#BookkeepingTips

Explore tagged Tumblr posts

Text

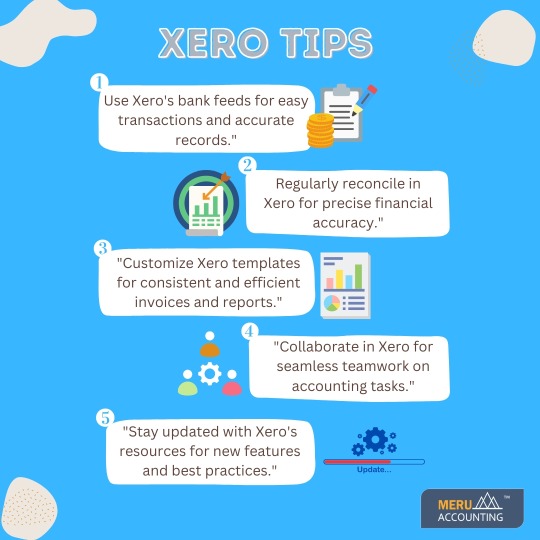

The power of seamless financial management with Xero! Our top tips help you to grow your business.

Meru Accounting is your trusted partner for top-notch accounting and bookkeeping services in the USA, UK, Canada, Australia, UAE, and New Zealand.

#MeruAccounting#xero#xerbookkeeping#xeroaccounting#bookkeepingtips#bookkeepingservices#bookkeepingandaccounting#accounting#accountingservices#usa#uk#canada#uae#australia#newzealand#india

2 notes

·

View notes

Text

#BookkeepingTips#Small Businesses in Columbia#South Carolina#bookkeepingonline#bookkeeping services#small business bookkeeping#remote bookkeeper#bookkeepingservices#smallbusinessbookkeeping

0 notes

Text

Why Falling Behind on Your Books Costs You More Than You Think | Part 2 of 3

If you’re months (or even years) behind on your books, you’re not alone. But what most business owners don’t realize is that falling behind quietly costs more than just late nights — it drains profits, kills tax deductions, and hides cash flow problems until it’s too late.

In Part 2 of this catch-up series, I break down the real cost of disorganized books — and how you can fix them fast.

💡 What You'll Learn:

✅ How late books lead to late fees, missed deductions, and bad decisions ✅ Why DIY fixes often make the problem worse ✅ How to catch up the right way — without the stress ✅ What to do today if you’re overwhelmed and behind

🎯 Take the First Step to Clean Books:

👉 Download the Free Checklist 👉 Use the ROI Calculator 👉 Request a Free Quote

📖 Read the full article here: 🔗 https://www.devinhaleybookkeeping.com/blog/2486354_part-2-of-3-catch-up-bookkeeping-why-falling-behind-costs-you-more-than-you-think

#catchupbookkeeping#bookkeepinghelp#smallbusinessfinance#financialclarity#taxseasonready#behindonbooks#bookkeepingtips#cashflowmatters#DevinHaleyBookkeeping#smbsuccess

0 notes

Text

"When you're a Tax Preparation Expert in the USA and it's 11:59 PM on April 15th: 😱💻📊 'Just one more deduction... I can do this!' 💪✨ #TaxSeason #AccountantLife #DeadlinesAreReal"

#Accounting#Tax#TaxPreparation#TaxSeason#TaxPreparationExpert#USAAccounting#FinancialPlanning#SmallBusinessTaxes#BookkeepingTips#TaxDeductions#BusinessAccounting#TaxConsultant#PersonalFinance#CPA#TaxAdvice#IRSHelp#TaxFiling#AccountingTips#TaxSolutions#FinanceExpert

0 notes

Text

Free QuickBooks Online Setup w/ Month-end Close

Please like, share, comment & follow my post and I'll follow back.

Free QuickBooks Online Setup and month-end close for the month of March only. Get your business setup in QuickBooks Online for free. We will move your Financial Statement from your current financial software to QuickBooks online and produce your company March 2024 Financial Statement for free. This offer is for a limited time only, first come first serviced. Act now! Website like:…

View On WordPress

#accountant#accountantlife#Accountants#Accounting#accountinglife#accountingservices#accountingsoftware#accountingtips#audit#bookkeeper#Bookkeeping#bookkeepingservices#bookkeepingtips#budget#budgeting#business#businessowner#businessowners#cloudaccounting#consulting#covid#CPA#entrepreneur#entrepreneurs#Finance#financialfreedom#financialplanning#financialservices#financialstatements#incometax

0 notes

Text

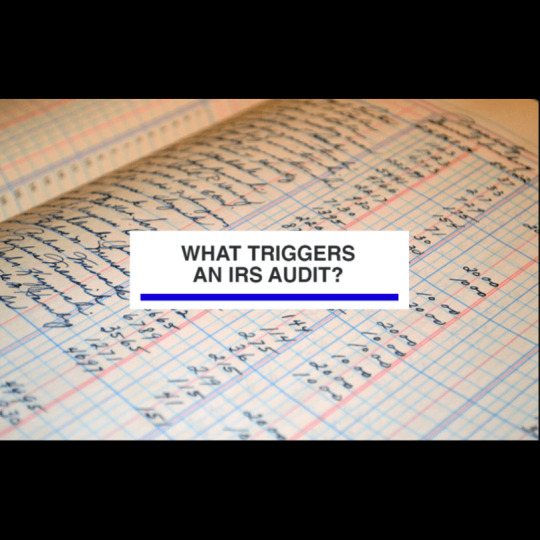

What Triggers An IRS Audit?

Preparing a tax return can be stressful. If you are being honest or use a professional you can breathe a little easier since IRS audits don’t happen to many people.

The IRS has audited fewer returns since 2010 due to federal budget cuts that have affected staff size. According to a 2022 GAO report, only 0.25% of all individual returns were audited in 2019, down from 0.9% in 2010.1

That said, taxpayers commonly make a few mistakes that increase the chance that an agent will take a second look at their returns.

IRS computer System Can Trigger An Audit.

The IRS computer system called the Discriminant Information Function (DIF) is designed to detect anomalies in tax returns. It scans every tax return the IRS receives. It’s looking for things like duplicate information—maybe two or more people claimed the same dependent—as well as deductions and credits that don’t make sense for the tax filer.

The computer compares each return to those of other taxpayers who earned approximately the same income. For example, most people who earn $40,000 a year don’t give $30,000 of that money to charity and claim a deduction for it, so your tax return is more likely to be flagged by the DIF system.

Can income Affects Triggering Of Audits?

The IRS isn’t going to waste its time on an audit unless agents are reasonably sure that the taxpayer owes additional taxes and there’s a good chance that the IRS can collect that money. This puts a focus on high-income earners.

According to the IRS Data Book, the majority of audited returns in 2019 were for taxpayers who earned $500,000 a year or more, and most of them had incomes of over $1 million. Additionally, the only income ranges that were subject to more than a 1% chance of an audit were $5,000,000 and over.

According to IRS statistics, you’re safest if you report income in the neighborhood of $25,000 to less than $500,000. These taxpayers were audited the least in 2019.

Additional Items That Can Trigger An Audit.

Large Cash Deposits Under the Bank Secrecy Act, various types of businesses are required to notify the IRS and other federal agencies whenever anyone engages in large cash transactions that involve more than $10,000. The idea is to thwart illegal activities.A side effect is that you can expect the IRS to wonder where that money came from if you plunk down or deposit a lot of cash for some reason, particularly if your reported income doesn’t support it. The IRS will be notified if you make a large deposit over the $10,000 amount. You should be prepared to show how and why you received that money if you file a tax return.Also “structuring” your deposit can trigger this. If you make two or more transactions that are less than $1,000 individually but that adds up to more than the $10,000 threshold. Banks are required to report deposits that are for amounts less than the threshold if they might indicate illegal activity.

Claiming Too Many Itemized Deductions You may trigger an audit if you’re spending and claiming tax deductions for a significantly larger amount of money than most people in your financial situation do.

You’re Self-Employed Deductions that are above the norm for your profession can trigger an audit. Don’t stretch the truth when filling out your tax returns. If you use your car for business and you want to deduct your expenses or mileage, don’t say that 100% of your travel was solely for business purposes if you have no other vehicle available for personal use. You presumably drove to do personal errands at some point.

Your Business Is Home-Base You must use your home office area only for business. You and your family members should not do anything else in that space. Review IRS Publication 587 if you’re planning to claim a deduction for a home office.

You Own A Cash Business Operating a mostly cash business can put you on the IRS’s radar as well. Businesses that fall into this category include salons, restaurants, bars, car washes, and taxi services, according to the IRS. Because there’s so much cash, it would be easier for these business owners to hide some of their income from the IRS.

You Have Investment Income Keep track of all your investment income so you can accurately report it to the IRS.

Have You Considered Hiring A Bookkeeper?

A professional bookkeeper does not need to be a full-time employee. These services are often best outsourced to firms who have strategies in place to help small to medium-sized businesses excel at what they do best, providing services and solutions to their clients. Bookkeepers are perfect workers to work remotely.

Stash Bookkeeping es has a knack for designing or re-designing bookkeeping systems that help owners take their business to greater levels. Using common sense as our greatest weapon, we love to find new ways to take the work out of paperwork.

Stash Bookkeeping has been established for nine-plus years, managing small to medium-sized businesses’ books ranging from $1,000,000 to $20,000,000 in annual revenue, and serving 100’s of happy clients in a variety of industries nationwide. With extensive experience in building/maintaining a solid set of books, we are able to produce an accurate set of financial statements every month.

0 notes

Text

Budget-Friendly Bookkeeping Tips for Busy Individuals

Financial management can be an overwhelming undertaking for individuals juggling multiple responsibilities at once. Here we explore practical and budget-friendly bookkeeping tips to keep on top of finances without spending precious time managing them. Here are a few budget-friendly bookkeeping strategies designed to keep the ship sailing smoothly.

Embrace digital tools for expense tracking, explore free accounting software options, and consider outsourcing bookkeeping services to CPA firms. These professionals offer expert guidance without breaking the bank. By staying organized, leveraging technology, and tapping into affordable expertise, bookkeeping professionals can help streamline the bookkeeping process so you can focus on what truly matters: your success. Say goodbye to financial stress with their efficient yet cost-effective approaches to bookkeeping!

Why Bookkeeping Matters

Understanding the importance of bookkeeping lays the foundation for effective financial management. It provides a clear picture of your income, expenses, and overall financial health.

Setting Up Your Budget

Define Your Financial Goals

Start by outlining both your short- and long-term financial goals. From saving for vacation to planning for retirement, having specific objectives will guide your budgeting efforts.

Categorize Your Expenses

Create categories to track all your expenses, such as housing, utilities, groceries and entertainment. This breakdown will enable you to identify areas in which costs could be cut back.

Allocate a Budget for Each Category

Set a realistic budget for each expense category to prevent overspending. Be wary of any sudden expenses to stay within your set limit.

Simplifying Bookkeeping Processes

Embrace Technology

Discover user-friendly budgeting apps and tools that make bookkeeping simpler, such as categorizing expenses, tracking income streams and providing real-time financial insights.

Set Reminders for Bill Payments

Late fees can quickly accumulate. Set reminders to pay bills promptly in order to reduce unnecessary expenses, and automate where possible to streamline this process.

Regularly Reconcile Accounts

Take time each month to reconcile your bank and credit card statements in order to ensure accuracy, and identify any discrepancies which need addressing.

Cutting Costs Effectively

Evaluate Subscription Services

Examine your subscription services periodically. Cancel those that no longer add significant value, or consider more cost-effective alternatives.

Negotiate with Service Providers

Don't hesitate to negotiate with service providers; many businesses offer discounts in order to retain customers.

Buy in Bulk

Consider purchasing non-perishable items in bulk to save both money and reduce shopping trips over time. This strategy could save both time and effort when it comes time for replenishment.

Maximizing Income

Explore Side Hustles

Investigate ways of increasing your income with side hustles or freelance work - even small additional sources can add up quickly!

Take Advantage of Discounts and Cashback

Before making purchases, look out for discounts and cashback offers that could add savings. Many credit cards provide rewards such as this that could add up over time to major savings opportunities.

Prioritize Debt Repayment

Set aside part of your budget to debt repayment. Cutting high-interest debt could free up funds that you could put toward savings or other financial goals.

FAQs

Should I review my budget regularly? For maximum effectiveness, review it monthly to track expenses and adjust as necessary.

Are budgeting apps safe to use? Reputable budgeting apps utilize encryption technology to keep financial data safe ensuring an enjoyable user experience.

Can Negotiating Service Providers Save Money?

Negotiations is certainly possible with many service providers, particularly if you are loyal customer.

What is the 50/30/20 Rule in Budgeting?

This budgeting rule proposes allocating 50% of income towards needs, 30% toward wants and 20% toward savings/debt repayment.

How can I stay motivated to stick to my budget?

Establish small, achievable milestones and celebrate any financial victories along the way as ways to stay on track and remain inspired.

Conclusion

Adopting these budget-conscious bookkeeping tips into your routine can vastly improve your financial well-being. By setting clear goals, embracing technology, cutting expenses and optimizing income generation you will find navigation of the financial journey easier than ever!

0 notes

Text

Automate Your Accounting: AI-Driven Success Tips

Discover how to build an efficient automated accounting system using AI. #AIAccounting #Automation #BusinessEfficiency #TechInFinance #Bookkeeping #AccountingAutomation #AIAccounting #BookkeepingTips #BusinessSuccess #AutomationTools #FinancialManagement #AIinBusiness #SmartAccountant #Efficiency #TechForBusiness from Mpho Dagada https://www.youtube.com/watch?v=M24y2Hg684E

#africanwealth#climatechangehoax#corruption#economicgrowth#europeagenda#mphodagada#recolonizingafrica#southafricapolitics

0 notes

Text

Every small business deserves a reliable bookkeeping partner. By maintaining accurate financial records, you can identify trends, manage cash flow, and plan for the future. Let’s work together to build a strong financial foundation for your business! https://www.hr.com.bd/blog/accounting/a-detail-guide-for-small-business-bookkeeping-2025/ #SmallBiz #Finance#BusinessGrowth #BookkeepingTips #SmallBizSupport

0 notes

Text

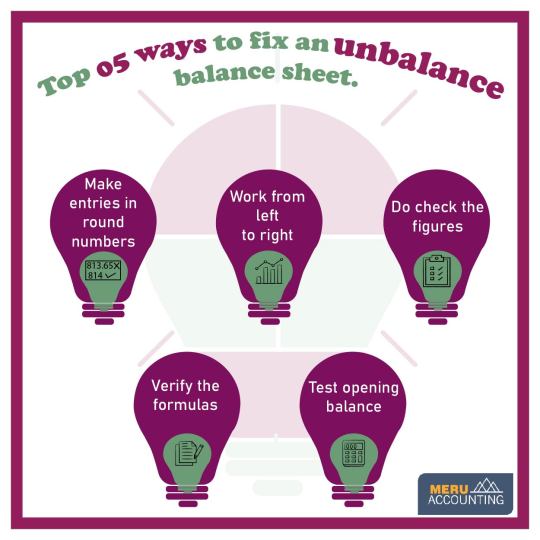

Is your balance sheet out of whack? Discover the top 5 strategies to restore financial equilibrium!

#MeruAccounting#bookkeepingcompany#bookkeepers#bookkeepingservices#bookkeepingtips#bookkeeping#accounting#accountingservices#balancesheet

3 notes

·

View notes

Text

Five concise tips for effective bookkeeping: 1. Stay organized: Keep records systematically arranged. 2. Regular entries: Record transactions promptly and consistently. 3. Monthly reconciliation: Match records with bank statements to spot discrepancies. 4. Separate finances: Maintain distinct accounts for business and personal expenses. 5. Use accounting software: Employ tools like QuickBooks or Xero for streamlined bookkeeping. #bookkeeping #bookkeepingtips #bookkeepinghelp #bookkeepingservices #bookkeepingforsmallbusinesses #bookkeepingforcreatives #bookkeepingandaccounting #bookkeepingforsmallbusiness #tipsandtricks

0 notes

Text

Why Bookkeeping Is the Hidden Key to Small Business Success

Most small business owners focus on marketing, sales, and growth — but the real key to sustainable success? Clean, accurate, and strategic bookkeeping.

In this video, I break down:

Why poor bookkeeping quietly holds businesses back

How smart bookkeeping unlocks profitability, tax savings, and growth

What steps you can take to regain control over your numbers and stop leaving money on the table

If you’re behind on your books, stressed about cash flow, or making decisions without a clear picture of your finances — this is for you.

📎 Watch the Full Video:

🔗 https://youtu.be/w9_qp6cTdtc?si=Rs7fVN2uweKobbBi

🛠 Bonus Tools to Help You Get Started:

👉 Download the Free Checklist 👉 Try the ROI Calculator 👉 Request a Free Quote

#smallbusinesssuccess#bookkeepinghelp#hiddenprofits#financialclarity#cashflowmatters#businessstrategy#DevinHaleyBookkeeping#bookkeepingtips#entrepreneurmindset#profitfirst

0 notes

Text

My 5 favourite features of Slack for Accounting and Bookkeeping practices | Future Proof Accountants

youtube

Hey there, accounting and bookkeeping enthusiasts! Today, I'm excited to share my top 5 favorite features of Slack for Accounting and Bookkeeping practices, brought to you by Future Proof Accountants. 📊💼

From seamless collaboration to efficient client communication, these features have been game-changers for my practice. Join me as I dive into how Slack is transforming the way we work in the finance world! 🚀📈

Stay tuned for some practical insights and tips! Let's elevate our accounting game together! 💪👩💼 #SlackForAccounting #BookkeepingTips #FutureProofAccountants #EfficientCollaboration #ClientCommunication #ProductivityBoost #AccountingTools #FinanceInnovation #StreamlineWorkflows #AccountingTech #ProfessionalGrowth

0 notes

Text

Bookkeeping services can provide a range of benefits for businesses, from streamlining financial processes to ensuring tax compliance.

Here are 5 ways bookkeeping services can help maximize your business finances:

𝟏. 𝐎𝐫𝐠𝐚𝐧𝐢𝐳𝐢𝐧𝐠 𝐟𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐫𝐞𝐜𝐨𝐫𝐝𝐬:

Bookkeeping services can help you keep track of all financial transactions, from income to expenses and everything in between. This can make it easier to understand your financial position and make informed decisions about future investments.

𝟐. 𝐒𝐚𝐯𝐢𝐧𝐠 𝐭𝐢𝐦𝐞 𝐚𝐧𝐝 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐬𝐭𝐫𝐞𝐬𝐬:

By outsourcing your bookkeeping needs, you can free up time to focus on other areas of your business. You won't have to worry about keeping up with paperwork or tax deadlines, allowing you to focus on what you do best.

𝟑. 𝐈𝐦𝐩𝐫𝐨𝐯𝐢𝐧𝐠 𝐟𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐚𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

Bookkeeping services can help you make sense of your financial data, providing you with accurate and up-to-date information that can inform financial decisions. This can help you identify areas for growth and make informed decisions about investments and expenditures.

𝟒. 𝐄𝐧𝐬𝐮𝐫𝐢𝐧𝐠 𝐭𝐚𝐱 𝐜𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐜𝐞:

Bookkeeping services can help ensure that your business is compliant with tax laws and regulations. This can help you avoid costly penalties and ensure that your business is running smoothly.

𝟓. 𝐏𝐫𝐨𝐯𝐢𝐝𝐢𝐧𝐠 𝐞𝐱𝐩𝐞𝐫𝐭 𝐚𝐝𝐯𝐢𝐜𝐞:

Many bookkeeping services offer additional financial advice and support, helping you make the most of your financial resources and achieve your business goals.

☛Follow @OffshoregeniX to learn more☚

If you're looking for an outsourcing company that will provide you with high-quality services at an affordable price, we’ve got you covered.

𝐂𝐚𝐥𝐥: 1800 897 833

or

𝐕𝐢𝐬𝐢𝐭: osgx.com.au

#outsourcingservices#outsource#outsourcing#offshoreservices#bookkeepingservices#bookkeepingtips#business

1 note

·

View note

Text

Check out my Gig on Fiverr: I will do bookkeeping in quickbooks online and accounting at affordable price

#bookkeeping#bookkeepingservices#quickbooksbookkeeping#bookkeepingtips#bookkeepinghelp#bookkeepingforsmallbusinesses#bookkeepingservice#bookkeepingforcreatives#bookkeepingforsmallbusiness#bookkeepingandaccounting#virtualbookkeeping#bookkeepingsolutions#bookkeeping101#smallbusinessbookkeeping#bookkeepingexpert#bookkeepingbusiness#onlinebookkeeping#businessbookkeeping

1 note

·

View note

Text

Tips for Effective Bookkeeping: Keeping Your Financial Records Organized

Effective bookkeeping is integral to the financial health and success of any business, recording transactions accurately and methodically. Here are some tips to keep your financial records organized:

Searching for reliable bookkeeping services in the USA? Proper bookkeeping is key to keeping your financial records organized and accurate, and by hiring professional bookkeepers in this country you can ensure your business or personal finances are in order.

With solutions ranging from daily transaction recording to bank reconciliation available these services offer all-encompassing solutions tailored specifically to meet your needs.

Do not underestimate the significance of keeping organized financial records; they form the cornerstone for informed decision-making and long-term financial success.

Trust professional bookkeeping services in the USA to assist in maintaining the integrity of your data while remaining compliant with tax regulations.

Best Tips for Effective Bookkeeping

Understanding the Importance of Bookkeeping

Before delving into the technical aspects of bookkeeping, it's essential to grasp why accurate financial records matter.

Accurate and organized financial records offer insight into your business's financial health, helping you make informed decisions, secure financing arrangements and meet tax regulations.

Setting Up a Dedicated Workspace

Establish a dedicated area for bookkeeping activities to maintain focus while gathering all pertinent documents and tools in one location. This can help keep everyone focused and organized.

Choosing the Right Accounting Software

Select an accounting software solution that best meets your needs, such as expense tracking, invoicing and financial reporting features. Popular options such as QuickBooks, Xero and FreshBooks could be ideal options to consider.

Creating a Chart of Accounts

Establish a comprehensive chart of accounts to track and analyze all financial transactions more easily. Doing this will make life much simpler when tracking finances.

Daily Transaction Recording

Do not delay. Record all financial transactions daily to ensure accuracy and avoid missing important details.

Regular Bank Reconciliation

Reconcile your bank statements regularly in order to detect any discrepancies or errors and preserve the accuracy of your financial records. By performing this practice, it can help maintain their integrity.

Invoice and Receipt Management

Organise and store invoices and receipts systematically. Consider digital tools as a way of reducing paper clutter.

Expense Tracking

Keep meticulous records of all business-related expenses, such as meals, travel costs, office supplies and more. This should include business meals, travel arrangements and supplies needed.

Employee and Vendor Records

Maintain accurate records on employees and vendors, including contact info, tax ID numbers and payment histories.

Tax Compliance and Preparation

Keep informed on tax deadlines and regulations to ease tax preparation and limit audit risk. Maintain accurate records to facilitate preparation.

Financial Statements and Reports

Create regular financial statements and reports in order to assess your performance, identify areas for growth, and pinpoi

Periodic Financial Reviews

Schedule regular reviews of your financial records in order to identify trends, anomalies, or areas in which costs could be reduced or revenue could increase.

Backup and Data Security

Maintain a regular backup schedule of your financial data to protect it and safeguard sensitive information. Employ encryption and strong passwords to keep information confidential.

Staying Informed About Tax Law Changes

Tax laws are constantly changing; stay abreast of relevant updates to avoid compliance issues.

Seeking Professional Help When Needed

If bookkeeping becomes overwhelming or complex, consider seeking assistance from a professional accountant or bookkeeper to manage it for you.

FAQs

Why does effective bookkeeping benefit small businesses?

Proper bookkeeping allows small businesses to manage their finances more effectively, make informed decisions, and remain compliant with tax regulations.

How frequently should I reconcile my bank statements?

Reconciling your bank statements regularly is recommended to detect errors and discrepancies quickly and address them immediately.

Are spreadsheets suitable for bookkeeping purposes?

Though spreadsheets can serve the basic bookkeeping needs, accounting software provides more features and automation.

What documents must I keep for taxation purposes?

Maintain records of income, expenses, invoices, receipts and any relevant tax documents for at least seven years.

When should I seek professional bookkeeping help?

Consider consulting an outside resource if the bookkeeping tasks become overwhelming or your financial situation becomes complex.

Conclusion

Effective bookkeeping is at the core of managing finances efficiently. By following these tips and keeping organized financial records, you can make more informed decisions, reduce financial risks, and ensure the long-term success of both business and personal finances.

0 notes