I am a Real Estate Broker in Great Neck, N.Y. and the surrounding areas of Nassau, Queens & Manhattan. I am always looking for qualified referrals who are coming to N.Y. I talk out of one side of my mouth, not like many agents who have 2-4 mouths and a ¼ of an ear (to listen with, LOL)!!!I pride myself in guiding ...my... clients and customers through the process in as much of a stress free transaction as I possibly can accomplish. If you ever have anyone who is considering selling, investing, purchasing or leasing within my areas, consider me. My website: http://WWW.Li-RealEstate.Com/

Don't wanna be here? Send us removal request.

Photo

(via All Things Real Estate: Many variables affect today's housing market - Business - The Island 360)

2 notes

·

View notes

Photo

We have 100 tickets to our 1st annual American Cancer Society Thurs Aug. 11th bar open 6:30pm show starts @ 8pm @ Governor's Comedy Club. We need to eradicate cancer by continuing to fund Cancer Research, come join us for a worthy cause and come out and laugh a lot with 5 comedians and 1 surprise guest comedian. Call Philip A. Raices for tickets as there will be no walk-ins the night of the show. #Americancancersociety #Cancercures #cancerresearch #cancerfundraiser #turnkeyrealestatefundraiser #turnkeyrealestate(via Come to our 1st annual American Cancer Society fund raiser - Community News - The Island 360)

0 notes

Photo

(via All Things Real Estate: Credit essential for life's big purchases today - Business - The Island 360)

1 note

·

View note

Photo

Are You single or about to be single? Then read this article #pheromonecologne #cologne #Smell #smellgood #men #women #attractingwomen #attractladies #attractions (via Best Pheromone Colognes In 2022: Top 4 Perfumes For Men - Blog - The Island 360)

0 notes

Photo

“Winners Never Quit & Quitters Never, Ever Win” (at Great Neck, New York) https://www.instagram.com/p/CGucFhylvI8/?igshid=ja86keay4fi4

0 notes

Text

Why are owners staying in their home longer today?

The demand from purchasers in buying homes has been growing in strength and there is no end in sight and bidding wars have become almost the norm, especially from those that have been in rentals.

I have been conversing with many buyers and they want to take advantage of the historically low-interest rates and the lower cost per month to purchase making it more affordable and are willing to provide higher offers and move out of their current rental (or parents home) into an ownership position.

Many are looking at the long term (not the short term) in building equity and wealth as well as participating and growing roots in their communities. However, many are losing the battle to purchase due to bidding wars, lack of inventory as well as job loss due to COVID-19.

Banks have been more carefully scrutinizing jobs and income to eliminate those that they feel might be a greater risk of not being able to pay.

With debts increasing, debt to income ratios will also come into play when determining mortgage approvals. Currently, there is a multitude of reasons why inventory is historically low and will continue to be that way. Prior to COVID-19, there was a housing shortage. Demand had been continuously reducing what was available.

Also, there were and are still those investors throughout the U.S. who instead of fixing and flipping homes were actually keeping and holding onto homes due to the demand and availability of renters who weren’t or couldn’t buy.

It was a perfect and safer environment for investors to build their long term wealth compared to other investments, like stocks that were and are perceived to be riskier with less control.

Another action related to lower inventory, noted by a study by RedFin a real estate brokerage, was the fact that a greater percentage of homeowners continue to stay in place and now are staying anywhere from three to five years longer than they did in 2010, (around 13 years) depending on where you are referencing around the U.S.

Many more are renovating for their later years as people are living longer. As more downsize and still desire to be in a home as opposed to a development or building,

I would imagine ranches will continue to become more and more popular as there are generally fewer steps to deal with. Also, due to the very low-interest rates in refinancing and availability of reverse mortgages using the equity to live on, we are seeing an increase in applications allowing more to stay in place further reducing future inventory.

During the Covid-19 greatly impacted the public from earning a living and foreclosures and evictions were halted and now have been extended a second time until August 31; which will hopefully allow those additional time to figure out their next consideration in moving. This too has also reduced available inventory initially for investors who would put the house back onto the market, for end-users who would maintain it as a primary residence.

Lately with Florida, Texas, California and other states seeing huge infection spikes on a daily basis, due to early openings of businesses and lack of people wearing masks many that are coming to New York State (now having some of the lowest daily infection rates in the U.S.), are required to quarantine for 14 days.

However, monitoring, controlling, and enforcing the rules with the influx of returning or new residents has been challenging.

I believe that those who had been thinking and potentially considering decisions on selling here and other safer states to permanently relocate to their second or another home have seen the Covid-19 infection rates increase in more than 50 percent of the states, have been put on the back burner for the foreseeable future, thus keeping much-needed housing stock off the market.

Aging in place is another reason and in September 2018, data was compiled and released as part of the senior advocacy group’s Home and Community Preferences survey, showed that almost 80 percent of adults age 50 and older wanted to remain in their homes and communities as they age.

For now, as long as the demand is greater than the available inventory and low-interest rates prevail allowing more to enter the market, prices should remain strong over the next several years. But after that period with so many variables in the mix, it’s anyone’s guess as to what changes will occur.

Philip A. Raices is the owner/Broker of Turn Key Real Estate at 3 Grace Ave Suite 180 in Great Neck. He has earned designations as a graduate of the Realtor Institute and also as a Certified International Property Specialist. To contact by cell call (516) 647-4289 or by email: [email protected] to answer any of your questions or concerns.

#stayinginplace#growingolderinyourhome#interestrates#refinancing#reversemortgages#upgradingyourhometostay#updatingyourhometostay#lowhousinginventory#lowestinterestratesin50years

0 notes

Photo

Reno’d corner coop largest two bedroom 1 1/2 bath in a very private 12 unit enclave. This is a very unique townhouse feel surrounded by lush mature landscaping & lawn. All new combo kitchen with black pearl granite island & countertops throughout w/soft close cabinets. All new stainless steel appliances dishwasher, washer-dryer combo, stove and refrigerator. Hardwood floors throughout living room/dining room area with working fireplace, central air conditioning, recess lighting throughout private entry with camera and buzzer. Private patio one car attached garage. Yeah bus and five minutes from the LIRR. Near Allenwood Park and part of the Great Neck Park District & Parkwood Pool complex which includes an oversized Olympic pool, lazy river, Children’s water slides & many activities within as well as tennis & ice skating. Lastly, our magnificent Steppingstone Park on the water. See complete details on mlsli.com ml#3218222. Call Phil @ Turn 🔑 Real Estate(516) 647-4289 https://www.instagram.com/p/CAy4g2jF-Sf/?igshid=1e88oe31qfdu2

0 notes

Photo

Things will improve but the $64,000 ? Is when🤔 https://www.instagram.com/p/CAObgHvFHlZ/?igshid=yqno15lyvw82

0 notes

Photo

Will U stay renovate & upgrade or buy when Covid-19 is minimized🤔 (at Great Neck, New York) https://www.instagram.com/p/CANmstSF0Uc/?igshid=1qz0oepk896ra

0 notes

Photo

Mindsets are changing as to where to live https://www.instagram.com/p/CAJhcl1l24v/?igshid=1xrny177g2fpn

0 notes

Photo

While many people across the U.S. have traditionally enjoyed the perks of an urban lifestyle, some who live in more populated city limits today are beginning to rethink their current neighborhoods. When it comes to social distancing, like we’ve experienced recently, the newest trend seems to be around re-evaluating a once-desired city lifestyle and trading it for suburban or rural living. The Harris Poll recently surveyed 2,000 Americans, and 39% of the respondents who live in urban areas indicated the COVID-19 crisis has caused them to consider moving to a less populated area. Today, moving outside the city limits is also more feasible than ever, especially as Americans have quickly become more accustomed to – and more accepting of – remote work. If you have a home in the suburbs or a rural area, you may see an increasing number of buyers looking for a property like yours. If you’re thinking of buying and don’t mind a commute to work for the well-being of your family, you may want to consider looking at homes for sale outside the city. DM me today to discuss the options available in our area. #sellyourhouse #moveuphome #dreamhome #realestate #homeownership #opportunity #housingmarket #househunting #makememove #homegoals #housegoals #investmentproperty #emptynest #downsizing #locationlocationlocation #newlisting #homeforsale #renovated #starterhome #dreamhome #curbappeal #keepingcurrentmatters https://www.instagram.com/p/CAJgVZ7Fooj/?igshid=1aovlekhnv2d9

#sellyourhouse#moveuphome#dreamhome#realestate#homeownership#opportunity#housingmarket#househunting#makememove#homegoals#housegoals#investmentproperty#emptynest#downsizing#locationlocationlocation#newlisting#homeforsale#renovated#starterhome#curbappeal#keepingcurrentmatters

0 notes

Photo

Today, according to John Burns Consulting, 58.7% of homes in the U.S. have at least 60% equity. That number is drastically different than it was in 2008 when the housing bubble burst. The last recession was painful, and when prices dipped, many found themselves owing more on their mortgage than what their homes were worth. Homeowners simply walked away at that point. Now, 42.1% of all homes in this country are mortgage-free, meaning they’re owned free and clear. Those homes are not at risk for foreclosure. In addition, CoreLogic notes the average equity mortgaged homes have today is $177,000. That’s a significant amount that homeowners won’t be stepping away from, even in today’s economy. If you’re wondering how you're positioned in today's market, DM me to learn more. #homeequity #equityposition #covid19 #coronavirus #recession #stayinformed #staycurrent #realestate #timetobuyahome #homeownership #homebuying #realestategoals #realestatetips #realestatelife #realestatenews #realestateagent #realestateexpert #realestateagency #realestateadvice #realestateblog #realestatemarket #realestateexperts #realestateagents #instarealestate #instarealtor #realestatetipsoftheday #realestatetipsandadvice #keepingcurrentmatters https://www.instagram.com/p/B_2sBAVFdy5/?igshid=1kch562czw5hc

#homeequity#equityposition#covid19#coronavirus#recession#stayinformed#staycurrent#realestate#timetobuyahome#homeownership#homebuying#realestategoals#realestatetips#realestatelife#realestatenews#realestateagent#realestateexpert#realestateagency#realestateadvice#realestateblog#realestatemarket#realestateexperts#realestateagents#instarealestate#instarealtor#realestatetipsoftheday#realestatetipsandadvice#keepingcurrentmatters

0 notes

Photo

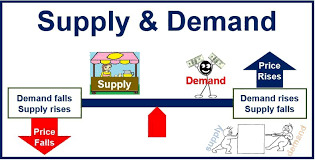

Do you want to learn some more, then read on#money #internationalrealestate #pricesofhomes #economics #priceversusvalue #valueofhomes #supplyanddemandeconomics #housing #homes #costofhomes #costofhousing #interestrates #interestrates #mortgages #lenders

(via All things Real Estate: How national, international economics impacts local housing market: Part 2 - The Island Now)

0 notes