Don't wanna be here? Send us removal request.

Text

How to Buy Bitcoin with Prepaid Card: A Quick Guide for Beginners

In this day and age of digital connectivity, purchasing Bitcoin is now more convenient than ever, even if you don't have a bank account or a credit card. If you want to know how to purchase Bitcoin using prepaid card, you're in the right place. Prepaid cards provide a secure and relatively anonymous means to make cryptocurrency purchases, especially for users who prefer privacy or don't want to share their bank information.

Why Use a Prepaid Card?

Prepaid cards are reloadable and may be used similar to a debit card or credit card. You may buy them online, in a supermarket, or at a convenience store. Shopping for Bitcoin with a prepaid card has various advantages:

No association with your individual bank accounts

Assists you in budgeting your crypto payments

Suitable for occasional spending

Gives you greater anonymity

Step-by-Step: How to Purchase Bitcoin using Prepaid Card

Here's how you can proceed in easy-to-follow steps:

Select a Reliable Crypto Exchange Not all exchanges take prepaid cards, so it's important to select one that does.

Be sure to check that the exchange takes your particular prepaid card (e.g., Visa or Mastercard).

Create and Verify Your Account Sign up on your preferred platform. Most platforms will require you to confirm your identity by providing a government ID and occasionally a selfie. Although this might seem like a nuisance, it's required for security and regulatory purposes.

Choose Prepaid Card as Your Payment Method Once you've verified your account, go to the "Buy Crypto" or equivalent part. Select prepaid card as payment method. Put in the card details as if making an online transaction.

Enter Purchase Amount Decide on the amount of Bitcoin you wish to purchase. Remember that some websites charge a small fee for purchasing using a prepaid card—about 3% to 5%.

Confirm the Transaction Check over the transaction information, such as fees, exchange rate, and the amount of Bitcoin you will receive. If you agree, the transaction will proceed, and your Bitcoin will be credited to your exchange wallet.

Things to Remember

Fees: Transactions on prepaid cards tend to have higher fees.

Limits: Certain cards or sites may have daily or monthly spending limits.

Security: Use a well-established exchange and activate two-factor authentication (2FA) on your account.

Card Restrictions: Some prepaid cards are restricted to specific regions or online purchases only.

Final Thoughts

Learning how to buy Bitcoin with prepaid card can be a great option if you’re looking for flexibility, privacy, or simply don’t want to use your bank account. Just be sure to use a trusted exchange, understand the fees, and take necessary security steps to protect your crypto assets.

1 note

·

View note

Text

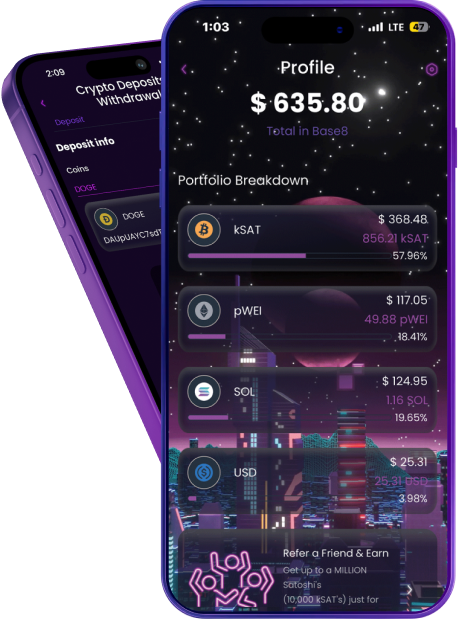

Discover the Power of the Satoshi App: A New Way to Earn Bitcoin

In the constantly changing universe of cryptocurrency, discovering straightforward means to obtain Bitcoin has turned into a mainstream aspiration for a lot of individuals. One revolutionary tool that's getting a great deal of consideration is the Satoshi app. As a crypto lover or an entry-level user getting familiar with digital money, the Satoshi app presents a simple and convenient route to begin constructing your Bitcoin portfolio.

What Is the Satoshi App?

The Satoshi app is a mobile app program aimed at assisting users in earning free Bitcoin rewards via different activities. The app has been named after Satoshi Nakamoto, the enigmatic founder of Bitcoin. The app connects with the philosophy of decentralized finance by enabling individuals to earn "sats" — a shortened term for satoshis, which are the smallest denominations of Bitcoin — without having to use complicated mining equipment or huge capital investments.

How the Satoshi App Works

Using the Satoshi app is straightforward. After downloading and creating an account, users can complete simple tasks, such as:

Answering surveys

Watching videos

Playing games

Participating in quizzes

Referring friends

Each activity rewards users with small amounts of Bitcoin, making the process engaging and rewarding. Over time, as you accumulate sats, you can transfer them to your Bitcoin wallet or use them in-app, depending on the platform's features.

Why the Satoshi App Is Popular

One of the central reasons the Satoshi app is increasing popularity is because it reduces the barrier to owning Bitcoin. There are a lot of people interested in crypto but afraid to spend their money on unstable markets. The Satoshi app offers a risk-free means to learn about Bitcoin and earn actual cryptocurrency.

Also, its friendly interface and minimum payout levels attract a wide client base. It does not require technical skills or previous knowledge about crypto to join.

Tips for Maximizing Your Earnings

If you want to make the most out of the Satoshi app, here are a few tips:

Be consistent: Completing daily tasks can steadily grow your Bitcoin balance.

Refer friends: Many apps offer bonus rewards for successful referrals.

Stay updated: New tasks and promotions can boost your earnings, so check the app regularly.

Final Thoughts

Satoshi App is a great starting point for anyone interested in making money with Bitcoin without taking a complicated or high-risk approach. Though you won't be a millionaire overnight, the app provides an entertaining and instructional experience that can lead you to the world of digital currencies. If you are ready to learn and earn, installing the Satoshi app could very well be the beginning of the thrilling world of Bitcoin.

0 notes

Text

Understanding Bitcoin to SATs: Why It Matters for New Crypto Users

As Bitcoin becomes more mainstream, there's a growing need to understand how it’s broken down into smaller units. You might’ve heard terms like SATs or satoshis floating around—but what do they actually mean? If you're just entering the crypto world, understanding the conversion from Bitcoin to SATs can make all the difference when dealing with small transactions or micro-rewards.

What Are SATs?

SATs or satoshis are the Bitcoin's smallest denomination. They are named after Bitcoin's elusive originator, Satoshi Nakamoto, and a SAT is worth 0.00000001 BTC. That is:

1 Bitcoin = 100,000,000 SATs

Just like a dollar divides into 100 cents, Bitcoin divides into SATs—on a very smaller level. It is how Bitcoin is made usable in everyday transactions, whether or not it experiences its prices rise to thousands of dollars.

Why to exchange Bitcoin to SATs?

The higher the price of Bitcoin, the fewer individuals will pay in whole Bitcoins on a daily basis. Look at buying a cup of coffee. You will not tell someone, "This coffee is worth 0.000042 BTC." Rather, it would be more convenient to say, "This coffee is worth 4,200 SATs."

This conversion unit makes Bitcoin more convenient for small transactions and microtransactions, particularly for novices or nations where even minor amounts of BTC are very precious.

How to Trade Bitcoin to SATs

The conversion of SATs to Bitcoin is straightforward:

Multiply the value of Bitcoin by 100,000,000.

For example:

0.01 BTC = 1,000,000 SATs

0.0005 BTC = 50,000 SATs

There are even online converters and crypto wallets that will display balances in SATs automatically for better comprehension.

Advantages of Using SATs :

Clarity: When working with small amounts of Bitcoin, SATs remove the ambiguity introduced by the presence of multiple decimal points.

Micro-earnings: Most crypto faucets and reward apps pay users in SATs, so users can accumulate small amounts of Bitcoin over time.

Adoption: As increasingly merchants take on Bitcoin, SAT prices bridge the informational gap to the consumer.

Bitcoin to SATs in Real Life Apps and platforms have simplified SATs by enabling users to toggle between BTC and SAT displays. SATs are usually used as the default unit in the Lightning Network, which is for fast, low-fee transfers because of the low values of what is being transferred.

Final Thoughts :

Learning Bitcoin to SATs is vital as Bitcoin keeps developing into a global digital currency. Whether you are investing, being paid, or buying something, knowing how SATs function makes you more comfortable in the crypto economy. As the usage increases, look for SATs to become the cents of Bitcoin—and a doorway to making crypto accessible and usable in everyday life.

0 notes

Text

The Importance of Regularly Checking Your Bitcoin Wallet Balance

Financial awareness in the cryptocurrency domain requires users to keep their wallet funds under constant review. Checking your wallet balance frequently contributes to both sound asset administration and security protection against possible threats. This paper examines why wallet balance checks should be done regularly while presenting real-world tips for crypto financial fitness success.

Understanding Wallet Balance

A particular wallet shows its cryptocurrency value through the wallet balance. The wallet balance shows every transaction made in addition to arrival and departure transfers by presenting your immediate holdings. Understanding your wallet cryptocurrency amount correctly creates the essential foundation to make both investment decisions and outline upcoming transactions.

Why Regularly Checking Your Wallet Balance Matters

Early Detection of Unauthorized Activity Regularly reviewing your wallet balance enables you to spot any unauthorized transactions promptly. Early detection is vital in the cryptocurrency realm, where transactions are irreversible. By identifying discrepancies swiftly, you can take immediate action to secure your assets and prevent further losses. citeturn0search2

Accurate Financial Tracking Consistent monitoring ensures that your records align with actual holdings, facilitating accurate tracking of your funds. This practice is especially important for active traders and investors who need to assess their portfolio's performance and make strategic decisions based on current data. citeturn0search2

Informed Investment Decisions Understanding your wallet balance allows you to make informed choices regarding buying, selling, or holding assets. It provides clarity on your financial position, enabling you to capitalize on market opportunities and manage risks effectively.

Ensuring Transaction Accuracy Regular checks help verify that all transactions have been processed correctly. This includes confirming that received payments have been credited and sent payments have been deducted appropriately, ensuring the integrity of your financial dealings.

How to Check Your Wallet Balance

The method for checking your wallet balance depends on the type of wallet you use:

Mobile and Desktop Wallets: Open the wallet application and navigate to the balance or home section to view your holdings.

Hardware Wallets: Connect your device to the corresponding software interface to access balance information.

Online Wallets: Log into the web platform to review your balance.

Blockchain Explorers: Input your wallet address into a blockchain explorer to view balances and transaction history without accessing the wallet directly. citeturn0search0

Best Practices for Wallet Balance Monitoring

Set Regular Check Intervals: Establish a routine for monitoring your wallet balance, such as daily or weekly reviews, to maintain consistent oversight.

Utilize Secure Devices: Always use trusted and secure devices when accessing your wallet to prevent exposure to malware or phishing attacks.

Keep Software Updated: Regularly update your wallet software to benefit from the latest security features and improvements.

Maintain Backup Records: Keep secure backups of your wallet's private keys or seed phrases to ensure recovery options in case of device failure or loss.

Conclusion

Regularly checking your wallet balance is a fundamental practice for anyone involved in cryptocurrency. It enhances security, ensures accurate financial tracking, and empowers you to make informed investment decisions. By integrating routine balance checks into your financial management habits, you can navigate the crypto landscape with greater confidence and control.

0 notes

Text

How to Earn Satoshi: A Beginner’s Guide

The financial world has been transformed by cryptocurrency, and earning Bitcoin in smaller units known as Satoshis is growing in popularity. We'll look at a number of ways to earn Satoshi in this article to help you get started in the cryptocurrency world.

A Satoshi: What Is It?

The smallest Bitcoin (BTC) unit is called a Satoshi, after its inventor, Satoshi Nakamoto. 100 million Satoshis are equivalent to one Bitcoin. This enables you to earn Satoshis even if you are unable to purchase a whole Bitcoin.

1. Faucets for cryptocurrency

Platforms known as "crypto faucets" give users Satoshis in exchange for performing easy tasks like playing games, watching advertisements, or solving captchas. Even though the payouts are little, they're an enjoyable and cost-free method to gradually accrue Satoshis.

2. Games to Play to Earn

Players that reach game milestones in blockchain-based games are rewarded with cryptocurrency, such as Satoshis. This is an entertaining and engaging method to earn digital assets while playing games.

3. Surveys and Microtasks

Websites such as Bituro and StormX reward users with Bitcoin for viewing films, conducting surveys, and doing other online tasks. Anyone with free time who wants to earn Satoshi without making an initial expenditure should use this strategy.

4. Cryptocurrency Lending and Staking

If you currently hold cryptocurrency, you can generate passive income by lending or staking your assets on cryptocurrency platforms. Over time, gains from this approach can be substantial, despite the inherent risk.

5. Referrals and Affiliate Programs

Numerous cryptocurrency businesses have affiliate programs that reward referrals with Satoshis. As more people sign up and make purchases, sharing your exclusive referral link might provide passive revenue.

6. Cloud mining and mining

By adding processing power to the network, you can earn Satoshi by mining Bitcoin directly or through cloud mining services. However, this approach necessitates a large equipment purchase or payment for cloud services.

Advice for Increasing Satoshi Profits

Remain Consistent: Over time, little everyday efforts build up. Research Platforms: Steer clear of frauds by using trustworthy services. Safe Wallet: For security, keep your Satoshis in a reliable cryptocurrency wallet.

Conclusion

Even if you have little money, earning Satoshis is a great way to get engaged in the cryptocurrency sector. There are several options available, ranging from mining to playing games and finishing questionnaires. Watch your cryptocurrency profits increase over time by starting small and being steady.

0 notes

Text

A Quick Guide to BTC to Sats Understanding

The way we think about money has been completely transformed by cryptocurrency, and within the Bitcoin network, satoshis—often shortened to sats—are a tiny unit of measurement that is becoming more and more popular. Converting Bitcoin (BTC) into its smallest unit, satoshis, which are named after the enigmatic Bitcoin founder, Satoshi Nakamoto, is known as "BTC to sats." The definition of Bitcoin and its significance in the cryptocurrency industry will be covered in this guide.

What Are Satoshis?

The smallest portion of a Bitcoin is called a satoshi. One bitcoin is worth 100,000,000 satoshis. The satoshi is equivalent to one hundred millionth of a bitcoin. Although many people consider Bitcoin to be pricey, particularly given its volatility, satoshis make it more accessible by enabling smaller, easier-to-manage transactions.

Why Convert BTC to Sats?

When dealing with microtransactions or trading on platforms, it is frequently more practical to measure smaller quantities because the value of Bitcoin can fluctuate. For example, a single Bitcoin can be quite costly for people wishing to invest tiny sums of money if its value exceeds $50,000. Investors can readily divide that value into more manageable components by employing sats.

Changing Bitcoin to Sats

All you have to do is multiply the quantity of Bitcoins you own by 100,000 to convert them to Sats. Here's a brief illustration: A balance of 0.01 Bitcoin is equal to one million satoshis. You will have 50,000 satoshis if you have 0.0005 BTC. Many cryptocurrency wallets and exchanges display both the BTC and satoshi values, making it easy for users to see the actual value of their holdings in both currencies.

Why Does the BTC to Sats Conversion Matter?

It's crucial to comprehend BTC to sats since it gives you more options when working with the cryptocurrency. For instance, the growing popularity of satoshis makes Bitcoin a more practical way to pay for minor transactions, including tipping, purchasing inexpensive goods, or even using internet services. More companies and people are learning to take payments in lower amounts as Bitcoin use rises, which should make Bitcoin a more useful means of exchange overall.

Additionally, as Bitcoin gains popularity as a store of currency, its relevance to sats is growing. Satoshis make Bitcoin more accessible and inclusive by enabling users to possess a portion of the cryptocurrency without having to buy an entire unit.

Conclusion

In the field of cryptocurrencies, particularly Bitcoin, BTC signifies a move towards more accessible and detailed financial transactions. More people can engage in the cryptocurrency economy and conduct transactions at any size, whether it's a quarter of a Bitcoin or the full amount, thanks to the capacity to divide it up into smaller parts. Knowing and utilising satoshis will contribute to Bitcoin's continued development as a useful and accessible digital currency.

0 notes

Text

The Secret to Quicker and Cheaper Bitcoin Transactions: The Bitcoin Lightning Wallet

Although Bitcoin has revolutionised the financial industry, issues with transaction prices and speed are becoming more prevalent as it gains traction. Bitcoin transactions can frequently be sluggish and expensive, particularly when traffic is heavy. The answer? a Bitcoin Lightning Wallet, which uses the Bitcoin Lightning Network's strength to provide quick, inexpensive transactions. We'll discuss the definition of a Bitcoin Lightning Wallet, its operation, and the reasons it's transforming Bitcoin transactions in this blog.

What is a Bitcoin Lightning Wallet?

A Bitcoin Lightning Wallet is a digital wallet that speeds up and lowers the cost of transactions by utilising the Bitcoin Lightning Network. Conventional Bitcoin transactions necessitate blockchain confirmations, which, depending on network congestion, may take minutes or even hours. On the other hand, users can establish private payment channels using the Lightning Network, a second-layer solution that is constructed on top of the Bitcoin blockchain. Bypassing the requirement that every transaction be directly recorded on the blockchain, these channels allow users to transact virtually instantaneously.

How Does a Bitcoin Lightning Wallet Work?

When you open a Bitcoin Lightning Wallet, it establishes a payment channel with another user or group of users. This channel allows multiple transactions to occur “off-chain,” meaning they aren’t recorded on the blockchain until the channel is closed. Here’s how the process generally works:

Wallet Funding: To begin, add Bitcoin to your Lightning Wallet. The blockchain records this first deposit, creating a channel with the recipient.

Using the Lightning Network for transactions: You can transmit and receive Bitcoin from your counterparties quickly as soon as the channel is open. Since blockchain miners are not needed to validate each transaction, transactions using this channel are essentially free.

Closing the Channel: The wallet closes the channel when you're finished using it, and the blockchain records the final balance. The transaction load on the Bitcoin blockchain is greatly reduced by this method, which only permits the recording of the two primary transactions (starting and shutting the channel).

Benefits of Using a Bitcoin Lightning Wallet

Faster Transactions: Lightning Network transactions happen almost instantly. Because of its speed, Bitcoin is more useful for routine purchases when it is impractical to wait for blockchain confirmations.

Low Fees: Compared to conventional Bitcoin transactions, Lightning transactions have far lower fees because they take place off-chain. Micro transactions are made feasible by this, which is especially helpful for tiny, routine purchases.

Improved Scalability: The Lightning Network makes it easier for Bitcoin to grow by lessening the strain on the main network. Bitcoin can handle further adoption since more users may transact without overloading the network.

Privacy: Off-chain transactions offer added privacy because they are not immediately visible on the public blockchain. Only the opening and closing transactions are recorded, making it harder to track activity within the channel.

Conclusion

Anyone wishing to conduct quick, inexpensive Bitcoin transactions needs a Bitcoin Lightning Wallet. Through the usage of the Lightning Network, these wallets allow users to transact instantly and affordably while avoiding the congestion of the main Bitcoin blockchain. A Bitcoin Lightning Wallet is an effective way to simplify your Bitcoin experience, regardless of whether you use Bitcoin frequently or are just searching for a more effective way to make payments.

0 notes

Text

How to Earn Satoshi: An Introductory Guide to Bitcoin Purchasing

Bitcoin maintains its position as the most widely used digital currency in the ever-evolving field of cryptocurrencies. Although Satoshis, the smallest unit of Bitcoin and its mysterious creator, Satoshi Nakamoto, are not widely known, many people are familiar with Bitcoin. Since one Bitcoin is the same as 100 million Satoshis, they are a practical way for newcomers to get involved with Bitcoin without having to put money into the whole coin. Here are some efficient ways to earn Satoshi if you want to increase the size of your crypto portfolio.

Understanding Satoshi

Before looking at how to earn satoshi, it's important to know what it is. As previously stated, 1 Satoshi is equivalent to 0.00000001 BTC. Earning Satoshi allows you to gradually accumulate Bitcoin as the price of Bitcoin rises. People who are cautious about investing large sums of money in cryptocurrencies will particularly find this strategy appealing.

Ways to Earn Satoshi

Bitcoin Faucets: Ways to Make Money with Bitcoin Faucets are websites that give away small amounts of Bitcoin to people who do simple things like take surveys, watch ads, or play games. Despite the small earnings per task, they can add up over time. Freebitco.in and Cointiply are two well-known faucets where you can earn Satoshi by completing various tasks.

Platforms for Microtasking : Microtasking lets you earn Satoshi by completing brief online tasks. Users can earn cryptocurrency by completing surveys, testing apps, or participating in other digital tasks on websites like Coinbucks and Bituro. Using this strategy can be a straightforward and lucrative way to earn Satoshi while also contributing to product and market research.

Programs for Bitcoin Rewards : A number of apps and platforms offer rewards in Bitcoin for everyday purchases. When you shop at partner retailers, you can earn Satoshi through services like Lolli and Fold. You can get a portion of your purchase back in Bitcoin by linking your credit or debit card, making your spending work for you.

Marking and Yield Cultivating : For the people who are more knowledgeable about the digital currency space, marking and yield cultivating can be rewarding ways of acquiring Satoshi. To support the network's operations and receive rewards, stake involves holding a cryptocurrency in a wallet. In contrast, yield farming involves lending cryptocurrency for interest on decentralized finance (DeFi) platforms. Even though these strategies may necessitate a greater level of understanding and initial investment, they have the potential to provide significant returns over time.

Participating in Airdrops : Tokens or Satoshi are given away for free to wallet holders through airdrops. Cryptographic money projects frequently lead airdrops to advance new tokens and support reception. You can stay up to date on upcoming airdrops and increase your chances of earning free Satoshi by joining the communities of a variety of crypto projects and following them on social media.

Mining : Mining is the process of adding transactions to the blockchain and verifying them. You can join mining pools, which let you pool your computing power with others, despite the fact that mining Bitcoin requires a lot of resources and technical know-how. By contributing to the pool in this manner, you can earn Satoshi without spending a lot of money on hardware.

In conclusion, anyone interested in cryptocurrencies has the unique opportunity to gradually accumulate Bitcoin by earning Satoshi. There are numerous ways to build your crypto portfolio without investing a lot of money up front, including faucets, microtasks, rewards programs, and more advanced strategies like mining and staking. To ensure a secure experience, remember to conduct thorough research and select dependable platforms as you investigate these options. You can successfully earn Satoshi and begin your journey into Bitcoin with patience and persistence.

0 notes

Text

Learning How to Use the Satoshi Calculator to Convert Bitcoin's Tiniest Units

The smallest unit of Bitcoin, the satoshi, lets users do business in fractions, making Bitcoin accessible to everyone, even to people who don't own a full BTC. Anyone looking to convert satoshis (sats) to Bitcoin (BTC) or other currencies can benefit from using a satoshi calculator, which makes it simple to comprehend the value of even the smallest amounts of Bitcoin.

A Satoshi: What Is It?

One hundred millionth of a Bitcoin (0.00000001 BTC) is represented by a satoshi, named after the anonymous creator of Bitcoin, Satoshi Nakamoto. Being able to divide Bitcoin into satoshis enables users to manage smaller amounts for transactions, micro-purchases, and tipping as its popularity grows and its price fluctuates. Knowing how many satoshis a Bitcoin contains and how much they are worth in fiat currency is becoming increasingly important as more merchants accept Bitcoin payments.

What is the Operation of a Satoshi Calculator?

A satoshi calculator is a tool that makes it simple for users to convert between satoshis and Bitcoin or between satoshis and monetary units such as dollars, euros, or pounds sterling. Users can see how much a specific amount of Bitcoin or satoshis is worth at any given time because the calculator uses real-time exchange rates to provide accurate conversions.

A satoshi calculator, for instance, would show that one satoshi is equivalent to 0.0003 USD for a BTC that is worth $30,000 Also, it can quickly figure out how much Bitcoin you have if you have 100,000 satoshis, for example.

What's the Use of a Satoshi Calculator?

For small transactions, a simple conversion: The smallest Bitcoin units permit flexibility, particularly in microtransactions. Users can quickly comprehend precise values without having to manually convert them with a satoshi calculator.

Investing Strategies: Satoshi calculators are used by a lot of investors to see how much their portfolios are worth in smaller units as they accumulate Bitcoin over time.

Valuation in Real Time: A satoshi calculator uses real-time data to provide precise conversions and helps users comprehend the current value of their satoshi holdings because the price of Bitcoin can fluctuate significantly throughout the day.

Where to Find a Satoshi Calculator

Websites, exchange platforms, and wallet apps are all available online. Calculators are frequently integrated into major cryptocurrency exchanges, and there are also specialized websites like CoinMarketCap and CoinGecko that provide tools for conversion. Satoshi calculators are included in many mobile crypto wallets, making it simple for users to track and convert their satoshis while on the go.

The usage of a satoshi calculator is straightforward. A quick guide is as follows:

Input: Enter the Bitcoin (BTC) amount or the number of satoshis you want to convert. Select a currency: Choose a fiat currency, such as USD, EUR, or GBP, to be converted. Calculate: To obtain the precise value in real time, press the "Convert" or button that is similar to it.

You can easily figure out how much BTC you can buy with a certain amount of money by entering a fiat amount into some calculators to see how many satoshis or Bitcoin it is worth.

Conclusion, Anyone working with small amounts of Bitcoin will benefit greatly from using a satoshi calculator. It makes it easier to convert between the smallest unit of Bitcoin and fiat currencies, allowing you to easily manage transactions, comprehend market value, and increase your Bitcoin holdings. Having access to a satoshi calculator enables you to remain informed and make faster, more effective financial decisions, regardless of whether you are a novice investor or an established Bitcoin user.

0 notes

Text

A Strategic Approach to Digital Assets: An Understanding of Bitcoin Reserve

The term Bitcoin reserve has gained a lot of traction among investors, businesses, and financial institutions in the ever-evolving field of cryptocurrencies. Holding Bitcoin reserves has become a smart strategy for diversifying portfolios and safeguarding wealth as more organizations recognize its value. In this blog, we'll investigate what Bitcoin holds are, their importance, and how to oversee them successfully.

A Bitcoin Reserve: What is It?

A Bitcoin save alludes to the amount of Bitcoin that an individual, organization, or association holds for different purposes, like speculation, liquidity the board, or as a support against financial insecurity. Bitcoin reserves, like traditional reserves in commodities or fiat currencies, can be crucial to financial strategy. They can be used as collateral for loans or other financial instruments and serve as a buffer during periods of market volatility.

The Value of Bitcoin Reserves

Protection Against Inflation: One of the essential reasons financial backers are going to Bitcoin saves is to fence against expansion. The purchasing power of fiat currencies is decreasing as the money supply is being increased by central banks worldwide. Bitcoin is a deflationary option with a limited supply of 21 million coins that has the potential to maintain value over time.

Portfolio Expansion: Integrating Bitcoin into a venture portfolio can improve broadening. Bitcoin's cost developments frequently vary from customary resources like stocks and bonds, making it an alluring choice for spreading risk. By holding Bitcoin saves, financial backers might possibly balance misfortunes in other resource classes.

Liquidity: In a market that moves quickly, individuals and businesses can maintain liquidity by having a Bitcoin reserve. Bitcoin is a versatile asset for managing short-term financial requirements because it can be quickly converted into cash or used for transactions.

Increasing Adoption in Institutions: Many organizations, including Tesla, MicroStrategy, and Square, have added Bitcoin to their monetary records as a save resource. This institutional reception not just legitimizes Bitcoin as a store of significant worth yet in addition shows a change in how companies view computerized resources. As additional establishments perceive Bitcoin's true capacity, the interest for saves is probably going to increment.

Methodologies for Building a Bitcoin Reserve

Mitigating risk over time (DCA): One compelling method for aggregating Bitcoin holds is through mitigating risk over time. This methodology includes buying a decent dollar measure of Bitcoin at normal stretches, no matter what its cost. DCA mitigates the impacts of instability, permitting financial backers to steadily collect Bitcoin.

Lockable Storage: Security is of the utmost importance when creating a Bitcoin reserve. To store your Bitcoin offline, you can make use of hardware wallets like Trezor or Ledger. Your assets are shielded from online threats and hacking by this. Consider using multi-signature wallets for larger reserves, which provide an additional layer of security by requiring multiple approvals for transactions.

Remain Informed: The landscape of cryptocurrencies is rapidly evolving. Staying aware of market patterns, administrative turns of events, and innovative headways is fundamental for settling on informed conclusions about your Bitcoin saves.

Put forth Clear Objectives: Establish your goals for maintaining Bitcoin reserves. Do you want to make money, build wealth, or conduct business with Bitcoin? Your strategy will be guided by clear goals, making it easier to stay focused.

In conclusion, maintaining a bitcoin reserve can be an effective and strategic strategy for managing digital assets. The significance of having reserves is likely to rise as more individuals and organizations acknowledge Bitcoin's value. You can position yourself for potential financial growth in an increasingly digital world by comprehending the advantages of building and securing Bitcoin reserves and employing efficient strategies. Whether you're a carefully prepared financial backer or simply beginning, consider the benefits of integrating Bitcoin into your monetary system today.

0 notes

Text

The Complete Guide to Crypto Lead-In to Coin for Novice Investors

Understanding the concept of a crypto lead-in to coin can be crucial for anyone interested in getting involved in the rapidly expanding field of cryptocurrencies. The process or steps that assist in guiding potential investors or users from their initial interest in cryptocurrency to making their first coin investment are referred to as this concept. It doesn't matter if you've never heard of digital currencies before or are already familiar with crypto; the key is to know how to move from curiosity to action.

In this blog, we'll talk about what a crypto lead-in to coin is, the most important steps to take to get started, and how to choose wisely when investing in cryptocurrencies.

What is a Crypto Lead in to Coin?

The process of introducing potential investors to the cryptocurrency industry is known as a "crypto lead-in." In this phase, people are taught about cryptocurrency, how it works, and why investing in it might be worthwhile. It basically serves as a warm-up before you buy your first coin.

This may entail researching various cryptocurrencies, comprehending blockchain technology, acquiring knowledge of wallets, and comprehending the fundamentals of cryptographic security. Depending on how comfortable and familiar an individual is with the idea, the lead-in phase can be long or short.

The Crucial Role of Education in the Pre-Installation Phase

The crypto industry is fraught with difficulties. Without a clear understanding of the risks and rewards, many investors jump in, frequently resulting in frustration or financial loss. As a result, acquiring the appropriate knowledge should be the primary focus during the lead-in phase.

Prior to making a coin investment, key areas of investigation include:

The technology of blockchain: Since this is the foundation of all cryptocurrencies, it's important to know how it works.

Various kinds of coins: From Bitcoin and Ethereum to alternative cryptocurrencies like Cardano and Solana, there are thousands of cryptocurrencies. The technology, community, and use case behind each coin are unique.

Basics of security: Securing your assets necessitates the use of crypto wallets, two-factor authentication, and secure trading strategies.

You'll be better able to choose which coins to invest in and how to securely manage your holdings if you build a solid foundation.

Moving from Lead-In to Coin Investment

After learning about the fundamentals of cryptocurrency, the first step is to invest. Effectively navigating this transition is as follows:

Select a digital currency: Choose a coin that meets your investment objectives based on the information you gathered during the lead-in phase. Due to their liquidity and long-term growth potential, Bitcoin and Ethereum are excellent starting points.

Choose an Platform: To purchase your first coin, you will need to select a crypto exchange. Platforms like Binance, Coinbase, and Kraken have intuitive user interfaces for novices.

Establish a Wallet: Consider creating a crypto wallet to safeguard your coins if you are investing over the long term. A higher level of security is provided by hardware wallets like Ledger and Trezor than by keeping funds on an exchange.

Begin small: It's best to start small because the cryptocurrency market can be volatile. You are able to familiarize yourself with the market in this way without taking on a lot of risk.

Final Thoughts

Any newcomer to the cryptocurrency industry must complete the crypto lead-in to coin journey. It will be easier to have a smoother experience if you educate yourself, comprehend the risks, and begin investing slowly with your first investments. You will be able to make sound investment decisions if you are prepared and well-informed as the crypto market continues to change.

If you're ready to embark on your crypto adventure, take it one step at a time and you'll be confidently investing in your first coin.

1 note

·

View note