#CommodityMarketUpdate

Explore tagged Tumblr posts

Text

Global Oil Markets Plummet: Analyzing the 7% Price Drop and Its Far-Reaching Implications

Key Points

Research suggests the 7% oil price drop on April 4, 2025, was driven by OPEC+ increasing output and global trade tensions, with U.S. policies under Trump boosting production.

It seems likely Trump's "drill, baby, drill" approach contributed to a global oil surplus, impacting prices.

The evidence leans toward economic challenges for oil-dependent nations and potential relief for consumers, with geopolitical shifts possible.

Background

On April 4, 2025, global oil markets experienced a significant 7% price drop, with Brent crude settling at $65.58 a barrel, marking a four-year low. This event was influenced by multiple factors, including a surprise output increase by OPEC+, escalating global trade tensions due to U.S. tariffs, and robust U.S. oil production under President Donald Trump's energy policies. This essay explores these dynamics, providing a comprehensive analysis for a general audience.

Causes of the Price Drop

The immediate trigger was OPEC+'s decision to triple its planned output hike for May, aiming to lower prices and address members exceeding quotas. This move added to a global oil surplus, with non-OPEC+ production, especially from the Americas, expected to grow significantly in 2025. Simultaneously, U.S. President Donald Trump's tariffs, including a 34% tariff on Chinese imports, escalated trade tensions, threatening global economic growth and reducing oil demand. These factors combined to create downward pressure on prices, with Brent crude hitting $64.03 at its session low.

U.S. Role and Trump's Policies

Central to this scenario is the United States, which, under Trump's "drill, baby, drill" policy, has prioritized fossil fuel production. Trump's administration declared a national energy emergency and eased regulations, boosting exploration on federal lands. According to the U.S. Energy Information Administration (EIA), U.S. crude oil production is forecasted to average 13.59 million barrels per day in 2025, making it the world's top producer. This surge, particularly from regions like the Permian Basin, has contributed to the global oil glut, undermining OPEC+'s efforts to stabilize prices.

Implications and Future Outlook

The price drop poses economic challenges for oil-dependent nations like Russia and Saudi Arabia, potentially leading to fiscal adjustments or geopolitical maneuvers. For consumers in importing countries, lower prices could offer relief at the pump, but trade war uncertainties might offset these benefits. Geopolitically, the U.S.'s energy dominance strengthens its position, possibly reshaping alliances. Looking ahead, while OPEC+ might reconsider its strategy, the combination of high non-OPEC+ supply and weakened demand suggests continued price pressure through 2026, with environmental concerns possibly tempering long-term U.S. growth.

An unexpected detail is the scale of weekly losses, with Brent down 10.9% and WTI down 10.6%, the largest in over a year, highlighting the market's volatility. This adds complexity to future energy policy discussions, especially given Trump's focus on fossil fuels amidst global sustainability goals.

Detailed Analysis

On April 4, 2025, at 01:42 AM EAT, global oil markets experienced a significant 7% price drop, with Brent crude settling at $65.58 a barrel, marking its lowest in over three years and part of a 10.9% weekly decline, its biggest in a year and a half. This event, as reported by Bloomberg and Reuters, was driven by a confluence of factors, including OPEC+'s policy shift, escalating global trade tensions, and robust U.S. oil production under President Donald Trump's energy agenda. This analysis delves into the details, providing a comprehensive overview for a professional audience.

OPEC+ Output Increase and Market Impact

The immediate trigger was OPEC+'s surprise decision to triple its planned output hike for May, a deliberate effort to lower prices and punish members pumping above quota, as noted in a Bloomberg article from April 4, 2025. This policy reversal, from being a defender of high prices to flooding the market, was unexpected and contributed to the price rout. The increased output added to an already anticipated global surplus, with the EIA forecasting global petroleum and other liquids supply to increase by 1.9 million barrels per day (b/d) in 2025, driven by non-OPEC+ countries like the U.S., Guyana, Canada, and Brazil. This growth, detailed in the EIA's February Short-Term Energy Outlook (STEO), contrasts with OPEC+'s restrained production, expected to grow by only 0.1 million b/d in 2025, highlighting the market imbalance.

Global Trade Tensions and Economic Uncertainty

Simultaneously, global trade tensions exacerbated the situation, with U.S. President Donald Trump's aggressive tariff policies playing a pivotal role. Trump's tariffs, including a 34% tariff on Chinese imports announced on April 1, 2025, triggered retaliatory measures from China, escalating fears of a trade war, as reported by Reuters on April 4, 2025. This uncertainty threatened global economic growth and energy consumption, with oil prices bearing the brunt due to their sensitivity to economic outlook. The ripple effects were evident, with commodities markets from metals to gas also feeling pressure, contributing to Brent crude hitting a session low of $64.03, its lowest since December 2021, and WTI touching $60.45, its lowest since May 2023, according to Reuters.

U.S. Energy Policy Under Trump

Central to this narrative is the United States' role, propelled by Trump's "drill, baby, drill" mantra, a policy emphasized in his inauguration speech and subsequent executive orders. On January 20, 2025, Trump declared a national energy emergency, aiming to boost fossil fuel production, as detailed in a White House fact sheet from February 15, 2025. This included easing regulations and encouraging exploration on federal lands and waters, including the Outer Continental Shelf. The EIA, in its February STEO, forecasts U.S. crude oil production to average 13.59 million barrels per day in 2025, up from a prior estimate of 13.55 million b/d, making the U.S. the world's top producer. This surge, driven by regions like the Permian Basin accounting for about 50% of U.S. production in 2026 forecasts, has contributed to a global oil glut, undermining OPEC+'s efforts to stabilize prices and intensifying downward pressure, as noted in the EIA's January 14, 2025, outlook.

Economic and Geopolitical Implications

The implications of this price drop are multifaceted, with economic challenges for oil-dependent nations like Russia and Saudi Arabia, potentially leading to fiscal adjustments or geopolitical maneuvers to regain market share. The World Bank's October 29, 2024, Commodity Markets Outlook press release indicates global commodity prices, including oil, are set to fall through 2026 amid a historic oil glut, which could limit price effects even in wider conflicts, suggesting economic pressures for exporters. For consumers in importing countries, lower prices, with Brent expected to average $74 in 2025 and fall to $66 in 2026 per EIA, could offer relief at the pump, but trade war uncertainties might offset these gains, impacting industrial activity and demand. Geopolitically, the U.S.'s energy dominance strengthens its leverage, possibly reshaping alliances and influencing global energy security discussions, as Trump's policies align with an "America first" agenda, detailed in a PMC article on energy order reconfiguration.

Future Outlook and Market Dynamics

Looking ahead, the oil market's future remains uncertain. While OPEC+ could reconsider its strategy if prices fall too low, the combination of robust non-OPEC+ supply and weakened demand growth, as forecasted by the EIA, suggests continued pressure on prices through 2026. Trump's policies may sustain high production, but environmental concerns and potential legal challenges, as discussed in NPR articles from January 2025, could temper long-term growth, especially given his rollback of climate initiatives. An unexpected detail is the scale of weekly losses, with Brent down 10.9% and WTI down 10.6%, the largest in over a year, highlighting the market's volatility and adding complexity to future energy policy discussions amidst global sustainability goals.

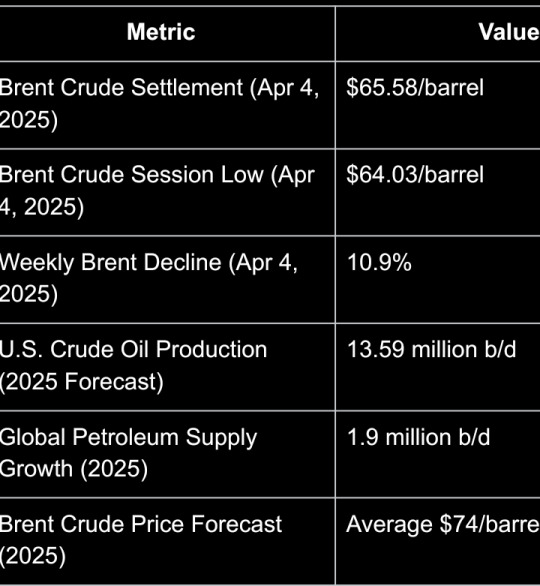

Supporting Data

To organize the key figures, the following table summarizes the critical data points:

This analysis, grounded in recent reports from Bloomberg, Reuters, EIA, and the World Bank, provides a comprehensive view of the 7% oil price drop, its causes, and implications, ensuring a thorough understanding for professional stakeholders.

Key Citations

Latest Oil Market News and Analysis for April 4

Oil settles down more than 2% after US crude stocks build, OPEC+ hike, US tariffs

EIA raises US oil production forecast for 2025

President Donald J. Trump Establishes the National Energy Dominance Council

Global Commodity Prices Set to Fall Through 2026 Amid Historic Oil Glut

#OilMarketAnalysis#GlobalOilPrices#EnergyMarketTrends#OilPriceDrop#EconomicImplications#GeopoliticalShifts#EnergyDominance#OilAndGasIndustry#CommodityMarketUpdate#FinancialMarketNews#GlobalEconomicTrends

0 notes

Photo

It's Market Quiz Time... Test your Market Knowledge by commenting right answer in comments :) For More Interesting questions follow us on all social media platforms.

For Free Trail - +91 9407533858 or mail us at:- [email protected] or visit - http://ethicalresearch.co.in/

#BestInvestmentAdvisoryCompany#stock cash#stockmarket#StockFutretips#commodityupdates#commoditymarketupdates#commoditytradingadvantages#bestinvestmentadvisory

0 notes

Photo

Commodities are objects that come out of the Earth such as wheat, cattle, soybeans, corn, oranges, gold, uranium, copper, aluminum, coal, cotton, and oil. Commodities of the same grade are considered fungible —that is, interchangeable with other commodities of the same grade regardless of who produced or farmed it. For example, if a mining company in Colorado produces high-quality copper, and a different mining company in Wyoming also produces high-quality copper, the copper produced by both mining companies is fungible as long as it receives the same grade.

Then visit our website:- http://ethicalresearch.co.in/

or contact us at:- 9407533858 or mail us at- [email protected] or inbox us your contact details and we will reach you asap

#BestInvestmentAdvisoryCompany#StockMarket#EthicalResearch#StockFutureUpdates#stockcashupdates#Derivatives#StockOptiontips#Stockoptions#commoditytips#commodityupdates#commoditymarketupdates

0 notes