Payal Rathore, an MBA graduate from one of the top business institutes in India. She is an independent insurance professional with 10 years of experience as a trusted insurance advisor to families, individuals, business owners, executives, entrepreneurs and the self-employed. Talks about investment, insurance, mutual funds and life in general.

Don't wanna be here? Send us removal request.

Text

Deductibles in Health Insurance Policies

The lengthy list of "terms and conditions" that comes with your health insurance policy documents is frequently the part of the purchase that gets the least attention. But, it can have significant consequences, so before you buy a health insurance policy, you must be fully aware of all of its terms. Ignoring these health insurance-related factors could lead to a number of issues when submitting claims. One of these terms you may come across when purchasing health insurance is deductible health insurance. Understanding health insurance deductibles is crucial. Continue reading to learn more about deductibles in medical billing, health insurance, and much more!

What does a Health Insurance Deductible Mean?

It's the sum paid to your health insurance company prior to the processing of your claim. This demonstrates that the insurer must pay the claim amount if it exceeds the deductible amount. A deductible's main advantage is that it reduces premiums; the higher your deductible, the lower your premium will be. Let's look at this example: Ravi Kumar has a health insurance plan with a 50,000 rupee deductible and a 4 lakh rupee sum insured. Ravi spent four days in the hospital following a car accident. Three lakhs rupees was the total bill. Ravi will now pay INR 50,000, and his insurance company will cover the remaining INR 2.5 lakhs. Suppose, for the purposes of this example, that Ravi Kumar is admitted to the hospital and that his bill is INR 35,000. In this instance, Ravi is responsible for paying the full amount due and the insurance company will not cover any costs because the claim is less than the deductible (INR 50,000).

Categories of Deductibles in Health Insurance

There are 3 categories in health insurance:~

Voluntary deductible

Compulsory deductible

Comparative deductible

What are the Benefits of Health Insurance Deductible?

The benefits of a health insurance deductible are given below:

Your health insurance policy's premium is reduced when you select a deductible.

It deters you from filing minor or pointless claims, which aids in your claim bonus (NCB) earning. You can also use this to expand the coverage that your primary health plan offers.

It lessens the frequency of needless claims, preserving the insurance funds for future use when you truly need them.

What are the disadvantages of Health Insurance Deductible?

Health insurance premiums can undoubtedly be reduced with the help of deductibles in medical bills. They do, however, have certain disadvantages. Remember the following if you decide to choose a deductible:

You will be responsible for paying the medical bills and any additional costs if the amount of your filed claim is less than your deductible.

If the claim amount at the time of filing exceeds the deductible, you will be responsible for covering the difference out of your own pocket.

How do I Select a Deductible for Health Insurance?

It may not be a good idea to choose a higher deductible even though you may believe that doing so will result in a lower premium, particularly when buying health insurance. Health insurance offers financial security in case of an emergency medical situation. You must thus make an informed choice prior to choosing the coverage. If you can increase the claim while paying more out of pocket, you might go with a higher deductible. Nonetheless, if you want your insurance to cover the majority of your medical expenses, opt for a lower deductible even if it means paying a higher premium.

Conclusion Although many people consider a health insurance deductible to be a disadvantage of their policy, there are actually a number of benefits. So, there's no need to worry about this clause. But you have to be aware of the deductible type and decide if it meets your needs. Select the type and amount of the deductible after carefully considering your insurance needs, projected medical expenses, and affordability.

0 notes

Text

Health Insurance without Medical Check-Up

With the advancement and technological driven nature of modern medicine, medical costs are rising at an exponential rate. As a result of lifestyle changes that have increased susceptibility to health risks, illnesses are also on the rise. In this case, financial limitations have made it harder and more difficult for many people to afford high-quality healthcare. For this reason, people purchase health insurance policies in order to guard against the financial burden of an unexpected medical expense.

Purchasing health insurance plans is simple because they can be done so online. Pre-entrance health examinations, however, are mandated by many policies prior to coverage being approved. Let's clarify the purpose of this examination:

Get more information on this Url:~ Health Insurance without Medical Check-Up

What is the purpose of the pre-entrance health check-Up? The risk of illnesses and accidents is covered by the insurance company when you purchase a health insurance plan. Although injuries are unpredictable, diseases are easy to predict based on your overall health. For this reason, before granting coverage, many insurance companies require you to have certain medical examinations completed. Since these examinations are necessary prior to purchasing insurance, they are referred to as pre-entrance health checks.

What is the requirement of health check-ups in health insurance plans? Now that you are aware of the reasons health insurance companies demand medical examinations, you should be aware that not all health insurance plans mandate pre-entrance physicals. Pre-entrance medical examinations are necessary in one or more of the following situations:

~ If your age is high Pre-entrance physicals are typically required by health insurance plans if you are 46 years of age or older. It is thought that people are generally healthy up until the age of 45, after which medical issues start to arise. Therefore, if you are over 45, you may find that many plans require pre-entrance health exams. However, some plans do not require pre-entrance physical examinations until a person is 55 or even 60 years old.

~ If you opt for a high sum insured The risk to the insurance company rises with the amount of the claim if you select a high sum insured. Therefore, even at a young age, pre-entrance health examinations are required for high levels of the insured sum. Pre-entrance medical examinations are usually mandated for sums insured above INR 10 lakhs, though certain plans may even cover up to INR 20 lakhs without them. However, even in your youth, medical examinations would become required if you selected a higher limit for the sum insured.

~ If you declare an adverse medical condition in the proposal form You must, to the best of your knowledge, disclose your medical history and current condition when completing the proposal form. Therefore, regardless of your age and the desired sum insured, the insurance company may request that you undergo a medical examination before issuing the policy if you disclose on the proposal form that you have a prejudicial medical condition.

Disclosures at the time of buying health insurance If you disclose any adverse medical condition in the proposal form when you apply for a health insurance policy, you may be required to undergo pre-entrance health check-ups, even if you are young or choose a low level of sum insured. Because of this fear, a lot of people attempt to conceal crucial medical information when purchasing health insurance. This is incorrect for the reasons listed below:

You violate the highest good faith principle if you withhold important information that has a direct bearing on the risk the insurance company takes. The insurance policy would be cancelled and rendered void if the insurance company discovered that you had failed to disclose. Not only would you lose coverage, but the policy's premium would also be forfeited.

If the insurance company discovers during the claims process that you concealed a medical condition when you purchased the policy, it may deny your claim.

When purchasing a health insurance plan, you should always disclose any medical conditions you may have in order to prevent claim rejections and termination of coverage. The insurer may decide to raise your premium or reduce your coverage in the event of a medical complication, but you will still be able to make claims at the appropriate time, and your policy will not be cancelled. Thus, full disclosure is necessary when purchasing a health insurance policy. Although some health insurance plans do not require annual physicals, keep in mind that these plans would only provide restricted coverage in the absence of physicals. Therefore, don't put off getting a medical checkup if you want comprehensive protection and a higher sum insured. Take the necessary health exams and obtain full coverage.

0 notes

Text

Best Insurance Company in India

Find the top insurance provider in India with competitive prices, top-notch customer support, and extensive coverage. Make the appropriate decision to safeguard your future.

0 notes

Text

Employee Pension Scheme

Learn everything there is to know about the Employee Pension Plan, including its special features and eligibility requirements. Your thorough manual for safeguarding your financial future.

0 notes

Text

How to Change Father Name in Aadhar Card

Are you trying to update or change the father's name on your Aadhaar card? To learn how to change your father's name via mail, enrollment centres, and more, click the link.

0 notes

Text

Road Charges Calculator

The Indian government levies a road tax on Indian citizens in order to fund basic infrastructure. This is a tax imposed by the government for the upkeep and construction of roads, highways, bridges, railway tracks, etc. The tax is typically levied by both the State Government and the Central Government, and it is collected in a variety of ways. This is due to the fact that road tax regulations differ from State to State, which causes some variation when moving between Indian States.

In order to drive the vehicle on Indian roads, you must pay the Indian government a certain amount of money as road tax when you purchase the vehicle. The Motor Vehicle Taxation Act mandates that it pay for the roads.

Types of Road Tax in India Various kinds of taxes are being levied on the vehicle by the respective state government as well as the Central Government. These kinds of taxes are the vital source of revenue for meeting the expenses for the central and state government.

All motor vehicles are subject to road taxes set by the State and the Federal Government, as well as fees for vehicle registration and insurance, according to Section 39 of the Motor Vehicle Act of 1988. The on-road price and the ex-showroom price are the two main costs to take into account when purchasing a new car. The on-road price of your vehicle is typically 10% higher than the ex-showroom price.

Road Tax is required for all types of vehicles, whether they are used for personal or professional purposes. Road taxes are assessed by:

~ State Government ~ Central Government

Road Tax Calculation

The method listed below can be used to find the Indian road tax calculator: ~ Type of Vehicle: Four-Wheeler/ Two-Wheeler/ Electric ~ Type of Fuel- Petrol/ Diesel/ LPG/ CNG ~ Invoice Price ~ Purchase Date ~ Vehicle Number

The RTA (Regional Transport Authority) or RTO (Regional Transport Office) will determine the road tax due in India based on the vehicle's invoice price and its age.

An example is shown below:

~ Vehicle’s Price- INR 8,00,000 ~ Present Depreciated Value: INR 7,50,000 ~ Purchase Date:11/10/2014 ~ Then the Approximate Road Tax @ 14%: INR 105000 The RTA (Regional Transport Authority) or RTO (Regional Transport Office) will determine the road tax due in India based on the vehicle's invoice price and its age.

Do you need to Pay Road Taxes after migrating to a different State? Yes, when moving to a new state, you will have to pay for re-registering your car. The road tax is paid at the time of purchase. You will need to go through the road tax process again if you decide to move to a new state in the future. Only when you are relocating permanently is it necessary to obtain a new registration number in accordance with the new state's regulations. This procedure is not necessary for brief visits. Paying the road tax for the new state you are moving to does not finish the process. You must first deregister your car from the state where it is currently registered. To transfer the registration to a new state, you must secondly obtain a NOC (No Objection Certificate) from the original RTO. The third and final step is to submit your NOC to the new RTO and pay the road taxes in order to get your vehicle's new registration number.

0 notes

Text

Third Party Car Insurance

Being able to easily navigate the congested streets makes a bike an efficient and practical mode of transportation. Insofar as it fits the budget of every typical middle-class person, it is also affordable. Bikes are very popular among both young people and adults because of this. If you also own a bike, you should be aware that your bike must have an insurance policy added to it. To comply with the requirements set forth by the Motor Vehicles Act of 1988, you must have a valid third-party bike insurance policy just like you need a valid driver's licence to operate a motorcycle.

What is third party bike insurance? The third party legal liability that arises if your bike hurts a third party is covered by a third party bike insurance policy. An individual who is not the insurance provider or the bike owner is referred to as a third party. You may be held liable for the loss caused if your bike causes a third party's injury or death, or damages a third party's property. This monetary responsibility is protected by third-party two-wheeler insurance.

Two-wheeler third party insurance premium calculator

As was already mentioned, the IRDAI sets and determines the premiums for third-party bike insurance plans. The insurance industry's regulatory body, IRDAI, sets the third-party premiums for both cars and bikes. Additionally, the premium rates are flexible. They could change as a result of the IRDAI's regular reviews. The following are the third-party motorbike insurance premium rates as of June 2019.

Renewal of third party bike insurance plans

You must regularly renew the policy when the period of coverage expires because a third-party bike insurance policy is legally required. If the policy is not renewed by the end of the coverage period, the coverage will end. You are still able to renew a lapsed policy, but only after the insurance provider has examined the bike. If the policy is not renewed, you may be subject to harsh legal repercussions and would be responsible for all third-party liabilities. Therefore, timely renewals are required.

Visit the website of the business where you originally purchased the policy, pay the renewal premium, and the policy will be instantly renewed online. You can also log into your account and renew the policy by paying the renewal premium if you purchased the policy from Turtelmint. It would be simple to renew the policy.

0 notes

Text

RTO Maharashtra Fancy Number

What is the procedure to get fancy registraion number in Maharashtra RTO? Purchase a new vehicle in 2020? If you don't want to spend money on it, you might even think about choosing a fancy number plate.

What is a fancy number for your vehicle? Any number, such as 8888, 0022, or 1111, is a fancy number. Your date of birth or any other number that fascinates you, perhaps in terms of astrology or numerology, could be one of your favourite numbers. Regardless, if you want to register your car with a particular number of your choosing, it will cost you money and is referred to as a "FANCY" number.

According to The Motor Vehicles Act of 1988, regardless of whether you have a fancy number plate or not, all vehicle owners are required to register their vehicles in accordance with the RTO number plate rules and fix the vehicle number plate on the back and front of the vehicle. Given that Maharashtra is one of the busiest states in India, it has the same law, so if you are staying there, you must abide by it.

Insurance Prices

There are several factors to take into account before purchasing a new insurance policy for a vehicle, which is required by law for every newly purchased vehicle. Fortunately, in this digital age, purchasing insurance has simplified and become more affordable, which benefits the customer.

Enter a few details about the insurance policy you want to buy, and you can compare the best IDVs and premium rates on the most pertinent insurance policies right away!

How can I determine whether fancy numbers are available? If you are considering a particularly fancy number for your car, the first thing to do is to see if it is already taken. Online availability checks for the fancy number in Maharashtra are quite simple. The easy steps to take are listed below:

Visit the official website of Vahan Parivahan (Government of India)

Click on the ‘Search by number’ option

Select the state name, choose RTO name, enter captcha code and then enter the fancy number you are looking for. Click on the ‘check availability’ tab.

Choice of numbers along with the series is displayed for you to check.

Fees in Maharashtra for a fancy number: Clicking "check available" will allow you to select your number from the ones that are currently available. https://vahan.parivahan.gov.in/fancy/faces/public/checkfancynumberavailability.xhtml

In Maharashtra, the cost of the ostentatious licence plate is specified in the list, and the fees must be paid accordingly.

Here is an example of the price range in Maharashtra for obtaining a fancy number:

Super Elite Category for a number like 0001 is INR 5,00,000

Elite Category for other single-digit numbers like 0002, 0003, 0004, 0005, 0006, 0007, 0008, 0009 is INR 3,00,000

Sequence numbers like 6789, 8888, 9999 and other double-digit numbers like 1122, 0099, etc. are INR 2,00,000

Other fancy numbers like 0300, 0400, 0500, 7000, 9000, etc. are INR 1,00,000. It's always exciting to receive a fancy car number, and it also generates a lot of excitement. Obtaining a fancy number is the cherry on top if you have a passion for driving and cars. So, have fun on your ride, but drive safely and within the rules of the road.

0 notes

Text

Aadhar Card Name Change Documents

As an accepted and legitimate form of identification and address documentation, Aadhaar is now used by many service providers throughout the nation. Once you register for Aadhaar, service providers won't have any issues performing Know Your Customer (KYC) checks repeatedly prior to rendering any services. They will not object to offering services to locals who lack any form of identification. Additionally, residents will no longer have to constantly present identification documents in order to access services like opening a bank account, obtaining a passport or driving licence, among other things. More importantly, if you have an Aadhaar, you can easily receive government subsidies and other benefits as well. Let's examine what an aadhar.

What is an Aadhaar Card? The Unique Identification Authority of India, or UIDAI, issues Indian citizens with Aadhaar Cards, 12-digit unique numeric identifications. This card is special because it contains both your demographic and biometric data, which is used for all required authentication. The government has taken the initiative to provide free Aadhaar cards to everyone and to make the process of applying for one voluntary at this time. Given the increasing importance of Aadhaar, it is our duty to provide accurate information when applying for Aadhaar. These particulars are extremely important because they will not only be verified when you apply for an Aadhaar, but they will also be kept in the government's central database. If you discover that some of the information in your aadhaar needs to be updated or corrected because it was entered incorrectly, for example, UIDAI has made it possible for you to update or modify your aadhaar information. UIDAI offers offline and online tools for updating or making corrections to your Aadhaar. Changes in life events, such as marriage, a death, etc.,changing your name and address, which are basic demographic information. Moving to a new location might necessitate changing your address and mobile number, or you might need to change your mobile number, email address, etc. for personal reasons. By completing the Aadhaar card update/correction form, you are able to correct any mistakes or update any of your personal data. If you make an update or change within 96 hours or 4 days of the enrollment date, there is no cost associated with doing this. However, after 4 days, any update or change request requires a small fee of INR 50. Here, we'll walk you through the specific steps involved in changing the name on your Aadhaar card.

Documents required for aadhaar card name change For a complete list of POI-Proof of Identity documents, go to the UIDAI website at https://uidai.gov.in/images/commdoc/valid_documents_list.pdf. According to the UIDAI list, 32 PoI approved documents are available. Refer to the list below:

Passport

Voter ID

PAN Card

Driving License

Ration or PDS Photo Card

Government Photo ID Cards or Service photo identity card issued by PSU

NREGS Job Card

Photo ID issued by Recognized Educational Institution

Photo Bank ATM

Photo Credit Card

Arms License

Freedom Fighter Photo Card

Pensioner Photo Card

Kissan Photo Passbook

Address Card with Name and Photo issued by Department of Posts

CGHS or ECHS Photo Card

Marriage certificate with photograph

Gazette notice for a name change

Bhamashah Card

ID Card for Disability or medical certificate of handicapped issued by the particular State or Union Territory Governments or Administrations

Certificate from Superintendent or Warden or Matron or the Head of Institution of certified shelter homes or orphanages etc. on UIDAI format

Certificate of Identity with photo issued by Village Panchayat head or Mukhiya

RSBY Card

SSLC book with a photograph of the candidate

School Leaving Certificate or SLC, School Transfer Certificate or TC

Certificate of Identity with photo and issued by an MP or MLA or MLC or Municipal Councillor on UIDAI format

Certificate of Identity with name and photo issued by Recognized Educational Institution signed by the Head of Institute on UIDAI format

Extract of School Records issued by the Head of School

Bank Pass Book

Certificate of identity with name, date of birth and photograph issued by Employees’ Provident Fund Organisation or EPFO on UIDAI format

ST or SC or OBC certificate with photograph

Updation of name in Aadhaar Card after marriage In India, it is customary and culturally accepted for women to change their names after marriage—typically the surname. All important documents, including the Aadhaar card, can have their names updated following a marriage. Given that Aadhaar is now required to file income taxes and qualify for many other government benefits, it's critical to understand how to change your name after getting married on your Aadhaar card. There are a few important things to keep in mind even though the procedure for updating names in offline and online modes is the same as mentioned above. The following are the key details to keep in mind and the documents you should have on hand: To change your name from maiden to married, keep your marriage certificate (proof of marriage) handy. You can obtain a copy of your marriage licence from the Sub-Divisional Magistrate's office in your area. You can update your name in many other documents, including your PAN card, passport, driving licence, voter ID and others, with the help of a marriage certificate. You can also present your marriage certificate as support documentation when having your name updated on your Aadhaar card.

0 notes

Text

Check Registration by the Chassis Number

How can I verify a Two-Wheeler's VIN number? You can check your two-wheeler's VIN number in a few different ways. You can check the details online by going to the NR e-services website. In addition to this, you can find the VIN number using a number of offline resources, such as your dealer, the dashboard of your car, the hood, the spare tyre, etc. The various ways to obtain your vehicle's VIN information will be covered in this article.

If you own a car, you've probably heard of terms like "chassis" and "vehicle identification number" etc. Do you know what they are specifically or where they are located on your car, though? To learn more about it, keep reading.

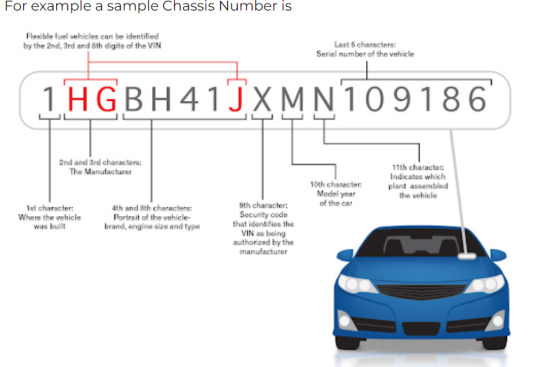

What is a Chassis Number or VIN? A Vehicle Identification Number, also known as a VIN or the Chassis number, is a unique identification number assigned to every vehicle. In India, the relevant authorities use this number to check registration by chassis number. Every single motor vehicle has a 17-digit VIN number that serves as the only means of identification for the vehicle. The VIN Chassis number of your car may be useful for a variety of reasons. The place and year of the vehicle's manufacture, as well as other significant figures and details, are implied by the VIN number. If you want to order specific car parts and are curious about the exact make and model of the car in question, you might also be interested in knowing the VIN number.

Different ways how to check your vehicle’s Chassis number How to check your car's chassis number is the next logical question. The VIN number may be visible on the plates attached to the chassis or frame of the vehicle. Typically, a VIN is stamped on the chassis, visible on the fixed plate for vehicle compliance, or located at the bottom angle of the windscreen. The receipt and registration certificate of the vehicle also include the VIN or chassis number. A skilled auto mechanic can locate any issues with the VIN number in the event that there are any. You might wonder how to determine the chassis number from the In-Vehicle Identification Numbers, or VIN, of the vehicle. Because the VIN is located differently in cars and motorcycles, the category of the vehicle one owns will determine how to trace the VIN. An engine number is a unique number that is engraved on the engine of a vehicle. Let's look at a few typical locations to look up your car's chassis number.

How to get your vehicle detailed online? Visit the official website of VAHAN, an online national registry project by the Ministry of Road Transport and Highways, if you want to find out information about your vehicle online. Your vehicle's registration number is stored in the registry, and you can find all the information about it online. Here's how to accomplish that.

Step 1: Go to VAHAN's official website. Step 2: From the menu bar, select "Know Your Vehicle Details". Step 3: When prompted, give the registration number for your vehicle. Step 4: Type in the Captcha code and select "Search Vehicle" However, the insurance won't divulge the entire engine or chassis number in order to protect your privacy.

1 note

·

View note