#15 minute loans from direct lenders

Text

What Steps Should You Take To Manage Your Debts?

If you owe too much debt, you should start finding ways to tackle with it. Create a budget to take a holistic view of your financial condition, talk to your lenders, consolidate debts if favourable, pay more than the minimum and create an emergency cushion to avoid borrowing more money.

0 notes

Text

1 note

·

View note

Text

Loans for Short-Term Cash: Mostly for Customers Who Are Physically Stressed

Would you like to benefit from a loan designed to help people with benefits so they can handle different, now-unavoidable installments? Is the state of your incapacity a barrier? Try not to worry! You can apply for the greatest credit help without providing any security here, and short term cash loans are available. It is implied by this that you can only find more resources when you really need them during difficult times.

You don't need to fax any documentation or go through any credit check procedures in order to obtain short term cash loans, which is between £100 and £1000. For a period of thirty-one days, this help is no longer provided. So, you can use the advance to cover sporadic expenses that come up in your budget, including paying for your mother's health check, electricity, gas, small house improvements, unexpected bank overdrafts, family unit expenses, and so on.

People who are tenants or paying guests but do not meet the requirements for a short term loans UK direct lender can quickly and easily apply online for additional subsidies. All that is needed of you is filling out a simple online application form that asks for all the necessary information, like your name, address, bank account balance, email address, and phone number. You then send the form to the loan expert for verification. Once the money has been approved, it only takes a few minutes for it to be safely authorized into your dynamic financial records.

When is it OK to take out a Short Term Loans UK?

Just as every short term loans UK has a distinct purpose, so do small loans. It isn't appropriate for every situation. If purchasing a home is one of your long-term goals, it might not be the right choice for you. You must have frequently encountered pressing financial needs to handle pressing matters, such as:

Repairing a boiler; replacing a car window; unavoidable dental issues; urgent medical costs; insurance resultants

final bill and subscription amounts

award of tuition fee

quick loans

you can review the top quotations on the site if any of these apply to you or if your requirements are comparable. Some other justifications for minor loans are:

out of money prior to salary day: you just need a small amount

you find it difficult to qualify with mainstream lenders because of your credit score when you urgently need money and find it difficult the same day. Look into your choices for a short term loans UK from a direct lender if you don't have any savings and need money right away.

Prior to disbursing cash for short term loans direct lenders, lenders examine continuous financial activities such as credit card payments and direct debits, as well as the debt-to-income ratio.

Some short term loans direct lenders taken out to cover essential costs could result in excessive debt. Short-term financing is the best choice if you want to minimize the chance that you won't make loan payments on time. When compared to other loans with limited eligibility, the nicest thing about tiny funding sources is that you can obtain a loan in as little as 15 minutes. In accordance with the flexible lending conditions, you can spread out the payments.

https://classicquid.co.uk/

4 notes

·

View notes

Text

Obtaining Funds with Short Term Loans UK Direct Lender Is Like Playing a Child's Play

Generally speaking, the lender would ask for a short term loans in order to provide the financial backup because it facilitates quick and timely repayment. The lender takes money out of the borrower's account after the conclusion of the loan payback period. But, since short term loans UK direct lender are a superior alternative for you to get the fastest amount in an easy approach, you don't need to worry if you don't have one.

If you have negative credit due to defaults, arrears, foreclosure, late payments, CCJs, IVAs, or bankruptcy, don't worry. The lender's refusal to review customers' history and current credit records is the cause of this. As a result, credit history is irrelevant in order to obtain the funds through the mentioned loan. To gain the confidence of lenders, you must meet the eligibility requirements listed below.

You meet the following requirements:

- You are a lawful resident of the United Kingdom;

- You are at least eighteen years old;

- You have been working for a reputable company for the past six months;

- To receive the funds by direct deposit, you must also have an active bank account.

You can now borrow money using short term loans UK in the range of £100 to £1000 without having to pledge any kind of collateral as security. You can utilize this modest cash solution to cover a variety of problems, including overdraft fees from banks, unpaid medical bills, electricity bills, grocery shop bills, travel costs, and house loan installments. As the name suggests, you have 30 days from the acceptance date to repay the money.

Obtaining short term loans UK direct lender is a very straightforward process. All you have to do is complete an application on the website, including accurate information such as your full name, address, bank account, email address, age, phone number, and so forth. Within 30 days of your application, the lender will sanction your funds directly into your account if your financing is approved.

Are 15 Minute Short Term Loans Available?

Sure, you can accomplish this, but it's also critical to comprehend the steps involved in applying for any kind of loan.

The first thing you should think about is how much you want to borrow. The next step will be to look for short term loans direct lenders, and the simplest way to do it in today's connected world is to go online. (If you find anything that works for you, you may also apply online for a loan.)

Depending on how you approach it and how many sites you review, this search process may take some time. Which lender—a licensed credit broker or a direct lender—will you use to search for a short term loans UK?

It's understandable why some people only consult two or three sources before selecting one. And that might be a mistake because you would pass up a lot of same day loans UK options that could be beneficial.

This raises another query. Is using a broker rather than a lender the best option? To help you decide whether to look for a 15-minute offer directly from a lender instead of a broker, let's examine the differences between the two.

4 notes

·

View notes

Text

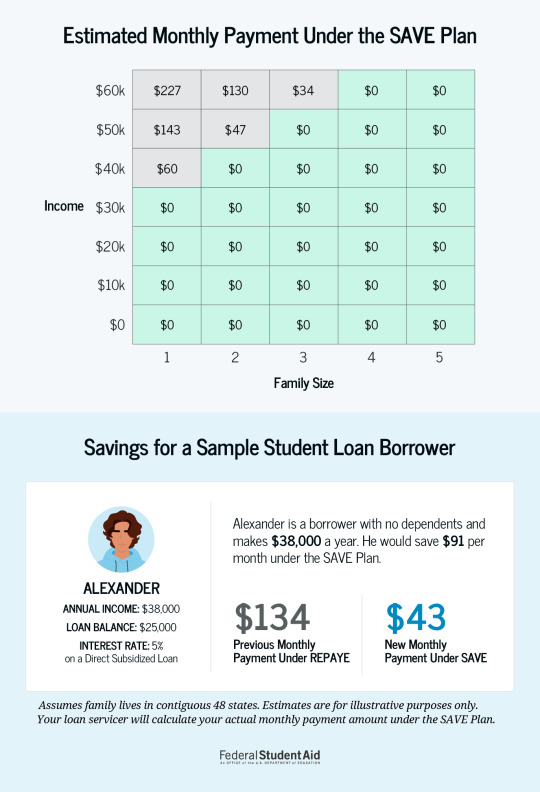

Americans: Don't forget to sign up for the new income-based student loan repayment plan

For anyone who's missed it (who wants to get depressed reading about student loan forgiveness after the Supreme Court decided "waive or modify loan obligations" did not in fact mean the power to waive or modify loan obligations if it's a Democratic President) the Biden administration is now putting a new income-based repayment plan in place that you can get signed up for before student loan repayments kick in.

This turns student debt into more of an extra tax that kicks in for people who went to higher education after they reach a certain income level.

Here's a handy chart for how high payments you'll have to make in different income brackets:

This new plan (it's called SAVE, and yes, all government acronyms are a bit cringe) means that as long as you make the above payments on your loans, the principal will not increase whatever your interest rate is.

The remaining balance will also be automatically forgiven after a set amount of time of payments (at least 10 years, so it will still take quite a while).

The application takes (2nd hand info) about 15 minutes to fill in, here's the govt page about it:

I took this paragraph from an NPR article on who's eligible:

"SAVE is for student borrowers with federally held loans, including all direct subsidized, unsubsidized and consolidated loans, as well as PLUS graduate loans.

Those with Federal Family Education Loans (FFEL) or Perkins Loans that are held by a commercial lender would need to consolidate into a federal direct loan in order to qualify.

Parents who took out a federal loan to help their children pay for college (known as Parent PLUS loans) are not eligible for SAVE."

2 notes

·

View notes

Text

Same Day Loans Online Direct Lender for People with Bad Credit

You normally need to supply a lot of personal information when applying for a same day loan online, including your Social Security number, bank account details, employer information, and information about your income and credit score. Online lenders can take up to five business days to approve your online loan application and deposit the money into your account due to this thorough application process.

A soft credit check is available for same day loans online from some internet lenders, nevertheless. Since these payday lenders offer instant approval for their short-term loans, you won't have to wait days to get the money from a loan application that has been accepted. Because they are issued with no credit checks and are processed swiftly, these loans are frequently referred to as same-day cash loans. The aim of the loan and the manner in which it is disbursed are described by the words "cash advances" and "payday loans," not necessarily the payday lender.

Even with a low credit score, you can still obtain your funds an hour after applying for a fast payday loans online as long as your application complies with certain standards (for instance, you have a bank account). When you need us most, Fast Cash Loans is here to assist you get back on your feet. To acquire the money you require right now so that you can resume living your life tomorrow, use our same-day loan solution.

Payday Loans Online Same Day No Credit Check

A payday loans online same day is a quick cash advance that may be used to pay for anything from an urgent car repair to catching up on bills. An example of a use for a payday loan online is as follows:

Auto Repair

Emergencies or Medical Bills

Maintenance or Repairs to the Home

Travel or vacation costs

Pay a bill that is due right now.

If your TV breaks, buy a new one.

Spend time with your family rather than worrying about money.

Why Use Near Me Same Day Cash Loans

We are aware that securing a loan quickly can be crucial. We provide same day cash loans close to me in order for you to receive the money you require immediately rather than waiting two weeks or a single day. Furthermore, in contrast to a federal credit union, our loan agreement is simple and doesn't involve signing a lot of paperwork.

You can pay your rent or shop for groceries without having to wait for a payday loan to process and clear thanks to our quick service. Instead, with same-day cash loans close by that can be approved in as little as 15 minutes and paid directly into your checking account by the next day, we'll be there for you when you need us most.

We're here for you regardless of your current financial condition, even if it's just a little off. We can discover a solution that exactly suits your demands if you have any questions or a concern regarding our services, and our kind, educated staff is here to help.

https://fastpaydayu.com/

0 notes

Text

How Can People With Bad Credit History Benefit from Short-Term Loans Direct Lenders?

If you have bad credit, it might be challenging to obtain financial relief through typical payday loans. But customers with bad credit don't have to worry; they can visit Payday Quid online and apply for a short term loans directly from the lender without any hesitation. Here, we think that everybody may benefit from short term loans direct lenders, including those with bad credit. We differ significantly from other UK lenders in this area. Our loan products are made to assist everyone who is struggling due to their poor credit ratings. Our loans are available to many consumers with credit scores of 450, 400, or even lower. Due to the fact that we are aware of the difficulties faced by people with bad credit, we do not run a credit check while arranging for loans for you.

Looking around for the greatest short term loans UK direct lender arrangement that is affordable? Apply here to receive the financial support you are due. We have a set of lending requirements similar to those for other loans, but these are relatively easy to meet. For instance, let's say you're 18 years old, have a job, and are paid every month directly into your account. If you have all of these requirements, enter them all in the online loan application. Within the same day, the authorised financing will be deposited into your account.

Is it possible for me to get a Short Term Loans UK Direct Lender today?

Our loans are open to anyone who satisfies the following criteria:

At least 18 years old.

UK national.

Proof of consistent income sufficient to cover loan repayment installments.

True British bank account.

Give the following details: your full name, your ID number, your bank account information, a breakdown of your income and expenses.

Why should I choose Payday Quid to get a Same Day Loans UK?

At Payday Quid, we make a concerted effort to provide our clients with access to the finest rates and offers currently on the market. With the help of cutting-edge technology, we deliver same day loans UK online in 15 minutes, something we take great pride in.

When you apply with us, you can request a modest loan of between £100 and £5,000, receive the money the same day, and spread the cost over a one- to 24-month period with affordable monthly payments.

Furthermore, even if you have poor credit or are unemployed, you may still be eligible for a same day loans online. We take other factors into account while determining whether to approve you. We take a broader perspective.

Even people with bad credit ratings can receive online loans the same day thanks to Payday Quid, which takes into account your people circumstances and your capacity to make repayments.

A same day loans direct lenders known as a "same day loan" can be available within 24 hours of a lender accepting and approving your application. These loans are not intended to address persistent money issues. In order for these loans to be rapidly approved, they have exorbitant interest rates.

You can apply for a same-day loan immediately online through a lender or credit broker that is FCA licenced. You will need to fill out an online application form, and you might need to provide documentation to demonstrate your eligibility.

0 notes

Text

Pmloansday is a one of the growing short term loans lender in the UK. Get fast 15 minute loans for bad credit with no credit check from direct lenders.

0 notes

Text

Short Term Loans UK Direct Lender - Get Cash Quickly in a Helpful Manner

The short term loans UK direct lender is custom-made for those who are employed when they require money to ease financial strains. Short term loans are the most well-known since they include a repayment period of 14 to 30 days and an amount ranging from £100 to £2500. The provided cash can be continuously used for paying medical bills, power bills, unanticipated car repairs, unpaid credit card bills, unpaid bank overdrafts, child's school or tuition fees, laundry costs, and many other expenses.

Other than that, bad credit histories like local court judgments, people voluntary agreements, bankruptcies, foreclosures, missed payments, and all of those things are permitted to apply for short term loans UK direct lender without going through the credit check system, enabling you to make the quickest cash provision possible wherever you are and at any time. You must promptly return the money because these are short term loans direct lenders.

Before applying for short term loans direct lenders, there are a few particular requirements that you must meet, like being 18 years old, a permanent employee with a stable source of income, and having an active bank account. Additionally, the loan is approved and sent into your account the same business day after you submit an online application on the website.

You must first meet the requirements listed below in order to be eligible to apply today:

Be at least 18 years old.

Currently living in the UK

Be employed full-time, part-time, or on your own

Obtain a Consistent Income

Possess a functioning debit card and bank account

If you are eligible, we would be pleased to see what we can do to quickly offer short term cash loans to you. You will need to provide additional documentation with your application, such as your previous three months' worth of bank statements, a copy of your ID, and confirmation of your address. This is necessary so that we can verify your identification and properly evaluate your capacity to make the minimal loan repayments. Here, you may learn more about how it functions.

If everything is accepted once we have checked your credit and affordability, we will send you a simple loans digital agreement to sign. We can deposit the agreed-upon loan amounts into your bank account in about 15 minutes after you electronically sign using your Smartphone, tablet, or computer.

Our short term loans UK are made to provide you with a quick means to cover a little price. They're perfect for when an emergency arises, such as a repair bill, or when you need funds to get through an expensive scenario. If you have a bad credit history, we can still help since we put more of an emphasis on your ability to pay. When compared to other types of short term direct lender loans, little cash loans are often for sums no higher than £2,000, such as our £200 short term loans UK. This implies that depending on how long you decide to spread the period, the repayments may be substantially lower.

4 notes

·

View notes

Text

Short Term Loans UK Direct Lender: Easy & Reliable Cash Solution in Rainy Days

There are tons and tons of extra expenses, and it's imperative to take care of them all before the following pay day. Therefore, short term loans UK with no fees are the most beneficial and effective financial option for everyone. As a result, you don't need to be concerned. With a flexible payback period of 14 to 31 days, you may definitely get money in the range of £100 to £2,500. Although interest rates on these loans may be fairly expensive in contrast to those on other loans, they do fluctuate occasionally, so keep up with them.

As a result, short term loans UK direct lender are frequently referred to as short-term financial aid and are made available to pay for a variety of monetary needs, such as electricity bills, grocery store bills, unexpected car repairs, home loan payments, birthday expenses, credit card bills, and so forth.

If you meet certain requirements, such as being eighteen years old, being a citizen of the UK, having a steady source of income, and having a current checking account, you may be eligible for short term loans UK direct lender, even if your credit history includes defaults, foreclosure, arrears, skipped payments, late payments, CCJs, IVAs, or insolvency. These terms and conditions are necessary for lenders to offer these loans.

You don't need to threaten the lender with any expensive assets because they disclose all of their essential information while completing the short term loans direct lenders application. The contact number of the office, permanent residency evidence, age proof, pay stub, current or savings bank account number, work experience proof, and the contact number of the office are a few examples of these basic details. This information enables the applicants to obtain emergency funding with a great deal of comfort.

How to Make a Short Term Loans UK Application Dedicated Lenders

With our straightforward loan application process for short term loans UK, getting started is easy. This is done so that you can swiftly and without delay receive the money you need after it has been approved.

Short term loans might help you pay back an unexpected purchase quickly and spread out the cost with manageable installments when you don't have the cash on hand or savings to cover it. With several small loans available online, direct lenders can assist with payday loans and short-term loans.

Even if your credit is less than excellent, our same day loans UK can give you an immediate cash infusion because of our trusted lending approach, which sets us apart from other same day loans direct lenders. Applying now will result in an immediate decision if you require a loan up to £1000 as a new client and can afford to repay either weekly or monthly for up to 8 months.

If you have bad credit, don't worry; we can still help you with loans as long as you can afford the required repayments. Start your application now if a modest loan would help you today. If approved, you might have the money in your account within 15 minutes of signing your loan documents.

4 notes

·

View notes

Text

Does obtaining a short term loans UK need a credit check?

Legally speaking, there are no short term loans available that do not involve a credit check because all lenders—from short term loans UK providers to mortgage lenders—are obligated by law to do credit checks prior to making short term loans online. This is because we must adhere to certain criteria in order to be accountable and reliable to each and every one of our clients. Part of that requires us to verify your ability to repay debts, which does entail obtaining a credit report.

Loans Profit can help if you need a loan to pay some unforeseen expenses but have a poor credit score because we evaluate each application individually. When thinking about taking out any kind of short term loans UK, it's crucial to exercise caution. Make sure you thoroughly study the terms and circumstances and only borrow money that you can afford to repay.

We recognize how difficult it can be to obtain loans if your credit isn't the best. As previously stated, Loans Profit is a legitimate lender that has been granted authorization by the Financial Conduct Authority. As a result, credit checks must be completed before any short term loans direct lenders are approved in order to protect those who are more susceptible from accruing debt they cannot afford or from becoming entangled in a cycle of borrowing.

New users can choose among short term loans UK of up to £1000, with minimum payback terms of two installments, which can be either weekly or monthly, based on your pay dates. This implies that you won't have to pay back the whole loan amount when you get paid next.

You can borrow up to £2,500 if you are a current customer and have successfully completed our application process and credit checks. We don't need the entire amount repaid in 60 days, and you have up to six months to repay your loan early without being penalized or charged costs.

How to use Loans Profit to apply for a 24-hour loan

After selecting the "Request Fund" option, complete our quick and simple online application.

After that, we'll examine your credit and affordability.

Your loan agreement will be given to you via email; upon approval, please sign and return it.

Receive your money straight into your bank account in the UK.

Emergencies happen to everyone, such as when your car breaks down right before you have to drop your kids off at school or your washing machine floods your kitchen. You won't be thinking about your credit score at that point. You shouldn't have to worry about not being able to acquire the assistance you require when these unforeseen charges arise. Even if your credit history isn't flawless, everyone should be given equal consideration for secure and short term cash loans, in our opinion at Loans Profit.

Every application for a short term loans UK direct lender is reviewed individually, and if you satisfy the primary requirements, you may be eligible for funding to be transferred into your bank account in as little as 15 minutes*.

https://loansprofit.co.uk/

1 note

·

View note

Text

ATD Money - Instant Loans For Small Retailers

ATD Money is an App that provides instant loans for small retailers. It is India's #1 Payday Loan App. It is also one of the top Instant Personal Loan Apps. While it is not an NBFC, ATD Money works with NBFC partners to provide loans to its users. With a simple application process, borrowers can get a loan for as little as $19.

Payday loan

ATD Money is an Instant Personal Loan App that is a leader in the Indian market. While it is not a direct lender, it works with many NBFC partners to provide loans to consumers. The app offers easy-to-use and convenient methods to apply for a payday loan or other small retail loan.

The ATD Money application process requires only a few minutes to complete, and you can get approved in minutes. You can choose from unsecured or secured loans, and you do not need a good credit score to apply for an ATD Money loan. You can also choose to apply online or at one of its retail locations. Another benefit of ATD Money is its mobile app, which allows you to apply for loans on the go. You can also open a new bank account right from your phone.

If you are worried about getting rejected by traditional banks, ATD Money is a great option for you. The process is fast and convenient, and you can receive your loan within one business day. You can use your ATD Money personal loan for any purpose, from car repairs to debt consolidation. You can also use it for emergency expenses.

ATD Money is a leading provider of short-term loans in India. It works with several NBFC partners to provide customers with cash within 24 hours. Its loan process doesn't require any credit checks and you can get your money on the same day, regardless of your credit. ATD money is registered with the RBI, so it's completely legal in India.

You can download the ATD Money app from the Google Play store. If you need a quick cash loan, ATD Money is the best choice for you. These loans are available to anyone with a monthly salary of 15k to 250k. ATD Money is a great way to avoid facing a financial emergency.

Instant Personal Loan

Applying for an instant personal loan with ATD Money is fast and easy. To qualify, you must have a Social Security number or taxpayer identification number and be at least 18 years old. Your credit report must show no more than two open accounts. If your credit history is poor or non-existent, this type of loan may not be available for you. You must pay an origination fee of $25 to $500 and an interest rate of between 1.5% and 15% of the loan amount.

This fast cash loan is ideal for people with urgent financial needs. You can use it to pay off your mortgage or other urgent expenses. You can even use it for investment opportunities. It is easy to apply for and easy to repay with a low rate of interest. The ATD Money app will also allow you to access your loan easily and quickly.

The approval process can take as little as 24 hours. When approved, you can expect your money in your bank account within the same day. Applying for a personal loan through an online lender is convenient because you can get a rough estimate of the interest rate and repayment schedule without damaging your credit. You can also make payments online.

ATD Money is India's most popular instant personal loan app. The app works with a network of NBFCs to provide you with a personal loan. The service is 100% online and carries a competitive interest rate. Whether you need to consolidate your debt or purchase a new car, this loan is an easy way to get the money you need.

Small retail loan

ATD Money Small retail loan is available for people earning in the range of 15k to 250k per month, and who are between 22 to 50 years of age. The loan is available for all citizens of India and carries an annual interest rate of 24%. There are no formal requirements for this loan, and you can easily apply online. The processing fee is low at 0% to 7% of the total loan amount. GST is 18% of the Processing Fee and may increase or decrease as per the rule and regulations of the government.

Small retail loan App

The ATD Money Small retail loan App is an easy way to get a loan for your small business, and it allows you to apply on the go. You can get the cash you need within thirty minutes. The company offers several loan types, including installment loans and unsecured personal loans. You will need to provide certain information, including your current income and residence. You will also be asked to provide proof of your identity. Unlike many other lenders, ATD Money will not look at your credit score during the approval process.

One of the major benefits of this app is its instant disbursement and low interest rates. Even if you have a low CIBIL score, you can still get approved for a loan using the app. This app is available in most parts of the country. Thousands of people have already used the app to get a small retail loan.

The ATD Money Small retail loan App is available for download from the Google Play Store. The application is available for both online and in-person loan applications. The approval process can take less than 24 hours and you can get up to $1,000. Unlike most loans, you will not be required to pay any interest on the loan until it is repaid.

The ATD Money Small retail loan App works through a network of lenders across the country. Once you apply, you will be matched with the lender that best meets your needs. You can use the money for any purpose, from debt consolidation to car repairs to emergency expenses.

Property of ATD Money

Property of ATD Money provides cashless loans to the working class at the touch of a button. Most salaried individuals in India face a financial crisis at the end of the month and this app is a boon to them. The app is available for download from the Google play store and can be used as a way of quick financial assistance.

The application process for the property of ATD Money is hassle-free and you can get approved for a loan on the same day. Once you get approved, you can use the loan at your own convenience. You can also apply for the loan online. This way, you can get the cash you need as soon as the next business day.

0 notes

Text

Why Are Businesses Looking to Go Green?

Why Are Businesses Looking to Go Green?

Business interests and environmental concerns were conventionally viewed as opposing ideas, but there had been a significant shift in this perception in recent years. The concept of corporate social responsibility or CSR has grown beyond mere symbolism into a more real movement where businesses are striving to develop and adopt eco-friendly practices. They are also finding ways to contribute to…

View On WordPress

0 notes

Text

Short Term Loans UK - Quick Extra Cash To Fix Financial Problems

Risk considerations that lenders consider before approving a loans for a borrower with poor credit include defaults, foreclosure, skipping payments, payments that are past due, late payments, CCJs, IVAs, and even liquidation. Making money from lenders on the free market is therefore never simple. However, there is short term loans UK direct lender available in the market to assist folks, regardless of their credit histories. This is due to the fact that these loans are granted to people based on their earning capacity.

Paying for short term loans UK obligations like power, phone, groceries, school or tuition fees, medical emergency bills, unforeseen travel expenses, laundry, etc., can be done successfully and without issue. But keep in mind that you must reach the stipulated repayment date on time.

You must first be a UK resident who is at least 18 years old, be employed on a permanent basis, and have an active checking account in order to receive immediate approval for short term cash loans. You must now complete a brief online application form with the necessary information and submit it for confirmation in order for the money to be safely transferred into your bank account within 30 minutes of the submission date.

How We Can Aid You in Getting Short-Term Loans UK Direct Lender

We comprehend that when you require money quickly, you want a straightforward procedure to obtain the necessary funds. Classic Quid is a short term loans UK direct lender that offers a simple application process with speedy approval times. Our payday loans and short-term loans are made to fill financial gaps without a drawn-out application process.

Simply fill out our quick application with the information requested, including the loan amount, term, and repayment schedule. After that, we'll provide you a general understanding and designate a personal Customer Care Manager who may get in touch with you for more information. The process moves more quickly when all the essential data from our credit search is available. This eliminates the requirement for a phone call. As a direct lender short term loans UK direct lender, we promote prudent borrowing and will evaluate your affordability to make sure a loan is first within your means.

We'll offer you a link to electronically sign your credit agreement by text message and email if we can approve the short term loans direct lenders. Once you have signed and returned this, we will, whenever feasible, send the money to your bank account within 15 minutes, allowing you to start utilizing it to deal with your issue that day.

Selecting Classic Quid offers the following advantages:

Swift funding and decision-making process

Effortless application process

Utilize responsible lending procedures and only borrow what you can afford to pay back.

Flexibility in using bank transfers for repayments

Reputable payday loan and short-term loan choices to fill financial shortages

Apply with us right away if you need a quick loan from a reputable direct lender in the UK. Alternately, get in touch with our staff to learn more about our loan application procedure.

4 notes

·

View notes

Text

Short Term Loans UK - Instant Cash Assistance for People with Wages

It might be difficult to find the greatest cash deal, especially for people who have never used a debit card. But in today's quick and modern loan market, you can easily acquire short term loans UK and confidently carry the excellent cash assistance in the shortest amount of time. Additionally, there are no important documents to fax or time-consuming procedures to complete. Additionally, a credit check is not necessary.

With this excellent financial option, you may obtain cash in amounts between £100 and £2500 with a flexible repayment time of 2-4 weeks. Additionally, you can use the short term loans UK without worrying about other financial obligations, such as clearing outstanding bank overdrafts, paying for medical expenses, grocery bills, child's education, hospital bills, credit card bills, and so forth.

What happens if your credit scores aren't great? You must, however, get the money. Don't worry! Before applying for payday loans, you must first meet a number of requirements. These include being a citizen of the United Kingdom, being eighteen years of age or older, working a permanent job with a solid income and having an open checking account.

If you are eligible for short term loans direct lenders, you may fill out the form in a matter of minutes, and the lender will approve the cash in a comparable amount of time. After approval, it only takes a few minutes for the funds to be safely credited into your account. This method is completely free of any bank problems, which accounts for its high level of market acceptance.

How Can I Obtain Short-Term Loans UK Direct Lenders Right Now?

You must first fulfill the following eligibility requirements in order to be eligible for an emergency loan online with Payday Quid:

Over the age of 18

A current resident of the UK who is employed on a regular basis, whether full-time or part-time, or who is self-employed

Being able to supply bank account and debit card information

If you fit the criteria listed above, click Apply Now to swiftly fill out an application for a short term loans UK.

Whether you require short term loans UK direct lender for £500 or more, the procedure is straightforward, and we have made it as quick as possible so that you can get a decision right away. Simply fill out the application with the loan amount and conditions you desire, as well as some personal information like your name, address, phone number, and email address, and we'll get started.

We can make a decision regarding your short term loans UK direct lender once we have evaluated your eligibility, run a credit check, and looked at your affordability. When you finish the digital signing of your emergency loan agreement using the link we'll send you after we approve it, the loan funds will be put into your bank account within only 15 minutes. You can obtain emergency same-day loans from us in a matter of minutes.

You can rely on Payday Quid for assistance if you suddenly find yourself in need of money due to an emergency. If you qualify, our rapid and dependable same day loans UK are meant to offer immediate financial assistance to meet your urgent demands right now.

https://paydayquid.co.uk/

4 notes

·

View notes