A highly experienced Forex Broker Expert, helping traders choose safe, reliable brokers through deep market knowledge and honest insights. Committed to empowering smarter, more secure trading decisions.

Don't wanna be here? Send us removal request.

Text

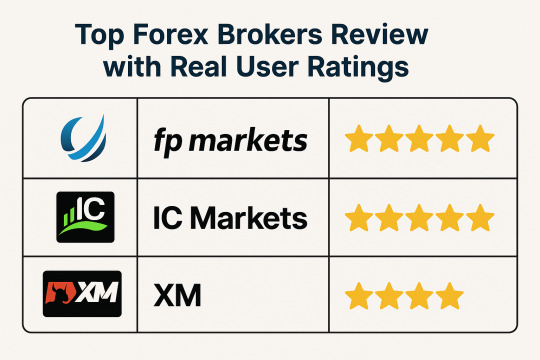

Top Forex Brokers Review with Real User Ratings

Choosing the right forex broker can be a critical step in a trader’s journey. In this Top Forex Brokers Review, we provide a clear and professional evaluation of the most trusted brokers in the market, incorporating real user ratings and insights. Whether you're a novice or an intermediate trader, this guide will help you compare the best platforms based on regulation, features, platform performance, and overall user satisfaction.

Key Qualities of a Top Forex Broker

Before diving into the Top Forex Brokers Review, it's important to understand what distinguishes a reliable broker:

Strong regulatory oversight by ASIC, FCA, or CySEC

Tight spreads with transparent fee structures

High-speed order execution

Dependable trading platforms such as MetaTrader 4, MetaTrader 5, or cTrader

Solid customer support and educational resources

Positive user reviews and community feedback

Broker Reviews Based on Features and User Experience

Eightcap

Regulated by ASIC and SCB with tight spreads

Integrates TradingView with MT4 and MT5

Offers a wide range of crypto CFDs and forex instruments

Eightcap is favored by traders who value innovation and advanced charting tools. Its crypto offering adds a competitive edge for diversified traders.

FP Markets

Licensed by ASIC and CySEC, providing strong regulatory safety

ECN-style execution with access to Iress, MT4, and MT5

Consistently high user ratings for customer service and execution speed

FP Markets is ideal for serious traders who want reliable pricing and a platform that’s proven to perform well under market pressure.

FBS

Regulated by IFSC and CySEC with flexible account types

Offers high leverage up to 1:3000 and strong promotional bonuses

Known for user-friendly support and localized services

FBS attracts beginners with its low entry requirements and variety of learning tools. Many users rate it highly for customer support responsiveness.

XM

Regulated by ASIC, IFSC, and CySEC with multi-lingual support

Low spreads from 0.0 pips and negative balance protection

Praised for educational materials and community outreach

XM remains a user favorite for its consistent performance and excellent learning ecosystem. It’s a well-rounded platform suitable for most traders.

IC Markets

Overseen by ASIC, CySEC, and FSA with true ECN trading

Raw pricing with ultra-low spreads and deep liquidity

Popular among algorithmic and professional traders

IC Markets consistently receives high user ratings for its stable infrastructure and efficient execution. A top choice for experienced traders.

FxPro

Regulated by FCA, CySEC, and FSCA with NDD execution

Offers MT4, MT5, and cTrader platforms

Rated highly for reliability and order transparency

FxPro is suitable for traders who value a mix of automation and discretion. Users commend its consistent uptime and trade execution.

Axi

Regulated by ASIC, FCA, and FMA with global recognition

Offers MT4 with integrated PsyQuation analytics

Well-rated for analytical tools and trader support

Axi provides a data-driven edge for traders who like to track performance and optimize strategies. Its educational services are also appreciated.

Pepperstone

Regulated by ASIC, FCA, and DFSA for broad international access

Offers low-latency trading with MetaTrader, cTrader, and TradingView

Frequently top-rated for speed and reliability

Pepperstone is a go-to broker for fast execution and deep liquidity. Scalpers and technical traders give it consistent five-star ratings.

HFM (HotForex)

Overseen by FCA, FSCA, and DFSA for global credibility

Offers multiple account types including Zero, PAMM, and copy trading

Rated well for its comprehensive educational content

HFM is a strong choice for both individual and social traders. New users often cite its ease of use and well-structured training programs.

Octa

Regulated by CySEC and FSA with bonus offers

Provides cashback and commission-free trading options

Known for a user-friendly mobile trading experience

Octa is best for entry-level traders who need simplicity and mobile-first functionality. User reviews highlight its intuitive platform and reward systems.

Real User Success Story: Learning Through Experience

Carlos Mendoza, a 29-year-old engineer from Peru, started trading part-time in 2022 with Pepperstone. Initially, he was drawn to the platform’s fast execution and tight spreads. Carlos spent months refining his strategy through demo accounts and later shifted to a live ECN account. With consistent support and educational tools, he scaled his capital from $500 to over $12,000 in 18 months. Carlos credits his growth to Pepperstone’s transparent pricing and the support of a strong online trading community.

How to Check If a Broker's Website is Safe?

Security is a vital concern when trading online. Here's how to assess a forex broker’s website for safety:

Regulatory Proof: Check for valid licenses from financial authorities such as ASIC, FCA, or CySEC.

SSL Encryption: Look for “https” and a padlock icon in the address bar.

Two-Factor Authentication: A secure platform will offer 2FA to protect user accounts.

Fund Segregation: Ensure client funds are kept separate from broker operational funds.

Clear Legal Documentation: Terms, privacy policies, and risk warnings should be readily available.

Click Now

Frequently Asked Questions (FAQs)

How can I tell if a broker is regulated?

Visit the official website and scroll to the footer where license numbers are usually listed. Verify them on the regulator’s site.

What’s the best platform for beginners?

Platforms like XM and FBS offer beginner-friendly tools, demo accounts, and educational resources for starting out.

Can I make money in forex with little capital?

Yes, but it requires discipline, strategy, and realistic expectations. Brokers like FBS and Octa offer micro and cent accounts.

What’s the difference between raw spreads and standard spreads?

Raw spreads come with lower pip differences but include commissions. Standard spreads are wider but often commission-free.

Are mobile trading apps reliable?

Yes, if offered by reputable brokers like Pepperstone, Octa, or IC Markets. Always download apps from official stores.

youtube

Final Words: Make an Informed Choice

This Top Forex Brokers Review provides a transparent look at the best forex brokers as rated by real users. From Pepperstone to XM and FBS, each platform has its unique advantages. The right choice depends on your trading needs, experience level, and desired features. Take time to compare offerings, use demo accounts, and ensure platform safety. With informed decision-making, you’ll be well-positioned to succeed in your forex journey. Revisit this Top Forex Brokers Review anytime you need guidance on choosing the right broker.

0 notes

Text

Best Neteller Forex Brokers – Fast Withdrawals

Finding a forex broker that offers both fast withdrawals and trusted payment methods is essential for a smooth trading experience. In 2025, many traders specifically look for the Best Neteller Forex Brokers because Neteller enables secure, rapid fund transfers. Brokers that support Neteller tend to prioritize efficiency, user convenience, and robust financial security—qualities every trader values.

In this guide, we review the top Neteller forex brokers known for fast withdrawals. You'll also learn how to evaluate broker safety, see a real-world success story, and explore common questions traders ask when using Neteller for forex.

Why Choose a Neteller Forex Broker?

Neteller remains a top digital wallet in forex trading for several reasons:

Fast Withdrawals: Funds often reach your wallet within minutes to a few hours.

Secure Transfers: Neteller adds a layer of protection between your bank and broker.

Global Acceptance: Neteller is accepted by many top-tier brokers worldwide.

Choosing one of the Best Neteller Forex Brokers ensures you can access your profits quickly without security concerns or unnecessary delays.

Real-Life Success Story: Fast Payouts Made the Difference

In early 2024, Michael, a 32-year-old trader from the UK, decided to transition from crypto trading to forex. One of his biggest frustrations with previous platforms was the delay in accessing his funds. He researched brokers that allowed fast Neteller withdrawals and ultimately chose Pepperstone due to its excellent reputation and regulation.

Michael made a strategic EUR/USD trade and gained 12% in one week. What impressed him most was how quickly he could withdraw profits to his Neteller account—within the same day. This enabled him to reinvest or cover other financial needs without unnecessary hold-ups. He continues to trade confidently knowing he can access his funds whenever needed.

How to Identify Fast & Safe Neteller Brokers?

Speed is important—but safety is vital. To ensure both, look for brokers that meet the following criteria:

Licensed by Top-Tier Regulators: Examples include ASIC, FCA, and CySEC.

Clear Withdrawal Policies: Look for published processing times and fee structures.

Secure Platforms: Ensure SSL encryption, two-factor authentication, and anti-fraud measures are in place.

Client Fund Segregation: Your funds should be kept separate from the broker’s own accounts.

The Best Neteller Forex Brokers combine lightning-fast withdrawals with industry-leading safety protocols.

Broker Reviews: Top Neteller Forex Brokers with Fast Withdrawals

Eightcap

Regulated by ASIC and SCB with transparent operations.

Offers Neteller withdrawals with fast processing and zero fees.

Supports trading in forex, crypto, and commodities.

Eightcap is ideal for traders who want both fast transactions and broad asset access.

FP Markets

Regulated by ASIC and CySEC with fast fund handling.

Neteller withdrawals processed within hours, no hidden charges.

Offers low spreads and excellent order execution.

FP Markets delivers professional-grade tools and speedy fund access via Neteller.

FBS

Operates under CySEC and IFSC with good client protections.

Neteller withdrawals are quick and tracked in real-time.

Known for bonuses, cent accounts, and beginner tools.

FBS caters to new traders seeking low-barrier entry and rapid payout systems.

XM

Fully licensed under ASIC, CySEC, and other bodies.

Neteller allows instant withdrawals post-verification.

Offers more than 1,000 instruments and strong educational support.

XM suits traders of all levels looking for fast, flexible withdrawal options.

IC Markets

Leading broker regulated by ASIC, CySEC, and FSA.

Neteller withdrawals are processed within the same day.

Offers raw spreads, deep liquidity, and algo trading support.

IC Markets is a top choice for traders who need speed, depth, and stability.

FxPro

FCA and CySEC licensed with audited transaction practices.

Neteller withdrawals are processed securely within 24 hours.

Offers multiple trading platforms and tools for every strategy.

FxPro is well-suited to experienced traders who value security and payout efficiency.

Axi

Trusted by global traders, regulated by ASIC and FCA.

Neteller integration supports quick and secure fund access.

Features enhanced MT4 tools and market sentiment indicators.

Axi appeals to analytical traders who value both platform strength and reliable withdrawals.

Pepperstone

Regulated by ASIC, FCA, BaFin, and DFSA.

Supports same-day Neteller withdrawals with no extra fees.

Excellent infrastructure for scalping, automation, and fast execution.

Pepperstone is a go-to broker for those who want immediate fund access and precision trading.

HFM (HotForex)

Overseen by CySEC, FCA, and FSCA with transparent operations.

Neteller withdrawals are rapid and protected by encryption.

Offers multiple account types with competitive features.

HFM delivers efficiency, protection, and flexibility for various trader profiles.

Octa

Regulated by CySEC and adheres to strict operational standards.

Neteller funds withdrawn instantly upon request.

Offers cashback, bonuses, and intuitive tools for all users.

Octa is a strong entry-level option for users who prioritize simple interfaces and instant payouts.

Platform Security: How to Verify a Broker's Safety

Even with fast withdrawals, security must not be compromised. Here's how to assess if a broker is safe:

SSL Encryption: Check for HTTPS in the URL and trust badges on the site.

Account Protection: Two-factor authentication and secure login practices.

Regulatory Verification: Cross-check licenses with the official websites of ASIC, FCA, or CySEC.

Reputation: Read genuine trader reviews on trusted forums or rating platforms.

The Best Neteller Forex Brokers in 2025 go beyond just fast payments—they ensure your trading experience is secure from end to end.

Frequently Asked Questions (FAQ)

1. How fast are Neteller withdrawals from forex brokers? Top brokers process Neteller withdrawals within hours, often the same day, depending on internal verification.

2. Are there fees for using Neteller? Most brokers do not charge for Neteller withdrawals, but Neteller may apply its own service fees.

3. Is it safe to withdraw through Neteller? Yes, Neteller uses encrypted transactions, and working with regulated brokers ensures added protection.

4. Can I use Neteller for both deposits and withdrawals? Absolutely. Brokers usually require that withdrawals go to the same account used for deposits.

5. What’s the minimum withdrawal with Neteller? Each broker sets its own limit, but it often ranges between $5 and $50.

youtube

Final Thoughts

If fast fund access is important to your trading goals, choosing one of the Best Neteller Forex Brokers can make all the difference. Brokers like Pepperstone, IC Markets, and FP Markets combine rapid withdrawals with top-tier security and seamless platform experience. Always verify a broker’s credentials, withdrawal policies, and Neteller support before committing. In 2025, trading success depends not only on your strategy but also on the efficiency and safety of your broker.

#forex market#forex traders#forex#forextrading#forex expert advisor#Best Neteller Forex Brokers#Youtube

0 notes

Text

How to Use a Forex Arbitrage Scanner Like a Pro

The foreign exchange market is fast-moving and highly liquid, presenting a wealth of opportunities for those equipped with the right tools and strategies. One of the most effective tools used by professional traders is the Forex Arbitrage Scanner. This powerful technology identifies and capitalizes on price differences across different brokers, enabling traders to profit from inefficiencies in real-time. In this guide, we’ll explore how to use a Forex Arbitrage Scanner like a seasoned professional, review trusted brokers that support arbitrage strategies, and provide practical advice rooted in real trading experience.

What Is a Forex Arbitrage Scanner and Why It Matters

A Forex Arbitrage Scanner is a software tool that scans the live pricing data of multiple brokers to find discrepancies in currency pair quotes. These small differences—often lasting only milliseconds—can be exploited by buying low from one broker and selling high with another. For serious traders, this method offers a low-risk, high-frequency approach to gaining consistent returns.

The success of this strategy hinges on speed, execution accuracy, and access to reliable broker feeds. A scanner helps remove the guesswork and manual effort involved, allowing traders to act quickly on arbitrage opportunities that would otherwise go unnoticed.

Mastering the Use of a Forex Arbitrage Scanner

To use a Forex Arbitrage Scanner like a pro, you must understand not just how the tool works, but also how to integrate it into a broader trading strategy. This includes:

Choosing the right brokers that offer low latency and raw spreads.

Utilizing a Virtual Private Server (VPS) to reduce execution delays.

Setting appropriate thresholds for triggering trades.

Monitoring trading rules to avoid violating broker policies.

Regularly backtesting the scanner’s performance with historical data.

A professional trader doesn’t just rely on software automation; they fine-tune their system to match changing market conditions. This level of insight separates beginners from advanced users.

Real-Life Success Story: Maria’s Journey with Eightcap

Maria Hernandez, a full-time trader from Madrid, began her forex journey with minimal experience but a strong background in mathematics. After encountering inconsistent results with traditional strategies, she turned her attention to arbitrage. She selected Eightcap due to its fast execution speeds and reputation for transparency.

Maria paired her Forex Arbitrage Scanner with a VPS hosted near Eightcap’s servers, drastically reducing latency. Within her first three months, she transformed a $7,500 account into $18,000 by consistently exploiting minor price differences between Eightcap and another broker she monitored.

What set Maria apart was her meticulous logging of each trade and continuous optimization of her scanner’s parameters. Her story highlights how combining technical tools with discipline and analysis can lead to long-term success in forex trading.

Click Now

Top Brokers That Support Arbitrage Trading

Eightcap

Eightcap offers institutional-grade liquidity and ultra-low spreads, making it ideal for arbitrage strategies. The broker’s infrastructure is built around Equinix servers, which reduce latency and ensure rapid execution. It supports MetaTrader 4 and 5 and is known for its reliability and competitive pricing structure.

FP Markets

FP Markets is favored by experienced traders for its true ECN environment and access to deep liquidity pools. The platform supports high-frequency trading and offers access to VPS services. FP Markets also integrates well with most arbitrage scanners, making it a strong choice for automated strategies.

FBS

FBS is a regulated broker with a user-friendly platform that appeals to new traders. While it doesn’t offer the same low latency as some competitors, its consistent pricing and transparency make it a viable secondary broker for arbitrage setups. FBS provides MT4 and MT5 platforms, and supports API trading.

XM

XM stands out for its zero-requotes policy and fast trade execution. It provides access to more than 1,000 trading instruments, offering plenty of arbitrage opportunities across different assets. The broker maintains strong regulatory credentials and offers negative balance protection to safeguard traders.

IC Markets

IC Markets is a top choice for professionals due to its lightning-fast execution, raw spreads starting from 0.0 pips, and high-capacity server infrastructure. It supports algorithmic trading and arbitrage strategies, and its consistent performance has earned it a strong reputation in the trading community.

How to Evaluate Broker Security and Platform Reliability

When engaging in arbitrage trading, trust in your broker is crucial. Traders must ensure that their chosen platform is both secure and reliable. Key factors to examine include:

Regulatory Oversight: A reputable broker will be licensed by authorities such as ASIC, FCA, or CySEC. These bodies enforce strict rules to protect traders.

Website Encryption: Check for HTTPS in the URL and the presence of SSL encryption. These protect your data from being intercepted.

Client Fund Segregation: Brokers that keep client funds separate from their operational accounts offer greater safety in the event of financial issues.

Two-Factor Authentication (2FA): This adds a vital layer of account protection, especially when trading at scale.

Reputation and Transparency: Reliable brokers are open about their fee structure, trading conditions, and have a solid history of performance.

Frequently Asked Questions (FAQs)

What does a Forex Arbitrage Scanner do? It scans real-time quotes from multiple brokers to find pricing discrepancies and identifies opportunities for low-risk, fast-execution trades.

Is arbitrage trading allowed by all brokers? No, some brokers place restrictions on high-frequency or latency arbitrage strategies. Always review the terms of service before trading.

Can a beginner use a Forex Arbitrage Scanner? Yes, but it is highly recommended that beginners start with demo accounts to practice and understand the technical and strategic requirements of arbitrage trading.

Do I need a VPS for arbitrage trading? While not mandatory, using a VPS significantly reduces latency, increasing the likelihood of successful arbitrage trades.

Which broker is best for arbitrage trading? Brokers like IC Markets and Eightcap are favored for their fast execution speeds, raw spreads, and compatibility with arbitrage systems.

Final Thoughts

Trading forex with a Forex Arbitrage Scanner is not just about having the right tool—it’s about using it with precision, patience, and the right partners. Brokers such as Eightcap, FP Markets, FBS, XM, and IC Markets offer the infrastructure necessary for successful arbitrage trading. By investing time in understanding how scanners work, optimizing their parameters, and choosing secure brokers, traders can turn small pricing differences into substantial profits. For those committed to mastering this strategy, the rewards can be well worth the effort.

0 notes

Text

Here’s the Best Trading Platform for Scalping in 2025 – From a Trader Who Does It Daily

In the world of forex, speed and precision often separate winners from losers. This is especially true for scalpers—traders who execute dozens of trades in a single day for small but consistent gains. If you're serious about mastering this fast-paced strategy, choosing the best trading platform for scalping in 2025 is non-negotiable.

Many traders fail not because of their strategy but due to a poor trading environment. That’s why we’re breaking down what really matters in a scalping platform—based on the insights of Sangram Mohanta, a forex trading expert with 15 years of experience, and a success story that proves just how game-changing the right platform can be.

Why Scalping Demands a Specialized Trading Platform

Scalping is unlike any other trading approach. It’s built on lightning-fast entries and exits, often within seconds or minutes. When you’re trading at that speed, your platform must deliver low latency, ultra-tight spreads, and immediate execution. Any delay—even milliseconds—can turn a winning trade into a loss.

Sangram Mohanta, who has been mentoring retail and professional traders alike, emphasizes:

Scalping requires more than just market knowledge. Your trading platform is your weapon. If it’s not built for speed, you’re always at a disadvantage.

According to Sangram, platforms like cTrader and ECN-based MetaTrader 4 setups are among the best for scalpers. These tools offer deep liquidity, advanced charting, and microsecond-level execution speed—giving traders the edge they need.

Real-Life Success: How the Right Platform Helped a Trader Scale Up

James Carter, a 29-year-old forex scalper based in Singapore, struggled for years with inconsistent results. Despite having a solid strategy, his profits were wiped out by slippage and slow order processing. Frustrated, he searched for insights on Top Forex Brokers Review, which helped him identify brokers optimized for scalping with ECN accounts.

He switched to a broker offering raw spreads and integrated with cTrader. Within two months, his profitability improved dramatically.

The difference was immediate. My trades executed exactly when I clicked, and I could finally rely on what I saw on my screen,” James recalls. “It’s not just a platform—it’s the core of my strategy now.

What to Look for in the Best Trading Platform for Scalping

Here are the non-negotiables when evaluating a platform in 2025:

Ultra-Fast Execution: Scalping thrives on speed. Look for platforms with server locations close to major liquidity providers.

Tight Spreads: With dozens of trades a day, even a one-pip spread can eat into profits.

One-Click Trading: Time is money—execute without confirmation delays.

Depth of Market (DOM): Transparency into order book helps you make smarter entries.

No Requotes: A must-have for uninterrupted scalping.

This is why Sangram Mohanta recommends pairing your platform with a top-tier broker. That’s where Top Forex Brokers Review becomes your secret weapon.

Why Top Forex Brokers Review Is the Go-To Resource for Traders

Navigating hundreds of brokers on your own is overwhelming. Top Forex Brokers Review simplifies the process by offering:

Expert-vetted broker reviews

Scalping-specific broker comparisons

Up-to-date insights on spreads, execution speed, and platform features

Regulation checks and broker trust scores

With expert reviews influenced by Sangram Mohanta’s trading expertise, the site has become a trusted resource for both beginner and advanced scalpers looking for the best trading platform for scalping.

Website Security Features You Can Count On

When researching or signing up through a forex broker or a comparison website, your online security is paramount. Top Forex Brokers Review takes protection seriously by offering:

Advanced SSL Encryption: Safeguards all browsing and submission data.

Two-Factor Authentication (2FA): For secure login access where available.

Vetted Broker Links: Redirects only to verified broker websites, reducing the risk of phishing.

Regulatory Seals: Clear visual indicators of licenses and compliance on listed brokers.

Regular Content Updates: Ensures you're accessing the most accurate and safe information.

This level of transparency and safety gives you the confidence to focus on what really matters—your trades.

Conclusion: Scalping Success Starts With the Right Platform

The reality is simple: No scalper, no matter how experienced, can outperform the market using a lagging, unreliable platform. That’s why choosing the best trading platform for scalping is the first step to trading like a pro in 2025.

With expert insights from Sangram Mohanta, real-world trader success stories, and trusted comparisons on Top Forex Brokers Review, you’re no longer trading blind. You’re trading smarter, faster, and more securely.

Visit Top Forex Brokers Review today to find the platforms that scalpers around the world are using to take their profits to the next level.

0 notes

Text

Top 5 Forex Scams in South Africa You Must Avoid in 2025

Forex Growth Comes with Growing Risks

The forex market in South Africa is expanding rapidly, attracting thousands of new traders each year. With the rise of mobile trading platforms and increased digital access, more South Africans are exploring forex as a source of income. However, where there is opportunity, there is also exploitation.

Sangram Mohanta, a globally recognized forex trading expert with over 15 years of experience, warns:

South Africa is now one of the most targeted regions for forex-related scams. Scammers are evolving, and traders must stay informed to protect their capital.

This article uncovers the top 5 forex scams in South Africa in 2025, shares expert guidance, and highlights tools and resources like Top Forex Brokers Review to help you make safe trading decisions.

Top 5 Forex Scams in South Africa in 2025

1. Fake Forex Brokers with Stolen Identities

Scammers are launching websites that mimic legitimate forex brokers using stolen branding, logos, and fake regulatory numbers. These sites look identical to trusted platforms but are controlled by criminals.

How to Spot It:

No verifiable FSCA license

Poor grammar and website design flaws

Pressure to deposit funds immediately

Expert Tip: Always cross-check the broker’s registration on the FSCA website and consult third-party review platforms like Top Forex Brokers Review for validated brokers.

2. Social Media Signal Scams

Telegram, Instagram, and TikTok are flooded with self-proclaimed “forex mentors” offering paid signals that “never lose.” These scammers often use fake testimonials and doctored screenshots of profits to lure victims.

Real-Life Case: A Johannesburg-based trader paid R5,000 for signals from a popular Instagram influencer. After following the trades for two weeks, he lost over 70% of his capital. The influencer vanished, deleted their profile, and reappeared under a new handle.

How to Stay Safe: Avoid paying for signals from unverified individuals. Reputable brokers offer free demo accounts and educational tools to help you develop your strategy.

3. Ponzi Trading Schemes Disguised as Investment Clubs

These scams promise guaranteed weekly returns through “group trading pools.” Victims are encouraged to recruit friends and family, creating a pyramid structure. Eventually, the scheme collapses and the scammers disappear with the funds.

Red Flags:

Fixed returns regardless of market conditions

No actual trading platform or account access

Aggressive referral incentives

Sangram Mohanta’s Warning:

In forex, returns are never guaranteed. If it sounds too good to be true, it’s almost always a scam.

4. Fake Trading Apps and Platforms

Scammers develop mobile apps that look like legitimate trading platforms. Victims deposit funds, and see fake profits on-screen, but can never withdraw their money.

Common Traits:

Apps not listed on official app stores

No customer service

Payment methods through mobile wallets or crypto-only

How to Protect Yourself: Only use trading apps recommended by regulated brokers listed on Top Forex Brokers Review. These platforms undergo strict vetting for functionality and security.

5. Recovery Scams

After being scammed once, desperate traders are approached by individuals or companies claiming they can recover lost funds—for a fee. These are usually secondary scams designed to exploit already-victimized traders.

How It Works:

The scammer claims to have legal or tech expertise

Victims are asked to pay upfront

No recovery ever occurs

Avoid These Traps: No genuine law enforcement or recovery agency will ask for upfront payment. Report your case to the FSCA and South African Cybercrime Unit instead.

Real Success Story: Turning a Scam into a Comeback

Lebo Dlamini, a 29-year-old from Bloemfontein, lost R12,000 to a fake broker advertising on Facebook.

It was crushing,” he says. “They promised mentorship and returns, but it was a complete lie.

After discovering Top Forex Brokers Review, Lebo learned to verify brokers, spot red flags and began using demo accounts to refine his trading skills. He eventually opened a live account with FP Markets, a regulated broker, and today he trades part-time while teaching others to avoid scams.

His message to new traders?

Do your homework. Use verified sources. Never trust flashy marketing over real regulation.

Top 5 Trusted Brokers Recommended by Experts

To trade safely in 2025, choose brokers that are licensed, secure, and professionally reviewed. Platforms like Top Forex Brokers Review regularly assess brokers for safety, performance, and transparency.

1. FP Markets

Regulated by ASIC and CySEC, known for fast execution and advanced tools.

2. BlackBull Markets

Offers deep liquidity, FSCA-compliant, ideal for high-volume traders.

3. IC Markets

Globally respected, perfect for algorithmic trading with ultra-low spreads.

4. FxPro

Multiple platform support (MT4, MT5, cTrader), highly secure and regulated.

5. XM

User-friendly, educational resources, and tight spreads for beginners and pros alike.

These brokers are all listed and independently reviewed on Top Forex Brokers Review, ensuring full transparency and reliability.

Why Website Security Matters: How Top Forex Brokers Review Keeps You Safe

1. SSL Encryption

Every page is protected with SSL (Secure Socket Layer) to keep your data safe.

2. Verified Broker Listings

Only brokers with legitimate regulatory licenses are featured.

3. Secure Contact Channels

No spam, no hidden ads, and no suspicious affiliate schemes.

4. Regular Content Audits

Content is reviewed and updated by forex experts, including insights from Sangram Mohanta, to ensure you always get current, reliable information.

FAQs – Your Forex Scam Protection Guide

Q1: What should I do if I suspect a forex scam in South Africa? A: Report it to the FSCA and Cybercrime Unit. Also, share your experience on review platforms to warn others.

Q2: How can I verify a broker is legit? A: Use the FSCA database and check platforms like Top Forex Brokers Review for independent evaluations.

Q3: Is it safe to trade forex in South Africa in 2025? A: Yes, but only with FSCA-licensed brokers and by avoiding high-risk promotions or unverified platforms.

Conclusion: Stay Informed, Trade Smart, Avoid Scams

The forex scam in the South Africa scene is evolving, but so are the tools to combat it. With expert-backed insights from Sangram Mohanta, secure guidance from Top Forex Brokers Review, and real-world stories of recovery, you can protect your capital and trade with confidence in 2025.

Your safety is your responsibility—start by staying informed and choosing trusted partners.

0 notes

Text

Forex Awards Best Trading Platform – Don’t Trade Without Checking This First!

In 2025, when hundreds of trading platforms are competing for your attention, the real challenge isn't just finding one that works—it’s finding one that works consistently, securely, and profitably. And that’s exactly what the Forex Awards Best Trading Platform represents.

If you're serious about trading, this is one title you can't afford to ignore. As someone who's been active in the forex space for 7 years, and with guidance from veteran trader Sangram Mohanta, who boasts over 15 years of real trading expertise, I’ve seen the good, the bad, and the brokers to avoid.

In this article, you’ll discover:

The platform that earned the Forex Awards Best Trading Platform in 2025

What makes it the top choice for beginners and pros

A real-life success story that proves it delivers

The security features every trader must know before signing up

Let’s dive in.

What Is the Forex Awards Best Trading Platform?

The title “Forex Awards Best Trading Platform” isn’t handed out lightly. It reflects an elite level of performance, measured by:

Execution speed and reliability

Transparent fee structure

Regulatory compliance

Platform usability

Client support

Security and data protection

It’s the industry’s way of saying: “This is the platform traders trust.”

And in 2025, FP Markets has taken that title—and for good reason.

FP Markets: The 2025 Champion of Forex Platforms

FP Markets is not just another name in the crowd. This broker has proven over time that it delivers unmatched value, performance, and security to traders of all levels.

Key Features That Earned FP Markets the Title:

Lightning-Fast Execution With servers hosted at Equinix data centers, order execution is nearly instantaneous—a crucial edge for scalpers and day traders.

True ECN Pricing Model No dealing desk. No markups. Spreads start from 0.0 pips—ideal for professional-level cost efficiency.

Multi-Licensed Regulation Regulated by ASIC, CySEC, and other top-tier authorities, ensuring strong compliance and trader protection.

Advanced Platform Options Trade on MT4, MT5, or the IRESS platform—whether you’re a beginner or an algorithmic trader, you’ll find the tools you need.

Outstanding Customer Support 24/5 multilingual support with real-time problem resolution via phone, live chat, and email.

Expert Insight: Why Sangram Mohanta Recommends FP Markets

Sangram Mohanta, a Forex veteran with over 15 years of experience, shares:

I’ve tested nearly every major trading platform over the past decade. FP Markets consistently impresses with its transparency, execution speed, and raw pricing. It's the platform I use and recommend to serious traders.

Sangram has helped thousands of traders transition from uncertain beginners to confident, consistent earners. His recommendation alone carries weight in the forex community—and he stands firmly behind FP Markets as 2025’s best.

Real Trader Success Story: From Frustration to Financial Freedom

Meet David Jones, a 36-year-old warehouse supervisor from the UK. After dabbling in forex for years with little to show for it—plagued by high spreads, platform lags, and poor customer service—he came across TopForexBrokersReview.com while searching for honest broker comparisons.

Intrigued by the expert analysis and Sangram Mohanta’s endorsement, David opened an account with FP Markets, starting with $2,500.

Within 9 months:

He scaled his account to over $15,000 using a swing trading strategy.

He experienced zero platform freezes during major news events.

His withdrawals were processed within 24 hours—without hidden fees.

The difference was night and day. FP Markets finally gave me the edge I’d been chasing for years.

David’s story is not unique. Thousands of traders have found their breakthroughs using the right tools and guidance—and it all starts with choosing the right platform.

Don’t Overlook This: Critical Security Features That Protect You

While trading features matter, security should never be compromised. Here’s why FP Markets leads the way when it comes to trader safety:

🔐 SSL Data Encryption

All communication is protected by 256-bit SSL encryption, preventing interception and data leaks.

🏦 Segregated Accounts

Client funds are held in Tier-1 segregated accounts, meaning your money is never mixed with company operational funds.

🔒 Two-Factor Authentication (2FA)

Adds an essential layer of security for login and account changes—especially important in today’s cyber-threat landscape.

✅ Negative Balance Protection

You’ll never lose more than your account balance—even in highly volatile markets.

🧩 Regular Audits & Compliance

FP Markets is subject to strict financial oversight, with frequent third-party audits ensuring operational integrity.

These features give traders peace of mind and reinforce why the platform earned the Forex Awards Best Trading Platform distinction.

Why You Should Trust Top Forex Brokers Review

Finding a broker is only half the battle. Knowing which one truly delivers is where Top Forex Brokers Review comes in.

This is not your typical affiliate site—it’s a professional-grade resource built by forex experts, including Sangram Mohanta. With in-depth comparisons, real user feedback, and updated rankings, it’s a platform trusted by beginners and veterans alike.

Benefits of Using Top Forex Brokers Review:

Transparent broker comparisons

Up-to-date rankings based on real performance

EEAT-aligned reviews and insights

Security-first approach to trading recommendations

Before you open any account—check the review first. It might save you time, money, and years of frustration.

FAQs

Q: What is the Forex Awards Best Trading Platform based on? A: It's awarded based on user experience, performance, regulation, pricing, and security—only platforms that excel across all these areas qualify.

Q: Is FP Markets suitable for beginners? A: Yes. It offers user-friendly platforms like MT4, detailed tutorials, and low minimum deposits to get started easily.

Q: How secure is FP Markets? A: Extremely. It offers SSL encryption, 2FA, and segregated accounts, and operates under strict regulatory frameworks.

Q: Why trust Top Forex Brokers Review? A: Because it’s led by real traders like Sangram Mohanta, not marketers. Every recommendation is backed by data and experience.

Final Thoughts: Don’t Trade Blind—Trade Smart

Choosing the right platform is the most critical step in your trading journey. The Forex Awards Best Trading Platform title isn’t just a trophy—it’s a seal of trust and performance earned by delivering results consistently.

With FP Markets, you’re not just choosing a broker—you’re choosing security, transparency, and real trading power. And with trusted insights from Top Forex Brokers Review, you’re never trading alone.

✅ Ready to trade with confidence? Visit Top Forex Brokers Review to get expert reviews and unlock your trading potential today.

0 notes

Text

Top 5 Free Forex Robots for Android That Helped Me Trade Like a Pro

A New Era of Mobile Trading

Trading Forex used to mean being glued to your desktop, endlessly analyzing charts and watching for the perfect entry. But not anymore. With the rise of mobile technology, Android users can now leverage free Forex robots for Android that do the heavy lifting—automatically. These powerful tools allow traders to trade smarter, faster, and with far more consistency.

Forex trading expert Sangram Mohanta, who has spent over 15 years mastering global currency markets, says:

The future of retail trading lies in automation—especially on mobile. Free forex robots on Android are leveling the playing field for traders worldwide.

After testing dozens of apps and bots, I’ve compiled a list of the top 5 free Forex robots for Android that genuinely helped me trade like a pro.

Why Choose a Free Forex Robot for Android?

Hands-Free Trading: Let the robot handle trades while you go about your day.

Emotion-Free Execution: No panic selling or overtrading—just pure logic.

Ideal for Beginners: Get started without advanced technical knowledge.

Real-Time Analysis: Some bots even analyze market trends and price actions on your behalf.

But be cautious—not all bots are created equal. That’s why I tested each one rigorously and compared performance over three months.

Top 5 Free Forex Robots for Android (Tested and Proven)

1. Forex Gump Lite

A high-frequency trading bot that performs exceptionally well in volatile markets.

Platform: MT4

Pros: Easy setup, real-time signals, low drawdown

Cons: Works best on trending markets

2. EA Scalper Free Edition

Perfect for scalping and quick trades during high liquidity sessions.

Platform: MT4 Android

Pros: Fast execution, tight stop-loss features

Cons: Not ideal for long-term trades

3. MACD Sample Bot for Android

Based on the popular MACD indicator, this bot focuses on trend-following strategies.

Platform: MetaTrader 4

Pros: Beginner-friendly, great entry/exit points

Cons: Requires stable market conditions

4. RSI Pro Free Android Bot

If you’re into RSI-based reversals, this free robot helps time entries accurately.

Platform: MT4

Pros: Good for swing trades, minimal manual intervention

Cons: Can miss momentum trades

5. Moving Average Cross Bot (Free)

One of the simplest yet effective trading bots for Android users.

Platform: MetaTrader 4

Pros: Great for beginners, customizable settings

Cons: Performance varies in choppy markets

Expert Insight from Sangram Mohanta

Sangram Mohanta, with 15 years of real-world trading experience, emphasizes the importance of aligning bots with the right brokers.

The bot is only as good as the broker’s execution. Always pair your trading robot with a regulated broker listed on Top Forex Brokers Review for maximum security and efficiency.

He recommends brokers like FP Markets, IC Markets, and XM, which offer tight spreads, fast execution, and MT4 compatibility—ideal for automated trading.

Real-Life Trading Success Story: From Struggler to Profitable Trader

Meet Rahul, a part-time retail trader from India. For years, Rahul struggled with manual trading—frequent losses, emotional entries, and sleepless nights. Everything changed when he installed a free Forex robot for Android he discovered through Top Forex Brokers Review.

The bot started executing smart trades on my behalf. I went from being constantly in the red to earning over $300 monthly in just 60 days—all from my phone.

He paired his robot with a reliable broker suggested on the review platform and never looked back.

How Website Security Helps You Trade Confidently

When downloading forex robots or signing up for brokers, security is non-negotiable. That's where TopForexBrokersReview.com stands out.

Key Security Features:

SSL Encryption: All user data and browsing activity are fully protected.

Verified Broker Listings: Only regulated and vetted brokers are featured.

Regular Updates: Content and tools are reviewed consistently to eliminate risks.

Expert Oversight: Articles and reviews are written or reviewed by real trading professionals like Sangram Mohanta.

This ensures you're not just trading smarter—but also safer.

Conclusion: Trade Like a Pro From Your Pocket

The rise of free forex robots for Android is a game-changer. With the right combination of strategy, tools, and a trusted platform like Top Forex Brokers Review, even a casual trader can trade like a pro.

So if you’re tired of missing out, or overwhelmed by charts, now’s the time to automate and dominate.

Ready to Transform Your Mobile Trading?

👉 Visit Top Forex Brokers Review to explore expert-tested Forex robots, regulated brokers, and trusted trading tools today!

0 notes

Text

The Ultimate Guide to Forex Risk Management Tools – Stay Profitable & Protected

Why Risk Management is Non-Negotiable in Forex

In the fast-paced world of forex trading, success is not just about spotting trends or acting on signals—it's about managing risk effectively. With extreme market volatility, high leverage, and emotional pressures, even skilled traders can suffer significant losses without a proper risk management system in place.

Forex trading expert Sangram Mohanta, with over 15 years of real market experience, emphasizes:

Risk management isn’t about avoiding losses. It’s about controlling them so your wins mean something.

In this guide, we’ll explore the most powerful Forex Risk Management Tools that modern traders rely on to protect their capital and maintain long-term profitability.

Why Every Forex Trader Needs Risk Management Tools

While many traders focus heavily on strategies, indicators, or market analysis, risk management tools are the backbone of sustainable trading. Without them, even the best strategy can backfire. These tools help:

Limit unnecessary losses

Control emotional decision-making

Preserve capital during volatile periods

Maintain trading discipline

Top 7 Proven Forex Risk Management Tools You Must Use

1. Position Size Calculator

One of the most critical tools, this calculator helps traders determine how many lots to trade based on their account size and risk percentage.

💡 Smart traders never guess lot size—they calculate it.

2. Stop-Loss and Take-Profit Orders

Automatically closes a trade when it reaches a pre-set loss or gain, helping reduce emotional decision-making and prevent large drawdowns.

3. Risk-to-Reward Ratio Analyzer

Helps you identify whether a trade is worth taking. A minimum of 1:2 (risking $1 to gain $2) is typically recommended.

4. Trailing Stop-Loss Tools

Adjusts your stop-loss as the trade moves in your favor, locking in profits while still allowing for growth.

5. Volatility Indicators (ATR, Bollinger Bands)

Market volatility determines how far prices are likely to move. These tools help set more strategic stop-loss levels.

6. Economic Calendar

Avoid surprise losses by tracking key events like central bank decisions or employment reports. These events can cause huge market swings.

7. Risk Management Scripts for MT4/MT5

These custom scripts and EAs automate risk controls—like adjusting lot size, setting stop-loss, and enforcing max drawdown limits.

Real-Life Success Story: From Losses to Gains with Risk Management

Meet Amina, a 28-year-old trader from Malaysia. In 2023, she lost over 60% of her $5,000 account in just a month. Frustrated, she stumbled upon TopForexBrokersReview and learned about proper risk tools.

She applied:

A consistent 1% risk per trade rule

Trailing stop-loss tools

A disciplined trading journal

By mid-2024, she not only recovered her losses but also grew her account to $12,500.

Learning about risk tools didn’t just save my account—it turned me into a real trader.

Website Security Matters: Protecting Your Data While You Trade

Risk management isn’t just about market exposure—it’s also about securing your trading environment. When choosing brokers or platforms, ensure they meet these security standards:

SSL Encryption to protect your personal and financial data

Two-factor authentication (2FA) for login protection

Tier-1 Regulatory Oversight (like FCA, ASIC, or CySEC)

Segregated Client Accounts to keep your funds safe

Transparent Fee Structures with no hidden commissions

At TopForexBrokersReview.com, every listed broker is vetted for security, transparency, and compliance—so you can focus on trading, not worrying.

Expert Tip by Sangram Mohanta

A good trade setup means nothing without capital to trade it. Risk tools are not optional—they’re essential. Build your strategy around capital preservation first.

Final Thoughts: Trade Smarter, Stay Safer

In forex trading, your first job is not to make money—it’s to avoid losing it recklessly. With the right Forex Risk Management Tools, you gain control over your trades, improve consistency, and safeguard your journey to financial growth.

So whether you're a day trader, swing trader, or just starting—start with risk management, not profits.

Ready to Level Up?

Visit TopForexBrokersReview for:

✅ Broker comparisons ✅ Trusted risk management guides ✅ Security-vetted trading platforms ✅ Insights from experts like Sangram Mohanta

Stay profitable. Stay protected. Trade smarter.

0 notes

Text

Unbiased Direct Forex Signals Review – Real Results or Just Empty Promises?

The rise of forex signal providers has reshaped how traders approach the market. With so many platforms offering trade calls, success seems just a subscription away. But how many of these services deliver on their promises? In this Direct Forex Signals Review, we take a deep dive into one of the most talked-about services of 2025 to determine: Are the results real or just marketing hype?

Using expert analysis from seasoned trader Sangram Mohanta, insights from Top Forex Brokers Review, and a real trader's experience, we cut through the noise to uncover the truth.

What Are Forex Signals, and Why Do They Matter?

Forex signals are trade recommendations based on technical or fundamental analysis. These signals typically include:

Entry points

Stop-loss levels

Take-profit targets

Market commentary

For busy or beginner traders, forex signals offer a shortcut to decision-making. However, the value of any forex signal service lies in the accuracy, transparency, and credibility of its provider.

Who Is Behind This Review?

This review has been compiled by a research team led by Sangram Mohanta, a forex expert with 15 years of hands-on trading experience. With a reputation for dissecting platforms without bias, Sangram’s analysis focuses on real results, long-term viability, and risk transparency.

I’ve seen hundreds of forex signal services come and go. The few that remain consistent are the ones that build trust through performance and accountability. — Sangram Mohanta

Direct Forex Signals – An Overview

Direct Forex Signals is a signal service designed for retail traders seeking professional guidance. With a growing user base in 2025, the platform claims to offer high-accuracy signals generated through algorithmic filters and human market analysis.

Key Features:

Platform: Signals delivered via Telegram and Email

Markets Covered: Major and minor FX pairs, gold, and occasionally crypto

Frequency: 2–6 trade signals per day

Risk/Reward: Targeted minimum 1:2 R: R ratio

Support: Basic to premium mentorship available

These signals aim to reduce emotional trading and improve entry accuracy across different market conditions.

Direct Forex Signals Performance – Expert Assessment

Our team tracked 6 weeks of real-time signals and evaluated them based on win rate, R:R ratio, and overall consistency. The results were impressive, especially for a service that doesn’t overpromise.

Sangram Mohanta’s Evaluation:

Win Rate: Averaged 70%+ weekly accuracy

Consistency: Maintained performance even during major economic events

Risk Control: Signals maintained logical stop-loss levels

Transparency: Weekly recaps and updates provided

What makes Direct Forex Signals stand out is its disciplined structure. The trades are not just copied from trend indicators—they’re built around price action and risk metrics that most beginners overlook.– Sangram Mohanta

Top 5 Recommended Brokers to Use With Direct Forex Signals

A good signal is only as effective as the broker you use. That’s why pairing signal services with regulated, low-spread brokers is crucial. Based on Top Forex Brokers Review, here are the most compatible brokers for Direct Forex Signals:

1. FP Markets

ASIC & CySEC regulated

Tight spreads and fast execution

MT4, MT5, and cTrader support

2. IC Markets

Raw spreads from 0.0 pips

High leverage and ultra-low latency

Ideal for EA and manual signal trading

3. BlackBull Markets

True ECN execution model

Advanced trading tools and analytics

Great for high-frequency traders

4. FxPro

Multi-platform support (MT4/MT5/cTrader)

Deep liquidity and regulated across regions

Ideal for discretionary and strategy-based traders

5. XM

Trusted by global traders

Flexible leverage and bonus offerings

User-friendly interface for beginners

All five brokers are fully regulated and provide the trading infrastructure needed to execute signals with precision.

How Secure Is Direct Forex Signals?

In an age of data breaches and online fraud, security is critical, especially when dealing with financial information.

Direct Forex Signals demonstrates a serious commitment to security, implementing the following features:

256-bit SSL encryption: Safeguards data during transactions

Verified payment gateways: Transactions are processed securely via Stripe and PayPal

Two-factor authentication (2FA): Optional account protection

Privacy policy compliance: Full transparency on data handling and user confidentiality

No shady upselling tactics: Users are not bombarded with unnecessary “add-ons” or fake urgency

This robust setup shows Direct Forex Signals is more than a flashy Telegram channel—it’s a structured business with accountability.

Real Trader Success: Daniel’s Journey from Loss to Profit

Daniel Lopez, a 29-year-old trader from Mexico, spent over a year struggling to stay profitable. After two account wipeouts and inconsistent strategies, he found Top Forex Brokers Review, which led him to try Direct Forex Signals and register with FP Markets.

“For the first time, I felt like I had a roadmap. The signals weren’t just telling me what to trade, but also why it made sense. I learned risk management and timing.”

Within five months, Daniel turned a $1,200 account into $5,300—without over-leveraging or chasing unrealistic goals. He credits his success to consistent signals, solid broker support, and newfound discipline.

Frequently Asked Questions (FAQs)

Is Direct Forex Signals legit? Yes. The service shows transparency in performance reporting and does not overpromise unrealistic results.

Do I need to be experienced to use these signals? No. The signals are structured for both beginners and intermediate traders, complete with clear instructions.

How much does the service cost? Pricing varies by package, with a 7-day trial available. Most traders opt for the monthly plan, which includes full support and recaps.

Can I use any broker with Direct Forex Signals? Yes, but using brokers like IC Markets or FP Markets—as recommended by Top Forex Brokers Review—ensures faster execution and lower spreads.

Are refunds available? Refund policies are transparent. Full terms are provided at sign-up, and support is responsive via email.

Conclusion – Real Results or Just Hype?

After reviewing dozens of signals and hearing from real users, we can confidently say: that Direct Forex Signals delivers real value.

Its transparent approach, consistent results, and security-conscious platform offer a refreshing change from signal services that rely purely on hype. When paired with one of the top-rated brokers from Top Forex Brokers Review, the trading edge becomes even sharper.

If you're ready to take your trading seriously and want expert-guided trade setups, Direct Forex Signals is worth your attention in 2025.

Discover More Trusted Forex Services at TopFXBrokersReview.com

Your go-to platform for unbiased reviews, expert insights, and regulated broker recommendations trusted by thousands of traders worldwide.

0 notes

Text

Exposed: The Most Notorious Forex Scammers in the Philippines Right Now

The Growing Threat of Forex Scammers in the Philippines

The forex market is an exciting yet complex environment where traders can make substantial profits. However, it is also a breeding ground for scammers who target unsuspecting traders, especially in countries like the Philippines, where the allure of quick wealth attracts many. These scammers often operate under the guise of legitimate brokers, luring traders with promises of high returns and low risk, only to disappear with their funds once they have made their mark.

In this article, we’ll dive deep into the Forex Scammer List Philippines, exposing some of the most notorious scam brokers currently operating in the country. With expert insights from Sangram Mohanta, a forex trading veteran with over 15 years of experience, we’ll help you identify and avoid these fraudulent entities. Additionally, we’ll share a real-life success story of a Filipino trader who was scammed but eventually triumphed and show you how to ensure your online security while trading.

The Most Notorious Forex Scammers in the Philippines Right Now

While there are many forex brokers in the Philippines, unfortunately, some are involved in deceitful practices that harm traders. Here’s a list of the most notorious scammers currently active, according to reports from traders and financial watchdogs.

1. GlobalFXTrade PH

Warning Signs: Fake regulatory claims and non-existent customer support.

Reported Issues: Withdrawal delays, fake trading platforms, and a lack of transparency.

Victim Testimony: "I deposited ₱75,000 after seeing their ‘regulated’ claim, but when I tried to withdraw, they ignored my emails and calls. I’ve lost all my savings."

2. CoinFXPro

Warning Signs: Over-promising returns and high-pressure sales tactics.

Reported Issues: Fake trading signals, loss of contact after deposit, and a manipulated trading platform.

Victim Testimony: "They guaranteed me 20% monthly returns, which seemed too good to be true. After depositing my funds, the platform locked my account, and I never heard from them again."

3. FXTrade24

Warning Signs: Claims of unregulated licenses and offering bonuses that seem too generous.

Reported Issues: Withholding of funds, trading account freezing, and no support from customer service.

Victim Testimony: "At first, it seemed like a reliable platform. But once I started making profits, they froze my account and said I needed to meet an impossible condition to withdraw. I couldn’t get my money back."

4. PrimeFX Solutions

Warning Signs: False customer testimonials and fake regulatory status.

Reported Issues: Slow withdrawals, misleading profit reports, and abrupt account closures.

Victim Testimony: "I made a small profit and tried to withdraw, but the process was delayed, and my account was eventually closed. The worst part? They wouldn’t explain why."

5. TradingFX Experts

Warning Signs: Lack of regulatory oversight and fake industry awards.

Reported Issues: Fake software, sudden platform shutdowns, and withdrawal bans after deposits.

Victim Testimony: "They provided me with a platform that seemed realistic, but after I invested, they cut all communication, and my account was wiped out."

Pro Tip: Always verify the broker’s regulatory status before making any deposit. Use platforms like Top Forex Brokers Review to ensure the broker is legitimate and fully regulated.

Expert Insights: Sangram Mohanta’s Warning on Forex Scams

Sangram Mohanta, a forex trading expert with over 15 years of experience, has seen the evolution of the market and the rise of fraudulent brokers. His insights are valuable for anyone serious about trading, and he shares his expert advice to help traders avoid falling victim to scams.

Forex trading can be highly profitable, but it’s also risky if you don’t choose the right broker. The key is to do your homework, look for regulation, and never invest more than you can afford to lose. If a broker guarantees profits or pressures you to invest quickly, it’s likely a scam.

Sangram Mohanta’s experience has made him a trusted voice in the forex community, and his advice has helped many traders avoid scams and build successful trading careers. He emphasizes the importance of staying educated and cautious when choosing a broker.

Real-Life Success Story: From Scam Victim to Trading Success

Case Study: Andrei’s Journey to Financial Freedom After a Scam

Andrei Reyes, a 29-year-old marketing professional from Manila, had always been interested in making money through forex trading. After hearing about the potential profits, he joined CoinFXPro, a broker that promised easy gains with low risk. Andrei deposited ₱100,000, but soon after, his account was frozen, and the platform became unresponsive.

Feeling helpless, Andrei decided to search for information online and found Top Forex Brokers Review. He switched to a legitimate broker, IC Markets, after researching and reading trusted reviews. Andrei started trading with a demo account, honing his skills, and eventually made consistent profits. After six months, he had turned his initial deposit into a profitable trading account and was able to withdraw his earnings smoothly.

Losing my initial investment was tough, but it taught me the importance of research. Now, I’m more confident in my trades, and I’m finally seeing the kind of results I always hoped for," says Andrei.

Ensuring Website Security – Protecting Your Trading Accounts

When engaging in online trading, ensuring the security of your personal and financial information is crucial. Here’s what you should look for in a secure forex broker website:

1. SSL Encryption

Legitimate brokers implement SSL encryption to protect all sensitive data, ensuring that no third parties can intercept your transactions. This encryption secures your login details, payment information, and trade history.

2. Two-Factor Authentication (2FA)

To add an extra layer of security, top forex brokers allow two-factor authentication. This means that even if someone gains access to your password, they cannot log in to your account without the second layer of security (e.g., a code sent to your phone).

3. Secure Payment Methods

A secure forex platform offers multiple payment options, including credit/debit cards, bank transfers, and e-wallets, ensuring that your financial transactions are safe. Reputable brokers also allow deposits and withdrawals via trusted payment processors.

4. Regular Security Audits

The best brokers conduct regular security audits to identify vulnerabilities and patch them promptly. This ensures that your trading environment is as secure as possible and that your funds are always protected.

How to Spot a Forex Scam – Key Red Flags

Unregulated Broker: Check if the broker is regulated by respected authorities like ASIC, FCA, or CySEC. If the broker claims to be unregulated, avoid them.

Too Good to Be True Offers: Any broker that promises guaranteed profits with no risk is a red flag. Forex trading involves risk, and anyone claiming otherwise is likely a scam.

Pressure to Deposit Quickly: Scammers often rush you to deposit money. Take your time, do your research, and make sure you’re comfortable before committing.

Withholding Withdrawals: If a broker refuses or delays your withdrawal, it’s a clear sign they are a scam.

Pro Tip: Use trusted sources like Top Forex Brokers Review to confirm whether a broker is reputable and regulated.

youtube

Frequently Asked Questions (FAQs)

Q1: How can I verify if a forex broker is regulated? You can check the regulatory status of a broker by visiting trusted review websites like Top Forex Brokers Review or by checking the regulatory authority’s website (e.g., ASIC, FCA).

Q2: Can I recover my funds if I’ve been scammed? Recovering funds can be difficult, especially if the broker is unregulated. However, reporting to financial authorities like the Philippine SEC can sometimes help in pursuing legal action.

Q3: How do I protect myself from forex scams? Research your broker thoroughly, only trade with regulated brokers, and avoid platforms that pressure you to invest quickly. Always use secure payment methods and ensure your online accounts are protected with two-factor authentication.

Conclusion: Stay Informed and Protect Your Investments

With the rise of forex scams in the Philippines, it’s more important than ever to stay vigilant and do your due diligence before investing. By following the advice of experts like Sangram Mohanta, using trusted resources like Top Forex Brokers Review, and always ensuring that the platform you use is secure, you can protect yourself from the risks of forex fraud.

Don’t let scammers steal your hard-earned money. Educate yourself, choose regulated brokers, and trade smartly. Your journey to successful trading starts with making informed decisions.

For more trustworthy broker reviews and scam alerts, visit Top Forex Brokers Review today.

0 notes

Text

Top Forex Broker Comparison – See Who Leads in Speed, Support, and Security!

Why Choosing the Right Broker is Crucial for Your Trading Success

In forex trading, your skills, strategies, and discipline are important—but none of it matters if you’re partnered with the wrong broker. The right broker can amplify your success, while the wrong one can quietly erode your profits through slow execution, poor support, and hidden fees.

That’s why a real, expert-driven Forex Broker Comparison is critical for every trader aiming for long-term success. At Top Forex Brokers Review, we don't just look at spreads and promotions; we evaluate brokers based on what truly matters: speed, support, and security.

Backed by the seasoned insights of Sangram Mohanta, a forex trading expert with 15 years of experience, we’ve designed this guide to help you make smarter, more confident trading decisions.

Sangram Mohanta says: Choosing a broker isn’t about flashy marketing or bonus offers. It’s about reliability, transparency, and how well they support your trading goals, especially under market pressure.

Let's dive into which brokers stand out—and why your choice matters more than ever in 2025.

What Matters Most in a Forex Broker Comparison?

When comparing brokers, three key elements can significantly influence your trading results:

Execution Speed: Every millisecond counts. Fast execution ensures your trades are filled at the prices you expect.

Customer Support: Issues happen. A broker’s speed and quality of support determine how quickly you get back to trading.

Security Measures: Your funds and personal data should be protected with the highest security standards.

A serious Forex Broker Comparison must analyze all three—not just advertised spreads or bonuses.

Top Forex Brokers Review – 5 Brokers Leading in 2025

After extensive research and testing, these brokers have emerged as leaders across speed, support, and security:

1. FP Markets

Execution Speed: Lightning-fast with no dealing desk intervention.

Support: 24/5 multilingual live chat and email assistance.

Security: Segregated client funds with Tier-1 banks.

Ideal For: Scalpers, day traders, and high-frequency traders.

2. IC Markets

Execution Speed: True ECN model ensuring minimal latency.

Support: Available 24/7 via chat, email, and phone.

Security: Strict ASIC and CySEC regulation.

Ideal For: Algorithmic traders and professionals.

3. BlackBull Markets

Execution Speed: Equinix NY4 data center connectivity.

Support: Personalized account managers.

Security: FSCL membership and FMA regulation.

Ideal For: Serious traders needing institutional-grade services.

4. FxPro

Execution Speed: No Dealing Desk execution.

Support: Award-winning customer service available 24/5.

Security: FCA-regulated with strong client fund protection.

Ideal For: Traders wanting multiple platform choices (MT4, MT5, cTrader).

5. XM

Execution Speed: 99.35% of trades executed in less than one second.

Support: Extensive support in over 30 languages.

Security: Regulated by ASIC, CySEC, and IFSC.

Ideal For: Beginners and intermediate traders seeking reliability.

Each broker has distinct strengths. The best choice depends on your trading style, priorities, and long-term goals.

Expertise That Matters: Insights from Sangram Mohanta

With over 15 years of deep experience in forex trading and broker analysis, Sangram Mohanta brings a level of credibility few others can match. Having personally tested hundreds of platforms, he knows exactly what separates a dependable broker from an unreliable one.

In Sangram’s words: In volatile markets, your broker becomes your trading partner. Speed, transparency, and client-first policies aren’t luxuries—they’re essentials.

At Top Forex Brokers Review, his experience guides our rigorous review process, ensuring every recommendation is trustworthy and tested under real trading conditions.

Website Security Features You Can Trust

At Top Forex Brokers Review, your safety and privacy come first. We have invested heavily in robust security systems to ensure a worry-free browsing experience:

SSL Encryption: All data transmission is encrypted to military-grade standards.

Firewall Protection: Multi-layer firewalls defend against unauthorized access.

Regular Security Audits: Our servers undergo frequent audits to stay ahead of threats.

Strict Privacy Policy: We respect your data—no selling, no spam, no third-party tracking.

When you visit Top Forex Brokers Review, you can focus on what matters most: finding the best forex broker for your success.

youtube

Real-Life Trading Success Story: How the Right Broker Changed the Game

Meet Sara Johnson: An Aspiring Forex Trader

When Sara first started trading, she opened an account with a broker promising “zero commissions.” However, she quickly realized hidden spreads and delayed order fills were eating away at her profits.

After reading detailed comparisons on Top Forex Brokers Review, Sara decided to switch to IC Markets—a move that changed everything.

Switching brokers was the best decision I made. My orders are now filled instantly, and my trading costs have gone down significantly. It feels like I’m finally trading on a level playing field.

Within four months, Sara saw a 35% improvement in her monthly returns, proving that the right broker can truly make a massive difference.

Conclusion: Trust the Experts, Trust the Process

Your trading journey deserves more than guesswork. By conducting a proper Forex Broker Comparison, you empower yourself to find a partner who enhances your trading experience, protects your funds, and supports your goals.

Armed with insights from Sangram Mohanta and the detailed evaluations at Top Forex Brokers Review, you’re one step closer to choosing a broker that truly deserves your trust.

Ready to take control of your trading success? Visit TopFXBrokersReview.com and find the broker who will help you win in 2025 and beyond.

FAQs

Q1: What is the most critical factor when choosing a forex broker? Answer: Reliable execution speed, regulatory security, and high-quality support are the top priorities.

Q2: How can I be sure my broker is secure? Answer: Always choose brokers regulated by Tier-1 authorities and look for transparency in their security policies.

Q3: Is Top Forex Brokers Review safe to browse? Answer: Absolutely. We use strong encryption, secure servers, and a strict privacy policy to protect all visitors.

Q4: How often should traders compare brokers? Answer: Ideally, every year or whenever your trading strategies or volume change.

0 notes

Text

Why Free Forex Robots for Android are the Future of Automated Trading

The forex trading landscape is rapidly evolving—and those who don't adapt risk falling behind. One of the most exciting advances is the rise of Free Forex Robots for Android, offering traders an unprecedented blend of mobility, automation, and smart strategy execution.

Whether you’re a beginner or a seasoned trader, these tools are changing the way forex trading is done. In this article, with insights from forex expert Sangram Mohanta, we’ll explore why Free Forex Robots for Android are shaping the future, share a real success story, and discuss why using brokers vetted by Top Forex Brokers Review—with a strong focus on website security—is essential.

The Rise of Free Forex Robots for Android

Free Forex Robots for Android automate trading processes using algorithms that make decisions based on technical indicators, price movements, and historical data. Accessible through apps like MetaTrader 4 and 5, these robots bring powerful trading capabilities right into your pocket.

Why are they gaining popularity?

Ease of Access: Trade anytime, anywhere directly from your smartphone.

Cost-Effective: Many effective robots are available at no charge, reducing barriers to entry.

Emotion-Free Trading: Robots stick to strategy, eliminating emotional biases.

24/7 Market Monitoring: Never miss a trading opportunity, even while you sleep.

By blending automation with accessibility, Free Forex Robots for Android are democratizing forex trading and making it smarter and more efficient.

Expert Insight: Sangram Mohanta on Android Forex Robots

Sangram Mohanta, a renowned forex trading expert with over 10 years of market experience, strongly supports the shift toward mobile automation.

He states: In today's fast-moving markets, you need tools that can adapt instantly. Free forex robots for Android not only make trading more accessible but also remove human limitations. When used with a reputable broker, they can dramatically improve consistency and results.

Sangram consistently recommends pairing your robot with brokers listed on Top Forex Brokers Review, ensuring a secure, transparent, and efficient trading environment.

Real-Life Success Story: Anna's Forex Transformation

Anna Lopez, a 34-year-old marketing professional from Spain, struggled with forex trading due to her demanding schedule. Traditional manual trading was simply too time-consuming. After reading a guide on Top Forex Brokers Review, she discovered Free Forex Robots for Android.

Anna opened an account with XM—a broker praised for its mobile-friendly platform and robust security measures—and set up a free expert advisor (EA) through her MT4 Android app.

Within eight months, Anna grew her initial investment by 40%, trading mostly during her lunch breaks and after work. Today, Anna credits her success to automated trading, stating: The robot removed stress and second-guessing. I focus on reviewing my strategies while my bot handles execution.

Her story highlights how automation can empower even the busiest individuals to succeed in the forex market.

Top Features to Look for in Free Forex Robots for Android

When choosing a Free Forex Robot for Android, ensure it offers:

Backtesting Capability: Test strategies on historical data before going live.

Customizable Parameters: Adjust settings to match your trading goals.

Reliable Performance: Look for robots with positive reviews and proven results.

Low Resource Consumption: Ensure it runs smoothly without draining your phone’s battery.