#Best ECN Brokers in the World

Text

Brokfolio - Your Ultimate Guide to Ranking the Best Brokers Online in 2024

In the fast-paced world of online trading, finding the right broker can make all the difference between success and frustration. With a myriad of options available, it's crucial to navigate through the sea of choices to pinpoint the broker that best fits your trading style and preferences. Thankfully, Brokfolio.com has emerged as a beacon of light for traders seeking to make informed decisions. In this article, we delve into Brokfolio's comprehensive approach to ranking the best brokers online in 2024, focusing on the best high leverage brokers and ECN brokers.

Brokfolio.com: Your Trusted Resource for Brokerage Reviews

Brokfolio.com stands out as a premier platform dedicated to providing unbiased and thorough reviews of online brokers. With its commitment to transparency and accuracy, Brokfolio empowers traders with the knowledge they need to navigate the competitive landscape of online trading. Whether you're a seasoned trader or a newcomer to the world of finance, Brokfolio offers valuable insights to help you make informed decisions.

Best High Leverage Brokers: Maximizing Your Trading Potential

For traders seeking to amplify their potential returns, high leverage can be a powerful tool. However, navigating the world of high leverage brokers requires caution and diligence. Brokfolio meticulously evaluates high leverage brokers based on a range of factors, including regulatory compliance, trading platform features, customer support, and, most importantly, risk management protocols.

Brokfolio's rankings highlight high leverage brokers that strike the right balance between offering competitive leverage ratios and implementing robust risk management measures. By prioritizing the safety of traders' capital while still providing ample trading opportunities, these brokers earn their place among the best in the industry.

Best ECN Brokers: Unmatched Transparency and Execution

For traders who prioritize transparency, fairness, and lightning-fast execution, ECN (Electronic Communication Network) brokers are the go-to choice. ECN brokers provide direct access to the interbank forex market, ensuring optimal pricing and minimal slippage. However, not all ECN brokers are created equal, which is where Brokfolio's expertise comes into play.

Brokfolio meticulously evaluates ECN brokers based on their pricing models, liquidity providers, trading conditions, and overall reliability. By scrutinizing every aspect of an ECN broker's offering, Brokfolio ensures that traders can confidently choose a broker that aligns with their trading objectives and preferences.

Conclusion: Empowering Traders with Knowledge and Insight

In the ever-evolving landscape of online trading, having access to reliable information is paramount. Brokfolio.com serves as a beacon of trust and transparency, empowering traders with the knowledge they need to navigate the complexities of the financial markets. Whether you're in search of the best high leverage brokers or ECN brokers, Brokfolio's comprehensive rankings and reviews are your roadmap to success.

As you embark on your trading journey in 2024 and beyond, let Brokfolio be your trusted companion, guiding you towards the brokers that best suit your needs. With Brokfolio.com by your side, you can trade with confidence, knowing that you're backed by expertise and insight every step of the way.

2 notes

·

View notes

Text

Best ECN Forex Broker In The World

One of the Top Trusted Best ECN Forex Brokers in the World is Xtreamforex. You can trade on more than 150 different financial CFD products with us, including stocks, indices, commodities, currencies, and forex currency pairings. Along with educational webinars, seminars, and live analysis, the best ECN broker also provides beginner to expert trading information.

#financial#market#money#forex trading#xtreamforex#traders#cryptos#crypto#copytrading#onlineforex#onlinemarket

3 notes

·

View notes

Text

Top Forex Brokers for 2024: A Comprehensive Guide

Top Forex Brokers for 2024: A Comprehensive Guide

The forex market, known for its vast liquidity and 24-hour trading opportunities, continues to attract traders worldwide. As we step into 2024, selecting the right forex broker becomes crucial for success. This article delves into the top forex brokers for 2024, highlighting their unique features and why they stand out in the crowded market.To get more news about forex broker, you can visit our official website.

1. TastyFX - Best Overall in the US

TastyFX has earned its reputation as the best overall forex broker in the US. It is CFTC registered and a member of the NFA, ensuring high regulatory standards. With over 80 forex pairs and competitive spreads, TastyFX offers an excellent trading platform that caters to both novice and experienced traders.

2. Exness - Best Overall for International Traders

Exness stands out for its multiple account types and competitive trading fees. It supports MT4, MT5, and its proprietary Exness Terminal, providing traders with a versatile trading experience. The Exness Academy and research tools further enhance its appeal, making it a top choice for international traders.

3. FXTM - Best for Professional Traders

FXTM is tailored for professional traders, offering ECN trading accounts and signals from Acuity Signal Centre. It supports MT4 and MT5 platforms, ensuring a robust trading environment. FXTM Invest copy trading feature allows traders to follow and copy the strategies of successful traders, adding another layer of flexibility.

4. Eightcap - Best for Cryptocurrency Trading

For those interested in cryptocurrency trading, Eightcap is the go-to broker. It offers over 100 cryptocurrencies and supports MT4, MT5, and TradingView platforms. The Crypto Crusher dashboard and zero commission with low crypto spreads make it an attractive option for crypto enthusiasts.

5. IC Markets - Best Low Spreads

IC Markets is renowned for its low spreads and low commissions. It supports MT4, MT5, and cTrader platforms, providing a seamless trading experience. With zero requotes and no minimum order distance restriction, IC Markets is ideal for traders seeking cost-effective trading solutions.

6. OCTA - Best for Beginners

OCTA is perfect for beginners, offering a demo trading account and commission-free trading. Its extensive educational materials and regular live webinars help new traders build their skills and confidence. OCTA’s user-friendly interface makes it easy for beginners to navigate the forex market.

7. Swissquote - Best Forex Trading Platform

Swissquote offers a comprehensive trading platform with access to MT4, MT5, and its Advanced Trader platform. It provides real-time pattern recognition and access to Autochartist and Trading Central. With over 3 million financial products available, Swissquote is a powerhouse in the forex trading world.

8. FP Markets - Best Forex Trading App

FP Markets excels in mobile trading, offering apps for iOS and Android. It supports MT4, MT5, and cTrader mobile apps, providing a wide range of exotic and emerging market currency pairs. The app includes over 50 technical indicators, making it a robust tool for traders on the go.

9. FxPro - Best Execution Speed

FxPro is known for its ultra-fast order execution, with speeds under 12 milliseconds. It supports the FxPro Platform, MT4, MT5, and cTrader, offering a wide range of CFD instruments. FxPro’s first-class in-house research and tools like Trading Central and LiveSquawk make it a top choice for traders seeking speed and reliability.

10. Tickmill - Best Research Tools

Tickmill offers excellent research tools, including Acuity Trading and Signal Centre ideas. Its Market Sentiment dashboard covers over 80,000 instruments, and the trading signal plugin for MT4 and MT5 enhances its research capabilities. Tickmill Traders Club provides additional resources and community support.

11. ActivTrades - Best for Share CFD Trading

ActivTrades is ideal for share CFD trading, offering over 1,000 global share CFDs and fractional shares. It supports MT4, MT5, TradingView, and ActivTrader platforms. With low minimum commissions and a wide range of trading tools, ActivTrades is a strong contender in the forex market.

Conclusion

Choosing the right forex broker is essential for a successful trading journey. The brokers listed above have been meticulously evaluated for their regulatory compliance, trading fees, platform versatility, and unique features. Whether you are a beginner or a professional trader, there is a broker on this list that can meet your trading needs in 2024.

0 notes

Text

The Best Forex Brokers for Advanced Traders

When venturing into the world of Forex trading, selecting the right broker is crucial to your success. Forex brokers serve as intermediaries, providing traders with access to trading platforms, market insights, and tools essential for making informed trading decisions. With numerous brokers in the market, finding the one that aligns with your trading style and financial goals can be challenging. This guide aims to help you navigate through the process of choosing the ideal Forex broker.

Understanding Forex Brokers

Forex brokers offer platforms where traders can buy and sell currencies. They provide access to the foreign exchange market, which operates 24 hours a day, five days a week. Brokers earn money through spreads (the difference between the bid and ask price) or commissions on each trade. It’s important to understand the different types of brokers:

Market Makers: These brokers create a market for traders by quoting both a buy and a sell price. They often have fixed spreads and may offer more stable trading conditions.

ECN Brokers: Electronic Communication Network (ECN) brokers provide direct access to the interbank market, where banks and large financial institutions trade. They usually offer variable spreads and charge a commission per trade.

STP Brokers: Straight Through Processing (STP) brokers route clients' orders directly to liquidity providers, ensuring fast execution without any intervention.

Key Factors to Consider

When evaluating Forex brokers, several key factors should be considered to ensure you choose a reliable and suitable partner for your trading journey:

1. Regulation and Security

The first and foremost factor is regulation. Ensure the broker is regulated by a reputable authority such as the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, or the Australian Securities and Investments Commission (ASIC). Regulation ensures that the broker adheres to strict financial standards, offering you a level of protection against fraud and malpractice.

2. Trading Platform

The trading platform is your gateway to the Forex market. It should be user-friendly, stable, and equipped with essential tools such as charting software, technical indicators, and real-time news feeds. Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely preferred due to their comprehensive features and ease of use.

3. Spreads and Commissions

Spreads and commissions can significantly impact your trading profitability. Compare the costs associated with different brokers and choose one that offers competitive pricing. While some brokers may offer low spreads, they might charge higher commissions, so it's essential to consider the overall cost of trading.

4. Leverage and Margin Requirements

Leverage allows you to control a large position with a relatively small amount of capital. However, high leverage also increases the risk of significant losses. Ensure you understand the leverage offered by the broker and the margin requirements. It’s advisable to use leverage cautiously and within your risk tolerance.

5. Account Types

Different brokers offer various account types tailored to different levels of traders, from beginners to professionals. Evaluate the account types available and choose one that suits your trading experience and financial capacity. Consider factors like minimum deposit requirements, available currencies, and access to premium features.

6. Customer Service

Reliable customer support is essential, especially for new traders who may require assistance. Test the broker’s customer service by contacting them through different channels such as live chat, email, or phone. Ensure they offer prompt and helpful responses to your inquiries.

Additional Services and Features

Some brokers go beyond the basics by offering additional services and features that can enhance your trading experience:

Educational Resources: Look for brokers that provide educational materials, webinars, and tutorials to help you improve your trading skills.

Research and Analysis Tools: Access to market analysis, economic calendars, and expert insights can aid in making informed trading decisions.

Demo Accounts: A demo account allows you to practice trading without risking real money, making it a valuable tool for beginners.

Making the Final Decision

After considering the factors mentioned above, narrow down your options to a shortlist of brokers that meet your criteria. Open demo accounts with these brokers to test their platforms, execution speed, and overall user experience. This hands-on approach will give you a better understanding of which broker aligns best with your trading style and preferences.

Conclusion

Choosing the right Forex broker is a critical step towards achieving success in the Forex market. By focusing on regulation, trading platforms, costs, leverage, account types, and customer service, you can make an informed decision. Remember that the best broker for one trader might not be the best for another; it’s all about finding the one that fits your unique needs.

In the fast-paced world of Forex trading, having a reliable and trustworthy broker by your side can make all the difference. Take the time to research, compare, and test different brokers before making your final choice. With the right partner, you’ll be well-equipped to navigate the complexities of the Forex market and achieve your trading goals.

0 notes

Text

ECN Liquidity: The Backbone of Modern Forex Trading

In the intricate world of forex trading, the concept of liquidity plays a pivotal role in determining the efficiency and smoothness of transactions. Among various mechanisms that ensure high liquidity levels, the Electronic Communication Network (ECN) stands out as a sophisticated, transparent, and increasingly popular platform. This article delves into the intricacies of ECN liquidity, examining its mechanisms, advantages, and impact on modern trading.

Understanding ECN

An Electronic Communication Network (ECN) is an automated system that matches buy and sell orders for securities in the forex market. Unlike traditional trading platforms, ECNs operate as intermediaries, connecting traders directly with liquidity providers, which can include banks, financial institutions, brokers, and other traders. This direct connection facilitates immediate trade execution and competitive pricing, crucial aspects for active forex traders.

The Role of Liquidity in Forex Trading

Liquidity refers to the ease with which an asset can be bought or sold in the market without affecting its price. In forex, liquidity is paramount because it determines how quickly and efficiently trades can be executed. High liquidity implies tighter spreads (the difference between the bid and ask price), lower transaction costs, and reduced slippage, making the trading environment more favorable for participants.

Mechanisms of ECN Liquidity

Order Matching: ECNs pool orders from various market participants and match them based on price and time priority. This order-driven system ensures that buy and sell orders are paired directly, reducing reliance on intermediaries and enhancing execution speed.

Access to Multiple Liquidity Providers: ECNs aggregate liquidity from numerous sources, including banks, hedge funds, and individual traders. This diverse pool ensures a constant flow of buy and sell orders, maintaining high liquidity levels even during volatile market conditions.

Transparency and Anonymity: One of the hallmarks of ECNs is their transparency. Market participants can view the depth of the market, including all buy and sell orders, providing a clear picture of market activity. Additionally, ECNs offer anonymity, allowing traders to execute large orders without revealing their identities, thereby reducing market impact.

Low Latency: ECNs utilize advanced technological infrastructure to ensure low latency, which is the time delay between the initiation and execution of a trade. Low latency is crucial for high-frequency trading strategies where even milliseconds can make a significant difference.

Advantages of ECN Liquidity

Tighter Spreads: Since ECNs aggregate orders from multiple participants, they often provide tighter spreads compared to traditional brokers. This is beneficial for traders as it reduces transaction costs and improves potential profitability.

Better Price Discovery: The transparent nature of ECNs allows traders to see the best available bid and ask prices from multiple sources. This enhances price discovery and ensures that traders get the best possible prices for their transactions.

Direct Market Access (DMA): ECNs provide traders with direct market access, enabling them to interact with the order book of the market. This direct interaction eliminates intermediaries, reducing delays and enhancing the overall trading experience.

Reduced Slippage: Due to the high liquidity and efficient matching mechanisms, ECNs minimize slippage, which occurs when there is a difference between the expected and actual execution price of a trade. This is particularly important for traders executing large orders.

24/5 Trading: ECNs facilitate round-the-clock trading, allowing participants to take advantage of market opportunities at any time. This is especially useful in the forex market, which operates 24 hours a day, five days a week.

Impact on Modern Trading

The introduction and evolution of ECNs have significantly transformed the forex trading landscape. Here are some of the key impacts:

Increased Market Participation: By providing a level playing field, ECNs have attracted a wide range of participants, from retail traders to institutional investors. This diversity contributes to higher liquidity and more dynamic market conditions.

Enhanced Competitiveness: The competitive environment fostered by ECNs has led to better pricing, lower costs, and improved services for traders. Brokers and liquidity providers constantly strive to offer the best possible terms to attract clients.

Technological Advancements: The demand for low latency and efficient order execution has driven significant technological advancements. High-speed internet, sophisticated trading algorithms, and advanced trading platforms are now integral parts of the trading ecosystem.

Regulatory Developments: The rise of ECNs has prompted regulatory bodies to adapt and establish frameworks that ensure fair and transparent trading practices. This has led to increased investor protection and confidence in the market.

Algorithmic and High-Frequency Trading: The efficient and low-latency environment of ECNs is ideal for algorithmic and high-frequency trading strategies. These strategies rely on rapid execution and minimal market impact, which ECNs are well-equipped to provide.

Challenges and Considerations

While ECNs offer numerous benefits, they are not without challenges. Traders must consider the following:

Cost of Access: While ECNs reduce transaction costs through tighter spreads, they often charge access fees or commissions. Traders need to evaluate these costs against potential savings.

Technological Requirements: Utilizing an ECN effectively requires advanced technological infrastructure and trading platforms. Traders must invest in high-speed internet, powerful computers, and reliable software.

Market Volatility: During periods of extreme market volatility, even ECNs can experience reduced liquidity and wider spreads. Traders must be prepared for such scenarios and implement appropriate risk management strategies.

Learning Curve: New traders may find the ECN environment complex and challenging to navigate. Understanding order types, market depth, and execution mechanisms is crucial for effective trading.

Conclusion

ECN liquidity has revolutionized the forex trading landscape by providing a transparent, efficient, and competitive trading environment. The direct market access, tight spreads, and low latency offered by ECNs make them an attractive choice for traders seeking optimal execution and cost efficiency. As technology continues to advance and markets evolve, the role of ECNs is likely to become even more prominent, shaping the future of forex trading in profound ways.

Understanding and leveraging ECN liquidity can significantly enhance a trader's ability to navigate the forex market successfully. By embracing the benefits and addressing the challenges associated with ECNs, traders can position themselves for success in the dynamic world of forex trading.

website: https://rectoq.com/

#forex#forexbroker#forextrading#forexbrokeragesetup#start your own forex brokerage#forexmarket#forex brokerage firm#business brokerage#stock market#forexnews

0 notes

Text

Maximize Profits with JRFX True ECN Forex Brokers

In the fast-paced and highly competitive world of forex trading, finding a broker that aligns with your financial goals is crucial. Among the various types of brokers available, True ECN (Electronic Communication Network) brokers are renowned for their transparency, efficiency, and ability to provide traders with a fair trading environment. JRFX, a prominent player in the forex market, offers True ECN forex broker services that are designed to help traders maximize their profits. This article delves into why choosing JRFX True ECN forex brokers can significantly enhance your trading performance and profitability.

The Advantage of True ECN Forex Brokers

True ECN forex brokers, like JRFX, connect traders directly to the interbank market. This setup ensures that traders receive real-time market prices from multiple liquidity providers, resulting in the best possible bid and ask prices. Unlike dealing desk brokers, who may trade against their clients, True ECN brokers provide a transparent trading environment where all participants have equal access to market data and liquidity.

Tight Spreads and Low Trading Costs

One of the key benefits of trading with JRFX True ECN forex brokers is the access to tight spreads. By aggregating prices from a diverse range of liquidity providers, JRFX ensures that traders can take advantage of some of the lowest spreads available in the market. Lower spreads mean reduced trading costs, which directly translates to higher profitability for traders. Additionally, JRFX charges competitive commissions, which are often significantly lower than those of traditional brokers, further reducing the overall cost of trading.

Superior Trade Execution

In forex trading, speed and precision are paramount. JRFX True ECN forex brokers leverage advanced technology to offer superior trade execution speeds. Orders are processed in milliseconds, ensuring that traders can capitalize on even the smallest market movements without delay. This high-speed execution is particularly advantageous for scalpers and high-frequency traders who rely on rapid entry and exit points to generate profits. With JRFX, traders can execute their strategies with confidence, knowing that their orders will be filled promptly and accurately.

Deep Liquidity for Large Trades

JRFX connects to a network of top-tier liquidity providers, offering traders deep liquidity that supports the execution of large orders without significant price slippage. This is especially beneficial for institutional traders and those dealing with high trading volumes. Deep liquidity ensures that traders can enter and exit positions swiftly, even during periods of high market volatility. By providing access to a broad pool of liquidity, JRFX helps traders maintain their strategies and maximize their trading potential.

Advanced Trading Platforms

The trading platform you choose can greatly impact your trading experience and performance. JRFX offers a range of advanced trading platforms, including the widely acclaimed MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are equipped with a comprehensive suite of tools and features, including customizable charts, technical analysis tools, and automated trading capabilities. Whether you are a beginner or an experienced trader, JRFX's platforms provide the functionality and flexibility needed to implement and refine your trading strategies effectively.

Comprehensive Educational Resources

To succeed in forex trading, continuous learning and skill development are essential. JRFX supports traders' educational needs by offering a wealth of resources, including articles, video tutorials, webinars, and live training sessions. These resources cover a wide range of topics, from basic forex concepts to advanced trading strategies, helping traders of all levels enhance their knowledge and improve their trading performance. By choosing JRFX True ECN forex brokers, traders gain access to a valuable educational platform that supports their growth and success.

Robust Customer Support

Having reliable customer support is crucial for any trading experience. JRFX excels in providing top-notch customer service, with a dedicated support team available 24/5 to assist traders with any inquiries or issues they may encounter. Whether you need help with account setup, platform navigation, or technical support, JRFX's professional and responsive customer service team is always ready to help. This commitment to excellent customer support ensures that traders can focus on their trading activities with peace of mind.

Conclusion

Maximizing profits in forex trading requires a combination of the right strategy, tools, and support. JRFX ( https://www.jrfx.com/?804 ) True ECN forex brokers offer an unparalleled trading environment that caters to the diverse needs of traders. With tight spreads, low trading costs, superior execution speeds, deep liquidity, advanced trading platforms, comprehensive educational resources, and robust customer support, JRFX provides traders with everything they need to succeed. By choosing JRFX, traders can optimize their trading experience and achieve their financial goals, making JRFX True ECN forex brokers an ideal partner in their trading journey.

0 notes

Text

GMI Edge Broker Review ( Legit Or Scam?)

GMI Edge - Global Market Index (GMI) Review: Your Gateway to Advanced Forex Trading

In this comprehensive review, we'll delve into the features, offerings, and reputation of GMI Edge Broker - Global Market Index (GMI), also known as Global Market Index Limited. With over a decade of experience in the financial markets, GMI has become a prominent player in the forex trading industry. Let's explore the key aspects that make GMI stand out in the crowded world of forex brokers.

Introduction to GMI:

GMI Edge , established in 2009, has earned its place as a respected forex broker. It strongly emphasizes delivering lightning-fast and stable order execution through modern technology. GMI provides a wide range of tradable assets, including currency pairs, precious metals like gold and silver, crude oil, and global indices. With a presence in over 30 countries and a user base of more than 1 million traders, GMI Edge operates through seven trading centers worldwide, making it a truly global brokerage.

Copy Trading Service:

One notable feature of GMI Edge is its copy trading service, allowing both novice and busy traders to replicate successful trading strategies and check top trading performance in GMI. This feature opens the door for traders to potentially boost their profitability by learning from experts in the field.

Awards and Recognitions:

GMI Edge has received industry awards, including recognition as the Best Liquidity Provider Platform, Best Broker Support for Traders, Best Trading Platform for Traders, and Best Trading Environment for Traders. These accolades reflect GMI's commitment to excellence in serving its clients and maintaining high standards in the industry.

Apart from the retail traders offering, the GMI Edge brings an advanced proprietary software that includes MT4 and MT5 bridges, tailored partnership programs for Institutional Trader, Money Managers, White Label and APIs via FIX connectivity network.Indeed, it is obvious that the main pro of GMI is a technology and software, which also was recognized by many awards received for special achievements within the industry and overall ratings.

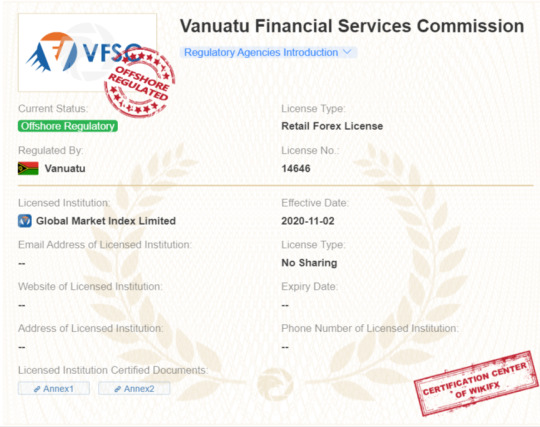

GMI Edge Regulatory Oversight:

Global Market Index Limited operates under various regulatory bodies and entities across the globe. Notably, GMIUK, based in London, is authorized by the Financial Conduct Authority (FCA). Additionally, GMINZ is registered in New Zealand, authorized by VFSC, and GMIVN operates in Vanuatu. The GMI Group also includes entities registered in Hong Kong, further enhancing its global reach.

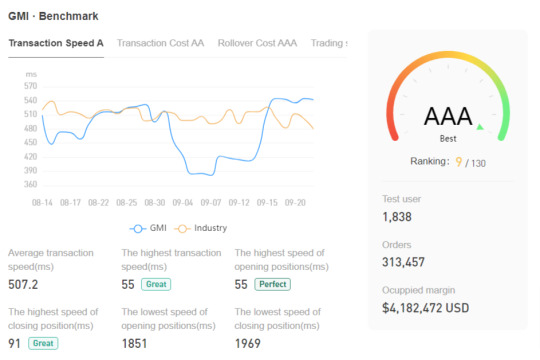

GMI Trading Platforms:

GMI Edge broker offers a diverse range of trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are renowned for their user-friendly interfaces and advanced trading tools. GMI's technology-driven approach ensures ultra-low latency and FIX API connectivity, making it a preferred choice for active traders seeking rapid order execution.

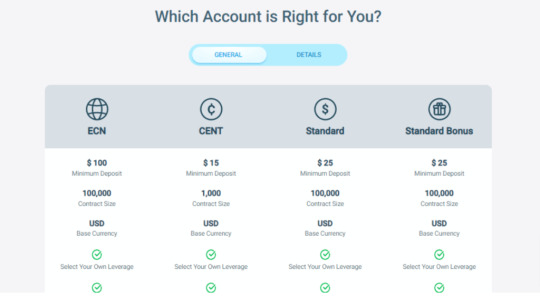

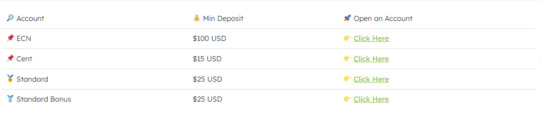

Account Types and Sign-Up Bonus:

GMI caters to various trader profiles by offering different account types, including ECN, Cent, Standard, Standard Bonus, and Risk-Free Demo accounts. The minimum deposit required to open a GMI Professional live trading account is just $15 USD. Additionally, GMI offers a deposit bonus of up to 30% on initial deposits, providing an extra edge to traders.

Safety and Security:

The safety and security of traders' funds are paramount at GMI. The brokerage operates under the umbrella of Global Market Index Limited (GMI), a group of companies registered in several jurisdictions. Each entity complies with the regulatory requirements of its respective jurisdiction, ensuring a high level of security and transparency.

Conclusion: Is GMI Edge Right for You?

In conclusion, GMI is a technology-driven brokerage solution that offers transparent pricing, advanced systems, multiple customer support options, and an array of software proposals. Its diverse range of trading instruments, including Forex, Indices, Cryptocurrencies, and CFDs, appeals to traders seeking variety in their portfolios.

However, it's worth noting that GMI may be better suited for professional and active traders rather than beginners due to its highly developed technology and advanced features. The broker's commitment to regulatory compliance, awards, and global presence make it attractive for those looking for a trusted partner in the forex trading world.

Whether you're an experienced trader seeking rapid execution or a newcomer looking to learn from the best through copy trading, GMI offers a comprehensive solution to meet your trading needs.

Our GMI review highlights a well-regulated firm with a global presence in key financial hubs, known for its transparent trading conditions and advanced technological connectivity. However, a few drawbacks include limited information on the website, the absence of educational support, and a relatively high initial deposit requirement of $2,000. On a positive note, GMI impresses with its extensive range of diverse trading platforms, catering to the needs of traders across the spectrum, from beginners to experienced professionals, both institutional and retail.

Read the full article

0 notes

Text

What is the best online forex trading platform?

Introduction

The Forex market has emerged as one of the largest financial markets in the world, with millions of traders participating in it daily. With the increasing popularity of online trading, there has been a surge in the number of Forex brokers offering their services to traders. In fact, there are more than 2000 Forex brokers in the world today. Despite this vast array of options, traders must be cautious when choosing the right Forex broker for their needs. However, the Forex market has remained relatively unscathed from the unexpected, negative effects of the COVID-19 pandemic. In fact, the volume of trading has increased due to the volatility that the pandemic has brought on. In this article, we will explore the best online Forex trading platforms, including CapitalXtend, to help traders make an informed decision.

Features of best website for forex trading

Choosing the right website for Forex trading is crucial for any trader. With the market being flooded with Forex brokers, it is important to know what to look for to make an informed decision. We have created a list of five qualities and characteristics that make a good Forex broker.

Firstly, a good Forex broker should follow all licensing and regulation requirements. Unregulated brokers can put your money and your trust at risk, so it is important to choose a regulated broker that adheres to industry standards.

Secondly, a good Forex broker should offer a demo or trial period. This allows you to test out the platform and become familiar with it before investing real money. A good, regulated Forex broker should have no problem offering you a trial period or demo account at no risk to you.

Thirdly, a good Forex broker should offer different types of accounts to choose from. As a client, you should have the option to choose the account type that best suits your needs. For example, an ECN Forex broker acts as a bridge between Forex traders and executing trader requests and orders, providing a more direct trading experience.

Fourthly, having adequate customer service is crucial for any Forex broker. The Forex market operates 24-hours a day, so it’s important to have access to customer service around the clock. Additionally, speaking to a real-life customer service representative can be a huge perk, especially for new traders.

Lastly, a good Forex broker should make it easy for you to deposit and withdraw funds. It’s important to choose a broker that allows you to access your money at any time without any issues. Before choosing a Forex broker, take the time to research what they offer and read reviews from other traders to get an idea of their reputation.

For example, CapitalXtend is a regulated Forex broker that offers a demo account, different account types, 24/7 customer service, and easy deposit and withdrawal options. By providing traders with these qualities and characteristics, CapitalXtend makes Forex trading more accessible and user-friendly for all traders.

Final Remark

In conclusion, choosing the right forex broker is a critical decision for successful trading. A good broker should offer a wide range of products, account types, and a solid trading platform to cater to the different needs and trading styles of traders. Additionally, reliable customer support and educational resources are important features to look for in a broker. By taking the time to research and compare different brokers, traders can find the best online forex trading platform that meets their needs and helps them achieve their trading goals.

Orginally Published on Wordpress

Source: https://capitalxtend992667378.wordpress.com/2023/03/13/what-is-the-best-online-forex-trading-platform/

0 notes

Text

The Role Of Forex Brokers In Currency Trading: Explained

The foreign exchange market, also known as Forex or FX, is a vast and complex financial system with numerous participants. It has become increasingly popular in recent years due to its high potential for profits and relatively low barriers of entry. At the heart of this trading activity are forex brokers: entities that facilitate transactions between buyers and sellers. This article will explain the role of forex brokers in currency trading, including their responsibilities and obligations to customers.

Forex brokers play an essential role in facilitating access to the global marketplace by providing retail traders with a platform on which they can buy and sell currencies using leverage. They provide access to competitive pricing from multiple liquidity providers, allowing users to execute trades quickly at the best available prices. In addition, most forex brokers offer additional services such as free educational materials, analytical tools and automated order execution systems designed to help users maximize their returns from each trade.

Finally, it is important to note that forex brokers act as intermediaries between buyers and sellers rather than principals; therefore, they do not take part in any speculative activities themselves nor do they have ownership of any positions held by their clients. Instead, they strive to ensure fairness throughout the entire process while adhering to industry standards set forth by regulators around the world.

What Is A Forex Broker?

A Forex broker is a financial intermediary who facilitates currency trading for its clients. Brokers provide access to the foreign exchange market, enabling traders to buy and sell currencies. They also offer advice on suitable strategies and risk management when trading in the volatile forex markets.

Forex brokers typically operate online platforms that enable users to gain access to real-time price quotes of multiple currency pairs across different exchanges worldwide. These trading platforms are equipped with essential tools such as charting capabilities and automated order entry systems that allow traders to make informed decisions regarding their trades. Additionally, some brokers offer additional services such as leveraged trading accounts and margin loans which can be used to increase profits or limit losses when participating in currency speculation.

The selection of an appropriate forex broker should not be taken lightly, due diligence must be conducted before committing funds into any account since all brokers vary greatly in terms of fees, commissions, customer service standards, platform features, etc. It is important for prospective traders to understand the differences between forex brokers so they can choose one most suited to their needs and objectives. With careful research and consideration, choosing an optimal forex broker will help ensure success when engaging in currency trading activities.

The Different Types Of Forex Brokers

Forex brokers are essential for currency trading since they provide the platform for traders to access the market. There are various types of Forex brokers that differ in terms of their services and features. These include ECN broker, market maker, scalping broker, social trading broker, and retail broker.

An ECN (Electronic Communication Network) broker is a type of direct-access or agency brokerage firm which allows its clients to trade directly with other market participants such as banks and large institutional players. This type of broker provides access to low spreads, high liquidity, and fast execution speeds due to their interbank connections. Furthermore, these brokers charge commissions rather than markups on trades.

A Market Maker is another type of Forex Broker who buys and sells against its clients by setting bid/ask prices and taking the opposite side of the trader’s position in order to make a profit from the spread between them. These brokers typically offer wider spreads and do not charge commission fees for each transaction but instead take a markup. They also tend to be more lenient when it comes to scalping strategies compared to ECN brokers since their profits depend on client losses as well as successful trades.

Finally, Scalping Brokers specialize in providing services suitable for traders who use short-term trading techniques like scalping or day trading. These often involve lower leverage levels along with faster trade executions due to tighter spreads offered by these brokers relative to others in the industry. Additionally, some Scalping Brokers may offer social trading platforms where users can copy successful trades made by experienced professionals in real time, allowing beginners an easier way into the world of online forex investment without having prior knowledge about markets or financial instruments themselves.

In summary, there are many different kinds of Forex Brokers available depending on one's individual preferences regarding service offerings and pricing models: from ECNs charging commissions per trade; Market Makers offering higher spreads; through Social Trading Platforms enabling novice investors easier entry points; up until Scalpers looking for speedier executions with reduced costs associated with them – all catering towards specific needs within this ever-evolving marketplace environment

How Forex Brokers Facilitate Currency Trading

Forex brokers are essential intermediaries in currency trading, providing traders with access to the forex markets. Brokers provide services such as offering a range of trading platforms and tools which enable traders to access different currency pairs. These tools allow traders to develop strategies for entering and exiting trades, based on market conditions and their own risk-return preferences. Forex brokers also provide clients with educational materials and tutorials on how to use these tools effectively.

In addition, many forex brokers offer additional services such as automated order execution systems that can help manage accounts or execute orders according to predetermined parameters set by the trader. This allows traders who may not have the time or expertise necessary to actively monitor the markets an opportunity to participate at a more passive level. Furthermore, some forex brokers even offer margin trading options that permit leverage up to 50:1, allowing smaller investors an opportunity to take part in larger trades than they could ordinarily afford.

These various features offered by forex brokers make them invaluable partners in helping individual traders maximize their returns while minimizing risks when conducting currency trades. By providing comprehensive solutions tailored specifically for each investor’s needs, these services can facilitate successful investment outcomes regardless of market volatility.

Advantages Of Using A Forex Broker

Using a forex broker can offer numerous advantages for currency trading. Their services provide access to the global foreign exchange market, which is considered one of the most liquid markets in the world. By having a forex broker as an intermediary between traders and the marketplace, investors have a better opportunity to maximize their profits from buying and selling currencies.

Forex brokers are able to provide expert advice on strategies related to foreign exchange trading and how different economic events may affect currency prices. Furthermore, they often offer educational resources such as tutorials or webinars so that traders can expand their knowledge about the industry. Additionally, many brokers also provide automated bots or sophisticated software programs designed with algorithms that allow users to make quick decisions when trading. These tools help reduce risk associated with manual trades by providing up-to-date data on price movements and giving alerts if necessary.

Overall, using a forex broker offers several benefits for those who are interested in getting involved with currency trading. With these advantages come increased opportunities for maximizing potential gains while reducing risks through proper guidance and access to reliable trading platforms.

Risks Involved In Using A Forex Broker

The use of a forex broker is an important part of currency trading. While brokers can provide access to markets and simplified processes, they come with certain risks that must be understood by traders prior to entering into any transaction. These risks include market volatility, liquidity, leverage, and other associated costs.

Market volatility is the risk that arises from sudden changes in prices that are out of the control of the trader or their broker. As such, it can have a significant impact on currency trades when market conditions change quickly. Traders should understand how these shifts could affect their profits or losses before making trades through a forex broker.

Liquidity risk refers to the difficulty in buying or selling large amounts of currencies due to lack of buyers or sellers at certain times. If a trader requires fast execution for a trade but there isn’t enough liquidity within the market then they may experience slippage – where they lose money because they don't get filled at their requested price level. Leverage risks involve using borrowed capital which magnifies potential returns as well as losses if not used carefully. It's essential that traders fully understand all aspects related to leveraging before engaging in this type of activity with their forex broker.

It's also important to consider fees charged by brokers when evaluating whether trading through them will be beneficial financially; including commission rates and margin requirements among others. Furthermore, traders need to assess whether the services offered meet their needs as some do not offer features such as automated trading systems or educational resources like free webinars and tutorials etc.. A thorough understanding of corresponding risks involved along with associated costs when using a forex broker ensures informed decision-making for successful currency trading activities.

Regulations For Forex Brokers

Forex brokers must adhere to a set of regulations in order to be able to conduct business legally. These broker regulations are designed to protect traders from fraud and other abuses, as well as ensure the stability of financial markets.

The most important regulation for forex trading is that all brokers involved in the transaction must hold a valid license issued by their respective country's financial regulator. This ensures that the broker has met certain standards and requirements, such as having adequate capitalization and fulfilling customer service obligations. Furthermore, forex brokers must comply with anti-money laundering (AML) laws and any other applicable legal or regulatory requirements.

In addition, many countries have also implemented additional measures to safeguard investors’ interests when trading on the foreign exchange market through their local brokers. For example, some countries require that forex brokers segregate clients' funds into separate accounts so they can't use them for their own purposes; while others may impose leverage limits or minimum account balances to reduce risk exposure. By following these rules, traders can rest assured that their investments are secure when using regulated forex brokers.

Key Considerations When Choosing A Forex Broker

When selecting a forex broker, there are some important considerations to keep in mind. One of the key factors is to choose a currency trading broker that can offer the type of service and products best suited for your needs. Forex brokers come in various shapes and sizes, from online platforms offering automated services to professional advisors providing personalized advice. Additionally, understanding different types of forex brokers and their features is essential when it comes to making an informed decision.

Additionally, evaluating particular forex broker regulations should also be considered when choosing a broker. Different countries have varying regulatory requirements which may affect traders’ rights and responsibilities on certain matters like dispute resolution or transaction costs. It is therefore important to check if a prospective broker meets all relevant laws as well as any additional certification standards they must adhere to.

Lastly, before committing to any brokerage service, it pays off to research customer reviews and compare multiple providers’ offerings in order to find the most suitable solution for you. By taking these steps prior to investing with a forex broker, individuals can ensure they will receive quality service throughout the currency trading process.

Frequently Asked Questions

How Much Leverage Do Forex Brokers Provide?

Forex brokers provide a key intermediary role in currency trading. Leverage is one of the main attractions for traders and investors, as it allows them to enter larger positions with less capital. It also enhances potential profits by allowing for higher ratios of return on investment. Forex broker leverage has been a subject of much interest among experienced traders, who are aware that different brokers offer varying levels of leverage depending on the type of account or strategy used.

A forex trader must understand the types of leverage available when choosing a brokerage firm and how they can affect their trades; this includes leveraging up, which involves increasing leveraged exposure to a given position without adding additional capital, and leveraging down, where a trader reduces their overall risk exposure by decreasing leverage. Additionally, there are various strategies such as margin trading and multi-currency hedging that involve varying degrees of leverage provided by forex brokers.

The amount of leverage available from forex brokers depends on many factors including customer experience and risk appetite. Some will offer higher levels than others based on these criteria, so it's important for traders to research each broker carefully before deciding upon an appropriate level of leverage for their needs. Ultimately, the use of leverage in currency trading should be tailored to individual preferences and goals while taking into consideration market conditions and personal financial circumstances.

How Secure Are My Funds When Trading With A Forex Broker?

When trading with a Forex broker, investors often have questions about the security of their funds. With this in mind, it is important to understand how secure one's funds are when trading currencies through a reliable Forex broker.

Forex brokers are generally highly regulated and offer a range of measures to ensure that clients' funds remain secure. Funds safety is typically achieved through segregated accounts; these accounts separate client money from operational expenses, thus protecting investments from any company-related losses. As an additional precaution, most reputable Forex brokers also keep their clients’ deposits at top-tier financial institutions around the world. This further ensures that no matter what happens to the broker itself, its customers’ money will still be safe and accessible for withdrawal or trade execution whenever required.

In addition to offering deposit protection services, some Forex brokers go even further by allowing traders to customize their own levels of risk management. For example, they may allow traders to set up stop loss orders which automatically close out trades if certain criteria are met; this helps protect against any potential market movements beyond the trader's control which could otherwise lead to significant losses. By employing such strategies as well as working with trusted FX providers, customers can rest assured knowing that their funds are being managed securely while currency trading.

What Are The Fees Associated With Using A Forex Broker?

When trading with a forex broker, it is important to consider the associated fees and costs. Forex brokers charge their clients for various services such as currency trading fees, trading costs, brokerage fees, or commission costs. These charges vary depending on the type of broker that one uses and the features they offer.

Generally speaking, most forex brokers will not charge any additional fee beyond the spread offered by them when executing trades. This means that traders do not have to pay an extra cost for every trade made through their broker’s platform. However, there are some exceptions where certain brokers may add other types of charges like commissions or margin rates which can significantly increase total expenses related to trading with a particular broker. In addition, some brokers also impose minimum deposits in order to open a live account which could be considered as another form of cost incurred while using their services.

It is necessary for potential traders to understand all the different types of forex broker fees before opening an account with any particular broker. Doing so can help them make informed decisions about whether working with a specific broker is beneficial or not based on the level of service provided along with its associated costs. Moreover, researching into these fees should also be followed up by reading reviews from past customers who have used that particular broker's services in order to ensure best practices are being followed regarding pricing and customer service satisfaction.

How Can I Find A Reliable Forex Broker?

Finding a reliable Forex broker is an important step for anyone looking to invest in the Forex market. A reputable and trustworthy Forex broker can provide investors with access to financial markets, advice on trading strategies, and even automated trading systems. In order to ensure that you select the best Forex broker for your needs, it is essential to consider several factors including cost, regulation, customer service, and account features.

When researching potential brokers, one should first look into their reputation and regulatory status. Checking reviews from other traders or online sources of information can be helpful here. Additionally, it is important to check if the broker has any active licenses with a regulatory body such as CySEC or FCA which are organizations that oversee brokers’ operations in many countries around the world. This will help to guarantee that your funds are safe while trading with them and protect you against frauds or scams. Furthermore, it is beneficial to assess the fees associated with using each broker before making a decision - this includes spreads (the difference between bid/ask prices) as well as commission charges.

Customer service is also critical when selecting a Forex broker; therefore make sure they offer support 24 hours per day throughout the week via phone, email or live chat services. It's useful to determine how responsive they are by testing out these channels yourself prior to signing up with them. Also take note of whether they have user-friendly software platforms available both desktop and mobile devices – this will allow you more flexibility when you need it most! Finally, investigate what types of accounts they offer so you can find one tailored for your individual requirements - some may require higher minimum deposits but come with better access to research tools or lower commissions on trades than others do.

In summary then, there are many aspects to consider when choosing a reliable Forex broker – from checking their licensing credentials and assessing costs associated with using them through to gauging levels of customer service offered alongside exploring suitable platform options for executing trades quickly and efficiently. By taking time upfront conducting thorough due diligence on prospective companies now could save money further down the line.

What Type Of Customer Support Do Forex Brokers Offer?

When seeking a reliable forex broker, customer support is an important factor to consider. Brokers are expected to provide customers with the highest quality of service and must have a customer service team available in case any issues arise during currency trading. Depending on the type of customer support that clients require, there are several options for them to choose from when selecting their forex brokers.

Customer service teams can range from providing basic technical assistance to offering more specialized services such as tailored advice or market analysis. Commonly offered by brokers, technical assistance may include help troubleshooting platforms, answering questions about trading conditions or giving guidance on how to use various features within their platform. Additionally, many brokers offer one-on-one coaching sessions with experienced traders who can give personalized tips and strategies on how to successfully trade currencies.

In addition to these services, some brokerages also provide client education through seminars, webinars and other events where investors can learn more about the foreign exchange markets. These educational opportunities allow clients to gain further knowledge about different types of trends and techniques they should apply while trading so they can make informed decisions before entering the market. By having access to this information, clients will be able to maximize their chances of success when making trades in the foreign exchange markets.

The availability and scope of customer service options vary greatly among different forex brokers; therefore it is important for potential investors to do thorough research prior to signing up with a particular brokerage firm in order to find out what kind of customer support they offer and if it meets their specific needs related to currency trading.

Conclusion

The role of Forex brokers in currency trading is essential to facilitate a successful and profitable venture. In order for traders to maximize their profits, they must have access to leverage offered by the broker, secure funds when trading with them, and be aware of any fees associated with using their services. Additionally, it is important that traders find reliable Forex Brokers who can provide customer support if needed.

When selecting the right Forex Broker for your individual needs, there are several factors that should be considered such as the amount of leverage available, security of funds while trading and fee structures associated with trading. Moreover, researching reviews from other users may help identify which type of service would work best for you.

In conclusion, choosing an appropriate Forex Broker is critical for success in currency trading. Researching key information related to leverage availability, fund security and fee structures will assist in making informed decisions about which options would suit individual needs best. Additionally, seeking out reviews from previous customers can also help ensure trustworthy services are provided.

0 notes

Text

Forex Brokers And Their Role In The Global Currency Market

The world of foreign exchange trading is a fascinating one, with billions of dollars traded daily across the globe. But what exactly are forex brokers and how do they fit into this complex landscape? Let's take a closer look at these professionals and their important role in the global currency market.

Forex brokers are financial intermediaries who provide an online platform for traders to buy and sell currencies. They represent clients’ interests by executing trades on their behalf based on market prices, taking a small commission or fee in return. As such, they play an essential part in connecting buyers and sellers from all over the world, allowing them access to profitable opportunities that would otherwise be unavailable due to geographic distance or limited capital resources.

In today's interconnected economy, it's never been more critical for investors to have reliable access to quality forex services. With so much money being moved around daily, having the right broker can maximise profits while minimizing risks. In this article, we'll discuss the features of different types of forex brokers and tips for choosing the best one for you.

Definition Of Forex

Forex, short for foreign exchange, is the global currency market. It's where currencies from different countries are traded against each other. This includes buying and selling of major world currencies such as US Dollars (USD), Euro (EUR), British Pound (GBP) and Japanese Yen (JPY). The forex market is open 24 hours a day, five days a week, making it one of the most liquid markets in the world.

For those looking to participate in this highly lucrative market, understanding how forex works is essential. Forex brokers offer services that enable traders to buy and sell various currencies with ease. These brokers act as intermediaries between buyers and sellers by providing access to multiple trading platforms via their websites or applications. They also provide quotes on current currency prices and help traders make informed decisions based on technical analysis tools available through these platforms.

Forex brokers serve an important role in the global currency market; without them, it would be difficult for individual investors to take part in this fast-paced marketplace.

Types Of Brokers

There are two main types of forex brokers: Market Makers and ECNs. Market makers act as intermediaries between buyers and sellers in the currency market, providing liquidity and setting prices. They make money by taking a spread on trades they execute. This means that when you buy or sell through a market maker, you pay more than if you were to trade directly with another trader. ECN (electronic communications network) brokers offer direct access to the interbank market without having to go through an intermediary. These brokers provide their clients with greater price transparency since they can see all bids and offers from other traders, but they may charge higher commissions for this service.

One key advantage of using a broker is that they handle all aspects of executing your trades, such as accessing the best available prices in the marketplace and ensuring compliance with applicable regulations. Brokers also typically have access to advanced trading platforms, which allow them to quickly identify opportunities in the market based on automated analysis tools and real-time data feeds. Additionally, many brokers offer additional services such as margin accounts, stop-loss orders, hedging capabilities and research resources designed to help customers make informed decisions about their investments. All these features can be invaluable for those looking to maximize returns or manage risks associated with foreign exchange transactions.

Leverage And Margin Trading

Leverage and margin trading are two key concepts that forex brokers use to enable traders to maximize their gains. By leveraging, or borrowing capital from a broker at an agreed upon rate in order to gain access to larger positions, traders can increase their buying power. This allows them to purchase more currency than they could normally afford with the money they have available.

The other side of the equation is margin trading, which involves depositing funds with a broker as collateral for a given position. These funds must be held in the account until the trade is closed out and any losses incurred by the trader are covered. Margin trading allows traders to take on greater risk while also potentially increasing their profits since they are able to open larger trades without having to deposit additional funds into their accounts.

Overall, leverage and margin trading provide forex traders with increased options when it comes to managing their investments. They allow investors to open larger positions and take on extra risk while still maintaining control over their own finances and limiting potential losses if things don't go as planned.

Role In The Global Currency Market

Having discussed leverage and margin trading, it is now important to discuss the role of forex brokers in the global currency market. Forex brokers are essential players in this vast financial market as they serve as intermediaries between buyers and sellers. They provide access to a range of currencies by allowing traders to place orders without having full knowledge of the process or even having direct contact with each other.

The main function of forex brokers is to facilitate trades, helping clients execute their transactions securely and quickly. They keep up-to-date records of all transactions which allows them to monitor prices and identify trends that can be used for profitable trading decisions. Furthermore, these brokers offer advice on how best to use leverage, providing assistance when needed. This helps reduce risk for investors who may be unfamiliar with the markets or lack experience in trading foreign currencies.

Lastly, forex brokers also offer educational services such as webinars and seminars designed to help traders learn about different aspects of the forex market, including technical analysis, fundamental analysis, risk management strategies and more. With proper guidance from experienced professionals, newcomers can become well-informed participants in this lucrative but competitive industry. In addition to teaching valuable skillsets related to successful trading activities, these resources empower individuals with increased confidence when making investment decisions that could potentially lead to higher returns over time.

Analyzing Financial Reports

Analyzing financial reports is a key part of forex trading. By understanding the performance of an organization, traders can assess whether to buy or sell its currency. Financial reports provide investors with insights into an organization's operations, including information on its income, expenses and balance sheet.

Financial statements are divided into two categories: primary financial statements and supplemental financial statements. Primary financial statements include the balance sheet, which shows assets and liabilities; the income statement, which reveals revenue and expenses; and the cash flow statement, which provides insight into how money flows in and out of the business. Supplemental financial statements give more detailed information about certain aspects of the company’s finances such as inventory levels or debt structure.

By analyzing these documents carefully, traders can gain valuable insights into how companies operate their businesses and what kind of risk they may be exposed to. This helps them make informed decisions when it comes to trading currencies on the global market. Traders should always consult professional advice before making any investment decision based on these documents.

Regulation And Licensing Requirements

Forex brokers must meet certain standards of regulation and licensing to legally operate in the global currency market. This is a critical factor when selecting a broker, as it ensures that clients' funds are safe and secure. Here are four things you should consider when researching forex brokers:

It's important to make sure that your chosen forex broker has all necessary licenses and approvals required to operate within their jurisdiction before making any investments. Additionally, check out reviews online to get feedback from other traders who may have had experiences with particular brokers. It is wise to take advantage of these resources as they can provide invaluable insight into how reliable a company really is.

The global currency market offers many opportunities for investors; however, it’s essential to ensure that you select a trustworthy forex broker who meets all applicable regulations before investing your hard-earned money. Doing thorough research beforehand will give you peace of mind knowing that your funds are secure and help maximize your profits over time.

Different Platforms Used By Brokers

Forex brokers play a pivotal role in the global currency market, and one of their most important functions is to provide trading platforms for users. These platforms allow traders to make orders and monitor developments on the foreign exchange markets.

There are many different types of forex trading platforms used by brokers, each with its own advantages and disadvantages. The main platform categories include web-based, desktop-based, mobile-based, virtual private server (VPS), copy trading and social trading platforms.

Platform

Advantages

Disadvantages

Web-Based

Accessible from any device connected to the internet; no download required

Limited customization options; slow response times during high traffic periods

Desktop-Based

High degree of customizability; fast processing speeds due to direct connection to servers

Requires installation on local computer or VPS; not accessible outside designated device(s) without remote access software installed

Mobile-Based

Can be accessed via smartphone or tablet devices anytime/anywhere; great for active traders who need constant updates while away from their desktops/laptops

Reduced functionality compared to other versions due to smaller screensizes; slower execution than desktop counterparts due to wireless connections being prone to latency issues

VPS Hosting Service (Virtual Private Server)

Copy Trading

Social Trading

All these platforms have their respective advantages and drawbacks depending on the user's needs and preferences. For example, if you're an active trader who needs real time data updates regardless of where they are, then a mobile app would serve best. On the other hand, if you prefer a more comprehensive analysis suite but don't mind having it installed locally or remotely via a VPS hosting service then this could be the right choice for you instead. Ultimately it comes down to what features you prioritize when selecting your preferred platform type.

Choosing A Broker

Choosing a broker is an important decision for any trader. It's essential to find one that is reliable and provides the services you need. There are several factors to consider when choosing a broker, such as fees, trading platforms, customer service, research tools, and regulatory compliance.

Fees can vary greatly among brokers. Some offer commission-free trades while others may charge commissions or annual fees. Fees should be weighed against the features offered by each broker and compared with other brokers on the market.

Trading platforms allow traders to execute orders quickly and easily. Many reputable brokers have their own proprietary trading platform but some also support third party software like MetaTrader 4 (MT4) or Ninja Trader. Different types of accounts may have different access levels to these platforms so it’s important to be aware of this before selecting a broker account type.

Customer service is critical in forex trading since issues can arise at any time due to market volatility. A good broker will provide 24/7 customer service via telephone, email or chat with knowledgeable staff who can assist with queries about deposits, withdrawals, technical problems etc., promptly and professionally. Research tools are also important for successful forex trading; make sure your chosen broker has up-to-date news feeds from major financial outlets as well as charts and real-time quotes from all relevant markets around the globe .

Finally, always ensure that your chosen brokerage firm holds valid licenses approved by appropriate regulatory bodies such as FINRA in the US or FCA in the UK - anything less could leave you vulnerable to fraudsters operating outside established rules and regulations! With these considerations in mind, choosing a quality broking partner shouldn't be too difficult – just take your time doing your due diligence to avoid disappointment later down the line!

Advantages And Disadvantages

Moving on, it's important to understand the advantages and disadvantages of forex brokers. Forex brokers are financial intermediaries that stand between traders and the currency market. They provide certain services such as providing access to trading platforms, researching information about different currencies and markets, offering advice related to investing strategies, executing trades on behalf of clients and more. As a result, they have become an integral part of the global currency market.

The primary advantage of working with a broker is that they provide professional expertise in foreign exchange transactions. Brokers can offer valuable insights into which pairings may be profitable or not at any given time, allowing traders to optimize their returns. Additionally, since brokers execute trades for clients in real-time, traders don't need to spend hours monitoring the currency markets themselves while still being able to capitalize on short-term fluctuations when necessary. This provides greater flexibility compared to other types of investment vehicles where investors must wait until set periods before making adjustments or taking profits from their investments.

On the other hand, there are some drawbacks associated with using a broker too. For one thing, fees charged by brokers typically cut into profits earned through successful trades - no matter how small those fees may seem at first glance. In addition, brokers may also increase risk if they advise inexperienced traders to invest beyond what would be considered prudent based on their level of experience or knowledge about the marketplace. Finally, depending on who you choose as your broker; conflicts of interest could arise if said broker is compensated for recommending specific trading instruments over others or engaging in activities like high frequency trading (HFT).

It's essential then that potential customers take their time researching potential options carefully when selecting a broker so as to ensure they get all the benefits while avoiding any unanticipated risks down the line.

Risk Management Strategies

Risk management is an essential part of any trading strategy. Forex brokers are no exception, as they have to constantly monitor market conditions and be aware of potential risks while also keeping their clients informed about them. By properly managing risk, forex brokers can help their clients protect themselves from unnecessary losses due to currency fluctuations or other unforeseen events. This can ultimately lead to increased profits for both the broker and their client.

One key aspect of successful risk management is understanding leverage. Leverage refers to using a small amount of capital to control larger positions in the foreign exchange market. Leverage allows traders to open much larger trades than if they were just investing with their own funds; however, it also increases the level of risk associated with those trades since gains and losses will be magnified accordingly. For this reason, forex brokers must ensure that all trades involving leveraged products are properly monitored so that they do not overextend themselves financially.

In addition, forex brokers should educate their customers on how best to manage risk through proper money management techniques such as setting stop-loss orders and taking profits when appropriate. These strategies limit the downside risk by capping total losses during a trade, thus allowing traders to stay in longer trends without risking too much capital at once. Proper money management can significantly reduce the chances of experiencing large losses which could potentially wipe out all gains made in previous profitable trades.

Forex brokers play a vital role in helping traders understand and implement effective risk management strategies so that they may increase their chances of achieving long term success in the foreign exchange markets.

Frequently Asked Questions

What Is The Minimum Amount Of Money Required To Start Trading With A Forex Broker?

When it comes to investing in the global currency market, one of the most important questions to ask is what is the minimum amount of money required to start trading with a forex broker? The answer to this question varies from broker to broker, but generally speaking there is no set number. Traders are free to open an account and deposit as little or as much funds as they would like.

That being said, some brokers may require a certain level of funding before they will activate a trader’s account. This can range anywhere from $100-$500 depending on the broker's individual requirements. Additionally, many brokers offer promotional incentives for new traders who meet their minimum balance requirement such as bonus points or even cash bonuses.

It’s also worth noting that regardless of how much capital you have available for trading purposes, having access to a reliable Forex brokerage service is essential if you want to make successful trades in FX markets. A good Forex Broker should provide research tools and educational resources including live streams and webinars so that traders can become more informed about current market conditions before making any decisions regarding their investments. Many online platforms also provide simulated accounts where users can practice their strategies without risking real capital - another great way to get comfortable with foreign exchange trading without taking too big of a risk upfront.

In summary, although there isn't necessarily a ‘set’ minimum investment when starting out in the forex market, different brokers may have varying requirements depending on their own policies and services offered. It's always best to do your research beforehand so you know exactly how much capital you need in order to get started with your chosen provider – not only will this help ensure your success as an investor but it will also give you peace of mind knowing that your funds are secure throughout all stages of your trading journey.

What Is The Difference Between A Market Maker And An Ecn Broker?