Don't wanna be here? Send us removal request.

Text

Buidl: Simple, Profitable Staking Protocol, and Easy Earnings with High Fixed APY

In DeFi space, it can be challenging for investors to choose a platform that aligns with their financial goals while also offering a stable and secure environment. The key factor that sets BUIDL apart is its ability to combine high rewards with long-term sustainability. Unlike many platforms that promise high returns but fall short due to unstable tokenomics, BUIDL’s carefully designed system ensures that rewards remain predictable and sustainable.

Investors are given clear expectations from the beginning, with a fixed 526.5% APY and automatic rebase rewards.

Unlike some DeFi platforms that rely on variable rates or obscure mechanisms, BUIDL offers a straightforward, transparent method of earning that ensures users understand how their rewards will accumulate.

Investors simply buy and hold $BUIDL tokens in their wallet, and the platform does the rest. The automatic staking, rebase, and compounding mechanisms ensure that users receive rewards without the need for constant monitoring or interaction.

How BUIDL Can Fit Into Your Investment Strategy

For those looking to diversify their portfolios and increase exposure to cryptocurrency, BUIDL presents a valuable opportunity. As part of a broader investment strategy, BUIDL can serve as a long-term, low-maintenance asset that steadily appreciates in value. Investors can complement their higher-risk crypto ventures with the stable, fixed rewards offered by BUIDL, creating a more balanced investment approach that includes both growth and passive income.

For those already involved in DeFi, adding BUIDL to a diversified portfolio can further strengthen one’s crypto holdings. By leveraging BUIDL’s fixed returns and automatic rewards, investors can generate income passively, allowing them to reinvest in other opportunities or simply enjoy the growth of their existing assets.

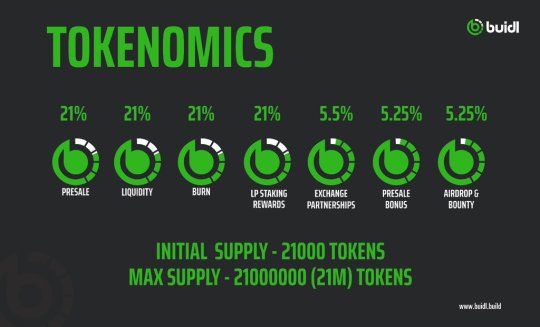

BUIDL Tokenomics: A Vision for Stability, Growth, and Sustainability

The BUIDL protocol is built on a carefully crafted economic model that prioritizes both the growth of its token value and the long-term sustainability of its ecosystem. The $BUIDL token, which serves as the backbone of the BUIDL ecosystem, operates on the Binance Smart Chain (BSC) as a BEP-20 token.

Its elastic supply and positive rebase formula enable it to reward holders while ensuring the protocol remains resilient and capable of delivering consistent returns. Let's take a closer look at how BUIDL's tokenomics create an environment that fosters growth, stability, and sustainability for all its users.

The Elastic Supply of BUIDL: A Scarcity-Focused Approach

One of the defining characteristics of the BUIDL token is its elastic supply. While many cryptocurrencies have fixed supplies, $BUIDL begins with a very small initial supply of just 21,000 tokens, significantly lower than the supply of well-known assets like Bitcoin.

This limited supply creates a sense of scarcity, which can help boost the value of $BUIDL over time. The protocol’s maximum supply is capped at 21 million tokens, a number that mirrors Bitcoin’s ultimate limit.

The decision to start with such a small initial supply ensures that the value of $BUIDL is not diluted from the outset. The low initial supply creates an environment where every token is precious, incentivizing early adoption and creating upward pressure on token value as demand for $BUIDL increases.

Transaction Fee Breakdown: Funding Key Functions to Ensure Longevity

The BUIDL ecosystem supports its automatic compounding and rebase rewards through a series of transaction fees that are carefully allocated to critical functions. These fees allow the protocol to support its APY, ensure liquidity, and provide protection against market volatility. Here’s how the fees break down:

Buy Transactions: When users buy $BUIDL tokens, a 13% transaction fee is applied. Of this, 5% is directed to the Risk-Free Value (RFV) fund, which helps to back the staking rewards provided by the positive rebase formula. Another 5% is allocated to the automatic liquidity pool (LP), which ensures there is enough liquidity for users to buy and sell tokens. 2% goes to the insured fund (BIF), which acts as a safeguard against sudden market downturns, while the remaining 1% is burned to reduce the overall supply of $BUIDL.

Sell Transactions: The transaction fee for selling $BUIDL tokens is slightly higher at 15%. Similar to buy transactions, 6% is directed to the RFV fund to sustain staking rewards, while 5% goes to the automatic LP to support liquidity. The BIF receives 3% of the transaction fee to further protect against market risks. As with buys, 1% of the sell transaction fee is burned, reducing the circulating supply and enhancing the potential scarcity of $BUIDL over time.

These fees are designed to serve multiple functions within the ecosystem, making the system self-sustaining while providing liquidity, backing the staking rewards, and protecting the value of the token from inflationary pressures.

The Rebase Mechanism in Buidl: Growing Your Holdings Automatically

BUIDL’s core feature is its automatic rebase mechanism, which allows users to earn rewards simply by holding $BUIDL tokens in their wallets. The protocol automatically distributes rewards to holders every 60 minutes, ensuring that users' holdings grow continually without any action required on their part. This feature is key to the protocol’s success in offering one of the highest fixed APYs in the crypto industry.

With every rebase, $BUIDL token holders receive 0.021% interest on their holdings, which is automatically compounded and added to their wallet balance. This frequent, fast compounding mechanism accelerates the growth of an investor’s holdings, allowing them to benefit from the snowball effect of compounding interest. Over time, this process leads to substantial gains, making BUIDL an attractive option for passive crypto investors.

Supporting Liquidity and Maintaining Stability

Liquidity is a crucial factor in maintaining a healthy and sustainable DeFi ecosystem. BUIDL addresses this by automatically directing 5% of the transaction fees to the liquidity pool. This ensures that there is always sufficient liquidity in the market to support trades, enabling users to enter and exit positions without difficulty. The automatic addition of liquidity also ensures that the value of $BUIDL remains stable, which is essential for maintaining the protocol’s promised returns.

Burning Mechanism: Reducing Inflation Over Time

BUIDL employs an automatic burn mechanism to reduce the total supply of the token over time. Each transaction, whether it is a buy or a sell, includes a small burn fee of 1%. This burn reduces the circulating supply of $BUIDL tokens, increasing scarcity and potentially driving up demand as the total number of tokens decreases.

The burn mechanism, combined with the capped total supply of 21 million tokens, creates a controlled, deflationary environment that rewards holders for their long-term commitment to the protocol.

The Path to Sustainability: Long-Term Value Creation

BUIDL’s tokenomics ensure that the protocol is built for long-term sustainability. The careful balance between rewards, liquidity, and scarcity is key to maintaining stability and ensuring that users continue to receive high returns over time. With a limited token supply, a strong liquidity system, and a robust risk management structure, BUIDL is designed to weather market fluctuations and deliver value to its holders.

In The End Post - By providing high, stable returns with minimal effort, BUIDL offers a smart and sustainable investment opportunity for crypto investors looking to build wealth in the ever-evolving world of decentralized finance.

If you need update and you can learn more at:

Website : https://buidl.build

Twitter : https://x.com/buidlbsc

Telegram Group : https://t.me/buidlbsc

Telegram Channel : https://t.me/buidl_bsc

Author:

Username: Naradom Sihanuk

Profile Link URL: https://bitcointalk.org/index.php?action=profile;u=3429350

Wallet Address: 0x52564bdCA07024a11AC7e3218d0123C61c795eAE

1 note

·

View note