#Affiliates Stock Loans Hong Kong

Link

Dover Stock Loans offers affiliates Stock Loans and Block Purchase solutions to Clients in Philippines, Hong Kong, Singapore, South Korea, Indonesia, Thailand & Australia.

#Stock Loan Services Hong Kong#Affiliates Stock Loans Hong Kong#Block Trade Company Hong Kong#Stock Secured Loan Hong Kong#Financial Services Company Hong Kong#Stock Loan Services Singapore

1 note

·

View note

Text

South Korea’s Chaebol Challenge

By Eleanor Albert

South Korea’s megaconglomerates have helped lift the country out of poverty, but their extraordinary influence could put the health of the Korean economy at risk.

Introduction

A group of massive, mostly family-run business conglomerates, called chaebol, dominates South Korea’s economy and wields extraordinary influence over its politics. These powerful entities played a central role in transforming what was once a humble agrarian market into one of the world’s largest economies.

The South Korean government has generously supported the chaebol since the early 1960s, nurturing internationally recognized brands such as Samsung and Hyundai. However, in recent years chaebol have come under fire amid a slowing South Korean economy and following a series of high-profile corruption scandals, including one that prompted mass protests and the ouster of Park Geun-hye.

What is a chaebol?

The word chaebol is a combination of the Korean words chae (wealth) and bol (clan or clique). South Korea’s chaebol are family-owned businesses that typically have subsidiaries across diverse industries.

Traditionally, the chaebol corporate structure places members of the founding family in ownership or management positions, allowing them to maintain control over affiliates. Chaebol have relied on close cooperation with the government for their success: decades of support in the form of subsidies, loans, and tax incentives helped them become pillars of the South Korean economy.

Although more than forty conglomerates fit the definition of a chaebol, just a handful wield tremendous economic might. The top five, taken together, represent approximately half of the South Korean stock market’s value. Chaebol drive the majority of South Korea’s investment in research and development and employ people around the world. Samsung Electronics, the largest Samsung affiliate, employs more than 300,000 people globally (more than Apple’s 123,000 and Google’s 88,000 combined).

Which are the largest chaebol?

Samsung. Founded in 1938, Samsung Group is South Korea’s most profitable chaebol, but it began as a small company that exported goods, such as fruit, dried fish, and noodles, primarily to China. Today the conglomerate is run by second- and third-generation members of the Lee family, the second-wealthiest family in Asia, according to Forbes. Over the past eighty years, the company has diversified to include electronics, insurance, ships, luxury hotels, hospitals, an amusement park, and an affiliated university. Its largest and most recognized subsidiary is Samsung Electronics, which for the past decade has accounted for more than 14 percent of South Korea’s gross domestic product (GDP).

Hyundai. Hyundai Group was a small construction business when it opened in 1947 but grew immensely to have dozens of subsidiaries across the automotive, shipbuilding, financial, and electronics industries. In 2003, following the Asian financial crisis and the death of its founder, Chung Ju-yung, the chaebol broke up into five distinct firms. Among the standout offshoots are Hyundai Motor Group, the third-largest carmaker in the world, and Hyundai Heavy Industries, the world’s largest shipbuilding company.

SK Group. The conglomerate, also known as SK Holdings, dates back to the early 1950s, when the Chey family acquired Sunkyong Textiles. Today, the chaebol oversees around eighty subsidiaries, which operate primarily in the energy, chemical, financial, shipping, insurance, and construction industries. It is best known for SK Telecom, the largest wireless carrier in South Korea, and its semiconductor company, SK Hynix, the world’s second-largest maker of memory chips.

LG. LG Corporation, which derives its name from the merger of Lucky with GoldStar, got its start in 1947 in the chemical and plastics industries. Since the 1960s, the company, under the direction of the Koo family, has heavily invested in the development of consumer electronics, telecommunications networks, and power generation, as well as its chemical business, which includes cosmetics and household goods. In 2005, LG split, spinning off a separate entity called GS, a chaebol whose core businesses are in energy, retail, sports, and construction.

Lotte. Shin Kyuk-ho founded Lotte Group in Tokyo in 1948 and brought the chewing gum company to South Korea in 1967. The conglomerate’s main businesses are concentrated in food products, discount and department stores, hotels, and theme parks and entertainment, as well as finance, construction, energy, and electronics. Lotte Confectionery is the third-largest gum manufacturer in the world. In 2017, the company opened the Lotte World Tower in Seoul, the tallest building in South Korea, with 123 stories.

How did chaebol emerge?

Many of South Korea’s chaebol date to the period of Japanese occupation before the end of World War II, modeling themselves after Japan’s powerful industrial and financial conglomerates, known as zaibatsu. As U.S. and international aid flowed into Seoul [PDF] following the Korean War (1950–1953), the government provided hundreds of millions of dollars in special loans and other financial support to chaebol as part of a concerted effort to rebuild the economy, especially critical industries, such as construction, chemicals, oil, and steel.

Park sought to build a South Korea that was self-reliant.

Scott A. Snyder, Council on Foreign Relations

These enterprises flourished under the leadership of General Park Chung-hee, who led a military coup in 1961 and then served as president from 1963 to 1979. As part of Park’s export-driven development strategy, his authoritarian government prioritized preferential loans to export businesses and insulated domestic industries from external competition. The practice was similar to that of the other Asian tigers, Hong Kong, Taiwan, and Singapore. “Park sought to build a South Korea that was self-reliant and not dependent on great powers for its security,” writes CFR’s Scott A. Snyder in his 2018 book, South Korea at the Crossroads.

Over time, the chaebol expanded into new industrial sectors and tapped into lucrative foreign markets, providing more fuel for South Korea’s engine. Exports grew from just 4 percent of GDP in 1961 to more than 40 percent by 2016, one of the highest rates globally. Over roughly the same period, the average income of South Koreans rose from $120 per year to more than $27,000 in today’s dollars. As South Korea lifted millions out of poverty, the parallel rise of chaebol embedded the conglomerates into the narrative of South Korea’s postwar rejuvenation.

Chaebol in the South Korean Economy

How did democratization and the 1997 financial crisis impact them?

South Korea’s democratic transition in the late 1980s had important but limited effects on the chaebol system. Democratization fostered the formation of strong labor unions, which fought for higher wages, better working conditions, and an unraveling of the close relationship between the government and chaebol. Reforms in the early 1990s introduced nominal improvements in economic governance and paved the way for South Korea to join the World Trade Organization and the Organization of Economic Cooperation and Development. However, throughout this period, the nexus between government and big business remained largely unchanged.

On the other hand, the 1997 Asian financial crisis, in which countries across the region were hit by plummeting currencies, debt crises, and recessions, tested South Korea’s chaebol-dominated economic model. In the lead-up to the crisis, South Korean banks lent aggressively to chaebol so they could expand into new sectors. Before and after the exchange rate crisis hit, fifteen of the top thirty conglomerates [PDF] were allowed to go bankrupt.

In December 1997, South Korea agreed to a more than $50 billion international bailout package, a record amount at the time. As a condition of the rescue, led by the International Monetary Fund, Seoul instituted reforms intended to weaken the chaebol system, including new corporate transparency measures and cuts to government subsidies. More broadly, the bailout required major economic adjustments: reducing government deficits, restructuring insolvent financial institutions, and liberalizing trade and foreign investment.

How close are chaebol to the government?

The South Korean government and the chaebol have long had a symbiotic relationship. Many leaders in Seoul have equated the success of the chaebol with South Korea’s postwar prosperity. “The large conglomerates and Korean economy cannot be separated from the politics and the culture and history,” says Rhyu Sang-young, a professor at Yonsei University in Seoul.

The large conglomerates and Korean economy cannot be separated from the politics and the culture and history.

Rhyu Sang-young, Yonsei University

Today, some politicians look to chaebol for financial support during campaigns and often tout chaebol economic successes as national ones. Meanwhile, the chaebol lobby for favorable legislation and public policy. Critics say the tight-knit relationship between Seoul and the chaebol has fostered a culture of corruption, in which embezzlement, bribery, and tax evasion have become the standard. “Asking for money from chaebol executives in return for political favors was considered quite normal until very recently,” Kang Won-taek, a professor at Seoul National University, told the Economist.

The cozy relationship between chaebol and government has increasingly roused the public’s ire. In recent decades, South Korea’s economic growth has dropped from near double digits to around 3 percent, while chaebol have gone global and moved many jobs overseas. Chaebol, once seen as instruments of growth, have become financiers for the government and “contributed more to Korean social inequality than to society,” says CFR’s Snyder.

Many top executives have been found guilty of corruption, including leaders from Samsung, Hyundai , Lotte, and SK. Despite their convictions, the businessmen rarely see the inside of a prison for long, if at all; many pay heavy fines instead, receive presidential pardons, or see their jail sentences suspended by the courts.

Public discontent with the chaebol reached a new peak in 2016–17 with the eruption of a massive influence-peddling scandal that led to the ouster of President Park Geun-hye. In April 2018, she was sentenced to twenty-four years in prison and fined almost $17 million for soliciting bribes from many of South Korea’s top chaebol. In a separate investigation, Park’s predecessor, Lee Myung-bak, was arrested in March 2018 on a slew of graft charges, for which he could receive a life sentence.

What are the ongoing challenges with chaebol?

Despite the scandals, chaebol have continued to stack their corporate boards with allies and place new generations of family in executive roles. While the boards generally adhere to international standards of transparency, analysts say that in practice chaebol families continue to dominate from the sidelines and have fostered a cult of personality that prioritizes loyalty. Practices such as cross-shareholding, in which families exert control over chaebol through a web of circular investments in various affiliates, persist.

Though the chaebol are responsible for the majority of the country’s investment in research and development, experts say they may also introduce challenges to the health of the Korean economy. Economists have warned that the behemoth conglomerates often use their monopolistic clout to squeeze small and medium enterprises (SMEs) out of the market, often copying their innovations rather than developing their own or buying out the SMEs. In this predatory environment, SMEs, which provide for most of the country’s employment, are unable to grow.

There is also a significant wage gap, as the average pay for workers at SMEs is only 63 percent of that at chaebol. South Korea faces growing income inequality levels [PDF] and limited job growth, with high youth unemployment rates.

Further, experts say that large-scale corruption, often associated with the chaebol, reduces economic competitiveness, diminishes social trust, leads to wasteful spending and poor decision-making, and sometimes necessitates large bailouts.

What’s the debate over reforming the chaebol system?

Many experts say the South Korean economy will require major corporate governance reforms to create sustainable growth and limit inequality.

The government, particularly under liberal administrations, has implemented some policies to change corporate management and ownership structures, increased transparency for management and financial reporting, and consolidated chaebol business ventures in core areas. However, analysts say reforms have so far only tackled low-hanging fruit. Chaebol remain dominant, with the top ten owning more than a quarter of all business assets in the country.

Elected in May 2017, President Moon Jae-in came into power with a mandate to sever the government-chaebol nexus and crack down on corruption. He has vowed to end the practice of pardoning convicted executives, raised the minimum wage, and modestly boosted the corporate tax rate from 22 to 25 percent. However, his ability to enact reforms is undermined by his party’s lack of a majority in parliament, where chaebol hold sway over many members.

Some economists have suggested other policy changes, including tougher antitrust laws, a ban on all cross-shareholding among subsidiaries, and greater voice to minority shareholders, to finally break the dominance of the chaebol. Yet many experts caution that changing the chaebol system’s deeply entrenched culture will not happen overnight.

©2021 Council on Foreign Relations. All rights reserved.

Privacy Policy and Terms of Use.

2 notes

·

View notes

Text

A Chinese Language Billionaires Son Is Publicly Criticizing Beijings Covid Coverage

Entry for different present COVID-19 entry necessities and restrictions. Following are latest questions and answers from our webusers and customers. You can learn many useful info from the discussion and cases. ● Already staying in Hong Kong or Macau, and going to go to the Pearl River Delta from Hong Kong and Macau. Hainan will support indepent travel by individual registration and allows extra objective of visiting soon.

The U.S. uses the Electronic System for Travel Authorization for on-line purposes. Travelers underneath the Visa Waiver Program to the U.S. should complete functions on the ESTA web site earlier than departure. For the document information, the requirements of the aforementioned government companies and establishments shall prevail. See our webpage for moreinformation on insurance coverage providers for overseas coverage. We strongly recommendsupplemental insuranceto cover medical evacuation.

Kazakhstan citizens could get 3-day visa-free travel to Tacheng (塔城, Xinjiang). From December 28th, 2017, China accredited Beijing-Tianjin-Hebei space to make use of 144-Hour Visa-free Transit for better serving international layovers. Once meeting all circumstances, guests could enter and exit through one of many six opened ports, visit Beijing, Tianjin and Hebei Province for not more than 144 hours. The updated “no-visa” rule gives aliens larger convenience and chance to make in-depth layover tour. Please read detailed necessities, utility information, airport layover and useful tips in 144-hour Visa-free Transit Policy in China to plan a wonderful visit to China.

Top China Journey Company, Top China Tours, China Journey Service

GZL is the one company which has been granted the “Client Satisfaction Vessel” by the China National Quality Association. Mr Zhao Wenzhi, Deputy President of GZL International Travel Service Ltd spoke on the COTTM Summit, in Guangzhou. Spring Tour is a department firm affiliated to Shanghai Spring International Travel Service Ltd positioned in Shanghai China. Many points of interest, journey businesses and motels in China are launching promotions, to assist the stricken tourist market's restoration. Although the inbound China travel is still pending on resuming because of the world rapidly-changing state of affairs of the COVID-2019, we confidently believe that we'll finally combat it and make our life back to normal.

This share represents all present assets not accounted for in accounts receivable and shutting stock. This share represents all claims towards debtors arising from the sale of products and companies and some other miscellaneous claims with respect to non-trade transaction. It excludes loan receivables and some receivables from associated events.

GCM designs tailor-made itineraries for clients based on their special requirements and meanwhile provide thoughtful and professional MICE service to them. GCM’s PR and Event team supplies professional one-stop occasion planning service to our shoppers, together with creativity and event planning and execution etc. GCM has a robust staff of creativity, and provides graphic and 3D design and video enhancing & making service as nicely as assist shoppers in making promotion and advertising measures. Tourism Bureau of the provinces, municipalities and autonomous regions is immediately underneath the central government. Tourism Bureau is the administration management of native tourism vacation spot, which by the native Party committee, government and National Tourism Administration of the dual leadership.

He even met his love in the office, they usually continue to work and journey together. He is a historical past fanatic, who believes that the lengthy run lies prior to now, and most present-day challenges can be answered with historic knowledge. You can see the parts of China that curiosity you most, in your dates, with your personal driver and information. It is sort of useful and sensible to be taught some useful Chinese phrases when you have the possibility to go to China. But with some efforts overseas folks nonetheless can master some useful and day by day life sentneces for use in their journeys to Beijing China.

Chinese Embassy In Beograd, Serbia

However, please observe that this option is not available to People’s Republic of China passport holders. This includes sporting occasions, worldwide conferences, and trade festivals, among different actions, that are both organized, co-organized or sponsored by Taiwanese government companies, or choose non-profit organizations. Applicants must make sure that the information on the visa is full and valid upon collection.

This could also be obtained prematurely either by way of a authorities diplomatic office or via an online software. The invitation letter may be within the form of fax, photocopy or pc printout, but the consular officer could require the applicant to submit the original of the invitation letter.. Photocopy of Chinese ID of the inviting particular person or foreign passport and everlasting residence permit. Frequent guests to Taiwan from these countries can also obtain multiple entry visas with validity of two to five years. ABTCs are additionally issued to nationals of China and permanent residents of Hong Kong; however, Chinese nationals residing in Mainland China are subject to entry restrictions and cannot use the card to enter Taiwan.

For non-public affairs, documentation figuring out the nature of the personal affairs must be offered as required by the consular officer. J1 Issued to resident overseas journalists of overseas news organizations stationed in China. Please notice that all visa candidates should have their fingerprints collected in individual at the Chinese Visa Application Service Centers. Applicants who forge fingerprints or use different folks's fingerprints may be denied entry to China and should bear all the consequences by themselves. Also created with the passing of the "Act for Recruitment and Employment of Foreign Professionals" in 2018, was the Employment Seeking Visa.

Entry and exit necessities are strictly enforced, as are restrictions on activities allowed by any specific visa class. Failure to register with the police inside 24 hours of arrival in the country might end in fines and deportation. You can register with lodge staff or the native police station.

Embassy Of The Individuals's Republic Of China In America Of America

Local rules require foreigners to carry valid passports and Chinese visas or residence permits at all times. Failure to register with the police inside 24 hours of arrival within the nation might result in fines and deportation. You should have a legitimate visa to exit China and you should depart China before the expiration of the listed duration of keep.

U.S. and European business groups are signaling that the costs of the policy, which hinges on a rigorous system of quarantine, testing and isolation as nicely as community lockdowns and travel restrictions, are outweighing any gains in public health. Shanghai’s lockdown as a part of the government’s “zero-Covid strategy” has evoked a sharp expression of public dismay from China's normally compliant overseas business neighborhood. The Solomons has sought to downplay the significance of the agreement and says it won't result in a China establishing a army base there, but many neighboring countries and Western nations remain worried. U.S. Assistant Secretary of State for East Asian and Pacific Affairs Kurt Campbell speaks throughout a press conference at the U.S. The deliberate US journey comes after Australian Minister for International Development and the Pacific Zed Seselja travelled to Honiara earlier in April to ask the prime minister in person not to signal the deal.

U.S.-Chinese twin citizens should navigate conflicting elements of Chinese nationality, which the Chinese authorities could inconsistently apply. Visit the internet site of theEmbassy of the People’s Republic of Chinafor current visa information as nicely as info on China’s immigration and nationality legal guidelines. Apply for a visa extension out of your localEntry/Exit Bureaubefore attempting to leave the country.

Apply Online For The Taiwan Evisa

The great cultural, historic, natural panorama will fulfill your dream tour to China. For those that want an in-depth discovery in China, featured China Panda Tour, Ancient Silk Road Tour, High Speed Train Tour, Colorful Ethnic Tour are good ways to seek out more fascinating places and genuine locals. The utility supplies ought to be delivered to the CVASC within the area of your residence. ⑵ View “Step by Step Guidance” & “Visa Knowledge” to know the required paperwork, frequently requested questions and suggestions, and basic procedures. If you enter the United States beneath the Visa Waiver Program, you are not permitted to increase your stay within the United States beyond the preliminary admission period.

Passport is a priceless private item, we strongly suggest you using courier delivery which provides tracking service, such as NZ Post, Courier Post, and NZ Couriers. Original and photocopy of certification exhibiting the connection of members of the family between the applicant and inviting particular person. Information on the applicant (full name, gender, date of birth, passport quantity, and so on.). Information concerning the applicant (full name, gender, date of birth, passport number, and so on.).

The X1 is related for folks planning to stay for more than a hundred and eighty days, while X2 means the duration is less than 180 days. Handling service fee is charged whatever the variety of purposes. For instance, in case you are sending one package deal with a quantity of purposes, you solely have to pay one handling service fee.

Electronic Visa Update System Evus Regularly Asked Questions

If you are out of the country, you have to contact the nearest Australian consultant workplace. 台胞證 holding a People’s Republic of China passport require a sound U.S. visa to enter Guam. People’s Republic of China passport holders carrying maximum validity (10-year) B1/B2, B1, and B2 visas should enroll in EVUS in order to journey to Guam or any U.S. vacation spot.

Nationals of countries not on this listing may be the beneficiary of an approved H-2A or H2-B petition in restricted circumstances at the discretion of the Department of Homeland Security if specifically named on the petition. All NIV adjudicating posts worldwide should annotate every 10-year, multiple-entry, B-1/B-2, B-1, or B-2 visa issued in a People's Republic of China passport. The Permit for Proceeding to Hong Kong and Macao, also referred to as the One-way Permit, is issued to Chinese citizens who're settling in Hong Kong or Macau and have relinquished their Chinese residency . After their initial entry to Hong Kong or Macau, they're thought of as SAR residents and are completely ineligible for an ordinary Chinese passport, and later they are going to be eligible for SAR passports in the occasion that they acquire a everlasting resident standing in the respective SARs.

If you've traveled to Turkey,please include a detailed assertion about your journey. Applicants must present proof of residency that displays their name and present street tackle. This can embody a copy of their legitimate driver’s license or government issued picture ID. A valid signed passport with at least six months validity remaining and at least two clean visa page. All functions have to be typed and all fields have to be crammed out. A $25 software payment will be charged for hand-written or double sided applications.

ETS will cost a charge of $50.00 to complete the applying types. An applicant who was born in China, Hong Kong or Taiwan is required to submit his /her Chinese passport or last foreign passport with a Chinese visa when he/she applies for a Chinese visa with his / her present passport. A letter of invitation (P/U) from the ministry of international affairs in China. Applicants who've beforehand held China visas are required to submit the passport containing these visas, together with the current passport. An applicant who was born in China, Hong Kong or Taiwan is required to submit his /her Chinese passport or last foreign passport with a Chinese visa when he/she applies for a Chinese visa with along with his / her current passport.

Discover For Online Chinese Language Visa Applications With E

You ought to check with the directions on the net site of the Embassy or Consulate Visa Section the place you will interview, or on their online appointment scheduling web site. You might want to provide proof of the need for an earlier appointment. A wait time listed as "999 calendar days" indicates that the Consular Section is simply providing that service to emergency cases. Please examine the Embassy or Consulate web site for further info.

You even have the option of getting your passport mailed again to you from the CVASC. You should present a self-addressed, pre-paid envelope and pay an extra charge for this service. Please note, these charges shall be charged in the local foreign money of the nation you're making use of from. In each circumstances, it’s a good suggestion to decorate appropriately as this helps to make an excellent impression. Plus, you have to keep in mind to take all the necessary documents in any other case you may need to start out the applying course of once more. From there, all you need to do is locate the country where you reside and click on the link which can take you to the net site of the embassy or consulate that you might be dealing with.

All People’s Republic of China Passport holders carrying 10-year B1/B2, B1 or B2 visas are required to have an EVUS enrollment to enter the United States by air, land, sea starting on November 29. If you are already in the United States on November 29, you'll not need to enroll in EVUS to depart the United States. However, you have to enroll before your subsequent trip to the United States. EVUS only applies to People’s Republic of China passport holders carrying 10-year B1/B2, B1, or B2 visas.

How To Apply

Because immigration rules in China are subject to alter at quick notice, expats should seek the advice of their native Chinese embassy for the newest record of necessities for every type of visa. All different nationalities are required to acquire a visa for China from a Chinese embassy or consulate abroad earlier than touring to the nation, whether the trip is for tourism, enterprise, to work or study, or for other functions. If you journey on enterprise, you are actually required to supply a a call for participation issued by the native Chinese government, establishment, or business entity, or by a licensed Chinese company. To pattern these trade reveals, it’s more than likely that the one visa you want is a tourist visa, referred to as an L visa.

If you need to go to China, you've numerous different visa options to remember. Going with 24 Hour Passport and Visas will make the Chinese visa application course of as clean as potential. In addition, those who are visiting Taiwan on business have to be interviewed by a Taiwanese consular officer, and their sponsors in Taiwan must submit a guarantee to the Bureau of Consular Affairs in Taiwan.

Multiple entries within these 90 days are allowed. The holder of an R.O.C. Travel Authorization Certificate from the National Immigration Agency, Ministry of the Interior may stay in Taiwan for 14 days, ranging from the day after arrival. 6) After finishing the form, please print out the confirmation page and visa form, and sign the affirmation web page and visa type.

1 note

·

View note

Text

Alibaba founders secure loans from global banks backed by company stock

Chinese billionaires Jack Ma and Joe Tsai have pledged part of their joint $ 35 billion stake in e-commerce group Alibaba in exchange for significant loans from investment banks, company documents show.

The stock commitments to banks like UBS, Credit Suisse, Goldman Sachs, and others have been taken over by offshore companies that control more than half of the two billionaires’ stakes in Alibaba, which stood at 5.8 percent in December. When pledging shares, banks accept shares as collateral for loans, but the borrower retains ownership of the shares.

The amounts of most of the stock awards were not disclosed in the documents, but the pair have repeatedly borrowed against their shares since Alibaba’s listing in the US in 2014, according to documents from the Financial Times.

Ma and Tsai, Alibaba’s two largest single shareholders, have used the loans to unleash vast personal wealth tied up in the group’s shares.

Global banks have provided a variety of loans to Ma and Tsai. Tsai’s Gulfstream 650ER private jet is pledged to Credit Suisse. The Swiss bank that launched Alibaba also made loans to an offshore shell company ahead of the IPO, which later went on to buy a luxury home in Hong Kong’s Elite Peak District and a new plane of the same model as Tsais was connected.

Pledging stocks carries risk and is capped by most US companies. Any forced sale of pledged shares by executives can worsen a company’s stock price decline. This can be triggered by margin calls when borrowers have to repay loans from brokers or stocks expire.

Credit Suisse, Nomura, Morgan Stanley, UBS, Mitsubishi UFJ Financial Group and Mizuho lost more than $ 10 billion this year when they were forced to liquidate positions in US-listed Archegos family office companies after failing to make margin calls had met.

Alibaba said Ma “and its affiliates” currently have no outstanding loans backed by Alibaba shares, while Tsai’s outstanding loans, backed by shares, are “easy to use” and offer “prudent lending ratios.” [a] considerable cushion against triggering a margin call ”.

The company said pledging shares for loans was part of “ordinary financial planning to provide liquidity and diversification without having to sell Alibaba shares.”

Ma resigned as CEO of Alibaba in 2019, while Tsai continues to serve as vice chairman.

Network of offshore companies

Ma and Tsai’s shares in Alibaba are mainly held through five offshore companies: JC Properties, JSP Investment, Parufam, PMH Holding and APN Ltd.

APN has made the largest known single pledge of Alibaba stock with 400 million shares. But rather than in exchange for a loan, it was part of the guarantees for Japanese SoftBank and Yahoo after Ma Alibaba’s payment unit Alipay – now part of its fintech Ant Group – separated from the e-commerce company.

Ma’s wife, Cathy Ying Zhang, who accepted Singapore citizenship, was instrumental in its business. Records show that two offshore holding companies of which Zhang is sole director, JSP Investment and JC Properties, hold 60 percent of the couple’s Alibaba stake.

In total, Zhang’s two holding companies for Alibaba shares have made more than a dozen asset pledges to investment banks for loans made to a network of offshore companies.

In addition, Zhang is the sole shareholder of a Hong Kong company with which Ma bought a castle and vineyards in France, and has power over the well-endowed Jack Ma Philanthropic Foundation, business records show. She has also signed cheap loans from Goldman Sachs to Enbao Asset Management, Ma’s family office.

On a deal, an investment in an online Chinese real estate platform in 2015 orchestrated by Enbao, Ma used two offshore holding companies to contribute $ 20 million. One of these was Rainbow Zone Enterprise, based in the BVI, which contributed $ 10 million while taking out a loan from Swiss bank UBS backed by unspecified securities that JSP Investment pledged to the bank.

In one day in 2019, the couple started three letterbox companies, Miracle Orchid Investment, Rising Orchid Investment, and Winning Orchid Investment. Three months later, they received loans backed by JSP Investment’s assets.

The records viewed by the FT revealed that Alibaba’s American Depositary Shares had been pledged on loans from Morgan Stanley and Credit Suisse, while Goldman referred to pledged American Depositary Shares and UBS reported pledged “securities” and other assets.

Diamond Key Worldwide, based in BVI, another company that Zhang controls, has received four separate loans from UBS. Last year, the company’s Chinese subsidiary in Hangzhou, where Alibaba is based, bought Rmb 35 million (US $ 5.4 million) of land to develop for educational purposes.

Freeing up liquidity without alarming the markets

Bankers say share pledges are a common way for Chinese executives to raise cash without losing control of their businesses or sending negative signals to the market by selling their shares.

“It’s really good business for banks, it feeds a lot of people,” said a former banker. “These founders are rich in wealth but poor in cash.”

American executives such as Tesla co-founder Elon Musk have also pledged shares in their companies against loans. But, as a US company, Tesla must disclose its commitments to shareholders under the Securities and Exchange Commission regulations.

But under the looser US disclosure requirements for “foreign private issuers,” a category that includes almost all US-listed Chinese tech companies, including Alibaba, Ma and Tsai are not required to disclose their stock awards.

According to the documents, many of Tsai, Ma and his wife Zhang’s stock and other property pledges remained in place until January, even after they began selling their Alibaba shares.

Recommended

Ma and his wife have paid out an estimated $ 11.4 billion in shares since Alibaba went public in New York, with the majority sold as of 2017. His charitable foundation sold an additional $ 4.1 billion. Tsai has sold an estimated $ 5.4 billion.

Alibaba said Ma and Tsai had “owned the company’s stock for 22 years and continue to hold significant stakes in Alibaba which make up the bulk of their assets.”

Former English teacher Jack Ma is one of China’s most famous entrepreneurs who co-founded Alibaba with Tsai in 1999 before building a Bloomberg fortune of $ 49.9 billion.

However, it largely disappeared from the public eye late last year after Beijing cracked down on the Ant Group, the fintech Ma that emerged from Alibaba in 2011.

Credit Suisse, Morgan Stanley, Goldman Sachs and UBS declined to comment.

Additional coverage from Joe Leahy in Hong Kong

source https://www.cassh24sg.com/2021/07/02/alibaba-founders-secure-loans-from-global-banks-backed-by-company-stock/

0 notes

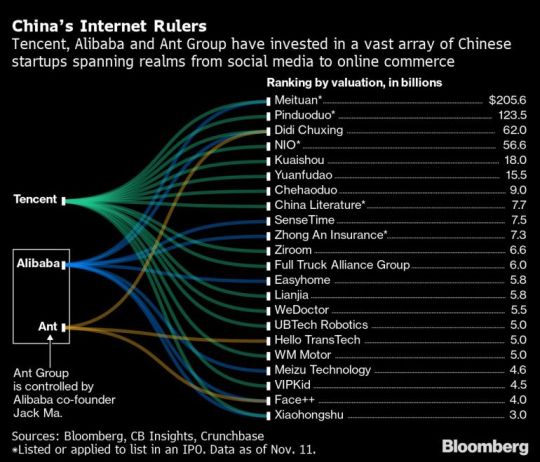

Photo

What's behind China's Big Tech crackdown and what does it mean?

Several governments are trying to defang the growing financial and economic might of tech giants, but few have the political leeway that China has.

China's government published draft antitrust rules this week aimed at curbing monopolistic behavior by its giant internet platforms, a move that analysts believe will lead to increased scrutiny of e-commerce marketplaces as well as food delivery and payment platforms, among others.

The move took investors by surprise, wiping hundreds of billions of dollars off the market value of some of the world's biggest tech companies.

The proposed rules are meant to protect or encourage fair competition and to safeguard consumers.

This is a dramatic shift from the mostly hands-off approach the government has adopted so far with its tech giants.

And while President Xi Jinping's government has not explained what led to the draft rules, the move is likely to affect some of the biggest internet firms in China including e-commerce giants like Alibaba, JD.com and Pinduoduo, as well as food delivery platform Meituan, and social media and gaming giant Tencent, among others.

So what are these companies being accused of doing?

Alibaba and Tencent dominate China's growing ecosystem of tech platforms that allow users to chat with friends and family, transfer money, shop online, take out loans, order a ride-hailing car, stream music and movies, play online games and much more.

[Bloomberg]

Some of the things these firms have been accused of doing include the compulsory collection of user data, treating customers differently based on their spending habits and setting algorithm-based prices favoring new users.

One of the most egregious examples of supposed arm-twisting by tech firms involves a “pick one of two” tactic, in which vendors - usually small enterprises - are forced to choose between Alibaba and e-commerce platforms such as Pinduoduo, in which Tencent is a shareholder.

Why is the government clamping down now?

While the large Chinese platforms have been accused of these kinds of practices for a while, it is unclear what made the government unleash these proposals now. China's State Administration for Market Regulation, the body which regulates monopolies and which issued the draft, said it wanted to prevent platforms from dominating the market or from adopting methods aimed at blocking fair competition.

Last year, the body called more than 20 platforms to a meeting to ask them to stop pushing vendors to sign exclusive agreements.

Did the economic fallout of the pandemic speed things up?

COVID-19 may have pushed the issue further up the market regulator's agenda. As China emerged from the painful lockdowns to curb the spread of the virus earlier this year, large tech firms benefitted from a surge in e-commerce, while smaller brick-and-mortar businesses struggled. Faced with the possibility of worsening an already alarming inequality problem, Beijing might have decided it was time to get tough.

According to Bloomberg News, a year ago, e-commerce accounted for about 25 percent of total retail sales; now, it is edging towards 30 percent.

Was there any warning that change was imminent?

The rules were unveiled after China's Financial Stability and Development Committee, a cabinet-level body headed by Vice Premier Liu He, flagged last month the need to improve mechanisms to ensure fair competition and called for the strengthening of anti-monopoly law enforcement.

They also come after the overnight suspension last week of the $ 35bn initial public offering (IPO) of Ant Group, an Alibaba affiliate which provides an array of payment and financial services, in what was billed to be the world's largest-ever listing, after regulators warned the financial technology firm that its online lending business would face tougher scrutiny.

Wasn't halting that Ant IPO a big deal?

It sure was. The sudden halt to the IPO shocked investors and markets globally who saw it as a step by the Chinese government to rein in Alibaba co-founder Jack Ma who, at a news conference just days before Ant's IPO, criticized the government for stifling innovation.

What have the companies said about the new draft rules?

Alibaba did not immediately respond to Al Jazeera's request for comment.

Meanwhile, Tencent's President Martin Lau has tried to reassure investors about the effect the new rules would have on his company.

He said the operator of the WeChat instant messaging-to-payments platform supports the government's goals of fair competition and that its social media and entertainment empire operates within competitive fields. He also made clear the company will comply with regulators' policies, Bloomberg reported.

How have investors reacted to the proposed rules?

They have been spooked! In the days since the draft rules were revealed, Chinese tech giants lost almost $ 290bn in market value as investors frantically sold the stocks. Between Tuesday and Wednesday, Hong Kong's Hang Seng Tech Index was down 11 percent, though it had recouped some of those losses by Friday following Tencent's statement.

[Bloomberg]

Given the market reaction, will the draft rules be enforced?

It is not clear whether the draft policies, which are open for public feedback until the end of November, will be enforced or not. If they do kick in, they are expected to have a negative effect on the more dominant firms.

One potential effect could be to end the practice of aggressively discounting, at times to below cost price, in order to gain market share.

Companies that exchange user data could also take a hit to their revenues, analysts say.

How will this affect the little guys? Consumers and small businesses?

The proposed rules are meant to protect consumers and small business owners who use online platforms to sell their goods. The regulations would theoretically reduce compliance costs for business operators and encourage the healthy growth of the platform economy.

But the lack of detail so far in the government plans makes it unclear whether it will be able to achieve those goals.

. #world Read full article: https://expatimes.com/?p=13947&feed_id=16700

0 notes

Text

Fintech: Key insights on the Ant Group IPO filing

- By Nuadox Crew -

Our partner The Last Futurist provided today some key insights on the recent IPO prospectus filing by fintech firm Ant Group (an affiliate company of the Chinese Alibaba Group).

Michael Spencer wrote:

So how innovative is Ant Group in fin-tech? Well the company reported a 1,000% jump in profits in the first half of 2020 from the same period last year. That’s not just an outlier, that’s a global leader and Jack Ma has a considerable stake again here.

It could also be the biggest IPO of all-time and it’s important to note it’s not even occurring in the U.S.

The company is planning a concurrent listing on the Shanghai stock exchange’s STAR market and the Hong Kong stock exchange. Politics aside, Alipay payments makes Ant Group the leading fin-tech company in the world that will eventually I think out-compete the likes of PayPal, plastic (think American Express) and even Square (as great as those businesses are).

So how profitable is Ant Group? There again the company is controlled by Alibaba founder Jack Ma, reported profit of 21.9 billion Chinese yuan ($3.2 billion) on total revenues of 72.5 billion yuan in the first half of the year, according to the exchange filing.

Ant Financial’s IPO is in a sense China’s coming out party. Revenues were also up significantly, climbing about 38% from the 52.5 billion yuan the firm made in the first half of 2019. How much is this spin-off of Alibaba worth in 2020? The company is targeting a $US225 billion valuation and could raise as much as $US30 billion in the deal if demand holds up. China can produce companies of global scale very efficiently as of 2020.

Ant Group’s future is also very bright, with Chinese consumers as more mobile native than Americans or Europeans or Japanese. Ant plans to speed up its formation of an online marketplace for everything from household goods to loans. The company most recently began pushing into the financial industry, leveraging data from its Alipay app to offer customers robo-advising and banking services.

Ant, 33% owned by e-commerce giant Alibaba Group Holding, has already amassed a range of financial licenses including payments, online banking, insurance and micro lending. So that’s where the innovation has really occurred, through very smart diversification.

How big is Alipay? The main payment method of Ant Group has over 1 billion annual active users and processed 118 trillion yuan in transactions in mainland China in the 12 months ended June 30. The platform also has an international presence, with annual transaction volume of 622 billion in markets outside China.

> Read the entire article at The Last Futurist

Read Also

The global Fintech ecosystem in 2019 (infographic)

0 notes

Text

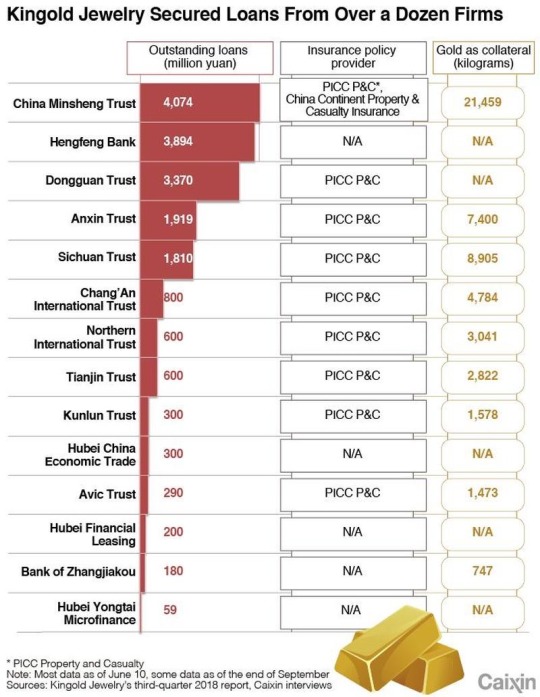

83 Tons Of Fake Gold Bars: Gold Market Rocked By Massive China Counterfeiting Scandal

— By Tyler Durden | Tuesday 06/30/2020 | ZEROHEDGE.COM

Over the years, we have periodically reported of the occasional gold bar discovered as counterfeit in Manhattan's Diamond District which instead of containing the yellow precious metal would be filled with gold-plated tungsten or in some cases copper. The news would spark a brief wave of outrage, prompting physical gold holders to run ultrasound spot checks of their inventory, at which point interest would wane and why not: buyer, after all, beware in gold as in every other market, and if someone is spending thousands to buy fake gold, well that's Darwinism in action.

Yet one market which seemed stubbornly immune to any counterfeiting was that of physical gold in China, which was odd considering that over the past decade China had emerged as the world's biggest counterfeiter of various, mostly industrial metals used to secure bank loans, better known as "ghost collateral", and which adding insult to injury, would frequently be rehypothecated meaning often several banks would have claims to the same (fake) asset.

All that is about to change with the discovery of what may be one of the biggest gold counterfeiting scandal in recent history. And yes, not only does it involve China, but it emerges from a city that has become synonymous for all that is scandalous about China: Wuhan itself.

With that preamble in mind, we introduce readers to Wuhan Kingold Jewelry Inc., a company which as the name implies was founded and operates out of Wuhan, and which describes itself on its website as "A Company with a Golden future."

In retrospect, it probably meant "copper" future, because as a remarkable expose by Caixin has found, more than a dozen Chinese financial institutions, mainly trust companies (i.e., shadow banks) loaned 20 billion yuan ($2.8 billion) over the past five years to Wuhan Kingold Jewelry with pure gold as collateral and insurance policies to cover any losses. There was just one problem: the "gold" turned out to be gold-plated copper.

Some more background: Kingold - whose name was probably stolen from Kinross Gold, one of the world's largest gold miners - is the largest privately owned gold processor in central China’s Hubei province. Its shares are listed on the Nasdaq stock exchange in New York (although its current market cap of just $10MM is a far cry from its all time highs hit when the company IPOed on the Nasdaq around 2010) . The company is led by Chairman Jia Zhihong, an intimidating ex-military man who is the controlling shareholder.

What could go wrong?

Well, apparently everything as at least some of 83 tons of gold bars used as loan collateral turned out to be nothing but gilded copper. That has left lenders holding the bag for the remaining 16 billion yuan of loans outstanding against the bogus bars. And as Caixin adds, the loans were covered by 30 billion yuan of property insurance policies issued by state insurer PICC Property and Casualty and various other smaller insurers.

The fake gold came to light in February when Dongguan Trust (one of those infamous Chinese shadow banks) set out to liquidate Kingold collateral to cover defaulted debts. As the report continues, in late 2019 Kingold failed to repay investors in several trust products. To its shock, Dongguan Trust said it discovered that the gleaming gold bars were actually gilded copper alloy.

The news sent shockwaves through Kingold’s creditors. China Minsheng Trust - another shadow banking company and one of Kingold’s largest creditors - obtained a court order to test collateral before Kingold’s debts came due. On May 22, the test result returned saying the bars sealed in Minsheng Trust’s coffers are also copper alloy.

And with authorities investigating how this happened, Kingold chief Jia flatly denies that anything is wrong with the collateral his company put up. Well, what else could he say...

As Caxin notes, the Kingold counterfeiting case echoes China’s largest gold-loan fraud case, unfolding since 2016 in the northwest Shaanxi province and neighboring Hunan, where regulators found adulterated gold bars in 19 lenders’ coffers backing 19 billion yuan of loans, or about USD $2.5 billion. In that case, a lender seeking to melt gold collateral found black tungsten plate in the middle of the bars.

In the case of Kingold, the company said it took out loans against gold to supplement its cash holdings, support business operations and expand gold reserves, according to public records. It then appears to have decided to apply a gold-layer to tons of copper and pretend it was money-good gold collateral. And even more shocking, for years nobody checked the authenticity of the pledged collateral!

In 2018, the company beat a number of competitors in bidding to buy a controlling stake in state-owned auto parts maker Tri-Ring Group. Kingold offered 7 billion yuan in cash for 99.97% of Tri-Ring. The Hubei government cited the deal as a model of so-called mixed-ownership reform, which seeks to invite private shareholders into state-owned enterprises. But Kingold has faced problems taking over Tri-Ring’s assets amid a series of corruption probes and disputes involving Tri-Ring.

After obtaining the test results, Minsheng Trust executive said the company asked Jia whether the company fabricated the gold bars: “He flatly denied it and said it was because some of the gold the company acquired in early days had low purity,” the executive said. In a telephone interview with Caixin in early June, Jia denied that the gold pledged by his company was faked.

“How could it be fake if insurance companies agreed to cover it?” he said and refused to comment further. Well, the answer is simple: the insurance companies were in on the scam, but that's a story for another day.

In early June, Minsheng Trust, Dongguan Trust and a smaller creditor Chang’An Trust filed lawsuits against Kingold and demanded that PICC P&C cover their losses. PICC P&C declined to comment to Caixin on the matter but said the case is in judicial procedure. A source from PICC P&C told Caixin that the claim procedure should be initiated by Kingold as the insured party rather than financial institutions as beneficiaries. Kingold hasn’t made a claim, the Caixin source said.

In total, Kingold pledge tens of thousands of kilograms of gold to no less than 14 creditors amounting to just under 20 billion yuan.

Caixin learned that the Hubei provincial government set up a special task force to oversee the matter and that the public security department launched an investigation. The Shanghai Gold Exchange, a gold industry self-regulatory organization, disqualified Kingold as a member as of last week.

Following Dongguan Trust and Minsheng Trust, two other Kingold creditors also tested pledged gold bars and found they were fake, Caixin learned. A Dongguan Trust employee said his company reported the case to police Feb. 27, the day after the testing result was delivered, and demanded 1.3 billion yuan of compensation from PICC P&C’s Hubei branch.

Meanwhile, Kingold defaulted on 1.8 billion yuan of loans from Dongguan Trust with an additional 1.6 billion yuan due in July.

The 83 tons of purportedly pure gold stored in creditors’ coffers by Kingold as of June, backing the 16 billion yuan of loans, would be equivalent to 22% of China’s annual gold production and 4.2% of the state gold reserve as of 2019.

In short, more than 4% of China's official gold reserves may be fake. And this assume that no other Chinese gold producers and jewelry makers are engaging in similar fraud (spoiler alert: they are.)

Founded in 2002 by Jia, Kingold was previously a gold factory in Hubei affiliated with the People’s Bank of China that was split off from the central bank during a restructuring. With businesses ranging from gold jewelry design, manufacturing and trading, Kingold is one of China’s largest gold jewelry manufacturers, according to the company website.

The company debuted on Nasdaq in 2010. The stock currently trades around $1 apiece, giving Kingold a market value of $12 million, down 70% from a year ago. A company financial report showed that Kingold had $3.3 billion of total assets as of the end of September 2019, with liabilities of $2.4 billion.

Jia, now 59, served in the military in Wuhan and Guangzhou and spent six years living in Hong Kong. He once managed gold mines owned by the People’s Liberation Army, which means he likely has connections all the way to the very top.

Jia Zhihong

“Jia is tall and strong,” one financial industry source familiar with Jia told Caixin. “He’s an imposing figure and speaks loudly. He is bold, reckless and eloquent, always making you feel he knows better than you.”

Several trust company sources said Jia is well connected in Hubei - the epicenter of the coronavirus pandemic - which may explain Kingold’s surprise victory in the Tri-Ring deal. But a financial industry source in Hubei said Jia’s business is not as solid as it may appear.

“We knew for years that he doesn't have much gold ― all he has is copper,” said the source, who declined to be named.

Local financial institutions in Hubei have avoided doing business with Kingold, but they don’t want to offend him publicly, the source said. Why? Because of his extnesive connections with the Chinese army.

“Almost none of Hubei’s local trust companies and banks has been involved in (Kingold’s) financing,” he said.

That explains why most of Kingold’s creditors are from outside Hubei. Caixin learned from regulatory sources that Minsheng Trust is the largest creditor of Kingold with nearly 4.1 billion yuan of outstanding loans, followed by Hengfeng Bank’s 3.9 billion yuan, Dongguan Trust’s 3.4 billion yuan, Anxin Trust & Investment Co.’s 1.9 billion yuan and Sichuan Trust Co.’s 1.8 billion yuan.

But wait, counterfeiting gold is just the tip of the company's fraud iceberg: several industry sources told Caixin that the institutions were willing to offer loans to Kingold because Jia promised to help them dispose of bad loans.

Hengfeng Bank is the only commercial bank involved in the Kingold affair. The bank in 2017 provided an 8 billion yuan loan to Kingold, which in return agreed to help the bank write off 500 million yuan of bad loans, bank sources said. Kingold repaid half of the debts in 2018. But the loan issuance involved many irregularities as access to the pledged gold and testing procedures was controlled by Kingold, one Hengfeng employee said.

The loan was pushed forward by Song Hao, former head of Hengfeng’s Yantai branch. Song was placed under graft investigation in March 2018 in connection with the bank’s disgraced former Chairman Cai Guohua, whose downfall led to a major revamp in the bank’s management. In 2019, Hengfeng’s new management sued Kingold for the unpaid loans and moved to dispose the collateral. But a test of the gold bars found they are “all copper,” the bank source said.

It is still unclear whether the collateral was faked in the first place or replaced afterward. Sources from Minsheng Trust and Dongguan Trust confirmed that the collateral was examined by third-party testing institutions and strictly monitored by representatives from Kingold, lenders and insurers during the process of delivery.

"I still can’t understand which part went wrong," a Minsheng Trust source said. Bank records showed that the vault where the collateral was stored was never opened, the source told Caixin.

The falling dominos

Public records showed that Kingold’s first gold-backed borrowing can be traced back to 2013, when it reached an agreement for 200 million yuan of loans from Chang’An Trust, with 1,000 kilograms of gold pledged. The two-year loan was to fund a property project in Wuhan and was repaid on time. Before this, Kingold’s financing mainly came from bank loans with property and equipment as collateral.

It appears that one way or another, the company realized that it could fabricate gold ownership and receive money in exchange for what were basically worthless copper bricks painted as gold; and thanks to Jia's military connections nobody would ask any other questions.

As a result, starting in 2015, Kingold rapidly increased its reliance on gold-backed borrowing and started working with PICC P&C to cover the loans. In 2016, Kingold borrowed 11 billion yuan, nearly 16 times higher than the previous year’s figure. Its debt-to asset ratio surged to 87.5% from 43.4%, according to a company financial report. That year, Kingold pledged 54.7 tons of gold for loans, 7.5 times higher than the previous year.

It is now safe to assume that most of that gold never existed.

A person close to Jia said the surge of borrowing was partly due to Kingold’s pursuit of Tri-Ring. In 2016, the Hubei provincial government announced a plan to sell Tri-Ring stakes to private investors as a major revamp of the Hubei government-controlled auto parts manufacturer.

In 2018, Kingold was selected as the investor in a deal worth 7 billion yuan. According to the investment plan, Kingold’s purchase of Tri-Ring was part of a strategy to expand into the hydrogen fuel cell business, which is obviously a "logical" fit for a company involved in gold jewelry. Sources close to the deal said Kingold was attracted by Tri-Ring for its rich holding of industrial land that could be converted for commercial development.

Yes, at the very bottom of the fraud we finally get to the one true and endless Chinese asset bubble: real estate.

A Dongguan Trust investment document showed that Tri-Ring owns land blocks in Wuhan and Shenzhen that are worth nearly 40 billion yuan.

The deal drew immediate controversy as some rival bidders questioned the transparency of the bidding process and Kingold’s qualifications.

And here things get even crazier: according to Kingold’s financial reports, the company had only 100 million yuan of net assets in 2016 and 2 billion yuan in 2017, sparking doubts over its capacity to pay for the deal. Despite the fuss, Kingold paid 2.8 billion yuan for the first installment shortly after the announcement of the deal. The second installment of 2.4 billion yuan was paid several months later with funds raised from Dongguan Trust.

In December, Tri-Ring completed its business registration change, marking completion of Kingold’s takeover. However, the new owner has since faced troubles mobilizing Tri-Ring’s assets because of a series of corruption probes surrounding the auto parts maker since early 2019 that brought down Tri-Ring’s former chairman. As Caixin the notes, a majority of Tri-Ring’s assets were frozen amid the investigation and subsequent debt disputes, limiting Jia’s access to the assets.

The fraud is finally exposed

Hobbled by the Tri-Ring deal, which cost billions of yuan but has yet to make any return, Jia’s capital chain was eventually broken when Hengfeng Bank pushed for repayment, triggering a series of events that brought the fake gold to light, said a person close to the matter. Insurers’ involvement was key to the success of Kingold’s gold-backed loan deals. The insurance policies provided by leading state-owned insurers like PICC P&C were a major factor defusing lenders’ risk concerns, several trust company sources said.

“Without the insurance coverage from PICC P&C, (we) wouldn’t issue loans to Kingold as the collateral can only be tested through random picked samples,” one person told Caixin.

PICC P&C’s Hubei branch provided coverage for most of Kingold’s loans, Caixin learned. All the policies will expire by October. As of June 11, 60 policies were still valid or involved in lawsuits.

PICC P&C faces multiple lawsuits filed by Kingold’s creditors demanding compensation. But a PICC P&C spokesperson said the policies cover only collateral losses caused by accident, disasters, robbery and theft. Not fraud, and certainly not losses when the collateral never even existed!

Whose fault

Wang Guangming, a lawyer at Dacheng Law Offices, said the key issue is what happened to the pledged gold and which party was aware of the falsification. If Kingold faked the gold bars and both the insurers and creditors were unaware, the insurers should compensate the lenders and sue Kingold for insurance fraud, Wang said. Insurers are also responsible to compensate if they knew of Kingold’s scam but creditors didn’t, Wang said.

If Kingold and creditors were both aware of the fake collateral, insurers could terminate the policies and sue the parties for fraud. But if insurers were also involved in the scam, then all the contracts are invalid and every party should assume their own legal responsibilities, Wang said.

A financial regulatory official told Caixin that previous investigations of loan fraud cases involving fake gold pledges found there was often collusion between borrowers and financial institutions.

Earlier this year, PICC P&C removed its Hubei branch party head and general manager Liu Fangming. Sources said staff members involved in business with Kingold were also dismissed. PICC P&C said Liu’s removal was due to internal management issues. It didn't answer Caixin’s question about whether Liu was involved in the Kingold scandal.

The above story is shocking in exposing just how multi-faceted fraud is in China: capitalizing on pre-existing cronyism and connections with China's powerful army, the founder of Kingold was allowed to basically do anything he wanted, no questions asked, including counterfeiting over 83 tons of gold bars to get billions in funds to participate in China's housing bubble, only for a series of unexpected events to unwind the frauds one after another and expose the type of sordid scandal that is at the heart of most Chinese "enterprises" and business ventures.

As for the gold, yes - several billion in gold bars never existed and yet resulted in a cascade of subsequent cash flow events allowing tens of billions in funds to be released, "benefiting" not only founder Jia, but China's broader economy. Which is, needless to say, terrifying: because whereas just after the financial crisis China was engaged in building ghost cities, everyone knew these were a symbol of demand that would never materialize, even if the cities themselves did exist. However, it now appears that a major part of China's subsequent economic boom has been predicated on tens of billions in hard assets - such as gold - which simply do not exist.

As for what this means for the price of gold... well, Kingold is certainly not the only Chinese company engaging in such blatant fraud, and the consequences are clear: once Chinese creditors or insurance companies start testing the "collateral" they have received in exchange for tens of billions in loans and discover, to their "amazement", that instead of gold they are proud owners of tungsten or copper, they have two choices: reveal the fraud, risking tremendous adverse consequences and/or prison time, or quietly buy up all the gold needed to literally fill the void from years of gold counterfeiting.

Something tells us option two will be far more palatable to China's kleptoculture where one domino cold trigger a collapse of the entire financial system. What happens next: a panicked scramble to procure physical gold, one which even our friends at the BIS will be powerless to stop from sending the price of the precious metal to all time highs.

0 notes

Text

A mysterious Indian-origin tycoon behind a bid to save India’s Yes Bank - business news

Erwin Singh Braich, the mysterious tycoon behind a $1.2 billion bid to rescue a beleaguered Indian bank, says he is Canada’s richest man with a story so fabulous that Netflix Inc. wants to tell it.There’s a less glittering account pieced together from interviews and court records: The son of a lumber baron has a history including bankruptcy, lawsuits and soured business deals. He has no headquarters, no banker to manage his money, and is currently living in a three-star motel in the Canadian prairies.The board of Yes Bank Ltd. will decide on Tuesday which version of Braich it supports at a meeting to approve a $2 billion preferential share sale, 60% of which would be taken up by Braich and his partner, Hong Kong-based SPGP Holdings. As Bloomberg News reported Monday, India’s fourth-largest private lender is likely to reject the offer from Braich and SPGP, opting instead for institutional investors, according to a person familiar with the matter.At stake is the future of the Mumbai-based bank that’s staggering under the weight of its bad loans, including to some of the non-bank lenders caught up in India’s shadow banking crisis. Yes Bank desperately needs the cash injection to replenish its core equity capital, which is barely above the regulatory minimum of 8%. The stock has plunged 69% this year, reducing its market value to 143 billion rupees ($2 billion).Braich says he has the money for the investment and has provided documentation to Yes Bank’s Chief Executive Officer Ravneet Gill on his ability to pay. Yes Bank didn’t respond to an email seeking comment about Braich and his bid.“I’ve been under the radar,” Braich, 63, said in a phone interview last week. “We have a lot of different holdings and assets that people don’t know about.” The funds will be in escrow by the time Yes Bank shareholders meet this month to approve the capital raising, he added.“I don’t think Mr. Gill is a stupid man,” Braich said, adding “a lot of skepticism will be erased” surrounding his bid.Yet there are plenty of signs from Braich’s past that some skepticism may be warranted. For two decades, he has been mired in dozens of lawsuits with family members, creditors and business associates, according to Canadian and U.S. court records.In one case, he pitched two investors on a plan to buy scrap metal from the Democratic Republic of Congo, telling them he had a multimillion dollar commodity trading business, according to a 2008 lawsuit filed in New York.Congo DealThe investors, Roger and Punit Menda, sued him and four others for defrauding them of $340,000, saying Braich lied about the metal contracts and “did not possess the personal wealth he claimed to and was, in fact, without any personal assets,” according to the filing. Braich failed to respond to the complaint or appear in court, according to a default judgment ordering the money be repaid with interest.Braich called the lawsuit “so stupid and frivolous we didn’t even bother to defend it.” He said he didn’t pay the judgment but might offer to pay the Mendas back because he feels badly they missed out on an opportunity.Robin Phinney, former president of Canadian potash developer Karnalyte Resources Inc., says he met Braich several times in 2015 when Braich said he was ready to fund a roughly C$2 billion ($1.5 billion) mining facility.Braich jumped the gun with a news release that said his group was set to take control of Karnalyte and would make an “immediate equity injection” of nearly C$200 million. The company responded by saying the proposal wasn’t binding and hadn’t been accepted by the board.The deal never happened, and Phinney said Karnalyte was unable to ascertain if Braich had the funding he claimed. “Everything looks wonderful until you have to show up with the check,” he said. “I still don’t know if he had any money or not.”Skeptical AnalystsBraich says he had a binding bid with Karnalyte but “they screwed me” and allowed another investor from Gujarat, India to push him out.Several analysts have expressed skepticism about the potential new investors in Yes Bank. The lender’s shares dropped 18% in the week after the names were announced on Nov. 29, including Braich, SPGP and Citax Holdings Ltd. (Braich says he has no affiliation with Citax.)“We have serious reservations regarding the quality of board of directors who are willing to consider these kinds of investors to be large shareholders,” Suresh Ganapathy, an analyst at Macquarie Capital Securities (India) Pvt., wrote in a note.Braich grew up in Mission, British Columbia, 70 kilometers (44 miles) southeast of Vancouver, the eldest of six children in a Sikh family originally from Punjab in northern India. His father Herman was a pillar of the local Indo-Canadian community who’d left India at the age of 14 -- taking little but the name of his tiny village, Braich -- and built a fortune in British Columbia’s forestry industry. The patriarch died in 1976.Father’s Trustee“The reason I’ve had so much litigation was because I was a trustee for my father’s estate,” said Braich. Those headaches include a 1999 involuntary bankruptcy he said was orchestrated by opponents, including his brother. Bobby Braich, reached by phone, said he’s been estranged from his brother for 20 years and declined to comment further.The bankruptcy remains undischarged with more than C$13 million in total liabilities, according to Canadian bankruptcy records. Braich was arrested and prosecuted after refusing to provide records of his assets or appear in court, the Public Prosecution Service of Canada said in an email.Braich said he always had assets and has repaid his debts with interest. He holds all his wealth in his children’s five trusts, which he controls as sole trustee, to keep them out of the reach of disgruntled family members and unscrupulous lawsuits, he added.He hasn’t owned a home since the 1990s, choosing to live and work out of hotel rooms around the world from Ritz-Carltons to Kempinskis to Travelodges, he said.Right now, it’s the three-star Sandman Hotel in Grande Prairie, Alberta, which Braich said he chose for its in-house Denny’s restaurant. He’s been undergoing dental work ahead of what he says are upcoming TV appearances with Stephen Colbert and Oprah Winfrey.TV Series“A bunch of the major networks want to have me go on a talk show tour,” Braich said by phone, a day after a three-hour, 25-minute stint in the dentist’s chair. “I’m going to get my teeth done so they’re like Chiclets.”Then there’s Netflix and Amazon.com Inc., which want to do a four-season series on him and his father, Braich said.The Oprah Winfrey Network said none of its producers are familiar with his name. CBS Entertainment said it doesn’t comment on Colbert’s bookings. Netflix and Amazon didn’t respond to requests for comment.To support the Yes Bank bid, Braich’s trusts and SPGP have various assets including Black Pearl Investments, a jointly owned Hong Kong company capitalized with about $200 million, he said. The partnership with SPGP is developing everything from retirement villages in the Philippines and Thailand to nitrogen-preserved tea in Sri Lanka through SPGP’s sister company Silverdale Services Ltd., he said.Due DiligenceAs of May, Silverdale Services’s total equity capital was HK$100,000 ($12,800), according to records from Hong Kong’s companies registry. A Hong Kong-registered company named Black Pearl Investments had HK$1 in paid-up capital the last time it filed an annual return in November 2017.SPGP’s CEO Somitra Agrawal, contacted via LinkedIn, referred questions on his firm’s investment plans to Braich.Braich said his rationale for investing in Yes Bank was simple:“I loved the logo and I had my people do the due diligence very deeply,” he said. “If it was called ‘No Bank,’ I wouldn’t have been interested.”

Source link

Read the full article

0 notes

Photo

Trump administration shelves plan to blacklist China's Ant Group

The administration of United States President Donald Trump has put on hold an effort to blacklist Ant Group Co Ltd, the Chinese financial technology company affiliated with e-commerce giant Alibaba, following a phone call between a company executive and a top US government official, four people familiar with the matter said.

Reuters News Agency reported last month that the US Department of State had submitted a proposal to add Ant Group to a trade blacklist in order to deter US investors from taking part in its initial public offering, which was expected to rake in a record $ 37bn before being postponed on Tuesday.

But the Department of Commerce, which oversees the blacklist, shelved the proposal after Alibaba Group Holding Inc President Michael Evans urged Commerce Secretary Wilbur Ross to reject the bid in a phone call, the people said, declining to be named because they were not authorized to speak on the matter.

Three of the people said fears of antagonizing Wall Street before Tuesday's presidential elections and the possibility of a lawsuit helped convince Ross to set the plan aside.

“It could spur legal action or cause a chill in markets,” one of the sources said.

In contrast, the fourth person said Ross was taking into account the fact that Alibaba's platform Taobao is already on the United States Trade Representative's notorious markets list due to concerns it includes some counterfeit goods. That means it already faces US government scrutiny, the person said, stressing that Ross's decision was neither due to the phone call nor market, election or legal concerns.

Ant and the State Department declined to comment. Ross and Evans could not be reached for comment.

Ant is China's dominant mobile payments company, offering loans, payments, insurance and asset management services via mobile apps. It is 33 percent owned by Alibaba and controlled by Alibaba founder Jack Ma.

Inclusion on the trade blacklist, known as the entity list, forces a company's US suppliers to seek special licenses before selling to it. It does not, however, prevent US investors from buying its shares, and its impact on a financial-tech giant like Ant would have likely been largely symbolic.

While Ant's Alipay payment app is currently unavailable for American users, according to a company spokesperson, China hawks in the Trump administration feared it could access sensitive banking data belonging to future US users.

The Trump administration has recently shown some reluctance to flex its muscle against Beijing before Tuesday's election, in which polls show the Republican incumbent trailing Democratic rival Joe Biden by double digits nationally.

In September, the Commerce Department softened a bid by the Defense Department to add China's top chipmaker SMIC to the entity list suppliers, instead instructing the company's US to seek licenses before shipping it certain high-tech items.

With the spread of the coronavirus, which originated in China last year, and Beijing's crackdown on freedoms in Hong Kong, Trump had stepped up actions against Chinese companies like Bytedance, which owns social media app TikTok, earlier this year.

But a move by the Trump administration to ban certain US transactions with the Chinese owners of messaging app WeChat and TikTok has been held up in court.

Investors had largely shrugged off concerns about Ant Group, bidding for a record $ 3 trillion for its shares before China suspended the Ant Group's stock market listing, in a dramatic move that left investors and bankers scrambling for answers.

The Hong Kong leg of the IPO was being sponsored by China International Capital Corp, Citigroup, JPMorgan and Morgan Stanley. Credit Suisse is working as a joint global coordinator. Goldman Sachs is also involved.

. #world Read full article: https://expatimes.com/?p=13296&feed_id=14086

0 notes

Text

Jack Ma’s Ant Group files IPO

In the file for IPO, it says that it made $3.2 billion in first-half profit.

In a document filed on Tuesday, An affiliate of Alibaba, Ant Group has provided the in front of its profoundly foreseen initial public offering (IPO). Alibaba founder Jack Ma is still controlling the financial technology powerhouse. According to the exchange filing, It reported of 21.9 billion Chinese yuan ($3.2 billion) profit on 72.5 billion yuan’s total revenues in the first half of the year.

Ant Group is formerly known as Ant Financial. It is trying to plan a concurrent listing on STAR market or Shanghai stock exchange, a Nasdaq-style tech board as well as the Hong Kong stock exchange. Yet, the company has not unveiled insights regarding the pricing of its shares. However, one expert recently revealed that its market valuation could be north of $200 billion, making it bigger than a portion of America’s greatest banks.