#Cramerica

Text

Cramer vs Burry

email-button:hover{background-color:#0066ff}

Battle of the demagogues

You are subscribed to Inverse Cramer

Quick unsubscribe

Welcome to Inverse Cramer by Alts.co.

And welcome to "Inverse Cramerica."

Is there anything more awkward than Cramer helling over callers when they call in?

"Hey Booyah Jim this is Tom from Philly, hope you're doing w- I'M DOING GREAT TOM HOW ABOUT THOSE EAGLES?!"

::awkward silence ensues::

..Luckily, we watch Mad Money so you don't have to.

Let's go 👇

But first, lemme tell you about RealBid

Real Estate tokenization is actually a pretty good use case for crypto. A staggering amount of crypto and NFTs is pointless, hyped-up garbage.

But tokenization of real estate allows you to buy small fractions of homes & multi-fam apartment complexes, using tokens which can be bought and sold like stocks.

Real estate is famously illiquid, but tokenization gives you liquidity. You can buy and sell the tokens much quicker than you can buy and sell actual properties.

There are a million real estate tokenization platforms out there, so RealBid is aggregating 'em.

The management team has a terrific track record with some huge exits. You'll want to check these guys out.

Monday Jan 30

JC kicked off the day by declaring the FAANG acronym dead.

He's right about the acronym - it's outdated as hell.

But boy is Meta doing his head in.

Inverse Cramer ETF (Not Jim Cramer)

@CramerTracker

Meta is now up a remarkable 85% since Jim gave up on it. Insane. pic.twitter.com/eH1Fh5iITq

February 2nd 2023

365

Retweets

4,986

Likes

Tuesday Jan 31

Inverse Cramer ETF (Not Jim Cramer)

@CramerTracker

BOOYAH! pic.twitter.com/IABo8MOdvU

January 31st 2023

81

Retweets

959

Likes

Wednesday Feb 1

Some drama as Jim got called out by Dave in Illinois over Upstart Holdings.

Apparently Cramer called the stock "uninvestable due to questionable business strategy and capital allocation choices." Recently however the stock has been storing, up 50% on the year. Cramer doubled-down and called Upstart "a coiled spring."

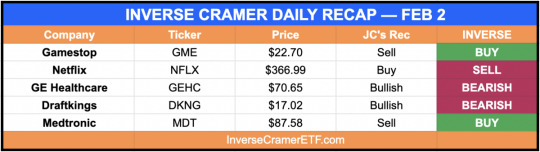

Thursday Feb 2

JC did a special live "Back to School" edition with students The University of Miami. So naturally the first question was about Gamestop.

Don't know if it was the questions or the heat, but boy was JC sweating like a pig 🐷

Friday Feb 3

They’re just not making enough money. They need a merger.

- Cramer on Zoom

Inverse Cramer ETF (Not Jim Cramer)

@CramerTracker

Jim's timing is impeccable pic.twitter.com/0O9oTDoLEJ

February 4th 2023

153

Retweets

2,020

Likes

Weekend Bonus

Inverse Cramer ETF (Not Jim Cramer)

@CramerTracker

1. Defraud $27.4m from investors 2. Charge $1800/hr for consulting pic.twitter.com/NCCTyz2Zdg

January 30th 2023

160

Retweets

2,788

Likes

Grifters gonna grift. But you gotta admire the hustle!*

*Note: You do not actually have to admire the hustle

My .0186 cents (inflation)

The big news this week was when Michael Burry, the hedge-fund manager at Scion Asset Management who correctly forecast the 2008 financial crisis, sent out a one-word tweet: “Sell.”

Burry didn’t elaborate, but it’s not hard to fill in the blanks.

The problem is, this is the exact opposite advice from JC, who on that very same day (just 26 minutes later!) announced the bull market is ON.

My oh my, what ever shall we do?

Hear me out for a minute: Could it be possible neither Burry nor Cramer are correct? That they're both validation-hungry demagogues looking for a score?

I happen to like Michael Burry. His position on investing in water rights has been misconstrued, and aside this week's ominous warning, rather than an annoying loudmouth, he's remained a somewhat quiet brainiac since 2008.

Don't get me wrong: If a guy who successfully predicted & profited from the '08 crash speaks, I'll listen.

But the key is, as always, to think critically.

Don't follow anyone blindly - not Cramer, not Burry, and certainly not us.

Inverse Cramer ETF (Not Jim Cramer)

@CramerTracker

pic.twitter.com/P9G4lR7mIA

February 2nd 2023

391

Retweets

4,241

Likes

That's a wrap. As always, we'll be following Cramer's every move so you can do the opposite.

Enjoy your week.

-IC

The best time to diversify was yesterday. 📈

The second best time is today.

Take advantage of our time spent in this space, and let us chase alpha returns for you.

Invest in ALTS 1 and you'll get access to a fully diversified portfolio of truly alternative assets.

This is our flagship fund. There is nothing else out there like ALTS 1.

Learn More →

The kill switch will unfollow you from all topics and remove you from all newsletters. If you flick this switch, you will never get an email from us ever again.

Adjust preferences:

Adjust Preferences →

Notes

The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing, and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several, or all of the alternative asset classes that Alt Assets, Inc. publishes content about on its site. Any published articles from Alt Assets, Inc., in which an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation, do not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc. site are purely coincidental, as the Fund is actively managed and guided by its own investment parameters, as summarized in the relevant private placement memorandum. The newsletter may contain affiliate links, meaning that Alts.co and its associated entities may receive compensation for referring customers to the noted companies.

© 2022 Alt Assets, Inc.

21 Southern Right Crescent, Encounter Bay, SA 5211

Discord | Twitter | Instagram | Podcast | YouTube

( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/08hwhgum489352hp/aHR0cHM6Ly9hbHRzLmNv ) You are subscribed to Inverse Cramer Quick unsubscribe ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/g3hx30llfwue2vl456h3/aHR0cHM6Ly9hbHRzLmNvL3NldHRpbmdzLXVwZGF0ZWQv ) Welcome to Inverse Cramer by Alts.co ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/l2heh6uopgn89whg/aHR0cHM6Ly9hbHRzLmNvLw== ). And welcome to "Inverse Cramerica." Is there anything more awkward than Cramer helling over callers when they call in? "Hey Booyah Jim this is Tom from Philly, hope you're doing w- I'M DOING GREAT TOM HOW ABOUT THOSE EAGLES?!" ::awkward silence ensues:: ..Luckily, we watch Mad Money so you don't have to. Let's go 👇 But first, lemme tell you about RealBid ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/m2h7h6uoxrqdp2ul/aHR0cHM6Ly9yZWFsYmlkLmNvbS8_cmVmPWFsdHMuY28= ) Real Estate tokenization is actually a pretty good use case for crypto. A staggering amount of crypto and NFTs is pointless, hyped-up garbage. But tokenization of real estate allows you to buy small fractions of homes & multi-fam apartment complexes, using tokens which can be bought and sold like stocks. Real estate is famously illiquid, but tokenization gives you liquidity. You can buy and sell the tokens much quicker than you can buy and sell actual properties. There are a million real estate tokenization platforms out there, so RealBid ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/m2h7h6uoxrqdp2ul/aHR0cHM6Ly9yZWFsYmlkLmNvbS8_cmVmPWFsdHMuY28= ) is aggregating 'em. The management team has a terrific track record with some huge exits. You'll want to check these guys out. ************* Monday Jan 30 ************* JC kicked off the day by declaring the FAANG acronym dead. He's right about the acronym - it's outdated as hell. But boy is Meta doing his head in. Inverse Cramer ETF (Not Jim Cramer)--> @CramerTracker Meta is now up a remarkable 85% since Jim gave up on it. Insane. pic.twitter.com/eH1Fh5iITq ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/dphehmuqx3olgvhl/aHR0cHM6Ly90d2l0dGVyLmNvbS9DcmFtZXJUcmFja2VyL3N0YXR1cy8xNjIwODk5MjQwMTgzNzU4ODQ4 ) February 2nd 2023 365 Retweets 4,986 Likes ************** Tuesday Jan 31 ************** Inverse Cramer ETF (Not Jim Cramer)--> @CramerTracker BOOYAH! pic.twitter.com/IABo8MOdvU ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/e0hph0ukzxl8gvs7/aHR0cHM6Ly90d2l0dGVyLmNvbS9DcmFtZXJUcmFja2VyL3N0YXR1cy8xNjIwMTY0NTEyMDQwMjM1MDA5 ) January 31st 2023 81 Retweets 959 Likes *************** Wednesday Feb 1 *************** Some drama as Jim got called out by Dave in Illinois over Upstart Holdings. Apparently Cramer called the stock "uninvestable due to questionable business strategy and capital allocation choices." Recently however the stock has been storing, up 50% on the year. Cramer doubled-down and called Upstart "a coiled spring." ************** Thursday Feb 2 ************** JC did a special live "Back to School" edition with students The University of Miami. So naturally the first question was about Gamestop. Don't know if it was the questions or the heat, but boy was JC sweating like a pig 🐷 ************ Friday Feb 3 ************ They’re just not making enough money. They need a merger. - Cramer on Zoom Inverse Cramer ETF (Not Jim Cramer)--> @CramerTracker Jim's timing is impeccable pic.twitter.com/0O9oTDoLEJ ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/7qh7h2u0eg6r75a9/aHR0cHM6Ly90d2l0dGVyLmNvbS9DcmFtZXJUcmFja2VyL3N0YXR1cy8xNjIxNjI2NTU2MzIwNzE4ODQ4 ) February 4th 2023 153 Retweets 2,020 Likes ************* Weekend Bonus ************* Inverse Cramer ETF (Not Jim Cramer)--> @CramerTracker 1. Defraud $27.4m from investors 2. Charge $1800/hr for consulting pic.twitter.com/NCCTyz2Zdg ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/owhkhwu4ez62vvbq/aHR0cHM6Ly90d2l0dGVyLmNvbS9DcmFtZXJUcmFja2VyL3N0YXR1cy8xNjE5ODM3MDE1NzAwNDM5MDQw ) January 30th 2023 160 Retweets 2,788 Likes Grifters gonna grift. But you gotta admire the hustle!* *Note: You do not actually have to admire the hustle ************************** My .0186 cents (inflation) ************************** The big news this week was when Michael Burry, the hedge-fund manager at Scion Asset Management who correctly forecast the 2008 financial crisis, sent out a one-word tweet: “Sell.” Burry didn’t elaborate, but it’s not hard to fill in the blanks. The problem is, this is the exact opposite advice from JC, who on that very same day (just 26 minutes later!) announced the bull market is ON. My oh my, what ever shall we do? Hear me out for a minute: Could it be possible neither Burry nor Cramer are correct? That they're both validation-hungry demagogues looking for a score? I happen to like Michael Burry. His position on investing in water rights ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/z2hgh7uozgkqv2sz/aHR0cHM6Ly9hbHRzLmNvL2ludmVzdGluZy1pbi13YXRlci1yaWdodHMv ) has been misconstrued, and aside this week's ominous warning, rather than an annoying loudmouth, he's remained a somewhat quiet brainiac since 2008. Don't get me wrong: If a guy who successfully predicted & profited from the '08 crash speaks, I'll listen. But the key is, as always, to think critically. Don't follow anyone blindly - not Cramer, not Burry, and certainly not us. Inverse Cramer ETF (Not Jim Cramer)--> @CramerTracker pic.twitter.com/P9G4lR7mIA ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/p8hehqu9ev2n0nar/aHR0cHM6Ly90d2l0dGVyLmNvbS9DcmFtZXJUcmFja2VyL3N0YXR1cy8xNjIwNzk0MjIzNDQ3Mzg0MDY1 ) February 2nd 2023 391 Retweets 4,241 Likes That's a wrap. As always, we'll be following Cramer's every move so you can do the opposite. Enjoy your week. -IC ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/8ghgkv84s3ug842mvrhl/aHR0cHM6Ly9hbHRzLmNvL2Z1bmRzLw== ) The best time to diversify was yesterday. 📈 The second best time is today. Take advantage of our time spent in this space, and let us chase alpha returns for you. Invest in ALTS 1 ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/6qh69r3wcoup4q5mg9h9/aHR0cHM6Ly9hbHRzLmNvL2Z1bmRzLw== ) and you'll get access to a fully diversified portfolio of truly alternative assets. This is our flagship fund. There is nothing else out there like ALTS 1. -->Learn More → ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/g3hrd8wmfwue2vl45qu3/aHR0cHM6Ly9hbHRzLmNvL2Z1bmRzLw== ) Learn More → ( https://alts.co/funds/ ) The kill switch will unfollow you from all topics and remove you from all newsletters. If you flick this switch ( https://unsubscribe.convertkit-mail4.com/d0uow67327s0h47k9qkfm ), you will never get an email from us ever again. Adjust preferences: -->Adjust Preferences → ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/6qhehoup4q5mg3u9/aHR0cHM6Ly9wcmVmZXJlbmNlcy5hbHRzLmNvLz9lbWFpbD10cnlsa3MudXo0c3RnQHphcGllcm1haWwuY29t ) Adjust Preferences → ( https://preferences.alts.co/[email protected] ) Notes The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing, and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several, or all of the alternative asset classes that Alt Assets, Inc. publishes content about on its site. Any published articles from Alt Assets, Inc., in which an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation, do not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc. site are purely coincidental, as the Fund is actively managed and guided by its own investment parameters, as summarized in the relevant private placement memorandum. The newsletter may contain affiliate links, meaning that Alts.co and its associated entities may receive compensation for referring customers to the noted companies. © 2022 Alt Assets, Inc. 21 Southern Right Crescent, Encounter Bay, SA 5211 Discord ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/kkhmh2u8p75kqpak/aHR0cHM6Ly9kaXNjb3JkLmdnL0RFa0hnemdnd0M= ) | Twitter ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/58hvh8u5wenr8ef7/aHR0cHM6Ly90d2l0dGVyLmNvbS9hbHRhc3NldHNjbHVi ) | Instagram ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/25h2h9u7x58kprs8/aHR0cHM6Ly93d3cuaW5zdGFncmFtLmNvbS9hbHRzX2NvLw== ) | Podcast ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/g3hnhwue2vl48la3/aHR0cHM6Ly9wb2RjYXN0cy5hcHBsZS5jb20vYXUvcG9kY2FzdC9hbHRlcm5hdGl2ZS1hc3NldHMvaWQxNTQzNTgzNDg4 ) | YouTube ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/9qhzhdug876ovxaz/aHR0cHM6Ly93d3cueW91dHViZS5jb20vY2hhbm5lbC9VQ3BtZ2s0Z3pRNTZRdnB5ZWdCSkpWUUE_c3ViX2NvbmZpcm1hdGlvbj0x )

( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/08hwhgum489352hp/aHR0cHM6Ly9hbHRzLmNv ) You are subscribed to Inverse Cramer Quick unsubscribe ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/g3hx30llfwue2vl456h3/aHR0cHM6Ly9hbHRzLmNvL3NldHRpbmdzLXVwZGF0ZWQv ) Welcome to Inverse Cramer by Alts.co ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/l2heh6uopgn89whg/aHR0cHM6Ly9hbHRzLmNvLw== ). And welcome to "Inverse Cramerica." Is there anything more awkward than Cramer helling over callers when they call in? "Hey Booyah Jim this is Tom from Philly, hope you're doing w- I'M DOING GREAT TOM HOW ABOUT THOSE EAGLES?!" ::awkward silence ensues:: ..Luckily, we watch Mad Money so you don't have to. Let's go 👇 But first, lemme tell you about RealBid ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/m2h7h6uoxrqdp2ul/aHR0cHM6Ly9yZWFsYmlkLmNvbS8_cmVmPWFsdHMuY28= ) Real Estate tokenization is actually a pretty good use case for crypto. A staggering amount of crypto and NFTs is pointless, hyped-up garbage. But tokenization of real estate allows you to buy small fractions of homes & multi-fam apartment complexes, using tokens which can be bought and sold like stocks. Real estate is famously illiquid, but tokenization gives you liquidity. You can buy and sell the tokens much quicker than you can buy and sell actual properties. There are a million real estate tokenization platforms out there, so RealBid ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/m2h7h6uoxrqdp2ul/aHR0cHM6Ly9yZWFsYmlkLmNvbS8_cmVmPWFsdHMuY28= ) is aggregating 'em. The management team has a terrific track record with some huge exits. You'll want to check these guys out. ************* Monday Jan 30 ************* JC kicked off the day by declaring the FAANG acronym dead. He's right about the acronym - it's outdated as hell. But boy is Meta doing his head in. Inverse Cramer ETF (Not Jim Cramer)--> @CramerTracker Meta is now up a remarkable 85% since Jim gave up on it. Insane. pic.twitter.com/eH1Fh5iITq ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/dphehmuqx3olgvhl/aHR0cHM6Ly90d2l0dGVyLmNvbS9DcmFtZXJUcmFja2VyL3N0YXR1cy8xNjIwODk5MjQwMTgzNzU4ODQ4 ) February 2nd 2023 365 Retweets 4,986 Likes ************** Tuesday Jan 31 ************** Inverse Cramer ETF (Not Jim Cramer)--> @CramerTracker BOOYAH! pic.twitter.com/IABo8MOdvU ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/e0hph0ukzxl8gvs7/aHR0cHM6Ly90d2l0dGVyLmNvbS9DcmFtZXJUcmFja2VyL3N0YXR1cy8xNjIwMTY0NTEyMDQwMjM1MDA5 ) January 31st 2023 81 Retweets 959 Likes *************** Wednesday Feb 1 *************** Some drama as Jim got called out by Dave in Illinois over Upstart Holdings. Apparently Cramer called the stock "uninvestable due to questionable business strategy and capital allocation choices." Recently however the stock has been storing, up 50% on the year. Cramer doubled-down and called Upstart "a coiled spring." ************** Thursday Feb 2 ************** JC did a special live "Back to School" edition with students The University of Miami. So naturally the first question was about Gamestop. Don't know if it was the questions or the heat, but boy was JC sweating like a pig 🐷 ************ Friday Feb 3 ************ They’re just not making enough money. They need a merger. - Cramer on Zoom Inverse Cramer ETF (Not Jim Cramer)--> @CramerTracker Jim's timing is impeccable pic.twitter.com/0O9oTDoLEJ ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/7qh7h2u0eg6r75a9/aHR0cHM6Ly90d2l0dGVyLmNvbS9DcmFtZXJUcmFja2VyL3N0YXR1cy8xNjIxNjI2NTU2MzIwNzE4ODQ4 ) February 4th 2023 153 Retweets 2,020 Likes ************* Weekend Bonus ************* Inverse Cramer ETF (Not Jim Cramer)--> @CramerTracker 1. Defraud $27.4m from investors 2. Charge $1800/hr for consulting pic.twitter.com/NCCTyz2Zdg ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/owhkhwu4ez62vvbq/aHR0cHM6Ly90d2l0dGVyLmNvbS9DcmFtZXJUcmFja2VyL3N0YXR1cy8xNjE5ODM3MDE1NzAwNDM5MDQw ) January 30th 2023 160 Retweets 2,788 Likes Grifters gonna grift. But you gotta admire the hustle!* *Note: You do not actually have to admire the hustle ************************** My .0186 cents (inflation) ************************** The big news this week was when Michael Burry, the hedge-fund manager at Scion Asset Management who correctly forecast the 2008 financial crisis, sent out a one-word tweet: “Sell.” Burry didn’t elaborate, but it’s not hard to fill in the blanks. The problem is, this is the exact opposite advice from JC, who on that very same day (just 26 minutes later!) announced the bull market is ON. My oh my, what ever shall we do? Hear me out for a minute: Could it be possible neither Burry nor Cramer are correct? That they're both validation-hungry demagogues looking for a score? I happen to like Michael Burry. His position on investing in water rights ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/z2hgh7uozgkqv2sz/aHR0cHM6Ly9hbHRzLmNvL2ludmVzdGluZy1pbi13YXRlci1yaWdodHMv ) has been misconstrued, and aside this week's ominous warning, rather than an annoying loudmouth, he's remained a somewhat quiet brainiac since 2008. Don't get me wrong: If a guy who successfully predicted & profited from the '08 crash speaks, I'll listen. But the key is, as always, to think critically. Don't follow anyone blindly - not Cramer, not Burry, and certainly not us. Inverse Cramer ETF (Not Jim Cramer)--> @CramerTracker pic.twitter.com/P9G4lR7mIA ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/p8hehqu9ev2n0nar/aHR0cHM6Ly90d2l0dGVyLmNvbS9DcmFtZXJUcmFja2VyL3N0YXR1cy8xNjIwNzk0MjIzNDQ3Mzg0MDY1 ) February 2nd 2023 391 Retweets 4,241 Likes That's a wrap. As always, we'll be following Cramer's every move so you can do the opposite. Enjoy your week. -IC ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/8ghgkv84s3ug842mvrhl/aHR0cHM6Ly9hbHRzLmNvL2Z1bmRzLw== ) The best time to diversify was yesterday. 📈 The second best time is today. Take advantage of our time spent in this space, and let us chase alpha returns for you. Invest in ALTS 1 ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/6qh69r3wcoup4q5mg9h9/aHR0cHM6Ly9hbHRzLmNvL2Z1bmRzLw== ) and you'll get access to a fully diversified portfolio of truly alternative assets. This is our flagship fund. There is nothing else out there like ALTS 1. -->Learn More → ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/g3hrd8wmfwue2vl45qu3/aHR0cHM6Ly9hbHRzLmNvL2Z1bmRzLw== ) Learn More → ( https://alts.co/funds/ ) The kill switch will unfollow you from all topics and remove you from all newsletters. If you flick this switch ( https://unsubscribe.convertkit-mail4.com/d0uow67327s0h47k9qkfm ), you will never get an email from us ever again. Adjust preferences: -->Adjust Preferences → ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/6qhehoup4q5mg3u9/aHR0cHM6Ly9wcmVmZXJlbmNlcy5hbHRzLmNvLz9lbWFpbD10cnlsa3MudXo0c3RnQHphcGllcm1haWwuY29t ) Adjust Preferences → ( https://preferences.alts.co/[email protected] ) Notes The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing, and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several, or all of the alternative asset classes that Alt Assets, Inc. publishes content about on its site. Any published articles from Alt Assets, Inc., in which an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation, do not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc. site are purely coincidental, as the Fund is actively managed and guided by its own investment parameters, as summarized in the relevant private placement memorandum. The newsletter may contain affiliate links, meaning that Alts.co and its associated entities may receive compensation for referring customers to the noted companies. © 2022 Alt Assets, Inc. 21 Southern Right Crescent, Encounter Bay, SA 5211 Discord ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/kkhmh2u8p75kqpak/aHR0cHM6Ly9kaXNjb3JkLmdnL0RFa0hnemdnd0M= ) | Twitter ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/58hvh8u5wenr8ef7/aHR0cHM6Ly90d2l0dGVyLmNvbS9hbHRhc3NldHNjbHVi ) | Instagram ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/25h2h9u7x58kprs8/aHR0cHM6Ly93d3cuaW5zdGFncmFtLmNvbS9hbHRzX2NvLw== ) | Podcast ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/g3hnhwue2vl48la3/aHR0cHM6Ly9wb2RjYXN0cy5hcHBsZS5jb20vYXUvcG9kY2FzdC9hbHRlcm5hdGl2ZS1hc3NldHMvaWQxNTQzNTgzNDg4 ) | YouTube ( https://click.convertkit-mail4.com/d0uow67327s0h47k9qkfm/9qhzhdug876ovxaz/aHR0cHM6Ly93d3cueW91dHViZS5jb20vY2hhbm5lbC9VQ3BtZ2s0Z3pRNTZRdnB5ZWdCSkpWUUE_c3ViX2NvbmZpcm1hdGlvbj0x )

0 notes

Photo

Capitalism in one MSnbc graphic

6 notes

·

View notes

Text

Jim Cramer: Everything You Need to Know

Jim Cramer ran a successful hedge fund for 14 years. He regularly made over $10 million annually. Then he retired from that life to focus on writing and media. He started a successful TV show in 2005 and has since reached an almost cult following. Many know him simply as Cramer and he addresses his fans as "Cramerica." It’s great that he gets so many people excited about stock picking, but what advice can we gain from this financial guru? Let’s see what Cramer has to say about building wealth for your future.

Top Financial Advice From Jim Cramer

Jim Cramer mostly advises people on which individual stocks to buy or to avoid. We won’t go into his stock picking advice here, though. Instead we’ll look at Cramer’s broader financial advice, which boils down to a few simple ideas.

First of all, Cramer stresses you are the only one who understands your exact financial situation. Don't trade stocks just because you heard someone say that it was a good thing to do. Cramer readily admits that stock trading isn’t for everyone. It requires work in order to have success and involves taking financial risk. If you have no savings and are struggling to make ends meet, Cramer advises that you forget picking stocks - at least for now. (You might want to consider you might want to try something like Dave Ramsey’s seven baby steps instead.)

If you do decide to trade stocks, Cramer says to remember that you that you can pull out of the market at any time. Maybe you have a high risk tolerance but then something changes at work and you can no longer handle the same risk. Adjust your investing strategy according to your life. Cramer tells people that risk isn't always bad thing, but he also likes to tell people that there are no second chances on Wall Street. So don't do anything you aren't comfortable with.

So let's say you want to trade stocks. Cramer says that your goal is to create a diverse portfolio of well-researched companies. Read everything you can about the companies you consider investing in. Research the company before you invest in it and continue to follow it closely after you invest. This advice applies regardless of your age but we can also break down Cramer’s advice by the different stages of your life.

In your 20s, Cramer advises focusing on savings before anything else. You may want to invest in a 401(k) from your employer or open an IRA. He recommends creating a portfolio of index funds like the S&P 500 index fund.

"There's too much risk in individual stocks to just put together a portfolio of them of your own choosing," Cramer says, according to CNBC. "So, at a minimum, I am demanding that you put your first $10,000 beyond what you have from your first 20 years into an index fund, the S&P 500 being my favorite."

Once you get into your 30s, Cramer thinks you can add more risk to your portfolio. He says to look for stocks that pay you dividends. Even if you want to stick with funds (instead of individual stocks), Cramer says to invest in a fund with higher dividends than the S&P 500 index fund. Keep in mind that this is general advice from a single financial expert and other experts may disagree. The best asset allocation for your portfolio will depend on your individual risk tolerance. If you're new to investing, you may want to find a financial advisor who can give you advice based on your specific financial situation.

Back to Jim Cramer. Not much should change from your 30s through your 50s, according to Cramer. The main difference he advises is adding bonds in your portfolio by your 40s. He notes that bonds won't earn you much but they will protect the investment capital that you’ve built thus far in your life.

By the time you get into your 60s, Cramer recommends that you play things safe and focus primarily on bonds. You don’t want to risk the retirement savings that you’ve worked hard for. He says you might want to have as much as 50% bonds in your portfolio. Then consider increasing the percentage of bonds in your portfolio by 10% for each decade after 60.

A Brief Bio of Jim Cramer

Cramer graduated from Harvard College, where he was president of the student newspaper, The Harvard Crimson. After college, he went on to multiple journalist positions. He covered various beats from sports to crime and worked at papers in many states from Florida to California.

A few years later he went to Harvard Law School to earn his J.D. However, Cramer never practiced law. He began investing in the stock market while he was in law school, even going as far as leaving stock tips on his answering machine. He impressed Martin Peretz, the owner of The New Republic, with his investing acumen. Peretz gave Cramer $500,000 to invest and Cramer earned Peretz about $150,000 in just a couple of years. This helped Cramer land a job as a stockbroker with Goldman Sachs in 1984. He left after just a few years to start his own hedge fund.

Cramer was with the hedge fund from 1988 to 2000. He had only one year of negative returns (though he made up for it the next two years with returns of 47% and 28%). He retired from active money management in 2001. In his time with the fund, he earned average annual returns of 24% and regularly made millions of dollars each year.

Jim Cramer got into media while he was working for his hedge fund. He served as editor-at-large for Dow Jones’ SmartMoney magazine. He and Martin Peretz co-founded TheStreet, a news source on finance and investing, in 1996. In the early 2000s he published multiple books. Cramer also made appearances on radio and TV before joining CNBC in 2005 for his own show. The show, "Mad Money With Jim Cramer," focuses on finance and speculation. It uses an entertaining presentation style instead of the strict, journalistic style applied to many investing programs at the time.

Financial Focus and Philosophy

Jim Cramer’s focus is, and always has been, picking stocks that will provide market-beating returns. This is something he tries to do with his own money and with all of the funds that he has managed in his life. After retiring from his hedge fund in 2001, Cramer has focused more on helping others to pick successful stocks on their own.

His TV show is mostly about which publicly traded stocks he thinks people should buy or sell. He does speak about broader financial and economic trends, but mostly to frame his opinions on individual stocks.

Where You Can Find Jim Cramer

There are a lot of ways to keep up with Cramer. His TV show, "Mad Money With Jim Cramer," airs weeknights on CNBC. You can find videos and stories from previous episodes on the CNBC website. He is also the co-host of "Squawk on the Street," a financial show that runs weekday mornings on CNBC.

You can find daily online articles by Cramer on RealMoney. RealMoney is a part of TheStreet, the digital media company that Cramer co-founded in 1996. His financial commentary and advice is available daily through the site's premium (paid) service.

You can also follow Cramer on Twitter. He posts regularly with financial advice, stories and videos.

Current Projects

Aside from his TV shows and online articles, Cramer runs the charitable trust portfolio, Action Alerts PLUS. If you become an Action Alerts PLUS member, you get access to all of Cramer's advice on picking stocks, trading and building a portfolio. Then you can build and manage your own portfolio with confidence.

Takeaway

Jim Cramer has made a career telling people which stocks to pick. As the Host of CNBC's "Mad Money," he is an energetic presenter who loves telling people what to buy buy buy and what to sell sell sell. However, he readily admits that you don't need to make risky trades to meet your financial goals. Regardless of how you invest, remember that you are the one who knows your financial situation the best. Make sure you understand your individual goals (or seek a financial advisor who can help you do so) and invest in the way that best helps you realize those goals.

Photo credit: flickr.com/khouryp23, TheStreet.com, Scott Beale/Laughing Squid

1 note

·

View note

Text

Cramer finds value-creating, investment-worthy CEOs across industries

CNBC’s Jim Cramer doesn’t like to look at the stock market as a whole.

“There’s no such thing as the stock market, not the way most people talk about it,” the “Mad Money” host said. “Instead, you have a market of stocks, and that’s an important distinction, particularly in Cramerica, because stocks are like snowflakes: no two are the same.”

Even though Cramer thinks investors’ first $10,000…

View On WordPress

#across#CEOs#cramer#creating#finds#industries#investment#investmentworthy#value#valuecreating#worthy

0 notes

Text

Forecast and bet on Croatia vs Wales on 8 June 2019

New Post has been published on https://betting-tips.site/forecast-and-bet-on-croatia-vs-wales-on-8-june-2019/

Forecast and bet on Croatia vs Wales on 8 June 2019

Croatia vs Wales will be held June 8 at 16:00 Moscow time at stadium “Gradski” in the third round of qualification for Euro 2020. What factor can make a bet on the game Croatia against Wales.

Croatia

The Croats after the second place at the world Cup results are not particularly encouraging. In the League of Nations the team on the road both games lost, and at home played draw with England 0-0 and defeated Spain 3-2, but still finished the group last.

In qualifying for the European championship in Croatia in March this year have both won and lost. Victoria wards of Delica produced at home over Azerbaijan 2-1. Moreover, the squad of the first missed, but the opponent put the squeeze on, thanks to goals from Rapid and Cramerica.

In the second round, the Croats turned away weaker Hungary 1-2. Also note that in the upcoming match the team will not play Rakitic and Vrsaljko, who heal injuries.

Wales

Wales are in the League of Nations also made unimpressive, finishing in only second place. The team twice defeated the national team of Ireland, but Denmark conceded both times. In fact, the team Giggs pleased with the game only in the opening bout, which was in the home gained a major victory over the Irish 4-1.

Its also a way in qualification for Euro 2020 Welsh began a heavy victory at home over team Slovakia 1-0. James already in the fifth minute put Wales ahead, but then the hosts on the game was not the better team, and with difficulty maintained his advantage.

Statistics of personal meetings Croatia — Wales

In the three previous intramural games Victoria invariably won by the team of Croatia.

The odds on the match from the bookmaker

Bookmaker Fonbet victory in the meeting, Croatia was estimated at is 1.57, and the draw and Victoria Wales respectively ready to take bets on quotations 4,0 and 6,0. At the same time TB 2.5 proposed ratio of 2.25, and TM 2,5 – of 1.65.

Bet on Croatia vs Wales

Both teams are aiming – access to the final part of the Euro, and the upcoming fight is very important for them. It should be noted that Croatia’s squad looks better, and the team of Galicia traditionally plays on the home field, rarely allowing a misfire. So the Welsh team to stand here the chances are low.

0 notes

Text

Cramerica - what were some #MadMarketMoments of 2014 that stood out to you?...

New Post has been published on http://midsessions.com/2017/04/10/cramerica-what-were-some-madmarketmoments-of-2014-that-stood-out-to-you/

Cramerica - what were some #MadMarketMoments of 2014 that stood out to you?...

Cramerica – what were some #MadMarketMoments of 2014 that stood out to you?

Source

0 notes

Photo

CRAmerica #wilmingtonnorthcarolina 2013 (at Hollywood)

0 notes

Text

Confessions of a Street Addict

Written By: Jim Cramer

What I gained from this book was different than expected. The lessons I learned were completely scattered, from relationships, to persistence, to interview and stock tips.

Jim applied to Goldman Sachs to achieve his first associate position with a big money management firm. The interview process was incredibly rigorous and Jim was under great pressure. Goldman’s program was selective and renowned. That weighed on him, but he focused and prevailed. After every question Jim was asked during the interview, he paused and thought. He exploited every bit of time he could.

This resonated strongly with me because I have a problem with thinking before I talk. We are human beings full of emotion; high stakes, excitement, and resentment are just a few variables that can cloud our thoughts and performance. Once we speak or act, we cannot take that back. Sometimes we only have one chance, and we have to make it count. It is imperative to take every second we can to think so we act in an effective way.

Once Jim got more deeply involved in trading, it began to consume him. His friends and family who had given him so much were nearly forgotten and began to resent him. Stock market analysis and trading were most certainly Jim’s passions, but his habits simply became too much. If it hadn’t been for Jim’s friends and family, he wouldn’t have had the opportunities and success he had achieved. Once he began to lose the support he once had from his family and friends, he finally started to turn around. If he hadn’t restored these relationships, he would have given up priceless gains that have continued on throughout his life.

On the business side of things, Jim provided some stock tips:

1. Stocks that are do not get a lot of attention are opportunities for big gains because they will eventually be found out.

2. Always have someone to check up on your stock choices. I believe this one to be incredibly important. Jim said in another one of his books that you should be able to convince another of your action, and if you can’t, you should reevaluate.

3. Cramer described how he created a stock market bottom with his hedge fund, and this is what he has to say about it: “At the bottom even the coolest, most hard bitten pros blink. At the bottom, the last bulls throw in the towel. At the bottom, there is the final capitulation.”

4. “Flexibility is what distinguishes a good trader from a bad one.” Don't cling to positions when you know the facts have changed and the original justification of ownership has deteriorated. Even if there are big losses that you want to regain, it is not safe to hold if the facts have changed!

Jim is a great man who is incredibly talented, but fallible. He always says that he wants his viewers and readers to learn from his mistakes. This is a great book to do just that. It is incredibly inspirational. I hope to be like Jim someday.

#Jim Cramer#Cramerica#Confessions of a Street Addict#Wall Street#Life#Life Lessons#Inspiration#Stocks#Investing#BooksForReflection

0 notes

Video

This guy cracks me up! 😂😂 #fbf #madmoney #thestreet #cnbc #cramerica #funny #happyfriday @jimcramer

0 notes

Text

CNBC

Jim Cramer and the Mad Money On CNBC team ring the closing bell for the NYSE! #CNBC #NYSE #Cramerica

0 notes

Text

Happy Anniversary Cramerica. #mmx kicks off tonight!...

New Post has been published on http://midsessions.com/2017/04/08/happy-anniversary-cramerica-mmx-kicks-off-tonight/

Happy Anniversary Cramerica. #mmx kicks off tonight!...

Happy Anniversary Cramerica. #mmx kicks off tonight!

Source

0 notes

Text

Happy St. Patrick's Day Cramerica!...

New Post has been published on http://midsessions.com/2017/04/05/happy-st-patricks-day-cramerica/

Happy St. Patrick's Day Cramerica!...

Happy St. Patrick’s Day Cramerica!

Source

0 notes

Text

#nbafinals2015 - who are you rooting for Cramerica? #clevelandcavs or #dubnation...

New Post has been published on http://midsessions.com/2017/04/02/nbafinals2015-who-are-you-rooting-for-cramerica-clevelandcavs-or-dubnation/

#nbafinals2015 - who are you rooting for Cramerica? #clevelandcavs or #dubnation...

#nbafinals2015 – who are you rooting for Cramerica? #clevelandcavs or #dubnation

Source

0 notes

Text

Because investing is all about math...and throwing pie at the wall. Happy #PiDay...

New Post has been published on http://midsessions.com/2017/03/26/because-investing-is-all-about-math-and-throwing-pie-at-the-wall-happy-piday/

Because investing is all about math...and throwing pie at the wall. Happy #PiDay...

Because investing is all about math…and throwing pie at the wall. Happy #PiDay Cramerica

https://scontent.cdninstagram.com/t50.2886-16/10476959_1048163595222810_1733067486_n.mp4

Source

0 notes

Text

What's your plan, Cramerica? #GetAPlan...

New Post has been published on http://midsessions.com/2017/03/24/whats-your-plan-cramerica-getaplan/

What's your plan, Cramerica? #GetAPlan...

What’s your plan, Cramerica? #GetAPlan

Source

0 notes

Video

undefined

tumblr

It’s National Coffee Day and Jim Cramer is really excited

5 notes

·

View notes