Text

3 Easy Steps To Sell Your Bitcoin In The Philippines

With the price of bitcoin price soaring to $11,900 within Q3 of 2019, cryptocurrency enthusiasts and new adopters alike are looking for new ways to can cash in and out of their bitcoin holdings. Whether it's your first time hearing about bitcoin or if you have been a long time bitcoin holder, there is still a lot of questions facing how bitcoin can be sold and traded into Philippine peso (PHP).

In this quick guide we will share with you some factors to take into consideration when selling your first bitcoin, as well as the best and most efficient ways to cash out from BTC to PHP.

1. Work with a Banko Sentral ng Pilipinas (BSP) accredited company

The BSP has been very open to virtual currencies such as bitcoin. With the Philippines crypto-friendly environment, bitcoin adoption has been on the rise as the Securities and Exchange Commission (SEC) has been working hard on cryptocurrency related transaction guidelines. BSP launched Circular no944, or the Guidelines for Virtual Currency Exchanges (VCE), back in 2017 with 13 companies within the Philippines including Rebittance Inc., a wholly owned subsidiary of Satoshi Citadel Industries (SCI), Etranss Remittance International Corp., Fyntegrate Inc., and others. The VCE license legally allows these firms to exchange crypto, such as bitcoin, to fiat, such as Philippine peso, in the Philippines. To avoid any unwanted scams or any illegal transactions, you can buy and sell bitcoin with these VCE registered and licensed exchanges.

2. Fastest way to sell bitcoin

Now that it is clear to us how we can transact bitcoin safely within the Philippines, let's talk about how we can sell bitcoin conveniently.

In order for you to sell bitcoin in the Philippines, it is required that you register across any VCE accredited company. Buybitcoin.ph, a service of VCE registered company Rebittance, Inc., allows you to register for free and allows you to buy or sell bitcoin within the Philippine exchange market.

Below are the steps for selling bitcoin after you have completed your registration:

Create a sell order on the exchange, reflecting how much bitcoin you want to sell.

Send your bitcoin to the exchange for cash out processing. You can send your bitcoin via QR code or wallet address.

Sell order sample:

It’s as simple as that! The transacted PHP amount will be credited and will be available via cash out though your selected pay out method. If you transacted via Buybitcoin.ph, you can receive your cash within 1-business working day.

3. Cashing out over the counter (OTC)

There is an option to do cash out transactions over the counter as well. Assuming you are already registered with the exchange provider, you can directly message and engage with providers for a quicker turnaround time.

Buybitcoin.ph offers real-time feedback though Facebook Messenger Chat as well as other channels such as Viber & Whatsapp (0999-229-5607 or 0999-229-5608) or Telegram (@borjcosco or @niechaln). Below is the step-by-step process:

Message exchange via social media or chat channels.

Buybitcoin.ph exchange will share with you the agreed BTC sell price.

Buybitcoin.ph exchange provides wallet address for sending bitcoin.

Once the bitcoin is received, Buybitcoin.ph exchange shares payout schedule.

Buybitcoin.ph exchange deposits Philippine peso straight to your shared bank account.

FAQ: When is the right time to sell bitcoin? Let’s be honest, no one can read the bitcoin market future. The best way you can make an informed decision would be for you to understand the underlying technology behind bitcoin which is blockchain technology while exploring BTC's historical trends.

Whether your strategy is related to buying low and selling high or investing periodically via cost averaging, you must take responsibility when making your financial decisions and weigh out the risks and reward. At the end of the day, be sure to invest responsibly and educate yourself on the potential of blockchain technology and bitcoin. You can keep up to date with the latest cryptocurrency & blockchain events in the Philippines though BlockchainSPACE Philippines.

Rebittance Inc. - is registered with the Bangko Sentral ng Pilipinas (BSP) as a Remittance and Transfer Company (RTC) Type A Remittance Agent with Money Changing (MC) / Foreign Exchange Dealing (FXD) Virtual Currency Exchange (VCE) service (MSB Registration No. 60-00107-0-00000.) BSP – Financial Consumer Protection Department (Tel. No.: (632) 708.7325; Fax No.: (632) 708.7345)

0 notes

Text

Quick & Easy Guide In Buying Your First Bitcoin In The Philippines

So you want to buy your first bitcoin? Congratulations, you have taken the first step in your journey towards being a bitcoin holder.

Bitcoin is a digital currency and payment network which uses open-source and peer-to-peer technology to operate with no central authority or banks. Simply put, bitcoin allows people to store, send, and receive digital currency across the internet.

The best way to learn more about bitcoin would be to understand its underlying technology which is blockchain. In this guide you will see important points one should consider when buying bitcoin, inclusive of a quick walkthrough of the easiest and most effective ways to convert PHP to BTC.

1. Working with a Banko Sentral ng Pilipinas (BSP) accredited company

The BSP has been actively regulating virtual currencies such as bitcoin in the Philippines. With the Philippines crypto-friendly environment, bitcoin adoption has been on the rise as the Securities and Exchange Commission (SEC) has been working hard on cryptocurrency related transaction guidelines. BSP launched Circular no944, or the Guidelines for Virtual Currency Exchanges (VCE), back in 2017 with 13 companies within the Philippines including Rebittance Inc., a wholly owned subsidiary of SCI Ventures, Inc., Etranss Remittance International Corp., Fyntegrate Inc., and others. The VCE license legally allows these firms to exchange crypto, such as bitcoin, to Philippine peso. To minimize risk of any unwanted scams or illegal transactions, we suggest coursing your transactions through these registered and licensed VCEs.

2. The first step in buying bitcoin

Now that we understand the importance of transacting bitcoin safely though accredited VCE holding companies in the Philippines, let's talk about the different methods in buying bitcoin. For you to buy bitcoin in the Philippines, you must first open and register an account through a VCE accredited company. For those based in the Philippines, you can buy bitcoin by signing up and registering your account with BuyBitcoin, a service of VCE registered company Rebittance, Inc. Below is a quick instruction guide in creating your free account within Buybitcoin.ph

Go to www.buybitcoin.ph and click ‘Sign Up’ from the homepage.

Enter your email address, full name (as shown on your valid ID), desired password, then check the box “I’m not a robot” for verification.

Once done, click ‘Create Account’ which will lead you to the verification process.

Follow the verification instructions, submit the necessary required information and documents, and you will be on your way to buy your first Bitcoin.

3. Choose your way of buying Once you have created your account, you can top-up your bitcoin wallet through any of the following methods.

Login to your verified Buybitcoin account

On the Buybitcoin.ph Home screen, Click or Tap “Receive” to view Peso (PHP) wallet loading options and select your preferred option.

Top up process may vary slightly depending on the option you will select. Current top up options available include Buybitcoin bank partner - Sterling Bank of Asia, Cebuana, Dragonpay, and 7-11.

Deposit cash via partner bank

Specify the amount to load into the wallet.

Select a Buybitcoin bank partner to deposit cash to. (Sterling Bank, BPI, PNB, RCBC, Security Bank, UCPB, Unionbank)

Deposit to selected bank partner and write down the deposit reference no. on the deposit slip.

Upload a photo of the deposit slip.

To ensure transaction security, you will be required to enter your Buybitcoin password before any transaction can be completed.

Top-up via Cebuana

Specify the amount to top up into your wallet and click on “Submit”.

Reference code and Buybitcoin’s registered receiver's name (Buybitcoin) for Cebuana Lhuillier will be generated on the next page.

Go to any Cebuana Lhuillier branch and fill up Cebuana’s Bills Payment Form indicating the amount, receiver's name (Buybitcoin), and reference code generated and submit to their teller to make the payment.

You will receive a notification once you have made the payment.

Once payment has been completed, the funds will automatically be added to your PHP wallet. Congratulations, your PHP is ready to be converted to BTC!

Top-up via 7-Eleven

Specify the amount to load into the wallet

From the list of ECPay partners, select 7-Eleven. A Buybitcoin reference number will be generated which will be used upon payment at 7-Eleven.

To ensure transaction security, you will be required to enter your Buybitcoin password before any transaction can be completed.

Proceed to any 7-Eleven branch with a Cliqq touch-screen payment kiosk.

Select E-Money, then Buybitcoin and enter your Buybitcoin reference no. and amount due on the kiosk - a physical receipt will be generated.

Hand over the generated kiosk receipt and cash to the 7-Eleven cashier to complete your payment and amount will be credited to your peso wallet.

FAQ: When is the right time to buy bitcoin? Whether you are planning on buying low or investing periodically via cost averaging, you are responsible for making your own financial decisions. Be sure to invest responsibly and while continuously educating yourself on the potential of bitcoin and its underlying technology, blockchain.

Keep up to date with the latest cryptocurrency & blockchain events in the Philippines though the BlockchainSpace Philippines community.

Rebittance Inc. - is registered with the Bangko Sentral ng Pilipinas (BSP) as a Remittance and Transfer Company (RTC). Type A Remittance Agent with Money Changing (MC) / Foreign Exchange Dealing (FXD). Virtual Currency Exchange (VCE) service (MSB Registration No. 60-00107-0-00000.). BSP – Financial Consumer Protection Department (Tel. No.: (632) 708.7325; Fax No.: (632) 708.7345)

0 notes

Text

How did you start your career?

It was back in 2013 when I first discovered Bitcoin. It was trading at around US$40 then, so I bought some. I read into its technicalities, and it became apparent that it was perfect for me - I was into tech, I'm a programmer, and I'm really interested in finance.

I met a number if people who were also interested in cryptocurrency, and together, we decided to set up a company; Satoshi Citadel Industries (SCI). The idea of it - cryptocurrency - was very vague back then. We just thought that Bitcoin would either blow up and be huge or be small. Either way, we took the leap and built something out of it.

What are you currently working on?

We're building a couple of new projects at SCI, one of which is an orderbook exchange called Citadax.

An orderbook exchange is similar to what a stock exchange is, except it's for cryptocurrency. We're at the final stages of launching that, pending regulations. We're also building an SCI network. We have a few products under our company and the network will combine and merge everything together into one token network.

What is your favorite part of the job?

Creating a product that could potentially be part and parcel of the future. I like that we have the opportunity to build something that has the potential to provide real value to other people. For example, in the space of blockchain, it's new technology that not many understand. But it we are successful in bringing products like this, people can learn more about it and take advantage of this technology in such a way that one may not yet realise. I want my company to be part of a future wherein blockchain technology is firmly entrenched in society and people are able to use it with ease and benefit from its advantages.

What's the biggest lesson you've learnt so far?

At the end of the ay, it's really about putting in the work. It doesn't matter how resourceful or wealthy or smart you are - work really has to come in.

For example, when we started in 2014, we engaged with the Central Bank. We told them that cryptocurrency is something they should start regulating and they refused, saying it was too small for them at the time. After three years we were able to convince them to come up with regulations and look into the whole industry. Now, they have set up a new unit within BSP to cover fintech or financial technology companies.

We need patience to endure and invest in all of this before seeing it come into fruition. But more importantly, we worked hard to lay the groundwork for all this. We also had to understand that being agile and versatile is necessary to move forward. So, you just really have to put in the work and be patient and just trust in what you're trying to do to be successful.

Photography: Alex Van Hagen;

Creative Direction & Styling: Monique Madsen;

Interview: Jeanna Lanting; Grooming: Myrene Santos;

Location: Discovery Primea Makati

Source: Philippine Tatler - Gen. T

https://ph.asiatatler.com/generation-t/2018-list/john-bailon

0 notes

Text

Philippines SCI Launches Enterprise Blockchain Solutions

SCI Blockchain Technologies is set up to lend SCI’s blockchain expertise to other companies wishing to leverage on the benefits of blockchain technology.

November 23, 2018. Blockchain company Satoshi Citadel Industries (SCI Ventures) has set up a Blockchain Innovation Division to help other businesses implement their own blockchain strategies.

The division, SCI Blockchain Technologies, is set up to lend SCI’s blockchain expertise to other companies wishing to leverage on the benefits of blockchain technology. With the increasing awareness of the public towards blockchain, SCI has experienced a surge of inquiries from small and medium enterprises (SMEs) who are interesting in implementing this new technology. “We want to help our customers decipher the value (blockchain) will bring to their businesses,” said Blockchain Innovation Division Head Peter Ing in a statement sent to BitPinas.

SCI has been building products around blockchain since its inception. The company is responsible for crypto wallet app Bitbit and also owns exchange site buybitcoin.ph. It was also in SCI where order-book style crypto exchange Coinage.ph (now a separate entity) was conceptualized. It is currently building Citadax, a new order-book style cryptocurrency exchange.

The company is also one of the first to acquire a virtual currency license from the Bangko Sentral ng Pilipinas (BSP).

In a way, setting up a division to focus on blockchain consulting makes sense for SCI. Cryptocurrency, a product of blockchain, and initial coin offerings, have witnessed declining interest with the public, but blockchain interest is growing from traditional businesses, education sector, and even the government. Regular meetups are happening in the Philippines on an almost weekly basis, centering mostly on blockchain. In several of these meetups, the consensus is that blockchain is, in reality, not a solution for everyone. This is acknowledged by Mr. Ing, who mentioned, “While blockchain is not a solution for everything, we promise honest guidance in helping companies determine that.”

In addition to Mr. Ing, SCI’s Chief Blockchain Architect Maro Mejia and Senior Blockchain Developers, Jerico James Flores and Tristan Peralta. Mr. Mejia is an early blockchain adopter and owner of Terravibe.com, the first bitcoin wallet in the Philippines, created in 2012. Mr. Flores and Mr. Peralta have built commercial grade apps for various companies with 10+ years of development experience.

0 notes

Text

Bitcoin Is Not A Get-Rich-Quick Scheme: How To Spot And Avoid Scams

When something becomes very popular, scammers are not far behind. When the internet was new, email scammers were victimizing people on a daily basis. Today’s version of this is happening in the Bitcoin and Cryptocurrency industry.

Since Bitcoin gained so much value in 2017, going from less than $900 per BTC in January to $5,700 today, the proliferation of get-rich-quick ponzi scams got much worse as well. The technology is so new that few people understand it, it has become easy to convince people to give up their hard earned money for the promise of impossibly massive earnings in a short time.

Bitcoin is a digital currency and a technological platform upon which financial services are built - it is NOT a get-rich-quick scheme.

How to spot a Bitcoin Ponzi scheme

Are you told that you have to have a “minimum” investment? Do they promise “guaranteed” returns of up to several percent per month? Do they show you pictures of lamborghinis and houses they bought from “mining” bitcoins?

If you answered yes to any of these questions, run the other way. That’s a ponzi scheme.

This tried and tested idea relies upon high yield investment programs and multi-level marketing. In this grey area schemes, a low initial investment can be multiplied by signing up additional members using referral links. Before long, hundreds of victims have joined the scheme. At a later point in time, the original scammer walks away and the pyramid collapses.

Other tips to protect yourself and others

1. Don’t trust anyone claiming they will give you or help you mine bitcoin, and avoid social media invites to join these money-making ventures. There is no such thing as guaranteed returns on cryptocurrencies.

2. If it is too-good-to-be-true, it probably is a scam.

3. When dealing with seemingly legitimate companies online, check if they are real registered companies. Better yet, ask to see their office or meet them in person. Be vigilant when engaging with the social media accounts of legitimate bitcoin brokers or trading platforms, as they are frequently victims of convincing impersonations as well.

4. Never engage in any financial transaction, bitcoin or otherwise, via direct message on social networks. These scammers use social media to reach tens of thousands of people and eventually will find someone to victimize.

5. When in doubt, call the BSP Consumer protection hotline. The BSP now regulates Bitcoin companies and they will be able to tell you if you are dealing with a licensed or at least legitimate company.

Consumer Assistance

Direct Line: 708-7087

Facsimile: 708-7088

Email Address: [email protected]

At the end of the day, greed is what these scammers rely on to succeed. Make sure you are informed about the investments you will make with your hard earned money.

1 note

·

View note

Text

SCI Leading The Public Education Effort for Cryptocurrency and Blockchain Tech in the Philippines

The blockchain and cryptocurrency industry has been quite busy this year, with Bitcoin reaching new heights by growing over 400% and the entire global cryptocurrency space keeping pace with it, growing to match the market cap of Bitcoin at almost $150 Billion combined today. As usual, more people are keen to learn about the technology, and SCI is leading the charge on this front with several media and speaking appearances just in the past months.

Here are some of the recent activities of SCI, as well as some announcements on future talks and conference appearances where you can catch up with us if you wish to do so!

Asia Tech Summit 2017 - The Asia Tech Summit featured a “What is Bitcoin and Blockchain” talk with SCI co-founder Miguel Cuneta presenting in the conference.

DLSU tech summit 2017 - SCI was back in DLSU to talk about Bitcoin and blockchain tech to future computer science professionals and entrepreneurs.

ANC on the money - SCI Co-founder Miguel Cuneta alongside BSP representative Melchor Plabasan on ANC’s TV Show “On The Money”, talking about cryptocurrency regulations in the Philippines, episode airing date to be announced.

DZRH news TV - The oldest radio station in the country at 78 years of broadcasting, DZRH News TV brings on Miguel Cuneta to talk about Bitcoin and Blockchain technology on their show.

Sustainability Summit 2017 - SCI participates in the Sustainability Summit 2017 to talk about how technology plays a key role today and will play an even bigger role in the future of sustainable development in the country.

The Asian Banker: Future of Finance 2017 - A premier banking conference attended by top banking officials in the region as well as the BSP’s top officials will feature several talks about blockchain technology and how it will play a big role in the future of the financial service industry, with SCI co-founder Miguel Cuneta participating as a panel speaker.

Seamless Philippines 2017 - SCI co-founder Miguel Cuneta and Chief of Compliance Rafael Padilla will be on a panel to talk about the future of payments and the role of blockchain technology in the financial service industry.

0 notes

Text

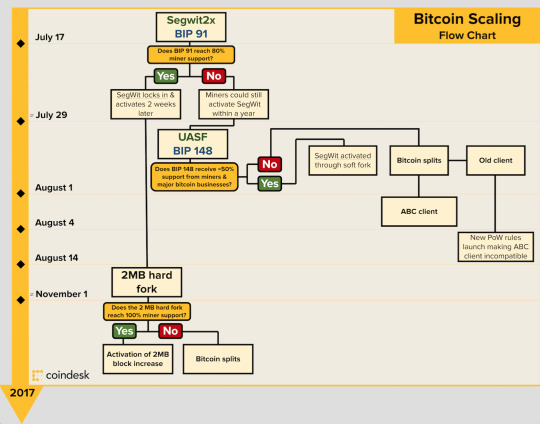

Public Service Announcement: What Will Happen to the Bitcoin Network on Aug. 1st, 2017?

The Bitcoin network is run by thousands of volunteer nodes and miners running the Bitcoin software to process transactions. The Bitcoin Blockchain maintains its integrity by making sure all the nodes are in agreement as to what is the most updated and accurate record of transactions in the network.

On Aug. 1st, 2017, some bitcoin nodes will try to force the miners to implement a protocol upgrade proposal called BIP148. They will attempt to do this because they believe that the recent explosive growth of Bitcoin has made the network slow and more expensive to use than before. One possibility is that if enough nodes decide to run a different version of the Bitcoin software, this might cause the chain to split, or what is called a “Hard Fork”. This will result in two versions of Bitcoin running at the same time. Here is an illustration of the possible scenarios (from Coindesk):

Four things that could happen: Your bitcoin balance will stay the same and you will be able to use it as usual. (likely)

You could be on the “wrong” chain and lose your Bitcoin balance. (unlikely)

You can have a balance on both chains and choose which one you want to use. (likely)

Nothing will happen, majority will adopt Segwit, and Bitcoin will continue onward (Most likely).

Most likely, this will be a non-event. As of this writing, Segwit (BIP91) has gotten locked-in and will likely be adopted, and looks like the community and industry are all after the same thing: for Bitcoin to keep improving and growing. The signs now point to an amicable and peaceful resolution to the scaling debate and we will see a burst in confidence from the market when we finally resolve this issue. Bitcoin price has rallied from $1850 to $2800 as of this writing due to this.

As a security measure, on August 1st, 2017, we will be temporarily suspending services that require the use of the bitcoin network including sending and receiving, buying and selling, payments, and remittances. This is to protect you, our customers, from any technical difficulties that might arise from the issue being resolved by the network. Rest assured that your deposits are safe and that we will resume regular services at the soonest opportunity. When it comes to financial services, we cannot be too careful. We strive to provide the best service and want to ensure that all your accounts are unaffected by whatever arises from the current situation.

If you have any questions or concerns, feel free to reach out to us!

For more detailed information, check out the official Bitcoin.org website.

0 notes

Text

Bitcoins and Bubbles: What To Do When The Market is Rising (or falling!) Like Crazy

Bitcoin and cryptocurrency valuations are at an all-time high. As of this writing, the combined value of these digital assets have exceeded $100 Billion, from $25 Billion just 3 months or so ago. There is a feeling of some kind of frenzy among crypto-enthusiasts, traders, investors, and now even the general public, and the mainstream media is eating it up and compounding the craziness. We would like to take this opportunity to tell our readers and customers to be rational in these seemingly irrational times. Assets that increase in value by 400% in 4 weeks can be quite dangerous for people who buy into the hype without actually understanding what they are getting into.

SCI has always refrained from providing investment advice because we believe that Bitcoin is more valuable as a technological platform than a speculative investment, and our business relies not on the exchange rate of bitcoins, but to the utility and reliability of the technology.

Here are a few tips from an old post we made a couple of years ago about what to consider if you are curious about what is happening in the cryptocurrency industry today:

1. DON’T PANIC!

Don’t panic. The “Fear of Missing Out” or FOMO is a powerful emotion. It can lead to irrational decision-making such as buying more bitcoins than you can afford. Calm down and understand that the market behaves in a very unpredictable way, and this price rise can suddenly turn into a price dump. Calm down and observe intelligently.

2. Invest only what you can afford to lose

Investing in ANYTHING is risky. It is easy to get caught up in the fact that the price is going up everyday so you can make some easy profit buying and selling. Bitcoin is much more than a speculative investment. It is an amazing technology that has great benefit to society as a whole. Go ahead and do trading, but make sure you are not breaking your piggybank or auctioning off your beloved dog just to buy more bitcoins

If you do decide, make sure you buy and sell bitcoins with the most trusted services like Buybitcoin.ph

3. Don’t believe anyone who tells you they can predict the price

Nobody can predict the future. Traders use past data to analyze the future, but it is impossible. The price is going up possibly because more people are buying bitcoin. Truth is, yes, there are many reasons as to why this happens so we can’t always listen to the first person who says they know what will happen with the bitcoin price. Again, keep calm and always rethink your decisions.

4. Beware of Scammers!

Scammers will come out of the woodwork when the price is going up just because they want your bitcoins. They will use the excitement of people to confuse everyone and try to make them commit mistakes when buying or selling bitcoins. Check out our Halloween post on how to defeat those annoying Bitcoin “Monsters”.

5. Do Your Own Research and LEARN

For bitcoin supporters and users, the price going up signifies that the industry is healthy and growing. This is a great time for new people to learn more about bitcoin and the amazing applications coming out for everybody’s benefit. Buy some bitcoins and SAVE it, put it in a wallet and don’t touch it, so you can just watch the price go up and down without any stress :)

Bitcoin is more than just a way to make quick profits. It is a revolutionary technology that will change the way we do finance and commerce online. The price of bitcoin will keep rising, and will also keep falling. What is important is that we understand how to take advantage of the technology without risking anything. If you are part of this community, you are already lucky, witnessing the emergence of a technology that we will all use to our benefit in the future.

0 notes

Text

What is Bitcoin and Blockchain Technology? This Comprehensive Resource List Has All The Answers For You.

What is bitcoin and the blockchain?

A comprehensive list of articles, blog posts, videos, books and courses to help get you started.

Bitcoin, Ethereum and other cryptocurrencies have recently been making a mainstream media frenzy because their prices are skyrocketing. Naturally, more and more people become interested and want to learn more, but have a hard time finding a good resource of easy-to-digest information about this technology.

Look no further. This list, put together by MIT Media Labs Digital Currency Initiative, is list of starter articles, blog posts, books and even entire university courses.

Please Feel free to share this list with others too. From beginner to advanced, everyone could learn something from the resources provided here.

Here you go!

Overviews (30–45 mins)

Here are several of the best short articles about Bitcoin by some of the brightest minds in the technology space, Including Marc Andreessen (Creator of Mosaic, the first modern web browser), Reid Hoffman (Founder of LinkedIn).

Why Bitcoin Matters by Marc Andreessen

Why the Blockchain Matters by Reid Hoffman

How Does Bitcoin Work? (video) by David Andolfatto

Programmable Blockchains in Context: Ethereum’s Future by Vinay Gupta

The Blockchain Application Stack by Joel Monegro

The Shared Data Layer on The Blockchain Application Stack by Joel Monegro

How Bitcoin Is Like SMTP by Joel Monegro

How The Blockchain Can Unshackle Us by Jalak Jobanputra

The Non-Expert’s Guide to the Mt. Gox Fiasco by Arianna Simpson

Applications (60–90 mins)

These are more specific articles about the benefits of Bitcoin tech, as well as practical applications for the technology in many different industries in today’s world.

Some ideas for native bitcoin apps by Chris Dixon

Certificates, Reputation and the Blockchain by Philipp Schmidt

Bitcoin Fact. Fiction. Future. by Tiffany Wan & Max Hoblitzell

State-Sponsored Cryptocurrency: Adapting the best of Bitcoin’s Innovation to the Payments Ecosystem by Deloitte

Elizabeth Rossiello Describes How BitPesa Slashes International Payment Fees by Laura Shin

Bitcoin Overview & Applications (video) by Brian Forde

How the blockchain will enable self-service government by Brian Forde &Michael Casey

Can Bitcoin Be Used For Good? by Chelsea Barabas & Ethan Zuckerman

Want to rent Star Wars? May the force be with you… by Brian Forde

Technical Overviews (2–4 hours)

The Original Bitcoin Whitepaper is here on this list. Only 8 pages long, this explains Bitcoin from the words of the creator of Bitcoin himself. Other links provide a more in-depth view of the technology and its applications.

Bitcoin: A Peer-to-Peer Electronic Cash System by Satoshi Nakamoto

Bitcoin: The new gold rush? by Val Srinivas

Bitcoin And Blockchain: Two Revolutions For The Price Of One? by Richard Gendal Brown

How the Bitcoin protocol actually works by Michael Nielsen

Network Security and Proof of Work: Do We Need an Alternative? by Arianna Simpson

Research Perspectives and Challenges for Bitcoin and Cryptocurrenciesby Joseph Bonneau, Andrew Miller, Jeremy Clark, Arvind Narayanan,Joshua A. Kroll, Edward W. Felten

Books (1–2 days each) For the bookworms out there, these books are considered the best in the industry. Some are technical, and others are more focused on the history and personalities in the industry.

Mastering Bitcoin by Andreas M. Antonopoulos

The Age of CryptoCurrency by Michael Casey, Paul Vigna

Blockchain Revolution by Don and Alex Tapscott

Digital Gold by Nathaniel Popper

Bitcoin Course & Textbook (4–5 weeks)

Full textbooks and even a full course on Cryptocurrency from Princeton University.

Bitcoin and Cryptocurrency Technologies (course) at Princeton University

Bitcoin and Cryptocurrency Technologies (textbook), by Arvind Narayanan, Joseph Bonneau, Edward W. Felten, Andrew Miller, Steven Goldfeder SOURCE: MIT Media Labs Digital Currency Initiative

2 notes

·

View notes

Text

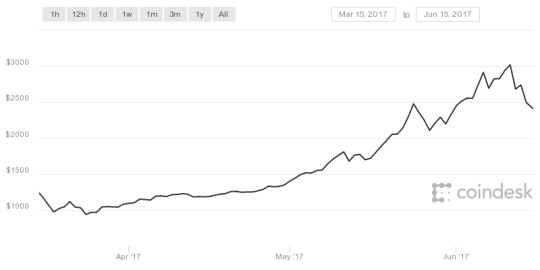

The Real Reason Bitcoin Is Skyrocketing

The price of Bitcoin just just rocketed past $2000, yet the truth is, the price of one bitcoin is the least interesting thing about it.

Most people are amazed that the price of Bitcoin has gone from $200 to $2200 in just 24 months. No asset class in the world has performed better, and it seems that there is nothing stopping this bull run from reaching even greater heights. Stories of people finding bitcoin in their computers that are now worth millions of dollars are going to start popping up in the news once again, and the media cannot get enough of it. And of course, it makes sense for this to be over hyped because 1000% growth in 24 months is not “normal”.

The thing is, people also want to know WHY bitcoin’s value keeps rising. Why is it worth $2200 for one bitcoin today? What gives it this valuation?

Whatever explanations you hear from so-called experts, don’t believe them. There is only one reason for the price of Bitcoin, or the price of anything else for that matter, to go up or down.

The Law of Supply and Demand

The law of supply and demand. Free market forces dictate that when there is more demand than there is supply, prices will rise. That’s it. There is nothing too complicated about it. The reason why Bitcoin’s price keeps rising is that there are more people buying bitcoins than there are people selling bitcoins, and because Bitcoin is capped at 21 million units.

This brings us to the real question we should be asking: Why are more people buying bitcoin today?

Utility + Scarcity = Value

Japan, one of the most advanced countries in terms of technology and also one of the biggest economies in the world, just made Bitcoin a legal payment method nationwide. Suddenly, Bitcoin became useful in Japan for merchants and consumers alike. This drove the demand for Bitcoin up, and since it is a very scarce asset, it naturally also drove the price up. It actually increased by over 100% since then. They are the first country to do this, with the Philippines following suit with circular no.944 of the BSP taking effect just a few months ago. Expect more countries to follow too.

A Hedge Against Financial Crises

Bitcoin, as mentioned by CNBC, has become a safe haven asset for investors, much like gold or other commodities that go against the flow of capital. Simply put, when the economies of the world are tanking, Bitcoin price tends to go up. Savvy investors are starting to learn that taking a small percentage of your savings or investments and placing them into Bitcoin will offset most losses and actually give much bigger gains, as proven historically. This means that more people want to buy Bitcoin, which translates to a higher price.

Speculation

The world of Finance is like one big casino. A lot of people get into forex currencies or the stock market for one reason alone - to make money. There are a lot of risks if you do not know what you are doing, and you could easily go broke. Bitcoin, being a very volatile asset class where the price fluctuates up and down, is seen by a lot of traders as a risky but exciting way to earn money. Historically, anyone who has ever bought Bitcoins at any given time in the last 8 years has made money. Since people want to trade Bitcoins daily, it only means that… more people are buying it on a daily basis.

Bitcoin Has Become A Global Reserve Cryptocurrency

Altcoins, or other cryptocurrencies, are also on the rise. There is a gold rush across the whole industry, and Bitcoin is the way to get in. Most Altcoins cannot be directly traded into regular currencies and need Bitcoin to be able to buy in or cash out. So all these people that want to trade cryptocurrencies are buying Bitcoins to fund their trading. This drives the demand for Bitcoin up and up and up, hence the price follows.

Here’s a fun fact: People who bought $100 worth of Bitcoin in 2010 and kept it all these years will be sitting on $72.9 Million today.

So, what is the real value of one Bitcoin? This can only be determined by the free market, and no one else. What gives it value? It’s utility and scarcity, or demand for its different use-cases outpacing its global supply.

The truth is, the price of Bitcoin is actually the least interesting thing about it. There is an underlying technology behind Bitcoin called The Blockchain that has captured the imagination of thousands of the smartest and most entrepreneurial minds in the world. It has created a multi-billion dollar industry that is now working together in building applications and services that will bring the benefits of Bitcoin and Blockchain technology into mainstream acceptance.

1 note

·

View note

Photo

SCI To Add XRP Support To Its Blockchain Ecosystem

Since 2014, SCI has been working on building the best technology platform for Blockchain-based services in the Philippines. Using the Bitcoin Blockchain, it has provided cheaper, faster, and more accessible financial services to over 500,000 users with services like Rebit.ph, Buybitcoin.ph, Bitbit.cash, and several more.

Today, we are happy to announce that SCI will soon start supporting Ripple’s XRP across several of our services. Starting with Buybitcoin.ph, our users will be able to buy and sell XRP with Philippine Pesos fast, safe, and easy, with support on Rebit.ph for remittances and Bitbit.cash for mobile money to follow in future integrations.

XRP is a digital asset that has recently proven itself to have a clear use case. As established financial institutions, as well as major cryptocurrency exchanges, start to partner with Ripple and support XRP, its utility as a payment rail and settlement layer becomes more evident. Combined with its speed, low cost, and scalability, SCI believes that XRP is a valuable asset to add to its growing ecosystem of blockchain services in the Philippines and the rest of the world.

0 notes

Photo

Ransomware on the Rise Again

A big Ransomware attack that has swept the globe a few days ago has made headlines in all major media outlets.

Ransomware is a malicious program that locks a computer's files until a ransom is paid. First emerging as early as 2009, it started in Russia and Eastern Europe and spread wider and faster, especially since the advent of social media and mass internet usage. The malware disables your device and asks the owner to pay a ransom until a certain time or else face deletion of their files forever. Up until recently, ransomware attackers demand payment either via Western Union and other remittance services, or even mobile money in some cases. Ever since Bitcoins became widely accepted globally a few years ago, it, and other cryptocurrencies, have become the choice of ransom for these criminals.

How to Prevent or Stop Ransomware

Update your operating systems. All of the computers recently infected are using outdated versions of Windows software.

Have a pop-up blocker and reliable and legitimate anti-virus software for your computer. If most of your work and even your personal life is on that computer, it makes sense to invest in proper anti-virus software.

This strain of ransomware was not spread by email, but there are some that do so be careful when opening email attachments. Always double check emails from “authoritative” sources pretending to ask you to open a file.

Last but not the least, and the easiest thing to do that can totally prevent this whole problem, is to BACKUP your files everyday. It is very easy nowadays to make backups on the cloud with Google and other software companies. If you have complete backups, you can simply ignore the demand and reboot/reinstall your files with updated software and proper anti-virus protection. “Too Late, I am a Victim. What Can I Do?”

For the most recent “Wannacry” ransomware that is spreading around, Microsoft has already identified the way this specific strain of ransomware spread from device to device, and has issued a issued a fix for it. Then backup your files offline and always be vigilant with the sites you visit or the files you open on email.

The most important advice here though, is this: Don't pay the ransom. Ransomware asks for amounts ranging from $200-$300, which seems small and easy to pay (that is the purpose). Wouldn’t you pay $200 to save all your files and work? Most people are opting to pay this, but since you are dealing with criminals, there is no logic in expecting that they will not ask for more after you have paid.

I Still Want To Buy Bitcoins To Pay For This, Can You Help? If you are buying Bitcoins to from us to pay for ransomware, please do not hesitate to tell us. We need to be able to identify these addresses so that we can make sure they are not used in any of our systems, or at least possibly identify the criminals if they ever try to use any of SCI’s services. Rest assured that SCI, with the cooperation of local authorities and the BSP, will help our customers avoid these attacks, or in the worst case, help them survive it.

You can send us an email on [email protected] with the title “Help, Ransomware” and we will do our best to guide you on what to do.

If you are purchasing Bitcoins to pay for Ransomware or any other cyberattack, please do not hesitate to inform us. SCI, in cooperation with the authorities, will do its best to help you.

0 notes

Photo

Three years may seem like a short span of time, but in the startup world, months can seem like years, as anyone who is involved in a startup can attest. The grind takes its toll on more than 90% of startups within the first 36 months, and most do not even make it this far.

In the Bitcoin and Blockchain world, however, three years is a lifetime. The technology itself was invented only around eight years ago, and Bitcoin startups started coming out en masse around 2012 onwards. Needless to say, surviving for three years in this cutthroat industry can be already considered an accomplishment.

Our secret? Instead of trying to become a “unicorn” startup, we ended up being a Cockroach startup. Want to know what it means to be a Cockroach startup? Read more about that here.

Yet SCI is not just surviving - it is thriving, growing, and doing some serious disruptive butt-kicking. As of today, we have grown from just a handful of founders to more than 40 bright, young (and some not so young) minds working as a team to build some of the best Bitcoin-powered services available anywhere in the world. Our services have never been better and more streamlined to achieve our goal of building a bitcoin ecosystem in the Philippines. We have the full backing of the Korean tech giant Kakao, as well as the Philippine Central Bank’s approval of new regulations that are favorable to our industry.

Our mission has always been to provide everyone with equal and easy access to world-class financial services, which works hand in hand with our vision of bringing financial inclusion to the millions of unbanked and underbanked, as well as to build the best money-transfer network for Overseas Filipino Workers. We are happy to share that SCI is right on track towards these goals. Transaction volumes are at an all time high, the number of new partners growing by the day, with the added bonus of the price of Bitcoin on an upward trajectory, rising along with transaction volumes and global adoption.

One Bitcoin, as of this writing, is at $1600+ USD. Considering it was only $200 just two years ago, it is a great indicator that the technology upon which we built our business has a solid foundation and market support. We are at the cusp of a shift in the way Bitcoin is seen by the world, both as a technology and as a currency. SCI, along with the rest of the Philippine Blockchain industry, is working non-stop to make sure that when this technology matures, The Philippines will be one of the first countries to reap the benefits.

Cheers to the next three years!

Fun fact: Did you know that since SCI started in May 2014, bitcoin has “died” 88 times?

0 notes

Photo

Bitcoin Hard Fork for Bigger Blocks: What’s The Rush?

When we first decided to dive into the Bitcoin industry back in late 2013, the “industry” itself was very small, and it was still trying to find its identity. Was it a transaction network like VISA, or a cross-border settlement layer like SWIFT? Was it a commodity or asset class for speculators, or a store of value for investors? Asking or guidance for our business venture, should we approach the central bank or the SEC? The answer to those questions, we soon learned, is no different from asking if the Internet is a communications channel, a publishing platform, or an information sharing network - it is all of those. We believe that Bitcoin transcends the limits of what we see as separate technologies today, for a future where all those financial applications or services mentioned above can seamlessly share a universal, inter-operable, and openly accessible platform. So, for the last three years, we built [our business] on this platform, the Bitcoin blockchain. We are not developing the technology itself, but building a commercial-use layer on top of it. As [the flagship of our services], we have built, along with several other players in this specific use-case for Bitcoin, a network of cross-border remittance platforms that are able to seamlessly work together from all over the world without needing to use the existing inefficient and expensive intermediary services, which in turn allows migrant workers who send money home to their families to save a lot of time and money. It also enables B2B transactions for SMEs to enjoy the same benefits as well. We call this Rebittance. The Bitcoin industry has grown by leaps and bounds in the last three years. In its current form, it has allowed many startups like us to flourish, and yes, we are still growing and expanding as we speak. Hell, we built our services when the price of Bitcoin was being flushed down the toilet and exchanges were getting hacked left and right. This never fazed us because we understood that these problems were the problems of third-party services and/or market forces, not Bitcoin technology itself. So what if exchanges get hacked? What if the price is tanking? As long as the technology was sound, we had nothing to worry about. This is why we believe the rush to do a hard fork is irresponsible and selfish. We know it’s important for some to be able to buy their morning coffee with Bitcoin, but is it really as important as making sure that the technology does not suffer catastrophic consequences in the process of doing so? What is the rush? Right now, Bitcoin WORKS. And we know that it doesn’t just magically work - we understand that a dedicated team of hundreds of the smartest developers in the world are working day and night to make sure it works. The sheer amount of work required to just keep the status quo is quite staggering. The fact that personalities and politics are now becoming a threat to the existence of this technology means that maybe it is time to take a step back and look at where we are now as a technology and an industry, to where we want to be in the near future, as well as much further down the road. Our stance on the Bitcoin hard fork is reflected by this [blog post] from the Bitgo team . It presents an objective and sober argument against a contentious hard fork, as well as offering solutions in the event of one happening, although we hope, along with many others like us who are working in the Bitcoin industry, that a contentious hard fork never happens. After attending a talk by Andreas Antonopoulos a few days ago in Singapore, I learned a few things that really hit the nail on the head regarding this whole issue we are facing today: There has never been anything like Bitcoin in the history of technology. Everything we are experiencing today (did anyone ever think that one day, there would be a $20 Billion debate about “forks”?) is uncharted territory, and every decision we make will shape the future of this technology for good. It is an amazing experiment, one in which we are proud to participate and contribute, and one that believe will be one of the most important technological breakthroughs of our time, at par with the development of the internet itself, * if* we don’t allow it to implode due to egos and politics. Bitcoin and Blockchain technology cannot be uninvented, but we should not smother the baby in its cradle, and yes, Bitcoin is still in its cradle today. As a potential disruptor of trillion-dollar industries, Bitcoin will be attacked from all directions from the outside, and being antifragile allows it to not just survive these attacks, but become stronger because of them. The only possible way to kill it would be from the inside, and it is in everybody’s best interest to avoid doing that.

0 notes

Photo

International Women’s Day

It was the year 2008 when Bitcoin was merely a concept that allows its users a new payment system. Little did we know, it would be the first peer-to-peer payment network that is powered by its users and not by a central authority. Released on 2009 by Satoshi Nakamoto, Bitcoin revealed to be fully open-source and decentralized, thus many took interest. The technology grew exponentially over the years with many developers working on bitcoin and companies who build their businesses around the technology that is Blockchain. Evidently, Bitcoin is the perfect example of the changing times.

Over the years, there would be many media outlets saying Bitcoin’s male dominance will be its downfall, but that isn’t really the case for this industry. As Fortune put it, “lack of women in the bitcoin industry is completely exaggerated.” With many women spearheading huge bitcoin companies like BitPesa, BitPay, and Digital Asset Holdings, Bitcoin remains to be a an innovation that people believe in. Here at SCI, women front business relations and the heart and soul of our company, which is operations.

Many would be surprised how Bitcoin is thriving here in the Philippines, just as they are surprised to see the many women in our headquarters. May we never forget that we now live in a time where women across the globe actively participate in politics, education, social work, IT, innovation and diverse fields, and have left their marks. The bitcoin industry, or any industry for that matter, isn’t just a place for men but for women as well. Clearly, the financial technology industry has gone a long way since, and so does gender equality, which includes more women sharing their knowledge and skills in their respective fields of work.

Today, we celebrate International Women’s Day--a worldwide event commemorating women’s achievements while fighting for gender equality. We give time to reflect on the progress that has been made not only with the fintech industry but to all other industries as well. This is for all the women who demonstrate different acts of courage, for mothers who play an extraordinary role in our lives, for all disruptors, and for equality. Together, we build!

0 notes

Photo

The Philippine Bitcoin Industry Grows Up: A Closer Look at the Upcoming BSP Regulations

In 2014, the Bangko Sentral ng Pilipinas published an ominous warning about Bitcoin, telling people to be careful when using this untested technology. Basically, the message was “Caveat Emptor”, or Buyer Beware.

Shortly thereafter, local startup companies working on Bitcoin technology, along with active individuals in the Bitcoin community, formed the Bitcoin Organization of the Philippines, a non-profit, SEC registered organization, to start a dialogue with the BSP. For the next two years, as the local and global Bitcoin industry grew by leaps and bounds, our dialogue also progressed into the development of a framework that would take the industry out of the gray area and legitimize the business and the technology.

This January of 2017, we have seen the BSP readying the public for coming regulations on what they have called “Virtual Currencies”. What most people don’t know is that this was two years in the making, with a lot of presentations, discussions, meetings, and debates. The BSP understands that Bitcoin and Blockchain as a technology is almost impossible to regulate, but the points where bitcoin enters and exits their monetary system is very much within their jurisdiction in which to provide the proper regulatory guidelines. This is where Philippine Bitcoin regulations will place most of its focus - on where Bitcoin is exchanged to Philippine Pesos, and vice versa.

(See BSP’s Regulations for Virtual Currency Exchanges here)

The result is something we see as beneficial for us at SCI and the entire industry as a whole. Anyone who wishes to enter the space will have to play by the rules set by the BSP, mainly: Be compliant with Anti-Money laundering / Know-Your-Customer practices. No fly-by-night companies. Proper consumer protection. Equal service from the banking system for companies that want to use blockchain technology (the mere mention of Bitcoin in your business can cause your bank to shut down your accounts without warning, even today, as of this writing). It will ensure that the playing field will be more level for bitcoin services to grow and provide alternatives to our somewhat exclusive banking system, and to promote financial inclusion for the 70+ million Filipinos who cannot access basic banking services or participate in digital commerce.

Every step forward that this nascent technology takes today will be historically unprecedented, and it will become the foundation of what is already shaping up to be a totally new and valuable industry, both locally and globally. Thankfully, the BSP can see the potential of Bitcoin and Blockchain technology, and we as an industry helped them realize this by growing our businesses from scratch, creating many jobs, and providing reliable, world-class services to the public.

“You cannot ignore it (Bitcoin) anymore because it’s a growing channel. In the overall scheme of things, it’s not yet that big but it has a potential to grow,” - BSP Deputy Governor Nestor Espenilla

At the end of the day, Bitcoin users shouldn’t be fearing regulation - Bitcoin can and will survive with or without it. But for corporate entities that need to abide by the rule of law, reasonable regulations with the cooperation of the industry and the government will help this industry reach its full potential.

0 notes

Photo

Bitcoin is now eight years old!

Last January 3, 2009, the first block of bitcoin known as the genesis block, was mined by its creator, Satoshi Nakamoto. The result was the birth of a new kind of money, cryptocurrency, and a new kind of technology, The Blockchain.

Today, after eight years of running non-stop, 446,539 blocks later, Bitcoin is stronger than ever. All time high market capitalization of $16 Billion, price at above $1,000 USD, transaction volumes in every country reaching all-time highs, and bitcoin wallets topping over 15 million, we can say for sure that Bitcoin and blockchain tech is here to stay. The exciting part? We have only just begun. For the last three years, we at SCI have been at the forefront of developing this amazing technology for the benefit of the Filipino people by building the Bitcoin and Blockchain ecosystem in our country today. We believe that the first 8 years is only the beginning, and that the next years to come will see more developments that will benefit not just Filipinos, but everyone in the world, through real financial inclusion.

Happy birthday Bitcoin!

Purchase your bitcoins from the most trusted Philippine buy and sell site, Buybitcoin.ph!

0 notes