#Cash App account closures

Text

Cash App Account Closed: Understanding Violations of Terms of Service

Cash App, a widely-used mobile payment platform, has established itself as a convenient and efficient means of handling financial transactions. However, it is crucial for users to understand and adhere to the terms of service provided by Cash App to avoid account closures. In this article, we will explore the concept of Cash App account closed due to violations of terms of service and provide insights into how users can prevent such situations.

Understanding Cash App's Terms of Service

Before delving into the reasons behind Cash App account closed, it is vital to comprehend the terms of service that govern the platform. These terms outline the rules and guidelines users are expected to follow when using Cash App. Violations of these terms can result in account closures.

Common Violations Leading to Account Closures

Engaging in Illegal Activities: One of the most significant violations of Cash App's terms of service is engaging in illegal activities through the platform. This includes using the app for money laundering, fraud, or any other illegal financial transactions. Such actions not only violate Cash App's policies but also breach legal regulations.

Fraudulent Transactions: Cash App account closures can also stem from participating in fraudulent transactions. This may involve deceiving other users or attempting to manipulate the platform to gain an unfair advantage. Fraudulent activities are a direct violation of the terms of service.

Unauthorized Use: Allowing someone else to use your Cash App account or using someone else's account without permission is considered unauthorized use, and it can lead to account closure. Each user is responsible for maintaining the security of their account.

Non-Compliance with Policies: Users are expected to adhere to Cash App's policies, including their policies on prohibited goods and services. Attempting to use Cash App for transactions involving prohibited items or services can result in account closures.

Multiple Account Creation: Creating multiple Cash App accounts without proper authorization or using them for deceptive purposes can also lead to account closures. Cash App typically allows one account per user, and any deviation from this may be considered a violation.

The Impact of Account Closures

Cash App account closures due to violations of terms of service can have significant consequences for users. These include:

Loss of Funds: Users may have funds in their Cash App accounts that become inaccessible upon closure. This can lead to financial difficulties and disrupt daily financial transactions.

Reputation Damage: Account closures can tarnish a user's reputation, especially if the closure is due to illegal or fraudulent activities. It can also affect one's credibility for future financial transactions.

Preventing Account Closures Due to Violations

To prevent Cash App account closures due to violations of terms of service, users should:

Read and Understand the Terms: Familiarize yourself with Cash App's terms of service and policies. Understanding these rules is the first step in compliance.

Use the Platform Responsibly: Conduct all financial transactions responsibly and ethically. Avoid engaging in illegal activities, fraudulent transactions, or any actions that violate Cash App's policies.

Protect Your Account: Maintain the security of your Cash App account by using strong and unique passwords. Enable two-factor authentication for added protection.

Adhere to One Account Per User: Respect Cash App's policy of one account per user. Avoid creating multiple accounts without proper authorization.

Report Suspicious Activity: If you come across any suspicious or unauthorized activities on your account, report them immediately to Cash App.

Conclusion

Cash App provides users with a convenient and efficient platform for managing their financial transactions. However, to maintain a smooth and uninterrupted experience, it is essential to adhere to the terms of service and policies provided by Cash App. Violations of these terms can result in account closures, leading to financial difficulties and reputational damage. By understanding the rules, conducting transactions responsibly, and protecting your account, users can prevent account closures and enjoy the benefits of Cash App without interruption.

0 notes

Text

Understanding Cash App Account Closure Due to Violation of Terms of Service

Cash App has rapidly become one of the most popular peer-to-peer payment platforms, offering a convenient way to send, receive, and manage money. However, like any financial service, Cash App has a set of terms of service that users are required to adhere to. In cases where a user’s cash app account is closed due to activity that goes against these terms, it’s important to understand the reasons behind the closure and the implications it carries.

The Significance of Terms of Service

Cash App’s terms of service are designed to ensure a secure and reliable platform for all users. These terms outline the rules and guidelines that govern the use of the platform, covering various aspects such as payments, transactions, account security, and prohibited activities. Users are expected to read and agree to these terms before using the service.

Reasons for Account Closure

When cash app account closed violation of terms of service, it typically indicates that the user has engaged in actions that violate the guidelines set forth. Here are some common reasons for such closures:

Fraudulent Activities: Engaging in fraudulent activities, such as attempting to manipulate transactions, exploiting system vulnerabilities, or conducting unauthorized transactions, can lead to account closure. Cash App has strict measures in place to identify and prevent fraudulent behavior.

Money Laundering and Illegal Transactions: Using the platform for money laundering, facilitating illegal transactions, or engaging in any criminal activities is a direct violation of Cash App’s terms of service. Such actions not only result in account closure but may also lead to legal consequences.

Abuse of Refunds: If a user repeatedly requests refunds without valid reasons, it can be seen as an abuse of the platform’s refund system. This behavior not only disrupts the system but also violates Cash App’s guidelines.

Sharing Sensitive Information: Sharing personal or sensitive account information with unauthorized third parties can compromise security and lead to account closure. Cash App places great importance on protecting user data.

Unauthorized Access and Hacking: Gaining unauthorized access to another user’s account, attempting to hack into the platform, or engaging in any form of cyberattack is strictly prohibited and can result in immediate account closure.

Implications of Account Closure

When your Cash App account is closed due to activity that goes against the terms of service, there are several implications to consider:

Loss of Access: Account closure means that you will lose access to the funds and transactions associated with that account. This can be especially problematic if you had a significant balance in the account.

Limited Customer Support: After account closure, your access to Cash App’s customer support may be limited. Reinstating the account might require addressing the violation and demonstrating a commitment to adhering to the platform’s terms.

Reputation and Trust: Being found in violation of Cash App’s terms of service can impact your reputation as a trustworthy user. It can also affect your ability to use other financial platforms in the future.

Legal Consequences: In cases of severe violations, Cash App might take legal action against the user. Engaging in illegal activities through the platform can result in serious legal repercussions.

Conclusion

Maintaining a Cash App account requires adherence to its terms of service to ensure the safety and integrity of the platform. Cash app Account closure due to activity that goes against these terms indicates a breach of the established guidelines. To prevent such closures, users should familiarize themselves with Cash App’s terms and use the platform responsibly. If an account closure does occur, it’s essential to address the violation and seek resolution through proper channels, understanding the implications and consequences of the actions that led to the closure.

0 notes

Text

Why is Cash App Closing Accounts [Most Common Reasons]

Cash App is a popular mobile payment app that allows users to send and receive money quickly and easily. However, Cash App has been known to close accounts for a variety of reasons.

Some of the most commons why is cash app is closing accounts

Here are some of the most common reasons why Cash App closes accounts:

Suspicious or fraudulent activity: Cash App has a team of fraud experts who monitor all transactions on the app. If they detect any suspicious activity, such as a sudden increase in transactions or sending money to a high-risk country, they may close the account.

Violation of terms of service: Cash App has a set of terms of service that all users must agree to. If a user violates these terms, such as by sending money to a prohibited merchant or using the app for illegal activities, their account may be closed.

Inactivity: If an account is inactive for a long period of time, Cash App may close it. This is to protect the account holder’s funds and to prevent fraud.

Insufficient funds: If an account is overdrawn or has insufficient funds to cover a payment, Cash App may close it.

Technical issues: In rare cases, Cash App may close an account due to technical issues. If this happens, the user should contact Cash App support to try to resolve the issue.

What can I do to prevent my Cash App account from being closed?

There are a few things you can do to prevent your Cash App account from being closed:

Be aware of the terms of service: Make sure you understand the terms of service and that you are not violating them in any way.

Be careful about who you send money to: Do not send money to merchants or individuals that you do not know or trust.

Keep your account active: Use your Cash App account regularly to send and receive money.

Keep your account in good standing: Make sure your account has sufficient funds to cover any payments.

If my Cash App account is closed, what can I do?

If your Cash App account is closed, you can contact Cash App support to try to get it reopened. You will need to provide them with information about your account, such as your username, email address, and phone number.

Cash App may be able to reopen your account if they determine that the closure was in error. However, if the closure was due to suspicious activity or a violation of the terms of service, it is unlikely that your account will be reopened.

How do I stop Cash App from cancelling payments?

There are a few things you can do to reduce the risk of your Cash App payments being cancelled:

· Only link debit or credit cards that are in your name.

· Only send payments to or receive payments from people you know or reputable businesses.

· Confirm the recipient’s phone number or $Cashtag before sending a payment.

· By following these tips, you can help to protect your Cash App account and prevent your payments from being canceled.

Safeguarding Your Cash App Account: Preventing Account Closure

Cash App has emerged as a convenient and user-friendly platform for financial transactions, making it easier to send and receive money, pay bills, and invest in stocks. However, to ensure a seamless experience, users must be vigilant about adhering to the platform’s terms of use and security guidelines. Account closure can be a frustrating experience, but by understanding and implementing preventive measures, you can safeguard your Cash App account effectively.

Verify Your Account Properly

One of the initial steps to prevent account closure is to ensure that you provide accurate and truthful information during the account verification process. Cash App may request your name, address, date of birth, and other relevant details. It is crucial to provide genuine information to comply with their policies and prevent any suspicion of fraudulent activity.

Use One Account per User

Each individual should have only one Cash App account. Using multiple accounts for the same person is against Cash App’s terms of use and can lead to the closure of all related accounts. Additionally, avoid sharing your account credentials with anyone to maintain security.

Be Cautious with Transactions

Cash App is designed for legitimate transactions, so refrain from engaging in suspicious or illegal activities. Engaging in fraudulent or unauthorized transactions can lead to account closure. Ensure that your transactions involve individuals or entities that you trust.

Stay Away from Third-party Apps

Avoid using third-party applications or services that claim to enhance your Cash App experience. These apps might compromise your account’s security and violate Cash App’s terms of use. Stick to the official Cash App application for all your transactions.

Implement Two-Factor Authentication (2FA)

Enabling two-factor authentication adds an extra layer of security to your Cash App account. This feature requires you to provide a verification code in addition to your password, making it significantly harder for unauthorized individuals to access your account.

Regularly Update Your App

To benefit from the latest security enhancements, always keep your Cash App application updated to the latest version. Developers frequently release updates that include bug fixes and security patches, ensuring that your account remains secure.

Beware of Phishing Attempts

Phishing is a common tactic employed by cybercriminals to steal sensitive information. Be cautious of emails, messages, or links that ask for your Cash App login credentials or personal information. Always double-check the sender’s email address and avoid clicking on suspicious links.

Monitor Your Account Activity

Regularly review your transaction history to identify any unauthorized or unfamiliar transactions. If you notice any discrepancies, contact Cash App’s customer support immediately to report the issue.

Comply with Cash App’s Policies

Familiarize yourself with Cash App’s terms of service and acceptable use policies. Adhering to these guidelines will ensure that your account remains in good standing. Ignorance of these policies could inadvertently lead to account closure.

Contact Customer Support

If you encounter any issues or have concerns about your Cash App account, don’t hesitate to reach out to their customer support. They can provide guidance, address your concerns, and help you resolve any account-related issues.

Conclusion

Preventing account closure on Cash App involves a combination of responsible usage and adhering to the platform’s guidelines. By verifying your account information accurately, maintaining transaction integrity, and employing security measures like two-factor authentication, you can significantly reduce the risk of account closure. Staying informed about Cash App’s policies and promptly reporting any issues to customer support will contribute to a safe and seamless experience while using the platform.

0 notes

Text

B-u-yVerified Cash App Accounts

B-u-y Verified Cash App Cash App Accounts

Purchasing a verified Cash App Cash App account ensures secure transactions and reliable service. B-u-yers must navigate a trusted platform offering such a service.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

In today's digital age, the ability to transfer money quickly and safely is paramount for both personal and business transactions. A verified Cash App Cash App account provides this convenience with an added layer of security, making it an attractive option for users who prioritize their financial safety online.

Why Verified Cash App Cash App Accounts Matter

The moment you decide to use Cash App Cash App for transactions, you must consider verification. A verified Cash App Cash App account stands as a shield. It secures your money and personal data.

The Need For Verification

Verification is the first step to a safe experience. With a verified account, you unlock higher limits. You get access to additional features, too. Verification proves your identity, building trust with others.

Increased sending and receiving limits

Access to Bitcoin trading

Direct deposit eligibility

Risks Of Unverified Accounts

Using an unverified account is risky.

Risk Factor

Consequence

Low Transaction Limits

Limited Money Flow

No Direct Deposits

Lack of Essential Services

Risk of Closure

Loss of Funds

Susceptibility to Fraud

Financial Threat

Unverified accounts tempt thieves. They invite scams and frauds. Lower limits can also disrupt your spending. Lack of verification may lead to account closure, trapping your funds.

Getting Started With Cash App

Embracing the ease of online transactions gets even easier with Cash App. If you're trying to step up your financial game with convenience and security, getting started with a verified Cash App Cash App account is a smart move. We'll walk you through all you need to know, from initial setup to exploring those nifty features that make Cash App Cash App a go-to financial tool for many.

Initial Setup

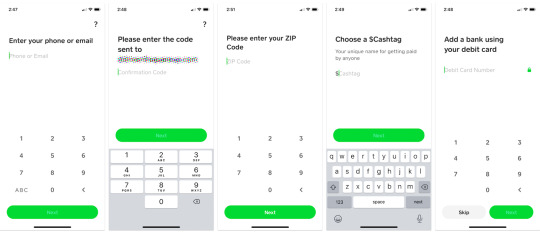

Setting up your Cash App Cash App account is as simple as pie. Download the app, enter your basic information, and you're halfway there. Follow these steps for a smooth start:

Download Cash App Cash App from your app store.

Open the app and enter your mobile number or email.

Enter the code sent to your phone or email.

Add your bank account for funding your Cash App Cash App balance.

Choose a unique $Cashtag, your identifier for transactions.

Account Features

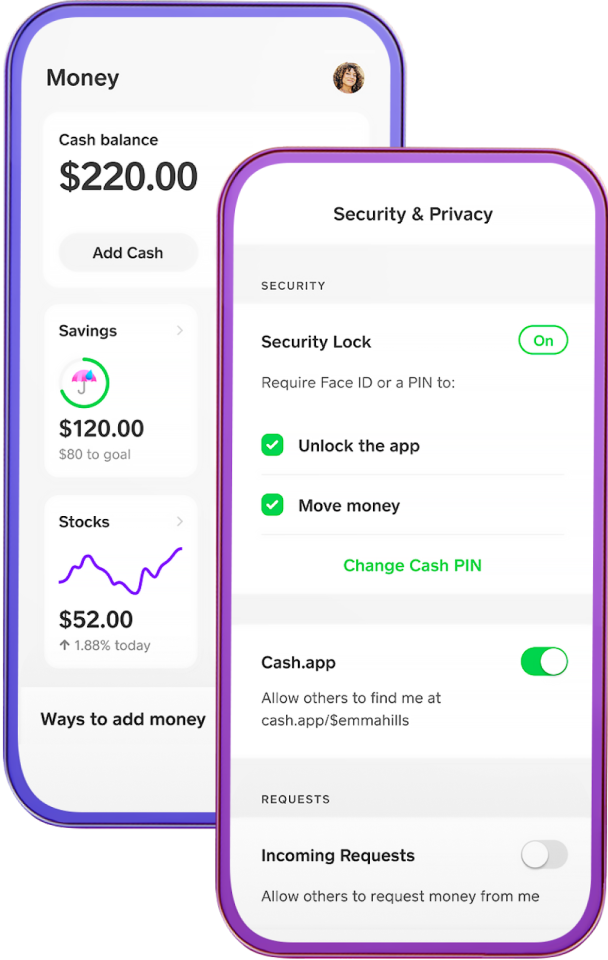

Your verified Cash App Cash App account comes with features that make money management a breeze. Let's check out the key benefits:

Feature

Description

Direct Deposit

Get paychecks delivered right into your account.

Instant Transfers

Send and receive money at lightning speed.

Cash Card

A personalized debit card for your spending needs.

Investment Options

B-u-y, sell, and hold Bitcoin or stocks, all from the app.

Free ATM withdrawals with direct deposits.

Customize your card's look for extra flair.

Robust security to keep your transactions safe.

Verification Process For Cash App

Cash App Cash App requires users to complete a verification process. This process keeps accounts secure. Verified accounts unlock additional features. Users can send and receive more money with a verified account. Get ready to enjoy the full Cash App Cash App experience!

Step-by-step Guide

Follow these simple steps to verify your Cash App Cash App Account:

Open your Cash App.

Tap the profile icon on your home screen.

Select Personal.

Enter your details: full name, date of birth, and the last 4 digits of your SSN.

Provide any additional information if asked.

Wait for the confirmation. This can take 24-48 hours.

Required Documentation

To complete verification, you need:

A government-issued ID.

Your Social Security Number (SSN).

Keep these documents handy for a smooth verification process.

Benefits Of A Verified Account

Many choose to B-u-y a verified Cash App Cash App account for good reasons. A verified status can transform how you use the platform.

Increased Limits

Verification bumps up your transaction limits. Unverified users hit limits quickly. Verified members enjoy more freedom.

Send more money weekly.

Withdraw higher amounts from ATMs.

No cap on receiving funds.

Feature

Unverified Account

Verified Account

Sending Limit

$250/week

$7,500/week

ATM Withdrawal

$250/day

$1,000/day

Wider Access To Features

Verification unlocks exclusive features. Your Cash App Cash App experience gets better.

Direct deposit payroll straight to Cash App.

Get a free custom Cash Card for spending.

Borrow money with Cash App Cash App Loan if eligible.

Verified users can also trade Bitcoin and stocks. This makes investing simple and accessible.

B-u-y Verified Cash App Cash App Accounts

Purchasing A Verified Cash App Cash App Account

Purchasing a verified Cash App Cash App account offers convenience for anyone wanting hassle-free transactions. It's crucial to follow the correct steps and know where to B-u-y. Awareness about potential scams is equally important to ensure a secure purchase.

Where To B-u-y

Finding a reputable source is the first step in acquiring a verified Cash App Cash App account. Look for platforms with positive feedback and a strong customer service record. Popular online marketplaces or fintech forums can be good starting points.

Check the marketplace's authenticity before any transaction.

Look for vendors who provide proof of verification.

Ensure they offer after-sale support.

Avoiding Scams

Stay vigilant to avoid falling victim to scams. Always perform due diligence before committing to a purchase. Remember these key tips:

Do not share personal information unless you trust the source.

Never make payments outside the official marketplace platform.

Ensure communication is documented for future reference.

Search for vendor reviews and feedback online.

Safety Measures For Transactions

When dealing with financial transactions, safety is key. Users often seek out verified Cash App Cash App accounts for increased security. Let's explore essential transaction safety measures.

Secure Payment Methods

Choosing the right payment method is crucial for safe transactions. Cash App Cash App offers several secure options:

Bank transfers – Link your account for easy transactions.

Debit cards – Use your card for swift payments.

Bitcoin – Benefit from the cryptocurrency option.

Enable two-factor authentication on your account. This step adds an extra layer of security.

Protecting Personal Information

Keep your personal details safe. Here are some methods:

Avoid sharing sensitive information like PINs or SSN.

Regularly update your app for the latest security features.

Monitor account activity. Report any suspicious behavior.

Remember, maintaining the confidentiality of your data helps prevent unauthorized access.

Prices For Verified Accounts

When shopping for a verified Cash App Cash App account, you'll notice diverse pricing options. These prices reflect the level of verification, the age of the account, and any additional features. Let's delve into what you might expect to pay and how to make an informed choice.

Understanding Market Rates

Understanding Market Rates

Market variations affect account prices. Seasoned accounts command higher prices. Embarking on a purchase starts with market rate awareness.

The table below provides a snapshot of current verified Cash App Cash App account rates:

Account Type

Price Range

Basic Verified

$50-$100

Premium Verified

$100-$200

Prices scale with features like transaction limits and support services. Keep this perspective to gauge offerings.

Comparing Sellers

Comparing Sellers

Compare sellers for the best deal. Evaluate their reputation, account quality, and customer feedback.

Reputation speaks volumes. Opt for sellers with proven track records.

Account Quality means fewer hurdles down the line. Seek high-quality accounts.

Customer Feedback reflects seller reliability. Positive reviews indicate trustworthy sellers.

Engage with sellers transparent about their prices and services. This approach prevents unforeseen expenses.

B-u-y Verified Cash App Cash App Accounts

Setting Up Your Purchased Account

Welcome to the ultimate guide on setting up your newly purchased verified Cash App Cash App account. Purchasing a verified account can fast-track your access to the robust features of Cash App, but it's crucial to get the setup right. In this segment, we'll guide you through essential steps to transfer ownership and customize account settings seamlessly.

Transferring Ownership

Ownership transfer is the first step after B-u-ying a Cash App Cash App account.

Receive account credentials from the seller securely.

Log in with the provided details.

Change all login information immediately.

Email and phone numbers must be updated to your own. This secures your access and ensures recovery is possible.

Navigate to settings for personal information updates.

Input your information to reflect the new ownership.

Complete these steps to legally own the account.

Customizing Account Settings

Customize settings to enhance security and user experience.

Enable security features like 2-factor authentication.

Link your bank account for seamless transactions.

Adjust privacy settings according to preferences.

Personalize your profile for a tailored Cash App Cash App experience.

Add a unique $Cashtag that represents you or your business.

Upload a personal or brand image.

Explore the app's features and settings for complete customization.

Maintaining Your Cash App Cash App Account

Keeping your Cash App Cash App account in good shape is essential.

Regular care prevents problems and keeps your account running smoothly.

Regular Updates

Keeping your app up to date is crucial.

Check for updates often.

Updates fix bugs and add features.

Updating is quick and keeps your account safe.

Verifying Continued Eligibility

Always make sure you are eligible to use your account.

Follow these steps:

Check Cash App Cash App rules yearly.

Ensure your information is current.

Provide required documents on time.

Troubleshooting Common Issues

Tackling problems with your verified Cash App Cash App account can sometimes be tricky. But don't worry about getting lost in technicalities. This guide simplifies some of the common hurdles you might face.

Login Problems

Can't access your account? Follow these steps:

Check your internet connection. A solid connection is crucial.

Verify your login details. Ensure your email and password are correct.

Update the app. An outdated app makes logging in harder.

Clear the cache. This fresh start could be the quick fix you need.

Contact support if nothing works. They'll help get you back in.

Transaction Errors

Seeing error messages during transactions?

Confirm your bank balance first. No funds, no transaction.

Check the recipient's details. Mistakes here cause errors.

Refresh the Cash App. Sometimes it just needs a quick reboot.

Look for app updates. Running the latest version prevents issues.

Still stuck? Reach out to Cash App Cash App support for precise solutions.

B-u-y Verified Cash App Cash App Accounts

Pros And Cons Of B-u-ying Verified Accounts

Many people want Cash App Cash App accounts that are ready to use. Some pick B-u-ying verified accounts. This way can be quick but has good and bad points.

Immediate Access

Get an account fast with B-u-ying a verified Cash App Cash App account. Just pay, and start using it. It saves time making one and waiting for checking your details.

No setup hassle: Skip steps like adding info.

Quick money moves: Send and get cash soon.

Full features: Get all that Cash App Cash App offers, right away.

Potential Risks

Risk

Explanation

Account bans

Rules say no to bought accounts. Cash App Cash App might close them.

Security fears

Accounts might not be safe. Hackers can steal info.

Costs more

You spend money for something normally free.

B-u-ying comes with risks. Know them before you decide.

Legal Considerations

Exploring the realm of digital finance invites one to consider the importance of legality. Specifically, when discussing B-u-y Verified Cash App Cash App Accounts, you cannot turn a blind eye to the legal boundaries that frame this digital landscape.

Platform Policies

First and foremost, Cash App Cash App a user-agreement that outlines permissible use cases. Users must understand these policies before creating or B-u-ying an account. Disregarding them can lead to account suspensions or legal consequences.

Account set up with real identity.

No fake details for verification.

One user per account stipulation.

Prohibition of resale or transfer of ownership.

Financial Regulations

Stringent laws govern financial platforms to prevent fraud and protect users. When purchasing verified Cash App Cash App accounts, remember:

Regulation

Requirement

Impact on Purchase

KYC Laws

Identity verification

Purchased accounts must have verifiable information

AML Directives

Prevention of money laundering

Accounts should have a clear transaction history

PCI DSS Compliance

Data security standards for payment cards

Ensures transaction data is protected

Remember, owning a Cash App Cash App account requires compliance with all local and international financial laws. It's not just about simple transactions but ensuring your activities are legal and secure.

B-u-y Verified Cash App Cash App Accounts

Cash App's Role In Digital Economy

The digital economy thrives on simplicity and trust in transactions. Cash App Cash App features heavily in this landscape with its streamlined approach to money management. Verified accounts on the Cash App Cash App platform signify a level of authenticity and security that is critical for users engaging in digital financial activities. These trusted accounts are cornerstones in the ever-evolving digital economy, enabling seamless peer-to-peer payments and reshaping how consumers handle their finances.

Mobile Payment Trends

Mobile payments are transforming how we transact. Services like Cash App Cash App are at the forefront, offering quick and secure ways to send or receive money. With the rise of smartphones, payment apps are becoming essential tools for the digital economy. They cater to a growing preference for digital wallets and tap-to-pay technology.

Increased mobile wallet adoption

Contactless transactions gaining ground

Preference for app-based financial services

Impact On E-commerce

Verified Cash App Cash App accounts influence e-commerce by providing a trusted payment option for online shoppers. Retailers now integrate these payment methods to capture more sales and improve customer experience.

Ease of checkout with one-tap payment

Secure transactions with verified accounts

Faster payments encourage repeat business

In summary, a robust digital economy relies heavily on platforms like Cash App, with verified accounts ensuring confidence in e-commerce and reflecting modern mobile payment trends.

Alternatives To B-u-ying Verified Accounts

Exploring Alternatives to B-u-ying Verified Accounts can be a safer path to managing finances online. Users often seek out verified Cash App Cash App accounts to bypass certain limits. Yet, this approach poses risks. Let's delve into legitimate and secure methods to access similar features without the risks involved in purchasing accounts.

Self-verification

Becoming verified on Cash App Cash App is straightforward. Input your SSN and personal info. Cash App Cash App then verifies your identity. Once verified, your account unlocks higher limits and additional features.

Other Payment Platforms

Many payment platforms exist. Each offers unique benefits and verification processes. Consider these popular alternatives:

PayPal: A well-known platform requiring user and bank account verification.

Venmo: Popular among friends for quick transfers after a user identity check.

Zelle: Integrates with bank accounts for instant, verified transactions.

Each platform secures your data and transactions reliably, negating the need to B-u-y accounts.

Platform

Verification Requirement

Features

PayPal

Linked bank, credit card

Global payments, B-u-yer protection

Venmo

Identity documents

Social sharing, fast transfers

Zelle

Direct bank linkage

Bank-level security, no extra app needed

User Reviews And Testimonials

Welcome to the realm of honest user feedback on Verified Cash App Cash App Accounts. Real people share their experiences. Their stories highlight the perks and downsides of these accounts. Dive in for some unfiltered opinions!

Success Stories

Real users share their joy:

Immediate setup: "I got my account in minutes!"

Smooth transactions: "B-u-ying and selling is now a breeze."

Top-notch security: "My money's safe and secure!"

These tales show happy users who enjoy their Verified Cash App Cash App experiences. They feel confident and satisfied.

Customer Complaints

Feedback isn't always sunny. Here are a few common gripes:

Support lag: "Help takes time to respond."

Verification hiccups: "The process was fussy for me."

Fees confusion: "I was unclear about some charges."

These reviews help paint a full picture. Knowing the issues others faced is helpful. You get to prep for potential hiccups ahead of time.

B-u-y Verified Cash App Cash App Accounts

Services Offered By Verified Accounts

Verified Cash App Cash App accounts unlock a world of financial possibilities. From seamless money transfers to investment options, these accounts offer a variety of services. Let’s dive into some of the key features that make verified accounts a must-have.

Direct Deposits

Enjoy the ease of getting payments straight into your account. With verified Cash App Cash App accounts, you can set up direct deposits for your paycheck or any other income.

Quick access to funds on payday

No waiting for check deposits

Direct deposit earnings early

Bitcoin Trading

Skip the complexity of traditional crypto exchanges. Verified accounts allow you to B-u-y and sell Bitcoin with just a few taps.

Bitcoin Trading Features

Simple B-u-y/sell interface

Safe storage of Bitcoins

Immediate trading option

Managing Finances With Cash App

Cash App Cash App revolutionizes money management. This digital wallet simplifies tracking expenses. It offers features like direct deposits and stocks. Users enjoy a seamless financial experience. B-u-y a verified Cash App Cash App account for this solution.

Budgeting Tools

Stay on top of spending with Cash App's budgeting tools. See where money goes at a glance. Create categories for rent, groceries, and more.

Visualize your finances through simple charts.

Set spending limits to prevent overspending.

Receive alerts for unusual activities.

Instant Payments

Send and receive money without delay using a Cash App Cash App account. Deal with emergencies or pay friends back instantly.

Feature

Description

Paycheck Deposit

Get salary straight into your Cash App.

Money Transfer

Move funds to others in seconds.

Cash Out

Withdraw to bank quickly.

The Future Of Verified Accounts

B-u-y Verified Cash App Cash App Accounts marks the beginning of safer, easier online transactions. Verified accounts mean trust and reliability. They represent a secure future for digital payments.

Technological Advancements

Verified accounts use the latest security features. These include fingerprint scanning and facial recognition.

New tech means fewer frauds. Users can trust accounts more.

AI monitors for unusual activity.

Encryption keeps information safe.

Verification is now quicker and smoother.

Predictions For Cash App

Experts predict big changes for Cash App. It's not just for sending money anymore.

Year

Prediction

2024

More users will have verified accounts.

2025

Cash App Cash App may introduce new cryptocurrency features.

2026

Payment verification might happen in seconds.

B-u-y Verified Cash App Cash App Accounts

User Security And Fraud Prevention

Keeping your finances secure online is vital. B-u-ying a verified Cash App Cash App account comes with robust security features for safe transactions. Let's delve into how Cash App Cash App ensures user security and fraud prevention:

Encrypted Transactions

Cash App Cash App uses advanced encryption to protect your data. Every purchase, transfer, or payment you make is secured. This means no prying eyes on your financial moves. Here are the essentials:

PCI-DSS level 1 certification keeps your information under wraps.

Automatic account logout after inactivity to prevent unauthorized access.

Data is sent over secure servers to block cyber threats.

Reporting Suspicious Activity

If you notice odd behavior on your account, you should act fast. Cash App Cash App has easy steps for reporting. This helps to clamp down on fraud swiftly. Follow these points:

Identify any unauthorized transactions.

Use the app to flag these for review.

Contact support immediately for help.

Remember, keeping your account safe also depends on your vigilance. Always check your transactions and keep your account information private.

Faqs For New Verified Account Owners

Welcoming new owners of verified Cash App Cash App accounts! This section aims to ease your journey. Curious about what comes next? We've compiled a list of frequently asked questions just for you. Quick, clear answers are right at your fingertips, guaranteeing a smooth start.

Common Questions Answered

Discover answers to top questions that new users often have:

What limits apply to my verified account? Verified accounts enjoy higher transaction limits.

Can I receive international payments? Yes, if Cash App Cash App supports payments in both countries.

Is customer support available 24/7? Cash App Cash App offers round-the-clock support for users.

How do I keep my account secure? Always enable two-factor authentication and never share your PIN.

What are Cash App's fees? Some services, like instant transfers, have small fees.

Tips For First-time Users

Get off to a flying start with these handy tips:

Explore the app to familiarize yourself with its features.

Connect a bank account for easy money transfers.

Verify your identity to unlock full benefits.

Test with small transactions to gain confidence.

Check out Cash Card to spend your Cash App Cash App balance.

Frequently Asked Questions For B-u-y Verified Cash App Cash App Account

What Is A Verified Cash App Cash App Account?

A verified Cash App Cash App account means it has passed additional identity checks. This ensures higher security and increased transaction limits. Verified users must provide full legal name, date of birth, and SSN.

Benefits Of B-u-ying A Verified Cash App Cash App Account?

B-u-ying a verified Cash App Cash App account gives instant access to higher transaction limits and other premium features without the normal waiting or verification hassles. It’s a quick solution for immediate financial activities.

How To B-u-y A Verified Cash App Cash App Account Safely?

To B-u-y safe, opt for credible platforms with positive user reviews and secure payment options. Always protect personal details and ensure a clear transfer of account credentials upon purchase.

Can You Legally B-u-y And Sell Cash App Cash App Accounts?

B-u-ying or selling Cash App Cash App accounts can violate Cash App’s terms of service. It’s important to review legal implications and Cash App’s policies before engaging in any transactions involving account sales or purchases.

Conclusion

Ensuring seamless transactions is pivotal in the digital age. Opting for a verified Cash App Cash App account can offer that tranquility. It streamlines your payments and secures your financial dealings. Remember, a verified account is more than convenience; it's your gateway to hassle-free digital finance.

Make the smart choice today. Embrace verified, embrace simplicity.

3 notes

·

View notes

Text

B-u-ying verified Cash App accounts is risky and often illegal. It's better to create and verify your own account.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

Verified Cash App accounts offer increased transaction limits and added security. Many users seek verified accounts for easier financial management. However, B-u-ying a verified account poses significant risks. These include potential scams, account closures, and legal repercussions. Always prioritize safety and legality by verifying your own Cash App account.

The verification process is straightforward and ensures your account remains secure. By doing so, you avoid the pitfalls associated with purchased accounts. Remember, maintaining control over your financial tools is crucial for security. Protect your financial information by adhering to legal methods. Creating and verifying your own account is the safest and most reliable option.

5 notes

·

View notes

Text

Recovering a Closed Cash App Account

Cash App is a popular mobile payment application that allows users to easily send and receive money with friends and family. However, there are times when a Cash App account may get accidentally or unexpectedly closed, leaving the user unable to access their funds and transaction history. If this happens, it's important to act quickly to try and recover the closed cash app account.

The first step is to try and determine why the Cash App account was closed in the first place. Cash App may close an account for a variety of reasons, such as suspected fraud, violating the app's terms of service, or if the account has been inactive for an extended period of time. Knowing the reason for the account closure will help guide the recovery process.

If the cash app account was closed due to suspected fraud, Cash App will require the user to provide additional verification and documentation to prove their identity before they can recover the account. This may include things like a government-issued ID, a recent utility bill, or bank statements. Cash App has a dedicated team that reviews these types of account recovery requests, so it's important to be patient and responsive during this process.

In cases where the cash app account was closed for violating the terms of service, the recovery process may be more difficult. Cash App takes these violations seriously and may be hesitant to reopen a closed account, even if the user claims it was an accident. The best approach is to thoroughly review the terms of service, identify where the violation occurred, and provide a clear and compelling explanation for why it won't happen again.

For accounts that were closed due to inactivity, the recovery process is usually more straightforward. Cash App may simply require the user to log back into the app and verify their identity to regain access to the account. However, it's important to note that any funds that were stored in the account may have been forfeited or sent to the appropriate state's unclaimed property division.

Regardless of the reason for the account closure, the key to successfully recovering a Cash App account is to be persistent, responsive, and provide all the necessary documentation and information requested by Cash App's support team. It's also a good idea to regularly monitor the account for any suspicious activity and to enable two-factor authentication to help prevent future closures.

In conclusion, recovering a closed Cash App account can be a frustrating and time-consuming process, but it is possible with the right approach. By understanding the reason for the account closure, providing the necessary documentation, and working closely with Cash App's support team, users can often regain access to their account and any funds that were stored within it.

Here are more details on the documentation required to recover a closed Cash App account:

When a Cash App account is closed, the user will typically need to provide a variety of documentation to prove their identity and ownership of the account in order to initiate the recovery process. The specific documentation required can vary depending on the reason for the account closure, but some common examples include:

Government-Issued ID: Cash App will almost always require the user to submit a copy of a valid government-issued photo ID, such as a driver's license or passport. This helps verify the user's identity.

2 notes

·

View notes

Note

Your latest ask about Prom and Gladio reminded me of a prompt I wanted to throw at you!

I’d love to see a written take on Noctis going through Pitioss. The player got to experience all the bullshit with a few lines from Noct, but I want to see what he was REALLY feeling while doing that dungeon. You can decide if he wins or says fuck it and gives up 😂😂

@seradyn OH LORD HAVE MERCY 😂😂😂 this was the ONE mission in the game I never completed. I spent 2 days at it and rage quit. NEVER AGAIN. Anyway, Noctis questioning his life choices coming right up!

The black hood shook in Noctis's grasp while he trembled. Even through the commotion of cheers and concern from his friends, Noctis didn't register a sound. A faint buzzing was all he could latch onto, followed by how the sun both felt welcoming and like an enemy at once.

Three days. He had spent Three days in what could only be described as the perfect hell. An endless menagerie of puzzles and traps at every corner and sight. Noctis lost count how many times a giant sphere almost ran him over. How on the second night he cried himself to sleep, wondering what sort of closure his friends would get if they could never find his corpse. How Eos would be doomed to calamity because he decided to screw off and perform a dangerous feat; all for some damned piece of cloth.

Noctis didn't know what he was expecting when he got to the end of the dungeon. There was no hidden knowledge acquired, no interesting artifacts, no treasure; just a rag of a hood and a window leading right back to where he started. The lackluster experience further added to his irritability while he clutched the hood and felt a strong temptation to rip it in half. He almost died for this thing, and the thought pissed Noctis off to no end.

"What did you see down there?" Ignis couldn't help but ask with excitement. His growing fascination with Ancient Solheim showed through his tone.

"What Ignis said!" Prompto chimed.

"By the ass of the Astrals, you look pale! Holy crap...you good, Noct?" Gladio raised a brow.

Noctis went neutral, his gaze poised on the Regalia straight ahead. He marched over to the car without a second thought, ignoring the confused glances his friends gave.

As soon as Noctis opened the door and slammed it behind him, be broke down. Crying hard into the black hood while the boys watched on from afar.

"Whatever he witnessed, it must've overwhelmed him with awe." Ignis murmured.

"I uh, don't think it's quite that..." Prompto chuckled nervously. "Um, should we go and check up on him?"

"No," Gladio shook his head and made a face. "That right there, is a man who has been broken down to where he's having an existential crisis. Let's give him some space."

"Considering the end game for Noct, that's messed up..." Prompto winced.

If you like my work and feel generous, feel free to donate to my ko-fi account or my cash app account!

Cash App: $JayRex1463

#drabbles#noctis lucis caelum#gladiolus amicitia#prompto argentum#ignis scientia#ffxv noctis#ffxv gladio#ffxv prompto#ffxv ignis#final fantasy xv#final fantasy 15#pitioss dungeon#more like pitty-ass dungeon#*insert Ardyn laughing his ass off in the distance at Noctis's expense*#ancient solheim

17 notes

·

View notes

Link

#bankaccount#bankaccountclosed#closeabankaccount#closeabusinessbankaccount#closebankaccount#closesbibankaccount#closedbankaccount#closingabankaccount#howtocloseabankaccount#howtoclosebankaccount#howtoclosebankaccountonline#whentocloseabankaccount

0 notes

Text

Cash App Closed My Account and Took My Money: What You Need to Know

Introduction

In recent years, Cash App has become a popular platform for transferring money quickly and conveniently. However, there are growing concerns among users who claim that Cash App closed their accounts and confiscated their funds. This issue can be distressing, especially if the money in question is crucial for personal or business needs. This article aims to provide a comprehensive guide on why Cash App closed your account, what you can do to retrieve your funds, and how to prevent this from happening.

Understanding Why Cash App Closes Accounts

Violation of Terms of Service

Cash App, like any other financial platform, has a set of Terms of Service (TOS) that all users must adhere to. Violating these terms can result in account suspension or closure. Common violations include:

Engaging in fraudulent activities: Any activity deemed fraudulent, such as creating fake accounts or engaging in scams, will lead to immediate account closure.

Suspicious transactions: Frequent or large transactions that trigger anti-money laundering alerts can lead to an account review and possible closure.

Linked accounts: Using the same bank account or card on multiple Cash App accounts can be seen as suspicious behavior.

Unverified Accounts

Cash App requires users to verify their identity to unlock full access to its features. If you fail to verify your account, your activities may be limited, and persistent use without verification can lead to cash app account closed.

Chargebacks and Disputes

If you frequently dispute transactions or request chargebacks, Cash App might view your account as high risk and opt to close it to mitigate potential losses.

What to Do If Cash App Closes Your Account

Contact Customer Support

If your cash app account has been closed, the first step is to contact Cash App Customer Support. Provide all necessary details, including your account information and any relevant transaction IDs. Be prepared to answer questions and provide identification to verify your claim.

Submit a Complaint

If contacting customer support does not resolve the issue, you can file a complaint with the Better Business Bureau (BBB) or the Consumer Financial Protection Bureau (CFPB). These agencies can sometimes expedite the resolution process.

Legal Action

In extreme cases where significant amounts of money are involved, you might consider seeking legal advice. An attorney specializing in financial disputes can provide guidance on whether you have a viable case and help you navigate the legal process.

Preventing Account Closure

Follow the Terms of Service

The simplest way to avoid cash app closing account is to adhere strictly to Cash App’s Terms of Service. Familiarize yourself with these terms and ensure that all your transactions comply with them.

Verify Your Account

Ensure your account is fully verified. This includes providing your full legal name, date of birth, and the last four digits of your Social Security Number (SSN). Verifying your account can reduce the likelihood of it being flagged for suspicious activity.

Monitor Your Transactions

Keep an eye on your transaction history for any irregularities. Report unauthorized transactions immediately to avoid having your account flagged for unusual activity.

Avoid Frequent Chargebacks

While disputes are sometimes necessary, frequent chargebacks can raise red flags. Try to resolve transaction issues directly with the other party before resorting to filing disputes through Cash App.

Understanding Your Rights

Fund Recovery

According to U.S. financial regulations, users have the right to recover their funds if a cash app account is closed. Understanding your rights can help you navigate the recovery process more effectively.

Regulation E

Under Regulation E of the Electronic Fund Transfer Act (EFTA), financial institutions must provide certain protections to consumers. If you believe Cash App has violated these regulations, you may have grounds to file a formal complaint.

Alternatives to Cash App

If you find Cash App’s policies too restrictive or unreliable, consider using alternative platforms. Some popular alternatives include:

Venmo: Known for its social media-like interface and ease of use.

PayPal: Offers robust buyer and seller protections and is widely accepted.

Zelle: A quick and secure way to send money directly between bank accounts.

Conclusion

Having your Cash App account closed and funds confiscated can be a frustrating experience. However, by understanding the common reasons for account closure and taking proactive steps to ensure compliance with Cash App’s policies, you can minimize the risk of encountering these issues. If your cash app account is closed, swift action and knowledge of your rights can help you recover your funds.

For those who have had persistent issues with Cash App, exploring alternative financial platforms might provide a more reliable solution.

0 notes

Text

Why did Cash App lock my account?

Have you ever experienced the frustration of logging into your Cash App account only to find it unexpectedly locked? If so, you're not alone. Many Cash App users have encountered this issue, leaving them bewildered and searching for answers. In this comprehensive guide, we'll delve into why your Cash App account might be locked seemingly out of the blue and provide actionable steps to resolve the issue. So, let's unravel why your Cash App account locked and what you can do to regain access to your funds.

Understanding Why Cash App Accounts Get Locked:

Cash App takes the security of its users' accounts seriously. Therefore, if suspicious activity is detected, such as unauthorised transactions or multiple failed login attempts, Cash App may temporarily lock your account to prevent fraud and protect your funds.

In some cases, Cash App may require additional verification to confirm your identity. If you fail to promptly provide the necessary verification documents, your account may be locked until the verification process is complete.

Suppose you violate Cash App's terms of service by engaging in prohibited activities, such as using the platform for illegal transactions or violating community guidelines. Your account may be subject to suspension or permanent closure in that case.

Unusual account activity, such as sending or receiving large sums of money quickly, may trigger Cash App's fraud prevention measures, leading to temporarily locking your account until the activity can be reviewed.

How to Unlock Your Cash App Account?

Contact Cash App Support: If your Cash App account locked with money, the first step is to contact Cash App support for assistance. You can contact them through the app or email to explain your situation and request help unlocking your account.

Verify Your Identity: If your account was locked due to verification issues, follow the instructions provided by Cash App to complete the verification process. This may involve submitting a photo ID and other documents to confirm your identity.

Review Account Activity: Take a closer look at your recent account activity to identify suspicious transactions or unusual behaviour. If you notice any unauthorized activity, report it to the Cash App immediately to expedite the resolution process.

Follow Security Best Practices: To prevent future account lockouts, follow Cash App's security recommendations, such as using strong, unique passwords, enabling two-factor authentication, and keeping your account information current.

Frequently Asked Questions (FAQs):

Q: Why did Cash App lock my account with money in it?

A: Cash App may lock your account with money as a precautionary measure if suspicious activity is detected or there are concerns about the security of your account. Rest assured that Cash App takes the necessary steps to protect your funds and prevent unauthorized access.

Q: How long does it take for Cash App to unlock your account?

A: The time it takes to unlock Cash App account may vary depending on the reason for the lock and the required verification process. In most cases, Cash App aims to resolve account lockouts as quickly as possible, but it may take several business days for the issue to be fully resolved.

Q: Can I still receive money if my Cash App account is locked?

A: If your Cash App account is locked, you may still receive money, but you can only access or withdraw funds from your account once it's unlocked. However, any incoming payments will be securely held in your account until you regain access.

Conclusion:

In conclusion, when Cash App locked account it can be a frustrating experience. Still, it's essential to understand that Cash App takes security seriously and employs measures to protect your funds from unauthorised access. Following the steps outlined in this guide and contacting Cash App support for assistance, you can proactively resolve the issue and regain access to your account. Remember to stay vigilant and follow best practices for account security to minimise the risk of future lockouts.

#Cash App account locked#Cash App account locked with money#Cash App account temporarily locked#why Cash App locked your account#how to unlock Cash App account

0 notes

Text

Streamlining Finances: A Guide on How to Delete Cash App Account on Facebook

In the digital age, managing financial transactions through mobile apps has become commonplace. If you're looking to declutter your digital footprint and wondering how to delete Cash App account, especially if it's linked to Facebook, this guide will walk you through the process.1. Accessing Your Cash App AccountBefore initiating the deletion process, ensure you have access to the Cash App account you wish to delete. Open the Cash App on your mobile device and log in with the associated credentials.2. Navigate to SettingsWithin the Cash App, locate the "Profile" icon or the three horizontal lines in the bottom right corner. This will lead you to the main menu. From there, select "Settings," typically represented by a gear or cog icon.3. Locate Account SettingsOnce in the Settings menu, navigate to "Account Settings" or a similar option. Here, you may find various account-related configurations and preferences.4. Deactivation or Close Account OptionLook for an option that allows you to either deactivate or close your account. The wording may vary, but the intent is to disable or delete your Cash App account.5. Follow the PromptsUpon selecting the account deactivation or closure option, the app will likely prompt you with additional instructions or warnings. Carefully read through these prompts to understand the implications of deleting your Cash App account.

0 notes

Text

Most common reasons why is your Cash App account closed?

Cash App is one the most popular digital payment app among millions of smartphone users. It allows you to send money, receive it, and manage your account with just a couple of taps. Cash App is a convenient app, but some users find that their account has been closed unexpectedly. Your Cash App account closed due to several reasons. These include violating the Terms of Service, engaging in suspicious or unauthorized activities, having verification issues, and suspicions of money laundering. A notification will usually be sent with specific instructions for what to do after an account is closed. Cash App may have closed your account due to a violation of their terms and conditions.

Cash App will ask you to follow their instructions and provide documentation, such as your transaction history or proof of identification. This will ensure that your account is treated fairly and impartially. Let's start by learning about the most common reasons why did my Cash App get closed. We will also discuss what you can do if this happens to your account and how to avoid it in the future.

Why Your Cash App Account Was Closed?

Cash App aims to offer a smooth and secure financial experience to its users. However, Cash App accounts can be closed for a variety of reasons which are mentioned below:

Cash App account closed for violating terms of service. This includes fraud, the use of false identities or illegal transactions. Accounts may be immediately closed and funds seized if someone violates the rules.

Cash App accounts can also be closed if they are suspected of being used to gamble. This is a violation of their terms of service agreement, and it allows them to close any suspected account of gambling activity.

Cash App's policy is to close any account that has been dormant or inactive for an extended period. This ensures users are active on the platform.

Cash App monitors account activity closely to detect signs of fraudulent or suspicious behaviour. Cash App may close your account if it is flagged as having unusual activity. This will protect you and the platform.

Cash App's security measures require users to confirm their identity. Your account could be closed if you do not complete the verification process or provide incorrect information.

Excessive chargebacks can cause account closure. These occur when customers dispute transactions through their bank and request refunds. Cash App may consider many chargebacks to be a sign that the platform is being abused or fraud.

How to Avoid Cash App Account Closed?

Cash App users are often in the unfortunate situation of having their accounts closed. This can be frustrating and confusing if they still have money in it. Do not worry: you can recover your money with the right knowledge. It is essential to follow the Cash App's guidelines and terms of service to avoid frustration and inconvenience. Here are some helpful tips to prevent account closed issues on Cash App:

Cash App will only allow you to keep your account operational if you adhere to the terms of service. For example, using Cash App to fund gambling activities is against their rules and could result in its closure. Other instances include unapproved behaviour, identity verification problems and suspicious behaviours.

If you have a Cash App account closed with money that was intended to be there, your first step should always be to contact customer service to explain the situation and get clarification. If an account is closed for violating the terms of service or due to fraud, all funds will be returned.

Cash App should be notified immediately if you notice any suspicious or unauthorized transactions.

Avoid engaging in prohibited activity such as fraud, money laundering or excessive chargebacks.

Cash App customer support takes all allegations of fraud or illegal activity seriously and will work hard to resolve any issues quickly. Please follow their instructions, including completing any requests for identity verification and documents. Also, be sure to review your account activity regularly and report any suspicious or unauthorized transactions.

0 notes

Text

Salaried Loan With Instant Approval From ATD Money

Salaried Personal Loans are an unsecured form of credit that can be availed by salaried professionals. They are easy to obtain and come with flexible repayment terms.

The eligibility criteria for a Salaried Loan depends on various factors including your location, income, employer’s reputation, existing debt, etc. However, you can enhance your chances of approval by reducing your debt-to-income ratio, paying your existing EMIs on time, and improving your creditworthiness.

How to Apply for a Salaried Loan?

A salaried personal loan is an unsecured debt that you can avail of to meet your short-term financial requirements. It is a great option to consider in case you are facing unexpected expenses that cannot wait until your salary gets credited. In addition, a personal loan for salaried individuals is easier to obtain and offers competitive interest rates compared to other types of loans.

To apply for a Salaried Loan with instant approval, you will need to submit some basic documents, including your recent bank statement, proof of income, and employment details. The application process is quick and hassle-free, and you can get a fast turnaround time once all of your documents have been verified. The maximum amount that you can borrow is based on your current monthly income, and some lenders may have minimum and maximum loan amounts in place.

Some of the common uses for a Salaried Loan include covering medical emergencies, home renovations, credit card repayments, or financing weddings. However, it is important to keep in mind that salary advance loans typically carry high interest rates and can harm your credit score if you fail to repay the loan on time. Hence, it is essential to only take out such loans when necessary and for the right reasons.

Several lenders offer Salaried Loans, and they each have different terms and conditions. You should compare these terms to find the best one for your needs. The lender you choose should also offer competitive interest rates and flexible repayment options. Additionally, they should report your repayment history to the credit bureaus, which can help improve your credit score over time.

Besides these, some lenders offer additional features such as zero or minimal closure charges and prepayment options. The best lenders will also have an easy-to-use online application that can help you complete the process quickly and efficiently. They will also have customer support available to answer any questions you might have. It is essential to research the options available to find the best lender for your needs.

Eligibility

ATD Money is committed to transforming the lives of millions of people by making the loan approval process as simple as possible. It offers a variety of financial solutions that can be tailored to fit the needs of working professionals, and its services are available online and through a mobile app. Its specialized products include personal loans and salary advance loans.

These types of loans are typically short-term, and the lender will deposit the money into the customer's bank account as soon as it has been approved. They are popular with people who need a quick cash advance, and they can be used to cover unexpected expenses until the next paycheck arrives. However, it is important to research different lenders before applying for a loan. It is also recommended to keep a good credit score, as this will improve your chances of being approved for a loan.

Unlike payday loans, salaried loans are regulated and offer lower interest rates. They are also available to most people without the need for a guarantor or credit check. Additionally, they are usually repaid every month, so you don't have to worry about repayment fees or late payments. Moreover, the application process is completely online and can be completed from any device with an internet connection.

Another benefit of a salaried loan is the fact that it can be approved with poor credit. It is important to note, however, that this type of loan has a high-risk factor and may affect your credit rating negatively. Despite this, it is still worth applying for a salaried loan if you need money quickly. The lender will take into account your employment history and income to determine if you are eligible for the loan.

ATD Money is a lending platform that provides instant salary advance loans to salaried employees in India. It uses its proprietary technology to facilitate loan disbursement from its NBFC partners according to the terms agreed upon by both parties. Its loan applications are easy to fill out and can be completed in minutes from a smartphone. The company has a proven track record of delivering quality service to customers, and it works within the law to ensure that its customers are treated fairly.

Interest Rates

If you’re a salaried individual, a Personal Loan with instant approval from ATD Money can provide the funds you need to meet unexpected expenses. The lender offers competitive interest rates and flexible repayment terms, so you can manage your debt without incurring additional costs. However, you should always compare rates and fees before applying for a personal loan. You’ll also want to check your credit score before making a decision.

The lender also offers other types of loans, such as payday and cash advance loans, which are designed for salaried employees who need extra funds for unforeseen expenses. These loans are unsecured and usually have lower interest rates than other types of debt. In addition, they can be approved quickly and are available online or at retail locations.

ATD Money provides a variety of different financing options, including personal loans for people with bad credit. The company focuses on transforming the lives of customers by simplifying the loan process and offering quick approvals. Its website is easy to navigate and includes a comparison tool that allows customers to compare loan prices and monthly payments. The company’s customer service representatives are available by phone, email, or live chat.

To get a personal loan from ATD, you’ll need to verify your income, submit documents like pay stubs, and provide a valid form of ID. You’ll also need to have a direct deposit account with a financial institution and agree to make regular payments. After you’ve been approved, you’ll receive the funds in your bank account as soon as the next business day.

ATD Money is one of the leading micro-finance lenders in India. They have been able to transform the lives of many Indians by offering them financial help. The company’s mission is to help people achieve their dreams by providing them with the money they need. The best part is that the company doesn’t charge high-interest rates, which makes it a great option for those with bad credit or no credit. The company’s team is dedicated to providing the highest level of customer service, and they work hard to make their services affordable for everyone.

Repayment Tenure

Salaried people can use personal loans to meet various financial requirements, including home renovations, paying off existing debt, and funding children’s education. These loans are often unsecured, meaning they do not require collateral such as your house or car. However, it is important to understand the terms of a personal loan before applying for one. For example, you should know what the minimum repayment term is and what the maximum repayment term is. This will help you choose a repayment period that fits with your budget and goals.

You may also want to consider a flexible loan option, which allows you to pay only the interest on your loan for a set amount of time. This can be a great way to manage your finances if you are struggling with payments or need extra cash flow for unforeseen expenses. However, you should be aware that this type of loan has a higher interest rate than conventional loans.

Another way to manage your loan repayments is to use a personal loan EMI calculator. This free tool helps you calculate your monthly EMIs and determine the best loan tenure for your situation. It will also help you avoid over-borrowing or under-borrowing by showing you the impact of different repayment periods on your total cost of credit.

ATD Money is a microfinance lender that offers several types of payday and salary advance loans to salaried workers in India. The company was founded in 2018 and has a large team of customer-facing employees. Its goal is to improve the lives of its customers through financial services. In addition to providing payday and salary advances, the company also offers a range of other financial services, such as unsecured business loans. It is a member of the Financial Conduct Authority (FCA).

#payday loans#quick cash loans#personal loans#instant loan#cash loans#loan app in india#payday loans in india#advance salary loan#fast cash loans online#loan apps

0 notes

Text

B-u-y Verified Cash App Accounts: Your Key to Secure Transactions

B-u-ying verified Cash App accounts is risky and often illegal. It's better to create and verify your own account.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

Verified Cash App accounts offer increased transaction limits and added security. Many users seek verified accounts for easier financial management. However, B-u-ying a verified account poses significant risks. These include potential scams, account closures, and legal repercussions. Always prioritize safety and legality by verifying your own Cash App account.

The verification process is straightforward and ensures your account remains secure. By doing so, you avoid the pitfalls associated with purchased accounts. Remember, maintaining control over your financial tools is crucial for security. Protect your financial information by adhering to legal methods. Creating and verifying your own account is the safest and most reliable option.

The Rise Of Cash App In Digital Transactions

In recent years, Cash App has revolutionized digital transactions. This platform has made sending and receiving money easier than ever. People now prefer Cash App for its simplicity and speed. But what led to its meteoric rise in the world of digital payments?

Popularity Of Peer-to-peer Payment Systems

Peer-to-peer (P2P) payment systems have gained immense popularity. These systems allow people to transfer money directly to one another. There are no intermediaries involved. This makes transactions faster and more convenient.

Cash App stands out among these P2P systems. It offers more than just basic money transfers. Users can also B-u-y and sell Bitcoin, invest in stocks, and even get a virtual debit card. This versatility has contributed to its widespread adoption.

Below is a table illustrating the features that make Cash App unique:

Feature

Description

Money Transfers

Send and receive money instantly

Bitcoin Transactions

B-u-y, sell, and hold Bitcoin

Stock Investments

Invest in stocks with no commission fees

Virtual Debit Card

Use a virtual card for online purchases

Cash App's Impact On Financial Exchange

Cash App has significantly impacted the way people handle money. Traditional banking methods are often slow and cumbersome. Cash App offers a faster alternative. This has led to a shift in how people manage their finances.

Many users find Cash App more reliable for daily transactions. The app's security measures also ensure peace of mind. Encryption technology protects user data, making transactions secure.

Here's a list of ways Cash App has changed financial exchange:

Speed: Instant transfers save time.

Convenience: Easy to use interface.

Security: Advanced encryption protects data.

Versatility: Multiple financial services in one app.

These features make Cash App a preferred choice for many. As its popularity grows, so does its impact on digital transactions.

Why Verified Accounts Matter

In today's digital age, financial transactions happen online. Verified Cash App accounts ensure that these transactions are secure and reliable. A verified account means trust and authenticity, reducing risks for users.

Security In Digital Payments

Security is critical in digital payments. With a verified Cash App account, you get higher protection against fraud. Verified accounts go through identity checks, making it safer for transactions.

Below is a table showing the security features for verified and unverified accounts:

Features

Verified Account

Unverified Account

Identity Checks

Yes

No

Transaction Limits

Higher

Lower

Fraud Protection

Enhanced

Basic

Benefits Of Having A Verified Status

Verified status on Cash App brings many benefits. Here are some key advantages:

Higher Transaction Limits: Send and receive more money.

Enhanced Security: Protect your funds with better security measures.

Credibility: Gain trust from others when making transactions.

With these benefits, using a verified Cash App account becomes a seamless experience. For those who often deal with money transfers, having a verified account is a must.

The Verification Process Explained

Understanding the verification process for Cash App accounts can help you ensure your transactions are secure. Verified accounts offer several benefits, including increased transaction limits and added security features. Let's dive into the steps to verify your Cash App account and address common hurdles you might face.

Steps To Verify Your Cash App Account

Open the Cash App: Launch the Cash App on your mobile device.