SimpleSolve was conceived in a local coffee shop in New Jersey by Antony and Sam, two insurance professionals with a vision of what insurance systems should be – simple and affordable. We take pride in the 20-year evolution of our Enterprise Insurance Solutions built by Insurance Professionals. When you deal with us, you are dealing with insurance professionals who understand your needs; not just programmers.

Don't wanna be here? Send us removal request.

Photo

The Challenges Faced in the UBI Market

The UBI (Usage-Based Insurance) market faces several challenges as it continues to evolve and gain adoption. Here are some of the critical challenges faced in the UBI market:

Standardization and Regulation: The UBI market lacks standardized approaches and metrics for data collection, analysis, and premium determination. This lack of standardization can make it challenging for insurance companies to compare and evaluate data from different sources. Additionally, regulatory frameworks need to keep pace with the evolving UBI market to address privacy, fairness, and transparency concerns.

Adverse Selection: UBI may face challenges related to adverse selection. Drivers with riskier behavior may be more motivated to opt-out of UBI programs, leading to a pool of policyholders who exhibit safer driving habits. This imbalance can impact the accuracy of risk assessment and pricing, potentially leading to higher premiums for participants in UBI programs.

Source URL: - https://www.simplesolve.com/blog/auto-insurers-it-platform-readiness-for-usage-based-insurance

0 notes

Photo

UBI Auto Insurance: A Fairer and More Affordable Approach to Coverage

UBI auto insurance provides benefits for both insurers and policyholders. Insurers gain access to real-time data to assess risk more accurately, potentially reducing claims costs and improving profitability. Policyholders, on the other hand, have the opportunity to receive personalized insurance premiums based on their individual driving habits. Additionally, UBI programs often provide feedback and insights to help drivers improve their behavior and become safer on the roads.

UBI auto insurance is part of a broader trend of leveraging technology, such as telematics and data analytics, to offer more personalized and usage-based insurance products in various industries.

Source URL: - https://www.simplesolve.com/blog/auto-insurers-it-platform-readiness-for-usage-based-insurance

0 notes

Photo

some future trends of Usage-Based Insurance (UBI)

Usage-based Insurance (UBI) is a type of auto insurance that utilizes telematics technology to collect data on an individual's driving behavior and other relevant factors to determine insurance premiums. Here are some technology trends influencing UBI:

Usage-based Commercial Insurance: UBI is expanding beyond personal auto insurance into commercial insurance. Commercial vehicle fleets can utilize telematics devices and data analytics to monitor and manage risks, optimize routes, and improve driver safety. UBI can help commercial insurance companies tailor premiums and coverage based on usage patterns, driving behavior, and fleet performance.

Gamification and Behavioral Incentives: To encourage safer driving habits, UBI programs are incorporating gamification elements. By turning safe driving into a game-like experience, drivers can earn rewards, discounts, or lower premiums based on their performance and adherence to safe driving practices.

Privacy and Data Security: As UBI relies on collecting and analyzing personal driving data, ensuring privacy and data security is crucial. Insurance companies must implement robust data protection measures, comply with regulations, and provide transparency to policyholders regarding data collection, usage, and sharing practices.

Source URL: - https://www.simplesolve.com/blog/auto-insurers-it-platform-readiness-for-usage-based-insurance

0 notes

Photo

Lets discuss about Artificial Intelligence in insurance underwriting

Artificial Intelligence (AI) refers to the simulation of human intelligence in machines that are programmed to mimic and replicate cognitive functions such as problem-solving, learning, reasoning, and decision-making. AI aims to develop intelligent systems that can perceive and understand their environment, learn from data or experiences, and make informed decisions or take actions to achieve specific goals.

Artificial Intelligence (AI) in insurance underwriting refers to the use of AI technologies, such as machine learning and predictive analytics, to automate and enhance the underwriting process in the insurance industry. It involves leveraging AI algorithms and data analysis to assess risks, determine policy eligibility, and set appropriate premiums.

Source URL: - https://www.simplesolve.com/blog/machine-learning-and-ai-in-insurance-industry/

0 notes

Photo

Here are some uses of AI and ML in Insurance

Certainly! Here are some specific use cases and applications of AI and ML in the insurance industry:

Predictive Analytics for Risk Mitigation: AI and ML models analyze historical and real-time data to identify patterns and trends that can help insurers assess risks more accurately. By leveraging predictive analytics, insurers can anticipate potential risks, such as weather events or health issues, and take proactive measures to mitigate losses or prevent adverse situations.

Telematics and Usage-Based Insurance (UBI): Telematics devices and sensors in vehicles gather data on driving behavior, enabling insurers to offer usage-based insurance. AI and ML algorithms analyze this data to assess risk levels and provide personalized premiums based on individual driving habits, such as speed, acceleration, and braking patterns.

Underwriting Automation and Decision Support: AI-based underwriting systems automate the evaluation of policy applications, analyzing data to assess risk and determine policy eligibility. By leveraging historical data and predefined rules, these systems can make underwriting decisions faster and with reduced human intervention, resulting in improved efficiency and accuracy.

Source URL: - https://www.simplesolve.com/blog/machine-learning-and-ai-in-insurance-industry/

0 notes

Photo

How AI and ML are Transforming the Insurance Industry?

AI (Artificial Intelligence) and ML (Machine Learning) are indeed transforming the insurance industry in several ways. Here are some key areas where AI and ML are making a significant impact:

Streamlined Claims Processing: AI and ML technologies enable automation and streamlining of the claims process. Chatbots and virtual assistants can handle initial customer inquiries, gather claim information, and provide real-time updates. ML algorithms can analyze claim data to expedite the processing and decision-making, reducing manual effort and improving customer experience.

Source URL: - https://www.simplesolve.com/blog/machine-learning-and-ai-in-insurance-industry/

0 notes

Photo

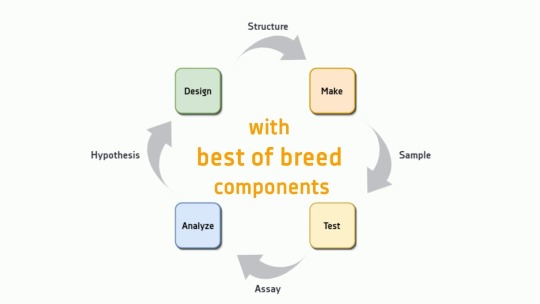

Some Disadvantages of Best-of-breed systems: Simplesolve

Best-of-breed systems refer to software solutions that are considered the best in their respective categories or functionalities. While they offer several advantages, it is important to consider their potential disadvantages. Here are some disadvantages of best-of-breed systems:

Integration Complexity: Best-of-breed systems are typically designed to excel in specific areas or functions, which can lead to challenges when integrating them with other systems. Integrating multiple best-of-breed systems often requires significant customization and complex integration efforts, as these systems may not have been originally designed to work seamlessly together. This can result in increased costs, longer implementation timelines, and potential compatibility issues.

Data Synchronization and Inconsistency: When using best-of-breed systems from different vendors, ensuring data consistency and synchronization can be a challenge. Data may need to be transferred or synchronized between systems, and discrepancies or delays can occur, leading to data integrity issues and potential errors in reporting or decision-making processes.

Vendor Management and Support: Implementing and maintaining multiple best-of-breed systems means dealing with multiple vendors, each with their own support processes and service level agreements. Managing relationships with multiple vendors can be time-consuming and complex, especially when issues arise or when upgrades or enhancements are needed. Coordination between vendors may also be required, adding an additional layer of complexity.

To know more about best-of-breed systems, visit our website.

Source URL: - https://www.simplesolve.com/blog/best-of-breed-vs-integrated-systems

0 notes

Photo

Embracing the Digital Revolution: The Impact of Digitization in Insurance | SimpleSolve

The impact of digitization in the insurance industry has been significant, transforming traditional practices and revolutionizing how insurers operate, engage with customers, and manage risks.

Digitization has had a profound impact on the insurance industry, revolutionizing processes, enhancing customer experiences, and enabling insurers to make data-driven decisions. The adoption of digital technologies has streamlined operations, improved efficiency, and transformed the way insurance products and services are offered.

One key impact of digitization in insurance is the automation of manual processes. Insurers are leveraging technologies such as robotic process automation (RPA) and artificial intelligence (AI) to streamline underwriting, claims processing, policy administration, and risk assessment. These technologies eliminate paperwork, reduce errors, and expedite turnaround times, improving operational efficiency and customer satisfaction.

Digitization has also enabled insurers to harness the power of data. Advanced data analytics, machine learning, and AI algorithms help insurers extract valuable insights from large volumes of data. By analyzing customer behavior, risk patterns, and market trends, insurers can personalize products, pricing, and coverage options. This data-driven approach enhances underwriting accuracy, enables targeted marketing, and improves risk management.

The customer experience has been significantly impacted by digitization in insurance. Insurers are leveraging digital platforms, mobile apps, and self-service portals to provide seamless, convenient, and personalized experiences. Customers can now access policy information, file claims, and receive real-time updates from anywhere, at any time. The digitization of customer interactions has improved accessibility, responsiveness, and overall satisfaction.

Digitization has also given rise to innovative insurance models. Usage-based insurance (UBI) utilizes telematics and IoT devices to collect data on customer behavior, enabling insurers to offer customized coverage and pricing based on actual risk. On-demand insurance allows customers to purchase coverage for specific events or time periods, providing flexibility and cost savings. These digital insurance models cater to evolving customer needs and preferences.

Furthermore, digitization has brought about a shift in distribution channels. Insurers are leveraging digital platforms, online marketplaces, and aggregators to reach customers directly, reducing dependence on traditional intermediaries. This shift has expanded market reach, increased transparency, and enabled insurers to offer products through more accessible and cost-effective channels.

The impact of digitization in insurance extends beyond internal operations and customer-facing processes. Insurers are embracing digital tools to enhance risk management and cybersecurity practices. Digital solutions enable insurers to identify, assess, and mitigate risks more effectively, including emerging risks such as cyber threats. Insurers are offering specialized cybersecurity insurance and risk management services to protect businesses from digital vulnerabilities.

In conclusion, digitization has had a transformative impact on the insurance industry. It has driven operational efficiency, improved customer experiences, facilitated data-driven decision-making, and fostered innovation in insurance models. Insurers that embrace digitization and leverage technology to their advantage are well-positioned to thrive in the evolving digital landscape.

Source URL: - https://www.simplesolve.com/blog/disruptive-innovation-in-insurance-industry

0 notes

Photo

Disruptive innovation in insurance industry: SimpleSolve Cutting-Edge Solutions

Disruptive innovation in insurance industry refers to the introduction of new technologies, business models, or approaches that fundamentally transform the way insurance products and services are delivered, disrupting traditional industry practices. Here are some examples of disruptive innovations in the insurance industry:

Insurtech Startups: The rise of insurtech (insurance technology) startups has brought forth innovative solutions to streamline insurance processes, enhance customer experience, and improve efficiency. These startups leverage technologies such as artificial intelligence (AI), machine learning, big data analytics, and blockchain to offer new insurance products, personalized pricing, automated claims processing, and digital distribution channels.

Usage-Based Insurance (UBI): UBI utilizes telematics and connected devices to collect real-time data on an individual's driving behavior, property usage, or health habits. This data is used to customize insurance policies and determine premiums based on actual risk. UBI promotes fairness, encourages safer behaviors, and offers potential cost savings to customers.

Peer-to-Peer (P2P) Insurance: P2P insurance models enable individuals or small groups to pool their risks together, forming a community that shares the burden of losses. P2P platforms leverage technology to facilitate risk sharing, claims processing, and administration. This approach can offer lower costs, increased transparency, and a sense of community among policyholders.

On-Demand Insurance: On-demand insurance allows customers to purchase coverage for a specific duration or a particular event, rather than traditional long-term policies. Mobile apps and digital platforms enable customers to customize and activate insurance coverage as needed, providing flexibility and cost savings for short-term insurance needs.

Digital Distribution and Direct-to-Consumer Models: Digital platforms and online marketplaces have opened avenues for insurers to reach customers directly, bypassing traditional intermediaries. Insurers can offer products, provide quotes, and handle policy administration through user-friendly interfaces, reducing costs and increasing accessibility for customers.

Artificial Intelligence and Automation: Artificial intelligence technologies, including natural language processing (NLP) and machine learning algorithms, are being applied in the insurance industry to automate underwriting, claims processing, customer service, and risk assessment. AI-powered chatbots and virtual assistants are enhancing customer interactions, improving efficiency, and reducing turnaround times.

Cyber Insurance: The growing threat of cyberattacks has led to the emergence of cyber insurance as a specialized insurance product. Cyber insurance covers losses resulting from cyber incidents, including data breaches, ransomware attacks, and business interruptions. Insurers are continuously adapting policies to address evolving cybersecurity risks and providing risk management services to policyholders.

To know more about Disruptive innovation in insurance industry, visit our website. I have written in depth on this topic.

Source URL: - https://www.simplesolve.com/blog/disruptive-innovation-in-insurance-industry/

0 notes

Link

Digital disruption in the insurance industry refers to the transformative impact of digital technologies and strategies that fundamentally reshape traditional insurance practices, business models, and customer experiences. Here are some key aspects of digital disruption in insurance: Digital Distribution Channels: Digital disruption has revolutionized the way insurance products are marketed, sold, and distributed. Insurers are leveraging online platforms, mobile apps, and aggregators to reach customers directly, provide instant quotes, enable self-service capabilities, and simplify the purchasing process. This shift reduces reliance on traditional intermediaries and opens up new customer acquisition channels. Customer Experience Transformation: Digital technologies are driving customer-centricity in insurance. Insurers are enhancing the customer experience through personalized interactions, self-service portals, intuitive user interfaces, and 24/7 accessibility. Mobile apps and online portals allow customers to manage policies, file claims, receive real-time updates, and access support services, improving convenience and satisfaction. Data Analytics and Personalization: Digital disruption enables insurers to collect and analyze vast amounts of data from various sources, including social media, wearables, connected devices, and customer interactions. Advanced analytics, machine learning, and artificial intelligence help insurers extract insights, assess risks, tailor products to individual needs, and personalize pricing and coverage options. Insurtech Collaboration and Partnerships: Insurtech startups are collaborating with traditional insurers to drive innovation and accelerate digital transformation. These partnerships facilitate the adoption of new technologies, such as AI, blockchain, and IoT, to enhance underwriting accuracy, claims processing efficiency, fraud detection, and risk management. Insurtech collaborations also bring agility, fresh perspectives, and entrepreneurial spirit to traditional insurance companies. Automation and Process Streamlining: Digital disruption automates manual and repetitive processes across the insurance value chain. Robotic process automation (RPA) and AI-driven solutions streamline underwriting, claims management, policy administration, and regulatory compliance. Automation reduces errors, improves operational efficiency, accelerates response times, and lowers costs. Usage-Based and On-Demand Insurance: Digital disruption enables insurers to offer innovative insurance models, such as usage-based insurance (UBI) and on-demand insurance. UBI utilizes telematics and IoT devices to gather data on customer behavior and usage patterns, allowing insurers to customize coverage and pricing based on actual risk. On-demand insurance empowers customers to purchase coverage for specific events or time periods, providing flexibility and cost savings. Cybersecurity and Risk Management: Digital disruption has fueled the demand for specialized cybersecurity insurance as organizations face evolving cyber threats. Insurers are developing cyber insurance products that address data breaches, ransomware attacks, and other cyber risks. They also offer risk management services, including cybersecurity assessments, training, and incident response support. Digital disruption in insurance presents both opportunities and challenges for traditional insurers. Embracing digital transformation enables insurers to streamline operations, enhance customer experiences, create innovative products, and gain competitive advantages. However, it requires investment in technology, talent acquisition or upskilling, regulatory compliance, and cultural change to adapt to the digital landscape and stay ahead in a rapidly evolving industry.

Source URL: - https://www.simplesolve.com/blog/disruptive-innovation-in-insurance-industry

0 notes

Photo

Unveiling the Disadvantages of Best-of-Breed Systems | SimpleSolve Insights

While best-of-breed systems offer several advantages, there are also some disadvantages that organizations should consider:

Integration Complexity: Integrating multiple best-of-breed systems can be complex and time-consuming. Ensuring smooth data flow and compatibility between different components requires robust integration efforts, such as developing and maintaining APIs or middleware. Integration challenges may lead to additional costs and potential disruptions during implementation.

Data Consistency and Duplication: When using multiple systems, maintaining data consistency and avoiding duplication becomes crucial. Synchronizing data across various systems can be challenging, and discrepancies or inconsistencies may arise, impacting accuracy and efficiency. Data governance and management practices must be carefully implemented to mitigate these issues.

Vendor Management: Adopting best-of-breed systems means working with multiple vendors. Managing relationships, contracts, support, and updates from different vendors can be demanding. Organizations need to allocate resources to vendor management, including coordinating communication and addressing potential conflicts or issues that may arise.

User Training and Experience: Implementing and maintaining multiple systems may require additional training efforts for users. Each system has its own user interface, workflows, and processes, which can lead to a steeper learning curve and potentially affect user productivity and satisfaction. Consistency and standardization across different systems may be challenging to achieve.

Potential Lack of System Cohesion: As best-of-breed systems are focused on specific functions, there may be a lack of cohesion between different components. It can be challenging to ensure seamless workflows and data sharing across various systems. This lack of cohesion can hinder efficiency and result in fragmented processes.

Higher Total Cost of Ownership: Implementing and maintaining multiple best-of-breed systems can result in higher total cost of ownership compared to a single, all-in-one solution. The costs associated with licensing, integration, training, ongoing support, and vendor management should be carefully evaluated to determine the long-term financial implications.

Organizations considering best-of-breed systems should carefully weigh these disadvantages against the specific needs and resources of their operations. It's crucial to assess the integration challenges, potential data inconsistencies, and the overall complexity of managing multiple systems to make an informed decision.

Source URL: - https://www.simplesolve.com/blog/best-of-breed-vs-integrated-systems

0 notes

Photo

Unleashing Efficiency and Performance: Advantages of Best-of-Breed Systems | SimpleSolve

Certainly! Here are some advantages of adopting a best-of-breed system approach:

Specialized Functionality: Best-of-breed systems are developed by vendors who specialize in specific areas or functions. They often offer advanced features and capabilities tailored to meet the specific needs of that function. This specialized functionality can provide superior performance and efficiency compared to all-in-one solutions.

Flexibility and Customization: Best-of-breed systems allow organizations to select and integrate solutions that best fit their unique requirements. This flexibility enables customization and adaptation to changing business needs. Companies can choose the most suitable software for each function and replace or upgrade individual components without disrupting the entire system.

Innovation and Competitive Edge: Best-of-breed systems are typically at the forefront of technological advancements within their respective domains. Vendors specializing in specific areas are often more agile in adopting emerging technologies and incorporating new features. By leveraging the latest innovations, organizations can gain a competitive edge and stay ahead in their industry.

Scalability and Growth: Best-of-breed systems offer scalability, allowing organizations to expand their capabilities as needed. They can easily add or replace individual components to accommodate business growth or changing requirements. This scalability is particularly beneficial for organizations that need to quickly adapt to market demands or scale their operations.

Source URL: - https://www.simplesolve.com/blog/best-of-breed-vs-integrated-systems

0 notes

Photo

Exploring the Pros and Cons of Integrated Systems: Simplify Your Operations with SimpleSolve

Pros of Integrated Systems: Streamlined Processes: Integrated systems provide a unified platform where different functions, such as policy administration, claims management, and underwriting, are interconnected. This streamlines processes by allowing data to flow seamlessly across departments, reducing manual data entry, minimizing errors, and enhancing overall operational efficiency. Data Consistency and Accuracy: With integrated systems, data is centralized and shared across functions. This improves data consistency and accuracy, as information is entered and updated in one place and can be accessed by authorized users in real-time. This enables better decision-making, reduces redundant data, and improves the overall quality of information. Improved Customer Experience: Integrated systems enable a holistic view of customer information and interactions. This leads to a more personalized and efficient customer experience, as customer data, policy details, claims history, and other relevant information are readily available to customer service representatives. This allows for faster response times, tailored communication, and better customer satisfaction. Easier Reporting and Analytics: Integrated systems facilitate data consolidation and reporting. By having data from various functions in one place, generating reports and performing analytics becomes more straightforward. This enables insurance companies to gain insights into their operations, identify trends, and make data-driven decisions to optimize performance and identify areas for improvement. Cons of Integrated Systems: Limited Flexibility: Integrated systems often offer a comprehensive set of functionalities, but they may not excel in every individual aspect compared to best-of-breed systems. Organizations might have to compromise on specific features or customizations to align with the integrated solution's capabilities. Vendor Lock-In: Adopting an integrated system means relying on a single vendor for multiple functions. This can create a dependence on that vendor and make it more challenging to switch or replace components if the relationship or the system itself does not meet expectations. It's important to consider vendor stability, support, and the ability to address evolving business needs. Implementation Complexity: Implementing integrated systems can be complex and time-consuming, particularly when migrating from legacy systems or dealing with data integration challenges. It requires careful planning, collaboration with stakeholders, and thorough testing to ensure a smooth transition without disruptions to ongoing operations. Higher Upfront Costs: Integrated systems often involve significant upfront investment, including licensing fees, implementation costs, customization, and training expenses. Organizations should carefully assess their budget and cost projections to determine the financial feasibility of implementing an integrated solution. When considering integrated systems, organizations should evaluate the specific needs of their insurance operations, weigh the pros and cons, and conduct a thorough analysis of available options to determine the best fit for their requirements. It's essential to consider long-term scalability, vendor reputation, system compatibility, and the potential impact on business processes and stakeholders.

Source URL: - https://www.simplesolve.com/blog/best-of-breed-vs-integrated-systems

0 notes

Link

Pros of Best-of-Breed Systems:

Specialized Functionality: Best-of-breed systems are typically developed by vendors who specialize in a specific area. They offer advanced features and functionality specifically tailored to meet the needs of that particular function. This specialization can result in better performance and efficiency compared to comprehensive, all-in-one solutions.

Flexibility and Customization: Best-of-breed systems allow organizations to select and integrate solutions that best fit their unique requirements. This flexibility enables customization and adaptation to changing business needs. It allows companies to choose the most suitable software for each function and replace or upgrade individual components without disrupting the entire system.

Cutting-Edge Technology: As specialized vendors focus solely on their area of expertise, they often invest heavily in research and development to stay at the forefront of technology. Best-of-breed systems are more likely to offer the latest advancements, innovative features, and improved user experiences.

Scalability: Organizations can scale best-of-breed systems more easily by adding or replacing individual components as needed. This scalability is particularly beneficial for growing businesses or those with evolving needs, as they can expand their capabilities without having to replace the entire system.

Cons of Best-of-Breed Systems:

Integration Challenges: Integrating multiple best-of-breed systems can be complex and time-consuming. Ensuring smooth data flow and compatibility between different components requires robust integration efforts, such as developing and maintaining APIs or middleware. Integration challenges may lead to additional costs and potential disruptions during implementation.

Data Consistency and Duplication: When using multiple systems, maintaining data consistency and avoiding duplication becomes crucial. Synchronizing data across various systems can be challenging, and discrepancies or inconsistencies may arise, impacting accuracy and efficiency. Data governance and management practices must be carefully implemented to mitigate these issues.

Vendor Management: Adopting best-of-breed systems means working with multiple vendors. Managing relationships, contracts, support, and updates from different vendors can be demanding. Organizations need to allocate resources to vendor management, including coordinating communication and addressing potential conflicts or issues that may arise.

Training and User Experience: Implementing and maintaining multiple systems may require additional training efforts for users. Each system has its own user interface, workflows, and processes, which can lead to a steeper learning curve and potentially affect user productivity and satisfaction. Consistency and standardization across different systems may be challenging to achieve.

It's important for organizations to weigh these pros and cons based on their specific needs, budget, and long-term goals when considering the adoption of a best-of-breed system approach.

Source URL: - https://www.simplesolve.com/blog/best-of-breed-vs-integrated-systems

0 notes

Photo

Machine Learning for Insurance Pricing | SimpleSolve: Advanced Solutions

SimpleSolve harnesses the power of machine learning for insurance pricing, revolutionizing the way rates are determined. Our sophisticated machine learning algorithms analyze vast amounts of data to generate accurate and personalized insurance pricing models. By leveraging this advanced technology, we ensure that your insurance rates are tailored to your specific needs, considering factors such as age, location, driving history, and more. With SimpleSolve, experience the benefits of machine learning for precise and fair insurance pricing.

Machine Learning in Insurance

For insurance companies to manage their data and analytics, they must implement emerging technologies like ML. It enables insurance businesses to improve operational efficiency while reducing the existing risk of insurance fraud. Here are some major innovations machine learning is bringing to the insurance sector.

If you want to know more about machine learning in Insurance, visit our website. We have written in-depth on this topic.

Source URL: - https://www.simplesolve.com/blog/dynamic-pricing-in-insurance-using-ai

0 notes

Link

Experience the power of dynamic insurance pricing with SimpleSolve. Our innovative approach to insurance pricing incorporates dynamic algorithms that adapt to changing risk factors in real-time. By utilizing advanced data analytics and machine learning, we can provide personalized and flexible insurance rates that reflect your specific circumstances. With dynamic insurance pricing from SimpleSolve, you can enjoy fair and transparent pricing that evolves with you.

Dynamic pricing in insurance is creating policies that are cheaper for low-risk customers. High-risk policyholders have a different premium model that is again divided based on various factors and user behaviors. For instance, infrequent drivers will pay lower auto insurance, while those driving more frequently on highways will pay a higher premium. Within the latter group, premiums can again differ based on their driving behavior(e.g. how many times do drivers shift lanes) and speed limits adhered to. These are only a few potential factors, there are actually hundreds of signals that can go into dynamic pricing.

If you want to know more about dynamic insurance pricing, visit our website. We have written in depth on this topic.

Source URL: - https://www.simplesolve.com/blog/dynamic-pricing-in-insurance-using-ai

0 notes

Link

If you're looking for the latest advancements in insurance pricing, look no further than SimpleSolve.com. Our team is at the forefront of the industry, using AI in insurance pricing to provide the most comprehensive coverage at the best prices. Our AI algorithms take into account a wide range of factors, from age and location to driving history and more, to create a customized pricing model just for you. Trust SimpleSolve.com to use the latest technology to provide you with the most accurate insurance pricing models. When thinking about using an automated pricing model, insurers must take this into account. Investing in self-learning algorithms is the next step after establishing the data infrastructure. Predetermined goals determine whether AI-based pricing models are best. Simple matrices to intricate simulation-based models can all be used as models. Please visit our website right now to learn more about insurance pricing models and the use of AI in insurance pricing.

0 notes