#AEPS Services Near Me

Text

AEPS Services Near Me

AEPS services near me refers to the availability of Aadhaar Enabled Payment System (AEPS) services in proximity to the location of an individual. AEPS is a digital financial inclusion initiative in India that allows customers to access banking and financial services using their Aadhaar number and biometric authentication. This system enables people in remote or rural areas to perform various banking transactions and financial services without the need for a physical bank branch.

0 notes

Text

Empowering Resolution: AEP Mediation & Notary Services Leading the Way in Conflict Resolution

In the realm of legal matters, finding effective solutions to disputes is paramount. AEP Mediation & Notary Services emerges as a cornerstone of excellence, providing unparalleled expertise in the field of alternative dispute resolution.

With a focus on mediation services, AEP Mediation & Notary Services offers a comprehensive range of solutions tailored to meet the unique needs of their clients. From divorce mediation services to civil dispute mediation and small claims resolution, their team of skilled professionals navigates the complexities of legal conflicts with finesse and proficiency.

What distinguishes AEP Mediation & Notary Services is their commitment to accessibility and convenience. By offering mediators near me, they ensure that clients can access their services without the hassle of long commutes or logistical challenges. This localized approach not only saves time but also fosters a sense of trust and rapport between the mediator and the parties involved.

In today's fast-paced world, time is of the essence. That's why AEP Mediation & Notary Services offers convenient online mediation services, allowing clients to engage in mediation sessions from the comfort of their own homes. This innovative feature not only enhances accessibility but also accommodates the busy schedules of modern-day individuals, making the resolution process smoother and more efficient.

Furthermore, AEP Mediation & Notary Services operates with integrity and professionalism at every step of the process. Their team of experienced mediators guides clients through the Mediation services process with transparency and empathy, ensuring that their interests are safeguarded and respected throughout.

One of the hallmarks of AEP Mediation & Notary Services is their commitment to personalized service. They understand that every case is unique, and as such, they tailor their approach to suit the specific needs and preferences of each client. This individualized attention fosters a supportive environment where parties can communicate openly and work towards resolution effectively.

In conclusion, AEP Mediation & Notary Services stands as a beacon of empowerment in the realm of conflict resolution. With their expertise, accessibility, and dedication to personalized service, they continue to lead the way in providing effective Small claims mediator, empowering individuals to move forward with confidence and peace of mind.

0 notes

Text

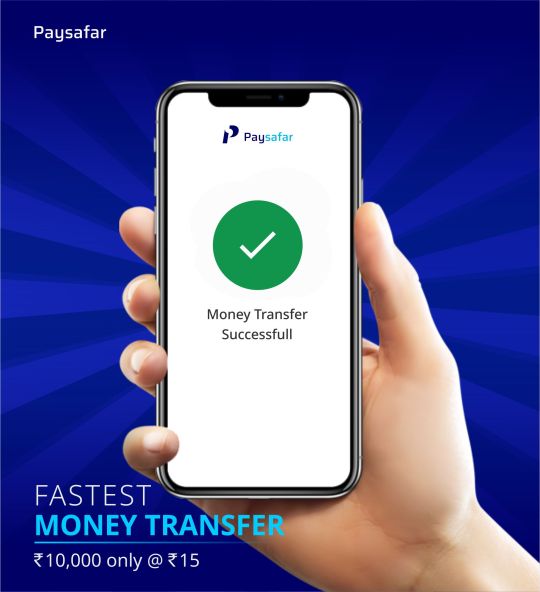

Money transfer service in india

aeps service in india

aeps service near me

0 notes

Text

Tops of 2022 – Double Derecho Proves Panhandle Response Abilities

“We evacuated to our basement, and I honestly thought every window in my house was going to shatter.”

That’s what Josh Contraguerro explained while recalling the tree-ripping, black-out-inducing double derecho that left thousands without power for several days if not for an entire week in June.

“There was that sound. I’ve heard about that sound on the Weather Channel … that train whistle that storms make when they are really, really strong.”

Contraguerro took a moment to survey the damage the storm caused to his property and in his neighborhood before jumping into action of the vice president of special services for Panhandle Cleaning and Restoration. The majority of Wheeling residents were awakened close to 1 a.m. in the early morning hours of June 14 by thunder and an electrifying lightning show that drenched the region and attacked certain areas with tremendous force.

Once assessed, Wheeling Park manager Nat Goudy reported that 50 trees were destroyed within the public facility’s 406 acres, and another 50 or so would need to be removed, too, for safety concerns.

Panhandle has warehouses packed full of equipment in preparation for storm responses.

“When you stood in a certain place on the hilltop here in the park,” Goudy said, “you could tell the path the storm took, and you can tell when it weakened near the end of the golf course.”

Contraguerro and his wife and two children reside in close proximity to Wheeling Park.

“I know there were some local residents who experience damage to their houses or their decks, but I thought it was pretty incredible there weren’t more in the areas where the most trees were downed by the storms,” he said. “There were a lot of trees that came down in the area of Wheeling Park, but even those trees didn’t cause as much damage as they could have to shelters and the playground.

“In the neighborhood where Stamm Lane is, I thought there would have been more damage to their homes there, but our (Panhandle) crews were only called to a couple, and that surprised me,” Contraguerro explained. “And Thank God there were no fatalities because, based on what the winds and rains left behind, there could have been.”

More than 1,500 employees of American Electric Power were summoned to the Upper Ohio Valley from other areas of the Mid-Atlantic Region, and restorations began about 24 hours after the storms downed and snapped trees and telephone poles.

Crews with Panhandle Cleaning and Restoration had to deliver and connect a plethora of generators following the storms in June.

“Our crews handled a lot on a daily basis but when something like those storms rolls through, there are going to be issues,” said Joelle Moray, manager of external affairs for AEP.“We welcomed hundreds of employees from outside the area and they worked in shifts for days until power was restored for our customers.

“The restorations took place in phases because one downed line fixed this part of town but not that one, so on. It was like they were building a puzzle so they could bring electricity back to people as quickly as possible,” she said. “But a double derecho? I’ve been told by the people I work with that someone only sees a storm like that once in their career, and I hope that’s it for me.”

The Contraguerro family, however, is in the disaster business, and now that Panhandle Cleaning and Restoration operates an office in Sarasota, Fla., the East Coast’s hurricane season has a new meaning for everyone inside the company’s South Wheeling headquarters. The double derecho, though, offered a little bit of everything when it comes to service offered.

“The storms we had here in the Wheeling were very unique because they were very unlike what we normally see in this region,” Josh explained. “Sometimes we experience a storm, and we’ll have some flash flooding in one neighborhood, and other times we’ll have a storm, and there will be a need for generators because of the loss of power.

“But this one involved a lot of everything,” he said. “We had water in basements, we had massive amounts of power outages, we had trees going through roofs, and we had a huge need for temporary air conditioning. We had to keep a lot of businesses and medical facilities up and running for almost an entire week until the folks from AEP were able to get everything hooked back up again.”

Read the full article

0 notes

Text

Difference between OEP and AEP

Medicare OEP Vs. AEP — What do these abbreviations stand for?

OEP stands for Open Enrollment Period, and AEP stands for Annual Enrollment Period. In this post, we outline the major differences between Medicare Open Enrollment Plan and Medicare Annual Enrollment Period.

Understanding the differences between each enrollment period is often a point of confusion for Seniors. This blog will focus on the difference between the Annual Election Period (AEP) and Medicare Advantage Open Enrollment Period (MA OEP).

The annual Annual Enrollment Plan allows you to review your current Medicare plans. In other words, it is the time to compare and review different health plans available in the market. It also allows the medical beneficiaries to change their current medical plan. It usually starts on 15th October and ends on 7th December.

Medicare health and drug plans can make changes in cost, coverage, and the providers and pharmacies in their networks. For Medicare Advantage (also known as Medicare Part C) and Medicare prescription drug plans, there’s an Annual Election (Enrollment) Period (AEP) when you can sign up for, change, or disenroll from a plan.

What can be Done During the Medicare Annual Enrollment Period?

Medicare beneficiaries can do any of the following:

1. Switch from one Medicare Advantage plan to another one.

2. Drop a current Medicare Advantage Plan and go ahead with the Medicare Original one

3. Switch from Medicare Original to a Medicare Advantage Plan

4. Select a Part D plan if you do not currently have one

5. Update your current medicare coverage by changing to a new plan. Now, you can do it with your existing insurer to switch to a new insurer. The choice is yours.

6. Cancel your existing Part D plan

Moreover, every year an Annual Notice of Change Letter (ANOC) is released to highlight all the changes in the health plans that can affect your medicare plan. In other words, the Medicare Annual Enrollment Period gives you a chance to change your medicare plan if you are not happy with your existing one. Also, please note that all changes you introduce during the Medicare Annual Enrollment Period will become active from 1st January of the following year.

About OEP — Medicare Open Enrollment Plan

As we saw above, AEP allows you to make amendments to your existing Medicare Advantage Plan or Part D plan. On the other hand, Medicare Open Enrollment Plan is only for those already enrolled in Medicare Advantage Plan.

Moreover, it commences on 1st January and ends on 31st March. Also, please note that it is also an annual plan like AEP.

How can you get ready for the Medicare Open Enrollment Plan?

Whether you enrolled recently or have had a Medicare Advantage Plan for some time, going for Medicare Open Enrollment Plan is a perfect opportunity to introduce changes to or review your plan.

All you need to do is think about your past experiences with your plan and overview its benefits. Apart from this, these factors can also help you in getting ready for this Medicare Open Enrollment Plan:

1. Are your doctor and other healthcare providers present in the plan network?

2. Consider if you are comfortable with your existing premiums, copays, deductibles, and coinsurance.

3. Are your prescription drugs on your existing plan formulary?

4. Are you looking forward to additional coverage for medical services like vision, dental or physical therapy, or rehab?

5. Are you content with your existing plan’s additional benefits like mail-order pharmacy, fitness programs, nurse line, etc.?

Bottom Line

So, this was all about OEP and AEP. Please consider searching for the best MD doctor near me on the internet to make the most of your current medicare plan.

0 notes

Text

Which is the best digital payment system for rural and semi-urban India?

To answer this question in a better way, let me briefly introduce you to the currently prevalent payment systems in India.

1. Cash-only system : People have preferred to keep small amounts of cash with themselves for a long time, which is used in day-to-day work. It is necessary so that a shortage of money is not encountered in times of need.

2. Cash in bank : Almost 80% of the Indian population above 14 years of age is banked as per the latest data of 2017 . Most of the money kept in these bank accounts is spent through cheques, drafts, or by pay-in-slips.

3. Mobile wallets: Most modern-day mobile wallets like PayTM, PhonePe, Google Pay (formerly Tez), etc. have emerged in the post-demonetization period and during COVID-19. The transactions made through them have crossed ` 36.5 Trillion in 2020, and are expected to more than triple by 2025 .

4. Card transactions: Debit and credit cards of Master, VISA, and more recently Rupay are being used for making payments from bank accounts, by either withdrawing cash from ATMs or directly by swapping on PoS machines or simply waving or touching them near payment terminals. While every commercial bank provides debit cards, eCommerce sites like Amazon and Flipkart have tied up with banks and finance companies to provide specific credit cards to their customers. There are around 94 Crores of active debit cards and 6.2 Crores of credit cards in India in January 2022 .

5. Internet banking: A customer with access to an internet connection can log in to the website of his bank and perform almost every banking transaction, from balance inquiry to transfer of funds to bank statements. Around 26% of people in India are reported to at least have a digital bank account in a 2022 survey, which is expected to increase to 46% by 2027 .

6. Unified Payment Interface (UPI): This is one of the facilities provided by banks in their mobile apps, through which payments can be made and received either through QR codes or direct transfers to someone’s mobile number through Virtual Payment Address (VPA); and account balances can be enquired about. Almost 4.6 billion transactions worth ` 84 Lakh Crore have been processed by UPI in the Financial Year 2022, which is more than double the volume and value of transactions in the previous year

7. Mobile and SMS banking: Banking is done in two ways through a mobile phone. First is the use of *99# provided by almost every telecom provider for doing banking through SMS, for which banks have implemented daily limits of transactions, under the system called Unstructured Supplementary Service Data (USSD). Second is the use of the mobile app for your bank account by providing a smartphone-ready interface of your bank’s website.

8. Aadhar Enabled Payment System (AEPS): Now, only an Aadhar card is required for making most banking transactions, like withdrawing or depositing money, inter-bank fund transfers, balance inquiry, etc., for which a customer has only got to visit a Banking Partner, like ‘Vedant Mitra’ who has Vedant Pay app installed on his phone and do the required transaction.

9. Micro ATM (mATM): This is a smartphone device in the hand of a business partner like Vedant Mitra through which you can withdraw or deposit money in your Aadhar-linked bank account by inserting your debit or credit card into it and authenticating your fingerprint.

10. Mobile Point of Sales (mPOS): POS machines are very popular in shops and malls for making payments. Now is the era of mobile POS, which are the same devices as mATM, just differing in functionality. Payments can be made using cards, AePS, Mobile Wallets, and QR Code scanners on this machine.

Now coming to your question about the most preferred digital payment system in rural and semi-urban India, let us cover it point-wise:-

(a) Cash-based payment is not feasible because of the risk of theft.

(b) A huge majority of Indians, including our rural population, now have a bank account, thanks to the Pradhan Mantri Jan Dhan Yojana. But withdrawing money through cheques, drafts, etc. is a tedious job, because of the time involved.

© USSD and SMS banking are old forms of mobile banking that are rarely used nowadays.

(d) UPI has emerged as one of the most preferred modes of making payment, because of its simple interface and ease of operations.

(e) mATM and mPOS devices have also become popular modes of making digital payments, mainly in rural and sub-urban regions of India, where banking penetration is relatively low as banks don’t want to open branches owing to logistical and operational concerns.

So, the answer to your question is that UPI, mATM and mPOS have become the best modes of making digital payments in rural and semi-urban India.

#vedantpay#digitalpayment#adharenabledpayment#empoweringdigitalindia#mATM#digitalindia#cashkahinvhi#aeps#bbps#mPOS#minibank#minibankindia#chahojokarovo#microatmbusiness#microatmmachine#digitalpaymentsystem#digitalpaymentsolutions#digitalpaymentindia#befreetodopayanywhere#money#coins#exchange#infinite#business#banking#insurance#Possibilities#dreamer#doer#independent

0 notes

Link

Aadhaar Enabled Payment Service (AEPS) allows customers to withdraw, deposit and transfer cash quickly using Aadhaar data and biometric authentication instead of their signature or debit card information. Instead of looking for an ATM or bank branch, customers can walk into their local MGS Digital Center and complete all these transactions using their Aadhaar data and biometric authentication.

#AEPS (Aadhaar Enabled Payment Service)#aeps aadhaar enabled payment system#how to use aeps payment#what is aeps payment#how to get aadhaar enabled payment system#how to use aadhaar enabled payment system#AEPS Service near me#aeps service provider near me#how do i apply for aeps#paynearby aeps service not active#aadhaar enabled payment service

0 notes

Link

Start your online multi recharge business and services, E24pay is the best AEPS Agent, portal and services provider for AEPS, DMT, BBPS, Recharge and more services. Best AEPS Cash Withdrawal service provider in India. You can sign up with us and start offering your services under your brand name in just a few days. We help you with on-boarding and technology set up. Get Started Now!

1 note

·

View note

Text

Why is AEPS Considered a UPI for Rural India?

Aadhaar Enabled Payment System (AEPS) is a payment service that lets a bank customer use Aadhaar as his or her identity to access his or her Aadhaar enabled bank account. The goal of the AEPS system is to give people more power, especially in rural areas, by giving everyone access for financial and banking services through Aadhaar.

AEPS infrastructure is a great move toward solving the basic banking problems caused by the lack of Digitalization in rural India by allowing basic banking transactions, increasing the use of digital financial services in rural India, and filling them into the formal financial system. As India is now a developing Nation and so a rural area should be, making the rural areas more digitalized, more cashless, and more educated about digitalization, AEPS has been a key role for rural people and thus it has been a modern UPI for the rural people of India.

How to use AEPS as UPI?

It’s easy to use AEPS; all you have to do is give the correct Aadhaar number, and the payment will be sent to the right merchant.

• Download the app on the Android or iOS platform

• Register for the service by giving details about your bank account.

• Set up a VPA and get an MPIN

Benefits of AEPS Payments

As part of “Paperless, Cashless, and Faceless” services across the country, especially in rural and remote areas, different ways to make digital payments are being offered. These include Banking Cards, Mobile Wallets, Internet Banking, Mobile Banking, Bank Pre-paid Cards, Micro ATMs, and Aadhaar Enabled Payment System (AEPS) Also, with the move to digital, banking services will be available to customers on a 24/7 basis and on all days of the year, including bank holidays.

• Cost-effective and less transaction fee: There are a lot of payment apps and mobile wallets that don’t charge any kind of service fee or processing fee for the service they provide. The UPI interface is one example of a service that the customer can use for free. Costs are going down because of the many digital ways to pay.

• Discounts and cashback: Customers who use digital payment apps and mobile wallets can get a lot of rewards and discounts. Many digital payment banks offer cash-back deals that are pretty good. This is great for customers and makes them more likely to stop using cash.

• One-stop solution for paying bills: Many digital wallets and payment apps can be used to pay bills all in one place. This makes it easy to pay for things like utilities. All of these utility bills, like cell phone bills, internet bills, and electricity bills, can be paid through a single app without any hassle.

Which are the best AEPS services provider in Rajasthan?

Paydeer Company is one of the best AEPS service provider companies in Rajasthan. You can start your own AEPS banking service with us as an admin and can offer cashless banking and financial services to your members.

Many fintech companies also support financial inclusion by setting up their own banking correspondent agent networks that offer AEPS services to their communities. These networks can also help people who don’t have bank accounts but have an Aadhar card join the formal financial system without having to go to a bank branch.

Conclusion

Since the cashless economy, the Indian government has been working on a number of projects to meet the financial needs of the last mile consumer. In a country like India, where digital literacy is still low, one important part of promoting digital payments among rural populations is how easy it is for them to use these methods in their daily lives.

Tags: aeps pe rajasthan, rajasthan aeps portal services, aeps cash withdrawal rajasthan, rajasthan aeps department, rajasthan aeps transaction limit, rajasthan aeps machine, rajasthan aeps service provider, rajasthan aeps agent registration, rajasthan aeps near me, rajathan aeps registration online

Originally Published at :- https://paydeer.medium.com/why-is-aeps-considered-a-upi-for-rural-india-5617dcc2e4ba

0 notes

Photo

How Micro ATM Service Is Going to Change Your Earning Potential

With the advancement in technologies, we are preferring easy to carry goods and easy to access services. The slimmer the thing, the better its performance. Likewise, in the banking sector, everything is turning digital and people are doing transactions online without visiting Banks. Earlier people had to go to the banks for their cash needs and to deposit money they had to stand in long queues. But, now after the demonetization, our society is moving towards a cashless economy. Alike to bank ATMs, the micro–Automated Teller Machine (ATM) is now another option to make transactions. It is providing services like micro ATM cash withdrawal, cash deposits, balance inquiry, and much more.

The main motto of introducing m-ATM is to withdraw cash at times when ATM machines run dry. Micro ATMs are a mini version of an ATM with key features like the point of sales (POS) and connect banking networks through GPRS for carrying bank-related transactions. It gives a card swipe facility, the miniature ones can even work by means of a unique mark scanner. These micro ATM services are arranged in distant or portable areas.

What is Micro ATM?

Micro ATM is a mini ATM in which the customers can swipe their debit cards to make daily transactions and this Aadhaar micro ATM price is also affordable that you can easily purchase for your retail shops. Micro ATM can easily connect with its core banking system to provide different services. Besides using Micro ATM for pulling out money, the customers can similarly benefit from different Micro ATM-like cash Deposits, Micro ATM cash withdrawal, Fund Transfer, and Balance Enquiry by completing two or three swipes. Micro ATM is based on a mobile phone connection and would be available at every Banking correspondent. Customers can do identity authenticated and withdraw or deposit money into their bank accounts. To avail of the services, you can search for “Aadhaar micro atm near me”. Micro ATM gives service and assistance with handling all types of issues related to money withdrawal. Earlier people staying in rural areas had to face a lot of problems due to the unavailability of ATMs nearby. But the micro-ATM has solved the problem related to cash deposits and withdrawals.

Can Micro ATM help your business?

Yes, Micro ATMs can be very helpful to grow your business by adding one more stream of income resources in your business. As with every successful transaction, you can easily gain commission. The customers would trust the process because they don’t have to show more documents to the retailers, with just their Aadhaar number or fingerprint scanning, they can withdraw the cash. The Aadhaar micro-ATM price is reasonable with assuring returns and in this way, more people would come to your shop for various purposes. People would opt for your shop for cash withdrawals, deposits, fund transfer, and other transactions, and in this way, your income would increase.

Benefits of using Micro ATM:

You don’t have to visit Banks

You don’t have to look for nearby ATMs

You don’t have to worry about any transactions

You can do money transfers round the clock

You can easily withdraw money

You can deposit cash anytime

You can carry this portable micro-ATM with you

How can you get Micro ATM for your shop?

If you are thinking to purchase your first Micro ATM, at that point you may be managing loads of inquiries and indeed, it tends to be a significant testing and overwhelming undertaking for you. As a customer, you can search for “Aadhaar micro atm near me”. Thus, for saving you from all the problems of running to a great extent, you can buy Micro ATM from iServeU. The expense of a Micro ATM or gadget shifts across various help sellers or suppliers. Aadhaar miniature ATM cost is one-time speculation to guarantee proceeded with returns. This Aadhar miniature ATM value can be affirmed with the customer care group of iServeU.

How can Micro ATM help your business?

Micro ATMs can help you to increase your business by adding one more stream of revenue in your business. With every transaction, you can easily gain commission.

It is a simple process of Aadhar Micro ATM that allows your customers to micro-ATM cash withdrawal using just their fingerprint for scanning. iServeU micro-ATM price is moderate with promising returns and it carries more clients to your shop who need to profit offices like Deposit, Fund Transfer, and Balance Enquiry. This will give a lift to your business.

How to use a Micro ATM?

To operate this portal, an individual needs to go through a confirmation cycle, for example, Aadhaar card with fingerprint scanning or card swipe choice. When confirmed, the individual will have the option to choose alternatives for different exchanges like money store, reserve move, eKYC based saving record, Aadhaar cultivating, money withdrawal, balance inquiry request, and administration demand acknowledgment. Note, these choices can be distinctive relying on banks or fintech.

Click on money withdrawal. Enter the needed amount and press okay. Then, select the miniature ATM Bluetooth gadget. Continue to introduce your card in the miniature ATM gadget, keeping the chip on the card outside. At that point, swipe the card in a left to right movement. Enter the ATM card pin code and select the green catch to settle the installment.

You will get a receipt of the exchange on your application screen. This should likewise be possible for balance requests.

For any buy made by your customer, you can again utilize the mATM by utilizing the settlement choice and afterward picking iServeU wallet or Bank account, to finish the deal exchange.

Miniature ATMs permit customers to convey charge cards to do fundamental monetary exchanges. The AEPS frameworks have just reached across 2 lakh client touchpoints, while in excess of 10,000 miniature ATM gadgets spread across the conditions of UP, Bihar, Jharkhand, and Orissa are facilitating monetary tasks for a great many Indians consistently.

iServeU provides Aadhaar Enabled Payment Systems and micro-ATM machine services that tackle these issues most productively. The Aadhaar micro-ATM price is reasonable. They permit fundamental monetary exchanges, for example, Cash Withdrawal and Balance Enquiry. Customers can swipe their debit cards on the machine and withdraw cash as per their needs. Balance inquiry through a protected PIN/ID-based framework should likewise be possible. For more info, visit at iserveu.in.

0 notes

Video

youtube

How to open IPPB account in mobile - IPPB account kaise khole - zero balance account how to open ippb account in dop finacle how to open ippb account in post office online how to open ippb account online in telugu how to open ippb bank account how to open ippb current account how to open ippb merchant account how to open ippb regular account how to open ippb account without pan card how to open ippb account in post office how to open a ippb account how to open account in ippb app how to open a bank account in ippb how to open ippb bank account online how to open digital account in ippb how to open account in ippb how to open account in ippb online how to open ippb account online how to open new account in ippb unable to open ippb account online how to open rd account in ippb online how to open ppf account in ippb how to open rd account in ippb how to open sb account in ippb is it good to open ippb account who can open ippb account How to open IPPB account in Mobile IPPB account login IPPB Regular saving account IPPB basic saving account IPPB account opening Menu IPPB App How to convert IPPB digital account to regular account IPPB account opening process in Finacle Page Navigation More results ippb mobile ippb app ippb ifsc code ippb micro atm ippb account open ippb toll free number ippb merchant ippb mobile banking apk ippb bank ippb online ippb account ippb apk ippb atm card ippb aeps ippb agent login ippb account check ippb a/c opening ippb a/c ippb a/c details is ippb a nationalised bank is ippb a public sector bank is ippb a jan dhan account is ippb a central govt job what is a ippb machine ippb balance enquiry ippb branch ippb bank app ippb bank full form ippb bank near me ippb branch name ippb bank app download ippb b ippb customer care ippb card ippb customer id ippb csp ippb current account ippb charges ippb check balance ippb card image ippb download ippb debit card ippb digital account ippb digital account open ippb details ippb download apk ippb dbt ippb details in hindi dop ippb ippb email ippb email id ippb exam ippb e kyc ippb established ippb error ippb exam syllabus ippb e banking pnb e statement ippb full form ippb full form in hindi ippb full kyc ippb full name ippb fd interest rate ippb facilities ippb form ippb franchise apply online ippb fmenu ippb gmail ippb gds ippb gds commission ippb gl code ippb guidelines ippb gpay ippb gov.in ippb guide ippb helpline number ippb hd logo ippb hindi ippb hq ippb how to login pnb home loan ippb holiday list 2020 ippb how to register ippbase.h ippb ifsc ippb ifsc code motihari ippb ifsc code siwan ippb ifsc code darbhanga ippb interest rate ippb ifsc code siwan bihar ippb imps charges ippb jobs ippb joint account ippb job profile ippb jan dhan account ippb jankari ippb jan dhan account opening ippb jobs 2020 ippb job recruitment ippb ka ifsc code ippb kyc ippb kya hai ippb ka ippb ka full form ippb kyc form ippb ka matlab ippb khata ippb login ippb logo ippb loan ippb location ippb latest news ippb logo png ippb limit ippb login customer id ippb mobile app ippb mobile banking ippb mini statement ippb mobile banking app download ippb m atm ippb m ippb near me ippb net banking ippb new account ippb neft charges ippb news ippb number ippb new user activation ippb news in hindi ippb online account ippb online service ippb opening ippb open account ippb online form ippb otp ippb officer salary ippb passbook ippb passbook print ippb post bank ippb photos ippb patna ifsc code ippb passbook image ippb pdf password ippb passbook format ippb qr card ippb quora ippb qr card login ippb qr card charges ippb qualification ippb question paper 2018 ippb quizlet ippb qas ippb q r card ippb registration ippb recruitment ippb rd ippb rates and charges ippb rd interest rate 2020 ippb rd interest rates ippb rd rates ippb rrb merger ippb scan ippb salary ippb saving account ippb sitamarhi ifsc code ippb sms banking pnb saharsa ifsc code ippb status ippb siwan ippb transaction charges ippb transfer limit ippb training ippb twitter ippb to paytm ippb therapy ippb training app ippb upi ippb upi id ippb user id ippb url ippb upi link ippb upsc ippb uses ippb upi pin ippb vacancy ippb virtual debit card ippb vpa id ippb video ippb vacancy online form ippb vacancy 2020 ippb vs sbi ippb vs posb ippb wikipedia ippb website ippb withdrawal ippb webmail ippb withdrawal limit per day ippb whatsapp group ippb whatsapp number ippb welcome kit ippb youtube ippb your account is locked ippb yojana ippb.your ippb sukanya yojana ippb previous year question paper ippb know your customer id ippb sukanya samriddhi yojana ippb zero account ippb zero balance account ippb zero balance account opening online ippb zimbra ippb bank zero balance account ippb 0 balance account SONUS KNOWLEDGE #sonusknowledge #ippb #ippbmobile #ippbbank #ippbmobilebanking #ippbaccountkaisekhole #zerobalanceacount by Sonus Knowledge

0 notes