Don't wanna be here? Send us removal request.

Text

What If You Don’t Have Money for a Down Payment? Here’s How You Can Use What You Have to Buy a Home!

A down payment and/or closing costs doesn't have to be a roadblock to homeownership. Many people think they need 20% of the home price saved up before they can buy, but that's not the case. There are several options, both traditional and creative, that could help you get into your dream home with little or no money down. It’s not about how much you’ve saved, but about knowing all the possibilities that are available to you. Let’s explore the low down payment programs for both first time homebuyers and current homeowners. These programs help lower your down payment so that it is affordable for you. 1. FHA Loans FHA loans are a popular option for first-time buyers. They only require a down payment as low as 3.5%. This could be the perfect fit if you don’t have a large amount saved but want to buy a home sooner. 2. Conventional Loans You might be surprised to learn that conventional loans can have down payments starting at just 3%. They are available to those with good credit and stable income, so even if you don’t have much in savings, this can be an affordable way to get into a home. 3. VA Loans If you’ve served in the military, a VA loan might be your best option. These loans require no down payment at all, and you also don’t have to pay private mortgage insurance (PMI), which can save you money every month. 4. USDA Loans Buying a home in a rural area? USDA loans allow you to buy a home with $0 down. This is a great option if you’re open to living outside the city and want to save on your down payment. Acceptable Assets for down payment and/or Closing costs 1. Down Payment Assistance Did you know there are programs out there that can give you money for a down payment? These are called down payment assistance programs. They can offer you a grant (which you don’t have to pay back) or a second mortgage with very low interest and sometimes even 0% interest. If you’re a first-time buyer, definitely ask about this when talking to a lender. 2. Gift Funds Family or friends may be able to help you out. If someone you know is willing to give you money for a down payment, speak with your lender to make sure you can use it! This is called “gift funds.” You’ll need to provide documentation that the money is a gift and not a loan, but this can be a huge help if you're short on cash. Documenting this gift is specific to the loan type, make sure you mention this to your lender during your initial consultation. 3. Cash Value Life Insurance Policies If you have a life insurance policy with cash value, you may be able to borrow against it or even cash it out to use for your down payment. These are typically tax free and penalty free. Many people don't realize that their life insurance policy could be a source of funds for homebuying. Speak with your financial advisor for more policy details. 4. Retirement Funds You can also tap into your retirement funds for your down payment. If you have a 401(k), IRA, or other retirement account, you might be able to withdraw or borrow against it for your home purchase. Most 401K's allow you to pull money out Penalty Free. You can also use stocks, bonds, mutual funds, CDs, or other assets in your retirement account to fund your down payment. Just be aware of any taxes or penalties that might apply. 5. Inheritance or Trust Funds If you’ve recently received an inheritance or have access to a trust fund, you may be able to use those funds for your down payment. It’s important to talk to your lender to make sure the funds are properly documented, but inheritance or trust fund money can be a great resource for homebuying. 6. Settlements If you’ve received a settlement (like a personal injury or legal settlement), you might be able to use that money for your down payment. Just like with inheritance funds, make sure the money is well-documented for the lender. 7. Bitcoin or Cryptocurrency If you own cryptocurrency, you might be able to use it for a down payment and/or closing costs. Many lenders are beginning to accept Bitcoin and other cryptocurrencies as valid assets, but this can depend on the lender’s specific policies. It’s worth asking about if you have crypto savings as it too must be documented accordingly! 8. Sale of Personal Property Have you sold a car, jewelry, or other valuable personal items? The proceeds from the sale of personal property can often be used for your down payment. If you’ve sold something valuable recently, be prepared to show proof of the sale with a "Bill of Sale" when working with a lender. 9. Sale of Real Estate If you’ve recently sold another property, the proceeds can be used for your down payment. Whether it’s a vacation home, land, or even an investment property, the money from the sale of real estate can be a valuable resource for buying your next home. Have your fully executed Closing Disclosure ready for the lender to show proof of sale. 4. Seller Credit A seller credit is when the seller agrees to contribute a portion of the sale price to help cover your closing costs, down payment or even your realtors' commissions. It’s a great way to reduce the upfront cash required. If you’re negotiating with the seller, make sure to ask if they’re open to providing credit at closing. 15. Realtor Credit In some cases, your realtor may offer a credit toward your closing costs. This is called a realtor credit, and it can be used to help cover some of the closing costs of buying a home, which can ease the financial burden on you. Talk to your agent about whether this is a possibility for you. 16. Lender Credit Lender credits are another way to reduce your out-of-pocket expenses. Sometimes, lenders will offer credits toward your closing costs in exchange for a slightly higher interest rate on your mortgage. This can be a helpful option if you don’t have enough money saved for your down payment but want to reduce your closing costs. There’s More Than One Way to Buy a Home! As you can see, the path to homeownership doesn’t always require years of saving for a 20% down payment. You can use a variety of assets to fund your down payment. The bottom line? Don’t let the down payment hold you back. Whether it’s a small or large amount, there are plenty of ways to make homeownership a reality. Reach out to a mortgage advisor today to explore your options and see what you qualify for. The journey to your new home might be easier than you think! Read the full article

0 notes

Text

How Our Expertise Makes the Homebuying Process Seamless and Painless

I am thrilled to announce that I recently received a Clear to Close on a loan in just 16 calendar days. While this is an impressive milestone, it is not an isolated incident. In fact, our processes are streamlined, efficient, and built on a foundation of experience, ensuring that we deliver quick, seamless closings for our clients. But what does it take to get to Clear to Close in such a short time? How does a mortgage loan process move so quickly? It all comes down to a combination of thorough reviews, meticulous planning, and the expertise of an experienced team that understands every step of the process. Why the Quick Turnaround? 1. Thorough Reviews and Preemptive Problem Solving: The key to closing quickly is ensuring that everything is in order before the loan officially begins processing. From the moment a loan application is submitted, we conduct a detailed review of the borrower’s financial situation, credit profile, and documents. By identifying potential issues early, we can address them right away, preventing delays down the line. Whether it’s requesting additional documentation or making sure the appraisal meets lender requirements, we are proactive in addressing every detail. 2. Expert Knowledge of the Process: As experienced mortgage advisors, we know how to navigate the various phases of a home loan with precision. We’re familiar with every part of the process—from underwriting to closing—so there’s no guesswork. With an in-depth understanding of the intricacies of each loan type and an established relationship with trusted vendors, our team can quickly obtain what is needed and move files forward. 3. Efficient Teamwork and Communication: The key to a smooth and fast closing is constant communication. We have built strong relationships with underwriters, appraisers, title companies, and real estate agents. This network of professionals ensures that any questions or issues are quickly addressed and that everyone is on the same page. When everyone is aligned and focused on the same goal, the loan moves forward at a rapid pace. The Power of Expertise in the Homebuying Process Working with a knowledgeable, experienced expert like myself and my team can make a significant difference in your homebuying journey. Our clients appreciate how we take the time to explain each step in the process, ensure all paperwork is accurate, and keep them informed every step of the way. We understand that homebuying can be stressful, but when you work with a team that is dedicated to making it as smooth as possible, the process becomes much less overwhelming. This particular client was referred to us by her cousin, who also closed her loan in less than 20 days. Referrals like this speak volumes. When people experience a fast, smooth closing process, they want to share it with others. And when you have a team that is committed to delivering results, it builds a reputation for being reliable and efficient. Why You Should Choose Us for Your Homebuying Journey If you’re considering buying a home and want a team that works quickly and efficiently, we are here to help. Whether you’re a first-time homebuyer or an experienced homeowner, we have the knowledge and resources to guide you through the mortgage process with ease. - Speedy Closings: With proven systems and a fast-moving process, we aim for the fastest closing times possible, without sacrificing quality or attention to detail. - Personalized Service: We take the time to understand your unique financial situation and provide tailored advice and solutions to fit your needs. - Expert Guidance: Our experienced team will ensure that you understand every part of the process, from application to closing. If you want to close on your dream home with confidence and speed, contact us today. Let’s make your homebuying process as seamless and painless as possible—just like we did for our previous clients, who were able to close in 16 days. You can trust our team to be there every step of the way, with expertise that makes all the difference. Let us help you turn your dream home into a reality—fast! Read the full article

0 notes

Text

How Timeshares Don't Affect Your Homebuying Journey

Are you considering buying a new home but worried that a past foreclosure on a timeshare could impact your mortgage application? The good news is, you're likely in the clear. Timeshares are not considered traditional mortgages, so they won’t hold you back from homeownership, even if you’ve had a foreclosure on one. Here’s why: 1. Timeshares Are Not Mortgages Timeshare ownership differs from owning a home or property with a traditional mortgage. When you purchase a timeshare, you’re essentially buying the right to use a property for a set period of time each year, not owning the property itself. Because of this, timeshares are not classified the same way as a home loan. As a result, if you foreclose on a timeshare, it will not be considered a foreclosure on your credit report in the same way that a mortgage would. 2. Timeshare Maintenance Fees Don't Count in Debt-to-Income Ratio Another key point: timeshare maintenance fees are not factored into your debt-to-income (DTI) ratio. Your DTI ratio is a crucial part of the mortgage application process, as it helps lenders assess your ability to manage monthly payments. Unlike a traditional mortgage or credit debt, timeshare maintenance fees are not considered when calculating your DTI. This means that if you have timeshare fees but manage them responsibly, they won’t hurt your chances of securing a loan for your new home. 3. Timeshare Ownership Doesn’t Affect First-Time Homebuyer Status If you’ve previously owned a timeshare, it will not disqualify you from first-time homebuyer programs. These programs are designed to help those who have not owned a primary residence in the past 3 years. Since a timeshare is not considered ownership of a home where you occupy it for more than 6 months out of the year, it doesn’t take away your eligibility for first-time homebuyer status. 4. A Roadblock You Don’t Need to Worry About It’s natural to feel concerned about any past financial setbacks, especially when buying a home, but a timeshare foreclosure is simply not one of those things that will derail your homebuying dreams. Whether you’re looking to buy a home, timeshare issues should not stand in your way. So, if you’ve experienced a timeshare foreclosure or have ongoing maintenance fees, you can rest assured that they won't negatively affect your mortgage approval process. Focus on your finances, maintain a healthy credit score, and get ready to embark on your new home journey without that extra worry. If you have any questions or concerns about your specific situation, feel free to reach out to a mortgage professional. We're here to help guide you through every step of the homebuying process! Read the full article

0 notes

Text

Wondering if You're Making a Huge Mistake by Waiting to Buy a Home?

If you're thinking about waiting to buy a home, you’re not alone. Many people have questions about whether they should jump in now or hold off, hoping for better deals down the road. The truth is, waiting could be a bigger mistake than you think. The housing market has a history of consistent growth, and with updated mortgage programs and guidelines, the chances of a crash or significant price drop are slim. In fact, waiting could mean missing out on the best opportunity in years. Owning a home is one of the smartest ways to build wealth, with values appreciating an average of 4-5% each year. There is no right time to time the market. If you take a look at a chart from MBS Highway (a trusted resource for mortgage professionals), it’s clear: homes have appreciated in value consistently since 1942. This means that, despite market ups and downs, home values have tended to rise over time. In fact, home prices have been steadily increasing for decades — and while there may be brief slowdowns, the overall trend is clear: homes are worth more today than they were a year ago, and they’ll likely be worth more a year from now. What Experts Are Saying About the Market Right Now Don’t just take my word for it — some of the top experts in the industry are also saying that now could be the perfect time to buy. Here’s what they’re predicting: MBS Highway points out that despite some people fearing a housing crash, current market conditions just don’t support that kind of dramatic downturn. With the current mortgage programs and updated lending guidelines, the market is well-regulated and has far fewer risks than some might think. Right now, the market is more stable than it has been in years, and we’re seeing a trend toward long-term, steady growth. So, while it might feel tempting to wait and see if prices fall, history tells us that they likely won’t. Realtor.com predicts that home prices will continue to rise, but at a slower pace compared to the crazy highs we saw during the peak of the pandemic. They expect the market to stabilize and even out, which is actually good news for buyers. It means you’re not likely to see any sharp drops in prices, but the opportunity to buy now, while competition is lower, could set you up for long-term financial gain. Realtor.com Market Outlook Forbes has echoed similar thoughts, noting that the combination of low inventory and continued demand will likely keep prices stable, if not rising. They also mention that mortgage rates are relatively more predictable than in the past, giving buyers more confidence in making a move. Forbes Real Estate Predictions Here is Why Waiting to Buy Could Cost You: Let’s be clear: if you’re hoping to get a better deal by waiting, you might be missing out on your best shot at homeownership. Here’s why: Stable Market: The current market is much more stable and predictable than the wild swings of the past. In fact, many experts are calling this the "new norm." Mortgage guidelines are tighter, meaning fewer risky loans are being made, and homes are being valued more accurately. Lower Competition: Right now, the market is quieter compared to the frenzied buying of recent years. If you wait, you might face even more competition in the future when interest rates normalize, and more buyers come back into the market. This could lead to bidding wars and higher prices. Rising Prices: As mentioned, home values tend to appreciate over time. If you wait, you could end up paying more for a home next year than you would today. The Bottom Line: The Chart and Data Don’t Lie Looking at historical trends, combined with expert predictions, it’s clear that the housing market is on a steady upward trajectory. Homes have appreciated for decades, and with the stability of today’s market and updated mortgage programs, there’s no indication of a major downturn coming anytime soon. If you’ve been waiting for the "perfect" moment to buy, remember that the longer you wait, the more expensive the home you want could become. The market we’re in now is more stable and predictable than it has been in years, and buying now could position you for long-term financial success as home values continue to rise. In short, the chart shows that waiting could be a mistake. Now is the time to act — while competition is low, and prices are still relatively stable. The market is primed for buyers who are ready to take advantage of these conditions before things heat up again. Still on the fence? Let’s chat about your options and debunk the myths! Read the full article

0 notes

Text

Are Tax Deductions Helping or Hurting You When It Really Matters?

As a self-employed individual or 1099 contractor, you’ve worked hard to build your business and keep your expenses low. But here’s the thing, those tax deductions you claim to save money at tax time might be working against you when it comes to buying a home. We understand that claiming deductions on your taxes is essential to keep more of your hard-earned money in your pocket, but it can make it harder to qualify for a mortgage. Lenders look at the Net Income on the buyer's tax returns, when you are self-employed, and in many cases, write-offs have lowered the taxable income too much. So, what if you could still buy a home without needing to show those higher income numbers? If you’ve got savings, investments, or retirement funds, an Asset Depletion Loan could be the game-changer you’ve been waiting for! Rather than relying on your taxable income, we can use the assets you’ve already built up to help you qualify for a mortgage. That means you won’t need to adjust your taxes or claim fewer deductions just to get approved. Here's How It Work? 🤔 - No more stress over deductions: You don’t need to adjust your tax returns or worry about your self-employed income not being enough to qualify. - Use your assets: Your savings, investments, or retirement accounts can be used to demonstrate the income you need to get approved. - It’s a simple calculation: Your assets are “depleted” over time to show how they could support a mortgage, making it easier for you to qualify. - Self-employed? Check. - 1099 contractor? Check. - Don’t want to cut down on your tax deductions? Check! You’ve already built the wealth; now let it work for you! You don’t have to settle for renting or miss out on the home you’ve always wanted especially in this buyer's market. With an Asset Depletion Loan, you can move forward without the headache of changing your tax strategy or worrying about your business deductions. As long as you meet the minimum standards below, we can get you closed in as little as 30 days. - Minimum Credit Score: 600 - Minimum Down Payment: As low as 20% - Qualify with just assets OR Blend this program with 1 or 2 Yr. of Income Docs, P&L, 1099 or Bank Statements Loan. It’s time to stop letting tax season hold you back from owning your own home. No more waiting for the perfect tax year to buy. Your assets are the key! Read the full article

0 notes

Text

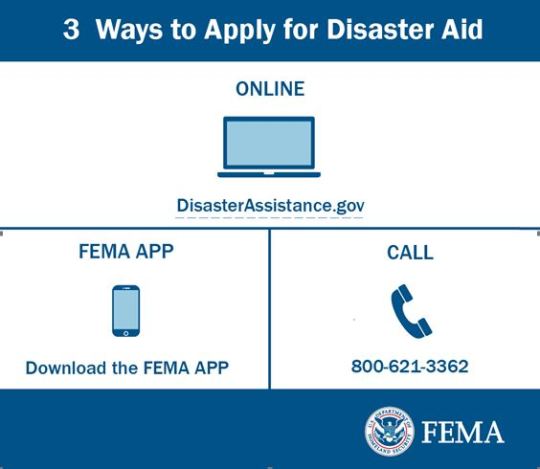

What to Expect After the Hurricane

Florida is no stranger to hurricanes. Over the last few decades, countless Floridians have faced the traumatic aftermath of powerful storms like Wilma, Ivan, Ian, Irma, Andrew, Charlie, and Helene. Many of which reached Category 3 to 5. Each storm has left its mark, causing not just physical damage, but also deep emotional scars. Many residents now carry the weight of anxiety and trauma from these experiences, making the aftermath of each new storm even more daunting. You are not alone. While we do our best to prepare, stocking up on food, canned goods, batteries, and securing shutters, there are always a few crucial items or steps that may slip our minds when disaster strikes due to the panic and anxiety. As you gather supplies and prepare, here are some additional tips to consider, along with important contacts to keep handy: What to Expect After the Storm 1. Assessing Damage: Before the storm hits, take photos of your property and save them in a secure folder on your phone or cloud storage. After ensuring your safety post-storm, assess the damage to your home. Document everything with photos for your insurance claim. 2. Contact Your Insurance Provider: Reach out to your insurance company as soon as possible to report any damage and initiate the claims process. Having documentation ready will expedite this process. Be sure to file the claim yourself. Do not have attorney's, adjusters or the insurance agent file for you. Your agent can help walk you through filing the claim, but it is important for you to do it yourself to assure all is explained and documented correctly, leaving nothing left for questioning to avoid delays. 3. Stay Informed: Stay updated with local news for recovery efforts and safety advisories. If power and internet are down, use Viber, Zello Walkie Talkie, or WhatsApp as an easy form of communication as these do not require internet to use them. Also, if you have an iPhone, you can also activate the satellite options on your for-emergency connectivity when outdoors. Your car can also serve as a charging station for your devices. Do not run the car or generator in an enclosed space to prevent carbon monoxide poisoning. Safety First. Resources for Assistance - FEMA Assistance: If you’ve been affected, you may qualify for federal assistance. Visit FEMA’s Disaster Assistance website or call 1-800-621-FEMA (1-800-621-3362) for more information. - Shelter and Safety: For immediate shelter needs, contact the Red Cross by visiting redcross.org or texting "Shelter" to 43362. - Local Community Resources: Many organizations are stepping up to offer support. Check with local churches, community centers, and non-profits for food, supplies, and temporary housing. As you navigate the aftermath of the storm, remember that you are not alone. The community is here to rally around you in your time of need. Our hearts and prayers go out to all those affected by recent hurricanes, those facing hardship and devastation, and those in the path of upcoming storms. Together, we can support one another through these challenging times. Stay strong, and don’t hesitate to reach out for help. We’re all in this together. Read the full article

0 notes

Text

Massive Jump in Mortgage Rates After Jobs Report

Today's much-anticipated jobs report ended up coming out much stronger than expected. A stronger result was all but guaranteed to cause carnage (relative) in the mortgage market and that's definitely what we're seeing. A caveat is that rates are still much lower than they were several months ago, but the average lender is now back in line with mid-August levels. Additionally, this is one of the largest single-day jumps we've seen with the average 30yr fixed rate moving from 6.26 to 6.53. A move of more than 0.25% in a single day is tremendously uncommon, but it can happen due to the underlying structure of the mortgage bond market. For those who would like to nerd out on those details, here you go: Whether a mortgage lender is lending their own stockpiles of cash or temporary cash obtained from a credit line, the chunk of cash wired to escrow at closing carries a cost. For a majority of mortgage lenders, the day to day changes in those costs are determined by the trading of mortgage-backed securities (MBS). MBS are similar to bonds like Treasuries in that investors pay a lump sum of cash and earn interest over time. They're different in several key ways. The most important difference is that the “borrower” of US Treasuries (i.e. the US Government) cannot return principal to the investor and end the deal. It must continue to pay for as long as it agreed. Mortgage borrowers, on the other hand, can sell/refi/etc and end the mortgage that underlies the mortgage-backed security. This introduces an element of uncertainty for investors that will be important in a moment. Another key difference for MBS is that they are offered in increments of half a percent and only a certain range of mortgage rates can fall into each 0.5% bucket. To make matters more confusing, there’s overlap between the buckets. For instance a rates of 6.75 to 7.125 could go 2 different buckets. Bucket choice matters. It corresponds to the prevailing rates in that bucket and certain ranges of rates exhibit different behaviors depending on what’s happening with rate trends. The simplest example is that a higher rate bucket is more likely to refinance when rates are trending lower. Is it good or bad for the investor when it owns mortgages that are refinancing? There’s no single, correct answer, because it depends on the price the investor paid at the time of purchase, but it’s almost always the case that the investor does NOT want mortgages to refinance when rates had been high, but might be starting to fall. Now let’s bring all this together with the example above of 6.75 to 7.125 rates having a choice between 2 MBS buckets. One of those buckets will contain lower average rates. That bucket will be LESS susceptible to the risk that borrowers refinance when and if rates begin to fall. Because of that, investors are willing to pay more for that lower bucket and conversely, they may shun the higher bucket by comparison. At this point, it’s important to note that mortgage lenders determine their pricing based on what investors will pay for loans. The net effect is that the highest allowable rates in the lower of the two buckets can actually be MORE PROFITABLE for a mortgage lender than the lowest allowable rate in the higher bucket. Here’s a real world example from an actual lender this week: a rate of 6.625% generated about 10% more profit for the lender, thus allowing them to decrease upfront costs by about 0.2% of the loan amount. On a $400k loan, that’s an $800 difference. In other words, you’d pay higher upfront costs if you opted for the 6.75% loan. The reason we’re diving so deep behind the curtain is to explain why rates can suddenly lurch sharply higher or lower by more than it seems like they should. The structure explained above means there are certain rates that are disproportionately more economically efficient. When rates fall enough to get close to the next lowest 0.5% MBS bucket, the highest rate in that bucket makes more and more sense to pursue, even if it means paying a bit more upfront. Depending on the methodology underlying any given mortgage rate index, this can make for quicker movement across certain ranges of rates, and large drops on days where the next lowest bucket suddenly becomes a viable option (or large increases on days where that lower bucket is no longer as viable). Read the full article

0 notes

Text

It's Time for your Annual Mortgage Review!

Market Conditions have improved in case you have not been following along. Although many may still be holding off on purchasing a home because of alleged "high interest rates". You may have purchased your home, when rates were literally at an all-time high, between 8-9%. If you purchased withing the last 2 years, you have been put on notice that it's time for your Annual Mortgage Review. With interest rates dropping, now might be the perfect moment to explore your options.

Interest rates are shifting, and this could mean significant savings for you. Whether it's refinancing your current mortgage or evaluating new opportunities, understanding your options could potentially save you thousands. Here's How the Annual Mortgage Review Works, It's as Easy as 1, 2, 3: 1. Start by scheduling your Annual Mortgage Review consultation. This helps us get a clear picture of your current mortgage situation and goals. 2. Provide your most recent mortgage statement. This document will help the mortgage lender understand your current loan details and assess potential savings. 3. Your lender will review and discuss any potential savings with you. If refinancing seems advantageous and fits your family's needs, you will proceed by completing a full loan application completed and submit all necessary documentation to process the loan.

Closed a loan with us before? As a valued member of our Customer for Life program, you enjoy an incredible benefit: No Lender Fees on future purchases or refinances under conventional, FHA, VA, and USDA home loan products. That's up to $1,590 in savings! Click the link below to schedule your free, no-obligation mortgage review with me. I'm here to help you make the most informed decision and ensure you're getting the best deal possible. Schedule Your Review Now! I look forward to helping you make the most of these favorable conditions! Read the full article

0 notes

Text

Down Payment Assistance That Never Run Out of Funds

Many people go out of their way and above their means to go see Hidden Gems throughout the world they never knew existed until they scrolled across a TikTok video. Why is the same effort not given when it comes to their future in real estate. There are more than just Conventional, FHA, VA and USDA home loans out there for both Homeowners and those currently renting, aspiring to own. If you are tired of feeling stuck in a rental rut because you can't seem to scrape together enough for a down payment, you're not alone. Many prospective homebuyers face this hurdle, and it’s no wonder that funds for city or county programs often dry up before you even get a chance. But what if I told you that there are down payment assistance options available right now that won’t run out of funds? That’s right—there are hidden gems in home financing that you might not know about. Let’s dive into these exciting options that could help you achieve homeownership sooner rather than later. 1. SmartBuy Down Payment Assistance Program The SmartBuy program offers a 3.5% down payment assistance (DPA) that can be used for down payment, closing costs, and other expenses paid outside of closing, like the home inspections and/or appraisal. Highlights: - Down Payment Assistance: Offers 3.5% or 5% towards down payment and/or closing costs. - Eligibility: Minimum 660 credit score; no first-time homebuyer requirement. - Repayment: The assistance is provided through a second lien, meaning it has to be paid back over 10 years with no forgiveness, but has 0% interest which means no monthly payments. - Property Types: Must be your primary home. Single Family, Townhome, Condo and Duplex allowed. even some manufactured homes (additional terms apply to manufactured homes). 2. MaxOne Down Payment Assistance Program MaxOne provides 3.5% total down payment assistance (DPA) that can be used for down payment, closing costs Highlights: - Down Payment Assistance: 3.5% total; 1.5% for closing costs, 2% for down payment. - Eligibility: Minimum 620 credit score; No first-time homebuyer requirement. - Repayment: 10-year term, but with a 0% interest rate and no monthly payments. Must be repaid if you sell, refinance, vacate the home or meet the 10 yr term. - Property Types: Must be your primary home. Single Family, Townhome, Condo and Duplex allowed. This program is excellent if you’re looking for assistance without the burden of monthly payments and a lower interest rate. 3. MaxOne Plus Down Payment Assistance Program What It Is: MaxOne Plus offers a comprehensive 3.5% assistance that can be used for both down payment and closing costs. Highlights: - Down Payment Assistance: 3.5% of the home’s purchase price - Eligibility: Minimum 620 credit score; No first-time homebuyer requirement. - Repayment: 10-year term with payments amortized over that period. Assistance is not forgivable, so there will be regular payments monthly. The interest rate is 2% higher than the rate on your 1st mortgage would be. - Property Types: Must be your primary home. Single Family, Townhome, Condo and Duplex allowed. For those who prefer a predictable monthly payment, MaxOne Plus can provide a solid path to homeownership while helping with both your down payment and closing costs. 4. MaxOne Home Assist Program MaxOne Home Assist offers a generous 5% down payment assistance. Highlights: - Down Payment Assistance: 5% of the home’s purchase price. - Eligibility: Minimum 620 credit score; NO first-time homebuyer requirement. NO Income Limit - Repayment: No monthly payments are required, but it must be repaid if you sell, refinance, or vacate the property or meet the 10 Yr term. - Property Types: Must be your primary home. Single Family, Townhome, Condo and Duplex allowed. This program is a great option if you need a larger amount of assistance and are interested in a flexible repayment structure. Don’t Let Your Dream Home Slip Away It's time to stop letting your landlord benefit from your hard-earned money. These down payment assistance programs are designed to make homeownership more accessible and affordable. By exploring these options, you could find a pathway to owning a home sooner than you think. Contact us today to see if you qualify for one of these fantastic programs and take the first step toward building your own generational wealth. Don't wait—your dream home is within reach! Read the full article

#homebuying#assets#buyingahome#cash#downpayment#downpaymentassistance#dreamhome#fundstoclose#homeloans#homeownership#homesweethome#money

0 notes

Text

What Happens If a Hurricane Hits While You're Buying a Home? Here's What to Expect.

Buying a home is a thrilling journey, but what happens if a hurricane or tropical storm hits while you're in the process? Don't worry—it's not the end of the road. Here’s what you need to know about navigating this stormy weather in your home-buying journey and what to expect from your mortgage lender. Understanding the Impact of a Storm on Your Home Purchase When a major storm hits, areas may be declared FEMA disaster zones. This declaration doesn’t mean your home purchase is off, but it does add a few extra steps to ensure everything remains on track. Your mortgage lender will prioritize your safety and the integrity of the property by requiring additional inspections and documentation. Be sure you communicate with your Realtor and Mortgage Lender before and after the storm. The Realtor will them relay the expectations with the listing agent and seller. What to Expect from Your Mortgage Lender - Possible Closing Date Delays: The closing process might be delayed as the underwriting department will need to verify that the property is still in good condition. This includes checking for any damage such as roof leaks, broken windows, electrical issues, or flooding. - Final Inspection Requirement: Before proceeding with the closing, a final inspection may be required to be conducted by the appraiser. This inspection ensures that the property is free from damage and that essential systems are functioning correctly. You will not need to arrange this, the Mortgage Lender will. If shutters or other storm protection measures were used, they must be removed from the windows, etc. for this inspection to take place. - Documentation and Proof: Your Mortgage Lender or Home Insurance Carrier might ask for additional documentation or proof that the property is undamaged. If the roof has broken or missing roof tiles and/or shingles, the home insurance company may require these to be replaced/repaired prior to issuing and/or binding home insurance coverage. I highly recommended that you obtain a roof certification showing no damage or leaks from the storm. This may not be a requirement but a good precautionary measure before you purchase and close on the home, especially after a major storm.

Key Takeaways:

It is very important to Stay in Touch and keep communication open with your mortgage lender. They will guide you through the additional steps required. Remember to be patient. While the process might take a bit longer than expected, these measures are in place to ensure you’re purchasing a safe and sound property. Check Property Condition. You are welcome to drive by the property and take a look at the condition of the home. Is there flooding, damage, etc. Your viewing of the home is important as well so you can determine if you want a roof certification or moisture inspection done. If a final inspection is needed, the appraiser will ensure that the property is in working order and any storm-related issues have been addressed. Navigating a home purchase during severe weather can be challenging, but understanding these steps can help you stay informed and prepared. If you have any concerns or need further clarification, don’t hesitate to reach out to your mortgage advisor. Stay safe and good luck with your home purchase! Read the full article

#buyingahome#georgiarealestate#homebuying#homeloans#homeownership#homesweethome#hurricaneseason#storm

0 notes

Text

Facing Challenges with Condo Transactions?

Unlocking Condo Closings: Your Guide to Overcoming Challenges and Streamlining Transactions Condo deals can be complex, but knowing the hurdles and having a solid plan can make all the difference. I have taught many Condo Education classes to real estate agents and brokers to help then simplify the condo transaction. Getting answers before getting a headache. If a condo has issues with insurance deductibles, structure issues, and no reserves, we don't want them wasting their time and yours by listing the property and accepting conventional financing offers. They most likely should list that property for cash only offers. It is important to do the due diligence up front for a hassle-free transaction on both sides for the buyer and seller. Here’s a breakdown of common challenges realtors and buyers face, and how we have taught our realtor partners how to overcome them upfront so that you can successfully close more condo deals. Common Condo Transaction Challenges: - Financing: Condo Reviews, Master Insurance Coverage Insufficient, Unclear Title, etc. - HOA Requirements: Understanding HOA rules, fees, and any special assessments can be tricky. - Appraisals: Finding reputable Comps, Assessing the unit and the Condo building. - Title & Legal Challenges: Ensuring clear title and resolving any legal issues can delay closings. Listing Agents: Condo Listing Checklist To make the process smoother, ask the Seller and/or HOA for the following when listing a condo: - HOA Contact Info - All positions of the board, CAM, Property Manager etc. - HOA Dues & Frequency: How much, is there a master and subdivision HOA, Any Capital Contributions? - Coverage of HOA Fees - What does this cover? Is water included? - Any Special Assessments? If so, for what? Is it structural? Is it pending or approved? - Unpaid Seller HOA Fees/Dues? - Condo Budget- Does the condo meet the 10% reserve requirement for home financing? - Condo Rules & Regulations - Income or credit restrictions? Rental restrictions? - Condo Application - Where to find it, how long does it take for Applicant review? - All Notices Received by the Property Owner - Most Recent 12 Months of Meeting Minutes Effective Communication with HOA To ensure clear and effective communication: - Introductory Call: Start with a call to establish a connection. - Prepare a Call Script: Outline key points and questions. - Include Text of Importance: Share critical details and requirements. - Document Communication: Keep records of all interactions. - Follow-Up: Offer multiple ways for the HOA to provide information and avoid unnecessary details when speaking with them, remember they are only there for a few hours a day 1 or 2 days a week, they are busy. - Build Relationships: Show appreciation with in-person visits, sweet treats, and thank you cards. Understanding the Financing Full Condo Review: Thorough examination of the condo’s financial health, HOA, and legal status. Required for conventional loans with less than 25% down payment. Limited Condo Review: Focused review when the condo meets specific criteria, typically resulting in faster processing. No Financials are needed. This occurs when the buyer is putting 25% or more down. Non-Warrantable Condo Review: For condos that don’t meet traditional criteria; requires specialized lenders and often higher down payments. Short on funds for a 25% down payment? Consider these options: - Down Payment Assistance: Explore city/county and state programs if you qualify. - Creative Financing: A combination of a first mortgage and a HELOC can help cover down payments. Ready to navigate the condo market with ease? Contact me today for personalized advice and solutions to ensure your transactions close smoothly and on time! Let’s turn those challenges into opportunities. 🏠💼 #CondoLiving #RealEstateTips #HomeBuying #FinancingSolutions #HOAChallenges #RealEstateAdvice #ContactMe #themtgmagician #condo #condofinancing #condocrisis #listingagents #buyersagents #floridarealestate Feel free to reach out if you have any questions or need further assistance with your condo transactions! Read the full article

#condo#condochallenges#condocrisis#condofinancing#economicinsights#homeloans#homeowner#homeownership#markettrends

0 notes

Text

What Happens If a Hurricane Hits While You're Buying a Home? Here's What to Expect.

Buying a home is a thrilling journey, but what happens if a hurricane or tropical storm hits while you're in the process? Don't worry—it's not the end of the road. Here’s what you need to know about navigating this stormy weather in your home-buying journey and what to expect from your mortgage lender. Understanding the Impact of a Storm on Your Home Purchase When a major storm hits, areas may be declared FEMA disaster zones. This declaration doesn’t mean your home purchase is off, but it does add a few extra steps to ensure everything remains on track. Your mortgage lender will prioritize your safety and the integrity of the property by requiring additional inspections and documentation. Be sure you communicate with your Realtor and Mortgage Lender before and after the storm. The Realtor will them relay the expectations with the listing agent and seller. What to Expect from Your Mortgage Lender - Possible Closing Date Delays: The closing process might be delayed as the underwriting department will need to verify that the property is still in good condition. This includes checking for any damage such as roof leaks, broken windows, electrical issues, or flooding. - Final Inspection Requirement: Before proceeding with the closing, a final inspection may be required to be conducted by the appraiser. This inspection ensures that the property is free from damage and that essential systems are functioning correctly. You will not need to arrange this, the Mortgage Lender will. If shutters or other storm protection measures were used, they must be removed from the windows, etc. for this inspection to take place. - Documentation and Proof: Your Mortgage Lender or Home Insurance Carrier might ask for additional documentation or proof that the property is undamaged. If the roof has broken or missing roof tiles and/or shingles, the home insurance company may require these to be replaced/repaired prior to issuing and/or binding home insurance coverage. I highly recommended that you obtain a roof certification showing no damage or leaks from the storm. This may not be a requirement but a good precautionary measure before you purchase and close on the home, especially after a major storm.

Key Takeaways:

It is very important to Stay in Touch and keep communication open with your mortgage lender. They will guide you through the additional steps required. Remember to be patient. While the process might take a bit longer than expected, these measures are in place to ensure you’re purchasing a safe and sound property. Check Property Condition. You are welcome to drive by the property and take a look at the condition of the home. Is there flooding, damage, etc. Your viewing of the home is important as well so you can determine if you want a roof certification or moisture inspection done. If a final inspection is needed, the appraiser will ensure that the property is in working order and any storm-related issues have been addressed. Navigating a home purchase during severe weather can be challenging, but understanding these steps can help you stay informed and prepared. If you have any concerns or need further clarification, don’t hesitate to reach out to your mortgage advisor. Stay safe and good luck with your home purchase! Read the full article

#buyingahome#georgiarealestate#homebuying#homeloans#homeownership#homesweethome#hurricaneseason#storm

0 notes

Text

Market Summary: Is the Fed Cutting Rates?

Surprisingly Strong Reaction to Equivocal Powell Opinions certainly vary as to whether today's communications from the Fed and Fed Chair Powell were dovish or hawkish, so let's focus on facts. The changes in the statement itself were bond-friendly but not enough for bonds to rally. Infact, there was modest selling until Powell began answering questions. Powell himself said a September rate cut was one possible scenario assuming the data remains consistent with recent progress toward goals. He was very clear, however, to say that no decisions have been made. A strong case can be made that today's rally isn't exclusively on Powell. Geopolitical headlines and month-end trading definitely had an impact. Still, history will remember that Powell did everything he could do to leave the door open for a September cut, short of promising that it would happen. Surprisingly Strong Reaction to Equivocal Powell (mbslive.net) Read the full article

#buyingahome#economicinsights#homebuying#homeloans#homeownership#housingmarket#interestrates#markettrends#RateCuts

0 notes

Text

📣 Attention Homeowners! Don't Forget to File Your Homestead Exemption 🏠✅

📣 Attention Homeowners! Don't Forget to File Your Homestead Exemption 🏠✅ This is just a friendly reminder that the deadline for filing your Homestead Exemption is fast approaching - March 1st, 2024 is just around the corner! 🗓️⏰ 🤔 What is Homestead Exemption?A Homestead Exemption can offer significant property tax savings by reducing the taxable value of your primary residence. It's like a discount on your property taxes, and who doesn't love a good discount? 💸🏡 🎉 There are many Benefits of Filing your Homestead Exemption:- Lower property taxes: Save money each year! 💰- Auto-renewal: File it once, and you're set for annual renewals! 🔄- Protects your home: Offers some protection from creditors in certain situations. 🛡️ 📲 We try to simplify every process. Therefore, for Easy E-Filing , just scan the QR Code for the applicable county in which you reside:These will take you straight to the e-filing page for:1. Broward County 🌴2. Miami-Dade County 🌊3. Palm Beach County 🏖️ Remember, the deadline is March 1st, so don't delay! If you have any questions or need assistance, feel free to contact me. I'm here to help you navigate this process smoothly. 🤝📞 Let's make sure you take advantage of this valuable homeowner benefit. Happy filing! 🌟📂 #HomesteadExemption #PropertyTaxSavings #HomeownerTips #DeadlineReminder #Broward #MiamiDade #PalmBeach #RealEstateSavings 💼🏠🌴#themtgmagician #homebuyertips #efile #TaxBenefits Read the full article

0 notes

Text

10 Ways to Cut Energy Costs

🌟 Happy National Cut Energy Costs Day! 🎉 Today is all about smart energy use and saving money! 💡💰 Here are 10 ways to slash those bills and be kinder to our planet. 🌍✨ - 🌞 Use Solar Heat: On sunny days, open curtains to let in natural warmth. It's free and eco-friendly! ☀️🏠 - 💡 Turn Off Lights: Always remember to switch off lights when leaving a room. It's a small step with big savings! 🔌🚪 - 🍽️ Full Dishwasher/Washing Machine: Run these appliances only when full to save water and energy. Every load counts! 💧👕 - 🚿 Shorter Showers & Efficient Showerheads: Cut shower time and install an energy-efficient showerhead to save both water and energy. Quick and impactful! 💦🕒 - 🔥 Lower Hot Water Heater Temp: Turn down the temperature a bit. You'll hardly notice, but your bill will! 🌡️💸 - 🔌 Unplug Unused Appliances: Even when off, appliances can draw power. Unplug to save! 📺⚡ - 🏠 Seal Foundation Walls: Insulate and seal any cracks to prevent moisture and loss of heat. A snug home is an efficient home! 🛠️🌬️ - 🌡️ Turn Down Thermostats: Just 1 degree lower can make a significant difference in energy usage over time. Cozy up with a sweater! 🧣🌡️ - 🪟 Energy-Efficient Windows: Invest in good windows to keep heat in and bills low. It's worth it! 🏡💨 - 🚗 Carpool: Share rides to cut down on fuel costs and emissions. It's fun and green! 🚙👫 Let's make a difference, one step at a time! 🌱💚 Share your own tips and join the energy-saving movement! #NationalCutEnergyCostsDay #SaveEnergySaveEarth 🌎✌️ Read the full article

0 notes

Text

🍰 Satisfy Your Holiday Cravings with a Scrumptious Christmas Tree Croquembouche Recipe 🎄

Christmas is the season of joy, love, and creating cherished memories with our loved ones. Just as in the world of real estate, where relationships are key, the bonds we share during the holidays make this season truly special. As a seasoned mortgage loan advisor with 19 years of experience, I'd like to share a delightful Christmas dessert recipe with you, the Christmas Tree Croquembouche. But first, let's explore the meaning and significance of holiday traditions. Christmas isn't just a date on the calendar; it's a time for coming together, showing appreciation, and building connections with our friends and family. Just like the strong relationships in real estate, these connections during the holiday season are built on shared experiences, traditions, and of course, scrumptious holiday treats. One of my favorite Holiday Desserts is the Christmas Tree Croquembouche. It is a delightful French pastry tower made of cream-filled choux puffs, drizzled with caramel, and shaped into a Christmas tree. Not only is it a showstopper on your holiday table, but it's also a symbol of togetherness and celebration. If you would like to take on the challenge of the Christmas Tree Croquembouche this year, here is the recipe. EQUIPMENT NEEDED:Hand or stand mixer.Large mixing bowlspatulaMedium saucepanBaking trayParchment paperPiping bags and tipsPastry brushINGREDIENTS Choux pastry:1 cup (230g) unsalted butter, cut into pieces.1 cup (240g) water1 cup (240g) milk (whole or 2%)1/2 tsp salt4 tsp granulated sugar2 cups (250g) all-purpose flour8 eggs, beaten.Vanilla pastry cream2 cups (480g) whole milk4 tbsp unsalted butter, cut into pieces.1/2 tsp salt2 tbsp vanilla extract5 egg yolks1/2 cup (100g) granulated sugar1/4 cup (25g) corn starchCaramel2 1/2 cups (500g) granulated sugar1/2 cup (120g) water INSTRUCTIONS: Day 1: Make the choux pastry.Combine butter, water, milk, salt, and granulated sugar in a medium saucepan over medium heat, stirring until the butter has melted. Bring the mixture to a simmer and then reduce heat to low. Add all of the flour and stir until completely incorporated. The dough should be a thick ball. Press against bottom of sides of the pan for 1 minute to cook the flour and remove from heat.Place ball of dough into a large mixing bowl and allow to cool before adding eggs.With hand or stand mixer on low speed, slowly add the beaten eggs in 3 or 4 batches with 30 seconds between each. Pour in very slowly and observe the texture of the dough. At first it won't look like it's coming together but will eventually become thick and glossy. Stop when you have a thick and pipeable texture. I like to save at least 1-2 tbsp of egg to use as the egg wash.Preheat oven to 400 degrees F. Line two baking sheet with parchment and lightly brush each sheet with water. The water helps create extra humidity in the oven, which helps with puffing.Fill your piping bag fitted with a 1/2-inch tip with the choux pastry dough. Pipe circles 1 inch in diameter. Space each circle 1 inch apart on the sheet.Bake for 15 minutes and then, making sure not to open the oven door, reduce oven temperature to 350 degrees F and bake for 5 – 10 more minutes until golden brown. Remove from oven and transfer to a cooling rack. Cool completely.Store choux puffs in an airtight container at room temperature until ready to assemble. Now its time to make the pastry cream.Whisk egg yolks and sugar in a medium bowl until pale, light, and fluffy, about 3 minutes. Whisk in corn starch until fully incorporated.Mix milk, butter, salt, and vanilla extract in a medium saucepan over medium heat. Bring to a simmer.Slowly pour the milk mixture into the egg mixture, whisking constantly. Pour the mixture back into the saucepan and cook on medium heat, whisking constantly until the mixture is thick and the whisk marks hold. This should take about 2 minutes.Remove from heat and pour into a bowl. Cover with plastic wrap, making sure the surface of the custard touches the wrap. Chill for at least 2 hours and up to 3 days. Day 2: Fill the puffs and prep for assembly.When ready to assemble, remove the puffs from airtight containers. Spread on baking sheet and dry out for 5 minutes in the oven at 350°F. Let cool before filling.Poke a small hole in the bottom of each choux puff. Place the pastry cream in a piping bag fitted with a 1/4-inch tip. Fill each puff by placing the piping tip inside of the puff and gently squeezing in cream. Be careful not to overfill. You should have about 50 – 60 filled puffs.Arrange the puffs from largest to smallest. This will help with assembly.Trace a circle on a sheet of parchment paper that is 8 inches in diameter. Flip upside down so you can still see the circle through the paper. This will be a guide for assembly.Ok, Let's ake the caramel.Fill a large bowl with ice water. Place sugar and water in a medium saucepan over medium-high heat. Stir the sugar to dissolve. Do not stir again after the sugar has dissolved. Brush down the sides of the pan with water to prevent crystallization. After the caramel is an amber color (about 340°F), remove from the stove and place the pan in the cold water to prevent further cooking.Now, Let's Assemble!Fill a glass with cold water and place next to your workstation in case of caramel burns. If your fingers touch the hot caramel, dip them into the water.Use the largest puffs for the bottom of the croquembouche. Dip the front and one side of a cream puff into the caramel, being careful not to burn your fingers. Stick the puff onto the sheet, with the top of the puff facing out. It should be just within the edge of the circle. Dip another puff into the caramel, coating the front and two sides. Place the puff so that one side sticks to the other puff, and the other side sticks to the parchment paper. Repeat until you close the circle, angling the puffs slightly inwards.Repeat with the second layer, using at least 1 less puff. Before placing each puff, drizzle caramel on top of the first layer to use a "mortar." Try to place puffs in the empty spaces between puffs in the first layer for structural stability. I find it helpful to hold the last puff I place while dipping the next puff to help the caramel set up.Continue to build layers, using less puffs for each layer. You may periodically need to reheat the caramel. Finish the tower with a single puff. You should have 8 layers.To decorate, you can make caramel strands by letting the caramel cool in the pan until thickened. It should form a thread when you lift it with a fork. Dip a fork in the caramel and spin around the croquembouche to encase in caramel threads. Alternatively, decorate with ribbon and fresh cranberries.The croquembouche will last for 5 – 8 hours before it begins to soften. Spending the holidays with loved ones is a precious gift. Just as we take time to savor every bite of this delectable Christmas dessert, we should savor every moment with those we care about. Sharing traditions, like making a Christmas Tree Croquembouche, strengthens our bonds and creates memories that will be cherished for years to come. Get the kids involved. I would love to see how your Christmas Tree Croquembouche turns out. As we approach this wonderful season, I challenge you to share your favorite Christmas dish with us. Whether it's a cherished family recipe or a newfound holiday delight, let's celebrate our shared love for delicious traditions. I want to wish each and every one of you a safe and joyful Christmas. May your celebrations be filled with warmth, love, and the sweetest of moments. 🎅🎄 If you're considering purchasing a new home or exploring opportunities to take out equity from your current one before the holidays, please feel free to reach out to me. I'm here to help make your real estate dreams come true during this festive season. Read the full article

0 notes

Text

🏡 5 Reasons to Make Your Homeownership Dream Come True Before the Holidays 🎁

🎁 It's a Gift That Keeps on Giving! 🎁 The holiday season is upon us, and amidst the hustle and bustle of planning vacations and savoring festive feasts, one question might pop into your mind - is this the right time to consider buying a home? While the holidays are notorious for being busy and unpredictable, they can also offer a unique opportunity for savvy homebuyers. As a seasoned mortgage loan advisor with 19 years of experience, I'm here to help you see homeownership during the holidays from a fresh perspective and understand why it might be the perfect time to turn your dream into reality. 1. Tax Advantages for the New Year If you purchase a home before the end of the year, you could potentially benefit from various tax advantages come tax season. Mortgage interest, property taxes, and other deductions could translate into substantial savings. Owning a home before December 31st can be a smart financial move, especially if you want to kick off the New Year on the right foot. 2. Motivated Sellers with Heartwarming Deals Sellers listing their homes during the holiday season often have strong motivations. They may need to relocate quickly due to work or personal circumstances, or they might simply be eager to close the deal before the year ends. This can work in your favor, potentially leading to more favorable pricing and conditions. It's a season of goodwill, and that can extend to the real estate market. 3. Less Competition, More Opportunities While others are caught up in holiday festivities, the number of buyers in the market typically decreases during this time. Less competition means you have a better chance of securing the home you desire at a reasonable price. It's like having the store all to yourself during a holiday sale, but in this case, it's the real estate market. 4. A Realistic Picture of Your Home The holiday season offers a unique chance to see homes in their true colors. With cozy fireplaces, twinkling lights, and family gatherings, you can get a more accurate feel for a property's potential. Unlike spring and summer, when homes can be dressed up with the greenery of gardens, holiday decor gives you an honest look at the home's indoor charm and warmth. 5. Greater Accessibility to Real Estate Professionals Real estate professionals, including mortgage loan advisors, often experience a less hectic schedule during the holidays. This means more dedicated time and attention for your needs. You'll have the opportunity to connect with experts who can guide you through the homebuying process with focus and care. Owning a home before the holidays, is my gift to you. Call me Santa if you'd like. Owning a home before the holidays is a unique time with distinctive advantages that can help turn your dream into a reality. I'd be surprised if you didn't have concerns. Don't worry, we've got the solution to your problems. If concerns about selling contingencies are holding you back, don't worry. We have bridge loan options to solve that problem, making the transition from your current home to your new one a smooth journey. The holiday season is a time for dreams to come true, and I'm here to help you make it happen. Feel free to set up an obligation free consultation to discuss your current homebuying scenario, how we can make homebuying affordable for you even during the holidays, and to run numbers to see if homeownership makes sense for you. Wishing you a joyful, safe, and meaningful holiday season, filled with the warmth of home and the magic of dreams coming true. 🏡🎄🎁 Read the full article

0 notes