#2290 Schedule 1

Photo

Tax2290.com is the perfect online form 2290 e-filing service provider to report form 2290 taxes online. Register for free and e-file your truck taxes now! https://blog.tax2290.com/everything-you-need-to-know-about-e-filing-form-2290-online-at-tax2290-com/

0 notes

Text

Why is Form 2290 required for heavy truckers?

By submitting E-File Form 2290 the IRS accepts tax payments from heavy truckers. After the IRS processes their form 2290 application, truckers will receive the IRS Schedule 1 payment proof of HVUT payments. Schedule 1 helps truckers drive taxable vehicles on public highways hassle-free.

#Form2290#TruckTax#IRSDeadline#Truckers#HeavyVehicleUseTax#HVUT#FileNow#TaxDeadline#Truck2290#2290Online

0 notes

Text

File Your Form 2290 Today – Don't Miss the Deadline!

The deadline for filing your Form 2290 is today, and filing on time can significantly avoid heavy penalties and interest charges. The form must be filed by truckers and owners operating a vehicle with a gross weight of 55,000 pounds or more and using public highways, and is often called the Heavy Vehicle Use Tax (HVUT) form. We will file this form on your behalf with the IRS so you get a stamped Schedule 1, which you take with you to register your vehicles. It is easy to file or renew your existing filing, and can be done in just a few minutes online. Penalties for not filing on time may include but are not limited to an assessed penalty of up to 47.60 dollars, the inability to register your vehicle, and possible legal action; take the steps now to stay in compliance. Take just a minute to get your vehicle information, EIN, and mileage and file your Form 2290 to avoid last-minute hassles. Take a lead over your responsibilities-file your Form 2290 today!

#custom truck#form2290#taxfilinghelp#efileform2290#taxi service#truckinglife#truckers#form2290online#2290online#truck#tax

0 notes

Text

IRS Form 2290 Online Filing

eForm2290.com's IRS Form 2290 Online Filing Service stands out for its user-friendly interface that simplifies heavy vehicle use tax (HVUT) filings. It offers automated validation checks for accuracy, provides instant Schedule 1 documents upon IRS approval, and ensures 24/7 access to filed documents with responsive customer support. By promoting paperless filing and integrating seamlessly with business operations, it enhances efficiency while meeting IRS compliance requirements.

0 notes

Text

Genesis Personal Injury & Accident Lawyers in Gilbert, AZ

In looking for a lawyer for a specific personal injury and accident case, you can consider Genesis Personal Injury & Accident Lawyers. Well, the aforementioned law office has remarkable Gilbert car accident lawyer for the people in Gilbert, AZ. In Arizona, where the roads are as diverse as its landscapes, car accidents can happen suddenly and have lasting impacts. If case you experience such an unlucky situation, having a knowledgeable and skilled lawyer is important. At Genesis Personal Injury & Accident Lawyers, their Arizona car accident lawyers specialize in handling claims after car crashes. Hence, allows them to help you recover compensation for your car accident injuries.

Gilbert, AZ

At the present time, is highly recommended to check out Eventbrite if you’re looking for pre-scheduled events in Gilbert, AZ. Here are some of the future activities that they posted on their site. First, there will be 2024 Inspire & Achieve Nash Bash & Friends Golf Tournament this coming Saturday, August 17, 2024, at around 1:00 PM at Seville Country Club. In addition, the 8/20- Gilbert, AZ- Evening on the Ranch event is scheduled on Tuesday, August 20, 2024, at around 7:00 PM at 2290 S Santan Village Parkway. Lastly, the "The Magical Voice", Marcelito Pomoy Live in Arizona Concert on Sunday, August 25, 2024, at around 12:00 PM at Higley Center for the Performing Arts.

Arizona Fish and Game Community Fishing Pond (Water Ranch Lake) in Gilbert, AZ

The popularity of the Arizona Fish and Game Community Fishing Pond (Water Ranch Lake) in Gilbert, AZ is notable. Many people visit the tourist attraction, too. Basically, it is designed to provide you with a place for both sightseeing and fishing. The Arizona Fish and Game Community Fishing Pond is also relaxing. More than 4 million Arizona residents live within a 20-minute drive of a stocked Community Fishing Program Lake. Furthermore, close by and convenient, all the parks offer parking and other amenities to make your fishing trip and park visit enjoyable. Additionally, distinctive Community Fishing Program signs are posted at key locations at all participating waters. As such, you can identify which place to go for fishing.

Higley's first day of school brings reminders of needed renovations

We know that there are many thought-provoking news reports in Gilbert, AZ. In a recent news article, there was a topic about renovation. As reported, from classes to friends, so much about the first day of school is new, however, some things never change. At Higley’s Traditional Academy, a school bell in front of the campus has been there for more than 100 years. Moreover, the bell is from 1909 and rings fewer than five times a year. It was also mentioned in the news that while history should be preserved, some parts of the campus need renovation. What can you say about this report?

Link to map

Arizona Fish And Game Community Fishing Pond (Water Ranch Lake)

Riparian Preserve Trail, Gilbert, AZ 85234, United States

Head north toward E Guadalupe Rd

16 sec (190 ft)

Drive along S Recker Rd

14 min (7.3 mi)

Drive to your destination

55 sec (466 ft)

Genesis Injury & Accident Lawyers - Gilbert Office

4365 E Pecos Rd Ste 138, Gilbert, AZ 85295, United States

0 notes

Text

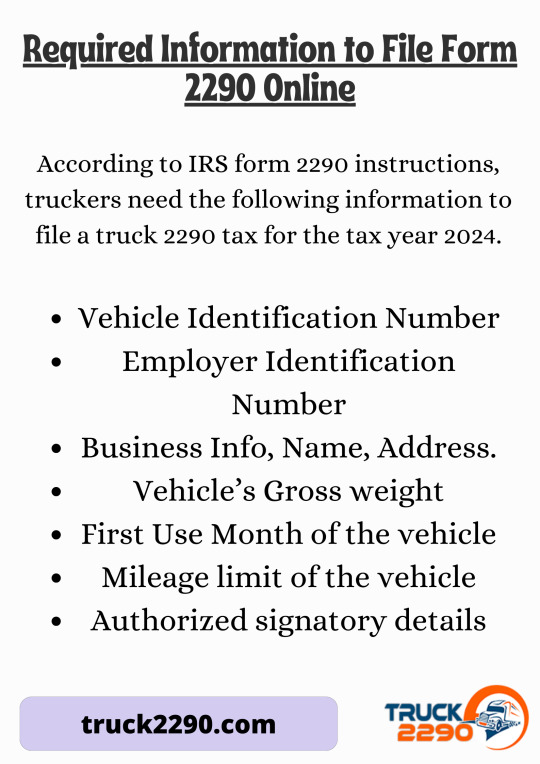

Required Information to File Form 2290 Online

Filing a 2290 tax form for the 2024 tax year is easy with Truck2290. Here, you will get assistance such as accurate tax calculations, free VIN correction, accessibility from anywhere, the ability to upload multiple VINs at once, and you will receive the instant schedule 1 proof in minutes.

0 notes

Text

0 notes

Text

0 notes

Photo

File your form 2290 for 2021-22 from everywhere & from any device with easy steps & quick processing correctly. go to: https://www.form2290onlinefiling.com

#Form 2290 Online#File Form 2290 Online#2290 HVUT#2290 Tax Form#File Form 2290#Tax Form 2290#2290 Schedule 1#Form 2290#IRS Form 2290#2290 Online#Download Form 2290#Heavy Highway Use Tax

0 notes

Photo

Pro-rated form 2290 truck taxes for February used heavy vehicles and trucks are due on March 31, 2023. E-file form 2290 and stay ahead of the deadline at Tax2290.com! More Visit at: https://blog.tax2290.com/tax2290-com-is-the-convenient-platform-to-e-file-form-2290-online/

#Tax2290.com#form 2290#efile form 2290#e-file form 2290 online#form 2290 truck taxes#schedule 1 copy#prorated tax

0 notes

Text

E-file Form 2290 at $7.99

E-file Form 2290 for just $7.99 with Truck2290.com. Get your IRS-stamped Schedule 1 instantly via email, ensuring quick, error-free filing. Save time and stay compliant with the easiest e-filing service available.

0 notes

Text

Streamline Your Form 2290 Filing with Simple Truck Tax: Fast, Easy, and Stress-Free

Form 2290, also known as the Heavy Vehicle Use Tax (HVUT), is an IRS-required form for truck owners and operators of vehicles weighing 55,000 pounds or more. Filing Form 2290 ensures compliance with federal regulations and helps maintain the nation's highways. With Simple Truck Tax, truck owners can easily and efficiently file their Form 2290 online, avoiding the hassle of traditional paper filing. Simple Truck Tax simplifies the process, offering quick processing, instant IRS Schedule 1 proof, and various payment options, ensuring truck owners meet their tax obligations on time without stress.

#custom truck#efileform2290#taxfilinghelp#form2290#truck#taxi service#truckers#truckinglife#form2290online

0 notes

Video

undefined

tumblr

IRS Form 2290 Schedule 1 is the proof of payment for the Heavy Vehicle Use Tax (HVUT) that Truckers pay to the IRS. Tax period beginning on July 1, 2021 and ending on June 30th 2022. Call: 316-869-0948

#2290 schedule 1#form 2290 schedule 1 proof#2290 schedule 1 proof#irs 2290 schedule 1#irs form 2290 schedule 1 proof

0 notes

Photo

Efile IRS Form 2290 2019 2020 | IRS Electronic Payment to file Form 2290

1 note

·

View note

Text

Complete HVUT Filing by August 31 to Secure Schedule 1 and Send in Form 2290 Copy

Up to the deadline: Utilize Truck2290.com to submit Form 2290 before the due date

Truck2290.com, an IRS-authorized e-file service, is contacting truckers to remind them of the impending due date and to promote the hassle-free alternatives they offer for a flawless filing experience as the annual deadline for filing Form 2290 approaches.

The Form 2290 submission date is quickly approaching, therefore time is of the importance. To ensure timely submission and stay clear of any fines, truckers are recommended to take advantage of Truck2290.com's quick and effective services. Form 2290 must be submitted by August 31, 2023.

For many truckers, submitting Form 2290 can be a difficult task that is fraught with difficulties like difficult paperwork, perplexing processes, and protracted processing times. Truck2290 is aware of these difficulties and has created a platform that offers workable answers.

AutoMagic2290 — Data entering work is made easier: The creative AutoMagic2290 is one of the platform's distinguishing qualities. Users can have their Form 2290 automatically pre-filled by uploading a copy of their prior year Schedule 1, which drastically minimizes the time and effort needed for data entry. Modern technology speeds up the procedure and makes sure that reliable data is submitted quickly.

Tailored interfaces for all needs: Truck2290 offers specialized interfaces for both single- and multiple-vehicle filing because they are aware that truckers' needs can differ.

This specialized method guarantees that each user's particular needs are satisfied, streamlining the procedure and reducing misunderstanding.

Truck2290 uses clever IRS validations to find any problems and inconsistencies before submission. This is a step toward reducing rejections. This feature is intended to lessen the likelihood of rejection due to errors, as well as the necessity for re-filing and other delays.

As the deadline for Form 2290 draws near, Alex from Truck2290 underlined the value of moving quickly, adding, "We want to make sure that truckers have a pleasant and trouble-free experience while e-filing. Our platform is made to take care of the frequent problems encountered in this procedure, giving truckers a convenient answer that reduces time and unneeded stress.

Truck2290 is a trustworthy partner in navigating the difficulties of tax filing for truckers looking for a dependable and expedient solution to e-file Form 2290 and get their Schedule 1 copy right away.

About Truck2290: Truck2290.com is an IRS-approved e-file company that specializes in helping truckers submit Form 2290 electronically without any hassle. Truck2290 wants to make the tax filing process for truckers simpler and less stressful with its cutting-edge features.

#2290duedate#trucktax#irsform2290#taxfiling#form2290#irs2290#truck2290#hvut#heavyvehicletax#taxseason

0 notes

Text

Fast and Easy Ways to file your IRS Form 2290

IRS form 2290 is a federal tax form used for reporting the HVUT tax. The HVUT is imposed on heavy vehicles weighing 55,000 pounds or more and have crossed 5,000 miles in a given tax period. The IRS tax money is used for the maintenance and construction of highways in the US. It is important to file 2290 online and pay the HVUT tax.

Schedule 1 Copy

Schedule 1 copy is the proof that you have filed your form 2290 return and paid your HVUT tax. When you file 2290 online, you will get your Schedule 1 copy which should have the IRS watermark on it. This copy will be sent once the IRS accepts your returns after verifying all the details that you’ve submitted. This is proof that you have filed your 2290 and paid the HVUT tax.

Registering with An IRS approved e-filing service provider

You can register with an IRS authorized e-filing service provider to file form 2290 online. You need to register an account with an e-filing partner. Once registered, you can e-file your return easily by entering details such as EIN, VIN, business name and address, taxable gross weight of your vehicle, among other details. Once you’ve keyed in all the details, you can proceed to pay the tax using your preferred method of payment.

Form 2290 Online Filing

Filing form 2290 online is simple and easy. You just need to follow 4 simple steps and you will be done.

Choose your ‘Business’

Select the ‘Tax Period’ and ‘First Used Month’ of your vehicle

Enter your vehicle information

Click on the IRS payment

Once you’ve entered all the details, review the information before submission to ensure that all the details are correct. Once reviewed, you can submit your form and pay your tax to receive your IRS watermarked Schedule 1 copy in your inbox.

0 notes