#Automatic Credit Administration Function Tool

Explore tagged Tumblr posts

Text

Is Payment Gateway Integration Suitable for Small Businesses?

In today’s rapidly evolving digital economy, small businesses are increasingly seeking efficient and scalable solutions to handle financial transactions. One of the most transformative tools available to them is payment gateway integration. But is it suitable for small businesses? The answer lies in understanding how this technology aligns with their operational needs, growth aspirations, and customer expectations.

What Is Payment Gateway Integration?

Payment gateway integration refers to the process of embedding a secure, digital payment processing system into a business’s online platform or point-of-sale system. This technology enables businesses to accept payments from customers through various channels, such as credit/debit cards, digital wallets, and bank transfers. By facilitating smooth and secure transactions, payment gateways ensure that both customers and merchants have a seamless experience.

For small businesses, integrating a payment gateway is not just a convenience; it’s becoming a necessity. The rise of e-commerce and digital payments has shifted consumer expectations, making it essential for even the smallest enterprises to provide flexible and secure payment options.

Benefits of Payment Gateway Integration for Small Businesses

Enhanced Customer Experience Payment gateway integration allows small businesses to offer their customers multiple payment options, including digital wallets, UPI, and net banking. This flexibility enhances the customer experience by making transactions quick and hassle-free.

Improved Security Payment gateways use advanced encryption and fraud detection technologies to ensure the security of customer data. For small businesses, this level of protection builds trust and encourages repeat business.

Streamlined Operations Integrating a payment gateway reduces the need for manual transaction management. Payments are processed automatically, minimizing errors and saving valuable time that can be redirected to other aspects of the business.

Global Reach A payment gateway enables small businesses to accept payments from international customers. This capability is particularly valuable for businesses looking to expand their market reach.

Cost-Effectiveness Modern payment gateway solutions often come with flexible pricing models that cater to the needs of small businesses. Some providers even offer pay-as-you-go plans, ensuring affordability for startups and smaller enterprises.

Payout Solutions: Simplifying Financial Management

One of the complementary services that often comes with payment gateway integration is payout solutions. Payout solutions allow businesses to automate payments to vendors, suppliers, and employees, streamlining the flow of funds. For small businesses, this functionality can significantly reduce administrative burdens and improve cash flow management.

By integrating payout solutions with payment gateways, small businesses can achieve end-to-end financial automation. This integration not only saves time but also provides transparency and accuracy in financial transactions. For example, a small business owner can use payout solutions to manage payroll, refunds, or vendor payments with just a few clicks.

Micro ATM: A Complementary Tool for Small Businesses

In addition to utility payment solutions technologies like Micro ATM are gaining popularity among small businesses. A Micro ATM is a portable device that allows merchants to accept card payments and provide basic banking services, such as cash withdrawals, to customers. This solution is particularly useful in areas where digital payment adoption is still growing and cash transactions remain prevalent.

Combining Micro ATM services with payment gateway integration provides small businesses with a comprehensive financial toolkit. While the gateway handles online payments, the Micro ATM ensures that businesses can cater to customers who prefer or rely on cash transactions. This dual approach bridges the gap between digital and traditional payment methods, making businesses more versatile and customer-friendly.

Challenges and Considerations

While payment gateway integration offers numerous benefits, small businesses must also be aware of potential challenges. These include:

Initial Setup Costs Although many payment gateway providers offer affordable plans, there can be initial setup costs associated with integrating the system into existing platforms.

Technical Expertise Small businesses may need assistance in integrating and maintaining a payment gateway. Partnering with a reliable technology provider can help overcome this hurdle.

Regulatory Compliance Businesses must ensure that their payment gateway complies with local and international regulations to avoid legal complications.

Choosing the Right Provider Not all payment gateways offer the same features or pricing models. Small businesses should carefully evaluate providers based on their specific needs.

Xettle Technologies: A Partner for Small Business Growth

One example of a provider catering to small businesses is Xettle Technologies. Xettle offers scalable payment gateway integration services along with advanced payout solutions. Their user-friendly platforms are designed to meet the unique challenges faced by small enterprises, ensuring a smooth and secure transaction experience. By choosing a partner like Xettle Technologies, small businesses can access reliable tools that support their growth and streamline their financial operations.

Conclusion

Payment gateway integration is not only suitable for small businesses but is increasingly becoming a cornerstone of their success. By providing secure, efficient, and flexible payment processing, gateways empower small enterprises to meet customer expectations, expand their market reach, and improve operational efficiency. When combined with technologies like payout solutions and Micro ATM, these tools offer a holistic approach to financial management.

While challenges exist, they can be mitigated by selecting the right provider and leveraging innovative solutions like those offered by Xettle Technologies. As digital payments continue to dominate the financial landscape, small businesses that embrace payment gateway integration will be well-positioned to thrive in a competitive market.

2 notes

·

View notes

Text

Simplifying Business Operations with Supplier Payment Facility in Dubai

Being in business in Dubai, whether as a new startup or a well-established firm, is about juggling a fine balance of operations, cash flow, and timely payments to suppliers. There are numerous variables of business finance, supplier payments are especially vital. They keep your supply chain moving, your relationships intact, and your reputation unblemished.

But as any business owner will advise, handling payments can be painful—particularly while dealing with different vendors, uneven invoice terms, and changing liquidity. That's where Supplier payment facility in Dubai step in. Let's unwind what they do, how it works, and why they are becoming a basic financial tool for businesses doing business in this exciting city.

What is a Supplier Payment Facility

A supplier payment facility is technically a payment financing service that aids businesses in processing their payments to suppliers more effectively. It helps firms stretch the payment terms but make sure the suppliers are paid in time. It functions similar to a short-term credit line tailored for the purposes of paying suppliers.

Ponder on it as a cash flow bridge: the payment facility provider remits payment to your suppliers on your behalf and you remit back to the provider at a subsequent agreed-upon date. This type of service buys you time to manage cash flow without stalling imperative payments or damaging supplier relationships.

Why It Matters in Dubai

Dubai is a world business hub. Its geographical position, pro-business policies, and world-class facilities attract businesses of all sectors. With this advantage, however, comes pressure: competition is stiff, customer demands are high, and financial flexibility is crucial.

Numerous firms in Dubai operate with both international and domestic suppliers. This results in dealing with a combination of payment terms, currencies, and shipping. A supplier payment facility reduces such complexity. It allows companies to eschew late charges, maintain credit terms, and keep an uninterrupted flow of goods and services.

More importantly, in Dubai’s fast-paced commercial environment, preserving supplier relationships is crucial. One delayed payment could mean delayed shipments or canceled orders, which in turn affects your operations and customer satisfaction. A payment facility minimizes that risk.

Key Benefits of Supplier Payment Facilities

If you’re still on the fence about using such a facility, consider the key benefits it brings:

1. Improved Cash Flow Management

Cash flow is the lifeline of any business. Supplier payment facilities enable you to stretch your payables without over-extending your cash reserves. It allows you to take care of emergency expenses or invest in growth prospects and still keep your suppliers satisfied.

2. Early Payment Discounts

Some suppliers provide early payment discounts. If the payment facility provider pays suppliers in advance, you can take advantage of these discounts even if you're paying the facility provider down the line.

3. Better Supplier Relationships

Consistency develops trust. With this type of facility, your suppliers have confidence that they will be paid on time, every time. That sets the stage for better terms, enhanced service, and a more stable supply chain.

4. Fewer Administrative Frustrations

Managing dozens of invoices, following due dates, and processing payments manually can be time-consuming and risk error. Numerous supplier payment solutions make the process automatic, freeing up your finance team to work on more important issues and minimizing the chance of payment oversight.

5. Credit Protection

By making use of a supplier payment facility, you will not have to tap into other credit lines for business operations or emergencies. This provides a financial cushion and provides you with greater flexibility when you need it.

How to Choose the Right Provider

Not all supplier payment facilities are created equal. When choosing a provider in Dubai, here are a few things to keep in mind:

Reputation: Search for a firm with a good presence and credible customer feedback.

Terms: Make sure the repayment time is compatible with your business cycle.

Fees and Interest: Be transparent—no surprise fees.

Flexibility: Select a provider that can grow with your business requirements.

Support: Find great customer service and an easy onboarding process.

The Future of B2B Payments in Dubai

As the commercial landscape in Dubai becomes more digitalized and integrated, supplier payment facilities are also changing to keep up. Nowadays, a great many providers provide combined platforms that integrate with your accounting system, give real-time monitoring, and provide analytics to optimize you spend.

And as the UAE keeps pushing for financial innovation and fintech growth, Supplier payment facility in Dubai will only become more effective, less expensive, and reachable to all sizes and kinds of businesses.

Final Thoughts

Money Dila provides convenient, transparent, and hassle-free supplier payment facilities designed to suit your business requirements. Whether you're a small startup or an expanding business, Money Dila will assist you in making your supplier payments easily and confidently.

We'll take care of the payments so you can do what's most important—building your business. Contact Money Dila today and take charge of your cash flow with a supplier payment facility tailored to the needs of the Dubai market.

0 notes

Text

What's Immediate Edge?

Immediate Edge is an automated device that may be used to invest within the cryptocurrency marketplace and earn a earnings each day. The machine uses smart buying and selling robots that automatically carry out transactions with finances deposited in a person’s account. all the earnings made on the cease of a trading session is credited to the customers’ account.

Immediate Edge used to be created and released in 2019; it functions a system that plays transactions quicker than the regular cryptocurrency marketplace approaches.

all and sundry can be a part of at no cost, we needed to create a Immediate Edge account to check the gadget, and it was absolutely free. The trading machine is monitored by professional brokers who make certain that all transactions performed on behalf of traders are worthwhile.

Our revel in with Immediate Edge has been amazing; we didn’t spend an excessive amount of time checking out the gadget due to the fact everything works easily.

The platform is automated and may be utilized by everybody who desires to begin being profitable on line by using buying and selling Bitcoins. it's far much like different splendid automobile buying and selling structures which includes the Bitcoin Revolution which we have additionally examined.

we can confirm that Immediate Edge isn't always a scam. we've got examined all its functions and used actual money to trade at the platform. everything works, and our revel in was once tremendous.

We had been also capable of have interaction with the administrative team strolling the platform to affirm specifics together with the online protection protocols used and licencing for operation.

Immediate Edge is the first-rate choice for a clever investor. We decided to preserve our Immediate Edge account after discovering that the system has a high win price of 96%, that is viable because of the wise robots which are surprisingly correct.

The cryptocurrency marketplace is known to be unstable; however, the risks are decrease whilst buyers use a clever device which includes Immediate Edge that works with trading robots programmed to perform transactions in seconds.

Our analytics tools reveal that Immediate Edge has a reliability score of 88%, which is very commendable. We additionally examined the customer support machine; it's miles responsive and managed through actual humans. we will verify that Immediate Edge is not a scam; you could make investments actual money and earn a profit after every live trading session.

https://www.instagram.com/immediateedgeaiapp/

https://x.com/_immediate_edge

https://www.linkedin.com/in/immediate-edge-ai/

1 note

·

View note

Text

Digital Wallets for Logistics Transactions: The Future of Seamless Payments

The logistics sector is ushering in a dynamic new era with the use of digital payment solutions. One of the most groundbreaking tools spearheading this change are digital wallets. These innovative payment platforms provide logistics firms with a quicker, more efficient, and secure means of processing their financial transactions, whether freight forwarding, warehousing, transportation, or moving services. Digital wallets provide increased transparency, support real-time tracking, and minimize dependence on legacy banking networks, paving the way for a frictionless and futuristic industry.

What Are Digital Wallets in Logistics

A digital wallet refers to a virtual payment platform where businesses and consumers can digitally store funds, effect transactions, and monitor finance. Digital wallets break the inefficiencies of paperwork-heavy processes as well as pay settlements delays offered by conventional banks. Their portability makes digital wallets suitable in the logistics segment where timely pay-out and cost visibility are prime conditions for smoother functioning.

Some of the key uses of digital wallets in logistics are:

Payment of freight forwarder fees

Warehousing storage cost management

Payment of transportation fees

Relocation payment processing

Receiving secure, instant payments from customers

Digital wallets enable logistics companies to bid farewell to administrative lag and welcome fast, efficient, and secure transactions.

How Do Digital Wallets Function in Logistics?

Step 1. Opening an Account

Open a digital wallet account on a desired platform.

Entered required information (bank information, business credentials, compliance materials) for verification.

Step 2. Wallet Fundings

Associate the wallet with your credit cards, bank accounts, or other gateways in order to fund.

Choose automated transfers to have balanced amounts.

Step 3. Payment Making

Utilize digital wallets to make immediate payments for freight forwarding, warehouse leasing, transport fees, and moving services.

Contactless payments and QR code support features allow secure and quick transactions.

Step 4. Receiving Payments

Streamline customer payments by making it possible for them to pay directly into your digital wallet.

Receipts and reports on transactions are automatically provided, ensuring proper financial tracking.

Step 5. Real-Time Tracking and Financial Management

Have access to real-time tracking of your transactions.

Link your wallet with accounting software for easier operational reporting and reconciliation.

Why Logistics Companies Should Use Digital Wallets

Digital wallets also offer numerous benefits for convenience in managing finances in logistics. Here’s why the majority of companies are switching to this new-age solution:

Improved Security: Applying common encryption and authentication practices in the business, e-wallets minimize fraud incidents to the barest minimum and lower the risk factor involved in financial transactions.

Lower Transaction Cost: Since digital wallets remove the middlemen (banks, for example), firms pay fewer fees for handling and other charges.

Faster Payments: Instant processing accelerates cash flow and pays instantly—critical to having a successful supply chain.

More Transparency: A digital transactions record reduces error and payment complaints for freight forwarder, carrier, and warehouse services.

Anywhere, Anytime Access: Carrier and logistics provider companies can process transactions on wireless devices, creating greater flexibility to work in office or remotely.

Seamless Integration: Digital wallets seamlessly integrate with ERP systems, fleet management software, and inventory management tools, providing a seamless workflow across your operations.

Multi-Currency Payment Support: Cross-border logistics receive a major fillip as digital wallets make international payments easier through multiple-currency support.

The Future of Digital Payment Systems in Logistics

Digital wallets are yet to reach their maturity phase, but their influence on the logistics sector is already phenomenal. New technologies like blockchain, artificial intelligence (AI), and the Internet of Things (IoT) will keep accelerating the efficiency of digital wallets.

Blockchain for Secure Transactions: Blockchain technology enhances the security and transparency of payments by making payments immutable and verifiable.

AI for Financial Insights: AI-powered analytics will enable logistics companies to predict cash flow with precision, streamline costs, and predict potential risks, thus guaranteeing better financial performance.

IOT-Based Automation: With IOT-powered sensors and devices, payments for services such as warehousing or fleet maintenance can be made automatically and in real time based on data-driven triggers.

The pairing of these technologies will render digital wallets a necessary component of logistics operations, allowing businesses to reduce errors, automate workloads, and future-proof their financial systems.

Major Uses in Logistics

Digital wallets are touching every step of the supply chain.

Freight Forwarding: Pay transport charges conveniently in real-time to carriers.

Warehousing: Implement real-time space-based payments or dynamic pricing schemes to enable automated storage.

Transportation: Streamline driver payments and fuel reimbursement using instant wallet-to-wallet transfer.

Moving Services: streamline contractor payments and reduce invoicing complexity.

Conclusion

The logistics sector relies more on speed, efficiency, and connectivity—and digital wallets meet all these needs. Through this technology, companies can establish adaptive financial systems that meet challenges of today’s and tomorrow’s needs.

#logistics software#freight forwarding software#software for freight forwarding software#wms#freight forwarder software#warehouse management system#freight logistics software#freight software#warehouse software#freight forwarding system

1 note

·

View note

Text

Digital Wallets for Logistics Transactions: The Future of Seamless Payments

The logistics sector is ushering in a dynamic new era with the use of digital payment solutions. One of the most groundbreaking tools spearheading this change are digital wallets. These innovative payment platforms provide logistics firms with a quicker, more efficient, and secure means of processing their financial transactions, whether freight forwarding, warehousing, transportation, or moving services. Digital wallets provide increased transparency, support real-time tracking, and minimize dependence on legacy banking networks, paving the way for a frictionless and futuristic industry.

What Are Digital Wallets in Logistics

A digital wallet refers to a virtual payment platform where businesses and consumers can digitally store funds, effect transactions, and monitor finance. Digital wallets break the inefficiencies of paperwork-heavy processes as well as pay settlements delays offered by conventional banks. Their portability makes digital wallets suitable in the logistics segment where timely pay-out and cost visibility are prime conditions for smoother functioning.

Some of the key uses of digital wallets in logistics are:

•Payment of freight forwarder fees

•Warehousing storage cost management

•Payment of transportation fees

•Relocation payment processing

•Receiving secure, instant payments from customers

Digital wallets enable logistics companies to bid farewell to administrative lag and welcome fast, efficient, and secure transactions.

How Do Digital Wallets Function in Logistics?

Step 1. Opening an Account

•Open a digital wallet account on a desired platform.

• Entered required information (bank information, business credentials, compliance materials) for verification.

Step 2. Wallet Fundings

• Associate the wallet with your credit cards, bank accounts, or other gateways in order to fund.

• Choose automated transfers to have balanced amounts.

Step 3. Payment Making

• Utilize digital wallets to make immediate payments for freight forwarding, warehouse leasing, transport fees, and moving services.

• Contactless payments and QR code support features allow secure and quick transactions.

Step 4. Receiving Payments

•Streamline customer payments by making it possible for them to pay directly into your digital wallet.

•Receipts and reports on transactions are automatically provided, ensuring proper financial tracking.

Step 5. Real-Time Tracking and Financial Management

•Have access to real-time tracking of your transactions.

•Link your wallet with accounting software for easier operational reporting and reconciliation.

Why Logistics Companies Should Use Digital Wallets

Digital wallets also offer numerous benefits for convenience in managing finances in logistics. Here's why the majority of companies are switching to this new-age solution:

1. Improved Security

Applying common encryption and authentication practices in the business, e-wallets minimize fraud incidents to the barest minimum and lower the risk factor involved in financial transactions.

2. Lower Transaction Cost

Since digital wallets remove the middlemen (banks, for example), firms pay fewer fees for handling and other charges.

3.Faster Payments

Instant processing accelerates cash flow and pays instantly—critical to having a successful supply chain.

4. More Transparency

A digital transactions record reduces error and payment complaints for freight forwarder, carrier, and warehouse services.

5. Anywhere, Anytime Access

Carrier and logistics provider companies can process transactions on wireless devices, creating greater flexibility to work in office or remotely.

6. Seamless Integration

Digital wallets seamlessly integrate with ERP systems, fleet management software, and inventory management tools, providing a seamless workflow across your operations.

7. Multi-Currency Payment Support

Cross-border logistics receive a major fillip as digital wallets make international payments easier through multiple-currency support.

The Future of Digital Payment Systems in Logistics

Digital wallets are yet to reach their maturity phase, but their influence on the logistics sector is already phenomenal. New technologies like blockchain, artificial intelligence (AI), and the Internet of Things (IoT) will keep accelerating the efficiency of digital wallets.

1. Blockchain for Secure Transactions

Blockchain technology enhances the security and transparency of payments by making payments immutable and verifiable.

2. AI for Financial Insights

AI-powered analytics will enable logistics companies to predict cash flow with precision, streamline costs, and predict potential risks, thus guaranteeing better financial performance.

3. IoT-Based Automation

With IoT-powered sensors and devices, payments for services such as warehousing or fleet maintenance can be made automatically and in real time based on data-driven triggers.

The pairing of these technologies will render digital wallets a necessary component of logistics operations, allowing businesses to reduce errors, automate workloads, and future-proof their financial systems.

Major Uses in Logistics

Digital wallets are touching every step of the supply chain.

• Freight Forwarding: Pay transport charges conveniently in real-time to carriers.

• Warehousing: Implement real-time space-based payments or dynamic pricing schemes to enable automated storage.

• Transportation: Streamline driver payments and fuel reimbursement using instant wallet-to-wallet transfer.

• Moving Services: streamline contractor payments and reduce invoicing complexity.

Conclusion

The logistics sector relies more on speed, efficiency, and connectivity—and digital wallets meet all these needs. Through this technology, companies can establish adaptive financial systems that meet challenges of today's and tomorrow's needs. https://www.quickmovetech.com/ https://youtu.be/PjDQMaFRazk?si=hGbrQasKB31iojDg https://www.linkedin.com/company/6638777/admin/dashboard/ https://www.instagram.com/quickmovetechnologies/

0 notes

Text

Amazon Web Service S3: How It Works And Its Advantages

Object storage from Amazon web service S3 is designed to allow you to access any quantity of data from any location.

What is Amazon S3?

An object storage solution with industry-leading scalability, data availability, security, and performance is Amazon Simple Storage solution (Amazon S3). For almost any use case, including data lakes, cloud-native apps, and mobile apps, millions of users across all sizes and sectors store, manage, analyze, and safeguard any quantity of data. You may optimize expenses, arrange and analyze data, and set up precise access restrictions to satisfy certain business and regulatory requirements with affordable storage classes and user-friendly administration tools.

How it works

Data is stored by Amazon S3 as objects in buckets S3. A file and its metadata are objects. A bucket is an object’s container. You must first establish a bucket and choose an AWS Region and bucket name before you can store your data in Amazon web service S3. After that, you upload your data as objects in S3 to that bucket. Every object in the bucket has a key, also known as a key name, which serves as its unique identification.

You can customize the functionality offered by S3 to suit your unique use case. For instance, you can restore mistakenly erased or overwritten objects by using Amazon S3 Versioning to store multiple copies of an object in the same bucket. Only those with specifically allowed access permissions can access buckets and the items within them since they are private. S3 Access Points, bucket policies, AWS IAM policies, and ACLs can manage access.Image credit to Amazon

Advantages of Amazon S3

Amazon S3 has unparalleled performance and can store almost any size of data, up to exabytes. Because Amazon web service S3 is completely elastic, it will automatically expand and contract as you add and delete data. You simply pay for what you use, and there’s no need to supply storage.

Sturdiness and accessibility

Amazon S3 offers industry-leading availability and the cloud’s most robust storage. Supported by the strongest SLAs in the cloud, S3’s distinctive architecture is built to deliver 99.99% availability and 99.999999999% (11 nines) data durability by default.

Data protection and security

Protect your data with unmatched security, compliance, and access control. Besides being private, safe, and encrypted by default, Amazon S3 has many auditing options to monitor requests for access to your resources.

Best performance at the lowest cost

Large volumes of data that are accessed frequently, seldom, or infrequently can be cost-effectively stored with Amazon web service S3 automated data lifecycle management and numerous storage classes with the greatest pricing performance for any application. Amazon S3 provides the throughput, latency, flexibility, and resilience to guarantee that storage never restricts performance.

S3 amazon price

A 12-month free trial of S3’s free tier includes 100 GB of data transfer out per month, 20,000 GET requests, 2,000 PUT, COPY, POST, or LIST requests, and 5GB of Amazon S3 storage in the S3 Standard storage class.

Only pay for what you actually use. There isn’t a minimum fee. The Amazon S3 Pricing of requests and data retrieval, data transport and acceleration, data management and insights, replication, and transform and query features are the cost components of S3.

Use cases

Construct a data lake

A data lake can hold any size structured or unstructured data. High-performance computers, AI, machine learning, and data analytics maximize data value.

A secure Amazon S3 data lake lets Salesforce users search, retrieve, and analyze all their data.

Make a backup and restore important data

With S3’s powerful replication capabilities, data security with AWS Backup, and a range of AWS Partner Network solutions, you can meet your recovery time goal (RTO), recovery point objective (RPO), and compliance needs.

Terabytes of photos may be restored in a matter of hours rather than days with Ancestry’s usage of Amazon web service S3 Glacier storage classes.

Data archiving at the most affordable price

To cut expenses, remove operational hassles, and obtain fresh insights, move your archives to the Amazon S3 Glacier storage classes.

Using Amazon S3 Glacier Instant Retrieval, the UK public service broadcaster BBC safely moved their 100-year-old flagship archive.

Make use of your data

Amazon S3 might be the beginning of your generative AI journey because it averages over 100 million requests per second and stores over 350 trillion objects exabytes of data for almost every use case.

Grendene is employing a data lake built on Amazon web service S3 to develop a generative AI-based virtual assistant for its sales force.

Read more on Govindhtech.com

#AmazonWebServiceS3#AmazonS3#AI#AWSBackup#S3storage#dataavailability#News#Technews#Technology#Technologynews#Technologytrends#govindhtech

0 notes

Text

Why POS Software is Essential for Your Super Shop

Running a super shop involves juggling numerous tasks, from managing inventory to processing sales and ensuring excellent customer service. To streamline these operations and stay competitive, investing in a reliable Point of Sale (POS) system is crucial.

POS software simplifies business operations, offering tools that improve efficiency and productivity. It helps you manage sales with an easy-to-use interface for transactions, reduces errors, and speeds up the checkout process, which enhances customer satisfaction.

How a POS System Can Improve Your Super Shop

A POS system optimizes your super shop's operations by tracking inventory in real-time, alerting you when stock is low, and automatically generating purchase orders for restocking. This helps you maintain proper inventory levels, avoiding stockouts or overstocking.

The system integrates key functions such as sales management, inventory control, customer relationship management (CRM), and accounting into one platform. This centralization makes it easier to manage daily operations and scale your business as needed.

What is a POS System?

A POS system combines hardware (such as barcode scanners, receipt printers, and cash registers) with software to manage various business activities. It provides a centralized solution for handling sales transactions, managing inventory, tracking customer data, and more.

Key Benefits of Using a POS System

1. Efficient Inventory Management

A POS system keeps track of your inventory in real-time. Every sale is automatically recorded, so you always know your stock levels. This helps prevent overstocking or running out of popular items, allowing you to restock efficiently.

2. Accurate Sales Tracking and Reporting

Each transaction is recorded, providing detailed sales data. You can use this information to generate reports, helping you analyze sales trends, best-selling products, and overall business performance.

3. Improved Customer Service

POS systems store customer data, allowing you to offer personalized service, such as recommending products based on past purchases or offering targeted discounts. Faster checkout processes also improve customer satisfaction by reducing wait times.

4. Multiple Payment Options

POS systems support various payment methods, including cash, credit cards, mobile payments, and digital wallets. Offering multiple payment options makes it convenient for customers and helps increase sales.

5. Increased Efficiency and Time Savings

By automating tasks like calculating totals and generating receipts, POS systems save time and reduce errors. This allows your staff to focus on providing better service to customers rather than performing repetitive administrative tasks.

6. Employee Management

A POS system can track employee performance, manage working hours, and calculate payroll more accurately. It also allows you to assign roles and permissions to employees, enhancing control and security.

7. Loyalty Programs

Many POS systems include built-in loyalty programs. You can reward repeat customers with points, discounts, or special offers, helping to increase customer retention and boost sales.

8. Real-Time Analytics

POS systems provide real-time insights into your business, including metrics like sales trends and profit margins. This data allows you to make informed decisions and quickly adjust strategies based on current market conditions.

9. Enhanced Security

Modern POS systems include security features that protect your business and customer data. With secure payment processing, encrypted transactions, and audit trails, you can safeguard your super shop from fraud and theft.

10. Scalability

Whether you operate one shop or several, a POS system can scale with your business. You can easily add more registers, locations, or additional features as your business grows.

11. System Integration

POS systems often integrate with other business tools, like accounting software or e-commerce platforms. This ensures smooth data flow across your systems, reducing manual data entry and the risk of errors.

12. Cost Efficiency and ROI

Although a POS system involves an initial investment, it leads to long-term cost savings by increasing efficiency, reducing errors, and preventing inventory issues. Over time, the system helps boost profits and improve return on investment (ROI).

13. Training and Support

Most POS providers offer training sessions and ongoing support to help you and your team fully utilize the software’s features. This ensures a smooth transition to using the system and assistance when needed.

Conclusion

A POS system is a powerful tool for any super shop. It simplifies inventory management, enhances customer service, and increases efficiency, helping you run your business more smoothly. By integrating technology into your daily operations, you can stay ahead of the competition and provide a better shopping experience for your customers.

0 notes

Text

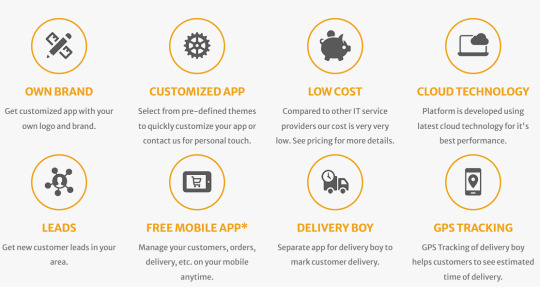

Take Your Tiffin Service to the Next Level with Cutting-Edge Technology

In the ever-evolving food delivery landscape, staying ahead of the competition means leveraging the latest technology. Tiffin Service Management offers a groundbreaking solution that allows you to create a fully branded, customized app for your tiffin service in less than 15 minutes. Here’s how this innovative platform can transform your business:

Instant App Creation:

Fast Deployment: Get your personalized app up and running in under 15 minutes.

Seamless Customization: Tailor your app’s features and design to reflect your brand’s unique identity.

Advanced Customer Insights:

Detailed Profiles: Capture and manage comprehensive customer data, including dietary preferences and order history.

Personalized Interactions: Deliver customized experiences that enhance customer satisfaction and loyalty.

Optimized Order and Delivery Management:

Efficient Order Handling: Streamline order processing and tracking from placement to delivery.

Real-Time Delivery Tracking: Provide customers with live updates on their order status, improving transparency.

Smart Route Planning: Optimize delivery routes to ensure timely and cost-effective service.

Flexible Payment Solutions:

Diverse Payment Methods: Accept payments through eWallets, net banking, credit, and debit cards.

Secure Transactions: Utilize an integrated payment gateway to ensure safe and seamless transactions.

Automated Financial Management:

Instant Invoicing: Automatically generate and send invoices to streamline billing.

Efficient Payment Tracking: Monitor and manage payments effortlessly, reducing administrative overhead.

Powerful Analytics and Reporting:

In-Depth Reports: Access detailed analytics on sales trends, customer behavior, and operational efficiency.

Strategic Insights: Leverage data-driven insights to make informed business decisions and drive growth.

Effective Communication through SMS Alerts:

Order Updates: Send automated SMS notifications for order confirmations and delivery statuses.

Promotional Messages: Keep customers engaged with updates on special offers and new menu items.

Enhanced Branding and Professionalism:

Branded App Experience: Showcase your business’s logo and branding for a professional and cohesive image.

Increased Customer Trust: Elevate your brand’s credibility with a polished, branded app experience.

Scalable and Future-Ready:

Adaptable Features: Easily scale your app’s functionality as your business grows.

Future-Proof Technology: Continuously evolve with new features and updates to stay ahead of industry trends.

Dedicated Support and Continuous Improvement:

Expert Assistance: Access dedicated customer support to address any issues and optimize your app’s performance.

Ongoing Updates: Benefit from regular updates and new features to keep your app at the forefront of technology.

Integrated Marketing and Promotion Tools:

Targeted Marketing: Use analytics to create effective marketing campaigns tailored to your customer base.

Promotional Tools: Attract and retain customers with in-app promotional features and campaigns.

Boosted Operational Efficiency:

Automated Processes: Reduce manual tasks with automated systems for order management, invoicing, and communication.

Centralized Management: Manage all aspects of your tiffin service from a single, intuitive platform.

Transform your tiffin service with Tiffin Service Management and experience the power of technology-driven efficiency. Build your custom app today and set a new standard for service excellence in the food delivery industry.

0 notes

Text

The Essential Guide to Membership Management Software Solutions

The unique purpose of membership management software is to consolidate the communication and administrative tasks of a membership organization. Members of the community may communicate with one another and with management in this virtual meeting place that the program generates.

There is a wide range of functionality across different platforms under membership management software. Although there are solutions that are designed with basic functionality for smaller organizations in mind, there are also more advanced options that can handle more complex tasks like event registration, education opportunities, content management, and contribution collection.

Benefits of Membership Software Solutions

Organizations often need to allocate resources (both time and money) to get the best software package. Thus, to help you select, let's examine the advantages of membership software solutions.

Streamlined Membership Management

Time savings and simplified everyday operations are two of the biggest benefits of membership management software India. It is possible to liberate precious resources that may be put to greater use elsewhere within the management team if you automate mundane chores. Software for membership organizations streamlines and automates administrative processes, including member correspondence, renewals, and registration, cutting down on human error and saving time.

Improved Engagement

There is only a critical responsibility in a company besides attracting and retaining customers. You can produce a significant amount of income in your sector via this skill. The ability to easily communicate with other members is a key component of membership software, which is why tools, including calendars, forums, and member directories, are so helpful.

Enhanced Communication

An integrated email system is a common feature of the best membership management software that lets administrators send bulk and targeted emails to individual users. A member-to-member chat system is also available, so users may have conversations without leaving the site. Membership platforms frequently provide communication capabilities to help organizations connect with their members, including message systems, notice boards, and email newsletters.

Centralized Data Management

Using membership software makes it simpler to monitor demographics, interests, and activities by centralizing member data. This information may be used to customize interactions and provide personalized services to each member. Another benefit of membership management software is the ability it provides for the safe and systematic storage, organization, and updating of member data. There will be fewer opportunities for mistakes and duplications due to the elimination of human record-keeping.

Membership Renewal Automation

Take care of renewing current members' memberships and remind them automatically when their tenure is up. Various payment options, including digital wallets and credit cards, are usually provided by the membership management software for users to renew their subscriptions. Members are more likely to renew, and the organization receives more money when they pay online and receive automated renewal reminders.

Event Management

Services like webinars, conferences, and seminars may be planned, publicized, and executed by organizations with the help of integrated event management tools. Members can enroll and pay online. Event management capabilities like registration, ticketing, and attendance monitoring are included in many membership systems. Events may be more efficiently planned and carried out as a result, which saves both time and resources.

Access Control and Security

To help organizations understand their members' actions, preferences, and level of participation, membership management software India often involves reporting and analytics capabilities. Using this information, one may make better decisions, personalize products, and spot chances for development. Membership software typically restricts access to items to preserve members' privacy.

Analytics and Reporting

Members, event-goers, and engagement metrics as a whole may be better understood with the use of robust reporting and analytics tools. For better decision-making and membership program performance measurement, organizations may use built-in analytics tools that provide membership trends, event attendance, and engagement indicators.

Scalability

Software solutions for membership organizations can usually be made to scale so they can add more features and cater to more members without spending an immense amount of money. This is a must-have tool in the best membership management software if you want to maximize efficiency, boost engagement, and propel your organization to new heights.

Integration Capabilities

Commonly included platforms and features in membership management software include payment processors and customer relationship management systems. In addition to this, it enables customization to conform to the organization's identity and particular needs. A great number of membership platforms allow for the integration of third-party applications, allowing for the automation of workflows and the smooth flow of data across various systems.

Why Membroz is best Membership Management Software?

Designed with membership-providing organizations and enterprises in mind, Membroz is web-based software. Membroz membership software, a cloud-based program, provides an all-encompassing perspective of company operations and streamlined activities. This implies no local installation is needed, and all actions are done via a web browser.

Clubs, resorts, timeshares, fitness firms, corporate and trade groups, chambers of commerce, non-profit organizations, and community organizations are all managed using Membroz membership management software. Whether you're in charge of a single location, a network of locations, or a franchise, our system can adjust to your needs—optimal resolution at our fingertips.

Included in Membroz software are capabilities such as inquiry management, cost & booking management, member mobile app, account & finance reporting, inventory management, and more. Management software for associations and societies, timeshares and vacation ownership, fitness centers, yoga studios, and gyms are among the software solutions we offer.

With only one click, Membroz can connect to any third-party app. Stripe, PayU, RazorPay, PayPal, and many more have become popular payment gateways. In addition, you have the option to set your preferred communication channel, whether it's SMS, email, WhatsApp (including services like Twilio), or social media.

Conclusion

With the help of membership management software, businesses may have more meaningful interactions with their customers. The program can satisfy the members, who will remain loyal and communicative with the firm if the tool is used correctly.

The importance of membership management software cannot be overstated as organizations strive to meet the ever-changing demands of their members. Member engagement may be greatly enhanced with the aid of membership management software, so don't hesitate to utilize it.

membership management software, membership management software India, best membership management software

#membershipsystemsoftware#membershipmanagementsystem#membershipmanagementsoftwareindia#bestmembershipmanagementsoftware#saasmembershipplatform

0 notes

Text

MLM software & MLM software companies are the best to explore now.

In reaction to growing demands, Digiature Technology Pvt. Ltd is working to create a modern MLM software system. They are not like traditional solutions, instead, this MLM software are simple technical solution that represents an understanding and powerful approach to managing MLM operations. Adding this software to your organization can help you provide the tools you need to simplify complicated operations that increase productivity and improve overall performance. It also serves as the foundation of your MLM operations, allowing everything from discount calculations to network management. This program is a highly effective partner, specifically altered for network marketing.

It simplifies the management of member networks and discount schemes, hence making it much easier to complete duties like sales administration and payment processing. Companies that assign these difficult duties to MLM software can focus on supporting development and expansion. Network marketing software is more than just a comfort instead it is a strategic partner that gives you proper record-keeping, detailed member tracking, and exact commission calculations. Its accurate design perfectly fulfills the goals of network marketing companies, providing the platform for long-lasting success.

Why should you apply MLM software in your business?

There are multiple payment methods are available, including classic options like credit card transactions and PayPal as well as new approaches like E-pin and E-wallet systems. The automatic payment process is the basis of any MLM company that underlines the urgent need for a rapid and secure payment transaction system that is easily added to MLM software. Developing an automatic payment method improves security and also makes it easier to run a business. MLM software Company values itself as an excellent solution that offers a variety of modern automatic payment processing solutions that set industry standards.

In the world of MLM computer software, mixing the internet and digital commerce has become important over the period. In this particular business, Maximum Online MLM software shows itself as a great choice, beating its competitors in this area and setting and establishing itself as a unique option. Businesses can benefit from this opportunity to increase their online sales and services by including e-commerce in their MLM software and combining these into the website.

The software's understanding of support for multiple MLM schemes shows its dedication to providing an original and flexible platform for MLM organizations. It offers increasing support for a wide range of MLM discount plans, party plans, MLM Gift programs, x-up plans, and other schemes created to meet a multitude of company needs. With its ability to support a wide number of discount systems,This software stands out as an effective and flexible option.

It does not matter if a company uses binary, matrix, or unilevel MLM software sales management methods are always essential. Among such platforms, an easy buying and storage system is very important. These functions are excellent at the level of inventory tracking, quick, replacement whenever it is required, and also in the process of orders. The design and creation of these services need to be done with extra care.

What types of plans does Network marketing software provide:

Generation MLM Plan: A systematic approach is key to the accomplishment of the top-notch plan that places it as the most important plan among all its rivals. The generation MLM plan stands out because it mainly focuses on product sales over member employment. Trained team members constantly play a crucial role in helping businesses in efficiently introducing new items. Its main function is to focus on enhancing product sales, minimizing the need for big advertising budgets, and managing costs. Numerous generation stages range between four to five. The discount structure is deeply reviewed with excellent communication routes and effective commission mechanisms. It can be customized to achieve the specific needs of the organization.

Matrix MLM Plan: The Matrix MLM plan is also known as the Ladder Matric MLM payment structure or the Forced Matrix plan. It is highly known for providing quick income possibilities, making it an attractive option for those seeking immediate earnings. It is a pyramid-shaped structure in which companies work in a chronological and triangular manner. The matrix plan is a great initial point for MLM firms looking to get their business on the ground and create considerable income quickly The matrix structure in this plan expands consistently, sometimes collecting a large number of members in a short period This plan is well known for giving quick chances to earn money making it a tempting offer for those who are looking for instant results. Profits begin immediately and remain for the duration of your business plan. Your initial responsibility is to start making efforts at the beginning and your team members will henceforth boost your earnings. The MLM Matrix plan is one of the best options for multi-level marketing businesses looking to make cash quickly. The matrix structure in this system grows consistently, quickly reaching a sufficient amount of member count in a short period. Your initial efforts will be concentrated on building the first level of the matrix that motivates existing members to expand the network beyond. Moreover, as the number of members of each consecutive level increases, your earnings will also increase. One of the advantages is that you don't have to take part in managing the chain's growth because the people in your downline are in charge of it.

Level MLM Plan: The Level MLM Plan is the most popular and thoroughly adopted international MLM Plan in the market and is highly known for its easy and well-defined structure. In the MLM level plan, the starting line of a unilevel incentive program can fit countless numbers of participants, to boost returns by utilizing dealers' combined efforts. Its simplicity has highly contributed to its success in the overall world MLM business location. Network marketing companies depend on level MLM software to carry out multiple tasks that include payouts, training, marketing, employment, and advertising, especially for the plans that are built around levels. It does not matter if a company uses binary, matrix, or unilevel Online MLM software sales management methods are always necessary. Among such platforms, an easy buying and storage system is very important. These functions are excellent at the level of inventory tracking, quick, replacement whenever it is required, and also in the process of orders. The design and creation of these services need to be done with extra care.

Binary MLM Plan: MLM software not only captures clients' interest but also actively asks them to act by buying. Supervisors value the capacity to manage all promotions and sales, hi giving them to pick monthly and weekly winners. Network marketing software must be easy to use and able to adapt to the screen size of many devices. The binary tree structure is further divided into two sub-parts which are known as the" profit leg" and the" power leg". New dealers get put directly under the power leg of the sponsor's power leg, forming a sliding system. All dealers are hired by their clients and are then grouped under the profit leg, allowing administration and tracking process. The Binary MLM plan in Online MLM software can easily create customers' interest and also strongly promote their participation through buying. DIGIATURE TECHNOLOGY Pvt. Ltd. has a skilled development team that excels in developing such techniques. With the committed staff focused on building MLM-level plans and giving modern tools to the worldwide MLM sector, the organization's worldwide success shows its ability to implement top-notch MLM Plans.

0 notes

Text

The Growing Influence of AI in Business Operations

Artificial intelligence (AI) is a growing force in business, with applications that help organizations automate repetitive tasks and provide insights to support decision-making. The goal of AI is to free humans up to focus on value-adding activities, and it has the potential to increase productivity and allow companies to compete more effectively in today’s fast-paced environment.

The impact of AI is being felt across a variety of industries and functions. From using voice assistants to hail rides to using AI tools to detect cancer, it seems as if we’re rapidly integrating the technology into our day-to-day lives. However, many businesses have yet to fully realize the benefits of this technology, with AI making its way into back-office operations, reducing administrative burdens and providing better customer service.

For example, many firms use AI to automate mundane and repetitive tasks, such as data entry or processing invoices, freeing up employees to spend more time on valuable activities that require human expertise and creativity. This can also reduce the risk of errors and save significant amounts of time and money.

In addition, AI can be a powerful tool for recruitment and HR. It can be used to screen applicants and resumes and identify the most qualified candidates technology viewer website for a given position. Additionally, it can be used to eliminate biases by removing assumptions about a candidate’s race, gender, age, income, or other characteristics that can lead to discrimination in hiring decisions.

Furthermore, AI is being used to optimize supply chains, ensuring that manufacturing processes are running at peak efficiency and preventing costly errors. For example, the technology can monitor inventory levels and reorder items when they’re close to running out, saving time and money. It can also analyze data from production lines to identify defects and make necessary adjustments. In addition, it can perform predictive maintenance by analyzing sensor data to predict when equipment will break down.

Many managers are hesitant to implement AI, fearing that it will take away jobs. This concern is valid, but it’s important to remember that AI does not replace humans; instead, it complements their work by completing low-value and/or monotonous tasks that would otherwise consume a lot of employees’ time.

For instance, many banks have embraced AI to enable customers to open and manage accounts without visiting a physical branch or even downloading an app. This is made possible by leveraging AI to recognize patterns in users’ purchases and credit card spending to offer customized experiences. Additionally, the technology can automatically process payments, send receipts, and make deposits, reducing bank costs.

While AI can help technology website businesses improve their operational efficiency, it has also created new challenges. For example, it can create deepfakes of images, videos, and voices, which threatens what people consider to be genuine. To address this, managers must carefully plan how to introduce AI to their business operations and communicate clearly with employees. In addition, they must avoid rushing to adopt AI and instead take a measured approach to implementing cognitive technologies with proof-of-concept pilots.

1 note

·

View note

Text

Comprehensive Loan Management Software Empowers Small Businesses

Efficient financial management is not just a need in the dynamic and cutthroat world of small enterprises but also a driver of expansion. A customized strategy is required to help small businesses overcome the specific obstacles they encounter while dealing with the complexities of loan administration. Here, we have loan management software for small business, a crucial tool with tools to improve efficiency, increase output, and encourage responsible spending. By delving into the key points and numerous advantages, this article will show how specialized loan management software may help small firms overcome financial obstacles and thrive in today's ever-changing business world.

Designed for Small Businesses:

Every small business faces distinct obstacles and needs specialized resources. Unlike generic solutions, loan management software for small business examines size, breadth, and resources. This customized approach guarantees that our software fulfills small business loan guidelines and is updated. The system works well for small businesses owing to streamlined processes and personalized features.

More excellent application and approval efficiency:

How soon small firms may get loans depends on application and approval times. Expert loan management software saves time for lenders and borrowers. Automatic approaches speed up decision-making by checking applications, paperwork, and credit. The shorter loan cycle lets small businesses and clients respond rapidly to market possibilities and threats.

Pocket-friendly, scalable:

Loan management software provides affordable and scalable choices for small firms with limited funds. Many systems offer flexible pricing for small businesses. The software can quickly scale up or down to handle a growing number of transactions, so it will continue to be a worthwhile investment even as a company expands. A broader spectrum of small firms may now access advanced financial management features previously only available to more giant enterprises, all thanks to the affordable price.

Integrating accounting and finance:

Small enterprises need integrated accounting and financial systems to streamline operations. Loan management software for small business often integrates with popular accounting software. With this relationship, data entry errors and financial health may be better understood. Integrating all financial data helps businesses make more intelligent decisions in real-time. With this connectedness, small enterprises may access an entire ecosystem of technologies without human data reconciliation, enhancing financial reporting accuracy and consistency.

Legality and Safety Improved:

Small businesses incur dangers and must follow guidelines to survive. A typical loan management software for small business helps monitoring and preventing risks. These credit scoring and compliance management solutions assist organizations in negotiating regulations. Compliance automation helps small businesses avoid errors and fines. This strengthens stakeholder trust and business security.

Intelligent Decision Making:

Several small company debt management solutions offer advanced analytics and essential functions. These tools show loan patterns, client behavior, and portfolio efficiency. Data analytics may enhance financial strategies, identify possibilities, and guide choices for small firms. Accessing and comprehending data in the ever-changing world of small company finance helps organizations respond to market changes and stay ahead.

Conclusion:

Finally, debt management software can improve small firms' finances. These technologies' customization, simplicity, cost, scalability, connectivity to accounting systems, risk management tools, and advanced analytics may help small businesses thrive sustainably. Loan management software helps small companies weather financial storms, seize new possibilities, and prosper with today's technologies. Specialist loan management software helps small businesses expand and survive in the competitive world of finance.

0 notes

Text

School Fee Management Software in Gurugram

School fee management is a sensitive task performing it manually can be a time-consuming and error-prone process a small mistake will arise as a big blunder. Vedmarg is a School Fee Management Software in Gurugram, a city in Haryana. It is designed to help in managing the fee system effectively and digitally. The user interface is uncluttered and parent-friendly so that they can track the daily activities of their wards or children. Vedmarg School Management Software allows you to have notifications about reminders, receipts, and other important information. Vedmarg’s mobile application is also available for Android as well as for iOS users.

Vedmarg is a School Fee Management Software in Gurugram unequivocally designed to speed up, simplify, and automate the whole fee management process to enhance transparency and provide a comfortable environment for carrying out fee operations in schools or other educational institutions.

The Vedmarg School Management Software is sketched on an AI-powered technological framework, which helps in supporting multiple modes of fee payments such as debit cards, credit cards, net banking, UPI, etc.

Advantages of School Fee Management Software:

Ease in Fee Collection - As we mentioned earlier nowadays parents avoid hard cash as it is not secure to carry amounts, this software allows parents to pay fees online using the Vedmarg Student App. Online payment will help the school and as well as parents to track & trace cash flow, receipts of the payment, and other essential documents for proper maintenance.

Configuring the Fee Structure - Schools or other institutions can set up or configure the fee schedules and they can also tailor the fee parameters to meet the requirements of each batch.

Integration of Payment Gateway - Our Software comprises different online payment modes. We already mentioned above that Vedmarg ERP supports multiple modes of fee payments such as debit cards, credit cards, net banking, UPI, etc.

Discount or Fee Abatement - This feature will be for individual students or groups of students who are eligible to get fee concessions or scholarships. Our software sanctions schools to enable this feature for their students in their fee schedule and This helps the management to make faster and better decisions.

Invoices and Receipts - Our ERP system allows the creation of custom invoices for all modes of fee payments, comprising tuition, transportation, hostel, and library. Automatic receipts formation is an integral tool of the Vedmarg School Management Software.

Key Functionalities of Vedmarg School ERP Software in Gurugram:

Automatic Fee Calculation

Command on the Administration

Strengthen Communication

Data Security

Cut down Manual Work

Conclusion

Vedmarg School Fee Management Software is 100% secure and trustworthy software, It is easy to use also easily accessible from anywhere and anytime. There is no need for parents to visit school and clear their child’s dues therefore it saves time and transportation costs. This displays the potential & effectiveness of the cloud-based school management software in Gurugram.

#school management software#school erp system#school fee management software#Vedmarg School Management Software#erp software

0 notes

Text

Digital Wallets for Logistics Transactions: The Future of Seamless Payments

The logistics sector is ushering in a dynamic new era with the use of digital payment solutions. One of the most groundbreaking tools spearheading this change are digital wallets. These innovative payment platforms provide logistics firms with a quicker, more efficient, and secure means of processing their financial transactions, whether freight forwarding, warehousing, transportation, or moving services. Digital wallets provide increased transparency, support real-time tracking, and minimize dependence on legacy banking networks, paving the way for a frictionless and futuristic industry.

What Are Digital Wallets in Logistics

A digital wallet refers to a virtual payment platform where businesses and consumers can digitally store funds, effect transactions, and monitor finance. Digital wallets break the inefficiencies of paperwork-heavy processes as well as pay settlements delays offered by conventional banks. Their portability makes digital wallets suitable in the logistics segment where timely pay-out and cost visibility are prime conditions for smoother functioning.

Some of the key uses of digital wallets in logistics are:

•Payment of freight forwarder fees

•Warehousing storage cost management

•Payment of transportation fees

•Relocation payment processing

•Receiving secure, instant payments from customers

Digital wallets enable logistics companies to bid farewell to administrative lag and welcome fast, efficient, and secure transactions.

How Do Digital Wallets Function in Logistics?

Step 1. Opening an Account

•Open a digital wallet account on a desired platform.

• Entered required information (bank information, business credentials, compliance materials) for verification.

Step 2. Wallet Fundings

• Associate the wallet with your credit cards, bank accounts, or other gateways in order to fund.

• Choose automated transfers to have balanced amounts.

Step 3. Payment Making

• Utilize digital wallets to make immediate payments for freight forwarding, warehouse leasing, transport fees, and moving services.

• Contactless payments and QR code support features allow secure and quick transactions.

Step 4. Receiving Payments

•Streamline customer payments by making it possible for them to pay directly into your digital wallet.

•Receipts and reports on transactions are automatically provided, ensuring proper financial tracking.

Step 5. Real-Time Tracking and Financial Management

•Have access to real-time tracking of your transactions.

•Link your wallet with accounting software for easier operational reporting and reconciliation.

Why Logistics Companies Should Use Digital Wallets

Digital wallets also offer numerous benefits for convenience in managing finances in logistics. Here's why the majority of companies are switching to this new-age solution:

1. Improved Security

Applying common encryption and authentication practices in the business, e-wallets minimize fraud incidents to the barest minimum and lower the risk factor involved in financial transactions.

2. Lower Transaction Cost

Since digital wallets remove the middlemen (banks, for example), firms pay fewer fees for handling and other charges.

3.Faster Payments

Instant processing accelerates cash flow and pays instantly—critical to having a successful supply chain.

4. More Transparency

A digital transactions record reduces error and payment complaints for freight forwarder, carrier, and warehouse services.

5. Anywhere, Anytime Access

Carrier and logistics provider companies can process transactions on wireless devices, creating greater flexibility to work in office or remotely.

6. Seamless Integration

Digital wallets seamlessly integrate with ERP systems, fleet management software, and inventory management tools, providing a seamless workflow across your operations.

7. Multi-Currency Payment Support

Cross-border logistics receive a major fillip as digital wallets make international payments easier through multiple-currency support.

The Future of Digital Payment Systems in Logistics

Digital wallets are yet to reach their maturity phase, but their influence on the logistics sector is already phenomenal. New technologies like blockchain, artificial intelligence (AI), and the Internet of Things (IoT) will keep accelerating the efficiency of digital wallets.

1. Blockchain for Secure Transactions

Blockchain technology enhances the security and transparency of payments by making payments immutable and verifiable.

2. AI for Financial Insights

AI-powered analytics will enable logistics companies to predict cash flow with precision, streamline costs, and predict potential risks, thus guaranteeing better financial performance.

3. IoT-Based Automation

With IoT-powered sensors and devices, payments for services such as warehousing or fleet maintenance can be made automatically and in real time based on data-driven triggers.

The pairing of these technologies will render digital wallets a necessary component of logistics operations, allowing businesses to reduce errors, automate workloads, and future-proof their financial systems.

Major Uses in Logistics

Digital wallets are touching every step of the supply chain.

• Freight Forwarding: Pay transport charges conveniently in real-time to carriers.

• Warehousing: Implement real-time space-based payments or dynamic pricing schemes to enable automated storage.

• Transportation: Streamline driver payments and fuel reimbursement using instant wallet-to-wallet transfer.

• Moving Services: streamline contractor payments and reduce invoicing complexity.

Conclusion

The logistics sector relies more on speed, efficiency, and connectivity—and digital wallets meet all these needs. Through this technology, companies can establish adaptive financial systems that meet challenges of today's and tomorrow's needs. https://youtu.be/PjDQMaFRazk?si=hGbrQasKB31iojDg https://www.linkedin.com/company/6638777/admin/dashboard/ https://www.instagram.com/quickmovetechnologies/

0 notes

Text

Choosing the Right Tax Software Solutions for Tax Resolution

Tax resolution software offered by the IRS is easy to use once you get the hang of its basic features, but finding the best one may be a hassle. There is software available for both federal and state returns.

Think about things very carefully before acting. Use this checklist to help you choose a IRS solutions tax resolution software. Find out if software to deal with the IRS is something you need.

Features to Look for in Tax Resolution Software

Capabilities of IRS Forms

When deciding on IRS solutions tax resolution software, check for features like fillable IRS forms and a user-friendly interface. Having this makes it a useful purchase. It's crucial to use programs that help you locate the optimal solution for your client.

You can immediately access all of the information surrounding your client's case from the IRS with the help of automated form functionality and analytical tools. It is important to transition between Form 433-A and Form 433-A(OIC) without re-entering any data.

Paperwork for filing taxes

It is crucial to have access to a wide range of federal forms, regardless of the complexity of the tax resolution issue. As a tax resolution expert, you must know the paperwork needed to help your customers. If you aren't an EA or CPA, it's also important that your software supports Form 2848, the Power of Attorney, and Form 8821, the Tax Information Authorization.

Important Notices from the IRS

Responding appropriately to IRS letters is an important element of being a successful tax resolution practitioner. Your chosen IRS solutions tax resolution software should inform you of the significance of each alert and the best way to fix the problem. It's a great way to save time while still providing excellent service to your client. To succeed in your career, you need to learn about each notification and how to deal with it.

Helping Businesses and Individuals Learn

There are annual renewal requirements for tax professionals because of the dynamic nature of tax law and practice. Those who work in tax resolution must keep up with the ever-changing tax code and rules and the annual continuing education obligations.

As part of the program, users of some IRS solutions tax resolution software, have access to educational materials, such as live classes taught by seasoned professionals in the field, that can be used to gain Continuing Professional Education (CPE) credits.

Tools for Managing a Practice

Make sure there are options for managing tasks and processes within the app. As a result, you may spend more time on billable work and less on mundane administrative activities, making your firm more profitable and efficient overall.

Full Report

Offering your client complete transparency into the work you're doing for them behind the scenes is essential to providing high-quality service. Using tax resolution software, you can compile a report detailing your efforts, potential outcomes, and next steps. Having this report automatically generated by your program will make it simple for clients to keep informed and for you to demonstrate your worth.

Conclusion

Investing in trustworthy IRS solutions tax resolution software will make tax time much easier for your business. When it comes to filing your taxes and claiming any refunds or credits to which you are entitled as a business owner, having the right IRS resolution software on your side may be a huge relief. Use this post as a guide to selecting the best IRS resolution software.

#irs solutions tax resolution software#irs resolution software#irs transcripts#IRS resolution#tax practice management software#tax resolution software

0 notes

Text

Amazon GuardDuty EC2 Runtime Monitoring is now available

AWS GuardDuty EC2

Amazon GuardDuty is an intelligent threat detection and security monitoring service that leverages machine learning (ML) to analyse and process a variety of AWS data sources. It also continuously scans your workloads and AWS accounts for malicious activity and provides comprehensive security findings for visibility and remediation.Image Credit to AWS