Video

youtube

Lowest Mortgage Rates Toronto

Real estate market of Canada can be unpredictable at times. What are the current real estate trends in Toronto? How to get the lowest Mortgage Rates in Toronto. Need expertise advice from an experienced Mortgage Broker? Call Ashish Gandhi today at (416) 621-7501📞 Visit : www.themortgagedivision.com for more details

0 notes

Photo

Best Mortgage Rates Mississauga | The Mortgage Division

For the Best Mortgage Rates in Mississauga, trust The Mortgage Division. We offer the Lowest Mortgage Rates in Mississauga for both home and commercial property

0 notes

Photo

At The Mortgage Division Your Satisfaction is our Goal!

#Lowest Mortgage Rates Toronto#Best mortgage rates Mississauga#lowest mortgage rates mississauga#best mortgage rates toronto

0 notes

Text

Why a Personalized Home Mortgage Refinancing Report is Crucial?

When going for home mortgage refinancing, finding the right refinance mortgage rates is the first important step. Refinancing report gives you a detailed comparison of different lenders offering refinance mortgage services and that clears the picture for you.

The Mortgage Division, experts of lowest refinance mortgage rates in Mississauga, offer free personalized home mortgage refinancing report to its clients. Personalized because every borrower is different in terms of income sources, current credit score, and reasons to go for refinance. Therefore, a detailed personalized report gives a more accurate estimate of which plan is good for you. Here’re the various benefits of refinancing report.

You get the lowest and the best mortgage rate

When you have what different lending institutions are offering spread out in front of you, you can analyze better. You can make better and smart choices based on the mortgage term and rate being offered. If you haven’t asked for your free report yet, ask for it today from your mortgage agent.

More savings

When you compare your existing loan repayment to the new loan repayment options, you can easily calculate the amount you’ll save on your monthly interest payment. That’ll not only strengthen your will to go for refinance but will also help expand your savings for investments elsewhere.

Changed Borrowing Capacity

Are you earning the same as you used to when you opted for your current mortgage? If no, have you tried to evaluate your changed borrowing capacity? A personalized refinance report helps you analyze your present income and evaluate your borrowing capacity in real time.

Better organization of finances

Once you have everything in check from mortgage refinance rates to your enhanced borrowing capacity, you can organize your repayment schedule in a better way. Refinancing report will change the way you plan repayments. With a better understanding of your present income vs. your repayment options, there’re little chances that you may go wrong.

Owing to the above mentioned reasons, many people opt for mortgage refinancing and it does give better returns. To make a good financial decision, it’s important to analyze your present situation from all aspects and a home mortgage refinancing report helps you do exactly the same.

0 notes

Photo

Lowest Mortgage Rates Toronto

Even with availability of the best mortgage rates, a huge decline was seen in the selling as well as prices in the real estate market of Canada.

#lowest mortgage rates toronto#best mortgage rates toronto#lowest mortgage rates mississauga#best mortgage rates mississauga

0 notes

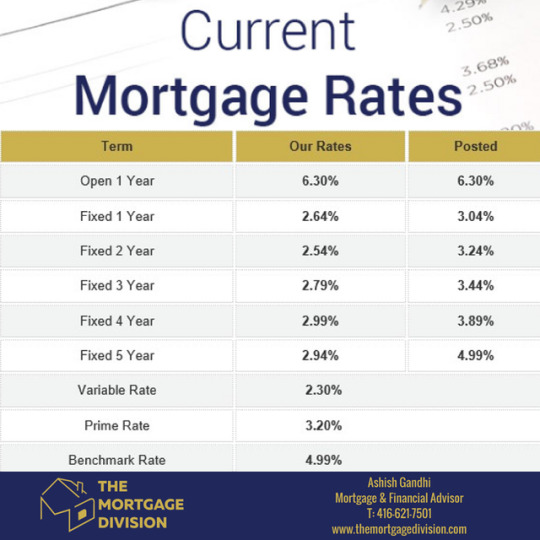

Photo

Current Mortgage Rates - The Mortgage Division

Your current mortgage rates for Monday January 8th 2018. Visit our website for more information or to apply now! www.themortgagedivision.com

#lowest mortgage rates mississauga#best mortgage rates toronto#Best mortgage rates Mississauga#lowest-mortgage-rates-toronto

0 notes

Link

0 notes

Text

Best Mortgage Rates Toronto in 2018

New Mortgage Rules that are likely to impact best mortgage rates in 2018

In October 2017, OSFI introduced three key changes to mortgage rules, applicable to B-20 guidelines that pertains to the same. These three changes will change the way people look at mortgages.

Taking effect from 1st January 2018 on wards, these rules will be applicable to new submissions and pre approvals converted on or after 1st Jan.

These changes have been made after thoroughly analyzing the mortgage market and taking into consideration the alarming percentage of bad loans that cause a havoc on the financial institutions in the long run.

LTV forms the highlight of these changes and its low value has been bothering OSFI for quite some time.

LTV is the loan-to-value ratio that measures in percentage the ratio of loan amount to the value of the property against which mortgage is provided. It can be understood as

Loan amount/property value * 100

OSFI took a strict route to counteract those lending institutions that tend to bypass the LTV ratio limits regulations. Earlier, lending institutions will bridge the gap needed to fulfill the LTV requirement by giving supplemental and unsecured credit to borrowers.

This practice will be banned from the onset of New Year onwards. This is a welcome change as it has the potential to save Banks from bad loans and piling up of unsecured credits.

Further, OSFI has asked lending Banks to adjust their LTV ratio limits and measurements. The LTV ratios should be reflective of risk and should oscillate with the evolution of housing market and general economic environment.

There is no point of maintaining a high LTV when there is a drop in the regional housing market. This step is taken to manage regional LTV limits and to bring them to more typical levels.

Apart from that, the new stress test or qualifying rate test needed for uninsured mortgages is another rule change that'll be introduced when clock strikes twelve on 31st December 2017. Now, uninsured borrowers will undergo the qualifying rate test along with default-insured borrowers. These qualifying rates are even higher for the former than the latter. That's because it's either of the two in case of uninsured borrowers- the usual stress test rate of 4.89% or 2% more than their existing mortgage rate which may be higher than 4.89%.

These are the changes introduced in the mortgage scene from the next year. Certainly things will be tough for borrowers who have a bad credit score. What are the long term impacts? Only time will tell.

0 notes

Photo

Best Mortgage Rates Toronto

We offer the Best Mortgage Rates in Toronto.Your Money Matters, which is why we work hard to get you these Amazing Rates.

#best mortgage rates toronto#best-mortgage-rates-mississauga#lowest mortgage rates mississauga#Lowest Mortgage Rates Toronto

0 notes

Text

Factors that Influence Best Mortgage Rates in Toronto

Whether you’re new to mortgage market or an old player, you can’t know everything at once. There are certain factors that influence your chances of getting best mortgage rates.

Living in the busy economic and financial hub as Toronto, one faces the problem of affordable housing. The listings are many but prices are high as compared to the neighboring cities in the same province. Knowing how mortgage rates fluctuate and which the best way to go is, you can procure the best mortgage rates in Toronto and get yourself your dream home in no time.

Mortgage rates depend upon macro and micro factors. Macro factors can be described as the economy of a country and monetary policies adopted by the apex banks. Micro factors are the factors that pertain to an individual like credit score etc. Let’s take these one by one.

Macro Factors

· The first factor is the level of the economic growth which is indicated by GDP and employment rate of Canada as a whole. Higher economic growth leads to a rise in mortgage rates as a larger population falls in higher income group. Spending is encouraged and mortgage market booms with an increase in mortgage rates. Vice versa is true in case of decline in economic growth.

· Monetary policy adopted by the Bank of Canada just recently gave a demonstration by increasing the Prime Rate which in turn increased the variable mortgage rates. The monetary policy depends on the various objectives that are to be achieved such as control of inflation-deflation cycle and much more.

Micro Factors

· On an individual basis, your credit score determines the mortgage rates you’ll get to a greater extent. Therefore, it’s imperative to maintain a good credit score. Credit score is calculated differently by different lending institutions but they all take payment history, credit utilization, and account handling into consideration. Avoid opening too many new accounts and make timely loan repayment towards your previous mortgages and credit card statements. Lenders look for credibility. Write it out for them in neon.

· The loan amount you opt for also shapes your mortgage rates. Too high or too low an amount can get you high mortgage rates.

· The down payment also impacts mortgage rates. If you put down the expected 20% of loan amount, you come under the low risk borrowers and offered low mortgage rates.

· Loan term also influences mortgage rates. Taking into account inflation, long term mortgage rates are comparatively higher than short term mortgage rates.

· Fixed rate mortgages are preferred to adjustable mortgage rates as they are independent of market forces and monetary policy changes. But that also implies that these are higher than adjustable mortgage rates from the start. You can take into account the loan term and loan amount before deciding upon whether you want fixed or adjustable mortgage rates.

These are the key factors that influence mortgage rates. For best mortgage rates in Toronto, trust the Mortgage Division, the best in Toronto.

0 notes

Photo

For the best mortgage rates in Mississauga, trust The Mortgage Division. We offer the lowest mortgage rates for both home and commercial property.

0 notes

Photo

Refinance Mortgage Rates Mississauga

It’s always a good measure to address the important issues in advance so that you stand prepared when the interest rate looks appealing for your home mortgage refinance. If the above reasons apply to you, then you can consult lenders who can get you the best mortgage rates in Mississauga.<

#refinance mortgage rates mississauga#lowest mortgage rates mississauga#best mortgage rates mississauga

0 notes

Link

0 notes

Photo

Lowest Mortgage Rates Mississauga By The Mortgage Division

0 notes

Text

Questions to Ask Before You Sign the Mortgage Loan Papers

One of the most time consuming process that almost all individuals undergo is the process of buying a home. Before you even initiate the process of searching home, there is another important task waiting for you. This is the task of getting the best mortgage rates in Mississauga so that you can get easy finance for your dream project. There are chances that in order to do so, you have to spend hours with the mortgage brokers to understand the inside out of whole lending process.

Once you have sorted out which broker you want to deal with, you have to explain your current financial situation in very specific terms including your annual salary, other major expenses and the amount you have planned to offer as the down payment. After the initial credit score check, the lender will give you a variety of options for which you are qualified for. Now it is up to you to select the best one out of many. For this, there are certain questions you should ask the broker as well as money lender before signing any documents. Let us find out what all those questions are:

#1 What is going to be the interest rates on this loan?

Lender’s loan estimate is the most important aspect of any mortgage loan that you apply for. Usually, with this kind of estimate, you get to know about the interest rate that is applicable on the loan and the lender’s fees. It also includes the yearly percentage rate that involves interest rates, fees as well as other charges.

#2 What would be the closing cost?

As a borrower, you have to pay a certain fees to the various parties that were involved in the whole mortgage process such as the lender and title companies. The lender has to provide you with a written and full documented estimate of all these costs within 3 days of getting the loan application.

#3 What is the minimum down payment of the loan?

Don’t forget to ask about the down payment of the loan. Usually when you put a big amount as down payment, the chances of getting the best mortgage rates in Mississauga along with better terms and conditions, increases. According to the experts, when the down payment is less than 20 per cent of the total loan amount, it increases the monthly installments.

Apart from all this, there are several other questions, including kind of documents required, time required for the whole process, that you should ask your broker or lender. In case, they don’t offer you satisfactory answers, then try contacting professionals of The Mortgage Division who will provide you the detailed answers as well as numerous mortgage options.

0 notes

Photo

Best Mortgage Rates Mississauga

We offer the BEST MORTGAGE RATES IN MISSISSAUGA & TORONTO. Your Money Matters, which is why we work hard to get you these Amazing Rates.

0 notes