#Australian Compound Interest Calculator

Explore tagged Tumblr posts

Text

Australian Compound Interest Calculator | Easycompoundinterestcalculator.com

Plan your financial goals with the Australian Compound Interest Calculator that reflects local banking and investment standards. Calculate potential returns with regular contributions and see how your wealth can grow in the Australian economy.

Australian Compound Interest Calculator

0 notes

Text

Long-Term vs. Short-Term Investing: What’s Best for ASX Investors?

The Australian stock market (ASX) offers a range of investment opportunities, catering to both short-term traders and long-term investors. Choosing between these two approaches depends on your financial goals, risk tolerance, and investment strategy. In this blog, we explore the key differences, benefits, and risks of both strategies to help you make informed investment decisions.

Understanding Long-Term Investing

Long-term investing involves holding stocks for an extended period, usually five years or more. Investors focus on fundamental analysis, looking at company earnings, market potential, and overall economic trends.

Benefits of Long-Term Investing:

Wealth Accumulation & Compounding: Long-term investments benefit from compound interest, allowing reinvested earnings to generate additional returns.

Lower Transaction Costs: Since long-term investors buy and hold, they avoid frequent trading fees and commissions.

Reduced Market Volatility Impact: Short-term market fluctuations are less significant over extended periods, leading to more stable returns.

Dividend Growth: Many ASX-listed companies offer dividends, which can be reinvested to enhance portfolio growth over time.

Tax Efficiency: In Australia, long-term investors benefit from the Capital Gains Tax (CGT) discount, reducing taxable profits on stocks held for over 12 months.

Risks of Long-Term Investing:

Patience is Required: Significant returns may take years to materialize.

Market Risks: Economic downturns can affect long-term investments, requiring a strong risk management strategy.

Understanding Short-Term Investing

Short-term investing typically involves buying and selling stocks within days, weeks, or months, relying on technical analysis, price trends, and market timing to generate quick profits.

Benefits of Short-Term Investing:

Quick Returns: Traders capitalize on short-term price movements, potentially earning profits in a shorter time frame.

Market Flexibility: Investors can respond to ASX live updates and economic news, adjusting strategies accordingly.

Diverse Opportunities: Day trading, swing trading, and momentum trading provide various methods to profit from market trends.

Risks of Short-Term Investing:

High Volatility Exposure: Short-term investments are highly sensitive to market fluctuations.

Frequent Trading Costs: Higher transaction fees can eat into profits.

Emotional Decision-Making: Quick decisions may lead to impulsive trading mistakes.

Tax Implications: Short-term capital gains are taxed at a higher rate than long-term investments.

Which Strategy is Best for ASX Investors?

Choosing between long-term and short-term investing depends on your financial goals:

If you prefer stability and steady wealth growth, long-term investing is a safer choice.

If you are willing to take calculated risks for quick profits, short-term trading may be appealing.

Hybrid Approach: Some investors combine both strategies by maintaining a long-term portfolio while actively trading in short-term opportunities.

Conclusion: Both long-term and short-term investing have unique advantages and risks. The key to success lies in understanding your risk tolerance, investment horizon, and market knowledge. For the latest ASX stock market insights, live updates, and expert interviews, visit The Stock Network and stay informed!

0 notes

Text

The Risks of Late Tax Return Filing in Sydney

Filing your taxes on time is a crucial aspect of financial responsibility. Late tax return filing in Sydney can lead to a range of penalties and consequences. It’s essential to understand the risks involved and take proactive steps to ensure timely compliance.

Financial Penalties

One of the most immediate consequences of late tax return filing without professional accounting and bookkeeping services is financial penalties. The Australian Taxation Office (ATO) imposes penalties on individuals who fail to meet their tax obligations. These penalties can include:

Late lodgement penalty: A flat fee is applied for each day the return is overdue.

Late payment penalty: A daily penalty is charged on the unpaid tax amount.

General interest charge: Interest is calculated on the unpaid tax and any penalties owed.

Interest Accumulation

The interest on unpaid taxes can accumulate quickly, making it even more challenging to repay the debt. The ATO uses a compounding interest rate, which means that interest is charged on both the original debt and any accrued interest. This can significantly increase the overall amount owed.

Potential Audit

Late tax return filing can increase the likelihood of an audit by the ATO. Auditors may scrutinize your financial records more closely to determine if there are any discrepancies or inconsistencies. An audit can be a stressful and time-consuming process, and it can result in additional penalties or even legal action.

Damage to Credit Score

If you fail to pay your taxes on time, it can have a negative impact on your credit score. The ATO may report your tax debt to credit reporting agencies, which can make it difficult to obtain loans, credit cards, or other forms of financing. A damaged credit score can have far-reaching consequences, affecting your ability to buy a home, rent a property, or even get a job.

By understanding the risks and taking steps to avoid them, you can protect your financial future and avoid the stress and consequences of tax delinquency.

Source

0 notes

Text

10 Tips to Financially Plan for a Comfortable Retirement

Retirement planning can be complex and challenging. Unfortunately, what you may have once thought was going to be enough to retire on may no longer be enough. According to the Association of Super Funds of Australia (ASFA), the cost of a “modest” retirement lifestyle exceeds Australia’s aged pension by about $4,000 each year, and a “comfortable” lifestyle costs around $20,000 more.

Australians are also living longer, which means we’re spending more time and money in retirement.

This likely explains why most Australians fear they don’t have enough to retire comfortably.

The good news? Most people with a decent income can leave this fear behind – provided they start financially planning for retirement at the earliest opportunity.

How to financially plan for retirement

There’s a good chance that a comfortable retirement is within your reach. But it doesn’t happen overnight or by chance. Peace of mind comes from following a tailored financial strategy plan for years, ideally decades.

Here are a few tips to help you plan for a comfortable and secure retirement.

1. Start early

The earlier you start saving for retirement, the more time your investments have to grow. Between compound interest and superannuation earnings, even a small amount saved each month will add up over time.

A good rule of thumb for retirement planning is to put aside 10-15% of your pre-tax income starting in your early 20s. However, we know most Australians don’t think about retirement in their 20s, or even 30s. So it’s a good thing Australian employers are required to contribute 11% of their employee’s regular income to superannuation (the superannuation guarantee, or SG).

Over time, superannuation builds a base for retirement planning. Older Australians who are only now thinking about retirement still have options to secure a comfortable future. You just need the right strategy and a good team.

2. Set realistic goals

Clear goals will help you calculate how much you need to save for retirement. To determine your goals, think about:

The age you want to retire

Specific lifestyle factors you aspire to

Potential living situations

Dependents and partners

Post-retirement travel plans

Assets you want to hold

Working backwards from these goals will help you establish a base case. Of course, you will want to aim higher to ensure you’re living on more than the bare minimum and can enjoy your well-deserved retirement.

3. Understand your super situation

On 1 July 2023, the SG rate rose from 10.5% to 11%. It’s scheduled to rise again to 12% on 1 July 2025.

This contribution grows through the wonders of compound interest and investment returns, and there is no age limit, meaning interest accrues even during retirement.

As good as the system is on paper, there is a reason for the SG rate rise. Australians simply were not retiring with enough to be comfortable and independent. While the increase from 10.5% to 12% will help, the little changes you make over the years will go further to ensuring your comfort later.

This is the difference between active and passive investing, and it will make all the difference come retirement. Working with an experienced financial advisor helps you grow out of a one-size-fits-all retirement strategy and maximise your chances of living comfortably.

4. Seek expert advice

Now that you understand your foundation and have clear goals for retirement, it’s time to consult with a financial advisor specialising in retirement planning.

Wealth creation is complex. Beyond the basics like risk tolerance and asset allocation, financial planning for retirement requires a detailed strategy and deep knowledge of financial instruments.

Everyone’s situation is unique. Working with a financial planner gives you peace of mind that your retirement is secure and you’re making the smartest moves in the years leading up.

5. Diversify your assets

There is no one-size rule for how to financially plan for retirement, and most financial advisors will recommend evolving your asset allocation strategy as your situation changes.

Still, diversification is generally considered important for managing risks and maximising returns. Consider a mix of asset classes such as shares, real estate, bonds and cash to spread risk and achieve long-term growth.

The shape, risk profile and asset mix depend on individual circumstances. For example, someone approaching retirement may look to stabilise their portfolio with allocation to high interest bearing cash, bonds and blue chip shares. In contrast, younger Australians with a higher risk appetite could have a higher allocation to growth assets like shares instead.

6. Review your plan regularly

Your needs and goals will likely change as you approach retirement. So too will the regulations, benefits and tax breaks that affect how you financially plan for retirement.

Be sure to review your plan and portfolio regularly with your financial advisor to make sure you are still on track.

The right retirement planning team will help you maximise contributions in the years –hopefully decades – leading up to retirement, giving you a greater chance of retiring with enough to live comfortably.

7. Plan for the unplanned

Unexpected expenses can happen to anyone, even in retirement. It is important to have a financial cushion to cover unexpected costs, such as:

Medical bills (yours or your partner’s)

Family emergencies

Property repairs and renovations

Economic events outside your control

Unforeseen tax bills

Although we don’t like to think about it, planning for the day when you are unable to make decisions is also wise. Whether that means medical expenses or estate planning, ensuring your loved ones aren’t financially burdened is an important part of financial planning for retirement.

8. Watch out for lifestyle creep

Lifestyle creep is a lurking threat, especially for high-income earners. Incidental spending that was once considered a luxury can over time become the norm and seem like a need.

What we once thought would be enough to retire on becomes an ever evasive target as our lifestyle ratchets up at a rate that outpaces our retirement savings.

The top 10% of income earners, in particular, need a well-modelled plan to ensure lifestyle creep doesn’t affect their ability to live comfortably well into retirement.

You can read more about the corrosive potential of lifestyle creep here, including a by-the-numbers breakdown to help financially plan for a retirement funded by passive income streams.

9. Consider healthcare costs

Healthcare expenses tend to increase in retirement. Australia’s public health system is one of the better examples worldwide, but you should still expect out-of-pocket expenses.

Ensure you have a plan for covering medical costs when you are no longer working. You may want to consider purchasing private health insurance to supplement Medicare, especially if you find a scheme that covers specific pre-existing conditions.

It’s a good idea to overestimate healthcare costs, as this will avoid passing the burden onto someone else.

10. Take advantage of entitlements and benefits

Tax structures, trusts, pension funds, franking credits: most people glaze over just reading about financial instruments. But understanding how these affect your financial position – and how to maximise your position accordingly – can be a boon when financially planning for retirement.

Australia’s tax system means that the ownership structure of your assets will significantly impact your potential retirement income.

This is where a knowledgeable financial advisor becomes a valued partner in retirement. By planning ahead and directing assets to the right structures we can help you get more from your nest egg than you may think is possible.

Are you ready to retire comfortably?

Regardless of where you are in life, thinking about your golden years is a good move. The earlier you can begin financially planning for retirement, the better time you will have once the working days are done.

However, starting early isn’t the only way to secure a comfortable retirement. By working with the right team and implementing good financial habits, you can use the assets and opportunities available to you to achieve your retirement goals.

Empire Financial Group will get you there. We invite you to get in touch for personalised advice from Perth’s leading retirement advisors.

1 note

·

View note

Text

Can bushfires affect the real estate market?

Can bushfires affect the real estate market? - With heavy rains hitting NSW and dramatically reducing the number of active fires in the state, australian house prices two potential disruptors to the real estate market now stand side-by-side. They beg the question of what influence increasingly severe and reoccurring weather events may have on the real estate market and whether they are having an effect already.

Over this summer, property market in sydney more than 11 million hectares have been destroyed by bushfires while over 2,000 homes have been lost from fires over the summer.

While these fires and the advent of coronavirus have been marked as two significant potential impacts on the Australian economy in the short-term, harga rumah di australia there is also the question of how these fires will affect the real estate market or whether they will have much of an impact at all. While there have been structural losses to many homes, much of the destruction has occurred to bushland in and outside of national parks, which complicates the potential for fires to have an impact on the real estate market acutely.

Read More : bisakah orang indonesia membeli rumah di australia

How will increasingly frequent and large-scale fires affect insurance premiums?

Since September last year, approximately 8,500 claims worth $700 million in losses have been made to insurance companies. rumah di australia The Insurance Council of Australia, led by chief executive Rob Whelan, warned the Australian government in January that insurance premiums could rise due to these events without effective adaptation and mitigation. This involves measures such as reevaluating where we live and how we prepare against future bushfire effects.

Climate risk analyst Karl Mallon authored a report with the Climate Council in 2019 called ‘Compound Costs: harga rumah di melbourne How Climate Change is Damaging Australia’s Economy’, noting that the property market could lose $571 billion in value by 2030 due to climate change and consequent extreme weather.

The report extended this projection to estimate a loss of property values from climate change of $770 billion by 2100. However, these projections do focus on the effects of flooding more than fires. While the Commonwealth Bank’s 2018 annual report noted the impacts of flooding, inundation, apartemen di australia bushfires, soil contraction and wind as all having a potential impact on the major bank’s lending portfolio and insurance premiums, inundation/flooding was seen as the most significant.

“High risk properties make up only 0.01% of our portfolio (by outstanding balance) in 2020,” beli rumah di australia the report states, “and rises to be around 1% in 2060 if there are no changes in the way we lend in these areas.”

“Locations affected by climate risk are expected to experience an increase in maintenance and damage costs, property in perth leading to higher insurance costs, due to flooding, storms, bushfire and drought, with rising sea levels expected to have the most significant increase.”

The relatively small scale of structural damage caused by fires compared to floods poses less of a direct risk to the insurance industry and property prices, real estate australia but there may be a strong potential for indirect impacts.

Will bushfires affect property prices?

The same report from the Climate Council warned that the effects of climate change could potentially wipe off $571 billion from property values by 2050, australia house while the Actuaries Institute warned that 1 in 10 houses could become uninsurable by the end of the century due to climate change, but predictions like these are made harder to make when you consider certain shifts in how (technological advancements, mitigation, adaptation) and where we live in the future as we continue to adjust to increasingly extreme weather events.

In the short term, there are more indirect effects on real estate prices that may be harder to measure. house in australia These include pressures placed on living standards, industries and businesses that may have a cumulative effect on markets. For instance, air quality in Canberra over the 2019/20 summer fires was so poor that in early January the very department which oversees Australia’s response to disasters and emergencies, the Department of Home Affairs,

was forced to temporarily shut its offices, while the health effects of Canberra’s compromised air quality is not yet known. australia house prices The Washington Post reported that emergency room visits for asthma and breathing problems in Sydney “increased more than 34 percent in the period from Dec. 30 and Jan. 5 compared to a year earlier.”

This raises the potential for people to consider their future options and seek new destinations less prone to such risks (though as was seen with smoke reaching New Zealand, houses for sale in australia this can be hard to escape). Whether this has an effect on prices is unclear.

Similar indirect effects might be seen when considering industries such as tourism, which are impacted by these volatile summer seasons exactly when they expect and rely on peak tourist numbers. australia property If tourism and related small business industries are hit by repeated seasons as was seen this past summer, the commercial and residential real estate markets may be affected.

The rental system sees short term pressures placed on it during times of severe natural disaster, when people forced from their homes require immediate living alternatives. property in australia As part of the recovery from natural disasters such as fires, those that can afford to repair and rebuild faster than others can financially land back on their feet faster, potentially exacerbating inequalities in the market. This isn’t restricted to individuals but entire communities, such as those on Kangaroo Island, which saw severe fires that damaged almost half of the island.

Finally, as part of a growing awareness of increased risks from intense fire seasons, there is the potential effect from increasing demand for homes within urban centres and decreased demand for homes in regional markets, houses for sale melbourne growing this price divide between urban and regional markets.

In the short term, however, there seems to have been little impact on regional markets from the fires. Corelogic data for December dwelling values showed .5% month-on-month growth for regional NSW, .7% growth for regional Vic and .8% growth for regional Qld, despite the large-scale fires. melbourne property It may be too soon to be assessing the effects of the fires on regional areas of those states most impacted. Larger market forces may have played a stronger short-term role in house values, such as interest rate cuts,

the loosening of loan serviceability policies, and the fact that standard variable mortgage rates are sitting at rates not seen since the 1960s, with November seeing rates at 4.8% compared to a peak of 17% in November 1989. sydney property Capital cities on the eastern seaboard weren’t affected by bushfires, which is hardly surprising, with Sydney seeing values rise by 8.2% since finding a floor in May 2019.

What is clear from this past bushfire season is that the economic considerations being factored by major industries, such as the banking sector, houses for sale sydney have moved from abstract calculations in annual reports to real impacts on regular homeowners and that calculating the effects of increasingly volatile fire seasons is more complicated than simply looking at those areas immediately affected by bushfires.

1 note

·

View note

Text

Top 5 Tips when Saving for Retirement

Saving for retirement can be a daunting task, but it is necessary if you want to have the freedom to do whatever it is that you want in life when you reach retirement age. Here are five tips that can help make saving for retirement less stressful:

1. Get informed about the tax breaks you are eligible for when saving for retirement.

To help you save for your retirement, governments generally either provide or encourage a range of tax-free and tax-favourable options to help you bolster your savings. It's in their interest for you to be financially strong and less reliant on public support during your retirement. The options will vary depending on where you are, but as an example Australians will benefit from the favourable tax benefits of their Superannuation account.

We recommend starting your research as soon as possible. It's important that you understand how these programs work so that they can benefit your overall financial situation while saving for retirement. For example, if one program pays out more than another at retirement age then it may be worth considering switching programs now instead of waiting until later on down the road when it might no longer be possible or beneficial due to other factors such as investment fees built into each plan which will affect how much money actually comes out at retirement time.

2. Start saving as soon as possible.

The earlier you start saving, the more time your money has to grow and compound. Start by contributing as soon as possible – even if it's just $10 or $20 each month. That small amount can really add up over time!

You also want to make sure that your retirement savings rate increases every year, so they keep up with inflation, which is a major factor in making sure that your money lasts forever into retirement.

3. Pay down any high-interest debts such as credit cards and store card debt first.

If you have a lot of high-interest debt, it's best to pay off this type of debt before putting money away elsewhere. Using a credit card calculator, you can see how much interest you are paying on your credit cards and other loans. If you use a credit card calculator, keep in mind that these are estimates based on averages—your actual rate may be higher or lower depending on when and where you got the loan, what type of loan (home equity line of credit vs. personal line of credit) and whether you have ever missed a payment or paid late before.

Credit cards can be useful for emergencies but they also come with very high interest rates so it is important not to spend more than what is necessary each month because even small amounts left over in the account will add up quickly! If this sounds like something that might be happening with your current spending habits, then consider using another form of plastic instead (such as debit). If this doesn't help, then perhaps consider getting rid of some other forms too (like cheques).

Debt negotiation can assist in reducing these cumbersome debts. Contact us to find out more.

4. Prioritise putting money aside over buying luxuries or non-essentials.

You should always have money to put aside for retirement. It's better to save up now than to spend it all on luxuries, non-essentials, or things you don't need.

The best way to make sure that you're putting enough money aside is by prioritising your savings over everything else when making purchases. If you want an expensive new car, wait until after you've paid off your mortgage or student loans—or better yet: borrow money from friends and family instead of taking out a loan!

5. Factor in lifestyle changes when planning your retirement savings strategy, e.g., whether you plan to downsize your home, have children or travel more in retirement etc.

As you plan for retirement, it's important to consider how your lifestyle will change in retirement. This is because some lifestyle choices can have a big impact on how much money you'll need to cover your expenses and whether or not you'll be able to maintain the standard of living that you desire once you stop working.

For example, having children could significantly increase your monthly expenses as well as the cost of buying a home; meanwhile, downsizing from a larger home could save you money each month by reducing property taxes and utility bills. These factors should all be factored into your retirement planning so that when it comes time for retirement, there are no surprises left over from unexpected costs like these!

Saving for retirement can be overwhelming but is necessary with the average life expectancy being well into one's 80s

If you're still in your 20s, 30s or 40s, saving for retirement can be overwhelming. You're probably thinking about student loans, a mortgage, car payments and maybe even some credit card debt.

That’s why it’s important to take advantage of the tax-deferred growth that comes with contributing money to a 401k or Superannuation account. With the average life expectancy being well into one's 80s nowadays; it might be wise to save more now so that you can slow down on the spending later on in life when expenses may start to increase exponentially due to medical bills or other costs associated with aging (i.e., assisted living).

Conclusion

It is important to remember that you are not alone in this process and that we are here for you every step of the way. We want to help you reach your goals and make sure that when it comes time to retire, you have enough money saved up so that you can enjoy it without having to worry about finances.

Flexible Finance Without the Fuss

At Loan Search, we don’t just try and sell you a service that lines our own pockets. We understand how confusing and time consuming it is going out and figuring out what the best solution is for your circumstances.

We are an innovative service that understands everyone's financial situation is different, we take the time to understand who you are as an individual, what your specific circumstances are and find the best solution for you right now.

You no longer have to scour the internet for debt consolidation loans, credit repair services, credit card deals etc. not fully understand if what you’re looking at is the best solution for you.

0 notes

Text

The Retrospective

(From ��Le Monde diplomatique, October, 1999).

It is not easy to write with feigned calm and dispassion about the events that have been unfolding in East Timor. Horror and shame are compounded by the fact that the crimes are so familiar and could so easily have been terminated by the international community a long time ago.

Indonesia invaded the territory in December 1975, relying on US diplomatic support and arms, used illegally, but with secret authorisation from Washington; there were even new arms shipments sent under the cover of an official “embargo”. There was no need to threaten bombing or even sanctions. It would have sufficed for the US and its allies to withdraw their active participation, and inform their close associates in the Indonesian military command that the atrocities must be terminated and the territory granted the right of self-determination that has been upheld by the United Nations and the International Court of Justice. We cannot undo the past, but we should at least be willing to recognise what we have done, and face the moral responsibility of saving the remnants and providing ample reparations – a small gesture of compensation for terrible crimes.

The latest chapter in this painful story of betrayal and complicity opened right after the referendum of 30 August 1999 when the population voted overwhelmingly for independence. At once, atrocities mounted sharply, organised and directed by the Indonesian army. The UN mission (Unamet) gave its appraisal on 11 September: “The evidence for a direct link between the militia and the military is beyond dispute and has been overwhelmingly documented by Unamet over the last four months. But the scale and thoroughness of the destruction of East Timor in the past week has demonstrated a new level of open participation of the military in the implementation of what was previously a more veiled operation.”

The mission warned that “the worst may be yet to come… It cannot be ruled out that these are the first stages of a genocidal campaign to stamp out the East Timorese problem by force” (1).

John Roosa, historian on Indonesia and official observer of the vote, described the situation starkly: “Given that the pogrom was so predictable, it was easily preventable… But in the weeks before the ballot, the Clinton Administration refused to discuss with Australia and other countries the formation (of an international force). Even after the violence erupted, the administration dithered for days” (2). Finally it was compelled by international (primarily Australian) and domestic pressure to make some timid gestures. Even these ambiguous messages sufficed to induce the Indonesian generals to reverse course and accept an international presence.

While President Clinton “dithered,” almost half the population were expelled from their homes, according to UN estimates, and thousands murdered (3). The air force that was able to carry out pin-point destruction of civilian targets in Novi Sad, Belgrade and Ponceva lacked the capacity to drop food to people facing starvation in the mountains to which they had been driven by the terror of the Indonesian forces, armed and trained by the US and its no less cynical allies.

The recent events will evoke bitter memories among those who do not take refuge, like the so-called international community, in “intentional ignorance”. We are witnessing a shameful replay of events of 20 years ago. After carrying out a huge slaughter in 1977-78 with the decisive support of the Carter Administration, Indonesia felt confident enough to permit a brief visit by members of the Jakarta diplomatic corps, among them the US ambassador, Edward Masters. They recognised that an enormous humanitarian catastrophe had been created. The aftermath was described by Benedict Anderson, one of the most distinguished scholars on Indonesia. Anderson testified before the UN that “For nine long months” of starvation and terror, “Ambassador Masters deliberately refrained, even within the walls of the State Department, from proposing humanitarian aid to East Timor.” He was waiting “until the generals in Jakarta gave him the green light” – until, as an internal State Department document recorded, they felt “secure enough to permit foreign visitors” (4).

One gruesome illustration of US complicity was the coup that brought General Suharto to power in 1965. Army-led massacres slaughtered hundreds of thousands in a few months, mostly landless peasants. The powerful communist party was destroyed. The achievement elicited unrestrained euphoria in the West and fulsome praise for the Indonesian “moderates”, Suharto and his military accomplices, who had cleansed society and opened it to foreign plunder. Robert McNamara, then Secretary of Defence, informed Congress that US military aid and training had “paid dividends” – including half a million corpses. A congressional report concluded they were “enormous dividends”. McNamara informed President Johnson that that US military assistance “encouraged (the army) to move against the communist party when the opportunity was presented.” Contacts with Indonesian military officers, including university programmes, were “very significant factors in determining the favourable orientation of the new Indonesian political elite” – the army (5).

So matters continued during 35 years of intensive military aid, training, and communication. As Indonesian troops and their back-ups were burning Dili, and the killings and destruction had reached new heights, the Pentagon announced that a US-Indonesian “training exercise” on rescue and humanitarian actions in disaster situations had ended on 25 August (6), five days before the referendum. The lessons of this cooperation were rapidly put into practice.

A few months earlier, shortly after the massacre of dozens of refugees who had taken shelter in a church in Liquica, Admiral Dennis Blair, the US Pacific Commander, had assured General Wiranto, head of the Indonesian armed forces and defence minister, of US support and assistance, proposing a new US training mission (7).

The degree of cooperation between Washington and Jakarta is impressive. US weapons sales to Indonesia amount to over $1 billion since the 1975 invasion. Military aid during the Clinton years is about $150 million, and in 1997 the Pentagon was still training Kopassus units (see article by Romain Bertrand), in violation of the intent of congressional legislation. In the face of this record, the US government lauded “the value of the years of training given to Indonesia’s future military leaders in the US and the millions of dollars in military aid for Indonesia” (8).

The reasons for the disgraceful record have sometimes been honestly recognised. During the latest phase of atrocities, a senior diplomat in Jakarta described “the dilemma” faced by the great powers: “Indonesia matters and East Timor doesn’t” (9). It was therefore understandable that Washington should keep to ineffectual gestures of disapproval while insisting that internal security in East Timor was “the responsibility of the government of Indonesia, and we don’t want to take that responsibility away from them”. This official stance, reaffirmed a few days before the August referendum, was repeated and maintained in full knowledge of how that “responsibility” had been carried out (10).

The reasoning of the senior diplomat was spelled out more fully by two Asia specialists from the New York Times. The Clinton Administration, they wrote, “has made the calculation that the United States must put its relationship with Indonesia, a mineral-rich nation of more than 200 million people, ahead of its concern over the political fate of East Timor, a tiny impoverished territory of 800,000 people that is seeking independence.” The Washington Post quoted Douglas Paal, president of the Asia Pacific Policy Centre, describing the facts of life: “Timor is a speed bump on the road to dealing with Jakarta, and we’ve got to get over it safely. Indonesia is such a big place and so central to the stability of the region” (11).

In the rhetoric of official Washington, “We don’t have a dog running in the East Timor race”. Accordingly, what happens there is not US business. But after intensive Australian pressure, the calculations shifted. A senior government official concluded: “We have a very big dog running down there called Australia and we have to support it” (12). The survivors of US-backed crimes in a “tiny impoverished territory” are not even a “small dog”.

The guiding principles were articulated in 1978, three years after Indonesia’s invasion of East Timor, by Washington’s ambassador to the UN, Daniel Patrick Moynihan. His words should be committed to memory by anyone with a serious interest in international affairs, human rights, and the rule of law. In his memoirs, Moynihan wrote: “The United States wished things to turn out as they did, and worked to bring this about. The Department of State desired that the United Nations prove utterly ineffective in whatever measures it undertook. This task was given to me, and I carried it forward with no inconsiderable success” (13).

Success was indeed considerable. Moynihan cited reports that within two months some 60,000 people had been killed: “10 percent of the population, almost the proportion of casualties experienced by the Soviet Union during the second world war”. A sign of the success, he added, was that within a year “the subject disappeared from the press.” So it did, as the invaders intensified their assault. Atrocities peaked in 1977-78. Relying on a new flow of advanced military equipment from the Carter Administration – with its emphasis on human rights – the Indonesian military carried out a devastating attack against the hundreds of thousands who had fled to the mountains, driving the survivors to Indonesian control. It was then that highly credible Church sources in East Timor sought to make public the estimates of 200,000 deaths – long denied, but now at last accepted. As the slaughter reached near-genocidal levels, Britain and France joined in, along with other powers, providing diplomatic support and even arms.

This year opened with a moment of hope. Indonesia’s interim president, B J Habibie, had called for a referendum with a choice between incorporation within Indonesia (“autonomy”) or independence. The army moved at once to prevent this outcome by terror and intimidation. In the months leading to the August referendum, 3,000 to 5,000 were killed (14) – a far larger order of magnitude of deaths than that cited by Nato (2,000) in the year leading up to the bombing in Kosovo.

Braving violence and threats, almost the entire population voted, many emerging from hiding to do so. Close to 80% chose independence. Then followed the latest phase of atrocities by the Indonesian army in an effort to reverse the outcome by slaughter and expulsion. Much of the country was reduced to ashes. Within two weeks more than 10,000 people may have been killed, according to Bishop Carlos Filipe Belo, the Nobel Peace laureate (see article by Sylvain Desmille). The bishop was driven from his country under a hail of bullets, his house burned down, and the refugees sheltering there dispatched to an uncertain fate (15).

Even before Habibie’s surprise call for a referendum, the army anticipated threats to its rule, including its control over East Timor’s resources, and undertook careful planning with “the aim, quite simply, … to destroy a nation”. The plans were known to Western intelligence. The army recruited thousands of West Timorese and brought in forces from Java. More ominously, the military command sent units of its dreaded US-trained Kopassus special forces, and, as senior military adviser, General Makarim, a US-trained intelligence specialist with experience in East Timor and “a reputation for callous violence” (16).

Terror and destruction began early in the year. The army forces responsible have been described as “rogue elements” in the West. There is good reason, however, to accept Bishop Belo’s assignment of direct responsibility to General Wiranto (17). It appears that the militias have been managed by elite units of Kopassus, the “crack special forces unit” that had, according to veteran Asia correspondent David Jenkins, “been training regularly with US and Australian forces until their behaviour became too much of an embarrassment for their foreign friends” (18).

These forces adopted the tactics of the US Phoenix programme in the Vietnam war, that killed tens of thousands of peasants and much of the indigenous South Vietnamese leadership, Jenkins writes, as well as “the tactics employed by the Contras” in Nicaragua. The state terrorists were “not simply going after the most radical pro-independence people, but going after the moderates, the people who have influence in their community.”

Well before the referendum, the commander of the Indonesian military in Dili, Colonel Tono Suratman, warned of what was to come: “If the pro-independents do win … all will be destroyed… It will be worse than 23 years ago” (19). An army document of early May, when international agreement on the referendum was reached, ordered that “Massacres should be carried out from village to village after the announcement of the ballot if the pro-independence supporters win.” The independence movement “should be eliminated from its leadership down to its roots” (20). Citing diplomatic, church and militia sources, the Australian press reported “that hundreds of modern assault rifles, grenades and mortars are being stockpiled, ready for use if the autonomy option is rejected at the ballot box” (21).

All of this was understood by Indonesia’s “foreign friends”, who also knew how to bring the terror to an end, but preferred evasive and ambiguous reactions that the Indonesian generals could easily interpret as a “green light” to carry out their work.

The sordid history must be viewed against the background of US-Indonesia relations in the post-war era (22). The rich resources of the archipelago, and its critical strategic location, guaranteed it a central role in US global planning. These factors lie behind US efforts 40 years ago to dismantle Indonesia, perceived as too independent and too democratic – even permitting participation of the poor peasants. These factors account for Western support for the regime of killers and torturers who emerged from the 1965 coup. Their achievements were seen as a vindication of Washington’s wars in Indochina, motivated in large part by concerns that the “virus” of independent nationalism might “infect” Indonesia, to use Kissinger-like rhetoric.

Surely we should by now be willing to cast aside mythology and face the causes and consequences of our actions, and not only in East Timor. In that tortured corner of the world there is still time, though precious little time, to prevent a hideous conclusion to one of the most appalling tragedies of the terrible century that is winding to a horrifying, wrenching close.

(1) Report of the Security Council Mission to Jakarta and Dili, 8 to 12 September 1999.

(2) New York Times, 15 September 1999.

(3) Boston Globe, 15 September 1999.

(4) Benedict Anderson, Statement before the Fourth Committee of the UN General Assembly, 20 October 1980. See also Noam Chomsky, Towards a New Cold War, Pantheon, New York, 1982.

(5) For review and sources, see Noam Chomsky, Year 501, South End, Boston, 1993.

(6) AP on line, 8 September 1999.

(7) The Nation, New York, 27 September 1999.

(8) New York Times, 14 September 1999.

(9) Financial Times, London, 8 September 1999; Christian Science Monitor, Boston, 14 September 1999.

(10) Sydney Morning Herald, 25 August 1999, citing State Department spokesman James Foley. Defence Secretary William Cohen, press briefing, 8 September 1999.

(11) Elizabeth Becker and Philip Shenon, New York Times, 9 September 1999. Steven Mufson, Washington Post, 9 September 1999.

(12) Australian Financial Review, Sydney, 13 September 1999.

(13)Daniel Patrick Moynihan, A Dangerous Place, Little Brown, Boston, 1978.

(14) Washington Post, 5 September 1999.

(15) New York Times, 13 September 1999.

(16) The Observer, London, 13 September 1999.

(17) Shenon, op. cit.

(18) Sydney Morning Herald, 8 July 1999.

(19) Australian Financial Review, 14 August 1999.

(20) The Observer, op. cit.

(21) Sydney Morning Herald, 26 July 1999.

(22) See Noam Chomsky, “Indonesia, master card in Washington’s hand”, Le Monde diplomatique, English Internet edition, June 1998, English print edition, September 1998.

0 notes

Text

SiteMinder raises $70M at $750M valuation after cresting $70M ARR in 2019

Today SiteMinder, an Australian software company focused on the hotel industry, announced a $70 million (USD) round that values the company at $750 million. That’s about $1.08 billion in Australian dollars, making the firm a Down Under Unicorn, even if it’s a bit shy here in America.

According to SiteMinder, the round was “led by equity funds managed by BlackRock.” The company has previously raised capital from TCV and Bailador.

TechCrunch discussed SiteMinder earlier this year as part of our running examination of companies that have reached certain annual recurring revenue (ARR) thresholds. At that time, we noted that the firm’s revenue was at AU$100 million ARR, while it was a bit light of the level in American dollars.

As we understand the company’s new valuation in both countries’ currencies, it is possible to calculate the company’s current ARR multiple. It’s about 11x. That price is similar to what public SaaS companies command in today’s market, according to Bessemer’s cloud index.

Growth

SiteMinder announced some time ago that it had surpassed the AU$100 million ARR mark in 2019. Software companies — SiteMinder appears to also generate service-oriented revenues from activities like website design — that reach similar scale tend to slow down in percentage growth terms.

To understand the company’s approach to growth, TechCrunch asked SiteMinder if its new capital would allow it to maintain its current pace of ARR growth. The firm had cited “accelerated go-to-market strategies” as a possible use for its new funds, helping frame the question.

According to SiteMinder CEO Sankar Narayan, the answer is “Yes, absolutely.” Narayan went on to say that the company has “the widest global footprint and the largest multilingual capability in our category, giving us pole position as technology adoption accelerates across the hotel industry.” Narayan also cited planned hiring and expanded distribution work in Europe and Asia as giving his company “even greater opportunities for growth.”

SiteMinder operates globally, providing it with a closer presence to some customers (80% of the firm’s revenue is international, it says). That distribution, however, raises a question. Quickly growing companies often struggled to hold their culture together when they are in a single office. SiteMinder operates in over a dozen countries, likely compounding the issue.

Narayan told TechCrunch that SiteMinder is “no stranger to the challenges that come with being a global business.” To combat cultural drift, the CEO says that he visits an overseas office every month, and that his company recently introduced “an all-staff shadow equity plan” to let everyone profit from the company’s progress.

With new capital, and presumably more staff and offices to come, it will be interesting to see what new things the company’s cultural integrity requires.

Regardless, SiteMinder is now the inaugural member of the AU$100 million ARR club, and is a local-currency unicorn to boot. And as it’s harder to reach that valuation outside of Silicon Valley than inside of it, neither of those honorifics should be viewed as dismissive; they’re compliments.

0 notes

Photo

New Post has been published on https://magzoso.com/tech/siteminder-raises-70m-at-750m-valuation-after-cresting-70m-arr-in-2019/

SiteMinder raises $70M at $750M valuation after cresting $70M ARR in 2019

Today SiteMinder, an Australian software company focused on the hotel industry, announced a $70 million (USD) round that values the company at $750 million. That’s about $1.08 billion in Australian dollars, making the firm a Down Under Unicorn, even if it’s a bit shy here in America.

According to SiteMinder, the round was “led by equity funds managed by BlackRock.” The company has previously raised capital from TCV and Bailador.

TechCrunch discussed SiteMinder earlier this year as part of our running examination of companies that have reached certain annual recurring revenue (ARR) thresholds. At that time, we noted that the firm’s revenue was at AU$100 million ARR, while it was a bit light of the level in American dollars.

As we understand the company’s new valuation in both countries’ currencies, it is possible to calculate the company’s current ARR multiple. It’s about 11x. That price is similar to what public SaaS companies command in today’s market, according to Bessemer’s cloud index.

Growth

SiteMinder announced some time ago that it had surpassed the AU$100 million ARR mark in 2019. Software companies — SiteMinder appears to also generate service-oriented revenues from activities like website design — that reach similar scale tend to slow down in percentage growth terms.

To understand the company’s approach to growth, TechCrunch asked SiteMinder if its new capital would allow it to maintain its current pace of ARR growth. The firm had cited “accelerated go-to-market strategies” as a possible use for its new funds, helping frame the question.

According to SiteMinder CEO Sankar Narayan, the answer is “Yes, absolutely.” Narayan went on to say that the company has “the widest global footprint and the largest multilingual capability in our category, giving us pole position as technology adoption accelerates across the hotel industry.” Narayan also cited planned hiring and expanded distribution work in Europe and Asia as giving his company “even greater opportunities for growth.”

SiteMinder operates globally, providing it with a closer presence to some customers (80% of the firm’s revenue is international, it says). That distribution, however, raises a question. Quickly growing companies often struggled to hold their culture together when they are in a single office. SiteMinder operates in over a dozen countries, likely compounding the issue.

Narayan told TechCrunch that SiteMinder is “no stranger to the challenges that come with being a global business.” To combat cultural drift, the CEO says that he visits an overseas office every month, and that his company recently introduced “an all-staff shadow equity plan” to let everyone profit from the company’s progress.

With new capital, and presumably more staff and offices to come, it will be interesting to see what new things the company’s cultural integrity requires.

Regardless, SiteMinder is now the inaugural member of the AU$100 million ARR club, and is a local-currency unicorn to boot. And as it’s harder to reach that valuation outside of Silicon Valley than inside of it, neither of those honorifics should be viewed as dismissive; they’re compliments.

0 notes

Text

How to Double Your Trading Returns with Minimal Risk

This post originally appeared on Wealth Within.

By Janine Cox | Published 12 November 2019

I remember presenting to an audience around ten years ago and following my presentation a gentleman came up to me as he wanted to show how he had doubled his money. He then reached into his pocket and pulled out a $50 note, folded it in half and said “there you go!” While he had a desire to make money in the stock market, he was skeptical although he clearly had a great sense of humour.

In all seriousness, while you can double your trading returns in the stock market with minimal risk, I realized that the gentleman’s response above merely reflects the skepticism that is widely held about the possibility of making great returns in the market. And while I understand why people may be skeptical, this is often based on fear and incorrect perceptions rather than founded on solid facts.

The statistics don’t lie

We have a 60 second trading assessment survey on our website that helps individuals identify what they may need if they want to achieve their goals in the stock market. Of those who have completed the survey, around 87.65 per cent said they have limited to no knowledge when it comes to trading the stock market, while 80.80 per cent state they are either not confident or only somewhat confident with their trading but they are still not profitable.

What was even more interesting, however, is that over 88 per cent of all respondents said they wanted to take the bull by the horns to gain a quality education, yet the majority had not done this, and statistics indicate that they never will. As Thomas Edison once said “Opportunity is missed by most people because it is dressed in overalls and looks like work”.

In regards to trading successfully and profitably, the statistics prove time and again that people fail to commit the necessary time and money because it takes sustained effort and involves a level of risk that they may fail. So all jokes aside, this is why those who have the potential to double their money will never give themselves the opportunity to do so because they fail to do what they know they should be doing, although this needn’t be the case.

To put this into perspective, we recently received an email from a client who had enrolled in our Diploma of Share Trading and Investment course in July of this year, and who had attended one of our seminars in Melbourne around 18 years ago. He literally started out with the email by saying “some people just don’t get it, and that’s me”.

You see, he communicated that he had wandered around in the trading wilderness looking at this and that, listening to many people and buying everyone’s program (except ours) in the hope of succeeding. But in all those years he had lost more money than he ever made from the market, as he had not learnt to protect his capital, among other things.

And it wasn’t until he was between a rock and a hard place that he realized he needed to do something about his trading. With his wife’s encouragement, he decided to finally enrol in our Diploma course, and while at the time it appeared to be a lot of money (as he was a pensioner), he had come to the conclusion about how much time he had already wasted, as he realized how much better off he would have been in so many ways had he acted sooner.

He finished up his email by saying that some people are just so thick and “know it all’s”, that they just don’t get it, BUT now I do and I have done something about my future.

Remember, the statistics don’t lie. Over 90 percent of people who believe they are traders fail to make money consistently because they focus their attention in all the wrong places.

The challenge with doubling your trading returns

You see the challenge with reading books, watching YouTube videos or attending weekend workshops is that many people only gain a fraction of the information they require to be consistently profitable in the stock market. But people are attracted to this way of learning because it is cheap and involves very little risk or effort, which is why Edison states that most people miss the opportunity.

In fact, many people end up scratching their head in confusion when they try to apply what they have learnt in a book or at a workshop to the real world of trading. That’s because they either don’t understand how to apply the knowledge they have gained or there are gaps in the information they have received. In the end, it costs them in lost capital and opportunity, which affects the quality of life for them and their family.

In essence, because the opportunity looked like work, they failed to allocate the necessary time and resources needed to be successful, and so achieved the opposite of what they desired.

Unfortunately, too many people believe that an investment in knowledge is a cost rather than an investment. Therefore, they focus on what education is costing them in time and money rather than looking at it from the perspective of how much it is costing them by not having the right knowledge or education.

But when you arm yourself with the correct knowledge and support, you will confidently begin your journey towards securing your financial future, and in doing so, you will come to know that you can deliver consistent results time and again, rather than just hoping you can. Remember, the statistics don’t lie. A lack of education or the wrong education costs you dearly both in time and money, so be careful about the path your take or who you choose to learn from.

Your trading returns are the most important factor when investing

Research conducted for the Australian Stock Exchange (ASX) indicates that Australian investors rate the return on their investments as the most important factor when looking to invest followed by either a guaranteed or stable return. And investors expect these returns to be in the order of 8 to 9 per cent per annum.

So what the research is suggesting is that investors expect high returns with no risks attached, which we all know is pretty unrealistic. But it is this thinking that is holding a lot of investors back from achieving the returns they desire.

The research also demonstrates that most investors prefer to do their own homework when it comes to investing with a considerable number relying on third party broker reports to make their investment decisions. But many are still unhappy with the returns they are achieving, as it is well below the expected 8 to 9 per cent per annum.

That said, many also prefer to make their own decisions despite not having much knowledge or understanding about the stock market, yet they still expect to achieve returns in the vicinity of 8 to 9 per cent. Given these unrealistic expectations, it’s no wonder that 90 per cent of those who invest in the stock market either breakeven or lose money.

So, let me ask, how much are you willing to invest in yourself in order to know how to double your returns?

Would an education be expensive if you could double your returns?

Let’s assume you invest $50,000 and you make an 8 per cent return, you will have made $4,000. Now, what If you made 12.5 per cent per annum, then your return would be $6,250, which equates to an improvement on your previous return of $2,250 or over 56 per cent.

It may surprise you to learn that over a 10 year period, trading the top 20 stocks on the ASX using a simple trend line and a stop loss, Dale Gillham achieved a return of around 12.50 per cent per annum in his latest book Accelerate Your Wealth, so these types of returns are very achievable.

So, what if you could double your returns without dramatically increasing your risk? How would that make you feel and how would that change your life?

Now imagine that you have doubled your returns without dramatically increasing the time you currently put in. No doubt you will begin to see why having a much better understanding about the stock market and how to trade it will change your life.

Let me show why a lack of knowledge is costing you a lot of money.

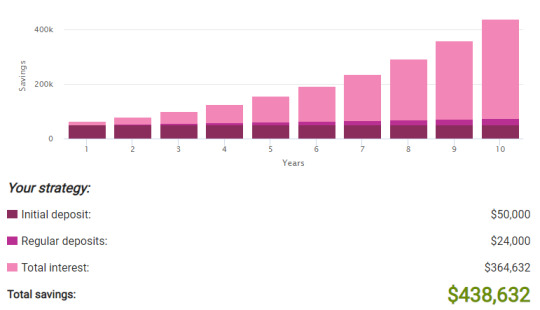

Let’s assume you have $50,000 to invest and you decide you will also contribute $200 each month in savings to invest in the market. Using ASIC’s compound interest calculator with an interest rate of 10 per cent, over 10 years, you can see your total investment would grow to over $176,000.

Figure 1: 10% return over ten years

Now let’s consider what the outcome would be if you invested the same amount but you achieved a return of 20 per cent. As you can see, your return would grow to over $438,000 or an improvement of around $262,300 over ten years. Now that has to be worth the value of putting on those overalls and getting a solid education.

Figure 2: 20% return over ten years

Unfortunately, it’s a lack of knowledge combined with fear, and our limiting beliefs about the stock market that is costing many individuals far more than they ever realise.

Benjamin Franklin once said “An investment in knowledge pays the best interest” while Jim Rohn said “If someone is going down the wrong road, he doesn't need motivation to speed him up, what he needs is an education to turn him around”.

Einstein was also famously known for saying “Education is the progressive realisation of our ignorance”. In fact, it’s a well-known fact that ignorance is far more expensive than education.

While many of you will appreciate the wisdom of what these gentleman are saying, you will continue to rely on hot tips or interact in chat forums and continue watching YouTube in the hope you will achieve high returns for little to no effort. But we all know that this results in disappointment because it’s not realistic.

So ask yourself, what’s it going to take for you to make the decision to put on those overalls and take on the opportunity to be able to achieve the results you’ve been seeking? As Dale Gillham’s (Chief Analyst at Wealth Within) late mentor used to say: “have a great day and make it a great day”. In other words, put on your overalls and grab those opportunities to ensure you achieve your goals.

Others who read this also enjoyed reading:

Why Backtesting Increases Your Trading Profits

Trading Options: A Reality Check

How to Increase the Odds of Winning Trade

0 notes

Link

Six years ago, the Chinese president Xi Jinping made a state visit to Britain. It was an important moment for both nations — the launch of a new “Golden Era”— designed to show that any differences caused by David Cameron’s meeting with the Dalai Lamai in 2012 were forgotten. Behind the scenes, however, it was preceded by months of difficult negotiations as Downing Street tried to meet Beijing’s conflicting demands for a schedule that showed their President to be an ordinary man of the people, while also according him with the respect that befits the leader of a nation better than any other on earth.

Finally, when they unfurled the flags for Xi’s three-day trip, there was lunch for the Red Emperor with the Queen, a glitzy state banquet, two nights at Buckingham Palace and an address to Parliament. But there were also pictures of the President standing aboard a London bus, enjoying fish and chips over a pint with Dave and hanging out with football stars in Manchester — all designed to reinforce the narrative of an ordinary bloke who happened to be ruling one-sixth of the world’s population.

“He has a confident and bullish exterior — he sees himself very much as the big leader,” wrote Cameron in his biography. “But behind the scenes I found him reflective and thoughtful.” Yet there seems surprisingly little wider interest in this enigmatic character who changed the course of China and now seeks to reshape the world.

That state visit came at a time of greater optimism, when many people beyond the Tory leadership fell for the delusion that China might be nominally a Communist country but, propelled by capitalism and consumerism, was sliding inexorably down a path towards greater freedom. How different the world looks today — and not just due to the devastating pandemic that mysteriously emerged from the heart of China, made all the worse by the state cover-up.

MORE FROM THIS AUTHOR

The WHO's Covid shame

BY IAN BIRRELL

Indeed, there is a growing consensus that this is a country intent on pushing its dictatorial creed in a tussle for global supremacy against Western liberal democracy. It is a nation which has inflicted genocide on Muslim minorities, throttled freedom in Hong Kong, threatened Taiwan, sabre-rattled on borders in the Himalayas, developed a sinister surveillance society and even infiltrated our universities to scoop up their latest research.

All of which makes the lack of curiosity surrounding the most powerful Chinese leader since Mao Zedong seem rather strange. As Jeffrey Wasserstrom, a professor of Chinese history, recently asked: “Why are there no biographies of Xi Jinping?”. Their absence is all the more striking when you consider that China’s ruler is not simply far more important than the likes of Russian President Vladimir Putin, who has spawned a small library of books; he is also a fascinating figure with a compelling life story.

Lurking behind that calm facade lies a childhood tale that helps cast some light on Xi’s controlling policies and his aggressive nationalism. Bear in mind that it is Xi who turned his nation back towards harsh totalitarianism, ordered his acolytes to ratchet up repression in Xinjiang and broke any pretence of keeping to the handover deal with Britain to protect Hong Kong’s freedoms. He has ditched term limits to retain power, crushed party foes, stifled domestic dissent and enshrined his name in the party constitution, elevating his position and ideology to the status of Chairman Mao. It is hard to disagree with the view of former Australian prime minister Kevin Rudd that he is “the most formidable politician of our age”.

It does not take a psychologist to see that the seeds of his ruthless desire for order, his rigid toughness and perhaps even his political pragmatism may have been sown during his turbulent background, even if it is hard to disentangle the myths from the man. Like any smart modern politician, Xi knows the power of public relations and has worked hard over the decades to create an image that dovetails with both his personal and national desires. Hence those “man of the people” pictures over a pint down The Plough with Cameron.

SUGGESTED READING

How China bought Britain's universities

BY MARK EDMONDS

Like his British host, Xi had an elite upbringing that involved attendance at one of his nation’s finest schools — although in his case, this led only to trouble and tragedy during the chaos of the Cultural Revolution. Xi, born in 1953, is the son of Xi Zhongxun, a Communist revolutionary hero who was close to Mao and became a vice premier. Although China was riddled with poverty, this prominent family lived in a compound for party chiefs with their own cooks, nannies and drivers. One official biography claims that his parents sought to ensure their children were not spoilt, so he wore clothes handed down from his siblings — including floral shoes from his sisters that were dyed black. His father, meanwhile, was so strict that friends said his treatment of his son bordered on inhuman, and Xi also attended the “CCP aristocracy school” in Beijing infamous for military-style discipline. Any hint of softness, said one classmate, was seen as weakness.

Disaster struck when he was nine. His father fell out with Mao amid party in-fighting, so was sent to work in a factory in central China and his family lost its prized home —although his mother Qi Xin retained her party job in Beijing. Worse came in the 1966 Cultural Revolution, with its brutal purging of senior officials as enemies of the state. His father was beaten, paraded on a truck through jeering crowds and jailed. The family home was ransacked by militants, his mother forced into hard labour on a farm. Xi, a bookish boy, was made to denounce his father and bullied by teachers as the child of a “black gang”, the term for disgraced officials. His older sister eventually killed herself after being “persecuted to death”.

The following year Xi’s school was shut down and turned into an exhibition to showcase the pampered privileges of the reactionary elite. At the age of 14, he was caught by a gang of revolutionary Red Guards, who threatened to execute him before making him read quotations from Mao. Another time, he fled from a meeting attacked by students armed with clubs, who caught and badly beat one of his friends. “I always had a stubborn streak and wouldn’t put up with being bullied,” he claimed later. “I riled the radicals and they blamed me for everything that went wrong.”

There can be little doubt that Xi suffered as the son of a prominent man who was purged repeatedly for remaining loyal to his lifetime cause of communism. Xi himself only evaded jail after Mao, seeking to regain control of spiralling chaos, ordered 30 million young city dwellers into the countryside for “re-education” by peasants. Analysts speculate this difficult period in his teenage years led to Xi’s ability to hide his feelings beneath an impassive surface, along with the development of his fervent desire for stability. “This generation had everything taken from them so they have the survival instinct,” said Kerry Brown, professor of China Studies at King’s College, London. “They had to deny who they were. It becomes all about control with no room for ego.”

SUGGESTED READING

China's plan for medical domination

BY STEVE BOGGAN

Xi has since made much of the seven long years he spent as a “son of yellow earth”, living from the age of 15 in a cave dwelling in a remote, impoverished village in Shaanxi region. “I felt lonely at first,” he admitted in his autobiography. He found it a shock to eat rough peasant food, sleep on flea-ridden blankets and perform hard rural labour. Dozens of others sent to this region died from disease or the tough conditions. Instead Xi developed extraordinary self-discipline: “The knife is sharpened on a stone, people are strengthened in adversity,” he said later.

His loathing of chaos was fuelled later by the collapse of the other major twentieth-century Communist empire. “Why did the Soviet Union disintegrate?” he once asked. “In the end nobody was a real man, nobody came out to resist.”

Yet during those formative years he also saw the danger of extremism, when children had free reign to kill and torture in the name of delivering utopia. Did this all leave him with the pragmatism needed to achieve his goals? A leaked US diplomatic cable, based on information from a friend, reported that Xi focused from an early age on reaching the top as an “exceptionally ambitious” character. Unlike many youths who “made up for lost time by having fun” after the Cultural Revolution, Xi “chose to survive by becoming redder than the red”, reading Karl Marx and laying foundations for a political career. He was seen as “cold and calculating”, deemed “boring” by women.

Now he wants to impose his will on the world, having navigated a path through the choppy waters of the Chinese Communist Party. Today, our challenge is not China, that huge land of epic history and extraordinary culture; it is President Xi and his vision of total control. His goal is clear: to make his country great again while usurping the global leadership of the United States — and he does not hide his aims.

In a speech to his party’s 2017 National Congress, Xi laid out “the Chinese dream of national rejuvenation”: to finish building a prosperous society by this year, centenary of the party’s birth; to assume global economic and military leadership by 2035; then to “resolve” the Taiwan issue by 2049, centenary of the People’s Republic, to conclude their rebirth as a “strong country”.

At the centre of his vision lies the Communist Party, firmly in control of everything in China, aided by skilled propaganda and use of technology to control his people in Orwellian style as they walk, talk, shop and work. Such is Xi’s sway that a smartphone app was developed which allowed users to compete over who could virtually applaud that party congress speech with the most enthusiasm — more than one billion claps were recorded in 24 hours. Two years later, the most downloaded app in the country was “Study the Great Nation”, which combined chat and games with quizzes about Xi’s ideology — a digital update on Mao’s Little Red Book designed to ensure compliance and diligence from citizens.

When Xi first met Putin in 2013, he told the Russian president: “We are similar in character.” There is truth in this statement, yet the Chinese leader is far more subtle and ambitious. Xi Jinping sees himself as a saviour of his creed and a man of destiny for his country, a ruthless character driven by fierce resolve inflamed by that suffering of his youth. He is the very embodiment of that Confucian saying: “To be wronged is nothing unless you continue to remember it.”

0 notes

Text

Beijing After Tiananmen: Part 1

The massacre of unarmed civilians that transpired in the early early morning hours of June 4, 1989 in Beijing did not conclude the tale of struggling, sorrow, and trauma for the city’s inhabitants that 12 months. In fact, the murders in Beijing – some trustworthy resources say of up to 10,000 people today, as quoted by the British ambassador to China at that time, Sir Alan Donald – have been the extraordinary catalyst for a lengthy period of tranquil but really productive terror under martial legislation that lasted for the rest of the year.

The story of those people 6 months is largely untold, for 3 explanations. Very first, there ended up very couple foreigners in Beijing adhering to the massacre. At most embassies, and among the still small enterprise neighborhood, all but vital employees were being evacuated from the metropolis. Lots of did not return for months or even months thereafter. 2nd, there were several Chinese who would have dared to speak with a foreigner at all, a lot less with a foreign information outlet. The implications would have been arrest, detention, and maybe worse.

The 3rd explanation also relates to the Chinese population, who created up, it will have to be remembered, much much more than 99.97 percent of the inhabitants of the city at that time. Beijing, and the rest of China, was however healing from the ravages of the Cultural Revolution, which had only finished 13 a long time prior, in 1976. The 10-yr interval of that upheaval, which noticed households across China torn aside by inside betrayals, modern society upended by zealous revolutionaries, and traditional markers of Chinese culture almost erased from both equally actual physical and psychological domains, experienced also claimed a even now unfamiliar selection of lives, absolutely in the hundreds of thousands. Beijing inhabitants ended up not fully inured to the massacre of 1989, but they experienced witnessed madness and murder right before.

Experiencing this posting? Simply click below to subscribe for comprehensive accessibility. Just $5 a month.

I had lived in Beijing considering the fact that August 1987, first as a college student at the Foreign Affairs University. The next calendar year, at the conclude of my system, I felt compelled to remain extended, emotion that I had only scratched the surface of this interesting, maddening, country. I observed work with a multinational business, and then with the Australian Embassy.

Someplace there are shots of me standing on the Monument to the People’s Heroes in Tiananmen Square all through the early demonstrations in April 1989. When the first demonstrators came out to honor Hu Yaobang, the Chinese leader who had sympathized with and supported previously pupil protests in the 1980s, I was right in the center of them from the first week on.

I was in the United Kingdom on June 4, having traveled across Asia and Europe on the Trans-Siberian railway three weeks earlier, in early May well. I woke up that early morning, as did the relaxation of the entire world, to the horrific information that People’s Liberation Military tanks and troopers had killed 1000’s in and all around the sq.. I may perhaps not have absolutely stopped crying for the upcoming five days.

I flew to Hong Kong within times, where by I managed to get as a result of by telephone to South American and Spanish buddies who had not been evacuated. They implored me to provide overseas information accounts of the massacre. Even senior diplomats experienced been not able to access any intercontinental media for entire accounts of the horror that experienced happened.

I went all over to newsstands in the course of Central and Tsim Sha Tsui, purchasing up, and typically remaining offered donations of, as several worldwide magazines and newspapers as I could have. I then went to Dragon Air to buy a ticket into Beijing. Dragon Air reported that they had practically nothing but evacuation flights likely into the Chinese funds, but that if I really needed to prospect it, they would give me a trip in for cost-free.

The airplane into Beijing was pretty much empty not far more than 5 passengers sat in the significant, roomy cabin. Signals at the examine-in desk at Kai Tek Airport in Kowloon experienced been clear: newspapers and journals were wholly forbidden to be taken into China.

My hand-carry duffel bag was whole of the newspapers and publications I experienced collected. It also contained two deals of female sanitary napkins, just one unopened and 1 open up, with two pads lacking. I experienced intentionally purchased them in Hong Kong so that the contents of the packaging would be prepared in Chinese, as perfectly as in English.

As I sat by the window in the rear of the plane, I tore out write-up soon after posting of information and pictures of the massacre, folding them into little packages no additional than 3 inches square.

With each article, I took out a person sanitary pad, and opened up a pocket together the lengthy facet of the napkin between its layers of cotton. Each and every folded post slid neatly into the pocket and became virtually unnoticeable, invisible to any but a devoted searcher.