#Anti money laundering GO AML/ CFT Penalties

Text

#Contact us for submitting#ESR (Economic Substance Regulations) Notification Effectively & Timely#ESR Deadline- Business with a financial year ending on 31st March 22 must file their ESR notification on the MOF postal by 30th Sep 2022.#Have a look to Penalties:-#•#Failure to file notification – AED 20000#Failure to submit the Report- AED 50000#Providing inaccurate information - AED 50000#Compliance Services Include:-#Economic Substance Regulations#Anti money laundering GO AML/ CFT Penalties#Unlimited Beneficial Owners (UBO)#Hurry Up for Getting Effective & Timely Solution#For further assistance you may call us on +971 52 348 4262#+971 50 202 8198#+971 50 304 5253 or visit website https://www.acuvat.com/. You can mail us on [email protected] or visit Acuvat Auditing#1607#Metropolis Tower#Business Bay#P.O BOX 385183#Dubai#U.A.E#audit#accounting#tax#accountant#finance#business#taxes#accountants

0 notes

Text

The amendments require every crypto service provider to register with the country’s financial regulator.

It also obliges crypto firms already registered with other European countries to register with the regulator.

Cyprus is going to amend its law around crypto asset firms operating in the country, as per a recent local media report.

Cyprus’s finance ministry is planning to amend the existing Prevention and Suppression of Money Laundering Law. The ministry has presented its set of amendments to the Parliamentary Committee on Legal Affairs.

It aims to align Cyprus with international standards for anti-money laundering and combating the financing of terrorism (AML/CFT) set by the Financial Action Task Force (FATF) and the recommendations of the MONEYVAL November 2022 report.

The amendments require that every service provider dealing with crypto assets must register with the country’s financial regulator, the Cyprus Securities and Exchange Commission (CySEC).

Crypto firms already registered with other European states also need to register with the CySEC. The Commission itself included this clause in the amendments.

In case of violation, the penalties range from fines of up to €350,000 to imprisonment of up to five years or a combination of both.

Cyprus, an EU member, tightens crypto rules ahead of MiCA

The Cyprus administration consulted the Cyprus Bar Association which voiced its concerns about the law’s scope. It specifically questioned the requirement for crypto firms already registered in other EU states to also register in Cyprus.

Notably, the bar association has proposed that the “Travel Rule” be incorporated into the law. Currently, the provision is not a part of Cyprus’ legislative framework.

The Finance Ministry promptly responded that the law is consistent with the single market functioning within the European Union (EU). They underline how CySEC holds authority over crypto firms providing services in Cyprus, regarding of their regulatory status in other EU states.

In November 2022, the European Union Blockchain Observatory & Forum published a report titled “EU Blockchain Ecosystem Developments.” The report said Cyprus, a member-state of the EU, had 48 blockchain companies.

Cryptocurrency is a taxable asset in the country. It taxes income from crypto trading at 12.5% under corporation tax. Cyprus is implementing these measures as the Markets in Crypto-Assets (MiCA) regulation gets implemented in the EU in 2024.

0 notes

Text

FATF units Pakistan October deadline to curb terror funding or face motion, asks nation to show efficient outcomes

http://tinyurl.com/yxapo6db

Washington: Pakistan has failed to finish its motion plan on terror financing, the Monetary Motion Process Pressure (FATF) stated Friday, warning Islamabad to satisfy its dedication by October or face motion, which might probably result in the nation getting blacklisted. The Paris-based world physique is working to curb terrorism financing and cash laundering and has requested Pakistan to reassess the operation of banned terrorist outfits within the nation. In June, 2018, the FATF positioned Pakistan on the gray record of nations whose home legal guidelines are thought of weak to sort out the challenges of cash laundering and terrorism financing. File picture of Pakistan prime minister Imran Khan. AP In a press release issued on the conclusion of its Plenary assembly in Orlando, Florida, the FATF expressed concern “that not solely did Pakistan fail to finish its motion plan objects with January deadlines, it additionally failed to finish its motion plan objects due Might 2019”. The FATF “strongly” urges Pakistan to swiftly full its motion plan by October, 2019 when the final set of motion plan objects are set to run out. “In any other case, the FATF will resolve the following step at the moment for inadequate progress,” the worldwide monetary physique stated leaving a powerful warning to Pakistan. The FATF stated Pakistan had taken steps in the direction of bettering its AML/CFT (anti-money laundering/combating the monetary terrorism) regime, together with the current improvement of its terror funding threat evaluation addendum. Nevertheless, it doesn’t show a correct understanding of Pakistan’s transnational terror funding threat. Reacting to the FATF’s warning, Pakistan on Friday stated it was dedicated to taking measures wanted to implement the motion plan agreed with the FATF to return out of the gray record. “The Authorities of Pakistan reiterates its dedication to take all crucial measures to make sure completion of the Motion Plan in a well timed method,�� the Ministry of Finance stated in a press release. Noting that the Plenary assembly of the FATF happened at Orlando from 16 to 21 June, it stated the assembly reviewed the compliance of numerous nations, together with Pakistan with the worldwide requirements on Anti-Cash Laundering and Counter Financing of Terrorism (AML-CFT). FATF reviewed progress made by Pakistan in the direction of the implementation of the Motion Plan and acknowledged the steps taken by Pakistan to enhance its AML/CFT regime and highlighted the necessity for additional actions for implementing the Motion Plan, the ministry stated in a press release. The ministry stated that the FATF will undertake the following evaluation of Pakistan’s Progress in October, 2019. “Pakistan ought to proceed to work on implementing its motion plan to handle its strategic deficiencies, together with by adequately demonstrating its correct understanding of the fear funding dangers posed by the terrorist teams and conducting supervision on a risk-sensitive foundation,” the FATF stated. It ought to show that remedial actions and sanctions are utilized in instances of AML/CFT violations, and that these actions affect AML/CFT compliance by monetary establishment, it stated. It requested Pakistan to show that competent authorities are cooperating and taking motion to establish and take enforcement motion in opposition to unlawful cash or worth switch providers (MVTS). It additionally requested Pakistan to indicate that authorities are figuring out money couriers and implementing controls on illicit motion of forex and understanding the chance of money couriers getting used for terror funding. “Pakistan ought to enhance inter-agency coordination together with between provincial and federal authorities on combating terror funding dangers and show that legislation enforcement companies are figuring out and investigating the widest vary of terror funding exercise,” it stated. It ought to show that terror funding investigations and prosecutions goal designated individuals and entities, and individuals and entities appearing on behalf or on the route of the designated individuals or entities, it stated. The FATF requested Pakistan to show terror funding prosecutions end in efficient, proportionate and dissuasive sanctions and enhancing the capability and assist for prosecutors and the judiciary. Pakistan must successfully implement focused monetary sanctions (supported by a complete authorized obligation) in opposition to all 1,267 and 1,373 designated terrorists and people appearing for or on their behalf, together with stopping the elevating and transferring of funds, figuring out and freezing property (movable and immovable), and prohibiting entry to funds and monetary providers, it stated. The FATF stated Pakistan wanted to show enforcement in opposition to TFS violations, together with administrative and legal penalties and provincial and federal authorities cooperating on enforcement instances. It ought to show that amenities and providers owned or managed by designated particular person are disadvantaged of their sources and the utilization of the sources, it stated. The FATF at present has 36 members with voting powers and two regional organisations, representing a lot of the main monetary centres in all elements of the globe. On three Might, 2018, former Finance Minister Arun Jaitley stated India will ask the FATF to place Pakistan on a blacklist of nations that fail to satisfy worldwide requirements in stopping monetary crime. China is ready to safe FATF presidency subsequent yr whereas Saudi Arabia representing the Gulf Cooperation Council is to develop into a full FATF member. Turkey was the one member that stood by Pakistan regardless of a powerful marketing campaign launched by the US, the UK, India and Europe. Your information to the newest cricket World Cup tales, evaluation, reviews, opinions, reside updates and scores on https://www.firstpost.com/firstcricket/series/icc-cricket-world-cup-2019.html. Observe us on Twitter and Instagram or like our Facebook web page for updates all through the continued occasion in England and Wales. !function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function() {n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)} ; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '259288058299626'); fbq('track', 'PageView'); (function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = "http://connect.facebook.net/en_GB/all.js#xfbml=1&version=v2.9&appId=1117108234997285"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk')); window.fbAsyncInit = function () { FB.init({appId: '1117108234997285', version: 2.4, xfbml: true}); // *** here is my code *** if (typeof facebookInit == 'function') { facebookInit(); } }; (function () { var e = document.createElement('script'); e.src = document.location.protocol + '//connect.facebook.net/en_US/all.js'; e.async = true; document.getElementById('fb-root').appendChild(e); }()); function facebookInit() { console.log('Found FB: Loading comments.'); FB.XFBML.parse(); } Source link

0 notes

Photo

Sneak Peek: Mexico’s Regulations for Crypto Exchanges Expected in ‘Weeks’

Regulation

Mexico’s bill to regulate fintech institutions including cryptocurrency exchanges is expected to become law within “weeks,” according to local crypto exchange ISBIT. Daniel Luévano, the exchange’s director of operations, shared with news.Bitcoin.com what to expect from the new law, citing a leaked document he obtained from the recent meeting of regulators.

Also read: Indians Look to Buy Bitcoin Overseas as Regulations Tighten

Changing Mexico’s Crypto Landscape

Mexico’s Chamber of Deputies will soon vote on the bill to regulate the country’s fintech institutions including cryptocurrency exchanges, which the Senate has already approved.

The bill “establishes a regulatory framework that regulates the platforms (called Financial Technology Institutions or ITFs)” which includes crypto exchanges, the document states. “The bill recognizes two types of ITFs: collective financing institutions and electronic payment fund institutions.”

News.Bitcoin.com (BC): Does the bill legalize bitcoin and other cryptocurrencies?

Daniel Luévano (DL): Bitcoin and other cryptos will not be legal tender. However, ITFs that the Bank of Mexico gives consent [to] will be allowed to operate with them.

BC: Can people legally use cryptocurrencies to pay for goods and services?

DL: Yes, they can!

BC: What are the most important changes brought about by the bill?

DL: Financial institutions will be able to operate with virtual assets, but also, they are allowed to invest in ITFs. ITFs will be constantly audited; everything must be transparent to regulators and consumers. AML/CFT [anti-money laundering/combating the financing of terrorism] practices will be a really important requirement for exchanges.

BC: What major changes to the existing Mexican crypto ecosystem will result from the bill?

DL: Changes in the Mexican financial ecosystem? Huge ones.

ITFs will be considered just as important as banks. All trade finance companies will be operating with them.

Only 44% of people in Mexico have a bank account, while the rest only use cash. The amount of money and transactions that can migrate to crypto and its technology is huge.

Licensing & Approved Crypto

BC: What is the role of the Bank of Mexico with respect to the crypto market going forward?

DL: They are more than open to keep new technologies [and] strengthen the Mexican financial ecosystem. They don’t want to lose control of things they still don’t understand widely, that’s why the Bank of Mexico will decide which virtual assets can be operated in the Mexican territory.

BC: Are crypto exchanges now required to get a license from the Bank of Mexico? What kind of authorization do they need?

DL:

Yes, now we will have an authorization as an ITF. But this is positive, because now all the financial institutions have permission to work with the now-called ITFs. Mainly, the authorization depends on how strong your security is, and several KYC [know your customer] and AML/CFT practices an exchange should have.

BC: Are there restrictions on what cryptocurrencies are approved in the bill?

DL: The Bank of Mexico will decide which ones [cryptocurrencies] are allowed to be listed on the exchanges.

They will decide according to Article 30 [which states that] “Bank of Mexico will take into account, among other characteristics, the public acceptance (its use, the trade of it, the storage, and the volume of transaction), other jurisdictions’ acceptance, other agreements, mechanisms, rules or protocols that allow to create, identify, partition, and control the replication of these assets.”

Penalties

BC: What are the penalties for non-compliance?

DL: The penalties are applicable only for the ITFs in case they don’t comply or they don’t follow the law. If you don’t have the authorization, the penalty is from 30k UMA to 150k UMA, according to Article 104 I. 1 UMA (Unit of Measurement and Update) = 80.6 MXN = 4.27 USD.

BC: When will this bill become law? And how long do exchanges have to comply?

DL: The bill will become law in the following weeks, as soon as the Chamber of Deputies votes for it.

Exchanges will have one year to comply.

What do you think of Mexico’s regulations for crypto exchanges? Let us know in the comments section below.

Images courtesy of Shutterstock and Isbit.

Need to calculate your bitcoin holdings? Check our tools section.

Article Source

The post Sneak Peek: Mexico’s Regulations for Crypto Exchanges Expected in ‘Weeks’ appeared first on Bitcoin E-Gold Rush.

0 notes

Text

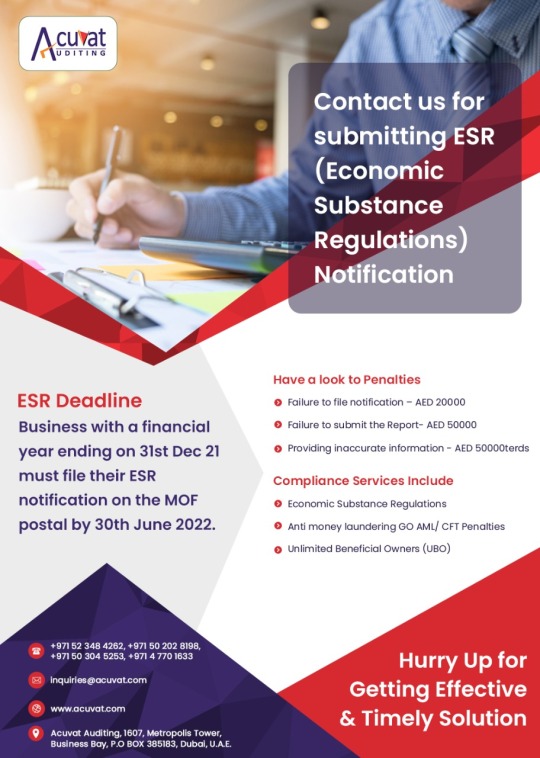

#Contact us for submitting#ESR (Economic Substance Regulations) Notification Effectively & Timely#ESR Deadline- Business with a financial year ending on 31st Dec 21 must file their ESR notification on the MOF postal by 30th June 2022.#Have a look to Penalties:-#•#Failure to file notification – AED 20000#Failure to submit the Report- AED 50000#Providing inaccurate information - AED 50000#Compliance Services Include:-#Economic Substance Regulations#Anti money laundering GO AML/ CFT Penalties#Unlimited Beneficial Owners (UBO)#Hurry Up for Getting Effective & Timely Solution#For further assistance you may call us on +971 52 348 4262#+971 50 202 8198#+971 50 304 5253 or visit website https://www.acuvat.com/. You can mail us on [email protected] or visit Acuvat Auditing#1607#Metropolis Tower#Business Bay#P.O BOX 385183#Dubai#U.A.E#audit#accounting#tax#accountant#finance#business#taxes#accountants

0 notes

Text

World watchdog FAFT warns Pakistan to finish motion plan on terror funding by October or face penalties

http://tinyurl.com/y5e64xgc

Washington: Pakistan has failed to finish its motion plan on terror financing, the Monetary Motion Process Drive (FATF) mentioned Friday, warning Islamabad to satisfy its dedication by October or face motion, which might probably result in the nation getting blacklisted. The Paris-based world physique is working to curb terrorism financing and cash laundering and has requested Pakistan to reassess the operation of banned terrorist outfits within the nation. In June, 2018, the FATF positioned Pakistan on the gray checklist of nations whose home legal guidelines are thought-about weak to deal with the challenges of cash laundering and terrorism financing. File picture of Pakistan prime minister Imran Khan. AP In a press release issued on the conclusion of its Plenary assembly in Orlando, Florida, the FATF expressed concern “that not solely did Pakistan fail to finish its motion plan objects with January deadlines, it additionally failed to finish its motion plan objects due Could 2019”. The FATF “strongly” urges Pakistan to swiftly full its motion plan by October, 2019 when the final set of motion plan objects are set to run out. “In any other case, the FATF will resolve the subsequent step at the moment for inadequate progress,” the worldwide monetary physique mentioned leaving a powerful warning to Pakistan. The FATF mentioned Pakistan had taken steps in direction of bettering its AML/CFT (anti-money laundering/combating the monetary terrorism) regime, together with the latest growth of its terror funding threat evaluation addendum. Nonetheless, it doesn’t show a correct understanding of Pakistan’s transnational terror funding threat. Reacting to the FATF’s warning, Pakistan on Friday mentioned it was dedicated to taking measures wanted to implement the motion plan agreed with the FATF to return out of the gray checklist. “The Authorities of Pakistan reiterates its dedication to take all obligatory measures to make sure completion of the Motion Plan in a well timed method,” the Ministry of Finance mentioned in a press release. Noting that the Plenary assembly of the FATF happened at Orlando from 16 to 21 June, it mentioned the assembly reviewed the compliance of various nations, together with Pakistan with the worldwide requirements on Anti-Cash Laundering and Counter Financing of Terrorism (AML-CFT). FATF reviewed progress made by Pakistan in direction of the implementation of the Motion Plan and acknowledged the steps taken by Pakistan to enhance its AML/CFT regime and highlighted the necessity for additional actions for implementing the Motion Plan, the ministry mentioned in a press release. The ministry mentioned that the FATF will undertake the subsequent evaluation of Pakistan’s Progress in October, 2019. “Pakistan ought to proceed to work on implementing its motion plan to handle its strategic deficiencies, together with by adequately demonstrating its correct understanding of the phobia funding dangers posed by the terrorist teams and conducting supervision on a risk-sensitive foundation,” the FATF mentioned. It ought to show that remedial actions and sanctions are utilized in instances of AML/CFT violations, and that these actions impact AML/CFT compliance by monetary establishment, it mentioned. It requested Pakistan to show that competent authorities are cooperating and taking motion to establish and take enforcement motion towards unlawful cash or worth switch companies (MVTS). It additionally requested Pakistan to indicate that authorities are figuring out money couriers and implementing controls on illicit motion of foreign money and understanding the danger of money couriers getting used for terror funding. “Pakistan ought to enhance inter-agency coordination together with between provincial and federal authorities on combating terror funding dangers and show that regulation enforcement companies are figuring out and investigating the widest vary of terror funding exercise,” it mentioned. It ought to show that terror funding investigations and prosecutions goal designated individuals and entities, and individuals and entities performing on behalf or on the course of the designated individuals or entities, it mentioned. The FATF requested Pakistan to show terror funding prosecutions end in efficient, proportionate and dissuasive sanctions and enhancing the capability and help for prosecutors and the judiciary. Pakistan must successfully implement focused monetary sanctions (supported by a complete authorized obligation) towards all 1,267 and 1,373 designated terrorists and people performing for or on their behalf, together with stopping the elevating and shifting of funds, figuring out and freezing property (movable and immovable), and prohibiting entry to funds and monetary companies, it mentioned. The FATF mentioned Pakistan wanted to show enforcement towards TFS violations, together with administrative and prison penalties and provincial and federal authorities cooperating on enforcement instances. It ought to show that amenities and companies owned or managed by designated particular person are disadvantaged of their sources and the utilization of the sources, it mentioned. The FATF presently has 36 members with voting powers and two regional organisations, representing many of the main monetary centres in all components of the globe. On three Could, 2018, former Finance Minister Arun Jaitley mentioned India will ask the FATF to place Pakistan on a blacklist of nations that fail to satisfy worldwide requirements in stopping monetary crime. China is ready to safe FATF presidency subsequent 12 months whereas Saudi Arabia representing the Gulf Cooperation Council is to change into a full FATF member. Turkey was the one member that stood by Pakistan regardless of a powerful marketing campaign launched by the US, the UK, India and Europe. Your information to the most recent cricket World Cup tales, evaluation, reviews, opinions, reside updates and scores on https://www.firstpost.com/firstcricket/series/icc-cricket-world-cup-2019.html. Comply with us on Twitter and Instagram or like our Facebook web page for updates all through the continued occasion in England and Wales. !function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function() {n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)} ; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '259288058299626'); fbq('track', 'PageView'); (function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = "http://connect.facebook.net/en_GB/all.js#xfbml=1&version=v2.9&appId=1117108234997285"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk')); window.fbAsyncInit = function () { FB.init({appId: '1117108234997285', version: 2.4, xfbml: true}); // *** here is my code *** if (typeof facebookInit == 'function') { facebookInit(); } }; (function () { var e = document.createElement('script'); e.src = document.location.protocol + '//connect.facebook.net/en_US/all.js'; e.async = true; document.getElementById('fb-root').appendChild(e); }()); function facebookInit() { console.log('Found FB: Loading comments.'); FB.XFBML.parse(); } Source link

0 notes

Text

Pakistan fails to meet 25 of 27 motion factors prescribed by FATF to curb terror funding; downgrading by IMF, World Financial institution could proceed

http://tinyurl.com/yxdhu4mj

New Delhi: Pakistan has failed to finish 25 of the 27 motion factors given by the worldwide terror financing watchdog FATF to examine funding to terrorist teams equivalent to LeT and JeM and frontal teams like Jamat-ud-Dawah and Falah-e-Insaniat Basis. With this, multilateral lenders just like the IMF, the World Financial institution and the EU could proceed downgrading Pakistan, making its monetary scenario extra precarious. Representational picture. AFP The Paris-headquartered Monetary Motion Process Drive has requested Pakistan to elucidate whether or not it has launched any investigation into the USD seven million allotted to keep up colleges, madrasas, clinics and ambulances initially operated by terror teams like Lashkar-e-Taiba, Jaish-e-Mohammad, and LeT fronts Jamat-ud-Dawah and Falah-e-Insaniat Basis. JuD and FIF are based by terror mastermind Hafiz Saeed. LeT is liable for various terrorist strikes in India, together with the 2008 Mumbai assaults and the hijacking of an Indian Airways plane to Afghanistan in 1999. Most not too long ago, it attacked a CRPF bus in Pulwama in February this yr, killing 40 troopers. Pakistan is in serious trouble on the FATF assembly starting Sunday in Florida within the US, individuals conscious of the event stated. “It has been unable to finish 25 of its 27 motion factors. It has one final probability, until its 15-month deadline ends in October 2019, when the FATF Plenary might be held,” one among them added. In June 2018, Pakistan was positioned within the ‘Grey’ listing and given a 27-point motion plan by FATF. This plan was reviewed on the final plenary in October 2018 and for the second time in February this yr, when the nation was once more put into the ‘Grey’ listing after India submitted new details about Pakistan-based terrorist teams. The FATF persevering with Pakistan within the ‘Grey’ listing means its downgrading by IMF, World Financial institution, ADB, EU and in addition a discount in danger ranking by Moody’s, S&P and Fitch. This can add to the monetary issues of Pakistan, which is looking for assist from all doable worldwide avenues. In a bid to bluff the monetary watchdog, Pakistani authorities have proven arrests of LeT, JeM, JuD and FiF cadres. However all have been apprehended below its Upkeep of Public Order Act and never below the Anti-Terrorism Act, 1997. Underneath the MPO Act, authorities can’t maintain a detainee past 60 days. Pakistan has detained JeM founder Masood Azhar and LeT founder Hafiz Saeed largely below the legal guidelines that present for detention for apprehension of breach of peace; they’ve by no means been prosecuted below anti-terror legal guidelines. The FATF implements UN designations, which don’t warrant arrest. They ask just for freeze of funds, denial of entry to weapons and journey embargo. The monetary watchdog additionally desires nations to impose penalties which can be proportionate and dissuasive. The MPO Act isn’t seen as satisfying both of the 2 situations. Subsequently, none of those arrests will fulfill the FATF or the UN Designations Committee. Pakistan has additionally seized a number of hundred properties of LeT, JuD, FiF and JeM, together with colleges and madrasas. Nonetheless, these properties at the moment are being run by its provincial governments.The Punjab provincial authorities has allotted USD 2 million (Pakistani Rs 30 crore or Indian Rs 14 crore) every year for his or her repairs. Equally, different provinces have allotted USD 5 million. The annual expense allotted by Pakistan totals USD 7 million (Pakistani Rs 105 or Indian Rs 49 crore). The FATF has now requested Pakistan to elucidate whether or not there are any terror-funding investigations to unearth the sources and entities that funded these organisations with USD 7 million every year for the previous a number of years. The FATF at the moment has 35 members and two regional organisations — European Fee and Gulf Cooperation Council. Within the final assembly of the FATF in Paris, the FATF stated Pakistan ought to proceed to work on implementing its motion plan to handle its strategic deficiencies, together with by adequately demonstrating its correct understanding of the fear financing dangers posed by the terrorist teams and conducting supervision on a risk-sensitive foundation, demonstrating that remedial actions and sanctions are utilized in instances of Anti-Cash Laundering and Combating Financing of Terrorism violations and that these actions impact AML/CFT compliance by monetary establishments. Pakistan, it stated, ought to exhibit that competent authorities are cooperating and taking motion to establish and take enforcement motion towards unlawful cash or worth switch providers, demonstrating that authorities are figuring out money couriers and implementing controls on illicit motion of foreign money and understanding the chance of money couriers getting used for terror financing (TF), bettering inter-agency coordination together with between provincial and federal authorities on combating TF dangers apart from others. Your information to the most recent cricket World Cup tales, evaluation, experiences, opinions, dwell updates and scores on https://www.firstpost.com/firstcricket/series/icc-cricket-world-cup-2019.html. Comply with us on Twitter and Instagram or like our Facebook web page for updates all through the continuing occasion in England and Wales. !function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function() {n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)} ; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '259288058299626'); fbq('track', 'PageView'); (function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = "http://connect.facebook.net/en_GB/all.js#xfbml=1&version=v2.9&appId=1117108234997285"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk')); window.fbAsyncInit = function () { FB.init({appId: '1117108234997285', version: 2.4, xfbml: true}); // *** here is my code *** if (typeof facebookInit == 'function') { facebookInit(); } }; (function () { var e = document.createElement('script'); e.src = document.location.protocol + '//connect.facebook.net/en_US/all.js'; e.async = true; document.getElementById('fb-root').appendChild(e); }()); function facebookInit() { console.log('Found FB: Loading comments.'); FB.XFBML.parse(); } Source link

0 notes