Don't wanna be here? Send us removal request.

Text

Commercial Kitchen Ventilation Market Set to Surpass $6.8 Billion by 2032. Here’s Why That Matters

Just came across some promising new data for the commercial kitchen ventilation system market, and it’s clear the sector is cooking up serious growth — so let’s break it down.

📊 Market Forecast Snapshot (2025–2032)

💰 2024 Market Size: $4.30 billion 🔮 2025 Projection: $4.51 billion 🚀 2032 Forecast: $6.82 billion 📈 CAGR (2025–2032): 6.1%

That’s a significant 58% market expansion in under a decade — fueled by evolving restaurant designs, safety mandates, and energy efficiency trends.

🌍 Why This Market is Heating Up

With the global hospitality and foodservice industries bouncing back, the demand for modern, high-efficiency ventilation systems is surging — especially across fast-growing urban and commercial hubs.

Here’s what’s behind the momentum:

🔧 1. Regulatory Push for Cleaner Kitchens Governments are tightening air quality and safety standards in commercial cooking spaces. Compliance is no longer optional — it’s a competitive advantage.

💡 2. Energy Efficiency is Non-Negotiable Next-gen ventilation systems reduce power consumption while maintaining optimal airflow and filtration. Restaurants and chains are prioritizing long-term savings and sustainability.

🏢 3. Central Kitchens & Cloud Kitchens on the Rise The boom in delivery-first food models is creating demand for high-performance ventilation in compact, high-output spaces — where airflow and grease capture are mission-critical.

🌱 4. Growing Focus on Indoor Air Quality With heightened awareness around employee and customer health, ventilation systems are being upgraded to reduce odors, contaminants, and airborne particles in commercial cooking zones.

🛠️ 5. Tech-Driven Automation IoT-integrated hoods, demand-controlled ventilation, and remote monitoring are turning traditional systems into smart, responsive infrastructure.

💭 What This Means for Stakeholders

If you’re in commercial HVAC, kitchen equipment manufacturing, or restaurant design/build, this market is ripe for innovation.

✅ For builders: Focus on modularity, smart integrations, and code-compliant designs. ✅ For investors: Mid- to long-term opportunities lie in retrofit solutions, sustainable tech, and international expansion — particularly in Asia and the Middle East.

0 notes

Text

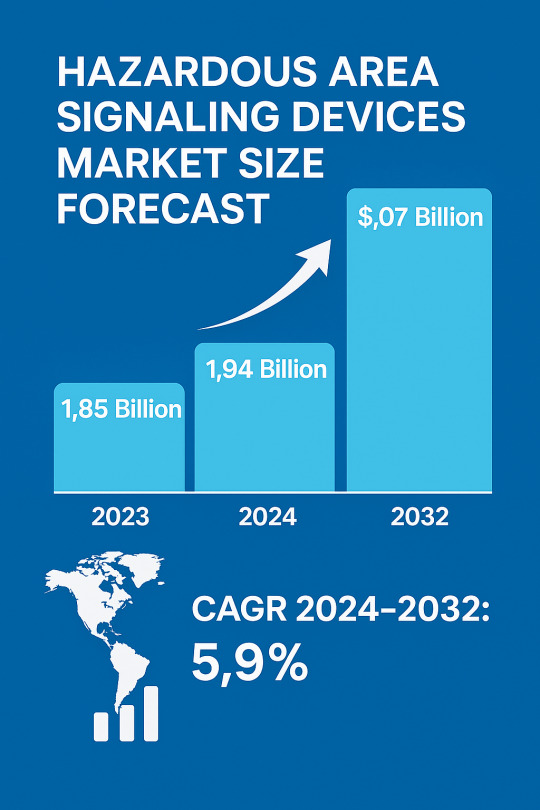

Hazardous Area Signaling Devices Market Set to Cross $3 Billion by 2032. Here’s What’s Powering the Rise

Just came across some compelling numbers on the hazardous area signaling devices industry — and if you’re in industrial safety, automation, or infrastructure, this one’s worth a deeper dive.

📊 Market Forecast (2024–2032)

💰 2023 Market Size: $1.85 billion 🔮 2024 Projection: $1.94 billion 🚀 2032 Forecast: $3.07 billion 📈 CAGR (2024–2032): 5.9%

That’s over 58% growth in just under a decade.

🌍 Safety First — And Everywhere

Hazardous area signaling devices are a critical piece of infrastructure in industries like oil & gas, mining, chemicals, and food processing — basically, anywhere explosive or dangerous environments require high-performance alerts and compliance with ATEX/IECEx norms.

🔑 Key Trends Fueling the Growth:

🚨 1. Industrial Safety Regulations Are Tightening

Governments and regulators worldwide are ramping up safety codes, especially in high-risk environments. That means more demand for reliable alarms, strobes, horns, and beacons designed for hazardous zones.

🏗️ 2. Expansion of Oil & Gas and Chemical Processing

As energy infrastructure expands — particularly in the Middle East, North America, and Asia — the need for certified signaling devices in explosive atmospheres is scaling accordingly.

⚙️ 3. Rise of Smart & Connected Devices

We're seeing the integration of IoT, diagnostics, and remote monitoring into signaling systems. These “smart alerts” improve incident response times and reduce maintenance downtime.

📦 4. Demand in Food & Pharma Cleanrooms

Signaling systems aren’t just for explosive zones — they’re increasingly deployed in sterile and contamination-sensitive spaces like pharmaceutical manufacturing and food processing, where audible/visual alerts ensure regulatory compliance.

��� 5. Emerging Markets Are Catching Up

Developing economies are now building out their industrial safety frameworks. As factories and energy plants come online, the market for ATEX- and IECEx-compliant signaling devices is set to boom.

🧠 What Does This Mean for Industry Players?

We’re moving toward automation-ready, network-integrated safety ecosystems. Whether you’re a manufacturer or investor, now’s the time to focus on scalable, smart, and regulation-driven solutions.

🔧 If you’re building: Prioritize interoperability with PLC/DCS systems, cloud diagnostics, and fail-safe compliance certifications.

💼 If you’re investing: Long-term demand will favor companies innovating in smart industrial safety, modular device design, and emerging economy installations.

0 notes

Text

Recycling Equipment Market Set to Hit $8 Billion by 2032 — Here's What’s Powering the Growth

Just came across some compelling market data on the Recycling Equipment industry, and the numbers tell a strong story of steady and resilient growth — let’s break it down.

📊 Recycling Equipment Market Forecast (2025–2032)

🌍 2024 Market Size: $5.41 billion 📅 2025 Projection: $5.61 billion 🚀 2032 Forecast: $7.97 billion 📈 CAGR (2025–2032): 5.1%

🌐 Why the Market Is Growing — The Key Drivers

♻️ 1. Policy Pressure and Sustainability Goals Governments and corporations are ramping up their sustainability commitments. New regulations around waste management, landfill reduction, and circular economy practices are forcing businesses to invest in more advanced recycling solutions.

🏭 2. Industrial Waste Is Becoming a Goldmine From metals and plastics to electronics and batteries, industrial sectors are increasingly seeing waste as a resource. Equipment that can efficiently recover materials is in high demand — especially as raw material prices stay volatile.

🔄 3. Tech-Enabled Recycling Is On the Rise Smart sorting systems, sensor-based separation, and AI-driven automation are making recycling processes more efficient and cost-effective. Innovation in machinery is helping tackle complex waste streams like e-waste and construction debris.

🌍 4. Emerging Economies Are Catching Up Countries in Asia, Latin America, and Africa are modernizing their recycling infrastructure rapidly — creating new demand for affordable, scalable equipment solutions.

🔧 5. Shift Toward Modular & Mobile Solutions Smaller, mobile, and modular recycling units are gaining popularity for their flexibility and lower upfront costs — ideal for remote or temporary waste management sites.

🔍 What This Means for Industry Players and Investors

We’re moving into the optimization phase of recycling. The focus is shifting from just “having equipment” to having the right, smart, and scalable equipment.

✅ If you’re building: Focus on efficiency, automation, and modularity. Equipment that integrates easily with broader waste management systems will win. 💼 If you’re investing: Keep an eye on innovation in e-waste recycling, AI-enabled sorting, and fast-growing markets in APAC and Latin America.

The recycling revolution is no longer optional — it's operational.

1 note

·

View note