem of scalable and interoperable blockchains. It facilitates seamless communication and collaboration among different chains, fostering innovation and synergy in the blockchain space. How do Chainlink (LINK) and Polkadot (DOT) differ in terms of architecture? Chainlink's architecture revolves around its decentralized oracle network, which consists of independent nodes retrieving data from various sources. It ensures data integrity and security through encryption, off-chain computation, and cryptographic proofs. In contrast, Polkadot employs a multi-chain platform with a central relay chain. This relay chain acts as a hub for cross-chain communication, allowing different parachains to interact and share information. What are the main use cases for Chainlink (LINK) and Polkadot (DOT)? Chainlink's primary use case lies in providing reliable data to smart contracts. It is widely adopted in decentralized finance (DeFi), where accurate price feeds are crucial for executing financial transactions. Chainlink also finds applications in insurance, gaming, supply chain management, and various other sectors requiring real-world data integration with blockchain. Polkadot, with its interoperability and scalability features, has use cases in DeFi, cross-chain asset transfers, decentralized applications (dApps), governance systems, and more. It enables projects to build specialized parachains tailored to specific use cases while benefiting from shared security and cross-chain communication. How do the governance models of Chainlink (LINK) and Polkadot (DOT) differ? Chainlink's governance model is primarily guided by the Chainlink team, with community input through the Chainlink Improvement Proposal (CLIP) process. In contrast, Polkadot employs a more decentralized governance model with stake-weighted voting. Token holders can participate in decision-making by voting on proposals and referenda, ensuring a democratic approach to network evolution and upgrades. What are the scalability approaches of Chainlink (LINK) and Polkadot (DOT)? Chainlink primarily focuses on data provision scalability rather than scaling the underlying blockchain itself. It achieves this by leveraging decentralized oracle networks and off-chain computation. Polkadot addresses scalability through its sharding mechanism. By dividing the network into multiple parachains, each with its dedicated set of validators, Polkadot can process transactions and execute smart contracts in parallel, significantly improving scalability. How do the communities surrounding Chainlink (LINK) and Polkadot (DOT) contribute to their ecosystems? Both Chainlink and Polkadot have vibrant and active communities supporting their respective ecosystems. Chainlink's community includes developers, data providers, and users, contributing to the project's development and expansion. Polkadot's community consists of developers and projects building on the platform, fostering collaboration and innovation within the ecosystem. Both communities play a crucial role in driving adoption, partnerships, and the overall growth of Chainlink and Polkadot.

Read More:

- Chainlink (LINK)

- Polkadot vs Ethereum

- Polkadot vs Solana

- What is Polkadot (DOT)?

- Difference between Polkadot and NEAR Protocol

Read the full article

0 notes

Text

Difference between Terra and Tether

If you've been curious about how these stablecoins operate, their mechanisms, and their specific use cases, you've come to the right place! Whether you're an avid cryptocurrency enthusiast or simply interested in understanding the evolving landscape of digital currencies, this article will provide you with valuable insights into Tether and Terra USD.

Stablecoins have gained significant traction in recent years due to their ability to offer stability in the volatile cryptocurrency market. Tether, often regarded as the pioneer of stablecoins, operates by pegging its value to traditional fiat currencies held in reserve. On the other hand, Terra USD takes a unique approach by employing an algorithmic stability mechanism and collateralization with its native token, Luna. These different mechanisms have implications for transparency, decentralization, regulatory considerations, and transaction speed, which we'll explore in detail.

By the end of this blog post, you'll have a comprehensive understanding of the differences between Tether and Terra USD, allowing you to make informed decisions in the realm of stablecoins. So, let's dive in and discover how these stablecoins operate and what sets them apart. Read on to unlock the secrets behind Tether and Terra USD and gain valuable insights into their mechanisms, use cases, and more.

Here's a quick comparison chart highlighting the key differences between Terra USD (UST) and Tether:

FeatureTerra USD (UST)Tether (USDT)Launch Year20182014Stability MechanismAlgorithmic stability using on-chain mechanisms and decentralized incentivesBacked by fiat reserves (initially the US dollar)Underlying TechnologyTerra blockchainVarious blockchains (primarily Ethereum)Stability AssetNative cryptocurrency (Luna) and algorithmic supply adjustmentsFiat currency reserves (USD, Euro, etc.)Ecosystem and Use CasesPart of the Terra ecosystem with diverse DeFi and e-commerce applicationsMainly used for liquidity and trading within the crypto marketScalabilityBuilt-in scalability with sharding and interchain communication protocolsDepends on the underlying blockchain's scalabilityEnvironmental ImpactUses a delegated proof-of-stake (DPoS) consensus algorithm, which is more energy-efficient compared to proof-of-work (PoW)Depends on the underlying blockchain's energy consumptionRegulatory ComplianceStrives to comply with relevant regulations and undergoes auditsAddresses concerns and improves transparency through auditsControversies and ScrutinyLimited controversies and scrutinyFaced scrutiny regarding transparency and reserves

Differences between Tether and Terra USD

1. Introduction to Stablecoins: A Brief Overview

Before we delve into the specifics of Terra USD (UST) and Tether, let's take a moment to understand the concept of stablecoins. Stablecoins are digital assets designed to minimize the volatility commonly associated with cryptocurrencies like Bitcoin and Ethereum. Unlike these volatile cryptocurrencies, stablecoins aim to maintain a stable value by pegging their price to a reserve asset or a basket of assets, usually a fiat currency like the US dollar.

Stablecoins have gained traction in the crypto space for various reasons. They provide a more reliable means of transacting and storing value, offering stability and reducing the risks typically associated with traditional cryptocurrencies. Stablecoins also enable users to seamlessly move funds between different crypto exchanges and platforms, acting as a bridge between the crypto and fiat worlds.

2. Tether: The Pioneer of Stablecoins

Tether (USDT) is one of the earliest and most widely recognized stablecoins in the cryptocurrency market. Launched in 2014, Tether was designed to provide users with a stable digital currency option backed by fiat reserves, initially the US dollar. Tether Ltd., the company behind Tether, claims that each USDT token is fully backed by its reserves, aiming for a 1:1 ratio between Tether tokens and the underlying fiat currency.

One of Tether's primary use cases is facilitating liquidity and enabling easy access to cryptocurrencies. It serves as a stable intermediary currency for traders, allowing them to quickly move in and out of positions without the need to convert their holdings to fiat currencies. Tether has gained significant popularity among crypto traders due to its widespread availability and high liquidity across various exchanges.

3. Terra USD (UST): A Stablecoin Powered by Algorithmic Stability

Terra USD (UST) is a relatively newer stablecoin that operates on a different principle compared to Tether. Launched in 2018 by Terraform Labs, Terra UST is an algorithmic stablecoin that aims to maintain its stability through a combination of on-chain mechanisms and decentralized economic incentives.

Unlike Tether, which relies on backing by fiat reserves, Terra UST achieves price stability by using a decentralized algorithmic model. It is designed to be pegged to the US dollar while leveraging its unique technology and ecosystem.

4. Algorithmic Stability: How Terra UST Maintains Price Stability

One of the key differentiators of Terra UST is its algorithmic stability mechanism. Instead of relying on external reserves, Terra UST employs an algorithmic approach that adjusts its supply dynamically to maintain price stability. This mechanism is primarily driven by the interactions between the Terra UST stablecoin and its native cryptocurrency, Luna.

Luna serves a crucial role within the Terra ecosystem. As the native cryptocurrency, it acts as collateral and helps stabilize the price of Terra UST. When the demand for Terra UST increases, the protocol automatically mints more Terra UST tokens and sells them in exchange for Luna. Conversely, when demand decreases, the protocol buys back Terra UST tokens, reducing their supply.

The unique aspect of Terra UST's algorithmic stability is its reliance on a decentralized network of validators who collectively manage the protocol. These validators ensure the stability of Terra UST by participating in governance and making decisions related to the stablecoin's operations. This decentralized approach aims to provide transparency, security, and decentralization, reducing the reliance on centralized entities and promoting community involvement.

5. Terra Ecosystem: Building on Interoperability and Diverse Applications

Terra UST is not just a standalone stablecoin but is part of a larger ecosystem known as Terra. The Terra ecosystem aims to create a sustainable and scalable blockchain platform that supports various decentralized applications (dApps) and financial services. Terra's infrastructure is built on the Terra blockchain, which employs a unique combination of delegated proof-of-stake (DPoS) and Byzantine Fault Tolerance (BFT) consensus algorithms to ensure efficiency and security.

Within the Terra ecosystem, Terra UST serves as the primary stablecoin for conducting transactions and storing value. Its stability and compatibility make it a preferred choice for developers and users of Terra's dApps. The Terra ecosystem also includes other tokens, such as Luna, which plays a pivotal role in maintaining stability, and various utility tokens associated with specific dApps and services.

6. Use Cases and Adoption of Tether

Tether, being one of the pioneers in the stablecoin space, has gained widespread adoption and usage across the cryptocurrency ecosystem. Its primary use case revolves around providing stability and liquidity within the crypto market. Traders often rely on Tether to hedge their positions during periods of high volatility or to move funds quickly between exchanges.

Tether's popularity extends beyond traders, as it also serves as a gateway for individuals looking to enter the crypto space. Many exchanges offer Tether trading pairs, allowing users to trade between Tether and other cryptocurrencies easily. Additionally, Tether has found utility in remittances, cross-border transactions, and as a means of preserving value in regions with volatile local currencies.

However, it's important to note that Tether has faced scrutiny and controversy over the years. Concerns have been raised regarding the transparency of its reserves and the extent to which each USDT token is backed by actual fiat currency. Tether Ltd. has faced legal challenges and regulatory inquiries, further fueling debates about its credibility and trustworthiness.

7. Use Cases and Adoption of Terra UST

Terra UST, with its algorithmic stability and unique ecosystem, has gained traction in various applications beyond the traditional use cases of stablecoins. The Terra ecosystem offers a range of dApps and services that leverage the stability and programmability of Terra UST to unlock innovative possibilities in finance, e-commerce, and more.

One prominent use case of Terra UST is in decentralized finance (DeFi) applications. Terra UST's stability makes it an attractive asset for collateralizing loans, providing liquidity in decentralized exchanges, and participating in yield farming strategies. The algorithmic stability mechanism ensures that the value of Terra UST remains relatively constant, reducing the risk associated with volatile cryptocurrencies.

Moreover, Terra UST has found adoption in e-commerce platforms and payment solutions. Its stability and compatibility with various blockchain networks enable seamless cross-border transactions, eliminating the need for traditional banking intermediaries. Merchants can accept Terra UST as a form of payment, providing their customers with a stable and borderless means of transacting.

8. Scalability and Environmental Considerations

Scalability and environmental impact are important factors to consider when evaluating stablecoins. Tether operates on different blockchains, including Ethereum, which has faced scalability challenges due to network congestion and high transaction fees. The increased usage of Tether on Ethereum has contributed to these issues, making transactions slower and more expensive.

On the other hand, Terra UST operates on its own blockchain, which has been designed to address scalability concerns. The Terra blockchain employs technologies like sharding and interchain communication protocols to ensure high throughput and efficient processing of transactions. This scalability advantage allows Terra UST to handle a larger volume of transactions without experiencing the same congestion issues faced by other blockchain networks.

Another aspect to consider is the environmental impact of stablecoin operations. As cryptocurrencies gain popularity, concerns about their energy consumption and carbon footprint have arisen. Tether, operating on blockchains like Ethereum, is subject to the energy consumption and environmental impact associated with the underlying network. Ethereum currently relies on a proof-of-work (PoW) consensus algorithm, which requires significant computational power and energy consumption.

In contrast, Terra UST operates on a delegated proof-of-stake (DPoS) consensus algorithm, which is more energy-efficient compared to PoW. This consensus mechanism allows for faster transaction validation and reduces the environmental impact associated with mining activities. By leveraging a more sustainable consensus algorithm, Terra UST aims to contribute to a greener and more eco-friendly blockchain ecosystem.

9. Regulatory Considerations and Transparency

Regulatory compliance and transparency are crucial aspects for stablecoins, as they operate in a financial landscape governed by various regulations. Tether has faced regulatory scrutiny in the past, with concerns raised about the transparency of its reserves and its compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. Tether Ltd. has made efforts to address these concerns by providing more transparency about its reserves and undergoing audits to verify the backing of USDT tokens.

Terra UST, being a relatively newer stablecoin, has also taken steps to ensure regulatory compliance and transparency. The Terra ecosystem aims to adhere to relevant regulations in the jurisdictions where it operates, working towards establishing partnerships with regulated financial institutions and undergoing audits to provide transparency and assurance to its users.

10. Conclusion: Unique Approaches to Stability and Ecosystem Development

In conclusion, Terra USD (UST) and Tether are two prominent stablecoins in the cryptocurrency space, each offering unique approaches to stability and ecosystem development. Tether, the pioneering stablecoin, relies on fiat reserves to maintain its price pegged to the US dollar, providing liquidity and stability within the crypto market. However, it has faced scrutiny regarding its transparency and regulatory compliance.

On the other hand, Terra UST adopts an algorithmic stability mechanism, utilizing decentralized economic incentives and a network of validators to dynamically adjust its supply and maintain price stability. It operates within the broader Terra ecosystem, which aims to provide a scalable blockchain platform for various applications, including DeFi and e-commerce.