#CreateACryptocurrencyExchange

Explore tagged Tumblr posts

Text

Cost to Create Your Own Crypto Token: Full Breakdown in 2025

So you're thinking about launching your own crypto token in 2025? Whether you're a startup, a creator, or a business exploring Web3, knowing the cost to create your own crypto token is a must. Let’s unpack every detail so you can budget smart, plan right, and avoid the common pitfalls that catch many off guard.

Introduction: Why Crypto Tokens Still Matter in 2025

Despite market fluctuations, crypto tokens continue to play a pivotal role in decentralized ecosystems. From loyalty rewards to governance in DAOs and utility in dApps, tokens aren't going anywhere—they’re evolving. And in 2025, creating your own token is more accessible than ever, but it’s not necessarily cheap.

What Is a Crypto Token?

Before diving into the costs, let’s get crystal clear on what a crypto token actually is.

Crypto Token vs Cryptocurrency: Know the Difference

Think of a cryptocurrency (like Bitcoin) as its own chain, while a crypto token is more like an app on top of an existing blockchain (like Ethereum or Binance Smart Chain).

Types of Crypto Tokens

Utility Tokens: Give access to products or services.

Security Tokens: Represent financial assets and are regulated.

Governance Tokens: Offer voting rights within a DAO or platform.

Stablecoins: Pegged to real-world assets like USD.

Key Benefits of Creating Your Own Token

Why even bother with your own token? Glad you asked.

Business Utility and Brand Value

Tokens can drive customer engagement, offer rewards, and represent ownership. Think of them as next-gen loyalty points.

Decentralization and Community Building

Tokens empower communities. From NFT platforms to GameFi ecosystems, tokens let users feel invested—literally and emotionally.

Factors That Affect the Cost to Create Your Own Crypto Token

Here’s the meat and potatoes—what actually drives the price tag of token development?

Blockchain Network Selection

Not all blockchains are created equal. The cost differs depending on which network you build on.

Ethereum

Pros: Most popular, high security.

Cons: Gas fees are high.

Estimated Cost: $1,000 - $5,000 just in gas fees.

Binance Smart Chain (BSC)

Pros: Lower fees, faster transactions.

Cons: Slightly less decentralized.

Estimated Cost: $500 - $2,000

Solana

Pros: Fast and cheap.

Cons: Less mature developer tools.

Estimated Cost: $800 - $3,000

Token Standards and Customization

ERC-20, BEP-20, or something more custom? More complexity = higher cost. A simple token might cost you $1,000, but custom logic could push that to $10,000+.

Smart Contract Development

Custom smart contracts for staking, minting, burning, and access control will rack up additional hours and money. Expect to pay $3,000 to $15,000 depending on functionality.

Security Audits

Security isn’t optional. A single vulnerability could wipe out your entire ecosystem.

Third-party audit costs: $5,000 to $25,000

Automated auditing tools: $500+

Tokenomics Design

Want your token to actually work long-term? Hire a tokenomics expert for $2,000 - $7,000. This covers supply, distribution, vesting schedules, and use-cases.

Legal and Compliance Costs

Depending on your jurisdiction, you might need legal counsel to avoid securities violations.

Estimated Legal Fees: $3,000 - $20,000

Marketing and Launch Expenses

Token isn’t going to promote itself. Budget for:

Website & Whitepaper: $2,000 - $6,000

PR, Influencers, Listings: $5,000 - $50,000+

The Average Cost Breakdown in 2025

Let’s simplify it with a few sample packages.

Basic Token Creation (DIY Tools)

Platforms like TokenMint or CoinTool

Cost: $300 - $1,000

Limited functionality and customization

Intermediate Development (Freelancer/Agency)

Semi-custom smart contracts

Moderate audits and marketing

Cost: $5,000 - $20,000

Advanced Token with Full Ecosystem

Custom contracts, staking, governance

Full audits, tokenomics, and legal

Cost: $25,000 - $100,000+

DIY vs Hiring a Professional Development Company

Both routes have their perks—and risks.

Pros and Cons of DIY Tools

Pros:

Budget-friendly

Fast turnaround

Cons:

Limited customization

Higher risk of security flaws

Pros and Cons of Hiring Experts

Pros:

Professional-grade output

Secure and scalable

Cons:

Higher upfront cost

Time-consuming due to collaboration

How Long Does It Take to Create a Token?

Time is money, right? Here's what to expect:

DIY Tools: 30 minutes to 2 hours

Freelancer: 1–3 weeks

Full Development Company: 1–3 months

Common Mistakes to Avoid

Even seasoned developers trip up. Don’t be that person.

Skipping Security Audits

Just one vulnerability and hackers will be knocking.

Poor Tokenomics Design

Tokens without a real use-case or flawed economics will fail—fast.

Real-Life Examples: Token Creation Costs from 2024

Indie Game Token (Polygon) Cost: $12,000 Used basic smart contracts, moderate marketing.

DAO Governance Token (Ethereum) Cost: $55,000 Included full audits, legal counsel, and tiered vesting.

Stablecoin Project (Solana) Cost: $38,000 Smart contracts plus aggressive influencer campaigns.

Tips to Save Money When Creating Your Token

Here are a few cost-cutting hacks without compromising quality.

Use Open-Source Frameworks

Starting with existing smart contract templates saves dev hours (and dollars).

Bundle Services with One Provider

Agencies offering “all-in-one” packages may give you discounts on audits, marketing, and legal work.

Final Thoughts: Is It Worth the Investment?

Creating a crypto token in 2025 isn’t just about tech—it’s about strategy. Whether you spend $1,000 or $100,000, your success hinges on planning, execution, and community building. If done right, a well-crafted token can unlock exponential growth and new revenue streams.

Conclusion

There’s no one-size-fits-all price tag when it comes to the cost to create your own crypto token. It all boils down to your goals, the blockchain you choose, and the ecosystem you want to build. Start small, plan big, and make every dollar count. Whether you're launching the next big DeFi platform or a fan token for your brand—2025 is your year to make it happen.

FAQs

1. Can I create a crypto token for free? Technically, yes—some platforms offer free basic token generation. But free tokens come with limitations in security and features.

2. What’s the cheapest blockchain to create a token on? Binance Smart Chain and Polygon are typically the most cost-effective in terms of gas fees and development tools.

3. Do I need coding skills to make a token? Not necessarily. No-code tools exist, but for anything advanced or secure, hiring a developer is a safer bet.

4. Is it legal to launch a crypto token? It depends on your location and the nature of the token. Always consult a blockchain-savvy legal expert.

5. How do I make my token successful? Success comes from utility, security, clear tokenomics, community support, and effective marketing. Build a token that solves a real problem.

#CreateACryptocurrencyExchange#BuildYourOwnCryptocurrencyExchange#HowToCreateACryptocurrencyExchange#LaunchYourCryptocurrencyExchange#ShamlaTech#CryptoDevelopment#BlockchainExperts

0 notes

Text

How to Choose the Right Crypto Token Development Company in 2025

Introduction: Why Choosing the Right Company Matters

Let’s be honest — launching a crypto token in 2025 isn’t as easy as it used to be. The industry is maturing, regulations are tightening, and the tech is evolving faster than ever. Whether you're a startup with a vision or an enterprise exploring blockchain solutions, your project's success hinges on one critical decision — choosing the right Crypto Token Development Company.

Understanding Crypto Tokens

What Are Crypto Tokens?

Crypto tokens are digital assets built on blockchain platforms. Unlike coins, which operate on their own chains (like Bitcoin or Ethereum), tokens are hosted on existing blockchains and rely on smart contracts to function. They're used for everything from governance and staking to digital ownership and fundraising.

Types of Crypto Tokens: Utility, Security, and More

Utility Tokens: These give users access to a product or service (e.g., BNB, UNI).

Security Tokens: Represent ownership of an asset, similar to stocks.

Governance Tokens: Allow holders to vote on project decisions.

Asset-Backed Tokens: Pegged to real-world assets like gold or real estate.

Understanding which token type fits your goals is crucial — and the right development company can guide you.

Trends in Crypto Token Development in 2025

Rise of Multi-Chain Token Development

The future is multi-chain. In 2025, projects are no longer limited to a single blockchain. Token interoperability across Ethereum, BNB Chain, Solana, and Polygon is the new standard. Your chosen company should be fluent in these ecosystems.

Smart Contract Automation and AI Integration

AI-enhanced smart contracts now detect and prevent vulnerabilities in real-time. Expect token developers to offer automated auditing tools and AI-driven analytics for tokenomics optimization.

Key Criteria for Choosing a Crypto Token Development Company

Technical Expertise and Blockchain Proficiency

It’s not just about coding — it’s about coding on-chain. Look for teams that master Solidity, Rust, or Vyper, and have experience building tokens on the blockchain of your choice. Bonus if they contribute to open-source protocols.

Security Protocols and Compliance Standards

The last thing you want is a token that’s exploitable. Top companies provide end-to-end security auditing, integrate Know Your Customer (KYC)/Anti-Money Laundering (AML) processes, and ensure global compliance.

Portfolio and Client Testimonials

Would you buy a car without reading the reviews? Of course not. Same applies here. A company’s portfolio and testimonials are your window into their experience and reliability.

Customization and Tokenomics Consulting

Tokenomics isn’t just math — it’s strategy. The best firms help you design supply, distribution, vesting, burn mechanisms, and governance models that work in the real world.

Post-Launch Support and Maintenance

You’re not done after launch. You’ll need ongoing support, updates, and maybe even relaunches. Make sure your developer offers long-term maintenance packages.

Common Mistakes to Avoid When Hiring

Going Cheap Over Competent

Bargain-bin developers might save you a few bucks now but could cost you your entire project later. Prioritize experience, not just price.

Ignoring Regulatory Compliance

Crypto is becoming more regulated. If your token fails to meet local laws, you risk fines, bans, or worse. Always pick a company with compliance experience in your target regions.

How to Vet a Crypto Token Development Company

Questions to Ask Before Signing a Contract

How many token projects have you completed?

Which blockchains and smart contract languages do you specialize in?

What security protocols do you use?

Do you offer tokenomics consulting?

Can I speak with past clients?

Red Flags and Warning Signs

Vague or generic answers

No open-source contributions or code examples

Unrealistic timelines or pricing

Lack of legal expertise or compliance support

Top Tools and Technologies in 2025

Blockchain Platforms: Ethereum, BNB Chain, Solana

Each has its pros and cons. Ethereum is the OG and most secure. BNB Chain is fast and cost-effective. Solana offers lightning-fast transactions and is great for DeFi and gaming.

Smart Contract Languages: Solidity, Rust, Vyper

Solidity: Most common for Ethereum and EVM-compatible chains

Rust: Used on Solana and Polkadot; known for security and speed

Vyper: Simpler and more secure, growing in popularity in 2025

Your ideal development partner should be proficient in the language best suited to your chosen blockchain.

Why Experience in Niche Markets Matters

DeFi, Gaming, Real Estate Tokens

The crypto space is branching out. A firm with DeFi experience will know how to build liquidity pools and yield farms. If you're in gaming or real estate, you'll need expertise in NFT integration and asset tokenization.

Case Study: A Successful Token Launch in 2025

Project Overview and Results

Let’s look at a real-world example. A real estate startup partnered with a leading crypto token development company to tokenize fractional ownership of properties. The result? $10M raised in 60 days, a thriving investor base, and a fully compliant STO (Security Token Offering) on Ethereum and Avalanche.

The company handled everything — smart contract development, investor dashboard UI, compliance integrations, and post-launch token governance.

How to Get Started with the Right Partner

Building a Clear Roadmap and Requirements Sheet

Before you reach out to any developer, write down:

Your token’s purpose

Target audience

Preferred blockchain

Budget

Timeline

With this info, your token developer can craft a tailored solution, saving time and money.

Conclusion

The crypto space in 2025 is bold, fast, and fiercely competitive. Whether you're launching a DeFi protocol, a gaming token, or a security asset, your choice of Crypto Token Development Company can make or break your vision. Do your homework, ask the tough questions, and never compromise on security or compliance.

Remember, you're not just hiring coders. You're choosing your co-pilots for a journey through the decentralized frontier.

FAQs

1. What should I expect to pay a crypto token development company in 2025? Expect to pay anywhere from $10,000 to $100,000+, depending on complexity, blockchain, and post-launch support.

2. Is it better to hire freelancers or a full-stack development company? Companies offer broader expertise and long-term support, while freelancers might be cheaper but riskier for high-stakes projects.

3. How long does it take to develop a crypto token? Basic tokens may take a week. Complex projects with governance, vesting, and compliance may take 2–3 months.

4. Can a development company help with marketing and exchange listings? Yes! Many firms offer token marketing, community building, and even CEX/DEX listing services as add-ons.

5. How do I know if my token is legally compliant? Hire a company with legal consultants or partners experienced in jurisdictions like the U.S., EU, and Asia. Always verify before launch.

#BuildYourOwnCryptocurrencyExchange#CreateACryptocurrencyExchange#HowToCreateACryptocurrencyExchange#LaunchYourCryptocurrencyExchange#CryptoExchangeDevelopment#ShamlaTech#WhiteLabelExchange#BlockchainExperts#CryptoSolutions

0 notes

Text

Everything You Need to Know About the Cost to Create Your Own Cryptocurrency

Cryptocurrencies have evolved from a niche interest into a global financial phenomenon. Entrepreneurs, startups, and even governments are launching their own digital coins to power projects, ecosystems, or communities. If you're considering launching your own crypto token or coin, the first question you might ask is: "What is the cost to create your own cryptocurrency?"

This article explores the various factors that determine the overall cost, the different approaches you can take, and what you should consider before starting your crypto journey.

What Is Cryptocurrency Creation?

Creating a cryptocurrency involves designing a blockchain (or using an existing one), developing smart contracts, setting up wallets, and ensuring compliance and security. Depending on your goals, you can either create a token on an existing blockchain like Ethereum or BNB Chain or develop a completely new coin with its own native blockchain.

Key Factors That Influence the Cost to Create Your Own Cryptocurrency

1. Type of Cryptocurrency: Token vs Coin

Token: Built on an existing blockchain (e.g., Ethereum ERC-20, Binance BEP-20). It’s faster and less expensive.

Coin: Requires the development of a custom blockchain, which is more complex and costly.

Estimated Cost:

Token: $1,000 – $5,000

Coin: $10,000 – $50,000+

2. Blockchain Development Approach

Open-Source Cloning: Cloning Bitcoin or Ethereum’s open-source code reduces development time and cost.

Custom Blockchain: Full customization requires expert developers and extensive resources.

Estimated Cost:

Cloning: $5,000 – $15,000

Custom: $20,000 – $100,000+

3. Smart Contract Development

If you're creating a token, smart contracts are essential. These contracts define how your token behaves, how it is distributed, and how transactions are processed.

Estimated Cost: $1,000 – $10,000 (cost varies with complexity and auditing)

4. Security Audits

Security is non-negotiable. A poorly audited contract can be exploited, resulting in major losses. Hiring a professional firm to audit your code is highly recommended.

Estimated Cost: $3,000 – $15,000+

5. Wallet Integration

To allow users to store, send, and receive your cryptocurrency, you'll need a wallet. You can opt for:

Web Wallets

Mobile Wallets

Desktop Wallets

Estimated Cost: $5,000 – $20,000

6. User Interface (UI) and User Experience (UX) Design

A smooth, user-friendly interface for your platform is critical for mass adoption. This includes frontend design for dashboards, wallets, admin panels, etc.

Estimated Cost: $2,000 – $15,000+

7. Listing on Exchanges

To gain visibility and allow trading, you’ll want your crypto listed on centralized (CEX) or decentralized exchanges (DEX). Some platforms charge significant fees.

Estimated Cost:

DEX (e.g., Uniswap): ~$500–$1,000

CEX (e.g., Binance, KuCoin): $10,000 – $500,000+

8. Legal and Compliance Costs

Launching a cryptocurrency comes with regulatory responsibilities. You may need to incorporate, get legal advice, and ensure compliance with your country's financial laws.

Estimated Cost: $5,000 – $50,000+

Average Cost Breakdown

ComponentEstimated Cost RangeToken Development$1,000 – $5,000Coin Development$10,000 – $50,000+Smart Contract$1,000 – $10,000Security Audit$3,000 – $15,000+Wallet Integration$5,000 – $20,000UI/UX Design$2,000 – $15,000+Exchange Listing$500 – $500,000Legal & Compliance$5,000 – $50,000+Total$10,000 – $500,000+

💡 The cost to create your own cryptocurrency can vary dramatically based on your goals, scope, and target market.

Additional Costs to Consider

1. Marketing and Community Building

Creating the coin is only the beginning. You’ll need to build awareness and trust.

Social media management

Influencer partnerships

Community management (e.g., Discord, Telegram)

Estimated Cost: $2,000 – $50,000+

2. Ongoing Maintenance and Support

Even after launch, you’ll need developers for updates, bug fixes, and tech support.

Estimated Cost (Annual): $10,000 – $100,000

3. Hosting & Infrastructure

Server and cloud costs for running nodes, websites, APIs, and more.

Estimated Cost: $100 – $5,000/month

DIY vs Hiring a Cryptocurrency Development Company

You can either go the DIY route if you have technical skills or hire a cryptocurrency development company for end-to-end solutions.

DIY Pros:

Lower upfront cost

More control

DIY Cons:

Time-consuming

Risk of bugs or exploits

Limited support

Hiring Pros:

Professional expertise

Faster time to market

Better security and scalability

Hiring Cons:

Higher cost

Final Thoughts

The cost to create your own cryptocurrency can range from a few thousand dollars to several hundred thousand depending on the scope, quality, and features of your project. Whether you're looking to launch a simple token or a fully customized blockchain-based coin, it's essential to plan thoroughly, work with experienced professionals, and budget accordingly.

If you’re serious about entering the crypto space, investing in reliable developers, proper security audits, legal compliance, and effective marketing will ensure your project has the best chance of success.

FAQs About the Cost to Create Your Own Cryptocurrency

Q1: Can I create a cryptocurrency for free?

Technically yes, if you’re only creating a test token using open-source tools. But launching a real, secure, and successful cryptocurrency comes with necessary costs.

Q2: How long does it take to create a cryptocurrency?

Token: 1–4 weeks

Coin: 3–6+ months Timelines depend on complexity, testing, and auditing phases.

Q3: What is the cheapest way to create a cryptocurrency?

The most cost-effective approach is launching a token on Ethereum or Binance Smart Chain using open-source tools like Remix and MetaMask, though this limits customization.

Q4: Do I need to register my cryptocurrency legally?

Yes. Depending on your country, there may be financial regulations requiring licenses, registrations, or disclosures, especially if your token has utility or acts as a security.

#LaunchYourCryptocurrencyExchange#ShamlaTech#CryptocurrencyExchangeDevelopment#CreateACryptocurrencyExchange#CryptoExchangeDevelopment#BlockchainSolutions

0 notes

Text

Cost to Create Your Own Cryptocurrency: Full Breakdown & Guide

As the digital economy expands, creating your own cryptocurrency has become more than just a tech experiment — it’s now a legitimate way to build decentralized ecosystems, raise capital, or launch next-gen business models. Whether you're a startup founder, a blockchain enthusiast, or a tech-savvy entrepreneur, understanding the cost to create your own cryptocurrency is crucial before diving into the development process.

This guide breaks down the overall expenses, influencing factors, and tips to keep your costs in check when launching a cryptocurrency.

🔍 What Is a Cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Unlike traditional fiat currencies, cryptocurrencies are decentralized and typically built on blockchain technology. Some well-known cryptocurrencies include Bitcoin, Ethereum, and Binance Coin.

You can create:

A coin (with your own blockchain)

A token (built on an existing blockchain like Ethereum)

Both require different development paths and costs.

💡 Why Create Your Own Cryptocurrency?

Before we explore costs, let’s understand why you might want to build one:

Raise Funds via ICO or IEO

Power Decentralized Applications (dApps)

Enable Secure Transactions

Build a Custom Blockchain Ecosystem

Create Reward Systems or In-App Currencies

💰 Cost to Create Your Own Cryptocurrency: Key Factors

The cost to create your own cryptocurrency varies significantly depending on the complexity, features, blockchain type, and who you hire. It can range from $5,000 to over $100,000. Here's a breakdown of the main components:

1. 🧱 Type of Cryptocurrency: Coin vs. Token

TypeDescriptionEstimated CostTokenBuilt on top of existing blockchains like Ethereum, BNB Chain, or Solana$5,000 – $15,000CoinRequires developing your own blockchain (like Bitcoin or Litecoin)$25,000 – $100,000+

Creating a token is much cheaper and faster because it leverages an existing ecosystem. A coin, however, offers more control and customization but requires more resources.

2. 🧑💻 Development Team or Blockchain Development Company

Whether you hire freelance developers or partner with a professional blockchain development company will impact your cost.

Freelancers: $25 – $100/hour (risk of inconsistency)

Development Agencies: $50 – $200/hour (quality assurance & full-stack support)

Working with experienced companies like Shamla Tech ensures secure architecture, audit-ready code, and scalable features — but it comes at a premium.

3. 📜 Smart Contract Development

If you're building a token or want to add functionality to your coin, you’ll need smart contracts (especially for ERC-20 or BEP-20 tokens).

Cost Estimate: $2,000 – $10,000

Optional Auditing: $5,000 – $15,000 (highly recommended)

Smart contract auditing ensures your crypto project isn’t vulnerable to exploits or hacks.

4. 🖥️ Blockchain Platform Fees

Depending on the blockchain platform used for token creation, there might be gas fees or other charges:

Ethereum: Higher gas fees (variable)

Binance Smart Chain (BSC): Lower and more stable fees

Polygon: Budget-friendly alternative

Gas fees can cost $100 – $1,000 depending on network congestion during deployment.

5. 🌐 Website & Dashboard Development

For launching an ICO or managing your token/coin, you’ll need:

Crypto Wallet Integration

Token Sale Dashboard (ICO/IEO Launchpad)

Staking or Liquidity Features

Estimated Cost: $3,000 – $20,000+

6. 🔒 Security & Compliance

Security is paramount in the crypto world. A hacked or vulnerable token can damage your brand instantly.

Code Review & Penetration Testing: $3,000 – $10,000

KYC/AML Integration (for ICOs/IEOs): $1,000 – $5,000/month

Legal Counsel for Regulatory Compliance: $2,000 – $20,000

Compliance costs vary by jurisdiction and the nature of your project.

7. 📢 Marketing & Token Launch

Even the best tokens fail without good promotion. Consider allocating a marketing budget for:

Website & Whitepaper Design

Community Management

Social Media Marketing

Press Releases & Listing Fees

Cost Range: $5,000 – $30,000+

🧾 Total Estimated Cost Breakdown

ComponentEstimated CostToken Development (Simple)$5,000 – $15,000Coin Development (Custom Blockchain)$25,000 – $100,000+Smart Contracts & Audits$7,000 – $25,000Website + Dashboard$3,000 – $20,000Compliance & Security$5,000 – $30,000Marketing & Launch$5,000 – $30,000TOTAL$10,000 – $150,000+

🧩 Optional Add-ons That Increase Cost

Mobile Wallet App: $10,000 – $25,000

Decentralized Exchange (DEX): $25,000 – $100,000+

NFT Integration: $5,000 – $20,000

Custom Tokenomics & Strategy Consulting: $1,000 – $10,000

🏗️ How to Reduce the Cost of Creating Your Own Cryptocurrency

Here are a few strategies to reduce costs without sacrificing security or scalability:

Start with a Token Instead of a Coin Use existing blockchains like Ethereum or BSC to cut down infrastructure costs.

Use White-Label Solutions Blockchain firms like Shamla Tech offer pre-built modules, reducing custom development time and cost.

Hire an Experienced Blockchain Development Company A company with a proven track record helps you avoid costly mistakes and speeds up time to market.

Audit Smart Contracts Using Open-Source Tools First Pre-auditing with open-source tools can catch minor issues before you spend on full-scale audits.

🛠️ DIY vs. Professional Services

ApproachProsConsDIY (Do It Yourself)Cheaper upfront, total controlSteep learning curve, security risksProfessional Blockchain CompanyExpertise, faster delivery, securityHigher initial cost

While building your own crypto project sounds thrilling, the risks are high if you lack experience. Hiring a company like Shamla Tech offers peace of mind with end-to-end blockchain development services.

✅ Checklist Before You Launch Your Cryptocurrency

✔️ Define the purpose and use case of your crypto ✔️ Choose between token or coin ✔️ Select a blockchain platform ✔️ Design tokenomics (supply, distribution, utility) ✔️ Hire developers or a blockchain firm ✔️ Build and audit smart contracts ✔️ Design a user-friendly website/dashboard ✔️ Plan a marketing strategy ✔️ Ensure legal compliance

📌 Conclusion: Is Creating Your Own Cryptocurrency Worth It?

The cost to create your own cryptocurrency ranges widely depending on your project goals, technology stack, and development approach. Whether you're launching a simple token or building a complex blockchain, investing in secure, scalable, and professionally developed solutions is critical to long-term success.

By understanding the components and planning accordingly, you can turn your crypto idea into a functional, secure, and market-ready digital asset.

❓Frequently Asked Questions (FAQs)

1. Can I create a cryptocurrency for free?

Technically, yes — you can deploy a basic token on a testnet or use open-source tools. However, a secure and production-ready crypto project requires investment in development, audits, and compliance.

2. How long does it take to create a cryptocurrency?

Token: 1 to 3 weeks

Coin (Custom Blockchain): 2 to 6 months

3. What is the cheapest way to create a cryptocurrency?

Creating a simple token on BSC or Polygon using a white-label platform is the cheapest route, usually costing $5,000 – $10,000.

4. Is it legal to create your own cryptocurrency?

Yes, but legality depends on your country. Ensure your project complies with local financial regulations and securities laws.

5. Who can help me build my cryptocurrency?

Companies like Shamla Tech specialize in full-cycle blockchain development and offer customizable packages based on your requirements.

#LaunchYourCryptocurrencyExchange#ShamlaTech#CryptocurrencyExchangeDevelopment#CreateACryptocurrencyExchange#CryptoExchangeDevelopment#BlockchainSolutions

0 notes

Text

Build a Crypto Exchange from Scratch: Tech, Time & Budget Guide

So, you’ve got your eyes on the booming crypto industry and are thinking, “Why not build a crypto exchange of my own?” Well, you're not alone—and you're not wrong. With cryptocurrencies now a mainstream financial asset, launching a crypto exchange can be a goldmine. But here's the kicker: it's no walk in the park. Between regulations, tech complexities, and budget planning, there’s a lot to unpack. That’s why this guide exists—to walk you through everything step-by-step. Let’s get into it.

What is a Crypto Exchange?

At its core, a crypto exchange is a digital marketplace that lets people buy, sell, and trade cryptocurrencies. Think of it like a stock exchange, but for Bitcoin, Ethereum, and other digital assets.

There are two main types of exchanges:

Centralized (CEX): A third party manages the trades and assets.

Decentralized (DEX): Trades occur directly between users, without intermediaries.

Why Start Your Own Crypto Exchange?

Launching an exchange isn’t just about riding the crypto wave—it’s about building a sustainable, revenue-generating business.

Here’s how you make money:

Trading Fees: Small cuts per transaction. Multiply that by thousands of trades per day.

Listing Fees: Charge projects to list their tokens.

Premium Features: API access, margin trading, analytics dashboards.

Bottom line: the profit potential is high if you play it right.

Step 1 – Define Your Exchange Type

Before writing a single line of code, decide what type of exchange you want to build.

Centralized Exchange (CEX)

Pros:

Easier user onboarding

High liquidity

Faster transactions

Cons:

Prone to hacks

Requires strict regulation

Use case: Ideal for beginners or regions with established financial laws.

Decentralized Exchange (DEX)

Pros:

No need for user data (privacy)

No custody of funds

Cons:

Harder UX

Limited trading pairs

Use case: Perfect for DeFi audiences and privacy-focused traders.

Hybrid Exchange

Combining the liquidity of CEXs with the privacy of DEXs. Though complex to build, this model is gaining traction.

Step 2 – Regulatory Compliance & Licensing

Let’s face it—crypto has a bit of a reputation problem. That’s why regulation matters.

Choosing a Jurisdiction

Want fewer headaches? Pick countries known for crypto-friendly policies:

Malta

Estonia

Switzerland

Singapore

Cost of Licensing

Malta: $30,000 - $70,000

Estonia: $15,000 - $35,000

USA: Up to $500,000 depending on state licenses

Get legal counsel. It’s worth every penny.

Step 3 – Core Features of a Crypto Exchange

No one wants a clunky platform. Your exchange must be sleek, secure, and fast.

User Interface (UI)/User Experience (UX)

Clean dashboards, simple navigation, and responsive design. Mobile-ready? Absolutely.

Trading Engine

This is the brain of your exchange. It handles:

Order matching

Trade execution

Transaction history

Milliseconds matter here.

Wallet Integration

Use hot wallets for quick access and cold wallets for secure storage.

Security Features

Security is non-negotiable:

SSL encryption

2FA

Anti-DDoS

IP Whitelisting

Admin Panel

For your team to manage users, review transactions, and control settings.

Step 4 – Choose the Right Tech Stack

Here’s your digital toolbox. Pick wisely.

Backend Technologies

Popular choices:

Node.js

Python

Golang

They offer high performance and scalability.

Frontend Technologies

Make it look good and feel good:

React.js

Vue.js

Angular

Blockchain Integration

Connect with:

Ethereum

Binance Smart Chain

Polygon

You’ll need APIs or smart contracts, depending on the setup.

Step 5 – Hiring a Development Team

DIY is great for furniture, not crypto exchanges.

In-house team: More control but costlier.

Outsourcing: Cost-effective, especially in India, Ukraine, or Vietnam.

Cost Estimate

MVP Exchange: $50,000 - $150,000

Full-fledged Platform: $200,000 - $500,000+

Timeframe: 6 to 12 months

Step 6 – Designing the Architecture

Your platform should be:

Scalable (handle growth)

Modular (easier to update)

Fault-tolerant (avoid downtime)

Use cloud services like AWS or Google Cloud for infrastructure.

Step 7 – Testing & Security Audits

Before you go live, test everything. And then test it again.

Load Testing

Penetration Testing

Bug Bounties

Smart Contract Audits (for DEXs)

Better safe than hacked.

Step 8 – Marketing & Launch Strategy

Even the best exchange is useless without users.

Listing Initial Coins

List popular coins like BTC, ETH, and USDT. Then add new tokens to draw attention.

Incentive Programs

Airdrops, sign-up bonuses, referral bonuses. Get creative. Build hype.

Also consider:

PR Campaigns

Community Building (Telegram, Discord)

Influencer Outreach

Maintenance and Upgrades

The crypto space evolves fast. Your exchange must too.

Regular patches

Feature rollouts

Security updates

Consider launching a mobile app for broader reach.

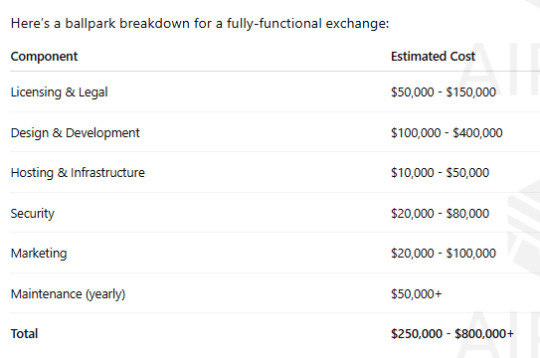

Cost Breakdown

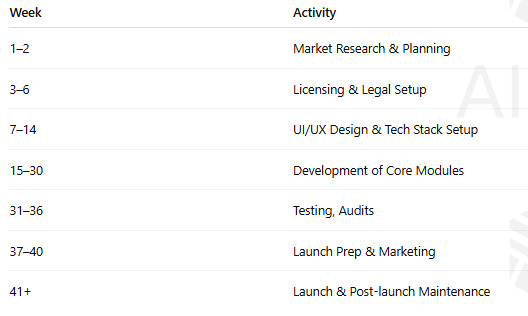

Timeline Overview

A realistic timeline might look like this:

Conclusion

Building a crypto exchange from scratch isn’t just about slapping together some code and flipping a switch. It’s a meticulous journey through regulatory hurdles, technical architecture, and business strategy. But if you get it right, it’s one of the most lucrative ventures in the digital finance world. So, whether you're a startup or a fintech giant, the roadmap is here—you just need to follow it.

FAQs

1. Can I build a crypto exchange without coding knowledge?

Technically yes, with white-label solutions. But for full control and scalability, you’ll need developers or a dev agency.

2. How do crypto exchanges make money?

Mainly through trading fees, listing fees, and premium service offerings like APIs or advanced analytics.

3. What licenses do I need to launch a crypto exchange?

That depends on your target market. Countries like Malta and Estonia offer favorable regulatory environments for crypto businesses.

4. How long does it take to launch a crypto exchange?

A basic platform can go live in 4-6 months. A more sophisticated, scalable exchange might take 9-12 months.

5. Is it safe to build and operate a crypto exchange?

Yes—if you invest in strong security infrastructure, conduct regular audits, and comply with all legal requirements.

#CreateACryptocurrencyExchange#HowToCreateACryptocurrencyExchange#BuildYourOwnCryptocurrencyExchange#LaunchYourCryptocurrencyExchange#CryptocurrencyExchangeDevelopment#ShamlaTech#CryptoExchange#BlockchainSolutions#CryptoBusiness#CryptoDevelopment

0 notes

Text

Start a Crypto Exchange: Legal Steps, Budget & Development Tips

Introduction

Thinking about launching your own crypto exchange? You're not alone. With the cryptocurrency industry booming, many entrepreneurs are exploring this digital frontier. But here's the deal — it's not as easy as flipping a switch. Starting a crypto exchange involves serious legal hoops, a solid budget, and top-notch development work. But don’t worry, this guide will walk you through the whole process in plain English.

Understanding the Crypto Exchange Landscape

What Is a Cryptocurrency Exchange?

A cryptocurrency exchange is a digital marketplace where users can buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, and more. Think of it as a stock exchange, but for digital assets.

Types of Crypto Exchanges

Centralized Exchanges (CEX)

These are traditional platforms like Coinbase or Binance where a central authority manages everything. They’re user-friendly, fast, and usually come with customer support.

Decentralized Exchanges (DEX)

DEXs like Uniswap or PancakeSwap remove the middleman. Trades happen directly between users using smart contracts. They’re more private, but less beginner-friendly.

Hybrid Exchanges

A combo of both — they offer the control and liquidity of CEXs, along with the privacy and autonomy of DEXs.

Legal Considerations Before Starting a Crypto Exchange

Getting the legal stuff right is non-negotiable.

Know Your Customer (KYC) and Anti-Money Laundering (AML)

You must verify the identity of your users to comply with KYC and AML regulations. This builds trust and keeps authorities off your back.

Choosing the Right Jurisdiction

Not all countries treat crypto equally. Countries like Switzerland, Singapore, Estonia, and Malta are known for being crypto-friendly. Pick a location that supports innovation while offering legal clarity.

Obtaining Necessary Licenses

Each jurisdiction has its own licensing requirements. You might need a Money Transmitter License (MTL) in the U.S. or a Virtual Currency License in the EU. Research this in-depth or consult a legal advisor.

Working With Legal Advisors

Don't skimp on legal advice. Hire experienced crypto lawyers who understand both the tech and regulatory sides of the business.

Budgeting for Your Crypto Exchange

Let’s talk numbers.

Initial Costs Breakdown

Licensing and Legal Fees

Legal costs vary wildly, from $5,000 to over $100,000 depending on your location and complexity.

Technology Stack and Development

Custom platform development can cost anywhere from $50,000 to $500,000. White-label solutions are cheaper but less flexible.

Marketing and Branding

You’ll need at least $20,000 for initial branding, SEO, and user acquisition campaigns.

Security Infrastructure

You can't afford to cut corners here. Secure wallets, encryption, DDoS protection — expect to spend $10,000 or more.

Ongoing Operational Costs

Think server maintenance, customer support, legal updates, and staff salaries. Budget at least $10,000 to $50,000 monthly depending on scale.

Building the Exchange Platform

Choosing Between White-Label vs. Custom Development

White-label solutions are ready-made platforms you can customize. They’re faster and cheaper. Custom development gives you full control and flexibility but takes time and money.

Essential Features Your Platform Must Have

User Registration & KYC

A seamless sign-up process integrated with KYC verification tools is a must.

Wallet Integration

You’ll need hot and cold wallets for deposits, withdrawals, and storage of crypto assets.

Trading Engine

This is the core. It matches buy and sell orders, ensures liquidity, and manages trades in real-time.

Admin Panel and Dashboard

Admins need control over user accounts, reports, security alerts, and fees.

Mobile Application

Most users prefer trading on the go. A well-designed mobile app is essential.

Cybersecurity Measures

Use 2FA, encrypted databases, DDoS protection, and regular penetration testing. Consider hiring ethical hackers to test vulnerabilities.

Assembling the Right Team

Development Team

Whether in-house or outsourced, you need developers skilled in blockchain, backend, frontend, and mobile app development.

Compliance Experts

You’ll need experts to keep your exchange in line with ever-changing crypto laws.

Customer Support

Offer 24/7 support — trust us, it’s worth it. Live chat, email, and even Telegram groups go a long way.

Funding Your Crypto Exchange

Self-Funding

Bootstrapping gives you full control but might limit your growth speed.

Venture Capital and Investors

VCs can provide big capital but will expect a stake in your business. Prepare a strong pitch and business plan.

Token Sale or ICO

Many exchanges fund their launch by issuing their own tokens. But make sure to comply with securities laws in your jurisdiction.

Marketing and User Acquisition Tips

SEO and Content Marketing

Start a blog, optimize your site, and publish educational content to bring in organic traffic. SEO is a long game, but it pays off big.

Community Building and Social Media

Telegram, Discord, Twitter — build communities there. Get people hyped and engaged before launch.

Partnerships and Influencer Marketing

Collaborate with known figures in the crypto world. Influencers can help build credibility and drive traffic.

Challenges to Anticipate

Regulatory Hurdles

Crypto laws are a moving target. Stay updated and flexible.

Market Competition

You're not alone. Competing with giants like Binance or Coinbase? You’ll need a niche or unique value proposition.

Trust and Security Issues

One breach can ruin your brand. Make security your #1 priority from day one.

Conclusion

Starting a crypto exchange is no walk in the park — it takes legal precision, deep pockets, and sharp tech skills. But if you’re passionate about crypto and ready to take on the challenge, the rewards can be massive. Focus on compliance, security, and user experience. And most importantly — never stop adapting. Crypto is a fast-moving space, and only the agile survive.

FAQs

1. How much does it cost to start a cryptocurrency exchange? Costs can range from $100,000 to over $500,000 depending on development, legal fees, and marketing.

2. Do I need a license to run a crypto exchange? Yes, most jurisdictions require specific licenses to legally operate a crypto exchange.

3. What is the best country to register a crypto exchange? Crypto-friendly countries include Estonia, Switzerland, Singapore, and Malta due to clear regulations and tax benefits.

4. Can I start an exchange using a white-label solution? Absolutely. White-label platforms are faster and cheaper to deploy but offer less customization.

5. How do crypto exchanges make money? Exchanges earn through transaction fees, withdrawal fees, listing fees, and sometimes even margin trading or staking services.

#CreateACryptocurrencyExchange#HowToCreateACryptocurrencyExchange#BuildYourOwnCryptocurrencyExchange#LaunchYourCryptocurrencyExchange#CryptocurrencyExchangeDevelopment#ShamlaTech#CryptoExchange#BlockchainSolutions#CryptoBusiness#CryptoDevelopment

0 notes

Text

Build a Crypto Exchange Platform: Features, Cost, and Timeline

Introduction to the Crypto Exchange Craze

Cryptocurrency is no longer just a buzzword—it’s a booming industry. From Bitcoin to altcoins, the demand for trading digital assets has skyrocketed. If you’ve been thinking about diving into this space, building a crypto exchange platform might just be your golden ticket.

But hold on—what does it really take to build a platform like Binance or Coinbase? In this guide, we’ll walk through everything: features you need, how much it’ll cost, how long it’ll take, and the juicy bits in between.

Why You Should Build a Crypto Exchange Platform

The Rising Demand for Digital Currency

Let’s face it—crypto is here to stay. With millions of users and trillions in market value, the appetite for a secure and reliable trading platform is only growing. People want in, and they need platforms to help them get there.

Profitable Business Model

Transaction fees, listing fees, and premium features—just a few ways your exchange can generate revenue. And unlike traditional finance, crypto runs 24/7. That means your income doesn’t sleep.

Types of Crypto Exchanges

Before jumping in, it’s important to choose the right exchange model that aligns with your vision.

Centralized Exchange (CEX)

These are run by companies that manage users’ funds. Think of Coinbase. Easy to use, but you’re responsible for a lot—including security.

Decentralized Exchange (DEX)

No central authority. Traders use smart contracts to execute deals. It’s safer in terms of custody but can be complex for users.

Hybrid Exchange

A combo of both. You get the user-friendliness of a CEX with the security of a DEX. Best of both worlds? Possibly.

Key Features of a Crypto Exchange Platform

A successful platform isn’t just a trading page—it’s an entire ecosystem. Here’s what it must include:

User Registration and Verification

Your users should register easily. Include email/phone verification and secure sign-up options.

Secure Wallet Integration

Hot wallets for instant access and cold wallets for safer storage. Multi-signature wallets are a plus.

Trading Engine

This is your heartbeat. It matches buy/sell orders and handles pricing and execution in milliseconds.

Admin Panel

To control operations, users, fees, listings—you name it. A robust backend makes your life a whole lot easier.

Liquidity Management

Without liquidity, users can’t trade efficiently. Integrate with external liquidity providers if needed.

Multi-Currency Support

Support for Bitcoin, Ethereum, and multiple altcoins makes your exchange more versatile.

Real-Time Analytics

Let users view their portfolio, market movements, and historical data on the fly.

KYC/AML Compliance

Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures are a must in most regions.

Two-Factor Authentication (2FA)

Security should never be optional. 2FA adds a much-needed layer to prevent hacks.

Step-by-Step Process to Build a Crypto Exchange

Let’s break down the journey:

Step 1: Market Research and Planning

Understand your target audience. Do you want to serve advanced traders or crypto newbies?

Step 2: Legal Framework and Licensing

Check regional regulations. You may need licenses depending on where you operate.

Step 3: Choose the Right Development Approach

Custom development? White-label solutions? Decide based on budget, timeline, and scalability.

Step 4: UI/UX Design

Clean, intuitive interfaces convert users. Don’t skimp on this—first impressions matter.

Step 5: Back-End and Blockchain Development

This is where the magic happens. Smart contract integration, wallet development, and trading engine setup all come in here.

Step 6: Testing and Security Audits

Run stress tests, penetration tests, and bug bounties to ensure everything’s solid.

Step 7: Launch and Marketing

Deploy your platform and spread the word through social media, influencers, and crypto forums.

Technology Stack Required

Let’s get technical for a second.

Front-End

React.js or Angular for smooth UI

HTML5, CSS3, and Bootstrap for responsiveness

Back-End

Node.js or Python for speed and scalability

PostgreSQL or MongoDB for databases

Blockchain Integration

Ethereum, Solana, or BNB Smart Chain for token support

APIs for wallet, price feeds, and liquidity

Cost Breakdown of Building a Crypto Exchange

Now for the big question: how much does it cost?

Development Team and Resources

A skilled team is key:

Project Manager

UI/UX Designer

Front-end & Back-end Developers

Blockchain Developer

QA/Test Engineer 💰 Estimated: $40,000 to $100,000

Infrastructure Costs

Servers, databases, and hosting platforms:

AWS or Google Cloud 💰 Estimated: $5,000–$20,000/year

Licensing and Legal Fees

Depends on jurisdiction: 💰 Estimated: $10,000–$50,000

Security and Compliance Tools

Firewalls, DDoS protection, encryption tools: 💰 Estimated: $5,000–$30,000

Total Estimated Cost: $60,000 to $200,000+ depending on scope and scale.

Timeline for Building a Crypto Exchange

Time is money, right? Here’s how long each phase might take.

Phase 1: Research and Planning (2–3 Weeks)

Business modeling, user personas, legal groundwork.

Phase 2: Design and Development (2–3 Months)

UI/UX and backend infrastructure.

Phase 3: Testing and QA (3–4 Weeks)

Detect and fix bugs, test under load, security audits.

Phase 4: Deployment and Launch (1–2 Weeks)

Final deployment and go-live strategy.

Total Estimated Timeline: 4–6 months

Common Challenges and How to Overcome Them

Regulatory Uncertainty

Stay informed. Work with legal experts in crypto regulations.

Security Threats

Invest in security from day one. Use best practices and external audits.

Market Competition

Differentiate. Offer unique features like lower fees or staking options.

Benefits of Hiring a Crypto Exchange Development Company

You don’t have to go it alone.

Expertise and Experience

Professional developers bring in-depth knowledge and technical skillsets.

Faster Time to Market

Agencies already have frameworks and teams in place.

Cost-Efficiency

Avoid trial and error. Save time and money in the long run.

Conclusion

Building a crypto exchange platform is no small feat—but it’s absolutely doable. With the right features, a smart budget, and a clear plan, your exchange could become the next big name in crypto.

Whether you want to cater to hardcore traders or simplify crypto for everyday users, this guide gives you the blueprint to make it happen. So, what are you waiting for? The world of crypto isn’t slowing down, and neither should you.

FAQs

1. How much does it cost to build a crypto exchange? It typically ranges from $60,000 to $200,000+, depending on the platform's complexity, features, and development team.

2. How long does it take to build a crypto exchange platform? Most platforms can be developed in about 4 to 6 months from start to finish.

3. Is it legal to launch a crypto exchange? Yes, but it depends on local regulations. You may need licenses and must comply with AML/KYC laws.

4. What’s the best type of crypto exchange to build? It depends on your goals. Centralized exchanges are easier to manage, while decentralized ones offer more security and privacy.

5. Can I use a white-label solution for faster development? Absolutely. White-label solutions save time and money, though they may offer limited customization compared to custom development.

#CreateACryptocurrencyExchange#HowToCreateACryptocurrencyExchange#BuildYourOwnCryptocurrencyExchange#LaunchYourCryptocurrencyExchange#CryptocurrencyExchangeDevelopment#ShamlaTech#CryptoExchange#BlockchainSolutions#CryptoBusiness#CryptoDevelopment

0 notes

Text

Create a Secure Cryptocurrency Exchange: Step-by-Step Guide

Introduction to Cryptocurrency Exchanges

So, you’re thinking about launching your own cryptocurrency exchange? Smart move. But there’s a catch — it’s not just about flipping a switch and going live. The real game-changer? Security.

When billions of dollars flow through digital platforms every day, hackers are always lurking. One slip-up and boom — your users are exposed, your credibility shattered. But don’t worry. In this detailed step-by-step guide, we’ll walk you through how to create a secure cryptocurrency exchange that’s resilient, compliant, and built to last.

What Is a Cryptocurrency Exchange?

A cryptocurrency exchange is a platform where people can buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, and more. Think of it as the Wall Street of the digital world — but 24/7 and global.

There are generally two types:

Spot exchanges where assets are traded instantly

Derivatives exchanges where contracts like futures or options are traded

But regardless of type, the key concern? Trust and security.

Why Security Matters in Crypto Exchanges

Here's the harsh truth — crypto exchanges are prime targets for cybercriminals. High-profile hacks like Mt. Gox, Coincheck, and Bitfinex led to billions in losses. That’s why creating an ironclad foundation is non-negotiable.

Step 1: Define Your Exchange Type

Before writing a single line of code, decide the structure of your exchange.

Centralized vs. Decentralized Exchanges

Centralized exchanges (CEX) are managed by a company and offer high speed and user support but require storing user funds — which makes them a target.

Decentralized exchanges (DEX) let users trade without an intermediary. Great for privacy but less user-friendly and harder to scale.

Hybrid Models

Want the best of both worlds? A hybrid model merges the security of DEX with the performance of CEX. Ideal, but technically complex.

Step 2: Choose the Right Jurisdiction

This is where many startups trip.

Regulatory Compliance and Licensing

Different countries have different crypto laws. Some require licenses; others ban exchanges outright. Align with local laws to avoid shutdowns or fines. You’ll likely need:

A Money Services Business (MSB) license in the U.S.

FCA approval in the UK

Virtual Asset Service Provider (VASP) registration in the EU

Crypto-Friendly Countries

Consider setting up in jurisdictions like:

Malta

Estonia

Switzerland

Singapore

They offer clearer regulations and support for crypto innovation.

Step 3: Design the Exchange Architecture

Let’s talk tech.

Backend Infrastructure

This is the brain of your exchange. It should include:

Order matching engine

Trade engine

Wallet system

User management

Admin panel

Redundancy and load balancing are key here. No one likes downtime — especially when money’s involved.

Frontend User Experience

A seamless user interface is essential. Think clean dashboards, real-time charts, fast response time, and mobile responsiveness. Tools like ReactJS or VueJS come in handy.

Step 4: Integrate Secure Wallet Solutions

Your wallets are your vaults.

Hot Wallets vs. Cold Wallets

Hot wallets are internet-connected and fast but vulnerable.

Cold wallets are offline and highly secure — ideal for storing the bulk of assets.

Use a hybrid wallet system to combine speed and safety.

Multi-signature Wallets

Multi-sig wallets require more than one key to authorize a transaction. This adds an extra layer of protection against internal threats.

Step 5: Implement Robust Security Measures

Here’s where we make your exchange hack-proof.

End-to-End Encryption

Encrypt all data between the client and server. Use SSL/TLS protocols and enforce HTTPS across all pages.

Two-Factor Authentication (2FA)

Require users and admins to enable 2FA using apps like Google Authenticator or hardware keys.

Anti-DDoS and Firewall Protection

Install WAF (Web Application Firewall) and Anti-DDoS systems to protect your platform from malicious traffic and brute-force attacks.

Step 6: Choose a Reliable Technology Stack

Your tech stack can make or break you.

Recommended Programming Languages and Frameworks

Backend: Node.js, Python, or Go

Frontend: ReactJS or Angular

Database: PostgreSQL or MongoDB

API Integration for Liquidity

Use APIs to connect with existing exchanges and market makers. This ensures users always have buy/sell options.

Step 7: Ensure Legal and KYC/AML Compliance

Security isn’t just tech — it’s also about trust and transparency.

Importance of Identity Verification

Know Your Customer (KYC) procedures verify users’ identities. It helps prevent fraud and meets regulatory requirements.

KYC/AML Software Tools

Integrate tools like:

Jumio

Chainalysis

SumSub

They automate identity checks and monitor suspicious transactions in real time.

Step 8: Partner with Liquidity Providers

Without liquidity, your exchange is like a ghost town.

Benefits of High Liquidity

Tighter spreads

Faster trades

Better prices

How to Choose the Right Partner

Look for providers with:

Proven track records

Transparent fees

24/7 support

Some top names include Binance Cloud, AlphaPoint, and B2Broker.

Step 9: Test and Audit Everything

Never go live without testing.

Security Audits

Hire cybersecurity experts to audit your code and infrastructure. Penetration testing helps uncover vulnerabilities before hackers do.

Beta Testing with Real Users

Soft-launch your exchange with limited users to test usability and performance. Gather feedback and fix issues early.

Step 10: Launch and Market Your Exchange

Time to go public — but go smart.

Launch Strategies

Start with a regional launch, then scale globally. Offer bonuses, referral programs, or airdrops to attract early adopters.

SEO, PR, and Influencer Marketing

Build a buzz:

Publish thought leadership blogs

Use SEO to rank on Google

Partner with influencers and run ads on crypto platforms

Common Mistakes to Avoid

Even the best teams make missteps. Here’s what to watch out for:

Neglecting Security Layers

Don’t skimp on firewalls, 2FA, and audits. It only takes one vulnerability.

Skipping Legal Setup

Avoiding legalities might seem easier, but it’s a ticking time bomb. Always operate within the law.

Future-Proofing Your Crypto Exchange

Markets change fast — your exchange should too.

Scalability and Updates

Design your platform to scale. Use cloud hosting (AWS, Google Cloud) and keep updating your software.

Staying Ahead of Compliance Trends

Crypto laws evolve. Stay updated and adapt fast. Set up a compliance team to monitor changes.

Conclusion

Creating a secure cryptocurrency exchange isn’t just a project — it’s a mission. From defining your model and choosing the right tech stack to implementing rock-solid security and complying with global regulations, every step matters.

Get it right, and you’re not just building an exchange — you’re building trust, credibility, and a thriving digital economy. So, are you ready to create a secure cryptocurrency exchange that people can depend on?

FAQs

1. How much does it cost to create a secure cryptocurrency exchange? The cost can range from $50,000 to over $500,000, depending on features, compliance, and security integrations.

2. Do I need a license to start a crypto exchange? Yes. Most jurisdictions require licenses. Always check local laws to avoid legal issues.

3. How long does it take to build a crypto exchange? With the right team, it can take 3 to 9 months depending on complexity and customization.

4. What programming languages are best for crypto exchange development? Node.js, Python, and Go are popular for backend; ReactJS or Angular for frontend.

5. What are the top features users expect in a secure crypto exchange? Strong security, fast transactions, easy UI, real-time updates, and responsive support.

#CreateACryptocurrencyExchange#HowToCreateACryptocurrencyExchange#BuildYourOwnCryptocurrencyExchange#LaunchYourCryptocurrencyExchange#CryptocurrencyExchangeDevelopment#ShamlaTech#CryptoExchange#BlockchainSolutions#CryptoBusiness#CryptoDevelopment

0 notes

Text

How to Start a Crypto Exchange Business: Cost & Setup Plan

Introduction to the Crypto Exchange Market

Thinking about diving into the crypto world with your own exchange? You're not alone. The cryptocurrency industry has exploded in recent years, and crypto exchanges are at the heart of it all. These platforms allow users to buy, sell, and trade digital assets like Bitcoin, Ethereum, and thousands of altcoins. If you're wondering how to start a crypto exchange business, you’re in the right place.

Why Start a Crypto Exchange Business in 2025?

2025 is shaping up to be a golden era for digital assets. With more institutional adoption, regulatory frameworks becoming clearer, and blockchain technologies evolving rapidly, there's a strong demand for reliable and innovative crypto trading platforms.

Besides that, user trust in digital finance is growing. The opportunity to create a profitable, scalable business in a booming market has never been better. So, why not ride the wave?

Types of Cryptocurrency Exchanges

Before you build anything, let’s figure out what kind of exchange you want to run.

Centralized Crypto Exchange (CEX)

These are traditional exchanges like Coinbase and Binance. You control user data, order books, and custodial wallets. This model is popular but requires a higher level of regulatory compliance.

Decentralized Crypto Exchange (DEX)

No middlemen here. Smart contracts do the work, and users hold their own keys. Uniswap is a great example. It’s trustless and more secure in some ways—but harder to monetize and regulate.

Hybrid Exchanges

Why not have the best of both worlds? Hybrid exchanges combine the liquidity and functionality of CEX with the privacy and control of DEX. If you’re looking for innovation, this is it.

Understanding the Crypto Exchange Business Model

Your exchange’s model defines everything—how you make money, your target market, and the features you’ll need. Some focus purely on spot trading, while others offer futures, staking, or margin trading. Decide early what you’ll offer.

Market Research and Competitor Analysis

Like any good business, success starts with knowing the competition. Study giants like Binance, Kraken, and KuCoin. Look at:

Their features

UI/UX

Fee structures

Supported cryptocurrencies

Also, identify underserved niches or countries with emerging crypto markets. That’s your opening.

Legal Requirements and Compliance

This is not the Wild West anymore. You’ll need to play by the rules—big time.

Licensing by Jurisdiction

Different countries = different rules. For instance:

USA: Requires Money Service Business (MSB) registration with FinCEN.

Estonia, Lithuania, Seychelles: Easier licensing frameworks.

Dubai and Singapore: Emerging crypto hubs with clear guidelines.

KYC/AML Obligations

Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols are mandatory almost everywhere. You'll need integrated KYC verification tools and transaction monitoring systems.

Technical Infrastructure and Software

Your platform must be rock-solid. Here’s what to consider:

Choosing Between White-Label vs Custom Development

White-Label Solutions: Fast and cheaper. Great if you want to get started quickly.

Custom Development: More expensive, but tailored exactly to your needs.

Must-Have Features for a Crypto Exchange

User dashboard and profile management

Order book and matching engine

Wallet integration

Trading charts and analytics

Admin panel for monitoring

Security protocols

Security Protocols and Measures

Security isn’t optional—it's life or death in crypto. Your platform must be:

Encrypted: End-to-end SSL and data encryption.

Protected: Multi-signature wallets, firewalls, and DDoS protection.

Audited: Get a third-party security audit before launch.

Pro tip: Use cold wallets for storing most user funds.

Cost Breakdown to Launch a Crypto Exchange

So, how much does it cost to start a crypto exchange? Here's a realistic breakdown:

Licensing and Legal Fees

Jurisdiction-based: $10,000–$100,000+

Ongoing legal compliance: $5,000/month

Development and Technology Cost

White-label solution: $25,000–$60,000

Custom-built exchange: $100,000–$500,000+

Security features: $15,000–$50,000

Marketing and Operational Costs

Initial marketing: $20,000–$100,000

Team salaries and operations: $10,000/month+

Step-by-Step Setup Plan for Your Crypto Exchange

Let’s get practical. Here's a roadmap to make it happen.

Step 1: Define Your Business Scope

Determine what kind of exchange you want, your target market, and supported currencies.

Step 2: Legal Registration and Licensing

Select your jurisdiction, register your business, and apply for the necessary licenses.

Step 3: Build the Exchange Platform

Choose between white-label or custom development. Work with experienced developers.

Step 4: Implement Liquidity Solutions

Partner with liquidity providers or integrate with external exchanges via APIs to avoid low-volume problems.

Step 5: Test and Launch

Perform rigorous testing—alpha, beta, and security audits—before going live.

Monetization: How Do Crypto Exchanges Make Money?

Want to know where the real cash comes in? Here’s how:

Trading fees: Your bread and butter (typically 0.1%–0.5%)

Withdrawal fees: Small cuts when users withdraw crypto or fiat

Listing fees: New coins pay to get listed

Margin trading interest: Earn from users borrowing funds

Staking rewards: Share profits with users while taking a fee

Marketing Strategies for a Crypto Exchange

Even the best exchange will flop without users. Here's how to attract them:

SEO & Content Marketing: Blog posts, tutorials, and market insights

Social Media Campaigns: Twitter, Reddit, Discord—build a community

Referral Programs: Reward users for inviting others

Influencer Partnerships: Collaborate with crypto YouTubers and streamers

Paid Ads: Run PPC and display ads to drive immediate traffic

Common Challenges and How to Overcome Them

Running a crypto exchange isn’t a cakewalk. Here’s what might trip you up—and how to dodge it:

Regulatory hurdles: Hire a good legal team from day one.

Liquidity issues: Use liquidity aggregators to fill order books.

Security breaches: Invest in cyber defense and get regular audits.

User trust: Offer 24/7 support, a clean UI, and strong security.

Conclusion

Starting a crypto exchange business in 2025 is both exciting and challenging. With a strategic setup plan, the right technical partners, and clear compliance, you can tap into one of the most promising industries of the decade. While the startup costs can be high, the potential returns are well worth it. Just remember—trust and security are everything in this business.

So, are you ready to build the next Binance or Coinbase?

FAQs

1. How much does it cost to start a crypto exchange? Costs range from $50,000 for a white-label solution to over $500,000 for a custom platform, depending on features, licensing, and marketing.

2. Do I need a license to run a crypto exchange? Yes, most jurisdictions require specific licenses and regulatory compliance, including KYC and AML practices.

3. Can I make money with a crypto exchange? Absolutely! You can earn from trading fees, listing fees, withdrawal fees, and more.

4. How long does it take to launch a crypto exchange? Depending on the approach, it can take 3 to 12 months from planning to launch.

5. What’s the best jurisdiction to register a crypto exchange? Popular choices include Estonia, Lithuania, Singapore, and Dubai due to favorable crypto regulations and licensing processes.

#CryptocurrencyExchangeDevelopment#CreateACryptocurrencyExchange#BuildYourOwnCryptocurrencyExchange#LaunchYourCryptocurrencyExchange#ShamlaTech#CryptoDevelopment#BlockchainSolutions#CryptoExchangePlatform#CryptoBusiness#CryptocurrencyExchange

0 notes

Text

How to Start a Cryptocurrency Exchange: 2025 Cost Guide Inside

Cryptocurrency is no longer the future—it's the present. And if you're wondering how to start a cryptocurrency exchange, you're on the right path to potentially tapping into one of the most profitable sectors of the digital economy. But before diving in head-first, there's a lot to unpack—costs, compliance, technology, and more. Don’t worry—we’re breaking it all down for you in this 2025 guide.

Introduction

Let’s face it: the world is going digital, and crypto exchanges are the banks of tomorrow. Setting up your own cryptocurrency exchange in 2025 is like owning a gold mine—if you do it right. But how do you start? What does it cost? What’s the catch? Let’s walk through everything you need to know, step-by-step.

What Is a Cryptocurrency Exchange?

Simply put, a cryptocurrency exchange is a digital marketplace where users can buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, and thousands of altcoins.

Centralized vs. Decentralized Exchanges

Centralized Exchanges (CEX): Think of Coinbase or Binance. They manage users’ funds and offer faster transactions.

Decentralized Exchanges (DEX): Peer-to-peer. No middleman. Offers better privacy but can be slower and less user-friendly.

Key Functions of an Exchange

Account creation & KYC

Trading pairs & order book

Wallets & storage

Liquidity management

Security & support

Why 2025 Is the Right Time to Launch a Crypto Exchange

With Web3 going mainstream, blockchain regulations tightening (making markets more trustworthy), and crypto adoption growing, 2025 is primed for new players. Plus, AI-powered trading and DeFi integrations are changing the game—new entrants with innovation have a real shot.

Business Planning Essentials

Before a single line of code gets written, you need a rock-solid plan.

Define Your Niche

Will you cater to beginners, institutional traders, or DeFi fanatics? Maybe focus on a regional market or offer NFT trading?

Understand Your Target Audience

Are they mobile-savvy Gen Z users? Serious traders looking for low latency? Knowing this helps shape your platform.

Competitor Analysis

List out your top 5 competitors. What do they do well? Where do they fail? That’s your opportunity gap.

Legal and Regulatory Requirements

This part isn’t sexy—but it’s absolutely crucial.

Licensing and Jurisdiction

Countries like Lithuania, Estonia, and the UAE offer crypto-friendly licenses. Depending on where you want to operate, costs and compliance differ drastically.

AML/KYC Compliance

Anti-Money Laundering (AML) and Know Your Customer (KYC) policies are a must. Integrate third-party providers like Jumio or Sumsub for automated checks.

Data Protection and Security Laws

You’ll need to comply with GDPR (for EU), CCPA (for California), and any other local laws concerning user data.

Essential Features of a Crypto Exchange Platform

What makes an exchange stand out? Let’s talk features.

User Interface (UI) and User Experience (UX)

Simple. Clean. Responsive. Your platform should be intuitive even for someone trading for the first time.

Trading Engine

This is your heart. It matches buy/sell orders, updates prices, handles slippage, and more.

Crypto Wallet Integration

You’ll need both hot wallets (for liquidity) and cold wallets (for security). Multi-signature functionality is a plus.

Liquidity Management

Without liquidity, users leave. You can join liquidity pools or connect to larger exchanges via APIs.

Security Measures

Must-haves:

Two-factor authentication (2FA)

Encryption

DDoS protection

Regular audits

Tech Stack and Development Process

Custom Development vs. White-Label Solutions

Custom: Full control, scalability—but costly.

White-Label: Faster, cheaper, but less flexibility.

Back-End and Front-End Tech

Popular choices:

Back-End: Node.js, Python, Go

Front-End: React, Angular

Databases: PostgreSQL, MongoDB

Blockchain: Ethereum, Binance Smart Chain, Solana

Choosing a Development Partner

Look for a firm with crypto experience, references, security expertise, and post-launch support.

The Cost Breakdown: How Much Does It Really Take?

Here’s the section you’ve been waiting for.

Licensing & Legal: $30,000 - $500,000+

Costs vary wildly based on jurisdiction and scope.

Software Development: $50,000 - $300,000

White-label: $50K–$100K

Custom build: $200K–$300K+

Hosting & Infrastructure: $10,000 - $50,000/year

Cloud services (AWS, Azure) aren’t cheap—especially with top-tier security.

Marketing & User Acquisition: $20,000 - $100,000+

You’ll need influencers, SEO, paid ads, community managers, and more.

Maintenance & Updates: $5,000 - $20,000/month

Bug fixes, feature updates, customer support—ongoing expenses never stop.

How to Monetize Your Crypto Exchange

Let’s talk about revenue.

Trading Fees

Standard model: Charge 0.1% to 0.5% per transaction.

Withdrawal Fees

Fixed fee for crypto withdrawals helps you cover blockchain gas costs.

Listing Fees for New Tokens

New projects pay to get listed. This can be $5,000 to $1M+ depending on your exchange’s popularity.

Marketing Strategies for 2025

Influencer Collaborations

Crypto Twitter, YouTube, TikTok—all goldmines for early traction.

Paid Ads & SEO

Targeted Google Ads, native ads, and high-quality SEO content will bring in organic traffic.

Community Building

Launch a Telegram group, Reddit forum, or Discord server. A loyal community is your best marketing tool.

Challenges to Watch Out For

Regulatory Hurdles

Laws change fast. Stay updated, or you’ll face hefty fines—or worse, shutdowns.

Cybersecurity Threats

Hackers love crypto. Invest in top-tier security or be ready to lose everything.

Market Volatility

Crypto is unpredictable. Ensure you have enough reserves to handle market downturns.

Final Checklist to Launch Successfully

✅ Business plan in place

✅ Legal approvals and licenses secured

✅ Platform tested and secure

✅ Liquidity partners integrated

✅ Marketing strategy locked in

✅ Customer support ready

✅ Community engagement ongoing

Conclusion

So, how to start a cryptocurrency exchange in 2025? It takes vision, planning, and yes—capital. But the payoff? Huge. With the right setup, your exchange can become a go-to platform in a market that’s still growing every year. Just follow this guide step-by-step, stay adaptable, and keep learning. Your crypto empire awaits.

FAQs

1. How long does it take to launch a cryptocurrency exchange? Typically, 4 to 12 months, depending on whether you use a white-label solution or go for a custom build.

2. Do I need a license to start a crypto exchange? Yes, most countries require specific licenses and regulatory compliance to operate legally.

3. Can I start a crypto exchange with under $100K? Yes, with a white-label solution and limited regional focus, it's possible—but it will come with trade-offs.

4. What’s the most profitable way to run a crypto exchange? Trading fees and token listing fees are the most consistent sources of income.

5. Should I hire a crypto development company? Absolutely. Working with experienced developers ensures security, scalability, and compliance.

#CryptocurrencyExchangeDevelopment#CreateACryptocurrencyExchange#BuildYourOwnCryptocurrencyExchange#LaunchYourCryptocurrencyExchange#ShamlaTech#CryptoDevelopment#BlockchainSolutions#CryptoExchangePlatform#CryptoBusiness#CryptocurrencyExchange

0 notes

Text

Best Way to Build a Crypto Exchange: Cost, Time & Tech Guide

Introduction: Why Build a Crypto Exchange?

Ever thought of owning your own crypto exchange like Binance or Coinbase? With the crypto market booming and digital assets becoming mainstream, launching your own exchange might just be the golden ticket. Not only does it offer multiple revenue streams—like trading fees and token listings—but it also puts you at the heart of the fintech revolution. But here's the catch: building a crypto exchange isn’t just about coding. It’s about compliance, trust, tech, and timing. Let’s walk through the best way to build a crypto exchange step-by-step.

Understanding Crypto Exchanges

Before diving in, you need to understand what you’re building.

Centralized vs. Decentralized Exchanges