#Analyzing Bitcoin price action

Text

Bitcoin Rainbow Chart Explained: Navigating Bitcoin's Price Trends

In today’s post, we’ll deeply dive into the Bitcoin Rainbow Chart.

Now, you might wonder: What does a rainbow do with Bitcoin?

Like other technical indicators, it’s a powerful tool for understanding Bitcoin’s long-term price trends.

Still feeling a bit lost?

Don’t worry! After reading this post, you’ll clearly understand the Bitcoin Rainbow Chart and how to use it.

So, buckle up – you won’t…

View On WordPress

0 notes

Text

https://cryptotale.org/bitcoin-stabilizes-at-60000-market-eyes-upcoming-cpi-data/

Title: Bitcoin Stabilizes at $60,000 as Market Eyes Upcoming CPI Data

Bitcoin, the leading cryptocurrency, has found stability around the $60,000 mark, with market participants closely monitoring upcoming Consumer Price Index (CPI) data for potential market impacts.

The $60,000 level has served as a key psychological and technical support level for Bitcoin, with the cryptocurrency demonstrating resilience in the face of recent market volatility. Traders and investors are observing Bitcoin's price action for clues about market sentiment and direction.

The upcoming release of CPI data is of particular interest to the market, as it provides insights into inflation trends and economic conditions. Inflation concerns have been a focal point for investors, and the CPI data release could influence market expectations and investor sentiment.

Bitcoin's ability to stabilize around $60,000 amid market uncertainties highlights its status as a store of value and a hedge against inflation. The cryptocurrency's price movements are closely linked to broader market dynamics, economic indicators, and geopolitical developments.

Market participants are analyzing technical indicators, support and resistance levels, and market sentiment to assess Bitcoin's short-term and long-term outlook. The stability around $60,000 is seen as a positive sign by many, signaling potential for further price appreciation.

As the market awaits the CPI data release and monitors Bitcoin's price action, traders and investors remain vigilant, adjusting their strategies based on evolving market conditions and economic fundamentals. Bitcoin's resilience and stability in the face of market events underscore its role as a significant asset class within the global financial landscape.

0 notes

Text

Bitcoin is on the rise again, with many traders speculating whether it is poised for a major price surge. Analysts on TradingView are discussing the potential for BTC to increase by 15 times its current value. Stay tuned for expert insights and Market updates on the latest cryptocurrency trends.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Bitcoin is experiencing a period of sideways movement, with prices remaining relatively stagnant and participation levels decreasing. Despite this lackluster performance and concerns of further declines, one analyst has shared data indicating that long-term holders are accumulating Bitcoin at current levels.

The analyst highlighted the increasing pace of accumulation among long-term holders, a trend reminiscent of the period preceding the remarkable bull run in 2021. This uptick in accumulation suggests a potential rally in the near future, with Bitcoin currently trading above $60,000, marking a 10% increase from the lows in May 2024.

By analyzing Unspent Transaction Outputs (UTXOs), the analyst categorized holders into long-term and short-term groups based on the age of their holdings. Typically, UTXOs older than 155 days are considered to be held by long-term holders, while those held for less than 155 days belong to short-term holders or traders seeking to capitalize on price fluctuations.

In 2021, when long-term holders refrained from selling their Bitcoin, prices surged significantly, reaching around $70,000 by November and representing a nearly 1,500% increase from the lows in 2020. Whether Bitcoin is poised for another substantial surge remains uncertain, with the potential for prices to exceed $700,000 in the future.

While on-chain data suggests a bullish outlook, some analysts advise caution. Bitcoin has strong support around the $60,000 level, with the potential for stabilization if bulls defend against further downward pressure. However, a breach below $60,000 could trigger a decline to the $52,000 to $55,000 range.

Despite short-term volatility, adopting a long-term perspective and accumulating Bitcoin at current levels could prove to be a successful strategy, as indicated by the ongoing accumulation by long-term holders. It is essential for investors to monitor price action closely, as recent movements have shown signs of potential demand despite the current consolidation around $66,000.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. Can BTC potentially increase by 15 times?

- Yes, there is a possibility that BTC could increase by 15 times based on Market trends and speculation.

2. What factors could contribute to a 15X increase in BTC?

- Factors such as increased adoption, positive regulatory developments, and institutional investment could contribute to a significant rise in BTC value.

3. Is it a good time to invest in BTC for a potential 15X return?

- Investing in BTC for a 15X return is considered a high-risk, high-reward strategy. It's important to do thorough research and consider your risk tolerance before investing.

4. Should I buy BTC now if I believe it will increase by 15 times?

- It's difficult to predict the future price movement of BTC. It's important to consider the risks and potential rewards before making any investment decisions.

5. Are there any potential challenges or obstacles that could prevent BTC from achieving a 15X increase?

- External factors such as Market volatility, regulatory changes, and competition from other cryptocurrencies could pose challenges to BTC reaching a 15X increase.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

0 notes

Text

Revamping Your B2B Strategy: The Power of Bitcoin and AI Transformation

The Synergy of Bitcoin and AI in B2B Marketplaces

While blockchain technology, which powers bitcoin, and artificial intelligence may appear to be opposing forces, their three essential components-automation, augmentation, and authenticity—indicate a powerful synergy for optimizing B2B processes. This combined approach is transforming operations due to several factors:[GU1] [SB2]

1. Authenticity and Security

Transactions on the bitcoin network are permanent and publicly recorded, eliminating the possibility of tampering with invoices and other B2B documents, which makes it a perfect platform for safe transactions and data storage because of its decentralized nature, which improves data trust and security. AI can be further enhanced by analyzing data patterns and identifying potential fraud attempts in the systems.

2. Augmentation and Data Analysis

AI can be integrated with smart contracts, which are self-executing systems on Bitcoin. Here, AI can analyze data and activate specific actions in the contract automatically, thereby streamlining the B2B processes against manual human intervention.

3. Invoice Processing and Payment Automation

Bitcoin’s AI-powered B2B Applications

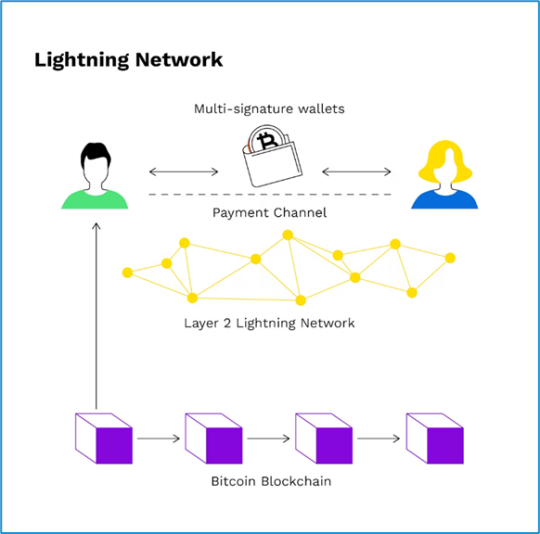

The Bitcoin blockchain, revolutionary but limited in handling high volume transactions, is complemented by the Lightning Network, a secondary layer that facilitates rapid and cost-effective micropayments between users. This network acts as a channel for direct transactions, bypassing the main blockchain’s congestion. Transactions are periodically settled on the blockchain, paving the way for AI applications in the B2B world.

The Lightning Network is completely changing how AI is developed and implemented in business-to-business settings. This cutting-edge technology enables the following significant advantages:[GU3] [SB4]

1. Democratizing AI Development

It is well known that training sophisticated AI models is highly costly. Through the Lightning Network, businesses may work together and split costs by making micropayments in Bitcoin. Due to the removal of financial obstacles, smaller businesses can now access cutting-edge AI development.

2. Effective Fine-Tuning

To keep current AI models functioning well, fine-tuning is essential. The Lightning Network makes it possible for people all around the world to take part in this process. By utilizing the extensive reach of the platform, they can obtain micropayments in Bitcoin for every task accomplished.

3. High-Speed Transactions

The Lightning Network offers almost instantaneous transaction speeds, which are essential for AI systems that interact and exchange data in real-time. Conventional blockchains are unable to keep up with this velocity. For smooth AI interactions in B2B applications, the Lightning Network proves to be the best platform.

4. Pay-Per-Use strategy

B2B applications may fully realize the potential of AI in a manner that is more cost-effective, productive, and collaborative by utilizing the Lightning Network. This opens the door for ground-breaking developments in several B2B industries.

Optimizing B2B processes with AI and Bitcoin

In this era of cutting-edge technology, artificial intelligence has emerged as a powerful ally to help traders swiftly and effectively understand complex markets.

Given the extreme volatility, quick price swings, and massive volume of data generated every day that characterize Bitcoin, artificial intelligence is particularly adept at analyzing enormous datasets rapidly and spotting patterns that human analysts might miss. In the fast-paced world of digital assets, using these characteristics gives traders the ability to make smarter decisions and gain an edge over their competitors.

Using AI to improve Bitcoin transactions for businesses is a big step forward in the dynamic field of B2B strategy transformation. The incorporation of AI seeks to improve bitcoin trading through:

Automated Trading

One of the most significant benefits of AI is automated analysis, where AI systems can swiftly process vast amounts of data. This capability allows them to uncover trends, correlations, and anomalies that human traders might overlook, furthermore providing a competitive edge over other competitors. The AI’s ability to provide real-time insights is invaluable in the fast-paced world of bitcoin trading. This speed is crucial in the volatile crypto market, where prices can fluctuate dramatically in a short period. These findings are incorporated into complex algorithms that power lightning-fast trading bots, enabling accurate execution. This AI-driven team reduces human mistakes and brings in a new era of efficient B2B cryptocurrency trading.

Predictive analytics

It is yet another significant benefit of AI in cryptocurrency trading. These algorithms forecast future prices by evaluating historical performance; this helps traders predict market moves and modify their strategies accordingly. This kind of insight is crucial for maximizing gains and reducing costs.

Though this highlights a drawback where AI would not be able to forecast abrupt market swings, the usefulness of AI in cryptocurrency trading is dependent on the quality of the data it is trained on. This emphasizes how crucial it is to choose the best AI trading platform. AI trading platforms should be chosen after considering aspects like advanced trading tools’ availability, safety, dependability, and user-friendliness.

Takeaways

The number of B2B transactions conducted online is increasing, and the use of AI and Bitcoin in B2B strategies is growing.

With fraud-fighting AI and tamper-proof Bitcoin, optimizing B2B processes has never been more secure.

Streamline B2B operations with AI-powered contracts and lightning-fast Bitcoin payments.

Unleash the power of data as large Bitcoin datasets are analyzed by AI to make better B2B decisions.

Conclusion

Bitcoin and AI together are changing business-to-business (B2B) strategy by providing efficiency, security, and data-driven insights. Companies that use bitcoin’s AI-powered B2B applications get a strategic and forecasting advantage, establishing themselves as leaders in the rapidly changing technology sector.

To stay ahead of the B2B industry, embrace AI and Bitcoin. Give your team the skills they need to succeed in the B2B market by future proofing them with AI Certs Bitcoin + Executive Certification.

1 note

·

View note

Text

Can Ethereum (ETH) Outshine Bitcoin (BTC) in May? These Analysts Weigh In

As the crypto market continues to navigate its intricate patterns, the rivalry between Ethereum (ETH) and Bitcoin (BTC) remains a focal point for traders and investors alike.

Recent analysis suggests a power struggle between Ethereum and Bitcoin in the coming month. Can ETH regain its bullish price action against BTC in May?

Analyzing ETH/BTC: Traders’ Insights on Crypto Price Trends

Ethereum…

View On WordPress

0 notes

Text

Deciphering Cryptocurrency's Momentum: An Intriguing Exploration

I. Introduction

Cryptocurrency, a digital or virtual form of currency secured by cryptography, has surged into the spotlight in recent years. Understanding its momentum is crucial for both seasoned investors and newcomers alike.

A. Defining Cryptocurrency

Cryptocurrency refers to a digital or virtual currency that uses cryptography for security and operates independently of a central bank.

B. Importance of Understanding Cryptocurrency's Momentum

Understanding the momentum of cryptocurrency is essential for investors to make informed decisions and navigate the volatile market effectively.

II. Historical Context of Cryptocurrency

A. Emergence of Bitcoin

Bitcoin, the first cryptocurrency, was introduced in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto.

B. Evolution of Altcoins

Following the success of Bitcoin, numerous alternative cryptocurrencies, or altcoins, have been developed, each with its unique features and purposes.

C. Major Milestones in Cryptocurrency Development

Over the years, cryptocurrencies have reached significant milestones, including mainstream adoption, regulatory recognition, and technological advancements.

III. Factors Influencing Cryptocurrency's Momentum

A. Market Demand and Supply Dynamics

The demand and supply dynamics of cryptocurrency play a crucial role in determining its momentum, with factors such as scarcity and utility driving price movements.

B. Technological Innovations and Upgrades

Technological innovations and upgrades, such as scalability solutions and improved security protocols, can significantly impact the momentum of cryptocurrencies.

C. Regulatory Environment

Regulatory developments and government policies regarding cryptocurrencies can influence investor sentiment and market dynamics.

D. Investor Sentiment and Speculation

Investor sentiment and speculation can drive short-term fluctuations in cryptocurrency prices, often leading to rapid momentum shifts.

Ready to elevate your crypto investments? Click here to explore this cutting-edge solution and unlock revolutionary features, setting yourself up for maximum profit potential starting today!

IV. Analyzing Cryptocurrency's Market Trends

A. Price Volatility and Fluctuations

Cryptocurrency markets are known for their high volatility, with prices often experiencing rapid fluctuations within short periods.

B. Trading Volume and Liquidity

Trading volume and liquidity are essential indicators of market health and can provide insights into the momentum of cryptocurrencies.

C. Market Capitalization and Dominance

Market capitalization and dominance metrics help assess the relative strength and influence of individual cryptocurrencies within the broader market.

V. Impact of External Events on Cryptocurrency's Momentum

A. Global Economic Conditions

Global economic conditions, such as inflation, interest rates, and geopolitical tensions, can influence investor behavior and, consequently, cryptocurrency momentum.

B. Geopolitical Tensions

Geopolitical tensions and regulatory actions by governments can have a significant impact on cryptocurrency markets, leading to sudden shifts in momentum.

C. Technological Advancements

Technological advancements, both within the cryptocurrency space and in related fields such as blockchain technology, can drive long-term momentum shifts.

VI. Understanding Cryptocurrency's Adoption and Acceptance

A. Merchant Adoption

Increased merchant adoption of cryptocurrencies as a form of payment can contribute to its mainstream acceptance and long-term momentum.

B. Institutional Investment

Institutional investment in cryptocurrencies, such as hedge funds and asset managers, can provide significant momentum and legitimacy to the market.

C. Regulatory Clarity and Compliance

Clarity and consistency in regulatory frameworks are essential for fostering trust and confidence among investors, thus positively impacting cryptocurrency momentum.

VII. Deciphering Cryptocurrency's Community and Ecosystem

A. Developer Community

The vibrant developer community behind various cryptocurrency projects plays a crucial role in driving innovation and sustaining momentum.

B. Decentralized Finance (DeFi) Ecosystem

The burgeoning DeFi ecosystem, built on blockchain technology, is reshaping traditional financial systems and driving significant momentum in the cryptocurrency space.

C. Social Media Influence and Community Engagement

Social media platforms and online communities have a significant influence on cryptocurrency sentiment and can drive short-term momentum shifts.

Ready to elevate your crypto investments? Click here to explore this cutting-edge solution and unlock revolutionary features, setting yourself up for maximum profit potential starting today!

VIII. Case Studies of Cryptocurrency's Momentum Shifts

A. Bitcoin Halving Events

Bitcoin halving events, which occur approximately every four years, have historically led to significant momentum shifts and price surges.

B. Ethereum's Upgrade to Ethereum 2.0

Ethereum's transition to Ethereum 2.0, a major upgrade aimed at improving scalability and security, has generated considerable momentum and anticipation within the cryptocurrency community.

C. Regulatory Changes in Major Economies

Regulatory changes in major economies, such as China's crackdown on cryptocurrency mining, can have far-reaching implications for cryptocurrency momentum.

IX. Strategies for Navigating Cryptocurrency's Momentum

A. Long-Term Investment Approach

Adopting a long-term investment approach can help investors navigate the volatility of cryptocurrency markets and capitalize on long-term momentum trends.

B. Risk Management Techniques

Implementing risk management techniques, such as diversification and portfolio rebalancing, can help mitigate the impact of short-term momentum shifts.

C. Staying Informed and Educated

Staying informed about market developments and educated about the underlying technology and fundamentals of cryptocurrencies is essential for making informed investment decisions.

X. Future Outlook for Cryptocurrency's Momentum

A. Potential Challenges and Opportunities

Cryptocurrency faces both challenges and opportunities in the future, including regulatory uncertainty, technological advancements, and evolving market dynamics.

B. Role of Emerging Technologies

Emerging technologies such as blockchain scalability

solutions and interoperability protocols could drive significant momentum in the cryptocurrency space.

C. Evolution of Regulatory Landscape

The evolution of the regulatory landscape will play a crucial role in shaping cryptocurrency momentum in the future, with clear and favorable regulations likely to drive increased adoption and investment.

XI. Conclusion

In conclusion, deciphering cryptocurrency's momentum requires a comprehensive understanding of its underlying factors and dynamics. By analyzing market trends, external events, and the broader ecosystem, investors can make informed decisions and navigate the evolving cryptocurrency landscape with confidence. Stay informed, stay educated, and stay ahead of the curve to capitalize on the exciting opportunities that cryptocurrency has to offer.

Ready to elevate your crypto investments? Click here to explore this cutting-edge solution and unlock revolutionary features, setting yourself up for maximum profit potential starting today!

Disclaimer: This article contains an affiliate link to a top-tier product, which may generate profits for me

#Cryptocurrency#Bitcoin#Blockchain#CryptoTrading#DigitalCurrency#Investing#Altcoins#Finance#BlockchainTechnology#Decentralization#CryptocurrencyNews#Ethereum#TradingTips#CryptoInvesting#CryptoCommunity#Tokenomics#CryptoEducation#CryptoTechnology#SmartContracts#CryptoWallets

0 notes

Text

Analyzing Bitcoin charts, we notice that the price action is positioned below the Ichimoku Cloud, indicating a bearish market environment.

0 notes

Text

XRP's emergence with bullish patterns against Bitcoin has sparked intriguing discussions within the cryptocurrency community. With XRP historically known for its correlation with Bitcoin's movements, the revelation of bullish patterns against Bitcoin is prompting traders and investors to reassess their positions.

Discussions delve into the technical analysis behind XRP's bullish patterns, examining factors such as price action, volume, and key support and resistance levels. Community members analyze the potential implications for XRP's price trajectory and its ability to outperform Bitcoin in the short and long term.

As traders adjust their strategies based on XRP's newfound bullish momentum, debates ensue about the broader market dynamics and the significance of XRP's performance against Bitcoin for the cryptocurrency ecosystem. The emergence of bullish patterns for XRP against Bitcoin underscores the dynamic nature of cryptocurrency markets and the importance of staying informed to capitalize on emerging opportunities.

0 notes

Text

The Insider's Dilemma: Do You Really Require Crypto News to Succeed in Investing?

In the quickly-paced globe of cryptocurrency investing, the inflow of crypto news is like a double-edged sword. On one hand, keeping educated about the latest developments in the marketplace can give worthwhile insights that could possibly support traders make far better decisions. From Bitcoin updates to the fluctuating traits in electronic currencies, possessing obtain to well timed info is undeniably crucial for those navigating the risky waters of the crypto place.

Nonetheless, the sheer quantity and occasionally conflicting nature of crypto news can also pose a dilemma for buyers. With headlines continually vying for interest and sensational stories dominating the narrative, it can be difficult to individual the sign from the noise. The concern then occurs: do you genuinely require to immerse by yourself in the sea of crypto information in purchase to be successful in investing, or is there a much more discerning approach that can produce much better final results?

The Part of Crypto Information in Investment Good results

When it comes to investing in the volatile planet of cryptocurrency, being educated about the most current developments and trends can give worthwhile insights that may possibly impact your expenditure selections. Crypto news serves as a crucial resource of info for traders, supplying updates on market movements, regulatory adjustments, technological breakthroughs, and other elements that can influence the value of electronic assets.

Maintaining abreast of cryptocurrency information can support buyers anticipate likely price tag fluctuations and make educated conclusions about when to acquire or market their property. By keeping educated about market circumstances and emerging developments, buyers can much better assess the danger and reward of different expense options, in the long run leading to more strategic and profitable expense results.

Additionally, in the rapidly-paced and continually evolving crypto market place, having obtain to well timed and accurate information can give traders a competitive edge. By understanding the factors driving price tag movements and market place sentiment, investors can place on their own to capitalize on expenditure opportunities and navigate the risks connected with investing in digital currencies effectively.

Analyzing the Effect of Cryptocurrency News on Marketplace Movements

When it comes to the entire world of cryptocurrency, being knowledgeable about the most recent information and developments is usually noticed as essential for making informed expense selections. Traders and traders intently monitor crypto news for any updates that could probably drive marketplace movements, no matter whether it really is a new regulatory announcement or a main technological breakthrough.

Cryptocurrency news has the electrical power to impact marketplace sentiment, foremost to fast cost fluctuations in digital belongings these kinds of as Bitcoin. Positive news like partnerships with recognized organizations or advancements in blockchain technological innovation can bring about purchasing frenzies, driving charges upward. Conversely, negative information this sort of as protection breaches or regulatory crackdowns can direct to panic promoting and sharp declines in cryptocurrency rates.

However, it really is essential to observe that not all news is produced equal in conditions of its effect on market actions. Traders require to exercise warning and critical thinking when digesting crypto news, as the market place can at times overreact to sensational headlines or rumors. Distinguishing in between sounds and beneficial insights in the quickly-paced planet of cryptocurrency information is essential for making rational expenditure conclusions.

Techniques for Being Knowledgeable in the Crypto Area

Initial, consider subscribing to reliable crypto news internet sites or newsletters to obtain typical updates on market place tendencies, new regulations, and technological developments. These platforms can support you stay knowledgeable with no having to actively seek out data.

2nd, join on-line communities and message boards dedicated to cryptocurrency discussions. Partaking with other traders and fans can supply worthwhile insights and different views on the most current information and activities in the crypto place.

And lastly, stick to essential influencers and professionals in the crypto industry on social media platforms like Twitter and LinkedIn. By following thought leaders in the area, you can acquire access to actual-time updates and specialist opinions on crucial developments in the industry.

#cryptocurrency news#memecoins news#crypto currency news#crypto news#NFTs news#ethereum news#cryptonews#crypto news today#bitcoin news#blockchain news

0 notes

Text

Backtesting Bitcoin Strategies on TradingView

The ever-evolving landscape of the cryptocurrency market presents both immense potential and inherent challenges. For Bitcoin (BTC) traders, crafting effective trading strategies requires a meticulous approach that goes beyond intuition. Backtesting emerges as a crucial tool in this process, allowing traders to assess the historical performance of their strategies using past market data. This article delves into how TradingView empowers you to backtest your Bitcoin trading strategies, enabling you to:

Evaluate Strategy Performance: Gain valuable insights into the potential profitability and risk associated with your trading ideas.

Refine and Optimize: Identify areas for improvement and optimize your strategy parameters based on historical results.

Boost Confidence: Approach live trading with a data-driven understanding of your strategy's effectiveness.

Understanding Backtesting

Backtesting simulates how your trading strategy would have performed in past market conditions. By applying your entry and exit rules to historical Bitcoin price data, you can analyze factors like:

Profitability: Assess the potential returns your strategy could have generated.

Drawdown: Evaluate the maximum peak-to-trough decline experienced during historical simulations.

Win Rate: Measure the percentage of successful trades your strategy would have executed.

Backtesting with TradingView

TradingView offers a user-friendly platform specifically designed for backtesting trading strategies. Here's a step-by-step guide:

Develop Your Strategy: Define your entry and exit rules based on technical indicators, price action patterns, or a combination of both.

Pine Script Integration: Code your strategy using TradingView's Pine Script, a powerful programming language specifically designed for developing trading strategies. Pine Script allows you to define entry/exit conditions, position sizing, and other essential elements of your strategy.

Historical Data Selection: Choose the desired timeframe for backtesting. TradingView provides access to extensive historical Bitcoin price data.

Optimization (Optional): Refine your strategy parameters (e.g., moving average periods, indicator settings) based on backtesting results to potentially improve performance.

TradingView Advantages

Visual Representation: TradingView offers a user-friendly interface that visually displays your backtested trades directly on the Bitcoin price chart. This allows you to easily identify successful and unsuccessful trades and understand the rationale behind each execution.

Strategy Optimization: TradingView provides built-in optimization tools that enable you to automatically test different combinations of strategy parameters and identify the settings that potentially yield the best historical performance.

Multiple Timeframes: Backtest your strategy across various timeframes (e.g., hourly, daily, weekly) to assess its effectiveness in different market conditions.

Beyond Backtesting: Additional Considerations

While backtesting offers valuable insights, it's crucial to acknowledge its limitations:

Historical Accuracy: Past performance is not a guarantee of future results. Market conditions can evolve significantly, and strategies that performed well historically may not replicate the same success in the future.

Overfitting: Optimizing your strategy solely based on backtesting results can lead to overfitting, where the strategy performs well on historical data but fails to adapt to new market dynamics.

FastBull Integration: A Multifaceted Approach

TradingView integrates with services like FastBull, providing additional layers of analysis to complement your backtested strategies.

FastBull offers:

Real-time News Sentiment Analysis: Gauge the overall market sentiment surrounding Bitcoin by analyzing the tone of news articles and social media discussions.

Identifying Potential Catalysts: Correlate news events and social media trends with historical price movements to understand how external factors may have influenced past market behavior.

By incorporating FastBull's insights alongside backtesting results on TradingView, you gain a more comprehensive understanding of the factors that potentially influence Bitcoin price movements. This can aid you in:

Identifying Potential Market Shifts: Anticipate how future news events or social media trends might impact the Bitcoin market.

Refine Risk Management: Adjust your risk management strategies based on the potential volatility associated with upcoming news or social media events.

Remember: Backtesting serves as a valuable tool for evaluating and refining your Bitcoin trading strategies. However, it should be combined with other forms of market analysis, including fundamental analysis and a deep understanding of the ever-evolving cryptocurrency landscape.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

0 notes

Text

Bitcoin and Ethereum have seen significant price fluctuations recently, presenting traders with potential profitable opportunities. By analyzing the Market trends, experts have identified two key levels where a swing trade could yield substantial gains. Stay updated on the latest developments in the cryptocurrency Market to make informed investment decisions.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Bitcoin and Ethereum are both facing interesting times in the Market this week. Ethereum seems to have a slightly more bullish outlook compared to Bitcoin. Traders have been experiencing a tough period with Bitcoin, as the consolidation phase continues. There is a growing possibility of a revisit to $60k for Bitcoin.

The Market sentiment over the weekend was explored by AMBCrypto, shedding light on where the price action for this week might go. Speculators are looking forward to bullish returns in the near term for one of these cryptocurrencies.

Bitcoin's Open Interest saw an increase on the 10th of May but has been trending downward since the price spike on the 6th of May. The price has been forming lower highs, descending from $64k to $61.1k. The Funding Rate for Bitcoin has fluctuated, indicating that the sentiment is not strongly bullish.

On the other hand, Ethereum also saw Funding Rates slip into negative territory in early May but has since recovered. The past week saw a slight bounce in price, which led to a jump in Open Interest and funding rate. Speculators seem more inclined to long ETH compared to BTC.

The next liquidity pockets that could attract prices are a point of interest for traders. Bitcoin's liquidation heatmap shows a cluster at the $60k area, with bullish targets at $61.8k and $63k. Traders might want to buy the dip to the $50.6k-$60k region and set stop-losses accordingly.

Similarly, Ethereum has liquidity nearby at $2950, with an attractive target at the $3.1k-$3.2k area. A drop below $2.8k could signal a strong short-term downtrend for Ethereum.

In conclusion, the Market is poised for interesting moves this week, with traders closely monitoring the price action of both Bitcoin and Ethereum. Stay tuned for more updates on the cryptocurrency Market trends.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. What is swing trading in the context of Bitcoin and Ethereum?

Swing trading involves buying and selling assets like Bitcoin or Ethereum within short-term price swings to profit from price fluctuations.

2. What are the two levels where a swing trade could be profitable for Bitcoin and Ethereum?

Swing trades can be profitable at both support and resistance levels, where the price tends to bounce or reverse direction.

3. How can I identify support and resistance levels for swing trading Bitcoin and Ethereum?

Support levels are where the price tends to stop falling and bounce back up, while resistance levels are where the price tends to stop rising and reverse. You can use technical analysis tools like trend lines or moving averages to identify these levels.

4. What should I consider before making a swing trade in Bitcoin or Ethereum?

Before making a swing trade, consider factors like Market trends, price momentum, and upcoming news events that could impact the price of Bitcoin or Ethereum.

5. Is swing trading suitable for beginners in the cryptocurrency Market?

Swing trading can be suitable for beginners as long as they understand the risks involved and have a solid trading strategy in place. It's important to start with small trades and gradually increase your investment as you gain experience.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

0 notes

Text

Emerging Altcoins to Watch: ANKR, RAY, and MASK

While Bitcoin (BTC) and several popular altcoins have been experiencing impressive growth in recent weeks, some lesser-known coins have also formed bullish patterns, potentially paving the way for significant profits. BeInCrypto's editorial team has analyzed three altcoins that could pleasantly surprise investors in March.

ANKR: Breaking Long-Term Resistance ANKR's price has been under a descending trendline since May 2022. Despite three attempts to break above it, each resulted in long upper wicks, indicating seller pressure. However, in February 2024, ANKR began an upward movement and solidified above the 644-day resistance. The weekly Relative Strength Index (RSI) confirmed the breakout by rising above 50. If the uptrend continues, ANKR could grow by another 30% and reach resistance around $0.050. Failure to sustain the rally could lead to a 30% drop to the descending resistance line at $0.027.

RAY: Breakout and Retest RAY has been rising since October 2023. Although its price corrected after reaching a peak of $1.99 in December, last week, RAY rebounded from the horizontal support area at $1 and broke above a short-term descending resistance line. The RSI remains above 50 and appears to have regained strength this week. If RAY successfully closes the week above the descending resistance, it could surge by 200% to the next resistance at $3.70. Conversely, closing below $1 would invalidate the breakout and trigger a 70% drop to $0.35.

MASK: Gaining Momentum MASK has been under descending resistance since August 2021. However, in early 2024, it began an upward movement and broke the trendline last week. If the bullish momentum continues, the altcoin's price could rise by another 50% and reach the next resistance at $7. Despite the bullish forecast, failure to sustain the achieved growth could lead to a 23% drop to the descending resistance line at $3.60.

Disclaimer: All information provided is for general informational purposes only. Readers are solely responsible for any actions taken based on the information presented.

Read the full article

#Binance#Bitcoin#Cryptocurrency#CryptocurrencyMarket#Ethereum#MarketCapitalization#Solana#TechnicalAnalysis

0 notes

Text

Analyzing Bitcoin's Trajectory: Key Market Indicators Hint at a Possible Correction

Bitcoin has recently achieved a historic breakthrough by closing a weekly candle above the .618 Fibonacci retracement level, marking a significant moment in its price trajectory. Matthew Hyland, a well-known figure in the blockchain space, highlights this accomplishment, emphasizing the resilience and growth potential exhibited by BTC.

At the current juncture, Bitcoin is valued at $52,044.40, accompanied by a 24-hour trading volume of $18.2 billion, showcasing a modest 0.82% increase over the past 24 hours. However, a closer examination of market indicators unveils potential nuances in Bitcoin's short-term prospects.

The 4-hour Relative Strength Index (RSI) sits at 58.20, indicating proximity to overbought conditions. This signals the possibility of an impending correction as selling pressure looms on the horizon. Bollinger bands on the 4-hour chart further emphasize the current market conditions, with upper and lower bands at 52,422 and 51,226, respectively. This suggests a period of constrained trading, setting the stage for a potential breakout.

A slight bearish divergence in the 4-hour chart compared to price action adds another layer of caution for traders and investors. However, it is imperative to recognize that short-term fluctuations are inherent in the cryptocurrency market, and relying solely on a single indicator may not provide a comprehensive view.

Looking beyond the immediate market indicators, Bitcoin's long-term outlook remains optimistic. The recent achievement of closing above the .618 Fibonacci retracement level attests to the strength of Bitcoin's bull run and its ability to surmount significant resistance levels.

Despite the potential for short-term corrections, Bitcoin's upward trajectory is supported by factors such as increasing adoption, growing institutional interest, and broader macroeconomic trends. Investors navigating the dynamic cryptocurrency market are advised to remain vigilant, utilizing a combination of technical analysis and fundamental research to navigate both the current volatility and the promising long-term prospects of Bitcoin.

0 notes

Text

"Bitcoin Halving: The Impact on Supply, Demand, and Market Dynamics"

Introduction:

In the ever-evolving landscape of cryptocurrency, few events capture the attention of enthusiasts and investors alike as much as the Bitcoin halving. A rare and predetermined occurrence, the halving plays a pivotal role in shaping the future of the world's most renowned digital currency. In this blog, we'll unravel the intricacies of Bitcoin halving, examining its profound effects on supply, demand, and the overall dynamics of the crypto market.

Chapter 1: Understanding the Bitcoin Halving

Let's start with the basics. What exactly is the Bitcoin halving, and why does it hold such significance? In this section, we'll explore the mechanics of the halving, its historical context, and the rationale behind the protocol that reduces the reward for miners by half approximately every four years. Gain insights into the scarcity model that underpins Bitcoin and the impact it has on its value.

Chapter 2: The Supply Conundrum: Scarcity in Action

With each halving event, the rate at which new bitcoins are created decreases, leading to a gradual reduction in the overall supply. Delve into the concept of scarcity and its influence on Bitcoin's value proposition. We'll analyze how this diminishing supply contributes to the digital gold narrative, attracting investors seeking a hedge against inflation and a store of value.

Chapter 3: Demand Dynamics: FOMO, Speculation, and Institutional Interest

As the supply dwindles, demand dynamics come into play. Explore the psychological and speculative aspects of Bitcoin halving, including the Fear of Missing Out (FOMO) phenomenon that often precedes and follows the event. We'll also examine the growing interest from institutional investors and its impact on the broader cryptocurrency market.

Chapter 4: Historical Performance: Patterns and Trends

Past performance can offer valuable insights into the potential outcomes of future halving events. This chapter will analyze the historical price trends surrounding Bitcoin halving, highlighting patterns and behaviors that have emerged in the aftermath of each occurrence. By understanding these trends, investors can better navigate the complexities of the market.

Chapter 5: Market Reaction and Volatility

Bitcoin halving events are often accompanied by increased market volatility. Explore the reasons behind the heightened price volatility during these periods and how it affects both short-term traders and long-term investors. We'll also discuss strategies for managing risk and seizing opportunities amid the market fluctuations.

Chapter 6: Beyond Halving: The Future Landscape

As we look to the future, what lies beyond each halving event? This chapter will explore the broader implications of Bitcoin halving on the cryptocurrency ecosystem. From technological advancements to regulatory developments, we'll examine the factors that could shape the landscape in the post-halving era.

Conclusion:

In this exploration of Bitcoin halving, we've uncovered the intricate interplay between supply, demand, and market dynamics. From the scarcity-driven value proposition to the psychological aspects influencing investor behavior, the halving event remains a cornerstone in the narrative of Bitcoin's evolution. As the cryptocurrency ecosystem continues to mature, the impact of each halving on the market is a captivating saga that will undoubtedly shape the future of digital finance.

0 notes

Text

What to consider before trading with Bitalpha AI

In the ever-evolving world of finance, technological advancements have revolutionized the way we approach trading. One such groundbreaking development is the integration of artificial intelligence (AI) into trading platforms. Among the pioneers in this space is Bitalpha AI, a platform that has garnered attention for its cutting-edge capabilities. In this blog, we will delve into the benefits that traders can harness by leveraging the power of Bitalpha AI.

Sophisticated Algorithmic Trading:

Bitalpha AI stands out for its sophisticated algorithmic trading capabilities. The platform employs state-of-the-art algorithms powered by artificial intelligence to analyze vast amounts of data swiftly and accurately. This enables traders to make informed decisions based on real-time market conditions, giving them a competitive edge in the fast-paced world of trading.

Predictive Analytics:

One of the key advantages of Bitalpha AI is its ability to perform predictive analytics. By analyzing historical market trends and patterns, the platform can make predictions about future market movements. This foresight is invaluable for traders looking to anticipate market shifts and make timely investment decisions.

Risk Management:

Trading inherently involves risk, and effective risk management is crucial for long-term success. Bitalpha AI excels in this area by employing advanced risk management tools. The AI algorithms can assess risk factors in real time, allowing traders to adjust their strategies and minimize potential losses. This dynamic risk assessment sets Bitalpha AI apart as a reliable ally in the volatile world of trading.

24/7 Market Monitoring:

Unlike human traders who need rest, Bitalpha AI operates tirelessly, providing continuous market monitoring. This round-the-clock vigilance ensures that traders never miss critical market developments, allowing them to capitalize on opportunities and react promptly to unexpected events.

Customizable Trading Strategies:

Bitalpha AI empowers users with the ability to customize their trading strategies. The platform allows traders to set parameters, preferences, and risk tolerance levels, tailoring the AI's actions to align with their unique investment goals. This flexibility is particularly beneficial for both seasoned traders and newcomers seeking a personalized approach to trading.

Efficient Execution of Trades:

Speed is of the essence in trading, and Bitalpha AI excels in executing trades with unparalleled efficiency. The platform's algorithms can swiftly analyze market data, identify opportunities, and execute trades in real time. This not only enhances the chances of securing favorable prices but also reduces the risk of slippage.

User-Friendly Interface:

While Bitalpha AI harnesses advanced technology, it remains accessible to traders of all experience levels. The user-friendly interface ensures that even those new to AI-based trading can navigate the platform with ease. The intuitive design and clear data visualization contribute to a seamless user experience.

1 note

·

View note

Text

Bitcoin's recent battle at the $65K mark has ignited heated debates within the crypto community, with traders and analysts closely watching to see whether bulls will prevail or bears will take control. The $65K level represents a critical resistance point for Bitcoin, and its ability to break through or retreat from this level could have significant implications for the broader market.

Discussions delve into various aspects, including technical indicators, market sentiment, and macroeconomic factors. Traders analyze price action, volume, and market depth, seeking clues about the direction of the next major move.

As the battle at $65K unfolds, opinions are divided, with some expressing confidence in Bitcoin's bullish momentum, while others remain cautious amid signs of potential exhaustion. The outcome of this battle will likely shape short-term price movements and set the tone for Bitcoin's trajectory in the coming weeks.

0 notes