#eSIM Market Size

Explore tagged Tumblr posts

Text

eSIM Market Product Analysis, Share by Types and Region till 2030

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in smartphones. For example, in 2018, Apple, Inc. released an iPhone featuring dual SIM capabilities, including a Nano-SIM and an eSIM. Furthermore, Apple, Inc. has included eSIM in their tablet and watch series.

SIM cards with eSIMs are considerably smaller than those with physical SIMs. Chipsets are therefore smaller when integrated into devices. Device manufacturers benefit from eSIM technology since they can save space by eliminating the physical SIM card tray and SIM card slot. Thus, factors such as compact design specification and multiple carrier support of the eSIM are propelling the market growth.

The 5G technology is intended to deliver faster internet speeds and more network capacity. 5G is expected to provide download speeds of 1 gigabit per second while lowering latency to less than a millisecond. This is expected to have a beneficial impact on the eSIM market, expanding its acceptance across a range of cellular-enabled devices. As a result, network service providers and OEMs are overhauling their infrastructure in order to efficiently manage the connectivity and speed provided by 5G. eSIM technology, which can be easily integrated into smaller devices like fitness bands, wearables, and smartwatches, is the future of 5G.

Gather more insights about the market drivers, restrains and growth of the Global eSIM Market

eSIM Market Report Highlights

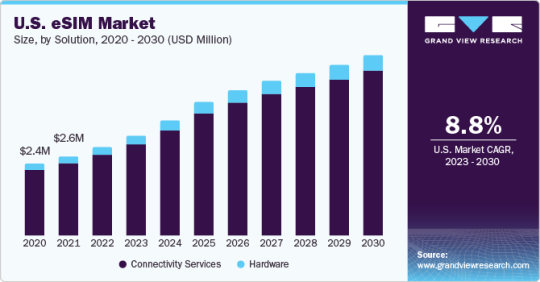

Due to connectivity subscriptions from M2M devices, the connectivity services segment held the greatest market share in 2022

The hardware segment is expected to attain a substantial CAGR throughout the forecasted period due to smartphone manufacturers' use of eSIM technology

Due to technological improvements and IoT connectivity among devices, the consumer electronics segment is expected to expand at a considerable CAGR of more than 9.2% throughout the forecast period

Browse through Grand View Research's Communication Services Industry Research Reports.

Open RAN Market: The global open RAN market size was estimated at USD 4.51 billion in 2024 and is projected to grow at a CAGR of 25.6% from 2025 to 2030.

Broadcasting And Cable TV Market: The global broadcasting and cable TV market size was estimated at USD 356.45 billion in 2024, registering a CAGR of 4.0% from 2025 to 2030.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030)

Hardware

Connectivity services

eSIM Application Outlook (Revenue in USD Million, 2017 - 2030)

Consumer Electronics

Smartphones

Tablets

Smartwatches

Laptop

Others

M2M

Automotive

Smart Meter

Logistics

Others

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Asia Pacific

China

Japan

India

Australia

South Korea

Latin America

Brazil

Mexico

Middle East and Africa

Saudi Arabia

South Africa

UAE

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

0 notes

Text

eSIM Market 2030: Trends, Opportunities, Challenges & Leading Key Players Review

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in smartphones. For example, in 2018, Apple, Inc. released an iPhone featuring dual SIM capabilities, including a Nano-SIM and an eSIM. Furthermore, Apple, Inc. has included eSIM in their tablet and watch series.

SIM cards with eSIMs are considerably smaller than those with physical SIMs. Chipsets are therefore smaller when integrated into devices. Device manufacturers benefit from eSIM technology since they can save space by eliminating the physical SIM card tray and SIM card slot. Thus, factors such as compact design specification and multiple carrier support of the eSIM are propelling the market growth.

The 5G technology is intended to deliver faster internet speeds and more network capacity. 5G is expected to provide download speeds of 1 gigabit per second while lowering latency to less than a millisecond. This is expected to have a beneficial impact on the eSIM market, expanding its acceptance across a range of cellular-enabled devices. As a result, network service providers and OEMs are overhauling their infrastructure in order to efficiently manage the connectivity and speed provided by 5G. eSIM technology, which can be easily integrated into smaller devices like fitness bands, wearables, and smartwatches, is the future of 5G.

Gather more insights about the market drivers, restrains and growth of the Global eSIM Market

eSIM Market Report Highlights

Due to connectivity subscriptions from M2M devices, the connectivity services segment held the greatest market share in 2022

The hardware segment is expected to attain a substantial CAGR throughout the forecasted period due to smartphone manufacturers' use of eSIM technology

Due to technological improvements and IoT connectivity among devices, the consumer electronics segment is expected to expand at a considerable CAGR of more than 9.2% throughout the forecast period

Browse through Grand View Research's Communication Services Industry Research Reports.

Open RAN Market: The global open RAN market size was estimated at USD 4.51 billion in 2024 and is projected to grow at a CAGR of 25.6% from 2025 to 2030.

Broadcasting And Cable TV Market: The global broadcasting and cable TV market size was estimated at USD 356.45 billion in 2024, registering a CAGR of 4.0% from 2025 to 2030.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030)

Hardware

Connectivity services

eSIM Application Outlook (Revenue in USD Million, 2017 - 2030)

Consumer Electronics

Smartphones

Tablets

Smartwatches

Laptop

Others

M2M

Automotive

Smart Meter

Logistics

Others

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Asia Pacific

China

Japan

India

Australia

South Korea

Latin America

Brazil

Mexico

Middle East and Africa

Saudi Arabia

South Africa

UAE

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

0 notes

Text

eSIM Market 2030 - Top Countries Data with Future Scope and Top Key Players Analysis

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in…

0 notes

Text

eSIM Market Size To Reach USD 15,464.0 Million By 2030

eSIM Market Growth & Trends

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in smartphones. For example, in 2018, Apple, Inc. released an iPhone featuring dual SIM capabilities, including a Nano-SIM and an eSIM. Furthermore, Apple, Inc. has included eSIM in their tablet and watch series.

SIM cards with eSIMs are considerably smaller than those with physical SIMs. Chipsets are therefore smaller when integrated into devices. Device manufacturers benefit from eSIM technology since they can save space by eliminating the physical SIM card tray and SIM card slot. Thus, factors such as compact design specification and multiple carrier support of the eSIM are propelling the market growth.

The 5G technology is intended to deliver faster internet speeds and more network capacity. 5G is expected to provide download speeds of 1 gigabit per second while lowering latency to less than a millisecond. This is expected to have a beneficial impact on the eSIM market, expanding its acceptance across a range of cellular-enabled devices. As a result, network service providers and OEMs are overhauling their infrastructure in order to efficiently manage the connectivity and speed provided by 5G. eSIM technology, which can be easily integrated into smaller devices like fitness bands, wearables, and smartwatches, is the future of 5G.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/esim-market

Industry 4.0 is a technological breakthrough that has introduced smart machinery with automatic communication and control. Industry 4.0 refers to a networked environment in which actionable data and information are transferred between Machine to Machine (M2M) and Machine to Other (M2O) devices via the Internet of Things (IoT). Wi-Fi, sensors, RFID (radio frequency administrations), and autonomous computing software are all used in M2M systems to analyze data and send it over a network for further processing. M2M systems frequently rely on public and cellular networks for internet access. These factors enabled the integration of electronic manufacturers with eSIM (embedded SIM cards) into M2M systems, thereby contributing to market expansion. By enabling M2M communication, eSIM technology has enabled advancements in the connected ecosystem.

eSIM Market Report Highlights

Due to connectivity subscriptions from M2M devices, the connectivity services segment held the greatest market share in 2022

The hardware segment is expected to attain a substantial CAGR throughout the forecasted period due to smartphone manufacturers' use of eSIM technology

Due to technological improvements and IoT connectivity among devices, the consumer electronics segment is expected to expand at a considerable CAGR of more than 9.2% throughout the forecast period

Regional Insights

North America dominated the market and accounted for the largest revenue share of 39.1% in 2022. and is expected to grow at the fastest CAGR of 8.7% over the forecast period. The growth is due to the network providers' high presence and the region's fastest technological advancements. The growth is due to the network providers' high presence and the region's fastest technological advancements.

Europe is expected to grow significantly during the forecast period. European companies are the early adopters of the latest technologies. At the same time, the regions are headquarters to several prominent market players, such as Giesecke+Devrient Mobile Security GmbH, NXP Semiconductors N.V., STMicroelectronics, and others. These areas also witness the rising adoption of smart connected devices and cars. Due to all these factors, these two regions are expected to maintain their lead during the forecast period.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030)

Hardware

Connectivity services

eSIMc Application Outlook (Revenue in USD Million, 2017 - 2030)

Consumer Electronics

M2M

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030)

North America

Europe

Asia Pacific

Latin America

Middle East and Africa

List of Key Players in eSIM Market

Arm Limited

Deutsche Telekom AG

Giesecke+Devrient GmbH

Thales

Infineon Technologies AG

KORE Wireless

NXP Semiconductors

Sierra Wireless

STMicroelectronics

Workz

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/esim-market

0 notes

Text

eSIM Market Regional Analysis, Trends & Forecast To 2032

eSIM Market Overview The global eSIM Market size valuation is expected to reach $5.77 billion by 2030 by registering a CAGR of 31.40%. E-SIM is also known as embedded SIM, a SIM chip built to operate with multiple mobile devices globally. The e-SIM allows a device to have multiple devices operating profiles at once, which results in simultaneous use of the same device by using different profiles.…

0 notes

Text

Travel eSIM Market Global Outlook and Forecast 2024-2030

Travel eSIM Market Size, Share 2025

Industry Overview:

A travel eSIM is an electronic SIM card designed for use during international travel. It allows you to connect to local mobile networks without the need for a physical SIM card.

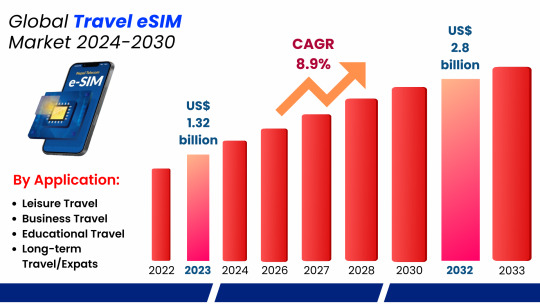

The global Travel eSIM market has shown significant growth over the past few years, with the market valued at approximately US$ 1.32 billion in 2024. This growth is set to continue, with projections indicating that the market will reach a value of US$ 2.8 billion by 2032, reflecting a Compound Annual Growth Rate (CAGR) of 8.9% from 2024 to 2032. The expanding market is driven by several factors, including the rising demand for seamless connectivity, increasing adoption of IoT devices, and the growing number of eSIM-enabled devices.

The eSIM (Embedded Subscriber Identity Module) market is revolutionising mobile connectivity by substituting a more adaptable and digital SIM card for conventional physical SIM cards. This technology is especially helpful for travellers, IoT devices, and organisations that need multi-network connectivity because it enables users to swap carriers remotely without having to change SIM cards. The business is anticipated to grow quickly as eSIM adoption rises, propelled by smartphone manufacturers, IoT applications, and linked autos. Telecom companies, device producers, and software vendors are important participants in ensuring a safe and smooth digital experience. Although there are still issues with international standardisation and compatibility, the eSIM business has a lot of room to development.

Industry Analysis by Segments

Consumer eSim to hold the highest market share: by type

In terms of type the global travel eSim industry has been segmented as Consumer eSim and Machine to Machine eSim.

The consumer eSIM category holds a dominant market share of 60-65% due to its incorporation into popular consumer devices such as wearables, tablets, and smartphones. The integration of eSIM technology into flagship products by major tech companies including as Apple, Samsung, and Google has greatly increased customer adoption.

The flexibility and ease of use that eSIMs provide have contributed significantly to this expansion. For those who travel frequently or require access to different networks, eSIMs are perfect as they enable carrier switching without the need to physically replace the card, in contrast to standard SIM cards. Users no longer need to visit a physical store to complete the activation process because they can connect to a network digitally instantaneously. To further improve the user experience, eSIMs also support dual-SIM capabilities, which enables users to manage their personal and work numbers on the same device. Demand is anticipated to be driven by the increasing number of eSIM-compatible handsets on the market as well as rising consumer knowledge of its benefits. The use of eSIM technology will probably pick up speed as 5G networks spread and consumers demand more dependable, quicker connectivity, thereby consolidating its dominance in the consumer electronics industry.

Further, the Machine-to-Machine (M2M) eSIMs hold a 35-40% share of the market. These eSIMs are critical in the growing IoT sector, where they enable devices to communicate with each other without human intervention. Their use is expanding in industries such as automotive, logistics, and smart cities.

Smart phone to hold the highest market share: by Application

With 50–55% of the market share, smartphones are the most popular application category in the eSIM industry. The increasing number of smartphones with eSIM support as a result of big manufacturers like Apple, Google, and Samsung including the technology into their most recent models is what is driving this domination. The ease that eSIMs provide—especially for travelers—is a major factor propelling this market's expansion. Since eSIMs eliminate the need to swap out traditional SIM cards, they are the perfect option for frequent travellers who need to access various networks in different areas. Customers find it more appealing when they can handle various profiles or providers on a single device rather than having to carry around multiple SIM cards.

Regional Analysis:

In terms of region the global travel eSim has been segmented as North America, Europe, Asia Pacific, Middle East and Africa and South America.

Leading the global Travel eSIM market, Europe holds a 35-40% market share. The region's advanced mobile infrastructure, high adoption of eSIM-enabled devices, and favourable regulatory environment contribute to its dominance. The travel eSIM market in Europe is quickly becoming one of the most competitive and dynamic areas in the world. Europe is a centre for the adoption of cutting-edge digital solutions like eSIMs because of its high volume of international travel, advancements in technology, and supportive regulatory environments. More and more European travellers are searching for flexible, affordable mobile connectivity options that let them stay connected without having to deal with the inconveniences of traditional SIM cards or exorbitant roaming fees. The growing consumer demand for digital-first solutions and the wide availability of eSIM-compatible products, such as wearables and smartphones, are further factors driving the need for the eSIM era.

The increasing international travel across Europe further accelerating the travel eSim market in the region, In comparison with the previous year, there were more foreign visitors arriving in Europe in 2024. In 2024, the number of inbound arrivals was approximately 708 million, which was less than in 2019. This was despite a notable annual growth.

The European Travel Commission (ETC) has published its most recent "European Tourism Trends & Prospects," which states that as of 2024, the sector is stronger than ever. Overnight stays have climbed by 7%, while the number of foreign visitors has increased by 6% from 2019.

End Use Industry Impact Analysis:

The rapid expansion of the global tour eSIM market is being driven by the rise in global tour, the development of the mobile technology, and the increasing demand for digital solutions that provide seamless connectivity.

A primary factor propelling the growth of the Asia tour eSIM market is the substantial growth of both international and intraregional travels. It is anticipated that the number of international visitor arrivals (IVAs) to Asia Pacific will rise from 619 million in 2024 to 762 million in 2026, representing a recovery rate of 111.6% in comparison to the level of 2019. By 2026, visitor arrivals in Asia are expected to reach 564.0 million, followed by those in the Americas (167.7 million) and the Pacific (30.4 million).

Saudi Arabia alone welcomed over 100 million tourists, marking a 56% increase from 2019 and a 12% rise from 2022. Furthermore more the World Travel & Tourism Council (WTTC) reported that in 2024, tourism contributed AED 220 billion to the UAE’s GDP, a figure expected to increase to AED 236 billion in 2024

According to the World Travel & Tourism Council’s (WTTC) latest Economic Impact Report (EIR), reveals the North America Travel & Tourism sector is projected to grow at an average annual rate of 3.9% over the next decade, outstripping the 2% growth rate for the regional economy and reaching an impressive $3.1 trillion in 2032.

According to the international Trade Association, International travel plays a critical role in the US economy. Prior to the COVID-19 pandemic, in 2019, international visitors spent $233.5 billion experiencing the United States; injecting nearly $640 million a day into the U.S. economy

Competitive Analysis:

Some of the key Players operating within the industry includes:

Airalo

Holafly

MAYAMOBILE

BNESIM

Dent Wirelss

Keepgo

Nomad

Sim Options

Surfroam

Airhub

TravelSim

ETravelSIM

Ubigi

Numero eSIM

Total Market By Segment:

By Type:

Consumer eSIM

M2M eSIM (Machine to Machine)

By Application:

Leisure Travel

Business Travel

Educational Travel

Short-term/Temporary Stay

Long-term Travel/Expats

By Connectivity Type:

Standalone eSIM

eSIM with Roaming

Regional eSIM

Global eSIM

By End User:

Individuals

Enterprises

Telecom Operators

Travel Agencies

By Service Offerings

Data Services

Voice Services

SMS Services

Region Covered:

North America

EuropeAsia Pacific

Middle East and Africa

South Africa

Report Coverage:

Industry Trends

SWOT Analysis

PESTEL Analysis

Porter’s Five Forces Analysis

Market Competition by Manufacturers

Production by Region

Consumption by Region

Key Companies Profiled

Marketing Channel, Distributors and Customers

Market Dynamics

Production and Supply Forecast

Consumption and Demand Forecast

Research Findings and Conclusion

Combined Plans:

There are several distinct players in the highly competitive travel eSIM market, including tech companies, eSIM providers, and mobile network carriers. Important rivals are well-known telecom giants, which use their extensive international networks and strong brand names to sell travel eSIM plans directly to customers. Specialised eSIM providers like Airalo, GigSky, and Ubigi, on the other hand, are becoming more and more popular by providing flexible data packages and multi-country plans as well as affordable, customised travel eSIM solutions that are specifically designed for travellers from outside.

Tech companies like Apple and Google also influence the competitive landscape by integrating eSIM technology into their smartphones, enabling direct access to eSIM services through their app ecosystems. This has created opportunities for third-party eSIM service providers to partner with these tech firms, enhancing their global reach.

Key industry Trends:

Integration with IoT and Connected Device:

The Internet of Things (IoT) and linked devices are integrating eSIM generation, which is greatly expanding its use cases and marketability. As the Internet of Things continues to expand, eSIMs are finding their way into a wider range of electronics than just smartphones, such as wearable’s, connected motors, and smart home appliances. There are various benefits to this integration:

Wearables: Wearables, such as fitness trackers and smart watches, can maintain independent connectivity without relying on a paired phone because of eSIMs. Customers can now benefit from instantaneous message delivery, phone calls, and mobile data access via their wearable device, enhancing functionality and user experience.

Connected Cars: eSIMs in the automotive industry enable smooth connectivity for linked automobiles, providing features like real-time navigation, remote diagnostics, and infotainment services. The incorporation of eSIMs into cars facilitates updates via the air, enhances safety features, and offers improved connectivity for telematics and navigation applications.

Smart Home products: Home automation controllers, security systems, and thermostats are examples of smart home products that are incorporating the eSIM era. Through this connection, devices can communicate with one other and with customers anywhere in the world with consistent and dependable connectivity.

The expansion of eSIM technology into these diverse applications enhances its utility and opens up new market opportunities. For device manufacturers, integrating eSIMs simplifies design and manufacturing processes by eliminating the need for physical SIM card slots, leading to more compact and robust devices. Additionally, eSIMs support global connectivity, allowing devices to operate seamlessly across different regions without the need for multiple SIM cards.

Industry Driving Factor:

Rising Demand for Flexible and Convenient Connectivity Solutions:

Due to the increasing demand for seamless communication and connectivity when on the go, consumers are placing an increasing emphasis on the flexibility and convenience of their connectivity solutions. This trend is particularly noticeable among travellers, who are searching for solutions to make staying connected in unusual locales easier. These demands are met by ESIM technology, which gives traditional SIM cards a more adaptable and user-friendly option. eSIMs, as opposed to physical SIM cards, eliminate the need for physical swaps and let users activate and manage their mobile subscriptions online. With this method, travellers will no longer need to buy and insert several SIM cards or put up with the hassle of switching SIM cards when travelling to different countries. Alternatively, they could easily switch between plans or businesses right from their device, usually through a mobile app. One further factor driving the growing demand for eSIMs is their capacity to support many profiles on a single eSIM. This feature enables users to manage private plans for personal and business use or seamlessly transition between local and international plans. This flexibility now ensures continuous connectivity and helps users avoid paying exorbitant roaming fees in addition to improving comfort. The popularity of eSIM technology is continuing to rise as more customers look for solutions that fit their busy lifestyles and travel habits. This indicates a larger trend towards more flexible, virtual, and hassle-free connectivity options.

Industry Restraining Factor:

Device compatibility is one of the major challenges facing the eSIM business. Although the eSIM technology is increasingly being included into more modern wearable, and smartphones, many older or even less advanced devices do not support eSIM functionality. Due to the fact that a significant section of the customer base still uses devices that require physical SIM cards, this issue limits the market penetration of travel eSIMs. The switch to eSIMs isn't always possible for clients with mismatched equipment, which is likely to cause annoyance and reduce the potential customer base for travel eSIM providers. The challenge of device compatibility is made more difficult by the slow rate of update or modification of older devices. The adoption of eSIM generation may be slow in many places, especially where clients are more price-sensitive or where older devices are still in widespread use. Travel eSIM providers face a challenge as a result of this delayed adoption rate because they must serve a wide range of target customers with different levels of technological proficiency.

Report Scope:

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides break down details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by types, applications, Connectivity type, end use and Service Offerings. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.Report AttributesReport DetailsReport TitleTravel eSIM Market Global Outlook and Forecast 2024-2030Historical Year2018 to 2022 (Data from 2010 can be provided as per availability)Base Year2024Forecast Year2032Number of Pages107 PagesCustomization AvailableYes, the report can be customized as per your need.

1 note

·

View note

Text

The Embedded SIM (eSIM) Market is growing at a CAGR of 7.05% over the next 5 years. Gemalto N.V. (Thales Group), Giesecke+Devrient GmbH, STMicroelectronics N.V., Infineon Technologies AG, Valid S.A. are the major companies operating in Embedded SIM (eSIM) Market.

#Embedded SIM (eSIM) Market#Embedded SIM (eSIM) Market Size#Embedded SIM (eSIM) Market Share#Embedded SIM (eSIM) Market Analysis#Embedded SIM (eSIM) Market Trends#Embedded SIM (eSIM) Market Report#Embedded SIM (eSIM) Market Research#Embedded SIM (eSIM) Industry#Embedded SIM (eSIM) Industry Report

0 notes

Text

ASX All Ordinaries: Telstra Group (ASX:TLS) Advances in Digital Infrastructure Expansion

Highlights:

Telstra Group expands its digital infrastructure assets across domestic and international networks

Key projects underway to strengthen mobile, fibre, and cloud-related services

Telstra is part of the ASX 200 and listed on the ASX All Ordinaries Index

Telecommunications Sector Overview with ASX All Ordinaries Index Context Telstra Group (ASX:TLS) operates in the telecommunications sector, providing network infrastructure, mobile services, internet access, and enterprise solutions. The company is part of the ASX 200 and also listed on the ASX All Ordinaries Index, which tracks hundreds of Australian companies across all industries. Telstra’s listing in these indexes reflects its relevance in market capitalisation and industry contribution.

As a national telecom provider, the company delivers mobile, broadband, and fixed-line services to residential and commercial users. In addition, it manages core wholesale and data connectivity services across submarine and terrestrial networks. The company is actively involved in modernising Australia's digital landscape by enhancing connectivity, rural mobile towers, and 5G network implementation.

Infrastructure Projects and Digital Connectivity Telstra Group maintains one of the largest communications networks in Australia. Recent projects include upgrades to its fibre infrastructure and ongoing deployment of 5G base stations. These upgrades are designed to improve coverage, speed, and latency for both urban and remote communities.

The company also maintains key international cable systems, connecting Asia-Pacific data traffic through strategic subsea links. These transnational cables support cloud computing and enterprise data transfer requirements. Through these systems, the company enables real-time traffic management, bandwidth on demand, and secure communication services.

Enterprise Services and Technology Solutions Telstra offers enterprise-grade technology products, ranging from cloud collaboration tools to cybersecurity services. The company supports government departments, multinational corporations, and medium-sized businesses with scalable network solutions. It operates secure data centres and provides integrated platforms for IT service management, hybrid cloud, and application delivery.

The group’s enterprise division collaborates with global technology providers to offer solutions tailored for industry-specific requirements. This includes network security, software-defined wide area networks (SD-WAN), and managed mobility solutions for workforce connectivity. These services are deployed across various sectors including mining, education, and transport.

Mobile Services and Customer Network Coverage Telstra remains a leading mobile network provider in the country, with a broad 4G and 5G footprint. The company has expanded regional coverage areas and introduced features like eSIM activation and voice-over-LTE calling. Its mobile business includes consumer and business plans, pre-paid and post-paid services, and device sales.

Service innovation includes automated support systems and digital-first customer service experiences. The company’s MyTelstra app integrates self-service tools and real-time network updates, allowing customers to manage usage, payments, and technical support remotely. Additional efforts have been made to improve connectivity during natural events and community disruptions.

ASX Dividend Yield Relevance and Capital Strategy Telstra Group’s dividend-related performance has historically drawn interest from dividend-focused segments of the market. The company allocates capital based on infrastructure development and strategic digital transformation, while maintaining payout levels aligned with cash flow and long-term value delivery.

As part of the ASX All Ordinaries and ASX 200 indexes, Telstra’s financial metrics are closely monitored across the broader equity landscape. The company’s strategy includes cost optimisation, legacy system migration, and asset divestments where applicable. It also focuses on capital-light business models, such as recurring service contracts, which generate consistent returns.

0 notes

Text

From eSIM Activations to Autopay: Action Triggers Every Telecom Loyalty Platform Should Reward

Not all customer behaviors are created equal. In telecom, some actions signal deeper engagement, higher revenue potential, and lower churn risk. The smartest telecom loyalty platforms recognize this—and design rewards around specific customer actions, not just spend.

If your loyalty program is still focused on usage points or anniversary milestones, it’s time to shift gears. Modern loyalty is about driving high-value behaviors in real time. Here's a breakdown of key actions every telecom loyalty platform should reward—and why it matters.

1. eSIM Activation

The adoption of eSIM technology reduces operational costs and speeds up customer onboarding. Yet many users still hesitate to make the switch. By offering small, instant rewards—like a free streaming trial or a digital gift card—telecoms can nudge users toward faster activation. The result? Lower churn risk and a more digitally native customer base.

Why it works: eSIM users are typically more tech-savvy and less likely to churn if they’re onboarded smoothly.

2. Autopay Enrollment

One of the most valuable customer behaviors, autopay not only improves cash flow but also correlates with longer customer lifecycles. By offering perks for autopay setup, telecoms can reduce involuntary churn and improve financial forecasting.

Reward idea: Offer a coffee voucher or a mobile data boost the moment autopay is activated.

3. Plan Upgrades

Rather than discounting premium plans, encourage upgrades by tying them to high-perceived-value perks. Customers are more willing to spend more when they feel they’re getting something exclusive in return—like lifestyle perks or subscription bundles.

Why reward it: ARPU (Average Revenue Per User) increases instantly, without long-term price erosion.

4. Referral Actions

Referral marketing is a cost-effective way to acquire new users, but it only works if customers are motivated to participate. Telecom loyalty platforms should incentivize both the referrer and the referee with action-based rewards like digital gift cards, free trials, or even experiential perks.

Tip: Make referrals easy to track and reward immediately to increase follow-through rates.

5. Profile Completion and App Usage

A completed customer profile and frequent app usage allow for more personalized campaigns and reduce support overhead. Encourage users to complete their profiles or use the app consistently by rewarding them with bite-sized perks.

Good to know: Customers who use self-serve apps tend to rate their provider higher on NPS and are more likely to discover new offers organically.

6. Timely Bill Payments

While autopay is the ideal, many users still pay manually. Rewarding consistent, on-time bill payments helps build a habit—and reduces missed payments and collection costs.

Reward idea: A monthly draw for on-time payers can keep things cost-effective yet engaging.

The Power of Action-Based Loyalty

What separates a high-performing telecom loyalty platform from a forgettable one is this: relevance and timing. Users don’t want to wait months for rewards—they want instant feedback. And telecoms don’t need to offer discounts—they need to influence behavior.

Platforms like Paylode make this possible by offering plug-and-play reward campaigns that are personalized, measurable, and fast to launch. The result? Increased ARPU, reduced churn, and higher customer satisfaction—without cutting into margins.

0 notes

Text

Travel eSIM Market 2025

Travel eSIM, or embedded SIM, is a revolutionary technology that eliminates the need for a physical SIM card, allowing users to switch between network providers seamlessly. This technology is particularly beneficial for frequent travelers, enabling them to access mobile networks in multiple countries without changing SIM cards. Travel eSIMs are widely used in business travel, leisure travel, and study abroad programs, offering cost-effective and hassle-free connectivity solutions.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/206/travel-esim

Market Size

The global Travel eSIM market was valued at US$ 325.62 million in 2023 and is projected to reach US$ 734.16 million by 2030, growing at a CAGR of 12.36% from 2024 to 2030.

North America: The market is expected to increase from US$ 90.44 million in 2023 to US$ 208.50 million by 2030, with a CAGR of 13.49%.

Asia-Pacific: Estimated to grow from US$ 64.78 million in 2023 to US$ 144.26 million by 2030, at a CAGR of 11.37%.

The increasing adoption of eSIMs by international travelers, the rising penetration of smartphones, and advancements in telecommunication technologies are driving this market’s growth.

Market Dynamics

Drivers

Increasing International Travel: The growing number of international travelers for business, tourism, and education is a significant driver for the Travel eSIM market.

Convenience & Cost-Effectiveness: eSIMs offer seamless connectivity, eliminating roaming charges and the hassle of purchasing local SIM cards.

Growing Adoption of IoT & Smart Devices: The rise of eSIM-compatible devices, such as smartphones, tablets, and smartwatches, is propelling demand.

Expansion of 5G Networks: The rapid rollout of 5G enhances the user experience by offering faster and more reliable internet connectivity.

Restraints

Limited Compatibility with Devices: Not all smartphones and devices support eSIM technology, which can slow down market adoption.

Lack of Awareness: Many consumers are still unaware of eSIM technology and its benefits.

Regulatory Challenges: Different regulations across countries regarding eSIM activation can hinder market expansion.

Opportunities

Integration with Smart Travel Solutions: Travel eSIMs can be integrated with digital travel platforms for an enhanced experience.

Emerging Markets Adoption: Regions like Africa and Latin America present untapped growth potential.

Partnerships with Telecom Providers: Collaborations between eSIM providers and mobile network operators can expand service offerings.

Challenges

Cybersecurity Risks: Ensuring secure authentication and data protection remains a challenge for eSIM technology.

Fragmented Market Competition: The presence of multiple players with varied pricing and service models leads to market fragmentation.

Regional Analysis

North America

Market Share: 27.7% (2023)

Major Players: Holafly, Airalo, Vodafone

Growth Drivers: High smartphone penetration, strong telecom infrastructure, and increased business travel demand.

Europe

Market Share: 25.6% (2023)

Major Players: Ubigi, Bouygues Telecom, Sim Local

Growth Drivers: EU-wide regulatory support for eSIM, high travel frequency within Schengen countries.

Asia-Pacific

Market Share: 19.9% (2023)

Major Players: Flexiroam, Sakura Mobile

Growth Drivers: Growing middle class, increasing international students, expanding digital economy.

Latin America & Middle East

Market Share: 16.8% (2023)

Major Players: Drimsim, TravelSim

Growth Drivers: Increasing tourism, mobile adoption, and digital transformation.

Competitor Analysis

Major Players & Market Share (2023)

Holafly

Airalo

Bouygues Telecom

Ubigi

Vodafone

These companies collectively hold approximately 35% of the total market revenue.

Global Travel eSIM: Market Segmentation Analysis

This report provides a deep insight into the global Travel eSIM market, covering essential aspects such as market trends, competitive landscape, niche markets, key drivers, and SWOT analysis.

Market Segmentation (by Application)

Individual Travelers

Corporate Travelers

Group Travelers

Frequent Travelers

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/206/travel-esim

Market Segmentation (by Type)

4G eSIM

5G eSIM

By Type of eSIM:

Standalone eSIM

Combinational eSIM

By Data Plan:

Prepaid eSIMs

Postpaid eSIMs

Unlimited Data Plans

Pay-As-You-Go

By Duration:

Short-Term eSIMs

Long-Term eSIMs

One-Time Use eSIMs

By End-User Device:

Smartphones

Tablets

Laptops

Wearables

IoT Devices

By Technology:

4G LTE eSIMs

5G eSIMs

By Pricing:

Budget eSIMs

Mid-Range eSIMs

Premium eSIMs

Key Companies

Holafly

Airalo

Bouygues Telecom

Ubigi

Vodafone

Matrix Cellular

Airhub

Flexiroam

Sakura Mobile

Sim Local

Drimsim

Mayamobile

Geographic Segmentation

North America (U.S., Canada)

Asia-Pacific (China, Japan, South Korea, India, Australia)

Europe (Germany, France, U.K., Italy, Russia)

Latin America (Mexico, Brazil, Argentina, Colombia)

Middle East & Africa

FAQ

What is the current market size of the Travel eSIM industry?

▶ As of 2023, the global Travel eSIM market was valued at US$ 325.62 million and is projected to reach US$ 734.16 million by 2030.

Which are the key companies operating in the Travel eSIM market?

▶ Major companies include Holafly, Airalo, Bouygues Telecom, Ubigi, Vodafone, Matrix Cellular, Airhub, Flexiroam, and Sakura Mobile.

What are the key growth drivers in the Travel eSIM market?

▶ Key drivers include increasing international travel, cost-effective connectivity, rapid 5G expansion, and growing IoT adoption.

Which regions dominate the Travel eSIM market?

▶ North America and Europe hold the largest market shares, followed by Asia-Pacific as an emerging leader.

What are the emerging trends in the Travel eSIM market?

▶ Trends include wider adoption of 5G, increased smartphone compatibility, integration with digital travel platforms, and regulatory support for eSIM activation.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/206/travel-esim

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Link

0 notes

Text

Things To Remember When You Move Overseas

When preparing to relocate abroad, it’s easy to overlook key details during packing that can lead to significant challenges down the line. To help ensure a smooth process, expats advise that new movers avoid these common packing oversights that they navigated during their own moves.

This will facilitate a seamless journey to your destination, allowing you to embrace your new environment with belongings that help you feel at home.

What Did You Forget To Pack Before Moving Overseas?

Many people make the mistake of assuming they can purchase a new wardrobe upon arrival in their destination country. While this may seem convenient, it can lead to frustration when familiar clothing items are unavailable or difficult to replace.

Sizes and styles vary significantly across different countries, making the task of finding garments that suit both your body and personal taste very challenging. It is important to bring your favourite, well-fitting clothes and fill in any gaps with inexpensive seasonal items sourced from second-hand stores once you are settled. By packing your own clothes and shoes, especially if using overseas shipping for your belongings, you will ensure greater comfort during your adjustment period.

In favour of packing essential items, many expats fail to consider the importance of packing supplies for personal hobbies and creative activities. It may seem like these items take up valuable space in a limited suitcase, but they are integral to maintaining your sense of normalcy and comfort while settling into a new country.

It is possible to purchase new supplies once you have reached your destination. However, the cost and availability of these items may vary significantly. Hobbies provide a sense of continuity and relaxation, so ensure you bring the tools and materials that allow you to stay connected with your passions with you.

It is crucial to pack over-the-counter medications that you frequently use, such as pain relievers, allergy tablets, and cold remedies. Navigating unfamiliar pharmacies in a foreign country can be a frustrating experience, particularly if the medicines you rely on are not available or are marketed under different names.

Bringing your regular medicines ensures you are well-prepared to handle minor health issues without unnecessary stress. This precaution will help you feel more at ease during your transition, especially if you fall ill in your new location.

What Did You Forget To Do Before Moving Overseas?

An often-overlooked task when preparing for an international move is ensuring that your SIM card is switched to a pay-as-you-go plan or activating an eSIM. This simple yet essential step ensures you will still receive critical two-step verification messages for your online banking apps.

Failing to make this change can result in being locked out of important services, causing unnecessary complications once you arrive at your destination. To avoid this inconvenience, be sure to make the necessary changes to your SIM card before departing.

Prior to moving, it is advisable to address any outstanding health or personal maintenance issues. Scheduling medical, dental, and other health-related appointments while you are still covered by your home country’s insurance will save you additional stress, money, and time.

In many cases, it can take weeks or months to secure appointments in an unfamiliar place. By taking care of routine health needs before your departure, you will have the peace of mind to focus on settling into your new environment.

Many expats regret not consulting with international removalists prior to their move, especially when it comes to shipping delicate or sentimental belongings. While some may consider leaving these items behind or purchasing new ones upon arrival, this can result in both emotional and financial strain.

Replacing cherished possessions is often more costly than shipping them, as it may not be possible to find equivalent items in your new country. To avoid these regrets, consider engaging an international removalist to safely ship your belongings. This will ensure that your treasured possessions arrive at your new home without the risk of damage or loss, providing comfort and familiarity during your transition.

Things To Remember When You Move Overseas

In the excitement of moving overseas, it is easy to overlook important details that can complicate your relocation. Before your departure, it is essential to consider these factors to ensure you have the confidence and organisation needed for a successful move. By staying on top of these expat recommendations, you can avoid common mistakes and make your relocation as smooth and efficient as possible.

#InternationalMovingcompanies#Internationalremovalists#OverseasShipping#Overseasmovingservices#MovingOverseasCompanies#OverseasRemovalists#InternationalMoversandPackers#OverseasPackersandShippers

0 notes