Text

WOULD INDIA EVER GET TO THE CRYPTO RACE ??

Market players think that cryptos can be viewed as an emerging asset because it is intangible, digital currency that uses advanced encryption to secure and verify transactions.

The notification of tax on crypto acquisitions in the Union Budget has raised the confidence of the crypto industry, especially the new players or startups. In the light of current growth across the globe, there are voices that India is hovering to appear as a global hub for crypto players and enterprises.

Budget 2022 explains that the Government of India does not consider cryptocurrency as a currency but as a virtual digital asset, said Vikas Ahuja, CEO of CrossTower India. he Government will treat cryptos as investments.

Indeed, India is honing its incredibly entrepreneurial skill, with large inhabitants of technology-driven young minds and budding startup culture.

On the contrary, Ishan Arora, Partner, Tykhe Block ventures, says that the tax is still relatively high for global crypto firms to be a destination.

By sharing more light around the sector, India will open up possibilities for the industry, Ahuja of CrossTower said.

According to Startup India, India is the third-largest startup ecosystem globally, with roughly 50,000 startups. Nearly 20 percent of these are technology startups.

With crypto-assets getting exposure and 'near-to-legal status in India, the blockchain startups will follow innovations, particularly the NFT marketplaces.

India's GDP can be raised by blockchain technology and alter various sectors, starting from - government projects, healthcare, supply chain, financial services, among others.

The move is anticipated to boost innovation in the blockchain sector, with startups growing in the future, said Ahuja of CrossTower India. "Since India is a startup hub, which may help it become a leader in the fast-growing digital asset industry."

#nftcritics#nft#nftart#nftartist#nftnews#nftcommunity#nftcreators#nftgallery#blockchain#nftcollection#cryptoart#nftblog#nftupdates

1 note

·

View note

Text

THE FOUNDER OF TWITTER IS BLOCKED ON TWITTER !!

Prominent venture capitalist Marc Andreessen blocks the co-founder of Twitter, Jack Dorsey, on Twitter.

Here's the back story!

Today's online platforms are too centralized and controlled by a handful of large internet companies, like Amazon, Apple, Alphabet and Facebook parent company Meta.

Andreessen, who has earned billions off the back of early bets on companies like Facebook, has supported many companies operating on technologies that could one day lay a foundation for Web3.

With programmer Eric Bina, Andreessen also invented the first widely used, point-and-click web browser, which ultimately became Netscape.

Andreessen Horowitz has a page on its website called "web3 Policy Hub," with the subhead: "We Deserve a Better Internet."

Andreessen Horowitz says: "We remain focused on bona fide decentralized governance and believe decentralized systems naturally have inherent benefits when compared to the centralized platforms of web2. As such, we believe they will come to dominate web3 without the need for regulatory advantages."

Dorsey rebuked specific corners of the venture capital industry and made several explicit remarks about the firm Andreessen co-founded, Andreessen Horowitz.

Dorsey has represented multiple perspectives on "Web3" — a potential decentralized version of the internet based on blockchain. Perhaps most notably, the entrepreneur said Web3 would be owned by wealthy VCs like Andreessen instead of "the people, " after which Dorsey was blocked.

So this clearly states that Jack Dorsey is banned from Web3.0.

Is the thought of Web3.0 acing in the future a nightmare to Jack Dorsey? But why should Andreesen have to block him instead of claiming facts?

Let Web3's victory or defeat end this cold war, haha

#nftcritics#nft#nftnews#nftart#nftartist#nftcommunity#nftgallery#blockchain#cryptoart#nftcreators#nftcollection#nftupdates#nftgaming

0 notes

Text

WHY IS NFT NOT JUST ABOUT THE “ART”? THE NFT CRINGE !!

Beyond just digital art, NFTs are being used to experiment with new forms of storytelling, particularly in the case of advertising and marketing.

Let's be honest now. Would NFTs even hold any value if they are not marketed properly?

Of course not!

NFTs, it is neither unique nor is it an art. It is a swindle. Would you buy the code itself written on a slip of paper? Of course not. But that's what you're buying. It makes money for coders, just as cryptocurrency is a con for computer geeks to charge a fee for every economic exchange.

And the shallowness cannot be more ridiculous. They have taken the fact that works of art, being unusual, are valuable because many people want them at the same time. Adding code creates a completely mimicking work "unique" in the shallowest and most meaningless way. It's non-fungible, but only because of a piece of code.

So, would anyone buy a slip of paper? Of course not! At least I wouldn't do that! So to blindfold dummies like us who think the NFT arts are ugly, there's a new selling tactic; create a brand, add a story to it, and start hyping the brand up!

A tech blogger William Terdoslavich describes NFTs in interruptive ads vs visual storytelling. He commented that "companies are evolving away from interruptive trade to storytelling that viewers do not perceive as ads." He later adds that "the foundation for crypto-storytelling is the non-fungible token (NFT)" and that "crypto storytelling provides a marketplace for anyone to list their digital asset and sell it using cryptocurrency."

As the hype around overnight millionaires fades, creative ways to use NFTs will continue to increase.

#nftcritics#nftnews#nftart#nft#nftartist#nftcommunity#nftcreators#nftgallery#cryptoart#blockchain#nftcollection#nft media box#nftupdates

0 notes

Text

MICROSOFT’S POTENTIAL TO OVERDO META !!

Blog and Vid

Is there a potential scope for Microsoft's Xbox to beat Meta?

The answer is a yes!

Tech Corporates worldwide are equipping for a new online innovation that will potentially conquer the virtual world. Investors are paying billions on realistic interfaces. They are ready to risk it all for technologies that furnish more splendid telepresence and carry emotions physically in a virtual space.

Microsoft is a gigantic company in the gaming space, and it has ascended its flag that contains Xbox gaming that can be more powerful than a virtual reality program. On the other hand, Facebook has access to the most extensive network through its social media platforms. It has revealed its Metaverse and changed its name to Meta.

Clearly, it's a neck-to-neck war!

Microsoft has expressed interest in obtaining Metaverse for video games. The immersive adventure will be on a new level by incorporating eCommerce and interacting with their favorite icons and players in new ways.

The new invention is created to attract users and create the illusion they are really in the reality they have entered. Instead of the usual two-dimensional screen, it helps take collaborative prospects to the next level by fetching users into a 3D environment where they interact closely with things around them. Metaverse is a good way of changing the future of virtual meetings and collaborative events with people across the world, giving Microsoft the upper hand.

With a bit of experience in gaming and having had very few game launches, it is doubtful for Meta to penetrate the Metaverse unless Mark Zukerberg doesn't believe in the traditional gaming system and has better alternatives mapped.

There are fair chances of Microsoft rewriting the history, so let's sit back and watch the show!

#nftcritics#nft#nftnews#nftart#nftartist#nftcommunity#nftgallery#blockchain#cryptoart#nftcreators#nftcollection#nftupdates#nftblog

0 notes

Text

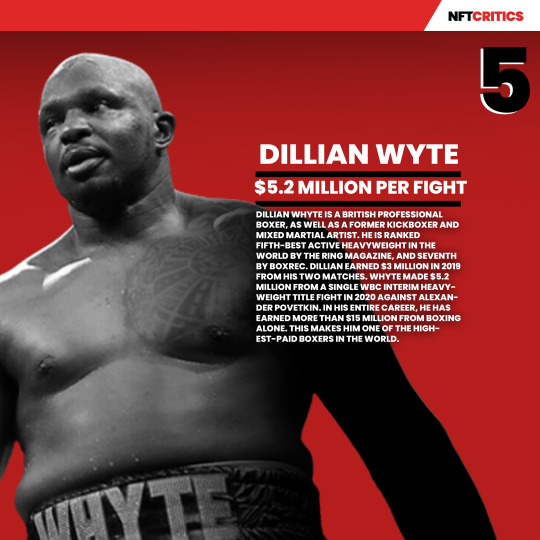

Top 5 Highest Paid Boxers !!

#nftcritics#nftnews#nfts#nftartists#crypto#cryptoart#nftarts#nftstories#nftupdates#media#nftgallery#nftpeople#nftlover

0 notes

Text

BITCOIN FOUNDER’S IDENTITY, THE GREATEST RIDDLE OF ALL TIME !!

Satoshi Nakamoto, the so-called "Founder" of Bitcoin, may not be real. The title might be an alias for the creator or creators of Bitcoin who wish to stay unidentified.

The origin and initial days of Bitcoin are bizarre. This "someone" develops an entirely new monetary system assembled from scrape besides some previous theoretical ideas. He(probably) has a small team and no allowance or support from organizations, companies, or governments. Bitcoin grows morally by word of mouth and volunteers organically. And in just ten years, it rises to be worth hundreds of billions of dollars and is beginning to disrupt the current monetary system.

There are fair chances of it not being a single person. The identity could constitute a group of finance-literate programmers because it would make sense why Hal was the first to participate in a BTC transaction with Satoshi, who, in actuality, was probably just one of his group members conducting a test transfer.

If carefully interpreted, Hal's work on PGP and Proof of Work before Bitcoin would also be beneficial in creating a feasible cryptocurrency. It's possible to say that with a bit of help from like-minded experts (or maybe even just by himself), Hal could've spearheaded the invention of Bitcoin under an anonymous pseudonym that would keep it decentralized.

Once proved that he is someone with an inclination for assembling model trains and a career wrapped in secrecy, having done classified work for major companies and the U.S. military. It would be best if you read this article that caught my eye. It could be a mere story, though!

It is also funny how people have stories of the Bitcoin founder being Elon Musk, while the others say that it's evident of being Lady Gaga. Bill Gates is also a topic of discussion, and Adam Back's name is also heard.

It's tough to believe that governments don't want to understand who this guy is. His enigmatic identity and the almost 1M bitcoin he mined that stays intact is one of the greatest riddles. But what if Satoshi had other wallets and did make his riches already?

But whoever it is, I bet he has a wallet filled with billions of dollars and could be out joyriding in one of those demilitarized spaces that have been sold. Or maybe he's yachting around his private island chain-smoking Cubans drinking champagne right now for all anyone knows.

#nft#nftnews#nftartist#nftgallery#blockchain#cryptoart#nftcreators#nftsstories#nftcollection#nftcommunity#nft crypto#nft marketplace

0 notes

Text

THE STORY OF PIRATE BAY, A PIRACY WEBSITE THAT WAS VERY HARD TO SHUT DOWN !!

According to Alexa data, the Pirate Bay was the 97th most-visited website on the whole internet in 2008 and is one of the few good and reliable sharing sites out there. For the past decade, if you desired to download copyrighted material and didn’t want to pay for it, you probably turned to The Pirate Bay. They want to share movies that, by technicality, are not illegal in a few countries. If the companies have a problem, they should do what the SYFY network did and create their free torrent site for all their stuff.

And that’s what scared Hollywood like crazy!! This war isn’t a legal versus illegal battle; it’s a rich keeping poor down battle.

The US was intimidated to impose trade sanctions against Sweden through The World Trade Organization unless something was done to take the site offline. That led to Swedish police raiding the outfit in 2006, confiscating enough servers and computer equipment to fill three trucks and making two arrests. Three days later, the site was back up and running and more popular than ever, thanks to a swell of mainstream media coverage.

During the 2009 trial that saw co-founders Fredrik Neij, Peter Sunde, and Gottfrid Svartholm seized $3.6 million in fines, along with time behind bars for obliging in copyright violation, it was reported that The Pirate Bay had some 22 million users — roughly the population of Texas.

A raid took The Pirate Bay offline briefly and propelled the site to change its operations slightly. As a result, it dragged to cloud-hosting in two countries running several virtual machine setups. In an interview with TorrentFreak, an anonymous Pirate Bay representative bragged that the move made the site raid-proof and that there wouldn’t be any servers to take, only a transit router — one of the pieces of tools used to hide the location of the cloud provider.

Swedish police then intruded a Stockholm-area server room and left with “several” servers and computers, with official counts inaccessible. This took all affiliated sites, bayimg.com, pastebay.net and The Pirate Bay’s message board, suprbay.org, including Pirate Bay.

In an interview with TorrentFreak, one of The Pirate Bay’s associates mentioned they weren’t shocked by the shutdown, adding that it’s something that goes with the territory.

“We have taken this opportunity to give ourselves a break. How long are we supposed to keep going? To what end? We were a bit curious to see how the public would react. Will we reboot? We don’t know yet. But if and when we do, it’ll be with a bang.”

Most of the illiterates who do not know the specific letter of the laws versus propaganda claimed it was a fraud. However, Pirate Bay leaders make zero profit off the site. It is a sharing site that, by the letter of the law, is 100% legal as copyright and trademark laws only prohibit making profits not sharing the copy you paid for. Most people on this site are uploaders who are supposed to upload their DVD or Bluray etc., copies they have bought to share with other users.

#nft#nftnews#nftart#nftartist#blockchain#nftcreators#nftgallery#cryptoart#nftcommunity#nftcollection#nftstories#nftupdates#nft media box

0 notes

Text

META EXPERIENCES THE LOSS THAT IS THE MOST SIGNIFICANT ONE-DAY DECLINE IN U.S. HISTORY BY NFT CRITICS !!

Meta Platforms, Facebook’s parent company, a well-known social media giant, saw a drop of more than 26% of the shares. The first day of trading after Meta recorded a plunge in profit and users during the last three months of 2021 — and most tellingly, predicted revenue declines in the recent quarter.

26% appears like a mere number, but it surely will blow your mind.

Last summer, when the company was still known as Facebook, the firm became only the fifth U.S. company to reach a market value topping $1 trillion. Still, evidently, Meta’s market value fell more than $230 billion to about $661 billion. The company’s market cap had been $898.5 billion in a day.

Facebook co-founder and Meta CEO Mark Zuckerberg lost nearly $32 billion. Zuckerberg is the most prominent Meta shareholder, with more than 374.8 million shares, or about 12.5% of total shares outstanding, according to S&P Global Market Intelligence.

Zuckerberg, who has been №7 on Bloomberg’s Billionaires, had seen a reduction of $4.9 billion in 2022.

That’s it? Wait for the enormous misery!

Meta reported that Facebook’s daily active users had fallen for the first time: 1.929 billion daily active users compared to 1.93 billion in the previous quarter.

But why?

Zuckerberg said competitors from other social media platforms, including viral video-sharing app Tiktok, is “influencing our business.”

Meta said the augmented and virtual reality business at the heart of its metaverse plans yields revenue but is unprofitable.

However, its metaverse project is in its early stages, and its acquisitions are eating into its profits. Reality Labs, the A.R. and V.R. unit accommodation the Oculus headset that will help anchor the push into the metaverse, generated $877 million in fourth-quarter revenue but lost $3.3 billion.

Meta’s efforts to build more digital realms has been bumpy. It doesn’t do enough to combat misinformation which would eventually create problems that will only grow more complex in the metaverse. Meta shuttered its Diem cryptocurrency project after regulatory pushback. Haha, no wonder The U.S. Federal Trade Commission and multiple states, led by New York, are reportedly investigating potential anti-competitive practices.

Is the stock fall temporary or acceptable? What does the company plan to do? Rebranding doesn’t seem like it worked out. Let’s see what Metal holds for the future.

#nft#nftart#nftnews#nftartist#nftgallery#cryptoart#nftcreators#blockchain#news#nftcollection#nftcommunity#nftartwork#nft crypto#nftblog

0 notes

Text

A CRYPTO TRILLIONAIRE’S OVERNIGHT GLORY BY NFT CRITICS !!

How would you react if your trading account showed you a balance of more than $1 trillion one morning immediately after you woke up? Realise it’s a dream and go back to bed?

Christopher Williamson, a nursing student, woke up on the morning of June 16 to check his trading account on Coinbase, one of the world’s largest cryptocurrency exchanges and fell out of bed. You guessed right, and it’s him I was talking about!

Hard work?

Nah!!

Hard luck?

Nope!!!

Let’s continue with the story to know!

He went on Twitter the same day to control things. “I’m going to need someone to explain what the heck is going on and then write me a check. I got a mega-yacht shaped like a penguin on standby,” Williamson posted on his Twitter handle.

It turned out that the $20 worth of RocketBunny cryptocurrency that Williamson had bought using his Coinbase account had not turned into more than $1 trillion overnight. The balance reflected on Williamson’s Coinbase account was a ‘technical error’.

Before getting into finer details into Williamson’s troubles, it is essential to recognise the cryptocurrency Williamson bought for $20.

RocketBunny is a recent entrant in cryptocurrency, pledging to be a deflationary token with the most outstanding supply of 777 quadrillions.

This is how RocketBunny defines its currency: “Each transaction incurs a 4% tax that is distributed in four equal parts: 1% to holders, 1% burned to The Rabbit’s Hole, 1% locked liquidity, and 1% as a bonus to liquidity providers. As volume boosts, the amount burned gains logarithmically, ultimately leading to an exponential decline in supply.”

The cryptocurrency was last quoting a price of $0.000000000036. Yes, that’s 12 decimal points after the zero! The value of the cryptocurrency has nosedived 76 per cent over the past 22 days, making the possibility of Williamson becoming a trillionaire because of the cryptocurrency a near impossibility.

Williamson’s gruelling adventure did not end soon. Despite multiple pleas to both Coinbase and RocketBunny, the $1 trillion balance crisis in his trading account could not be sorted out until publication.

Williamson notified on Twitter that the value of his account was still going up, but he could not cash out as Coinbase had frozen it. The attention drawn to Williamson’s story has boosted RocketBunnny’s coin as the cryptocurrency surged over 9 per cent in a day or two.

Williamson’s story has captured the cryptocurrency world. Many are recommending Coinbase to rectify its mistake, while others urge him to make sure he gets some relief for his emotional and financial troubles.

Addressing the Coinbase accounts, Williamson joked: “I’m going to need someone to explain what the heck is going on and then write me a check. I got a mega-yacht shaped like a penguin on standby.

In my opinion, this isn’t a Rocket Bunny issue; it is strictly on Coinbase. Doesn’t that sound like a publicity stunt?

#nft#nftnews#nftart#nftartist#nftgallery#blockchain#cryptoart#nftcreators#nftcommunity#nftcollection#nftupdates#nftstories#nft media box

0 notes

Text

NBA Top Shot !!

The National Basketball Association (NBA) and its players' union (NBPA) collaborated with Vancouver-based blockchain firm Dapper Labs to devise a new digital platform called NBA Top Shot.

Top Shot is a non-fungible token (NFT) marketplace where fanatics can buy, sell and trade NBA moments, packaged highlight clips that function like trading cards. In the same way, basketball fans collect physical items; Top Shot brings that experience into the digital realm, where users are banking on the value of their highlight collections advancing over time.

Confusing, but interesting, right?

Business Insider documented that the platform had recorded more than 800,000 users, who can interact with each other on Top Shot's messaging platform Discord. To date, Top Shot has developed north of US$500 million in sales, with the most priceless moment – LeBron James dunking against the Houston Rockets – going for a reported US$387,600. Revenue from transactions is shared between Dapper Labs, formed in 2018, the NBA and the NBPA.

As famous as Top Shot has become, it has not reached without confusion. Tedman also took the opportunity to address some of the most typical misunderstandings people have about the medium and the privilege of digital collectable means.

Top Shot is developed to be like a digitally improved collecting experience. Digital collectables, more broadly, can come in many forms, whether it be a video highlight or a virtual recreation of a ticket stub from an iconic game. Whatever form they may take going forward, there seems to be increasing curiosity around possibilities to pair NFTs with physical incidents. The Golden State Warriors, for example, recently announced that some of the objects known in their first digital collectables offering would come with life experiences, such as a custom championship ring presentation at a future game.

#nft#nftnews#nftart#nftartist#nftcommunity#cryptoart#blockchain#nftcreators#nftgallery#nftcollection#nftblog#nft media box

0 notes

Text

Top 5 Big Brands are Joining the NFT Industry!!

For those who consider NFTs are only for the artists and Picasso’s of the world, take another peek at the fashion houses you love. Because aside from the digital artworks that have made headlines, style is only one area everyone can enjoy in the real world or as NFTs.

1. RTFKT is an Extravagance fashion trademark with virtual sneaker drops

The RTFKT brand was established in 2019 and evolved into an expert selling virtual sneakers. Early in 2021, the firm had an alliance project with “Fewocious”, a famous crypto artist who was 18 years old at the time.

The highest bidder also could obtain the physical pair of sneakers to wear in real life. The association lived up to the hype, with 600 pairs of sneakers sold in under 7 minutes, reaching revenue of 3.1 million USD.

2. Gucci is the first prominent luxury fashion house selling NFTs

Gucci became the first luxury label to delve into the incursions of NFTs.

The Italian fashion house’s NFT was not fashion goods but a film inspired by their “Aria” collection in partnership with Alessandro Michele. The 4-minute film was sold at Christie’s auction for 25,000 million USD.

3. NFT enters fashion week!

Due to the COVID-19 pandemic, fashion week switched to a digital format, with NFTs recreating a large part.

“French Fashion” and “Haute Couture Federation” partnered up with the “Ariane” platform to develop NFTs that could be exchanged in the 2022 men’s fall/summer fashion week in Paris and other high fashion exhibitions.

These tokens allow users to view exclusive fashion, one of them from famous fashion digital artist Richard Haines.

4. Louis Vuitton and NFTs collecting game

In the festivity of its founder’s 200th anniversary birthday on August the 4th, Louis Vuitton converged fashion and technology by training “Louis the Game”, an adventure-style game where players would have to traverse through a dollhouse belonging to Vivienne.

Apart from that, players travelled to different lands to collect 200 candles representing the 200th anniversary birthday.

The adventure featured 30 hidden NFTs, with 10 NFTs collaborating with “Beeple”, a famous NFT artist.

5. Overpriced – scannable hoodies that allow owners to show off their NFT

Overpriced, the self-proclaimed first fashion brand in the world driven by NFTs has devised a real-life hoodie with a scannable code that allows its owners to show it off.

This hoodie is sold on the NFT platform “BlockParty” for 26,000 USD.

Aside from the fashion industry receiving NFTs and using blockchain technology as part of their business tactics, Prada, Richemont, and LVMH, the parent company of Louis Vuitton, have collaborated in ways “never before seen”.

Boom! That’s quite an interesting boom, do cheggit out.

#nft#nftnews#nftart#nftartist#nftcommunity#nftgallery#cryptoart#nftcreators#blockchain#nftcollection#nftstories#nft media box#nftupdates

0 notes

Text

Top 10 NFT Sales till date !!

The Merge — $91.8M

The Merge is a digital artwork created by an anonymous digital artist nicknamed Pak. On December 6, 2021, it was sold for $91.8 million on the NFT decentralized marketplace Nifty Gateway.

The First 5000 Days

Everyday: The First 5000 Days is an NFT artwork designed by Michael Winkelmann, a digital artist called Beeple. The artwork was auctioned at Christie's with an initial bid of roughly $100 made by traditional customers.

Beeple, Human One — $29.98M

Human One during his lifetime so the art will never remain static.

The concept attracted numerous investors at Christie's, but crypto billionaire Ryan Zurrer snapped it up for $29,985,000 on December 9, 2021.

Larva Labs, CryptoPunk #7523 — $11.75M

On June 2021, London's auction house Sotheby's saw CryptoPunk #7523, also dubbed "Covid Alien," sold for $11.75 million, making it the most costly CryptoPunk sold to date. The NFT belonged to a series of rare aliens, which consisted of 9 "Alien Punks."

Larva Labs, CryptoPunk #3100 — $7.58M

CryptoPunk #3100 is part of the 9 Alien Punks series, and it's barely above CryptoPunk #7804 as one of the most pricey Alien Punks sold to date. #3100 is an Alien wearing a blue and white headband.

Xcopy: Right-Click and Save As Guy — 7.09M

It is an NFT portrait auctioned on the decentralized marketplace Super rare and was sold for 1,600 ETH worth 7.09 Million on December 10 to Comozo de Medici.

Interestingly enough, the trader belongs to hip hop legend and world-class celebrity – Snoop Dogg.

Art Blocks, Ringers #109 — $6.93M

Ringers #109 is a thriving art collectable from the Art Blocks collection. It consists of a sum of 99,000 Art Block NFTs. It was sold for 2,100 ETH worth $6.93 million in October 2021, as per Dappradar.

Beeple, Crossroad — $6.6M

Crossroad is an animated NFT created by Mike Winkelmann, also known as Beeple. It features the retired US President Donald Trump fibbing on a field while bystanders ignore him.

This Changed Everything — $5.4M

It is an NFT of the source code used for one of the earlier renditions of the World Wide Web. On June 30, 2021, it was traded to an unidentified user for $5.4 million via Sotheby's.

Save Thousands of Lives — $4.5

It is an NFT created by Noora Health, an association that saves patients' lives in South Asia. The artwork was sold for 1337 ETH, worth $4.5 million in May 2021. The profits were allocated to the organization's plan to save newborns' lives.

1 note

·

View note

Text

Marketplace review of 2021 - Open Sea !!

In general, 2021 was a substantial year for NFTs. The entire trading volume across 14 NFT marketplaces, including OpenSea, Rarible, Axie Infinity, SuperRare, NBA Topshot, grew from $85.7 million in 2020 to $19.6 billion in 2021, as per a report by cryptocurrency-focused acquisition firm confirmation.

“NFTs had a getaway year in 2021, but the asset class is still small relative to cryptocurrency broadly,” the confirmation report noted.

The market capitalization of NFTs is about $31.4 billion, making up 1.53% of the existing $2.05 trillion entire market cap for cryptocurrency, according to data from CoinMarketCap.

Nevertheless, the investment firm said NFTs would ultimately be more significant than cryptocurrencies by the end of this decade and steps carried by NFT developers in 2022 will contribute to that evolution.

OpenSea, as expected, is sailing ahead!

OpenSea, the vastest NFT marketplace by trading volume, shows no sign of slowing down in 2022. The capital raise gives OpenSea a $13.3 billion post-money valuation.

“In 2021, the world woke up to the prospect of NFTs to open utility and economic empowerment across a vast set of enterprises, communities and creative categories,” Devin Finzer, CEO of OpenSea, told Blockworks. “Our idea is to be the terminus for these new open digital thrift. We’ll start this year by diminishing the obstacles to access the NFT space on OpenSea and funding in the ecosystem and the community that powers it,” Finzer added.

OpenSea has around 1.26 million active users, 2 million collections and over 80 million NFTs. It offers cross-blockchain support across Ethereum, Polygon and Katlyn. OpenSea Polygon traders have increased to record levels from just 15 users in late June 2021 to over 846,433 users as of Thursday, niftytable’s data on Dune Analytics revealed.

Total OpenSea Ethereum traders have also hit new all-time highs — from 36,540 on the year-ago date to 942,721 as of Jan. 5, data collected by user rchen8 on Dune Analytics showed.

“We saw the NFT ecosystem blast last year, with OpenSea’s trade volume-boosting over 600x in 2021,” Finzer reported in a blog post on Tuesday. “But we’re just getting started,” he added.

#nft#nftnews#nftart#nftartist#nftcommunity#nftcreators#cryptoart#nftcollection#blockchain#nftgallery#nftstories#nftblog#nftupdates

1 note

·

View note

Text

This Art is Amazing !!

Art by - @pabloandrespozo

0 notes

Text

Lazy Minting !!

Minting an NFT on a blockchain typically costs money since writing data requires a gas fee for computation and storage. It can hinder NFT creators, particularly those new to NFTs who may not want to invest much money upfront before comprehending whether their work will sell.

It's feasible to defer the cost of minting an NFT until the point it's sold to its first buyer using a few advanced techniques. The gas fees for minting are rolled into the actual transaction that allocates the NFT to the buyer, so the NFT creator never has to pay to mint. Instead, a part of the asset price covers the supplementary gas needed to create the initial NFT record.

Minting "just in time" at the instant of investment is often called lazy minting. It has been embraced by marketplaces like OpenSea to lower the barrier to entry for NFT creators by making it feasible to create NFTs without any up-front costs.

How does it work?

The basic assumption of lazy minting is that rather than creating an NFT instantly by calling a contract operation, the NFT creator schedules a cryptographic signature of some data using their Ethereum account's private key.

The signed data acts as a "coupon" or ticket redeemed for an NFT. The coupon includes all the details that will go into the actual NFT. It may optionally retain extra data that isn't recorded in the blockchain. The signature proves that the NFT creator authorized the creation of the specific NFT described in the voucher.

When traders want to purchase the NFT, they call a redeem operation to redeem the signed voucher. If the signature is reasonable and belongs to an account authorized to mint NFTs, a new token is created and transferred to the buyer based on the voucher.

To conclude, lazy minting is a robust procedure that can let creators administer new NFTs at no up-front cost!

0 notes

Text

NFT Burning !!

Do NFTs get burnt?

The term “NFT burning” summons up ideas of an investor lighting a match to real money. Of course, digital arts are available in virtual form since this is not physically viable. Token burning is a deliberate action performed by the developers/artists to “burn” or remove a specific number of tokens from the total collection from circulation. Burning tokens help various purposes, the most common of which is to reduce inflationary pressures in the market.

How do creators burn an NFT?

Token burning can happen in several ways, even though the premise is simple. The objective is to lower the total quantity of access tokens.

A token burning takes place in the following order in general:

An NFT holder can access the burn feature and mention the number of NFTs they want to burn.

The contract will then check to see that the individual has the gas fees in their wallet and if the specified number of tokens is correct.

If you do not have enough currency to cover the gas fee, the transaction is invalidated, and the NFT is not burned. If the mandated gas fee is available in your wallet, then you must sign the contract approving the transaction before your NFT is gone forever.

The NFT burn transacts as a public, irreversible, and permanent transaction on the blockchain ledger. The blockchain documents this transaction, and the NFT is deemed no longer functional.

Moreover, the fees charged on trades do not go to a central authority; instead, in the case of most marketplaces, the prices serve as a burning means.

Burning tokens also instils trust and reliability, especially in the early stages of an NFT’s life cycle. Some creators burn unsold tokens after an offering to establish greater accountability and protection to investors. If you are an owner, you need to remember that token burning is expensive and can include pretty high gas fees.

Isn’t this comfortable and profitable? It indeed is!

0 notes

Text

NFTs in Virtual Education !!

The future of higher education is ripening with the introduction of NFT and the metaverse. NFT is branching out, where students, educators, and institutions can use NFTs to better the industry.

Evidence Of Lifelong Learning

With NFT, a student's education moments can now be seized, reserved, and used as 'experimental' evidence. This will verify that a person has partaken in the hands-on aspects and does not just have high academic grades.

It includes the first time a salesman closed a deal, the first surgery of a surgeon, a pilot's initial flight, and more. These learning moments can be essential to companies that want to ensure the individuals they're hiring are as professional and experienced as they claim to be.

Transparency

Certificates are issued to indicate a student's mastery in a particular area. However, it is increasingly challenging to verify one's skills by creating false credentials. Higher education institutions can publish certificates as NFTs. It simplifies the validation process as all diplomas, degrees, and PhDs can be administered by academies and stored by students in a digital space to be used as an academic profile.

Smooth Transition

Until today, the surest way to validate one's educational history and qualifications is by reaching the institution that allocated the credentials.

For instance, high school seniors in the United States must pay the fees to send their test scores to the college they are applying for.

This method will soon be outdated, as NFT can make it a hassle-free shift. Everything in a students' records – grades, achievement, transcripts – will be wholly owned by them in the form of a plausible educational profile token.

Credits and Royalty

Educators can create and sell educational content to universities through NFT. It allows them to receive the royalty they deserve.

For example, a textbook author will only profit from their first sale. NFT allows them to add an option that includes royalties from secondary sales.

The metaverse has a lot of prospects in the higher education industry. 'Metaverse' is a virtual world where users can shop, socialize, and participate in leisure activities using their avatars. As metaverse makes its way into education, students will have a cyber-physical campus experience.

Some of the advantages of a metaverse in education are:

Rev's online delivery of lectures

Allows multinational students and instructors to meet virtually

Virtual classes and campus activities

You can read more about the advantages of a metaverse in education on our website.

NFT and metaverse will be no strangers to the education industry in the next few decades. Let's see how much time is left and how fast this system takes to get integrated into universities worldwide.

#nft#nftnews#nftblog#nft media box#nftgallery#nftstories#nftart#nftartist#nftgaming#nftcollection#nftcreators#nft crypto#crypto art

0 notes