Text

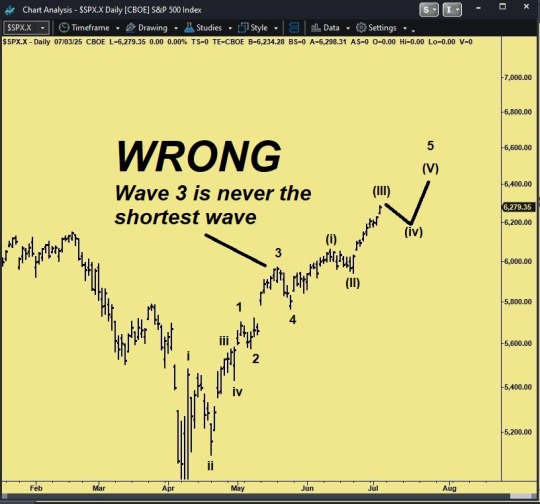

Finding The Five

Too many wrong counts. Even one blatant Elliott violation (wave 3 can never be the shortest wave). The wave structure from the April lows to mid-May continues to confound...even to the present.

So the fallback position of "finding the five" on lower timeframes becomes paramount. My sole focus for now, right or wrong.

Meanwhile the US dollar still looks like it wants to test 94.98 over the next weeks. Still want to be short EURUSD and SPX from there. Would be quite interesting if the new US Crypto regs end up igniting demand for US dollars.

0 notes

Text

Another Count Bites The Dust

Never intended this to be a trading blog, but with the dearth of non-political social mood cues lately, the one thing on my mind here is nailing the SPX structure.

Here's the tweak: the huge May 12th breakaway gap has been labeled as wave "3" and the wave structure since the retest of the breakaway (which left the gap wide open) is being viewed as an extended wave "5" which sees us in the third wave of it, perhaps explaining the three gaps since June 23rd.

Yes, the count is awkward, but it does line up with third-wave strength in the right places.

What would really blow some minds is if I'm wrong again and we've actually been in a series of 1s and 2s and in the middle of a third-of-a-third currently.

I'm all for aggressive counts, but usually when I see "third-of-a-third" counts around the blog-o-sphere, the move is usually near failure. Just saying.

So I'm all for trying to nail this top. Why?

The US dollar.

We're about a week or two away from seeing if this monthly chart is for realz. If it is, turbulence could be ahead in FX and yields, and SPX could get lumpy fast.

The Fibs are off by a few shekels because I slapped it together quickly, but you get the point. The target is actually 94.98.

Two additional things: there is a 127% Fib expansion target at the SPX 6500 area which could coincide nicely with "5."

Also, watch Thursday, the full moon, for a possible culmination of "(iii)."

If you think this is voodoo read the RBS Moon Trading study:

The study of S&P 500 index versus moon phases for the period since 1928 till 2010. Having invested £1,000 in S&P in 1928, by now would outcome in holding £63,864 worth portfolio, while by implementing the proposed moon trading strategy, the value of portfolio would have been £1,502,689.

Addendum: regarding the US dollar chart above, finally some social mood appeared. Found this today, July 7th. What luck. Now all we need is a dollar-negative magazine cover.

Addendum #2: from today, July 9th.

0 notes

Text

Updated SPX Count

The wave count from June 11th got invalidated, but not in a bad way.

Here's an updated version which views the initial rally from the April 7th low, which I previously didn't even address, as a leading diagonal. Just got that sorted this afternoon while viewing my moon phase chart overlaid on a 60-minute SPX cash chart. Seeing how the new and full moons -- back to April 11th -- so closely coincided with peaks and troughs, breakouts, and continuations inspired me to dig deeper.

Again, this is the cash SPX which I prefer to chart and the labels are just for simplicity. You may need to click on it if Tumblr crops it out.

Judging how the S&P e-mini futures sold off immediately after today's record high (6265.50), there's a good chance Turtle Soup is on the menu if prices respect that level.

Note that wave "4" is drawn conservatively at what Elliott called "wave 4 preceding." Yet with gaps below that level (~5800, ~5665 areas) it could decline more, but it would also weaken the structure.

Anything above SPX 6235.22 invalidates this count.

0 notes

Text

IBM Retraction

I need to retract the IBM chart and discussion from June 10th. Though I always set my charts to log scale, I toggled it slightly just before capturing the screen the shot, and caused it to revert arithmetic scale. I didn't notice the error. I owe many thanks to Peter Goodburn from WaveTrack International for kindly confirming it.

If you're a retail trader and want institutional-quality Elliott wave analysis, WaveTrack is a must. As much as insist on doing my own analysis, there is only one place I check my work against, and that's with Peter and his team at WaveTrack. None better.

The upshot is that I discovered that my usual data feed, Tradestation, will indeed provide data much farther back than I previously thought, and I was able to build a chart back to 1974. Needless to say, it's much different from my previous analysis, hence the retraction.

Tumblr loves to cut off images. If you can't see IBM's late-1974 low, click on the chart to make it full size.

Scenario #1:

Scenario #2:

Before posting these, my preferred count was #2. However, IBM is acting well, regardless of its lack of volume since the 2020 pandemic low, and is fast approaching a 161.8% Fib extension target at 312.76 which would be an ideal target for the proposed (iii) -- again, not real Elliott nomenclature here.

Currently flirting with the 132.8% Fib extension at 279.76, IBM certainly has enough momentum to blow it away. If it suddenly fails, well, that's an instant red flag. But for now, the facts have changed because my charts have changed, and I apologize for the error.

0 notes

Text

Intraday SPX

This previously posted chart is valid as drawn up to SPX 6077.24. Thing is, there is a volume shelf target just above at the 6082 area, which would invalidate the count.

The market feels like it's subdividing higher, thus the proposed (V) of v of 3 could extend.

Note as always these are not real Elliott labels.

Note also that I have omitted counting the rally and retracement from the April 7th lows. Who knows what it is. My focus is always simply finding the five -- the developing impulse.

0 notes

Text

IBM Reaching Maturity Date?

IBM was originally incorporated in 1911 as the Computing-Tabulating-Recording Company (CTR) through the merger of several companies.

In 1924, CTR was renamed International Business Machines Corporation (IBM), and eventually went public in 1931.

Perhaps its darkest day was in 1993 when it posted an almost unheard of $8 billion loss.

Lou Gerstner was brought in from RJR Nabisco to be its new CEO and started the company on its long path to former glory.

Assuming the infamous 1993 rout marked the "surprising disappointment" of a wave-4 low using Prechter's Elliott Wave "personality" parlance, it appears IBM may have since created a rare multi-decade expanding diagonal for an ending 5th wave. (Click on the chart if Tumblr is crimping it, a common problem.)

Note the lack of volume beneath the rally since 2020. Note also the "volume shelves" well below current prices, especially the area surrounding the "white" wave 4 low and the "red" wave 4 low (~$80 and $27 per share respectively). (Note as well that these aren't proper Elliott notations but are just drawn for simplicity.)

Now, what if this chart looks the way it does because this is where AI was born and where it might die.

IBM is credited with the first practical example of artificial intelligence...way back in 1956.

IBM debuted its artificial intelligence program, Watson, in 2011. It's still in use, albeit in advanced iterations.

The point is that AI has been around a long time. What if its current hype is an illusion.

Turns out, I'm not the only one asking the question.

Apple Researchers Just Released a Damning Paper That Pours Water on the Entire AI Industry

In the paper, a team of machine learning experts makes the case that the AI industry is grossly overstating the ability of its top AI models, including OpenAI's o3, Anthropic's Claude 3.7, and Google's Gemini.

Who knows if Apple is pooh-poohing AI because they're so far behind, or if they're simply shedding light on the truth.

At some point, current AI darlings could be ripe for one hell of a fall.

Perhaps the above chart, if correct, is the warning shot. First for IBM, then eventually the AI industry itself.

2 notes

·

View notes

Text

SPX Market Comment

Current wave count I'm using. Gaming another marginal high. Anything below 5843.66 before a new high flips my focus to 5600 area.

0 notes

Text

FDIC Sleeping Pill Alert

The FDIC Quarterly Banking Profile was released today, and everyone can go back to sleep.

Yay, Domestic Deposits increased for the third consecutive quarter.

Yay, Estimated Insured Deposits increased 1 percent.

Yay, the Deposit Insurance Fund Reserve Ratio increased three basis points to 1.31 percent.

Yay, 1.31 percent...$140.9 billion in reserves.

Yay...

Meanwhile, total estimated insured deposits are approximately $10.76 trillion.

0 notes

Text

Fib Failure

Exceeded the 78.6% Fibonacci resistance then closed below it.

Fail.

A close back above the 78.6% would suggest a developing impulse from the April 21st 5101.63 low (the most aggressive count possible).

Who knows what the price action off the April 7th low was. Don't know, don't care. Not yet.

Next volume shelf below (support) is 5811 area. Bigger one at 5665 area.

Still love this market for spec shots with calls, but probably won't consider allocating capital until a test of the 5268 area, at least.

0 notes

Text

Boom

The SPX blew away the "important Fib confluence level" and the March 25th swing point with volume.

Better than expected China negotiations, 90-day tariff pause.

Epic prescription drug re-pricing plan (probably the most ballsy Executive Order yet).

India-Pakistan cease fire.

Potential Russia-Ukraine cease fire.

All this on a full moon.

Multiple options remain for a completion of the corrective pattern, but that's what I'm calling the move down from the all-time highs now: a corrective pattern.

Was it a simple ABC correction down to the April 7th low that's now resolving as an impulse to record highs (where we might be somewhere in a strong 3rd-wave)?

Are we nearing completion of an ABC rally before some sort of re-test of the lows?

Are we testing the 78.6% retracement of the decline and about to fall out of bed before tracing out a high level triangle before new highs?

Corrective patterns are many. Detecting which one is a mix of art and guesswork. Not a fan of the latter.

The absolute most simple thing is to take it step by step. We're closing in on the 78.6% at 5866.58. How it acts there is a huge tell.

Oh, and regarding the full moon, the market move could be *full* as well. I'll be most likely pricing short-dated puts tomorrow.

(click on the chart if Tumblr is cropping it)

0 notes

Text

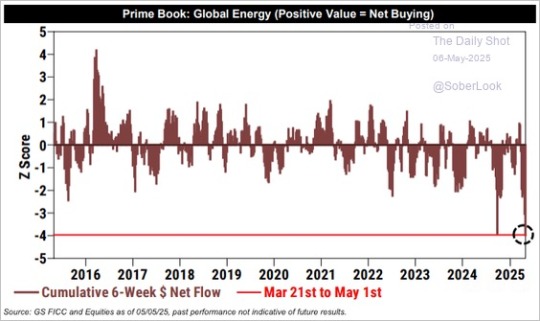

Tariff Hysteria Versus Hard Data

With oil prices down, I've been slowly accumulating shares across the energy space and broadening out into chemicals, fertilizers, and shippers.

The following charts are quietly making the rounds and make a very different case from the current hysteria.

Powell was asked about one of these today by a reporter warning "container ship departures from China have plunged."

They've only plunged from a very high "pull-forward" level to a level commensurate with prior years.

Total US power demand (red) is tracking prior years, actually running a bit higher.

And the most bullish chart for me? This one showing hedge funds puking energy shares at the fastest rate in 10 years. (Good ol' Tumblr...you'll need to click on the chart to see the entire image)

Hedge funds need to be right each month. I don't.

I would have been fired for lugging around my gold stock portfolio for the past two years. Now things are different.

Things will soon be different for energy. Slowly sprinkling profits there.

0 notes

Text

Market Comment: Very Near-Term Targets

In addition to the March 25th 5786.95 swing point mentioned here recently, there are two spots that have my attention for short-term trades...ODTE short-term options trades. The new White Lightning.

It feels as though the pain trade is still higher which could pressure the Fib confluence level and ultimately the 5786.95.

But mind the 5433.24. For now I'm viewing this as the fulcrum of the rally, which if broken, could risk some sort of sloppy re-test of the lows.

I also want to be cautious of a test of the Fib confluence level without a break of the 5786.95. Such action could spell disaster if a sell off were to gather steam from a failure there.

Current IV skew continues to provide ample opportunity for explosive SPY ODTE call backspreads, even more fun than trading the infamous OEX back in the 2006-2008 period. SPY has a gusher of liquidity with incredibly tight bid-ask spreads, unlike the $1.50 OEX bid-ask spreads which took serious aggression to play, hence the "White Lightning" nickname. 10X gain, 20X gain, or ZERO, all possible in a day. But you really had to work for it.

Today, for example, OEX traded a grand total of 10 calls vs over 4 million SPY calls. Sad but true. Lucky for us.

1 note

·

View note

Text

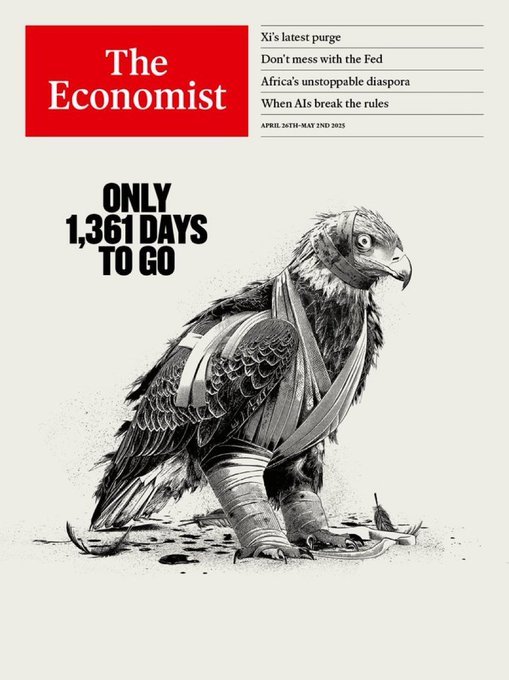

Another Day, Another Classic Economist Cover

Globalists pining for the good ol' days of globalism.

As politically offensive as this cover is, from a social mood standpoint, it's probably the most bullish USA mood cue yet.

Way to go, guys.

1 note

·

View note

Text

China Wants Respect?

They lie. They spy. They cheat. They steal. Now they want respect.

CHINA OPEN TO TALKS IF TRUMP SHOWS RESPECT SAYS EX-MINISTER —HIS PERSONAL VIEW, NOT OFFICIAL CHINESE GOVERNMENT STATEMENT - BBG INTERVIEW

Reality: if this ex-minister doesn't want to be disappeared, his personal view IS an official Chinese Government statement.

The biggest problem with totalitarian regimes is they get so used to supreme power over their unfortunate subjects that they assume such power extends to the rest of the world.

If China wants respect, it can change its behavior.

0 notes

Text

The Radical-Left Cult Goes All-In On The Latest Messaging Theme

God only knows how much the Democrats paid for their latest Big Idea, but the result is a social mood doozy.

CHAOS.

WSJ - Democrats Bet Casting Trump as Agent of Chaos Will Boost Their Fortunes

It was all over the Sunday morning new shows. Elizabeth Warren, Cory Booker, Amy Klobuchar, Chuck Schumer and other operatives were once again reading from the same script in true lefty unison.

CHAOS.

These grifters are great at two things: running their grift "machine" and complaining. Now that their grift-powered machine has been DOGED, they're the chaos.

Their repetitive script reading is creepy and non-authentic. It's why they don't connect with voters. It's why they need the Machine. It's why they have to pay people to protest. It's why they have to pay people to vote. It's weak. It's robotic. It's spooky.

It's a cult.

And it's why they need so much help from the media.

Newsweek - Trump Says He's Not Considering Pausing Tariffs Despite Global Financial Chaos

Bloomberg - Market Chaos Puts Wall Street on Alert for Funding Strains

Bloomberg - Wall Street Battered Again by Trump Chaos as New Winners Emerge

WSJ - Wall Street’s ‘Smart Money’ Braced for Tariff Chaos. It Was Still Caught Off Guard

They've even got their globalist friends in on it.

Guardian - Minnesota senator Amy Klobuchar... “Chaos up, corruption up, and, sadly, prices of eggs up….”

Reuters - Wall Street posted solid gains on Friday as big banks kicked off first-quarter earnings season and investors closed the book on a turbulent week of wild swings driven by the chaos of U.S. President Donald Trump's multi-front trade war.

EuroNews - Dow and S&P Drop as Trump's Tariffs Spark Trade Chaos on Wall Street

Globe And Mail - Why Stock Market Chaos Made Trump Blink on Tariffs

Canada's Globe And Mail would love it if Trump blinked on tariffs.

What's the real CHAOS? Having to listen to the chorus of complainers who have been profiting from the long slide of the United State of America.

The re-ordering is here. Atlas has shrugged. I'm glad it's happening.

Trading wise, two levels I'm watching this week: SPX cash 5488.73 and S&P futures 5533.75.

The cash level was missed last week by a measly 7.39 points. An overlap would, in my world, immediately put pressure on the 5786.95 swing point from March 25th and, if exceeded, would leave a large correction in its wake that could either be finished, or have been wave A of a developing ABC down.

This market is primed for trading. It was pumped up by more stimulus than the world has ever seen while trying to elect the most inauthentic candidate the world has ever seen. No wonder why the correction has been violent. I simply wasn't going to believe it until it finally happened.

Chaos yields opportunity. We can either complain about it or embrace it.

0 notes

Text

Three-Dimensional Chess: Belligerence Edition

Just like the purpose of the BlackRock-CK Hutchinson deal might have been to prove de-facto control of the Panama Canal by the Chinese Communist Party, so too may have *Trump's tariffs* been a way to isolate the world's most disingenuous bad actor.

Over 75 countries initiated trade dialogue without retaliation. China escalated.

Trump rewarded the 75+ countries with a 90-day pause.

Trump rewarded China's belligerence with a tariff rate of 125%.

China cheats, lies, and steals. When we seek fairness they label us bullies and wail that they will fight to the end...to keep profiting from cheating, lying, and stealing.

China is admitting it got no game.

Instead, China should remember they're at the mercy of the world's longest petroleum supply chain with Venezuela (9,500 miles) and Angola (6,500 miles) at the far end and the bulk of its daily consumption, 37%, flowing from the Middle East (~4,500 miles) through two very piracy-prone chokepoints, the Straits of Hormuz and the Malacca Straight.

It would be a pity if the USA should stop protecting global trade security by ceasing to patrol the world's sea lanes.

Perhaps the Houthis will suddenly become useful.

Who would be the bully then?

Elsewhere, the echo chamber was working hard today. I happened to hear Rick Santelli make the unwelcome point on CNBC that the main benefit of the tariffs was "globalism coming to an end."

Tim Seymour asked sarcastically: "How did we lose in globalism? I mean, can you explain that? Do we have time? Maybe we don't."

We lost our middle class, Timmy. We lost our ability to sustain ourselves. Isn't that enough?

0 notes