#Buy Now Pay Later Market Challenges

Text

In March 2007, Google’s then senior executive in charge of acquisitions, David Drummond, emailed the company’s board of directors a case for buying DoubleClick. It was an obscure software developer that helped websites sell ads. But it had about 60 percent market share and could accelerate Google’s growth while keeping rivals at bay. A “Microsoft-owned DoubleClick represents a major competitive threat,” court papers show Drummond writing.

Three weeks later, on Friday the 13th, Google announced the acquisition of DoubleClick for $3.1 billion. The US Department of Justice and 17 states including California and Colorado now allege that the day marked the beginning of Google’s unchecked dominance in online ads—and all the trouble that comes with it.

The government contends that controlling DoubleClick enabled Google to corner websites into doing business with its other services. That has resulted in Google allegedly monopolizing three big links of a vital digital advertising supply chain, which funnels over $12 billion in annual revenue to websites and apps in the US alone.

It’s a big amount. But a government expert estimates in court filings that if Google were not allegedly destroying its competition illegally, those publishers would be receiving up to an additional hundreds of millions of dollars each year. Starved of that potential funding, “publishers are pushed to put more ads on their websites, to put more content behind costly paywalls, or to cease business altogether,” the government alleges. It all adds up to a subpar experience on the web for consumers, Colorado attorney general Phil Weiser says.

“Google is able to extract hiked-up costs, and those are passed on to consumers,” he alleges. “The overall outcome we want is for consumers to have more access to content supported by advertising revenue and for people who are seeking advertising not to have to pay inflated costs.”

Google disputes the accusations.

Starting today, both sides’ arguments will be put to the test in what’s expected to be a weekslong trial before US district judge Leonie Brinkema in Alexandria, Virginia. The government wants her to find that Google has violated federal antitrust law and then issue orders that restore competition. In a best-case scenario, according to several Google critics and experts in online ads who spoke with WIRED, internet users could find themselves more pleasantly informed and entertained.

It could take years for the ad market to shake out, says Adam Heimlich, a longtime digital ad executive who’s extensively researched Google. But over time, fresh competition could lower supply chain fees and increase innovation. That would drive “better monetization of websites and better quality of websites,” says Heimlich, who now runs AI software developer Chalice Custom Algorithms.

Tim Vanderhook, CEO of ad-buying software developer Viant Technology, which both competes and partners with Google, believes that consumers would encounter a greater variety of ads, fewer creepy ads, and pages less cluttered with ads. “A substantially improved browsing experience,” he says.

Of course, all depends on the outcome of the case. Over the past year, Google lost its two other antitrust trials—concerning illegal search and mobile app store monopolies. Though the verdicts are under appeal, they’ve made the company’s critics optimistic about the ad tech trial.

Google argues that it faces fierce competition from Meta, Amazon, Microsoft, and others. It further contends that customers benefited from each of the acquisitions, contracts, and features that the government is challenging. “Google has designed a set of products that work efficiently with each other and attract a valuable customer base,” the company’s attorneys wrote in a 359-page rebuttal.

For years, Google publicly has maintained that its ad tech projects wouldn’t harm clients or competition. “We will be able to help publishers and advertisers generate more revenue, which will fuel the creation of even more rich and diverse content on the internet,” Drummond testified in 2007 to US senators concerned about the DoubleClick deal’s impact on competition and privacy. US antitrust regulators at the time cleared the purchase. But at least one of them, in hindsight, has said he should have blocked it.

Deep Control

The Justice Department alleges that acquiring DoubleClick gave Google “a pool of captive publishers that now had fewer alternatives and faced substantial switching costs associated with changing to another publisher ad server.” The global market share of Google’s tool for publishers is now 91 percent, according to court papers. The company holds similar control over ad exchanges that broker deals (around 70 percent) and tools used by advertisers (85 percent), the court filings say.

Google’s dominance, the government argues, has “impaired the ability of publishers and advertisers to choose the ad tech tools they would prefer to use and diminished the number and quality of viable options available to them.”

The government alleges that Google staff spoke internally about how they have been earning an unfair portion of what advertisers spend on advertising, to the tune of over a third of every $1 spent in some cases.

Some of Google’s competitors want the tech giant to be broken up into multiple independent companies, so each of its advertising services competes on its own merits without the benefit of one pumping up another. The rivals also support rules that would bar Google from preferencing its own services. “What all in the industry are looking for is fair competition,” Viant’s Vanderhook says.

If Google ad tech alternatives win more business, not everyone is so sure that the users will notice a difference. “We’re talking about moving from the NYSE to Nasdaq,” Ari Paparo, a former DoubleClick and Google executive who now runs the media company Marketecture, tells WIRED. The technology behind the scenes may shift, but the experience for investors—or in this case, internet surfers—doesn’t.

Some advertising experts predict that if Google is broken up, users’ experiences would get even worse. Andrey Meshkov, chief technology officer of ad-block developer AdGuard, expects increasingly invasive tracking as competition intensifies. Products also may cost more because companies need to not only hire additional help to run ads but also buy more ads to achieve the same goals. “So the ad clutter is going to get worse,” Beth Egan, an ad executive turned Syracuse University associate professor, told reporters in a recent call arranged by a Google-funded advocacy group.

But Dina Srinivasan, a former ad executive who as an antitrust scholar wrote a Stanford Technology Law Review paper on Google’s dominance, says advertisers would end up paying lower fees, and the savings would be passed on to their customers. That future would mark an end to the spell Google allegedly cast with its DoubleClick deal. And it could happen even if Google wins in Virginia. A trial in a similar lawsuit filed by Texas, 15 other states, and Puerto Rico is scheduled for March.

31 notes

·

View notes

Text

— BASICS

Name: Suresh Lal

Age / D.O.B.: 38 / October 3rd, 1985

Gender, Pronouns & Sexuality: Cismale. He/Him. Demisexual / Homoromantic

Hometown: Born: Puducherry, India. Grew up: Newcastle on Tyne, England and Marseille, France. Now: Lower East Side, Manhattan, NY

Affiliation: Syndicate

Job position: Captain / Owner of Shady Plots Funeral Home and Crematorium

Education: Most of medical school

Relationship status: Single

Children: none

Positive traits: Pragmatic, Calculated, Practical, Fastidious, Persuasive

Negative traits: Cold, Morbid, Controlled, Selfish, Resentful

— BIOGRAPHY

tw: body horror, organ harvesting

Born in Puducherry, India. Parents relocated to England when Suresh was 5. His mother was French his Father was Indian. So Suresh has British, French and Indian passports. Left England at 15 to live with his Mother's family in Marseille.

Suresh was fascinated by forensic pathology and consumed large amounts of information on it growing up.

Went into medical school in France at 18. He was considered slightly off-putting with his clinically cold demeanor but showed great aptitude for trauma surgery.

When Suresh was approached by a few criminally minded individuals looking for help with a business idea he agreed not because he needed the money, and not for some type of sadistic need, but for the sheer personal challenge it offered to hone his surgical skills.

But it came crashing down three years later and Suresh was jailed at 27 after it was found that Suresh had helped a "friend" to remove and sell their kidney to pay of illegal gambling debts. Only one of the many surgeries they had performed over that three year term selling body parts and making a tidy profit. He was not allowed to complete his specialization as a surgeon and was stripped of his medical license.

In prison Suresh worked as an ad-hoc medic inside. His release was secured after only a year in prison, paid for by the business partners that he hadn't flipped on and that hadn't gotten caught.

After his release ten years ago he relocated to New York with a carefully cleaned background and first worked as a medic and cleaner for the Syndicate. Opening a Funeral home, he showed natural business acumen specializing in black-market sales.

Suresh became a Captain for the Syndicate five years ago. A feat on it's own considering his younger age.

Suresh is clean, efficient and professional. And is uninterested in letting personal feelings affect the Syndicate negatively.

He hasn't spoken to his family since his arrest in France.

Has a soft spot for horror films good and bad no matter how D list they are.

— WANTED CONNECTIONS / PLOTS

Employees of Shady Plots - Syndicate affiliated is a must for any illegal work

Close friends - Suresh is hard to get to know but there are a few that have made it past the surgical steel wrapped around his heart. (most likely Syndicate or Syndicate adjacent)

Professional acquaintances - (medical backgrounds, mortuary backgrounds, utilized the Funeral Home for legitimate business)

Resurrection men- (people that supply bodies or buy the bodies)

Romantic connections - Did you flirt at a horror convention? Did you hit on Suresh at your Great-Aunts funeral? Are you one of the few people that actually got a date? Or one of the even more rare people that actually got to go home with Suresh?

His bunkmate in prison that he grew close to.

— PHYSICAL APPEARANCE

Height: 6’

Body type: thin

Hair: Black

Eyes: Brown

Piercings/Tattoos: none

Languages: English, French, Tamil, Telugu, Malayalam

6 notes

·

View notes

Note

challenge accepted? blackberry movie LETS GOOO

okay so

theres this guy

i think his names mike

i cant remember

he makes this company called RIM (research in motion)

but he has this communicator

that is revolutionary

its called the pocketlink

but noone on his team is marketing

theyre all engineers

so they go to this guy jim

who quits his job to go work for him

now they have a killer product and a fantastic marketer

so they go to at&t and pitch it

at&t laughs at them and says it wont work

mike says it will work with 500k devices at a time

at&t says 10

so mike explains how the 500 000 devices will work

and at&t gets a contract with RIM (mike's company)

to buy a crazy amount of pocket links

but pocket link is not a good name

so when jim (whos pitching it) is asked for the name of the product can't think of a response

he looks over at mike's blackberry stained shirt and says

BlackBerry

right

so

blackberry are doing fantastic

selling hundreds of thousands of units

got their own messaging program that is free

while sms was costing 20c per message

theyre flourishing

media loves them. even obama gets one

but THEN

they reached the device cap

500 000 units on the network

so they go to google, motorola , ericsson

and they poach their top network engineers

and pay them in stock (this is relevant later)

so they get to work

and they increase the bandwidth from 500 000 across all networks to 2 000 000 for each network (6 000 000 total)

blackberry is booming

theyve got customers all over the world

its a status symbol

its the most premium thing you can fit into your hand

right

then comes 2007.

macworld

steve jobs

i think we both know what happens next

the iphone comes

all the major execs (like mike, steve ball(s) mer from microsoft and others) say its gonna flop within a year

but it doesnt

blackberry's next phone sells horribly

the iphone has all their numbers

and then the SEC comes in

and investigates blackberry for fraud

because that stock that it gave to the employees?

there was no stock evaluated at that much at that time

jim is sent to court and arrested (tho he gets out on a loophole and serves no jail time)

and mike is broke

and now instead of blackberries and everything else we have iphones and smasnugs and everything else

:3

huh, that is very :3 indeed. pocketlinks wouldve been a sick ass name though, but he changed it to blackberry? justifiable to lock up the guy who changed that last minute

3 notes

·

View notes

Text

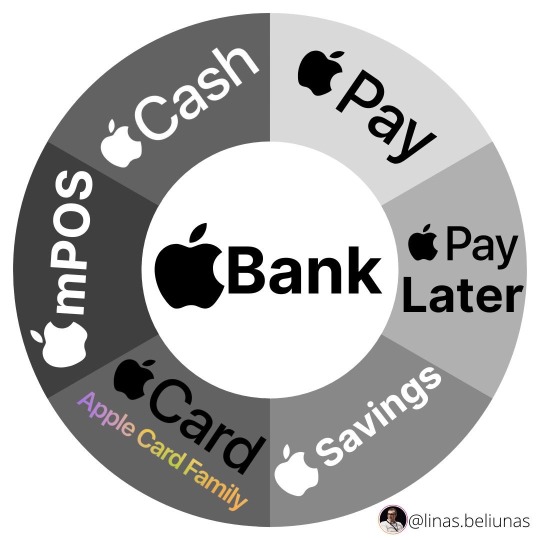

In 2023, Apple can become the biggest bank

in the world 🤯

Without actually being a bank…

When you think about it, a bank effectively has:

1. A giant balance sheet

2. Lots of data and capabilities to process it

3. Distribution

4. A license and/or regulatory oversight

Apple has it all even without the banking charter.

More importantly, recent moves into Buy Now, Pay Later and Savings accounts are yet another building blocks for the Apple Finance empire showing the tech titan is seriously planning on diving deeper into the financial services sphere.

And it makes a ton of sense for Apple to become a bank (directly or not):

- Revenue diversification 📊 52% of Apple’s revenue today comes from a single product - iPhone. By doubling down on the finance sector, Apple would be able to diversify its revenue streams and tap into a stable and growing market. A case in point here could be Shopify which now makes 73% of its revenue from FinTech solutions.

- Strong brand recognition 🔥 Apple has the most valuable and trusted brand in the world. This brand recognition is a major advantage for the tech giant vs. any other FinTech or challenger bank. Plus, every 6th person in the world already has an iPhone in his/her pocket.

- Strong financial position 💸 Apple is a financially strong company with large cash reserves. With $20.7 billion in profit just in the last quarter and more than $23 billion of cash at hand, the tech giant has all the resources it needs to compete pretty much with anyone in the banking world. Also, with massive valuation declines in both public and private markets, it might be a brilliant time for Apple to go on a buying spree and further solidify its market dominance. Potential acquisitions could be Goldman Sachs’ consumer banking division aka Marcus, Revolut, or Dave.If Apple executes this strategy the way it does its software and hardware, it’s going to be massive.

And a game-changer to FinTech as we know it.

#tumovs#wkwgroup#тумовс#crypto#fintech#blockchain#defi#rtumovs#reinis tumovs#neobankers#apple inc#apple news#applepodcasts

34 notes

·

View notes

Text

there is not a single thing you can "invest" in on fr that'll hold value other than treasure and gems, scrolls, g1/g2 imps, and low digit dragons. maybe ks stuff but if you own ks stuff you probably do not need to invest.

scrolls will always have a minimum sell price. you may or may not make money, but you won't lose it. low digit dragons are less reliable because the value of any dragon is subjective and the price is really only what people are willing to pay for them. the only saving grace is that the supply is not going up.

dragons, even g1s and triples and doubles etc etc etc are being created every day. the supply only goes up, even more with roundsey. special eyed dragons crashed the same day scattervials crashed. lineage dragons are valuable only so much as the buyer cares about the lineage and the only ones that people really care about are naomi and ignis. heck, i have a naomi descendant

fest doesn't retire anymore. it gets harder to acquire, but it doesn't retire. even retired fest regularly gets new copies via roundsey. old fest also crashed (slightly) due to joxar - if you think sunchasers are soooo beautiful but now joxar has cindersphere baubles for a single candy coin, you are getting the baubles. the only reason you go for sunchasers at that point is if you are super picky, or doing a challenge, or want them as a status symbol.

fiona dropped demand for retired fams massively. if all you care about is completing the bestiary, you can do it now without shelling out for sprites. elimantes crashed with galore, scattervials crashed with normal vials, i don't know if invisibility cloaks have crashed yet but you know they're gonna in about *checks calender* eleven months. eggs rise and fall but the top price has been going down for years.

the uma market is massively inflated. limited skins, tons of recolors, higher prices (600g is barely unusual for an accent now) (not gonna get into stuff about artist skill and subjective value but like. that did not used to be the norm), fomo, customs commissioned just to auction later or even immediately. did i mention fomo?

if you want to get rich, get into dom and flip fodder or grind. you can always buy fest stuff and resell it later for a profit but godamn dude its a game. the devs are actively invested in making stuff easier for people to get, that's the whole point. prices going down or at least rising slower is good. stop hoarding eggs for resell and liquidate already.

mildly related: the lorwolf economy is chaos rn, because its existed for less than a week. this is supposed to happen. people are already over there freaking out because it's not behaving like a mature economy with established prices and stable ratios rn. calm down. give it time. the cross site trading is not helping btw.

#hi this is me being petty and bitter again#its a godam dragon game its not the stock market#i just can't wait for the uma market to finally oversaturate and crash#i say that mildly vindictively but also with fascination (and as a skinmaker)

16 notes

·

View notes

Text

February 25 - Day 7

Event/Recovery

Ashraniel’s pleasant babbling filtered into the kitchen from where he was playing in the living room of Meryn’s row house. Her half-brother had been gracious enough to watch his four year old nephew for a week while she’d been preoccupied with other business.

Lyn smiled and palmed her mug of coffee, the warmth between her palms an extension of the comfort that enveloped this home that Meryn and his husband had built together over the years. He set a pot of cooking mint in the middle of the table in front of her before drawling, overly-pleased, in his low-Thalassian, “I’ve got some bad news for you, Lyn.”

Meryn only carried that tone when he was about to be extremely annoying, and she sat up a little straighter in preparation for whatever he was about to drop on her, “About a mint plant? It looks great, but you’ve always had the green thumb between the two of us.”

He had inherited their grandmother’s inclination toward nature magic, something he hadn’t really had time to nurture until later in his adult years; his grasp of it was middling at best, but he had managed to get her some of the freshest cooking herbs she’d ever managed to get her hands on.

His smirk grew as he held his hands out in presentation, pointing at the lush plant sitting pretty in front of her, “Y’owe me fifty gold.”

No. She’d only been away for a WEEK. Her long ears slanted back and her freckled nose wrinkled as she shot a glance toward the living room before narrowing her eyes at her brother. “Absolutely not, he’s four. There’s no way he’s gotten his magic yet and—”

Meryn cut her off with a pleasant shout toward the living room, “Hey Ash! You wanna tell yer mom about th’ plant?”

They both looked at the doorway when Ash toddled over, the top of a small wooden spire tower in his hand that he’d brought over with him from whatever little city he’d been building, “I fixed it, momma! Uncle Em said it was sad, and that made me sad, so every day I talked to it and now it’s happy!”

Her brother grinned, obnoxiously pleased at the simple explanation, “An’ now it’s his friend, so y’own a mint plant.”

Lyn did her best not to huff — this was actually a big event, even if Ash didn’t realize it, and as much as she’d hoped he’d be a Light user like her there had always been a solid chance that he’d be able to use any kind of magic. Ana, his long deceased aunt, had been an arcanist, and between the surrogacy and not knowing who Ash’s father actually was or what they had been capable of… well.

She smiled back at her son, proud (if not a little miffed that she’d missed such a significant milestone), “You did a good job, hon. Maybe you can help make a window box with your uncle sometime soon, and we can pick up a few more sad plants at the Bazaar market on our way home?”

Ash beamed and bounced in place, obviously excited by the prospect, “YEAH!”

Her brother chuffed a pleased laugh, “Fine, fine. I’ll draw up some plans,” he leaned in and stage-whispered at Lyn for effect, “an’ buy some materials with th’ fifty gold you owe me.”

Lyn sighed and unlaced the coin purse from her belt, ready to pay up on a bet well won.

@daily-writing-challenge

10 notes

·

View notes

Text

Unlocking Capital: Why Digital Lending is the Next Big Bet for Smart Investors

Introduction

The digital lending sector is revolutionizing the way individuals and businesses access capital. In an era where speed and convenience are paramount, fintech-driven digital lending platforms are displacing traditional banks, providing faster, more flexible loans to consumers and enterprises alike. With its rapid growth, the digital lending market has become a focal point for investors looking to capitalize on the shift to digital finance.

But what exactly makes digital lending such a compelling investment opportunity? In this blog post, we'll explore the forces driving the rise of digital lending, the benefits of investing in this space, and how smart investors can position themselves to unlock the capital and potential that this industry holds.

1. The Digital Transformation of Lending

a. Traditional Lending Bottlenecks

For decades, the lending process has been plagued by inefficiencies, rigid approval processes, and slow turnaround times. Borrowers had to endure lengthy paperwork, invasive credit checks, and long waiting periods just to receive loan approval. This system, while effective in its time, was slow to adapt to the evolving needs of today’s borrowers, particularly in a world that thrives on immediacy and personalization.

b. The Rise of Digital Lending Platforms

Enter digital lending, where financial technology companies (fintechs) have disrupted the outdated lending system with innovative solutions. Digital lending platforms, such as LendingClub, Kabbage, and SoFi, leverage AI, big data, and machine learning to streamline loan applications, assess credit risk, and approve loans in a fraction of the time traditional lenders can.

The global digital lending market is expected to exceed $20 billion by 2026, driven by increased adoption of digital banking, the rising demand for quick financing, and the growing sophistication of alternative credit scoring models.

2. Key Drivers Behind Digital Lending’s Growth

a. Tech-Driven Efficiency

The digital lending process is powered by advanced algorithms that analyze a variety of data sources to evaluate a borrower’s creditworthiness. Traditional lenders primarily rely on credit scores, but digital lenders incorporate alternative data points such as income patterns, transaction history, and even social behavior to assess risk. This allows for more accurate, real-time lending decisions, resulting in faster approvals and more accessible financing.

b. Changing Consumer Preferences

Consumers today, particularly millennials and Gen Z, value speed, convenience, and flexibility. The days of waiting weeks for loan approval are over. Digital lending platforms offer an experience that meets modern expectations, providing everything from instant personal loans to buy now, pay later (BNPL) options for e-commerce purchases. This shift in consumer behavior has been a significant driver of growth for digital lenders.

c. Financial Inclusion

Digital lenders are bridging the gap for individuals and small businesses who may not have access to traditional banking services. Many digital platforms cater to underserved segments, including gig economy workers, small business owners, and individuals with thin or no credit files. By offering loans to borrowers who might be overlooked by traditional banks, digital lenders are promoting financial inclusion and tapping into a massive, underbanked market.

d. The Pandemic Effect

The COVID-19 pandemic accelerated the shift towards digital solutions in the financial sector. As traditional banks struggled to meet the demand for quick capital during the crisis, digital lenders stepped up, providing fast, flexible financing solutions to individuals and businesses facing cash flow challenges. This further entrenched the importance of digital lending as a viable and scalable financial service.

3. Why Digital Lending is a Smart Investment Bet

a. High Growth Potential

Digital lending is one of the fastest-growing sectors within fintech. According to industry reports, the digital lending market is expected to grow at a compound annual growth rate (CAGR) of more than 10% over the next five years. This rapid expansion is fueled by consumer demand for faster financial solutions and the increasing adoption of digital banking across the globe.

For investors, this high growth potential offers significant upside. By getting in early, smart investors can take advantage of the sector’s rapid evolution and position themselves to reap the rewards as digital lending becomes mainstream.

b. Diverse Investment Opportunities

The digital lending space offers a wide variety of investment opportunities across different verticals. Whether through peer-to-peer (P2P) lending platforms, buy now, pay later (BNPL) services, small business lending, or digital mortgage providers, investors can choose from a range of lending models to match their risk tolerance and financial goals.

Some prominent areas for investment include:

P2P Lending: Platforms that connect individual borrowers with lenders, allowing investors to fund loans directly and earn interest.

BNPL Services: Companies like Affirm, Klarna, and Afterpay allow consumers to split payments into installments, a rapidly growing sector.

Small Business Lending: Platforms like Kabbage and OnDeck provide working capital solutions for small businesses.

Digital Mortgages: Simple, Online Mortgage | Better Mortgage and Blend are transforming how consumers secure home loans through digital processes.

c. Higher Returns Compared to Traditional Investments

Digital lending platforms often offer higher returns than traditional investment avenues. For instance, P2P lending can provide returns in the range of 6-10%, depending on the level of risk involved. Additionally, investing in the shares of publicly traded digital lending companies or participating in venture capital rounds for early-stage fintech lenders can yield substantial capital appreciation as these companies scale.

d. Access to Untapped Markets

Traditional banks tend to shy away from certain market segments due to the perceived risk. However, digital lenders are using innovative ways to assess risk, making it possible to lend to previously untapped markets. This gives investors exposure to new growth opportunities, particularly in regions where access to financial services has been limited.

4. Key Risks to Consider

a. Regulatory Challenges

As digital lending platforms grow in prominence, they face increased scrutiny from regulators. Governments are introducing stricter regulations to ensure that borrowers are protected and that lending practices are ethical. For investors, navigating the regulatory landscape is crucial, as compliance risks can impact the profitability of digital lending companies.

b. Economic Sensitivity

The digital lending industry is sensitive to macroeconomic conditions. In times of economic downturn, borrowers are more likely to default on loans, which can affect platform performance and investor returns. Diversifying investments across different lending sectors and geographies can help mitigate these risks.

c. Competition

The digital lending space is becoming increasingly competitive, with a growing number of fintech startups entering the market. This can lead to margin compression as platforms compete on rates, fees, and customer experience. Investors should focus on backing platforms with strong technological infrastructure, robust customer acquisition strategies, and clear competitive advantages.

5. How to Invest in Digital Lending

a. Direct Lending Platforms

Many digital lending platforms allow investors to directly fund loans. This offers the opportunity to earn interest income, but it also carries risk if borrowers default. Diversifying your loan portfolio across multiple borrowers and loan types can help mitigate this risk.

b. Invest in Publicly Traded Companies

Investing in established digital lending companies that are publicly traded is another way to gain exposure to the sector. Some examples include LendingClub, Upstart, and SoFi. These companies have proven business models and offer the potential for capital appreciation as they continue to grow.

c. Venture Capital

For more risk-tolerant investors, participating in venture capital rounds for early-stage digital lending startups can provide higher returns. While this approach carries significant risk, it also offers the potential for outsized gains if the company scales successfully.

Outcome

Digital lending is not just a passing trend—it’s a fundamental shift in how capital is accessed and distributed. As technology continues to drive innovation in the financial sector, digital lending platforms will play a pivotal role in reshaping the lending landscape. For smart investors, this presents a unique opportunity to unlock capital and participate in the growth of a rapidly expanding industry.

#DigitalLending#InvestmentOpportunities#Fintech#CapitalUnlocking#FutureOfFinance#SmartInvesting#LendingInnovation

0 notes

Text

Unlock Your Path to Homeownership with Innovative Rent-to-Own and Financing Solutions in Texas

Learn More About Flexible Rent to Own as Well as Financing Options for Buying Your Home

Purchasing homes is a dream that is sometimes unreachable, but finding homes for sale that are within a person’s financial reach may also be difficult, but the possibility of Rent to Own and financing solutions makes steps towards homeownership less daunting. These solutions are meant to take care of the challenge of the transition from the rentals to home ownership by enabling you to live in the home you hope to own while you establish your financial base. Rent to own and financing solutions provide flexibility for the customer as the terms given are going to be suitable for your monetary capacity as well as building you up for success.

Learn Why Rent to Own Texas Houses Has Really Become Popular among Those Wanting to Own a Home.

Due to the relative newness of the phenomenon, however, most Texans are discovering that rent to own Texas homes are a feasible way of acquiring homes. This option enables the renters to reside in their preferred home while at the same time saving money which they will use to buy the house. The houses you get from the rent to own Texas homes are affordable and you can pay after several months having saved for a down payment or having improved on your credit score while residence in the house. It is as popular with the young people due to its flexibility and the fact that one does not have to get approval for a mortgage to own property.

Benefits for Buyer: Utilise Texas Rent to Own Programmes for a trouble-free transition to Homeownership.

Owning a house is something big and through Texas rent to own, it becomes easier for those who are not ready financially for the big step yet. Such programs allow you to live in the future house while upgrading your savings account or a credit rating. Various types of Texas rent to own have a provision where you agree on the price that you will pay at the end of the rental terms, which is a plus to most. This method is especially helpful when markets are rapidly developing and the value of the property may go up, thus helping you to lock-in your dream home at today’s prices as well as provided you lock in for tomorrow’s prices.

Market Advantage: Take advantage of rising property values in fast-growing Texas markets.

Peace of Mind: Enjoy the stability of your future home while working towards full ownership.

Learn How Rent to Own Homes Texas Can Help You Achieve Your Dream of Homeownership

Why Rent to Own Programs in Texas Are an Excellent Solution for Future Homeowners

Many prospective buyers are turning to rent to own programs in Texas to bridge the gap between renting and owning. These programs allow renters to move into their desired home with the option to buy at a later date. Over time, rent to own programs in Texas can help you save for a down payment and improve your credit, all while living in your future home. This approach provides financial flexibility and ensures you don’t miss out on your dream property, offering a secure and practical way to achieve homeownership on your terms.

Rent to Own Real Estate in Texas: A Flexible Path to Owning Property

Securing rent to own real estate in Texas is a smart choice for those looking to ease into homeownership without the need for immediate mortgage approval. This option gives buyers the flexibility to rent while working towards ownership over time. Rent to own real estate in Texas is an excellent solution for individuals who want to improve their financial situation before committing to a purchase. It provides the security of knowing you can buy the property later, while still enjoying the benefits of living in your desired home today.

Immediate Enjoyment: Live in your ideal home now while preparing for future ownership.

Strategic Planning: Benefit from the flexibility to plan and save for a down payment or other financial needs.

Find Your Future Home with Houses for Rent to Own in Texas

If you’re exploring alternative ways to purchase a home, houses for rent to own in Texas might be the perfect solution. These agreements allow renters to live in the house they intend to buy, offering them time to secure financing or improve their credit. Houses for rent to own in Texas also give buyers a head start on building equity while enjoying the stability of a long-term residence. It’s an attractive option for those who want to lock in a home now while preparing for full ownership later.

Discover the Benefits of Homes for Rent to Own in Texas for a Smooth Transition to Homeownership

Rent to Own Homes in Texas: Your Opportunity for Homeownership

With rising property prices, securing rent to own homes in Texas is a smart way to achieve your goal of homeownership without the immediate financial strain. This option allows you to rent a property while a portion of your rent goes toward its eventual purchase. Rent to own homes in Texas provide a unique opportunity to transition from renting to owning, giving you time to improve your financial standing while already living in your dream home. It’s a practical and flexible solution for anyone looking to buy a home in today’s competitive market.

Homeownership Across Texas: Achieving Your Dream of Owning a Home

Programs aimed at securing homeownership across Texas are making it easier for more people to achieve their goal of owning a home. From rent-to-own agreements to owner financing, these options allow individuals to live in their future homes while building the financial security necessary for ownership. Homeownership across Texas is within reach for many who might otherwise be unable to buy through traditional means, offering a flexible and accessible path to making your dream of owning a home a reality.

Innovative Solutions: Explore rent-to-own and owner financing as flexible alternatives to traditional home buying.

Immediate Occupancy: Move into your future home now while working towards securing full ownership.

Owner Financed Homes For Sale

Houses for Sale Owner Financing.

Taking a house through houses for sale owner financing is convenient to buyers especially those who have challenges with mortgage approvals. In houses for sale owner financing the buyer and the seller negotiate adjusting flexible payment procedures without involving a financial institution. This is far less rigid than the traditional models, which many families find far more achievable with this method of financing.

Homes for Sale seller financing

Even in the case where there is no way one is able to get traditional loan, seller financing Homes for Sale could be the perfect option. This option enables one to make a cash purchase of a home directly from the seller making cash payments at his or her convenience. If you choose Homes for Sale seller financing, you will be able to avoid conventional mortgage limits and the amount of credit that you can receive can be adjusted according to your needs.

FAQs:

Q: How does rent-to-own work in Texas?

A: Rent-to-own allows you to rent a home with the option to purchase it after a specified period. Part of the rent may go towards the purchase price, giving you time to improve your financial situation.

Q: Can I invest in rent-to-own properties in Texas?

A: Yes, rent-to-own investment properties allow investors to secure properties while renting them, providing an opportunity for long-term gains.

Q: What is owner financing in Texas?

A: Owner financing allows buyers to purchase homes directly from sellers with flexible payment terms, bypassing traditional bank financing.

Q: Are there rent-to-own options in Houston, TX?

A: Yes, many homes lease to own in Houston TX offer opportunities for prospective buyers to live in their desired home while preparing for full ownership.

0 notes

Text

The Growing Trend of Buy Now, Pay Later (BNPL) Market: A Comprehensive Analysis

The Buy Now, Pay Later (BNPL) market is rapidly transforming the global financial landscape. With the rise of e-commerce, consumer demand for flexible payment options has surged, making BNPL services an attractive alternative to traditional credit. This payment solution allows consumers to purchase goods and services upfront while spreading the cost over time, often without interest. The convenience and simplicity of BNPL market are driving its adoption, reshaping both consumer behavior and retail practices.

In this article, we'll delve into the current state of the BNPL market, its growth drivers, challenges, and future trends.

What is BNPL?

BNPL is a type of short-term financing that allows customers to make purchases and pay for them over time, typically in installments. Unlike traditional credit cards, BNPL services are usually interest-free, provided the payments are made on time. Major players in this space include companies like Klarna, Afterpay, Affirm, and PayPal, which offer easy-to-use platforms that integrate seamlessly into e-commerce websites.

The Global BNPL Market: Growth Trends

The global BNPL market has experienced exponential growth in recent years, especially in regions like North America, Europe, and Asia-Pacific. Some key statistics include:

Market Size: The global BNPL market was valued at $120 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 25% from 2024 to 2030.

Consumer Adoption: According to recent reports, 45% of consumers in the U.S. have used BNPL services, with younger generations like Gen Z and Millennials leading the charge.

Retail Integration: E-commerce platforms, from large-scale retailers to small businesses, are integrating BNPL solutions to increase conversions and reduce cart abandonment.

Key Drivers of BNPL Growth

Several factors are propelling the growth of the BNPL market:

Rise of E-commerce: The global shift toward online shopping has fueled the demand for flexible payment solutions. BNPL options appeal to consumers looking for ways to manage their finances without accruing credit card debt.

Changing Consumer Behavior: Younger consumers, particularly Millennials and Gen Z, prefer to avoid traditional credit lines and are attracted to the simplicity and transparency of BNPL services. This demographic prefers payment options that offer flexibility without hidden fees or interest.

Merchant Benefits: For retailers, offering BNPL increases the average order value, improves customer loyalty, and reduces cart abandonment rates. Many businesses have reported higher sales after integrating BNPL into their payment systems.

Low Interest Rates: BNPL services often offer interest-free payment plans, making it an attractive alternative to credit cards. This is a major incentive for consumers looking to avoid high-interest debt.

Challenges Facing the BNPL Market

Despite its rapid growth, the BNPL market faces several challenges:

Regulatory Scrutiny: As the BNPL sector expands, governments are starting to impose regulations to protect consumers from potential financial pitfalls. Some critics argue that BNPL encourages overspending and can lead to debt accumulation, particularly for younger consumers.

Default Risks: Since BNPL providers often do not perform extensive credit checks, there's a higher risk of payment defaults. Some companies are addressing this issue by partnering with credit agencies and implementing stricter lending criteria.

Competition: As the market grows, more financial institutions and tech companies are entering the BNPL space, creating intense competition. Established credit card companies and banks are developing their own BNPL products, potentially eroding the market share of specialized BNPL providers.

The Future of BNPL

Looking ahead, the BNPL market is poised for continued growth, but there will likely be key developments shaping its evolution:

Expansion into New Markets: While the BNPL model is well-established in Western markets, there’s significant room for growth in emerging markets across Africa, Latin America, and parts of Asia. As digital payment infrastructure improves, more consumers in these regions will likely adopt BNPL solutions.

Partnerships with Financial Institutions: As competition heats up, BNPL providers are likely to forge partnerships with banks and traditional lenders to expand their reach and reduce default risks. This will allow consumers to benefit from more robust credit assessments while still enjoying the flexibility of BNPL.

Integration with Physical Stores: Although BNPL is primarily associated with online shopping, the future will likely see a greater integration of BNPL options in physical stores, enhancing the omnichannel shopping experience.

Technological Advancements: Innovations like artificial intelligence and machine learning will help BNPL companies refine their risk assessment models, providing more personalized and secure payment plans for users.

Buy the Full Report for More Insights on the BNPL Market Revenue

Download a Free Sample Report

0 notes

Text

Gucci: A Journey Through Triumph and Turmoil in Luxury Fashion

Humble Beginnings

Guccio Gucci, the founder of the renowned luxury brand, started his journey in his parents' straw hat shop.However, when the family business went bankrupt, he found himself penniless and in need of a fresh start.

Guccio moved to London, where he worked at the prestigious Savoy Hotel. There, he noticed the affluent guests carrying expensive luggage and wearing fine leather goods as symbols of status. This inspired him to dream of opening his own leather shop catering to high-end customers.

After serving in World War I, Guccio returned to Italy with a wealth of knowledge about the leather goods industry. In 1921, he opened a small shop in Florence. As demand for his unique designs grew, he expanded his operations by opening a workshop and hiring employees. Despite financial struggles, Guccio taught his sons the intricacies of the business. With their encouragement, he expanded to Rome, Milan, and eventually New York City.

Image credit : https://www.vecteezy.com/vector-art/23871111-gucci-logo-brand-clothes-with-name-symbol-design-fashion-vector-illustration

Family Feuds and Expansion

The history of Gucci is marked by family turmoil and power struggles. Guccio's sons inherited the company after his death, but conflicts over control of the brand soon emerged. The third generation of the Gucci family had different visions for the company's future. Tensions escalated when Maurizio Gucci married Patricia Regiani against his father's wishes and took ownership of 50% of the company.

Maurizio's decision to eliminate Gucci's licensing deals initially cost the brand over $100 million. However, this move ultimately helped establish Gucci as an exclusive luxury brand. Meanwhile, Paulo Gucci's attempts to create his own fashion line were costly and unsuccessful. The family's constant drama kept them in the public eye but tarnished the brand's image.

The Downfall of Maurizio Gucci

Under Maurizio's leadership, Gucci faced significant challenges. He convinced the family to sell their shares to Invest Corp, and with the company now 50% owned by Invest Corp, Maurizio implemented major changes.

He aimed to make Gucci an exclusive brand for the wealthy by reducing the number of stores, cutting the accessories line, and eliminating the classic GG logo.

While some of his decisions did elevate Gucci's status, the company began losing $30 million annually. Unable to pay salaries or suppliers, Gucci was on the brink of bankruptcy. Invest Corp, growing nervous, suggested appointing a new CEO. Maurizio refused, leading Invest Corp to buy out his 50% share for $150 million. Although Maurizio's predictions eventually came true and the brand's fortunes turned around, it was too late for him. In a tragic turn of events, he was murdered by a hitman hired by his ex-wife, Patricia Reggiani, who was later imprisoned.

The Tom Ford Era and Beyond

After the tumultuous period of family control, Gucci entered a new era under the creative direction of Tom Ford. By 1996, Gucci's sales had nearly doubled from $263 million to $500 million. With the Gucci family no longer involved, the brand was free from internal power struggles. Invest Corp capitalized on this success, making Gucci a publicly traded company and reaping a $2 billion profit from their investment.

However, in 1997, a drop in Gucci's stock price, coupled with an economic crisis in the Japanese luxury market, created an opportunity for LVMH to buy shares at a discount. Bernard Arnault, CEO of LVMH and known for his aggressive acquisition strategies, saw potential in Gucci.

The iconic Tom Ford and Domenico De Sole duo eventually resigned from the company in 2004. Despite this, Gucci has continued to thrive, becoming one of the most popular luxury brands worldwide, with over 500 stores and about 50 million followers on Instagram. The brand's journey from humble beginnings to global dominance is a testament to its enduring appeal and resilience.

#gucci#luxury fashion#fashion history#gucci marketing strategy#italian fashion brands#luxury brands#sustainable luxury#celebrity#endorsement#gucci fashion

0 notes

Text

"Seamless Payments: The Future of Financial Transactions"

Introduction:

The Payment Processing Solutions Market has experienced rapid growth, driven by the global surge in digital transactions and the increasing adoption of e-commerce. The shift towards contactless payments, fueled by the pandemic, has significantly accelerated this trend. Growth factors include the widespread use of smartphones, the rise of digital wallets, and the increasing integration of AI and machine learning in payment systems.

Read more - https://market.us/report/payment-processing-solutions-market/

However, the market also faces challenges such as stringent regulatory requirements, cybersecurity threats, and the need for constant technological innovation. For new entrants, opportunities lie in tapping into emerging markets, offering innovative solutions to underserved sectors, and leveraging the growing demand for personalized payment experiences.

Emerging Trends:

Contactless Payments: The popularity of contactless payments, driven by convenience and hygiene concerns, continues to rise, especially in retail and hospitality sectors.

Cryptocurrency Integration: An increasing number of payment processors are beginning to accept cryptocurrencies, reflecting growing consumer interest and the potential for blockchain-based payment solutions.

AI and Machine Learning: The integration of AI and machine learning is enhancing fraud detection, personalizing payment experiences, and streamlining customer service.

Buy Now, Pay Later (BNPL) Services: BNPL options are becoming more prevalent, allowing consumers to make purchases and pay in installments, which is driving higher sales volumes for merchants.

Cross-Border Payments: There’s a growing emphasis on improving the efficiency of cross-border payments, making them faster, cheaper, and more accessible for global commerce.

Top Use Cases:

Retail Transactions: Payment processing solutions are vital in retail for handling in-store, online, and mobile transactions, ensuring seamless payment experiences for customers.

E-commerce Platforms: E-commerce businesses rely on advanced payment processing solutions to securely handle large volumes of online transactions.

Subscription Services: Companies offering subscription-based models depend on payment processors to manage recurring payments efficiently and securely.

Point-of-Sale (POS) Systems: Modern POS systems integrate payment processing solutions to offer businesses comprehensive tools for managing sales, inventory, and customer data.

Peer-to-Peer (P2P) Transfers: Payment solutions facilitate instant P2P transfers, allowing users to quickly send money to friends or family, a feature growing in popularity with apps like Venmo and PayPal.

Major Challenges:

Cybersecurity Threats: With the rise of digital payments comes an increase in cybersecurity risks, requiring constant vigilance and investment in advanced security measures.

Regulatory Compliance: Navigating the complex landscape of global regulations is a significant challenge, especially for companies operating across multiple regions.

High Competition: The market is highly competitive, with numerous players vying for market share, making it difficult for new entrants to establish a foothold.

Technological Integration: Ensuring seamless integration of payment processing solutions with existing business systems can be challenging and resource-intensive.

Consumer Trust: Building and maintaining consumer trust is crucial, as any security breach or service disruption can severely damage a brand’s reputation.

Market Opportunity:

Emerging Markets: There is significant potential in emerging markets where digital payment adoption is still in its early stages, offering opportunities for growth.

SME Solutions: Developing tailored solutions for small and medium enterprises (SMEs) can tap into a large, underserved market segment.

Innovation in Security: Investing in advanced security technologies, such as biometric authentication and blockchain, can provide a competitive edge.

Financial Inclusion: Expanding access to payment processing in underbanked regions presents a considerable market opportunity.

Partnerships and Integrations: Collaborating with fintech companies and other technology providers can lead to innovative products and expanded market reach.

Conclusion:

The Payment Processing Solutions Market is poised for continued growth as digital transactions become increasingly central to global commerce. While the market offers significant opportunities, particularly in emerging markets and through technological innovation, it also presents challenges such as regulatory hurdles and cybersecurity threats.

New entrants must focus on differentiation, security, and seamless integration to succeed. As the industry evolves, staying ahead of trends like contactless payments and AI integration will be key to maintaining a competitive edge. Ultimately, those who can balance innovation with consumer trust will thrive in this dynamic market.

0 notes

Text

Inventory Funding: Essential Money to Buy Inventory for Business Growth

Inventory funding can be a crucial component for businesses looking to expand their product offerings or maintain optimal stock levels. Accessing capital specifically for inventory purchases allows companies to meet customer demand without sacrificing cash flow. Businesses that secure inventory funding can purchase stock upfront, leading to increased sales opportunities and enhanced profit margins.

With various financing options available, including loans and lines of credit, it is essential for entrepreneurs to understand how inventory funding works and how it can benefit their operations. Many financial institutions recognize the importance of inventory in a company's balance sheet, making such funding feasible and attractive. Companies can leverage this capital to ensure they are always prepared to meet market demands.

The process of obtaining inventory funding might seem daunting, but many resources exist to help simplify it. From understanding eligibility requirements to exploring different lending options, businesses can find pathways to secure the necessary funds. With informed planning, this financial strategy can lead to substantial growth and sustainability in a competitive market.

Understanding Inventory Funding

Inventory funding is essential for businesses looking to maintain stock levels without straining cash flow. It provides the necessary resources to purchase goods, allowing companies to meet customer demand efficiently.

Concepts and Importance of Inventory Funding

Money to buy inventory involves securing capital specifically for purchasing inventory. For businesses, having sufficient stock is crucial to capitalize on sales opportunities. Insufficient inventory can lead to lost sales and dissatisfied customers.

Efficient inventory management directly impacts profitability. By utilizing inventory funding, businesses can effectively balance supply and demand, ensuring they have the right products available when customers need them. Additionally, strong inventory levels can enhance negotiating power with suppliers, often resulting in better terms and pricing.

Types of Inventory Funding

Several methods exist for financing inventory purchases. Common options include:

Bank Loans: Traditional loans can provide lump sums to purchase inventory. Terms and interest rates vary.

Credit Lines: Credit lines offer flexible borrowing against anticipated sales, allowing businesses to withdraw funds as needed.

Purchase Order Financing: This allows businesses to secure funding based on confirmed orders from customers.

Trade Credit: Suppliers may extend terms, allowing businesses to buy now and pay later.

Each funding type has unique benefits and drawbacks, making it important to choose the right fit based on the specific business model and cash flow situation.

Securing Funds for Inventory Purchases

Securing funds for inventory purchases is critical for businesses looking to maintain or grow their stock levels. Understanding the criteria for eligibility, the steps to obtain funding, and potential challenges can help businesses make informed decisions.

Criteria for Inventory Financing Eligibility

To qualify for inventory financing, a business must meet specific criteria. Lenders typically evaluate factors such as:

Business Credit Score: A high credit score indicates a lower risk for lenders.

Inventory Type: The quality and marketability of the inventory matter.

Sales History: A strong track record of sales can improve eligibility.

Business Plan: A clear strategy for inventory use and profitability is essential.

Additional requirements may include providing financial statements, tax returns, and a list of inventory to be financed. Meeting these criteria can significantly increase the likelihood of securing funding.

Steps to Obtain Inventory Funding

The process for obtaining inventory funding generally follows several key steps:

Assess Financing Needs: Determine how much funding is necessary for inventory purchases.

Research Lenders: Explore different financing options, including banks, credit unions, and alternative lenders.

Prepare Documentation: Gather required financial statements, tax returns, and inventory details.

Submit Application: Complete the application process with chosen lenders, submitting all necessary documentation.

Review Offers: Carefully evaluate loan offers, considering interest rates, terms, and repayment schedules.

Following these steps can streamline the funding process and improve the chances of approval.

Challenges and Considerations in Inventory Funding

Businesses may encounter various challenges when seeking inventory funding. Understanding these obstacles is essential for effective planning:

High Interest Rates: Some lenders may charge high rates, impacting profitability.

Risk of Overleveraging: Taking on too much debt can strain finances and limit operational flexibility.

Inventory Fluctuation: Changes in market demand can affect inventory value, leading to potential losses.

Application Process: The documentation and approval process can be cumbersome and time-consuming.

Awareness of these challenges can help businesses prepare adequately and explore alternative funding options if necessary.

0 notes

Text

E-Commerce Development: Trends, Challenges, and Opportunities in 2024

Trends

Personalization and AI Integration:

AI-Powered Recommendations: Leveraging AI to provide personalized product suggestions based on browsing and purchase history.

Chatbots and Virtual Assistants: Enhancing customer service with AI-driven chatbots that provide instant responses and support.

Omnichannel Retailing:

Seamless Integration: Connecting online and offline channels to provide a cohesive shopping experience.

Unified Commerce Platforms: Utilizing platforms that integrate inventory, sales, and customer data across all channels.

Mobile Commerce (M-Commerce):

Mobile-First Strategies: Designing websites and apps with mobile users as the primary audience.

Progressive Web Apps (PWAs): Offering app-like experiences directly in web browsers, enhancing speed and usability.

Sustainability and Ethical Shopping:

Eco-Friendly Practices: Emphasizing sustainable sourcing, packaging, and shipping methods.

Transparent Supply Chains: Providing visibility into product origins and manufacturing processes.

Advanced Payment Solutions:

Digital Wallets and Cryptocurrencies: Expanding payment options to include digital wallets like Apple Pay and cryptocurrencies.

Buy Now, Pay Later (BNPL): Offering flexible payment plans to attract more customers.

Challenges

Data Privacy and Security:

Regulatory Compliance: Navigating complex data protection regulations like GDPR and CCPA.

Cybersecurity Threats: Protecting against increasing cyber attacks and data breaches.

Supply Chain Disruptions:

Global Instabilities: Managing disruptions caused by geopolitical issues, pandemics, and natural disasters.

Inventory Management: Balancing inventory to meet demand without overstocking.

Customer Retention:

Competition: Standing out in a crowded market with numerous competitors.

Customer Expectations: Meeting high customer expectations for fast delivery and excellent service.

Technological Integration:

Adopting New Technologies: Keeping up with rapid technological advancements and integrating them seamlessly.

Legacy Systems: Upgrading or replacing outdated systems without disrupting operations.

Opportunities

Expanding Global Markets:

Cross-Border E-Commerce: Tapping into international markets with localized content and payment options.

Emerging Markets: Capitalizing on growth in regions like Southeast Asia, Africa, and Latin America.

Enhanced Customer Experience:

Augmented Reality (AR) and Virtual Reality (VR): Offering immersive shopping experiences, such as virtual try-ons.

Voice Commerce: Leveraging voice-activated devices for hands-free shopping.

Sustainability Initiatives:

Green Logistics: Implementing eco-friendly delivery options and reducing carbon footprints.

Circular Economy: Promoting the reuse and recycling of products.

Artificial Intelligence and Machine Learning:

Predictive Analytics: Using AI to forecast demand and optimize inventory.

Automated Customer Support: Implementing AI-driven support for efficient and effective customer service.

Social Commerce:

Social Media Platforms: Leveraging platforms like Instagram, Facebook, and TikTok to drive sales through direct shopping features.

Influencer Marketing: Collaborating with influencers to reach targeted audiences and build brand credibility.

Conclusion

The e-commerce landscape in 2024 is shaped by rapid technological advancements, changing consumer behaviors, and a growing emphasis on sustainability. Businesses that embrace these trends, address the challenges, and seize the opportunities will be well-positioned to thrive in the competitive market. Integrating AI, enhancing the customer experience, and expanding into new markets are key strategies for success in the evolving e-commerce ecosystem.

Website : Technorizen.com

1 note

·

View note

Text

This week, Richemont and Burberry are under the spotlight, with both luxury giants facing significant challenges that have financial markets abuzz.

Richemont, scheduled to report its first-quarter results on July 16, has generated headlines with recent leadership changes. This shake-up saw new CEOs at Cartier and Van Cleef & Arpels, heightening questions about succession strategies within the conglomerate led by 74-year-old Johann Rupert. Compounding matters, Bernard Arnault, LVMH's chairman, has acquired a personal stake in Richemont, fueling speculation of acquisitive intentions. Additionally, the future of Yoox Net-a-Porter (YNAP) hangs in the balance after a failed deal with Farfetch, with Mytheresa among potential buyers. Stakeholders are keenly anticipating any definite move from Richemont regarding YNAP.

On July 19, Burberry will reveal its first-quarter results, and forecasts are grim. Despite efforts to position itself as a more upmarket brand under the direction of designer Daniel Lee, customer response has been lukewarm, particularly against the backdrop of aggressive pricing strategies. Critics, including columnist Luca Solca, argue that Burberry should reposition itself akin to Coach, suggesting a mid-market focus could be more profitable than its current high-fashion trajectory.

Beyond these luxury heavyweights, Amazon's Prime Day on July 16-17 is another focal point, albeit with a different tone. While not prominent in the luxury sector—aside from some fragrance and eyewear listings—Amazon's recent collaborations with Saks and Neiman Marcus hint at aspirations in luxury retail. For now, Prime Day remains dedicated to accessible price points, with continued momentum from buy-now-pay-later options likely driving consumer spending.

As these events unfold, the strategic decisions made—or not made—by Richemont and Burberry will be closely monitored, potentially reshaping their paths in the luxury market. https://timesofinnovation.com/this-week-richemont-and-burberry-have-some-explaining-to-do/?feed_id=558&_unique_id=669c9d354e9ad&utm_source=Tumblr&utm_medium=editor15&utm_campaign=FS%20Poster

0 notes

Text

William Mason: The Impact of Central Bank Policy Changes on Investors

Global Market Dynamics and Energy Stock Investment Opportunities

Recently, global market dynamics have been complex and ever-changing, from Apple canceling its "buy now, pay later" service to Fisker filing for bankruptcy, Berkshire Hathaway increasing its stake in Occidental Petroleum, and various central banks adjusting their monetary policies amidst evolving geopolitical situations. These events have had significant impacts on the market. William Mason believes that investors should closely monitor these dynamics, adjust their investment strategies in response to market changes, and strive for optimal investment returns.

Market Dynamics Analysis

Recently, Apple launched its "buy now, pay later" service in the U.S. only to cancel it within a few months. This decision reflects the reevaluation of Apple on market demand and risks, which may impact similar services offered by other tech companies. Meanwhile, electric vehicle startup Fisker filed for bankruptcy intending to sell its assets, highlighting the high-risk nature of investments in emerging automotive technologies.

Berkshire Hathaway increasing its stake in Occidental Petroleum to nearly 29% shows a sustained bullish outlook on the energy sector. Mason points out that energy stocks have high investment value in the current market, especially amidst continued global energy demand growth. Additionally, McDonald's will terminate its testing of the AI-driven drive-thru technology of IBM, indicating that the commercialization of AI technologies is still in the exploration stage, prompting investors to follow advancements in related technologies.

Central Bank Policies and Geopolitical Analysis

Bank of Japan Governor Ueda hinted at a possible rate hike in July, the Reserve Bank of Australia maintained rates unchanged but did not rule out further hikes, and the Bank of Korea hinted at a rate cut by year-end. The policy adjustments by various central banks will have broad impacts on global markets, and investors should closely monitor these changes to adjust their investment strategies promptly.

On the geopolitical front, Putin vowed support for North Korea against the U.S. and plans to deepen trade and security relations, while the U.S. warned China to defend the Philippines. These events may exacerbate market uncertainties. Mason points out that increased geopolitical risks may negatively impact global markets, emphasizing the need for strengthened risk management and diversified investments to mitigate risks.

Economic Data and Market Expectations

U.S. retail sales in May showed subdued performance, with a 0.1% month-on-month growth, below the expected 0.3%. The June ZEW Economic Sentiment Index of Germany saw its first monthly decline since January, and the economy of New Zealand is expected to emerge from recession but with moderate growth. Mason believes that these economic data indicate ongoing challenges in global economic recovery, prompting investors to pay attention to the release of economic data worldwide to assess market risks and opportunities effectively.

To better seize market opportunities, investors can register and download stock trading apps to access the latest market information and professional investment advice. Through in-depth market analysis and prudent risk assessment, investors can identify suitable investment opportunities and enhance investment returns in volatile market environments. Mason believes that amidst global economic recovery and increasing market demand, energy stocks and tech stocks will continue to strengthen, providing investors with lucrative returns.

0 notes

Text

Streets In Hong Kong Are Quiet: Why Online Shopping Like Taobao May Uproot More Street Shops?

Shopping is an appeal to innate human rapture. New ideas rise and old shops fall, but we still shop.

People used to shop in stores; swiping through hangers or caressing items on supermarket shelves. Now, products are mere digital images that you can scroll past. You can log on to an online shopping platform from anywhere and order even chicken and papaya. Shopping online is all about ticking boxes: species, colour, size, number and grade of quality which are all options appearing on the screen of your computer or mobile phone, with no need for personal touch. It is a mechanical process but worth on its own.

Online shopping can never completely replace some shops especially those restaurants where romantic ambience is the reason for enjoyment. It will not replace shops selling luxury goods where you want to be treated like a VIP. For shops which are ordinary and cannot offer competitive prices of their products, it is hard to see how they will be able to battle against their online counterparts. At the end, only the convenient shops satisfying a customer’s daily needs may survive. This is why I still frequent 7-Eleven or Circle K. In a competition, there are always winners and losers. Losers will disappear.

In Hong Kong, Taobao(淘寶) is the market king. It is an online shopping platform headquartered in Hangzhou(杭州), China and owned by Alibaba which at first targeted at a ‘B2B’(business-to-business) and later at a ‘B2C’(business-to-customer) operating model. Taobao is almost the most-visited website for shopping among the Chinese.

Few years ago, I resisted but now Taobao is too hard to resist for me.

My friends said the following: “China used to produce low-cost and low-performing goods, and the focus, in recent years, has shifted to high-quality goods. The trick is to look for the mid-range prices and you seldom get disappointed.” “Most shops in Hong Kong typically close at 7pm. With the rise of e-commerce, I can buy what I want from the comfort of my own home, any time of day or night.” “Buying something online is often cheaper and delivery is much faster, usually within 1-3 business days.” “My God! One of the benefits of online shopping is that specialty items, hard-to-find products and almost everything under the sun particularly out-of-stock goods can be found on the internet.” “Shoppers’ comments are available on Taobao and I can assess at once which is good and what is bad. I can also know how many items that the manufacturer had sold. I just wisely follow the crowd.”

Chinese people are very creative and this is why you will be amazed by the innovative products which emerge from Taobao every day: curtains without drilling nails, bedside tables with different lighting ideas, fake muscle T shirts which can make you look like having a six-pack abs, slippers which feel like jelly, ladders that can be turned into a chair and more…

Some Taobao sellers hire Hong Kong transportation companies to take back the goods back to the Chinese Mainland if you are not happy with the quality that you have bought. Some Mainland suppliers display their samples in Hong Kong and let you go to check out the grade. Some house fittings manufacturers employ local Hong Kong workers to provide installation services at your home.

Taobao is a wonderland where you can pay no mind—just relax, enjoy and spend your money in full swing.

Online retailers such as Taobao, Amazon, Carousell, eBay and Tmall are popular in Hong Kong and are quietly forcing many small street shops to close down. Land and labour in Hong Kong are expensive. This is why the prices of products in physical shops with the same quality can be 3 or 4 times more. Only those who are not accustomed to ‘cyber shopping’ or who insist on personalized encounter still do in-store shopping.

The big challenge to cyber shopping is the cost of ‘e-commerce logistics’ which term refers to the movement of goods in online retail. It involves managing inventory, order fulfilment, warehousing, transportation and delivery. The latter two are not cheap. Often, transportation charges are equal to the price of a product and you are forced to buy many other things at the same time in order to justify delivery charges. It encourages ‘prodigal spending’.

It is also a pity that most e-commerce sites are just a product list. They do not have stories or human inspiration. They do not tell you why the products are made or who developed the idea behind.

My life has changed. I seldom go out for aimless shopping. I simply wait happily for an order to show up at my door every single day. It is always like Christmas! Online shopping wins because I can do it in bed or even in my toilet! Carrying stuff which is a kind of heavy lifting can cause a problem to us after a certain age. There is already too much stuff to carry around like cellphone, wallet, keys and a briefcase when we go home. Grocery bags surely piss us off now!

Great shopping is when laziness finds respectability.

Maurice Lee

Chinese Version 中文版: https://www.patreon.com/posts/you-yi-zhong-qu-104771940?utm_medium=clipboard_copy&utm_source=copyLink&utm_campaign=postshare_creator&utm_content=join_link

Online Shopping Fraud https://youtu.be/gQBNkKdecCc?si=YPwHvFlgDNDwhmil Acknowledgement-HK Police

Even kids do online shopping https://youtu.be/9PtwmK36Of8?si=lQfOAN5PaFF2T0bN Acknowledgement – RTHK

Development of online shopping in HK https://youtu.be/pbGU74aURvg?si=ezNc59RssgZcoh-r Acknowledgement – China Daily Asia

0 notes