#AmazonSellerGlossary

Text

What is (Amazon)

Sometimes called (AZ) is Abbreviation to name the world's largest e-commerce company, Amazon.

Amazon.com, Inc., is an American multinational technology company based in Seattle, Washington that focuses on e-commerce, cloud computing, and artificial intelligence. Amazon is the largest e-commerce marketplace and cloud computing platform in the world as measured by revenue and market capitalization.

The company was initially a bookseller but has expanded to be responsible to a wide variety of customers' demands like consumer products and digital media in addition to its electronic devices, like the Kindle e-book reader, Kindle Fire tablet and Fire TV, a streaming media adapter.

Read the full article

1 note

·

View note

Text

What is MOQ (Minimum Order Quantity)

The least amount of order which the seller can accept as he/she states on the listing. this subject is mostly negotiable.

MOQ is a supplier's Minimum Order Quantity which is characterized by the minimal amount of components which seller's eager to produce (or market ) at one time. MOQs are most frequently defined by the number of elements presented in a production run, such as ten units or 1000 units, by way of instance, but sometimes MOQs can be described by currencies also, for example, $100 or $1000 of product. MOQ is calculated by every seller independently and is determined by which it costs them to produce each unit. MOQs cover the cost, effort, and energy it takes to generate a production run and ensures that the provider will be able to earn a profit as well.

Minimum order amounts aim to allow sellers to increase their profits while getting rid of more inventory faster and removing the "bargain shoppers" simultaneously. A minimum purchase amount is set depending on seller's overall cost of stock and any other expenses he/she needs to cover before receiving any profit -- which means MOQs help wholesalers stay profitable and maintain wholesome cash flow. Wholesalers don't always favor this way of conducting business, but frequently, wholesalers are forced to sell using MOQs since they're made to purchase a minimum of stock from the manufacturer.

Read the full article

0 notes

Text

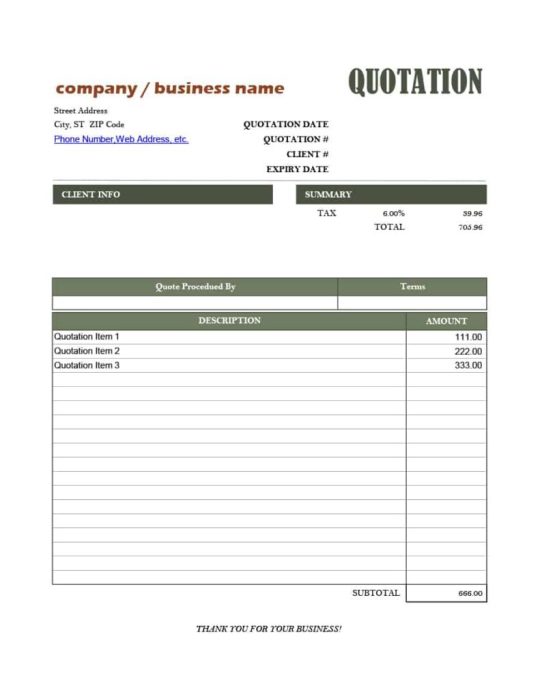

What is (Quotation)

An offer to sell products with specified cost and under a particular condition

A quotation is used to allow a potential customer to understand the price of merchandise or services before they choose to purchase them. When a seller sends a quotation, it engages them to a specific price. That is the reason why quotations are mostly used when prices are relatively stable, and the services/products to be provided can be accurately estimated (labor, cost of raw materials, etc.).

Several items need to be included and considered when planning a quotation for a client. First of all, a quotation should consist of the price that the seller has opted to charge for the service or products that he/she will provide. The seller may also want to specify a time program: i.e., just how long the project will require the seller or how much time it will be until products are delivered. A quotation may also signify a particular time interval for which it is legitimate, e.g., 30 days. Also, a product or service quotation may incorporate clarification of just how many requests for modifications or modifications will affect the price once the project is underway.

Read the full article

0 notes

Text

What is PO (Purchase Order)

The seller sends a document to the customer which contains the agreed terms like approving product order, quantity, shipping cost, etc.

A PO specifies Quantity purchased Product or service being bought Specific brand names, SKUs, or model amounts, Cost per unit, Delivery date, Delivery location, Billing address, Payment provisions, such as on delivery or at 30 days.

A purchase order, or PO, is an official document issued by a customer committing to pay the seller for the sale of particular products or services to be delivered. The customer's advantage to place an order without instant payment. From the seller's standpoint, a PO is a way to provide shoppers credit with no risk, since the customer is responsible for payment once the merchandise or services have been delivered. Every PO has an exceptional number associated with it, which assists both seller and buyer to track payment and delivery. A blanket PO is a devotion to buy services or products on an ongoing basis until a specific maximum is reached.

Read the full article

0 notes

Text

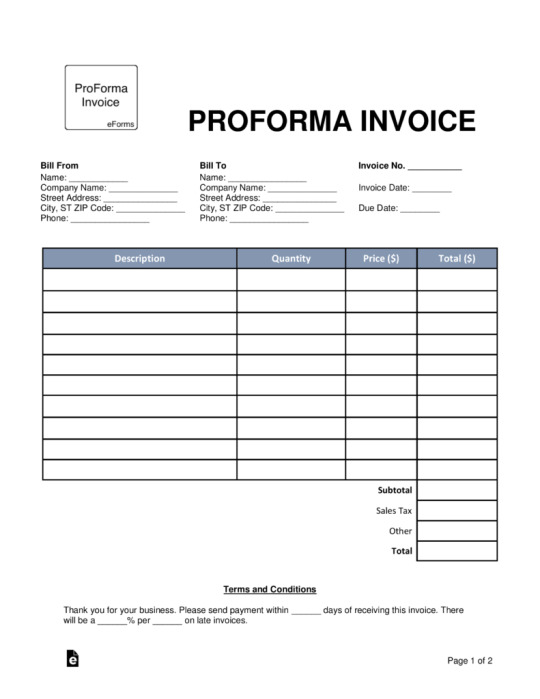

What is PI (Pro forma invoice)

An invoice provided by a seller before the shipment of product, informing the buyer of the types and amounts of products to be shipped, their price, and essential specifications (weight, dimension, etc.).

A proforma invoice is an initial bill of sale delivered to customers in advance of dispatch or delivery of products. The invoice will typically explain the bought items and other relevant details such as the shipping weight and transportation fees. It indicates the type and quantity of products, their price, and other significant information such as weight and transportation fees. They differ from a general statement rather than being a request or demand for payment.

The customer agrees to the indicated cost on the pro forma bill, And then the seller delivers the product. There's no way back after that the seller fulfilled its end of the bargain as it's all agreed up front. Also, There are different advantages to pro forma bills, They're perfect if the seller doesn't have the details for a commercial invoice - for example, before the goods are delivered. As an extension of the pro forma invoices are often sent to announce that the value of products for customs to get a smooth delivery process. They are not a payment demand or request. Pro forma invoices are 'good faith' agreement, so your client is aware of what to expect. Some businesses request proforma statements for their internal purchasing approval process.

Read the full article

0 notes

Text

What is (Unit Price)

The price of an item which the customer will pay and generally it is excluding the shipping cost.

A unit price is a value for one product or its dimension, like a pound, a kilogram, or even a pint, which may be employed to compare the same sort of products offered in varying weights as well as amounts. Multiple pricing is selling two or more of the same item at a price that's lower than the unit cost of one product. The shelf tag indicates the value for your multipack, as well as the unit cost of every can.

The"Unit Price" (or"unit cost") tells you that the cost per liter, per kilogram, per pound, respectively, of what you would like to purchase. Just divide the price by the quantity.

Example: 2 liters for $3,80 is $3,80/2 liters = $1,90 per liter

Read the full article

0 notes

Text

What is VAT (Value Added Tax)

A kind of utilization tax which is placed on a product just as the cost added to the production level and final sale.

A value-added tax (VAT) is a consumption tax placed on a product whenever a value is added at every stage of the supply chain, from manufacturing to the purpose of sale. The amount of VAT that the consumer pays is on the cost of the product, less than the costs of materials used in the product that has already been taxed.

VAT is commonly expressed as a percentage of the total cost. For example, if a product costs $100 and there is a 15% VAT, the consumer pays $115 to the merchant. The merchant keeps $100 and remits $15 to the government.

A general tax that applies, in principle, to all commercial activities involving the production and distribution of products and the supply of services. However, if the annual turnover of this person is under a specific limit (the threshold), which differs based on the Member State, the individual does not need to charge VAT on their earnings. It is not a charge on businesses. It is billed as a percentage of the price, which means that the actual tax burden is evident at each stage in the production and distribution chain.

The tax is assessed and collected at every stage, in contrast to a sales tax, which is just assessed and paid by the consumer at the very end of the distribution chain.

If not applied correctly, VAT might become an extra cost to the organization, and non-compliance with the tax law will cause severe penalties. Therefore a VAT is a sort of double taxation. Besides being a requirement, it also suggests that the majority of the VAT you incurred can be reclaimed and isn't a charge to you. A VAT would offer extra income to cut back the deficit and fund critical programs like health care for American society.

VAT's are indirect taxes, and they're imposed on every region of production. The last consumer pays the VAT. In Russia, VAT has to be registered with the rest of the taxes, as there isn't any individual office to register for VAT only. The VAT isn't perfect, but it could be the most relatively attractive choice readily available to us, in terms of methods to raise badly-needed revenue.

Read the full article

0 notes

Text

What is (Excise Tax)

A domestic tax excised on the production, sale or utilizing a product inside a country which is able to refund once the product is exported.

Excise tax is flat-rate taxation, which applies to specific products, services, and actions. At the U.S., products like alcohol and facilities like indoor tanning are assessed an excise tax, which refers to every unit or occasion despite its cost. Revenue created by excise taxes targets specific requirements in a society often directly about the good or service being taxed.

Excise taxes are a kind of indirect taxation, such as sales taxes, in that they're passed on to the customer at the point of sale. However, sales tax differs from excise tax in that it applies to virtually all products while excise taxes only apply in specific cases. These include Alcohol and tobacco products. Gasoline. Indoor tanning and medical devices, Telephone services, Firearms, etc.

Excise taxes apply to certain merchandise and solutions. The third and fourth explanations for why excise taxes may be used are about the negative implications of the items being taxed. They can be and are made by federal, state and local governments and are not uniform throughout the United States. They are often included in the price of the product. It is paid at the local town office where the owner of the vehicle resides. Because excise taxes are included in the price of the goods you get, it's really hard to understand what you are spending.

No Excise Tax is going to be paid on goods that are exported. An excise tax is often defined as an indirect tax on a solution or service offering that's covered by the person selling the goods in question. Excise taxes finally have come to be an established portion of the overall budget in addition to the source of funds for assorted trusts. It is an annual tax that must be paid prior to registering your vehicle.

Read the full article

0 notes

Text

What is (Free Port)

An area which is usually a port and its suburb which products can be imported duty-free or subject to a low-cost tariff.

A place near a port or airport to which particular products from foreign countries could import without tax payment.

Free trade zone contains an entire port area, for example, Hong Kong, Isla Margarita, Panama, and Singapore, where an imported product may be stored pending duty-free, re-export or even duty-paid entrance into the importing country.

Read the full article

0 notes

Text

What is GATT (General Agreement on Tariffs and Trade)

The General Agreements on Tariffs and Trade is a multilateral trade deal among authorities, including obligations and rights. The rules set out in the Arrangement develop a code which the parties to the Agreement have agreed upon to rule their trading associations.

The General Agreement on Tariffs and Trade was a free trade arrangement between 23 nations that dropped tariffs and increased global trade. It was the first worldwide multilateral free trade agreement. It had been in effect from January 1, 1948, until January 1, 1995. It ended when the more robust World Trade Organization replaced it.

Read the full article

0 notes

Text

What is (Import License)

to import products in any country, there will be a need for some documents which are issued and approved by the country's government's officials, this type of documents are called Importing license.

Import licensing is defined as administrative procedures demanding the submission of an application or other documentation (other than the one which is required for customs purposes) to the relevant governmental body as a prior condition for the importation of goods.

Read the full article

0 notes

Text

What is (Export)

sending or shipping any type of products and stuff to abroad and overseas countries.

An export is a part of global trade whereby products produced in one nation are sent to a different country for future business or sale. Exports are an essential part of a nation's economy since the selling of these products increases the producing country's gross output.

Read the full article

0 notes

Text

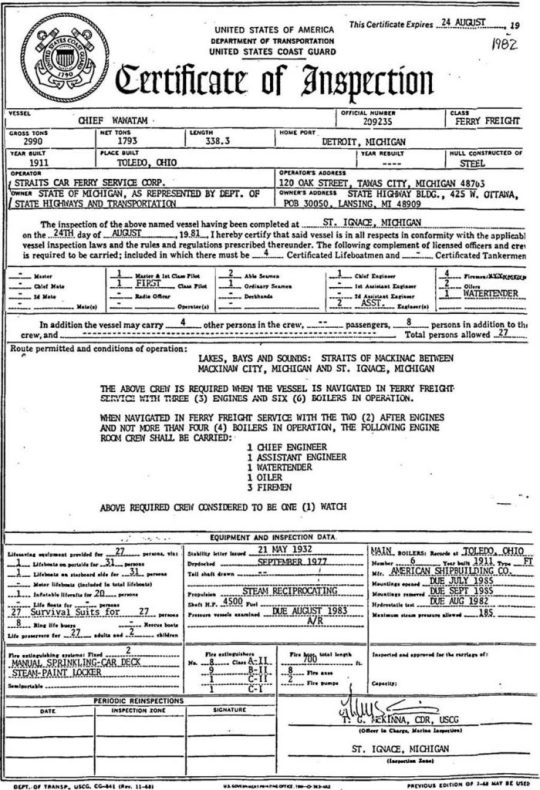

What is (Certificate of inspection)

A document which proves the good condition of the product just until its shipping.

Inspection certificate, sometimes called as the certificate of inspection or pre-shipment inspection certification, is a commerce deed utilized in global trade transactions, issued commonly by an independent inspection firm after conducting a detailed inspection, certifying whether the products are in question conform with the specs stated on the sales contract.

Companies specializing in the inspection of products at ports like the Swiss SGS or even the French Bureau Veritas have offices in the main exporting countries. Additionally, some companies specialize in inspections in certain countries like Asia Inspection in China and other Asian nations.

Read the full article

0 notes

Text

What is DDU (Delivered Duty Unpaid)

This indicates the evolution of "door-to-door" courier contracts or carriage where the customer pays the destination customs duty and taxes (if any).

Delivered Duty Unpaid is a global trade term suggesting that the seller is responsible for creating a safe delivery of products to a destination, paying transportation costs, and considering all risks during transport. Once the products arrive in the agreed-upon place, the customer becomes responsible for paying import duties, as well as further transport costs.

Delivered Duty Unpaid (DDU) was not contained in the latest (2010) edition of the International Chamber of Commerce's Incoterms. However, it's still utilized in the global trade language. The official term which best describes the use of DDU is now Delivered at Position (DAP). On paper, the term is followed by the location of delivery; for example, "DDU: Port of Miami."

Read the full article

0 notes

Text

What is (Export Broker)

A person or a company which brings both the exporter and importer together for a price, and then draws back from their business. meaning that he/she will not join the trade between two sides.

An export broker (agent) is a person or a company accountable for linking the gap between the purchaser and the seller. It acts as a middleman between the company that has products intended for export as well as the foreign company which wants to import that item.

Read the full article

0 notes

Text

What is (Handling Charges)

a fee added on top of the product price, taxes, and shipping costs at checkout.

A handling fee is an amount billed to a purchaser in addition to the order subtotal and transport charges — for example, warehouse storage price, dispatch cost, and packaging price. Handling fees are billed once per purchase but not to every product in an order.

x hourly rate.

Read the full article

0 notes