#Cellular M2M connectivity

Explore tagged Tumblr posts

Text

Forecast Unveiled: CAGR of 20.4% Propels Cellular M2M Market to US$ 20.9 Billion by 2023

The size of the global cellular M2M connections and services market is anticipated to propel at a CAGR of 20.4% from 2023 to 2033. By 2023, its value is anticipated to reach US$ 20.9 billion.

By 2033, the market for cellular M2M connections and services is expected to reach a value of about US$ 134 billion. From 2023 to 2033, it is projected to expand to have a real financial potential of US$ 113.1 billion.

Through 2033, it is expected that countries in North America, such as Canada and the United States, will dominate the market for cellular M2M connections and services. The ongoing development of telemedicine and remote patient monitoring in these nations is anticipated to push demand. These new services frequently use real-time data and transmit the same between medical equipment and healthcare specialists, necessitating M2M connections.

Elevate Your Understanding: Get Your Valuable Sample Here: https://www.futuremarketinsights.com/reports/sample/rep-gb-17952

Several health insurance companies in North America might also employ cellular M2M connections and services to track policyholders’ health. Delivering personalized incentives and insurance policies for leading healthy lives can be done using the data provided.

North America is also projected to be a leading hub for clinical trials and medical research. As these would be required to transmit and gather information from participants, the need for cellular M2M connections and services might increase. Researchers can use these services to assess patient health and medication efficacy remotely.

Demand in Asia Pacific is projected to increase as wearable technology for health monitoring becomes more widely accepted. There has been an increase in the release of new smartwatches and fitness trackers that can record information on activity levels, heart rate, and sleep habits.

The need for cellular M2M connections and services is anticipated to increase due to the growing popularity of smartwatches in China, India, and Japan. These could send real-time data to mobile applications and medical personnel. Healthcare practitioners might create individualized treatment plans and enable remote patient monitoring with cellular M2M connections.

As the number of seniors increases, there will likely be a greater demand for aged care services across Asia Pacific. It is anticipated that GPS-enabled watches and wearable fall detection systems will be used to monitor the whereabouts and well-being of elderly patients. As a result, makers of wearable technology are turning to cellular M2M connections to relay location information and alarms to caregivers or emergency personnel.

Key Takeaways from Cellular M2M Connections and Services Market Study

The global cellular M2M connections and services industry grew at a decent CAGR of 25.4% in the historical period from 2018 to 2022.

The United States is projected to exhibit a CAGR of 20.3% in the forecast period.

China is likely to reach a valuation of US$ 20.9 billion by 2033 in the cellular M2M connections and services industry.

In terms of organization size, the large enterprises segment is set to showcase a CAGR of 20.2% in the assessment period.

Based on end-users, the transportation & logistics segment expanded at an average CAGR of 25.1% between 2018 and 2022.

“By 2033, it is anticipated that both developed and emerging nations will experience a rise in traffic control-related challenges. Several nations invest large sums in creating smart cities to ease traffic congestion and improve traffic management. Adoption is anticipated to be supported by cellular M2M connections’ and services’ capacity to enhance traffic flow, reduce traffic congestion, and improve urban mobility.” – opines Sudip Saha, managing director and MD at Future Market Insights (FMI) analyst.

Access the Complete Report Methodology Now: https://www.futuremarketinsights.com/request-report-methodology/rep-gb-17952

Competitive Landscape

Players in the cellular M2M connections and services market concentrate on developing and expanding their networks to lower latency, improve dependability, and provide extensive coverage. By developing 5G networks, they are also delivering tremendous bandwidth, making them perfect for M2M connections.

Customers should be very worried about security while using M2M applications. As a result, renowned corporations plan to spend a lot of money creating top-notch security software to safeguard devices and data. They are acquiring security certificates and providing encryption and authentication technologies.

For instance,

In July 2023, Soracom introduced a cutting-edge cellular data package to help European entrepreneurs and SMBs deploy connected goods and services more quickly while keeping data prices low. Soracom’s Plan X3-EU offers a simple, affordable M2M sensors and devices solution.

Bharti Airtel announced in October 2022 that the ‘Always On’ IoT connectivity technology would be introduced in India. An IOT device can constantly maintain a mobile network connection from multiple Mobile Network Operators (MNOs) through an eSIM thanks to the dual profile M2M eSIM.

Restraints:

Despite the promising outlook, challenges do exist. Concerns regarding data security and privacy in M2M applications need to be addressed. Additionally, the cost of implementing M2M solutions and the need for skilled professionals may hinder market growth.

Region-wise Insights – Category-wise Insights:

The regional dynamics of the Cellular M2M Connections and Services Market vary, but each region is contributing to its expansion. North America is prominent in healthcare and automotive applications, while Europe excels in smart city implementations. Asia-Pacific shows immense potential for agriculture and manufacturing M2M solutions.

Drive Your Growth Strategy: Purchase the Report for Key Insights: https://www.futuremarketinsights.com/checkout/17952

Global Segmentation of Cellular M2M Connections and Services Market

Cellular M2M Connections and Services Market by Organization Size:

Large Enterprises

SMEs

Cellular M2M Connections and Services Market by End-User:

Transportation & Logistics

Energy & Utilities

Manufacturing

Healthcare

Others

Cellular M2M Connections and Services Market by Region:

North America

Latin America

Western Europe

Eastern Europe

South Asia and Pacific

East Asia

Middle East and Africa

0 notes

Text

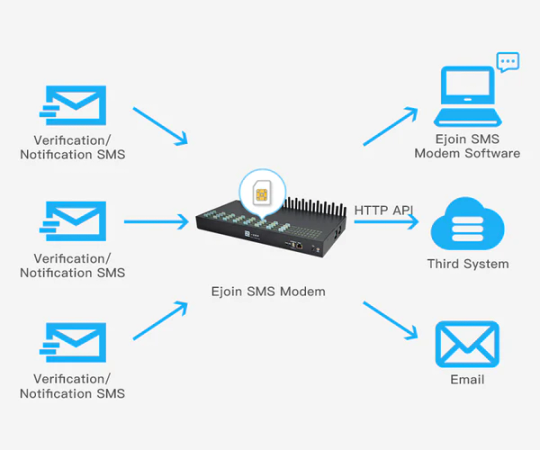

What is the use of SMS modem ?

An SMS modem is a device that enables computers and other electronic devices to send and receive SMS messages over a cellular network. It typically connects to a computer via a USB or serial port and utilizes a SIM card to establish a connection with the cellular network. SMS modems are frequently employed in applications where automated or bulk SMS message transmission and reception are required.

Here are some common applications of SMS modems:

Two-factor authentication: SMS modems can be used to send one-time passwords (OTPs) to users for two-factor authentication. This enhances security by requiring both a password and access to the user's phone for login.

Remote monitoring: SMS modems can transmit alerts and notifications from remote devices, such as sensors or alarms. This facilitates monitoring equipment in remote locations or receiving security breach alerts.

Bulk SMS messaging: SMS modems enable sending bulk SMS messages for marketing or notifications. This efficiently reaches a large audience compared to individual messages.

M2M (Machine-to-Machine) communication: SMS modems facilitate communication between machines, such as vending machines or ATMs. This enables status updates, command reception, or action triggering.

SMS voting and polling: SMS modems can collect votes or poll responses from a large population. This aids surveys, elections, or other feedback gathering methods.

SMS modems are versatile tools for SMS communication, with diverse applications in telecommunications, security, marketing, and automation.

2 notes

·

View notes

Text

5G NTN Market Size, Share, Growth Analysis, Forecast, and Trends to 2032

The 5G NTN Market was valued at USD 5.5 Billion in 2023 and is expected to reach USD 77.9 Billion by 2032, growing at a CAGR of 34.14% from 2024-2032.

The 5G Non-Terrestrial Network (NTN) market is witnessing exponential growth as it reshapes global communication infrastructure. Integrating satellite and airborne platforms with terrestrial 5G, NTNs promise unprecedented coverage, bridging the digital divide across remote and underserved areas. Major technology firms and telecom operators are investing heavily in NTN solutions to power industries like maritime, aviation, defense, and emergency services, where terrestrial networks fall short. This global push is further fueled by rising demand for real-time data, low latency, and seamless mobility across geographies.

5G NTN Market Transforming traditional limitations, 5G NTN enhances connectivity through a seamless blend of satellite and terrestrial systems. It empowers a broad range of applications—from autonomous transport to remote healthcare—bringing ubiquitous, resilient, and scalable communications to the forefront. This fusion is instrumental in the rollout of future-ready networks, enabling countries and enterprises to boost digital infrastructure and achieve economic and technological advancements.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/5978

Market Keyplayers:

SpaceX – Starlink

OneWeb – OneWeb LEO Satellite Network

Telesat – Lightspeed Constellation

Amazon (Project Kuiper) – Kuiper Satellite System

AST SpaceMobile – BlueWalker 3

SES S.A. – O3b mPOWER

Eutelsat – EUTELSAT KONNECT VHTS

Inmarsat (Viasat Inc.) – ORCHESTRA Network

Thales Group – Thales Alenia Space SATCOM Solutions

Lockheed Martin – Pony Express 1

Hughes Network Systems – Jupiter 3 Satellite

Nokia – Nokia AVA for NTN

Ericsson – Ericsson 5G Core for NTN

Huawei – 5G NTN Integrated Solutions

Intelsat – FlexMove Connectivity

Market Analysis

The global 5G NTN market is characterized by intense innovation and strategic collaborations. Key players are entering partnerships with satellite operators, device manufacturers, and governments to accelerate the deployment of NTN-enabled services. The competitive landscape is dynamic, with startups and legacy firms racing to launch Low Earth Orbit (LEO) satellite constellations and integrate AI-based traffic and signal management. Regulatory progress across regions is also accelerating the time-to-market for NTN solutions.

The market is being shaped by various use cases across sectors such as aerospace, transportation, agriculture, mining, and defense. Demand for reliable, always-on connectivity is a strong catalyst, particularly in geographically challenged areas like rural zones, oceans, and disaster-hit regions. Government initiatives for rural broadband and smart infrastructure are significantly driving adoption.

Market Trends

Integration of LEO satellites with 5G terrestrial networks

Growth in IoT and M2M applications via NTN infrastructure

Emergence of hybrid networks combining air, ground, and sea coverage

Partnerships between telecom providers and space tech firms

Focus on energy-efficient NTN hardware and network sustainability

Regulatory frameworks being adapted to enable commercial NTN use

Increased use of AI and edge computing in NTN systems

Market Scope

Global Reach: Expands high-speed connectivity to the most inaccessible terrains

Emergency Services: Ensures robust communication during natural disasters

Autonomous Systems: Enables operation of drones, vehicles, and machinery in remote areas

Maritime & Aviation: Delivers uninterrupted coverage over sea and air routes

Government & Defense: Secures mission-critical and surveillance communications

The scope of the 5G NTN market is vast and transformative, impacting industries that rely on connectivity beyond traditional cellular networks. Its cross-sectoral applications position it as a pivotal enabler of Industry 4.0 and next-generation digital infrastructure.

Market Forecast

The market is projected to grow rapidly over the coming years, driven by the confluence of satellite advancements, 5G proliferation, and the demand for resilient, global connectivity. Continuous innovation in satellite technology, cost-effective deployment strategies, and international collaborations are expected to fuel this momentum. As commercial launches accelerate, NTN is set to become a cornerstone of next-generation telecommunications, complementing terrestrial 5G to provide truly borderless network access.

Access Complete Report: https://www.snsinsider.com/reports/5g-ntn-market-5978

Conclusion

The 5G NTN market is not just a technological leap—it is a bridge to an interconnected future where no location is left behind. As it continues to mature, it will redefine how businesses, governments, and individuals communicate across the globe. With strategic foresight and global collaboration, 5G NTN stands as the next frontier of wireless innovation, promising an inclusive, always-connected world that meets the evolving needs of the digital age.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

0 notes

Text

5G NTN Market Intelligence Report: Key Drivers, Restraints & Opportunities

Introduction

As the global digital ecosystem evolves, connectivity is becoming as essential as electricity. While terrestrial 5G networks have already begun transforming industries through ultra-low latency and blazing-fast speeds, there are still major gaps in coverage — especially in remote, rural, or maritime areas and across air and space. To close this connectivity gap, the industry is turning to 5G Non-Terrestrial Networks (NTN).

5G NTN integrates satellite and airborne communication systems with terrestrial cellular networks, offering seamless global coverage and creating a new frontier for communication infrastructure. With its potential to redefine global connectivity, the 5G NTN market is expected to experience explosive growth through 2032, fueled by technological advances, increased adoption of autonomous systems, and the booming satellite communication sector.

What Are Non-Terrestrial Networks (NTNs)?

Non-Terrestrial Networks refer to communication systems that rely on space-based and airborne platforms rather than conventional ground-based cellular towers. These can include:

Low Earth Orbit (LEO) satellites

Medium Earth Orbit (MEO) satellites

Geostationary Earth Orbit (GEO) satellites

High-Altitude Platform Stations (HAPS) such as balloons and unmanned aerial vehicles (UAVs)

When integrated with 5G, NTNs promise uninterrupted global coverage, including in areas where terrestrial infrastructure is impossible, costly, or impractical.

Download a Free Sample Report:-https://tinyurl.com/423kdpjr

Market Drivers

1. Expanding Need for Global Connectivity

One of the core drivers behind 5G NTN is the demand for reliable communication in remote and underserved regions. From rural communities and oceans to deserts and polar zones, NTNs bridge the digital divide by extending coverage to locations that were previously beyond reach.

2. Surge in Satellite Deployment

The rapid increase in commercial and government satellite launches, driven by private firms like SpaceX (Starlink), Amazon (Project Kuiper), and OneWeb, is creating a robust backbone for the 5G NTN ecosystem. These constellations are enabling high-bandwidth, low-latency communication, unlocking the full potential of NTN-based 5G services.

3. Defense and Disaster Recovery Applications

Military operations, search and rescue missions, and disaster recovery efforts require secure and resilient communication systems that work even in the most adverse conditions. NTNs offer uninterrupted service, even in the event of natural disasters or conflict-induced infrastructure damage.

4. Growth in Autonomous Systems

The expansion of autonomous vehicles, drones, and IoT devices in sectors like logistics, agriculture, mining, and transportation creates a growing need for consistent, wide-area, high-reliability networks. NTNs support machine-to-machine (M2M) and IoT communication even in areas far removed from urban infrastructure.

5. Integration with 3GPP Standards

The inclusion of NTN capabilities in 3GPP’s Release 17 has solidified NTN's role in future 5G ecosystems. This standardization ensures interoperability between satellite networks and traditional 5G terrestrial systems, speeding up deployment and adoption.

Market Segmentation

By Component:

Hardware (Satellites, Ground Stations, Antennas)

Software (Network Management, Orchestration)

Services (Consulting, Implementation, Managed Services)

Hardware remains the largest segment, but software and service layers are becoming crucial for network optimization, security, and predictive maintenance.

By Platform:

Low Earth Orbit (LEO)

Medium Earth Orbit (MEO)

Geostationary Earth Orbit (GEO)

High-Altitude Platform Stations (HAPS)

LEO satellites currently dominate the 5G NTN landscape due to their low latency and high throughput, making them ideal for real-time applications like video streaming, remote diagnostics, and autonomous vehicle coordination.

By Application:

Maritime & Offshore Communication

Remote Sensing

Emergency & Disaster Recovery

Defense & Military

Telemedicine

Aviation

Rural Broadband Expansion

Industrial IoT

The defense sector is an early adopter, while commercial growth is being driven by rural broadband, maritime, aviation, and autonomous transport use cases.

By End User:

Government and Public Sector

Commercial Enterprises

Aerospace & Defense

Telecommunication Providers

Telecom providers are increasingly collaborating with satellite operators to offer hybrid terrestrial-satellite solutions, especially in emerging economies.

Regional Insights

North America

North America, led by the U.S., is a leader in the 5G NTN space due to its advanced aerospace sector, extensive government funding for space programs, and private sector giants like SpaceX. The region is also witnessing robust demand in defense, autonomous vehicles, and rural broadband initiatives.

Europe

Europe is making significant strides with the European Space Agency's initiatives and the EU's ambitions for digital sovereignty, driving investments in both GEO and LEO constellations.

Asia-Pacific

APAC is forecast to be one of the fastest-growing regions, driven by rural connectivity programs in India, China’s space race, and Japan's heavy investment in satellite IoT networks.

Industry Trends

LEO Satellite Mega-Constellations

The deployment of thousands of LEO satellites is reshaping the telecom landscape. These mega-constellations offer near-global, low-latency coverage, directly addressing the gaps left by traditional terrestrial networks.

Direct-to-Device Communication

One of the most disruptive trends is the ability of NTN networks to offer direct-to-device (D2D) connectivity, eliminating the need for ground-based relays or additional hardware for smartphones and IoT devices.

AI-Driven Network Management

Artificial intelligence and machine learning are increasingly used to manage 5G NTN networks, optimize bandwidth, predict congestion, and ensure fault tolerance in real time.

Convergence with IoT

5G NTN is seen as a key enabler of massive Machine-Type Communication (mMTC) for IoT devices, particularly in industries like shipping, agriculture, oil & gas, and wildlife monitoring, where cellular connectivity is limited.

Challenges

While the market outlook is highly promising, several challenges could slow adoption:

High Initial Costs: Satellite development, launch, and maintenance require significant capital investment.

Latency Issues (for GEO satellites): Although LEO addresses latency for real-time use cases, GEO satellites still face delays that may not be suitable for all applications.

Spectrum Regulation: Allocating spectrum for NTNs on a global scale involves complex international agreements.

Security Concerns: The potential for cyberattacks on satellite communication links remains a key concern for both commercial and government users.

Future Outlook: Forecast to 2032

According to industry analysts, the 5G NTN market is poised for double-digit compound annual growth (CAGR) through 2032. Key factors contributing to this trajectory include:

The convergence of AI, IoT, and 5G with satellite and HAPS systems.

Private-public collaborations that accelerate satellite launches and network rollouts.

The rising role of NTNs in national defense and security strategies.

Ongoing efforts by global telecom providers to expand their coverage footprint, particularly in emerging economies.

By 2032, the market is expected to evolve from early adopter niche applications to mainstream commercial and consumer deployments, potentially enabling new services such as space-based cloud computing, truly global emergency communications, and fully autonomous transportation networks.

Conclusion

The 5G NTN market represents a paradigm shift in the future of global connectivity, offering seamless coverage to every corner of the planet. As terrestrial and non-terrestrial networks converge, industries from healthcare to defense and logistics to entertainment will benefit from enhanced reach, reliability, and resilience.

With standardized frameworks, ambitious satellite constellations, and expanding demand for universal connectivity, 5G NTN is not just the next step for telecom — it is the future of how the world will stay connected.

Read Full Report:-https://www.uniprismmarketresearch.com/verticals/information-communication-technology/5g-ntn

0 notes

Text

Challenges and Opportunities in the Industrial Internet of Things Market

The global industrial internet of things market size is anticipated to reach USD 1,693.30 billion by 2030 and projected to grow at a CAGR of 23.2% from 2024 to 2030, according to a new report by Grand View Research, Inc. The market growth is being driven by a significant focus on predictive maintenance, automation, and efficient supply chain management across various industrial sectors, particularly manufacturing. Many organizations have acknowledged the advantages of integrating industrial IoT to enhance productivity and have implemented a variety of advanced Industrial IoT solutions using compatible hardware, such as actuators and sensors, along with software. This has contributed to the market growth.

Companies are involved in strategic partnerships and collaborations and are allocating substantial resources towards research and development to drive innovation and to stay competitive in the industry. For instance, in February 2024, Digi International Inc. introduced the Digi IX40, a 5G edge computing industrial IoT cellular router solution. The Digi IX40 is specifically designed for Industry 4.0 applications, including advanced robotics, predictive maintenance, asset monitoring, industrial automation, and smart manufacturing. Such strategies by market players are anticipated to augment the market growth in the coming years.

The increasing application of M2M across various industries, such as automotive, smart cars, utilities, smart grids, home automation, healthcare, and security, is expected to drive the adoption of industrial IoT across businesses. The data collected by OT, M2M, and IoT systems is expected to integrate both operational and informational technology, thereby opening new insights to innovate the decision-making process.

The adoption of sensors and distributed control systems will help to control and manage work processes and automate management processes for all industrial operations. As a result, the demand for implementing sensors and DCS in various business operations will increase annually. Thus, there is a global increase in the need for sensors and DCS due to multiple associated advantages, which is driving the market growth in the coming years.

Gather more insights about the market drivers, restrains and growth of the Industrial Internet of Things Market

Industrial Internet of Things Market Report Highlights

• Based on component, the services segment is anticipated to grow at the fastest CAGR from 2024 to 2030, owing to a significant increase in the number of connected gadgets

• Based on end use, the manufacturing sub-segment led the market with the largest revenue share of 18.22% in 2023, as companies are rapidly adopting digital manufacturing technologies, while logistics & transport segment is anticipated to grow at the fastest CAGR from 2024 to 2030

• North America accounted for the largest revenue share of 32.0% in 2023, closely followed by Europe owing to the early adoption and implementation of industrial internet of things technology

• In May 2024, Proxgy, an industrial internet of things startup, launched a satellite-based smart lock locator, designed for the transportation and logistics industry. The smart lock comes with state-of-the-art features, including real-time tamper alerts, geofencing, geolocation tracking, RFID and NFC smart key unlock, and remote lock/unlock capabilities

Industrial Internet of Things Market Segmentation

Grand View Research has segmented the global industrial internet of things market report based on component, end use, software, connectivity technology, device and technology, and region.

Industrial Internet of Things Component Outlook (Revenue, USD Million, 2018 - 2030)

• Hardware

• Solution

o Remote Monitoring

o Data Management

o Analytics

o Security Solutions

o Others

• Services

o Professional

o Managed

• Platform

o Connectivity Management

o Application Management

o Device Management

Industrial Internet of Things End Use Outlook (Revenue, USD Million, 2018 - 2030)

• Aviation

• Metal & Mining

• Chemical

• Manufacturing

• Energy & Power

• Smart Grids

• Oil & Gas

• Healthcare

• Logistics & Transport

o Intelligent Signaling System

o Video Analytics

o Incident Detection System

o Route Scheduling Guidance System

• Agriculture

o Precision Farming

o Livestock Monitoring

o Smart Greenhouses

o Fish Farming

• Retail

o Point of Sales

o Interactive Kiosks

o Self-Checkout Systems

• Others

Industrial Internet of Things Software Outlook (Revenue, USD Million, 2018 - 2030)

• Product Lifecycle Management

• Manufacturing Execution Systems

• SCADA

• Outage Management Systems

• Distribution Management Systems

• Remote Patent Monitoring

• Retail Management Software

• Visualization Software

• Transit Management Systems

• Farm Management Systems

Industrial Internet of Things Connectivity Technology Outlook (Revenue, USD Million, 2018 - 2030)

• Wired Technology

o Ethernet

o Foundation Fieldbus

• Wireless Technology

o Wi-Fi

o Bluetooth

o Cellular Technologies

o Satellite Technologies

Industrial Internet of Things Device and Technology Outlook (Revenue, USD Million, 2018 - 2030)

• Sensors

• Radio Frequency Identification (RFID)

• Industrial Robotics

• Distributed Control Systems

• Condition Monitoring

• Smart Meters

• Electronic Shelf Labels

• Cameras

• Smart Beacons

• Interface Boards

• Yield Monitors

• Guidance & Steering

• GPS/GNSS

• Flow & Application Control Devices

• Networking Technology

Industrial Internet of Things Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o Germany

o UK

o France

o Italy

o Spain

o Benelux

o Nordics

• Asia Pacific

o China

o Japan

o India

o South Korea

o Australia

• Latin America

o Brazil

o Mexico

o Chile

o Peru

• Middle East & Africa (MEA)

o UAE

o Saudi Arabia

o South Africa

Order a free sample PDF of the Industrial Internet of Things Market Intelligence Study, published by Grand View Research.

#Industrial Internet of Things Market#Industrial Internet of Things Market Size#Industrial Internet of Things Market Share#Industrial Internet of Things Market Analysis#Industrial Internet of Things Market Growth

0 notes

Text

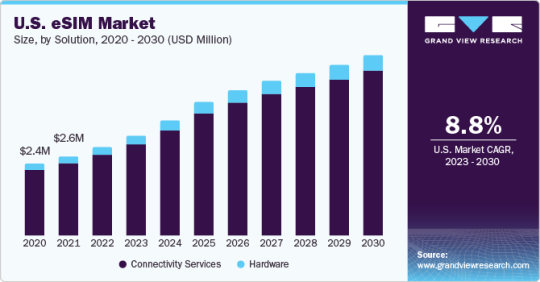

eSIM Market Product Analysis, Share by Types and Region till 2030

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in smartphones. For example, in 2018, Apple, Inc. released an iPhone featuring dual SIM capabilities, including a Nano-SIM and an eSIM. Furthermore, Apple, Inc. has included eSIM in their tablet and watch series.

SIM cards with eSIMs are considerably smaller than those with physical SIMs. Chipsets are therefore smaller when integrated into devices. Device manufacturers benefit from eSIM technology since they can save space by eliminating the physical SIM card tray and SIM card slot. Thus, factors such as compact design specification and multiple carrier support of the eSIM are propelling the market growth.

The 5G technology is intended to deliver faster internet speeds and more network capacity. 5G is expected to provide download speeds of 1 gigabit per second while lowering latency to less than a millisecond. This is expected to have a beneficial impact on the eSIM market, expanding its acceptance across a range of cellular-enabled devices. As a result, network service providers and OEMs are overhauling their infrastructure in order to efficiently manage the connectivity and speed provided by 5G. eSIM technology, which can be easily integrated into smaller devices like fitness bands, wearables, and smartwatches, is the future of 5G.

Gather more insights about the market drivers, restrains and growth of the Global eSIM Market

eSIM Market Report Highlights

Due to connectivity subscriptions from M2M devices, the connectivity services segment held the greatest market share in 2022

The hardware segment is expected to attain a substantial CAGR throughout the forecasted period due to smartphone manufacturers' use of eSIM technology

Due to technological improvements and IoT connectivity among devices, the consumer electronics segment is expected to expand at a considerable CAGR of more than 9.2% throughout the forecast period

Browse through Grand View Research's Communication Services Industry Research Reports.

Open RAN Market: The global open RAN market size was estimated at USD 4.51 billion in 2024 and is projected to grow at a CAGR of 25.6% from 2025 to 2030.

Broadcasting And Cable TV Market: The global broadcasting and cable TV market size was estimated at USD 356.45 billion in 2024, registering a CAGR of 4.0% from 2025 to 2030.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030)

Hardware

Connectivity services

eSIM Application Outlook (Revenue in USD Million, 2017 - 2030)

Consumer Electronics

Smartphones

Tablets

Smartwatches

Laptop

Others

M2M

Automotive

Smart Meter

Logistics

Others

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Asia Pacific

China

Japan

India

Australia

South Korea

Latin America

Brazil

Mexico

Middle East and Africa

Saudi Arabia

South Africa

UAE

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

0 notes

Text

eSIM Market 2030: Trends, Opportunities, Challenges & Leading Key Players Review

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in smartphones. For example, in 2018, Apple, Inc. released an iPhone featuring dual SIM capabilities, including a Nano-SIM and an eSIM. Furthermore, Apple, Inc. has included eSIM in their tablet and watch series.

SIM cards with eSIMs are considerably smaller than those with physical SIMs. Chipsets are therefore smaller when integrated into devices. Device manufacturers benefit from eSIM technology since they can save space by eliminating the physical SIM card tray and SIM card slot. Thus, factors such as compact design specification and multiple carrier support of the eSIM are propelling the market growth.

The 5G technology is intended to deliver faster internet speeds and more network capacity. 5G is expected to provide download speeds of 1 gigabit per second while lowering latency to less than a millisecond. This is expected to have a beneficial impact on the eSIM market, expanding its acceptance across a range of cellular-enabled devices. As a result, network service providers and OEMs are overhauling their infrastructure in order to efficiently manage the connectivity and speed provided by 5G. eSIM technology, which can be easily integrated into smaller devices like fitness bands, wearables, and smartwatches, is the future of 5G.

Gather more insights about the market drivers, restrains and growth of the Global eSIM Market

eSIM Market Report Highlights

Due to connectivity subscriptions from M2M devices, the connectivity services segment held the greatest market share in 2022

The hardware segment is expected to attain a substantial CAGR throughout the forecasted period due to smartphone manufacturers' use of eSIM technology

Due to technological improvements and IoT connectivity among devices, the consumer electronics segment is expected to expand at a considerable CAGR of more than 9.2% throughout the forecast period

Browse through Grand View Research's Communication Services Industry Research Reports.

Open RAN Market: The global open RAN market size was estimated at USD 4.51 billion in 2024 and is projected to grow at a CAGR of 25.6% from 2025 to 2030.

Broadcasting And Cable TV Market: The global broadcasting and cable TV market size was estimated at USD 356.45 billion in 2024, registering a CAGR of 4.0% from 2025 to 2030.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030)

Hardware

Connectivity services

eSIM Application Outlook (Revenue in USD Million, 2017 - 2030)

Consumer Electronics

Smartphones

Tablets

Smartwatches

Laptop

Others

M2M

Automotive

Smart Meter

Logistics

Others

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Asia Pacific

China

Japan

India

Australia

South Korea

Latin America

Brazil

Mexico

Middle East and Africa

Saudi Arabia

South Africa

UAE

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

0 notes

Text

Small Cell 5G Network Market 2024 : Industry Analysis, Trends, Segmentation, Regional Overview And Forecast 2033

The small cell 5g network global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Small Cell 5G Network Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The small cell 5G network market size has grown exponentially in recent years. It will grow from $2.86 billion in 2023 to $3.59 billion in 2024 at a compound annual growth rate (CAGR) of 25.5%. The growth in the historic period can be attributed to rising government focus on digitalization of processes, rising demand for high-speed internet connectivity, rapid penetration of mobile devices in rural areas, increase in network densification, increase in investment in 5G infrastructure.

The small cell 5G network market size is expected to see exponential growth in the next few years. It will grow to $8.85 billion in 2028 at a compound annual growth rate (CAGR) of 25.3%. The growth in the forecast period can be attributed to growing mobile data traffic, increasing demand for fast mobile data connectivity, evolution of network technology and connectivity devices, increasing demand for fast mobile data connectivity, rising demand for 5G services. Major trends in the forecast period include technological advancement, launching advanced indoor and outdoor 5G networking technologies, adoption of 5G network technologies by governments and implementation of Internet of thing (IoT) devices, latest launches of integrated communication platforms, rise of IoT (Internet of Things) and M2M (Machine to Machine) communication.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/small-cell-5g-network-global-market-report

The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Market Drivers - The growing mobile data traffic is expected to propel the growth of the small cell 5G network market going forward. Mobile data traffic refers to the volume of data transmitted over a wireless cellular connection to mobile devices like smartphones and tablets. Mobile data traffic is rising due to increased smartphone adoption, growing demand for mobile applications and services, and the expansion of high-speed mobile networks. The deployment of small cell 5G networks enhances data traffic by improving network capacity, coverage, and reliability in densely populated areas, meeting the increasing demand for high-speed and low-latency connectivity. For instance, in November 2023, according to a report published by Telefonaktiebolaget LM Ericsson, a Sweden-based telecommunications company, the average mobile data usage per smartphone is expected to rise from 21 GB in 2023 to 56 GB in 2029 globally. 5G's share of mobile data traffic is expected to increase to 76% by 2029. Therefore, the growing mobile data traffic is driving the growth of the small cell 5G network market.

Market Trends - Major companies operating in the small cell 5G network market are developing advanced solutions, such as cloud-native software, to gain a competitive edge in the market. Cloud-native software refers to applications and services that are designed and built to fully leverage the capabilities and advantages of cloud computing environments. For instance, in September 2022, Mavenir Systems Inc., a US-based telecommunications software company, launched a 5G small cell E511 designed for high-capacity in-building standalone coverage. This small cell is ideal for communication service providers and private network operators targeting 5G coverage in enterprise and public spaces. It supports both distributed and centralized open radio access network (ORAN) architectures, offering flexibility for deployment scenarios like office, retail, warehousing, manufacturing, and public space.

The small cell 5G network market covered in this report is segmented –

1) By Component: Hardware, Services 2) By Architecture: Distributed, Virtualized 3) By Deployment Mode: Indoor, Outdoor 4) By Application: Enhanced Mobile Broadband, Massive Internet of Things (IoT), Massive Machine Type Communication And Ultra Reliable Low Latency 5) By End-use: Residential, Commercial, Industrial, Smart City, Transportation And Logistics, Government And Defense, Other End-Users

Get an inside scoop of the small cell 5g network market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=14493&type=smp

Regional Insights - North America was the largest region in the small cell 5G network market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the small cell 5G network market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies operating in the small cell 5G network market are Samsung Electronics Co. Ltd., Huawei Technologies Co. Ltd., Cisco Systems Inc., Qualcomm Technologies Inc., Fujitsu Limited, Telefonaktiebolaget LM Ericsson, Nokia Corporation, NEC Corporation, ZTE Corporation, Corning Incorporated, CommScope Inc., Altiostar Networks Inc., Sterlite Technologies Limited, Aviat Networks Inc., Cambium Networks Corporation, Ceragon Networks Ltd., Casa Systems Inc., Airspan Networks Holdings Inc., Baicells Technologies, Comba Telecom Systems Holdings Ltd., Contela Inc., ip.Access Limited, Radisys Corporation, Qucell Inc., Blinq Networks, Shenzhen Gongjin Electronics Co. Ltd., PCTEL Inc., and Radwin.

Table of Contents 1. Executive Summary 2. Small Cell 5G Network Market Report Structure 3. Small Cell 5G Network Market Trends And Strategies 4. Small Cell 5G Network Market – Macro Economic Scenario 5. Small Cell 5G Network Market Size And Growth ….. 27. Small Cell 5G Network Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

ESIM Imaging Market Size, Status and Forecast 2030

eSIM Industry Overview

The global eSIM market size was valued at USD 8.07 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. The market growth is driven by the rising adoption of IoT-connected devices in M2M applications and consumer electronics. There is an upsurge in the number of times eSIM profiles were downloaded across consumer devices. The eSIM market is propelling due to the rise in the adoption of eSIM-connected devices. According to Mobilise, in 2021, there were 1.2 billion eSIM-enabled devices, with the number expected to climb to 3.4 billion by 2025.

Gather more insights about the market drivers, restrains and growth of the eSIM Market

The introduction of eSIM in the automobile industry has provided tremendous flexibility in providing cellular connectivity to trucks and cars while unlocking new capabilities and features. It is expected that within the next several years, all cars will be cellular enabled, resulting in a better driving experience facilitated by novel linked services. Recently, the automotive industry took a giant step toward enabling the next generation of connected automobiles by implementing the GSMA-embedded SIM specification to strengthen vehicle connectivity. It is intended to improve security for various connected services.

The eSIM-enabled solutions offer automatic interoperability across numerous SIM operators, connection platforms, and remote SIM profile provisioning. With multiple network service providers involved in the operating chain, maintaining the security of these systems has grown complicated. Mobile Network Operators' (MNOs') credentials are collected and kept by the eSIM in the device's inbuilt software, making them vulnerable to security breaches. Furthermore, the operation of eSIM across numerous physical platforms and MNOs exposes it to several virtual environment concerns. As a result, the operational flexibility provided by eSIM may be rendered ineffective if security is breached, impeding market expansion.

Industry 4.0 is a technological breakthrough that has introduced smart machinery with automatic communication and control. Industry 4.0 refers to a networked environment in which actionable data and information are transferred between Machine to Machine (M2M) and Machine to Other (M2O) devices via the Internet of Things (IoT). Wi-Fi, sensors, RFID (radio frequency administrations), and autonomous computing software are all used in M2M systems to analyze data and send it over a network for further processing. M2M systems frequently rely on public and cellular networks for internet access. These factors enabled the integration of electronic manufacturers with eSIM (embedded SIM cards) into M2M systems, thereby contributing to market expansion. By enabling M2M communication, eSIM technology has enabled advancements in the connected ecosystem.

The increasing penetration of smartphones across countries such as China, India, Japan, and the U.S. is further anticipated to fuel market growth. Smartphone manufacturers such as Google, Samsung Electronics Co., Apple, Inc., and Motorola Mobility LLC, Ltd. have started implementing eSIM technology into their smartphones in alliance with several network service providers. For instance, Apple, Inc. has partnered with six service providers, Ubigi, MTX Connect, Soracom Mobile, GigSky, Redtea Mobile, and Truphone, to offer eSIM service. Smartphone and consumer electronics manufacturers' increasing adoption of eSIM to provide an enhanced and secure user experience is expected to bolster market growth.

Browse through Grand View Research's Communication Services Industry Research Reports.

• The global speech analytics market was valued at USD 2.82 billion in 2023 and is projected to grow at a CAGR of 15.7% from 2024 to 2030. Advancements in omnichannel integration capabilities fuel the market's growth.

• The global commerce cloud market size was estimated at USD 17.78 billion in 2023 and is expected to grow at a CAGR of 22.8% from 2024 to 2030. The market is experiencing robust growth driven by several key factors.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030) • Hardware • Connectivity services

eSIMc Application Outlook (Revenue in USD Million, 2017 - 2030) • Consumer Electronics o Smartphones o Tablets o Smartwatches o Laptop o Others • M2M o Automotive o Smart Meter o Logistics o Others

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030) • North America o U.S. o Canada • Europe o UK o Germany o France • Asia Pacific o China o Japan o India o Australia o South Korea • Latin America o Brazil o Mexico • Middle East and Africa o Saudi Arabia o South Africa o UAE

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

Key Companies profiled: • Arm Limited • Deutsche Telekom AG • Giesecke+Devrient GmbH • Thales • Infineon Technologies AG • KORE Wireless • NXP Semiconductors • Sierra Wireless • STMicroelectronics • Workz

Recent Developments

• In May 2023, Lonestar Cell MTN, a South African conglomerate, introduced eSIM technology in Liberia. This advancement allows subscribers to switch to eSIM-compatible devices without the hassle of removing physical SIM cards. Customers can scan a QR code provided at any Lonestar Cell MTN service center.

• In March 2023, Gcore, a public cloud and content delivery network company, launched its Zero-Trust 5G eSIM Cloud platform. This platform offers organizations across the globe a secure and dependable high-speed networking solution. By utilizing Gcore's software-defined eSIM, companies can establish secure connections to remote devices, corporate resources, or Gcore's cloud platform through regional 5G carriers.

• In February 2023, Amdocs, a software company, collaborated with Drei Austria to introduce a groundbreaking eSIM solution. This collaboration enables Drei Austria's customers to access the advantages of digital eSIM technology through a fully app-based experience. The innovative "up" app offers a seamless and entirely digital SIM journey powered by Amdocs' eSIM technology at Drei Austria.

• In December 2022, Grover, a subscription-based electronics rental platform, joined forces with Gigs, a telecom-as-a-service platform, to introduce Grover Connect, its very own mobile virtual network operator (MVNO), in the U.S. Through Grover Connect, customers in the U.S. can effortlessly activate any eSIM-enabled technology device, eliminating the complexities associated with carrier offers and contracts that may not align with their device rental duration.

• In October 2022, Bharti Airtel, a telecommunications service provider based in India, unveiled its "Always On" IoT connectivity solutions. This offering enables seamless connectivity for IoT devices across multiple Mobile Network Operators (MNOs) through an embedded SIM (eSIM) technology. Particularly beneficial for vehicle tracking providers, auto manufacturers, and scenarios where equipment operates in remote areas, requiring uninterrupted and widespread connectivity.

0 notes

Text

What is GSM modem and how it works?

A GSM modem is a device that allows electronic devices to communicate with each other over the GSM network. GSM stands for Global System for Mobile Communications, and it is the most widely used cellular network standard in the world.

GSM modem work by connecting to the GSM network using a SIM card. A SIM card is a small, removable card that contains your mobile phone number and other subscriber information. Once the SIM card is inserted, the GSM modem can start sending and receiving SMS messages and data.

GSM modem use a variety of protocols to communicate with the GSM network, including:

SMS (Short Message Service): SMS is used to send and receive text messages.

GPRS (General Packet Radio Service): GPRS is used to send and receive data packets.

EDGE (Enhanced Data Rates for GSM Evolution): EDGE is a faster version of GPRS that can be used to send and receive data at speeds of up to 384 kbps.

GSM modem can be used in a variety of applications, including:

Home automation: GSM modems can be used to control home automation devices, such as thermostats, lights, and security systems, using SMS messages.

Machine-to-machine (M2M) communication: GSM modems can be used to send and receive SMS messages between machines. For example, an SMS modem could be used to send an SMS message from a vending machine to its owner to alert them that it is running low on stock.

Business messaging: GSM modems can be used to send and receive bulk SMS messages to customers. For example, a business could use an SMS modem to send SMS messages to customers about sales and promotions.

Emergency alerts: GSM modems can be used to send emergency alerts to people in a specific area. For example, a government agency could use an SMS modem to send SMS messages to people in a hurricane evacuation zone to warn them about the storm.

GSM modem are a versatile and affordable way to communicate. They are used in a variety of applications, from home automation to business messaging to emergency alerts.

Here is a simplified explanation of how a GSM modem works:

The GSM modem connects to the GSM network using a SIM card.

The GSM modem sends and receives data and SMS messages using a variety of protocols, including SMS, GPRS, and EDGE.

The GSM modem communicates with other electronic devices using a variety of interfaces, such as USB and serial.

To use a GSM modem, you will need to:

Insert a SIM card from a mobile phone carrier.

Connect the GSM modem to your computer or other electronic device.

Install and configure the necessary software.

Once the GSM modem is set up, you can start sending and receiving SMS messages and data.

2 notes

·

View notes

Text

emnify revolutionizes IoT connectivity in Brazil with single SIM card and full national coverage

Initiative enables mobile connectivity for all IoT/M2M devices in Brazil, regardless of where they are located. São Paulo, September 10, 2024 – emnify, a global leader in cellular IoT connectivity, has launched a groundbreaking solution that guarantees full coverage across all of Brazil using SIM cards with single IMSIs and local numbering. This initiative was made possible thanks to emnify’s…

0 notes

Text

eSIM Market Size To Reach USD 15,464.0 Million By 2030

eSIM Market Growth & Trends

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in smartphones. For example, in 2018, Apple, Inc. released an iPhone featuring dual SIM capabilities, including a Nano-SIM and an eSIM. Furthermore, Apple, Inc. has included eSIM in their tablet and watch series.

SIM cards with eSIMs are considerably smaller than those with physical SIMs. Chipsets are therefore smaller when integrated into devices. Device manufacturers benefit from eSIM technology since they can save space by eliminating the physical SIM card tray and SIM card slot. Thus, factors such as compact design specification and multiple carrier support of the eSIM are propelling the market growth.

The 5G technology is intended to deliver faster internet speeds and more network capacity. 5G is expected to provide download speeds of 1 gigabit per second while lowering latency to less than a millisecond. This is expected to have a beneficial impact on the eSIM market, expanding its acceptance across a range of cellular-enabled devices. As a result, network service providers and OEMs are overhauling their infrastructure in order to efficiently manage the connectivity and speed provided by 5G. eSIM technology, which can be easily integrated into smaller devices like fitness bands, wearables, and smartwatches, is the future of 5G.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/esim-market

Industry 4.0 is a technological breakthrough that has introduced smart machinery with automatic communication and control. Industry 4.0 refers to a networked environment in which actionable data and information are transferred between Machine to Machine (M2M) and Machine to Other (M2O) devices via the Internet of Things (IoT). Wi-Fi, sensors, RFID (radio frequency administrations), and autonomous computing software are all used in M2M systems to analyze data and send it over a network for further processing. M2M systems frequently rely on public and cellular networks for internet access. These factors enabled the integration of electronic manufacturers with eSIM (embedded SIM cards) into M2M systems, thereby contributing to market expansion. By enabling M2M communication, eSIM technology has enabled advancements in the connected ecosystem.

eSIM Market Report Highlights

Due to connectivity subscriptions from M2M devices, the connectivity services segment held the greatest market share in 2022

The hardware segment is expected to attain a substantial CAGR throughout the forecasted period due to smartphone manufacturers' use of eSIM technology

Due to technological improvements and IoT connectivity among devices, the consumer electronics segment is expected to expand at a considerable CAGR of more than 9.2% throughout the forecast period

Regional Insights

North America dominated the market and accounted for the largest revenue share of 39.1% in 2022. and is expected to grow at the fastest CAGR of 8.7% over the forecast period. The growth is due to the network providers' high presence and the region's fastest technological advancements. The growth is due to the network providers' high presence and the region's fastest technological advancements.

Europe is expected to grow significantly during the forecast period. European companies are the early adopters of the latest technologies. At the same time, the regions are headquarters to several prominent market players, such as Giesecke+Devrient Mobile Security GmbH, NXP Semiconductors N.V., STMicroelectronics, and others. These areas also witness the rising adoption of smart connected devices and cars. Due to all these factors, these two regions are expected to maintain their lead during the forecast period.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030)

Hardware

Connectivity services

eSIMc Application Outlook (Revenue in USD Million, 2017 - 2030)

Consumer Electronics

M2M

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030)

North America

Europe

Asia Pacific

Latin America

Middle East and Africa

List of Key Players in eSIM Market

Arm Limited

Deutsche Telekom AG

Giesecke+Devrient GmbH

Thales

Infineon Technologies AG

KORE Wireless

NXP Semiconductors

Sierra Wireless

STMicroelectronics

Workz

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/esim-market

0 notes

Text

5G Chipsets Market: Trends, Drivers, Challenges & Opportunities

The global 5G chipsets market size is estimated to be USD 36.29 billion in 2023 and is projected to reach USD 81.03 billion by 2028 at a CAGR of 17.4%.

The growing demand for high-speed internet, the need for better network coverage, increased cellular and M2M IoT connections, growing adoption of 5G in automobiles, increase in mobile data traffic, rising demand for high-speed and low-latency 5G infrastructure, and widespread use of chipsets in consumer electronics is driving the market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=150390562

Market Dynamics:

Driver: High use of M2M communication technology The speed and reliability of 5G are expected to have a massive impact on machine-to-machine (M2M) and IoT. Key reasons for the increased adoption of new M2M technologies are better connectivity for smooth communication and low power requirements. The existing capacity of mobile networks must handle billions of nodes that are anticipated to ascend in the next couple of years to achieve effective M2M communication. Currently, the network capacity cannot manage M2M and human-based communications and their different communication patterns, such as latency time. For this reason, a next-level cellular network for mobile communication featuring hyper-connectivity and larger bandwidth is required (e.g., a 5G network). M2M communication technology will be widely used in heavy manufacturing and process industries (e.g., food industries) to increase the efficiency of different processes and reduce human interference with machines. M2M communication is thus expected to drive the 5G chipsets market.

Restraints: High cost of 5G chips for mobile devices The high price of 5G chips contributes to increased initial deployment expenses for manufacturers and mobile device producers. This cost is incurred when integrating 5G capabilities into smartphones, tablets, and other mobile devices. The cost of 5G chipsets is a substantial component of the overall manufacturing cost of 5G-enabled devices. This, in turn, affects the retail price of these devices, potentially limiting their affordability for a significant portion of the consumer market. High chipset costs may restrict research, development, and innovation resources in the 5G chipset market. This can potentially slow down technological advancements, limiting the pace of improvements and optimizations.

Opportunities: The emergence of private 5G networks to address wireless communication requirements in industrial IoT Private 5G networks offer low-latency communication and high reliability, which are crucial for industrial applications. 5G chipsets play a pivotal role in delivering these capabilities, ensuring that the communication infrastructure meets the stringent requirements of industrial environments. Industrial IoT applications generate large volumes of data that require high bandwidth and capacity for efficient and real-time communication. 5G chipsets enable the transmission of massive amounts of data at faster speeds, facilitating the seamless operation of IloT devices and systems. Private 5G networks cater to industrial use cases, including smart manufacturing, predictive maintenance, remote monitoring, and augmented reality applications. The versatility of 5G chips makes them suitable for addressing the diverse communication requirements of these use cases. As industries worldwide recognize the benefits of private 5G networks for their lloT needs, the demand for 5G chips is expected to grow globally.

Challenges: Design challenges for RF devices operating at higher frequency 5G technology operates at higher frequency bands than previous generations, utilizing millimeter-wave (mmWave) frequencies. The design challenge arises because higher frequencies present unique characteristics and technical obstacles that demand careful consideration in RF device design. Higher frequency signals, such as those in the mmWave spectrum, have shorter wavelengths. This results in challenges related to signal propagation and range. Signals at higher frequencies are more prone to absorption by atmospheric gases and are susceptible to obstacles like buildings and foliage, requiring sophisticated design techniques to overcome these limitations. As the 5G landscape evolves, ensuring standardization and compatibility across different devices and manufacturers becomes crucial. Design challenges include meeting industry standards and ensuring interoperability within the diverse ecosystem of 5G-enabled devices.

0 notes

Text

Future of the eSIM Market: How It’s Revolutionizing the Telecom Industry

The global eSIM market was valued at USD 8.07 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. This market growth is primarily driven by the increasing adoption of Internet of Things (IoT)-connected devices, particularly in machine-to-machine (M2M) applications and consumer electronics. One of the key trends contributing to this growth is the rising frequency of eSIM profile downloads across consumer devices. As more and more devices become eSIM-enabled, the market continues to accelerate.

According to Mobilise, the number of eSIM-enabled devices reached 1.2 billion in 2021, and this number is expected to increase significantly to 3.4 billion by 2025, reflecting the growing integration of eSIM technology across a wide range of devices.

A significant factor in the expansion of the eSIM market is its adoption within the automobile industry. The integration of eSIM technology into vehicles has introduced remarkable flexibility in offering cellular connectivity to cars and trucks. This shift is unlocking new capabilities and features for connected vehicles. In the coming years, it is expected that all cars will be equipped with cellular connectivity, improving the driving experience through innovative linked services. Recently, the automotive industry has made a significant advancement by implementing the GSMA-embedded SIM specification. This development is set to enhance vehicle connectivity and improve the security of various connected services, further enabling the next generation of connected and smarter automobiles.

Gather more insights about the market drivers, restrains and growth of the eSIM Market

Regional Insights

North America

North America led the eSIM market in 2022, accounting for the largest revenue share of 39.1%. The region is also expected to grow at the fastest compound annual growth rate (CAGR) of 8.7% during the forecast period. This growth is primarily driven by the strong presence of network providers and the rapid pace of technological advancements within the region. North America benefits from its advanced infrastructure, robust digital ecosystem, and the increasing adoption of IoT devices, all of which support the continued growth of eSIM technology.

Europe

Europe is also projected to experience significant growth over the forecast period. European companies have historically been early adopters of new technologies, and the region is home to many key market players, including Giesecke+Devrient Mobile Security GmbH, NXP Semiconductors N.V., and STMicroelectronics, among others. Additionally, Europe is witnessing a rising demand for smart connected devices and connected vehicles, particularly with the growing adoption of eSIM-enabled smartphones, smart cars, and other IoT devices. These factors position Europe to maintain a strong market presence alongside North America during the forecast period.

Asia Pacific

Asia Pacific is expected to see substantial growth as well, fueled by the increasing number of eSIM-enabled devices, particularly in the smartphone market. Major smartphone manufacturers such as Huawei and Samsung Electronics have already introduced eSIM-enabled devices, which are driving the momentum for eSIM adoption across the region. This shift is positioning eSIM as the future mainstream SIM technology for connected devices. Additionally, several original equipment manufacturers (OEMs) in countries like China and India are developing eSIM solutions, collaborating across the ecosystem to create innovative development paths. For example, in June 2021, IDEMIA, a leading eSIM manufacturer, expanded its production capacity in India, aiming to boost global eSIM production. According to Giesecke+Devrient (G&D), a German digital solutions provider, it is projected that 25-30% of smartphones will have eSIM capabilities by 2024.

Browse through Grand View Research's Communication Services Industry Research Reports.

• The global web real-time communication market size was valued at USD 8.71 billion in 2024 and is projected to grow at a CAGR of 45.7% from 2025 to 2030.

• The global near field communication market size was valued at USD 30.85 billion in 2024 and is projected to grow at a CAGR of 12.3% from 2025 to 2030.

Key Companies & Market Share Insights

Industry players in the eSIM market are actively pursuing strategies like product launches, acquisitions, and collaborations to expand their global presence and enhance market competitiveness. For example, in September 2022, BICS, a digital communications services and IoT company, partnered with Thales, a global technology provider, to streamline the integration of eSIM for the Internet of Things (IoT). This strategic collaboration aims to build an open ecosystem for eSIM technology within the IoT sector, allowing for easier integration and more efficient deployment of eSIM solutions across various industries. The collaboration is designed to enhance connectivity and operational efficiency, which could lead to more widespread adoption of eSIM technology.

As the eSIM market grows, competition is expected to intensify, with companies focused on developing advanced, cost-effective solutions. The ability of eSIM technology to simplify the process of switching between mobile network operators is expected to drive heightened competition among service providers. The growing ease with which consumers can change operators is likely to encourage more switching, leading to a more competitive landscape in the telecommunications sector.

For instance, in September 2021, Deutsche Telekom AG announced the launch of an in-car 5G and personal eSIM networking service in partnership with Bayerische Motoren Werke AG (BMW). The collaboration utilized personal eSIM technology and MobilityConnect to link the vehicle's connectivity with the customer’s mobile network on a 5G basis, enabling a more integrated and seamless experience for connected car users. This innovative solution highlights how companies are leveraging eSIM technology to enhance connectivity and create new value-added services in the automotive sector.

The following are some of the major participants in the global eSIM market

• Arm Limited

• Deutsche Telekom AG

• Giesecke+Devrient GmbH

• Thales

• Infineon Technologies AG

• KORE Wireless

• NXP Semiconductors

• Sierra Wireless

• STMicroelectronics

• Workz

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

0 notes