Host of The Investors Podcast which is the #1 stock investing podcast worldwide with 12 million+ downloads and counting.

Don't wanna be here? Send us removal request.

Text

The Intrinsic Value of VOXX International Corp.

Introduction

VOXX International Corp. is a manufacturer and supplier of consumer electronic products in the automotive, premium audio, accessory and biometrics industries.

Their business is divided into three segments:

The Consumer Electronics unit sells speakers, headphones, audio systems, and other mostly audio-related electronics products. It includes the former Premium Audio segment and the former Consumer Accessories segment, less EyeLock, LLC. The company’s Klipsch brand is the number one premium speaker brand both in the US and in Canada.

Automotive Electronics consists of the Company's OEM and aftermarket automotive business. Here, VOXX offers several solutions for the automotive market, such as rear-seat entertainment devices, automotive security and remote start systems, advanced driver assistance systems, aftermarket satellite radio, and others.

Biometrics is a newly formed segment which includes EyeLock, LLC, the Company's majority-owned investment. EyeLock offers iris-authentication solutions for protecting identity and assets.

The revenue of International Corp. has massively declined during the last years. While in 2013 the company still reported sales of $836 million, this figure today stands at only $439 million. A recent decline in car sales and the timing of various programs explains this drop during the last one or two years, but the company’s problems run deeper. Lately, VOXX International Corp. also had to write down a large part of its goodwill, sending earnings sharply negative. One reason for these problems might be the various business segments, which seem to have little overlap and therefore offer only limited synergy savings.

VOXX International Corp.’s stock price has fallen from more than $18 in 2013 to a price of only $4.90 today. Is this a bargain, or is the stock market right to be so pessimistic?

The Intrinsic Value of VOXX International Corp.

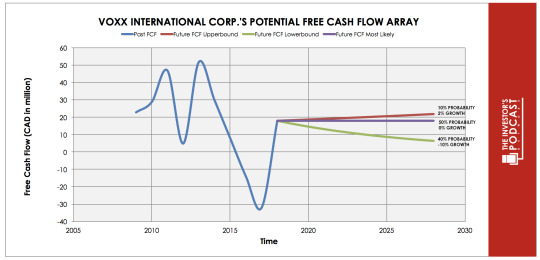

To determine the value of VOXX International Corp., let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of VOXX International Corp.’s free cash flow over the past years.

As one can see, the cash flows have been highly volatile. This is due to the cyclical business VOXX International Corp. is operating in. Also, the company has been repeatedly reorganized, and its business has constantly changed. As a consequence of these additional risks, we will use a conservative estimate for VOXX International Corp.’s future cash flows.

Each line in the above graph represents a certain probability for occurring. The upper growth rate of 2% assumes that the company can be successfully transformed and that its revenue stabilizes. While it might not be unreasonable to assume this sce

nario, we only set a 10% chance for this outcome. This might be overly pessimistic, but the company’s future is quite unpredictable. As most probable, we consider zero change in cash flow. For this scenario, we assign a probability of 50%. The worst case is assumed to be a sharp decline of 10% annually, which might be caused by a severe recession or if VOXX International Corp.’s current transformation is unsuccessful. We estimate the chance for this happening at 40%.

Assuming these growth rates and probabilities are accurate, VOXX International Corp. can be expected to give a 12.1 % annual return at the current price of $4.90. Now, let’s discuss how and why those free cash flows could be achieved.

The Competitive Advantage of VOXX International Corp.

VOXX International Corp. possesses some unique advantages that should allow it to be successful in the future:

Solid Balance Sheet. Despite its problems, VOXX International Corp. has consistently managed to keep a solid balance sheet. The current ratio and quick ratio are very healthy, and the company managed to get rid of almost its complete long-term debt. This was achieved by selling assets such as Hirschmann Car Communication.

Profitable Consumer Electronics. The Consumer Electronics segment is profitable and growing. The incorporated Klipsch brand is the market leader both in the US and in Canada.

Growth Potential. Biometrics is a new segment with vast possibilities. Due to the rise of the Internet of Things, secure verification procedures such as iris identification may yield vast rewards.

Opportunity Costs

When looking at various investing opportunities on the market today, let’s compare the expected return of VOXX International Corp. to other ideas. First, one could invest in the ten-year treasury bond, which is producing a 1.79% return. Considering the bond is completely impacted by inflation, the real return of this option is likely barely positive. Currently, the S&P 500 Shiller P/E ratio is 30.1. According to this valuation metric, the US Stock market is priced at a 3.3% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

Macro Factors

The Consumer Electronics segment is strongly dependent on the general state of the world economy. In a recession, people first save on luxuries – such as state-of-the-art loudspeakers or high-end multimedia devices.

VOXX International Corp.’s Automotive Electronics segment is especially dependent on car sales, which in turn is again depending on the state of the global economy. Recently car sales have already plunged, and the company was negatively affected. The rise of the Internet of Things (IoT) offers use growth possibilities for the Biometrics segment, although this is also a new field which can be quite unpredictable. If the IoT does not deliver on its promises, this could also lead to disappointment for the Biometrics segment.

Risk Factors

There are several risks that might limit the growth prospects of VOXX International Corp.:

Uncertainty Due to Transformation. Revenue has fallen sharply for several years, showing that VOXX International Corp.’s business model was not sustainable. As a result, management tries to change course: Several parts of the company were sold and the structure of its business units reorganized. It is yet unclear if this new business model will be more successful than the old one.

Declining Automotive Car Sales. This already negatively impacts the automotive electronics segment. Car sales are very cyclical and closely connected to the state of the world economy. If another global recession strikes or if car sales continue to drop because of other reasons, demand for products of VOXX International Corp.’s Automotive Electronics products might be lowered.

Disconnected Business Parts. While the Consumer Electronics and Automotive Electronics segments are similarly aligned, it is hard to see a huge connection to the Biometrics segment. Loudspeakers and automotive entertainment devices bear very little resemblance with iris identification solutions. This limits the scope of synergies, and it remains to be seen if these different segments can be successfully integrated within a single company.

Summary

VOXX International Corp. is currently undergoing a vast transformation of its business model, and the outcome is as yet unclear. The company has solid finances, looks cheap, and offers the potential for huge growth – especially in its Biometrics segment. On the other hand, things can also easily go downhill, if the business transformation fails, global car sales deteriorate further, or the Internet of Things does not fulfill its vast promises.

The Biometrics segment is especially the big unknown variable: This company part has yet no meaningful revenue, the potential of the technology is still unknown, and management has little experience in this field. But if all works out well, the rewards are huge.

At this point, it is quite hard to determine if VOXX International Corp. is a bargain or a value trap. If the company manages to prosper within the new business environment, the expected annual return of 12.1 % seems generous. But the risks are equally large. Before investing in VOXX International Corp., investors are well-advised to investigate the company in more detail.

*

This article was written in collaboration with Christoph Wolf from Christoph Wolf Value Investing

Stig Brodersen is the host of the business podcast “We Study Billionaires.” You can find his free intrinsic value index here of popular stock picks.

0 notes

Text

The Intrinsic Value of XCel Brands Inc.

Introduction

XCel Brands Inc. is a media and consumer company with a novel approach to retail. The company is engaged in the design, production, marketing, and direct-to-consumer sales of branded apparel, footwear, accessories, and home goods. Its brands include Isaac Mizrahi, C. Wonder, Halston, Judith Ripka, and Highline.

Using its novel approach of a fast-to-market supply chain and using its integrated technology platforms, the company aims to give its retail partners an edge over existing fast fashion models. Its retail partners get exclusive rights of XELB’s brands, while XELB earns its revenues from royalties, design fees, margin participation, as well as marketing and other fees.

The company aims to address the problem of the disconnect between short-lead social media and long-lead supply chains. This is achieved by using an integrated technology platform using consumer insight testing, trend analytics tools, data science, 3D design, and AI. This allows XELB to react very fast to the market’s needs, while also maintaining a high quality of its products.

By applying both its novel fast-fashion model and working closely together with its retail partners, the company can operate on a capital-light approach. The firm does not need to rent huge areas for storage and selling of its wares – this capital-intensive part is done by its partners.

Although this approach has huge advantages, the company’s stock price has consistently declined during the last four years: From $9.10 in 2015, the stock has fallen to only $1.54 today. This is all the more surprising since XELB has consistently managed to raise revenue during this time, and also most of the time stayed profitable. Is XELB, therefore, a buy at its current price of $1.54?

The Intrinsic Value of XCel Brands Inc.

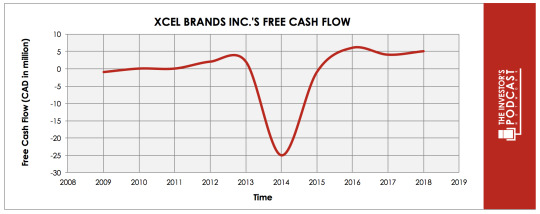

To determine the value of XELB, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of XELB’s free cash flow over the past ten years.

As one can see, the results have been quite volatile – but with an upward trend. The volatility is due to fluctuations in the operating and net margins – and not because of volatile revenue. In fact, revenue has consistently grown throughout the last decade.

Although these numbers look quite good, we will use a very conservative estimate of its future cash flows.

Each line in the above graph represents a certain probability for occurring. We assume a 25% chance for the upper growth rate of 2% per year, a 50% chance for zero growth and a 25% chance for the worst-case scenario of a 5% annual decline.

Assuming these growth rates and probabilities are accurate, XELB can be expected to give a 17.1% annual return at the current price of $1.54. This return seems very rewarding. Now, let’s discuss how and why those free cash flows could be achieved.

The Competitive Advantage of Xcel Brands Inc.

XELB possesses several advantages:

Innovative Company. XELB has a completely new approach to selling and marketing its products. By using social media and other tools, the company can always find out current trends and build its brands and products accordingly. This is not only done very fast, but also the high quality of its products can be maintained.

Capital-Light Business. XELB’s business is mostly focused on the capital-light part of retail, such as designing or marketing. No heavy machinery or inventory has to be kept by the company – this part is mostly taken care of by its retail partners. This frees up cash and allows the company to act fast and remain flexible.

Stickiness. By providing its retail partners with unique tools such as its virtual vertical platform, it enables these partners to be successful. This is a strong incentive for its partners to stay loyal to XELB.

Risk Factors

While XELB has been mostly successful so far, several issues also need to be included in the assessment of the company.

Untested novel business approach. XELB’s approach is completely new and might work out wonderfully. But new and untested ideas also carry a high risk of uncertainty and failure.

Multiple brands added recently. Except for Mizrahi, all of XELB’s brands have been acquired and launched within the last five years. The company, therefore, only has limited experience with the things it owns. Successfully integrating all into one company might still take some time and effort.

Risk of a global recession. While an economic downturn would affect all global companies, XELB might be especially vulnerable due to two reasons: Firstly, the retail sector is quite sensitive to a recession. Secondly, XELB’s retail partners will all aim to slash costs when the economy tanks. The first things to go are often expenses for novel and untested experimental business operations – such as the collaboration with XELB.

Opportunity Costs

When looking at various investment opportunities on the market today, let’s compare the expected return of XELB to other ideas. First, one could invest in the ten-year treasury bond, which is producing a 1.47% return. Considering the bond is completely impacted by inflation, the real return of this option is hardly above zero. What about investing in U.S. stocks? Currently, the S&P 500 Shiller P/E ratio is 28.8. As a result, the U.S. Stock market is priced at a 3.5% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

Macro Factors

The retail sector currently experiences a major disruption– not only because of Amazon but also because of demographic factors and changed shopping behavior. Multiple retail companies have declared bankruptcy recently, and several others are struggling.

This is exactly the issue that XELB aims to address with its novel approach. While revenue is at best flat and margins are under pressure for most traditional brick-and-mortar retailers, XELB’s approach aims to react fast to customer’s needs and give them what they want. This allows the company to earn comparatively high margins.

Summary

XELB is a very interesting company, which brings a novel and refreshingly new approach to retail. As the current retail environment experiences a major disruption, this might just be the right time for such an entry.

While the expected annual return of 17.1% seems very rewarding, investors are well-advised to further analyze the company before investing. Only if one is truly convinced by XELB’s novel approach to retail, the stock should be considered for purchase.

*

This article was written in collaboration with Christoph Wolf from Christoph Wolf Value Investing

Stig Brodersen is the host of the business podcast “We Study Billionaires.” You can find his free intrinsic value index here of popular stock picks.

0 notes

Text

The Intrinsic Value of Vitamin Shoppe, Inc.

Introduction

Vitamin Shoppe, Inc. is a leading global retailer and manufacturer of nutritional products. Vitamin Shoppe manufactures and brands its own products, in addition to also manufacturing a variety of white-label products for third-parties. Its proprietary brands include BodyTech, True Athlete, and ProBioCare. Coupled with its e-commerce store, Vitamin Shoppe has approximately 750 physical stores spread across its two brands, Vitamin Shoppe, and Super Supplements.

At the time of this writing, Vitamin Shoppe, Inc.’s market capitalization is about $94 million, which has been cut from nearly $2 billion as recently as early-2013. Its revenue and cash flows for the 2018 fiscal year were $1.1 billion and $62 million, respectively. Its stock has hit a 52-week low of $3.32 and a 52-week high of $13.95. At today’s price of $4.34, is the stock undervalued?

Source: Google Finance

The Intrinsic Value of Vitamin Shoppe, Inc.

With net income being easily manipulated and not a true representation of the cash available to a company’s owners, we prefer to use free cash flow to value a company’s stock. Using free cash flow instead of net income allows investors to value the company based on the actual cash it generated for its owners. Below is a chart of VSI’s free cash flow for the past ten years.

From its 2009 level of $22 million, Vitamin Shoppe, Inc. was able to grow its free cash flow to over $60 million in 2018, a compounded annual growth rate (CAGR) of 11%. However, this growth was not linear. Vitamin Shoppe, Inc.’s free cash flow generation was volatile without much of a dependable trend. Had 2018 not been its strongest year in over a decade, Vitamin Shoppe, Inc.’s cash flow would have contracted since 2009. The various risks discussed in detail in the ‘Risks’ section below may illustrate some of the causes of Vitamin Shoppe, Inc.’s volatile free cash flow generation, as well as potential issues it may face into the future.

To value Vitamin Shoppe, Inc.’s stock, its future free cash flows must be estimated. To do this, the array model below has been developed to account for three potential outcomes of Vitamin Shoppe, Inc.’s future free cash flows.

The upper-bound line (red) illustrates a -10% contraction rate with a 15% probability of occurrence. The middle line (blue) represents a -33% contraction with a 50% probability of occurrence. Finally, the lower-bound (green) line illustrates a -50% contraction with a 35% probability of occurrence. The contraction in Vitamin Shoppe, Inc.’s free cash flow generation is assuming that competitors and online retailers continue to disrupt the retail industry, Vitamin Shoppe, Inc.’s management fails in its strategies to expand its physical store footprint, its agreement with the US Navy isn’t material, and the United States economy enters into a recessionary period over the next one to three years, resulting in a significant slowdown in consumer spending.

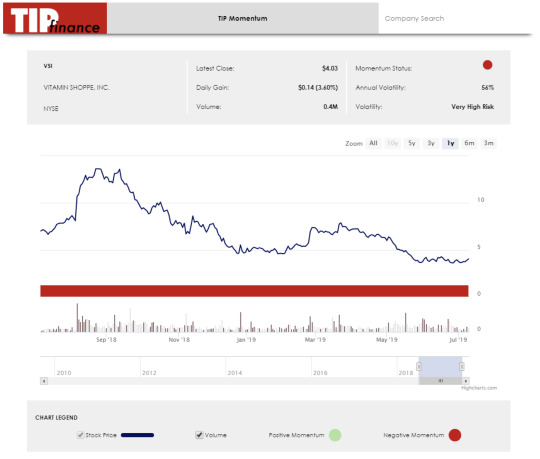

Looking at these growth rates and probabilities, you will notice there is a drastic skew towards negative growth/contraction over the next decade. This may seem quite pessimistic, which it is, but it also allows for a conservative valuation and to consider the potential downside risk. While protecting downside risk is almost always important when investing, I see it as even more important in a situation like with Vitamin Shoppe, Inc. The stock may appear undervalued on a quantitative basis, which we will visit in the next part of this article, but there are two important considerations that must be addressed when analyzing Vitamin Shoppe, Inc.’s stock: 1) The base off which the future free cash flow growth is calculated, and 2) the momentum of the stock, before arriving at an “undervalued” conclusion.

When looking at our estimates for Vitamin Shoppe, Inc.’s future free cash flow generation, it is being estimated off of the most current year’s levels (2018). The reason this can potentially be an issue if overlooked is because this free cash flow figure is much higher than 2017, and is the highest in the last decade. This means that 2019 is being estimated off of a high base and subsequent years are continuing to be estimated off of this potentially misleading figure. If 2018 levels had been more in line with previous years, the estimate for 2019 and subsequent years would be significantly less, which would reduce Vitamin Shoppe, Inc.’s value. While this does not necessarily indicate that Vitamin Shoppe, Inc.’s stock is overvalued, it is an important consideration that needs to be thought about when completing a quantitative analysis, as we did.

Second, it is also important to consider the current momentum of the stock. Even if a stock may appear to be undervalued on a quantitative basis, it can continue in a downtrend for a significant period of time if it is showing negative momentum, resulting in a test on an investors emotions and psychology. In the TIP Finance chart below, you can see that Vitamin Shoppe, Inc.’s stock is currently in a negative momentum trend, which furthers my concern regarding it being a potential “falling knife” or “value trap.”

When creating a valuation model, one must consider the economic environment in which their investment would be made. In today’s environment, it is likely wise to estimate growth rates very conservatively with a margin of safety. Any outperformance of the conservative growth rates would provide investors with additional returns above and beyond what was expected.

It is also important to recognize that the above-estimated contraction rates are not expected to be exact each and every year over the next decade. In fact, that is very unlikely. Vitamin Shoppe, Inc.’s results will likely fluctuate from year-to-year. We do not attempt to estimate results on a yearly basis. Rather, we look to estimate accurate growth/contraction rates annualized over five to ten years.

Assuming the estimated outcomes discussed above prove accurate, Vitamin Shoppe, Inc.’s stock may be priced at a 13.7% annual return at today’s price of $4.34.

Source: TIP Finance

The Competitive Advantage of Vitamin Shoppe, Inc.

VSI’s competitive advantages will be discussed in detail below:

Brand. While VSI does face significant competition with many of its products, it does have a very strong brand. VSI’s products are very well known across the world and are known for being high-quality. It will be able to leverage its strong brand as the company continues to expand and compete with other retailers.

Diversified Business. Its diversified business model provides various avenues for potential growth, while also providing a hedge against competitive pressures. As the health and wellness industry continues to grow, VSI can take advantage of this buy, increasing its focus on manufacturing and white-labeling products to third-party companies. If its in-house brands continue to feel pressure, it can be offset by increasing its focus on white-label manufacturing.

Risk Factors

Let’s look at the potential risks that can offset Vitamin Shoppe, Inc.’s competitive advantages discussed above:

Relatively Weak Balance Sheet. Its balance sheet is heading in the right direction – management has paid off all of its short-term debt, and it is paying down its long-term debt. However, it has very little cash on its balance sheet, and a significant portion of its assets are tied up in “Other long-term assets” and “Property, Plant & Equipment.”

Severe Competition. With the strong growth in the popularity of the health and wellness industry over the last five to seven years, there has been a massive influx of competition into the industry. Not only is it facing competition from other traditional players, but it is facing increased competition from independent providers and influencers. Influencers have been able to disrupt markets by using their following and marketplaces like Alibaba and AliExpress to source products. If you combine the significant growth in new and strengthening competitors with the issues being faced by physical retailers (due to Amazon), Vitamin Shoppe, Inc. is faced with competitive pressures it may not be able to overcome.

Economy. Many of Vitamin Shoppe, Inc.’s products are discretionary and premium. This means that if/when the economy enters tough times, Vitamin Shoppe, Inc. is going to have weaker demand for its products in two-fold because, 1) consumers do not need its products, and 2) its products are expensive. When consumers have less disposable income, they will cut their spending on supplements, or transition away from the premium brands towards more affordable products.

Opportunity Costs

Although opportunity costs will not appear in your brokerage statements, it is a very real cost to investors that must be considered. When making an investment, an investor makes the conscious decision to forego other investment opportunities for the one chosen. Despite having a positive real result, an investment could actually be negative when considering opportunity costs if capital is not allocated to its most efficient use. Vitamin Shoppe, Inc. is currently priced to return better results than the 10-year treasury and the S&P 500 over the next decade, but it may not offer the best risk-adjusted return in comparison to other individual companies.

Macro Factors

Attempting to time the market is rarely a recipe for success when investing, but it would likely be unwise to not at least consider the overall macro environment. Specifically, with brick-and-mortar retailers like Vitamin Shoppe, Inc., economic conditions play a pivot role in their success. During a recessionary period, consumer spending is significantly reduced, and retailers see their sales plummet. Unemployment is currently at, or near, 50-year lows, and U.S. private debt levels have exceeded previous major financial crisis. With various economic indicators pointing to a potential peak, an investor should consider protecting oneself from an economic downturn.

Summary

On a quantitative basis, Vitamin Shoppe, Inc. appears to fall well into Benjamin Graham’s “cigar-butt” category or potentially a Warren Buffett value-investment. However, the negative momentum trend illustrated by the TIP Finance tool raises concern and may point to a value-trap more than a value-opportunity.

Vitamin Shoppe, Inc. provides a great example for investors of when they must look past the numbers and consider the qualitative side of the business. Purely quantitatively speaking, Vitamin Shoppe, Inc. would be a buy, but when you consider its negative momentum, the headwinds it faces, and the risks involved, an investor must carefully weigh the risk-reward opportunity presented. If you decide, based on your risk tolerance and holding period, that Vitamin Shoppe, Inc. provides a value-opportunity rather a value-trap, with more potential upside than downside, it is recommended you consider your portfolio allocation strongly when initiating your position. Given the assumptions outlined in this analysis, a return of approximately 13.7% can be expected at today’s prices.

*Disclaimer: The author does not currently hold any ownership in Vitamin Shoppe, Inc. (VSI) and has no intentions of initiating a position over the next 72 hours.

This article was written in collaboration with Robert Leonard from “The Investor’s Podcast.”

Stig Brodersen is the host of the business podcast “We Study Billionaires.” You can find his free intrinsic value index here of popular stock picks.

0 notes

Text

The Intrinsic Value of Stamps.com

Introduction

Stamps.com is a leading provider of Internet-based mailing and shipping solutions both in Europe and the U.S. The company offers customers the possibility to print postage approved by the United States Postal Service (USPS), requiring only a PC and a printer.

The firm operates under multiple brands like Stamps.com, Endicia, ShipWorks, ShipStation, or Metapack and offers its services both to individuals, small businesses, and large corporations.

Stamps.com has managed to grow revenue dramatically from $10 million in 2009 to $273 million in 2018. During this time, EPS rose from $0.38 to $8.99, and book value increased from $4.82 to $36.95 – an annual increase of 41.6% and 25.1% respectively.

Due to these very high growth rates, Stamps.com used to be a darling of Wall Street, trading as high as $285 only one year ago. But then the company experienced a double blow in 2019. Firstly, its exclusive relationship with USPS via Negotiated Service Agreement (NSA) was ended. Three months later, USPS also announced its intention to renegotiate the NSAs from existing resellers, thus also cutting this indirect relationship between STMP and USPS.

Both issues are highly problematic for Stamps.com since they strongly affect the core of its business model. As Stamps.com has already drastically reduced its earnings and revenue guidance, the stock dropped like a stone and trades for currently $46.33. Is Stamps.com now a bargain worth buying or are the risks for its business models too great?

The Intrinsic Value of Stamps.com

To determine the value of Stamps.com, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of Stamp.com’s free cash flow over the past years.

The growth in free cash flow surely looks impressive – but due to multiple recent obstacles, this growth cannot be expected to continue in the next years. In fact, even a drop in free cash flow seems highly likely. We will, therefore, use a very conservative estimate for Stamps.com’s future cash flows.

Each line in the above graph represents a certain probability for occurring. We assume a 10% probability for the upper band to be 0% annually, and for the most likely scenario, we estimate an annual decline of 7%, which we assign a 50% probability. The worst-case scenario could be a contraction of 15% every year, that is considered quite possible. We estimate the probability of that to happen to be 40%.

Assuming these growth rates and probabilities are accurate, Stamps.com can be expected to give a 23.7% annual return at the current price of $46.33. Now, let’s discuss how and why those free cash flows could be achieved.

The Competitive Advantage of Stamps.com

Stamps.com possesses some unique advantages that should allow it to be successful in the future:

Leading Provider. Stamps.com remains by far the leading provider of internet-based shipping solutions. This position could also give Stamps.com clout when dealing with the USPS. While there are other USPS-approved PC postage services like EasyPost and Pitney Bowes, Stamps.com offers a superior user interface and a larger number of features.

Sticky business. Stamps.com’s churn rate (the percentage of subscribers that are discontinuing their subscriptions) in the latest quarter was a very low 2.9%. This indicates that customers tend to stay loyal and seem to be satisfied with the offer from Stamps.com.

Chances due to canceled USPS deal. One must bear in mind, that Stamps.com decided to cancel the NSA with USPS, not the other way around. While the risks of this move are obvious, it also gives Stamps.com new possibilities, since it is no longer bound by this rather restrictive agreement. Now Stamps.com can do more deals and agreements with other players.

Opportunity Costs

When looking at various investment opportunities on the market today, let’s compare the expected return of Stamps.com to other ideas. First, one could invest in the ten-year treasury bond, which is producing a 2.04% return. Considering the bond is completely impacted by inflation, the real return of this option is likely only around 1%. Currently, the S&P 500 Shiller P/E ratio is 29.75. As a result, the US Stock market is priced at a 3.36% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

Macro Factors

The mailing and shipping business is vast and will only grow more important in the future. While Stamps.com is a leading provider of Internet-based mailing and shipping solutions in the U.S. and Europe, this large business attracts multiple competitors. Users have many other ways to use the services of USPS, and there are also many other private carriers, package manifesting systems, and enterprise software solutions that offer easy mailing and shipping systems.

Until recently, the NSA with the USPS gave Stamps.com a huge advantage over these competitors. It remains to be seen, how successful Stamps.com can operate without this competitive advantage. The market might also experience a major disruption in the future if, for example, Amazon delivers much or even all of its shipping itself.

Risk Factors

Several risks might limit the growth prospects of Stamps.com:

End of NSA with USPS. In February 2019, the company announced that it ends its exclusive relationship via Negotiated Service Agreement (NSA) with the U.S. Postal Service. As a result of the company drastically decreased its sales and earnings targets and lowered its guidance. This is especially problematic because many of Stamps.com’s customers were lured by its favorable USPS prices due to the NSA. No longer able to offers such cheap prices, Stamps.com may lose both customers and see a drop in its margins.

Renegotiating of NSAs between USPS and its resellers. In May 2019, the USPS announced its intention to renegotiate its existing NSAs with its resellers. This might also threaten the indirect relationship of Stamps.com with the USPS using these intermediate companies.

Amazon’s aggressive expansion into the shipping market. Amazon is both friend and foe for Stamps.com. The deliveries of Amazon’s postage accounted for a whopping 88% of Stamps.com’s revenue. This makes Stamps.com very dependent on Amazon, which is especially risky since Amazon explores several ways to deliver its goods itself – thus no longer relying on Stamps.com’s services.

Goodwill. Stamps.com’s impressive growth was at least partly realized by multiple acquisitions. As a result, the company has currently $385 million goodwill on its balance sheet, which is more than half of its market capitalization. If this huge amount of goodwill has to be written down in the future, earnings can easily become negative. On the positive side, Stamps.com’s debt level seems sustainable and does not yet raise a red flag.

Summary

Stamps.com is an intriguing company. On the one hand, its historical performance has been breathtaking and has included very high growth rates in revenue, earnings, free cash flow, and book value. The company is an important player in a vast global market that can be expected to remain relevant for the foreseeable future.

On the other hand, its whole business model has been completely turned upside down by the cancellation of the NSA with the USPS and the renegotiation of the NSAs between the USPS and its resellers. Obviously, this makes Stamps.com’s future path highly uncertain and the business in five years will probably look very different from the one today.

Although risky, the decision to cut the relationship with the USPS also holds interesting opportunities for Stamps.com. While the USPS remains relevant, its numbers and influence have been declining for years. Doing “business as usual” with the USPS would therefore also have carried risks for Stamps.com.

At this point, it is quite hard to determine if this is a bargain or a value trap. If Stamps.com manages to prosper within the new business environment, this stock could offer vast returns of 23.7% annually. If not, things can go downhill very fast. Before investing in Stamps.com, investors are well-advised to investigate the company in more detail.

*

This article was written in collaboration with Christoph Wolf from Christoph Wolf Value Investing

Stig Brodersen is the host of the business podcast “We Study Billionaires.” You can find his free intrinsic value index here of popular stock picks.

0 notes

Text

The Intrinsic Value of GNC Holdings, Inc.

Introduction

GNC Holdings, Inc. is a leading multinational health and wellness brand which is a manufacturing and retail business at its core. GNC manufactures its own branded products, while also manufacturing white-label products for third-party companies. Its retail segment consists of company-owned physical stores, franchise locations, and e-commerce. Of its 8,500 locations, approximately 75% of them are in the United States, while the remaining 25% of stores are spread across about 50 different countries. Through its physical and online stores, GNC sells performance and diet supplements, vitamins, health and beauty products, other food and drink products, and general sports-related goods.

At the time of this writing, GNC’s market capitalization is about $120 million, which has been cut from over $4 billion as recently as mid-2015. Its revenue and cash flows for the 2018 fiscal year were $2.4 billion and $77 million, respectively. Its stock has hit a 52-week low of $1.32 and a 52-week high of $4.65. At today’s price of $1.42, is the stock undervalued?

Source: Google Finance

The Intrinsic Value of GNC Holdings, Inc.

With net income being easily manipulated and not a true representation of the cash available to a company’s owners, we prefer to use free cash flow to value a company’s stock. Using free cash flow instead of net income allows investors to value the company based on the actual cash it generated for its owners. Below is a chart of GNC’s free cash flow for the past ten years.

From the bottom of the Housing Crisis in 2008-2009 to its peak in 2015, GNC was able to grow its cash flow from $85 million to over $309 million, a compounded annual growth rate (CAGR) of 20%. However, since then, it’s cash flow has been in a near free fall. Its 2018 free cash flow was $8 million lower than it was a decade ago. The various risks discussed in detail in the “Risks” section below illustrate the causes of this large decline.

To value GNC’s stock, its future free cash flows must be estimated. To do this, the array model below has been developed to account for three potential outcomes of GNC’s future free cash flows.

The upper-bound line (red) illustrates a -15% contraction rate with a 15% probability of occurrence. The middle line (blue) represents a -33% contraction with a 50% probability of occurrence. Finally, the lower-bound (green) line illustrates a -50% contraction with a 35% probability of occurrence. The contraction in GNC’s free cash flow generation is assuming that competitors and online retailers continue to disrupt the retail industry, GNC’s management fails in its strategic and joint venture initiatives, and the United States economy enters into a recessionary period, resulting in a significant slowdown in consumer spending.

Looking at these growth rates and probabilities, you will notice there is a drastic skew towards negative growth/contraction over the next decade. This may seem quite pessimistic, which it is, but it also allows for a conservative valuation and to consider the potential downside risk. While protecting downside risk is almost always important when making an investment, I see it as even more important in a situation like GNC. The stock may appear undervalued on a quantitative basis, which we will visit in the next part of this article, but the momentum of the stock has been very strong downwards, leading to a potential “falling knife” or “value-trap” situation.

When creating a valuation model, one must consider the economic environment in which their investment would be made. In today’s environment, it is likely wise to estimate growth rates very conservatively with a margin of safety. Any outperformance of the conservative growth rates would provide investors with additional returns above and beyond what was expected.

It is also important to recognize that the above-estimated contraction rates are not expected to be exact each and every year over the next decade. In fact, that is very unlikely. GNC’s results will likely fluctuate from year-to-year. We do not attempt to estimate results on a yearly basis; rather we look to estimate accurate growth/contraction rates annualized over 5-10 years.

Assuming the estimated outcomes discussed above prove accurate, GNC’s stock may be priced at an 11.3% annual return at today’s price of $1.42.

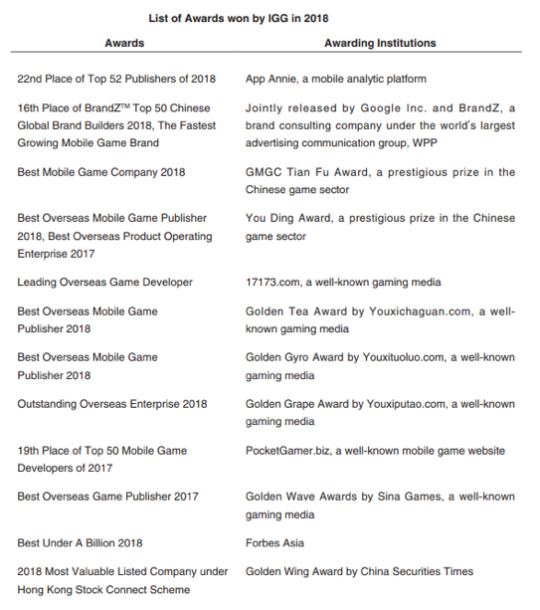

Two other valuable quantitative metrics to consider when analyzing a stock’s potential return are the earnings yield (inverse P/E) and free cash flow yield (inverse P/FCF). At the time of this writing, GNC’s current earnings and free cash flow yields are 34.2% and 111.1%, respectively. This is due to its low P/E ratio of just 2.92x and its P/FCF ratio of just 0.90x. Its earnings and free cash flow yields are significantly above our DCF analysis and are at levels that are not realistic. In many cases, these yields are indicative of the potential return an investor might earn by owning a stock, but not always – as we can see here with GNC. This example provides investors with a reminder that an investment cannot be made blindly based solely on quantitative metrics with the expectation of actually obtaining those returns. An investor must consider other quantitative factors, as well as qualitative factors when developing an investment thesis.

Given the abnormally and likely unrealistically high yields just discussed, GNC appears to be priced significantly better than the S&P 500 and the industry average on an earnings and free cash flow yield basis. This relationship is not unexpected as it is indicative of investors having a much higher required rate of return when investing in a struggling individual company than they do when investing in a broad index, like the S&P 500. The graph below illustrates the earnings and free cash flow yields for GNC, the S&P500, and the industry average.

Up to this point, everything quantitative about GNC’s valuation indicates it may be undervalued and priced to outperform the S&P 500 over the next decade. However, before we come to that as our final conclusion, let’s further compare GNC to its competitors.

In the graph below, you will see GNC’s valuation metrics compared to that of the industry’s average on a P/E, P/B, P/S, and P/FCF basis. GNC currently trades at a significant discount to the industry averages on a P/E, P/S, and a P/FCF basis (GNC’s book value is negative, so its P/B value is incalculable). Given GNC’s risks that we will discuss in the next section, it is reasonable to believe that GNC should trade at a discount to the overall industry. The size of the discount is subjective to the investor; if you believe that GNC’s risks are overstated by the market and it shouldn’t trade at this deep of a discount to its competitors, you may consider the stock undervalued. However, if you believe the market is rightly capturing the risks facing GNC, then the discount may be warranted.

The Competitive Advantage of GNC Holdings, Inc.

GNC’s competitive advantages will be discussed in detail below:

Brand. While GNC does face significant competition with many of its products, it does have a very strong brand. GNC’s supplements and overall health products are very well known across the world and are known for being high-quality. It will be able to leverage its strong brand as the company continues to expand internationally.

Diversified Business. Its diversified business model provides various avenues for potential growth, while also providing a hedge against competitive pressures. As the health and wellness industry continues to grow, GNC has the ability to take advantage of this buy, increasing its focus on manufacturing and white-labeling products to third-party companies.

Risk Factors

Let’s look at the potential risks that can offset GNC’s competitive advantages discussed above:

Weak Balance Sheet. GNC appears to have a fairly strong cash position (1.14x its market cap), but in comparison to its debt levels, it is immaterial and misleading. It currently has nearly $900 million in debt, in addition to $518 million in capital leases, $175 million in accounts payable, and over $250 million in “other long-term liabilities.” Also, a significant portion of its assets is not easily usable to generate cash or growth the business. Over $800 million of its $1.7 billion in assets is tied up in intangible assets and “other long-term assets.” Its debt-heavy and cash-light balance sheet does not allow for GNC to take advantage of potential opportunities that may arise.

Severe Competition. With the strong growth in the popularity of the health and wellness industry over the last 5-7 years, there has been a massive influx of competition into the industry. Combine the significant growth in new and strengthening competitors with the issues being faced by physical retailers (due to Amazon), GNC is faced with competitive pressures; it may not be able to overcome.

Economy. Many of GNC’s products are discretionary and premium. This means that if/when the economy enters into tough times, GNC is going to have significantly weaker demand for its products in two-fold because, 1) consumers do not need its products, and 2) its products are premium and expensive. When consumers have less disposable income, they will cut their spending on supplements, or transition away from the premium brands like GNC towards more affordable products.

Opportunity Costs

Although opportunity costs will not appear in your brokerage statements, it is a very real cost to investors that must be considered. When making an investment, an investor makes the conscious decision to forgo other investment opportunities for the one chosen. Despite having a positive real result, an investment could actually be negative when considering opportunity costs if capital is not allocated to its most successful and efficient use. GNC is currently priced to return better results than the 10-year treasury and the S&P 500 over the next decade, but it may not offer the best risk-adjusted return in comparison to other individual companies.

Macro Factors

Attempting to time the market is rarely a recipe for success when investing, but it would likely be unwise to not at least consider the overall macro environment. Specifically, with brick-and-mortar retailers and premium brands like GNC, economic conditions play a pivot role in their success. During a recessionary period, consumer spending is significantly reduced, and retailers see their sales plummet. Unemployment is currently at, or near, 50-year lows, and U.S. private debt levels have exceeded previous major financial crisis. With various economic indicators pointing to a potential peak, an investor should consider protecting oneself from an economic downturn.

Summary

On a quantitative basis, GNC appears to be a perfect Benjamin Graham “cigar-butt” or potentially Warren Buffett “value-investment.” However, the momentum of GNC’s stock indicates investors seeking a value opportunity might be instead purchasing into a value-trap. GNC provides a great example for investors of when they must look past the numbers and consider the qualitative side of the business. Purely quantitatively speaking, GNC would be a buy, but when you consider the headwinds it faces and the risks involved, an investor must carefully weigh the risk-reward opportunity presented. If you decide, based on your risk tolerance, that GNC provides a valuable opportunity rather a value-trap, with more potential upside than downside, it is recommended you consider your portfolio allocation strongly when initiating your position. Given the assumptions outlined in this analysis, a return of approximately 11.3% can be expected at today’s prices.

Disclaimer: The author does not currently hold any ownership in GNC Holdings, Inc. (GNC) and has no intentions of initiating a position over the next 72 hours.

This article was written in collaboration with Robert Leonard from “The Investor’s Podcast.”

Stig Brodersen is the host of the business podcast “We Study Billionaires.” You can find his free intrinsic value index here of popular stock picks.

0 notes

Text

The Intrinsic Value of Kohl’s Corporation

Introduction

With over 1,150 stores across 49 states and its headquarters in Menomonee Falls, Wisconsin, Kohl’s Corporation is one of the United States largest traditional brick-and-mortar department stores. It has a wide range of product offerings, ranging from men’s and women’s clothing to cosmetics to home furnishings. Within its stores, it carries numerous national brands, such as Oakley, PUMA, and Adidas, as well as its own portfolio of exclusive brands (Simply Vera Vera Wang, LC Lauren Conrad, and Apt. 9).

At the time of this writing, the market capitalization for Kohl’s is about $8.34 billion and its revenue and cash flows for the 2018 fiscal year were $20.2 billion and $1.5 billion, respectively. Currently trading at about $51.83, the stock has hit a 52-week low of $50.40 and a 52-week high of $83.28. At today’s price of $51.83, is its stock undervalued?

The Intrinsic Value of Kohl’s Corporation

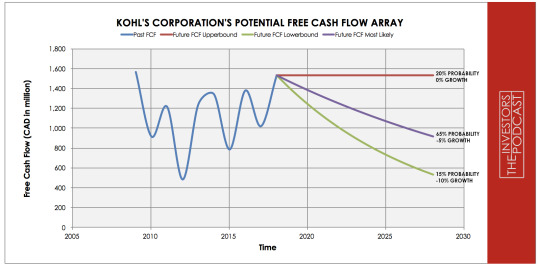

With the net income being easily manipulated and not a true representation of the cash available to a company’s owners, we prefer to use free cash flow to value a company’s stock. Using free cash flow instead of net income allows investors to value the company based on the actual cash it generated for its owners. Below is a chart of Kohl’s free cash flow for the past ten years.

With the exception of 2012, Kohl’s free cash flow has remained in a range between about $800 million and $1.4 billion from 2010 to 2017, as illustrated by the lines on the graph below. There certainly has been volatility from year to year, but it has been successful in maintaining relatively consistent free cash flow generation as e-commerce companies have attempted to replace traditional retailers. Looking at Kohl’s free cash flow more closely from 2012 to present, it appears it may be slightly trending upwards as it has made higher lows and higher highs. In future sections when we value the company, we will not rely on growth in free cash flow, but it is important to note that it may be trending upwards.

From 2009 to 2018, Kohl’s free cash flow actually contracted by about 2.5%, cumulatively. From its low in 2012, Kohl’s free cash flow has grown from $915 million to $1.5 billion, for a compounded annual growth rate (CAGR) of about 5.9% (67% cumulatively).

To value Kohl’s stock, its future free cash flows must be estimated. To do this, the array model below has been developed to account for three potential outcomes of Kohl’s future free cash flows.

The upper-bound line illustrates a 0% growth rate with a 20% probability of occurrence. This growth rate was assigned to allow for the potential of management to successfully maintaining its current free cash flow levels, while also considering the highly competitive nature of the retail landscape.

The middle line represents a -5% contraction with a 65% probability of occurrence. This outcome assumes that Kohl’s will be semi-successful competing in the increasingly competitive and changing retail industry, but will still see some of its free cash flow diminish.

Finally, the lower-bound line illustrates a -10% contraction with a 15% probability of occurrence. The contraction in Kohl’s free cash flow generation is assuming that competitors and online retailers continue to disrupt the retail industry, Kohl’s management fails in its new strategic initiatives, and the United States economy enters into a recessionary period, resulting in a significant slowdown in consumer spending.

Looking at these growth rates and probabilities, you will notice there is a skew towards negative growth or a contraction over the next decade. This may seem pessimistic, but it allows for a conservative valuation and to consider the potential downside risk. When creating a valuation model, one must consider the economic environment in which their investment would be made.

In today’s environment, it is likely wise to estimate growth rates very conservatively with a margin of safety. Any outperformance of the conservative growth rates would provide investors with additional returns above and beyond what was expected. It is also important to recognize that the above-estimated growth rates are not expected to be exact each and every year over the next decade. In fact, that is very unlikely. As they have since 2009, Kohl’s results will likely fluctuate from year-to-year. We do not attempt to estimate results on a yearly basis. Rather, we look to estimate accurate growth rates annualized over a decade. Assuming the estimated outcomes discussed above prove accurate, Kohl’s stock may be priced at a 13.1% annual return at today’s price.

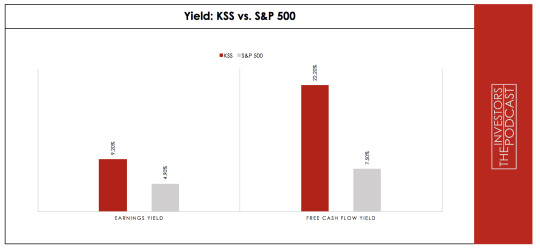

Two other valuable quantitative metrics to consider when analyzing a stock’s potential return are the earnings yield (inverse P/E) and the free cash flow yield (inverse P/FCF). At the time of this writing, Kohl’s current earnings and free cash flow yields are 9.2% and 22.2% respectively. Its earnings and free cash flow yields appear to be below and above our calculated expected return from our DCF analysis. Kohl’s also appears to be priced moderately better than the S&P 500 on an earnings yield basis and significantly better on a free cash flow yield basis. This relationship is not unexpected as it is indicative of investors having a higher required rate of return when investing in an individual company than they do when investing in a broad index, like the S&P 500, but it also puts into perspective the extra return an investor might be able to achieve by taking on more risk. The graph below illustrates the earnings and free cash flow yields for Kohl’s and the S&P 500.

Source: Morningstar

Up to this point, everything quantitative about Kohl’s valuation indicates it may be undervalued and priced to outperform the S&P 500 over the next decade. However, before we come to that as our final conclusion, let’s compare Kohl’s to its competitors.

In the graph below, you will see Kohl’s valuation metrics compared to that of the industry’s average on a P/E, P/B, P/S, and P/FCF basis. It is quite close on all of these metrics. Given Kohl’s competitive advantages that we will discuss in the next section, it is reasonable that Kohl’s should trade at a slight premium to the overall industry.

Source: Morningstar

The Competitive Advantage of Kohl’s Corporation

Kohl’s has multiple advantages that will be discussed in detail below:

Management. While other companies and management teams have struggled to adjust to the changing retail landscape, Kohl’s management team has excelled. It has been willing to think “outside-the-box” and look for unconventional ways to drive traffic to the stores and ignite growth. It has entered into two strategic partnerships (one with Amazon and one with Planet Fitness) that really help illustrates management’s ability to differentiate itself from its competitors.

Financial Strength. Despite a difficult environment over the past decade, Kohl’s has been able to grow its topline revenue, maintain high Returns on Equity and Returns on Invested Capital, pay down its debt and preserve a healthy cash position. It has consistently raised its dividend every year since 2012 and has bought back nearly half its stock.

Rewards/Loyalty Program. As illustrated from the likes of Starbucks and Domino’s, customer loyalty programs can drive great customer retention. Kohl’s is widely known for its “Kohl’s Cash” rewards program, which management continues to focus on and improve. This has helped management successfully achieve positive comp sales year over year, while many retailers are struggling to get customers to return to its stores.

Risk Factors

Although Kohl’s has competitive advantages, it is not without risks that could weaken an investor’s returns.

Severe Competition. It is no secret that the retail industry has become extremely competitive over the last 5-7 years, and this trend continues to this day. In addition to competing with major brick-and-mortar and e-commerce players like Walmart and Amazon, Kohl’s is increasingly having to compete with individual sellers and small businesses through platforms such as Etsy.

Lack of Switching Costs/Stickiness. When it comes to buying well-known, non-exclusive brands, consumers do not generally have a preference where they purchase the products from – their main focus is on price. It is difficult to convince customers to continually purchase products from Kohl’s when there are other stores offering the same products at a cheaper price.

Lack of Bargaining and Pricing Power. Due to the dynamic discussed in the previous bullet, this makes for a difficult bargaining and pricing power relationship for the retailers, such as Kohl’s. In general, an $11 billion retailer like Kohl’s cannot demand significantly better pricing from a major brand and/or manufacturer than other large, $290 billion retailers like Walmart can. This reduces its bargaining power and limits its ability to improve margins through lower cost of goods. On the other end of the transaction, Kohl’s also struggles with a lack of pricing power. Kohl’s cannot consistently demand a significantly higher price for its products when customers are able to get the same product at another retailer for a lower price. Lack of power on both the bargaining and pricing sides leads to increased pressure on Kohl’s margins.

Protecting Customer Data. With mass amounts of customer data, retailers have become a target for hackers. In 2018 alone, nine retailers (Macy’s, Adidas, Sears, Kmart, Best Buy, Saks Fifth Avenue, Lord & Taylor, Forever 21, and Gamestop) were victims of data breaches. It can be a short-term problem if handled appropriately, but it still poses a major risk to companies in possession of large amounts of valuable data.

Opportunity Costs

Although opportunity costs will not appear in your brokerage statements, it is a very real cost to investors that must be considered. When making an investment, an investor makes the conscious decision to forgo other investment opportunities for the one chosen. Despite having a positive real result, an investment could actually be negative when considering opportunity costs if capital is not allocated to its most successful and efficient use. Kohl’s is currently priced to return better results than the 10-year treasury and the S&P 500 over the next decade, but it may not offer the best risk-adjusted return in comparison to other individual companies.

Macro Factors

Attempting to time the market is rarely a recipe for success when investing, but it would likely be unwise to not at least consider the overall macro environment. Specifically, with brick-and-mortar retailers like Kohl’s, economic conditions play a pivot role in their success. During a recessionary period, consumer spending is significantly reduced, and retailers see their sales plummet. Unemployed is currently at, or near, 50-year lows, and US private debt levels have exceeded previous major financial crisis. With various economic indicators pointing to a potential peak, an investor should consider protecting oneself from an economic downturn.

Summary

While the current conditions of the retail industry have attracted many value investors, it is recommended you do extra due diligence when researching individual companies to help combat against the possibility of a value-trap.

Kohl’s skilled management and its ability to identify and implement intriguing strategic partnerships add potential upside that most retailers do not have. Although both initiatives are still in their infancy, Kohl’s has recently expanded its return-program partnership with Amazon to all its stores and plans to lease space to Planet Fitness next to ten of its stores this year. These characteristics do provide exciting potential upside, but the risks must not be forgotten. It currently trades at a discount to our calculated intrinsic value, but the risks may prove severe and dampen expected returns. Given the assumptions outlined in this analysis, a return of approximately 13.1% can be expected at today’s price.

Disclaimer: The author does not currently hold any ownership in Kohl’s (KSS), but may initiate a long position in KSS over the next 72 hours.

This article was written in collaboration with Robert Leonard from “The Investor’s Podcast.”

Stig Brodersen is the host of the business podcast “We Study Billionaires.” You can find his free intrinsic value index here of popular stock picks.

0 notes

Text

The Intrinsic Value of Schaeffler

Introduction

Schaeffler is a German supplier for automotive and industrial companies. Their products include parts and systems for engines, gearbox, chassis, as well as ball bearing, and friction bearing. Their business is divided into three units.

Automotive OEM is by far the largest segment. This unit creates solutions for all major automotive companies. Besides the traditional combustion engine, hybrid and electric propulsion systems are also developed here. Automotive Aftermarket is a new unit, which deals with all aspects of automotive spare parts. The Industry unit sells various components and systems for rotative and linear movement to multiple different industrial companies.

Schaeffler has recently run into problems and issued several profit warnings and reduced its guidance. Due to declining margins and a generally harsher business environment, Schaeffler’s stock price has fallen from its high of more than €16 at the end of 2017 to a price of only €7.26 euros today. Is this a bargain or do the increased risks outweigh the stock’s cheap price?

The Intrinsic Value of Schaeffler

To determine the value of Schaeffler, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of Schaeffler’s free cash flow over the past years.

As one can see, the cash flows have been trending upward with a high volatility. This is due to the cyclical business it is operating in. As a consequence of this additional risk, we will use a conservative estimate for Schaeffler’s future cash flows.

Each line in the above graph represents a certain probability for occurring. The upper growth rate of 5% is slightly higher than the approximate annual growth during the last seven years and is given a 25% chance. As most probable, we consider a small annual increase of 3%, which is in line with expected GDP growth. For this scenario, we assigned a probability of 50%. The worst case is assumed to be a sharp decline of 5% annually, which might be caused by a severe recession or if Schaeffler’s current problems cannot be resolved. We estimate the chance for this happening at 25%.

Assuming these growth rates and probabilities are accurate, Schaeffler can be expected to give a 7.6 % annual return at the current price of 7.26 euros. Now, let’s discuss how and why those free cash flows could be achieved.

The Competitive Advantage of Schaeffler

Schaeffler possesses some unique advantages that should allow it to be successful in the future:

Consistent Revenue Growth. Over the last seven years, Schaeffler increased revenue consistently by an annual average of more than 4%. While the current stronger focus on profitability should limit this vast growth, the company is growing its sales even during this period of uncertainty.

Innovative Company. For the last five years, Schaeffler has been the company with the second-most claimed patents in Germany. This is very impressive for such a small firm and is vital due to the rapidly changing business environment that Schaeffler is operating in. The company is strong both in e-mobility and autonomous driving. Its “Space Drive” system is a unique adaptive drive and steering system, which enables severely disabled persons to drive.

Crucial Link in Worldwide Supply Chains. Another reason for the company’s moat is its position in the global supply chains. Since these structures are highly complex and globalized, replacing Schaeffler with another company would result in high switching costs for a customer. This further stabilizes Schaeffler’s position.

Solid Balance Sheet. Although Schaeffler’s business is capital-intensive and the company has strongly expanded over the last years, its debt load remains manageable and even has vastly declined over the last few years. This was possible due to consistently positive and strong free cash flows.

Opportunity Costs

When looking at various investment opportunities on the market today, let’s compare the expected return of Schaeffler to other ideas. First, one could invest in the ten-year treasury bond which is producing a 2.43% return. Considering the bond is completely impacted by inflation, the real return of this option is likely only around 1%. Currently, the S&P 500 Shiller P/E ratio is 29.86. According to this valuation metric, the US Stock market is priced at a 3.4% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

Macro Factors

As a car supplier, Schaeffler is deeply ingrained in the global car supply chains, which is a double-edged sword. On the one hand, the company is a vital part of the chain, which gives it a high barrier of entry. Its business is capital-intensive, relies on long-established connections and includes much know-how that would be costly to replicate. But while Schaeffler’s position within the current supply chain seems safe, there are two major threats.

Firstly, the health of the current supply chain can come under threat. This might happen because of increased trade barriers and cooling of the world economy. Secondly, the nature of the chain itself is expected to change dramatically in the next years. The traditionally-used combustion engine will be replaced by electric or hybrid propulsion systems, and also autonomous driving adds a completely new element to the development of cars. While Schaeffler is engaged in all of these new technologies, this is a new business environment for the firm, which includes high costs and risks.

Risk Factors

Several risks might limit the growth prospects of Schaeffler:

Dependency on Global Car Sales. Car sales are very cyclical and closely connected to the state of the world economy. If another global recession strikes or if car sales drop because of other reasons, demand for Schaeffler’s products would fall. Also, imposed tariffs could increase the price of cars, which adds pressure to car sales.

Protectionism. Increased trade barriers pose multiple threats to Schaeffler. It can increase its production costs, make it costlier to ship its products to its customers, and also dampen car sales in general.

Dramatically changing the car sales market. Cars in twenty years will very likely be quite different than the one we see today. Electric cars or autonomous driving will have a vast impact on the industry, which adds uncertainty. Schaeffler is already investing in electric and hybrid propulsion systems, but this undertaking is costly, and the exact direction the car market will take is yet unclear.

Summary

Schaeffler is a very interesting company. The firm possesses a strong position in the global car supply chain – which also makes it vulnerable to the health and nature of this chain. If global car sales fall or electric propulsion systems and autonomous vehicles change the nature of driving, Schaeffler’s business model is under threat.

Reassuringly, the company has invested heavily in these new technologies, but this incurs high costs and risks – and forces Schaeffler to operate in a new and yet relatively unknown business environment. If the current price of 7.26 euros and an expected annual return of 7.6% adequately compensate for this risk should be further investigated before buying this stock.

*

This article was written in collaboration with Christoph Wolf from Christoph Wolf Value Investing

Stig Brodersen is the host of the business podcast “We Study Billionaires.” You can find his free intrinsic value index here of popular stock picks.

0 notes

Text

The Intrinsic Value of Tillys Inc.

Introduction

With 229 stores spread across the United States and its headquarters in Irvine, California, Tillys is a specialty brick-and-mortar apparel retailer with a growing e-commerce platform. Through its larger-than-average physical stores and its online store, Tillys sells various well-known brands, such as Nike, Vans, Adidas, and RVCA, as well as its own exclusive brands (Full Tilt, RSQ, Sky & Sparrow, White Fawn, Ivy + Main, and Blue Crown).

At the time of this writing, Tillys’ market capitalization is about $352 million and its revenue and cash flows for the 2018 fiscal year* were $598 million and $32 million, respectively. Currently trading at about $11.82, the stock has hit a 52-week low of $10.19 and a 52-week high of $25.46. At today’s price of $11.82, is Tillys’ stock undervalued?

*Note on Tillys’ Fiscal Years from its Annual Report: “Our fiscal year ends on the Saturday closest to January 31. For example, “fiscal 2018” refers to the fiscal year ended February 2, 2019; “fiscal 2017” refers to the fiscal year ended February 3, 2018; and “fiscal 2016” refers to the fiscal year ended January 28, 2017.

The Intrinsic Value of Tillys

With net income being easily manipulated and not a true representation of the cash available to a company’s owners, we will use Tillys’ free cash flow to value its stock. Using the free cash flow allows investors to value the company based on the actual cash it generated, which can be used to reinvest in the business, pay dividends, or buy back its own stock. Below is a chart of Tillys’ free cash flow for the past ten years.

Tillys’ free cash flow saw strong growth the three years prior to its Initial Public Offering (IPO) on May 4th, 2012. Likely in an attempt to win over the public markets, management began reinvesting heavily in the business, which significantly increased its capital expenditures (CapEx) and therefore reducing its free cash flow. After 2014, its most capital-intensive year over the past decade, management scaled back its CapEx spending in 2015 and continues to do so to this day. This reduced CapEx spending over the past five years has led to a generally increasing free cash flow trend, as illustrated by the black arrows in the graph below.

From 2010 to 2019, Tillys’ free cash flow grew from $18 million to $32 million, for a compounded annual growth rate (CAGR) of 6% (78% cumulatively).

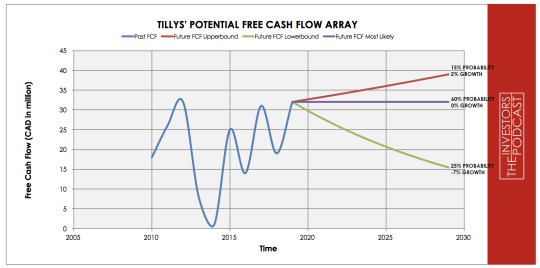

To value Tillys’ stock, its future free cash flows must be estimated. To do this, the array model below has been developed to account for three potential outcomes of Tillys’ future free cash flows.

The upper-bound line illustrates a 2% growth rate with a 15% probability of occurrence. This growth rate was determined by using the United States governments’ target inflation rate of 2%, as well as discounting Tillys’ current earnings yield (inverse P/E ratio) by about two-thirds (66%) in order to build in a margin of safety for the risks we will visit in the ‘Risks’ section below. It was assigned this probability to allow for the potential of some growth - conservatively estimated at the country’s target inflation rate - while also accounting for the challenges Tillys would face in the coming years, as its previously obtained growth rates are unlikely to materialize again over the next decade.

The middle line represents a 0% growth rate with a 60% probability of occurrence. This outcome assumes that Tillys will face competitive and economic pressure, but will be able to maintain its current free cash flow levels by using its large stores to provide an above-average experience for its customers and further improving its online presence.

Finally, the lower-bound line illustrates a -7% contraction with a 25% probability of occurrence. The contraction in Tillys’ free cash flow generation is assuming that online retailers, such as Amazon, continue to disrupt the retail industry and that the United States economy enters into a recessionary period, resulting in a significant slowdown in consumer spending on discretionary items.

The noticeable pessimistic skew of growth rates and probabilities to the downside and the 85% probability that Tillys will have zero or negative growth over the next decade may appear high, but this is to allow for a conservative valuation. Given where we currently are in the market cycle, it is likely wise for investors to err on the side of caution when creating valuation models, as we have done here. It certainly is possible for Tillys to outperform these estimates, but it behooves investors to add in a margin of safety and be a bit defensive, especially in market conditions like today. If the expected return is satisfactory with conservative estimates, any outperformance of these growth rates will provide investors with an added bonus.

It is also important to recognize that the above-estimated growth rates are not expected to be exact every year for the next decade. The growth rate is expected on an annualized basis. As they have from 2014 to 2019, Tillys’ results will likely fluctuate from year-to-year. We shall not try to estimate those results; rather we look to estimate accurate growth rates annualized over the next decade. Assuming the estimated outcomes discussed above prove accurate, Tillys’ stock may be priced at a 7.0% annual return at today’s price.

Two other valuable quantitative metrics to consider when considering a stock’s return are the earnings yield and free cash flow yield. At the time of this writing, Tillys’ current earnings and free cash flow yields (inverse P/FCF ratio) are 7.1% and 9.1%, respectively. Its earnings and free cash flow yields both illustrate a similar expected return to that of our discounted cash flow (DCF) analysis above. Tillys also appears to be priced for a better-expected return over the next decade than does the S&P 500. The graph below illustrates the earnings and free cash flow yields for Tillys and the S&P 500.

The Competitive Advantage of Tillys

Tillys has multiple advantages that will be discussed in detail below:

Financial Strength. As of its most recent 10-K, Tillys cash and cash equivalents total about $15 million more than its total liabilities. It has no debt, a growing cash position, and inventory levels that have remained satisfactory. Tillys current and quick ratios are 2.2 and 1.5, respectively. Over the last decade, it has shown revenue and free cash flow growth, while maintaining its margins. These characteristics not only allow Tillys to be in a position to take advantage of future opportunities, but it should also help the company weather an economic downturn.

Omnichannel Strategy. Tillys has been successfully implementing an omnichannel strategy that provides its customers with a better, more streamlined experience. Customers are able to purchase products through its e-commerce platform and pick them up in-store. This is an important feature, specifically for clothing retailers, because purchasing clothes/shoes/accessories online has been notoriously frowned upon by consumers. However, Tillys is able to provide a more pleasant experience for customers by allowing them to be able to see the items online and then trying the items on in-store – often preceding the tedious online shopping return process that might arise from purchasing clothing through other online retailers, such as Amazon.

Customer Experience. Tillys’ management team has been successfully following the trend of improving the customer experience to compete with online retailers. The physical stores have been designed to not only carry the trendiest clothing but to also provide a great atmosphere to shop. Tillys is also launching a promotion called “Second Saturdays” in which they host in-store parties. The success of this venture is yet to be seen, but it illustrates management’s focus on improving the customer experience.

Risk Factors

Although Tillys has competitive advantages, it is not without risks that could weaken an investor’s returns.

Large Stores. Tillys’ large stores are the proverbial double-edged sword. They allow Tillys to differentiate itself from its most direct competitors (Pac Sun and Zumiez) by carrying a much larger variety of products and being a destination retailer. When the economy is strong, this plays into Tillys hand by benefiting from strong consumer spending, but when the economy takes a turn for the worse, it has significantly more overhead than its competitors with a smaller store format.

Severe Competition. Tillys not only has competition from online retailers and other brick-and-mortar retailers, but it is also competing directly with the brands it sells, such as Nike. It is competing directly with the major brands it sells in two different ways; The first, Tillys has its own exclusive brands that it sells, which competes in-store with other well-known brands. The second, well-known brands have begun cutting out the middle-man, Tillys in this case, to go directly to the consumer. The rise of e-commerce and the strength of their brands has allowed large consumer brands to sell directly to its customers through its own online stores.

Lack of Switching Costs/Stickiness. Customers cannot get Tillys’ RSQ or Ivy + Main products in other stores, but they can get products very similar, as well as the other major consumer brands, in other stores. Customers are able to go to Pac Sun, Zumiez, Foot Locker, Target, Walmart, or various other stores to purchase many of the well-known non-exclusive brands that Tillys carries without suffering from any switching costs.

Opportunity Costs