#Automated Storage and Retrieval System Market Forecast

Explore tagged Tumblr posts

Text

This automated storage and retrieval system (ASRS) market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the automated storage and retrieval system (ASRS) market, contact Data Bridge Market Research for an Analyst Brief. Our team will help you take an informed market decision to achieve market growth.

0 notes

Text

Pharmacy Automation Devices Market to boom with 8–9% CAGR due to accurate dispensing by 2029

The pharmacy automation devices market is experiencing steady growth, with a projected CAGR of approximately 8-9% during the forecast period. This expansion is driven by the increasing need for efficient medication management systems, rising demand in hospitals and retail pharmacies, and the growing focus on patient safety through error reduction.

Pharmacy automation devices are systems designed to streamline various pharmacy processes, such as medication dispensing, packaging, labelling, and inventory management. These devices reduce human errors, enhance efficiency, and ensure proper medication tracking, particularly in large hospitals and retail pharmacies. The technology behind automation devices includes robotic dispensing systems, automated storage and retrieval systems, and medication compounding systems. Their implementation helps improve patient safety, reduce operational costs, and optimise workflow within healthcare facilities.

🔗 Want deeper insights? Download the sample report:https://meditechinsights.com/pharmacy-automation-devices-market/request-sample/

Increasing Demand for Automated Solutions in Chronic Disease Management

A key factor driving the growing adoption of pharmacy automation devices is the rising need for effective chronic disease management. As the global population ages, the incidence of long-term conditions such as diabetes, cardiovascular disease, and respiratory disorders is surging, requiring continuous medication management. This growing burden on healthcare systems demands error-free, efficient, and scalable dispensing processes to ensure patient safety and timely delivery of prescriptions. Automation technology plays a crucial role by streamlining these tasks, reducing human error, and allowing pharmacies to handle high prescription volumes more effectively. With chronic disease cases expected to rise further, the demand for automated pharmacy systems is anticipated to increase, making them essential for hospitals and retail pharmacies to keep pace with patient needs.

AI and Predictive Analytics: A Game-Changer for Pharmacy Automation

The integration of AI and predictive analytics is emerging as a game-changing trend in the pharmacy automation market. AI-enabled systems are significantly improving the ability to forecast medication demand by analyzing consumption patterns, patient data, and inventory levels, allowing pharmacies to optimize stock management and reduce the risk of shortages or overstocking. In addition, machine learning algorithms are enabling more accurate and personalized medication dispensing, ensuring the right dose is provided based on individual treatment plans. This not only enhances operational efficiency but also improves patient outcomes by minimizing dispensing errors. The rise of AI-driven solutions is transforming the pharmacy landscape, positioning these advancements as vital for the future of automation in healthcare settings.

Gain a competitive edge-request a sample report now! https://meditechinsights.com/pharmacy-automation-devices-market/request-sample/

Competitive Landscape Analysis

The global pharmacy automation devices market is marked by the presence of established and emerging market players such as Amerisource Bergen Corporation (Cencora); Accu-Chart Plus; Healthcare Systems, Inc.; Omnicell, Inc.; McKesson Corporation; Pearson Medical Technologies; Baxter; Scriptpro LLC; Deenova S.R.L; Fulcrum Pharmacy Management, Inc.; Swisslog Healthcare, and Yuyama Co. Ltd among others. Some of the key strategies adopted by market players include product innovation and development, strategic partnerships and collaborations, and geographic expansion.

About Medi-Tech Insights

Medi-Tech Insights is a healthcare-focused business research & insights firm. Our clients include Fortune 500 companies, blue-chip investors & hyper-growth start-ups. We have completed 100+ projects in Digital Health, Healthcare IT, Medical Technology, Medical Devices & Pharma Services in the areas of market assessments, due diligence, competitive intelligence, market sizing and forecasting, pricing analysis & go-to-market strategy. Our methodology includes rigorous secondary research combined with deep-dive interviews with industry-leading CXO, VPs, and key demand/supply side decision-makers.

Contact:

Ruta Halde Associate, Medi-Tech Insights +32 498 86 80 79 [email protected]

0 notes

Text

Retail Automation Market Sees Technological Innovation Reshaping Traditional Retail and Consumer Interaction

The retail automation market is undergoing a remarkable transformation driven by technological advancements, evolving consumer preferences, and the increasing need for operational efficiency. Retailers across the globe are embracing automation solutions to enhance customer experiences, reduce costs, streamline operations, and stay competitive in an increasingly digital economy. This rapid adoption is significantly reshaping the retail landscape across both developed and emerging markets.

Market Overview

Retail automation involves the use of technology to automate retail processes such as inventory management, billing, customer engagement, and product tracking. It includes a wide range of solutions such as self-checkout systems, vending machines, electronic shelf labels (ESLs), barcode and RFID systems, interactive kiosks, and automated storage and retrieval systems (AS/RS). These solutions not only reduce dependency on manual labor but also improve accuracy, speed, and customer satisfaction.

The global retail automation market has seen robust growth over the past few years. As of 2024, the market size is valued at over USD 20 billion and is projected to surpass USD 35 billion by 2030, growing at a CAGR of over 8% during the forecast period. This growth is largely driven by advancements in AI, IoT, robotics, and cloud computing.

Key Drivers of Growth

Increased Consumer Demand for Contactless Shopping The COVID-19 pandemic accelerated the adoption of contactless technologies. Customers today prefer minimal physical interaction, which has driven retailers to invest in self-checkout systems and mobile payment solutions. These technologies also reduce wait times and improve convenience.

Rising Labor Costs and Labor Shortages Retailers are increasingly facing labor-related challenges, especially in developed countries. Automation offers a sustainable alternative by minimizing human error and lowering operating costs in the long run.

Data-Driven Decision Making Retail automation tools collect vast amounts of real-time data that help retailers make informed decisions regarding inventory levels, customer preferences, and product placement. AI-powered analytics tools enhance this further by providing predictive insights.

Enhanced In-Store Experience Interactive kiosks, smart mirrors, and AR/VR technology allow retailers to provide immersive shopping experiences that improve customer engagement and satisfaction, helping brick-and-mortar stores compete with e-commerce.

Market Segmentation

The retail automation market can be segmented by product type, end-user, and region.

By Product Type: Point-of-sale (POS) terminals, barcode & RFID systems, electronic shelf labels, self-checkout systems, and vending machines.

By End-User: Supermarkets, hypermarkets, convenience stores, fuel stations, and online retailers.

By Region: North America holds the largest market share, followed by Europe and Asia-Pacific. However, the Asia-Pacific region is expected to witness the fastest growth due to increasing urbanization, rising disposable incomes, and rapid digitalization in countries like China and India.

Competitive Landscape

The market is highly competitive and fragmented. Major players include Honeywell International Inc., Fujitsu Limited, Diebold Nixdorf, Zebra Technologies, NCR Corporation, and Toshiba Global Commerce Solutions. These companies are investing heavily in R&D and forming strategic partnerships to expand their product offerings and reach.

Startups are also playing a significant role by introducing innovative solutions, particularly in AI-driven analytics and cashier-less checkout technologies. Amazon Go is a notable example, setting new benchmarks for automation in retail environments.

Challenges and Limitations

Despite the benefits, the adoption of retail automation is not without challenges. High initial investment costs can be a barrier for small and medium-sized enterprises (SMEs). There are also concerns around data privacy, cybersecurity, and job displacement. Retailers must ensure a balanced integration of automation and human labor to maintain both efficiency and customer trust.

Future Outlook

The future of the retail automation market looks promising. Emerging technologies such as AI, machine learning, robotics, and edge computing will continue to drive innovation. Personalization will become a key focus, with automation enabling hyper-personalized shopping experiences tailored to individual consumer behavior.

Moreover, sustainability will play an increasing role, with automated systems helping reduce waste and optimize energy consumption in stores. As competition intensifies and consumer expectations rise, retailers that strategically invest in automation will be better positioned to succeed in the evolving landscape.

0 notes

Text

AI in Action: Intelligent Solutions for the Document Management System Market

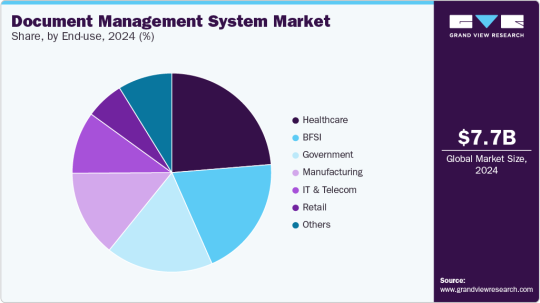

The global document management system market was valued at USD 7.68 billion in 2024 and is projected to reach USD 18.17 billion by 2030, demonstrating a robust Compound Annual Growth Rate (CAGR) of 15.9% from 2025 to 2030. This expansion is primarily fueled by organizations' increasing need to securely manage and store vast volumes of digital information.

As businesses worldwide embrace digital transformation and move towards paperless operations, the demand for effective solutions for document storage, retrieval, and management has escalated. The accelerated adoption of cloud-based DMS solutions has further spurred this trend, offering businesses scalable, cost-effective, and readily accessible options. Moreover, the heightened focus on compliance and regulatory mandates is significantly contributing to the growth of the DMS industry. Enterprises operating in heavily regulated sectors like healthcare, finance, and legal are increasingly implementing DMS to ensure strict adherence to data security, privacy, and record-keeping regulations. These systems facilitate streamlined audits, maintain secure document trails, and mitigate the risk of non-compliance penalties.

Key Market Trends & Insights:

Regional Leadership: The North American document management system market commanded a substantial revenue share of almost 40.0% in 2024, driven by the escalating demand for digital transformation across various industries.

Component Dominance: The software segment held the largest market share, exceeding 67.0% of the revenue in 2024. This dominance is attributed to the growing demand for cloud-based, AI-driven, and compliance-ready solutions.

Deployment Preference: The cloud segment led the market with a revenue share of over 67.0% in 2024. This is propelled by the integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA) into cloud DMS platforms.

Enterprise Size Leadership: Large enterprises accounted for nearly 67.0% of the market's revenue share in 2024. This is due to the immense volume of enterprise-grade documents they manage and their critical need for scalable, secure, and intelligent document workflows.

End-Use Sector Dominance: The healthcare segment generated over 23.0% of the market's revenue share in 2024. A significant driver here is the accelerating shift towards Electronic Health Records (EHRs) and paperless systems within the healthcare industry.

Order a free sample PDF of the Document Management System Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 7.68 billion

2030 Projected Market Size: USD 18.17 billion

CAGR (2025-2030): 15.9%

North America: Largest market in 2024

Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Leading companies in the document management system (DMS) industry, including Microsoft, IBM Corporation, Oracle Corporation, Open Text Corporation, and Hyland Software, Inc., are actively engaged in strategic initiatives to enhance their competitive edge. These strategies largely involve new product development, forging partnerships and collaborations, and entering into agreements.

Illustrative of these efforts, in April 2025, Hyland Software, Inc. significantly expanded its product offerings by integrating advanced AI capabilities. Through substantial updates to Hyland Automate, Hyland Knowledge Discovery, and key improvements to Hyland OnBase and Hyland Alfresco, the company aims to provide organizations with sophisticated tools for optimizing content, processes, and application intelligence. Their Hyland Content Intelligence product line is designed to empower businesses with actionable insights derived from simple natural language queries, thereby streamlining complex searches and delivering precise information from vast enterprise content.

Similarly, in March 2025, IBM Corporation launched IBM Storage Ceph as a Service, broadening its suite of flexible on-premises infrastructure solutions. This new service complements IBM Power delivered as a service, offering a distributed compute platform with diverse form factors and adaptable consumption models. The IBM Storage Ceph service facilitates the integration of cloud-based solutions with on-premises environments, providing a unified software-defined storage solution that encompasses block, file, and object data. Its goal is to help organizations eliminate data silos and modernize their data lakes and virtual machine storage, delivering a seamless cloud storage experience within their own data centers.

Further demonstrating industry innovation, in December 2024, OpenText introduced Core Digital Asset Management (Core DAM). This solution is engineered to optimize the digital content supply chain by incorporating powerful features that yield tangible results. Core DAM leverages practical AI to automate tasks such as image tagging, video transcript generation, and the creation of design inspiration images using OpenText Experience Aviator, significantly boosting the efficiency and accuracy of creative workflows. It also provides global content access, enabling users to generate instant links for high-performance display worldwide.

Key Players

Agiloft, Inc.

Alfresco Software Inc.

Cflowapps

DocLogix

Hyland Software, Inc.

IBM Corporation

Integrify

Browse Horizon Databook for Global Document Management System Market Size & Outlook

Conclusion

The document management system (DMS) market is rapidly growing, driven by the need for secure digital information management and paperless transitions. Cloud-based solutions and regulatory compliance are key growth factors. North America leads the market, with software and cloud deployments dominating. Large enterprises and the healthcare sector are major adopters. Leading companies are innovating with AI and strategic collaborations to enhance their offerings.

0 notes

Text

Logistics Automation Market

Logistics Automation Market size is estimated to reach $56.9 billion by 2030, growing at a CAGR of 7.9% during the forecast period 2024–2030.

🔗 𝐆𝐞𝐭 𝐑𝐎𝐈-𝐟𝐨𝐜𝐮𝐬𝐞𝐝 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝟐𝟎𝟐𝟓-𝟐𝟎𝟑𝟏 → 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐍𝐨𝐰

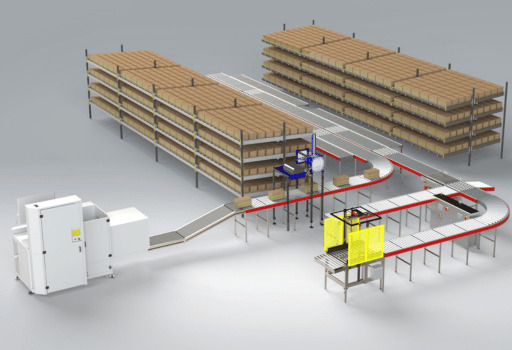

Logistics Automation Market is rapidly transforming global supply chains by integrating technologies such as AI, robotics, IoT, and machine learning to enhance efficiency, reduce costs, and improve accuracy. Automation solutions — including autonomous mobile robots (AMRs), automated storage and retrieval systems (AS/RS), and real-time tracking — are increasingly adopted across warehousing, transportation, and last-mile delivery.

Driven by e-commerce growth, labor shortages, and rising demand for faster delivery, the market is expanding globally. Key sectors embracing logistics automation include retail, manufacturing, healthcare, and food & beverage.

🚚 𝐊𝐞𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐃𝐫𝐢𝐯𝐞𝐫𝐬

📦 𝐄-𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐁𝐨𝐨𝐦

Rapid growth in online shopping increases demand for faster, more efficient order fulfillment and delivery systems.

🤖 𝐋𝐚𝐛𝐨𝐫 𝐒𝐡𝐨𝐫𝐭𝐚𝐠𝐞𝐬 & 𝐑𝐢𝐬𝐢𝐧𝐠 𝐂𝐨𝐬𝐭𝐬

Shortages in skilled labor and rising wages are pushing companies to adopt automation to maintain productivity and reduce operational costs.

📈 𝐃𝐞𝐦𝐚𝐧𝐝 𝐟𝐨𝐫 𝐒𝐮𝐩𝐩𝐥𝐲 𝐂𝐡𝐚𝐢𝐧 𝐕𝐢𝐬𝐢𝐛𝐢𝐥𝐢𝐭𝐲

Businesses seek real-time tracking and data analytics to enhance decision-making and responsiveness across logistics networks.

⚙️ 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐢𝐜𝐚𝐥 𝐀𝐝𝐯𝐚𝐧𝐜𝐞𝐦𝐞𝐧𝐭𝐬

Innovations in AI, robotics, IoT, and machine learning are making logistics automation more scalable, affordable, and adaptable.

🔗 𝐍𝐞𝐞𝐝 𝐟𝐨𝐫 𝐎𝐩𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐜𝐲

Companies aim to streamline warehousing, inventory management, and transportation to boost speed, accuracy, and cost-effectiveness.

𝐋𝐢𝐦𝐢𝐭𝐞𝐝-𝐓𝐢𝐦𝐞 𝐎𝐟𝐟𝐞𝐫: 𝐆𝐞𝐭 $𝟏𝟎𝟎𝟎 𝐎𝐟𝐟 𝐘𝐨𝐮𝐫 𝐅𝐢𝐫𝐬𝐭 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞

𝐓𝐨𝐩 𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬:

EXL | Ryder System, Inc. | Wesco | GXO Logistics, Inc. | CJ Logistics America | DSC Logistics | Invio Automation | Lineage | Geek+ | Vee Technologies | Bastian Solutions | Iris Software Inc. | TGW North America | GoComet | OnProcess Technology | Unipart | Danos Group

#LogisticsAutomation #WarehouseAutomation #SupplyChainAutomation #SmartLogistics #LogisticsTech #DigitalSupplyChain #AutomatedLogistics #AutomationInLogistics #LogisticsInnovation #SupplyChainTech

0 notes

Text

Emerging Trends in Logistics Automation: Market Dynamics and Forecast

The global logistics automation market was valued at USD 34.56 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 15.0% from 2024 to 2030. Logistics automation encompasses a broad range of hardware and software solutions designed to streamline and enhance key logistics operations, including transportation, storage, retrieval, and data management. By automating these functions, businesses can significantly improve operational efficiency, reduce manual errors, and decrease turnaround times. The adoption of automation enables companies to scale operations effectively, as larger volumes of goods can be managed more efficiently with the aid of autonomous mobile robots (AMRs), conveyor systems, automated guided vehicles (AGVs), and automated storage and retrieval systems (AS/RS).

One of the primary drivers behind the rapid expansion of this market is the growing consumer preference for online shopping, which is accompanied by increasing expectations for faster and more efficient delivery services. This shift in consumer behavior has led to a significant rise in the number of fulfillment centers, particularly those catering to last-mile delivery and on-demand or quick-delivery services. These centers are increasingly turning to advanced automation technologies, evolving from basic mechanized solutions to fully autonomous, operator-free systems. As robotics and automated vehicle technologies continue to advance and mature, their applications in logistics and warehousing are expected to expand further, opening up substantial growth opportunities for the market throughout the forecast period.

However, the logistics automation industry also faces a number of challenges and barriers to adoption. Key among these is the intensifying competition among market players, which exerts pressure on pricing and innovation cycles. Another significant hurdle is the lack of standardization within the industry. The absence of universal standards across platforms and processes complicates integration and interoperability, making it difficult to implement uniform, scalable supply chain solutions. As a result, companies often incur high development and customization costs to create tailored systems for specific operational needs.

Moreover, the sector is affected by a shortage of skilled labor, particularly in developing economies such as India and China. The sophisticated nature of automation equipment and related software systems requires specialized training and expertise, which is not always readily available. This gap in technical workforce availability can slow down the implementation of automation projects and limit their effectiveness.

Despite these challenges, the overall outlook for the logistics automation market remains highly positive. With technological advancements, increasing investments in smart warehouses, and growing pressure on businesses to improve speed, accuracy, and efficiency, automation is set to play a central role in the transformation of logistics and supply chain operations worldwide.

Detailed Segmentation:

Component Insights

Based on components, the hardware segment dominated the market with the largest revenue share of 66.6% in 2023. Based on the hardware, the market is further segmented into automated sorting systems, autonomous robots, conveyor systems, de-palletizing/palletizing systems, automated storage and retrieval systems, automatic identification and data collection.

Vertical Insights

Based on vertical, the retail and e-commerce segment dominated the market with the largest revenue share in 2023. The sector uses logistics automation solutions in order to meet the increasing volumes of orders and shipments. Logistics automation solutions improve reliability and ensure timely delivery, which aligns with the retail and e-commerce industry's interest.

Function Insights

Based on functions, the market is segmented into inventory & storage management and transportation management. The transportation management segment dominated the market with the largest revenue share in 2023. Autonomous robots, conveyor systems, and de-palletizing/palletizing systems are used for transportation management.

Logistics Type Insights

Based on logistics type, sales logistics dominated the market with the largest revenue share in 2023. Sales logistics is the most critical aspect of the supply chain as it involves moving or delivering the goods to the end consumer. Sales logistics include order management, inventory management, shipping management, and vendor management. Automation solutions such as autonomous robots and automated storage and retrieval systems improve efficient

Organization Size Insights

Based on organization size, large enterprises dominated the market with the largest revenue share in 2023. Large enterprises handle huge volumes of products through the entire supply chain processes, which include raw materials, inventory, and final products.

Software Application Insights

Based on software applications, the market is segmented into inventory management, yard management, order management, labor management, vendor management, shipping management, customer support, and others. Among these, the order management segment dominated the market with the largest revenue share in 2023.

Regional Insights

North America led the logistics automation market in 2023, with a revenue share of 35.5%. The region's growth can be attributed to the presence of several logistics automation solution providers and several logistics companies, such as DHL, UPS, and FedEx Corporation, among others, in North America.

Curious about the Logistics Automation Market? Get a FREE sample copy of the full report and gain valuable insights.

Key Logistics Automation Company Insights

Some of the key companies operating in the logistics automation market include SAP., Jungheinrich AG, and Daifuku Co., Ltd., among others.

Jungheinrich AG is a supplier of warehousing technology and material handling equipment, offering extensive products and services. Its diverse product portfolio encompasses a wide range of equipment, including reach trucks, tow tractors, counterbalanced forklift trucks, shuttle and pallet carriers, order pickers, driverless transport systems, high rack stackers, rack servicing cranes, automatic high-rack silo conveyors, and materials handling systems. In addition, Jungheinrich AG provides various electric pedestrian trucks, explosion-proof forklifts, electric pedestrian stackers, batteries, and associated accessories. The company specializes in internal logistics services and delivers innovative solutions in warehousing technology.

Daifuku Co., Ltd. is an engineering, designing, manufacturing, installation, consultation, and after-sales service company for logistics systems and material handling equipment. The company caters to various industries, including automobile, transportation & warehousing, and commerce & retail. It has operations in 26 countries across Asia Pacific, Europe, and North America.

Key Logistics Automation Companies:

The following are the leading companies in the logistics automation market. These companies collectively hold the largest market share and dictate industry trends.

Dematic (Kion Group AG)

Daifuku Co., Ltd.

Swisslog Holding AG (KUKA AG)

Honeywell International Inc.

Murata Machinery, Ltd.

Jungheinrich AG

KNAPP AG

TGW Logistics Group

Kardex

Mecalux, S.A.

BEUMER GROUP

SSI SCHÄFER AG

Vanderlande Industries B.V.

WITRON Logistik

Oracle

One Network Enterprises

SAP

Recent Developments

In February 2024, Dematic announced a partnership with Canadian logistics company Groupe Robert and opened Quebec's first fully automated cold storage facility for third-party logistics. The facility features a high-capacity Automated Storage and Retrieval System (AS/RS) with 130-foot-tall cranes for managing fresh and frozen products. It also prioritizes sustainability and advanced fire safety measures and aims to enhance supply chain efficiency and serve as a central hub for manufacturers distributing products across North America.

In May 2023, Swisslog Holding AG announced a partnership with Northern Tool + Equipment to implement a Swisslog Automation Solution within the latter’s facility in Fort Mill in the U.S. state of South Carolina. The collaboration was aimed at addressing the omnichannel distribution requirements of Northern Tool + Equipment. The solution designed by Swisslog Holding AG’s experts features the AutoStore system optimized using Swisslog Holding AG’s SynQ software. Anticipated to be fully operational by October 2023, the solution would significantly enhance the efficiency and effectiveness of Northern Tool + Equipment's operations.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes

Text

Magnetic Pick And Place Machine Market Set to Reach $407.9 Million by 2035

The Magnetic Pick And Place Machine market is forecasted to experience significant growth, with industry revenue expected to rise to $407.9 million by 2035, up from $248.7 million in 2024. This growth is anticipated to be driven by an average annual revenue increase of 4.6% from 2024 to 2035. Magnetic Pick And Place Machines are crucial across a variety of industries, with applications in assembly lines, pick & place stations, storage & retrieval systems, and quality control. This report delves into key opportunities for growth and expansion, examining product types, applications, technology, operating speed, and accuracy levels, along with industry revenue forecasts.

Detailed Analysis - https://datastringconsulting.com/industry-analysis/magnetic-pick-and-place-machine-market-research-report

Market Dynamics and Growth Drivers

The market for Magnetic Pick And Place Machines is set to expand substantially, propelled by advancements in industrial automation and the growing demand for high-precision manufacturing. The increasing requirements for precision in electronics assembly and manufacturing are expected to further support this growth. Additionally, the expanding electronic components industry plays a significant role in driving the demand for Magnetic Pick And Place Machines, as companies seek to automate and improve efficiency.

Industry Leadership and Competitive Landscape

The Magnetic Pick And Place Machine market is marked by intense competition, with several key players leading the industry. Prominent companies include Panasonic Corporation, Yamaha Motor Co. Ltd., FUJI Corporation, Hanwha Precision Machinery Co. Ltd., CHM Precision Automation, Mycronic AB, Europlacer, Essemtec AG, Autotronik SMT GmbH, Manncorp Inc., Juki Corporation, and ASM Assembly Systems GmbH & Co. KG. These companies are expected to drive market growth by leveraging innovations in technology, strategic partnerships, and a focus on high-precision manufacturing.

Regional Shifts and Supply Chain Evolution

North America and Europe are the leading regions in the Magnetic Pick And Place Machine market. However, challenges such as high initial investment costs and operational complexity remain. As the supply chain evolves, from raw material supply to machine assembly and distribution, market players will need to adapt to these challenges while pursuing growth in emerging markets. Regions such as Brazil, India, and South Africa represent key opportunities for revenue diversification and expansion of the Total Addressable Market (TAM).

Opportunities for Expansion

The market presents significant opportunities in untapped segments and through technological innovations. The growing demand for automation in various sectors and the increasing complexity of electronic components are expected to create new growth avenues. Strategic collaborations and advancements in machine technology are also predicted to accelerate market expansion, particularly in major demand hubs like the U.S., Germany, China, Japan, and South Korea.

About DataString Consulting

DataString Consulting offers comprehensive market research and business intelligence solutions for both B2C and B2B markets. With over 30 years of combined experience in market research and strategic advisory, DataString Consulting provides tailored insights to meet the specific strategic goals of businesses. The company’s team of industry experts continuously monitors high-growth sectors across more than 15 industries, providing clients with timely, accurate, and actionable insights to help them stay ahead of emerging trends and opportunities.

0 notes

Text

Warehouse Automation: 2025 Trends, Types, and Best Practices

Warehouse automation, a cornerstone of the fourth industrial revolution, is transforming logistics by enhancing efficiency, accuracy, and scalability. Technologies like robotic pickers, conveyor belts, and AI-driven systems reduce manual labor and streamline operations to meet soaring e-commerce demands. As global retail sales are projected to hit $7.4 trillion by 2025, automation is critical for staying competitive. This 700-word guide explores the benefits, types, trends, and best practices for warehouse automation in 2025.

What is Warehouse Automation?

Warehouse automation leverages advanced technologies—robotics, software, and automated systems—to optimize tasks with minimal human involvement. It replaces repetitive, error-prone manual processes with faster, more accurate solutions. For instance, robotic arms sort goods, while conveyor systems move items seamlessly, saving time, cutting costs, and boosting efficiency in today’s fast-paced logistics landscape.

Benefits of Warehouse Automation

Enhancing Efficiency and Productivity

Automation streamlines workflows, accelerating tasks like storage and retrieval. Automated Storage and Retrieval Systems (AS/RS) maximize space, while robotic pick-and-pack stations enable rapid order fulfillment, supporting services like overnight shipping. Operating 24/7, automated systems reduce bottlenecks and boost productivity.

Reducing Errors and Improving Accuracy

Technologies like barcode readers achieve near-100% data capture, eliminating picking and tracking errors. Real-time monitoring ensures accurate inventory, and precise systems deliver 99.9% picking accuracy, minimizing costly mistakes and enhancing order reliability.

Lowering Operational Costs

Automation reduces labor and material waste, offering significant savings. AS/RS systems provide a 3–5-year payback period and can last 30 years, optimizing resources. By automating repetitive tasks, businesses lower operational expenses and achieve sustainable cost reductions.

Scaling Operations Seamlessly

Automated solutions adapt to seasonal spikes or growth without major overhauls. Scalable systems like Autonomous Mobile Robots (AMRs) integrate new technologies, ensuring warehouses remain agile in dynamic markets.

Types of Warehouse Automation Technologies

Collaborative Robots (Cobots)

Cobots work alongside humans, handling repetitive tasks like sorting or packing. Equipped with safety sensors, they prevent collisions and free workers for complex duties, such as quality checks, improving efficiency and safety.

Autonomous Mobile Robots (AMRs)

AMRs use AI and sensors to navigate warehouses, transporting goods precisely. Integrated with Warehouse Management Systems (WMS), they enhance inventory tracking, reduce labor costs, and operate 24/7 to support peak periods.

Conveyor and Sortation Systems

Conveyor belts and sortation systems use barcode scanners and RFID to move and sort goods efficiently, streamlining picking, packing, and shipping while reducing manual labor.

Automated Storage and Retrieval Systems (AS/RS)

AS/RS use robots or cranes to store and retrieve items, maximizing vertical space and speeding up inventory management. Integrated with WMS, they reduce congestion and boost throughput.

Key Trends in Warehouse Automation for 2025

Advancements in Robotics

Robots now handle picking, packing, and sorting with 99.9% accuracy. AI and machine learning enable them to manage complex tasks, like handling delicate items. The robotic picking market is expected to reach $5.7 billion by 2028.

Growth of AI Applications

AI optimizes restocking and demand forecasting, preventing stockouts and overstocking. AI-driven systems enhance quality control and adapt to customer demands, integral to modern WMS.

Increasing IoT Connectivity

IoT sensors provide real-time data on equipment and inventory, minimizing downtime via predictive maintenance and streamlining workflows for seamless operations.

Adoption of Predictive Analytics

Predictive analytics tools forecast demand, reducing inventory costs (averaging $3.7 million annually). They drive smarter decisions and faster ROI.

Sustainable Automation

Energy-efficient conveyors and AI-driven energy management reduce environmental impact, aligning with green logistics demands.

Steps to Implement Warehouse Automation

Assess Processes: Identify inefficiencies, like slow picking, to prioritize automation’s impact.

Set Goals: Define targets, such as 20% higher order accuracy, aligned with business needs.

Choose Tools: Select scalable solutions like AGVs or robotic arms, balancing cost and ROI.

Pilot Test: Start small in a low-traffic area, measuring metrics like processing time.

Train Workforce: Upskill staff on WMS and robotics for smooth adoption.

Implement in Phases: Begin with simple tasks like barcode scanning, progressing to robotic sorting.

Monitor and Optimize: Track KPIs like order accuracy and adjust workflows to maintain efficiency.

Overcoming Challenges

High Costs: Use financing or grants to offset investments. Solutions like Pio achieve 99.9% accuracy, reducing long-term costs.

Change Resistance: Involve staff, highlight benefits like less physical strain, and share success stories.

Compatibility: Assess systems and test integrations to ensure seamless operation.

Downtime: Schedule implementations during low-demand periods and monitor early stages.

Calculating ROI

Cost Savings: Automation cuts labor and error-related costs, with savings outweighing investments in 2–3 years.

Productivity: Sorting systems process thousands of packages hourly, far surpassing manual labor.

Error Reduction: Accurate systems boost customer retention, as 17% of consumers abandon brands after one error.

Scalability: Dynamic systems handle growth without reinvestment.

Conclusion

Warehouse automation delivers faster, more accurate, and cost-effective operations. Technologies like cobots, AMRs, and AI enable warehouses to meet e-commerce demands and scale efficiently. By starting small, integrating with WMS, and training staff, businesses can maximize ROI and overcome challenges. With the automation market projected to reach $69 billion by 2025, now is the time to invest for sustainable success.

1 note

·

View note

Text

The Future Trends of North America Pharmacy Automation Systems Market

Business Market Insights recently announced the release of the market research titled North America Pharmacy Automation Systems Market Outlook to 2030 | Share, Size, and Growth. The report is a stop solution for companies operating in the North America Pharmacy Automation Systems market. The report involves details on key segments, market players, precise market revenue statistics, and a roadmap that assists companies in advancing their offerings and preparing for the upcoming decade. Listing out the opportunities in the market, this report intends to prepare businesses for the market dynamics in an estimated period.

Is Investing in the Market Research Worth It?

Some businesses are just lucky to manage their performance without opting for market research, but these incidences are rare. Having information on longer sample sizes helps companies to eliminate bias and assumptions. As a result, entrepreneurs can make better decisions from the outset. North America Pharmacy Automation Systems Market report allows business to reduce their risks by offering a closer picture of consumer behavior, competition landscape, leading tactics, and risk management.

A trusted market researcher can guide you to not only avoid pitfalls but also help you devise production, marketing, and distribution tactics. With the right research methodologies, Business Market Insights is helping brands unlock revenue opportunities in the North America Pharmacy Automation Systems market.

If your business falls under any of these categories – Manufacturer, Supplier, Retailer, or Distributor, this syndicated North America Pharmacy Automation Systems market research has all that you need.

What are Key Offerings Under this North America Pharmacy Automation Systems Market Research?

Global North America Pharmacy Automation Systems market summary, current and future North America Pharmacy Automation Systems market size

Market Competition in Terms of Key Market Players, their Revenue, and their Share

Economic Impact on the Industry

Production, Revenue (value), Price Trend

Cost Investigation and Consumer Insights

Industrial Chain, Raw Material Sourcing Strategy, and Downstream Buyers

Production, Revenue (Value) by Geographical Segmentation

Marketing Strategy Comprehension, Distributors and Traders

Global North America Pharmacy Automation Systems Market Forecast

Study on Market Research Factors

Who are the Major Market Players in the North America Pharmacy Automation Systems Market?

North America Pharmacy Automation Systems market is all set to accommodate more companies and is foreseen to intensify market competition in coming years. Companies focus on consistent new launches and regional expansion can be outlined as dominant tactics. North America Pharmacy Automation Systems market giants have widespread reach which has favored them with a wide consumer base and subsequently increased their North America Pharmacy Automation Systems market share.

Report Attributes

Details

Segmental Coverage

Type

Automation Medication Dispensing Systems (Product Type and Operation)

Automated Packaging and Labelling Systems

Automated Table-Top Counters

Automated Storage and Retrieval Systems

and Other Types

End User

Hospital Pharmacy

Retail Pharmacy

and Others

Regional and Country Coverage

North America (US, Canada, Mexico)

Europe (UK, Germany, France, Russia, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, Australia, Rest of APAC)

South / South & Central America (Brazil, Argentina, Rest of South/South & Central America)

Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA)

Market Leaders and Key Company Profiles

McKesson Corp

Becton Dickinson and Co

Capsa Solutions LLC

Omnicell Inc

Oracle Corp

ScriptPro LLC

Veradigm LLC

Innovation Associates

YUYAMA Manufacturing Co Ltd

Swisslog Healthcare AG

Other key companies

What are Perks for Buyers?

The research will guide you in decisions and technology trends to adopt in the projected period.

Take effective North America Pharmacy Automation Systems market growth decisions and stay ahead of competitors

Improve product/services and marketing strategies.

Unlock suitable market entry tactics and ways to sustain in the market

Knowing market players can help you in planning future mergers and acquisitions

Visual representation of data by our team makes it easier to interpret and present the data further to investors, and your other stakeholders.

Do We Offer Customized Insights? Yes, We Do!

The Business Market Insights offer customized insights based on the client’s requirements. The following are some customizations our clients frequently ask for:

The North America Pharmacy Automation Systems market report can be customized based on specific regions/countries as per the intention of the business

The report production was facilitated as per the need and following the expected time frame

Insights and chapters tailored as per your requirements.

Depending on the preferences we may also accommodate changes in the current scope.

About Us:

Business Market Insights is a market research platform that provides subscription services for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductors, Aerospace & Defense, Automotive & Transportation, Energy & Power, Healthcare, Manufacturing & Construction, Food & Beverages, Chemicals & Materials, and Technology, Media & Telecommunications.

Contact Us: : www.businessmarketinsights.com

0 notes

Text

0 notes

Text

The Future Of Smart Warehousing In India: Innovations And Opportunities

Introduction to Smart Warehousing in India

The landscape of warehousing services in India is undergoing a remarkable transformation. As the country embraces digitalization and technological advancements, smart warehousing is emerging as the cornerstone of modern logistics. Imagine warehouses that not only store products but also optimize operations through cutting-edge innovations. This shift isn't just about efficiency; it's about redefining how businesses manage their supply chains. From bustling cities to remote areas, every sector stands to benefit from these advancements. The integration of automation, IoT, AI, and sustainable practices indicates a future where warehousing becomes more intelligent and responsive than ever before. As we delve into this exciting realm, you'll discover not only the innovations reshaping the industry but also the immense opportunities waiting for entrepreneurs ready to leap into this evolving market. Get ready to explore what lies ahead for smart warehousing in India!

Key Innovations Transforming Warehousing Sector

The warehousing sector in India is experiencing a profound transformation driven by innovative technologies. These advancements enhance efficiency and streamline operations. Automated storage and retrieval systems (AS/RS) are gaining traction. They optimize space utilization and reduce human error. With these systems, warehouses can process orders faster than ever before. Robotic picking solutions are also revolutionizing the way goods are handled. Robots work alongside humans to pick items with precision, minimizing physical strain on workers while increasing productivity. Additionally, cloud-based warehouse management systems allow for real-time tracking of inventory. This transparency helps businesses make informed decisions quickly. Smart sensors and data analytics play crucial roles as well. By analyzing trends, companies can forecast demand accurately, ensuring they meet customer needs without excess stock. These innovations not only elevate operational standards but also reshape how businesses view warehousing services in India today.

Role of Automation and Robotics

Automation and robotics are reshaping the landscape of warehousing services in India. These technologies streamline operations, significantly reducing human error and enhancing efficiency. Automated guided vehicles (AGVs) have become indispensable. They transport goods across warehouses swiftly, allowing for quicker order fulfillment. This not only saves time but also optimizes space utilization, which is critical in a country with burgeoning e-commerce demands. Robotic arms are now common sights on warehouse floors. They handle repetitive tasks like picking and packing with precision that humans simply cannot match. This frees up personnel to focus on more strategic roles within the organization. Moreover, integration of automation systems improves inventory management drastically. Real-time tracking ensures accurate stock levels, minimizing overstock or stockouts—a key concern for businesses aiming to meet customer expectations consistently. As these technologies evolve, they promise even greater advancements that will redefine how warehousing operates in India’s dynamic market environment.

Impact of IoT on Warehouse Operations

The Internet of Things (IoT) is revolutionizing warehouse operations in India. By connecting devices and equipment, IoT enables real-time monitoring of inventory levels, enhancing visibility and accuracy. Smart sensors track temperature, humidity, and other conditions essential for goods storage. This minimizes waste and ensures quality control throughout the supply chain. Automated alerts inform managers about stock discrepancies or equipment malfunctions immediately. This immediate feedback loop helps businesses respond swiftly to potential issues. Data collected from IoT devices also aids in demand forecasting. Companies can analyze patterns to optimize their inventory management strategies effectively. With enhanced connectivity between systems, collaboration within warehouses improves significantly. Teams can make informed decisions based on accurate data insights rather than relying solely on intuition or guesswork. As a result, operational efficiency increases while costs decrease—an essential factor for businesses looking to thrive in a competitive market like warehousing services in India.

AI and Machine Learning Applications

Artificial Intelligence (AI) and Machine Learning are redefining the landscape of warehousing services in India. By leveraging advanced algorithms, businesses can optimize inventory management with unprecedented accuracy. These technologies facilitate predictive analytics. This allows warehouses to forecast demand trends effectively. As a result, companies can reduce excess stock and minimize storage costs. Moreover, AI-driven robots enhance picking efficiency. They navigate through complex warehouse layouts seamlessly. The precision they offer not only speeds up operations but also reduces human errors. Machine learning models analyze historical data to streamline logistics processes further. This leads to smarter decision-making regarding supply chain dynamics. The integration of AI transforms everyday tasks into automated workflows, freeing staff for more strategic roles within the organization. With each advancement, the potential for innovation in warehousing expands exponentially.

Sustainable Practices in Smart Warehousing

Sustainable practices are becoming integral to smart warehousing. As environmental concerns grow, the logistics sector is adapting by implementing eco-friendly solutions. Energy-efficient lighting and heating systems reduce power consumption significantly. Solar panels on warehouse rooftops harness renewable energy, decreasing reliance on fossil fuels. Moreover, advanced inventory management reduces waste. By optimizing stock levels and minimizing overproduction, warehouses cut down unnecessary excesses that contribute to pollution. Green packaging materials are gaining prominence as well. Instead of traditional plastics, companies opt for biodegradable or recyclable options that lessen environmental footprints. Water conservation methods like rainwater harvesting further enhance sustainability efforts in these facilities. Investing in electric vehicles for transportation not only lowers emissions but also contributes to quieter operations within urban areas where noise regulations can be strict. These initiatives solidify the link between innovation and ecological responsibility in India’s evolving warehousing landscape.

Opportunities for Startups and Entrepreneurs

The rise of smart warehousing in India presents a wealth of opportunities for startups and entrepreneurs. As logistics becomes increasingly sophisticated, innovative solutions are in high demand. New entrants can focus on developing niche technologies tailored to this evolving sector. Whether it’s software for inventory management or IoT devices that enhance supply chain visibility, the possibilities are vast. Moreover, partnerships with established players can provide startups access to resources and expertise. Collaborating on pilot projects allows new businesses to showcase their capabilities while gaining valuable market insights. Entrepreneurs also have the chance to create sustainable warehousing solutions that align with global eco-friendly trends. With consumers demanding greater responsibility from brands, green practices can set newcomers apart. Investment in research and development is crucial as well. Staying ahead of technological advancements will ensure long-term relevance in this competitive landscape focused on innovation and efficiency.

Challenges Facing the Industry's Growth

The growth of smart warehousing in India faces several hurdles. One significant challenge is the high initial investment required for technology and infrastructure upgrades. Many businesses hesitate to allocate funds, fearing uncertain returns. Another issue is the skills gap in the workforce. Advanced technologies like robotics and AI demand specialized knowledge that many existing employees lack. This creates a bottleneck, hindering efficiency. Moreover, data security poses a major concern as warehouses become more connected through IoT devices. Cyberattacks can lead to significant disruptions and losses. Additionally, regulatory compliance adds complexity to operations. Adhering to various local laws while integrating new technologies can be daunting for businesses trying to innovate rapidly. Varying market demands can create unpredictability. Companies must adapt quickly or risk falling behind competitors who embrace change faster.

Government Policies and Incentives

The Indian government is taking significant steps to bolster the warehousing sector. Various initiatives aim to enhance infrastructure and logistics capabilities across the country. Policies like the Goods and Services Tax (GST) have streamlined operations, making it easier for businesses to manage inventories efficiently. This has encouraged investment in modern warehousing facilities. Additionally, schemes such as Make in India promote local manufacturing and increase demand for efficient storage solutions. The focus on developing multi-modal transport hubs also facilitates faster movement of goods. Financial incentives for startups targeting smart technology integration are becoming more common. These grants can help entrepreneurs innovate while easing entry barriers into a competitive market. With continued emphasis on digital transformation, government support can catalyze growth within this vital industry segment. As policies evolve, they will likely address emerging challenges that warehouses face today.

The Road Ahead for India

The road ahead for smart warehousing in India is paved with potential. As e-commerce continues to flourish, the demand for efficient logistics will only increase. This presents a unique opportunity for businesses to innovate and adapt. Investments in technology are crucial. Leveraging AI, robotics, and IoT can streamline operations significantly. Companies that embrace these advancements will set themselves apart. Moreover, collaboration among stakeholders is essential. Partnerships between tech providers and logistics firms can drive progress and create synergies that benefit all parties involved. Sustainability is becoming a priority as well. Warehouses adopting eco-friendly practices may attract consumers who value environmental responsibility. With government support through policies and incentives, there's ample room for growth. The industry stands on the brink of transformation, ready to seize new opportunities as they arise.

This content is originally posted on: https://www.equitylogistic.com/ Source URL: https://www.equitylogistic.com/blogs/details/the-future-of-smart-warehousing-in-india-innovations-and-opportunities

0 notes

Text

Growth Drivers Fueling the Digital Asset Management Market Boom

According to a recent report published by Grand View Research, Inc., the global digital asset management (DAM) market is projected to reach a value of USD 11.94 billion by 2030. The market is expected to grow at a compound annual growth rate (CAGR) of 16.2% from 2024 to 2030. This substantial growth trajectory is attributed to the increasing reliance of organizations on rich media content—such as videos, graphics, and interactive visuals—for enhancing brand visibility and effectively marketing their products.

One of the key drivers contributing to this market expansion is the widespread adoption of portable and mobile devices within corporate environments. As businesses become more mobile-centric, they are encountering heightened data security concerns. This trend is fueling the demand for robust digital asset management solutions that not only offer secure data handling but also streamline content organization and access across multiple platforms and users.

Furthermore, the digital asset management market is gaining momentum due to the growing demand among enterprises for advanced digital marketing tools and applications. Companies are increasingly utilizing DAM solutions for a variety of strategic purposes, including asset analytics, lifecycle management, and digital rights management. These capabilities allow organizations to maximize the value and performance of their digital content throughout its lifecycle.

Another significant factor propelling market growth is the rising preference for integrated and SaaS-based solutions. Integrated DAM platforms allow seamless collaboration across departments and systems, while Software-as-a-Service (SaaS) models offer scalability, cost-efficiency, and remote accessibility—making them particularly appealing to businesses seeking flexibility and reduced infrastructure costs.

The distinct advantages of digital asset management solutions over traditional content management methods are also expected to present considerable growth opportunities in the years ahead. As companies transition from conventional marketing models to real-time, consumer-centric digital strategies, the role of DAM systems becomes increasingly vital. These solutions are being widely adopted due to their affordability, ease of use, and ability to facilitate efficient storage, management, sharing, and retrieval of a wide range of digital content.

Curious about the Digital Asset Management Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Frequently Asked Questions (FAQs) About the Digital Asset Management (DAM) Market

1. What is the current size of the DAM market, and what is its growth forecast?

As of 2023, the global DAM market was valued at approximately USD 4.22 billion. It is projected to grow at a compound annual growth rate (CAGR) of 16.2% from 2024 to 2030, reaching an estimated USD 11.94 billion by 2030.

2. What factors are driving the growth of the DAM market?

Key drivers include:

• Increased reliance on rich media content for brand promotion and product marketing.

• Widespread adoption of portable devices in enterprises, leading to heightened security requirements.

• Growing demand for digital marketing applications, including asset analytics and lifecycle & rights management.

• Rising preference for integrated and SaaS-based solutions, offering scalability and cost-efficiency.

• Transition from traditional marketing to real-time, consumer-driven digital strategies.

3. What are the deployment models available for DAM solutions?

DAM solutions are primarily available in two deployment models:

• On-premise: Installed and maintained within an organization's infrastructure.

• Cloud-based: Hosted on the cloud, offering remote accessibility, scalability, and reduced IT overhead.

4. How is artificial intelligence (AI) transforming DAM solutions?

AI enhances DAM solutions by automating tasks such as metadata tagging, content recognition, and personalized content recommendations. These AI-driven features improve searchability, scalability, and overall usability, making DAM platforms indispensable for enterprises managing vast volumes of digital assets.

5. What challenges are associated with implementing DAM solutions?

Challenges include:

• High initial costs and ongoing maintenance expenses, especially for on-premise solutions.

• Data privacy and security concerns, particularly with cloud-based deployments.

• Integration complexities with existing systems and workflows.

• Resistance to change from employees accustomed to traditional asset management methods.

Order a free sample PDF of the Digital Asset Management Market Intelligence Study, published by Grand View Research.

#Digital Asset Management Market#Digital Asset Management Market Size#Digital Asset Management Market Share#Digital Asset Management Market Analysis

0 notes

Text

Global Cardiology Information System (CIS) Market Size: Analysis Of Market Segmentation And Trends

The Cardiology Information System (CIS) Market was valued at USD 1.09 billion in 2023 and is projected to grow to USD 2.24 billion by 2031, expanding at a compound annual growth rate (CAGR) of 9.4% over the forecast period from 2024 to 2031. The rising demand for advanced healthcare IT infrastructure, increased focus on reducing clinical errors, and the growing prevalence of cardiovascular diseases are driving the global CIS market forward.

Get Free Sample Report on Cardiology Information System (CIS) Market Size

As cardiology departments across the globe look to enhance their diagnostic and treatment capabilities, Cardiology Information Systems have emerged as essential tools to support clinicians with workflow efficiency, data management, and informed decision-making.

What is a Cardiology Information System?

A Cardiology Information System (CIS) is a specialized software platform designed to manage clinical, administrative, and diagnostic data in cardiology departments. It facilitates the storage, retrieval, analysis, and sharing of cardiac-related patient information, including imaging, test results, electrocardiograms (ECGs), echocardiograms, and catheterization lab data.

CIS enables cardiologists and healthcare providers to streamline their operations by integrating with hospital information systems (HIS), picture archiving and communication systems (PACS), and electronic health records (EHRs). With real-time access to data, clinicians can improve accuracy, minimize redundant testing, and enhance patient care.

Key Market Drivers

Rising Global Burden of Cardiovascular Diseases Cardiovascular disease remains the leading cause of death worldwide. With aging populations and lifestyle changes contributing to the surge in heart-related conditions, there is an urgent need for advanced cardiac care management tools. CIS solutions help in early detection, better tracking of patient histories, and clinical decision support.

Growing Adoption of Healthcare IT and Digitalization Healthcare providers are rapidly embracing digital tools to manage patient data efficiently and comply with government mandates. CIS platforms are a key part of this digital transformation, helping hospitals and specialty clinics digitize workflows, reduce paperwork, and improve communication among care teams.

Integration with Imaging and Diagnostic Tools Cardiology relies heavily on imaging and diagnostic data. Modern CIS systems integrate seamlessly with PACS and diagnostic imaging devices, enabling clinicians to access high-quality visuals and patient history from a single platform. This integration improves diagnostic precision and reduces turnaround times.

Need for Workflow Efficiency and Cost Reduction Hospitals and cardiology practices face increasing pressure to reduce operational costs while maintaining high standards of care. CIS platforms offer automation, data analytics, and intelligent reporting features that enhance workflow efficiency and resource management.

Supportive Government Initiatives and Regulations Governments in regions like North America and Europe are investing in healthcare IT infrastructure and encouraging the adoption of interoperable systems to improve population health management. Such policies are further accelerating the growth of the CIS market.

Market Segmentation

The Cardiology Information System Market is segmented based on component, mode of deployment, end user, and region.

By Component: The market includes software, services, and hardware. The software segment holds the largest share, driven by increasing demand for integrated, cloud-based platforms. Services such as maintenance, training, and technical support are also witnessing robust growth.

By Deployment Mode: CIS solutions can be deployed via on-premises, cloud-based, or hybrid models. Cloud-based systems are rapidly gaining popularity due to their scalability, remote accessibility, and reduced upfront costs, especially among small to mid-sized hospitals.

By End User: Hospitals, specialty clinics, diagnostic centers, and academic institutions are the primary users of CIS. Large hospitals lead the market due to their ability to invest in comprehensive digital systems and manage higher patient volumes. However, ambulatory cardiac care centers are expected to grow steadily as outpatient procedures become more common.

KEY PLAYERS:

Some of the major key players are as follows: GE Healthcare, Siemens Healthcare GmbH, CREALIFE Medical Technology, Honeywell Life Care Solution, Lumedx, Esasote, Cerner Corporation, Fujifilm Medical Systems, McKesson Corporation, Digisonics, Inc., Merge Healthcare Inc, Philips Healthcare, Cisco Systems and Other Players.

Make Enquiry about Cardiology Information System (CIS) Market Size

Future Outlook

As the demand for value-based and personalized care continues to rise, Cardiology Information Systems will play an increasingly central role in how cardiac care is delivered. The integration of artificial intelligence, predictive analytics, and machine learning is expected to enhance CIS platforms, offering clinicians deeper insights and more proactive patient management tools.

With increasing global focus on early diagnosis, efficient data handling, and patient-centered care, the CIS market is expected to witness strong momentum throughout the forecast period. Healthcare stakeholders investing in advanced information systems today are well-positioned to lead in the cardiology care of tomorrow.

About US

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President Of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Cardiology Information System (CIS) Market Size#Cardiology Information System (CIS) Market Size Trend#Cardiology Information System (CIS) Market Size Share#Cardiology Information System (CIS) Market Size Growth#Cardiology Information System (CIS) Market.

0 notes

Text

Warehouse Automation Market: Transforming Logistics Operations with Robotics, AI, and IoT for Maximum Efficiency

The Evolving Warehouse Automation Market: Trends and Challenges

Warehouse automation has rapidly transformed the logistics and supply chain industry, driven by advancements in robotics, artificial intelligence, and data analytics. As e-commerce continues its upward trajectory and consumer expectations push for faster, more efficient deliveries, the demand for automated solutions in warehousing is stronger than ever. The global warehouse automation market is expected to witness substantial growth over the next decade, but it is not without its challenges.

Market Growth and Key Drivers

The warehouse automation market is experiencing a significant boom, with industry reports forecasting a compound annual growth rate (CAGR) exceeding 10% in the coming years. The growth is primarily fueled by increasing online shopping trends, rising labor costs, and the need for optimized warehouse operations.

E-commerce Boom: The rapid rise of online shopping, accelerated by the pandemic, has created immense pressure on supply chains to fulfill orders quickly and accurately. This has led companies to invest in warehouse automation technologies, such as robotic picking systems, automated storage and retrieval systems (AS/RS), and autonomous mobile robots (AMRs).

Rising Labor Costs and Shortages: Warehouse operators are struggling with labor shortages and high employee turnover. Automated systems reduce dependency on human labor and enhance productivity, making them a compelling investment for businesses looking to optimize their operations.

Technological Advancements: Innovations in artificial intelligence, machine learning, and IoT have made warehouse automation smarter and more efficient. These technologies enable predictive analytics, real-time inventory tracking, and improved accuracy in order fulfillment.

Sustainability Initiatives: Companies are under pressure to reduce their carbon footprint and improve energy efficiency. Automated warehouses can help achieve sustainability goals by optimizing energy use, reducing waste, and minimizing transportation inefficiencies.

Emerging Trends in Warehouse Automation

Several trends are shaping the future of warehouse automation, making operations more agile and scalable:

Robotic Process Automation (RPA): AI-driven robots are being increasingly used for tasks such as sorting, picking, packing, and transporting goods within warehouses. These robots can work 24/7 without fatigue, significantly boosting efficiency.

Warehouse Management Systems (WMS) Integration: Modern WMS solutions integrate seamlessly with automation technologies, providing real-time insights and facilitating better decision-making.

5G Connectivity: With the rollout of 5G, warehouses can leverage faster and more reliable communication between automated systems, reducing downtime and improving overall efficiency.

Micro-Fulfillment Centers: As last-mile delivery becomes a key focus, businesses are investing in smaller, strategically located automated warehouses to speed up deliveries.

Challenges Facing the Warehouse Automation Market

Despite its rapid growth, the warehouse automation market faces several challenges that could slow adoption:

High Initial Investment Costs: Implementing automation solutions requires significant capital investment, making it difficult for small and mid-sized businesses to adopt these technologies.

Integration Complexities: Many companies still rely on legacy systems that may not be compatible with modern automation solutions, leading to integration hurdles.

Cybersecurity Risks: With increased reliance on AI and IoT, warehouses are more vulnerable to cyber threats, requiring robust security measures to protect data and operations.

Job Displacement Concerns: While automation improves efficiency, it also raises concerns about job losses in the warehousing sector. Companies need to balance automation with workforce reskilling programs.

Supply Chain Disruptions: Global supply chain disruptions, such as semiconductor shortages, can impact the availability of automation hardware, leading to deployment delays.

The Future of Warehouse Automation

The future of warehouse automation looks promising, with continuous innovation paving the way for more intelligent and adaptable systems. AI-driven analytics, blockchain-enabled inventory tracking, and cloud-based robotics will further enhance automation capabilities. As businesses seek to remain competitive, warehouse automation will become a necessity rather than a luxury.

Companies that embrace automation early will gain a significant competitive edge by improving efficiency, reducing costs, and meeting evolving consumer demands. However, businesses must also address the challenges associated with automation to ensure smooth adoption and integration.

In conclusion, the warehouse automation market is at an exciting juncture, driven by technological advancements and shifting market dynamics. As the industry evolves, companies that strategically invest in automation while considering potential challenges will emerge as leaders in the future of warehousing and logistics.

0 notes

Text

Optimizing Efficiency: The Benefits of Warehouse Automation Services

In today’s fast-paced logistics and supply chain industry, efficiency and accuracy are critical for businesses aiming to stay competitive. Warehouse automation services have emerged as a game-changer, helping companies streamline operations, reduce costs, and enhance overall productivity. In this blog, we explore the key benefits and applications of warehouse automation services.

What is Warehouse Automation?

Warehouse automation involves the use of technology, robotics, and software systems to manage warehouse tasks with minimal human intervention. It includes automated storage and retrieval systems (AS/RS), robotic picking solutions, conveyor systems, and warehouse management software (WMS). These technologies work together to optimize material handling, inventory management, and order fulfillment.

Key Benefits of Warehouse Automation

1. Increased Efficiency and Productivity

Automated systems perform repetitive tasks at a much faster pace than human workers. With robots and AI-driven solutions handling order picking, packing, and sorting, warehouses can process higher volumes of goods efficiently, reducing labor-intensive operations.

2. Improved Accuracy and Reduced Errors

Automation significantly minimizes human errors in order fulfillment. AI-powered warehouse management systems ensure accurate picking and packing, reducing returns due to incorrect shipments. Barcode scanning and RFID tracking also enhance inventory accuracy.

3. Cost Savings and Labor Optimization

By reducing reliance on manual labor, businesses can lower operational costs. Automation helps redistribute human resources to more strategic roles while mitigating challenges related to labor shortages and workforce fatigue.

4. Better Space Utilization

Automated storage and retrieval systems enable warehouses to optimize vertical space, allowing for higher storage capacity within the same footprint. This maximizes storage efficiency and improves warehouse organization.

5. Enhanced Safety

Warehouse automation reduces the risk of workplace injuries by minimizing the need for employees to perform physically demanding or hazardous tasks. Autonomous robots and conveyor systems transport goods safely, preventing accidents associated with manual handling.

Popular Warehouse Automation Technologies

Autonomous Mobile Robots (AMRs): These self-navigating robots transport goods within the warehouse, improving picking and sorting efficiency.

Automated Guided Vehicles (AGVs): AGVs follow predefined paths to move inventory between locations.

Conveyor and Sortation Systems: Automated conveyor belts and sorting systems accelerate order processing and distribution.

Pick-to-Light and Put-to-Light Systems: These systems use LED lights to guide warehouse workers in picking and placing items, reducing errors and increasing speed.

AI-Powered Warehouse Management Systems (WMS): AI-driven software solutions optimize inventory tracking, demand forecasting, and workflow automation.

Future of Warehouse Automation

The future of warehouse automation is driven by AI, IoT, and machine learning. Smart warehouses are adopting predictive analytics, real-time tracking, and robotic process automation to improve decision-making and operational efficiency. As technology advances, fully autonomous warehouses are becoming a reality, revolutionizing supply chain logistics.

Conclusion

Warehouse automation services are transforming logistics by increasing efficiency, reducing costs, and enhancing accuracy. As businesses continue to invest in automation technologies, they will gain a competitive edge in an ever-evolving market. If you’re looking to optimize your warehouse operations, now is the time to explore automation solutions tailored to your business needs.

Ready to automate your warehouse? Contact us today to learn how our warehouse automation services can elevate your operations.

0 notes

Text

Smart Warehousing Market Landscape: Opportunities and Competitive Insights 2032

The Smart Warehousing Market Size was valued at USD 22.7 billion in 2023 and is expected to reach USD 75.7 billion by 2032 and grow at a CAGR of 14.3% over the forecast period 2024-2032

The smart warehousing market is experiencing rapid expansion as businesses embrace automation, artificial intelligence (AI), and the Internet of Things (IoT) to optimize inventory management and logistics. With the rise of e-commerce and the need for efficient supply chain operations, companies are shifting towards digitized warehouse solutions. Increasing demand for real-time tracking, predictive analytics, and robotic process automation (RPA) is fueling this transformation.

The smart warehousing market continues to grow as industries recognize the benefits of advanced technologies in streamlining operations and reducing costs. Automated storage and retrieval systems (AS/RS), AI-driven inventory management, and cloud-based warehouse management systems (WMS) are reshaping the industry. Businesses are investing heavily in these innovations to improve efficiency, enhance accuracy, and meet the rising consumer expectations for faster and more reliable deliveries.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3579

Market Keyplayers:

3PL Central (3PL Warehouse Manager, 3PL Billing)

Blue Jay Solutions (Blue Jay WMS, Blue Jay Transportation Management)

Blue Yonder (Luminate Control Tower, Warehouse Management System)

EasyEcom (EasyEcom WMS, EasyEcom Multichannel Inventory Management)

Epicor (Epicor ERP, Epicor Advanced Warehouse Management)

Foysonis (Foysonis WMS, Foysonis Inventory Management)

Generix (Generix WMS, Generix Supply Chain Management)

IBM (IBM Sterling Supply Chain Insights, IBM Maximo)

Increff (Increff Warehouse Management System, Increff Inventory Management)

Infor (Infor CloudSuite WMS, Infor Supply Chain Management)

Korber (Korber Warehouse Management System, Korber Logistics Software)

Locus Robotics (Locus Solution, Locus Fleet Management)

Manhattan Associates (Manhattan WMS, Manhattan Active Omni)

Mantis (Mantis WMS, Mantis Inventory Management)

Microlistics (Microlistics WMS, Microlistics Inventory Control)

Oracle (Oracle Warehouse Management Cloud, Oracle SCM Cloud)

PSI Logistics (PSI Logistics Software, PSI WMS)

ShipHero (ShipHero WMS, ShipHero Fulfillment)

Softeon (Softeon WMS, Softeon Distributed Order Management)

Tecsys (Tecsys WMS, Tecsys Supply Chain Management)

Market Trends Driving Growth