Don't wanna be here? Send us removal request.

Text

Privo Instant personal Loan

Privo is offering instant credit line personal loans. You will get fast loan approval up to 2 lakhs. The loan process is digital. Choose the loan repayment tenure from 3 months to 60 months. Privo instant credit line loan is a paperless process. The interest rate starts from 13.49% to 29.99% per annum. Benefits of Privo Instant Loan Loan Amount- ₹20,000 to ₹2 lakh Tenure- 3 to 60 months Application Process- 100% Online & Minimal documentation Disbursal- Instant approval & quick disbursal Others- Cibil-650+,No Processing fees, No Pre-Closure fees, forever exclusive access to all features, Personalized Welcome Kit, ₹500 Amazon voucher, Interest Rates- 13.49% to 29.99% p.a Important Terms & Conditions Your mobile number must be linked with your Aadhaar Eligibility Criteria Salaried - Age Group: 21 - 57 years - Income Range: ₹18,000+ - Documents Required: - Identity proof: Any one of the documents - PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence - Address proof: Any one of the documents - Aadhaar card, passport, Voter ID Card - Income Proof: Salary certificate, Recent salary slip, Employment letter - You must be a resident of India - CIBIL score must be 650+ Other Eligibility Criteria Application Process Please keep the following documents and details handy to start the process - Your PAN card - Aadhaar card - Bank account details and - A Mobile number linked with Aadhaar card Install the Privo app from the Google Play Store by clicking on the link and start the application journey Let’s start! Set up your profile - Open the app, log in with your mobile number and click ‘Continue’ - Enter the OTP sent to your mobile number and verify - Allow all mandatory permissions to the app and continue 01 Set up your profile - Enter your personal details such as full name (as per PAN), date of birth, PAN number, etc., and click on ‘Continue’ - Add your employment details such as employment type, company name, etc.,and continue - The best loan offer will be shown to you according to your profile 02 Complete your KYC - Click on ‘Proceed to KYC’ - Enter your Aadhaar number for KYC verification and click on ‘Submit’ - Enter the OTP sent to your Aadhaar registered mobile number and continue - Upload a selfie to verify your identity - Read and accept the loan agreement of Privo - Now your Credit Line is ready to use 03 Add your bank account details and set up auto-pay - Click on ‘Proceed to withdraw’ and select your primary bank, enter your account number, IFSC code and click ‘Continue’ - Privo will transfer ₹1 to your bank account for account verification - Now setup your monthly EMI auto debit repayment and click on ‘Continue’ 04 Choose an amount to withdraw - Add details such as loan purpose, loan amount, tenure and click on ‘Withdraw’ - Enter your current residential address and confirm - After the verification, the cash will be transferred to your bank account within 24 hours FAQs on Privo Credit Line Loan Help & Support FAQs - What documents are required to apply for a loan? Aadhaar Number and PAN are mandatory to apply for a loan - How much is the processing fee? Processing fee for this loan is 1% to 3% of the loan amount + GST - Why Privo? Privo is a digital lending app of Credit Saison India - the Neo-lending subsidiary of Credit Saison. Credit Saison India is a technology-led neo-lending conglomerate with a Global MNC Parent. We offer bespoke solutions to cater to the different financial needs of Individuals, SMEs, FinTech and NBFCs - What is Privo? Privo is a credit line app of Credit Saison. Credit Saison is the brand name of Kisetsu Saison Finance India Private Limited which is NBFC registered with RBI. So, Privo is a 100% trusted lending application. - Can students apply for the Privo credit line? Absolutely yes. Students are eligible to apply for a Privo credit line loan. - Is CIBIL Score important to apply for Privo Loan? A minimum CIBIL score of 650 is required to apply for a Privo credit line loan. - What is the Privo loan customer care number? Privo loan customer care number is 18001038961. This is a toll-free number. - How much credit line Privo offers? Privo is offering up to 2 lakhs instant credit lines. Benefits of Privo Credit Line Loan Instant Approval: It will take approx. 30 minutes to get the loan. The loan process is very fast. Paperless Process: The whole process is 100% paperless. Upload all the documents at the time of application. Zero Foreclose Charge: Don’t need to pay any foreclose charge. The charge is zero. Higher Loan Amount: You will get the maximum loan through Privo. The loan amount is up to 2 lakhs. Flexible Interest: The interest rate is flexible. Privo is offering 13.49% to 29.99% interest rate per annum. No Hidden Fees: Privo does not charge any hidden fees from customers. Safe & Secure: Privo is 100% safe to use. The app is using advanced encrypted technologies. Congratulations! Enjoy the perks of borrowing money without risking your assets Read the full article

0 notes

Text

Prefr Instant Loan

Benefits of Prefr Instant Loan Loan Amount - ₹25,000 to ₹3 lakh Tenure - 3 to 36 months Application Process - 100% digital process - Minimal documentation - No paperwork - Fast & easy process Disbursal - Quick loan disbursal Others - No collateral required - Low processing fee - Fast & flexible Interest Rates - 18% p.a. onwards Benefits of Prefr Instant Loan Eligibility Criteria Salaried - Age Group: 22 - 55 years - Income Range: ₹18,000+ - Documents Required: - Identity proof: Any one of the documents - PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence - Address proof: Any one of the documents - Aadhaar card,passport, Voter ID Card - Income Proof: Salary certificate, Recent salary slip,Employment letter Eligibility Criteria Salaried - Age Group: 22 - 55 years - Income Range: ₹20,000+ - Documents Required: - Identity proof: Any one of the documents - PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence - Address proof: Any one of the documents - Aadhaar card, passport,Voter ID Card - Business Proof: Proof of Business Existence, Certificate of Incorporation, Certificate of Registration with Appropriate RegistrationBody - Income Proof: ITR of Past 2 years, Certified Profit and Loss Statement - Customer must be an Indian resident Other Eligibility Criteria Application Process Please keep the following documents and details handy to start the process - Your PAN card - Aadhaar card - Bank account details - Last 3 month’s bank statement with salary credits or business proof Visit the Prefr website by clicking on the link and start the application journey. Let’s start! Mobile number authentication: - Click on ‘Apply Now’, enter your mobile number and click on ‘Send OTP’ - Enter the OTP sent to your mobile number and proceed 01 Fill your details: - Enter your details such as full name, date of birth,desired loan amount, select employment type, etc., and click on ‘Proceed’ 02 - Enter your personal details such as gender, PAN number, Pincode, personal email ID and click on ‘Get Offer’ Credit bureau authentication: - After completing your application details, you will go through credit bureau authentication. - An OTP will be sent for authentication, enter the OTP and proceed - For additional authentication, you have to answer some bureau-related questions and click on ‘Generate Offer’ 03 - For additional authentication, you have to answer some bureau-related questions and click on ‘Generate Offer’ Choose your loan offer: - Provide your work details based on the type of employment - a) If you are salaried, enter your company details such as company name, company email ID and office address 04 - b) If you are self-employed, enter your business details such as business name, business type, business place ownership and business address - Click on ‘Proceed To KYC’ The final step is to complete your KYC: - Upload the required documents and complete KYC 05 Add your bank account details such as bank name, account number, IFSC code, etc., and verify - Set up auto EMI repayment - Read the loan agreement and click on ‘I Agree’ - Prefr team will review your loan application and disburse the loan within 24 hours Help & Support FAQs - What documents are required to get a personal loan from Prefr? List of documents - - PAN Card - Aadhaar Card - 3 months bank statement in PDF format - Business proof - I don’t have a credit(CIBIL) score. Will I get a loan? Yes, Prefr will use your banking data to generate an offer for you. - How long will it take to get Prefr Personal Loan? Prefr personal loan will be disbursed in your bank account within 24 hours - How can I contact prefr customer care? You can send an email to [email protected] Congratulations! "Enjoy the benefits of Prefr Instant Loan" Read the full article

0 notes

Text

SimplySAVE SBI Credit Card

SBI SimplySAVE is the most suitable credit card for beginners and for people looking for a rewarding card for everyday spending. You will get: ✅ 10X rewards on spends with partners✅ Fuel surcharge waiver✅ Cashback on first ATM withdrawal Why you should apply from here: ✔ 100% online process✔ Minimal documentation Apply now to get your SimplySAVE credit card - https://wee.bnking.in/ZjdiOTcw Benefits of SimplySAVE SBI Credit Card Milestone - 2000 Bonus points on spending ₹2000 in first 60 days - Annual Fee Reversal if previous year spends is ≥ ₹1,00,000 in a year Fuel - 1% Fuel surcharge waiver on purchase above ₹500 Others - 10X reward points on Dine-in, Grocery & Movie - Get ₹100 cashback on first ATM cash withdrawal - Earn 1 reward points on other spends - No annual fee from 2nd year onwards - Accepted in more than 24 million outlets worldwide - Convert purchases above ₹2500 into EMI using Flexipay Important Terms & Conditions - You can avail bonus reward points only after payment of joining fee* - Benefits, Rewards & Offers may differ as per the card type/variant - Credit limit varies as per your credit score *Differs from card to card variant* Eligibility Criteria Salaried - Age Group: 21 - 65 years - Income Range: ₹20,000+ - Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card - Income Proof: Salary certificate, Recent salary slip, Employment letter ❏ Age Group: 21-70 years ❏ Income Range: ₹30,000+ ❏ Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card - Income Proof: Certified financials, Recent ITR (Income Tax Returns), Audited profit and loss statement or balance sheet Eligibility Criteria Self-employed - Credit Score should be 730+ Application Process Visit the SBI credit card website by clicking on the link shared by your advisor. Keep the following details handy to start the process - Your PAN card - Aadhaar card and - Bank account details 01 Click on ‘Start apply journey’ Now, select any card of your choice and click on ‘Apply Now’ Enter your personal details such as name, mobile number, tick the terms & conditions checkbox and click on 'Continue' 02-Enter your professional details such as employment type, office address and click on 'Continue to Digilocker' 03-Enter your Aadhaar number, Security code(captcha) and click ‘Next’ 04-Enter the OTP sent to your mobile number and click on 'Continue' 05-Your application has been 06 successfully submitted If your application is approved, the bank executive will contact you in the next 48 hours for verification and completion of KYC - On completion of the due process, the bank will take a final decision on card approval - Once approved, you will get the credit card within 7 to 15 days of the final decision Help & Support FAQs - Which SBI credit card is good for beginners? SBI SimplyCLICK is the most popular entry-level SBI credit card for beginners. This card comes with an annual fee of ₹499 and is suitable for you if you want to avail good benefits at a low annual fee. SBI SimplyCLICK is beneficial if you frequently shop online. - What is the credit limit offered on SBI SimplyCLICK Credit Card? SBI SimplyCLICK Credit Card limit depends on your income, credit score, the highest limit on existing credit cards and many other internal factors. Hence the limit varies from one applicant to another. SBI Card does not communicate the credit limit at the time of application; you will get to know about your limit only when you get your new SBI SimplyCLICK SBI Card. - How to redeem SBI credit card points in cash? SBI Card has provided the facility to convert reward points into cash. You can call on the toll-free number 1800 180 1290 or (prefix local STD code) 39 02 02 02 and ask for the conversion of your points into cash. You can also write a mail by visiting https://www.sbicard.com/en/webform/write-to-us-logi n.page. - What is the validity of SBI credit card reward points? The reward points earned on your SBI credit card come with a validity of 24 months, i.e., 2 years. For an instance, if you have a rewards balance of 1,000 reward points on 25 Jan 2022. Then, this balance will be valid till 25 Jan 2024. After this date, your earned reward points will expire and you won't be able to redeem them. - Can I change the delivery/billing address after placing an order through my SBI Credit Card? The item will be delivered only to the registered address of the primary credit card owner. If you want to make any changes to the given address, then you can do the same by calling SBI Card customer care. You must remember that any kind of change in address will be made after successful verification. - What is the interest-free grace period offered on SBI SimplySAVE Credit Card? The interest-free credit period offered on SBI SimplySAVE Credit Card ranges from 20 to 50 days, depending on claims submitted by the merchant. - How can I pay my SBI SimplySAVE Credit Card bill? You can pay your credit card bill both online as well as offline. The online payment options include NEFT, electronic bill payment, National Automated Clearing House (NACH), Visa credit card pay, pay via debit card, etc. You can pay the credit card bill offline by cash, cheque, demand draft and SBI ATM. - Is BPCL SBI credit card good for beginners? BPCL SBI Card offers a 4.25% value back on your fuel purchases at BPCL petrol pumps. Apart from this, you can also earn 5X points on your spends at selected categories, which is an added advantage of this card. This is a good option if you are looking for a card to save more on your fuel expenses. Congratulations! Enjoy the benefits of SBI Credit Card. Read the full article

0 notes

Text

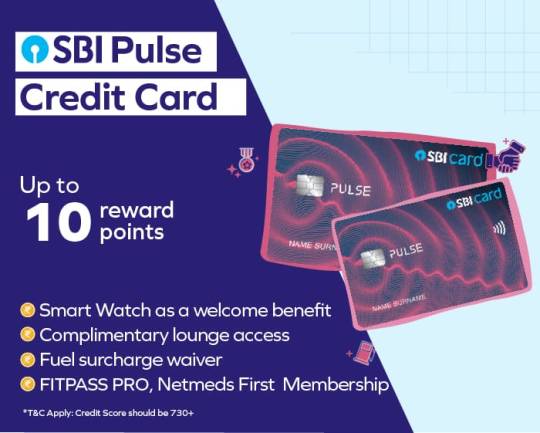

SBI Pulse Credit Card

In today's digital age, credit cards have become an essential tool for managing financial transactions conveniently and securely. Among the prominent players in the credit card industry, SBI Credit Cards stand out as a reliable and customer-centric option. With a wide range of cards tailored to suit various lifestyles and financial needs, SBI Credit Cards offer numerous benefits and rewards to their users. Let's explore the features and advantages that make SBI Credit Cards an excellent choice for individuals seeking a reliable financial companion. Benefits of SBI Pulse Credit Card Welcome Benefits - Get a Noise ColorFit Pulse 2 Max Smart Watch worth Rs. 5,999 on payment of joining fee Health & Benefits - Enjoy 1 year complimentary FITPASS PRO Membership, to be received every year, on card renewal - Enjoy 1 year complimentary Netmeds First Membership, to be received every year, on card renewal Rewards - Earn 10 Reward Points per Rs. 100 spent on Chemist, Pharmacy, Dining and Movies spends - Earn 2 Reward Points per Rs.100 spent on all your other spends Milestone - Waiver of Renewal Fee on annual spends of Rs. 2 Lakhs - Get Rs. 1500 E-Voucher on achieving annual retails spends of Rs. 4 Lakhs Travel - Complimentary 8 Domestic Lounge visits (Restricted to 2 per quarter) - Complimentary Priority Pass Membership for first two years of cardholder membership Others - 1% Fuel Surcharge waiver for each transaction between ₹500 & ₹4,000. Maximum Surcharge waiver of ₹250 per statement cycle, per credit card account - Get complimentary Air Accident Liability Cover of ₹50 Lakhs - Get complimentary credit card Fraud Liability Cover of ₹1 lakh - Loss of check in baggage up to ₹72,000 (1000 USD) - Delay of check in baggage ₹7,500 - Loss of travel documents up to ₹12,500 - Baggage Damage- Cover up to ₹5000 Eligibility Criteria Salaried - Age Group: 21 - 65 years - Income Range: ₹20,000+ - Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID - Income Proof: Salary certificate, Recent salary slip, Employment letter, etc. - You should be new to SBI Bank You must be an Indian resident - Credit Score should be 730+ Eligibility Criteria Self-employed ❏ Age Group: 21-70 years ❏ Income Range: ₹30,000+ ❏ Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, , or any other government-approved ID - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID - Income Proof: Certified financials, Recent ITR (Income Tax Returns), Audited profit and loss statement or balance sheet, etc. - You should be new to SBI Bank You must be an Indian resident - Credit Score should be 730+ Application Process Visit the SBI credit card website by clicking on the link shared by your advisor. Keep the following details handy to start the process - Your PAN card - Aadhaar card and - Bank account details 01 Click on ‘Start apply journey’ Now, select any card of your choice and click on ‘Apply Now’ Enter your personal details such as name, mobile number, tick the terms & conditions checkbox and click on 'Continue' 02 Enter your professional details such as employment type, office address and click on 'Continue to Digilocker' 03 Enter your Aadhaar number, Security code(captcha) and click ‘Next’ 04 Enter the OTP sent to your mobile number and click on 'Continue' 05 Your application has been 06 successfully submitted If your application is approved, the bank executive will contact you in the next 48 hours for verification and completion of KYC - On completion of the due process, the bank will take a final decision on card approval - Once approved, you will get the credit card within 7 to 15 days of the final decision Help & Support FAQs - Is SBI Pulse credit card beneficial for fitness freaks? Yes, you can say that the SBI Pulse credit card is made for fitness freaks, where the user gets a complimentary Noise ColorFit Pulse Smartwatch after paying the joining fee. You can track your fitness activities through this smartwatch. - How can I access my FITPASS PRO membership using the SBI Card Pulse? You will have to make a prior reservation using the FITPASS mobile application. - Can I use SBI Card Pulse internationally? Yes, SBI Card Pulse can be used in over 24 million outlets across the world. - Is SBI Card Elite credit card internationally acceptable? SBI ELITE credit card is accepted at over 24 million Visa outlets worldwide, including 3,25,000 outlets in India. - Does SBI Card Elite credit card provide Fraud liability cover? Yes, you get a cover of Rs. 1 Lakh against fraudulent transactions. - Does SBI Card Elite credit card offer fuel surcharge waiver & if yes, where can I avail it? Yes, SBI Elite Credit Card offers fuel surcharge waiver. It can be availed at any petrol pump in India. - How can I connect with SBI Bank customer care? Please call SBI's 24X7 helpline number i.e. 1800 1234 (toll-free), 1800 11 2211 (toll-free), 1800 425 3800 (toll-free),1800 2100(toll-free), or 080-26599990. Congratulations! Enjoy the benefits of SBI Credit Card. Read the full article

0 notes

Text

SBI Elite Credit Card

In today's digital age, credit cards have become an essential tool for managing financial transactions conveniently and securely. Among the prominent players in the credit card industry, SBI Credit Cards stand out as a reliable and customer-centric option. With a wide range of cards tailored to suit various lifestyles and financial needs, SBI Credit Cards offer numerous benefits and rewards to their users. Let's explore the features and advantages that make SBI Credit Cards an excellent choice for individuals seeking a reliable financial companion. Benefits of SBI Elite Credit Card Welcome Benefits - Get e-gift voucher worth Rs. 5,000 Movies - Free movie tickets worth Rs. 6,000 every year - Transaction valid for at least 2 tickets per booking every month. Maximum discount is Rs. 250/ticket for 2 tickets only Rewards - Get 5X Reward Points on Dining, Departmental stores and Grocery Spends - Earn 2 Reward Points per Rs. 100 on all other spends, except fuel Milestone - Earn upto 50,000 Bonus Reward Points worth Rs. 12,500 per year - Earn 10,000 bonus Reward Points on achieving annual spends of Rs. 3 lakhs and 4lakhs Travel - Enjoy complimentary Trident Privilege Red Tier membership - Enjoy 2 complimentary Domestic Airport Lounge visits every quarter in India - Enjoy complimentary Club Vistara Silver membership - Get 1 complimentary Upgrade Voucher - Earn 9 Club Vistara Points for every Rs. 100 spent on Vistara flights - Get exclusive 1,000 Welcome Points on registration - Enjoy 1,500 Bonus Points on your first stay & additional Rs. 1,000 hotel credit on extended night stay, by using Promo code: SBITH Others - Lowest Foreign Currency Markup Charge of 1.99% on International usage - Complimentary membership to the Priority Pass Program worth $99 - Dedicated assistance on flower delivery, gift delivery, online doctor consultation - 1% fuel surcharge waiver, on every transaction between Rs. 500 to Rs. 4,000, at any petrol pump across the country (maximum surcharge waiver of Rs. 250 per statement cycle, per credit card account) - Complimentary credit card fraud liability cover of Rs. 1 Lakh Eligibility Criteria Salaried - Age Group: 21 - 65 years - Income Range: ₹20,000+ - Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID - Income Proof: Salary certificate, Recent salary slip, Employment letter, etc. - You should be new to SBI Bank You must be an Indian resident - Credit Score should be 730+ Eligibility Criteria Self-employed ❏ Age Group: 21-70 years❏ Income Range: ₹30,000+❏ Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, , or any other government-approved ID - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID - Income Proof: Certified financials, Recent ITR (Income Tax Returns), Audited profit and loss statement or balance sheet, etc. - You should be new to SBI Bank You must be an Indian resident - Credit Score should be 730+ Application Process Visit the SBI credit card website by clicking on the link shared by your advisor. Keep the following details handy to start the process - Your PAN card - Aadhaar card and - Bank account details 01 Click on ‘Start apply journey’ Now, select any card of your choice and click on ‘Apply Now’ Enter your personal details such as name, mobile number, tick the terms & conditions checkbox and click on 'Continue' 02 Enter your professional details such as employment type, office address and click on 'Continue to Digilocker' 03 Enter your Aadhaar number, Security code(captcha) and click ‘Next’ 04 Enter the OTP sent to your mobile number and click on 'Continue' 05 Your application has been 06 successfully submitted If your application is approved, the bank executive will contact you in the next 48 hours for verification and completion of KYC - On completion of the due process, the bank will take a final decision on card approval - Once approved, you will get the credit card within 7 to 15 days of the final decision Help & Support FAQs Experience Convenience and Rewards with SBI Credit Cards In today's fast-paced world, financial transactions have become an integral part of our daily lives. Whether it's paying bills, shopping online, or dining out, having a reliable and rewarding credit card can make a significant difference. State Bank of India (SBI), one of the largest and most trusted banks in India, offers a range of credit cards tailored to suit various needs. With SBI credit cards, customers can experience convenience, security, and exciting rewards like never before. Wide Range of Credit Cards to Suit Your Needs: SBI understands that every individual has unique requirements when it comes to credit cards. That's why they offer an extensive range of credit cards, ensuring there's something for everyone. Whether you are a frequent traveler seeking travel rewards, a shopaholic looking for cashback offers, or someone who wants to build their credit score, SBI has the perfect credit card for you. SBI Prime Card: This card is ideal for those who love to travel and indulge in luxury. With attractive travel benefits, complimentary lounge access, milestone rewards, and accelerated reward points, the SBI Prime Card is designed to provide a superior experience. SimplyCLICK SBI Card: Geared towards the tech-savvy generation, this card offers exciting rewards on online shopping. Earn accelerated reward points on e-commerce transactions and access exclusive deals from partner websites. SBI Card ELITE: For those who appreciate the finer things in life, the SBI Card ELITE is a premium offering that brings exclusive lifestyle privileges, golf privileges, and an extensive rewards program. SBI SimplySAVE Card: Designed to make everyday expenses more rewarding, this card offers cashback on various spends such as groceries, dining, and department store purchases. SBI IRCTC Card: Travel enthusiasts can make the most of this card as it provides excellent benefits on railway ticket bookings and other travel-related expenses. Convenience and Security: SBI credit cards are equipped with cutting-edge technology and security features, ensuring a safe and hassle-free experience for cardholders. With the added layer of security provided by the chip-and-PIN feature, customers can have peace of mind while making transactions at both physical stores and online portals. Moreover, SBI's 24x7 customer support is always available to assist with any queries or concerns, making the overall experience even more convenient. Rewarding Loyalty: One of the significant advantages of using SBI credit cards is the rewards program. Cardholders can earn reward points on every transaction and redeem them for a wide range of products, gift vouchers, or even to pay off outstanding bills. Additionally, SBI frequently offers exciting promotional campaigns, providing cardholders with the chance to earn bonus points and avail themselves of exclusive discounts. Easy Bill Payments: With SBI credit cards, paying utility bills becomes a breeze. Customers can set up autopay facilities for their bills, ensuring they never miss a due date. This feature not only saves time but also helps build a positive credit history, boosting one's credit score over time. Financial Discipline and EMI Options: SBI offers a convenient feature known as "Flexipay," which allows customers to convert big-ticket purchases into easy EMIs with attractive interest rates. This feature promotes financial discipline and empowers users to make essential purchases without straining their budget. Contactless Payments: SBI credit cards are contactless-enabled, making transactions quicker and more convenient. By simply tapping the card on the point-of-sale terminal, customers can make secure payments without the need to enter a PIN for small-ticket transactions. Conclusion: SBI credit cards have proven to be valuable financial tools for millions of individuals across India. The wide range of cards, coupled with convenience, security, and exciting rewards, makes SBI an excellent choice for both seasoned credit card users and those new to the world of credit. Whether you want to travel in style, earn cashback on everyday expenses, or experience financial flexibility, SBI has a credit card tailored to meet your needs. So why wait? Experience the world of convenience and rewards with SBI credit cards today! - Is SBI Pulse credit card beneficial for fitness freaks? Yes, you can say that the SBI Pulse credit card is made for fitness freaks, where the user gets a complimentary Noise ColorFit Pulse Smartwatch after paying the joining fee. You can track your fitness activities through this smartwatch. - How can I access my FITPASS PRO membership using the SBI Card Pulse? You will have to make a prior reservation using the FITPASS mobile application. - Can I use SBI Card Pulse internationally? Yes, SBI Card Pulse can be used in over 24 million outlets across the world. - Is SBI Card Elite credit card internationally acceptable? SBI ELITE credit card is accepted at over 24 million Visa outlets worldwide, including 3,25,000 outlets in India. - Does SBI Card Elite credit card provide Fraud liability cover? Yes, you get a cover of Rs. 1 Lakh against fraudulent transactions. - Does SBI Card Elite credit card offer fuel surcharge waiver & if yes, where can I avail it? Yes, SBI Elite Credit Card offers fuel surcharge waiver. It can be availed at any petrol pump in India. - How can I connect with SBI Bank customer care? Please call SBI's 24X7 helpline number i.e. 1800 1234 (toll-free), 1800 11 2211 (toll-free), 1800 425 3800 (toll-free),1800 2100(toll-free), or 080-26599990. Congratulations! Enjoy the benefits of SBI Credit Card. Read the full article

0 notes

Text

SBI SimplySAVE Credit Card

Shopping + Savings Simply CLICK SBI Credit Card is your best friend for online shopping. You will get: ✅ 10X Rewards on shopping✅ Gift voucher of ₹500✅ Fuel surcharge waiver Why you should apply from here: ✔ 100% online process ✔ Minimal documentation Apply now to get your Simply CLICK credit card - https://wee.bnking.in/ZWJiN2Vk Joining fee Annual fee Starts from ₹499 Starts from ₹499 Credit Limit Upto ₹10 Lakhs Benefits of Simply CLICK SBI Credit Card Shopping - FREE Amazon gift voucher worth ₹500 on joining - 10X reward points on online spends with exclusive partners - 5X reward points on all other online spends Fuel - 1% Fuel surcharge waiver on purchase above ₹500 Others - Get FREE voucher of ₹2000 on spending above ₹1 lakh - Annual Fee Reversal if previous year spends is ≥ ₹1,00,000 in a year Benefits of Simply SAVE SBI Credit Card Milestone - 2000 Bonus points on spending ₹2000 in first 60 days - Annual Fee Reversal if previous year spends is ≥ ₹1,00,000 in a year Fuel - 1% Fuel surcharge waiver on purchase above ₹500 Others - 10X reward points on Dine-in, Grocery & Movie - Get ₹100 cashback on first ATM cash withdrawal - Earn 1 reward points on other spends - No annual fee from 2nd year onwards - Accepted in more than 24 million outlets worldwide - Convert purchases above ₹2500 into EMI using Flex pay Benefits of BPCL SBI Credit Card Fuel - 1% Fuel surcharge waiver on purchase above ₹500 Others - FREE Amazon gift voucher worth ₹500 on joining - 2000 bonus points worth ₹500 on paying joining fee - Win 1 reward point on other spends - Annual fee reversal if previous year spends is ≥₹50,000 - 5X reward points on every ₹100 spent at Grocery, Stores, Movies & Dine-in Important Terms & Conditions - You can avail bonus reward points only after payment of joining fee* - Benefits, Rewards & Offers may differ as per the card type/variant - Credit limit varies as per your credit score *Differs from card-to-card variant* Eligibility Criteria Salaried - Age Group: 21 - 65 years - Income Range: ₹20,000+ - Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card - Income Proof: Salary certificate, Recent salary slip,Employment letter ❏ Age Group: 21-70 years ❏ Income Range: ₹30,000+ ❏ Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card,Ration Card, Aadhaar Card, Voter ID Card, Driving Licence - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card - Income Proof: Certified financials, Recent ITR (Income Tax Returns), Audited profit and loss statement or balance sheet Eligibility Criteria Self-employed - Credit Score should be 730+ Other Eligibility Criteria Application Process Visit the SBI credit card website by clicking on the link shared by your advisor. Keep the following details handy to start the process - Your PAN card - Aadhaar card and - Bank account details 01 Click on ‘Start apply journey’ Now, select any card of your choice and click on ‘Apply Now’ Enter your personal details such as name, mobile number, tick the terms & conditions checkbox and click on 'Continue' 02-Enter your professional details such as employment type, office address and click on 'Continue to Digilocker' 03-Enter your Aadhaar number, Security code(captcha) and click ‘Next’ 04-Enter the OTP sent to your mobile number and click on 'Continue' 05-Your application has been 06 successfully submitted If your application is approved, the bank executive will contact you in the next 48 hours for verification and completion of KYC - On completion of the due process, the bank will take a final decision on card approval - Once approved, you will get the credit card within 7 to 15 days of the final decision Application Process - Which SBI credit card is good for beginners? SBI SimplyCLICK is the most popular entry-level SBI credit card for beginners. This card comes with an annual fee of ₹499 and is suitable for you if you want to avail good benefits at a low annual fee. SBI SimplyCLICK is beneficial if you frequently shop online. - What is the credit limit offered on SBI SimplyCLICK Credit Card? SBI SimplyCLICK Credit Card limit depends on your income, credit score, the highest limit on existing credit cards and many other internal factors. Hence the limit varies from one applicant to another. SBI Card does not communicate the credit limit at the time of application; you will get to know about your limit only when you get your new SBI SimplyCLICK SBI Card. - How to redeem SBI credit card points in cash? SBI Card has provided the facility to convert reward points into cash. You can call on the toll-free number 1800 180 1290 or (prefix local STD code) 39 02 02 02 and ask for the conversion of your points into cash. You can also write a mail by visiting https://www.sbicard.com/en/webform/write-to-us-logi n.page. - What is the validity of SBI credit card reward points? The reward points earned on your SBI credit card come with a validity of 24 months, i.e., 2 years. For an instance, if you have a rewards balance of 1,000 reward points on 25 Jan 2022. Then, this balance will be valid till 25 Jan 2024. After this date, your earned reward points will expire and you won't be able to redeem them. - Can I change the delivery/billing address after placing an order through my SBI Credit Card? The item will be delivered only to the registered address of the primary credit card owner. If you want to make any changes to the given address, then you can do the same by calling SBI Card customer care. You must remember that any kind of change in address will be made after successful verification. - What is the interest-free grace period offered on SBI SimplySAVE Credit Card? The interest-free credit period offered on SBI SimplySAVE Credit Card ranges from 20 to 50 days, depending on claims submitted by the merchant. - How can I pay my SBI SimplySAVE Credit Card bill? You can pay your credit card bill both online as well as offline. The online payment options include NEFT, electronic bill payment, National Automated Clearing House (NACH), Visa credit card pay, pay via debit card, etc. You can pay the credit card bill offline by cash, cheque, demand draft and SBI ATM. - Is BPCL SBI credit card good for beginners? BPCL SBI Card offers a 4.25% value back on your fuel purchases at BPCL petrol pumps. Apart from this, you can also earn 5X points on your spends at selected categories, which is an added advantage of this card. This is a good option if you are looking for a card to save more on your fuel expenses. Congratulations! Enjoy the benefits of SBI Credit Card. Read the full article

0 notes

Text

Moneytap Personal Loan

MoneyTap offers Instant Personal Loan of up to 5 Lakhs without any collateral or guarantor. You can use this money for your travel plans, purchasing mobile phones, medical emergencies, education, weddings, home renovation, and so on. Money Tap Personal Loan starts at an interest rate of 1.08% per month and can be repaid within up to a period of 36 months. Money Tap App Looking for a safe and reliable platform for an urgent need of funds? MoneyTap is here to provide you with a credit line to serve your financial needs Benefits of using MoneyTap Personal Loan: ✅ Approved credit limit of up to ₹5 Lakh ✅ Borrow flexibly ✅ Safe & Secure Credit Get cash in your account instantly with MoneyTap Download the MoneyTap app now- https://wee.bnking.in/NmM5ODIx Money Tap app is India’s first and most trusted mobile and web app-based loan provider. Over 10 million people have downloaded this app. You can easily apply for an instant personal loan or credit card online through the Money Tap loan app without any hassle and get digital approval within minutes. MoneyTap Personal Loan Features Purpose of the loan: MoneyTap Personal Loan can be used for just about anything. It can be used for planning travel, wedding, debt consolidation, education expenses for self or children, medical expenses, and so on. There is no restriction on end-use. Quantum: The minimum quantum for Money Tap loan is Rs. 3,000 and depending on the income and repayment capacity of the borrower it can go up to a maximum of Rs. 5 Lakhs Personal Loan. Interest: The MoneyTap loan interest rate starts from 1.08% per month or 13% per annum. The interest is to be paid only on the amount utilised. Repayment: Repayment tenure can be from 2 months to 36 months and the EMI will be fixed as per the loan tenure. Location: Right now, the facility is available in select cities like Mumbai, Bangalore, Delhi, NCR, Anand, Ahmedabad, Chennai, Chandigarh, Coimbatore, Gandhinagar, Hyderabad, Indore, Jaipur, Kolhapur, Mohali, Panchkula, Pune, Rajkot, Secunderabad, Surat, Vizag, Vadodara, and Vijayawada. Credit score: The CIBIL score of the applicant should not be less than 700. The credit report should not contain remarks like "settled" or "written off". The total loans including Credit Card should be between 2 and 6. Credit history for at least 12 months should be available. Earlier loan repayment should not have gone beyond 60 days past due in the last 2 years and 30 days past due in the last one year. MoneyTap Personal Loan Interest Rates The MoneyTap personal loan interest rates typically range from 13% to 24.03% p.a. The exact interest rate depends on the borrower’s credit score, which is based on their repayment record, defaults and bounced payments. MoneyTap Personal Loan 2.0 enables you to pay interest only on the amount utilised and not on the entire approved limit. The applicable rates of interest are shown to the borrower upfront with their EMI and they are charged only after they approve it. MoneyTap Personal Loan Benefits - One can get an instant approval for MoneyTap Personal Loan whereas for regular Personal Loans, instant approval is given only in some preferred cases. - For MoneyTap Personal Loan a credit limit is fixed and one can borrow in parts and pay interest only on the money utilised. However, in other Personal Loans money comes in a lump sum into one's account and interest has to be paid for the entire amount. - The interest rate for MoneyTap Personal Loan is lower than regular Personal Loans because you pay interest only on the amount utilised. - Once the loan is approved a RBL Money Tap Card is issued in MoneyTap Personal Loan which can be used like a regular Credit Card. You can even make cash withdrawals with this card without any extra charge. Personal Loan does not have this advantage. - Repayment schedule can be chosen in MoneyTap Personal Loan but in the case of regular Personal Loans, one cannot choose repayment schedule. - With the Money Tap loan app, you can manage your credit, repayments, and fund transfer via an app, which is not possible with regular loans. MoneyTap Personal Loan Eligibility Criteria The applicant must meet the following MoneyTap Loan eligibility: - Salaried individuals, government employees, business owners, and self-employed professionals like lawyers, doctors, architects, shop owners, and Chartered Accountants are eligible for the loan. - Applicant must be earning a minimum net monthly income of Rs. 20,000. - Applicant must be in the age group of 23 years to 55 years. MoneyTap Personal Loan Charges - Processing Fee: It depends on the amount withdrawn. The fee is divided into the below-mentioned brackets: - Rs. 3,000: Rs. 199 + GST - Rs. 5, 000: Rs. 399 + GST - Rs. 10,000: Rs. 499 + GST - Rs. 25,000 and above: 2% of the amount borrowed + GST Note: The processing fee is levied on the amount transferred, not on the approved limit. The fee is added to the next statement of the borrower. Every time the borrower withdraws money from the MoneyTap app, a nominal processing fee + applicable GST will be charged on the amount used. The amount of fee is added to the borrower's next month's statement. - One-time Line Setup Fee: Rs.499 + GST (It is charged to let the MoneyTap block the amount of money you can use 24X7). This fee includes the KYC processing & initial home visit charges. - Late payment fee for missing/not paying the scheduled Personal Loan EMI: 15% of the defaulted EMI amount (Minimum Rs. 350 to Maximum Rs. 1,000). Documents Required for MoneyTap Personal Loan After the MoneyTap app download, the documents required to be uploaded for MoneyTap Personal Loan are: - Pan Card - Aadhaar Card - Professional Selfie (taken on the MoneyTap App). - Identity Proof (anyone): Driving license/ Passport/ Voter ID/ Aadhaar/ PAN. - Address Proof (anyone): Driving license/ Passport/ Voter ID/ Aadhaar/ Utility Bills/ Scheduled Bank Statements. MoneyTap Personal Loan Verification Process The verification process for MoneyTap Personal Loans is explained below: - Download the MoneyTap mobile app on Android or iOS. - After MoneyTap login, fill in the required details and upload documents. - MoneyTap loan experts will verify your details like your identity, address, and income. - MoneyTap will then scrutinize the documents (PAN card, address proof, and identity proof) submitted by you. - After verifying all the information, you will be sanctioned the loan and the Instant Personal Loan MoneyTap amount will be transferred to your bank account. How to Check MoneyTap Application Status? You can check your MoneyTap personal loan application status through any of the following ways. Via MoneyTap Mobile App - Android users can download the MoneyTap application on mobile from Google Play Store and iPhone users from Apple Store. - After downloading the app and Money Tap login, you can easily check your personal loan application's status. Via MoneyTap Support Team - You can also send an email to MoneyTap at [email protected] or call at MoneyTap customer care number to enquire about your personal loan application status. MoneyTap Personal Loan - Customer Care - You can contact MoneyTap Personal Loan Customer Care by sending an email at [email protected]. Congratulations! Enjoy the benefits of Fibe Instant Loan. Read the full article

0 notes

Text

Privo Instant Loan

Benefits of Privo Instant Loan Loan Amount - ₹20,000 to ₹2 lakh Tenure - 3 to 60 months Application Process - 100% Online - Minimal documentation Disbursal - Instant approval & quick disbursal Others - No Processing fees - No Pre Closure fees - Forever exclusive access to all features - Personalized Welcome Kit - ₹500 Amazon voucher Interest Rates - 13.49% to 29.99% p.a Benefits of Privo Instant Loan Important Terms & Conditions Your mobile number must be linked with your Aadhaar Eligibility Criteria Salaried - Age Group: 21 - 57 years - Income Range: ₹18,000+ - Documents Required: - Identity proof: Any one of the documents - PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence - Address proof: Any one of the documents - Aadhaar card, passport, Voter ID Card - Income Proof: Salary certificate, Recent salary slip, Employment letter - You must be a resident of India - CIBIL score must be 650+ Other Eligibility Criteria Application Process Please keep the following documents and details handy to start the process - Your PAN card - Aadhaar card - Bank account details and - A Mobile number linked with Aadhaar card Install the Privo app from the Google Play Store by clicking on the link and start the application journey Let’s start! Set up your profile - Open the app, log in with your mobile number and click ‘Continue’ - Enter the OTP sent to your mobile number and verify - Allow all mandatory permissions to the app and continue 01 Set up your profile - Enter your personal details such as full name(as per PAN), date of birth, PAN number, etc., and click on ‘Continue’ - Add your employment details such as employment type, company name, etc., and continue - The best loan offer will be shown to you according to your profile 01 Complete your KYC - Click on ‘Proceed to KYC’ - Enter your Aadhaar number for KYC verification and click on ‘Submit’ - Enter the OTP sent to your Aadhaar registered mobile number and continue - Upload a selfie to verify your identity - Read and accept the loan agreement of Privo - Now your Credit Line is ready to use 02 Add your bank account details and set up auto-pay - Click on ‘Proceed to withdraw’ and select your primary bank, enter your account number, IFSC code and click ‘Continue’ - Privo will transfer ₹1 to your bank account for account verification - Now setup your monthly EMI auto debit repayment and click on ‘Continue’ 03 Choose an amount to withdraw - Add details such as loan purpose, loan amount, tenure and click on ‘Withdraw’ - Enter your current residential address and confirm - After the verification, the cash will be transferred to your bank account within 24 hours 04 Help & Support FAQs - What documents are required to apply for a loan? Aadhaar Number and PAN are mandatory to apply for a loan - How much is the processing fee? Processing fee for this loan is 1% to 3% of the loan amount + GST - Why Privo? Privo is a digital lending app of Credit Saison India - the Neo-lending subsidiary of Credit Saison. Credit Saison India is a technology-led neo-lending conglomerate with a Global MNC Parent. We offer bespoke solutions to cater to the different financial needs of Individuals, SMEs, Fintechs and NBFCs Congratulations! Enjoy the perks of borrowing money without risking your assets Read the full article

0 notes

Text

mPokket Instant Loan

Benefits of mPokket Instant Loan Loan Amount - ₹500 to ₹30000 Tenure - Up to 4 months Application Process - 100% Online - No paperwork is required Benefits of mPokket Instant Loan Disbursal Get disbursed in minutes Interest Rates 24% to 48% p.a. Others - Instant personal loans for students - No collaterals needed Eligibility Criteria Salaried - Age Group: 18+ years ● Income Range: ₹9,000+ ● Documents Required: - Identity proof: Any one of the documents - PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence - Address proof: Any one of the documents - Aadhaar card, passport, Voter ID Card - Income Proof: Salary certificate, Recent salary slip, Employment letter - For Students: Valid College ID Card, PAN Card , Address Proof like: Voter card, Aadhaar,PAN, Driving licence & Passport. - Customer must be an Indian resident Other Eligibility Criteria Application Process Please keep the following documents and details handy to start the process - Your PAN card - Aadhaar card and - Bank account details - Install the mPokket app from the Google Play Store by clicking on the link and start the application journey - Open the app and click on “Get Started” - Give all the permissions to the app by ticking on “I Accept Permissions, Terms & Conditions” and click on “Continue” - Now enter your mobile number and click on “Send OTP” - Enter the OTP received on your number and click on “Verify” Let’s start! Creating Your Profile - Select your current status such as Student, Salaried and Self-Employed and click on“Continue” - To demonstrate, we are selecting current status as salaried, but you can choose your status accordingly, the process will be almost similar. - Skip the referral code by clicking on “I don’t have a referral code” - Now select your second preferred language other than English, like Hindi or any other language of your choice, and click on "Continue" 01 Creating Your Profile - Click on “Agree” to give all the required permissions to the app and click on “allow” to all the permission requests - You will be redirected to the home page of the mPokket app. - Click on the profile tab to complete your profile before applying for the loan - In your profile you will have to provide your KYC details, Basic Information, Employment details and Selfie Video. 01 Providing your KYC details - Click on the KYC verification option, upload your selfie photo, and enter your PAN number - Select KYC document type like Aadhaar Card and enter your Aadhaar number and click on “Send OTP” - Now you will receive an OTP on your mobile number linked to your Aadhaar card. - Enter the OTP and proceed 02 Providing your KYC details - Now you will have to provide your basic information like name, gender, date of birth, marital status, highest qualification, parent's name and click on “Next” - Enter your permanent and current address details and click on “Next” - Now inform if this number is available on WhatsApp or not and also enter an alternate number and click on “Next” 02 Providing your employment details - Provide your employment details like Company name, Office Address, Office Pin Code and click on “Next” - Enter your monthly in-hand salary, designation, date of joining - Upload an employment proof such as Payslip, Offer letter, Joining letter, Permanent ID or Appraisal letter and click on “Next” 03 Providing your bank account details - Enter the IFSC Code of your bank and click on “Next” - Now if you provide bank details of your salary account like IFSC code, Account holder name, Account number - Upload 3 months bank statement and click on “Next” 04 Recording a video Now you will have to record a video of yourself in which you will have to read out a text displayed in the app and submit the video 05 Taking the loan amount in your account - After submitting all your details, go to the homepage of the app. - You can see your credit limit at the top of the screen - Choose the loan amount and tenure, click on “Request Loan” - The app will now show you loan and repayment details, after checking the details click on “Request loan” 06 Taking the loan amount in your account - Now choose bank account option and it will show you your verified bank details - Tap on your bank details to proceed further - Accept the Terms & Condition and click on“Confirm” - Now select the purpose of your loan and click on “Continue” - Tick on all the terms and conditions and click on “Agree” 06 Taking the loan amount in your account - Click on “View Contract” read the loan agreement and click on “ Agree” - Now enter the OTP and click on “Confirm Transfer” - Congratulations! Within 30 minutes, you will receive the loan amount in your bank account. 06 Help & Support FAQs - How can I get a loan while in college? mPokket, one of the best college loan app offerings in India, provides instant loan for college students who furnish proof of admission - mark sheet, college ID, letter of admission, etc., along with their KYC documents to get approved - What is the maximum loan a college student can get? mPokket, one of the best loan apps for college students in India, offers college students a maximum loan limit of ₹30,000 - How can I get a small loan at 18? mPokket provides instant loan for college students who furnish proof of their college enrollment along with their KYC documents. If you're a young professional, you will have to submit your salary slips for the last 3 months along with your KYC documents - Can I get mPokket personal loan without any documents? No, it is necessary to provide a few documents to borrow money from mPokket, such as college ID card, ID proof, PAN card, bank statement of last 3 months, and salary slips of last 3 months/ Offer Letter/ Joining Letter - How do I check my loan status? Under the activity section in the mPokket app, you will be able to check the status of all your open loans - How much is the processing fee? Processing fee for this loan is ₹50 to ₹200 + 18% GST of the loan amount Congratulations! Now enjoy a better borrowing experience with mPokket! Read the full article

0 notes

Text

Prefr Instant Loan

Benefits of Prefr Instant Loan Loan Amount - ₹25,000 to ₹3 lakh Tenure - 3 to 36 months Application Process - 100% digital process - Minimal documentation - No paperwork - Fast & easy process Disbursal - Quick loan disbursal Others - No collateral required - Low processing fee - Fast & flexible Interest Rates - 18% p.a. onwards Benefits of Prefr Instant Loan Eligibility Criteria Salaried - Age Group: 22 - 55 years - Income Range: ₹18,000+ - Documents Required: - Identity proof: Any one of the documents - PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence - Address proof: Any one of the documents - Aadhaar card,passport, Voter ID Card - Income Proof: Salary certificate, Recent salary slip,Employment letter Eligibility Criteria Salaried - Age Group: 22 - 55 years - Income Range: ₹20,000+ - Documents Required: - Identity proof: Any one of the documents - PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence - Address proof: Any one of the documents - Aadhaar card, passport,Voter ID Card - Business Proof: Proof of Business Existence, Certificate of Incorporation, Certificate of Registration with Appropriate RegistrationBody - Income Proof: ITR of Past 2 years, Certified Profit and Loss Statement - Customer must be an Indian resident Other Eligibility Criteria Application Process Please keep the following documents and details handy to start the process - Your PAN card - Aadhaar card - Bank account details - Last 3 month’s bank statement with salary credits or business proof Visit the Prefr website by clicking on the link and start the application journey. Let’s start! Mobile number authentication: - Click on ‘Apply Now’, enter your mobile number and click on ‘Send OTP’ - Enter the OTP sent to your mobile number and proceed 01 Fill your details: - Enter your details such as full name, date of birth,desired loan amount, select employment type, etc., and click on ‘Proceed’ 02 - Enter your personal details such as gender, PAN number, Pincode, personal email ID and click on ‘Get Offer’ Credit bureau authentication: - After completing your application details, you will go through credit bureau authentication. - An OTP will be sent for authentication, enter the OTP and proceed - For additional authentication, you have to answer some bureau-related questions and click on ‘Generate Offer’ 03 - For additional authentication, you have to answer some bureau-related questions and click on ‘Generate Offer’ Choose your loan offer: - Provide your work details based on the type of employment - a) If you are salaried, enter your company details such as company name, company email ID and office address 04 - b) If you are self-employed, enter your business details such as business name, business type, business place ownership and business address - Click on ‘Proceed To KYC’ The final step is to complete your KYC: - Upload the required documents and complete KYC 05 Add your bank account details such as bank name, account number, IFSC code, etc., and verify - Set up auto EMI repayment - Read the loan agreement and click on ‘I Agree’ - Prefr team will review your loan application and disburse the loan within 24 hours Help & Support FAQs - What documents are required to get a personal loan from Prefr? List of documents - - PAN Card - Aadhaar Card - 3 months bank statement in PDF format - Business proof - I don’t have a credit(CIBIL) score. Will I get a loan? Yes, Prefr will use your banking data to generate an offer for you. - How long will it take to get Prefr Personal Loan? Prefr personal loan will be disbursed in your bank account within 24 hours - How can I contact prefr customer care? You can send an email to [email protected] Congratulations! "Enjoy the benefits of Prefr Instant Loan" Read the full article

0 notes

Text

NIRA Finance Instant Loan

Looking for a Personal loan? Get instant NIRA personal loan of up to Rs. 1 Lakh Reasons to apply for NIRA Finance: ✅ Easy online application process✅ Loan tenure - 3 to 12 months✅ Minimal documentation Download the NIRA app now - https://wee.bnking.in/ZDg2OWQ2 Benefits of NIRA Finance Instant Loan Loan Amount From ₹5000 to ₹1 lakh Tenure From 3 to 12 months Application Process - 100% Online - Paperless process Interest Rates 24% - 36% p.a Disbursal 3 minute approval & disbursal Benefits of NIRA Finance Instant Loan Eligibility Criteria Salaried ❏ Age Group: 25 to 60 Years ❏ Income Range: ₹25,000+ ❏ Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card - Income Proof: Salary certificate, Recent salary slip, Employment letter Other Eligibility Criteria - You must be a resident of India - CIBIL score must be 660+ Application Process Open the app and select the preferred language Select the loan amount, loan term and click on ‘Apply now’ On the next screen, you can see NIRA Lending Partners and click ‘Apply Now’ Accept the Terms & conditions, click ‘I Agree’ and allow all mandatory permissions Enter your mobile number and an OTP will be sent to it, enter the OTP and click on ‘Register’ Enter your salary details such as employment type, monthly income, etc., and click on ‘Proceed’ Also, enter the information such as loan purpose, total work experience, etc., and click on ‘Proceed’ Enter your employment details such as current company name, designation and complete employment verification via company email or by uploading ID proof If you are eligible, you will be shown the credit limit, check the EMI amount and complete the loan application Upload your selfie, PAN and enter current address details such as pin code, city, state, etc., and proceed to upload the bank statement Proceed with Net Banking or upload a PDF to upload the bank statement To complete the KYC, upload current address proof, Identity proof, etc., and click on ‘Next’ Now you can see your experian score on the screen and click on ‘Continue’ Your application will be submitted and it will be reviewed by the NIRA Finance verification team - What does NIRA offer? NIRA offers line of credit of upto ₹1 lakh. Avail credit whenever you want, wherever you want. - What are the required documents to apply? List of Documents - Proof of Identity:- Passport / Driving Licence / Voter ID / PAN Card / Aadhaar Card (any one) - Proof of Residence:- Leave and Licence Agreement / Utility Bill (not more than 3months old) / Passport (any one) - Latest 3 months Bank Statement (where salary/income is credited) - Salary slips for last 3 months Help & Support FAQs - Once approved, how long does it take for the money to come into my account? After the final approval and completing the auto-debit setup, you can submit a draw request on your credit line any time, and the money will come into your account within 2-24 hours. Money will come into your account faster on subsequent draws. If you make a draw request over the weekend, the money will be credited to your account on the following Monday. - What is a processing fee and why is it charged? There will be a processing fee of a minimum of ₹350 + GST and a maximum of 2% of loan amount on your first loan. This is to cover the costs of on-boarding including document collections, verifications and payment setup. Congratulations! Enjoy the benefits of NIRA Finance Instant Loan. Read the full article

0 notes

Text

Money View Personal Loan

Get instant paperless Money View personal loan of up to Rs. 5 Lakhs without any collateral. The loan amount can be used for all personal needs, including travel, mobile phone purchase, medical emergency, education, wedding, home renovation, and so on. Moneyview loans come at an interest rate of 1.33% per month and can be paid back under 5 years' tenure. Looking for a Personal loan? Get instant paperless MoneyView personal loan of up to Rs. 5 Lakhs to fulfill all your needs Top benefits for you: ✅ Collateral Free Loans ✅ 24 Hour Disbursal✅ Affordable EMI plans Why you should apply from here: https://wee.bnking.in/NTg3NDlk ✔ Simple application process ✔ Hassle-Free Documentation Benefits of Money View Personal Loan Loan Amount- ₹5000 to ₹5 lakh Application Process- 100% Online & Minimal documentation Tenure- Up to 60 months Disbursal- 24-hour disbursal & Direct bank transfer in a few minutes Interest Rates- 16% per annum Others - Check eligibility in 2 Minutes! - No hidden charges - Collateral-free loan - Easy EMI Eligibility Criteria Salaried ❏ Age Group: 21 to 57 years ❏ Income Range: ₹13,500+ ❏ Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card - Income Proof: Salary certificate, Recent salary slip,Employment letter Eligibility Criteria Self-employed ❏ Age Group: 21 - 57 years ❏ Income Range: You must have a regular source of income ❏ Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence - Address proof: Any one of the documents - Aadhaar card, passport, Voter ID Card - Business Proof: Proof of Business Existence, Certificate of Incorporation, Certificate of Registration with Appropriate Registration Body - Income Proof: ITR of Past 2 years, Certified Profit and Loss Statement Other Eligibility Criteria ❏ You must be a resident of India ❏ CIBIL score must be 600+ ❏ Experian score must be Other Eligibility Criteria ❏ You must be a resident of India ❏ CIBIL score must be 600+ ❏ Experian score must be 650+ ❏ No settlement/ write-off in the last 36 months 650+ ❏ No settlement/ write-off in the last 36 months Application Process - Visit the Money View website by clicking on the link and start the application journey. Enter your mobile number and click on ‘Send OTP’ Enter the OTP sent to the mobile number and click on ‘Verify Now’ - Enter your full name as per your PAN card, select employment type, monthly income, etc., and click on ‘Continue - Select your gender, enter your date of birth, PAN number, etc., and click on ‘Get Offer’ - Based on the information provided, the eligible loan amount will be displayed on the screen. Select the loan amount, repayment tenure and proceed - Enter your employment details such as office address, Pin-code, etc., and continue. - KYC verification successful and Upload and submit the required documents. - Upload and submit the required documents. Click ‘Submit Now’ - Click ‘Enable Now’ Post E Mandate/p-NACH: - Final Review - Loan Agreement - Disbursement - App download Help & Support FAQs ❏ What documents are required to apply for a loan? - Proof of Identity: Self-attested photocopy of any one of the following: - Driving license - Passport - Voter ID - Aadhaar - PAN - Income proof: Form 16/ITR for the last 3 years - Latest 3 months salary slip - Banking: Latest 3 month’s salary credit bank statement ❏ Money view Personal Loan Interest Rates Money View loan interest rate starts from 1.33% per month. The Money View interest rate may differ depending on several factors, such as borrower’s credit score, repayment history, employment status, income to loans ratio, existing relationship with the lender, the loan amount availed, and so on. ❏ How can I repay my Personal Loan? Loan repayments have to be made in Equated Monthly Instalments (EMIs). The loan will be paid through ECS. You can also pay through a standing instruction to debit your Tata Capital account with the EMI amount. ❏ Can I prepay/foreclose my personal loan? You can prepay/foreclose the entire loan outstanding any time after paying 12 instalments for Salaried Clients and any time after 12 instalments for Self Employed Clients. Prepayment charges as applicable would be levied on the outstanding loan amount. The exact amount for pre-closure of the loan is available in the Foreclosure Letter issued by the bank. ❏ How much is the processing fee? 2% of the loan amount ❏ How to Calculate Money View Personal Loan EMI? - The calculation for Money View loan EMI payment can be easily done using our Personal Loan EMI Calculator. Personal Loan EMI Calculator requires loan amount, rate of interest, and repayment tenure details for instant EMI calculation. ❏ How to Check Money View Personal Loan Application Status? After applying for a Money View Personal Loan, you can check your Money View loan application status through any of the following ways: ❏ If you have applied for the loan through the website of Money View: - Visit the official website of Money View and click on 'Sign In'. - Enter your registered mobile number and OTP to login into your loan account. - After money view login, go to the 'Dashboard' section, scroll down and come to the 'Application Status' tab to check your loan personal loan application status. ❏ If you have applied for the loan through the mobile app of Money View: - Login to the Money View Loans app. - If you already have the Money View app, directly go to the 'Loans' section. - You will be automatically directed to the Money View's 'Application Status' screen. You can check your personal loan application status there. - If you already have the Money View Loan app, you will automatically be taken to the loan 'Application Status' screen when you open it. You can also contact the Money View customer care helpline number or send them an email to know the status of your loan application. ❏ Money View Personal Loan Charges Money View personal Loan Interest rates start from 1.33% per month. Apart from interest rate, the loan involves the following fees and charges: Loan processing fee- Starting at 2% of the sanctioned loan amount Charges for prepayment of loan (in part or full)- Part payment is not allowed For full prepayment, you must have paid minimum 3 EMIs. The charges are applicable as per the Money View personal loan agreement. Interest on overdue EMIs- 2% per month ❏ How to Login on Money View Portal? You can login to money day loan app by following the steps mentioned below: - Visit the website of Money View and click on ‘Sign In’. - Login by entering your registered mobile number and the OTP received. - You can also opt for Money View loan app download on your mobile phone. - Once logged in, you will get access to the multiple online services available on the Money View’s platform, including the loan outstanding, details of previous payment, due date and amount of next EMI date, and so on. ❏ Money View Personal Loan Customer Care You can contact Money View Customer Care number for any query at 080 4569 2002. OR send email on Money View customer care mail id [email protected] for any loan-related queries If you have any loan payment queries, email at [email protected]. ❏ How should I upload my selfie or video on Money View Loans App? - Here's what you will need to do to upload your selfie or video on the app: - Record a video of yourself in a bright room with a plain background holding your PAN card and say your full name a clear audible voice and upload. - Click (or upload from mobile media) your clear picture in a bright room with a plain background and upload. ❏ What are the reasons of loan rejection? - If the CIBIL score is less than 650. - If the salary is less than the required income criteria. - If the documents submitted are incomplete or incorrect. - When one does not qualify to get a loan as per Money View credit process. ❏ What is a paperless process? The loan processing flow of Money View is completely digital and is done through the app. One need not submit any physical documents. This process is known as a paperless process. ❏ Does one really get a loan with 2 business hours? - Money View tries their level best to process the loan within 2 business hours. The 2- hour period starts from the time one has reviewed and submitted loan agreement and ends once the loan amount is received. - Application, NACH, eligibility check is not a part of 2 business hours. This stage requires back and forth movement between the customer and customer support team for which providing a conclusive time is difficult. ❏ Can one change the loan amount after applying for the loan? No, one cannot change the loan amount with the app. If a mistake has occurred while applying then the same can be rectified by sending an email to their customer care team. ❏ Can one get multiple loans? No. The existing loan has to be repaid in full and a fresh loan should be applied. ❏ How does one repay the loan? An authorisation will be given to deduct the EMI from one's bank account while applying for the loan in the app. So, the EMI will be deducted directly from the bank account. ❏ Can manual payment be made for the loan? Yes. If the auto debit is not activated in one's bank account, then one can transfer the EMI amount by using the "pay" button in the app. ❏ Why do NACH EMI and the actual EMI differ at times? - The NACH EMI is fixed as per the loan amount, but the EMI debited will be the EMI chosen by the applicant on the app. - It is done to avoid multiple NACH forms to accommodate additional deductions when top-up loans are availed. ❏ What if the EMI is not paid on time? EMI is debited normally on the 5th of every month. If funds are not available on that date a grace period of 3 days is all Forward. Beyond that late fee will be charged. ❏ What documents required for the KYC after approval on the app? You just need to have PAN Card or Aadhaar Card for KYC. ❏ What are the fees and interest charges I have to pay? In addition to the interest rate starting at 1.33% p.a., you will have to pay a processing fee of 2% onwards of the sanctioned loan amount, prepayment charges (if you wish to prepay your loan), and 2% p.m. interest on overdue EMIs. ❏ How is the credit limit decided? Money View scrutinizes your age, monthly in-hand income, CIBIL score, documents, and other details to deicide your credit limit. Congratulations! Enjoy the benefits of Money View Personal Loan. Read the full article

0 notes

Text

Kotak League Platinum Credit Card

Looking for a Lifetime FREE Credit Card? Look no further than Kotak League Platinum Credit Card! This card offers a wide range of benefits every time you shop, allowing you to explore rewards like never before. You will get: ✅ Welcome benefits✅ Up to 8X reward points✅ Fuel surcharge waiver Why you should apply from here: ✔ Fast and Secure ✔ 100% online process Apply now to get your Kotak League Platinum Credit Card - https://wee.bnking.in/ZDM3OTFh Joining fee Annual fee Free ₹1000 Benefits of Kotak League Platinum Credit Card Welcome Benefits - 500 Bonus reward points* Milestone - Spend ₹1.25 lakh every 6 months and get 4 free* PVR tickets or 10,000 bonus reward points Rewards - Earn 9 reward points* Others - Contactless payment - Get a railway surcharge waiver of up to ₹500 annually - 1% fuel surcharge is waived off for all fuel transactions between ₹500 & ₹3,000 - Get a protection liability up to ₹1,25,000 in case of theft or loss of card up to 7 days Benefits of Kotak Mojo Platinum Credit Card Welcome Benefits - 500 Bonus Reward Points* Milestone - Get 2500* Mojo points every quarter on spending ₹75,000. Valid for the first year only Travel - Get 2 complimentary domestic airport lounge access every quarter (8 per year) Rewards - Get 2.5 Mojo points for every spend of ₹100 on online purchases - Get 1 Mojo point for every spend of ₹ 100 on all other spends - Get 5 Mojo points for every ₹100 spent on KayMall Others - Contactless payment - Insurance cover worth ₹1.25 lakhs against unauthorized transactions on a lost/stolen card - Save railway surcharge of 1.8% for transactions on www.irtc.co.in - Save 2.5% for transactions on Indian Railways booking counters - 1% fuel surcharge is waived off for all fuel transactions between ₹500 & ₹3,000 Eligibility Criteria Salaried ❏ Age Group: 21 - 65 years ❏ Income Range: ₹40,000+ net income per month ❏ Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID - Income Proof: Salary certificate, Recent salary slip,Employment letter Eligibility Criteria Self-employed ❏ Age Group: 21 - 65 years ❏ Income Range: You must have a regular source of income ❏ Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID - Income Proof: Certified financials, Recent ITR (Income Tax Returns), Audited profit and loss statement or balance sheet, etc. Other Eligibility Criteria - Minimum CIBIL score of 730 - Minimum CIBIL history of at least 9 months - You must be new to Kotak Mahindra Bank Visit the Kotak Mahindra Bank website by clicking on the link and start the application journey. Application Process Check out the benefits of all Kotak credit cards and choose the one that suits your needs 01 Choose your card: Click on ‘Get your card now’ 02 Mobile number authentication:-Enter the OTP sent to your mobile number and verify Enter your mobile number, give consent and continue Fill in your details:-Enter your personal details such as your PAN number, date of birth, email address, gender, etc., and click on 'Next' 03-Enter your mother's maiden name, father's name, marital status and click ‘Next ‘Enter your work details such as employment type, company email address, company name, monthly income, etc. If your residential address is the same as your permanent address, please tick the checkbox or type your residential address Confirm your current residential address and click on ‘Submit’ Select the card delivery address, accept the terms & conditions and proceed Enter the OTP sent to your Aadhar linked mobile number and verify Enter your Aadhaar number or Virtual ID and give consent Complete your KYC:-You can go through 2 different flows depending on your profile: 04 - In the happy flow, you will directly go through the KYC process of completing eKYC and v-KYC. - Some users will be asked to upload documents and complete further verification from the bank before completing v-KYC. Make sure you keep your original PAN card handy to complete the video KYC process. You have the flexibility to complete the video KYC call either right away or at a later time. Set your MPIN and confirm Your card will be created instantly and ready to use If you are asked to upload documents, confirm your office address Select your card delivery address Upload documents such as latest 3 months’ salary slips, credit card/bank statement to verify your application Help & Support FAQs ❏ How do I redeem my Kotak League Platinum Credit Card rewards? You can easily redeem the reward points against a variety of options like airline tickets, air miles, cash, movie tickets, merchandise, mobile recharges and more. ❏ Can I use Kotak League Platinum Credit Card internationally? Yes, this credit card can be used for international transactions as well. However, a foreign exchange markup fee will be applicable on transactions made in foreign currency. ❏ How do I redeem my Kotak Mojo Platinum Credit Card reward points? You can redeem your Kotak credit card rewards through cash, airline tickets, movie tickets, mobile recharge, or branded merchandise. ❏ How many airport lounge visits can I get in a quarter with Kotak Mojo Platinum Credit Card? You can get 2 visits per quarter. ❏ My Mojo points are valid for how long? Mojo points are valid for 1 year from the date of accrual. ❏ To get the railway waiver, should I book only through IRCTC? Yes, you should book your tickets via IRCTC to get the railways waiver. ❏ Can I make contactless payments via Kotak Mojo Platinum Credit Card? Yes, you can make contactless payments for transactions of up to ₹5,000. ❏ What is the limit of Kotak Mojo Platinum Credit Card? There is no fixed credit limit that is assigned to every Mojo Platinum Credit cardholder, but it can vary on the basis of different factors including your income, credit score, etc. ❏ How can I connect with Kotak Mahindra Bank customer care? If you have any queries, you can contact customer care 1860 266 0811 from 9.30 AM to 6.30 PM (Monday to Saturday excluding Bank holidays) Congratulations! Enjoy the benefits of Kotak Mahindra Bank Credit Card. Read the full article

0 notes

Text

Kotak Mojo Platinum Credit Card