Text

The Facts About Non-owned Car Insurance

As well as, having a Non-owner plan will certainly allow you to acquire an Umbrella plan for much more insurance coverage. Call us today and also allows make sure you're safeguarded or demand a Free Quote.

You might assume that if you don't have a car that you couldn't possibly need automobile insurance coverage. That if you do drive your buddy's insurance coverage will certainly cover you, but this may just be the situation for the vehicle, not you and your travelers. A non-owner automobile insurance plan can be useful if you occasionally drive a vehicle yet do not have one.

Depending on state requirements, you may require to have proof of car insurance policy in order to obtain or restore a motorist's license. A non owner insurance policy can please these requirements.

Rumored Buzz on Your Guide To Non-owner Car Insurance

Obtain a quote in 5 mins at . If you are listed as a primary or periodic driver on a vehicle insurance coverage, you have insurance coverage when driving the car. If you drive a relative's or roomie's automobile, you ought to be provided as a chauffeur on their automobile insurance policy.

As your life modifications, so do your insurance coverage needs. To find out more regarding non-owner insurance and if it makes sense for you, speak to an Acuity independent insurance policy representative.

Unlike conventional cars and truck insurance coverage, non-owner policies just cover the individual that acquires it. You can not add various other chauffeurs to the plan. Exactly how does non-owner cars and truck insurance policy job? Non-owner car insurance coverage works as a. It pays for damages above and also beyond what a car's main insurance covers. Non-owner vehicle insurance plan just cover damages if the primary plan's insurance coverage restriction is much less than the secondary coverage.

Get This Report on Non-owner Car Insurance: Car Insurance Without A Car

Instance: You borrow a close friend's vehicle and trigger $60,000 of building damage in an accident. Your pal just has $25,000 of home damages coverage, meaning you are responsible for the remaining $35,000. Your non-owner policy applies, however only if you have at the very least $25,000 of residential or commercial property damages coverage on it.

Though the majority of car-sharing firms offer motorists some responsibility protection, it's not always enough. You need an SR-22 or FR-44 If you require to submit an FR-44 or SR-22 kind with your state due to a DUI or various other driving conviction, non-owner insurance coverage could be an inexpensive means for you to fulfill your obligation insurance policy demands.

You marketed your cars and truck but haven't changed it If you sold your vehicle and also haven't bought a brand-new one, non-owner car insurance policy can avoid a gap in protection. Plus, it can cover you when you evaluate drive feasible replacements. Who should not obtain non-owner car insurance? Obtaining non-owner cars and truck insurance may not be the ideal suggestion if you don't rent or borrow cars and trucks frequently, or if you intend to borrow an auto for some time.

The Best Guide To Non-owned Car Liability Insurance

You deal with a moms and dad, close friend or flatmate and utilize their cars and truck Non-owner auto insurance policy usually won't cover you if the vehicle you borrow belongs to someone you live with, like a moms and dad, good friend or roommate. The most effective way to protect yourself in this circumstance is to have that person include you to their auto insurance plan.

The automobile owner's insurance policy protection. The coverage linked to your credit history card.

com LLC makes no representations or guarantees of any kind of kind, reveal or indicated, regarding the operation of this website or to the info, content, products, or items consisted of on this site. You specifically concur that your use this site is at your single danger.

How Non-owner Car Insurance: Can Save You Time, Stress, and Money.

Jim doesn't have an automobile, yet his partner, Melanie, allows him borrow hers whenever he requires it. One evening, while Jim is driving Melanie's cars and truck, he comes to be a bit sleepy as well as inadvertently drives into oncoming website traffic, causing a four-car pileup. 2 of the other vehicles are completed, and also 4 individuals with major injuries are transported to the medical facility.

The responsibility damages of the accident greatly surpass what her policy will certainly cover. This is simply one example of a scenario where somebody who does not own a lorry would have benefited from carrying a non-owner cars and truck insurance coverage policy.

youtube

0 notes

Text

The smart Trick of Non Owners Car Insurance - Cheapest Auto Insurance That Nobody is Discussing

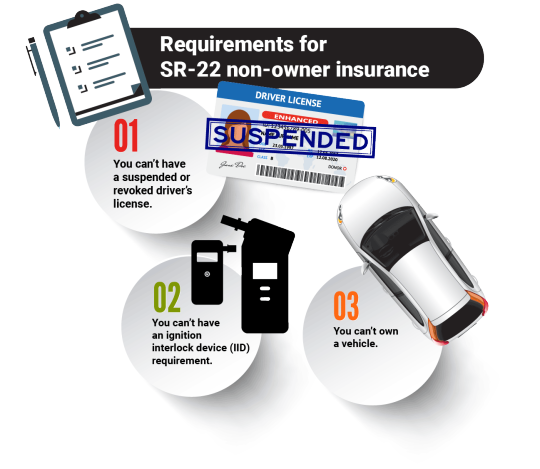

As you 'd expect, yet here are 2 other pieces of requirements that you typically need to fulfill as well: you have to own a vehicle as well as you should to an auto. These constraints are likely put in place to ensure that car proprietors do not enroll in non-owner insurance for reduced automobile insurance coverage prices.

There is for non-owner cars and truck insurance policy either. Your age can impact the price of your non-owner car insurance coverage's costs (much like typical car insurance). Just How Much You Can Expect to Pay for Non-Owner Auto Insurance policy, You can expect to pay an annual premium when you buy a non-owner insurance coverage and also like any other insurance plan, this can be pricey.

This indicates that you do not have to pay anything past your costs for coverage to kick in as well as if your non-owner policy resembles the majority of, the insurance business will certainly cover you from day one. Additionally, because the business can't determine your premium based on the worth of a vehicle, your.

And also, non-owner vehicle insurance. This suggests that your prices may be reduced if you eventually buy a car as well as require car insurance coverage. For referral, not having car insurance for an extensive time period can make your prices more expensive if you decide to purchase an automobile in the future.

Car Insurance, Non-owners, And Sr22

You need to have a look at just how several days a year you really rent out autos. After that, take the average of just how much much you pay to purchase insurance coverage from the rental car company as well as contrast it to what the insurance company quotes you. If you conserve money or are close to recovering cost, it may be worthwhile to get a non-owner insurance plan.

This can be the insurance consisted of with a rental automobile or obtained automobile, yet it's constantly best to get in touch with the rental cars and truck firm initially. So in practice, you might not need to declare on your non-owner insurance policy if you have a tiny minor car accident. Rather, you can lean on the rental car's included insurance coverage.

On the various other hand, your non-owner insurance coverage will pay. So if you obtain a friend's automobile as well as they only have the state minimum for obligation insurance, you're shielded if something fails. The specifics of non-owner automobile insurance coverage differ from insurance supplier to insurance supplier. Make sure to ask regarding points like c that your insurance policy includes like roadside assistance.

The important point that it doesn't cover is that you're obtaining or renting out. With this in mind, you might intend to pay for your rental with a bank card that provides a . Some credit score cards offer up to $75,000 in main insurance coverage, meaning that a complete loss of a lot of ordinary rental vehicles will cost you nothing out of pocket.

Non-owner Car Insurance: What It Is And When You Need It for Dummies

Expect to for a damage waiver straight from the rental automobile business the price might differ based on lorry type and place. Without a damage waiver, you'll be stuck paying out of pocket for damages to or theft of the car, so see to it you have some sort of car protection prior to you drive.

Sadly, we were not able to locate a non-owner insurance company that offered an insurance quote on its site. This means that you have to call the insurance firm or see a brick-and-mortar insurance policy office for a quote. This can make looking around for quotes hard, yet you must still look around for the very best feasible price.

Final Thoughts, Leasing an automobile without vehicle insurance policy can be challenging, but it's certainly possible. Whether you pick to pay-as-you-go for insurance or decide to acquire an annual non-owner car insurance coverage plan, it's always worth having additional insurance policy over the obligation insurance consisted of with the rental. As talked about, the included obligation insurance policy is usually just at the state minimum, which can be very low.

This will certainly conserve you cash over acquiring additional obligation insurance coverage each time you rent a vehicle and also guarantees that you can drive without fear whenever you rent out. Nonetheless, prepares to individuals that only lease vehicles 1 or 2 times per year. A yearly costs is not most likely to conserve you cash in this situation, and you're far better off acquiring responsibility insurance coverage from the rental car business when you rent.

The Greatest Guide To Non-owner Car Insurance: Car Insurance Without A Car

This will secure you from damage to as well as burglary of the car you're renting out and also can possibly conserve you 10s of hundreds of bucks if something goes incorrect during your rental. As well as keeping that: drive safe!.

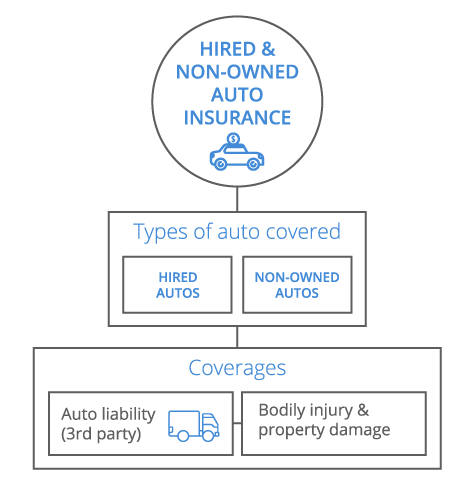

Did you understand you may need cars and truck insurance coverage even if you don't own a cars and truck? Non-owner or non-owned automobile insurance coverage is liability protection for chauffeurs who do not possess a car. Somebody who does not own a car may need this protection if they frequently lease cars, or are required to bring liability insurance policy to maintain their chauffeur's license.

https://calbizjournal.com/the-most-common-reasons-why-your-car-needs-insurance/

youtube

0 notes

Text

The 9-Minute Rule for What Is Non-owner Car Insurance And Do You Need It

Your state's legislations or the insurer might require any person in your household with an automobile to detail you on their car insurance policy. Required vehicle insurance coverage? There are a pair restrictions to non-owner auto insurance. Below is what it will not cover. Non-owner automobile insurance coverage does not give comprehensive or crash coverage.

Solutions like Zipcar may provide motorists with some sorts of insurance policy coverage, but non-owner insurance policy can give additional security if the price of injuries or damages you cause go beyond the car-sharing solution's coverage limitations. If your motorist's permit is suspended for something like a DUI, you might be required to give an SR-22 kind (or FR-44, in some states) in order to restore it.

Non-owner insurance policy is just supplied by a few auto insurance policy business. And the ones that offer it may require you to call or check out a neighborhood office for an insurance quote rather of enabling you to obtain a quote online.

The Ultimate Guide To Non-owners Insurance North Carolina - Protective Agency

Required car insurance policy? Stephanie Colestock is an individual financing writer with an interest for aiding viewers take control of their money. If it involves planning for the future, leaving debt, or eve Find out more. Related Articles.

We might receive financial payment when you click on web links as well as are accepted for debt card items from our marketing partners. Viewpoints as well as product recommendations on this site are ours alone, and have actually not been affected, evaluated or authorized by the issuer. For those of you without automobiles of your own, it can be a mess to rent a vehicle given that you normally do not have vehicle insurance.

The Ultimate Guide To Non-owner Auto Insurance Basics

There are a couple of different manner ins which you can rent out an auto without cars and truck insurance policy of your own while still staying guaranteed when traveling you simply need to understand where to look. Below are right you can rent an automobile without car insurance coverage. We'll start by considering purchasing insurance from the rental company and also after that study the total guide to non-owner automobile insurance.

Picture Debt: Alexander Ptter, You have a pair of options when renting automobiles without your very own auto insurance. Rental Autos Are (Kind Of) Instantly Insured, Something to keep in mind concerning rental vehicles: virtually all rental cars and trucks in the U.S.

Not known Incorrect Statements About Non Owner Sr22 Insurance, The Cheapest!

Sounds great? The Golden State just needs that cars are guaranteed for are included, and also $5,000 in home damage liability.

So if you lease there, there's an opportunity you might be driving a vehicle entirely without insurance. Pretty scary things. So keeping that in mind,. You might be responsible for a huge costs if you end up in a vehicle crash. Getting Obligation Insurance Policy From the Rental Business, Almost all rental automobile business let you acquire far better responsibility insurance when you pick up your rental auto.

This will offer you peace of mind when driving as well as make sure that you're covered if you obtain in a wreck. This insurance coverage can be pricey, though, and also there's no uncertainty that it'll add up over time if you rent out cars and trucks frequently.

Fascination About Non-owner Car Insurance: Everything You Need To Know

can anticipate to, however factors like chauffeur age, lorry kind, as well as extra may impact the rates depending upon the rental business. To make matters worse, you normally can't buy liability insurance policy online. This suggests that you need to particularly ask for it when you go to get the cars and truck, leaving you based on cost surprises at the counter.

You can purchase obligation insurance from Silvercar by choosing at check out. You can elect to purchase coverage at checkout, and also prices might vary from city to city.

youtube

1 note

·

View note