#CELSIUSNETWORK

Explore tagged Tumblr posts

Text

Crypto Lender Celsius Network’s Founder Arrested on Fraud Charges

Read more:👇

#crypto #cryptocurrency #CelsiusNetwork #Alexander Mashinsky #todayonglobenews #todayonglobe #tognews #tog #news #dailynews #dailynewsupdate

#crypto#cryptocurrency#CelsiusNetwork#Alexander Mashinsky#todayonglobenews#todayonglobe#tognews#tog#news#dailynews#dailynewsupdate

0 notes

Text

Celsius Network Approved for Bitcoin Mining Exit Plan in Bankruptcy

Celsius Network, the crypto lending company that filed for bankruptcy last year, has received approval from a U.S. judge for a new exit plan. The plan involves creating a public company focused solely on Bitcoin mining, instead of the previous proposal to expand operations managed by the Fahrenheit consortium. The decision came after the U.S. Securities and Exchange Commission (SEC) rejected the initial plan. As part of the new plan, creditors will receive shares in the upcoming mining company, and $225 million in crypto assets initially meant for new business ventures will be unlocked.

The original proposal involved creating a new company called NewCo, which would have been managed by the Fahrenheit consortium. However, the SEC denied relief required to implement this plan. The approved alternative, known as the Orderly Wind Down, was supported by the creditors. It will allow Celsius to establish a Bitcoin mining company and redistribute approximately $2 billion worth of Bitcoin and Ether to its creditors.

Celsius Network was one of several crypto lenders to face bankruptcy last year. Its former CEO, Alex Mashinsky, was arrested in 2023 on charges including securities fraud and wire fraud. Some creditors and the U.S. Department of Justice's bankruptcy watchdog had argued that the new restructuring strategy should have been put to a new vote. However, the judge determined that the new plan would not negatively affect the creditors.

Read the original article #CelsiusNetwork #Bitcoin

0 notes

Text

Joel E. Cohen, a mathematician and biologist representing Celsius Network’s valuation advisor Stout Risius Ross, LLC, confirmed the accuracy of the fair value of certain of the debtors’ assets and liabilities as of May 31, 2023.Following months of back and forth, most Celsius creditors recently voted in favor of a plan to see approximately $2 billion worth of Bitcoin (BTC) and Ethereum (ETH) returned to creditors.The voting results are in! Over 95% of creditors across all eligible classes voted to accept the Plan, a testament to our collaborative efforts during Chapter 11. @CelsiusUcc @FahrenheitHldg.— Celsius (@CelsiusNetwork) September 25, 2023 Two days after attaining consensus around Celsuis’ reorganization plan, a Sept. 28 court filing confirmed the accuracy of the value of debtors’ assets and liabilities. Stout conducted the valuations of cryptocurrency assets, loans and alternative investments. Summary of conclusions provided for Celsius Network's valuation report. Source: cases.stretto.comIn the declaration provided at the New York bankruptcy court, Cohen explained the methodologies used in the valuation analysis, and concluded:“Based on my work performed and the information and methodologies considered, I believe the Valuation Report accurately reflects the fair value of certain of the Debtors’ assets and liabilities as of May 31, 2023.”According to a disclosure statement filed on Aug. 17, approximately $2 billion will be redistributed among creditors and the plan will also distribute equity in a new company, temporarily dubbed “NewCo.���Sporting a similar situation, bankrupt cryptocurrency lending platform BlockFi’s liquidation plan got approval from the New Jersey bankruptcy court. Sept. 26 court filing in the bankruptcy case of BlockFi. Source: KrollThe repayment amount received by BlockFi’s unsecured creditors will largely depend on whether BlockFi succeeds in its legal battle against FTX and other bankrupt cryptocurrency firms. Source

0 notes

Text

✅Celsius Network Doubles Crypto Loan Interest in Past Three Months✅

Read Out More 👉 https://www.cryptoknowmics.com/news/celsius-network-doubles-crypto-loan-interest-in-past-three-months?utm_source=tumblr&utm_medium=Sakshi&utm_campaign=Promotion

#CelsiusNetwork#AlexMashinsky#CryptoLoanInterest#EthereumbasedDeFi#decentralizedfinance#DeFi#BlockFi#CryptoLendingIndustries#Cryptocurrency#CryptocurrencyMarket#Cryptocurrencies#CryptoNews

2 notes

·

View notes

Photo

Cryptocurrency lender Celsius was “insolvent since inception,” investigation finds Turns out the Celsius Network, a cryptocurrency lender that promised customers 17% annual yields on their deposits, was indeed too good to be true. Read more... https://qz.com/cryptocurrency-lender-celsius-was-insolvent-since-ince-1850052862

#business2cfinance#martinglenn#shobapillay#charlesponzi#economy#celsiusnetwork#alexmashinsky#fraud#confidencetricks#requests#digitalcurrencies#deception#cryptocurrencies#ponzischeme#bitcoin#Scott Nover#Quartz

0 notes

Text

Celsius Network (CEL)'in 0’lik yükselişinin arkasında Ripple mı var?

Piyasa değerine göre ilk 100 kripto para arasında olan Ethereum tabanlı bir altcoin, yaşadığı zor günlerin ardından, son bir aylık dönemde üç haneli rakamlarla inanılmaz bir yükseliş kaydetti.

Ethereum tabanlı altcoin CEL’e Ripple’dan doping!

Ethereum ağında bulunan merkezsiz finans platformu Celsius Network’un yerel tokeni CEL, günü 0,735 dolardan kapattığı 12 Temmuz tarihinden bu yana 0’leri aşan bir artış yakaladı. ( Celsius Network (CEL), yazımızı yayına hazırlanırken 2.47$’dan işlem görüyor ve piyasa değerine göre 77. sırada yer alıyor.) Geride kalan iki aylık sürede CEL, yaşadığı likidite sıkıntıları nedeniyle platformda para çekme işlemlerini durdurmuştu. Ancak haziran ortasında 2022’nin en düşük seviyesi olarak 0.28$ seviyelerine kadar gerileyen fiyat baz alındığında ise 0’yi aşan bir artış yakaladı. İşin ilginç tarafı ise; bu toparlanma, Celsius Network’ün geçen ay yaptığı iflas başvurusundan sonra geldi. Ethereum tabanlı altcoinin fiyatındaki bu toparlanma, blockchain ödeme firması Ripple Labs’in “iflas başvurusunda bulunan Celsius Network’ün varlıklarını satın almakla ilgilendiği yönünde yapılan haberler ile daha güçlü bir hal aldı. Çarşamba günü bir Ripple yetkilisi, Reuters’e yaptığı açıklamada, şirketin Celsius platformunda bir fizibilite çalışması yapmak istediğinden bahsetti. Ripple sözcüsü şu ifadeleri kullandı: “Celsius platformu ve varlıkları hakkında bilgi edinmek ve bunların bizim platformumuza katkı sağlayıp sağlamayacağını öğrenmek istiyoruz.” Bu arada CEL token fiyatındaki toparlanmanın arkasındaki bir diğer faktör de, Celsius Network’ün iflas sürecini nasıl yöneteceğinin netlik kazanması oldu. Platform yetkilileri geçen ay yaptıkları açıklamada müşterilerin talep acentesi Stretto aracılığıyla talepte bulunabileceklerini duyurdu. Celsius Network ayrıca, müşterilerinin ya nakit olarak tazminat almalarına ya da kripto varlıklarını hodl etmelerine izin vereceğini açıkladı. Güncel son dakika gelişmelerden anında haberdar olmak için Kriptokritik.com‘u Twitter’da takip edin, Yaay’da takip edin, İnstagram’da takip edin, Tiktok‘ta takip edin, Facebook sayfamızı beğenin ve Telegram kanalımıza katılın! Read the full article

0 notes

Photo

It’s been a complete bloodbath this week! I am down $2.8 MILLION from all time high $ETH alone. HODL Diamond Hands 💎🙌 — at least I am getting my 5% interests for staking my ETH on @CelsiusNetwork! #ethereum #eth #crypto #blockchain #cryptocurrency #celsiusnetwork https://www.instagram.com/p/CPODC1dM11O/?utm_medium=tumblr

0 notes

Text

More than 95% of creditors across all eligible classes voted to accept the plan, reported Celsius on September 26. It is a “testament to our collaborative efforts during Chapter 11” and a “major milestone” it added in reference to the bankruptcy proceedings. “The confirmation hearing is scheduled to begin October 2, 2023. We are hoping for swift approval to continue our path to emergence. The voting results are in! Over 95% of creditors across all eligible classes voted to accept the Plan, a testament to our collaborative efforts during Chapter 11. @CelsiusUcc @FahrenheitHldg. — Celsius (@CelsiusNetwork) September 25, 2023 Creditors Not Celebrating Yet However, the responses to the announcement were far from congratulatory. A large number simply asked when they would get their money back. Celsius shared a declaration filed in the bankruptcy case regarding the solicitation and tabulation of votes on the proposed reorganization plan. According to the Sept. 25 filing, most of the creditor classes voted in favor of the plan by more than 98%. It also summarized other elections made by creditors, such as opting into a convenience class, making weighted distribution elections, opting out of third-party releases, and contributing claims. A disclosure statement filed in mid-August revealed that the current plan will see around $2 billion worth of Bitcoin and Ethereum redistributed to Celsius creditors. The plan included equity distribution via a new company, temporarily labeled “NewCo.” The new company plans to operate and further build out the debtors’ Bitcoin mining operations, stake Ethereum, and monetize other illiquid assets. At the time, Celsius stated that the amended plan would enable most clients with interest-bearing Earn accounts to retrieve up to 67% of their funds. Notably, NewCo will be managed by the Fahrenheit Group, an association of crypto industry executives and venture capital firms. Some creditors remained unimpressed with the proceedings, however. Sudden Impact Labs director Joey Hendrickson said: “You financially impregnated the clients you abused, stole our cash, legally ended the financial relationship, and “collaborated” by making us pay your friends to babysit NewCo while we can’t even be in the room. This post is gaslighting.” Celsius Executive Pleads Guilty Celsius filed for bankruptcy in July 2022 following the collapse of the Terra/Luna ecosystem. This followed a lawsuit from the Securities and Exchange Commission on July 13, 2022. Celsius CEO Alex Mashinsky was arrested at the same time for securities and wire fraud, among others. On Sept. 15, CryptoPotato reported that Roni Cohen-Pavon, a former executive at the bankrupt cryptocurrency lender, pleaded guilty to four charges and agreed to collaborate with investigators. Source

0 notes

Photo

Waiting for Monday. The best day of the week. Payday. Thanks to #celsiusnetwork https://www.instagram.com/p/CSUPGfNq7z6/?utm_medium=tumblr

0 notes

Text

https://fi.cryptogandalf.com/post/with-cel-even-the-down-is-up

0 notes

Photo

Hallo Cashflowfreunde, Neuer Monat neue Abstimmungen💯 Die Community hat sich für folgende 3 Werte entschieden: tsmc, rwe, 7c Solarparken 💪 Welche Aktien hättest du ausgesucht oder bist du zu 100% der gleichen Meinung wie die Community??? Am Sonntag kommt die nächste Abstimmung für das Tenbagger Depot ���️ Willst du keinen Cashflow mehr verpassen??? Dann Folge🙏@projektcashflow und checke mein Investment Tagebuch ‼️ Wenn du Fragen zum Projekt oder zu den Plattformen hast dann schreib mich via DM gerne an👀 Herzliche Grüße 👇👇Hashtags 👇👇 #portfolio | #bitcoin | #zinseszins | #money | #passiveincome | #twino | #celsiusnetwork | #peertopeer | #bulkestate | #börse | #crowdlending | #dividenden | #ethereum | #lending | #cashflow | #lendermarket | #crowdcube | #assetzcapital | #kuflink | #highyield | #investinlatvia | #finanziellebildung | #investinpoland | #return | #profit | #bridgecrowd | #cryptocurrency | #investinuk | #invoicetrading (hier: Mannheim am Neckar) https://www.instagram.com/p/CE_Sb6fH2TU/?igshid=1xu0kds7228n

#portfolio#bitcoin#zinseszins#money#passiveincome#twino#celsiusnetwork#peertopeer#bulkestate#börse#crowdlending#dividenden#ethereum#lending#cashflow#lendermarket#crowdcube#assetzcapital#kuflink#highyield#investinlatvia#finanziellebildung#investinpoland#return#profit#bridgecrowd#cryptocurrency#investinuk#invoicetrading

0 notes

Photo

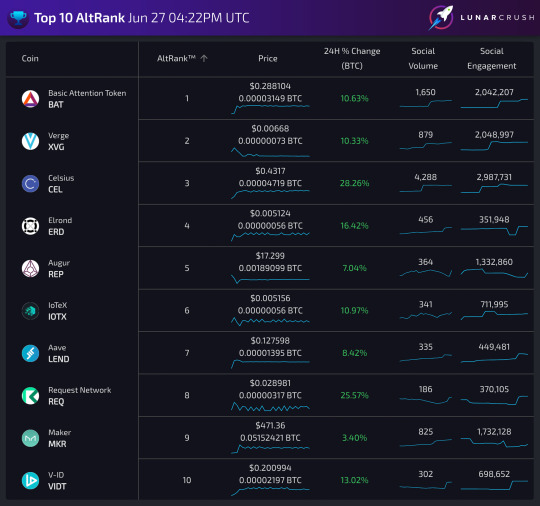

Real-time Top 10 Altrank™ Jun 27 04:22PM UTC Altrank™ = Increasing social activity + exceptional price performance vs Bitcoin + rising trading volume https://lunarcrush.com 1 Basic Attention Token 2 Verge 3 Celsius 4 Elrond 5 Augur 6 IoTeX 7 Aave 8 Request Network 9 MakerDAO 10 V-ID

#basicattentiontoken#vergecurrency#celsiusnetwork#elrond#augur#iotex#aave#requestnetwork#makerdao#v-id

0 notes

Text

Celsius Web Services: The Billion-Dollar Plan That Could Have Saved The Network From Bankruptcy

Celsius Web Services: The Billion-Dollar Plan That Could Have Saved The Network From Bankruptcy https://bitcoinist.com/celsius-the-billion-dollar-saved-network-bankruptcy/ According to a report from The Block, Celsius Network, a cryptocurrency lending company that filed for Chapter 11 bankruptcy last year, had attempted to raise $1 billion for a project called Celsius Web Services (CWS). CWS aimed to offer generic versions of Celsius’s yield and custody-focused products and was described as a “web3 toolbox for a New World” in pitch decks presented to Goldman Sachs and Abu Dhabi-backed fund ADQ May and June 2021, respectively. Former Celsius CEO’s Plan Celsius’s former CEO, Alex Mashinsky, spearheaded the CWS plan, but the project failed to get off the ground as investors, including Celsius’s board, chose not to participate. Mashinsky had hoped to pivot Celsius away from its core crypto lending business and create the “Amazon Web Services of crypto” with CWS. The CWS plan was seen as a last-ditch effort by Mashinsky to save the company, as employees openly expressed concerns about Celsius’s financial health in May 2021. However, according to The Block, Mashinsky continued to assure customers that all was well. Mashinsky was later hit with a civil lawsuit by New York attorney general Letitia James, who accused him of misleading investors about the health of Celsius. Mashinsky dismissed the fraud claims as “baseless.” Celsius’s lending business ultimately led to its downfall as the company froze withdrawals on June 12, 2021, and filed for bankruptcy a month later. Over 100,000 users were owed over $4.7 billion. Despite Mashinsky’s efforts to launch new products and pivot the company, CWS couldn’t save Celsius from bankruptcy. The CWS plan was also likened to Plaid, a fintech startup that helps customers connect their financial data to new apps and services, by a second source close to Celsius. While the CWS plan did not come to fruition, it offers insight into how Mashinsky hoped to save the company. The plan involved white-labeling Celsius’s products and offering services for business transformation and growth. The types of services in the pitch deck included yield, custody, on-ramp services, and a tool for bridging centralized and decentralized ecosystems. The CWS project had the board’s and external investors’ full backing, but ultimately, Celsius’s existing investors chose not to participate. The Network’s Custody Settlement Withdrawals For Eligible Users On May 9th, Celsius Network announced that withdrawals have begun for eligible Custody account users who have opted into the Custody Settlement. The settlement was authorized by the Court last month and allowed users to receive a distribution of their assets in exchange for electing not to pursue any Custody-related claims or causes of action against Celsius and for voting their Custody claims in favor of the Plan. Last month, the Court authorized our settlement with the UCC and Custody Ad Hoc Group. Today, withdrawals begin for those who have opted in to the Settlement. — Celsius (@CelsiusNetwork) May 9, 2023 Furthermore, according to the announcement, the distribution of eligible assets will be carried out in two stages. The first distribution consists of 36.25% of each settling Custody account holder’s Custody account balance. Users can withdraw their assets once all account information is updated and verified. Moreover, the Network has provided a Custody Account Withdrawal FAQ for users seeking more information. Featured image from iStock, chart from TradingView.com via Bitcoinist.com https://bitcoinist.com May 13, 2023 at 02:00AM

8 notes

·

View notes

Photo

It's not too late to invest in Crypto and with stablecoins you remove the risk. #UnbankYourself #CelsiusNetwork https://www.instagram.com/p/CNgATHMHcYT/?igshid=ecjwpfdu0yzw

0 notes

Text

The creditors involved in the Celsius bankruptcy case have voted in favor of a plan that will see funds returned to them as well as distributing equity through a new company.According to a Sept. 25 filing from bankruptcy firm Stretto, most of the classes voted in favor of the plan by more than 98%. The voting results are in! Over 95% of creditors across all eligible classes voted to accept the Plan, a testament to our collaborative efforts during Chapter 11. @CelsiusUcc @FahrenheitHldg.— Celsius (@CelsiusNetwork) September 25, 2023 While voters have made a near-unanimous decision on the plan, the plan still needs final approval at a confirmation hearing in the United States Bankruptcy Court for the Southern District of New York scheduled for Oct. 2.Celsius network creditor class vote breakdown. Source: StrettoAccording to a disclosure statement filed on Aug. 17, the current plan will see approximately $2 billion worth of Bitcoin (BTC) and Ether (ETH) redistributed to Celsius Network creditors. The plan will also distribute equity in a new company, temporarily dubbed “NewCo.”“NewCo will operate and further build out the Debtors’ Bitcoin mining operations, stake Ethereum, monetize the Debtors’ other illiquid assets, and develop new, value-accretive, regulatory-compliant business opportunities," it wrote.Notably, the new company will be managed by the Fahrenheit Group — a consortium of crypto-native individuals and organizations including former Algorand CEO Steven Kokinos, venture capital firm Arrington Capital, crypto miner US Bitcoin Corp, Proof Group Capital Management and Arrington Capital advisor Ravi Kaza.Celsius Network was one of the first major casualties of the 2022 bear market, with the now-defunct crypto lender filing for bankruptcy on July 14, 2022.On July 13, 2023, the SEC sued Celsius and its former CEO Alex Mashinsky for allegedly raising billions of dollars through unregistered and fraudulent offers involving “crypto asset securities.” Mashinsky was then arrested on the same day, following an indictment from the U.S. Department of Justice, which accused the former CEO of fraudulent financial activity, misleading investors and a number of other similar charges. Source

0 notes

Photo

Celsius kocht vorige week rond de 2 miljoen cel tokens om intresten te betalen. Als we 1 miljoen users halen zal het flywheel pas echt beginnen draaien… #celsiusnetwork #flywheel #hodlers https://www.instagram.com/p/CSRBrDfqCja/?utm_medium=tumblr

0 notes