Form 2290 and the Heavy Vehicle Use Taxes can be reported and paid online at @Tax2290. Receive the IRS watermarked Schedule 1 Proof instantly. Talk to us for 2290 eFile at 866 - 245 - 3918 or write to us at [email protected]. Choose eFile and move towards priority eFiling for your 2290 reporting.

Don't wanna be here? Send us removal request.

Photo

Why you need to choose @tax2290.com to complete your HVUT Form 2290 online for 2022 - 23.

· The Most Experienced Form 2290 E-file Service Provider

· Handpicked, Industry’s Best Customer Service via Phone, Chat & Email

· Instant Alert for all the actions via Email & Text

· Import Vehicle Information from Previous years Filings

· Bulk vehicle upload using excel spreadsheet

· E-file from Desktop, Laptop, Tablet or Mobile phones

· Mobile App for both Android & iOS

· Stamped Schedule 1 Copy by Fax

· Option to E-file Pro-Rated Tax Returns

· Flexible Pricing Plan for Business Owners & Trucking Companies

· Seasonal Pricing Plan for Frequent Filers

· Special Pricing Plans for Accountants, CPA’s & Book Keepers

· Easy & Simple IFTA Return Preparation

· Certified by the IRS to Claim Refunds through Form 8849

· E-file 2290 Amendments to Correct your Mistakes on Form 2290

· Resubmit Rejected Returns for FREE

· Handle Multiple Businesses under a Single Login

· McAfee Secure certificate for safe website usage, free from malware and malicious links

· BBB accreditation with an A+ rating.

#2290 truck tax e file for 2022#form 2290 e file for 2022#hvut form 2290 e file for 2022#form 2290 for 2022#hvut for 2022#irs tax 2290 e file for 2022

0 notes

Photo

Heavy Truck Tax Form 2290 Electronic Filing for July 2022 - June 2023 Tax Year

This is that time of the year where the truckers and truck taxpayers report #Form2290. This #2290tax season make a perfect move from manual reporting to efiling. Get many benefits like fast processing of your #2290TaxReturn, receive @IRS Schedule 1 Proof of Payment instantly today

#Heavy truck tax#Heavy truck tax 2290#heavy truck tax 2290 online#heavy tax 2290#heavy road tax 2290#heavy vehicle use tax#heavy truck tax 2290 for 2022#truck tax form 2290#truck tax form 2290 efile#truck tax form 2290 e filing

0 notes

Photo

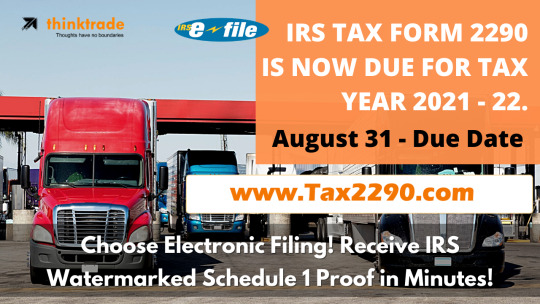

Form 2290 - HVUT Returns - Due Date - Tax Year 2021 - 22

When is Form 2290 Due? The Form 2290 #HVUT returns are due in July 2021 through June 2022, has to be reported and paid between July 1 and August 31. 2290eFiling is the best way to report and pay, to receive the IRS stamped Schedule 1 instantly.

#Pay 2290 online for 2021#pay 2290 taxes for 2021#pay 2290 electronically for 2021#pay 2290 taxes#pay 2290 tax due#pay 2290 truck tax for 2021

0 notes

Photo

TaxExcise.com is now accepting and processing HVUT Form 2290 returns for Tax Year July 2021 – June 2022. TaxExcise.com is the first ever IRS authorized E-file service provider for E-filing Form 2290 & is now ready to accept 2021 –22 and receive the IRS Watermarked Schedule 1 Proof Instantly.

We also have the Android and iOS platform Mobile Apps, try it today where you can efile Form 2290 HVUT returns with a flat 10% off by applying the code ANDRIOD2290 and IOS2290.

#Truck tax form 2290 efile#truck tax form 2290 efile for 2021#truck tax 2290 efile for 2021#hvut form 2290 efile for 2021#vehicle use tax form 2290 efile for 2021#tax2290.com#tax 2290 efile#tax 2290 online#tax 2290 electronic filing for 2021

0 notes

Photo

Though some taxpayers have the option of filing Form 2290 on paper, the IRS encourages all taxpayers to take advantage of the speed and convenience of filing this form electronically and paying any tax due electronically. Taxpayers reporting 25 or more vehicles must e-file. Here are the benefit that you could enjoy by choosing e-file; The IRS Stamped Schedule-1 proof will be made available in just minutes once IRS accepts.

#Tax 2290#Tax 2290 efile#tax 2290 efile for 2021#truck tax form 2290#tax 2290 electronic filing#2290 tax efile#hvut#Tax 2290 online

0 notes

Photo

Truckers and heavy motor vehicle owners have to report and pay the Federal HVUT returns for the Tax Year 2021–22. After working with truck taxpayers to understand their challenges in reporting the #2290taxes, we at @tax2290 developed an online website to make it easier & faster. The 2021 Tax 2290 season is just around the corner, get started with efiling today.

#tax 2290#tax form 2290#tax 2290 efile#tax 2290 efiling#tax 2290 online#tax 2290 efiling for 2021#tax 2290 for 2021#tax 2290 prefiling#tax 2290 for 2021 - 22

0 notes

Photo

Form 2290 - Heavy Vehicle Use Tax Reporting on highway heavy vehicles with the IRS between July through June of a 12 month tax period. We do accept pre filing in June for the tax period 2021 now. Pre file is early filing and we manage it from there...

2290 Electronic filing: WHAT, WHEN, WHERE, WHY…?

WHAT IS FORM 2290:

· The IRS tax form 2290 is used to prepare and report the highway heavy vehicle use taxes on motor vehicles with a taxable gross weight of 55,000 pounds or more.

· Form 2290 and Schedule -1 could be prepared and reported electronically with the IRS, anyone who requires to file 2290s can use TaxExcise.com to file it electronically.

· Electronic filing is safe, secured and fast; quickest way of filing 2290 returns with the IRS.

WHEN IS FORM 2290 DUE:

· Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period.

· The current period begins July 1, and ends June 30.

· August 31, is the due date for heavy vehicle used in July 2021.

WHERE TO FILE FORM 2290:

· Electronic filing is by and large the best way of reporting 2290 heavy vehicle use tax returns with the IRS and through TaxExcise.com & Tax2290.com, you get the best available resources.

· The most trusted and top rated website since 2007.

· First ever IRS Authorized e-File provider for 2290 and all federal excise tax returns

· Most experienced and simple website, IRS stamped schedule-1 proof in minutes.

WHY TO EFILE FORM 2290:

· Electronic filing is required for each return reporting and paying 2290 tax on 25 or more vehicles.

· However, all taxpayers are encouraged to file electronically.

· Electronic filing generally allows for quicker processing of your heavy highway vehicle use tax return.

· A stamped Schedule 1 can be available within minutes after filing and acceptance by the IRS.

2290 CALL SUPPORT:

Though some taxpayers have the option of filing Form 2290 on paper, the IRS encourages all taxpayers to take advantage of the speed and convenience of filing this form electronically and paying any tax due electronically. Taxpayers reporting 25 or more vehicles must e-file. Here are the benefit that you could enjoy by choosing e-file;

· The IRS Stamped Schedule-1 proof will be made available in just minutes once IRS accepts

· No math required, as the website will take care of all tax calculation automatically

· 100% Accurate, 100% Simple and 100% Easy, hassle free filing experience

· Get Instant TEXT Alert in your cell phone once IRS completes processing your tax return

· Receive IRS Stamped Schedule-1 by FAX

Call us at 1-866-245-3918 or mail us at [email protected] for any support.

#Form 2290#form 2290 efile#form 2290 online#tax 2290#tax 2290 online#tax 2290 efile#tax 2290 efiling#tax2290.com#taxexcise.com#tax form 2290 efile for 2021#prefile 2290 tax 2290#hvut online#hvut efile#hvut prefile

0 notes