#Chevron Finance Development Program

Explore tagged Tumblr posts

Text

New England States Target Fossil Fuel Companies, but New Hampshire Stays Out

https://oilgasenergymagazine.com/wp-content/uploads/2024/12/1-New-England-States-Target-Fossil-Fuel-Companies-but-New-Hampshire-Stays-Out-Source-pv-magazine-usa.com_.jpg

Source: pv-magazine-usa.com

Category: News

Maine Joins the Legal Battle Against Fossil Fuel Giants

Maine has joined four other New England states in suing major fossil fuel companies over allegations of deception and negligence related to climate change. Maine Attorney General Aaron Frey filed a lawsuit against ExxonMobil, Shell, Chevron, BP, Sunoco, and the American Petroleum Institute, accusing them of misleading residents about the environmental harm caused by their products. The complaint alleges violations of Maine laws, including negligence, nuisance, and failure to warn, as well as breaches of the Maine Unfair Trade Practices Act.

“For over half a century, these companies chose to fuel profits instead of following their science to prevent what are now likely irreversible, catastrophic climate effects,” said Frey. Maine’s lawsuit seeks to hold these companies accountable for climate-related damages and demands they stop their deceptive practices while compensating for past and future harm. The state’s filing highlights the growing legal pushback from New England as the region grapples with the consequences of rising sea levels, extreme weather, and other climate impacts.

Broader New England Efforts to Hold Fossil Fuel Companies Accountable

Maine’s lawsuit follows similar actions by Vermont, Connecticut, Massachusetts, and Rhode Island. These states argue that fossil fuel companies have engaged in systematic deception regarding the effects of their products on climate change.

Vermont filed its case in 2021 against major oil and gas firms, including ExxonMobil and Shell, for deceptive marketing and distribution practices. Connecticut’s lawsuit, initiated in 2020, accuses ExxonMobil of a decades-long campaign to obscure the link between fossil fuel use and climate change. Massachusetts began its legal challenge in 2019, alleging ExxonMobil deliberately misled consumers and investors. Meanwhile, Rhode Island’s 2018 case targets 20 oil and gas companies, seeking compensation for damages such as flooding and sea-level rise along its extensive shoreline.

The collective efforts of these states underscore a unified regional stance against the fossil fuel industry. They aim to not only seek damages but also push for greater corporate accountability in addressing climate change.

New Hampshire’s Mixed Stance on Climate Action

New Hampshire remains the sole New England state not to file a lawsuit against fossil fuel companies. A 2022 bill proposing a commission to calculate the financial costs of climate damage and explore ways to recover those costs failed to gain traction. Attempts to reintroduce the bill remain uncertain, as its lead sponsor has yet to comment.

Despite its reluctance to take legal action, New Hampshire has maintained its net metering (NEM) program for solar energy users, set to expire in 2040. However, the state’s relatively low NEM rates, particularly for larger installations, and high electricity costs—averaging 23.1 cents per kilowatt-hour—pose challenges for renewable energy adoption. According to Sam Evans-Brown, Executive Director of Clean Energy NH, the uncertainty surrounding net metering credits complicates solar project financing. He emphasized that extending NEM policies to a rolling 20-year tariff could better support residents and developers.

While New Hampshire has made modest progress in renewable energy policy, its lack of legal action against fossil fuel companies contrasts sharply with other New England states, reflecting a cautious approach to addressing climate change at the state level.

0 notes

Text

Fueling Your Future: How an Online MBA in Oil and Gas Management Can Propel Your Career to New Heights

Introduction:

In an era where energy resources play a pivotal role in global economics, the oil and gas sector emerges as a powerhouse of opportunities. But how does one tap into its vast potential? The answer might lie in an Online MBA in Oil and Gas Management. Dive in to discover how this specialized MBA can be your catalyst for success in the dynamic world of energy.

What is MBA in Oil and Gas Management?

The MBA in Oil and Gas Management isn't just another degree—it's a finely-tuned program tailored for those with a vision to lead in the energy sector. Merging the foundational principles of a traditional Master of Business Administration with industry-specific expertise, it prepares aspirants to tackle the unique challenges and leverage the opportunities in the oil and gas world.

Top MBA Colleges for Oil and Gas Management:

University of Petroleum and Energy Studies (UPES): Esteemed for its intensive energy-centric curriculum and industry partnerships.

Indian Institute of Management (IIM) Indore: A balance of classic MBA teachings with a dedicated focus on oil and gas.

Rajiv Gandhi Institute of Petroleum Technology: Famed for its deep-rooted ties with the energy sector and practical training modules.

Pandit Deendayal Petroleum University: A blend of technical prowess and managerial acumen in the domain of energy.

Career Opportunities after the MBA:

With an MBA in Oil and Gas Management, an array of roles beckon:

Energy Consultant

Petroleum Project Manager

Reservoir Engineer

Oil and Gas Trader

Upstream Supply Chain Analyst

Downstream Supply Chain Strategist

Energy Finance Manager

Sustainability Officer in Energy Firms

Oil and Gas Business Developer

Operations Manager in Refineries

From navigating the intricacies of energy contracts to spearheading green initiatives in the sector, these profiles offer a rewarding career trajectory.

Why an Online MBA in Oil and Gas Management?

The flexibility and accessibility of online programs, coupled with a curriculum updated with real-time industry changes, make online MBAs especially appealing. For those looking to join the oil and gas sector without geographical constraints, this program offers global insights, networking opportunities, and a thorough grounding in both the business and technical aspects of the energy sector.

Top Hiring Companies:

In India:

Reliance Industries Ltd.

ONGC

Indian Oil Corporation Ltd.

Essar Oil Ltd.

Cairn India

Tata Petrodyne Ltd.

GAIL

BPCL

Oil India Ltd.

Hindustan Petroleum Corporation Ltd.

Globally:

ExxonMobil

Shell

BP

Chevron

Total

Gazprom

Lukoil

Rosneft

Equinor

ConocoPhillips

Decision Time: Assessing the Impact on Career:

An MBA, especially in a specialized sector like oil and gas, is a significant investment. Aspiring students should weigh the program's merits against their career aspirations, the growth trajectory in the energy sector, and the unique opportunities that an online format presents.

Why ShikshaGurus ?

ShikshaGurus is an AI enabled platform where students can compare universities, colleges and courses and make the best decision for their career.

Conclusion:

Charting a career in the vast expanse of the oil and gas sector demands both knowledge and niche expertise. An Online MBA in Oil and Gas Management equips you with the right tools, knowledge, and network to not only enter this dynamic field but to lead and innovate. For those poised at the crossroads of ambition and opportunity, this might just be the compass you need.

0 notes

Text

Apply Now: Chevron Undergraduate and Graduate Development Programs 2023

Apply Now: Chevron Undergraduate and Graduate Development Programs 2023

Chevron Undergraduate and Graduate Development Programs is currently open for applications from motivated candidates. These programs will provide you with an opportunity to expand your knowledge and benefit from invaluable on-the-job experience. Begin a career at Chevron and be a part of the team that brings the world vital energy. Chevron’s undergraduate development programs offer the…

View On WordPress

#Apply Now: Chevron Undergraduate and Graduate Development Programs 2023#Chevron Careers#Chevron Finance Development Program#Chevron graduate program#Chevron Graduate Trainee 2022#Chevron Horizons program salary#Chevron Internship salary#Chevron Internships 2023#Chevron MBA Development program salary#Chevron Sales Development program salary#Chevron Scholarship 2022 application portal#Chevron Scholarship for Undergraduate#Chevron Scholarship portal#Chevron Undergraduate Scholarship 2022

0 notes

Link

Over more than a decade, the rise of the left in Latin American governance has led to remarkable advances in poverty alleviation, regional integration, and a reassertion of sovereignty and independence. The United States has been antagonistic toward the new left governments, and has concurrently pursued a bellicose foreign policy, in many cases blithely dismissive of international law.

2390

Jose M. Vivanco at Senate hearing in 2004. Photo by Jeremy Bigwood.So why has Human Rights Watch (HRW)—despite proclaiming itself “one of the world’s leading independent organizations” on human rights—so consistently paralleled U.S. positions and policies? This affinity for the U.S. government agenda is not limited to Latin America. In the summer of 2013, for example, when the prospect of a unilateral U.S. missile strike on Syria—a clear violation of the UN Charter—loomed large, HRW’s executive director Kenneth Roth speculated as to whether a simply “symbolic” bombing would be sufficient. “If Obama decides to strike Syria, will he settle for symbolism or do something that will help protect civilians?” he asked on Twitter. Executive director of MIT’s Center for International Studies John Tirman swiftly denounced the tweet as “possibly the most ignorant and irresponsible statement ever by a major human-rights advocate.”

1

HRW’s accommodation to U.S. policy has also extended to renditions—the illegal practice of kidnapping and transporting suspects around the planet to be interrogated and often tortured in allied countries. In early 2009, when it was reported that the newly elected Obama administration was leaving this program intact, HRW’s then Washington advocacy director Tom Malinowski argued that “under limited circumstances, there is a legitimate place” for renditions, and encouraged patience: “they want to design a system that doesn’t result in people being sent to foreign dungeons to be tortured,” he said, “but designing that system is going to take some time.”2

Similar consideration was not extended to de-facto U.S. enemy Venezuela, when, in 2012, HRW’s Americas director José Miguel Vivanco and global advocacy director Peggy Hicks wrote a letter to President Hugo Chávez arguing that his country was unfit to serve on the UN’s Human Rights Council. Councilmembers must uphold the highest standards in the promotion and protection of human rights, they maintained, but unfortunately, “Venezuela currently falls far short of acceptable standards.”3 Given HRW’s silence regarding U.S. membership in the same council, one wonders precisely what HRW’s acceptable standards are.

One underlying factor for HRW’s general conformity with U.S. policy was clarified on July 8, 2013, when Roth took to Twitter to congratulate his colleague Malinowski on his nomination to be Assistant Secretary of State for Democracy, Human Rights and Labor (DRL). Malinowski was poised to further human rights as a senior-level foreign-policy official for an administration that convenes weekly “Terror Tuesday” meetings. In these meetings, Obama and his staffers deliberate the meting out of extrajudicial drone assassinations around the planet, reportedly working from a secret “kill list” that has included several U.S. citizens and a 17-year-old girl.4

Malinowski’s entry into government was actually a re-entry. Prior to HRW, he had served as a speechwriter for Secretary of State Madeline Albright and for the White House’s National Security Council. He was also once a special assistant to President Bill Clinton—all of which he proudly listed in his HRW biography. During his Senate confirmation hearing on September 24, Malinowski promised to “deepen the bipartisan consensus for America’s defense of liberty around the world,” and assured the Foreign Relations Committee that no matter where the U.S. debate on Syria led, “the mere fact that we are having it marks our nation as exceptional.”5

That very day, Obama stood before the UN General Assembly and declared, “some may disagree, but I believe that America is exceptional.” Assuming that by “exceptional” Obama meant exceptionally benevolent, one of those who disagreed was Brazilian president Dilma Rousseff, who had opened the proceedings at the same podium by excoriating Obama’s “global network of electronic espionage,” which she considered a “disrespect to national sovereignty” and a “grave violation of human rights and of civil liberties.” Rousseff contrasted Washington’s rogue behavior with her characterization of Brazil as a country that has “lived in peace with our neighbors for more than 140 years.” Brazil and its neighbors, she argued, were “democratic, pacific and respectful of international law.”6 Rousseff’s speech crystallized Latin America’s broad opposition to U.S. exceptionalism, and therefore shed light on the left’s mutually antagonistic relationship with HRW.

*

Malinowski’s background is but one example of a larger scenario. HRW’s institutional culture is shaped by its leadership’s intimate links to various arms of the U.S. government. In her HRW biography, the vice chair of HRW’s board of directors, Susan Manilow, describes herself as “a longtime friend to Bill Clinton,” and helped manage his campaign finances. (HRW once signed a letter to Clinton advocating the prosecution of Yugoslav President Slobodan Milosevic for war crimes; HRW made no case for holding Clinton accountable for NATO’s civilian-killing bombings despite concluding that they constituted “violations of international humanitarian law.”)7 Bruce Rabb, also on Human Rights Watch’s Board of Directors, advertises in his biography that he “served as staff assistant to President Richard Nixon” from 1969-70—the period in which that administration secretly and illegally carpet bombed Cambodia and Laos.8

The advisory committee for HRW’s Americas Division has even boasted the presence of a former Central Intelligence Agency official, Miguel Díaz. According to his State Department biography, Díaz served as a CIA analyst and also provided “oversight of U.S. intelligence activities in Latin America” for the House Permanent Select Committee on Intelligence.9 As of 2012, Díaz focused, as he once did for the CIA, on Central America for the State Department’s DRL—the same bureau now to be supervised by Malinowski.

Other HRW associates have similarly questionable backgrounds: Myles Frechette, currently an advisory committee member for the Americas Division, served as Assistant U.S. Trade Representative for Latin America and the Caribbean from 1990-93, and then became U.S. Ambassador to Colombia from 1994-97. Frechette subsequently worked as the executive director of a “nonprofit” group called the North American-Peruvian Business Council, and championed the interests of his funders in front of Congress. His organization received financing from companies such as Newmont Mining, Barrick Gold, Caterpillar, Continental Airlines, J.P. Morgan, ExxonMobil, Patton Boggs, and Texaco.10

Michael Shifter, who also currently serves on HRW’s Americas advisory committee, directed the Latin America and Caribbean program for the National Endowment for Democracy (NED), a quasi-governmental entity whose former acting president Allen Weinstein told The Washington Post in 1991 that “a lot of what we do today was done covertly 25 years ago by the CIA.”11 Shifter, as current president of a policy center called the Inter-American Dialogue, oversees $4 million a year in programming, financed in part through donations from the U.S. Agency for International Development (USAID), the embassies of Canada, Germany, Guatemala, Mexico and Spain, and corporations such as Chevron, ExxonMobil, J.P. Morgan, Microsoft, Coca-Cola, Boeing, and Western Union.

To be sure, not all of the organization’s leadership has been so involved in dubious political activities. Many HRW board members are simply investment bankers, like board co-chairs Joel Motley of Public Capital Advisors, LLC, and Hassan Elmasry, of Independent Franchise Partners, LLP. HRW Vice Chair John Studzinski is a senior managing director at The Blackstone Group, a private equity firm founded by Peter G. Peterson, the billionaire who has passionately sought to eviscerate Social Security and Medicare. And although Julien J. Studley, the Vice Chair of the Americas advisory committee, once served in the U.S. Army’s psychological warfare unit, he is now just another wealthy real-estate tycoon in New York.

That HRW’s advocacy reflects its institutional makeup is unremarkable. Indeed, an examination of its positions on Latin America demonstrates the group’s predictable, general conformity with U.S. interests. Consider, for example, HRW’s reaction to the death of Hugo Chávez. Within hours of his passing on March 5, 2013, HRW published an overview—“Venezuela: Chávez’s Authoritarian Legacy”—to enormous online response. In accordance with its headline’s misleading terminology, HRW never once mentioned Chávez’s democratic bona fides: Since 1998, he had triumphed in 14 of 15 elections or referenda, all of which were deemed free and fair by international monitors. Chávez’s most recent reelection boasted an 81% participation rate; former president Jimmy Carter described the voting process as “the best in the world.”12 The article neglected to cite a single positive aspect of Chávez’s tenure, under which poverty was slashed by half and infant mortality by a third.

In contrast, HRW’s August 21, 2012 statement regarding the death of Ethiopian leader Meles Zenawi was decidedly more muted: “Ethiopia: Transition Should Support Human Rights Reform,” read the headline. Leslie Lefkow, HRW’s deputy Africa director, urged the country’s new leadership to “reassure Ethiopians by building on Meles’s positive legacy while reversing his government’s most pernicious policies.” Regarding a leader whose two-decade rule had none of Chávez’s democratic legitimacy (HRW itself documented Ethiopia’s repressive and unfair elections in both 2005 and 2010), the organization argued only that “Meles leaves a mixed legacy on human rights.”13 Whereas HRW omitted all mention of Chávez-era social improvements, it wrote, “Under [Meles’s] leadership the country has experienced significant, albeit uneven, economic development and progress.”

The explanation for this discrepancy is obvious: as a New York Times obituary reported, Meles was “one of the United States government’s closest African allies.” Although “widely considered one of Africa’s most repressive governments,” wrote the Times, Ethiopia “continues to receive more than $800 million in American aid each year. American officials have said that the Ethiopian military and security services are among the Central Intelligence Agency’s favorite partners.”14

*

HRW has taken its double standard to cartoonish heights throughout Latin America. At a 2009 NED Democracy Award Roundtable, José Miguel Vivanco described Cuba, not the United States, as “one of our countries in the hemisphere that is perhaps the one that has today the worst human-rights record in the region.” As evidence, he listed Cuba’s “long- and short-term detentions with no due process, physical abuse [and] surveillance”—as though these were not commonplace U.S. practices, even (ironically) at Guantánamo Bay.15 Vivanco was also quoted in late 2013, claiming at an Inter-American Dialogue event that the “gravest setbacks to freedom of association and expression in Latin America have taken place in Ecuador”—not in Colombia, the world’s most dangerous country for trade union leaders, or in Honduras, the region’s deadliest country for journalists (both, incidentally, U.S. allies).16

Latin America scholars are sounding the alarm: New York University history professor Greg Grandin recently described HRW as “Washington’s adjunct” in The Nation magazine.17 And when Vivanco publicly stated that “we did [our 2008] report because we wanted to show the world that Venezuela is not a model for anyone,” over 100 academics wrote to the HRW’s directors, lamenting the “great loss to civil society when we can no longer trust a source such as Human Rights Watch to conduct an impartial investigation and draw conclusions based on verifiable facts.”18

HRW’s deep ties to U.S. corporate and state sectors should disqualify the institution from any public pretense of independence. Such a claim is indeed untenable given the U.S.-headquartered organization’s status as a revolving door for high-level governmental bureaucrats. Stripping itself of the “independent” label would allow HRW’s findings and advocacy to be more accurately evaluated, and its biases more clearly recognized.

In Latin America, there is a widespread awareness of Washington’s ability to deflect any outside attempts to constrain its prerogative to use violence and violate international law. The past three decades alone have seen U.S. military invasions of Grenada and Panama, a campaign of international terrorism against Nicaragua, and support for coup governments in countries such as Venezuela, Haiti, Honduras, and Guatemala. If HRW is to retain credibility in the region, it must begin to extricate itself from elite spheres of U.S. decision-making and abandon its institutional internalization of U.S. exceptionalism. Implementing a clear prohibition to retaining staff and advisers who have crafted or executed U.S. foreign policy would be an important first step. At the very least, HRW can institute lengthy “cooling-off” periods—say, five years in duration—before and after its associates move between the organization and the government.

After all, HRW’s Malinowski will be directly subordinate to Secretary of State John Kerry, who conveyed the U.S. attitude toward Latin America in a way that only an administrator of a superpower could. In an April 17, 2013 House Foreign Affairs Committee hearing, a member of Congress asked Kerry whether the United States should prioritize “the entire region as opposed to just focusing on one country, since they seem to be trying to work together closer than ever before.” Kerry reassured him of the administration’s global vision. “Look,” he said. “The Western Hemisphere is our backyard. It is critical to us.”19

4 notes

·

View notes

Text

Global oil prices have fully recovered from the pandemic

New Post has been published on https://appradab.com/global-oil-prices-have-fully-recovered-from-the-pandemic/

Global oil prices have fully recovered from the pandemic

What’s happening: Brent crude futures, the global benchmark, have breached $60 per barrel, their highest level since January 2020.

The immediate catalyst appeared to be weekend remarks from President Joe Biden that the United States will not lift sanctions on Iran to get the country back to the negotiating table. But oil prices have been on the upswing for months thanks to optimism that coronavirus vaccines will unleash demand while producers avoid flooding the market with supply.

“With Covid-19 cases now declining in certain regions, including the US and the UK, there will be a glimmer of hope that the worst is now behind us, particularly as the rolling out of vaccinations picks up,” ING commodities strategists Warren Patterson and Wenyu Yao said in a recent note to clients.

There are also meaningful signs of demand recovery in high-growth economies such as China, India and Brazil, UBS oil analyst Giovanni Staunovo told me.

The demand trajectory is definitely “pointing upwards,” he said.

Meanwhile, producers are working hard to keep supply in check so there can continue to be a meaningful drawdown in inventories, which filled up last year.

The Organization of the Petroleum Exporting Countries and allies agreed to keep production broadly steady in February and March, while Saudi Arabia said it would voluntarily cut its production by 1 million barrels per day from January’s levels.

Producers in the United States, for their part, are expected to need longer to get back up to speed.

“Investment activity has been relatively muted, and it will still take time to see a bigger impact,” Staunovo said.

Taken together, this is good news for prices. The trend has supported the shares of oil companies like Exxon and Chevron since November.

That said: Such stocks remain well below where they were before the pandemic hit, underscoring the long road ahead.

If investors become worried that asset prices have moved too high, too fast, both stocks and oil prices could be put under pressure. And the demand forecast remains murky, especially as new coronavirus variants complicate back-to-normal timelines.

AstraZeneca said over the weekend that its Covid-19 vaccine showed limited protection against the variant first identified in South Africa. It’s working to develop a new version that it could deploy this fall.

Remember: The International Energy Agency last month revised its forecast for 2021 global oil demand lower, citing “renewed lockdowns in a number of countries” that would weigh on fuel sales. Oil companies are also locked in a serious debate about whether demand can ever fully bounce back. Looking ahead to the next 12 months, the picture looks brighter, but with many unknowns.

Hyundai and Kia: We’re not talking to Apple about a car deal

Shares of Hyundai (HYMTF) and Kia plunged Monday after the South Korean automakers said they were not in talks with Apple to develop self-driving cars, closing the door on weeks of speculation.

“We are not having talks with Apple about developing self-driving cars,” Hyundai said in a statement.

The statement added that Hyundai has received requests from “numerous companies” about developing self-driving electric cars, but that “no decision has been made as we are in the beginning stage.” Apple declined to comment, my Appradab Business colleagues Jill Disis and Gawon Bae report.

The announcement jolted investors who had been betting on some kind of tie-up between the companies following news reports. Kia’s stock plummeted nearly 15%, its worst day since at least 2001, according to data provider Refinitiv. The fall wiped $5.4 billion off its market value.

Hyundai’s stock fell more than 6%, losing about $2.8 billion in market value.

Interest from Apple in South Korea’s automakers made sense. Analysts have pointed out that Hyundai has been open to joining forces with tech firms. It already has partnerships with with Chinese search giant Baidu and US chipmaker Nvidia on autonomous driving, for example.

The big question: If Apple moves ahead with its car, prevailing wisdom is that it would opt to work with an experienced manufacturer. But who? Analysts have also floated Honda and Volkswagen as possible options, and attention may now turn in that direction.

Despite huge losses, US airlines are rolling in cash

The US airline industry just closed the books on the worst year in its history. But carriers still ended 2020 awash in cash, my Appradab Business colleague Chris Isidore reports.

The nation’s four largest airlines — American, Delta, United and Southwest — closed out last year with a collective $31.5 billion in cash on their balance sheets. That’s up from $13 billion one year earlier, before the pandemic hit.

What gives: Though these airlines blew through $115 million a day over the course of the final nine months of 2020, easy borrowing has allowed them to shore up their finances.

Like a struggling family flooded with credit card offers, airlines have plenty of people on Wall Street eager to lend them money or help them raise funds from investors. Rock-bottom interest rates play a big role.

“The liquidity is at record levels,” said Philip Baggaley, chief credit analyst for the airline industry at Standard & Poor’s. “That’s good, and it’s one of the few strong points they have at this point.”

In addition to selling bonds and taking out loans, airlines have mortgaged their planes, frequent flyer programs and other assets, and even sold additional shares of stock, an unusual move for an industry in crisis. Meanwhile, they’ve made deep cost cuts.

“I think the general feeling is they’re wounded but they’re going to make it,” Baggaley said.

Up next

Hasbro (HAS) reports results before US markets open.

Coming tomorrow: Earnings include Twitter (TWTR), Nissan (NSANF), Honda (HMC) and Total (TOT).

0 notes

Text

#Top 10 tallest buildings in the World

1. BURJ KHALIFA, DUBAI, UAE

Location : DubaI

Height : 2,717 ft (828 m)

Floors : 163

Public observatory : Yes

Completed : 2010

Inaugurated in 2012. The building was originally named Burj Dubai but was renamed in honor of the ruler of Abu Dhabi, after he lent money to the Dubai developers, who ran into financial issues during the construction of the tower. The tower’s design is inspired by the geometries of a regional desert flower and the patterning systems embodied in Islamic architecture. The Burj Khalifa contains offices, retail space, residential units, and the Armani hotel.

2. SHANGHAI TOWER, CHINA

Location : Shanghai

Height : 2,073 ft (632 m)

Floors : 128

Public observatory : Yes

Completed : 2015

The Shanghai Tower is the tallest of the world’s first triple-adjacent supertall skyscrapers in Shanghai’s financial center, the other two being the Jin Mao Tower and the Shanghai World Financial Center. The tower rises high above Shanghai’s impressive skyline, its curved façade and spiraling form symbolizing the dynamic emergence of modern China. Its tiered construction, designed for high energy efficiency, provides nine vertical zones divided between office, retail and leisure use. Shanghai Tower is one of the most sustainably advanced tall buildings in the world: a transparent skin wraps around the entire building, creating a buffer between the inside and outside that warms up the cool outside air in the winter and dissipates heat from the interior in the summer.

3. MAKKAH ROYAL CLOCK TOWER, MECCA, SAUDI ARABIA

Location : Mecca, Saudi Arabia

Height : 1,972 ft (601 m)

Floors : 120

Public observatory : Yes

Completed : 2012

The Abraj Al-Bait is a government-owned complex of seven skyscraper hotels located next to the world’s largest mosque and Islam’s most sacred site, the Great Mosque of Mecca. The central tower, the Makkah Royal Clock Tower, contains the Clock Tower Museum on its top four floors. The tower also houses has two large prayer rooms (one for men, one for women) and a Fairmont managed hotel to help provide lodging for the millions of pilgrims that travel to Mecca annually to participate in the Hajj. The developer and contractor of the complex is the Saudi Binladin Group, the Kingdom’s largest construction company. It is the world’s most expensive building with the total cost of construction totaling $15 billion USD.

4. PING AN FINANCE CENTER, SHENZHEN, CHINA

Location : Shenzhen

Height : 1,965 ft (599 m)

Floors : 115

Public observatory : Yes

Completed : 2017

Ping An is the physical and iconic center of Shenzhen’s growing central business district. The stone and glass tower’s four facades are sheathed in chevron-shaped stone verticals that extend from the building’s base. The latter includes five floors of retail shops that terrace away from the tower to form a large amphitheater-like space. The building is also defined by a central atrium, which serves as a public vestibule and allows daylight in, creating a welcoming space for meeting, shopping and dining. The original plan was to add a 60 m (197 ft) antenna atop the building to surpass the Shanghai Tower (cf below) and become the tallest building in China, although that plan was abandoned due to the possibility that it might obstruct flight paths.

5. LOTTE WORLD TOWER, SEOUL, SOUTH KOREA

Location : Seoul

Height : 1,819 ft (554.5 m)

Floors : 123

Public observatory : Yes

Completed : 2017

Lotte World Tower is one of Korea’s architectural crown jewels. The design of the 123-story tower draws from the forms of traditional Korean ceramics and calligraphy. The skyscraper rises in a sleek, tapered profile that contrasts with the city’s mountainous topography. Inside, the tower contains a wide variety of program types, including retail spaces, office floors, a five-star luxury hotel, and an “officetel.” Commonly found in Korea, officetels offer studio-style apartments for employees who work in the building and feature service typically found in hotels such as standard furnishings, front desk services and gym access. Other features include the shopping mall Avenuel, Korea’s best urban aquarium, a spectacular classical music hall, and Asia’s largest multiplex.

6. ONE WORLD TRADE CENTER, NEW YORK, USA

Location : New York

Height : 1,776 ft (541.3 m)

Floors : 94

Public observatory : Yes

Completed : 2014

One World Trade Center – also known as Freedom Tower – is located in the city’s bustling financial district in Downtown Manhattan. The skyscraper cost $4 billion USD and took eight years to build between the start of construction in 2006 and the first tenants moving in 2014. Its sheer size, geographic constraints, and safety necessities make it easily one of the Western Hemisphere’s most complex projects ever built. The tower is home to a stunning observation deck and the 9/11 Memorial & Museum. Situated on the site of the original World Trade Centre, the 9/11 Museum uncovers the story of this ill-fated day with over 10,000 artefacts on display, as well as interviews of 2,000 first-hand accounts, photographs and family testimonies.

7. GUANGZHOU CFT FINCANCE CENTER, CHINA

Location : Guangzhou

Height : 1,739 ft (530 m)

Floors : 111

Public observatory : No

Completed : 2016

Guangzhou CTF Finance Center is a super high-rise tower which houses a hotel, serviced apartments, office space, and a retail mall podium. The tower’s design is derived from the efficient synthesis of its multiple uses. Its form is sculpted at four major transition points: office to residential, residential to hotel, hotel to crown, and crown to sky. Instead of tapering to accommodate the smaller floor plates required for different programs, the tower steps back at four angled parapets. These four setbacks allow for lush sky terraces and dramatic skylights. The building also employs a number of energy efficient tools to reduce its environmental footprint: the use of high-efficiency chillers and heat recovery from the water-cooled chiller condensers all contribute to the building’s sustainability.

8. Tianjin CTF Finance Centre

Location : Tianjin

Height : 1,740 ft (530 m)

Floors : 97

Public observatory : No

Completed : 2019

The Tianjin Chow Tai Fook (CFT) is a striking new landmark in the Tianjin Economic-Technological Development Area (TEDA), located just outside the coastal metropolis of Tianjin. The skyscraper houses offices, 300 serviced apartments, and a five-star, 350-room hotel. The main structure has a hyperboloid and softly curving glass surface, which integrates eight sloping megacolumns. These curving columns increase the structure’s response to seismic concerns and are integral to both the gravity and lateral systems. Strategically placed, multistory wind vents combined with the tower’s aerodynamic shape reduce vortex shedding, which in turn dramatically minimizes wind forces (a problem which affects.

9. CITIC TOWER (CHINA ZUN), BEIJING, CHINA

Location : Beijing

Height : 1,731 ft (527.7 m)

Floors : 109

Public observatory : Yes

Completed : 2018

CITIC Tower is a supertall skyscraper in the Chinese capital’s business district. The building’s intriguing profile – wide at the top and at the base and slender in the middle – is inspired by the zun, an ancient Chinese ritual vessel for drinking wine, which also lends the structure its nickname. The tower’s smooth vertical curve gives the building a contemporary and elegant expression that assists in maximizing the floor area at the top, while provide structural stability at the base. The tower is likely to remain the tallest building in Beijing for the foreseeable future, as in 2018 authorities capped new projects in the central business district to a height of no more than 180 m (590 ft) in a bid to reduce congestion.

10. TAIPEI 101, TAIWAN

Location : Taipei

Height : 1,667 ft (508 m)

Floors : 101

Public observatory : Yes

Completed : 2004

Towering above the city like the gigantic bamboo stalk it was designed to resemble, Taipei 101 is impossible to miss. At 508 m (1667 ft), Taipei 101 held the title of ‘world’s tallest building’ from 2004 until the 2010 completion of Dubai’s Burj Al Kalifa. Until 2011, it also held the title of the world’s tallest green building. Taipei 101’s postmodernist architectural style evokes Asian traditions in a modern structure employing industrial materials. Its design incorporates a number of features that enable the structure to withstand the Pacific Rim’s earthquakes and the region’s tropical storms. The tower houses offices and restaurants as well as both indoor and outdoor observatories. The building is Taiwan’s most iconic attraction and the Taipei 101 fireworks displays are a regular feature of New Year’s Eve broadcasts.

0 notes

Photo

Beyond Petropolis Designing a Practical Utopia in Nueva Loja

Each year, the Graduate Program in Urban Design at The City College of New York travels to a city somewhere in the world that is experiencing a revelatory form of stress. In January of 2006 joined by students and faculty from the Universidad Catolica in Quito and from the architecture and landscape programs at CCNY – the destination of the group was the small town of Nueva Loja in the Amazon basin of Ecuador.

At the time, a population of around 100,000 was expanding exponentially. Nueva Loja was the fastest growing municipality in the country. There was one reason for this: the oil boom. Indeed, almost everyone calls the place “Lago Agrio” – Bitter Lake, after the town in Texas that houses the headquarters of Texaco, the first petroleum giant on the scene. There’s little irony in this name. As the endless lawsuit against Chevron, Texaco’s successor, has made abundantly clear, Lago’s growth has come at the cost of extremely bitter consequences...Keep reading: HERE

Related title:

City for City

Preface by Lance Jay Brown Introduction by Achva Benzinberg Stein

City for City presents examples of the work of the City College Architectural Center over the past fifteen years. The projects selected are grouped under the categories of exhibitions, visioning exercises, planning and urban design studies and also include a few examples of assignments for implementation. The work was developed at the request of the affected communities and undertaken with their full participation. The projects were financed in various ways, from pro-bono studies to grant-supported efforts. These grants and the special support from state and municipal entities enable the center to develop the projects in greater depth. Read more: HERE

https://www.oropublishers.com/collections/bestdealtoday

0 notes

Text

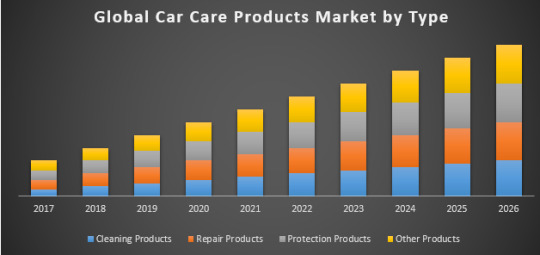

Global Car Care Products Market

Global Car Care Products Market was valued at US$ 85.12Bn in 2017 and is expected to reach US$ 131.82Bn by 2026, at a CAGR of 5.62% during a forecast period. Car is as crucial to its appearance and longevity as performing with regular maintenance.

Major driving factors of the Car Care Products Market are in rising phase via service and manufactures in connected, autonomous, shared, electrified, will be the future of the industry and calls for significant additional investments, and in order to finance. Consumers have become additional attentive to the advantages of automobile wash services like improved potency and safety. Also, the increasing environmental awareness among folks is driving the expansion of automobile wash services. A new phase of consolidation and partnerships is expected in the global auto industry. Increasing demand in emerging markets, supporting the mid-term perspectives of the car market. Intensifying consumer appetite for alternative fueled vehicles and new mobility services via car care products. High cost associated with manufacturers along with the low degree of awareness among consumers will act as restraint to the market.

Based on the type, Protection products is expected to hold the largest share in the market during the forecast period. Used cars sales are growing. These vehicles typically outlive their OEM warranties and have higher maintenance needs, creating demand among consumers that are increasingly accustomed to buying vehicle Commercial Use and also create growth opportunity in car care products. New way of protection are coming up like an apps will integrate the vehicle with a smart home, programming your home from the car or summoning the car from home. Apps will give additional flexibility for insurance, safety, and legal protections. OEMs are to selectively Commercial Use which claim new touch points with their current and potential consumers as protection from these threats.

In terms of region, Asia Pacific is expected to hold the largest share in the market during the forecast period. Over the last decade the Asia pacific automotive industry has undergone the greatest transformation it has experienced in its history. Asia is taking an increasing share of global vehicle sales and is the only major market expected to see continued strong growth in both the medium and long term. China, India, Malaysia and other developing markets in Southeast Asia. In China for example, a rising middle class will continue driving the steady growth of the Chinese auto market, with the markets for new purchases and replacement of vehicles growing rapidly.

The report includes a detailed study of Porter’s Five Forces model to analyze the different factors affecting the growth of the market. Moreover, the study also covers a market attractiveness analysis, brand portfolio expansion, mergers, collaborations, joint ventures, acquisitions, PESTLE analysis, Value Chain Analysis, and SWOT analysis.

For More Information Visit@https://www.maximizemarketresearch.com/market-report/global-car-care-products-market/25224/

Scope of the Report for Car Care Products Market

Global Car Care Products Market, By Type

Cleaning Products

Repair Products

Protection Products

Other Products

Global Car Care Products Market, By End-User

Commercial Use

Individual Use

Global Car Care Products Market, by Region

North America

Europe

Asia Pacific

Middle East & Africa

South America

Key Players Operating in Car Care Products Market

Shell

ExxonMobil

BP

Chevron

TOTAL

Valvoline

Idemitsu Kosan

Sinopec

FUCHS

JX GROUP

LUKOIL

CNPC

3M

Illinois Tool Works

Spectrum Brands

Turtle Wax

Prestone

Altro

Sonax

Tetrosyl

Biaobang

SOFT99

This Report Is Submitted By @Maximize Market Research Company

Customization of the report:

Maximize Market Research provides free personalized of reports as per your demand. This report can be personalized to meet your requirements. Get in touch with us and our sales team will guarantee provide you to get a report that suits your necessities.

About Maximize Market Research:

Maximize Market Research provides B2B and B2C research on 20,000 high growth emerging opportunities & technologies as well as threats to the companies across the Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.

Contact info:

Name: Lumawant Godage

Organization: MAXIMIZE MARKET RESEARCH PVT. LTD.

Email: [email protected]

Address: Omkar Heights, Sinhagad Road, Manik Baug, Vadgaon Bk,Pune, Maharashtra 411051, India.

Contact: +919607195908

0 notes

Text

With its Greenlots acquisition, Shell is moving from gas stations to charging stations

In a bid to show that it’s getting ready for the electrification of American roads, Royal Dutch Shell is buying Greenlots, a Los Angeles-based developer of electric vehicle charging and energy management technologies.

Shell, which is making the acquisition through its Shell New Energies US subsidiary, snatched the company from Energy Impact Partners, a cleantech-focused investment firm.

“As our customers’ needs evolve, we will increasingly offer a range of alternative energy sources, supported by digital technologies, to give people choice and the flexibility, wherever they need to go and whatever they drive,” said Mark Gainsborough, Executive Vice President, New Energies for Shell, in a statement. “This latest investment in meeting the low-carbon energy needs of US drivers today is part of our wider efforts to make a better tomorrow. It is a step towards making EV charging more accessible and more attractive to utilities, businesses and communities.”

Courtesy of Ed Robinson/Shell

Since Greenlots raised its cash from Energy Impact Partners, the company has become the partner of choice for utilities for electric vehicle charging, according to the firm. Greenlots was selected as the sole software provider for VolksWagen’s “Electrify America” charging program last January.

“Utilities are playing a pivotal role in accelerating the transition to a future electric mobility system that is safer, cleaner and more efficient,” said Greenlots CEO Brett Hauser, adding, “We look forward to now working with the resources, scale and reach of Shell to further accelerate this transition.”

“Greenlots is on an incredible trajectory and, in the hands of a company with the resources such as Shell, will be able to advance the important electrification of transportation even faster,” said EIP managing partner Hans Kobler in a statement.

For Shell, the deal adds to a portfolio of electric charging assets including the Dutch-based company, NewMotion.

Across the board energy companies are spending more time and money backing and deploying electric charging technology companies. ChargePoint, a Greenlots competitor, raised $240 million in a November financing that included Chevron Technology Ventures, while BP bought the UK-based public charging network Chargemaster last year.

Despite pushback in some corners of America to the increasing electrification of U.S. highways and byways, the future of mobility needs to be electric if there’s any hope of slowing (and ideally halting and reversing) climate change globally.

Some signs of hope can be found in the latest earnings statement from Tesla, which points to increased uptake of its electric vehicles. The teased release of an electric truck could potentially even help win converts among those drivers who like to “roll coal” in the presence of hybrids or electric cars.

Elon says Tesla might unveil its pickup truck “this summer”

States are already investing heavily in electric infrastructure themselves to promote the adoption of vehicles. California, New York, and New Jersey announced last June a total of $1.3 billion in new infrastructure projects focused on electric vehicle charging.

That’s still not enough to meet the goals necessary to reduce greenhouse gases significantly enough. In all, the U.S. needs to put roughly 13 million electric vehicles on the road in order to meet the targets put forward in the Paris Accords climate treaty (which the U.S. walked away from last year).

According to estimates from the Center for American Progress, the U.S. needs to spend $4.7 billion through 2025 to buy and install the 330,000 public charging outlets the nation will need to meet that electric demand.

“As power and mobility converge, there will be a seismic shift in how people and goods are transported,” said Brett Hauser, Chief Executive Officer of Greenlots. “Electrification will enable a more connected, autonomous and personalized experience. Our technology, backed by the resources, scale and reach of Shell, will accelerate this transition to a future mobility ecosystem that is safer, cleaner and more accessible.”

0 notes

Text

2017 - General Electric Nigeria Early Career Development Program

2017 – General Electric Nigeria Early Career Development Program

General Electric Nigeria Early Career Development Program Opportunities 2017

GE is the world’s Digital Industrial Company, transforming industry with software-defined machines and solutions that are connected, responsive and predictive. Through our people, leadership development, services, technology and scale, GE delivers better outcomes for global customers by speaking the language of…

View On WordPress

#Chevron Nigeria recruitment for a Completions Engineer in Lagos Aug 2017#Finance#General Electric Nigeria Early Career Development Program Opportunities 2017#Job Title: Early Career Development Program (ECDP)-SSA

0 notes

Text

Growing Scenario of Ethylene Global Market Outlook: Ken Research

The ethylene market effectively consists of sales of ethylene and its connected services. Ethylene is an acyclic hydrocarbon, optimized in the manufacture of polymers such as polyethylene (PE), polyethylene terephthalate (PET), polyvinyl chloride (PVC) and polystyrene (PS) as well as fibers and several other organic chemicals.

According to the report analysis, ‘Ethylene Global Market Report 2020’ states that in the ethylene global market there are several corporate which recently operating more effectively for leading the highest market growth and registering the handsome value of market share during the short span of time while decreasing the linked prices, delivering the better consumer satisfaction, employing the young work force, implementing the profitable strategies, analyzing and monitoring the strategies and policies of the competitors and government, establishing the several research and development programs, developing the applications of such and developing the specifications of the production function includes AkzoNobel, BASF SE, Borealis, Chevron Phillips Chemical Company LLC, China Petrochemical Corporation, China Petroleum & Chemical Corporation, Clariant, Dow Chemical, Equistar Chemicals and Exxon Mobil Corporation.

The worldwide ethylene market reached a value of approximately USD 222.1 billion in 2019, having increased at a compound annual growth rate (CAGR) of 5.25% since 2015, and is expected to increase at a CAGR of 4.77% to approximately USD 267.6 billion by 2023.The ethylene market has been geographically divided into North America, Western Europe, Asia-Pacific, Eastern Europe, South America and Middle East & Africa. The Asia Pacific was the largest region in the ethylene market during 2019.

Throughout the historic period, enlarged ultimatum for polythene products underwritten to the ethylene market's growth. Ethylene is majorly utilized in polyethylene products such as low density polyethylene (LDPE), high density polyethylene (HDPE) and linear low density polyethylene (LLDPE). The polyethylene market has grown up substantially owing to the augmented demand for plastic across the world. The great penetration of plastics in electronic products and frothy products in vehicles has improved the consumption of plastics. According to National Geographic, 40% of the plastic fashioned every year is single-use plastics. In addition, the production of plastic enlarged exponentially to 448 million tons by 2015 from 2.3 million tons throughout 1950 and this number is being projected to double by 2050. Such factors that have influenced the approval of polyethylene impacted the growth of the ethylene market.

Although, the ethylene introducing companies are financing in ways to advance bio-based green polyethylene compound. Such plastic are easy to harvest, consume less energy and proposes the same versatility of chemically synthesized plastic. Following the trend, Braskem, a Brazil based bio polymer creator, during 2018 partnership with LEGO Group, a Danish toy manufacture company, to supply its I'm greenT polyethylene. I'm greenT polyethylene is a plastic made from sugarcane which is 100% environmental and contributes to the lessening of greenhouse gases.

During August 2019, Huntsman Corporation arranged to sell its ethylene business to Indorama Ventures for USD 2 billion. This procurement will add products such as ethylene, ethylene oxide and monoethylene glycol, encompassing the product profile of Indorama Ventures and will support the PET feedstock supply chain and progress its position as PET constructer. The deal delivers Indorama Ventures admittance to a number of fresh derivative products, involving propylene/PO derivatives, surfactants, ethanolamines, glycol ethers and MTBE. However, the Indorama Ventures is an intermediate petrochemicals industry. Therefore, in the near years, it is predicted that the market of ethylene will increase around the globe more actively.

For More Information, click on the link below:-

Global Ethylene Market Research Report

Related Reports:-

Global Styrene Ethylene Butylene Styrene (SEBS) Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread)

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249

0 notes

Text

Ecoplant: Israeli IoT start-up wins grant, VC financing, brand-new collaboration

Ecoplant.

This story is offered solely to Company Insider customers. End Up Being an Expert and start reading now.

Ecoplant’s software application monitors air compressors– used in different agricultural and production processes– through sensing units, and immediately handles the system using IoT-technology.

” 5%of the world’s energy is utilized by air compressors,” Aviran Yaacov, cofounder and CEO of Ecoplant informed Service Expert.

Israeli IoT start-up Ecoplant, which develops software application that monitors and manages air compression systems used in lots of industries, has actually raised $8 million in grant and VC funding to expand its United States operations.

Air compressors, typical in farming and production industries, consume enormous quantities of energy, and Ecoplant declares its software can reduce wastage. The company has raised $8 million in the form of tidy energy grants from the US Department of Energy, Israel’s Ministry of Energy (MoE), and the Israel Innovation Authority, plus additional funding from accelerator program Techstars and Ecolab.

A 2015 report by the United States Department of Energy estimated that compressed air systems represent 10%of all electricity and approximately 16%of all motor system energy use in United States production industries– an incredible figure.

” 5%of the world’s energy is used by air compressors,” Aviran Yaacov, cofounder and CEO of Ecoplant, informed Service Insider in an interview. “So much energy is lost every year from leakages, breaks, and other downtime which our IoT option has the ability to assist solve.”

Yaacov claims that the business’s software application conserves approximately 30%more energy, and halves unplanned downtime. To that end, Ecoplant has actually signed a collaboration with Atlas Device, a Kentucky-based distributor of industrial air compressors, and agreed to bring Ecoplant’s tech to US factories.

” Our partnership with Atlas enables us to significantly scale through the countless factories they service,” Yaacov added. “During COVID we managed to install a whole job from another location which was amazing.”

Ecoplant’s software application keeps an eye on air compressors through a connection to controllers and pipeline sensing units, and automatically manages the system with IoT-tech. Other clients include Nestle, Unilever, Danone, and Elbit.

Take a look at Ecoplant’s pitch deck listed below:

Ecoplant

Ecoplant pitch deck.

Ecoplant.

Ecoplant

Ecoplant pitch deck.

Ecoplant.

Ecoplant

Ecoplant pitch deck.

Ecoplant.

Ecoplant

Ecoplant pitch deck.

Ecoplant.

Ecoplant

Ecoplant pitch deck.

Ecoplant.

Ecoplant

Ecoplant pitch deck.

Ecoplant.

Ecoplant

Ecoplant pitch deck.

Ecoplant.

Ecoplant

Ecoplant pitch deck.

Ecoplant.

Ecoplant

Ecoplant pitch deck.

Ecoplant.

Ecoplant

Ecoplant pitch deck.

Ecoplant.

Ecoplant

Ecoplant pitch deck.

Ecoplant.

Ecoplant

Ecoplant pitch deck.

Ecoplant.

.

Loading Something is packing.

More:

Functions BI Prime Energy Green Energy

Chevron icon It indicates an expandable area or menu, or often previous/ next navigation alternatives.

.

%%.

from Job Search Tips https://jobsearchtips.net/ecoplant-israeli-iot-start-up-wins-grant-vc-financing-brand-new-collaboration/

0 notes

Text

Lowongan Kerja PT Chevron Pacific Indonesia 2020

Lowongan Kerja PT Chevron Pacific Indonesia 2020

Saat ini CPI sedang membutuhkan sumber daya manusia yang berkualitas, memiliki keterampilan dan pengetahuan agar mampu memberikan kontribusi bagi kesuksesan perusahaan.

Posisi Yg Terbuka : 1. Accounting 2. Administrative 3. Business Development 4. MBA Commercial Development Program 5. Land Internships 6. Business Strategy 7. Downstream & Chemicals Development Program 8. Senior Drilling Engineer 9. Chemistry 10. Drilling and Completions 11. Drilling Engineering 12. Completion Engineering 13. Subsea Intervention Engineering 14. Drill Site/Well Site Management 15. Senior Community Empowerment 16. Facilities Design Engineering 17. Petroleum Engineering 18. Drilling Engineering 19. Operation Engineering 20. Process Engineering 21. Research and Development Engineering 22. Senior Development Geologist 23. Technical Sales/Support Engineering 24. Downstream & Chemicals Engineering Development Program 25. Engineering Internships 26. Finance 27. Site Planner 28. Production Method Engineer 29. Finance M.B.A. Internships 30. Finance Development Program 31. Geology/Geophysics 32. Earth Science Internships 33. Research 34. Health, Environment and Safety 35. Day Drilling Supervisor 36. HES Internships 37. Human Resources 38. HR Internships 39. HR Development Program 40. Information Technology 41. Maintenance 42. IT Internships 43. IT M.B.A. Leadership Development Program 44. Senior Data Management Engineer 45. Legal

Persyaratan : 1. Pria/Wanita Usia Max 35 tahun 2. Pria, Pengalaman Min 1 tahun 3. Pendidikan min. D3/S1 & S2 semua jurusan 4. Wanita ,Pendidikan Min. D3 semua jurusan/Fresh graduate 5. Mampu mengoperasikan komputer (Min. Ms. Word & Excel) 6. Mampu berbahasa asing akan menjadi nilai tambah

To Apply For Jobs in Samarinda Visit JobsMicro.

0 notes

Text

Million-Dollar, One-Person Business Revolution Accelerates

When Apurva Batra, now 29, walked into a supervisor’s office at Chevron and gave notice that he was leaving his engineering job, the incredulous look on his manager’s face said it all.

Batra read the look in his eyes as, “Why would you want to quit this? No one does this.”

It was easy to see why someone might wonder about Batra’s decision, given the prestige, attractive pay and social approval that came with working at the oil and gas giant.

But Apurva realizes that saying goodbye to his well-paying, five-year career was the best move he could have made. He genuinely liked his colleagues but many days when he went to work, he’d said to himself, “I’m going to spend the rest of my life going into someone else’s office, at a time someone else prescribed and do meetings for someone else. At the end of the day, the reward of that is going to go to the boss.”

Recognizing he was meant to be an entrepreneur, Apurva didn’t want to force fit himself into the corporate mold and live a life of regrets. Taking a leap of faith in 2015, the Houston resident founded a one-man business called FlexiblePouches, which makes pouches for packaged food and other products. He hit annualized revenue of $1 million his first year and expects to bring in $3 million in revenue this year at the profitable company.

Apurva is part of an exciting trend: the growth of the million-dollar, one-person business. A growing number of nonemployer firms—those with no paid employees but the owners—are bringing in $1 million to $2.49 million a year in revenue. Their numbers hit 36,984 in 2017, up 2% from 36,161 in 2016, according to just-released data from the U.S. Census Bureau. That count rose 38% from 26,744 in 2011. Most non-employer firms are solo businesses, but some are partnerships and family businesses.

There are also an elite group of 2,229 nonemployer firms bringing in $2.5 million to $4.99 million (up from 2,090 in 2016) and 356 bringing in $5 million or more, up from 316 in 2016.

Meanwhile, many entrepreneurs are hitting six-figures and beyond—and their numbers are rising. There were 1.97 million bringing in $100,000 to $249,999 (up from 1.86 million in 2016); 629,837 generating from $250,000 to $499,999 (up from 590,948 in 2016); and 282,819 generating revenue from half a million to $999,999 (up from 264,140 in 2016).

How are they generating this kind of revenue in tiny, one-person firms? Among the top industries were professional services (9,745), construction, (4,699), real estate (3,050), retail (2,976), healthcare and social services (2,791) and finance (2,781).

Growth in new business creation was highest in the low-tax states of Florida (9.3%) and Texas (6.5%), as well as in Massachusetts (5.7%), where e-commerce surged.

Many trends are contributing to the growth of these high-revenue, one-person firms. The cost of starting a business has come down, thanks to cloud-based technology and low-cost apps and digital tools that make it easier than ever to automate routine tasks. Giant freelance platforms have made it possible to find contractors easily, allowing owners to extend what they can accomplish. The growth of the internet has made it easier for entrepreneurs like Batra to find resources to manufacture their goods and to advertise around the world. And there are many outsourced fulfillment and drop shipping services that simply product delivery for those who sell goods.

To be sure, the vast majority of one-person businesses never get to $1 million in revenue. For some context, there were 25.7 million nonemployer firms in 2017, up by 3.6% from just under 25 million in 2016. Among these firms, the average annual revenue was $46,978. (The Census Bureau doesn’t publish profit figures, so it is not possible to determine how much owners of the firms in the research are taking home).

The data doesn’t show how many of the firms are full-time versus part-time, but there are indicators that some of the growth is driven by side hustles. In 2017, there was a 26.5% increase in the transportation and warehousing sector, the category to which rideshare driving belongs, with 230,572 brand new establishments. Rideshare driving is on the lower end of the pay scale for solo entrepreneurs.

Although not every business will make it to $1 million, every solo entrepreneur can learn valuable growth strategies from those who break into the seven figures in nonemployer firms. Here are the stories of Apurva and two other entrepreneurs who pulled it off.

Apurva Batra, Houston

Although Apurva Batra yearned to quit his job at Chevron for years, he didn’t do so abruptly. With dreams of becoming an entrepreneur filling his mind, he tucked away money in his savings account on a regular basis, long before giving notice. Although he knew that he had plenty of runway to take risks while in his twenties, he still needed to pay his bills. “Everyone cares about security,” he says. “But I think it’s something you make for yourself.”

Batra threw himself into researching potential businesses he could pursue. He set several criteria for the business he would start: It would have to be in the well-paying B2B space. It would need to be based on repeatable processes. And it offered an opportunity to scale. “I wanted to create something of value that is a cash-flow generating asset,” he says.

As he conducted his research, he was drawn to the idea of a product-service hybrid. “Service businesses are easier to start. Product businesses are easier to scale,” he says. “Being a hybrid offers the advantages of both.”

His research led him to creating plastic pouches for groceries. Moving back in with his parents, he tapped into $25,000 he had saved during his year as an engineer to get started. Initially, he flew to China to research his manufacturing options. He then invested $10,000 in inventory, printed some business cards and headed to the natural-products trade show circuit to pick up clients.

Although he started making sales at trade shows, what proved to be more fruitful was promoting his website using Google advertising, which he taught himself how to do using YouTube videos. It was hard for a startup like his to win business with food giants, but he found that small and midsize companies were very receptive. He built a reputation for being willing to do ultra-small print runs, thanks to an investment he made in a digital printing tool needed. “That press changed the game,” he says.

So far, Apurva has not hired any employees. As an avid word traveler, he’s not sure if he wants to take that step yet. “If I have employees, I’ll have to manage them closely,” he says. “I might lose some freedom. That freedom is what I started the business for.”

But for now, he doesn’t have to make an immediate decision on that front. He has a lifestyle and business he loves and has no regrets about leaving the world of traditional careers and its vestiges, like commuting, behind.

“I get up every morning and see the traffic outside and am not envious,” says Batra.

Hafeez Lakhani, New York City

Hafeez Lakhani, now 37, didn’t set out to become an entrepreneur when he first started his career. Born in Hyderabad, India, and raised in South Florida, Lakhani, a gifted student, attended Yale University and earned a Bachelor’s degree in math and economics.

Lakhani initially worked as a Wall Street commodities trader, and, having enjoyed a past stint at a camp counselor, became a volunteer SAT prep coach at a community center in Queens on the side. Leaving Wall Street to pursue his passion for writing fiction, he doubled down in his work with students and became a freelance SAT tutor to support himself. With a perfect score on both the SAT and ACT, he had plenty of credibility in the college preparatory area.

Lakhani was quite successful as a fiction writer, publishing his fiction in literary magazines such as The Southern Reviewand Tikkun and winning fellowships from PEN Center USA and The Center for Fiction. He was also recognized by Best American Essays and twice nominated for a Pushcart Prize. He is now writing a novel.

However, Lakhani could not ignore his impact as a tutor. “My students were seeing dramatic leaps in their scores,” he says. Soon he was receiving requests to help refine students’ college application essays, work that tapping into his writing experience. “I was helping them to excavate the most interesting stories from their experiences that were relevant,” he says. With referrals building up, he decided to go out on his own and in 2013, formed Lakhani Coaching in New York City.

“As I got busier, I became aware of my impact and had to keep raising my rates,” says Lakhani. “I had to ask myself, ‘How does it make sense to scale?’” Lakhani built up a roster of part-time tutors with elite test scores, who worked as contractors.

Hitting $1.6 million in revenue in 2018 as a solo entrepreneur, Lakhani hired his first full-time employee in December of that year. The business currently works with 70 students, mostly in person or by Skype. It currently includes an opera singer and a former social justice worker.

Today, at Lakhani Coaching, the father of three brings in more than $1 million a year in revenue, offering academic counseling, test prep and help with more intangible aspects of the student experience such as goal-setting, character development and motivation of students to pursue passions outside the classroom.

He now charges $1,000 an hour for his services but also offers help from his lead instructor for $550 an hour, a senior instructor for $375 an hour, and an associate instructor for $260 an hour. Aware that these rates are not affordable for many families, he added scholarship program two years ago and just awarded the second scholarship.

One of the most important elements of Lakhani Coaching’s program, he says, is character development. This aspect of the business was hard for me to visualize, so, to see what it looked like in action, I asked Lakhani to chat on speaker phone about it with my 15-year-old twins, who will be entering 10thgrade.

“Let’s imagine you are sitting around a dinner table with a limited number of seats,” he told them. “What will make you the most interesting contributor to that dinner table conversation? What do you add to the discussions that no one else can? That is how we start to understand character.”

As he went on to explain, college admissions officers care about students being involved in activities outside of school primarily to gain an understanding of what the students will contribute to an intellectual community.

He suggests students keep a journal to record their impressions of powerful experiences from their activities to mine for future college essays.

Since the college admissions scandals, at least half a dozen people have approached Lakhani to ask how to start their own education consulting business. “I worry about anyone entering the space because they think it is a good business, not because they want to be a great educator,” he says.

He believes education consulting should be a personal calling, as it is for him. “I loved being a camp counselor, and I love being an educator,” he says.

Lakhani is in a position where he could potentially scale considerably but is moving very carefully on that front, asking himself, “Do I want to have 1,000 students—and if I did, would it dilute the impact?”

“I think I could scale by five to 10 times what I am doing now and have the right people in place to maintain quality,” he says. “I don’t want to become a factory.”

For the moment, he says, “I’ve come to realize I have to have a finite number of people I can help. The more time you’re able to really invest in people and really make an impact, the more it comes through.”

Kendall SummerHawk, Tucson, Ariz.

After 13 years in healthcare IT, Kendall SummerHawk, now 59, decided to pursue a long-simmering passion: Helping women change their relationship with money as a money coach. “My whole purpose is to empower women to increase their earning power through entrepreneurship,” says SummerHawk, based in Tucson, Ariz. “I believe that as they make more money, they can solve a lot of the world’s problems.” SummerHawk points to research that shows that when women work, they invest 90% of their income into their families, while men invest 35%.

Drawing on what she’d learned about entrepreneurship from her mother, who owned a successful hairdressing business, and the professional knowledge she’d built in her technology career, SummerHawk went into business 18 years ago, simply aiming to replace her income, then in the $53,000 to $55,000 range. She focused on teaching women how to find their ideal clients and set prices in workshops she offered and getting an often brutal crash course. “My first year in business was torture,” she recalls. “I made $7,000.”

Realizing she needed to find out how to market herself more effectively, she took a teleclass on how to create an engaging business card and immersed herself in learning about marketing. As she learned more, she dove into tasks like building a robust email list and public speaking. As she reached more clients, she focused on helping clients package their services as entrepreneurs, setting prices and developing core sales skills. That helped her break into six-figure revenue.

“It was about showing up consistently, with great content,” she says. One tip that helped many of her women clients in building confidence around their pricing, she says, was encouraging them to state their desired fee, out loud, one hundred times a day, so it became as automatic as saying “Please pass the salt.”

Hovering in the six figures for several years, SummerHawk was determined to grow her business past that and set a goal in 2006: “I decided I wanted to be a million-dollar business owner,” she says. “You have to want it.” She started using that goal as a filter for making decisions: “I would say, ‘As a million-dollar business owner, how do I handle my email?’” she recalls. “’How do I handle getting paid by my clients?’ I started making lots of changes by seeing myself as a million-dollar business owner.”

Those changes included hiring someone to handle tasks that were draining her time, such as cleaning her house, doing her grocery shopping and running errands. She also changed her business model. After introducing one-on-one coaching, she’d been charging clients by the month but shifted to offering a more intensive, year-long program for $10,000, a fee that reflected the financial value she determined she was bringing them. Fifty clients from her mailing list, which then included less than 5,000 people, signed up. By 2007, she made the leap to seven figures and has brought in seven figures or multiple seven figures every year since then, she says.

Rather than trying to continually win brand new clients, SummerHawk focused on developing fresh offerings for existing customers. “I have an attitude of ‘A client for life,’” says Summerhawk.

In 2009, in response to the feedback she was getting, SummerHawk began certifying some of these clients as coaches in the methods she uses, so they could teach others to do what they were doing.

“I realized I couldn’t have the impact I wanted to have alone, even doing groups,” she says. “I believe in the ripple effect.”

For SummerHawk and the growing number of entrepreneurs breaking six and seven figures in very lean businesses, it will be interesting to see where those ripples lead. Very likely, as more solo entrepreneurs realize what’s possible, we’ll see a lot of exciting new case studies emerge.

Canada company registration for Canadian residents

We incorporate your new corporation federally or provincially in any province of Canada according to the provisions of federal and provincial Business Corporation Acts. Company Formations Canada provides fast and easy Canada Online Incorporation Service for only $99.99. Continue here to register today your new company in Canada.

https://companyformations.ca/corporations/

Canada Company Registration for Non-Canadian Residents

Incorporating in Canada – Canada Incorporation for Non-Canadians for only $2200 (All Inclusive.) Company Formations provides fast and easy Company Registration in Canada for non-Canadians residents and provides all the documents your new Canada corporation will need to stay up-to-date and in compliance with your province of registration corporations law.

Learn more about our services

https://companyformations.ca/canada-corporations-non-canadian-residents/

Canada Company Registration for Foreign Companies

Company Formations offers a full range of services designed to help global entrepreneurs and small and medium sized businesses create new businesses in Canada or expand current businesses to Canada.

Our services to non Canadian residents includes:

New Company Registration (Canada Corporations)

Registration of foreign companies in Canada (Extra Provincial Registration)

Canada Registered Agent Services

Canada Corporate Bank Account Introduction & bank account opening

Canada Residency Visa under the Canada Startup Program

This Article first appeared in Forbes

The post Million-Dollar, One-Person Business Revolution Accelerates appeared first on Company Formations Canada.

from Company Formations Canada https://ift.tt/302KGWU

0 notes

Text

With its Greenlots acquisition, Shell is moving from gas stations to charging stations

In a bid to show that it’s getting ready for the electrification of American roads, Royal Dutch Shell is buying Greenlots, a Los Angeles-based developer of electric vehicle charging and energy management technologies.

Shell, which is making the acquisition through its Shell New Energies US subsidiary, snatched the company from Energy Impact Partners, a cleantech-focused investment firm.

“As our customers’ needs evolve, we will increasingly offer a range of alternative energy sources, supported by digital technologies, to give people choice and the flexibility, wherever they need to go and whatever they drive,” said Mark Gainsborough, Executive Vice President, New Energies for Shell, in a statement. “This latest investment in meeting the low-carbon energy needs of US drivers today is part of our wider efforts to make a better tomorrow. It is a step towards making EV charging more accessible and more attractive to utilities, businesses and communities.”

Courtesy of Ed Robinson/Shell