#$27.1M

Explore tagged Tumblr posts

Quote

Although the official number of deaths caused by Covid-19 is now 7M, our single best estimate is that the actual toll is 27.1M people. We find that there is a 95% chance that the true value lies between 17.9M and 32.9M additional deaths.

from The Economist (via Kottke)

112 notes

·

View notes

Text

1 Carlos Alcaraz: $42.3m - ($32m off-court)

2 Novak Djokovic: $37.2m - ($25m off-court)

3 Coco Gauff: $27.1m - ($20m off-court)

4 Iga Swiatek: $26.7m - ($15m off-court)

5 Jannik Sinner: $26.6m - ($15m off-court)

6 Rafael Nadal: $23.3m - ($23m off-court)

7 Daniil Medvedev: $20.3m - ($13m off-court)

8 Naomi Osaka: $14.6m - ($14m off-court)

9 Casper Ruud: $13.9m - ($10m off-court)

10 Aryna Sabalenka: $13.7m - ($7m off-court)

#carlos alcaraz#novak djokovic#coco gauff#iga swiatek#jannik sinner#rafael nadal#daniil medvedev#naomi osaka#casper ruud#aryna sabalenka#tennis#prize money

16 notes

·

View notes

Text

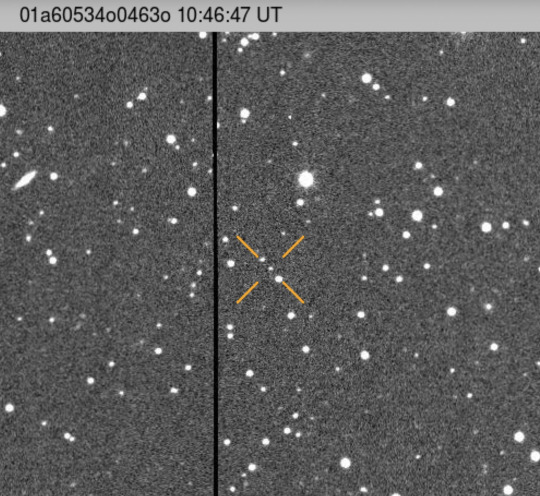

Automated Planetary Defense warning systems detected a 50m asteroid heading straight for us on 7 August. To everybody's relief this turned out to be the returning JUICE spacecraft coming back in for a gravity assisted boost to its speed.

JUICE was detected by ESA's Optical Ground Station in Tenerife, Spain on 7 August (top) and the NASA/University of Hawaii ATLAS NEO survey telescopes in Hawaii (bottom). Of course JUICE isn't 50m (163ft) across, it has an array span of 27.1m (89ft), but being metallic it reflects as much light as a 50m asteroid would. JUICE is making a close pass of the Moon tonight (19 Aug) and the Earth tomorrow (see previous post). Pics: ESA/NASA

0 notes

Text

In the time it took from the merch drop to this delivered on my doorstep Dream has already reached 27.1M

6 notes

·

View notes

Text

0 notes

Text

Mothercare – free from running its own stores and website – turns a profit

As a brand, Mothercare has turned the profit it proved unable to as a retailer. Image courtesy of Mothercare

In 2019, Mothercare put its UK business into administration, closing all of its stores in this market. Its chief executive Mark Newton Jones said at the time that its store estate was no longer financially viable. Today it has reported a profit for the first time in years. How? By closing all its directly-run UK stores and websites and becoming a brand.

Mothercare’s shift from retailer to brand, which started in 2019, has been complicated by Covid-19 along the way. But today Mothercare reported a top line pre-tax profit of £3.6m in the half-year to September 25 2021 – turned around from a loss of £13.2m in the same period last year, on sales of £41.7m – down from £44.4m last time. The retailer says it expects profits to improve further when it returns to more normal levels of business.

Its franchise partners, meanwhile, turned over £184.3m – down from £189.2m last time – including £17.6m from online retail sales, down from £27.1m a year ago, when shops were closed during Covid-19 lockdowns. Some 9.5% of retail sales took place online, up from 4.9% in the same period in pre-pandemic 2019.

Today Mothercare chairman Clive Whiley says the brand is getting “closer to unlocking the true underlying potential of Mothercare”. This, he says, reflects “the strong foundations we have created for the business over recent years, despite the impact that Covid-19 still has had over the period”.

He adds: “With positive feedback to our new product ranges and a lean operating structure, we enter the second half with growing confidence for our future prospects.”

The background

Back in 2019, Mothercare put its UK operations into administration, closing all of its stores in this market. At the time, that part of its business had not made an annual operating profit in more than 10 years – and all efforts to do so had failed, said then chief executive Mark Newton-Jones. In 2017 it cut its store numbers from 250 to 140, and took online sales to about 50% of turnover. Newton-Jones said at the time: "It was simply not financially viable to maintain the UK store estate and supporting infrastructure any longer without putting the whole Mothercare Group at risk."

Its stores were too big and discounting was rife, and that, said Newton-Jones, made sales of third-party brands less profitable. Indeed, he said, Mothercare UK had provided 70% of UK store space to many leading brands - but the profit margin had reduced over time and no longer covered the retailer’s costs. In 2018, the size of its store estate was further cut, to 80 shops, through a series of company voluntary agreements (CVAs) in order to reduce costs. By the following year, its UK business was put into administration – and the retailer decided its future lay in becoming a brand. “From a strategic perspective,” said Newton-Jones at the time, “we knew that the effort and energy that were being expended on fixing the conundrum of UK retailing would be better served on our global ambitions and building the Mothercare brand and proposition around the world.”

The strategy

With its UK stores closed, Mothercare has focused on the profitable part of its business – its international franchises. Its UK business is now also a franchise as well – with Boots its exclusive franchisee until 2030. Now the retailer is working with long-term franchisees around the world, through an asset-light model in about 40 markets. Its franchisees trade through 740 shops, down from 793 a year ago. At the end of the half-year, about 10% of its partners’ stores around the world were still closed in Covid-19 lockdowns.

Now, some 84% of deliveries for the current spring/summer season will go direct from the country of manufacturing. That’s expected to rise to 88% by autumn/winter 2022, and its UK distribution centre will close, as previously set out, early next year. Mothercare is currently reviewing perceptions of its brand, and will then build a new brand strategy around its conclusions.

Mothercare, founded in 1961, marked its 60th anniversary as a parenting business in September.

0 notes

Text

CipherTrace, which helps track crypto crimes and sells compliance tools, raises $27.1M Series B (Danny Nelson/CoinDesk)

Danny Nelson / CoinDesk: CipherTrace, which helps track crypto crimes and sells compliance tools, raises $27.1M Series B — The hedge funder’s latest crypto bet adds fuel to CipherTrace’s growing crypto compliance and investigations business. — CipherTrace, a security firm that tracks crypto crimes … Source link

View On WordPress

#271M#CipherTrace#compliance#crimes#Crypto#Danny#helps#NelsonCoinDesk#raises#Sells#Series#tools#Track

0 notes

Photo

Prompt: 'Long'

The first thing that came to mind when I sat down to do this one was HMS Agincourt, only battleship built with 7 turrets, originally laid down for Brazil during the micro-dreadnought race between the South American powers, then sold to Turkey, and finally taken over by Britain at the outbreak of war in 1914. The ship was regarded as little more than a 'floating magazine with a tremendous volume of fire as her best protection.' At Jutland, her gunnery officer ordered full broadsides from the 'Gin Palace' to dispel rumours that she might turn turtle if all 14 guns were fired at once; the sheet of flame reportedly looked like a battlecruiser blowing up.

She was 204.7m long, 27.1m broad and drew about 8.2m. Armour was weak, with a belt and barbettes 22.9cm (9") at their thickest. She carried 14 305mm (12") guns in 7 turrets, named after the days of the week, as well as 20 152mm (6"), 10 76mm (3"), 2 76mm (3") AA guns, and 3 533mm (21") submerged torpedo tubes. Best speed was 22kts.

- - - - - -

Ink wash on paper. Scanned area 3.5″ x 5″. © Avatar Z Brown

| Deviantart | Twitter | Picarto | support me on Patreon | Tip Jar | Ko-Fi |

33 notes

·

View notes

Text

Lille owner Gerard Lopez on the secrets behind their transfer success

Angel Gomes, Nicolas Pepe and Gabriel Magalhaes are contemporary examples of Lille’s youthful recruitment path of

They are the membership who chanced on Eden Hazard, sold Nicolas Pepe for £72m and tempted Angel Gomes to designate from Manchester United.

Ligue 1 facet Lille have turn out to be masters at growing young talents earlier than promoting them on for a huge profit – and Brazilian defender Gabriel, a target for Premier League clubs on this switch window, is at chance of be next.

But what’s the major in the again of their success?

“We are a creep place that young avid gamers love,” proprietor Gerard Lopez told BBC World Carrier’s World Soccer. “They know we’re going to have confidence childhood.

“Final year we played with the youngest squad in the Champions League, so or no longer it’s a great creep place for a young participant.”

Hear to the fat interview here

Just a few of the game’s most excessive-profile avid gamers spent their childhood at the Stade Pierre-Mauroy, including Exact Madrid forward Hazard, who joined the membership’s academy ancient 14 in 2005, joining Chelsea for £32m seven years later.

Extra skills has been developed since Lopez took over the membership at the muse of 2017.

Ivory Wing worldwide Pepe signed from Angers in 2017 for 10m euros (£9m) earlier than joining Arsenal for £72m final summer. In July, Nigeria forward Victor Osimhen joined Napoli for an initial 70m euros (£63.3m) greatest a year after signing from Belgian facet Charleroi for decrease than a third of that payment.

Lille have worn about a of the money from the Osimhen deal to select 20-year-odd Canada forward Jonathan David from Gent, some other Belgian membership, for a membership-sage payment, reportedly 30m euros (£27.1m).

The membership moreover persuaded England Under-20 midfielder Gomes to switch from Outdated Trafford on a free switch earlier than joining Portuguese facet Boavista on a season-lengthy loan.

Such recruitment has translated into on-pitch progress.

They had no longer received a most well-known trophy in 56 years when Hazard helped them to the French league and cup double in 2011.

They have got executed outside the head eight appropriate twice in eight years since, including finishing runners-up in 2019.

‘He’ll call me up, actually out of nowhere’

The man in the again of great of their contemporary switch success is sporting director Luis Campos.

The 55-year-odd joined the membership in 2017 after a successful spell at Monaco, the place he signed Fabinho, Anthony Martial and Bernardo Silva.

“He [Campos] will call me up, actually out of nowhere,” added Lopez, a ancient proprietor of Formula 1’s Lotus F1 crew (now Renault). “He’ll even be in Chile after which he calls me two days later and he is in the Czech Republic, and he tells me ‘we gotta rep this child’.

“Everyone knows that Messi is candy, or Ronaldo, or Dybala. We rep avid gamers that folks haven’t viewed.

“We are never going to be Exact Madrid or Barcelona. So you have received to hunt out your place, name the place your energy is – and ours from day one became as soon as to divulge ‘all americans knows for the broad, huge skills, we are no longer an ending membership’.

“We would favor to be in a location to position skills early on so we set no longer must use 60m or 70m euros on a participant we spent 20m on and that is classic.”

‘Gabriel is leaving’

Defender Gabriel, who joined from Brazilian facet Avai in 2017, is determined to be the subsequent huge-money departure.

The 22-year-odd has been linked with a £30m switch to Everton, Arsenal and Napoli.

“Gabriel is young, extraordinarily extremely effective, presently appropriate now potentially no doubt one of many two most dominant central defenders in the French league,” mentioned Lopez.

“The capability we work is awfully easy. We uncover to him and his environment, his agent, what we’re procuring for, and when we rep these offers the need is his, like we did with Nico [Pepe] and Victor [Oshimen].

“We are there now, so we told him: ‘In the atomize or no longer it’s crucial to kind a choice but we’re no longer urgent you.’ I reveal he’ll kind it this week, or next week at the most contemporary. He is leaving, we now have given the OK for that.

“There’s quite a bit of opponents. He’s a young participant so he is received to be lunge he makes the categorical decision. We motivate him out a tiny bit so we narrate him: ‘We assume this could presumably well presumably also be the categorical manager or membership for you.’

“He’s received so great skills, he’ll succeed wherever he goes.”

from WordPress https://ift.tt/3iLeLDK via IFTTT

0 notes

Text

SIG management blunders rack-up £112.7m loss

Materials distribution giant SIG made a pre-tax loss of £112.7m loss last year following a series of management failures leading to a loss of market share.

Accountants PwC were called in earlier this year to investigate divisional financial forecasting issues which left the Board “unsighted as to the overall picture.”

The company is now vowing to grow the business again with the long-term aim of hitting 5% margins.

Chief Executive Officer Steve Francis,who took up the role in February, said: “After nearly a decade of contraction, which has included disposals, rationalisation, debt and cost reduction, it is now time to focus on how to grow SIG and rebuild our core USPs of customer proximity, service and expertise.

“We play an important role in the construction industry, providing a channel through which suppliers can bring their products to a fragmented customer base conveniently and efficiently.

“I firmly believe that our new strategy for growth will provide the basis, not only for the restoration of profit and cash conversion, but also serve as a foundation to play a leading role in our industry in the years to come.

“Since my appointment as CEO on 25 February, we have been developing a new strategy and organisational model which focuses on people, growth and active industry leadership.

“The essence of our new strategy is re-connection with our people – employees, customers, suppliers and the communities in which we do business – we are a local, sales and service-driven business.

“The new management team will empower our customer-facing people and promote an entrepreneurial spirit throughout the Group, thereby re-connecting with our customers and suppliers, re-energising our highly talented employees, and re-setting the growth ambition of SIG.”

The impact of Covid-19 saw 2,000 staff furloughed and group revenues fall £138.9m during March and April from the prior year – a drop of 37%.

SIG said trading is “now returning to pre Covid-19 levels in most of its operating companies as the group adapted swiftly to new social distancing protocols.”

Turnover this year is expected to be £500m down on 2019 and not return to those levels until 2022.

An underlying pre-tax profit last year of £20.6m was sunk by impairment charges of £90.9m, restructuring costs of £27.1m, and other costs of £9.5m.

The impairment charges of £90.9m (2018: £4.0m) principally relate to impairment of goodwill in relation to UK Distribution (£57.4m) and France Exteriors (Lariviere) (£32.2m).

SIG also confirmed that US private equity firm Clayton Dubilier & Rice is investing £85m in the business in return for a 25% stake.

0 notes

Text

SIG management blunders rack-up £112.7m loss

Materials distribution giant SIG made a pre-tax loss of £112.7m last year following a series of management failures leading to a fall in market share.

Accountants PwC were called in earlier this year to investigate divisional financial forecasting issues which left the Board “unsighted as to the overall picture.”

The company is now vowing to grow the business again with the long-term aim of hitting 5% margins.

Chief Executive Officer Steve Francis,who took up the role in February, said: “After nearly a decade of contraction, which has included disposals, rationalisation, debt and cost reduction, it is now time to focus on how to grow SIG and rebuild our core USPs of customer proximity, service and expertise.

“We play an important role in the construction industry, providing a channel through which suppliers can bring their products to a fragmented customer base conveniently and efficiently.

“I firmly believe that our new strategy for growth will provide the basis, not only for the restoration of profit and cash conversion, but also serve as a foundation to play a leading role in our industry in the years to come.

“Since my appointment as CEO on 25 February, we have been developing a new strategy and organisational model which focuses on people, growth and active industry leadership.

“The essence of our new strategy is re-connection with our people – employees, customers, suppliers and the communities in which we do business – we are a local, sales and service-driven business.

“The new management team will empower our customer-facing people and promote an entrepreneurial spirit throughout the Group, thereby re-connecting with our customers and suppliers, re-energising our highly talented employees, and re-setting the growth ambition of SIG.”

The impact of Covid-19 saw 2,000 staff furloughed and group revenues fall £138.9m during March and April from the prior year – a drop of 37%.

SIG said trading is “now returning to pre Covid-19 levels in most of its operating companies as the group adapted swiftly to new social distancing protocols.”

Turnover this year is expected to be £500m down on 2019 and not return to those levels until 2022.

An underlying pre-tax profit last year of £20.6m was sunk by impairment charges of £90.9m, restructuring costs of £27.1m, and other costs of £9.5m.

The impairment charges of £90.9m (2018: £4.0m) principally relate to impairment of goodwill in relation to UK Distribution (£57.4m) and France Exteriors (Lariviere) (£32.2m).

SIG also confirmed that US private equity firm Clayton Dubilier & Rice is investing £85m in the business in return for a 25% stake.

from https://www.constructionenquirer.com/2020/05/29/sig-management-blunders-rack-up-112-7m-loss/

0 notes

Photo

Arsenal head coach Mikel Arteta has confessed that the club may be forced to sell some of their players in the summer if they fail to qualify for the Champions League again. The Gunners announced they made a £27.1m loss in the 2018/19 season, and the lack of Champions League football this season certainly won't have helped. Factor into that the £72m signing of Nicolas Pépé last summer, and you'll get a good idea of how much money Arsenal have available right now. Given they currently sit... Via All the latest breaking football news, transfer rumours, analysis, and match reports - 90min http://www.90min.com/

0 notes

Text

How N Brown Group is focusing on digital to boost its profits

Almost all Jacamo sales were made over the internet

Simply Be to Jacamo parent company N Brown Group today set out its progress as it focuses on digital and on the UK in order to return to sustainable profitability.

Overall, 84% of product revenue came from digital during the first half of its financial year – up from 80% a year earlier – with Simply Be (97.6%) and Jacamo (97.2%) almost entirely online. Digital revenues grew in both women and menswear - by a combined total of 5%. However, overall product brand revenue fell by 14.3% as the group managed the decline of its offline business, while digital revenue was down by 5.7%. While there was strong digital growth at brands including Oxendales (+21.6%) and Figleaves (+15.5%), the retail group is also seeing sales fall at House of Bath, Premier Man and High & Mighty.

N Brown Group reported group revenue of £432.9m in the six months to August 31, and down by 5.4% compared to the same time last year. Product sales of £282.3m were down by 9.3% on last time. Financial services revenues of £150.6m were up by 2.9%. The retailer posted a pre-tax profit of £18.8m – up by 169% on the same time last year, from a loss of £27.1m.

Chief executive Steve Johnson said the retailer had made good progress in the first half of the year as it focuses on the UK market and on digital. “In particular we have delivered on our strategy of growing digital revenue across Simply Be, JD Williams, Jacamo and Ambrose Wilson," he said. "This has been achieved by taking a more targeted approach to marketing and customer recruitment. The retail strategy remains heavily promotional but we are concentrating on continuing to improve our customer proposition and ensuring we operate as efficiently as possible, which has led to an increase of 4% in adjusted EBITDA for the period. We remain focused on implementing our plans and the board’s full-year expectations are unchanged.”

Social media

N Brown Group has also relaunched its social media strategy and says that results from steps such as relaunching the Jacamo feed with new content has generated good results. “This demonstrates the potential of social media channels as this is, increasingly, where our customers are engaging,” it said. It is selling third-party brands on its websites, including Seasalt and Joules on JD Williams and Tommy Hilfiger on Jacamo.

Improving the customer experience

It has also adopted a new agile approach to customer experience improvements, with more than 125 members of staff working to streamline the digital user experience, delivering improvements such as changing size guides and improving the navigation structure on the Simply Be app. Investment is now focused on customer lifetime value.

Operations and logistics

In November automated returns will launch at its Shaw warehouse. “This investment,” said N Brown Group, “will deliver benefits to the customer through faster refunds, better stock availability and improved presentation of items returned to stock. It will also deliver operational benefits, by removing 66% of receiving and sortation activity.”

Image courtesy of N Brown Group

from InternetRetailing https://ift.tt/33kjW5E via IFTTT

0 notes

Text

Report: West Ham tables club-record £27.1M bid for Carvalho

Report: West Ham tables club-record £27.1M bid for Carvalho

After years of being heavily linked with a move to the Premier League, it appears as if Portuguese international William Carvalho is finally on the verge of a move to England’s top flight. West Ham is set to lure the Sporting midfielder with a club-record £27.1-million offer, with the Telegraph’s Jason Burt reporting Thursday that Irons’ representatives are currently in Portugal to negotiate a…

View On WordPress

0 notes

Text

Report: West Ham tables club-record £27.1M bid for Carvalho

Report: West Ham tables club-record £27.1M bid for Carvalho

After years of being heavily linked with a move to the Premier League, it appears as if Portuguese international William Carvalho is finally on the verge of a move to England’s top flight. West Ham is set to lure the Sporting midfielder with a club-record £27.1-million offer, with the Telegraph’s Jason Burt reporting Thursday that Irons’ representatives are currently in Portugal to negotiate a…

View On WordPress

0 notes

Text

Report: West Ham tables club-record £27.1M bid for Carvalho

Report: West Ham tables club-record £27.1M bid for Carvalho

After years of being heavily linked with a move to the Premier League, it appears as if Portuguese international William Carvalho is finally on the verge of a move to England’s top flight. West Ham is set to lure the Sporting midfielder with a club-record £27.1-million offer, with the Telegraph’s Jason Burt reporting Thursday that Irons’ representatives are currently in Portugal to negotiate a…

View On WordPress

0 notes