#Commercial Flooring in Harrah

Text

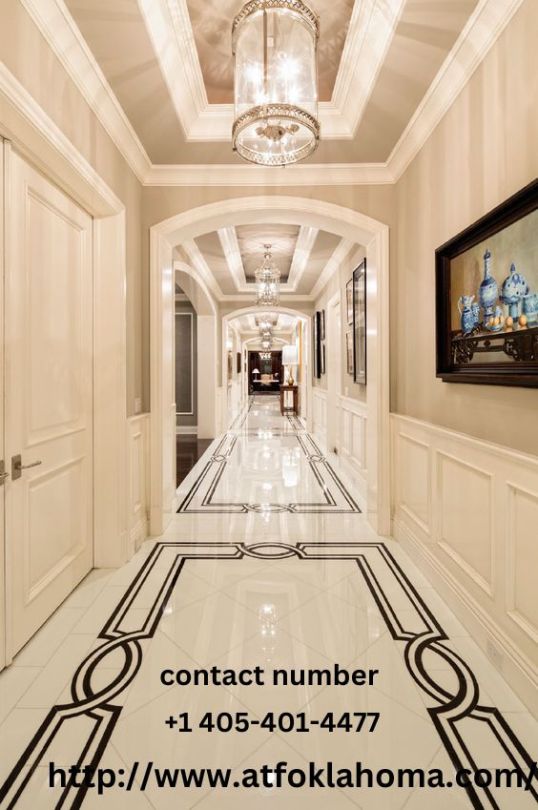

Premium Floor Coating Services in McAlester | ATF Oklahoma

Transform your space with expert epoxy concrete floor solutions in McAlester. Explore various epoxy flooring types and top-notch floor coating services at ATF Oklahoma, serving Woodward and Yukon. www.atfoklahoma.com

#Residential Flooring in Harrah#Epoxy Kitchen Floor Residential in Harrah#Commercial Flooring Contractors in Harrah#Flooring Installation Contractors in Harrah#Flooring Contractors in Harrah#Commercial Flooring in Harrah#Industrial Flooring in Harrah#Industrial Flooring for Kitchen in Harrah#Flooring Contractor in Harrah

0 notes

Text

Elevator Control Market Report Analysis By Key Players, Share, Revenue, Growth Rate With Forecast Overview To 2025

The elevator control market is expected to register a CAGR of 5% over the forecast period 2020-2025. Increasing population, rising industrialization and urbanization, economic development and growing infrastructure spending is boosting the elevator control market globally.

- Rise in urbanization across the world in search of a job and better life standard has led to an increase in demand for residential apartments. In order to cater to the needs, governments have supported the construction of the multi-storey building to accommodate the maximum number of families in the same land area. According to the United Nation, more than one half of the world population lives in urban areas, and virtually all countries are experiencing urbanization. Developed countries’ large population resides in urban areas, whereas developing countries in Africa and Asia, still dwell in rural areas but will urbanize faster than other regions over the coming decades. It will drive the elevator control market in the coming years.

Click Here to Download Sample Report >> https://www.sdki.jp/sample-request-85987

- The rapid increase in infrastructure spending in developing economies is expected to boost the elevator market. According to the report, India's infrastructure investment would grow by 43% in the fiscal year 2020-2021 projected by the government which would strengthen the demand of elevators and steel. Infrastructure spending by central, state governments and the private sector is forecast to be around USD 254 billion in 2020-21 compared with estimated spending of USD 178 billion in 2019-20.

- In addition, developments in elevator technology that leverage digitalizationto improve flow and travel time in busy mid and high-rise buildings, primarily commercial buildings are encouraging engineers to develop next generation smart elevator control systems. Smart connected buildings, Internet of Things capabilities, and evolving standards of safety and quality are the new generations elements evolving the elevator market. Key vendors would benefit after implementing these elements. For instance, KONE’s BACnet PR18-compliant controller is a native BACnet device, fully integrated system, that doesn’t require any elevator controls integrator or translation and allows building operator to manage, operate, and maintain smart buildings in the best and efficient ways.

- Moreover, increase focus on development, and modernization of airports, metro rails projects, and redevelopment of railway stations, offers opportunities in the infrastructure segment and hence to the elevator control market.

Key Market Trends

Smart Cities to Drive the Elevator Control Market

Modern or smart cities will fuel the need for smart and efficient technologies to support urban growth with smart buildings. Smart cities have smart transportation services, greener buildings with advanced technologies that use renewable energy sources and provide an eco-friendly and connected world. Elevator technologies are essential to ensure future smart city sustainability. Global green infrastructure standards together with statutory requirements are influential in promoting the application of smart elevators inside the building.

As buildings are responsible for 40% of the energy consumption across the world, 10% of electrical consumption in buildings is associated with elevators' power consumption. Advanced elevator technologies ensure significant energy savings with a possible 27% reduction in energy consumption with a 30% increase in usable floor space and promises energy self-sufficient buildings. These are usually made up of modern digital security system controls such as touch screens, biometrics, destination dispatching, and access control.

For instance, KONE, Finland based elevator and escalator company, has introduced the world's first digital elevator series in November 2019, KONE DX Class, that provides a host of new, multisensory experiences inside the elevator by combining physical hardware and digital services. It is also customizable to individual needs and preferences that can bring new levels of ease and convenience. The company has collaborated with Blindsquare, Robotise, Soundtrack Your Brand to bring new levels of sophistication to the people flow experience.

Moreover, Asia-Pacific will experience highest number of smart city project in the forecast period. Out of 1000 smart city project that are currently being built around the world, China accounts more than half of it. For instance, Xiong'an’s smart city brain project, the latest and most prestigious smart city project in China, aims to implement a high level of intelligence in city administration, engineering construction, corporate and social credit systems, public transport and other civil services and provide a taste of future to the city dwellers.

Asia-Pacific will Experience Significant Growth in Forecast Period

Multi-National companies are expanding their presence in Asia, emerging markets, to capture the potential growth with minimum cost. They are streamlining operations in a more established market and increasing their headcount in Asian countries. Information technology and the pharmaceutical sector had experienced the maximum growth of MNC’s expansion. According to Singapore’s Economic Development Board (EDB) report, more than 37,000 international companies, including 7,000 MNCs, have their headquarters in Singapore. The expansion has fueled the construction of multi-story buildings for workspace and need of fast and smart elevators to move an authentic employee to the desired floors with the fewest number of stops.

The rapid urbanization of Asia-Pacific region has shaped the skyscrapers’ market due to increased demand for infrastructure and population density and has fueled the need for towering skyscrapers, both for residential and commercial purposes. High-rise construction is no longer confined to a few financial and business centers and is accepted as a global model for densification. As a result, tall buildings are financed and built in virtually around the world with Asia accounting to more than 63% of the world’s tallest building projects which is boosting the speedy growth of elevator control market in Asia-Pacific region.

For instance, Wuhan Greenland Center is a skyscraper construction project aimed to build 636 meter tall structure that would provide spaces for three distinctive functions for office, apartment, and hotel. The estimated cost of the project is USD 4.5 billion and is estimated to complete in 2020. The elevator is provided by the Kone Corporation and Schindler to support speedy and efficient commute throughout the building.

China accounts more than half of the world’s new lift installations and the spread of COVID-19 has impacted the construction activity across the globe. All the construction projects have been halted due to the risk of COVID-19 poses to vulnerable workers and other citizen. All the governments are restricting the movement of people and limiting manufacturing operations. It has impacted the vendors' delivery time and the pace of installation in many markets. But the elevator maintenance business sector is not highly impacted. Even though China has lifted the lockdown over COVID-19 but other countries has sealed the borders to prevent any further outbreak of pandemic. This has negatively effected the elevator control market as most of the components were manufactured in Asian countries.

Competitive Landscape

The elevator control market is competitive and is dominated by a few major players like Thyssenkrupp AG, OTIS Elevator, Kone Corporation, Schindler Group, and Hitachi Ltd. These major players with a prominent share in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets.

- March 2020 - KONE Corporation has won an order to provide elevators for Harrah's Cherokee Casino Resort, located in Cherokee, North Carolina, the United States. Its solution includes 16 KONE MonoSpace elevators that are planned to be installed in August 2020 and are expected to be completed by 2021. The new conference center and resort will have more than 700 hotel rooms in a 19-story tower, that also includes 83,000 square feet of conference space. The facility includes retail and dining, a pool and fitness center and a 2,000-space parking garage.

- February 2020 - Otis Elevator will be providing 112 Gen2 elevators for the second phase of the Bengaluru Metro project conducted by Bangalore Metro Rail Corporation Ltd. The company will supply the units from its local manufacturing facility in Bengaluru. The metro project’s second phase is expected to be completed by 2023. It will cover 27 stations connecting the city’s manufacturing and technical hubs of Electronics City and Whitefield.

Reasons to Purchase this report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

The dynamic nature of business environment in the current global economy is raising the need amongst business professionals to update themselves with current situations in the market. To cater such needs, Shibuya Data Count provides market research reports to various business professionals across different industry verticals, such as healthcare & pharmaceutical, IT & telecom, chemicals and advanced materials, consumer goods & food, energy & power, manufacturing & construction, industrial automation & equipment and agriculture & allied activities amongst others.

For more information, please contact:

Hina Miyazu

Shibuya Data Count

Email: [email protected]

Tel: + 81 3 45720790

Related Links

https://www.sdki.jp/

0 notes

Text

Explore unrivaled expertise in epoxy flooring services through our dedicated team serving Piedmont, Miami, and Muskogee. Our skilled contractors are devoted to delivering outstanding results, utilizing precision and craftsmanship to transform your spaces. Whether you prioritize durability, aesthetic appeal, or a seamless finish, our experts are poised to assist you. Encounter superior craftsmanship and dependable service as we address your unique flooring needs. Rely on our proficiency as we bring a harmonious blend of professionalism and quality to every project, ensuring your satisfaction with the premier epoxy flooring solutions in Piedmont, Miami, and Muskogee. Visit our website for more information: www.atfoklahoma.com

#Residential Flooring in Harrah#Epoxy Kitchen Floor Residential in Henryetta#Commercial Flooring Contractors in Holdenville

0 notes

Text

Commercial Casinos Energy Policy Act Tax Opportunity

The Casino Environment

Before the recent economic downturn, commercial casinos collected at least $30 billion in revenues each year from 2005 through 2008.1 During this period, US casino owners built new facilities and expanded the size of their existing facilities. As a result of the economic downturn, new US commercial casino construction has come to a screeching halt and casino operators are now focused on existing facility cost reduction.

The Section 179(D) Tax Provisions

Increasingly, casino operators are taking advantage of the EPAct IRC section 179(D) commercial building energy efficiency tax provisions, which have been extended through 2013. EPAct tax deductions are available for qualifying energy reductions in lighting, HVAC(heating, ventilation, and air conditioning), and building envelope. (Building envelope consists of the building's foundation, walls, roof, windows, and doors, all of which control the flow of energy between the interior and exterior of the building.)

The Nature of Casino Properties

Commercial casinos often encompass hotel resorts, which offer attractive packages of services for their corporate and family customers. Casinos are particularly suited to EPAct because of their large gaming floors, hotel occupancy rooms, meeting halls, and parking garages. Each of these features typically consumes large square footage and the EPAct benefit has a potential for up to 60 cents per square foot for each of the three measures described above. Some of the smallest commercial casinos are about 50,000 square feet while most American casinos are typically over 100,000 square feet. One of the largest ones, MGM Grand on the unibet Las Vegas strip is almost 2 million square feet. Hotels themselves are the most favored of Section 179 building category. (See "Hotels and Motels Most Favored Energy Policy Act Tax Properties")

It is common to think of commercial casinos as located in two states Nevada and New Jersey. While it is true that these two states have the largest commercial casino revenues, there are 12 states with commercial casinos in the United States, the other commercial casino states are: Colorado, Illinois, Indiana, Iowa, Louisiana, Michigan, Mississippi, Missouri, Pennsylvania, and South Dakota. Members of the American Gaming Association have publicized some of their commitments to energy reduction. Reporting casinos include Boyd Gaming Corporation, Harrah's Entertainment, Inc., and MGM Mirage. They have projects which include significant energy savings via cogeneration, ERV(energy recovery ventilation), more efficient HVAC units, replacing incandescent lights with energy efficient lightings, windows with energy efficient day lighting systems, solar thermal storage and numerous other energy saving initiatives.

The underlying rule set to qualify for the Section 179D lighting tax deduction makes casinos and particularly casino hotels the most favored property category for the tax incentive. The rule set requires at least a 25% watts-per-square foot reduction as compared to the 2001 ASHRAE (American Society of Heating Refrigeration and Air Conditioning Engineers) building energy code standard. Full tax deduction is achieved with a 40% watts-per-square foot reduction compared to the ASHRAE 2001 standard. The ASHRAE 2004 hotel/motel building code standard requires 40% wattage reduction, which means that any hotel or motel lighting installation that meets that building code requirement will automatically qualify for the maximum EPAct tax deduction.

Occupancy Rooms

For most other building categories, the Section 179D tax provisions require compliance with the bi-level switching requirement. The comparison is always based on wired rather than plug-in lighting. Casino hotel occupancy rooms have a major advantage in that they often use plug-in lighting, and because these rooms function as hotel and motel spaces, they are specifically excluded from the tax bi-level switching requirement. Since occupant rooms are usually one of the larger spaces in hotel casinos, casinos are typically able to use energy efficient lighting to generate large EPAct tax deductions for the facility.

Back of the House Spaces

Casinos often have large kitchen, storage, and laundry (so called back of the house) spaces that have historically used T-12 fluorescent lighting. This lighting is so energy inefficient compared to today's lighting products that it will be illegal to manufacture in the United States after July 1, 2010.4 Once manufacturing of these prior generation lighting products ceases, the cost of replacing these inefficient bulbs will increase. Simply stated, casinos should consider acting now to replace these lighting fixtures to save both energy and lamp replacement costs. The EPAct lighting tax incentive can be used to address the opportunities related to these legally mandated product changes

Ball Rooms, Banquet Rooms and Restaurants

These areas of casinos have historically used designer type lighting that is energy inefficient and often very expensive to maintain and replace. In particular, replacing bulbs and lamps in high ceilings is very costly since expensive mobile hydraulic platform equipment must be rented or purchased to handle the replacements. New lighting products and, in particular, light emitting diode (LED) products, use a fraction of the energy and have a much longer useful life and are now being substituted. The combination of large energy cost reduction, operating cost reductions, utility rebates and EPAct tax deductions can greatly improve the economic payback from these more costly lighting upgrades.

Parking Garages

Many casinos have large adjoining parking garages that can save substantial energy costs and generate large tax deductions by upgrading to energy efficient fixtures. In Notice 2008-40 issued March 7th, 2008, the IRS announced that parking garages are a property class that is specifically entitled to use the EPAct tax deductions. Also, parking garages are excluded from the tax bi-level switching requirement. Please see the September, 2008 International Parking Institute article devoted to parking garages EPAct lighting deduction tax opportunities.5

Slot Machines and Gaming Floors

One of the biggest energy users on hotel gaming floors is slot machines. Although these were early adapters of fluorescent technology, even these energy efficient bulbs normally have to be changed 3 times a year because of 24/7 operating hours. Due to the high labor maintenance costs, casino owners are now transitioning to LED technology in their slot machines. LED's, while they have higher up front costs, have high energy efficiency and much longer life cycle, offering significant savings in labor and maintenance costs.

0 notes

Text

ATF Oklahoma - Showcase of Our Premier Services

Welcome to ATF Oklahoma, your go-to destination for top-notch flooring services in Norman, Oklahoma, and beyond. Our commitment to excellence and customer satisfaction makes us the premier choice for all your flooring needs. Let's explore the showcase of our exceptional services, with a special focus on Epoxy Kitchen Floors for residential spaces.

Epoxy Kitchen Floors - Transforming Homes in Norman

Epoxy Kitchen Floor Residential in Miami:

Discover the epitome of style and durability with ATF Oklahoma's Epoxy Kitchen Floors. Our residential services extend to Miami, ensuring your kitchen floor is not only visually stunning but also resilient against daily wear and tear. Elevate the heart of your home with our expertly crafted epoxy flooring solutions.

Flooring Contractors in Miami:

Our team of skilled flooring contractors in Miami is dedicated to bringing your vision to life. From the initial consultation to the final installation, ATF Oklahoma ensures a seamless and stress-free experience. We prioritise quality craftsmanship and attention to detail, making us the preferred choice among flooring contractors in the Miami area.

Commercial Epoxy in Muskogee:

For businesses in Muskogee looking to make a lasting impression, ATF Oklahoma offers premier commercial epoxy solutions. Enhance the aesthetics and functionality of your commercial space with flooring that reflects professionalism and durability. Our expertise extends beyond residential projects to cater to the unique needs of Muskogee's commercial establishments.

Epoxy Kitchen Floor Residential in Mustang:

Mustang residents, enhance the beauty and functionality of your kitchen with our specialized Epoxy Kitchen Floors. ATF Oklahoma brings innovation and style to residential spaces, ensuring that your kitchen becomes a focal point of elegance and practicality.

Epoxy Kitchen Floor Residential in Newcastle:

Newcastle homeowners, experience the transformative power of ATF Oklahoma's Epoxy Kitchen Floors. Our residential services extend to your area, offering a range of customizable options to suit your aesthetic preferences and lifestyle. Elevate your kitchen with flooring that combines beauty and durability.

ATF Oklahoma - Your Trusted Flooring Partner

At ATF Oklahoma, our commitment goes beyond delivering exceptional flooring solutions. We pride ourselves on being a trusted partner for residents and businesses in Norman, Oklahoma, and surrounding areas. As you explore our showcase of premier services, rest assured that our team is dedicated to exceeding your expectations.

Visit our website at ATF Oklahoma to learn more about our services, browse our portfolio, and connect with our team. Experience the difference ATF Oklahoma brings to flooring, where style meets substance, and durability meets design. Your dream space is just a step away with ATF Oklahoma by your side.

#Epoxy Flooring Contractors in McAlester#Flooring Contractor in Grove#Industrial Flooring for Kitchen in Lone#Industrial Flooring in Lawton#Commercial Flooring in Jenks#Flooring Contractors in Idabel#Flooring Installation Contractors in Hugo#Commercial Flooring Contractors in Holdenville#Epoxy Kitchen Floor Residential in Henryetta#Residential Flooring in Harrah

0 notes

Text

Commercial Casinos Energy Policy Act Tax Opportunity

The Casino Environment

Before the recent economic downturn, commercial casinos collected at least $30 billion in revenues each year from 2005 through 2008.1 During this period, US casino owners built new facilities and expanded the size of their existing facilities. As a result of the economic downturn, new US commercial casino construction has come to a screeching halt and casino operators are now focused on existing facility cost reduction.

The Section 179(D) Tax Provisions

Increasingly, casino operators are taking advantage of the EPAct IRC section 179(D) commercial building energy efficiency tax provisions, which have been extended through 2013. EPAct tax deductions are available for qualifying energy reductions in lighting, HVAC(heating, ventilation, and air conditioning), and building envelope. (Building envelope consists of the building's foundation, walls, roof, windows, and doors, all of which control the flow of energy between the interior and exterior of the building.)

The Nature of Casino Properties

Commercial casinos often encompass hotel resorts, which offer attractive packages of services for their corporate and family customers. Casinos are particularly suited to EPAct because of their large gaming floors, hotel occupancy rooms, meeting halls, and parking garages. Each of these features typically consumes large square footage and the EPAct benefit has a potential for up to 60 cents per square foot for each of the three measures described above. Some of the smallest commercial casinos are about 50,000 square feet while most American casinos are typically over 100,000 square feet. One of the largest ones, MGM Grand on the Las Vegas strip is almost 2 million square feet. Hotels themselves are the most favored of Section 179 building category. (See "Hotels and Motels Most Favored Energy Policy Act Tax Properties")

It is common to think of commercial casinos as located in two states Nevada and New Jersey. While it is true that these two states have the largest commercial casino revenues, there are 12 states with commercial casinos in the United States, the other commercial casino states are: Colorado, Illinois, Indiana, Iowa, Louisiana, Michigan, Mississippi, Missouri, Pennsylvania, and South Dakota. Members of the American Gaming Association have publicized some of their commitments to energy reduction. Reporting casinos include Boyd Gaming Corporation, Harrah's Entertainment, Inc., and MGM Mirage. They have projects which include significant energy savings via cogeneration, ERV(energy recovery ventilation), more efficient HVAC units, replacing incandescent lights with energy efficient lightings, windows with energy efficient day lighting systems, solar thermal storage and numerous other energy saving initiatives.

The underlying rule set to qualify for the Section 179D lighting tax deduction makes casinos and particularly casino hotels the most favored property category for the tax incentive. The rule set requires at least a 25% watts-per-square foot reduction as compared to the 2001 ASHRAE (American Society of Heating Refrigeration and Air Conditioning Engineers) building energy code standard. Full tax deduction is achieved with a 40% watts-per-square foot reduction compared to the ASHRAE 2001 standard. The ASHRAE 2004 hotel/motel building code standard requires 40% wattage reduction, which means that any hotel or motel lighting installation that meets that building code requirement will automatically qualify for the maximum EPAct tax deduction.

Occupancy Rooms

For most other building categories, the Section 179D tax provisions require compliance with the bi-level switching requirement. The comparison is always based on wired rather than plug-in lighting. Casino hotel occupancy rooms have a major advantage in that they often use plug-in lighting, and because these rooms function as hotel and motel spaces, they are specifically excluded from the tax bi-level switching requirement. Since occupant rooms are usually one of the larger spaces in hotel casinos, casinos are typically able to use energy efficient lighting to generate large EPAct tax deductions for the facility.

Back of the House Spaces

Casinos often have large kitchen, storage, and laundry (so called back of the house) spaces that have historically used T-12 fluorescent lighting. This lighting is so energy inefficient compared to today's lighting products that it will be illegal to manufacture in the United States after July 1, 2010.4 Once manufacturing of these prior generation lighting products ceases, the cost of replacing these inefficient bulbs will increase. Simply stated, casinos should consider acting now to replace these lighting fixtures to save both energy and lamp replacement costs. The EPAct lighting tax incentive can be used to address the opportunities related to these legally mandated product changes

Ball Rooms, Banquet Rooms and Restaurants

These areas of casinos have historically used designer type lighting that is energy inefficient and often very expensive to maintain and replace. In particular, replacing bulbs and lamps in high ceilings is very costly since expensive mobile hydraulic platform equipment must be rented or purchased to handle the replacements. New lighting products and, in particular, light emitting diode (LED) products, use a fraction of the energy and have a much longer useful life and are now being substituted. The combination of large energy cost reduction, operating cost reductions, utility rebates and EPAct tax deductions can greatly improve the economic payback from these more costly lighting upgrades.

Parking Garages

Many casinos have large adjoining parking garages that can save substantial energy costs and generate large tax deductions by upgrading to energy efficient fixtures. In Notice 2008-40 issued March 7th, 2008, the IRS announced that parking garages are a property class that is specifically entitled to use the EPAct tax deductions. Also, parking garages are excluded from the tax bi-level switching requirement. Please see the September, 2008 International Parking Institute article devoted to parking garages EPAct lighting deduction tax opportunities.5

Slot Machines and Gaming Floors

One of the biggest energy users on hotel gaming floors is slot machines. Although these were early adapters of fluorescent technology, even these energy efficient bulbs normally have to be changed 3 times a year because of 24/7 operating hours. Due to the high labor maintenance costs, casino owners are now transitioning to LED technology in their slot machines. LED's, while they have higher up front costs, have high energy efficiency and much longer life cycle, offering significant savings in labor and maintenance costs.

HVAC

Casinos because of their typical 24 hour occupancy can achieve significant energy cost savings from energy efficient HVAC systems. In particular, Nevada's hot climate further makes energy efficient HVAC a very worthwhile investment. Fortunately. Nevada with the highest revenues from Click here has America's second highest capacity for energy efficiency through renewable geothermal energy.6 Certain categories of very efficient HVAC investments will often qualify for the HVAC EPAct tax incentive including geothermal and thermal storage.

For more information: https://wm55.co/

0 notes

Text

Las Vegas Sands Corp & MGM Vs Bodog & Party Gaming - Let the Battle Commence

It could well be the war that defines the net gambling industry for many years to come back, the conflict that units all of the new standards and expectations for the web gamers but who might be positive? Who will be the proverbial last man status 188xoso.com To photo the battle in all it is full glory we must take a step again and make a few assumptions. Firstly permit's assume that today is the day that Sen. Barney Frank has had his bill surpassed and online gambling within the United States is now criminal. Next we should take a look at just who's presently dominating the web playing space.

We should take a international view however let us stay with the American marketplace as it is in reality extra a laugh. Leading the way currently might ought to consist of Bodog Casino, Go Casino, and lets include Online Vegas, then we have the large on line poker operators consisting of Poker Stars and Full Tilt.

Fighting inside the contrary nook are the huge boys from Las Vegas, Las Vegas Sands Corp (NYSE:LVS), MGM (NYSE:MGM), Harrahs and Steve Wynn (NASDAQ:WYNN). We surely might provide just about anything to have a height in their government files to see what the plans appear to be for whilst on line playing (observe when not if) is legalized within the United States.

So who holds the pleasant hand? The cutting-edge on line on line casino and poker operators that take wagers from American gamers have loved a staggeringly high degree of commercial enterprise in the previous couple of years with their market really worth billions of bucks. They have in reality perfected the ability to both optimize for and sell to the online gambler.

They are also no longer brief of coins need to they decide to head mainstream with their marketing in a large marketing push.

The Las Vegas Boys? Well you'll ought to count on that Las Vegas Corp and MGM have built up quite a list of ability on line gamblers from their residences in Vegas, we have to expect that they have got a totally big statistics base of player e mail addresses that they might invite to enroll in their new on line challenge.

That all seems pretty easy, the 2 opposing sides seem well matched for the conflict however while we look a touch deeper we discover there are a quite some troubles standing inside the way for both sides.

If we study our Las Vegas corner, and take MGM then we are able to image the situation. Online Gambling has been legalized, they have got a ready made purchaser base from their player records base, a software provider has been selected and the internet website online is prepared and looks first rate.

There is a hollow here and it comes within the shape of the bonus that MGM will provide. If we compare it to Go Casino we are able to see that they currently provide a deposit fit bonus, so if you deposit they will suit it one hundred% really worth $20,000. Yes that turned into not a typing mistake their new participant bonus is worth up to $20,000.

Now you need to expect that Go Casino have run the numbers and know that they are able to nevertheless make it pay, they've had this offer for a while so honestly MGM can suit it? But can they if which means taking their player listing from their land based totally casinos and providing them this sort of huge incentive to not come and go to them?

It might appear to cause quite a contradiction for the advertising and marketing department. You can also pay attention the managers of the Las Vegas casino flooring in their month-to-month meetings complaining that the online division has an unfair gain.

Ultimately it'll come right down to a few very intensive information mining and player profiling to ascertain which plan and offer shape benefits the group as a whole the most. Maybe some players who play small and eat all the buffet meals are more valuable sitting at domestic and having the online bonus. That is for the MGM number crunchers to determine.

So it's miles starting to seem like the current stable of on line operators have the upper hand, but as they are saying on TV "however wait there is greater". It is widely believed and expected in the enterprise that once online playing is legalized there can be a caveat within the license software system with a view to nation " when you have ever taken illegal bets, do not hassle making use of".

Now despite the fact that you may anticipate the operators to preserve doing what they're doing now, they will be severely handicapped as they'll not have access to the large media buys. Go Casino or Poker Stars will no longer as an instance be able to purchase a 1/2 time Super Bowl advert.

So this is it then, the Las Vegas boys win, properly they do look like the favorites but there is a little blot on their plan. When we are saying little it comes within the shape of a Billion dollar London stock marketplace organisation called Party Gaming (LON:PRTY).

This company does now not receive American players any extra although they did inside the past, so why will they be able to follow? Because Party Gaming came to a settlement with the U.S. Department of Justice and paid them $one zero five million to absolve themselves from any past wrong doing.

It is beyond doubt that after on-line playing is legalized absolutely within the United States at the Federal degree, no longer the complicated piecemeal State with the aid of State legislative attempts we see at the moment we are able to have one of the most exciting battles in the history of playing. If we needed to selected which company to shop for our inventory in based on the future revenue from on-line gambling it would be simple, it's a three way split between LVS, MGM and Party Gaming however then again what will we recognise?

Calida Gaming have Four Generations of Gambling Industry revel in and certify simplest the very nice Casino Bingo, Poker and Sports websites. Having written substantially at the prison thing of online gambling in America Calida Gaming are the authentic supply of records. Daily information and opinion to both inform and spark healthy debate.

0 notes

Text

Commercial Casinos Energy Policy Act Tax Opportunity

The Casino Environment

Before the recent economic downturn, commercial casinos collected at least $30 billion in revenues each year from 2005 through 2008.1 During this period, US casino owners built new facilities and expanded the size of their existing facilities. As a result of the economic downturn, new US commercial casino construction has come to a screeching halt and casino operators are now focused on existing facility cost reduction.

The Section 179(D) Tax Provisions

Increasingly, wm casino operators are taking advantage of the EPAct IRC section 179(D) commercial building energy efficiency tax provisions, which have been extended through 2013. EPAct tax deductions are available for qualifying energy reductions in lighting, HVAC(heating, ventilation, and air conditioning), and building envelope. (Building envelope consists of the building's foundation, walls, roof, windows, and doors, all of which control the flow of energy between the interior and exterior of the building.)

The Nature of Casino Properties

Commercial casinos often encompass hotel resorts, which offer attractive packages of services for their corporate and family customers. Casinos are particularly suited to EPAct because of their large gaming floors, hotel occupancy rooms, meeting halls, and parking garages. Each of these features typically consumes large square footage and the EPAct benefit has a potential for up to 60 cents per square foot for each of the three measures described above. Some of the smallest commercial casinos are about 50,000 square feet while most American casinos are typically over 100,000 square feet. One of the largest ones, MGM Grand on the Las Vegas strip is almost 2 million square feet. Hotels themselves are the most favored of Section 179 building category. (See "Hotels and Motels Most Favored Energy Policy Act Tax Properties")

It is common to think of commercial casinos as located in two states Nevada and New Jersey. While it is true that these two states have the largest commercial casino revenues, there are 12 states with commercial casinos in the United States, the other commercial casino states are: Colorado, Illinois, Indiana, Iowa, Louisiana, Michigan, Mississippi, Missouri, Pennsylvania, and South Dakota. Members of the American Gaming Association have publicized some of their commitments to energy reduction. Reporting casinos include Boyd Gaming Corporation, Harrah's Entertainment, Inc., and MGM Mirage. They have projects which include significant energy savings via cogeneration, ERV(energy recovery ventilation), more efficient HVAC units, replacing incandescent lights with energy efficient lightings, windows with energy efficient day lighting systems, solar thermal storage and numerous other energy saving initiatives.

The underlying rule set to qualify for the Section 179D lighting tax deduction makes casinos and particularly Click here hotels the most favored property category for the tax incentive. The rule set requires at least a 25% watts-per-square foot reduction as compared to the 2001 ASHRAE (American Society of Heating Refrigeration and Air Conditioning Engineers) building energy code standard. Full tax deduction is achieved with a 40% watts-per-square foot reduction compared to the ASHRAE 2001 standard. The ASHRAE 2004 hotel/motel building code standard requires 40% wattage reduction, which means that any hotel or motel lighting installation that meets that building code requirement will automatically qualify for the maximum EPAct tax deduction.

Occupancy Rooms

For most other building categories, the Section 179D tax provisions require compliance with the bi-level switching requirement. The comparison is always based on wired rather than plug-in lighting. Casino hotel occupancy rooms have a major advantage in that they often use plug-in lighting, and because these rooms function as hotel and motel spaces, they are specifically excluded from the tax bi-level switching requirement. Since occupant rooms are usually one of the larger spaces in hotel casinos, casinos are typically able to use energy efficient lighting to generate large EPAct tax deductions for the facility.

Back of the House Spaces

Casinos often have large kitchen, storage, and laundry (so called back of the house) spaces that have historically used T-12 fluorescent lighting. This lighting is so energy inefficient compared to today's lighting products that it will be illegal to manufacture in the United States after July 1, 2010.4 Once manufacturing of these prior generation lighting products ceases, the cost of replacing these inefficient bulbs will increase. Simply stated, casinos should consider acting now to replace these lighting fixtures to save both energy and lamp replacement costs. The EPAct lighting tax incentive can be used to address the opportunities related to these legally mandated product changes

Ball Rooms, Banquet Rooms and Restaurants

These areas of casinos have historically used designer type lighting that is energy inefficient and often very expensive to maintain and replace. In particular, replacing bulbs and lamps in high ceilings is very costly since expensive mobile hydraulic platform equipment must be rented or purchased to handle the replacements. New lighting products and, in particular, light emitting diode (LED) products, use a fraction of the energy and have a much longer useful life and are now being substituted. The combination of large energy cost reduction, operating cost reductions, utility rebates and EPAct tax deductions can greatly improve the economic payback from these more costly lighting upgrades.

Parking Garages

Many casinos have large adjoining parking garages that can save substantial energy costs and generate large tax deductions by upgrading to energy efficient fixtures. In Notice 2008-40 issued March 7th, 2008, the IRS announced that parking garages are a property class that is specifically entitled to use the EPAct tax deductions. Also, parking garages are excluded from the tax bi-level switching requirement. Please see the September, 2008 International Parking Institute article devoted to parking garages EPAct lighting deduction tax opportunities.5

Slot Machines and Gaming Floors

One of the biggest energy users on hotel gaming floors is slot machines. Although these were early adapters of fluorescent technology, even these energy efficient bulbs normally have to be changed 3 times a year because of 24/7 operating hours. Due to the high labor maintenance costs, casino owners are now transitioning to LED technology in their slot machines. LED's, while they have higher up front costs, have high energy efficiency and much longer life cycle, offering significant savings in labor and maintenance costs.

HVAC

Casinos because of their typical 24 hour occupancy can achieve significant energy cost savings from energy efficient HVAC systems. In particular, Nevada's hot climate further makes energy efficient HVAC a very worthwhile investment. Fortunately. Nevada with the highest revenues from casinos has America's second highest capacity for energy efficiency through renewable geothermal energy.6 Certain categories of very efficient HVAC investments will often qualify for the HVAC EPAct tax incentive including geothermal and thermal storage.

LEED Casinos

We expect to see more casinos obtain LEED status. (See LEED Building Tax Opportunities Article7). In 2008, The Palazzo, Las Vegas Casino became the largest LEED certified building and one of the first certified LEED casinos in the US.8 Casinos and hotels find that certain categories of frequent travelers are very interested in staying in facilities that have clearly demonstrated they are focused on the environment and sustainable design. To become LEED certified, a casino must have a building energy simulation model created by a qualified engineer. Modeling is also required for the EPAct, HVAC and Building Envelope tax deductions. Qualified tax experts that know how to make the adjustments to convert LEED computer models to EPAct tax deduction models can evaluate LEED models and determine whether large tax deductions are probable. For example, a 500,000 square foot LEED casino that qualifies for the maximum EPAct tax deduction will receive an immediate tax deduction of $900,000 =(500,000*$1.80). Casino owners who understand the magnitude of these benefits can use the tax savings to help justify the costs related to achieving LEED status.

For more information: http://wm.bet

0 notes

Text

Commercial Casinos Energy Policy Act Tax Opportunity

The Casino Environment

Before the recent economic downturn, commercial casinos collected at least $30 billion in revenues each year from 2005 through 2008.1 During this period, US casino owners built new facilities and casino online the size of their existing facilities. As a result of the economic downturn, new US commercial casino construction has come to a screeching halt and casino operators are now focused on existing facility cost reduction.

The Section 179(D) Tax Provisions

Increasingly, casino operators are taking advantage of the EPAct IRC section 179(D) commercial building energy efficiency tax provisions, which have been extended through 2013. EPAct tax deductions are available for qualifying energy reductions in lighting, HVAC(heating, ventilation, and air conditioning), and building envelope. (Building envelope consists of the building's foundation, walls, roof, windows, and doors, all of which control the flow of energy between the interior and exterior of the building.)

The Nature of Casino Properties

Commercial casinos often encompass hotel resorts, which offer attractive packages of services for their corporate and family customers. Casinos are particularly suited to EPAct because of their large gaming floors, hotel occupancy rooms, meeting halls, and parking garages. Each of these features typically consumes large square footage and the EPAct benefit has a potential for up to 60 cents per square foot for each of the three measures described above. Some of the smallest commercial casinos are about 50,000 square feet while most American casinos are typically over 100,000 square feet. One of the largest ones, MGM Grand on the Las Vegas strip is almost 2 million square feet. Hotels themselves are the most favored of Section 179 building category. (See "Hotels and Motels Most Favored Energy Policy Act Tax Properties")

It is common to think of commercial casinos as located in two states Nevada and New Jersey. While it is true that these two states have the largest commercial casino revenues, there are 12 states with commercial casinos in the United States, the other commercial casino states are: Colorado, Illinois, Indiana, Iowa, Louisiana, Michigan, Mississippi, Missouri, Pennsylvania, and South Dakota. Members of the American Gaming Association have publicized some of their commitments to energy reduction. Reporting casinos include Boyd Gaming Corporation, Harrah's Entertainment, Inc., and MGM Mirage. They have projects which include significant energy savings via cogeneration, ERV(energy recovery ventilation), more efficient HVAC units, replacing incandescent lights with energy efficient lightings, windows with energy efficient day lighting systems, solar thermal storage and numerous other energy saving initiatives.

The underlying rule set to qualify for the Section 179D lighting tax deduction makes casinos and particularly casino hotels the most favored property category for the tax incentive. The rule set requires at least a 25% watts-per-square foot reduction as compared to the 2001 ASHRAE (American Society of Heating Refrigeration and Air Conditioning Engineers) building energy code standard. Full tax deduction is achieved with a 40% watts-per-square foot reduction compared to the ASHRAE 2001 standard. The ASHRAE 2004 hotel/motel building code standard requires 40% wattage reduction, which means that any hotel or motel lighting installation that meets that building code requirement will automatically qualify for the maximum EPAct tax deduction.

Occupancy Rooms

For most other building categories, the Section 179D tax provisions require compliance with the bi-level switching requirement. The comparison is always based on wired rather than plug-in lighting. Casino hotel occupancy rooms have a major advantage in that they often use plug-in lighting, and because these rooms function as hotel and motel spaces, they are specifically excluded from the tax bi-level switching requirement. Since occupant rooms are usually one of the larger spaces in hotel casinos, casinos are typically able to use energy efficient lighting to generate large EPAct tax deductions for the facility.

Back of the House Spaces

Casinos often have large kitchen, storage, and laundry (so called back of the house) spaces that have historically used T-12 fluorescent lighting. This lighting is so energy inefficient compared to today's lighting products that it will be illegal to manufacture in the United States after July 1, 2010.4 Once manufacturing of these prior generation lighting products ceases, the cost of replacing these inefficient bulbs will increase. Simply stated, casinos should consider acting now to replace these lighting fixtures to save both energy and lamp replacement costs. The EPAct lighting tax incentive can be used to address the opportunities related to these legally mandated product changes

Ball Rooms, Banquet Rooms and Restaurants

These areas of casinos have historically used designer type lighting that is energy inefficient and often very expensive to maintain and replace. In particular, replacing bulbs and lamps in high ceilings is very costly since expensive mobile hydraulic platform equipment must be rented or purchased to handle the replacements. New lighting products and, in particular, light emitting diode (LED) products, use a fraction of the energy and have a much longer useful life and are now being substituted. The combination of large energy cost reduction, operating cost reductions, utility rebates and EPAct tax deductions can greatly improve the economic payback from these more costly lighting upgrades.

Parking Garages

Many casinos have large adjoining parking garages that can save substantial energy costs and generate large tax deductions by upgrading to energy efficient fixtures. In Notice 2008-40 issued March 7th, 2008, the IRS announced that parking garages are a property class that is specifically entitled to use the EPAct tax deductions. Also, parking garages are excluded from the tax bi-level switching requirement. Please see the September, 2008 International Parking Institute article devoted to parking garages EPAct lighting deduction tax opportunities.5

Slot Machines and Gaming Floors

One of the biggest energy users on hotel gaming floors is slot machines. Although these were early adapters of fluorescent technology, even these energy efficient bulbs normally have to be changed 3 times a year because of 24/7 operating hours. Due to the high labor maintenance costs, casino owners are now transitioning to LED technology in their slot machines. LED's, while they have higher up front costs, have high energy efficiency and much longer life cycle, offering significant savings in labor and maintenance costs.

0 notes

Text

Commercial Casinos Energy Policy Act Tax Opportunity

previously the recent economic downturn, advertisement casinos collected at least $30 billion in revenues each year from 2005 through 2008.1 During this period, US casino owners built other services and expanded the size of their existing facilities. As a result of the economic downturn, new US public notice casino construction has come to a screeching terminate and casino operators are now focused upon existing faculty cost reduction.

The Section 179(D) Tax Provisions

AGEN SABUNG AYAM ONLINE

Increasingly, casino operators are taking advantage of the EPAct IRC section 179(D) public notice building spirit efficiency tax provisions, which have been elongated through 2013. EPAct tax deductions are friendly for qualifying vivaciousness reductions in lighting, HVAC(heating, ventilation, and freshen conditioning), and building envelope. (Building envelope consists of the building's foundation, walls, roof, windows, and doors, all of which control the flow of energy in the midst of the interior and exterior of the building.)

The birds of Casino Properties

Commercial casinos often encompass hotel resorts, which have enough money handsome packages of facilities for their corporate and intimates customers. Casinos are particularly suited to EPAct because of their large gaming floors, hotel occupancy rooms, meeting halls, and parking garages. Each of these features typically consumes large square footage and the EPAct improvement has a potential for going on to 60 cents per square foot for each of the three dealings described above. Some of the smallest personal ad casinos are virtually 50,000 square feet even if most American casinos are typically exceeding 100,000 square feet. One of the largest ones, MGM Grand upon the Las Vegas strip is more or less 2 million square feet. Hotels themselves are the most favored of Section 179 building category. (See "Hotels and Motels Most Favored life Policy case Tax Properties")

It is common to think of public notice casinos as located in two states Nevada and new Jersey. while it is authenticated that these two states have the largest commercial casino revenues, there are 12 states taking into account flyer casinos in the associated States, the additional flyer casino states are: Colorado, Illinois, Indiana, Iowa, Louisiana, Michigan, Mississippi, Missouri, Pennsylvania, and South Dakota. Members of the American Gaming relationship have publicized some of their commitments to sparkle reduction. Reporting casinos append Boyd Gaming Corporation, Harrah's Entertainment, Inc., and MGM Mirage. They have projects which combine significant moving picture savings via cogeneration, ERV(energy recovery ventilation), more efficient HVAC units, replacing aflame lights when sparkle efficient lightings, windows later simulation efficient hours of daylight lighting systems, solar thermal storage and numerous additional vibrancy saving initiatives.

The underlying decide set to qualify for the Section 179D lighting tax elimination makes casinos and particularly casino hotels the most favored property category for the tax incentive. The consider set requires at least a 25% watts-per-square foot dwindling as compared to the 2001 ASHRAE (American work of Heating Refrigeration and ventilate Conditioning Engineers) building energy code standard. Full tax subtraction is achieved following a 40% watts-per-square foot point compared to the ASHRAE 2001 standard. The ASHRAE 2004 hotel/motel building code pleasing requires 40% wattage reduction, which means that any hotel or motel lighting installation that meets that building code requirement will automatically qualify for the maximum EPAct tax deduction.

Occupancy Rooms

For most further building categories, the Section 179D tax provisions require agreement in the same way as the bi-level switching requirement. The comparison is always based on wired rather than plug-in lighting. Casino hotel occupancy rooms have a major advantage in that they often use plug-in lighting, and because these rooms doing as hotel and motel spaces, they are specifically excluded from the tax bi-level switching requirement. in the past occupant rooms are usually one of the larger spaces in hotel casinos, casinos are typically skilled to use excitement efficient lighting to generate large EPAct tax deductions for the facility.

Back of the house Spaces

Casinos often have large kitchen, storage, and laundry (so called support of the house) spaces that have historically used T-12 fluorescent lighting. This lighting is correspondingly dynamism inefficient compared to today's lighting products that it will be illegal to build in the united States after July 1, 2010.4 in imitation of manufacturing of these prior generation lighting products ceases, the cost of replacing these inefficient bulbs will increase. comprehensibly stated, casinos should adjudicate acting now to replace these lighting fixtures to save both excitement and lamp replacement costs. The EPAct lighting tax incentive can be used to dwelling the opportunities aligned to these legally mandated product changes

Ball Rooms, Banquet Rooms and Restaurants

These areas of casinos have historically used designer type lighting that is vivaciousness inefficient and often categorically costly to preserve and replace. In particular, replacing bulbs and lamps in high ceilings is unconditionally expensive back expensive mobile hydraulic platform equipment must be rented or purchased to handle the replacements. new lighting products and, in particular, blithe emitting diode (LED) products, use a fraction of the enthusiasm and have a much longer useful moving picture and are now bodily substituted. The raptness of large activity cost reduction, functioning cost reductions, relieve rebates and EPAct tax deductions can greatly tally the economic payback from these more costly lighting upgrades.

0 notes

Text

Commercial Casinos Energy Policy Act Tax Opportunity

The Casino Environment

Before the recent economic downturn, commercial casinos collected at least $30 billion in revenues each year from 2005 through 2008.1 During this period, US casino owners built new facilities and expanded the size of their existing facilities บาคาร่า. As a result of the economic downturn, new US commercial casino construction has come to a screeching halt and casino operators are now focused on existing facility cost reduction.

The Section 179(D) Tax Provisions

Increasingly, casino operators are taking advantage of the EPAct IRC section 179(D) commercial building energy efficiency tax provisions, which have been extended through 2013. EPAct tax deductions are available for qualifying energy reductions in lighting, HVAC(heating, ventilation, and air conditioning), and building envelope. (Building envelope consists of the building's foundation, walls, roof, windows, and doors, all of which control the flow of energy between the interior and exterior of the building.)

The Nature of Casino Properties

Commercial casinos often encompass hotel resorts, which offer attractive packages of services for their corporate and family customers. Casinos are particularly suited to EPAct because of their large gaming floors, hotel occupancy rooms, meeting halls, and parking garages. Each of these features typically consumes large square footage and the EPAct benefit has a potential for up to 60 cents per square foot for each of the three measures described above. Some of the smallest commercial casinos are about 50,000 square feet while most American casinos are typically over 100,000 square feet. One of the largest ones, MGM Grand on the Las Vegas strip is almost 2 million square feet. Hotels themselves are the most favored of Section 179 building category. (See "Hotels and Motels Most Favored Energy Policy Act Tax Properties")

It is common to think of commercial casinos as located in two states Nevada and New Jersey. While it is true that these two states have the largest commercial casino revenues, there are 12 states with commercial casinos in the United States, the other commercial casino states are: Colorado, Illinois, Indiana, Iowa, Louisiana, Michigan, Mississippi, Missouri, Pennsylvania, and South Dakota. Members of the American Gaming Association have publicized some of their commitments to energy reduction. Reporting casinos include Boyd Gaming Corporation, Harrah's Entertainment, Inc., and MGM Mirage. They have projects which include significant energy savings via cogeneration, ERV(energy recovery ventilation), more efficient HVAC units, replacing incandescent lights with energy efficient lightings, windows with energy efficient day lighting systems, solar thermal storage and numerous other energy saving initiatives.

The underlying rule set to qualify for the Section 179D lighting tax deduction makes casinos and particularly casino hotels the most favored property category for the tax incentive. The rule set requires at least a 25% watts-per-square foot reduction as compared to the 2001 ASHRAE (American Society of Heating Refrigeration and Air Conditioning Engineers) building energy code standard. Full tax deduction is achieved with a 40% watts-per-square foot reduction compared to the ASHRAE 2001 standard. The ASHRAE 2004 hotel/motel building code standard requires 40% wattage reduction, which means that any hotel or motel lighting installation that meets that building code requirement will automatically qualify for the maximum EPAct tax deduction.

Occupancy Rooms

For most other building categories, the Section 179D tax provisions require compliance with the bi-level switching requirement. The comparison is always based on wired rather than plug-in lighting. Casino hotel occupancy rooms have a major advantage in that they often use plug-in lighting, and because these rooms function as hotel and motel spaces, they are specifically excluded from the tax bi-level switching requirement. Since occupant rooms are usually one of the larger spaces in hotel casinos, casinos are typically able to use energy efficient lighting to generate large EPAct tax deductions for the facility.

Back of the House Spaces

Casinos often have large kitchen, storage, and laundry (so called back of the house) spaces that have historically used T-12 fluorescent lighting. This lighting is so energy inefficient compared to today's lighting products that it will be illegal to manufacture in the United States after July 1, 2010.4 Once manufacturing of these prior generation lighting products ceases, the cost of replacing these inefficient bulbs will increase. Simply stated, casinos should consider acting now to replace these lighting fixtures to save both energy and lamp replacement costs. The EPAct lighting tax incentive can be used to address the opportunities related to these legally mandated product changes

Ball Rooms, Banquet Rooms and Restaurants

These areas of casinos have historically used designer type lighting that is energy inefficient and often very expensive to maintain and replace. In particular, replacing bulbs and lamps in high ceilings is very costly since expensive mobile hydraulic platform equipment must be rented or purchased to handle the replacements. New lighting products and, in particular, light emitting diode (LED) products, use a fraction of the energy and have a much longer useful life and are now being substituted. The combination of large energy cost reduction, operating cost reductions, utility rebates and EPAct tax deductions can greatly improve the economic payback from these more costly lighting upgrades.

Parking Garages

Many casinos have large adjoining parking garages that can save substantial energy costs and generate large tax deductions by upgrading to energy efficient fixtures. In Notice 2008-40 issued March 7th, 2008, the IRS announced that parking garages are a property class that is specifically entitled to use the EPAct tax deductions. Also, parking garages are excluded from the tax bi-level switching requirement. Please see the September, 2008 International Parking Institute article devoted to parking garages EPAct lighting deduction tax opportunities.5

Slot Machines and Gaming Floors

One of the biggest energy users on hotel gaming floors is slot machines. Although these were early adapters of fluorescent technology, even these energy efficient bulbs normally have to be changed 3 times a year because of 24/7 operating hours. Due to the high labor maintenance costs, casino owners are now transitioning to LED technology in their slot machines. LED's, while they have higher up front costs, have high energy efficiency and much longer life cycle, offering significant savings in labor and maintenance costs.

HVAC

Casinos because of their typical 24 hour occupancy can achieve significant energy cost savings from energy efficient HVAC systems. In particular, Nevada's hot climate further makes energy efficient HVAC a very worthwhile investment. Fortunately casino. Nevada with the highest revenues from casinos has America's second highest capacity for energy efficiency through renewable geothermal energy.6 Certain categories of very efficient HVAC investments will often qualify for the HVAC EPAct tax incentive including geothermal and thermal storage.

LEED Casinos

We expect to see more casinos obtain LEED status. (See LEED Building Tax Opportunities Article7). In 2008, The Palazzo, Las Vegas Casino became the largest LEED certified building and one of the first certified LEED casinos in the US.8 Casinos and hotels find that certain categories of frequent travelers are very interested in staying in facilities that have clearly demonstrated they are focused on the environment and sustainable design. To become LEED certified, a casino must have a building energy simulation model created by a qualified engineer. Modeling is also required for the EPAct, HVAC and Building Envelope tax deductions. Qualified tax experts that know how to make the adjustments to convert LEED computer models to EPAct tax deduction models can evaluate LEED models and determine whether large tax deductions are probable. For example, a 500,000 square foot LEED casino that qualifies for the maximum EPAct tax deduction will receive an immediate tax deduction of $900,000 =(500,000*$1.80). Casino owners who understand the magnitude of these benefits can use the tax savings to help justify the costs related to achieving LEED status.

0 notes

Text

On the web Casinos Vs Land Casinos

Before the new economic downturn, professional casinos collected at the very least $30 thousand in revenues each year from 2005 through 2008.1 During this time, US casino owners developed new features and widened how big their existing facilities. Consequently of the economic downturn, new US professional casino construction has arrived at a screeching halt and casino operators are now dedicated to existing facility cost reduction.

Significantly, casino operators are taking advantage of the EPAct IRC area 179(D) commercial creating power performance tax provisions, which were extended through 2013. EPAct tax deductions are available for qualifying power savings in light, HVAC(heating, ventilation, and air conditioning), and building envelope. (Building Sam Woo consists of the building's foundation, surfaces, roof, windows, and gates, which get a handle on the movement of energy between the inner and outside of the building.)

Industrial casinos usually encompass resort resorts, which offer beautiful packages of services due to their corporate and household customers. Casinos are especially worthy of EPAct because of their large gambling floors, resort occupancy rooms, meeting halls, and parking garages. All these functions typically consumes large square video and the EPAct benefit features a potential for approximately 60 dollars per square base for each of the three steps defined above. Some of the tiniest professional casinos are about 50,000 square legs some American casinos are usually around 100,000 sq feet. Among the biggest people, MGM Fantastic on the Las Vegas reel is almost 2 million sq feet. Accommodations themselves are the absolute most favored of Part 179 making category. (See "Hotels and Motels Most Favored Energy Policy Behave Duty Attributes")

It is frequent to think of professional casinos as positioned in two claims Nevada and New Jersey. Whilst it is true that those two claims have the largest commercial casino earnings, you will find 12 states with commercial casinos in the United Claims, one other commercial casino states are: Colorado, Illinois, Indiana, Iowa, Louisiana, Michigan, Mississippi, Mo, Pennsylvania, and South Dakota. Members of the National Gambling Association have publicized some of their commitments to energy reduction. Confirming casinos include Boyd Gambling Organization, Harrah's Activity, Inc., and MGM Mirage. They have jobs such as substantial power savings via cogeneration, ERV(energy recovery ventilation), more efficient HVAC models, replacing incandescent lights with power successful lightings, windows with power efficient day lighting techniques, solar thermal storage and numerous other energy saving initiatives.

0 notes

Text

Commercial Casinos Energy Policy Act Tax Opportunity

The Casino Environment

Ahead of the current economic recession, commercial casinos accumulated at least $30 billion in revenues every year from 2005 through 2008.1 During this period, US casino owners built new facilities and expanded the size of the current facilities. As a consequence of the economic recession, new US commercial casino structure has come to a screeching stop and casino operators are currently focused on present facility price decrease.

The Section 179(D) Tax Provisions

More importantly, casino operators now are benefiting from this EPAct IRC section 179(D) commercial building energy efficiency tax provisions, that are expanded through 2013. EPAct tax deductions are available for qualifying energy discounts in lighting, HVAC(heating, venting, and air conditioning), and building envelope. (Building envelope is composed of the building's foundation, walls, windows, roof, and doorways, all which control the flow of energy between the inside and exterior of the building.)

The Nature of Casino Properties

Commercial casinos frequently encompass resort hotels, which provide attractive bundles of solutions for their company and household clients. Casinos are especially suited to EPAct due to their big gaming flooring, hotel occupancy rooms, assembly halls, and parking garages. Every one of those features typically consumes big square footage along with the EPAct advantage includes a capacity for as many as 60 cents per square foot for all the three steps described previously. A number of the tiniest commercial casinos are approximately 50,000 square feet while many American casinos are usually over 100,000 square feet. Among the biggest ones, MGM Grand on the Las Vegas strip is nearly two million square feet. Hotels themselves would be the most preferred of Section 179 construction group. (See "Hotels and Motels Most Favored Energy Policy Act Tax Properties")

It's not uncommon to consider commercial casinos as situated in two countries Nevada and New Jersey. Although it's correct that both of these countries have the biggest commercial casino earnings, there are 12 states with commercial casinos in the United States, another commercial casino states are: Colorado, Illinois, Indiana, Iowa, Louisiana, Michigan, Mississippi, Missouri, Pennsylvania, and South Dakota. Members of the American Gaming Association have researched a few of the responsibilities to energy decrease. Reporting casinos comprise Boyd Gaming Corporation, Harrah's Entertainment, Inc., and MGM Mirage. They've jobs including significant energy savings through cogeneration, ERV(energy recovery ventilation), more efficient HVAC components, replacing incandescent lighting with energy efficient lightings, windows using energy efficient afternoon light systems, solar thermal storage along with other energy saving projects.

The underlying rule place to be eligible for the Section 179D light taxation deduction makes casinos and especially casino resorts the most preferred property class for your tax incentive. The principle set requires a 25 percent watts-per-square foot reduction when compared with 2001 ASHRAE (American Society of Heating Refrigeration and Air Conditioning Engineers) building energy standard. Complete tax deduction is reached using a 40 percent watts-per-square foot decrease in contrast to the ASHRAE 2001 standard. The ASHRAE 2004 hotel/motel construction code standard requires 40% reduction, meaning that any hotel or incandescent light setup that satisfies that construction code requirement will automatically qualify to your highest EPAct tax deduction.

Occupancy Rooms

For many other construction types, the Section 179D tax provisions require compliance with all the bi-level shifting requirement. The contrast is obviously based on wired instead of plug in lighting. Casino resort occupancy rooms have a significant benefit because they frequently utilize plug-in light, and since these rooms operate as hotel and motel spaces, so they are specifically excluded by the taxation bi-level shifting requirement. Because occupant rooms are often among those bigger spaces in resort casinos, casinos are usually able to utilize energy efficient lighting to create big EPAct tax deductions to your center.

Back of this House Spaces

Casinos frequently have large kitchen, storage, and laundry (so called back of their home ) spaces which have historically utilized T-12 fluorescent light. This light is energy inefficient when compared with the current lighting products it will be prohibited to manufacture from the United States after July 1, 2010.4 Once manufacturing of those prior generation lighting goods stops, the price of replacing these ineffective bulbs increase. Simply stated, casinos should think about acting now to substitute these light fixtures to conserve energy and lamp replacement costs. The EPAct lighting taxation incentive can be utilized to address the possibilities associated with those legally mandated product varies

Ball Rooms, Banquet Rooms and Restaurants

All these regions of casinos have used designer kind lighting that's energy inefficient and frequently quite expensive to keep and replace. Specifically, replacing lamps and bulbs in large ceilings is quite expensive since costly mobile hydraulic system equipment has to be leased or bought to take care of the replacements. New lighting products and services, particularly, light emitting diode (LED) products, use a small percent of the energy and also have a much longer useful life and are presently being substituted. The mixture of high energy expenditure reduction, operating cost reductions, utility acquisitions and EPAct tax deductions may greatly enhance the financial revival from these more expensive lighting upgrades. To check more details click GCLUB G Club

Parking Garages

Many casinos have big adjoining parking garages which could save significant energy costs and create large tax deductions by upgrading to energy efficient fittings. In Notice 2008-40 issued March 7th, 2008, the IRS announced that passengers are a property type that's specially eligible to utilize the EPAct tax deductions. Additionally, passengers have been excluded from the taxation bi-level changing requirement. Please visit the September, 2008 International Parking Institute article dedicated to parking garages EPAct lighting deduction taxation chances.5

Slot Machines and Gaming Floors

Among the greatest energy users on resort gaming flooring is slot machines. Though these were early adapters of fluorescent technologies, these energy efficient bulbs normally must be changed 3 times every year due to 24/7 working hours. On account of the high labour maintenance expenses, casino owners are currently transitioning to LED technologies in their own slot machines. LED's, while they have greater up front costs, have high energy efficiency and more life cycle, offering substantial savings in labour and labor costs.

HVAC

Casinos due to their average 24 hour occupancy may achieve substantial energy cost savings from energy efficient HVAC systems. Specifically, Nevada's hot climate farther makes energy efficient HVAC an extremely rewarding investment. Fortunately. Nevada with the greatest earnings from casinos has America's second greatest capability for electricity efficiency through renewable geothermal energy.6 Certain categories of rather effective HVAC investments will frequently qualify for its HVAC EPAct tax incentive for example geothermal and thermal storage.

LEED Casinos

We hope to find out more casinos acquire LEED status. (See LEED Building Tax Opportunities Article7). Back in 2008, The Palazzo, Las Vegas Casino became the greatest LEED certified building and among the first accredited LEED casinos at the US.8 Casinos and resorts discover that particular types of regular travelers are extremely enthusiastic about staying in centers which have clearly shown they're centered on the environment and sustainable design. To become LEED certified, a casino needs a building energy simulation design made by an experienced engineer. Modeling can also be needed for the EPAct, HVAC and Building Envelope tax deductions. Licensed tax specialists that understand how to make the alterations to convert LEED computer versions to EPAct tax deduction versions can appraise LEED versions and ascertain whether big tax deductions are likely. By way of instance, a 500,000 square foot LEED casino which qualifies for the highest EPAct tax deduction will obtain an immediate tax deduction of $900,000 =(500,000*$1.80). Casino owners that know the size of those benefits may use the tax savings to help justify the expenses associated with attaining LEED status.

Conclusion

Casinos due to their big subspaces are a favorite building group below the EPAct commercial construction tax deduction laws. Property owners that know these opportunities can behave during the present economic recession to increase their facilities, decrease operating costs and possibly become LEED accredited centers.

0 notes

Text

Transforming Miami Kitchens with Durable Industrial Flooring

Introduction:

In the vibrant city of Miami, where the culinary scene is as diverse as its culture, homeowners are constantly seeking innovative ways to enhance their kitchens. One key element that often goes overlooked is the flooring. Today, we'll explore the importance of industrial flooring for kitchens in Miami, and how it can revolutionize your cooking space.

The Need for Resilient Residential Flooring:

Miami's kitchens are bustling hubs of activity, and it's crucial to have flooring that can withstand the demands of daily life. For residents in Piedmont, Muskogee, Mustang, Newcastle, Noble, Okmulgee, Owasso, Pauls Valley, Perry, finding the right residential flooring is essential. Whether you're cooking up a storm or entertaining guests, your Kitchen Floor should be both stylish and durable.

Epoxy Kitchen Floor Residential in Muskogee:

One excellent option gaining popularity is epoxy kitchen floor residential in Muskogee. Epoxy flooring is a seamless and robust solution that not only enhances the aesthetic appeal of your kitchen but also provides unmatched durability. It is resistant to stains, chemicals, and impact, making it an ideal choice for high-traffic areas.

Discovering the Benefits of Industrial Flooring:

Industrial flooring is designed to endure heavy foot traffic and resist wear and tear. In a city like Miami, where the kitchen is the heart of the home, choosing industrial flooring brings several advantages: