Don't wanna be here? Send us removal request.

Text

How Insurtechs Are Strengthening Core Software with Advanced Cybersecurity Measures

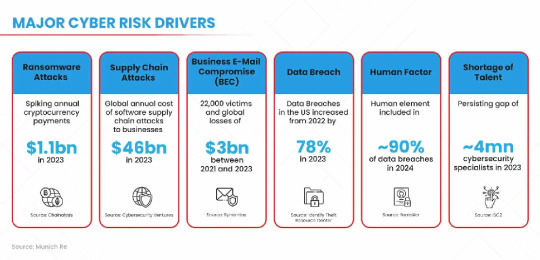

As cyber threats continue to evolve in complexity, securing sensitive customer information has become a top priority, particularly within the core software systems that drive the insurance industry. Insurers are enhancing their cybersecurity efforts, and it’s fascinating to see how they are approaching this critical challenge.

Many insurtech companies are leading this transformation by incorporating state-of-the-art technologies, such as AI-powered threat detection systems soc security operations center, into their platforms. Instead of merely reacting to cyberattacks, these companies are taking proactive steps to identify and mitigate risks before they escalate into significant issues.

The Growing Need for Cybersecurity in Insurance

Property & Casualty (P&C) insurance companies are sitting on a wealth of sensitive personal and financial data, making them prime targets for cybercriminals. As insurers embrace technologies like cloud computing, artificial intelligence (AI), and the Internet of Things (IoT) to streamline operations, they gain substantial efficiencies—but also open themselves to new vulnerabilities.

For insurers, investing in cybersecurity isn’t just about avoiding regulatory penalties. In today's increasingly hostile digital environment, robust cybersecurity is essential for long-term survival.

To underscore this point, let’s take a look at a real-world example that rattled the insurance sector: the 2020 data breach at Folksam, one of Sweden’s largest insurance providers. This incident served as a major wake-up call for the industry. Folksam unintentionally leaked sensitive data for around one million customers, not due to an external cyberattack, but because of an internal oversight. In an attempt to analyze customer behavior and provide more personalized services, the company shared private customer information with tech giants such as Facebook, Google, Microsoft, LinkedIn, and Adobe.

While Folksam stated there was no evidence of misuse by these third parties, the breach raised serious concerns among customers and regulators alike. It demonstrated that even well-intentioned actions could lead to significant security failures if proper safeguards are not in place.

Core Platform Security: A Critical Priority

Your core platform—the system responsible for policy management, claims processing, billing, and customer relations—is the backbone of your insurance business. But it also becomes a prime target for cyberattacks if not adequately protected.

AI: The Ultimate Security Co-Pilot

Leading insurers are increasingly integrating AI-powered soc security operations center “co-pilots” into their core platforms. These AI-driven systems analyze vast amounts of data to:

Detect Anomalies: Machine learning algorithms can identify unusual patterns in claims, underwriting, or policy modifications that may indicate fraudulent activity or a security breach. For instance, an unexpected increase in claims from a particular region or a sudden surge in requests to modify policy details could signal potential fraud.

Automate Incident Response: Once a threat is detected, AI can automatically isolate compromised systems, preventing the breach from spreading. This might involve shutting down affected servers or disabling user accounts to contain the damage.

Predict Attack Vectors: By analyzing data from threat intelligence feeds and the dark web, AI can help insurers anticipate and defend against future attacks. This might include identifying emerging malware strains or pinpointing vulnerabilities in third-party software.

Take Zurich Insurance, for example. Their AI models soc security operations center successfully identified and stopped a credential-stuffing attack targeting their Asian SME clients, blocking thousands of fraudulent login attempts within hours. This kind of rapid response is only achievable when AI is deeply embedded in the core platform.

0 notes

Text

What the 10-for-1 Deregulation Order Means for Insurance Risk Management

In January 2025, President Donald Trump signed executive order 14192, titled "Unleashing Prosperity Through Deregulation." This bold directive builds on his earlier deregulatory efforts by mandating that for every new federal regulation introduced, at least ten existing ones must be scrapped. That’s a major leap from the previous "two-for-one" policy—and it's already shaking things up across industries, including insurance.

The move is meant to spark economic growth and encourage innovation. But for the insurance sector, it’s far from business as usual. With many longstanding regulations potentially on the chopping block, insurers are entering a new era of uncertainty. Companies are being forced to rethink how they manage risk without the familiar guardrails of regulatory oversight.

Mixed Reactions and Legal Pushback

Many companies, especially those burdened by costly compliance requirements, are welcoming this shift. Fewer rules could mean lower administrative costs and more flexibility. But not everyone’s on board—and not every regulation can be rolled back overnight. Legal hurdles are already mounting, and the process of repealing established rules is far from simple.

The deregulation executive order 14192 debate has drawn strong opinions from both sides. Supporters argue that less government interference can improve efficiency and reduce red tape. They see it as a return to business-first principles, where companies are trusted to manage their own affairs responsibly.

On the other hand, advocacy groups like ShareAction and the Interfaith Center on Corporate Responsibility (ICCR) warn that rolling back oversight could open the door to corporate negligence. They emphasize that regulations play a key role in holding businesses accountable on issues like climate responsibility, ethical governance, and social equity.

In short, the question isn’t just whether deregulation will boost profits—it’s whether it will come at the expense of broader societal goals.

Deregulation and Risk: Lessons from the Past

The insurance industry has seen deregulation before—and the results have been mixed.

Take the liability insurance crisis of the 1980s. Between 1984 and 1987, general liability premiums in the U.S. tripled from $6.5 billion to nearly $20 billion. Many nonprofits, municipalities, and businesses were priced out of coverage, creating widespread disruption. That crisis was driven in part by regulatory gaps that failed to anticipate how market shifts would affect insurers' ability to cover growing losses.

Fast forward to 2000, and the Commodity Futures Modernization Act (CFMA) removed regulatory oversight for financial derivatives like credit default swaps (CDS). These swaps weren’t technically classified as insurance, so they slipped through the cracks—allowing unchecked risk to build up in the financial system. When the housing market collapsed, the consequences were catastrophic. Financial institutions holding vast amounts of CDS were undercapitalized and exposed, contributing to the 2008 global financial crisis.

International examples echo similar themes. Norway’s banking crisis in the late 1980s and early ’90s followed deregulation of lending rates and credit controls. Banks engaged in high-risk lending, and when oil prices fell sharply, the bubble burst. The result? A full-blown systemic banking crisis.

What This Means for Insurance Today

As the U.S. embraces a more aggressive deregulatory agenda, insurers must prepare for a more volatile regulatory landscape. While some companies may find opportunities in reduced oversight, the potential for long-term risks—from economic instability to reputational damage—shouldn’t be ignored.

Risk management in a deregulated environment requires a proactive approach. Insurers will need to build more robust internal policies, strengthen governance frameworks, and stay alert to legal and market changes. Ultimately, success will depend on finding a careful balance: capitalizing on new freedoms without sacrificing the discipline that safeguards trust, solvency, and long-term value.

Market Stability and Consumer Protection in a Deregulated Era

Deregulation can spark fierce competition among insurers, but it may also encourage riskier behavior as companies chase higher returns. Without strong regulatory oversight, the industry could face increased instability—something we’ve seen before during past financial crises. Weakened protections may also put consumers at risk, potentially leading to issues like mis-sold policies or unjust claim denials.

Regardless of whether one supports or opposes deregulation, it’s clear that cutting back on compliance requirements doesn’t remove the risks—it simply shifts the responsibility. In this new landscape, insurance companies must take a more active role in managing their own risk. That means identifying potential threats early, putting safeguards in place, and maintaining high standards internally, even in the absence of external mandates.

If companies fail to rise to the occasion, the consequences could be serious—from financial losses to reputational damage, or even legal trouble.

As for executive order 14192—“Unleashing Prosperity Through Deregulation”—its long-term impact on the insurance sector remains to be seen. What’s clear is that firms will need to keep a close watch on how these changes affect both industry stability and consumer protection in the years ahead.

0 notes

Text

Although predictive maintenance has long been a staple in fleet management, its application in insurance is still in the early stages. With telematics, insurers have the opportunity to shift from being passive risk assessors to proactive partners in driver safety.

One example comes from Munich Re, which demonstrates how insurers can use vehicle diagnostics to anticipate and prevent breakdowns—ultimately reducing claims. Their telematics solution is available either as a ready-to-deploy white-label app or as a versatile Software Development Kit (SDK). The SDK enables insurers to integrate Munich Re’s full suite of telematics features directly into their own mobile platforms, offering full control over the user experience and interface. This approach gives insurers access to cutting-edge tools and precise risk analytics, making it easier to implement and maximize the benefits of predictive maintenance.

Across the industry, insurers are beginning to pair telematics car insurance with AI and IoT technologies to unlock more advanced predictive maintenance capabilities. Enhanced usage-based insurance (UBI) models now utilize machine learning to forecast potential mechanical issues and prompt timely maintenance, minimizing risk before it materializes. For instance, insurers like State Farm are using AI-powered data from real-time driving and vehicle diagnostics to offer personalized maintenance advice. In addition, partnerships with connected car platforms are helping insurers gain a deeper understanding of vehicle performance, leading to more accurate risk assessments and customized coverage offerings.

0 notes

Text

Is the Cloud a Cost-Saver or Innovation Driver for Insurers?

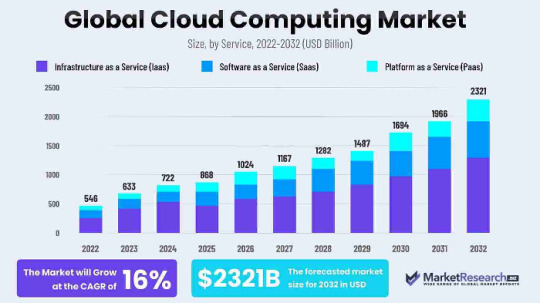

Cloud technology has rapidly transformed industries worldwide, and the insurance sector is no exception. At its core, the cloud migration benefits offers one key advantage: scalability. Over the years, the journey of cloud adoption in the insurance industry has followed a familiar trajectory—initial skepticism, gradual acceptance, and now, a pivotal turning point. While cloud technology is now widely integrated, how insurers use and perceive its potential is still evolving.

In the early stages, insurers saw the cloud as a way to reduce costs and manage fluctuating demand. It was seen as a practical solution for improving operations and minimizing the need for physical infrastructure. But as time has passed and the cloud's capabilities have been explored more deeply, insurers have realized that it’s not just about cost savings cloud migration benefits. There’s far more potential at play.

The Cloud as a Catalyst for Operational Efficiency

Let's take a look at the numbers. A recent McKinsey study forecasts that by 2030, cloud adoption in the insurance industry could lead to an EBITDA run-rate impact of $70 billion to $110 billion. For context, EBITDA—Earnings Before Interest, Taxes, Depreciation, and Amortization—is a measure of a company's profitability from its core operations. In other words, it shows how well a business is performing in its primary activities without factoring in expenses like taxes and interest.

Cloud computing’s impact on insurance is not just a tech upgrade; it’s a game-changer for operational efficiency, directly translating into increased profits. A significant portion—43% to 70%—of the total EBITDA impact across all industries could be attributed to cloud adoption. For insurers, this means faster claims processing, better data analytics, and improved customer service, all while reducing the costs associated with managing traditional infrastructure.

In essence, the cloud is not just saving insurers money; it’s creating new revenue streams—a shift that cannot be ignored in today’s competitive market.

Cloud Strategy: The Engine Driving Insurance Innovation

The cloud migration benefits is no longer just a tool for supporting operations—it’s a catalyst for groundbreaking innovations. It provides a platform where next-gen technologies like AI-driven underwriting, real-time risk modeling, and dynamic policy pricing can thrive. What’s particularly unique about the cloud is how it redefines scalability. Instead of simply handling data, the cloud enables insurers to experiment, innovate, and deploy disruptive technologies quickly and efficiently, allowing these advancements to scale across global markets.

The insurance industry, once dominated by legacy players, is now being reshaped by collaborations between established insurers and innovative insurtech companies. At the heart of this transformation lies the cloud, a technology that has evolved beyond supporting IT infrastructure to become a powerful force driving industry-wide disruption.

Cloud Adoption Fuels Agility in a Rapidly Evolving Industry

Agility has become the competitive edge in today’s insurance market. The slow, cumbersome processes that once characterized the insurance lifecycle—such as lengthy policy updates, reliance on outdated hardware, and complex data migrations—are rapidly being replaced by the speed and flexibility offered by the cloud.

Take American Family Insurance, for example. In 2022, the company partnered with Amazon Web Services (AWS) to accelerate its cloud migration, with the goal of driving innovation and improving digital capabilities. This partnership enabled the insurer to roll out new insurance products, like Usage-Based Insurance (UBI) programs, much faster than before. This agility is a major advantage, as the cloud allows insurers to deploy solutions on a national or even international scale without the substantial upfront investments that used to be necessary.

Global Scalability: The Cloud’s Role in Expanding Insurance Offerings

Expanding globally is no longer a challenge unique to tech companies; it’s a critical goal for insurers. Cloud technology equips insurers with the infrastructure to seamlessly scale their offerings across borders.

Chubb, for instance, implemented a cloud-native platform to scale its cyber insurance solutions worldwide. By processing and analyzing vast amounts of localized regulatory data in real-time, Chubb was able to introduce region-specific cyber policies across multiple continents with ease. This ability to scale globally has helped Chubb stay ahead of the curve in addressing the emerging risks of a digital-first world.

Quantum Computing: The Next Frontier in Insurance Innovation

Another lesser-known advantage of cloud technology is its role in preparing insurers for quantum computing. Leading insurers are exploring cloud platforms that offer quantum-ready environments to test quantum-safe encryption algorithms. But beyond just security, quantum computing holds the potential to revolutionize key areas like portfolio optimization, risk modeling, and fraud detection.

How Quantum Computing Will Transform Insurance

Quantum computing uses quantum bits (qubits) instead of traditional binary bits, offering massive increases in processing power. This allows quantum computers to analyze huge datasets and solve problems that would take classical computers years, if not centuries, to solve. Here’s how quantum computing could change the insurance industry:

Risk Modeling and Pricing: Traditional risk assessments rely on complex models, but quantum computing can process millions of variables simultaneously, leading to real-time risk modeling and more accurate pricing. For example, quantum systems could analyze billions of variables, such as wind speeds and flood risks, to predict natural disasters much faster than current systems.

Optimized Portfolio Management: Quantum computing could also revolutionize investment strategies. By quickly analyzing vast amounts of financial data, insurers can optimize their portfolios, maximizing returns while minimizing risks.

Fraud Detection: Quantum’s ability to process massive datasets could significantly improve fraud detection. By uncovering subtle anomalies and patterns in claims data, insurers could identify fraudulent claims more effectively, saving billions annually.

Collaborating with Insurtechs to Unlock Innovation

The growing trend of insurers partnering with insurtech companies is helping them stay competitive in a rapidly changing market. According to The Geneva Association, over 80% of insurers are already working with tech companies to develop digital ecosystems.

This shift towards collaboration makes sense. By working with insurtechs, insurers can avoid the high costs and lengthy timelines of developing new systems in-house. These partnerships also allow insurers to tap into the latest technological innovations without having to reinvent the wheel.

As the insurance industry continues to evolve, it’s clear that collaboration between traditional insurers and insurtechs is key to unlocking new levels of efficiency and innovation. In today’s fast-moving environment, the future of insurance lies in partnerships that drive progress, not in isolated efforts to build everything internally.

0 notes

Text

Why 25% of P&C Insurers Are Using AI to Tackle Extreme Weather Risks

A New Perspective: Proactive Resilience and Adaptation

The increasing intensity and frequency of extreme weather events have forced property and casualty insurers to adopt innovative strategies to manage risks effectively. Hurricanes Helene and Milton in 2024 serve as critical examples of how these events can disrupt lives and economies. Helene caused widespread destruction across 39 counties in North Carolina, impacting small businesses and leaving over a million residents without essential services. Recovery efforts included the delivery of over 13,500 tons of humanitarian aid and the restoration of critical infrastructure by the National Guard.

Hurricane Milton’s path of destruction through Florida, particularly in Tampa and St. Petersburg, highlighted the vulnerabilities of homeowners and small businesses. The storm’s aftermath brought prolonged power outages and severe flooding, leading to financial strain and operational disruptions for many. These events underscore the need for insurers to rethink their approaches to risk management and response.

How AI is Changing the Game

As extreme weather events become more common, a growing number of climate risk insurance are turning to artificial intelligence to enhance their predictive and responsive capabilities. A survey by ZestyAI revealed that 25% of P&C climate risk for insurers in the U.S. are leveraging AI to better manage weather-related risks. Rather than solely focusing on post-disaster recovery, insurers are using AI to proactively prepare for and mitigate the impacts of these events.

Here are some examples of how climate risk insurance providers are utilizing AI to tackle extreme weather challenges:

USAA’s High-Tech Claims Processing USAA has implemented AI-powered claims processing to expedite payouts for policyholders. By incorporating drones for damage assessments, they can access hard-to-reach areas and accelerate the repair process. This approach not only reduces the time it takes to process claims but also helps members recover faster.

Zurich North America’s Predictive Risk Modeling Zurich uses AI-driven risk modeling to anticipate the impacts of hurricanes before they make landfall. Their tool, CATIA, combines traditional and generative AI to streamline claims tagging by analyzing loss causes and descriptions. This capability has enhanced their operational efficiency and improved reinsurance recoveries.

Allstate’s Virtual Adjusters Allstate employs virtual adjusters powered by AI to evaluate catastrophe claims in real time. These tools prioritize urgent claims, ensuring swift responses while reducing operational costs. The automation of claims-related tasks has streamlined their processes and improved customer satisfaction.

Farmers Insurance and Drone Technology Farmers Insurance leverages machine learning to analyze satellite images and drone footage for assessing property damage. This innovative approach enables faster claim settlements and provides valuable insights for future underwriting, helping to create more resilient coverage options.

Citizens Property Insurance Corporation’s Real-Time Risk Adjustments Florida’s Citizens Property Insurance Corporation integrates historical data with real-time weather updates to refine their risk assessments. This dynamic strategy allows them to adjust pricing models and better prepare for future disasters, ensuring financial stability and preparedness.

The Future of AI in Insurance

AI is not only transforming how insurers respond to disasters but also how they plan for them. For example, AI-driven tools can process claims reports and correspondence within seconds, significantly reducing the time required for claims managers to take action. McKinsey predicts that by 2030, over half of claims activities could be automated, while Oliver Wyman estimates that automation could save up to 20% of the time spent on these tasks.

The integration of generative AI and machine learning into insurance workflows allows for more precise risk assessments, dynamic pricing, and innovative policy designs. As climate change continues to pose new challenges, insurers adopting AI technologies are better equipped to navigate uncertainties and provide reliable coverage to their customers.

By embracing these advancements, the climate risk insurance industry is moving towards a future where proactive resilience and adaptation are the norms, ensuring sustainability in the face of extreme weather risks.

0 notes

Text

The Synergy Behind Intelligent Underwriting in Risk Assessment

1. Explainable AI (XAI): Bridging Compliance and Client Trust

In an industry where trust and compliance are paramount, Explainable AI (XAI) plays a pivotal role in demystifying complex underwriting automation decisions. Unlike traditional black-box AI models, XAI offers insights into the factors driving outcomes, ensuring that insurers maintain regulatory standards and build stronger client relationships.

Beyond SHAP and LIME: While SHAP and LIME are instrumental in explaining AI outputs, insurers are also leveraging newer methodologies, such as Counterfactual Explanations. These tools allow underwriters to identify minimal changes a policyholder could make to improve their risk profile—providing actionable guidance and fostering goodwill.

Example: A life insurer utilizing Counterfactual Explanations might show a policyholder how improving their cholesterol level or exercise frequency could lower their premium. This empowers clients with tangible steps, while the insurer benefits from enhanced health metrics across its portfolio.

2. Advanced Simulation Techniques: Preparing for Emerging Risks

Insurers are expanding their simulation capabilities to model not just natural disasters but also emerging global threats like pandemics and cyberattacks. These advanced techniques enable companies to identify vulnerabilities and design adaptive strategies.

Beyond Monte Carlo Simulations: Tools such as agent-based modeling and digital twin simulations are gaining traction. These methods allow insurers to model complex interactions between individual entities (like policyholders or systems) and their environments, providing granular insights into cascading effects.

Example: A global health insurer employs agent-based modeling to simulate the spread of infectious diseases under varying intervention strategies. This allows the company to design flexible policies with pandemic-specific coverage and adjust premiums dynamically during outbreaks.

3. Real-Time Analytics and Continuous Underwriting: Staying Ahead of the Curve

The shift from static to dynamic underwriting is revolutionizing risk management, with real-time analytics enabling insurers to respond instantly to changes in risk environments. This proactive approach ensures better alignment with evolving customer needs and market conditions.

Beyond Apache Kafka: Innovations like stream processing platforms (e.g., Flink and Pulsar) and real-time predictive analytics models are further enhancing insurers’ ability to make instant adjustments.

Example: A commercial property insurer uses real-time weather data from IoT sensors to monitor flood risks. When sensors detect rising water levels, the insurer automatically triggers notifications for preventive measures and recalculates coverage terms, protecting both the client and the company's bottom line.

Synergizing Advanced Techniques for a Competitive Edge

By combining the transparency of XAI, the foresight of advanced simulations, and the adaptability of real-time analytics, insurers can address not only current challenges but also prepare for future disruptions. These technologies work in harmony, creating a robust framework for intelligent underwriting that prioritizes compliance, customer trust, and long-term sustainability.

Looking Ahead: As these tools evolve, the insurance industry will likely see a greater emphasis on hyper-personalization, where every decision—whether pricing, coverage, or claims—reflects an in-depth understanding of individual needs, powered by cutting-edge AI and data integration.

0 notes

Text

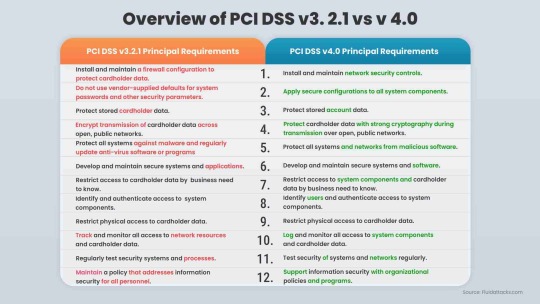

Over half of consumers now favor digital wallets over traditional payment methods such as cash or physical card transactions, according to Forbes Advisor. This growing preference significantly heightens the insurance industry's vulnerability to cyberattacks, emphasizing the critical need for stronger security measures in digital payment systems.

To address these challenges, insurers are adopting advanced solutions such as multi-factor authentication (MFA), already utilized by 56% of organizations, and innovative biometric authentication technologies. Additionally, regulatory updates like pci dss version 4, implemented in 2024, establish stricter standards, pushing for enhanced data security protocols.

0 notes

Text

The claims automation software Lifecycle is a multi-step process that begins when the insurer receives a claim notification and ends with the final settlement. The journey starts with the First Notice of Loss (FNOL). For example, when a car is involved in an accident, the insurance company promptly receives the FNOL. Afterward, an insurance adjuster assesses the damage by reviewing relevant reports to determine the appropriate settlement amount.

Despite advances in technology, many insurance companies still rely on manual handling of FNOLs and document processing. This outdated approach leads to fragmented claims management, excessive file transfers, and unnecessary delays in settlement. Such inefficiencies often clash with the expectations of today’s customers, who demand a seamless, transparent, and automated experience, resulting in frustration and dissatisfaction.

0 notes

Text

How Adaptive Software Platforms Are Transforming the Insurance Industry

Insurance companies are moving away from outdated legacy systems and embracing adaptive software solutions to remain competitive in today’s digital landscape. This shift is fueled by the open architecture of these solutions, which contrasts sharply with the rigid frameworks of proprietary software.

Adaptive software platforms do more than just automate processes; they fundamentally change how insurers engage with their data, customers, and the market. Digital engagement is at the heart of this transformation. Dynamic interfaces provide vendors, agents, brokers, employers, and administrators with an exceptional user experience across all digital channels. As a result, insurance processes can be streamlined and customized to meet the specific needs of various stakeholders, positively impacting the bottom line.

Why Insurers Are Embracing Adaptive Software Solutions

Take, for example, a mid-sized insurance company grappling with the inefficiencies of a legacy system. Claims processing was sluggish, new product launches faced delays, and customer satisfaction was declining. To transform its operations, the company implemented automated workflows customized to its specific needs. They incorporated real-time data analytics to better understand and anticipate customer behavior, enabling them to swiftly launch new insurance products aligned with market demands. The outcome? A significant increase in new policy subscriptions.

This illustrates the flexible insurance software— as insurers expand, their software must evolve without requiring a complete overhaul. Nobody wants to endure another round of evaluating and implementing new software, as it consumes valuable time and resources.

1 note

·

View note