Text

Business Leaders & Branding Association

Last week, we discussed leadership in terms of branding, and specifically talked about the qualities or attributes that business leaders have and portray. I have always considered the best business leaders to portray specific positive attributes such as competence and confidence but in class we discussed how business leaders that show vulnerabilities are actually more likable! As I finish my second year of grad school and look to enter the third and final year of my dual degree MBA-MPA program, I would like to think about what qualities I possess that I hope to convey to the world (that is, the brand associations that people have with me as a person) and also embrace my vulnerabilities. I think that this will empower me to be an authentic leader – someone that people will trust and admire to get the job done and someone they want to be around.

One leader, in particular, who I greatly admire for his authentic sense of leadership is Barack Obama. He conveys his confidence and competence regarding his job, but also comes across as a very authentic, extremely likable, and incredibly approachable person: a devoted husband, a loving father, someone who gives out fist bumps to his staff, and who is not afraid to be silly around kids nor feels the need to put on airs. He also has a certain charm and swagger to him!

0 notes

Text

Leadership Branding: Better World Books… An Example of Working Towards a Better World

In reading the Better World Books case, I was struck by how steadfast the company’s commitment was to its social mission, and how it purposefully made decisions that factored the “so-called cost of doing good” into its structure. Even the company’s choice of operations, for example, was purposefully made as it was committed to helping the local, blue collar community in Indiana, especially given the high rate of unemployment there.

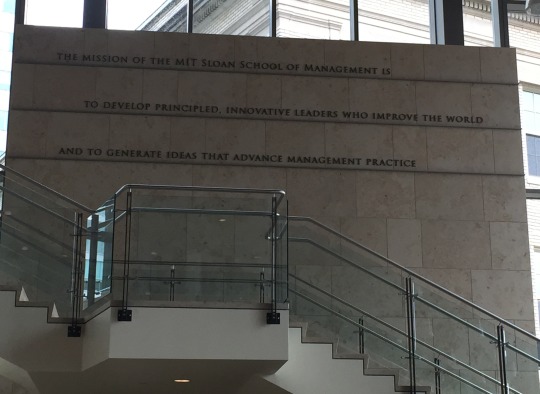

I chose MIT in large part due to its mission and believed that it would prepare me well to make an impact on the world. As I thought about building my own personal brand, I felt that this mission most resonated with me and was a brand that I wanted to be associated with in the long-run. I also knew that I wanted to stay true to my core values of using my education to help others – be it in a full-time role or extensive public service – and work at the nexus of the public and private sectors to effect change.

If someone had told me almost two years ago that I would come back to graduate school and end up building a hotel brand, I would have laughed them out of the room. I was not sure what kind of function I even wanted to hold, let alone the industry that I wished to be in. In fact, working in the hotel industry was just one of multiple industries I was considering. But opportunities seem to come your way when you are a graduate student at MIT Sloan & Harvard Kennedy School and I have decided to fully embrace that reality, let go of my risk aversion, and seize opportunities. I have recently been approached about joining a team that will be building a hotel in the developing world in partnership with the World Bank. That’s not your ordinary, traditional post-MBA job like consulting or investment banking. But it’s an opportunity to be a part of a mission-driven team, to build something meaningful, and to make an impact on a community.

Just as is the case with Better World Books, if this hotel development model is successful and were to be scaled, it could have a profound impact on much of the developing world. And ultimately, that is what I came back to graduate school looking to do: make an impact.

0 notes

Text

When a Company Loses Control of its Brand -- How a Hashtag can become a Bashtag

In an increasingly digital world, social media platforms offer companies a way to better engage with their customers. But with the use of these platforms also comes a corresponding loss of control -- the company can no longer tightly control the message that they are trying to deliver the way that they can when using traditional marketing tactics that do not allow real-time exchange.

As such, companies choosing to engage with consumers on social media need to be nimble and react smartly and quickly to direct the narrative being told on their social media platforms. Such was the case with #McDStories. There McDonald’s use of the hashtag “McDStories” became what some in the industry not-so-fondly refer to as a “bashtag.”

Hence, rather than creating a campaign filled with stories about positive McDonald’s experiences meant to warm the heart and inspire nostalgia, many consumers (or in some cases, former consumers) shared their negative experiences, filing them under the same bashtag -- ahem, I mean hashtag. These stories, filled with snark and sarcasm, were not exactly what Mickey D’s had in mind:

In my opinion, in order to avoid such embarrassment, Mickey D’s should have done two things: First, it should have more tightly tailored its social media campaign by using a more specific hashtag that was not susceptible to sarcasm or reinterpretation. For example, #McDhappystories. Second, it could have also maintained more control by having lined up fans and influencers who could share content that it had pre-approved rather than letting everyone post in what became a free for all public roast. By doing both of these things, Mickey D’s would have maintained more control over its brand and the narrative that was being told about it.

0 notes

Text

Positioning Burberry: Making More than just your Dad’s Plaid Check Jacket

Burberry’s historic roots in designing trench coats for the British Army in World War I positioned it for decades as a coat company that, in particular, was known for its signature check motif. While a good trench coat is a staple item in every wardrobe, it is not something that your average consumer thinks they will need to make multiple purchases of in their lifetime. This was especially true because, until recently, Burberry did not offer the trench in several different colors. Burberry’s shift from a standard khaki trench coat with its plaid check lining to trench coats that are fashionably cut with pops of color illustrates the direction that the company wanted to go in -- it wanted to move from its tired, “stodgy old man” image to one that was more dynamic. Hence, it wanted to be a classy and functional luxury brand, that was considered stylish without necessarily having to be cutting edge.

In addition to revamping its brand, it was also clear that Burberry needed to better control its brand (namely through its licensing practices), as the use of its signature check motif on a wide range of products was diluting an important element of any luxury brand: the exclusivity factor.

By positioning itself between Coach and Gucci when it comes to accessories, Burberry faced a decision: did it want to position itself closer to Coach (which in recent years can be obtained at bargain basement prices thanks to the plethora of Coach Outlet stores and online Outlet sales) or did it want to position itself closer to Gucci, which by contrast only maintains ten outlet stores in all of the United States and still commands a rather high price point? I would argue that Burberry decided to position itself closer to Gucci in terms of its number of product lines/offerings and price point. By doing so, it was able to hang onto the scarcity element that high-end luxury consumers value and maintain its brands integrity. Hence, while you frequently see 12 year old “teeny boppers” hanging out at your local suburban mall carrying a Coach bag you would rarely see a young carrying a Burberry bag (unless perhaps she was “borrowing it” from her auntie who is a pushover!)

0 notes

Text

Marriott + Starwood = Brand Confusion & Brand Dilution?

Last fall, Marriott announced that it will be acquiring Starwood for $12.2 billion. While many loyal SPG customers immediately began to fret about their loyalty program points, others working in the hospitality industry began to wonder how these two hoteliers would be able to bring these two portfolio of brands together in a way that made sense. (And some bloggers even speculated that the company will have to “kill off” some brands).

That is, the chief concern was making sure that the brands were not diluted while also making sure that the company would not cannibalize its own profit (by offering more than one hotel option with similar strategic positioning in terms of its price and quality).

Another factor that should be considered is that both of the major players in the hotel industry based on number of properties and number of hotel rooms (i.e., Marriott and IHG) have adopted an asset light strategy. Thus, both have franchise agreements with the owner-operators of their hotels. Marriott’s acquisition of Starwood could potentially open the door for a franchisee to want to rebrand their hotel under what they perceive to be a “better” Starwood brand, leading to further potential confusion regarding brands and dissatisfaction from its other hotel franchisees in terms of multiple hotel offerings falling under the same brand in a given region. This could be especially problematic for Marriott in certain densely populated regions of the country like New York City for example.

0 notes

Text

The Wine Industry: Where Perception Trumps Taste

Wine consumption seems to be more about perception than taste. In spite of the fact that California wines have won tasting contests, for instance, French, Italian, and Spanish wines still enjoy a wide-scale perception of being the best. These wines are perceived as “classy” and connote status – they are for individuals with refined and sophisticated palettes.

This is not to say that the California wine industry has not taken off –– it has. But the wine industry has little brand loyalty. People’s perceptions of wine are grounded in the wine’s geographic origin rather than taste. As such, the industry has allowed little room for competitors from other countries. And, certain countries such as Costa Rica, face the problem of one wineries’ strategy (of producing and marketing “cheap” wine) affecting all brands. Such is the problem that Concha y Toro, a Costa Rican winemaker, is facing as it decides whether to take a “bottom-up” or “top-down” strategy. It seems that “top-down” strategies are difficult to implement in industries where consumers are turning their noses up to certain brands based on their perception of the product rather than its actual quality (e.g., the auto industry or the wine industry). Thus, I would recommend that Concho pursue a “top-down” strategy by investing in the back end of the value chain to exploit the prestige and name brand recognition of its higher-end wines.

0 notes

Text

Examining Product Diffusion: Balancing Product Needs/Wants with Willingness to Pay

This week we were asked to read a 2002 HBS Case entitlted “Four Products: Predicting Diffusion.” The case discussed how managers are better able to predict the success of products with incremental variations or improvements on an existing product as opposed to “new-to-the-world” products. The case defines “product diffusion” as “the rate and scope of product adoption among the target market” and states that there are factors inherent in the product that either encourage or hinder adoption among target customers. It then describes four new-to-the-world products (sliced peanut butter, high-tech silver bandages, satellite radio, and a plug-in apparatus for PCs meant to waft different odors).

While some products may have met customer needs/wants, it seemed clear that they would not achieve mainstream adoption given consumer’s willingnes to pay. For example, although high-tech silver bandages show incredible effectiveness, it is unlikely for them to be adopted by individual consumers (as opposed to hospitals, who can use them to treat burn victims) given that they cost much more. In addition, consumer’s willingness to pay a much higher premium for a product is largely reliant on education/awareness as to the added value of the product -- something that the case estimates would cost between $20 to $30 million to achieve.

Similarly, satellite radio was another product that was examined. In this case, the product would meet customers’ wants in that they would enjoy a wider array of genres of music which would also be commercial-free. But the case pointed out that the switching costs were extremely high (not to mention that the advent of disruptive technology like the iPod made it possible to create your own playlists to achieve an ideal musical experience not only when you are in the car but also for leisure activities, exercise, etc.)

0 notes

Text

Building Brands – Thinking About What Your Brand “Says” About You

I recently surveyed friends, family members, and classmates, and asked them about their purchasing decisions over coffee. Specifically, I wanted to know what makes them choose between two different brands in the same category and how powerful a factor a product’s brand plays in their purchasing decisions. I selected handbags in particular for these conversations (one of my favorite purchasing decisions to make) – and yes, the participants in this informal survey were female! Initially, the obvious responses came to the surface: color, material, size, style, and quality. But when I started to probe deeper and threw out two specific brand names – Michael Kors versus Louis Vuitton – the responses were more nuanced. All of a sudden, the discussion revolved around brand perception and what carrying each bag “said” about them. A Michael Kors was described as a great “every day bag” that could be taken to the office or even the grocery store. But a Louis Vuitton apparently signaled more status and prestige and was the type of bag that would be carried to an important meeting or a fancier work event.

Unlike handbags, however, beers are not a long-lasting investment. They are purchased one-at-a-time and then consumed. Presumably, your purchasing decision may be scrutinized but is not looked at as closely as women scrutinize handbag choices! That is, no one is the wiser as to which one you chose or whether you switched brands on any given day. Or so I (initially) thought.

Unlike with soda consumption, beer consumption is more often associated with a social experience than with an everyday routine. It is more typical for consumers to purchase a soft drink with their lunch or as a thirst-quencher when it is hot outside, than it is when they go out to a bar with their friends. Given this social element to beer consumption, consumers apparently are conscious about the likelihood of others noting their beverage choice – or event scrutinizing it – when they are out with friends and having a beer than when they are purchasing a soda.

Hence, as I approached the Corona question, I began to wonder:

What is it about the Heineken brand that has made it stand out and are there any particular vulnerabilities of Heineken that Corona could demonstrate as one of its advantages?

While I thought people chose mainly on beer taste, it is clear that the two companies know about consumer consciousness when it comes to beverage choices, and are cognizant of the shape of their bottle, the style of their labels, etc. They took completely different approaches to their brand image. Corona used a “Fun, Sun, and Beach” tagline and conveyed an image of relaxation and vacation. It wanted to market itself as a simple, non-pretentious choice. By contrast, Heineken focused its efforts on conveying that its product is of high quality. It focused its advertising on conveying how its beer is brewed and emphasized its heritage. While this approach worked for Heineken for several decades, its market share has begun to slip. Most likely, in my opinion, because when people consume a beer they want to do so to relax and have a good time -- images that Corona stir up for them through its branding strategy. As such, Heineken may need to rethink its positioning strategy.

That being said, according to another HBS case (the Boston Beer Case), beer consumers have a strong preference for branded products that “say something about who they are when they are drinking the product.” As such, perhaps Corona and Heineken can compete with one another for the same consumers but at different points that they are drinking the products. Where as the average grad student may opt for a Corona when she is on a beach or out with friends exploring a new city, for instance, she may choose a Heineken when at a work-related event in order to project a more serious sort of image of herself.

0 notes

Text

Black & Decker’s Branding -- not using all of the tools in its belt

In spite of its strong name brand recognition, B&D was not doing well in the professional tradesmen segment of the market. Why you ask? Ironically, they weren’t using the right “tools,” as a simple Marketing 101 4P analysis reveals.

Looking at the 4 P’s

In examining the 4 P’s, it is clear that B&D fell short in a few categories -- but it was surprising where they did not.

For example, in terms of PRICE, B&D was actually behind its competition. That is, in spite of being priced lower, it was unable to capture market share in the tradesmen segment of the market from competitors like Milwaukee and Makita.

When looking at PRODUCT it is clear that B&D’s quality was actually deemed to be higher than many of its competitors when a blind study was conducted. As such, its brand perception is clearly an issue and one that B&D needs to address in terms of PROMOTION (which I believe is B&D’s greatest issue).

While B&D enjoys an incredibly high degree of brand awareness among consumers, it seems to have been unable to differentiate its product from its consumer segment and thus is perceived to be of lower quality than it actually is. This was clear by some of the quotes made by potential customers in this segment. For example, one said, “...B&D Makes a good popcorn popper, and my wife just loves her dust buster, but I’m out here to make a living...”

Clearly, B&D’s strength in consumer goods is thus seen as some sort of negative when it comes to other segments like trade. The perception is that a brand that is strong in consumer goods cannot also possibly excel in a niche/technical area like the tradesmen segment of the market.

So what can B&D do to address this issue?

One possible way that B&D can address this issue is by considering launching a new line, as was suggested by the case. Being able to use a well-known industry leader and stating that it is “DeWalt line by B&D” would allow B&D to still leverage its brand awareness while improving customer perceptions. It also helps to show differentiation in the market: That is, that these products are somehow different from the ones marketed to consumers and are geared toward this niche customer segment within the overall market.

PLACE

One other issue that has come up is PLACE. While B&D markets its products in stores like Home Depot, it is clear that tradesmen make the majority of their purchasing decisions based on what they see and hear on the job. As one person said, for instance, “On the job, what you are working with ... if I came out here one of those B&D grey things, I’d be laughed at.”

As such, tying into the above-mentioned issue, changing perceptions regarding B&D’s product (perhaps by a differentiated product line!) is key but even something as simple as changing its color could go a long way to changing perceptions such that its products are distinguished from its consumer goods in this additional way. A bright color that stands out and appears to be more manly (that is not being used by its competitors) that is different from its other product lines would be a good start at differentiation.

Given that purchasing decisions are being influenced so heavily on the job, the company may also want to consider taking its product to job sites and allowing tradesmen to test out their tools. This seems like it could be especially effective in light of the fact that B&D’s products were rated so highly by those who tested them in the blind study.

* * * * *

The above are just a few ideas as to how B&D could use some of its 4P “tools” to improve its performance in the professional tradesmen segment of the market.

1 note

·

View note