#Creditscore

Explore tagged Tumblr posts

Text

Key Factors Influencing Your Credit Score in 2024

In the ever-evolving landscape of personal finance, it's crucial to stay ahead of the curve when it comes to understanding the factors that could impact your credit score in 2024.

Here are three key considerations that might shape the credit environment in the year 2024. Proactively monitoring and adapting to these three key factors—economic trends, regulatory changes, and technology-related developments—will empower you to navigate the credit landscape in 2024.

Remember, staying informed is the first step towards making sound financial decisions and securing a strong credit standing for the future.

Follow https://www.thecreditapp.org to learn more or start reporting non-payments of your customer to credit bureau in the United States.

2 notes

·

View notes

Text

10 Essential Tips for Effective Financial Management

Introduction

Effective financial management is the cornerstone of a stable and prosperous life. Whether you're an individual or a business owner, mastering the art of managing your finances can lead to greater financial security and opportunities. In this article, we will delve into the 10 essential tips for effective financial management, providing you with actionable advice to help you make informed financial decisions.

1. Create a Detailed Budget

Managing your finances starts with creating a detailed budget. A budget helps you track your income, expenses, and savings goals. By understanding where your money goes, you can make necessary adjustments to achieve your financial objectives.

2. Set Clear Financial Goals

To effectively manage your finances, set clear and achievable financial goals. These goals will serve as a roadmap for your financial journey, helping you stay motivated and focused.

3. Build an Emergency Fund

Life is full of unexpected surprises, and having an emergency fund is crucial. Aim to save at least three to six months' worth of living expenses in an easily accessible account.

4. Reduce Debt

High-interest debts can hinder your financial progress. Create a plan to reduce and eventually eliminate your debts. Start by paying off high-interest debts first.

5. Invest Wisely

Make your money work for you by investing wisely. Diversify your investments, consider long-term strategies, and seek advice from financial experts if needed.

6. Monitor Your Credit Score

Your credit score plays a significant role in your financial life. Regularly monitor it and take steps to improve it if necessary. A good credit score can lead to better borrowing terms and financial opportunities.

7. Save for Retirement

Don't wait until retirement is around the corner to start saving. The earlier you begin, the more you can accumulate. Explore retirement account options and contribute regularly.

8. Review and Adjust

Financial management is not a one-time task. Periodically review your budget, goals, and investments. Make adjustments as your financial situation changes.

9. Seek Professional Advice

If you find financial management overwhelming, consider seeking advice from a financial advisor. They can provide personalized guidance and strategies to optimize your finances.

10. Stay Informed

Stay updated on financial news, trends, and opportunities. Knowledge is power, and being informed will help you make better financial decisions.

10 Essential Tips for Effective Financial Management

In this section, we will briefly recap the ten essential tips for effective financial management:

Create a Detailed Budget

Set Clear Financial Goals

Build an Emergency Fund

Reduce Debt

Invest Wisely

Monitor Your Credit Score

Save for Retirement

Review and Adjust

Seek Professional Advice

Stay Informed

FAQs

Q: How do I start creating a budget?

A: Begin by listing all your sources of income and your monthly expenses. Categorize your expenses and identify areas where you can cut back.

Q: What's the ideal emergency fund size?

A: Aim for three to six months' worth of living expenses, but adjust based on your personal circumstances and risk tolerance.

Q: Can I manage my investments on my own?

A: While it's possible to manage your investments independently, seeking advice from a financial advisor can help you make more informed decisions.

Q: How often should I review my financial goals?

A: Regularly review your financial goals, at least once a year, and adjust them as needed to reflect changes in your life or financial situation.

Q: What's the best way to improve my credit score?

A: To boost your credit score, pay bills on time, reduce outstanding debts, and avoid opening too many new credit accounts.

Q: When should I start saving for retirement?

A: Start saving for retirement as early as possible to maximize your savings. The earlier you begin, the more you can accumulate over time.

Conclusion

Effective financial management is a skill that anyone can master with dedication and commitment. By following these 10 essential tips for effective financial management, you can take control of your finances, secure your future, and achieve your financial dreams. Remember that financial management is an ongoing process, so stay informed, adapt to changes, and always strive for financial excellence.

#FinancialManagement#MoneyManagement#PersonalFinance#FinancialGoals#Budgeting#InvestingTips#CreditScore#RetirementPlanning#DebtManagement#FinancialFreedom#Savings#FinanceTips#SmartInvesting#BudgetingTips#FinancialPlanning#WealthManagement#FinancialEducation#Finance101#FinancialAdvisor#MoneyMatters#MoneySmarts

6 notes

·

View notes

Text

Break Free Fast: The Ultimate Escape Plan from Credit Card Debt

TL;DR:Struggling with credit card debt? You’re not alone. We’ve got the ultimate escape plan to help you ditch the debt, rebuild your credit, and breathe easy—without needing a financial guru. Spoiler: it’s easier than you think. Ever feel like your credit card balance is quietly plotting against you? One minute you’re buying boba, the next you’re getting a passive-aggressive email from your…

0 notes

Text

Unlocking Financial Opportunities: Your Guide to Loan Eligibility Check

In today's dynamic financial landscape, understanding your loan eligibility is crucial. Whether you're planning to buy a home, start a business, or manage personal expenses, knowing where you stand can make all the difference.

What is a Loan Eligibility Check?

A loan eligibility check is a preliminary assessment that helps you determine whether you qualify for a specific loan. It considers factors like your income, credit score, employment status, and existing debts. This process provides insights into the loan amount you might be eligible for and the terms you can expect.

Why is it Important?

Financial Planning: Helps in budgeting and understanding your repayment capabilities.

Time-Saving: Prevents applying for loans that you may not qualify for.

Credit Score Protection: Reduces the number of hard inquiries on your credit report.

How to Perform a Loan Eligibility Check

Utilizing online tools can simplify this process. For a comprehensive assessment, consider using our loan eligibility check tool. It offers a user-friendly interface and provides instant results based on your inputs.

Factors Influencing Loan Eligibility

Income Level: Higher income often increases loan eligibility.

Credit History: A good credit score reflects financial responsibility.

Employment Stability: Consistent employment can positively impact eligibility.

Existing Liabilities: Fewer existing debts can enhance your loan prospects.

Tips to Improve Loan Eligibility

Maintain a Healthy Credit Score: Pay bills on time and manage debts wisely.

Reduce Existing Debts: Aim to lower your debt-to-income ratio.

Provide Accurate Information: Ensure all details are correct during the application.

Conclusion

Understanding and checking your loan eligibility is a proactive step towards achieving your financial goals. By leveraging tools like our loan eligibility check, you can make informed decisions and approach lenders with confidence.

0 notes

Text

Reliance Capital Finance Limited offers both secured and unsecured loan products to cater to various financial needs.

View On WordPress

#BorrowSmart#budgeting#BusinessLoans#CollateralLoans#creditscore#CreditTips#debtfree#fastloans#finance#FinanceTips#FinancialFreedom#financialliteracy#FinancialPlanning#instantloan#investment#KnowYourLoans#LoanAdvice#loanapproval#LoanComparison#LoanEducation#LoanOptionsExplained#LoanTypes#LoanTypesExplained#loanwithoutcollateral#money#news#noCollateralLoan#NoCollateralLoans#PersonalFinance#personalloans

0 notes

Text

💳 Boost Your Financial Identity – CreditLineCard.com!

A strong, trustworthy domain ideal for credit card services, fintech startups, loan providers, or financial comparison platforms. CreditLineCard.com speaks directly to consumers seeking credit solutions and financial empowerment.

✨ Finance-focused and highly brandable

✨ Perfect for credit products or fintech tools

✨ Instantly communicates trust and value

#FinanceDomain#CreditCard#FintechStartup#CreditLine#LoanServices#MoneyMatters#CreditScore#FinancialTools#PremiumDomain#CreditLineCard

0 notes

Text

Credit Utilization Revolution 2025: Best Mortgage Online Review

Boost your credit score by keeping utilization below 30% with Best Mortgage Online’s 2025 strategies. Our utilization calculator shows real-time balance impacts. A spring promotion includes a $199 ‘Balance Master’ program. Features limit optimization, balance transfer tips, and automated alerts. Get personalized ratio recommendations to enhance your score. Bonus: two months of free monitoring to maintain ideal 2025 utilization.

0 notes

Text

Stay updated on the latest credit card offerings, rewards programs, and financial management strategies. Learn how to maximize benefits while maintaining healthy credit scores with expert advice on choosing the right card, avoiding fees, and leveraging cashback offers. Discover comparisons between premium cards, travel benefits, and security features to make informed decisions. Essential reading for savvy spenders looking to optimize their financial tools.

0 notes

Photo

📊 Unlock better loan deals! Discover how boosting your credit score opens doors to more opportunities. 🔑💳 https://cstu.io/6c7489

0 notes

Text

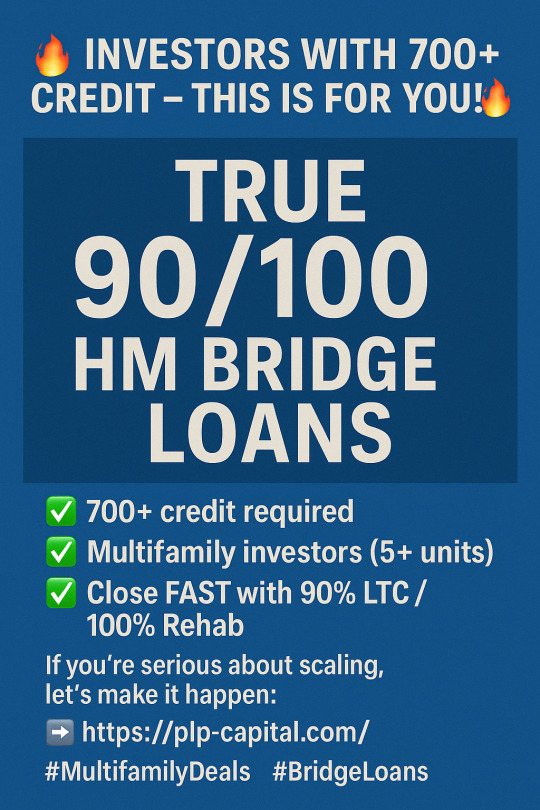

🔥 Investors with 700+ Credit – This is for YOU! 🔥

Looking to buy MFR (5+ unit) deals? I’ve got the hookup on TRUE 90/100 HM Bridge Loans — no gimmicks, real capital ready to deploy.

✅ 700+ credit required

✅ Multifamily investors (5+ units)

✅ Close FAST with 90% LTC / 100% Rehab

If you’re serious about scaling, let’s make it happen:

➡️ https://plp-capital.com/

#MultifamilyDeals #BridgeLoans #PrivateMoney #90LTC #100Rehab #MFRInvesting #RealEstateInvesting

#mfr#hardmoney#privatemoney#entrepreneur#multifamily#bridgeloan#900/100#900LTC#100rehab#creditscore#investor#HML

0 notes

Text

Simplify Your Loan Journey with the PSB59 App!

Get business loans faster and easier with the PSB59 App! Apply online, get approval in just 59 minutes, and access loans up to ₹5 crore — all digitally, securely, and hassle-free. Make your loan process simple and quick with PSB59!

#PSB59#PSBLoansIn59Minutes#mythvfact#LoanMyths#LoanFacts#FinancialFreedom#LoanRejection#FinancialTips#CreditScore#LoanApproval#FinancialGoals#KeepGoing#FinancialJourney#StayPersistent#NeverGiveUp#LoanOpportunities#SmartFinance#FinancialGrowth#LoanOptions#CreditImprovement#ResilientFinance#PersonalFinanceTips#UnlockOpportuniti

0 notes

Text

What Is A Bad Credit Loan?

A bad credit loan is a type of personal loan specifically designed for individuals with poor credit histories. These loans are often offered by lenders who are willing to take on higher risk, but as a result, they typically come with higher interest rates and less favorable terms. People with bad credit may have difficulty qualifying for traditional loans from banks or credit unions. What is a bad credit loans can provide a much-needed option for accessing funds.

For freelancers and self-employed individuals, obtaining a loan with bad credit can be challenging, but not impossible. Online lenders, peer-to-peer lending platforms, and certain alternative lenders are more flexible and may offer loans even with a less-than-perfect credit score. However, it’s important to carefully compare the terms of these loans to ensure they are affordable and suitable for your financial situation.

If you are self-employed and have bad credit, it’s crucial to present strong documentation of your income, such as tax returns or bank statements, to increase your chances of approval. While bad credit loans can be a useful tool for covering urgent expenses, they should be approached cautiously to avoid worsening your financial situation.

0 notes

Text

Whether it's investment, credit, or just understanding your money better — knowledge is power 💡 At FundDECODE, we help you break down the complex world of finance into simple, actionable steps. 📈 Start making smarter money moves today!

#FinanceTips#InvestSmart#MoneyMatters#CreditScore#PersonalFinance#FundDECODE#FinancialFreedom#MoneyTalks#WealthBuilding

0 notes

Text

Personal Loan Simplified: Everything You Need to Know Before You Borrow

Sometimes, life doesn’t wait. Whether it’s a sudden medical bill, a much-needed home upgrade, or an opportunity you can’t miss—having quick access to funds can make all the difference. That’s where a personal loan steps in.

Flexible, fast, and unsecured, personal loans have become one of the most trusted financial tools in India. But before you apply, understanding how they work, what to expect, and how to make the most of them is essential.

Let’s break it all down.

What Is a Personal Loan?

A personal loan is a short to medium-term loan you can borrow from a bank, NBFC, or online lender without offering any collateral. It's called "unsecured" because you don’t have to pledge an asset like a car or property.

What makes a personal loan so popular is its versatility—you can use the loan amount for nearly anything: medical expenses, wedding planning, education, travel, home improvements, or consolidating existing debts.

Key Benefits of a Personal Loan

Here’s why millions of Indians are opting for personal loans today:

1. No Collateral Needed

Unlike secured loans, a personal loan doesn’t put your assets at risk.

2. Quick Disbursal

With digital platforms like Fincrif, your loan can be approved and credited in as little as 24–48 hours.

3. Fixed EMIs

Predictable monthly payments make it easier to manage your budget.

4. Flexible Usage

You’re not restricted on how to spend the money—it’s your call.

5. Improve Your Credit Profile

Regular, on-time repayments can strengthen your credit score over time.

Popular Reasons to Get a Personal Loan

While the possibilities are almost endless, here are the most common uses:

Emergency medical treatment

Debt consolidation

Wedding expenses

Home repairs and renovation

Higher education or online courses

Vacation or travel plans

Gadget or appliance purchase

A personal loan is ideal when you need funds quickly and want repayment flexibility.

How Personal Loans Work

Once your application is submitted, the lender evaluates your profile—credit score, income, employment, and repayment ability. If everything checks out, you receive the loan directly in your bank account. You then repay it through fixed EMIs over a set period, usually between 12 to 60 months.

The total cost includes interest and any additional charges like processing fees or late payment penalties.

Eligibility for a Personal Loan

While each lender has their own set of rules, here’s what most require:

Age: 21 to 60 years

Income: Minimum ₹15,000–₹20,000/month

Employment: Salaried or self-employed with consistent income

Credit Score: Generally 650 and above

Stability: At least 6 months with your current employer or 1 year in business

Meeting or exceeding these criteria increases your chances of getting approved at a lower interest rate.

Documents Required

You won’t need to run around gathering files. Most lenders (especially online platforms like Fincrif) only ask for:

KYC documents (PAN, Aadhaar, Passport)

Income proof (Salary slips, IT returns, or bank statements)

Address proof (Utility bills or rental agreements)

Photograph (passport-sized)

Everything can be uploaded online, and the process is 100% paperless.

Interest Rates and Charges

Interest rates for personal loans typically range between 10% and 24%, depending on:

Your credit history

Your income and employer profile

Loan tenure and amount

Relationship with the lender

Apart from interest, you should also look out for:

Processing fees (usually 1–3%)

Late payment charges

Foreclosure or prepayment fees

Always calculate the total cost of borrowing, not just the EMI.

How to Choose the Right Personal Loan

With so many lenders in the market, comparing offers is crucial. Here’s what you should look at:

Interest rates

Loan tenure

Monthly EMI

Processing and hidden charges

Customer service reputation

Prepayment flexibility

Fincrif helps simplify this comparison with its easy-to-use platform that lets you view, filter, and apply—all in one place.

Why Fincrif Is the Smarter Way to Borrow

Applying through Fincrif gives you an edge in the borrowing process:

✅ Compare 30+ lenders in one place

✅ Instant eligibility check

✅ Personalized offers based on your profile

✅ 100% online process—no paperwork, no queues

✅ Expert support at every step

✅ Safe and secure document uploads

Fincrif isn’t just a loan marketplace—it’s your partner in making better financial choices.

Tips for Managing Your Personal Loan Responsibly

Borrowing is easy, but managing your loan smartly is what keeps your finances on track. Here’s how:

Don’t borrow more than you need: Higher loan amounts mean higher interest payments.

Set up automatic EMI payments: Never miss a due date.

Build an emergency buffer: Always have a cushion to cover at least 2–3 EMIs.

Avoid multiple loans: Focus on closing one loan before opening another.

Prepay if you can: If there are no prepayment penalties, paying early can save you a lot on interest.

Is a Personal Loan Right for You?

Here’s a quick checklist:

Do you have a genuine financial need?

Can you repay on time without stretching your budget?

Have you compared multiple offers for the best rate?

Do you have a steady income source?

If you answered “yes” to all, a personal loan could be a smart and strategic move.

Final Thoughts

A personal loan is more than just borrowed money—it’s financial flexibility when you need it most. Whether you're consolidating debt, upgrading your home, or covering emergency expenses, it’s a quick and accessible solution.

0 notes

Text

International Business Loan Providers

International Business Loan Providers Guide to top business loan providers. International business loan providers offer critical financing solutions for companies expanding beyond domestic borders. These institutions provide capital to support global trade, infrastructure projects, and operational growth. Understanding how these providers operate, their offerings, and their impact on businesses…

View On WordPress

#cash#creditscore#financialadvisor daytrader#goals#InternationalBusinessLoans GlobalFinancing BusinessExpansion trade finance project funding Reliancecapitalfinancelimited SBLC fina#investments#funding#GlobalFinancing#InternationalBusinessLoans#news#project funding#Reliancecapitalfinancelimited

0 notes

Text

Huffman Irrell Co. Discusses How Debt Affects Your Credit Score

Huffman Irrell Co. delivers professional debt collection services, helping individuals and businesses navigate financial obligations. One common concern we often hear is how debt affects credit scores. Understanding this relationship is important for keeping your finances healthy. Let’s break it down in simple terms.

How Credit Scores Work

Your credit score is a three-digit number that shows how well you handle credit. Lenders use it to decide if you qualify for a loan, credit card, or mortgage. Scores usually range from 300 to 850, with higher numbers being better.

Your score is based on five key factors:

Payment history (35%) – Do you pay your bills on time?

Credit utilization (30%) – How much of your available credit are you using?

Length of credit history (15%) – How long have you had credit?

Credit mix (10%) – Do you have different types of credit (loans, credit cards, etc.)?

New credit inquiries (10%) – Have you applied for new credit accounts recently?

Now, let’s look at how debt affects these factors.

The Impact of Debt on Your Credit Score

1. High Debt Can Lower Your Credit Score

Owing too much money can lower your score, especially if you are using a big part of your available credit. This is called credit utilization.

For example, if you have a credit card with a $10,000 limit and you owe $9,000, your utilization rate is 90%. Lenders like to see this below 30%. A high utilization rate can hurt your score.

2. Late Payments Hurt Your Score

Your payment history is the most important part of your credit score. If you miss payments on a loan or credit card, it gets reported to credit bureaus and can stay on your report for up to seven years.

Even one late payment can lower your score. Huffman Irrell Co. recommends setting up reminders or automatic payments to avoid this.

3. Different Types of Debt Can Help

Having different types of debt (like a mortgage, student loan, and credit card) can help your score. It shows lenders you can handle credit responsibly.

However, taking on too much debt can have the opposite effect. If you open many loans at once, lenders may think you are struggling financially.

4. Applying for Too Much Credit Can Lower Your Score

When you apply for a loan or a new credit card, lenders check your credit report. This is called a hard inquiry, and it can lower your score slightly.

If you apply for too many credit accounts in a short time, it can make lenders worry. Huffman Irrell Co. suggests spacing out credit applications to avoid this.

How to Manage Debt and Protect Your Credit Score

1. Pay On Time

Late payments can hurt your score. Always try to pay at least the minimum amount on time. Setting up automatic payments can help.

2. Keep Credit Utilization Low

Try to use less than 30% of your available credit. If possible, pay down balances before the billing cycle ends so they report lower to credit bureaus.

3. Don’t Open Too Many Accounts at Once

Each new credit application can lower your score a little. If you need new credit, apply only when necessary.

4. Consolidate or Negotiate Debt

If you have many debts, a debt consolidation loan or negotiating lower interest rates can make payments easier. This can help you avoid missed payments.

Final Thoughts

Debt plays a big role in your credit score. Having some debt isn’t always bad, but how you manage it matters. By paying on time, keeping balances low, and being careful with new credit, you can keep a good credit score.

Huffman Irrell Co. understands that dealing with debt can be stressful. If you need help, we’re here for you. Contact us to learn more about managing debt and protecting your financial future.

0 notes